YouTube TV Custom Bundles: Breaking Streaming Costs Down [2025]

Introduction: The Great Streaming Realignment

Remember when streaming was supposed to be cheaper than cable? That promise feels ancient now. Over the past five years, we've watched an entire industry repeat the exact same cycle that made cable unbearable in the first place: start cheap, add content, raise prices, watch subscribers get frustrated, then wonder why people aren't happy anymore.

YouTube TV is trying something different. And it's worth paying attention to, because it might signal where the entire streaming industry is headed.

On February 9, 2025, YouTube announced a fundamental shift in how it sells live TV streaming. Instead of forcing everyone into a single

This isn't just a pricing change. It's an admission that the streaming wars broke something fundamental about how people want to consume media. And it's a genuine attempt to fix it.

But here's what makes this moment interesting: YouTube TV isn't alone in this struggle. The entire live TV streaming category is facing existential pressure. Cord-cutting accelerated during the pandemic, then plateaued as prices climbed and content fragmentation worsened. Consumers now face a choice that feels a lot like the cable dystopia they tried to escape. And that's driving a fundamental rethinking of how streaming services structure themselves.

This article breaks down what YouTube TV's new bundles actually mean, how they compare to competitors, why this happened now, and what comes next for an industry that's finally realizing that one-size-fits-all pricing doesn't work for anyone.

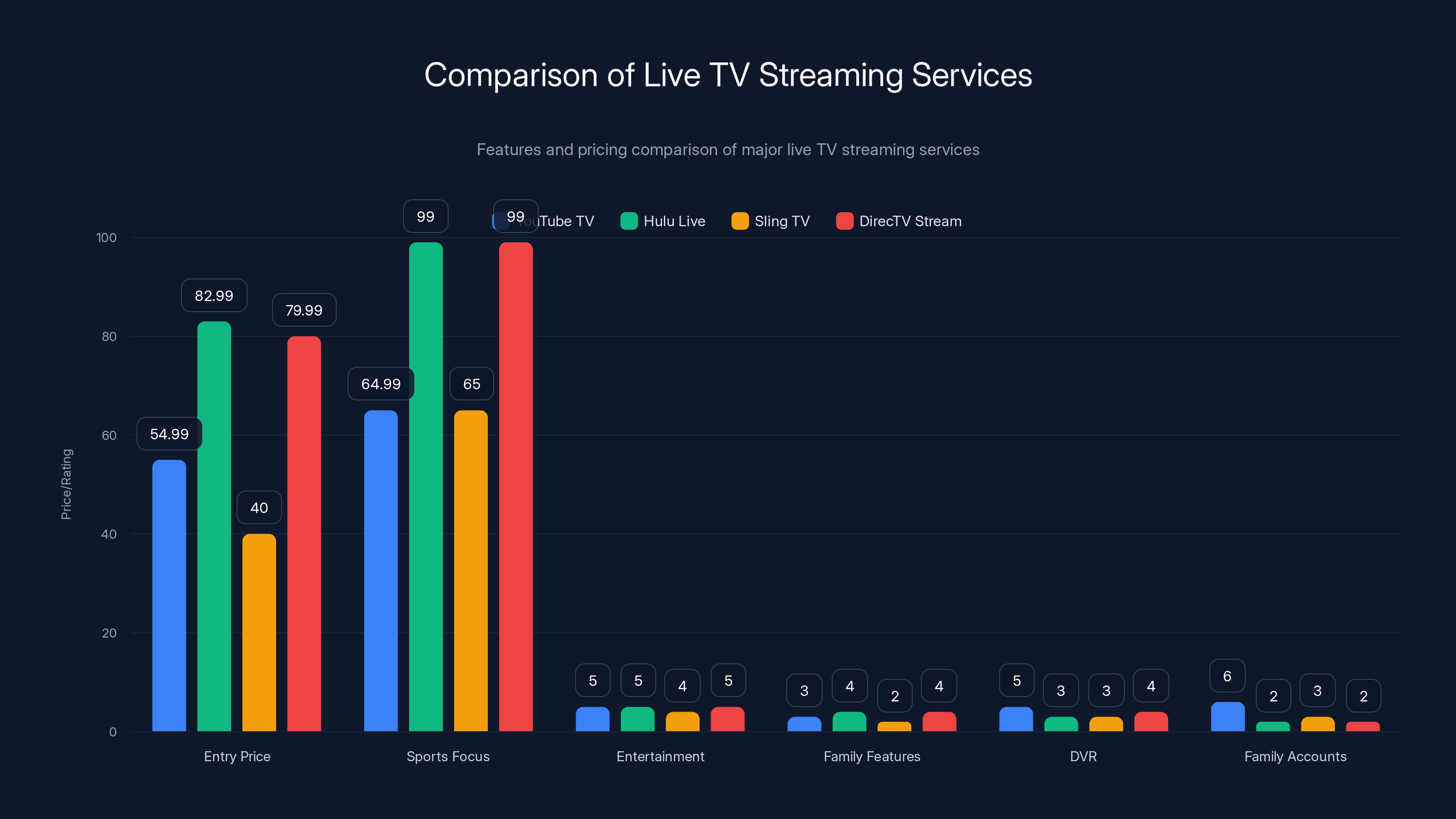

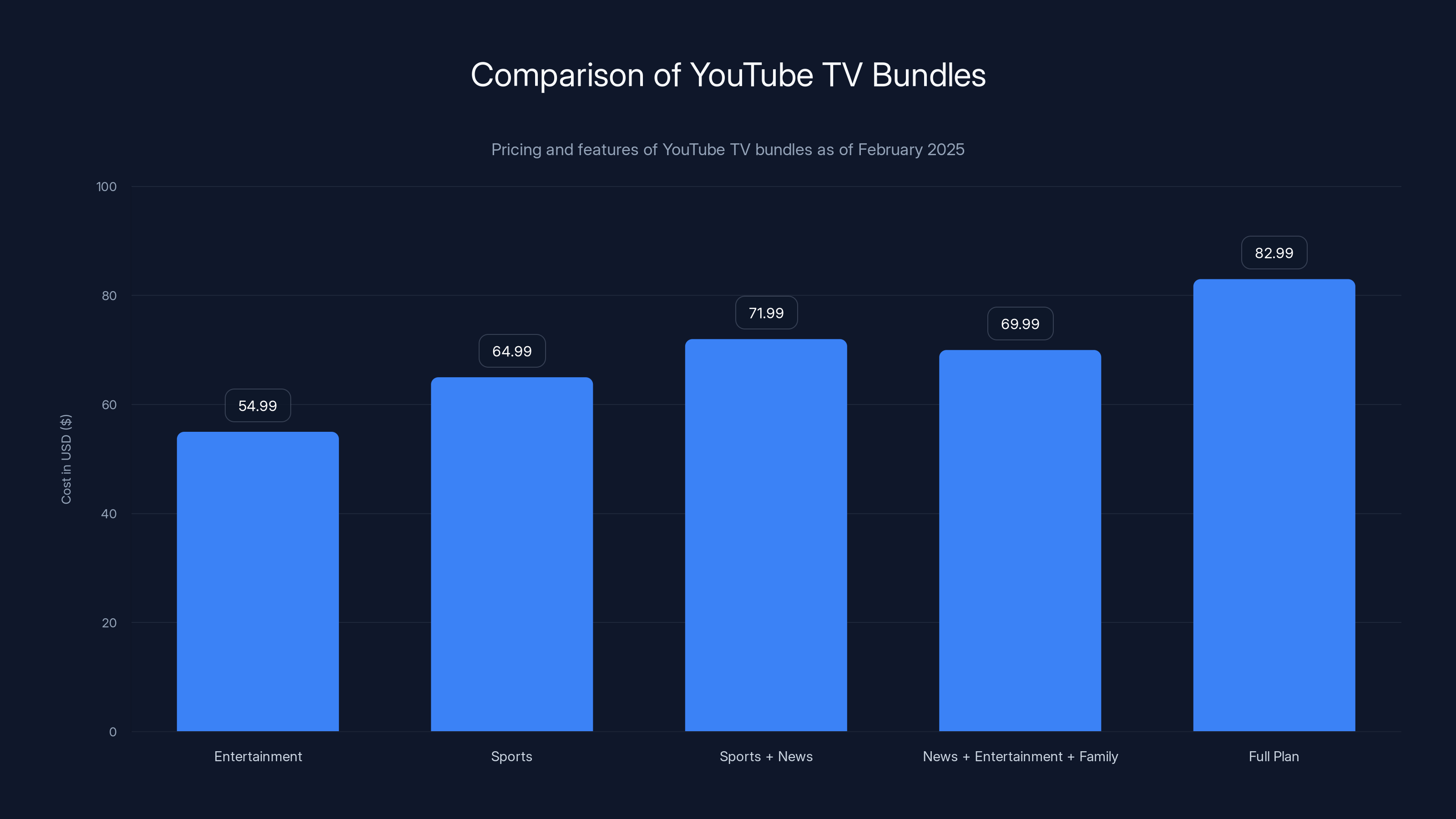

YouTube's pricing strategy uses psychological pricing to differentiate content value. Sports content is priced highest at

TL; DR

- YouTube TV launches customizable bundles starting at 82.99 for the full plan

- **Sports package costs 18 compared to the all-inclusive plan

- News + Entertainment + Family plan offers $69.99/month pricing with kids' content included

- Major broadcasters and networks are available across all tiers, with differentiation based on specialty channels

- Unlimited DVR, six family accounts, and multiview remain standard across all plans

- The shift reflects broader cord-cutting trends as consumers demand more flexibility and lower entry prices

- Competitive pressure from Sling TV, Hulu Live, and others forced YouTube TV to embrace à la carte pricing

- Bottom line: Streaming is finally learning the lesson cable never did—people want choice, not bloat

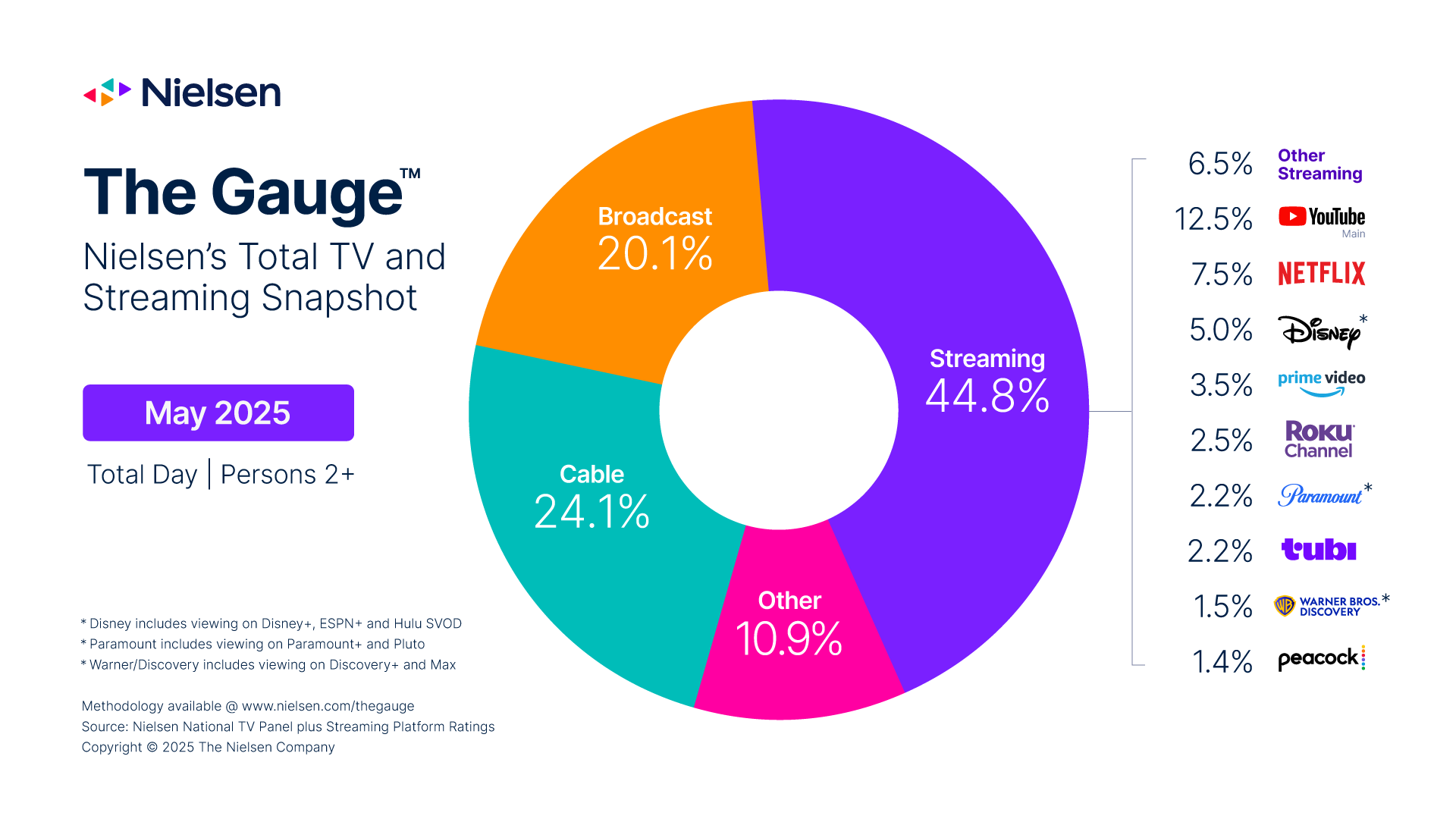

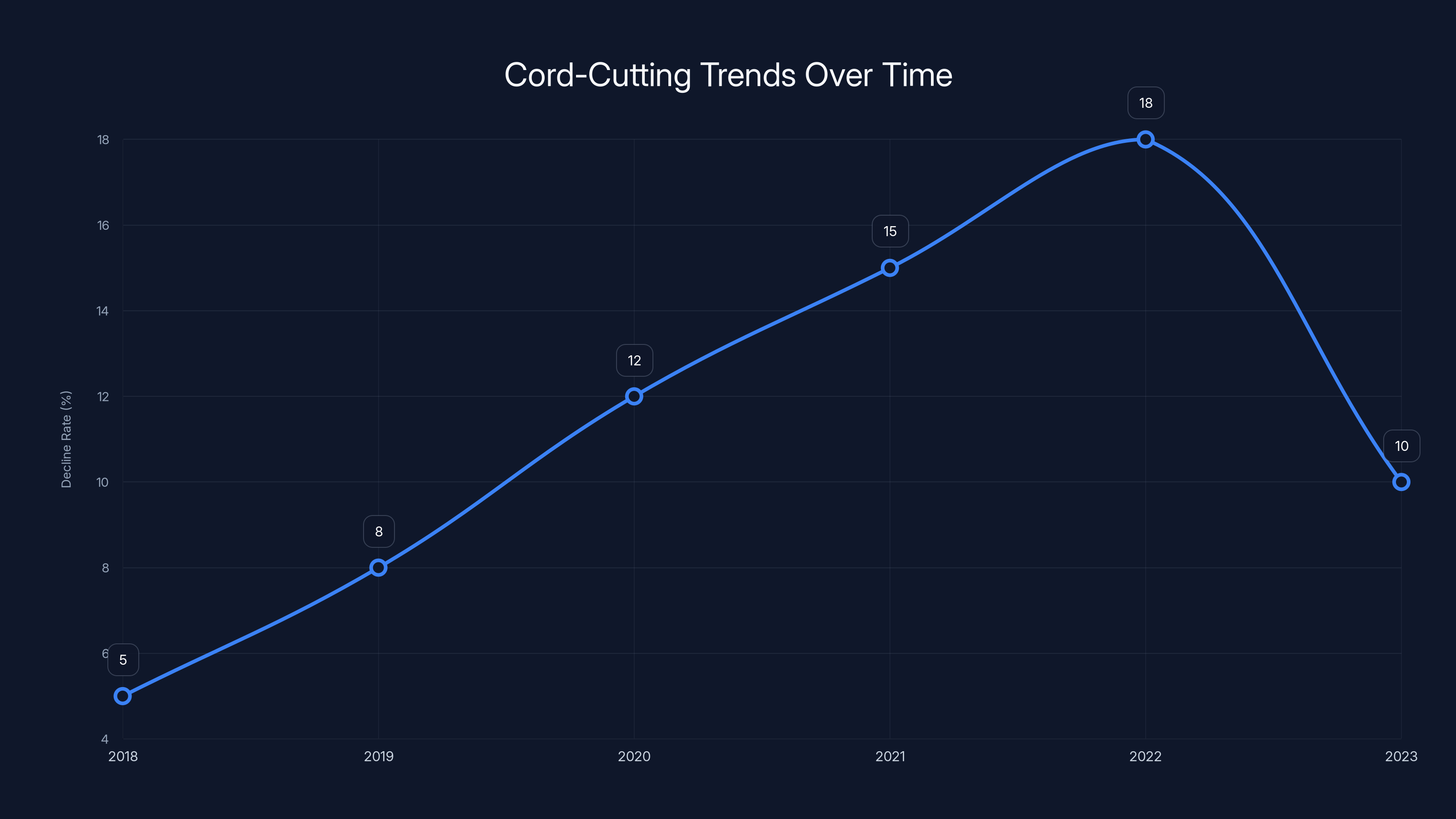

Cord-cutting peaked around 2022 with an 18% decline rate, but the decline has slowed in 2023 to 10% as the market matures and remaining subscribers have complex needs. Estimated data.

The Streaming Pricing Crisis Nobody Talks About

Let's start with the uncomfortable truth about streaming in 2025: it failed its original mission.

When Netflix launched in 2007, it charged

Then the networks figured out what they had on their hands.

By 2020, Netflix was charging

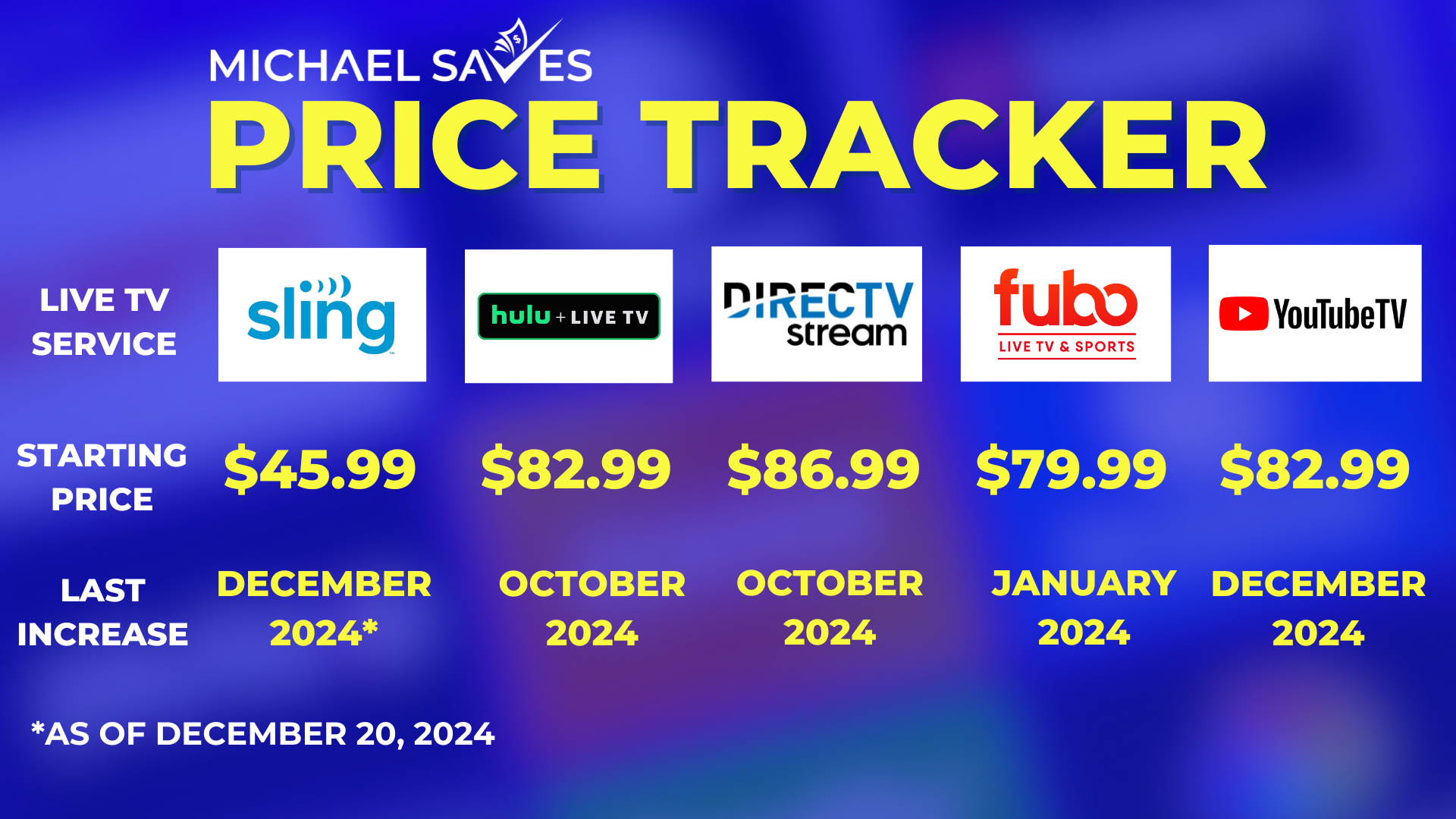

Live TV streaming—the category YouTube TV pioneered—faced an even sharper problem. These services need to license sports rights, news networks, and premium cable channels to be competitive. Those licenses are expensive. Really expensive. YouTube TV's $82.99 starting price reflected the brutal economics of live sports and breaking news.

But that price point had a problem: it was a hard barrier for casual viewers. Someone who just wanted sports or just wanted news looked at $82.99 and laughed. They'd stick with their cable subscription or find illegal streams. YouTube TV was optimizing for an impossible middle ground—not cheap enough to disrupt cable completely, but expensive enough to feel like a bad deal for anyone with specific interests.

Understanding YouTube TV's New Bundle Structure

Here's how YouTube TV's new tiered approach actually works:

The Four Main Tiers:

At the bottom sits the Entertainment plan for

The Sports plan at

Then there's the Sports + News plan for

Finally, the News + Entertainment + Family plan at $69.99/month packages news and entertainment content with kids' channels like Disney Channel, Nickelodeon, National Geographic, Cartoon Network, and PBS Kids. This is the family compromise tier—nobody has to argue about what's on.

Beyond these primary bundles, YouTube TV is offering 10+ additional combinations. The company also built in add-on flexibility. Want HBO Max? Add it. Need NFL Sunday Ticket? Available as an add-on. The architecture is explicitly designed around the idea that different people want different things.

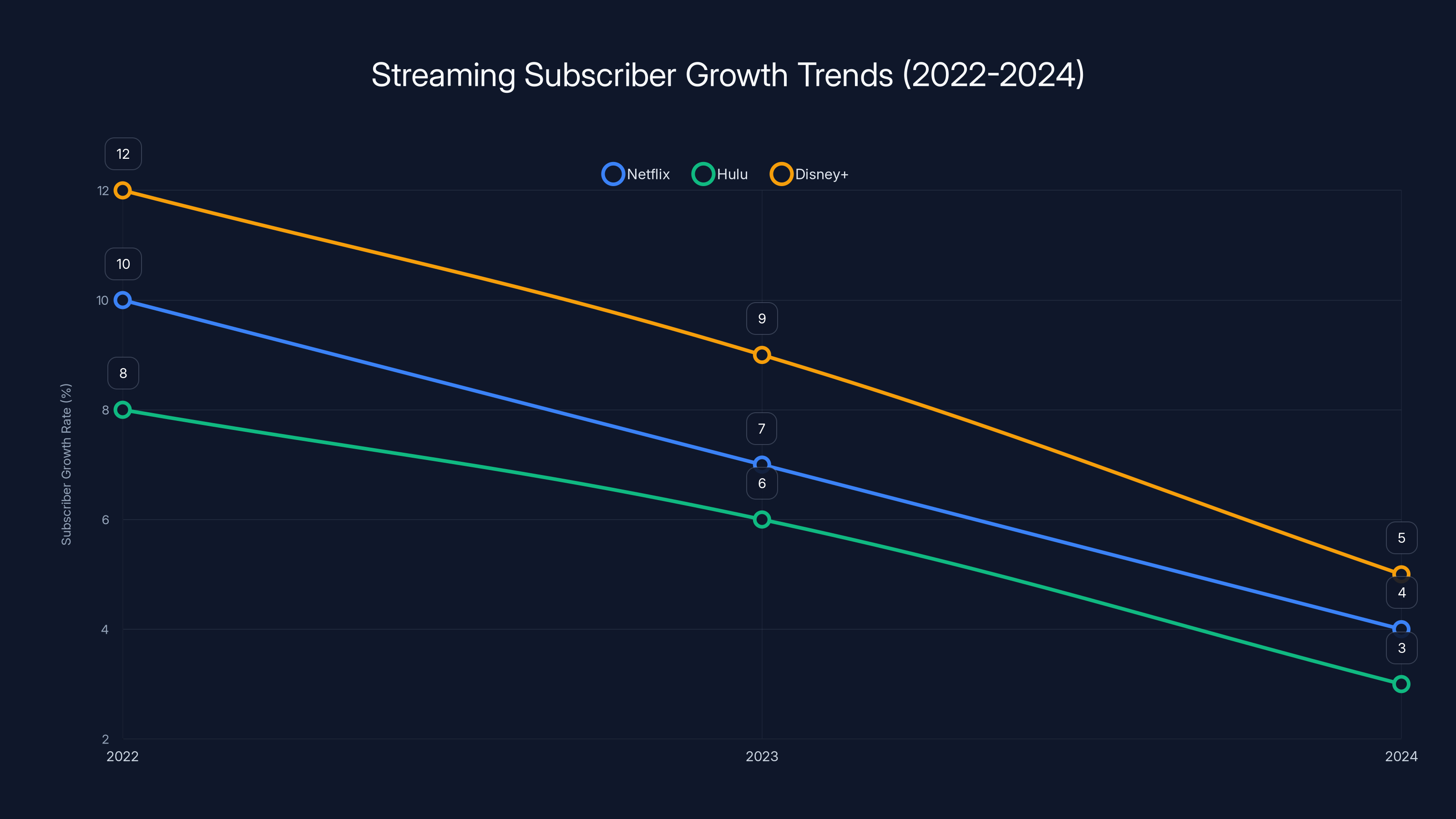

Estimated data shows a decline in subscriber growth rates for major streaming services from 2022 to 2024, highlighting the competitive environment YouTube TV faces.

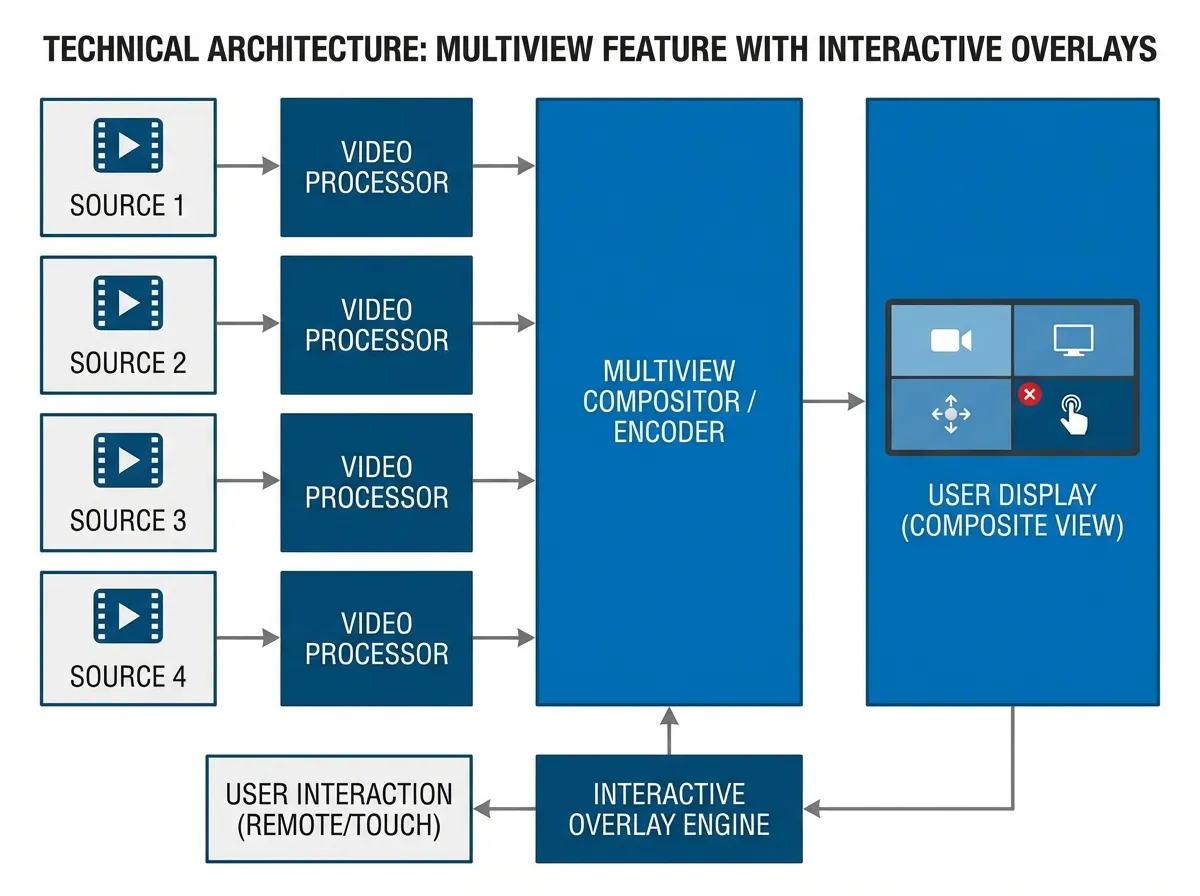

The Technology Behind Customizable Bundles

People don't realize how technically complex it is to offer custom bundles at scale. When you're dealing with licensing agreements from 100+ networks, each with its own regional broadcast rules, blackout restrictions, and contractual requirements, creating separate product tiers becomes a licensing and rights-management nightmare.

Each of YouTube TV's bundles has to map precisely to underlying licensing agreements. ESPN, for example, has different pricing tiers depending on whether you bundle it with news, sports commentary, or entertainment content. Regional sports networks have blackout rules that vary by geography. International rights differ from domestic. Suddenly you're managing hundreds of combinations, each with different legal and financial implications.

YouTube's approach here involves treating each bundle as a distinct product in their backend systems. Each bundle gets its own rights certification, licensing accounting, and delivery architecture. From a technology perspective, YouTube TV is essentially running multiple streaming services inside one interface.

The practical impact: the interface needs to elegantly present these choices without overwhelming subscribers. YouTube's design decision is to make bundle selection a relatively high-friction moment—something you actively choose once, then the system respects that choice. This prevents the common pitfall where customers accidentally downgrade themselves or constantly second-guess their selection.

This level of customization also generates enormous data value. YouTube now understands which combinations of content drive retention, which bundles have the highest cancel rates, and which add-ons generate genuine engagement versus impulse purchases. That data feeds back into product decisions, pricing optimization, and content acquisition strategy.

Pricing Psychology: Why These Numbers Exist

Notice something specific about YouTube's pricing:

First, they're all under

Second, the spreads are deliberate. Entertainment to Sports is a

Third, YouTube is using price as information architecture. By making Entertainment the cheapest tier, they're signaling that entertainment content is abundant and somewhat commoditized. Sports has the steepest per-item cost, reflecting that sports rights are genuinely expensive and licensors demand significant revenue share. News content sits in the middle—valuable but not as universally demanded as sports.

Fourth, the promotional discount strategy ("first three months at X% off" or "first year discounted 25%") is an acquisition funnel designed to convert hesitant customers. Someone thinking "Maybe

From a financial perspective, YouTube is optimizing for three competing objectives: (1) capturing price-sensitive customers who were priced out of the $82.99 plan, (2) maintaining revenue per subscriber across existing customers, and (3) maximizing net subscriber growth. These bundles let them pursue all three simultaneously.

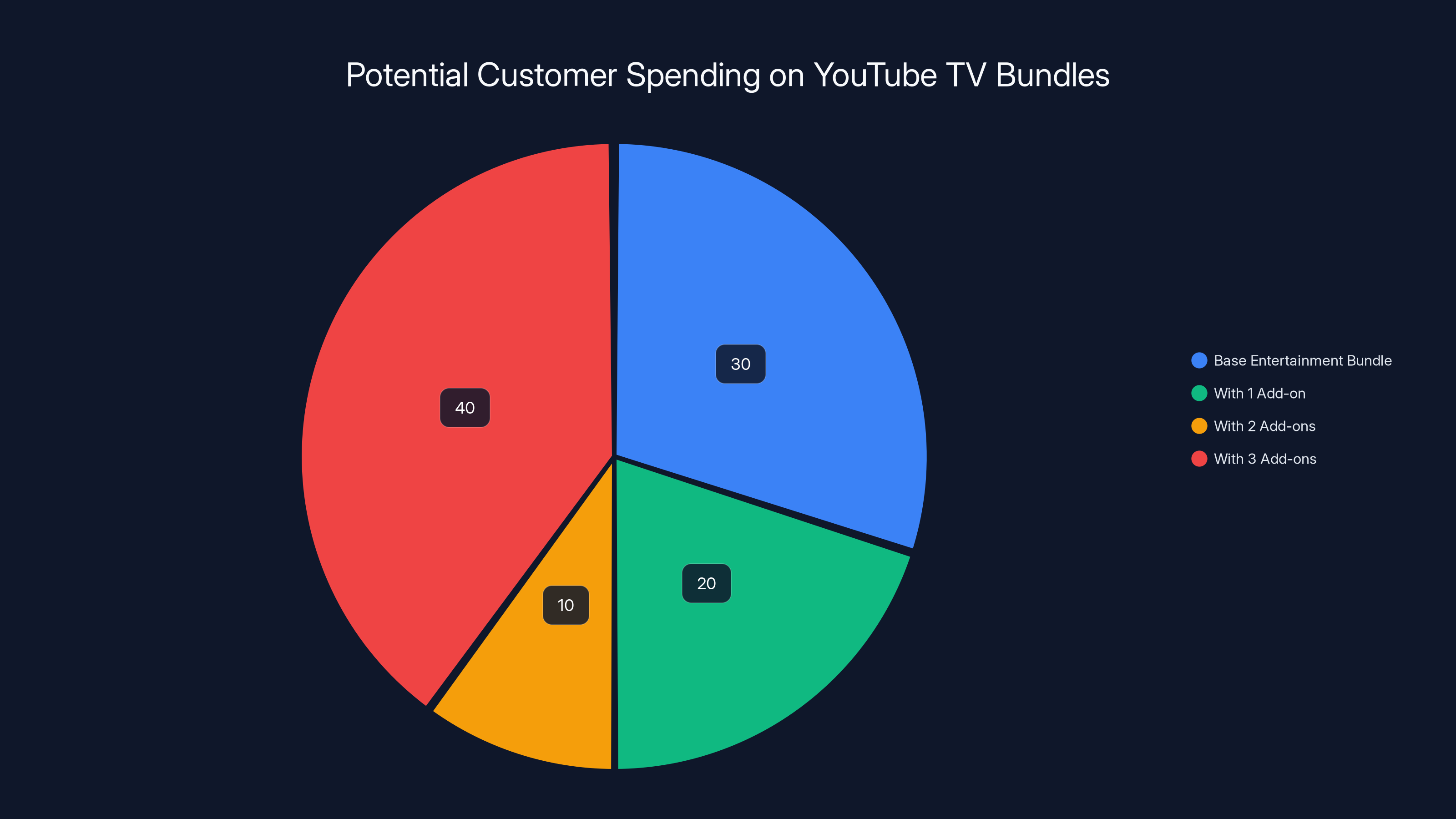

Estimated data shows that 40% of customers end up with three add-ons, increasing their monthly spend significantly beyond the base $54.99 bundle price.

How This Compares to Competitors

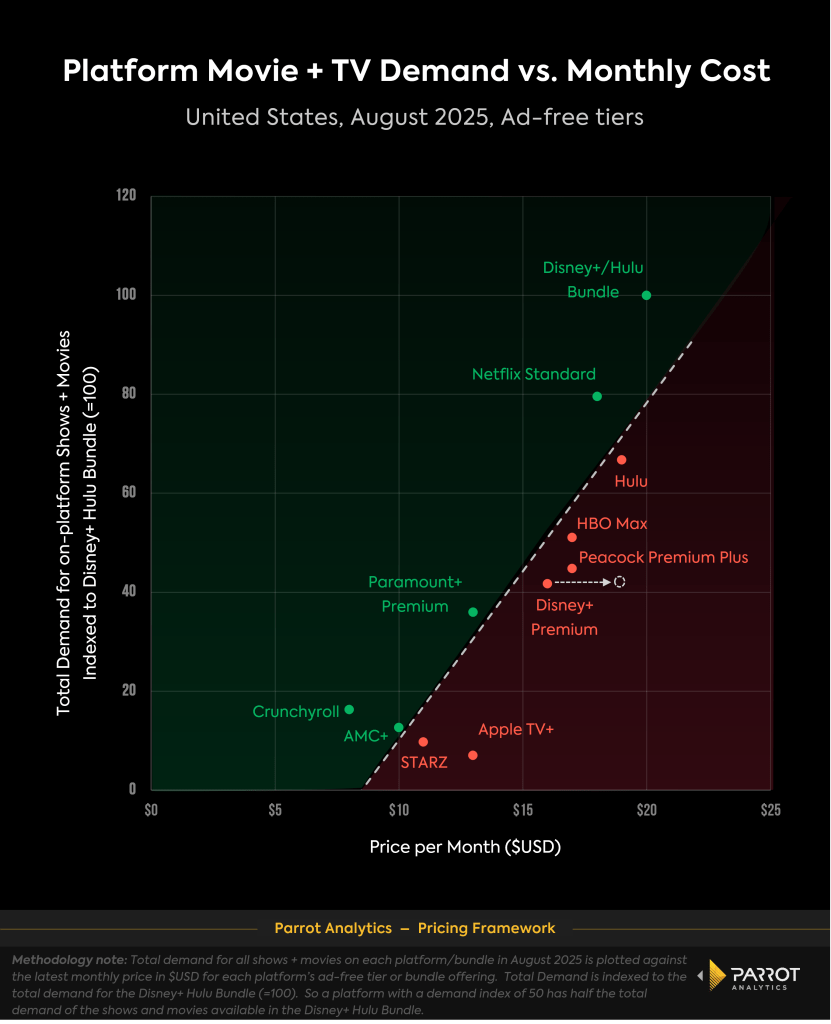

YouTube TV didn't invent customizable bundles. Sling TV launched in 2015 with an explicit à la carte philosophy—you picked a base package, then added channels as you wanted them. Hulu Live offers similar customization.

But YouTube TV's approach is different in execution. Most competitors use a "base + à la carte add-ons" model. You start at a lower price point, then build up. YouTube TV is using "preset bundles + add-ons." This is subtly but meaningfully different. The preset bundles make decisions easier for customers and reduce decision fatigue. Psychological research shows that people actually prefer having choices made for them, as long as the choices feel legitimate.

Hulu Live TV starts at

International competitors vary wildly. In the UK, Sky Sports offers sport-specific tiers but as add-ons to a base cable package. In Canada, Bell's Fibe TV uses similar bundle structures. What YouTube TV is doing isn't revolutionary globally—it's just that American streaming adopted bundling later than international competitors.

The competitive question here is whether YouTube TV's bundles will actually stick. Sling TV proved that customization is technically possible but challenging to execute. Customers often optimize poorly (choosing a bundle that seems right but missing something), then have to reconfigure, creating friction. YouTube's preset approach mitigates this by accepting that the company makes better bundle decisions than individuals do.

The Unlimited DVR and Family Account Advantage

One detail that's easy to gloss over but worth emphasizing: YouTube TV's bundles all include unlimited DVR storage and six simultaneous family accounts. These aren't premium add-ons. They're baseline features across all tiers.

This matters because it's a retention feature disguised as a functionality feature. Customers who use unlimited DVR (recording everything, culling later) become more engaged with the service. They're not just passively watching; they're actively managing their content. That's correlated with lower churn rates. Similarly, family account sharing creates household switching costs. Once your kids know how to navigate YouTube TV, switching becomes a family debate, not an individual decision.

Compare this to cable, where family accounts are standard but DVR storage is often capped at 500 hours or charges $5-10/month for unlimited storage. YouTube TV is saying: "Even on our cheapest tier, you get premium DVR." That's a psychological win that costs YouTube relatively little but feels enormous to customers.

The multiview feature—watching multiple channels simultaneously on a single screen—carries similar strategic value. It's used by maybe 10-15% of customers regularly, but those customers have incredibly high retention rates. They've integrated the service so deeply into their viewing habits that cancellation becomes unthinkable. It's the streaming equivalent of a cable box with a split-screen feature that almost nobody uses but everybody loves having.

YouTube TV offers the lowest entry price and competitive sports pricing, with strong DVR and family account features. Hulu Live and DirecTV Stream provide more comprehensive entertainment packages but at higher costs.

The Broader Cord-Cutting Landscape

YouTube TV's bundle strategy exists within a larger context of cord-cutting acceleration and plateau.

Peak cord-cutting hit around 2022-2023. During those years, cable subscribers were declining at an accelerating rate as streaming alternatives matured and more content became available online. But here's what's interesting: that decline has started to slow. The low-hanging fruit—people who wanted to cut cable—already cut it. What's left is more complicated: households that are economically sensitive to subscription costs, heavy sports viewers who often can't get complete content through streaming, and older demographics with cable habits but growing streaming interest.

YouTube TV's bundles are explicitly targeting this remaining audience. The company is saying: "We know you can't cut cable entirely because you need ESPN for football season. We know you can't give up your local news. But maybe you can give up the 40 channels you never watch." It's an honest market positioning.

The economics supporting this shift are real. The FCC has documented that cable's monopoly power in many markets meant consumers had no efficient way to optimize their spending. You had to buy a bloated bundle to get cable news, forcing you to subsidize 60 other channels you'd never touch. Streaming breaks that model, but only if streaming services offer genuine choice.

This is also a response to what economists call the "subscription paradox." Streaming was supposed to be cheaper than cable. Instead, the average household now pays for 4-5 streaming services monthly, often spending $50-75 total. They've implicitly reconstructed the cable bundle they were trying to escape. YouTube TV's bundles are an attempt to escape that trap for live TV at least.

The Launch Timeline and Rollout Strategy

YouTube is rolling these bundles out in waves, not as a hard switch. The company announced that bundles will be available "over the next several weeks." This staged rollout serves multiple functions.

First, it lets YouTube monitor adoption patterns and adjust based on real customer behavior. If 80% of conversions are going to Sports bundles, that tells the company something about their market positioning. If Entertainment bundles convert but have high churn, that indicates pricing issues. Staged rollout lets them adapt in real-time.

Second, it prevents the customer service nightmare of forcing all subscribers to choose a new tier simultaneously. Instead, YouTube can notify existing subscribers sequentially, letting them gradually understand their options. This reduces support escalations and improves the perception of the change. "YouTube is giving me options" feels better than "YouTube is forcing me to re-evaluate my subscription."

Third, the staggered timing lets YouTube's marketing and public relations team manage the narrative. A sudden announcement of budget cuts feels disruptive. A gradual rollout of new options feels like responsive product management.

For new subscribers, the bundles become the default experience. Existing subscribers get grandfathered into their current plans until they proactively switch or their accounts need renewal. This is the classic upgrade path that minimizes subscriber loss while setting new customers up for the company's preferred pricing structure.

The Entertainment bundle is the most affordable at

Economic Context: Why Now?

There's a reason YouTube TV made this move in February 2025. The economic environment shifted.

Consumer confidence has reached its lowest point in over a decade. People are anxious about labor market stability and concerned about inflation eating into discretionary spending. This isn't the environment where services raise prices. This is the environment where services compete on value and flexibility.

Streaming growth has also slowed. Netflix's subscriber growth in 2024 was measurably slower than 2023, which was slower than 2022. The easy growth is gone. Companies are now fighting over the remaining addressable market, and that means competing on price and customer experience instead of content breadth.

Simultaneously, sports streaming is becoming a viable category. Apple's deals with MLS, Amazon's Thursday Night Football contract, and the NFL's Open TV initiative all signal that sports are becoming streaming's killer app. YouTube TV needs strong sports positioning to remain competitive. The $64.99 Sports bundle is a direct response to this. If YouTube TV can't offer sports at a competitive price, they lose an entire customer segment.

The regulatory environment also shifted subtly. Consumer advocacy groups and state attorneys general have increased scrutiny of subscription dark patterns and surprise billing. Offering clear, simple bundles is good regulatory optics. It demonstrates that YouTube TV isn't trying to trap customers in expensive plans they don't need.

Finally, YouTube's parent company Google has renewed focus on profitability and unit economics. Streaming services that acquire customers at high cost but keep them at low revenue-per-user are being pressured to improve. YouTube TV's bundles are designed to improve customer lifetime value by better matching price to actual willingness to pay.

The Feature Differentiation Strategy

One interesting aspect of YouTube TV's bundle approach: the company is using network inclusion as the primary differentiator, not feature differentiation. All tiers get unlimited DVR. All tiers get family accounts. All tiers get multiview. The differences are purely about which networks you access.

This is actually a sophisticated strategy. Feature-based tiers (Standard gets 1 screen, Premium gets 4 screens) create pricing friction because customers feel punished for wanting features. Network-based tiers (You want ESPN? Sports bundle costs $64.99) feel more like selection than restriction. The customer is actively choosing what interests them, not being denied features.

It also reflects how streaming economics actually work. Licensing specific networks to include in specific bundles is complex, but it's a solved problem with decades of precedent from cable. Artificially restricting access to features just to create tier separation creates customer frustration.

There's also a content strategy buried here. By offering customized bundles, YouTube TV gains the ability to adjust which networks belong in which tiers as licensing agreements evolve. If a major sports network decides to go streaming-exclusive, YouTube can bundle it strategically. If a cable network loses relevance, they can phase it out of lower tiers without restructuring the entire product architecture.

Potential Customer Confusion and Adoption Challenges

Despite the thoughtful design, YouTube TV's bundles face real adoption challenges.

First, there's the switching friction problem. Current subscribers on the $82.99 plan who are happy with their service have almost no incentive to reconfigure. Even if a lower tier technically matches their needs, moving requires active choice and risk perception ("What if I downgrade and then miss something?"). The company estimates many current customers will simply stay on the full plan because it's easier.

This is actually beneficial for YouTube TV's revenue—higher-paying customers stick. But it does mean the revenue upside from this change is primarily from new customers, not existing subscriber optimization.

Second, there's the educational problem. Most cable customers don't know exactly which networks they watch. Suggesting they choose a $54.99 Entertainment bundle without understanding which networks are included requires significant research. YouTube's website will show bundle contents, but that's friction. Some customers will choose wrong, experience the "I regret this" moment, then have to reconfigure. That negative experience gets amplified on social media and review sites.

Third, there's the add-on temptation. Once a customer chooses the Entertainment bundle, YouTube will naturally suggest adding HBO Max (

This isn't necessarily deceptive—YouTube legitimately offers these add-ons as value-adds. But it does mean the advertised "$54.99" isn't the typical customer experience.

The Missing Piece: International and Regional Content

One aspect YouTube TV glosses over in its bundle marketing: what happens with regional sports networks and international content.

Most Major League Baseball games are distributed through regional sports networks owned by Sinclair Broadcast Group and Bally Sports. These networks have wildly different inclusion in cable packages depending on geography. YouTube TV has historically solved this by licensing broadly, ensuring most subscribers have access to their local teams.

But what happens when YouTube TV creates bundles? If you're in San Francisco on the Entertainment bundle, do you get local Giants games? The company hasn't publicly addressed this. It's likely that the Sports bundle guarantees full RSN access while other bundles get limited or no access. This creates a customer education problem: someone on the Entertainment bundle might purchase thinking they'll catch baseball games, then discover they need the Sports bundle to do so.

International content creates similar complexity. YouTube TV doesn't currently offer much international programming (it's primarily focused on North American content), but if the company wanted to expand, bundling becomes challenging. Do international Olympics broadcasts belong in the Sports bundle or Entertainment? If you add an International News bundle for CGTN or BBC News, how is that priced relative to domestic news?

These aren't simple problems. They're part of why most streaming services avoid regional customization entirely—it's complex, legally complicated, and difficult to explain to customers. YouTube TV's approach side-steps these issues but leaves real gaps in the product.

The Long-Term Industry Implications

What YouTube TV is doing isn't just a YouTube TV story. It's a signal about where the entire streaming industry is heading.

The experiment with all-you-can-eat streaming pricing has reached its conclusion. Netflix proved that millions of people will pay for unlimited streaming, but the content costs to make that worthwhile are astronomical. Studios can't keep licensing all their content to streaming services at the same bundled rates they used for cable.

This means we're moving toward a more complicated ecosystem:

- Customizable bundles will become standard for any service with diverse content (sports, news, entertainment mixed)

- À la carte pricing will emerge for niche content (premium sports, specific networks, exclusive shows)

- Tiered access will differentiate by features and simultaneous streams more than by which content is available

- Ad-supported tiers will expand to make $15-25/month pricing sustainable

- Micro-subscriptions will exist for single networks (ESPN+, Peacock+) that work alongside larger bundles

YouTube TV's experiment is testing which of these approaches actually work at scale. If the bundles succeed in converting price-sensitive customers while maintaining revenue-per-user, other services will rapidly copy. If bundles confuse customers or cannibalize higher-tier revenue, the industry will try different approaches.

The deeper implication: streaming is becoming less revolutionary and more evolutionary. It's adopting cable's complexity while hoping to maintain cable's customer satisfaction levels. It's a hard balance. YouTube TV's bundles are a sincere attempt to find it.

Comparing Services: Full Breakdown

Here's how YouTube TV's new structure compares to other major live TV streaming options:

| Service | Entry Price | Sports Focus | News Focus | Entertainment | Family Features | DVR | Family Accounts |

|---|---|---|---|---|---|---|---|

| YouTube TV | $54.99 | $64.99 | Included | Excellent | Basic | Unlimited | 6 |

| Hulu Live | $82.99 | $99+ | Included | Excellent | Good | 50 hrs | 2 |

| Sling TV | $40 | $55-75 | Add-on | Good | Add-on | 50 hrs | 3 |

| DirecTV Stream | $79.99 | $99+ | Included | Excellent | Good | 500 hrs | 2 |

YouTube TV's strategic positioning is clear from this comparison: lowest entry price for entertainment, competitive sports pricing, included DVR and family accounts. The trade-off is that Hulu Live includes Disney+ and ESPN+ in some tiers, creating ecosystem value YouTube TV doesn't match.

Recommendations for Different Customer Types

Sports Fans: The

News Junkie: The

Entertainment/Casual Viewers: The $54.99 Entertainment bundle is the value play. You get major networks, cable basics, and specialty channels without sports markup. This tier will probably have the highest growth because it's the lowest barrier to switching from cable.

Families with Kids: The $69.99 News + Entertainment + Family bundle bundles kids' content, which removes the need for a separate Disney+ or Nickelodeon subscription if you're willing to access kids content through YouTube TV.

Heavy Streaming Users: Consider whether you actually need YouTube TV or whether a combination of cheaper streaming services (Paramount+, Netflix, ad-supported Hulu, etc.) gets you to the same programming. YouTube TV costs start at $55 and trend upward with add-ons; other approaches might be cheaper.

Technical Execution and User Experience Considerations

From a product design perspective, YouTube TV's bundle approach creates several execution challenges the company needs to solve:

The Recommendation Problem: When subscribers are on the Entertainment bundle and ESPN broadcasts an important event, YouTube TV's recommendation engine needs to understand it shouldn't surface that content. More broadly, the UI needs to gracefully handle content the user's bundle doesn't include—showing it but explaining why it's not accessible, not burying it as if it doesn't exist.

The Search and Discovery Problem: What happens when someone searches for a specific show and YouTube TV needs to explain they don't have access because it's on a channel in a different bundle tier? This is friction. Well-designed streaming services reduce friction; poorly-designed ones create dead ends where users feel restricted rather than informed.

The Add-on Upsell Problem: YouTube TV will naturally recommend upgrading when users search for bundle-restricted content. That's product management 101. But aggressive upsells damage customer satisfaction. Finding the balance between "we're here to help you get what you want" and "we're aggressively trying to get you to spend more" is genuinely difficult. The companies that get this wrong end up with high retention but terrible word-of-mouth.

The Billing Clarity Problem: Split billing between base bundle and add-ons creates an itemized statement. Some customers love this transparency; others find it confusing. YouTube needs to ensure the billing experience reinforces the value story ("You're saving $18/month with our Sports bundle") rather than making customers regret their decision.

FAQ

What bundles does YouTube TV offer?

YouTube TV offers four primary bundles starting in February 2025: an Entertainment bundle at

How much does YouTube TV Sports bundle cost compared to the full plan?

The Sports bundle costs

Can I still get the full YouTube TV plan with all networks?

Yes, YouTube TV's original $82.99/month plan remains available. Existing subscribers can maintain their current plan or switch to a bundle if they prefer. The company is not forcing existing customers to move to bundles; it's offering them as an option for new subscribers and those seeking to reduce costs.

What streaming features are included in all YouTube TV bundles?

Regardless of which bundle you choose, all YouTube TV tiers include unlimited DVR recording, the ability to create accounts for up to six family members, multiview functionality to watch multiple channels simultaneously, and support for streaming on multiple screens. These premium features previously were only available on the full plan.

How does YouTube TV's pricing compare to cable television?

YouTube TV's bundles range from

Can I add channels or networks to my YouTube TV bundle?

Yes, YouTube TV offers multiple add-on options including HBO Max, NFL Sunday Ticket + Red Zone, and additional premium networks depending on your base bundle. Add-ons allow you to customize your bundle further after selecting a primary tier, though each add-on increases your monthly cost.

When does YouTube TV's bundle rollout happen?

YouTube announced bundles will roll out "over the next several weeks" starting in February 2025. The company is using a staggered rollout rather than immediately switching all subscribers. New customers will have access to bundles first, while existing customers on the standard $82.99 plan get the option to switch gradually.

Will my YouTube TV subscription cost increase if I stay on the full plan?

YouTube TV has not announced price increases for the existing full $82.99/month plan as part of this bundle launch. However, the company may adjust prices in future separately from bundle availability. Current subscribers should monitor their billing for any changes to their tier.

The Future of Streaming Customization

YouTube TV's bundle strategy represents a turning point in streaming maturity. For the first time, a major live TV service is acknowledging that one-size-fits-all pricing doesn't work. More importantly, it's betting that customers will embrace complexity if the payoff is real savings.

The test case now is adoption. Will customers actually switch from the $82.99 plan to lower tiers? Will the bundles reduce churn? Will the company maintain or improve revenue-per-user despite lower entry pricing? These metrics will determine whether other streaming services follow YouTube TV's path or stick with monolithic pricing.

What's certain is that the era of streaming as a simple alternative to cable is over. The new era is streaming as a legitimate but complex alternative that requires active decision-making. YouTube TV's bundles are an attempt to make that complexity feel like empowerment rather than burden.

The industry that revolutionized television by eliminating choice (Netflix's "watch anything anytime" simplicity) is now rebuilding choice back into the model. It's the natural evolution of a maturing market. Whether customers will view it as liberation or annoying optimization is the question YouTube's new bundles will help answer.

For now, if you're considering cord-cutting or looking to reduce your current streaming spend, YouTube TV's bundles are worth serious evaluation. The entry prices are genuinely competitive. The feature parity across tiers is better than competitors offer. And the staggered rollout gives you breathing room to decide without feeling pressured. Test a bundle for a few months. You can always add a higher tier later.

Key Takeaways

- YouTube TV now offers customizable bundles starting at 64.99 for Sports, versus $82.99 for the full plan

- All bundles include unlimited DVR, six family accounts, and multiview—no feature restrictions across pricing tiers

- Sports bundle saves 216 annually) compared to the standard plan while including ESPN, FS1, and all major sports networks

- Staggered rollout strategy lets new customers access bundles first while existing subscribers gradually transition and maintain current pricing

- Bundle structure reflects broader cord-cutting trends and consumer demand for flexibility, with lowest consumer confidence in 11+ years driving adoption

- YouTube TV bundles position between Sling TV's à la carte approach and Hulu Live's bundled model, offering preset combinations that reduce decision fatigue

- Industry implications suggest customizable bundles may become standard for streaming services with diverse content categories

Related Articles

- YouTube TV Custom Channel Packages & Pricing Guide [2025]

- YouTube TV $80 Discount: How to Get It Before 2025 Ends

- Watch Ski Jumping Winter Olympics 2026 Free Live Streams [2025]

- HBO Max UK & Ireland Launch [2025]: Complete Guide & Pricing

- HBO Max UK Launch Date, Pricing & How It Compares to Netflix [2025]

- HBO Max UK Launch 2025: Everything You Need to Know [2025]

![YouTube TV Custom Bundles: Breaking Streaming Costs Down [2025]](https://tryrunable.com/blog/youtube-tv-custom-bundles-breaking-streaming-costs-down-2025/image-1-1770653344497.jpg)