2026 Winter Olympics Memorabilia: The Explosive Secondary Market for Milano Cortina Collectibles

The 2026 Winter Olympics haven't even concluded, and a completely different competition is already underway. It's not about medals or world records, but something that hits the collector's heart just as hard: the hunt for exclusive, hard-to-find Olympic memorabilia. Right now, across platforms like eBay, Vinted, and specialty resale sites, people are paying eye-watering markups for official Olympic gear from Milano Cortina. We're talking about three, four, sometimes five times the original retail price.

This phenomenon isn't new, but the scale and speed at which it's happening in 2026 tell us something important about how collectibles, scarcity, and nostalgia intersect in the digital age. When the Games end, official merchandise dries up fast. Athletes, volunteers, sponsors, and attendees walk away with limited-edition items that were never meant to flood the market. What happens next? Those items become golden tickets on the resale circuit.

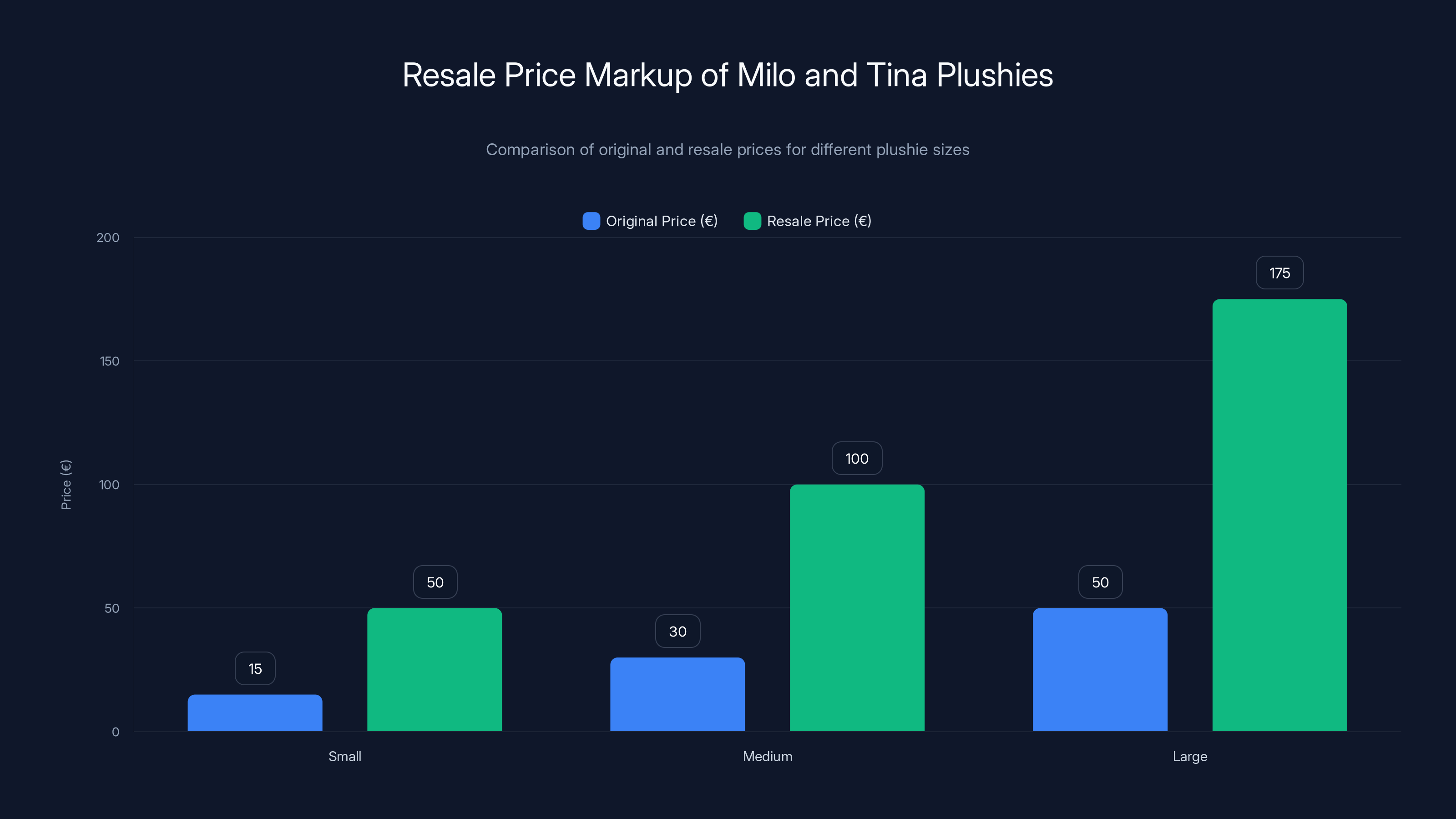

The data is striking. Mascot plushies that originally cost between €15 and €50 (roughly

This isn't just about a few enthusiasts willing to overpay. This is a real, functioning market with genuine supply constraints, established pricing tiers, and increasingly sophisticated buyer demand. The Milano Cortina Games have created what amounts to a secondary economy around Olympic memorabilia, complete with its own dynamics, patterns, and economics worth understanding.

TL; DR

- Mascot plushies (Milo and Tina) are selling for 3-4x original prices, up to €150-€200 (236) for larger versions

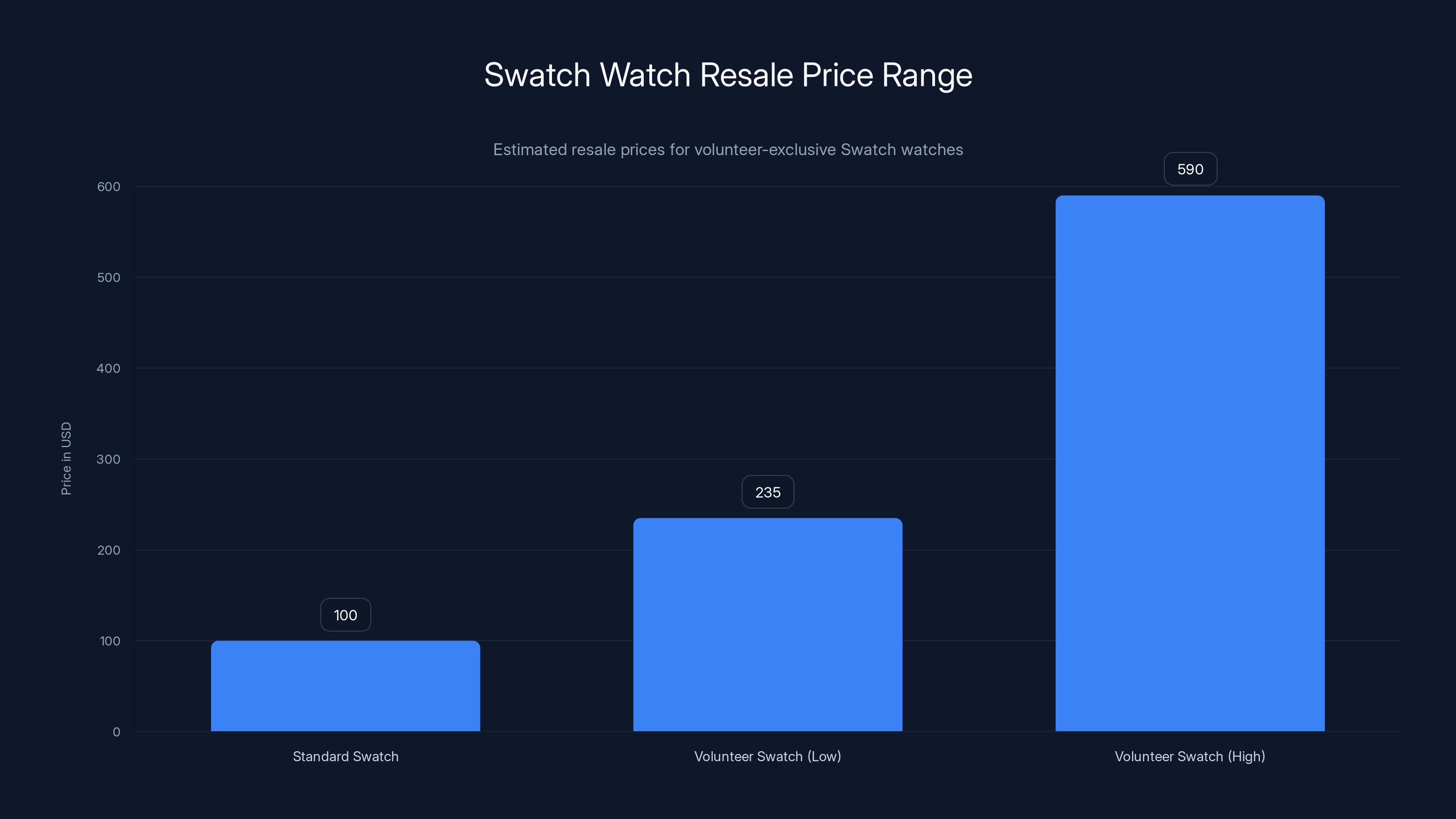

- Swatch volunteer watches command €200-€500 (590) on resale despite €0 original cost

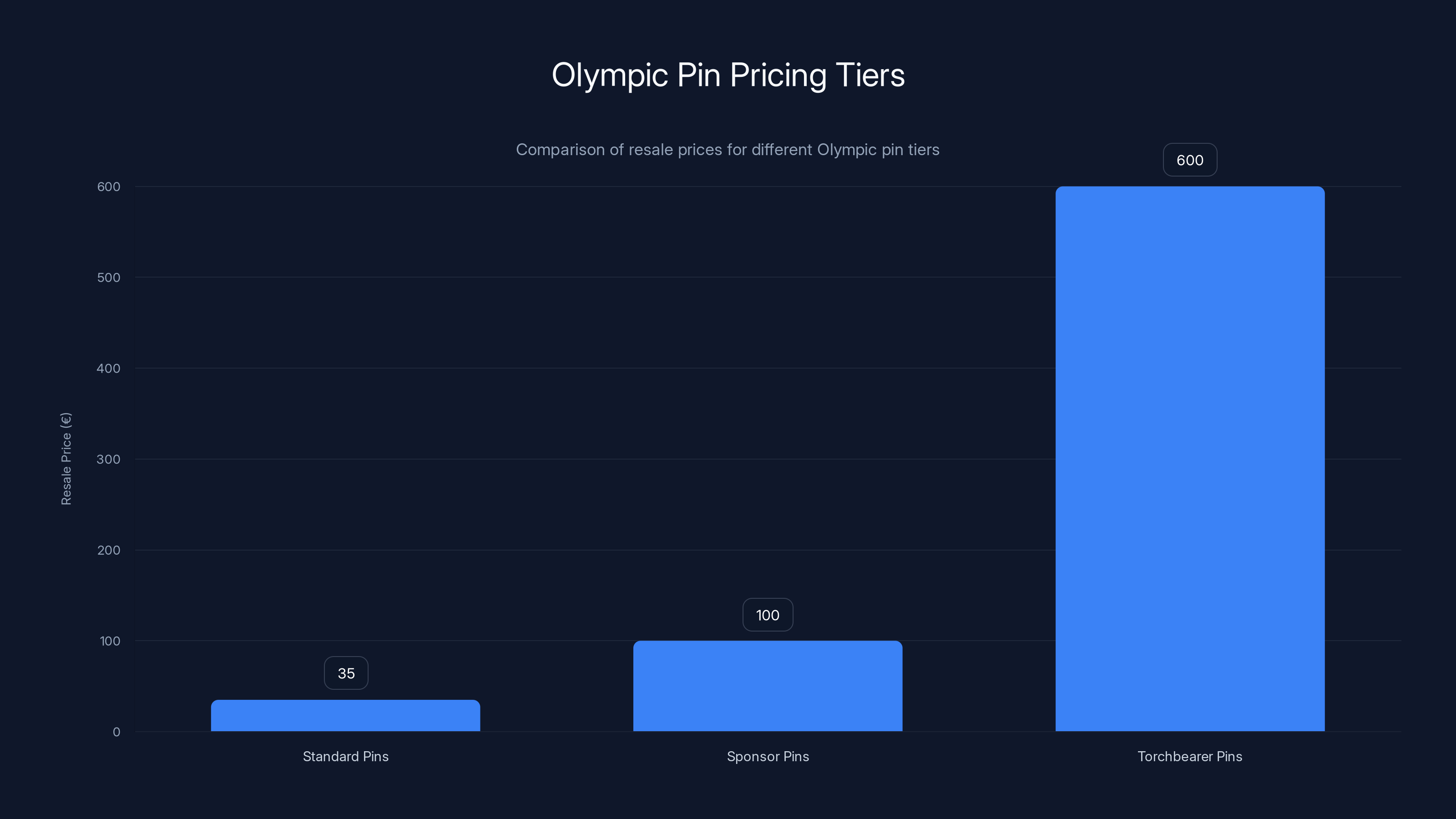

- Limited-edition pins range from €30 for standard editions to €600+ ($707+) for torchbearer variants

- Samsung Galaxy Z Flip 7 phones distributed to athletes are listed at $1,680 on eBay

- Supply scarcity and nostalgia drive the secondary market, with items typically unavailable or delayed from official channels

Torchbearer pins command the highest resale prices at €600, reflecting their rarity and significance. Sponsor pins also show a significant markup compared to standard pins.

Why Olympic Memorabilia Becomes Valuable: Understanding the Economics of Scarcity

Olympic memorabilia occupies a unique space in the collectibles market. Unlike, say, limited-edition sneakers or gaming consoles, where manufacturers can theoretically produce more runs, Olympic merchandise is intentionally finite. The Games only happen every four years in winter, and every venue is different. You can't manufacture more Milan 2026 mascot plushies after the Games close. That scarcity is baked into the business model from day one.

The psychology behind Olympic collectibles is equally interesting. People don't just buy these items because they're rare, though that's certainly part of it. They buy because of what the items represent: a moment in time, a place, a collective experience. A Milo and Tina plushie from Milano Cortina isn't just a stuffed animal; it's a souvenir from one of the world's largest sporting events, held in a specific city in a specific year. That emotional weight translates into real purchasing power.

Supply constraints feed into demand in predictable ways. Official Olympic shops run inventory like any retail business. They stock based on expected sales, not infinite demand. Once the Games wrap, restocking isn't an option. Some items, particularly those created exclusively for volunteers or athletes, were never meant for public sale at all. The Swatch watches given to volunteers are the clearest example. These weren't available in the official shop. They existed in fixed quantities, maybe a few thousand units distributed to a specific group. When those volunteers decided to sell their watches online, they weren't competing with new inventory from Swatch or the Olympics shop. They were the only source.

This creates a textbook supply-demand inversion. Supply is fixed at zero new production. Demand, however, can actually grow over time. As the Games become more distant, as nostalgia sets in, as word spreads about the items' rarity and value, more collectors enter the market. Prices adjust upward accordingly.

There's also a network effect at play. Early resellers create visibility. When someone lists a Milo plushie for €120, suddenly other sellers see that price point and adjust their listings upward. Buyers see higher prices and assume that's the market rate. Within weeks, what started as a 2x markup becomes a 3x or 4x markup as the new baseline. It's not malicious; it's how price discovery works when information spreads across decentralized platforms.

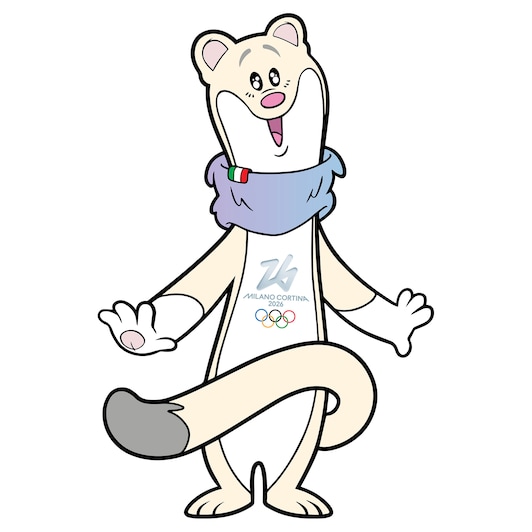

The Mascot Plushies: How Milo and Tina Became Goldmines

Milo and Tina, the official mascots of the Milano Cortina Games, are dominating the secondary market right now. These aren't obscure collectibles known only to hardcore Olympics fans. They're cute, they're marketable, and they represent the 2026 Games in a way that medals or official pins don't quite capture. That combination has made them the crown jewel of Milano Cortina memorabilia trading.

The original pricing was straightforward. Small Milo and Tina plushies cost around €15. Medium sizes ran closer to €30. The larger, premium versions hit €50. These weren't expensive items. A parent could buy one as a souvenir, or an Olympics attendee could grab a couple without breaking the bank. The Olympics shop stocked them, and initially, availability seemed fine.

Then something changed. Perhaps it was media coverage of resale prices. Maybe word spread through collector communities. Possibly a few high-profile listings showing 2x or 3x markups caught people's attention and created FOMO. Whatever the trigger, demand on secondary platforms exploded. Collectors, casual fans, and investors all started hunting for these plushies.

Resale prices tell the story. The small plushies that cost €15 originally are now going for €45, €50, sometimes €60. That's a 3x markup. The medium sizes, originally €30, are selling for €80 to €120. The largest versions, which retailed for €50, are commanding €150 to €200. In dollar terms, that's

What's particularly clever about this market dynamic is that some of these plushies are still available through the official Olympics shop. But here's the catch that matters. Shipping delays are real. As of early 2026, some plushies ordered from the official shop weren't expected to arrive until June. For someone who wants a souvenir right now, waiting months isn't acceptable. For someone investing in a collectible, the delayed timeline raises questions about whether the item will hold its value once stock finally arrives. That uncertainty alone justifies a resale purchase at higher prices.

The physical quality matters too. Official shop items might arrive damaged, or the packaging might be suboptimal for collectors who care about condition. Resellers, particularly those pricing premium units, often highlight the condition meticulously. Never opened. Perfect box. Factory seal intact. These condition indicators, which are standard in collectibles trading, can justify 50% premiums over items sold as general retail stock.

Size variation also plays a role. Limited data suggests the largest plushies are appreciating faster than smaller versions. This could indicate that buyers view large Milo and Tina plushies as superior collectibles, or it could simply reflect that fewer large versions were produced. Either way, it's creating a tiered market where bigger isn't just more impressive, it's more scarce.

The resale market for Milo and Tina plushies shows significant markups, with the largest plushies seeing prices up to 3.5 times the original retail price.

The Swatch Watch Phenomenon: Volunteer Exclusivity Drives Premium Pricing

If the Milo and Tina plushies represent the most accessible piece of the Milano Cortina collectibles puzzle, the Swatch watches represent the opposite extreme. These watches were never sold. They weren't available in the Olympics shop, not even marked up as premium editions. They were gift items, distributed exclusively to the Games' volunteer workforce as a thank-you for their service.

That's the critical distinction. Volunteers weren't resellers. They were people who worked long hours during the Olympics for little or no pay, receiving merchandise as appreciation. Some of them probably wore their Swatch watches during the Games, cherished them as mementos, and kept them. Others, recognizing the collectible potential or simply needing cash, decided to sell.

The resale prices are staggering. A never-worn Swatch watch, still in its original box, is selling for €200 to €500. In dollars, that's

What makes the Swatch situation particularly interesting is the total addressable market. Volunteers at a Winter Olympics usually number in the low thousands, maybe 5,000 to 10,000 depending on event scope. If Milano Cortina distributed watches to, say, 8,000 volunteers, that's 8,000 units in existence, ever. No more will be made. Some volunteers will keep their watches forever. Others will hold them but never sell. Only a fraction will hit secondary markets. This creates a mathematical scenario where supply is not just limited, but potentially extremely limited.

Authenticity matters enormously for Swatch watch resales. A buyer paying €300 for a volunteer-edition watch needs confidence they're buying an authentic item, not a counterfeit or a regular Swatch painted to look official. Successful resellers include certificates of authenticity, detailed photography, and sometimes personal provenance stories. "Received directly from volunteer," or "Previously owned by official Games volunteer," these narrative elements add credibility and justify premium pricing.

The Swatch watches also benefit from brand prestige. Swatch isn't a luxury brand, but it carries cultural cachet. The watches are well-made, reliable, and attractive. A collector who buys a Milano Cortina Swatch watch isn't just buying a collectible, they're buying a functional watch they might actually wear. This dual utility (collectible plus wearable) creates broader appeal than merchandise that's purely decorative.

Condition is also critical. A watch still in its original packaging, never worn, batteries still factory-set, commands a significant premium over one that's been worn or opened. Some resellers are marking watches as "new old stock," indicating they've never been used despite potentially being several months old. This condition-based pricing mirrors how vintage watch markets work, creating a sophisticated taxonomy of value tiers.

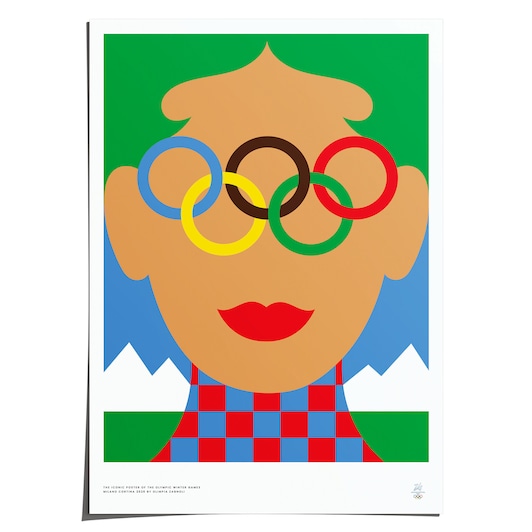

Pins and Their Tiers: From Standard Issues to Rare Torchbearer Editions

Olympic pins represent one of the most established collectibles markets. Athletes exchange pins as souvenirs. Attendees collect them. Countries trade pins. This tradition runs decades deep, and Milano Cortina is no exception. What's different in 2026 is the visibility and accessibility of secondary markets. Where collectors once met at Olympic venues or specialty conventions, they now trade on eBay and Vinted from anywhere globally.

Pin pricing is tiered and specific. Standard pins, available through the official Olympics shop, retail for around €15. These are generic designs, often featuring the Milano Cortina logo, mascots, or simple Olympic iconography. On secondary markets, these standard pins are reselling for €30 to €40, roughly double the original price. It's not dramatic appreciation, but it's consistent and indicates steady demand.

Sponsor pins represent the next tier. Samsung, for instance, produced special limited-edition pins with their branding integrated. These weren't available to everyone; they were likely distributed to Samsung employees, athletes using Samsung products, or attendees at Samsung-sponsored events. On resale platforms, Samsung sponsor pins are selling for around €100, or about $118. That's roughly a 6-7x markup compared to standard pins, reflecting the scarcity and sponsor prestige.

At the absolute top tier are torchbearer pins. Athletes selected as Olympic torchbearers receive special pins as part of their official kits. These are rare by definition. Only a few dozen people carry the Olympic torch during the Games. Each might receive multiple torchbearer pins, but total volume is tiny. WIRED Italia reported spotting torchbearer pins online for around €600, or $707. That's a staggering amount for a small metal collectible, but it reflects the ultra-scarcity and the historical significance of being a torchbearer.

The pin market also reveals interesting psychological dynamics. Collectors often pursue complete sets. If you own standard pins from Milano Cortina but you're missing the Samsung sponsors edition or a key variant, that missing piece creates incomplete satisfaction. You're motivated to pay premium prices to complete your collection. This completionism drives secondary market prices higher than individual items alone would justify.

Authenticity is another factor. Unlike plushies or watches, pins are easier to counterfeit. Successful resellers often provide multiple angles of photography, close-ups of pin details, and sometimes Olympic official documentation or original packaging. This verification work adds credibility and allows buyers to feel confident in their purchases.

Geographic variation also influences pin pricing. A pin commemorating the Milan or Cortina region specifically might appeal more to Italian buyers or those with Italian heritage. International buyers might prefer pins with broader Olympic themes. This creates micro-markets within the broader pin category, with some variants appreciating faster than others based on regional demand.

The Unexpected Market: Samsung Galaxy Z Flip Phones as Collectibles

When Samsung distributed Galaxy Z Flip 7 smartphones to 2026 Olympics athletes, they probably anticipated those phones would be used, appreciated, maybe occasionally mentioned in social media posts. What they probably didn't anticipate is that at least some of those phones would end up on eBay with four-figure price tags.

A Samsung Galaxy Z Flip 7 with official Olympics branding, distributed to athletes, appeared on eBay with a Buy It Now price of

What explains this valuation? Several factors converge. First, it's a current-generation flagship device from a major manufacturer. The Galaxy Z Flip 7 is cutting-edge technology, functionally useful, not just decorative. A buyer isn't purchasing a historical artifact they'll preserve in a case. They're potentially buying a premium phone they'll actually use.

Second, it's athlete-distribution. The phone was given to someone who competed at the Olympics. That's meaningful provenance. It's not like a random phone; it's one that was specifically provided to someone who achieved an extraordinary feat. Some buyers might be willing to pay a premium for that association alone.

Third, it's limited edition in a specific way. Samsung presumably didn't send regular Galaxy Z Flip 7s to athletes. They likely sent specially packaged, possibly customized, definitely marked as Olympic editions. These likely feature special packaging, engraving, or other distinguishing marks. The total quantity is bounded by the number of athletes at the Games, maybe 3,000 or so.

Fourth, there's the novelty of a tech device as a collectible. While phones are replaced regularly by most users, a limited-edition Olympic phone is a different category. It's tech plus collectible plus historical significance. This hybrid category appeals to multiple buyer types simultaneously: tech enthusiasts, Olympics fans, collectors, and people seeking unusual luxury items.

However, there's a risk here that differs from other Olympic memorabilia. Technology becomes obsolete. In five years, the Galaxy Z Flip 7 will be old hardware. Its value as a current-generation flagship will evaporate. That $1,680 price might look absurd in retrospect, or it might become justified if the device becomes historically significant enough. For now, it's an unusual data point in the Olympics memorabilia market, more speculative than established collectibles like pins or plushies.

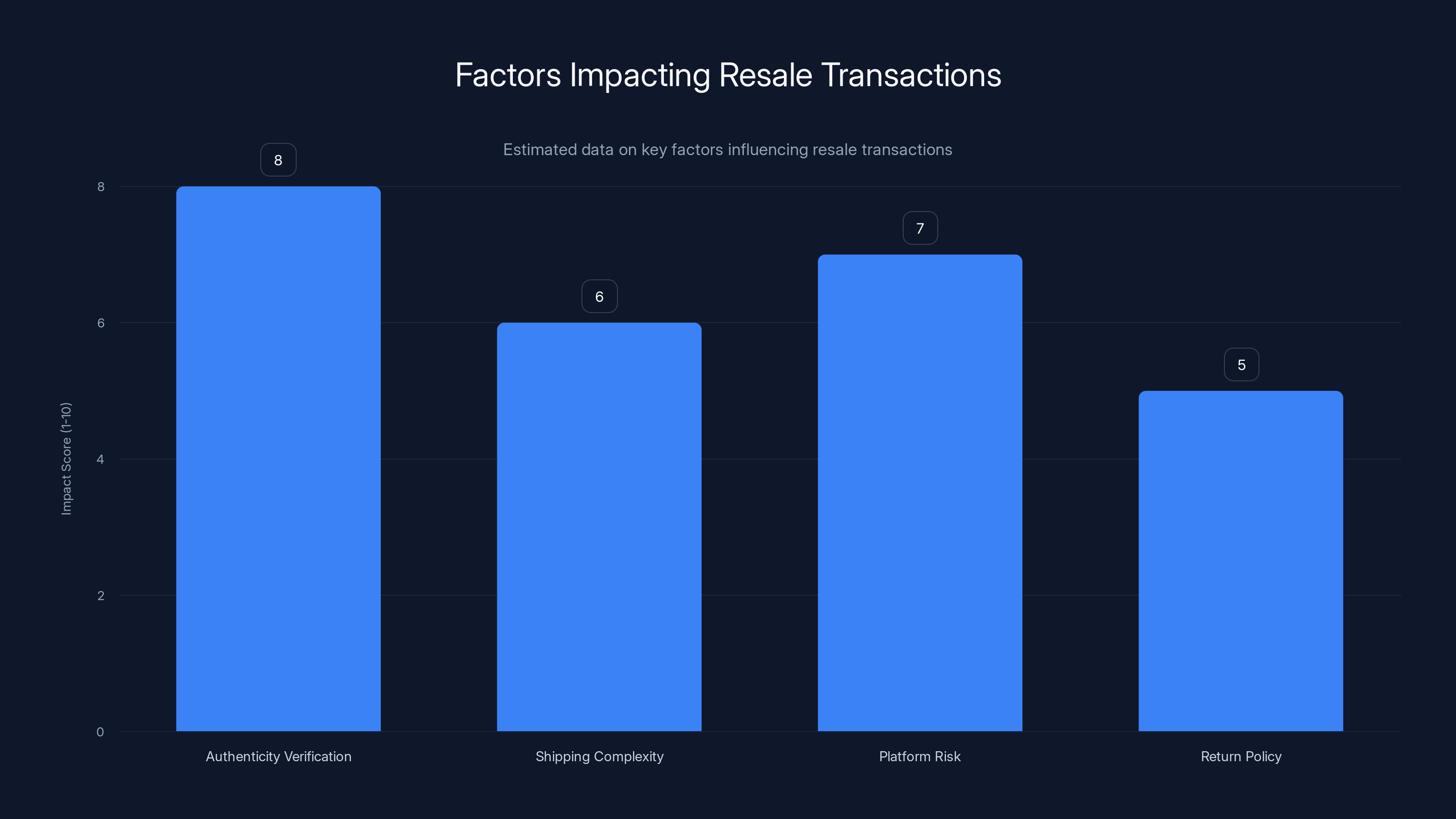

Authenticity verification has the highest impact on resale transactions, followed by platform risk and shipping complexity. Estimated data based on typical resale challenges.

Replica Medals: The Controversial Segment of the Resale Market

One product category that appears frequently in resale listings is replicas of Olympic medals. Officially, these aren't actual competition medals awarded to athletes. They're merchandise versions, commemorative pieces sold in the official Olympic shop. Single medals start around €50, and complete sets of three (gold, silver, bronze) run €150 to €200, or

The existence of replica medals in the secondary market raises questions about what people are buying and why. Are they buying these as collectibles, genuinely interested in owning a piece of Olympic memorabilia? Or are some buyers confused, thinking they're purchasing actual competition medals? The distinction matters for understanding market dynamics.

Realistic pricing suggests these are marketed honestly. If someone were trying to deceive buyers into thinking replica medals were authentic competition medals, they'd price them much higher. The €150-€200 price point for a set indicates these are understood to be merchandise, not authentic Olympic medals (which would be essentially priceless and never sold publicly).

The medal replicas also serve as accessible entry points into Olympics memorabilia collecting. They're cheaper than Swatch watches, more visually impressive than standard pins, and less challenging to authenticate than rare variants. Someone without deep collector expertise can feel confident buying Olympic medal replicas because the stakes are lower. That accessibility drives volume, which helps sustain the secondary market even if individual items don't appreciate dramatically.

Platform Dynamics: eBay, Vinted, and Specialized Resale Markets

The secondary market for Milano Cortina memorabilia isn't concentrated on a single platform. It's distributed across eBay, Vinted, Depop, Grailed, and specialized collectibles marketplaces. Each platform attracts different buyer types and exhibits different pricing patterns.

eBay is the broadest marketplace, attracting auction bidders and fixed-price buyers. Items on eBay tend to reach the widest audience, which can drive competitive bidding and price discovery. However, eBay also charges seller fees, which get passed to buyers, so items might be slightly more expensive than on fee-light platforms.

Vinted is a peer-to-peer marketplace that skews younger and more casual. It attracts people selling excess items alongside dedicated collectors. Vinted's interface emphasizes photos and descriptions, which suits collectibles well. The platform has lower fees than eBay, potentially allowing competitive pricing.

Specialized collectibles platforms like Grailed cater to serious collectors willing to pay premium prices for authenticated, high-condition items. These platforms position themselves as quality-focused, which attracts higher-end merchandise and serious buyers prepared to spend significant amounts.

The choice of platform matters for seller strategy. Someone with a Swatch watch in perfect condition might use a specialized platform to reach collectors prepared to pay €400+. Someone with a standard pin might use eBay to maximize exposure to casual buyers. This platform distribution creates a complex market where the same item type might have different price distributions depending on where it's listed.

Platform features also influence behavior. Auction formats on eBay can create bidding wars that push prices above fixed-price alternatives. Vinted's photo-heavy interface appeals to people who want to verify condition carefully. The choice of platform isn't neutral; it actively shapes the market.

The Role of Shipping, Authenticity Verification, and Risk in Resale Transactions

Once you're buying Olympics memorabilia sight-unseen from someone across the country or internationally, several risks emerge. Is the item authentic? Will it arrive in the condition described? What if the seller misrepresented the item? These aren't theoretical concerns; they're practical friction points in secondary markets.

Authenticity verification is easier for some items than others. A Swatch watch with official Olympics branding is relatively straightforward to verify. You can compare the design against official documentation, examine materials, check serial numbers if they exist. Pins and plushies are simpler; they either look right or they don't. Tech devices are trickier; you'd need to verify the device actually runs, the Olympics branding is genuine, and it's actually a limited distribution variant.

Successful high-value resellers invest in verification. They provide multiple high-resolution photos, sometimes including comparison images with official reference materials. Some offer certificates of authenticity or provide provenance documentation. These measures reduce buyer risk and justify premium pricing.

Shipping adds another layer of complexity. A Swatch watch or pin is easy to ship internationally at reasonable cost. A large Milo and Tina plushie requires more careful packing to prevent damage. Shipping costs might be

Return policies vary by platform. eBay offers some buyer protections. Vinted's policies are less generous. Specialized platforms typically have stricter rules. A buyer paying €500 for a Swatch watch on an unfamiliar platform takes real risk if the watch doesn't match the description or arrives damaged. This risk premium is often baked into prices for items purchased on less established platforms.

Dispute resolution also matters. If something goes wrong, how do you get your money back? eBay has established dispute processes. Vinted has some protections but fewer resources than eBay. International transactions add complexity if the seller is in a different country with different consumer protection laws.

Memorabilia from the 2026 Winter Olympics in Milano Cortina are selling at significant markups on secondary markets, with resale prices often three to four times higher than original prices.

Regional Variations and International Market Dynamics

Milano Cortina 2026 is in Italy, which creates interesting regional market dynamics. Italian buyers might have easier access to official memorabilia, potentially depressing prices domestically. International buyers paying in currencies other than euros face currency conversion costs, making purchases more expensive. These factors create regional price variations worth noting.

Items with strong local appeal, like Milano or Cortina region-specific designs, might appreciate faster in Italy than internationally. Conversely, globally appealing items like the Swatch watches or mascot plushies attract international buyers, creating more competition and higher prices.

Language can also matter. Official documentation, packaging, and certificates in Italian might be more valuable to Italian collectors or appeal more broadly to European buyers. The same items in English-only formats might attract a different buyer demographic at different price points.

Tariffs and import duties add friction to international transactions. A buyer in the US purchasing Italian Olympics memorabilia might face unexpected costs that don't show up in the listed price. These hidden costs can shift buyer behavior and affect which items people are willing to import.

The Secondary Market as a Pricing Engine: How Resale Data Informs Collector Value

Secondary markets serve a critical function beyond just allowing people to buy and sell used items. They're price discovery mechanisms that reveal what these items are actually worth to real people making real purchasing decisions with real money.

When a Milo plushie sells for €120 on eBay, that's data. It tells us that someone, faced with available alternatives, decided this item was worth €120. If similar plushies consistently sell in the €100-€150 range, that's establishing a market price. The official Olympics shop might have priced it at €50, but the market has discovered a different valuation.

These resale prices eventually feed back into official channels. If Swatch watches are selling for €400 on secondary markets, Swatch and the Olympics organization are noting that data. Future Olympics merchandise strategies might shift accordingly. They might price items higher officially, create more exclusive variants, or limit official distribution more severely to maintain scarcity.

For collectors, resale prices create investment implications. If you bought a Milo plushie at retail for €50, and you see identical items selling for €150 on eBay, you have a potential exit strategy. You've captured €100 of appreciation, minus fees and shipping. That might justify selling, or it might convince you to hold and hope for further appreciation.

For investors treating Olympics memorabilia as an investment class, secondary market prices are essential data. They track appreciation rates, identify which items are appreciating fastest, and spot opportunities where prices might not yet reflect scarcity or historical significance.

Supply Constraints and Market Saturation: How Long Will Prices Hold?

A critical question looms over the entire Milano Cortina memorabilia market: will prices hold, or are they destined to collapse as supply increases and scarcity fades?

Some items have hard supply constraints. Torchbearer pins exist in fixed quantities. Volunteer Swatch watches are limited by volunteer count. These items can't increase in supply. However, other items like mascot plushies might still be available through official channels, and supply could increase if the Olympics shop restocks or if warehoused inventory is released.

The timeline matters. If official sources exhaust inventory within months and never restock, supply constraints become real quickly. If the Olympics shop maintains stock availability for years, that undercuts secondary market pricing. Some items listed as out of stock might be temporarily unavailable, with restock coming in weeks or months.

Market saturation could occur if too much supply hits secondary markets simultaneously. If a large holder, perhaps an official distributor or a reseller who accumulated inventory, decides to liquidate, they could crash prices. This is a real risk in collectibles markets where a single large sale can depress prices significantly.

Conversely, as items age and some get damaged or lost, effective supply actually decreases. A Milo plushie that gets damaged and discarded represents one less plushie in the market. Over decades, attrition effects become real. This is why old Olympics memorabilia from the 1980s commands premium prices; many items have been lost to time.

The psychological question of "is this a real collector item or a speculative bubble?" will ultimately determine long-term prices. If serious collectors view Milano Cortina memorabilia as historically important and culturally significant, prices might hold or appreciate. If it's pure speculation, prices could crash once the initial excitement fades.

Milano Cortina 2026 memorabilia, such as plushies and Swatch watches, have significantly appreciated in value on secondary markets, with plushies seeing up to a 3x markup.

Speculation vs. Collection: Understanding Buyer Motivation

Not everyone buying Milano Cortina memorabilia is a longtime Olympics collector. Some are speculators betting on appreciation. Others are casual fans making emotional purchases. Understanding these different buyer motivations helps explain market dynamics.

True collectors are playing a multi-decade game. They're acquiring items they believe will be historically significant and culturally valuable. They care about condition, authenticity, and completeness. They're willing to hold items for years, even decades. These buyers have relatively stable demand that doesn't spike or crash dramatically.

Speculators are playing a shorter game. They're buying items they expect to appreciate in value over months or a few years, then selling at profit. They care about resale value more than personal enjoyment. Speculator demand is more elastic; it's responsive to price movements and expectations. When it becomes clear that prices are rising, speculators enter and push prices higher. When appreciation slows, speculators exit, and prices fall.

Casual buyers are purchasing out of emotion or nostalgia. They watched the Olympics, saw cool merchandise, and bought items. They're not strategizing about appreciation or completing collections. Casual buyer demand is driven by proximity to the Games and emotional engagement with Olympic competition.

Different buyer types create complex market behavior. Speculators entering the market create upward price momentum that attracts more speculators. This generates the dramatic 3x and 4x markups we're seeing. As speculators dominate, the market becomes less stable. Once momentum reverses, speculators exit quickly, potentially causing sharp price declines.

The longer-term value depends on whether genuine collectors view Milano Cortina memorabilia as worth pursuing. If serious collectors create sustained demand, prices will stabilize at elevated levels. If the market is purely speculative, prices will eventually crash back toward manufacturing cost as speculators exit.

The International Collector Community and Social Media Influence

Olympics memorabilia collectors are globally distributed, connected through Reddit communities, Instagram hashtags, Facebook groups, and Discord servers. This international network creates information flow that affects pricing and demand.

When one reseller posts a Swatch watch sale for €450, that photo gets shared across collector communities within hours. Other resellers see the sale and adjust their prices upward. Potential buyers see the price and form expectations about market rates. This information cascades quickly through digital channels, affecting pricing across multiple platforms.

Social media creates FOMO, fear of missing out, that drives urgency. Someone who sees spectacular Milo plushies appreciating rapidly might panic-buy to avoid missing out. That FOMO-driven buying pushes prices higher, creating a feedback loop.

Influencers within the collector community also matter. If a respected Olympics collectibles blogger or YouTuber features Milano Cortina memorabilia, that visibility affects demand. They might provide authentication guides, market analysis, or investment recommendations that influence buyer behavior.

This social media dynamics add volatility to secondary markets. Prices can spike based on a single influential post. Once the attention fades, demand can cool just as quickly. The Swatch watch market, for instance, might be experiencing temporarily elevated prices driven by media coverage, with prices potentially normalizing once initial hype fades.

Historical Comparison: How Milano Cortina Memorabilia Stacks Against Past Olympics

Understanding how Milano Cortina memorabilia prices compare to past Olympics helps contextualize whether 2026 represents a typical market or an exceptional one.

Pyeongchang 2018 memorabilia, now roughly eight years old, provides recent comparison data. Official mascot plushies from Pyeongchang can sell for 2-3x original prices on secondary markets, similar to what we're seeing with Milano Cortina in 2026. Swatch watches given to Pyeongchang volunteers command premiums, though historical data is limited. Pins show similar tiered pricing, with rare variants appreciating dramatically.

Rio 2016 memorabilia, now a decade old, shows stronger appreciation in many categories. Official mascot plushies regularly sell for 4-5x original prices. Rare variants command even more. This suggests that as time passes, Milano Cortina items might appreciate beyond current 3-4x markups.

Older Olympics like Tokyo 1964 or Montreal 1976 show even more dramatic appreciation, with rare items selling for 10-50x original prices or more. However, these are old enough that supply has been decimated by loss and damage. That's not comparable to fresh 2026 merchandise.

The data suggests Milano Cortina memorabilia is following predictable patterns consistent with recent Olympics. The 3-4x markups for plushies and 2x for standard pins are typical for Olympics memorabilia in the first year after the Games. Whether these items will continue appreciating depends on collector interest, scarcity, and market dynamics as time passes.

Volunteer-exclusive Swatch watches resell for

Tips for Navigating the Secondary Market: Avoiding Pitfalls and Making Smart Purchases

If you're interested in purchasing Milano Cortina memorabilia, either as a collector or an investor, several practical strategies can help you avoid overpaying or getting scammed.

First, research comparable sales. Before bidding on an item, check eBay's completed listings and Vinted's sold items to see what similar pieces actually sold for. List prices don't matter; sold prices do. If you see a Milo plushie listed for €200, but completed sales show recent sales at €100-€120, the listing is probably overpriced and won't sell.

Second, verify condition carefully. High-resolution photos matter enormously. Damaged boxes, worn plushies, or items showing signs of use should be priced accordingly. Don't pay premium prices for average-condition merchandise.

Third, be skeptical of claims about rarity or scarcity. Just because a seller says something is rare doesn't make it true. Check if you can actually find other listings for the same item. If you see the same item from multiple sellers, it's probably not as rare as claimed.

Fourth, start small. If you're new to secondary market purchases, buy lower-value items first to understand how transactions work, how items arrive, and whether seller descriptions are accurate. Once you've built confidence, you can make larger purchases.

Fifth, use platform protections. Buy through platforms offering buyer protection, not through direct sales with no recourse. eBay's buyer protection and Vinted's protections exist for a reason. Use them.

Sixth, understand tax implications. Depending on your location, selling items at profit might create tax obligations. If you're treating this as an investment, understand the tax rules in your jurisdiction.

The Psychology of Collectibles: Why We Value Memories and Scarcity

Beyond economic factors, the Milano Cortina memorabilia market reveals fundamental aspects of human psychology around collectibles, scarcity, and nostalgia.

We assign emotional value to items connected to significant events. The 2026 Winter Olympics were a global event watched by millions. For many people, watching the Games created memories and emotional connections. A souvenir from those Games carries emotional weight that transcends its practical utility.

Scarcity creates perceived value independent of utility. A standard Swatch watch might cost

Nostalgia intensifies over time. Right now, Milano Cortina is fresh and current. In five years, it will be nostalgic. In 20 years, it will be deeply nostalgic. People often pay premium prices for items that evoke nostalgic memories. A Milo plushie purchased for €150 in 2026 might be cherished in 2036 when the buyer has stronger emotional connections to the 2026 Olympics.

Completion seeking drives behavior. Collectors often pursue complete sets. Missing one variant creates psychological incompleteness that motivates additional purchases. This completionism effect explains why people sometimes overpay for the final item needed to complete a collection.

Status and identity also matter. Owning rare Olympics memorabilia signals to others that you're a serious collector or experienced investor. The status associated with owning rare items creates demand independent of the items' practical value.

Understanding these psychological factors helps explain why the secondary market exists at all. Rational utility-maximizing behavior wouldn't justify paying €300 for a watch. But humans aren't purely rational. We're emotional, nostalgic, and status-seeking. Those psychological drives create real economic value in secondary markets.

Future Market Evolution: What Happens to Milano Cortina Memorabilia in 2030, 2040, and Beyond

Predicting long-term market evolution for Milano Cortina memorabilia requires considering multiple scenarios.

In the optimistic scenario, Milano Cortina memorabilia becomes recognized as a significant, culturally important Olympics. Items appreciate steadily as time passes. By 2040, current 3-4x markups become 10-15x markups as attrition reduces supply and nostalgia increases demand. Serious collectors regard Milano Cortina as a golden-era Olympics and actively pursue memorabilia. Items become museum pieces and investment assets.

In the pessimistic scenario, the secondary market hype fades within 1-2 years. Speculators exit, prices collapse back toward manufacturing cost. Most memorabilia becomes worthless or nearly so. Only the rarest items, like torchbearer pins, maintain significant value. The market essentially stops functioning as people lose interest.

In the realistic scenario, prices stabilize somewhere between these extremes. Some items, particularly rare or athlete-associated pieces, hold value and appreciate slowly. Common items, like standard pins and plushies, depreciate from their current peaks but remain worth more than original retail. The market becomes quiet but functional, with dedicated collectors trading items without dramatic price swings.

Historical data suggests the realistic scenario is most likely. Past Olympics memorabilia markets don't typically experience catastrophic collapses, but they also don't experience continuous 10%+ annual appreciation. They settle into stable secondary markets where supply and demand balance at elevated but stable price points.

What would accelerate the optimistic scenario? Historical significance of the Games themselves, recognition of Milano Cortina as an exceptional Olympics, emergence of dominant collecting culture around 2026 items, and rarity that persists even as time passes.

What would accelerate the pessimistic scenario? Flood of supply from warehouses or forgotten inventory, revelation of counterfeits, loss of cultural relevance, and shift of collector attention to newer Olympics.

Conclusion: The 2026 Winter Olympics Memorabilia Market as Microcosm of Digital Commerce and Human Behavior

The Milano Cortina 2026 Winter Olympics memorabilia market isn't just about Olympics fans overpaying for plushies and watches. It's a window into how digital marketplaces, supply scarcity, human psychology, and global connectivity create real economic value around items that, on their surface, seem frivolous.

The economics are clear. Supply is fixed or declining for most items. Demand is substantial, distributed globally, and driven by emotional attachment and collector psychology. When supply is fixed and demand is elastic, prices rise. Simple as that. The 3x markup on Milo plushies, the €400 Swatch watches, the €600 torchbearer pins—these aren't anomalies or overpayment. They're rational market adjustments to scarcity.

What's striking is the speed. These price spikes happened within months of the Games' conclusion. That suggests modern digital markets are incredibly efficient at price discovery. Information spreads globally in hours. Buyers and sellers connect instantly. Markets equilibrate fast.

The risks are also worth noting. Speculation creates volatility. Price peaks can be followed by crashes. Items that seem valuable today might be forgettable in five years. Buyers treating these items as investments should understand that collectibles markets are illiquid and unpredictable.

For casual buyers or genuine collectors, the calculation is different. If you're buying a Milano Cortina souvenir because you watched the Games and want a memento, paying 3-4x retail is steep but defensible if it brings you joy. If you're investing hoping for dramatic appreciation, you're taking real risk.

The Milano Cortina market also reveals how global, digital commerce has democratized collectibles trading. Thirty years ago, buying a rare Olympics item required specialized knowledge, travel to conventions, or connections to collectors' networks. Today, you can search eBay from your phone and buy anything within minutes. That democratization drives volume and price discovery, but it also enables speculation and creates volatility.

Looking forward, the interesting questions are whether Milano Cortina memorabilia becomes historically significant, whether collector communities sustain interest long-term, and whether supply constraints persist. These factors will determine whether 2026 Olympics items become genuine collectibles or just merchandise with temporary speculative value.

For now, the market is active, prices are high, and both collectors and speculators are actively trading. Whether that continues depends on factors beyond anyone's control: the cultural legacy of the Games, the evolution of collector communities, and the persistence of scarcity. Time will tell whether owning a €300 Swatch watch from Milano Cortina becomes a point of pride or an expensive mistake.

FAQ

What makes Milano Cortina 2026 memorabilia valuable?

Milano Cortina memorabilia gains value from scarcity (limited production quantities), nostalgia (emotional attachment to the Olympics), and rarity (some items like volunteer Swatch watches were never sold publicly). Supply is typically fixed after the Games conclude, while demand from collectors, investors, and casual fans creates upward price pressure. Emotional value combined with fixed supply creates the economic conditions for secondary market price premiums.

How much are Milo and Tina plushies worth right now?

Small Milo and Tina plushies originally priced at €15 are now selling for €45-€60 on secondary markets, representing a 3x markup. Medium versions originally at €30 are selling for €80-€120. Larger plushies originally priced at €50 are commanding €150-€200 (

Are Swatch Olympic volunteer watches a good investment?

Swatch watches distributed exclusively to Milano Cortina volunteers are currently selling for €200-€500 (

Where should I buy 2026 Olympics memorabilia?

The major platforms are eBay (broadest selection, most established buyer protections), Vinted (peer-to-peer, lower fees), Depop (younger demographic, photo-focused), and specialized collectibles sites like Grailed (higher-end items, serious collectors). eBay offers the most buyer protection and price transparency through completed sales data. Vinted has lower fees but fewer protections. Always compare sold prices across platforms before making offers, and verify seller reputation before purchasing high-value items.

Is there a risk of counterfeit 2026 Olympics merchandise?

Counterfeit risk exists for high-value items like Swatch watches and rare pins, especially on less-regulated platforms. Mitigation strategies include purchasing from established sellers with verified histories, requesting multiple high-resolution photos including branding details, comparing against official reference materials, and using platforms with buyer protection. For items under €50, counterfeit risk is lower since they're not valuable enough to justify sophisticated fakes. For €200+ items, authentication becomes critical.

Will 2026 Olympics memorabilia continue appreciating in value?

Historically, Olympics memorabilia does appreciate over time, but trajectory varies. Recent Olympics (2018, 2022) show similar 3-4x short-term appreciation that stabilizes or moderates over years. Older Olympics like Rio 2016 and Tokyo 2020 show stronger appreciation, potentially 5-10x over a decade, but this partly reflects additional rarity from attrition. Milano Cortina items will likely hold current values or appreciate slowly if genuine collector demand persists. Items purely held by speculators risk price declines once hype fades. The realistic scenario is modest long-term appreciation (3-5% annually) for rare items and price stabilization or slight decline for common items.

What Olympics memorabilia appreciates fastest?

Based on current market data, rare and exclusive items appreciate fastest: athlete-distributed technology (Samsung phones), volunteer-exclusive items (Swatch watches), limited-edition pins (particularly torchbearer variants), and rare mascot variants. Common items like standard pins and readily available plushies show slower appreciation. Items with unique provenance (signed by athletes, tournament-used, historically significant) command highest premiums. Size and condition matter enormously; larger plushies and never-used items in perfect packaging appreciate faster than standard versions.

Should I buy 2026 Olympics memorabilia as an investment?

If your primary goal is investment returns, understand the risks. Collectibles markets are illiquid (hard to sell quickly), unpredictable, and dependent on subjective demand. Speculators exiting can cause price crashes. Some items will prove valuable; others will become worthless. If you're buying for emotional reasons—you watched the Olympics and want a souvenir—paying premium prices is optional but understandable. If you're investing purely for appreciation, diversify (don't put significant money in single items) and do thorough research before purchasing. Treat collectibles as a speculative investment class, not a stable store of value.

What is the total supply of Milano Cortina 2026 memorabilia?

Exact production numbers are proprietary Olympic data, but estimates are possible. Mascot plushies likely totaled hundreds of thousands of units. Swatch watches numbered in the low thousands (distributed to volunteers). Rare pins numbered dozens to hundreds. The market is ultimately bounded by how much merchandise was produced initially. Supply is essentially fixed—no new merchandise will be manufactured post-Games. The only supply increase comes from inventory releases, which would depress prices. Over time, supply actually decreases as items get damaged or discarded, supporting long-term value appreciation if collector demand persists.

Related Topics Worth Exploring

If you're interested in Olympics memorabilia markets, you might also want to explore collectibles investment strategies, how scarcity drives value in digital marketplaces, the economics of limited-edition merchandise, and how nostalgia influences consumer behavior. Additionally, understanding price discovery in decentralized secondary markets, the role of social media in driving collector demand, and historical comparisons of Olympics memorabilia across different Games can provide deeper insights into this market segment.

Key Takeaways

- Mascot plushies appreciate 3-4x from €15-€50 retail to €45-€200 on secondary markets within months

- Volunteer-exclusive Swatch watches command €200-€500 premiums despite zero original cost, driven by scarcity

- Rare torchbearer pins exceed €600 due to ultra-limited distribution to only Olympic torch carriers

- Fixed supply combined with distributed global demand creates predictable upward pricing pressure

- Long-term value depends on sustained collector interest—speculative peaks often reverse as hype fades

Related Articles

- Figure Skating After 2026 Winter Olympics: Sport Transformed [2025]

- Olympic Choreographer's Viral Jacket Trick: The Story Behind the Moment [2026]

- The Curling Controversy Everyone's Debating Gets the Rule Wrong [2025]

- Olympic Bobsledding Technology: The Gear Behind Gold [2026]

- Ilia Malinin's Quadruple Axel: The Physics and History Behind Figure Skating's Greatest Innovation [2025]

- Heated Rivalry Hockey Effect: LGBTQ+ Inclusion & The 2026 Olympics [2025]

![2026 Winter Olympics Memorabilia Resale Market Explodes [2025]](https://tryrunable.com/blog/2026-winter-olympics-memorabilia-resale-market-explodes-2025/image-1-1771677376371.jpg)