The Comcast Crisis Nobody Saw Coming (Even Though Everyone Did)

In April 2025, Mike Cavanagh made a statement that should've shocked absolutely nobody. The Comcast president admitted his company's cable broadband division was "not winning in the marketplace." Not losing. Not struggling. Not facing headwinds. Not winning.

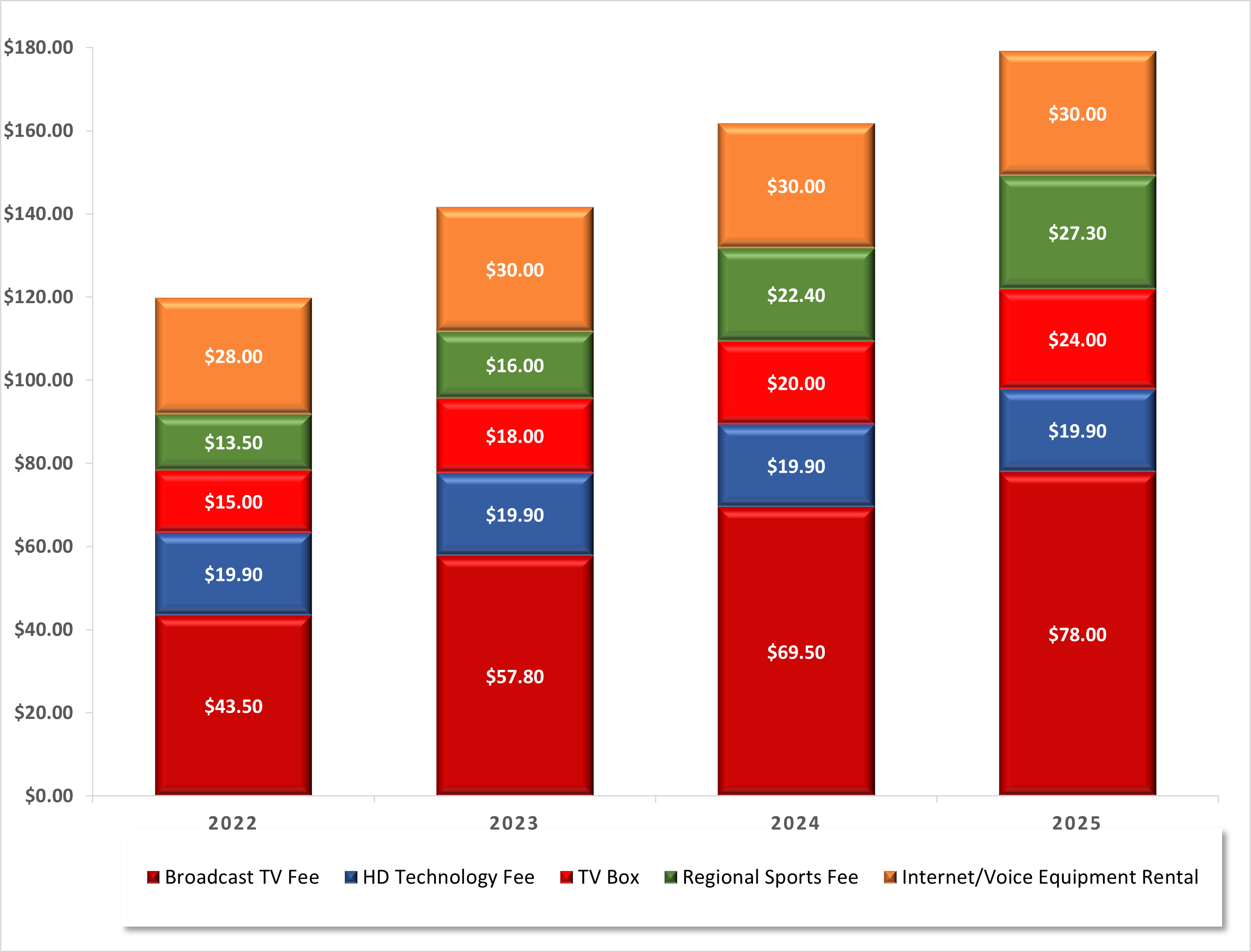

Here's the thing: customers had been screaming this from the rooftops for years. Your bill kept going up. Prices weren't transparent. Customer service was a nightmare. Data caps felt punitive. Switching services took forever and required actually talking to someone.

So Comcast did what any massive corporation does when the house is on fire. It announced a major makeover. A five-year price guarantee. Free Xfinity Mobile service bundled with broadband. Plans with unlimited data instead of those infuriating caps. The whole nine yards.

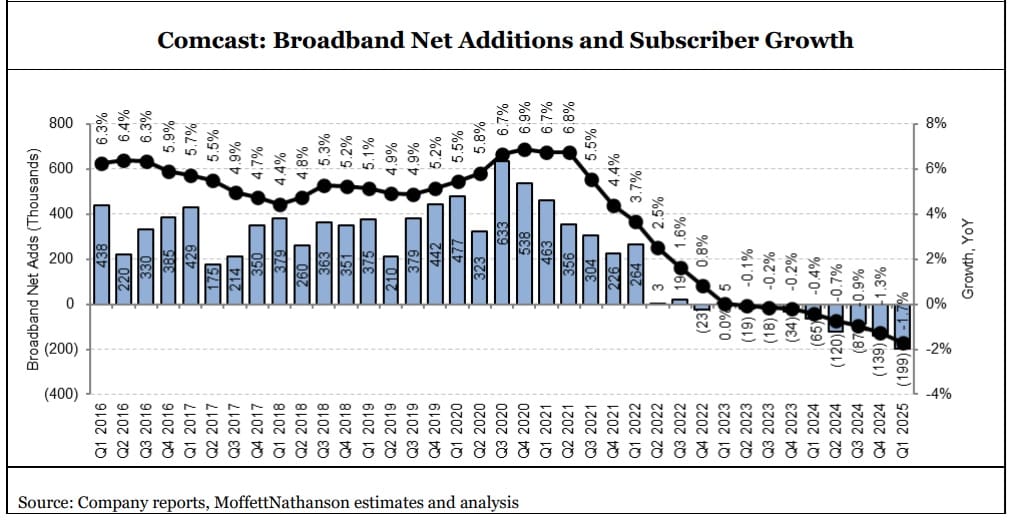

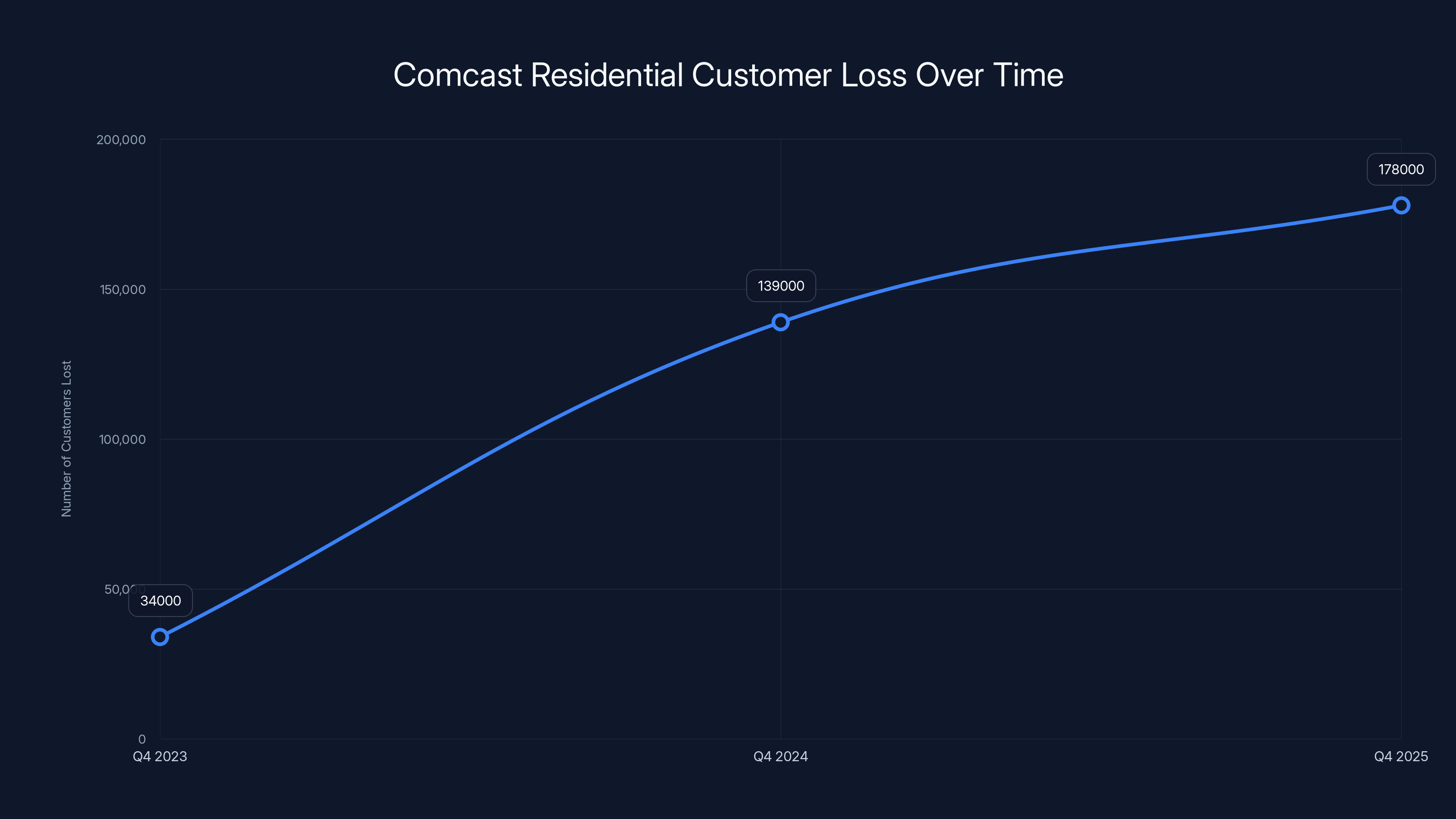

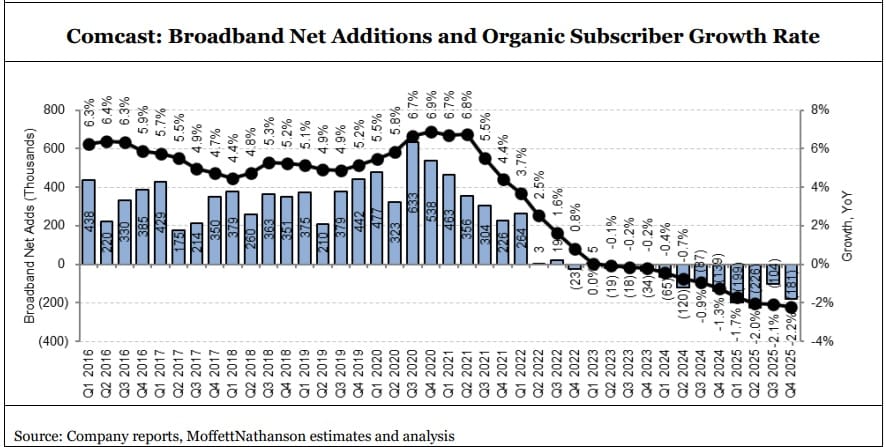

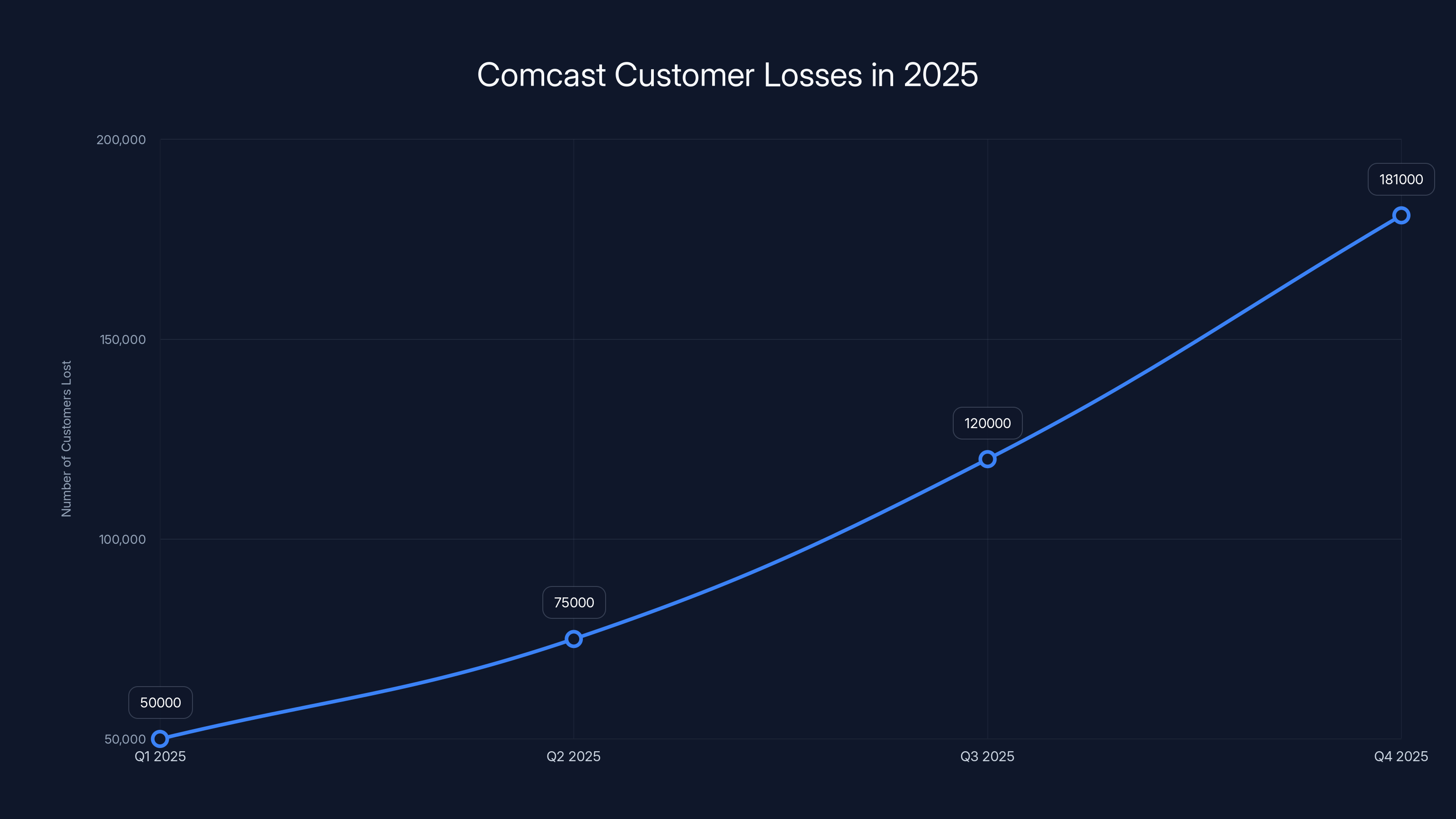

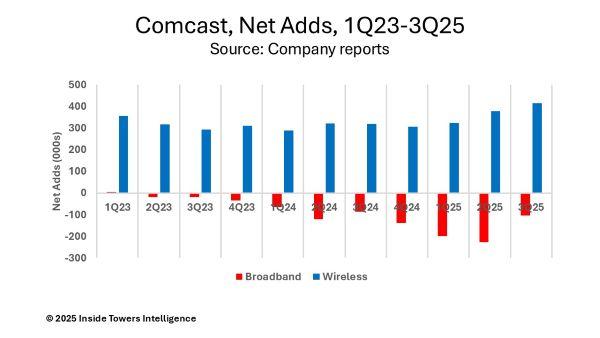

But here's the plot twist that isn't actually a plot twist: it's not working. Not yet, anyway. In Q4 2025 earnings announced today, Comcast reported losing 181,000 residential and business broadband customers in the United States. That's 178,000 residential customers plus 3,000 business customers. More than analysts predicted. Worse than what Cavanagh warned about nine months earlier. Significantly worse than the same quarter last year.

This isn't just a number. This is Comcast's largest broadband customer loss in recent memory. This is what happens when you've dominated an industry for decades by being the least terrible option, then suddenly everyone has other choices.

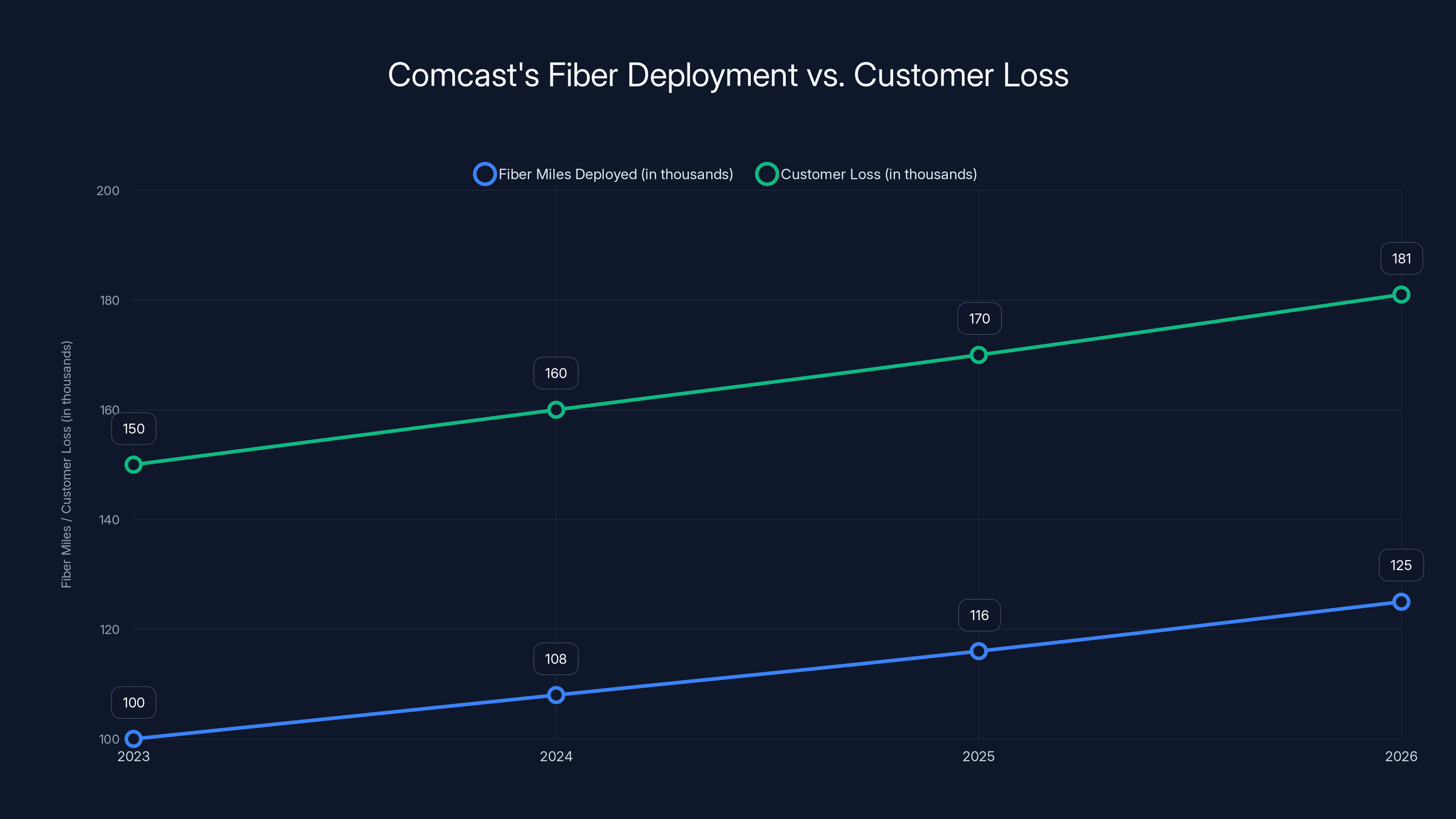

Fiber providers are laying down networks at an aggressive pace. Fixed wireless from companies using 5G infrastructure can compete on price. Satellite internet is actually becoming viable. For the first time in Comcast's existence, customers have real alternatives.

And Comcast's billion-dollar rebranding effort? It's not stopping the bleeding.

TL; DR

- Comcast lost 181,000 broadband customers in Q4 2025, worse than analyst predictions despite a price guarantee overhaul

- Competitive intensity from fiber and fixed wireless is proving stronger than price guarantees and bundled incentives

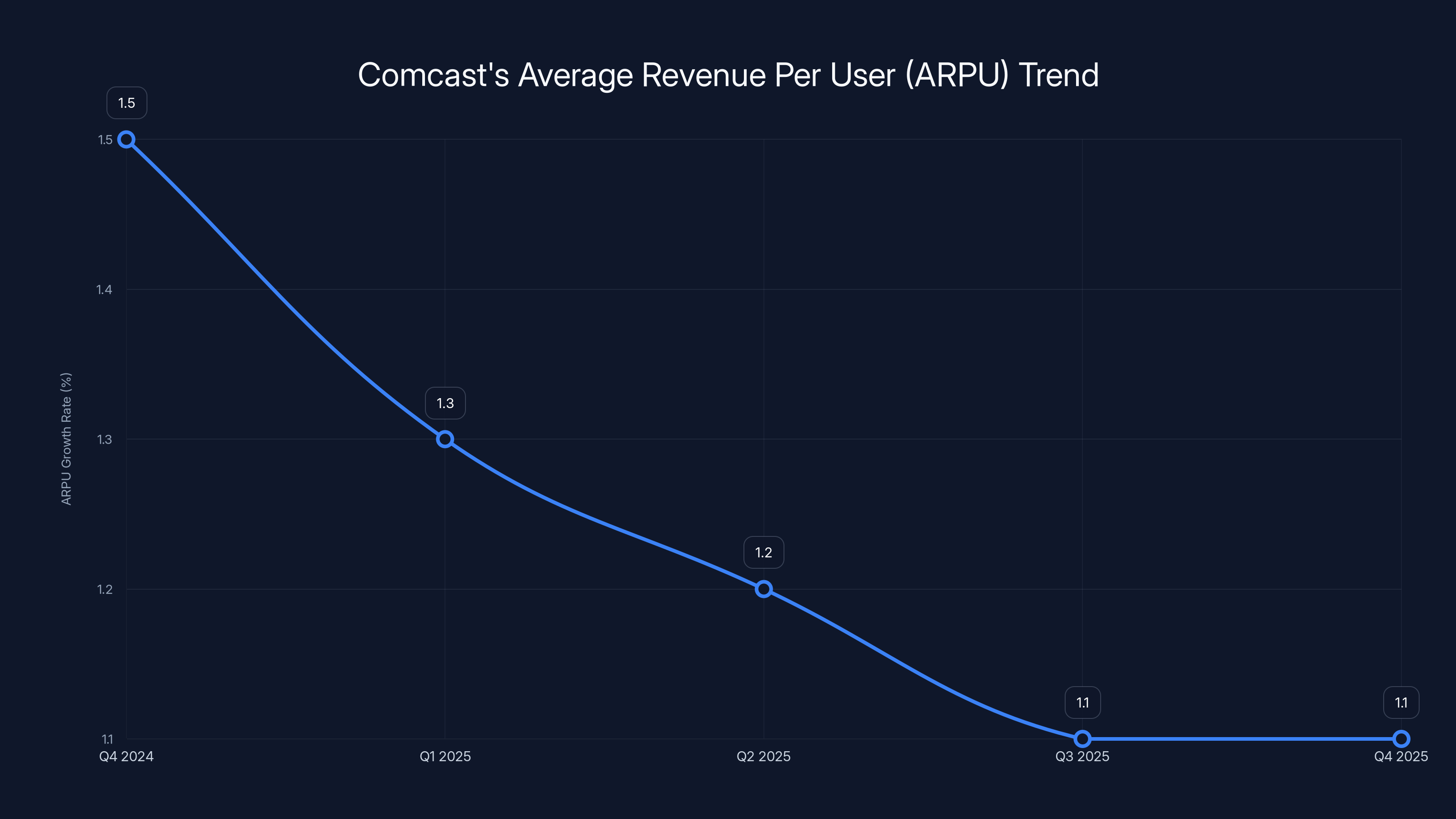

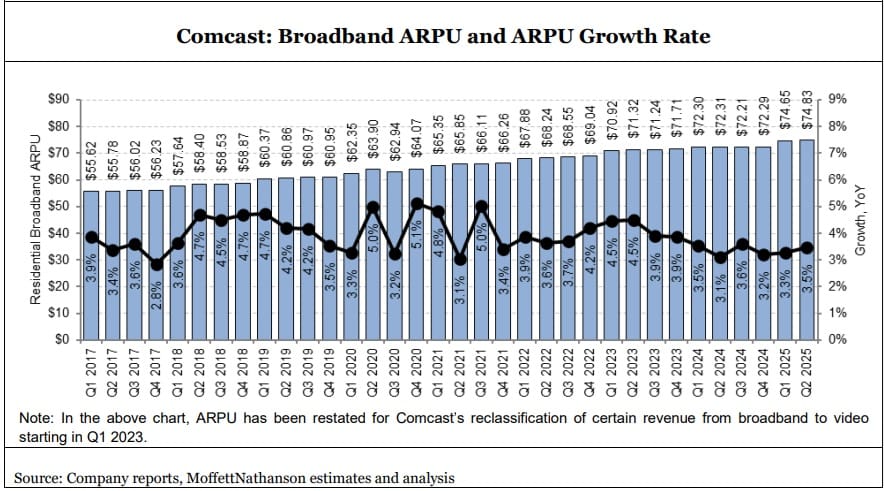

- Revenue per user grew only 1.1%, indicating customers are pushing back on monetization strategies

- **The broadband division generated 6.38 billion year-over-year

- 2026 will be Comcast's largest broadband investment year ever, signaling desperation rather than confidence

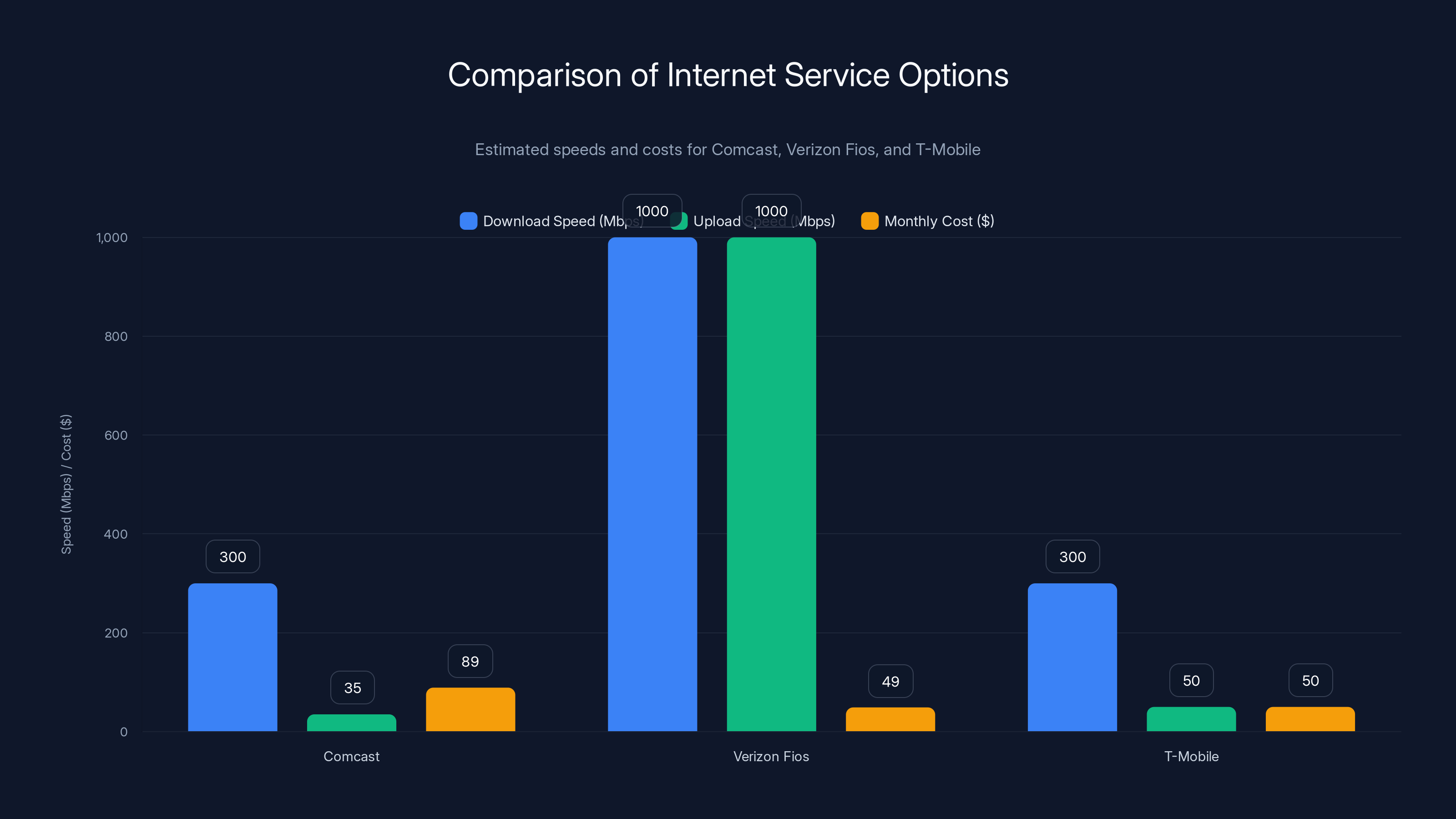

Comcast offers slower speeds at a higher cost compared to Verizon Fios and T-Mobile. Estimated data highlights competitive disadvantages.

Understanding Comcast's Market Position in 2025

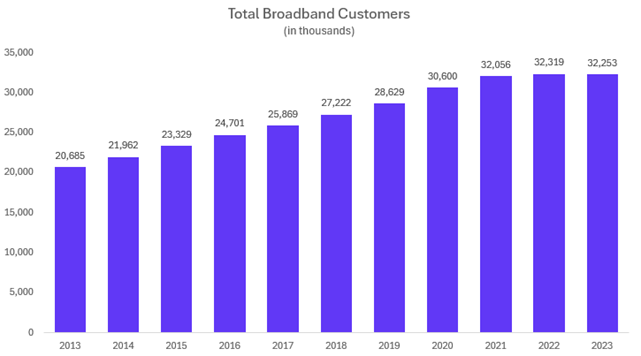

Comcast isn't just another internet provider. It's the second-largest cable provider in America alongside Charter Communications. For decades, it operated in a duopoly or near-duopoly in most markets. If you wanted fast, reliable broadband, you often had exactly two choices: Comcast or nothing.

That created a predictable business model. You could raise prices consistently. Customers had nowhere else to go. Data caps were profitable because customers who used more had to either accept paying more or suffer slower speeds. Promotions were complex, creating stickiness through confusion. Phone service bundled with broadband meant higher switching costs.

The numbers tell the story. Comcast controlled 28.72 million residential broadband customers at the end of Q4 2025. That's a massive base. In residential markets, that means roughly one in four American households uses Comcast for internet. The company's domestic broadband division generated $6.32 billion in revenue during the quarter.

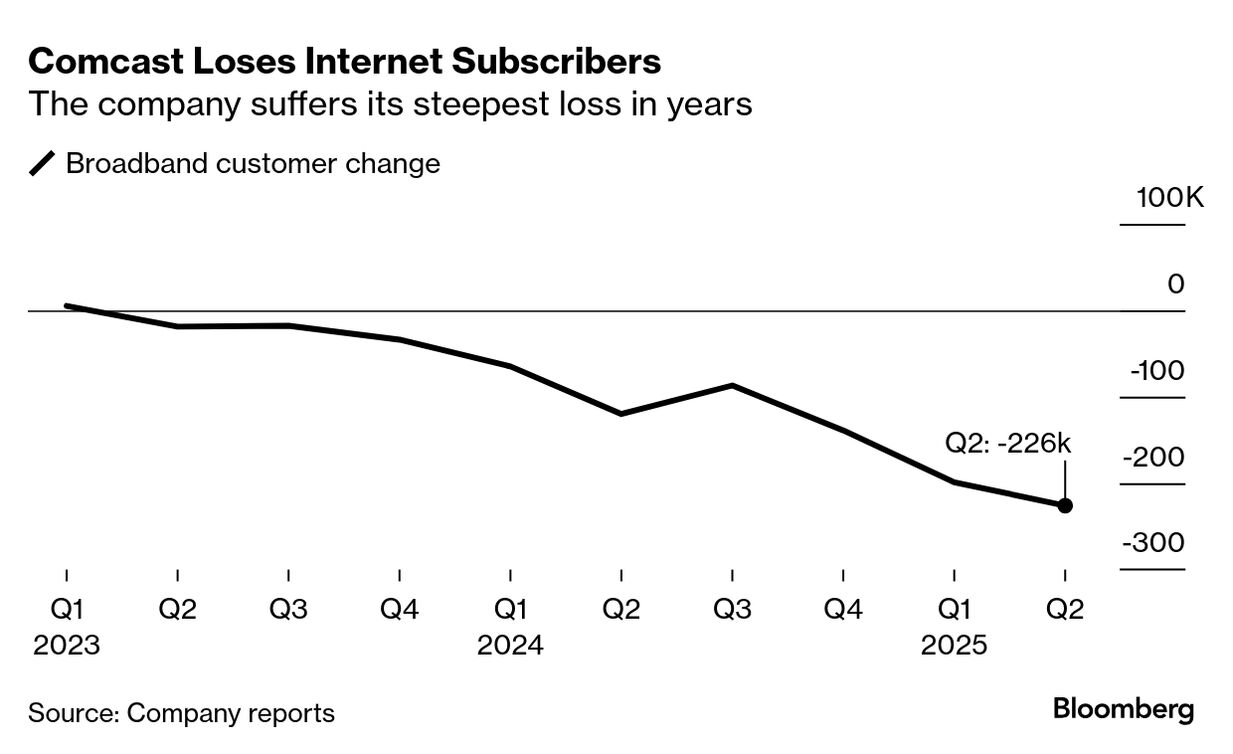

But for the first time in a generation, that number is shrinking. Not slightly. Not temporarily. Consistently shrinking.

The Q4 2025 loss of 178,000 residential customers follows a Q4 2024 loss of 139,000 customers. Go back further: Q4 2023 lost 34,000. The trajectory is clear. Competition is accelerating. Comcast's moat is disappearing.

Comcast has experienced a consistent increase in customer loss from Q4 2023 to Q4 2025, indicating growing competition and a shrinking market position.

The Price Guarantee That Didn't Guarantee Anything

Comcast's April 2025 reboot included something that sounds genuinely helpful: a five-year price guarantee. For five years, your broadband price wouldn't increase. That's a real commitment in an era where price increases are practically annual.

Except it's already not working.

Why? Because a price guarantee only matters if the price you're guaranteeing is competitive. If customers are already paying more than they would for fiber, a guarantee on that higher price isn't a win. It's just slower loss.

Consider the math. Comcast's average revenue per user grew 1.1% despite the price guarantee. That means the company is either raising prices on new customers while guaranteeing existing customers, or it's losing customers to lower-priced competitors. Probably both.

The problem is structural. Comcast inherited a cable network designed for television delivery. Upgrading that network to competitive broadband speeds requires massive capital investment. Those costs get passed to customers. Fiber companies, meanwhile, can deploy new infrastructure more efficiently. Fixed wireless providers leverage existing 5G towers. Both have lower cost structures.

A price guarantee can't overcome a cost structure disadvantage.

Comcast CFO Jason Armstrong acknowledged this during earnings. He said the company is experiencing "continued competitive intensity" that's overwhelming "early traction" from the new initiatives. Translation: customers like the idea of the price guarantee, but they're still switching because the base price is still too high.

Why Unlimited Data Isn't the Game-Changer Comcast Thought It Was

For nearly a decade, Comcast used data caps as a revenue instrument. Go over your limit, pay overage fees. The company could keep headline prices low while making money from customers who actually used their internet. It was elegant and infuriating.

Removing data caps sounds generous. It sounds like Comcast finally heard customers complaining about working from home during the pandemic and hitting artificial limits. And on one level, it is.

But here's what Comcast didn't account for: customers don't actually want unlimited data as much as they want cheap data. The distinction matters.

When Comcast removed data caps, they didn't necessarily lower prices. They removed a penalty structure, but the base price remained uncompetitive. A customer might think, "Great, I won't hit overages anymore," while simultaneously thinking, "But I could get fiber for $20 less per month."

Unlimited data is table stakes now, not a differentiator. Every competitor offers it. Fiber providers offer unlimited data. Fixed wireless providers offer unlimited data. Satellite providers offer unlimited data. By making unlimited data standard, Comcast brought itself in line with competition. It didn't leap ahead.

What would've been revolutionary: keeping the price guarantee while actually lowering prices. But that cuts into the $6.32 billion revenue stream. So instead, Comcast removed a cost center (data cap enforcement) while keeping prices high. Customers correctly interpreted that as a non-move.

The real issue is that Comcast still thinks it's competing on features when it's actually competing on price. Unlimited data is a feature. A $40/month bill is a price. Customers care more about the latter.

Comcast's average revenue per user (ARPU) growth rate has been declining, with a minimal increase of 1.1% in Q4 2025. Estimated data shows a consistent slowdown over the quarters.

The Fiber Invasion: Why Comcast Can't Compete on Speed

Fiber is the real enemy. Not the phantom threat of satellite internet. Not the niche appeal of fixed wireless. Fiber.

Fiber provides gigabit speeds as a baseline. One thousand megabits per second, symmetric upload and download. That's not a marketing claim. That's physics. Fiber's optical-based technology has no theoretical speed limit. You can upgrade speeds by changing software, not digging up the street again.

Comcast's cable network tops out around 1.2 gigabits downstream with DOCSIS 3.1 technology, and that requires perfect conditions. Upstream speeds are capped at 35 megabits. For a remote worker uploading video? That's a bottleneck. For someone running a home security system? Unnecessary. For future-proofing? Inadequate.

Fiber companies don't need price guarantees or unlimited data. They just need to show a speed test. One side shows "Comcast: 300 Mbps," the other shows "Verizon Fios: 1000 Mbps" for almost the same price. Game over.

Comcast knows this. The company is investing heavily in network upgrades. But upgrading a cable network designed in the 1990s to compete with fiber designed in the 2020s is fighting yesterday's battle with today's weapons.

Here's the real problem: fiber deployment is accelerating. Municipalities are requiring fiber builds. Federal broadband subsidy programs are funding fiber. Private equity is investing in fiber startups. Comcast's 181,000-customer loss in Q4 2025 will look small compared to what happens when fiber reaches critical mass in major metropolitan areas.

Cavanagh acknowledged this explicitly. "We're facing a more competitive environment from fiber," said Steve Croney, Comcast's Connectivity & Platforms chief. "The market is going to remain intensely competitive."

That's not a prediction. That's a surrender. Comcast has already decided it can't beat fiber, only slow the bleeding.

Fixed Wireless: The Underestimated Competitor

Comcast executives mention fiber constantly. They're less focused on fixed wireless, and that might be a strategic error.

Fixed wireless access (FWA) uses 5G towers to beam internet directly to homes. No digging. No permits. No fiber deployment delays. Just a wireless router on your roof and you've got broadband.

T-Mobile and Verizon have deployed millions of fixed wireless lines. The speeds are respectable, not spectacular. You're looking at 100-300 Mbps typically, not fiber's gigabit speeds. But for the average customer who streams Netflix and works from home? That's enough. And it's $50 cheaper per month than Comcast.

Fixed wireless also scales faster than fiber. Fiber requires digging, permits, and months of construction. Fixed wireless requires equipment installation in days. For a company wanting to enter Comcast's markets quickly and profitably, fixed wireless is the shortcut.

Comcast's competitive analysis probably underestimated fixed wireless because it's younger and noisier in the media. But look at the customer migration patterns. Many of those 181,000 lost customers aren't switching to fiber. They're switching to fixed wireless because it's faster than they need and cheaper than Comcast.

The fixed wireless providers also aren't offering price guarantees or trying to bundle services. They're just offering a clean, simple value proposition: faster speeds, lower price, no long contract. That's becoming Comcast's worst nightmare because it's the inverse of every strategic choice the company made in 2025.

Comcast's fiber deployment is growing slowly compared to the increasing number of customers leaving for competitors. Estimated data highlights the strategic gap.

The Bundling Strategy That's Supposed to Save Comcast

Comcast's genius move was bundling internet with mobile service. Free Xfinity Mobile for one year with new broadband customers. That's worth hundreds of dollars. It should work.

But it is working. Just not the way Comcast hoped.

The company added 1.5 million mobile lines in 2025 and now has over 9 million total mobile lines. That's real growth. Comcast estimates it now has over 9 million customers using some combination of internet, TV, and mobile services.

Here's the problem: mobile growth masks broadband decline. Comcast gained 1.5 million mobile lines but lost 181,000 broadband customers. That's a weird trade. Broadband margins are higher. Mobile service margins are thinner because Comcast has to pay Verizon and T-Mobile for access to their networks. The company is essentially trading high-margin customers for low-margin ones.

Cavanagh mentioned that the company wants to "migrate the majority of residential broadband customers to bundles of Internet and wireless service." That's code for: we're going to be a mobile-first company eventually because we can't win on broadband alone.

That's not a strategy. That's a retreat.

Real talk: bundling works when all parts are competitive. If your internet is more expensive than fiber and your mobile is more expensive than T-Mobile by itself, bundling just means customers lose on two fronts. Bundling works for customers when it actually saves them money, not when it locks them into a company they'd otherwise leave.

Comcast is using bundling as a stickiness tool, not a value proposition. That's why it's not working as well as the company hoped.

Revenue Per User: The Metric That Reveals Everything

Average revenue per user grew 1.1% in Q4 2025. Armstrong explicitly said this growth is being suppressed by the new pricing initiatives.

That's a warning light. Comcast added price guarantees, unlimited data, and free mobile. All of that should increase revenue. Instead, revenue per user barely grew.

Why? Because new customers aren't as profitable. They're getting better deals. Existing customers who aren't switching are getting the same deals. The company is losing its ability to monetize customers at the levels it historically did.

Comcast domestically broadband revenue was

The math is brutal. Losing 181,000 customers combined with declining revenue per user means Comcast is in a downward spiral on two axes simultaneously. It's losing customers AND making less money per customer.

Armstrong expects this trend to continue. He said revenue per user "will continue growing slowly for the next couple of quarters, driven by the absence of a rate increase, the impact from free wireless lines, and the ongoing migration of our base to simplified pricing."

Translation: for the next two quarters, we're going to make even less money per customer because we're still transitioning to the new model. That's brutal honesty for shareholders.

What Comcast is hoping: that volume declines slow and price per user eventually stabilizes at a new, lower level. That's optimistic given fiber deployment acceleration and fixed wireless expansion.

Comcast experienced increasing customer losses throughout 2025, culminating in a significant 181,000 loss in Q4. Estimated data.

The Cable TV Death Spiral Nobody Talks About

While broadband is the flashy story, Comcast's cable TV business is quietly collapsing. Cable TV revenue was

That matters because cable TV used to be the cash machine that subsidized everything else. Comcast made money on TV, decent money on broadband, and breakeven money on phone service. Bundling maximized profit.

Now TV is dying and broadband is the profit center. But broadband customers are cheaper to acquire and have lower switching costs than TV customers. Someone with just internet can leave for fiber in minutes. Someone with TV and internet feels more locked in because they've got channels, DVR schedules, all that stuff.

Comcast is trying to transform from a TV company that also does broadband to a broadband company that also does TV. That's basically a different business model. The margins are different. The customer loyalty is different. The competitive dynamics are different.

When Cavanagh said 2026 would be "the largest broadband investment year in our history," he wasn't kidding. Comcast is desperately trying to become a broadband competitor before it becomes irrelevant. But it's starting that transition from a position of weakness.

Peacock as the Hail Mary Pass

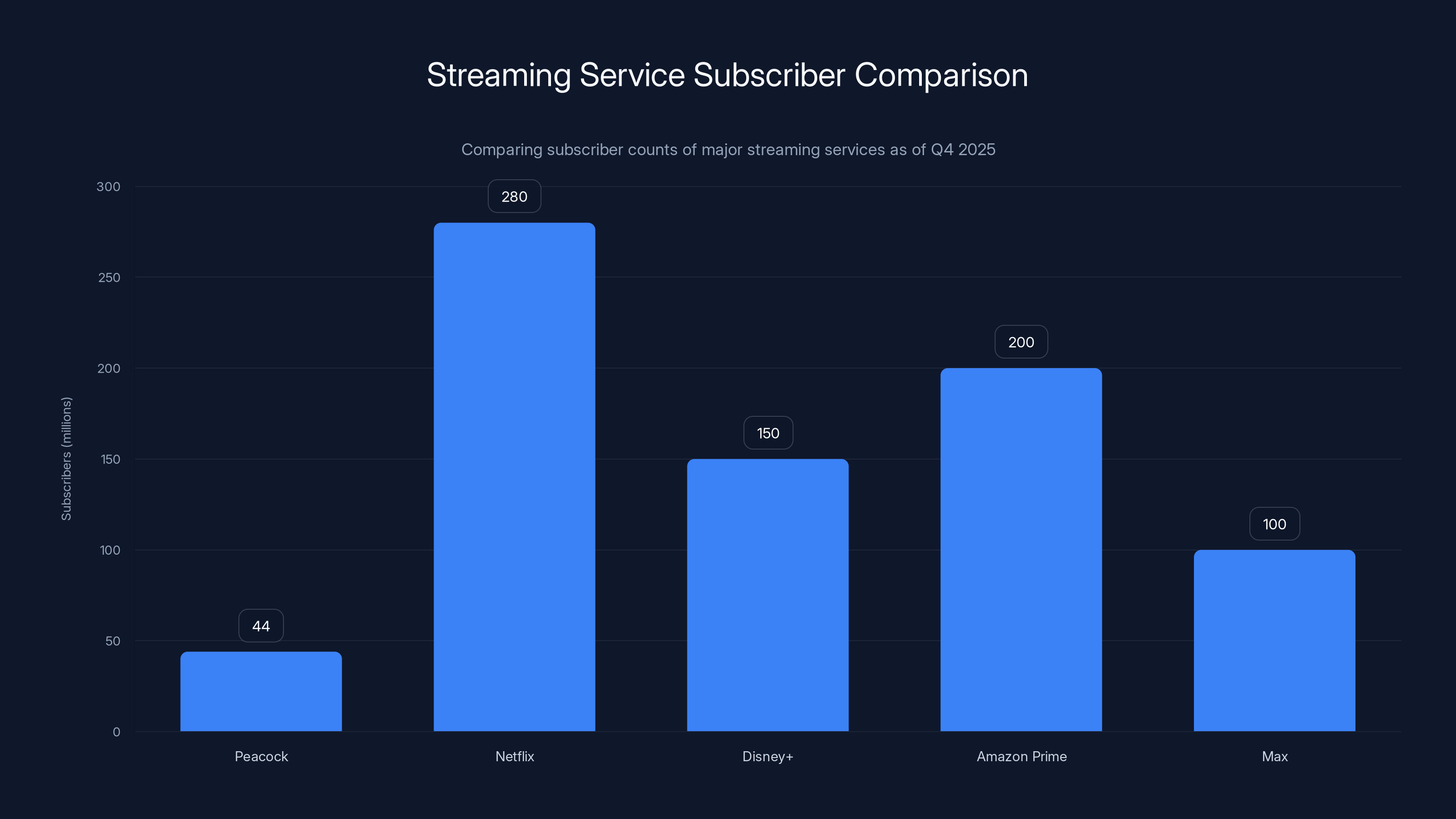

Here's where Comcast gets interesting. While broadband bleeds and TV dies, Peacock is actually growing.

Peacock paid subscribers increased 22% year-over-year to 44 million, and revenue grew 23% to $1.6 billion in the quarter. For Comcast's broader earnings, that's becoming the growth engine.

Comcast's total Q4 2025 revenue was $32.31 billion, up 1.2% year-over-year, mostly because of Peacock growth. Without Peacock and Universal Studios theme parks, Comcast's core connectivity business would look pretty sad.

Comcast is betting that Peacock bundled with broadband becomes a differentiator. Free Peacock for broadband customers? Maybe. Peacock + broadband + mobile for a bundle price? That could work.

But here's the trap: Peacock is a commodity now. Netflix, Disney+, Amazon Prime, Max. Everybody has streaming services. Bundling Peacock doesn't make your broadband more appealing; it just means customers get a service they might not actually watch.

Where Comcast has actual leverage: bundling speed with content. Gigabit internet bundled with 4K streaming and offline downloads. But Comcast can't offer that because its network doesn't support it competitively with fiber.

So Peacock becomes a subsidy for broadband acquisition. Comcast loses money on Peacock to protect broadband customers. That's a doomed strategy long-term.

While Peacock has grown rapidly to 44 million subscribers, it still significantly trails behind Netflix's 280 million. Estimated data for other services.

Charter's Situation: A Warning Sign

Comcast isn't alone. Charter Communications, the other big cable provider, reported Q3 2025 losses of 109,000 internet customers, slightly more than Comcast's losses in the same quarter.

Charter is trying to acquire Cox Communications, which would consolidate the cable industry further. That move basically admits the industry can't compete as individual companies and needs to consolidate for survival.

If Charter can't grow through acquisition, it faces the same fate as Comcast. Both companies are fighting the same battle against fiber and fixed wireless. Both have cable network limitations. Both are trying to transform into broadband companies.

The consolidation trend is about reducing competition and raising prices, not about innovation. When oligopolies start consolidating, it's because the business model is broken. You can't innovate your way to victory, so you buy competitors to reduce the competition.

That usually doesn't end well for customers. Higher prices. Worse service. Less innovation.

Why 2026 Is Make-or-Break

Cavanagh said 2026 would be "the largest broadband investment year in our history, focused squarely on customer experience and simplification, with the goal of migrating the majority of residential broadband customers to our new simplified pricing and packaging by year-end."

That's not optimistic. That's desperate. If the majority of customers aren't already on simplified pricing after a full year, something went wrong with the execution.

Comcast is basically saying: we spent 2025 rolling out new plans, and most customers didn't switch. We're going to spend 2026 forcing migration by phasing out legacy plans. That's not a market win. That's operational necessity.

The company is also investing in network upgrades. Better speeds, better reliability. That's necessary just to compete with fiber. It's not a differentiator; it's catching up.

Here's what success looks like for Comcast in 2026: customer losses slow down. The company might even stabilize broadband subscriber count. That would be a victory after the bloodbath of 2024-2025.

Here's what failure looks like: losses accelerate as fiber deployment reaches critical mass and fixed wireless pricing becomes more aggressive.

Comcast is betting everything on 2026. If it doesn't work, the company is in structural decline. The cable broadband model is broken. The company knows it. Shareholders are starting to figure it out. Stock prices have fallen 16% in the past 12 months.

What Customers Actually Want (That Comcast Isn't Delivering)

Go back to what Cavanagh admitted in April 2025. Prices aren't transparent. They rise too frequently. Dealing with Comcast is too difficult.

Comcast tried to fix transparency with a price guarantee. That only works if the base price is competitive. It's not.

Comcast tried to fix frequent price increases by guaranteeing five years of no increases. That only works if customers believe the company. After decades of surprise rate increases, belief is hard to come by.

Comcast tried to fix the "dealing with the company is difficult" part by removing data caps and offering bundles. But that doesn't fix the underlying problem: Comcast's customer service infrastructure is designed around extracting money from people with limited options, not serving customers who have choices.

What customers actually want: cheap, fast internet with no contract, no bundling, no surprises, and service that doesn't require a 30-minute phone call.

Fiber delivers that. Fixed wireless delivers that (minus the speed for some). Comcast's approach of offering incentives and bundles is the opposite of what customers want.

Comcast is still thinking like a monopoly. It's trying to create reasons for customers to stay through complexity and bundling. What it should be doing: making it dead simple to be a Comcast customer because the alternative is to pay less and get more from someone else.

That requires a fundamental shift in company culture from extraction to service. That's not a five-year price guarantee. That's a complete business model overhaul. Comcast hasn't shown it's willing to do that.

The Broader Internet Service Provider Industry Crisis

Comcast's problem is industry-wide. Cable internet service providers are losing customers to fiber across the country. The duopoly is breaking down. Competition is real.

But the industry is also consolidating because it's impossible to compete as a single cable provider anymore. You need scale to invest in network upgrades. You need a larger customer base to spread fixed costs. You need multiple revenue streams (broadband, TV, mobile) to offset declines in any single category.

Comcast is trying to solve that by becoming bigger and more diversified. That requires buying other cable companies (like Charter is doing with Cox) or developing new revenue streams (like Comcast is doing with Peacock).

But neither approach solves the fundamental problem: cable networks are architecturally inferior to fiber for broadband delivery. No amount of bundling or consolidation changes that.

The internet service provider industry is in the middle of a structural shift. In five years, the winners will be fiber providers and wireless providers. Cable will be in decline.

Comcast knows this. The company is trying to transition before the decline is terminal. But transitions are hard, especially when your current business model is still generating $6.32 billion in quarterly broadband revenue.

Strategic Failures: Lessons for Investors and Customers

Comcast's turnaround effort failed because it attacked symptoms instead of causes.

Symptom: Prices aren't transparent. Solution: Price guarantee (symptom treatment).

Root cause: Prices are uncompetitive because the network is expensive to operate and upgrade.

Symptom: Customers hate data caps. Solution: Remove data caps (symptom treatment).

Root cause: Network speeds can't compete with fiber, so you need artificial scarcity to monetize.

Symptom: Customers are switching to fiber and fixed wireless. Solution: Bundle more services (symptom treatment).

Root cause: Those competitors have better value propositions on core broadband.

Comcast spent billions on marketing a strategy (price guarantees, unlimited data, bundling) that doesn't address the fundamental problem. The company's network is slower and more expensive than fiber. That's not a marketing problem. That's a reality problem.

What Comcast should be doing: investing every penny in fiber deployment, not trying to make cable broadband competitive through pricing gimmicks.

But that's not a five-year turnaround. That's a decade-long capital deployment plan that reduces shareholder returns in the short term.

Comcast chose the easier path. Price guarantees and bundling are cheap compared to fiber deployment. They look good in press releases. They make it seem like the company is doing something.

Meanwhile, 181,000 customers vote with their feet.

The Customer Perspective: Why the Turnaround Failed

Let's think like a Comcast customer who switched providers in Q4 2025.

You've been paying Comcast $89/month for 300 Mbps internet. It's fine. Not great. You sometimes see bill increases. You've got a data cap (now removed). Customer service is frustrating.

In April 2025, Comcast announced a five-year price guarantee. Your price stays at $89. Unlimited data. Free Xfinity Mobile for a year.

But then you notice: fiber is available in your neighborhood. Verizon Fios is offering $49/month for 500 Mbps internet, no contract. No price guarantee needed because fiber companies aren't trying to squeeze customers like cable was.

You do the math. Comcast:

Even with free Xfinity Mobile for a year (maybe

You switch.

Comcast sends you a retention offer.

You stay with Fios.

That's why Comcast's turnaround failed. The company tried to compete on incentives (price guarantees, free mobile, unlimited data) when the real competition was on core value (price plus product quality). Comcast lost on both fronts.

The customer doesn't need a price guarantee. The customer needs a better price.

What's Next for Comcast and the Broadband Industry

Comcast will keep investing in broadband in 2026. The company might slow customer losses. Stock might stabilize.

But the long-term trend is clear. Fiber deployment will accelerate. Fixed wireless will improve. Comcast's cable networks will become a legacy asset, not a growth engine.

The company will probably accept a smaller market share and higher churn as the new normal. Profitability will come from Peacock, mobile service, and bundling, not from broadband growth.

That's not a turnaround. That's managed decline.

For customers, this is actually good news. Competition forces price discipline. Fiber providers have to keep speeds high and prices low or customers switch to fixed wireless. Fixed wireless providers have to keep improving or customers switch to fiber.

Comcast used to be the only option. Now it's one of several options, and it's not the best on any dimension. That's healthy market competition.

The question for Comcast isn't whether it can win back customers. The question is whether it can maintain profitability while shrinking. Based on Q4 2025 earnings, the answer is: not yet, and getting harder.

FAQ

Why is Comcast losing broadband customers despite offering a price guarantee?

Comcast's price guarantee doesn't address the fundamental problem: its cable network is architecturally slower and more expensive than fiber from Verizon or fixed wireless from T-Mobile. A guarantee on an uncompetitive price doesn't change the underlying value proposition. Customers can get gigabit fiber speeds from Verizon Fios for

What's the difference between Comcast's cable broadband and fiber?

Comcast uses DOCSIS 3.1 technology over coaxial cable, which tops out around 1.2 Gbps downstream but requires perfect conditions and newer equipment. Fiber uses optical cables that deliver gigabit speeds consistently and can scale to much higher speeds by changing software rather than physical infrastructure. Fiber also has symmetrical upload and download speeds, while Comcast maxes out around 35 Mbps upstream. For work-from-home professionals, remote schooling, and content creators, fiber's upload speeds are a massive differentiator that cable simply cannot match.

How does fixed wireless internet compare to cable broadband?

Fixed wireless uses 5G towers to beam internet directly to homes, typically delivering 100-300 Mbps speeds with no installation digging required. While slower than fiber, it's faster than many cable speeds and significantly cheaper. Fixed wireless deploys in days rather than months, making it a faster competitive threat to Comcast. The main limitation is that fixed wireless speeds depend on tower proximity and network congestion, while cable and fiber are more consistent. For most households streaming video and working from home, fixed wireless is more than adequate.

Why is Comcast's revenue per user declining even with new services?

Revenue per user grew only 1.1% despite unlimited data, price guarantees, and free mobile bundles because the new pricing strategy actually reduces monetization per customer. New customers get better deals than legacy customers. Free wireless lines for a year reduce mobile revenue. The price guarantee prevents annual rate increases. All of these initiatives are designed to slow customer losses, not maximize profitability. Comcast is essentially accepting lower profit per user to try to maintain total customer count—and it's not even succeeding at that.

What is DOCSIS and why does it matter?

DOCSIS (Data Over Cable Service Interface Specification) is the technical standard for delivering broadband over cable networks. DOCSIS 3.1 is the latest version and theoretically supports up to 10 Gbps, but real-world Comcast deployments max out around 1.2 Gbps downstream. The limitation isn't the standard itself but the underlying coaxial cable infrastructure, which wasn't designed for the speeds and usage patterns of 2025. Fiber has no such limitations because optical technology is fundamentally faster. Upgrading entire cable networks to be competitive with fiber requires massive capital investment, which is why Comcast is instead trying to make cable work through bundling and incentives.

What does Comcast's "simplified pricing" actually mean?

Comcast's simplified pricing consolidates multiple promotional tiers and pricing structures into a few clear options: a base price with no promotion, unlimited data included, and a five-year price guarantee. The company is phasing out complex promotional schemes that were difficult for customers to understand and easy for Comcast to hide price increases within. Simplified pricing sounds customer-friendly, but it's really a necessity because the old promotional model only works when customers don't have competitive alternatives. With fiber and fixed wireless available, hiding complexity doesn't work anymore. Comcast is forced to be more transparent.

Why is Peacock's growth important to Comcast if broadband is declining?

Peacock's 22% subscriber growth and 23% revenue growth provide Comcast with a new business model if broadband competition makes broadband unprofitable. By shifting from cable TV to streaming, Comcast maintains relevance with customers even as broadband becomes commoditized. However, Peacock is also a commodity service competing against Netflix, Disney+, and Amazon Prime in a saturated market. Bundling Peacock with broadband provides customer stickiness but doesn't solve the core problem that Comcast's broadband is uncompetitive. Peacock growth is important for shareholder returns but doesn't reverse the underlying broadband decline.

What will happen to Comcast's market share if fiber deployment accelerates?

Comcast's market share will continue declining as fiber reaches more neighborhoods. In markets with robust fiber competition, cable typically retains only customers who lack fiber alternatives or customers locked into bundles with TV service. Comcast will likely stabilize at a much smaller market share, perhaps 40-50% of its current base in competitive markets. In areas without fiber, Comcast will maintain dominance. Overall, the company is transitioning from national broadband provider to regional provider in non-fiber areas, with mobile and streaming services becoming larger contributors to revenue.

Is Charter Communications facing the same customer loss problem as Comcast?

Yes. Charter reported 109,000 internet customer losses in Q3 2025, indicating the entire cable industry is struggling with competition from fiber and fixed wireless. Both Comcast and Charter are losing customers at accelerating rates despite network improvements. Charter is attempting to consolidate through acquisition of Cox Communications, which suggests the industry believes it cannot compete as individual companies. Both companies face the same structural problems: cable networks that are slower and more expensive than fiber, high customer service costs, and limited pricing power in competitive markets.

The Bottom Line

Comcast's April 2025 turnaround strategy was well-intentioned and poorly executed. The company correctly identified the problems customers hated: non-transparent pricing, frequent increases, and difficult service experiences. But the solutions—a price guarantee, unlimited data, and bundled services—addressed symptoms without fixing the underlying issue.

That issue is simple: Comcast's cable network cannot compete with fiber on speed, and it cannot compete with fixed wireless on price. No amount of bundling, guarantees, or free services changes that reality.

The 181,000-customer loss in Q4 2025 is a data point that shareholders and customers both understand. Comcast is losing. It's losing faster than expected. The fixes aren't working.

The company's strategy for 2026—the largest broadband investment year in its history—suggests desperation rather than confidence. If 2025's major overhaul had worked, Comcast wouldn't need to invest even more heavily in 2026. The company is basically saying: last year's strategy failed, so we're doubling down.

For customers, this is actually good. Competition is forcing Comcast to lower prices, offer better service, and invest in network quality. Comcast's decline is consumers' gain.

For Comcast shareholders, this is a problem. The company is transitioning from a high-growth, high-margin broadband provider to a lower-growth, lower-margin connectivity plus streaming company. That's a significant value destruction, and it's just beginning.

The question facing Comcast isn't whether it can win the broadband wars. That ship sailed. The question is whether it can shrink gracefully while maintaining profitability through bundling, mobile, and streaming. Early evidence from Q4 2025 suggests that's harder than management expected.

Comcast made its bed when it treated customers like captive markets instead of valued relationships. Now it's sleeping in it.

Key Takeaways

- Comcast lost 181,000 broadband customers in Q4 2025, exceeding analyst predictions and accelerating from prior quarters, despite major strategic overhauls

- Fiber networks and fixed wireless providers offer superior value propositions: fiber at 1-gigabit speeds for 89/month

- Price guarantees and unlimited data don't address fundamental architectural problems: cable networks are slower and more expensive to upgrade than fiber

- Average revenue per user grew just 1.1% despite price guarantees and free mobile bundles, indicating new customers are lower-margin and existing customers resist monetization

- Comcast is transitioning from a cable TV company to a broadband and streaming company, but lacks competitive advantages in either core market facing saturation

![Why Comcast Keeps Losing Broadband Customers Despite Price Guarantees [2025]](https://tryrunable.com/blog/why-comcast-keeps-losing-broadband-customers-despite-price-g/image-1-1769717268416.jpg)