Everything We Expect from Xbox in 2026: A Year of Transformation and Industry Disruption

The gaming landscape shifted beneath our feet in 2025. Microsoft made moves that would've been unthinkable five years ago. Halo, the franchise that defined Xbox, is coming to PlayStation. Starfield is heading to Sony's platform. The walls between ecosystems are crumbling faster than anyone expected.

This isn't just about porting games anymore. It's about survival. Microsoft spent the last year walking a tightrope between maximizing revenue and maintaining the Xbox brand as a distinct hardware platform. By 2026, we'll see whether that gamble paid off.

The year ahead looks like a turning point, not just for Xbox, but for how the entire industry thinks about exclusivity, hardware, and where games actually live. Sony locked down marketing rights for GTA 6. Microsoft is throwing everything at Game Pass, trying to convince players that subscription access matters more than owning a console. Neither company has fully figured out the next decade yet, but 2026 will reveal which approach is winning.

Here's what we're watching, why it matters, and what it means if you're considering where to invest your gaming dollars.

TL; DR

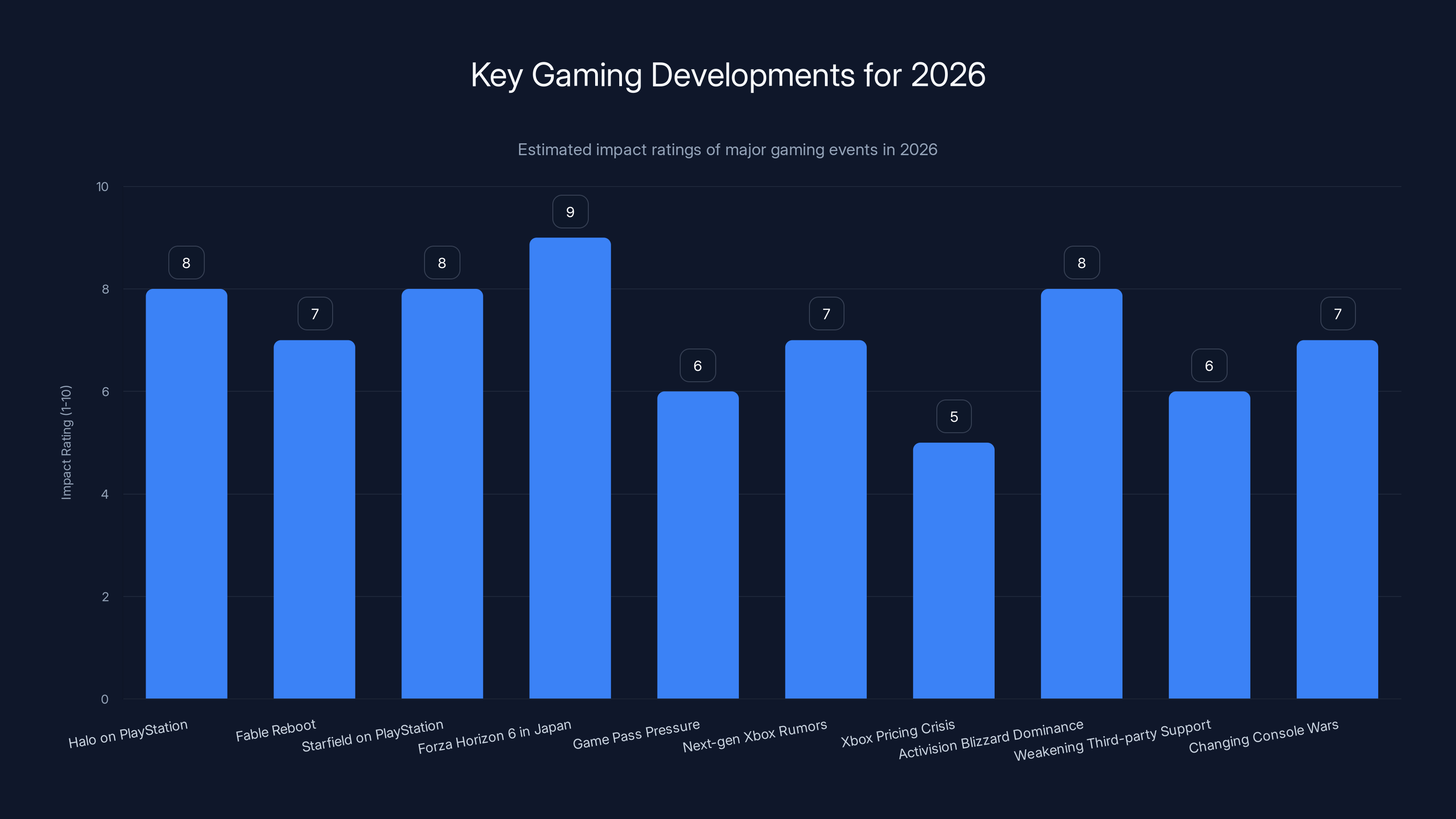

- Halo arrives on PlayStation in 2026, marking a historic shift in Microsoft's exclusivity strategy

- Fable reboot finally launches after multiple delays, with fresh gameplay and Lionhead's signature British humor

- Starfield is coming to PlayStation with a major overhaul and enhanced features

- Forza Horizon 6 heads to Japan, fulfilling years of fan requests

- Game Pass subscription model faces pressure as Microsoft struggles to deliver promised 75+ yearly titles

- Next-gen Xbox hardware rumors suggest a multi-storefront, PC-like ecosystem rather than traditional console

- Xbox hardware pricing crisis makes the Series S nearly as expensive as the PS5, despite lower power

- Activision Blizzard games dominate Microsoft's lineup with CoD, Diablo, WoW expansions

- Third-party support weakens as Sony locks down marketing for massive titles like GTA 6

- Console wars are fundamentally changing as hardware becomes less important than ecosystem access

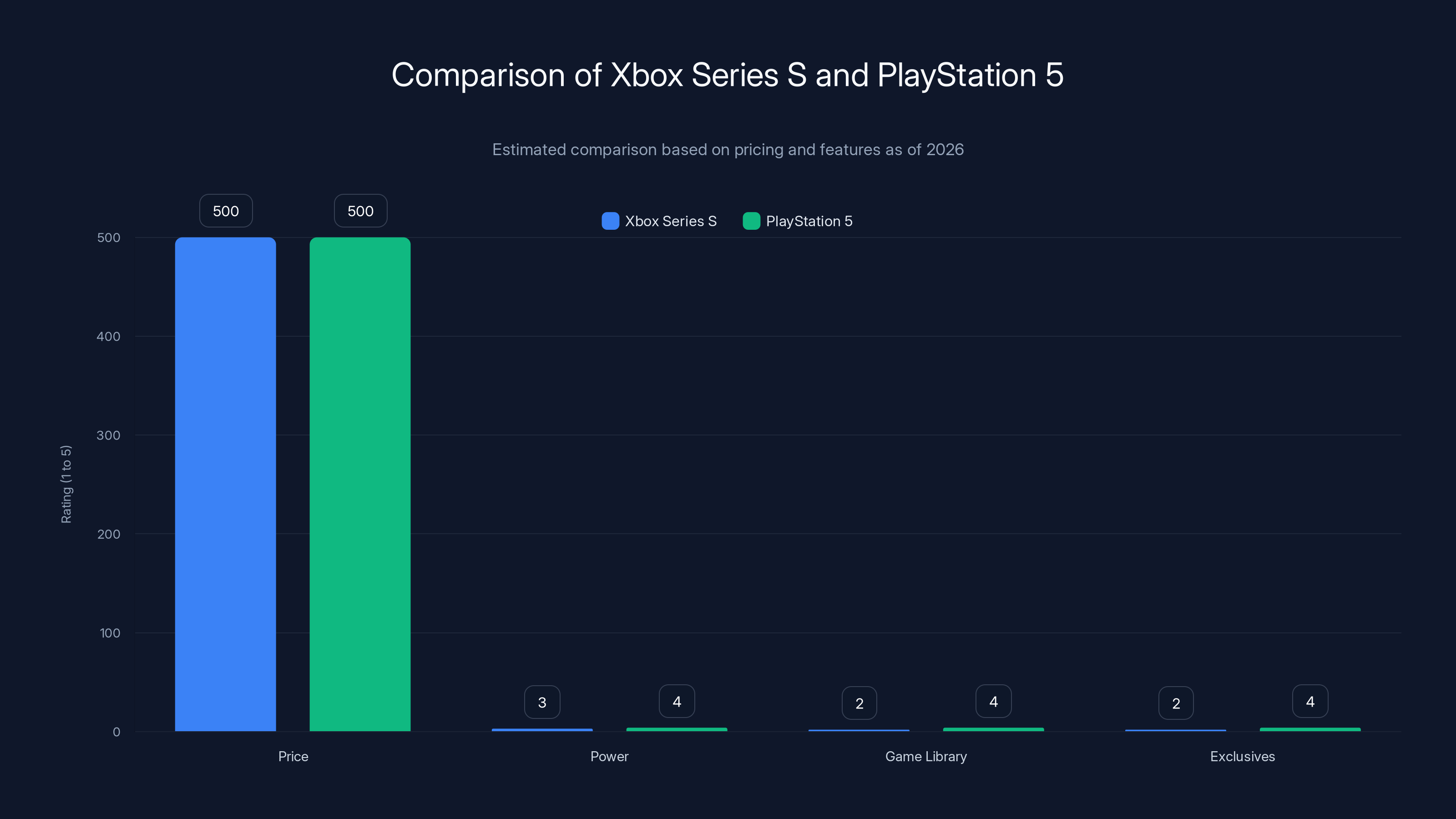

Estimated data shows that while Xbox Series S matches PS5 in price, it lags in power and game library, impacting its value proposition.

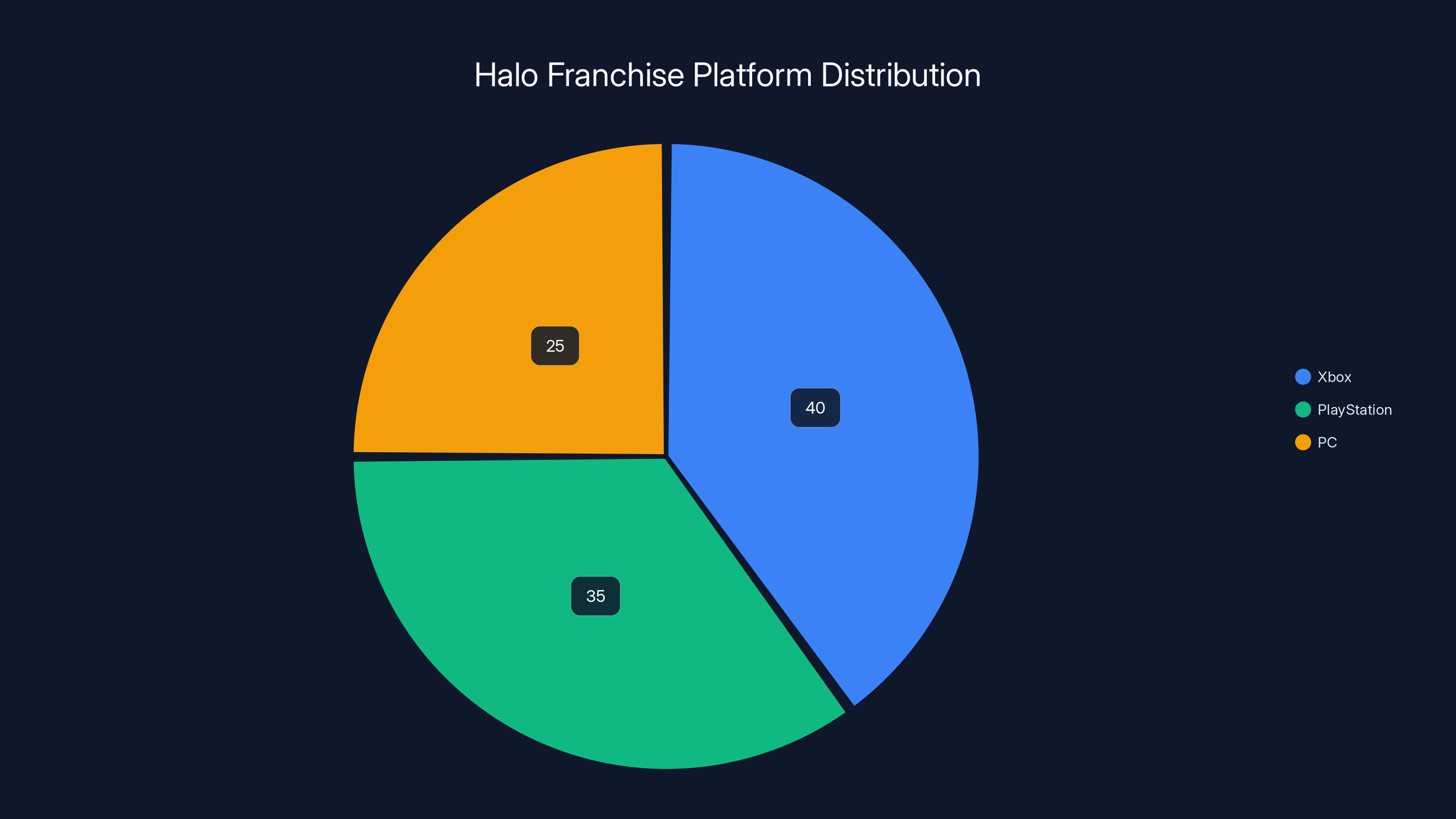

The PlayStation Problem: How Halo Became a Multiplatform Franchise

Let's be direct: Halo on PlayStation feels like surrender. Not because the game shouldn't be there, but because it represents the moment Microsoft acknowledged that Xbox as a hardware platform can't survive on exclusives alone.

Halo: The Master Chief Collection will be PlayStation's entry point. It's not a new game. It's a repackaging of games that launched between 2001 and 2015. But that's exactly what makes it significant. Microsoft is betting that players have spent the last decade wondering what all the fuss was about, and PlayStation owners might finally want to find out.

The single-player campaign of the original Combat Evolved is coming first. It's a reasonable starting point. The game that started it all, stripped of multiplayer, bundled with enough historical weight to matter. But here's where it gets interesting: the Master Chief Collection, the massive compilation that collects 10 years of Halo games, will almost certainly follow. That's not an assumption. That's a recognition of market reality.

When Sony released Helldivers 2 on Xbox, it wasn't a strategic pivot by Sony. It was an acknowledgment that live-service games need massive player bases to survive. Helldivers 2 thrived because it launched with crossplay and cross-progression from day one. The install base matters more than the platform logo.

Halo faces the same math. The multiplayer component of modern Halo games is designed around millions of concurrent players. Keep it Xbox-exclusive, and you're artificially limiting your competitive pool. Release it on PlayStation, and suddenly your matchmaking queues are healthy, your cosmetic monetization scales, and your esports scene has a real audience.

Microsoft isn't ignoring the damage this does to Xbox hardware sales. They're making a calculated bet that they can't win console sales anymore, so they might as well own the software distribution layer instead.

Starfield's PlayStation Transformation: Remaking a $200 Million Bet

Starfield cost Microsoft somewhere north of $200 million. The game launched as an Xbox exclusive in September 2023 to respectable reviews but didn't set the world on fire. Within a year, rumors emerged that it was coming to PlayStation. In 2026, that's happening.

But it's not a straight port. Microsoft and Bethesda are planning a major overhaul. That phrase carries weight. In software, "overhaul" usually means one of two things: either the game was broken and needed fixes, or you're rebuilding major systems to suit a new audience.

In Starfield's case, it's probably both. The game received mixed reactions to its space exploration mechanics. Planets felt procedurally generated and sparse. Ships, while deep, required significant time investment to customize. The character creation system was praised, but the combat felt dated compared to modern standards.

Imagine Starfield 2.0: improved planetary exploration, refined ship customization, faster combat responsiveness, enhanced graphics leveraging PlayStation 5 hardware. That's a game that justifies the PlayStation port beyond just chasing sales. It becomes a redemption arc.

This matters because Bethesda is now owned by Microsoft. For decades, Bethesda games thrived on multiplatform release. Oblivion, Skyrim, Fallout 3—all arrived on multiple platforms simultaneously. Bethesda's internal culture wasn't built around exclusivity. Making Starfield exclusive to Xbox for two years created friction. Releasing it on PlayStation resolves that friction and returns Bethesda to its natural habitat: everywhere.

The danger for Microsoft is that PlayStation owners get the definitive version. Better graphics, maybe better content optimization for DualSense features, possibly exclusive cosmetics to justify the PlayStation platform. Xbox players who stuck with their console feel like they got the beta version.

That's a political problem. Not a technical one. But it compounds the console perception issue. If you buy an Xbox Series X in 2025, and in 2026 Starfield launches on PlayStation "enhanced edition," suddenly your $500 hardware feels like a poor investment.

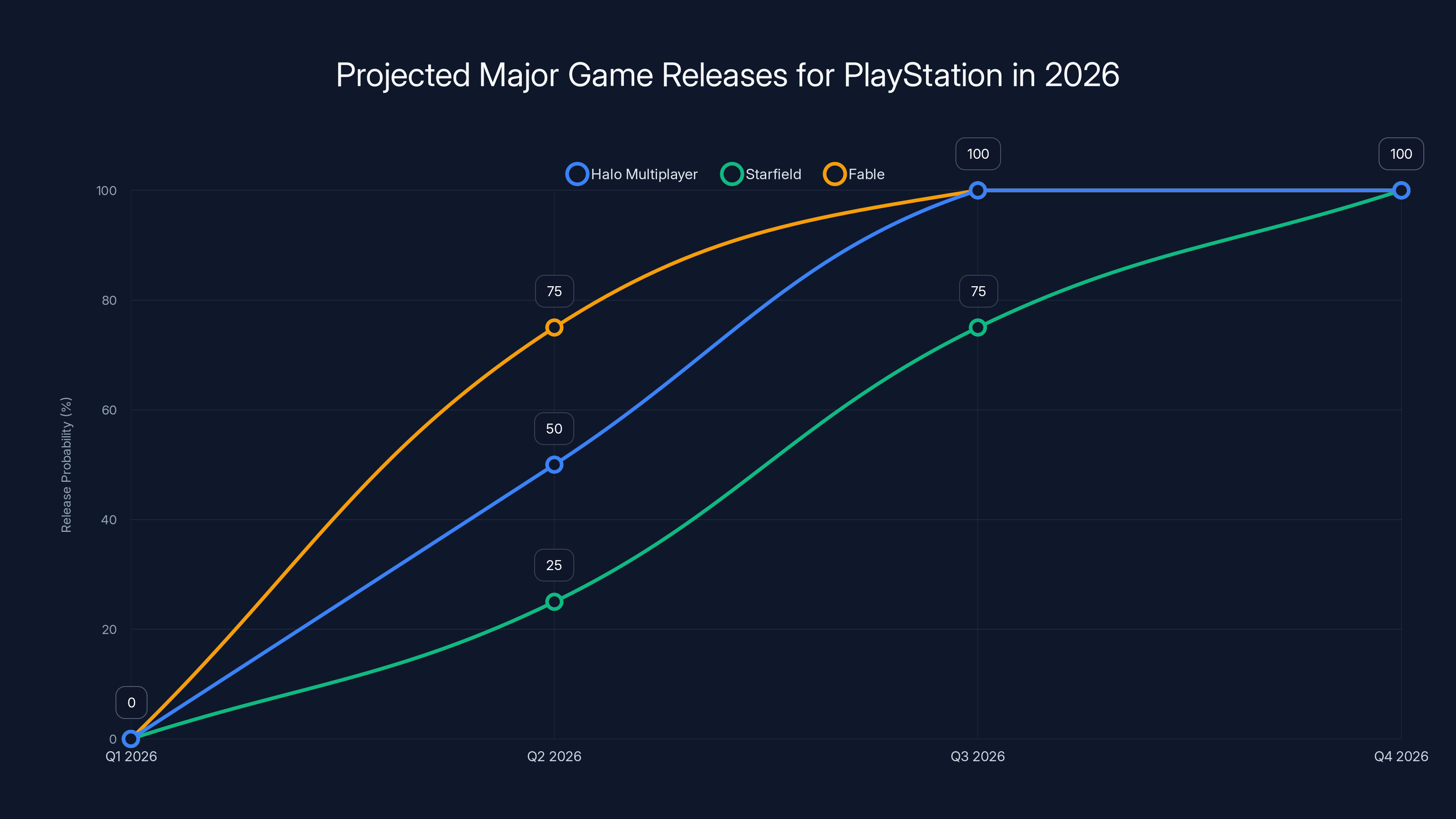

Estimated data suggests Halo Multiplayer and Fable are likely to release by mid to late 2026, while Starfield may arrive later in the year.

Forza Horizon 6: Japan, Expectations, and What We Actually Know

Forza Horizon 5 was a masterpiece. Set in Mexico with 500+ cars, it redefined open-world racing. It launched in November 2021 and is still receiving content updates. That's not typical for racing games. Most franchises move on after two years. Forza Horizon stays.

Forza Horizon 6 is coming to Japan. Fans have been asking for this for years. Japan's street culture, its automotive heritage, its neon-soaked cities—it's obvious territory for a racing game. The surprise is that it took Playground Games this long to get there.

Here's what we know: almost nothing. A tone trailer dropped. It showed Mount Fuji, rain-soaked Tokyo streets, and the visual style you'd expect from a modern Forza game. No gameplay footage. No car list. No multiplayer details. No release window beyond "2026."

That's either confidence or caution. Probably confidence. Playground Games has earned it. But it's also a reminder that Xbox's 2026 lineup is less concrete than Microsoft would like. Most of these games are coming, but the specifics are blurry.

What matters about Forza Horizon 6: it's not going to save Xbox hardware sales. Racing game enthusiasts already know Forza is the genre's gold standard. Everyone else has already decided whether open-world racers interest them. A new setting doesn't change fundamental appeal.

But it does reinforce that Xbox Game Pass has real blockbuster content. Forza Horizon is the type of game subscription owners use. It doesn't need to be system-exclusive. It just needs to exist for Game Pass subscribers. That's the model now.

Fable's Return: British Humor, Delayed Expectations, and Redemption

Fable is coming back. After 15 years, Lionhead's fantasy RPG franchise is getting rebooted by Playground Games. The studio that perfected open-world racing is now trying to capture the quirky, darkly humorous fantasy adventure that made the original Fable special.

That should be concerning. It's not.

Playground Games has proven capable of understanding genre conventions and then breaking them thoughtfully. Forza Horizon works because it respects racing traditions while ignoring the sim-racing gatekeeping. Fable needs the same treatment: respect the original's character-driven storytelling and British comedy while modernizing the systems.

What we've seen so far: not enough. There's been no gameplay blowout like Bethesda showed for Starfield, or what Clockwork Revolution demonstrated with its detailed systems showcase. Fable has shown tone, setting, and character design. No actual gameplay.

That's a problem for 2026 expectations. Fable has been delayed multiple times already. Fans have heard "it's coming soon" for years. A vague tone trailer in late 2025 followed by silence until 2026 release? That's a recipe for either brilliant surprise or spectacular letdown.

Here's why Fable actually matters: it's not a franchise anyone expected to return. Unlike Halo or Gears, Fable wasn't killed by poor execution. Lionhead Studios was shut down in 2016. Microsoft let the IP sit dormant. Reviving it required not just development resources, but faith that the original games still meant something to players.

If Fable lands, it proves Microsoft can resurrect legacy franchises thoughtfully. If it doesn't, it suggests the studio system overhaul Microsoft has been conducting is leaving them without the institutional knowledge to make character-driven games.

The game's British humor is critical here. Fantasy games have gotten grimdark and serious. Fable was silly. It was weird. The original game had a pimped-out chicken pet as a legitimate quest reward. Modern game design trends toward gravitas. Fable's strength was irreverence. Playground Games either captures that, or they make a technically competent fantasy game that misses what made Fable special.

Gears of War E-Day: Prequel Storytelling and Franchise Fatigue

Marcus Fenix is back. But not the version you remember. Gears of War: E-Day takes the franchise back to its beginning, showing the original Locust invasion that sparked the entire conflict.

Prequels are tricky. They've got to explain things without overdoing exposition. They've got to introduce stakes that matter even though you know the historical outcome. They've got to justify their existence beyond brand extension.

Gears of War has been running since 2006. That's 18 years of chainsaws and Locusts. The core audience has either aged out or moved on to other franchises. E-Day needs to appeal to that audience while also introducing newer players to the universe.

The challenge: Gears' identity is wrapped up in Marcus Fenix specifically. A young version of Marcus, or a Marcus in training, lacks the gravitas the character built over five games. The Gears franchise succeeded because its characters mattered. E-Day has to walk that line between familiarity and fresh perspective.

What this actually signals: Microsoft is protecting its heritage franchises across Game Pass. Whether E-Day is a critical hit or a moderate success, it'll launch day-one on subscription. That's the guarantee now. Game Pass isn't the B-tier option. It's where blockbuster campaigns premiere.

The arrival of Halo on PlayStation and Forza Horizon 6 in Japan are expected to have the highest impact in 2026, marking significant shifts in gaming strategies. (Estimated data)

Call of Duty Modern Warfare 4: Annual Releases and the Franchises That Won't Die

Call of Duty is getting a new mainline entry in 2026. Modern Warfare 4, based on leaks. Black Ops is taking a break. The franchise is shifting its release pattern away from strict annual same-franchise installments.

This matters because Call of Duty used to be the gaming industry's equivalent of an annual franchise film release. Same time every year. Slight improvements. Massive sales. That model is breaking. Players are fatigued. Development studios are fatigued. The multiplayer landscape has fragmented.

Modern Warfare's return signals Activision's strategy: cycle through prestige subtitles while developing multiple games simultaneously. This is actually more sustainable than annual releases, even if it looks less exciting on paper.

The real question: does Call of Duty still matter to console sales? GTA 6 is launching on PlayStation first (with Xbox port likely delayed). That's the marketing juggernaut of 2026. Call of Duty exists as a comfort food franchise. It'll sell millions. It'll be on Game Pass. But it's not going to convince anyone who doesn't already want Xbox to buy one.

World of Warcraft Midnight: Blizzard's Expansion and the Subscription Model

Activision Blizzard is having a 2026. World of Warcraft's Midnight expansion, Diablo IV's Lord of Hatred DLC, the return of BlizzCon, and Call of Duty all launching means Microsoft's biggest acquisition is finally justifying the price.

World of Warcraft has been controversial. The Activision scandal hurt perceptions. Player confidence wavered. But the game still has millions of active subscribers. Midnight is designed to prove that WoW still has stories worth telling and systems worth refining.

For Microsoft, this matters because it validates subscription access to premium MMO content. Game Pass Ultimate will include World of Warcraft. That's a game that people pay

Overwatch 2 has actually been winning back player trust after a rough launch. Blizzcon's return, combined with WoW and Diablo updates, signals Microsoft intends to use Blizzard properties as anchors for Game Pass Premium tier.

The Game Pass Gamble: 75+ Games and the Math That Doesn't Work

Microsoft promised game density on Game Pass. 75+ new games per year, with heavy first-party and third-party day-one releases. 2025 showed the problem with that promise.

Clair Obscur: Expedition 33 and Hollow Knight: Silksong were excellent. But they were islands in a sea of mediocrity. Independent games, ports of five-year-old titles, games nobody asked for. When you're promising 75+ games annually, you're either publishing quantity with sacrificed quality, or you're padding the numbers with obscure releases.

Game Pass works when subscribers feel discovery. When they find a game they wouldn't have otherwise tried and it becomes their favorite. But that requires curation. It requires editorial taste. Netflix figured this out. You need good original content, but also strategic licensed content that justifies the subscription.

Xbox Game Pass is struggling with that balance. The price hike from

2026 will reveal whether Microsoft can sustain Game Pass or whether it needs restructuring. If Fable, Starfield's PlayStation port, and the other major releases don't drive subscriber growth, expect Game Pass to get more expensive or lose its day-one release guarantees.

Estimated data suggests significant improvements in Starfield's features for the PlayStation release, particularly in planetary exploration and graphics.

The Hardware Crisis: Why Series S Pricing Undercuts Xbox's Entire Strategy

The Xbox Series S now costs roughly the same as a PlayStation 5 in many regions. It's less powerful. It has fewer games. It has fewer exclusive titles. The value proposition has inverted.

Microsoft didn't want this. The Series S was supposed to be the affordable entry point, the way to get players into the ecosystem at $300. It became a legacy product in a faster console generation than anyone anticipated. The Series S spec sheet became insufficient within three years.

This is the core problem facing Xbox in 2026. You can't charge PS5 prices for inferior hardware and expect market leadership. The psychology doesn't work. Consumers understand value ratios. They know what they're getting. When the cheaper console costs the same, players default to the platform with more games.

Microsoft's theoretical solution: don't sell consoles, sell Game Pass and Game Pass is the ecosystem. But that only works if Game Pass has enough exclusive, high-quality content that the lack of hardware differentiation doesn't matter. They haven't achieved that yet.

The pro move for Microsoft: either discount Series S aggressively or kill it and focus Series X as the premium option. Instead, they've left it in pricing limbo where it makes no one happy.

Next-generation hardware rumors suggest a more PC-like, storefront-agnostic console. Imagine a box that can access Game Pass, Steam, Epic, and eventually PlayStation titles through subscription or purchase. That's not a console in the traditional sense. That's a platform.

If that's the direction, 2026 becomes the bridge year. Current generation Xbox exists as the legacy product while Microsoft experiments with the future.

Third-Party Partnerships: Where Sony's Marketing Rights Matter

Sony locked down marketing rights for GTA 6. That sounds arcane, but it's massive. Every GTA 6 commercial, every streaming showcase, every influencer partnership: PlayStation logo first. That creates perception ownership.

When casual players see a TV ad for GTA 6 with the PlayStation button, it creates assumption that the game is "better" on PS5. It's not. It's functionally identical. But perception drives behavior. That single marketing deal could swing tens of millions of console purchase decisions.

Microsoft can't compete on marketing for third-party blockbusters. They don't have the negotiating leverage Sony does. Instead, they're trying to own the subscription layer. If GTA 6 doesn't appear on Game Pass on day one (it won't, licensing would be impossible), then Microsoft loses that narrative edge.

Pragmata, Resident Evil Requiem, 007 First Light: all coming to multiple platforms. None have exclusive marketing with Xbox. Microsoft will get these games, but without the cultural momentum Sony is building.

This is how console wars actually play out now. Not on exclusive games, but on ecosystem perception. Which platform feels like the future? Which one has the games you want to play?

Xbox's answer is increasingly: it doesn't matter what platform. Play on whatever you want. Game Pass connects you across devices. That's either visionary or a surrender of hardware ambitions depending on your perspective.

The Next Generation Question: Will There Even Be a Console?

Rumors about next-generation Xbox suggest something radical: it might not be a traditional console. It's supposed to feature multiple storefronts, giving access to PC titles from various platforms, and eventually allowing access to third-party content.

That's not a console. That's an open platform.

The theoretical advantage: console wars become meaningless if you're not actually locked into exclusive ecosystems. The disadvantage: you stop having a reason to buy proprietary hardware.

Microsoft might be moving toward a world where they don't care whether you buy Xbox hardware. They want you buying Game Pass on PC, on console, on phone, on whatever. The hardware becomes an access device, not the product itself.

This is both logical and devastating. Logical because game companies make money on software, not hardware. Devastating because consoles are built on brand identity. Xbox fans want to be Xbox fans. Treating hardware as interchangeable commoditizes that loyalty.

Nintendo proved the opposite: distinctive hardware creates market differentiation. The Switch exists because Nintendo needed something unique. Microsoft is moving toward not needing that.

2026 won't announce next-gen console hardware. But the strategy hints will become clear. If Microsoft commits to multiple storefronts and cross-platform compatibility, the console wars as we know them are over.

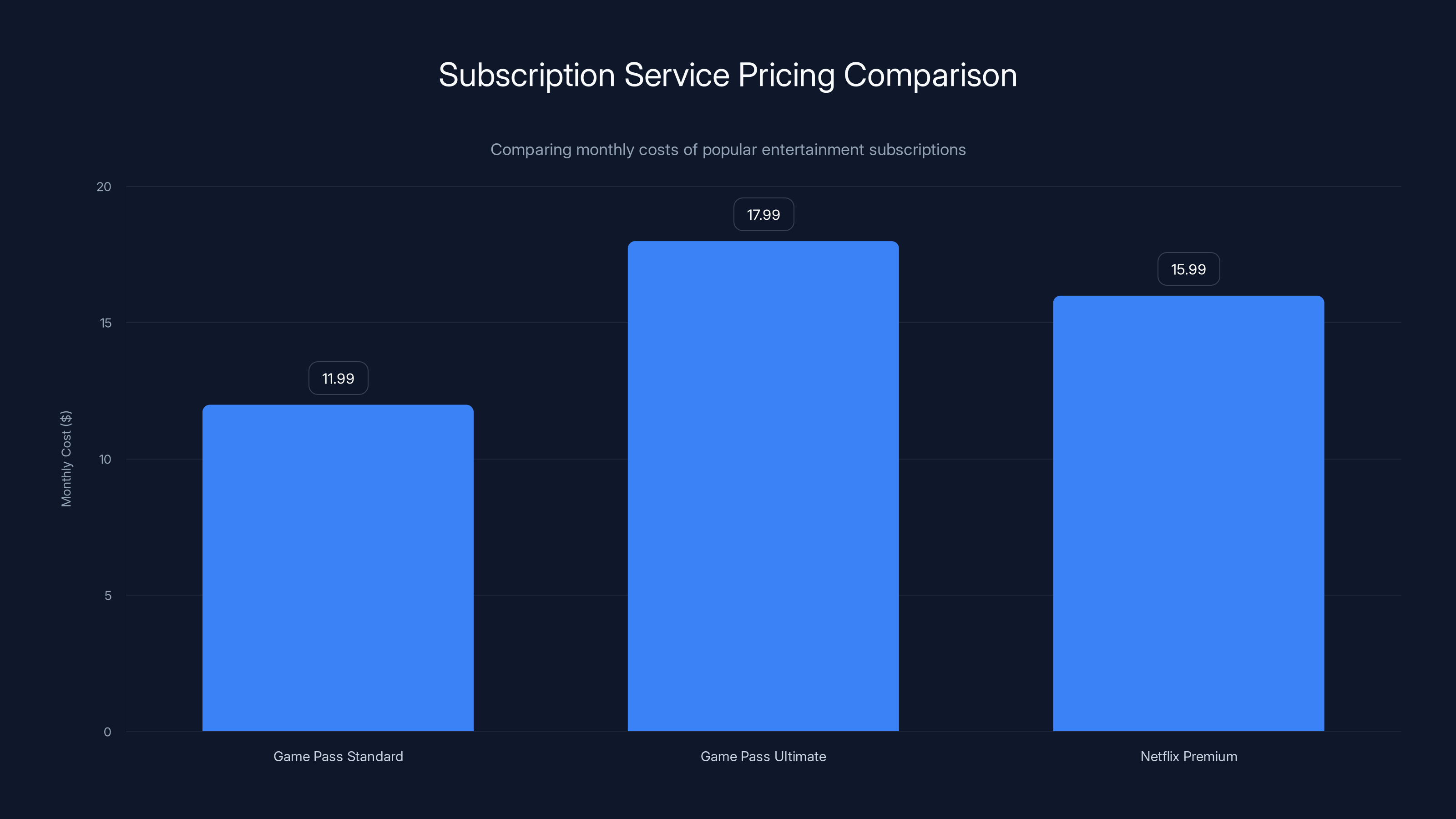

Game Pass Ultimate is the most expensive at

First-Party Development and the Studio Shutdowns That Haunt 2026

Microsoft shut down entire studios in 2024 and 2025. Tango Gameworks, Arkane Austin, other teams scattered. The Perfect Dark reboot got cancelled. Players noticed. Developers noticed more.

This shapes 2026 because it means the games Microsoft is releasing aren't necessarily the games they're proudly building. They're the projects that survived the restructuring. That's fine for established franchises like Fable or Gears, but it creates uncertainty for new IP.

Xbox's strength used to be fresh franchises. Halo, Gears, Forza—these started as new ideas. Microsoft had the money to take risks. Studio consolidation and layoffs suggest risk appetite has declined.

For 2026, this means relying on legacy properties and Bethesda's catalogue. No major new IP is expected. That's not necessarily bad. Fable is new even if it's not new. But it signals Microsoft is playing it safe.

The studio shutdown controversy also affects hiring and morale. Developers wondering if their project will survive aren't going to deliver their best work. It takes time to rebuild institutional confidence.

By 2026, Microsoft will have had a year to stabilize. New leadership, clear direction, renewed commitment to specific projects. The question is whether that translates to better games or just better messaging.

The PlayStation Advantage: Why Sony's 2026 Strategy is "More of the Same"

Sony is coasting. Not strategically, just relatively. PlayStation 5 is still dominating hardware sales. Exclusive games keep coming. The marketing machine runs smoothly.

Sony doesn't need to disrupt 2026. They can release God of War: Ragnarok DLC, new Spider-Man content, and let multiplatform blockbusters like GTA 6 drive hardware sales through their exclusive marketing.

This is the position Microsoft wants to be in. Stable, confident, letting the market work for you. Instead, Microsoft is making radical moves because the market isn't working for them.

By 2026, the difference between the two strategies will be visible. Sony is building momentum. Microsoft is redefining what momentum means.

The Content Creation Ecosystem and Streaming Implications

Content creators shape gaming perception as much as traditional media. Twitch, YouTube, TikTok: these platforms drive what games matter culturally.

Halo on PlayStation means Halo streamers gain access to millions of new viewers. Starfield on PlayStation expands the audience that experiences that game. From a content ecosystem perspective, cross-platform parity serves Microsoft's interests. Everyone talks about the same games.

But it also dilutes platform identity. If you can watch Halo on a PlayStation streamer's channel, does it matter which console you own? The answer is no, until multiplayer crossplay starts feeling essential.

Xbox Game Pass could own content creation if the library had enough killer exclusive content. Right now, the ecosystem is fragmented. Streamers play whatever's popular. That's usually multiplatform.

2026 will reveal whether exclusive content can still drive viewership in an era where everything gets ported eventually.

Estimated data suggests that after Halo's multiplatform release, Xbox will still hold a significant share, but PlayStation will capture a substantial portion of the player base.

Pricing, Value, and the Subscription Sustainability Question

Game Pass went up in price. Xbox Game Pass Standard is now

That's premium pricing for a subscription service. Netflix is $15.99 for their highest tier. For that price, Microsoft needs to prove Game Pass provides better value than Netflix or other entertainment subscriptions.

The problem: Netflix has global content libraries. Game Pass has games, which require more development time and resources to produce. Netflix can refresh content constantly. Game Pass has major releases maybe monthly, with fillers between.

Microsoft's bet is that gaming audiences value quality over quantity and will pay more for access to day-one AAA games. If 2026 doesn't deliver on that value consistently, expect price pressure or subscription restructuring.

The dangerous precedent: subscription fatigue is real. Players are canceling Game Pass between games. They're checking the monthly additions and unsubscribing if nothing interests them. That's not sustainable long-term. Subscriptions require habitually engaged users, not casual dippers.

Regional Variations and Global Market Dynamics

Xbox's challenge isn't uniform globally. In Japan, Nintendo dominates. PlayStation leads Europe. Xbox is consistently third in most regions except North America.

Forza Horizon 6 heading to Japan makes sense strategically, but it won't move Nintendo's market share significantly. PlayStation players will play it, but Xbox hardware won't benefit.

Microsoft's global strategy seems to be: mobile, PC, and cloud for emerging markets. Console placement in mature markets is secondary. Game Pass on phones and subscription access on non-proprietary hardware becomes the global expansion strategy.

2026 will test whether that approach works or whether regional gaming preferences remain stubbornly tied to console ecosystems.

The Competitive Landscape: Nintendo, Mobile, and Cloud Gaming

Xbox isn't just competing with PlayStation anymore. Nintendo's Switch is still selling millions annually. Mobile gaming dominates by playtime. Cloud services like GeForce Now and PlayStation Plus Premium are fragmenting the market.

Microsoft's response has been to play everywhere. Game Pass on PC, phone, cloud. Eventually, Game Pass on web browsers. The strategy is not dominance on one platform, but presence everywhere.

That's smart market strategy. It's also the opposite of traditional console wars logic. Nintendo and Sony are still fighting for hardware supremacy. Microsoft is surrendering hardware and betting on software distribution.

By 2026, this will either look visionary or desperate depending on Game Pass subscriber growth.

What 2026 Really Means: The End of Console Wars as We Know Them

The biggest story about Xbox in 2026 isn't any single game. It's the fundamental shift in how console manufacturers think about business.

Xbox is transitioning from "platform to own" to "service to subscribe." That's not unique anymore. PlayStation is doing it too. But Xbox is doing it because they have to, while PlayStation is doing it because they can.

The difference matters. When you're transitioning because market position demands it, you make different choices than when you're adding a subscription layer on top of hardware dominance.

By 2026, players will start understanding that the console they buy doesn't lock them into an ecosystem anymore. A PlayStation can access Xbox content through Game Pass. An Xbox can play PlayStation exclusives eventually. A PC can access everything.

That's either the death of console wars or their complete transformation. Microsoft is betting on the latter.

FAQ

Will Halo multiplayer come to PlayStation in 2026?

The initial announcement covers only Halo: Combat Evolved's campaign. Multiplayer is almost certainly coming to PlayStation by mid-2026 or later, as it would significantly boost player populations and ensure the franchise's long-term health across both platforms.

Is Starfield worth waiting for on PlayStation?

If you don't own Xbox or Game Pass, waiting for the PlayStation version makes sense. The overhaul will include optimizations for PS5 hardware, likely better performance targets, and potentially DualSense feature integration. However, if you have Game Pass access now, the current Xbox version is absolutely playable.

When exactly will Fable launch in 2026?

Official release dates haven't been confirmed, but industry patterns suggest a late spring or summer 2026 release. Playground Games has learned from multiple delays that overpromising on timelines damages credibility, so expect a more cautious announcement closer to actual launch.

Is Game Pass Ultimate worth the price in 2026?

Value depends on your play habits. If you actively play 3+ games monthly and value day-one access to new releases, it's worth $17.99. If you're a casual player who finishes one game per season, individual purchases make more financial sense. Check the monthly additions before subscribing.

Will next-generation Xbox hardware launch in 2026?

Highly unlikely. Microsoft has suggested next-gen is being designed, but 2026 appears to be a bridge year for current-generation consoles. Expect announcements about next-generation architecture and strategy, but hardware won't ship until 2027 at earliest.

How does Forza Horizon 6's Japan setting compare to previous locations?

Japan offers untapped variety: mountain passes near Fuji, dense Tokyo metropolitan areas, rural countryside, and distinct automotive culture. It's visually distinct from Mexico (Horizon 5), Australia (Horizon 4), and Colorado (Horizon 3), offering fresh photography and environmental storytelling opportunities.

Should I buy an Xbox Series X in 2026 or wait for next-generation?

If you want to play 2026 exclusives like Fable or Gears of War E-Day, the Series X is the only option. If you're patient and primarily interested in third-party multiplatform games, waiting until 2027 for next-generation announcements might be smarter. Game Pass legitimizes current-generation hardware, so it's not a wasteful purchase.

What happens if Fable doesn't launch in 2026?

That would be catastrophic for Xbox messaging. Multiple delays have already strained credibility. If Fable misses 2026, expect Microsoft to fundamentally reconsider its first-party development strategy and possibly accelerate next-generation hardware announcements to refocus narrative away from current-generation failures.

Will Game Pass prices increase again in 2026?

Probably not. Microsoft raised prices aggressively in 2024-2025. Another hike would face massive player backlash during a period when they're struggling to prove value delivery. However, don't be surprised by tier restructuring that removes some benefits or adjusts day-one release guarantees to lower-priced tiers.

How does Xbox 2026 affect PC gaming and Game Pass for PC?

PC becomes increasingly important. Game Pass for PC is where Microsoft can leverage their Windows ecosystem strength. 2026 will likely see more exclusive optimizations, Play Anywhere cross-save features, and integration with Windows itself. PC players might actually get better value than console players.

Looking Ahead: What Xbox in 2026 Means for You

If you're sitting on an Xbox console wondering if 2026 justifies your hardware investment: Fable, Starfield's enhanced port, and Gears E-Day give you legitimate exclusives to play. Game Pass still offers decent depth. But the console feels like yesterday's technology marketed as today's solution.

If you're on PlayStation: Halo and Starfield bring some of Xbox's best content to your platform. You're not missing out. You're benefiting from Microsoft's ecosystem expansion.

If you're deciding which console to buy in 2026: the question isn't really about the console anymore. It's about which subscription service has content you want. That's a different decision than it was five years ago, and it favors whoever's willing to bend on exclusivity and embrace service access.

2026 won't announce the future. But it will clarify which companies understand that future, and which ones are defending yesterday.

Key Takeaways

- Halo and Starfield coming to PlayStation represent Microsoft's shift from platform exclusivity to service-based ecosystem strategy

- Game Pass pricing increases and unfulfilled content promises create subscriber fatigue that threatens long-term sustainability

- Xbox hardware pricing crisis makes Series S uncompetitive while rumors suggest next-gen will be multi-storefront PC-like device

- Fable's delayed return and studio shutdowns indicate Microsoft is playing it safe with legacy franchises rather than bold new IP

- Console wars are fundamentally changing as platforms converge toward subscription services and cross-platform accessibility

![Xbox 2026 Predictions: Halo on PlayStation, Fable Returns [2025]](https://tryrunable.com/blog/xbox-2026-predictions-halo-on-playstation-fable-returns-2025/image-1-1767019085463.jpg)