The Clean Energy Revolution is Here—And These 22 Startups Are Leading the Charge

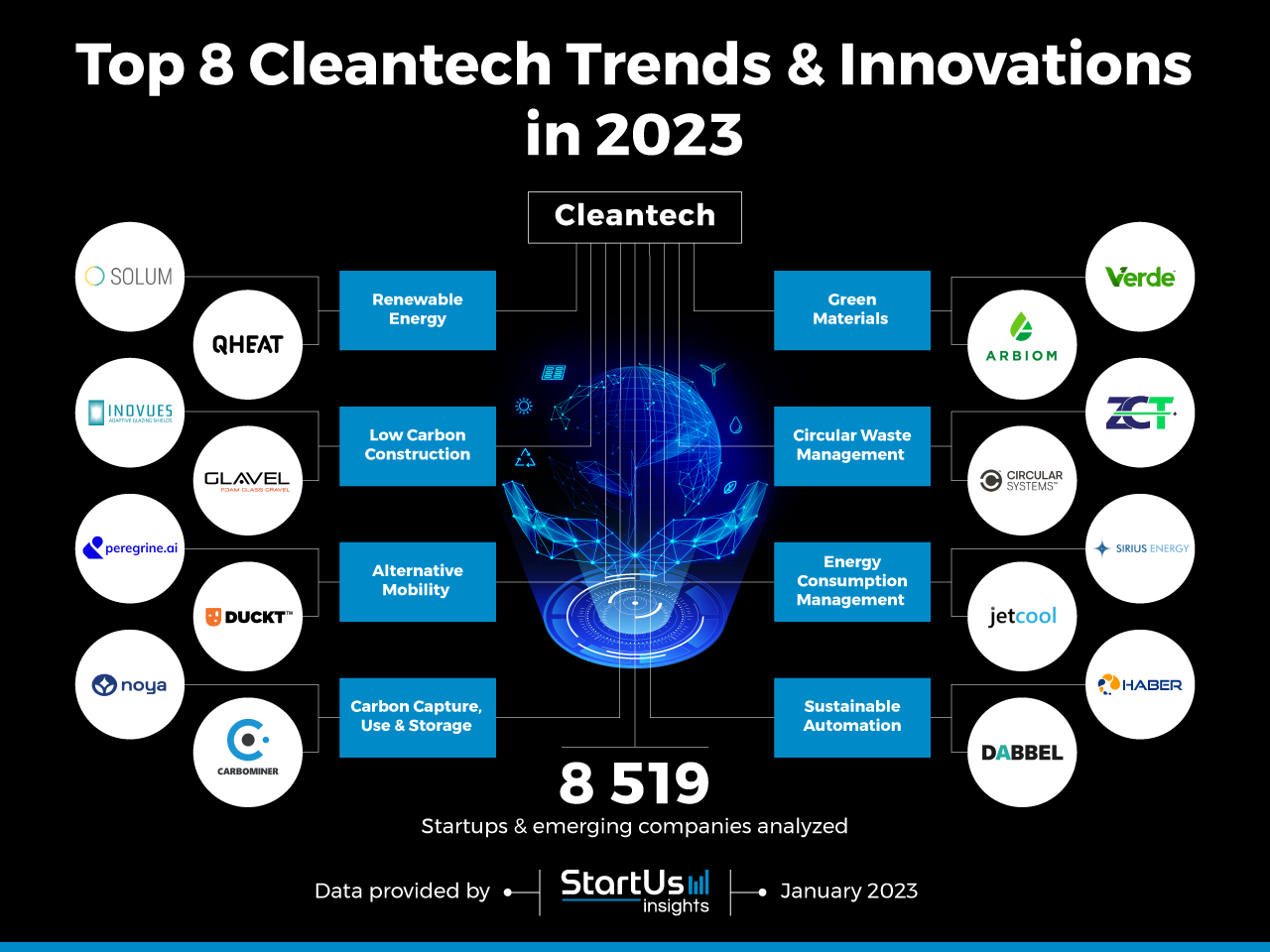

Look, if you've been paying attention to the startup landscape, you know clean tech is no longer niche. It's mainstream. Every major VC is scrambling to fund sustainable energy solutions, carbon capture tech, and next-generation battery innovation. But with thousands of startups claiming to save the planet, how do you separate the hype from the real breakthroughs?

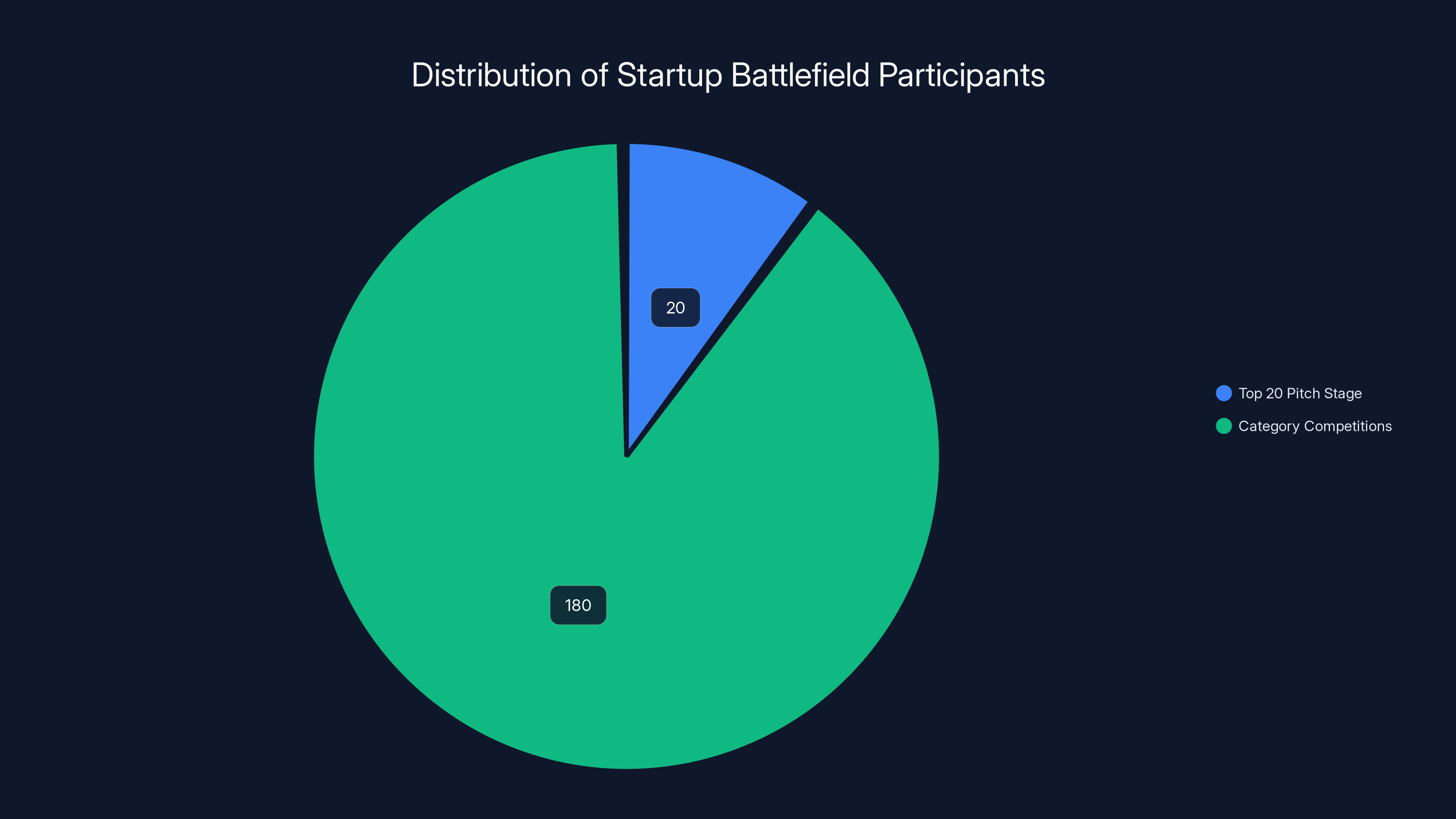

That's where TechCrunch's Startup Battlefield comes in. Every year, they whittle down thousands of applications to just 200 startups. Out of those 200, the top 20 compete on stage for the Startup Battlefield Cup and $100,000 in prize money. But here's the thing: the remaining 180 startups in the competition are equally impressive in their own right. They've all been vetted against rigorous criteria for innovation, market potential, and transformative impact.

This year, we're focusing specifically on the clean tech and energy category. These aren't just companies with good intentions. They're solving real problems that matter: recovering critical metals from old batteries, creating compostable alternatives to plastic, capturing carbon at scale, and generating renewable energy more efficiently than ever before.

I spent weeks researching these companies, digging into their technology, understanding their business models, and evaluating their market opportunity. What surprised me most? The sheer diversity of approaches. You've got companies using biology to recycle batteries, AI to optimize energy grids, and aerospace engineering to create better HVAC systems. They're not all competing in the same space. They're addressing different bottlenecks in the clean energy ecosystem.

So here's what we're going to do: break down what each startup does, why their approach matters, and what problem they're actually solving. This isn't just a list. It's a deep dive into the most promising clean tech innovations that could genuinely reshape how we produce, store, and use energy over the next decade.

TL; DR

- Battery recycling startups like Ara Bat are using bio-based processes to recover critical metals from spent lithium-ion batteries without toxic chemicals

- AI-powered platforms are optimizing energy grids, carbon accounting, and industrial waste transformation in real time

- Next-gen battery tech companies are doubling energy density while cutting costs by up to 40%

- Hydrogen and fuel cell innovations are enabling zero-emission power generation for data centers and industrial sites

- Circular economy solutions transform waste streams (agricultural by-products, industrial gases, building materials) into valuable products

In the TechCrunch Startup Battlefield, 10% of the 'Battlefield 200' startups pitch on stage, while 90% compete in category competitions. Estimated data.

The Battery Recycling Revolution: Recovering Value From Waste

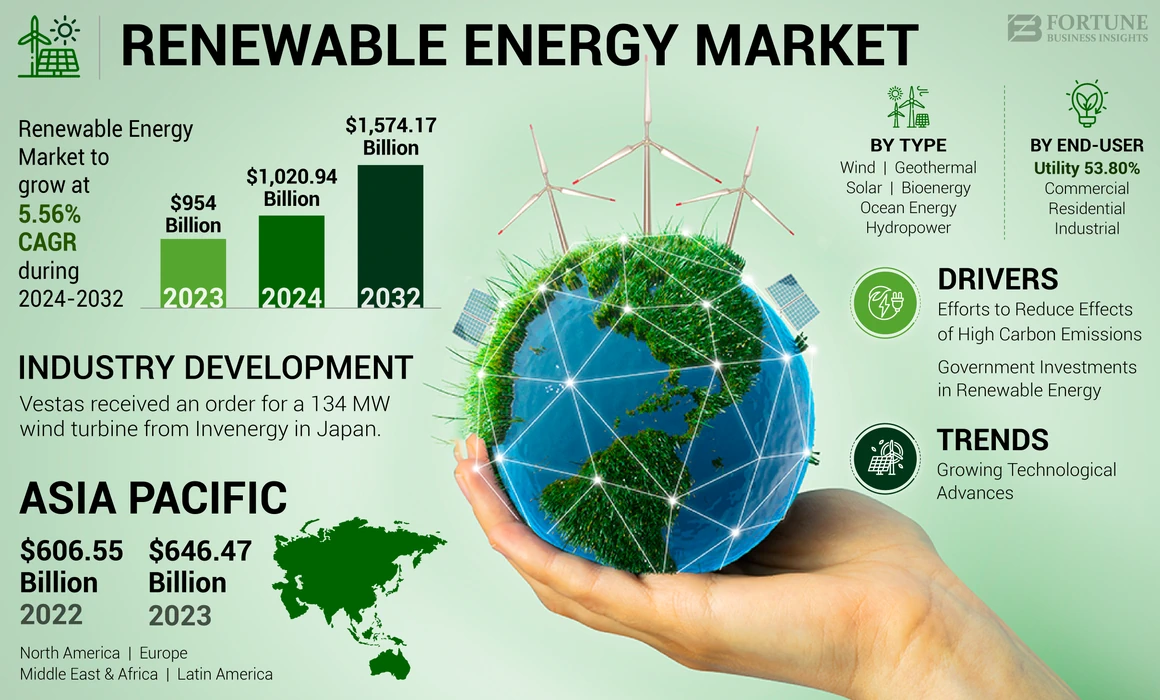

Spent lithium-ion batteries are a massive problem. And I mean massive. By 2030, we'll generate over 2 million tons of lithium-ion battery waste annually. That's not just an environmental crisis—it's an economic opportunity being left on the table.

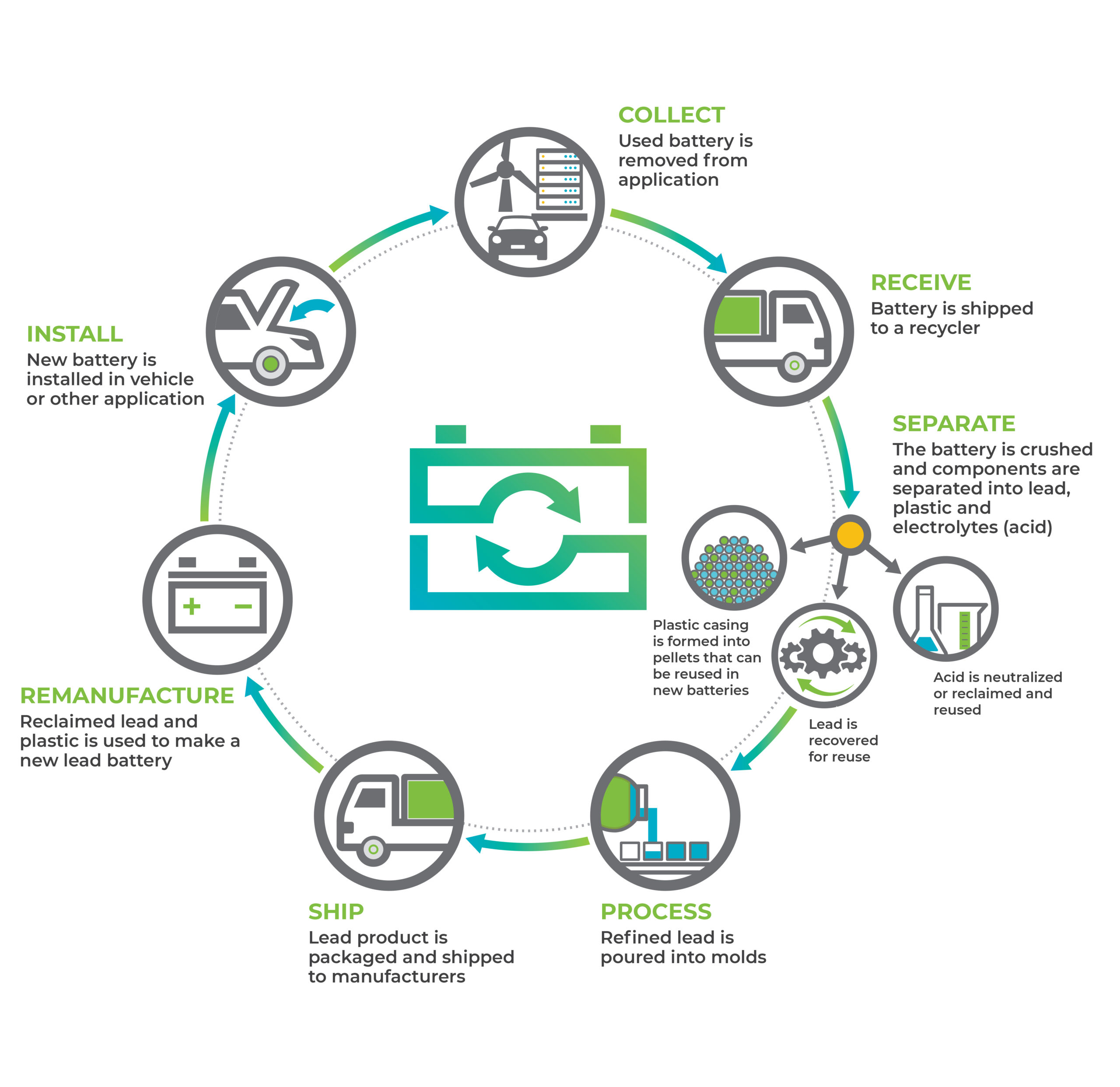

Here's why this matters: lithium, cobalt, nickel, and manganese aren't cheap. A single battery contains thousands of dollars worth of recoverable materials. But traditional recycling methods? They're expensive, energy-intensive, and often toxic. They typically involve crushing batteries, dissolving the materials in harsh chemicals, and dealing with hazardous waste streams.

That's where bio-based recycling enters the picture.

Ara Bat: Plant Waste Meets Battery Recovery

Ara Bat has cracked a genuinely interesting problem: what if you could recover critical metals from batteries using something as simple as citrus peels?

Their process is bio-based, meaning they're using natural plant waste—specifically agricultural by-products like citrus peels—instead of toxic chemicals to leach metals from spent batteries. The environmental benefits are obvious: no hazardous waste, lower energy consumption, and you're essentially turning one waste stream into a recycling solution for another waste stream.

But here's the practical angle: their process is also faster and cheaper than conventional methods. They recover nickel, cobalt, and other critical metals with higher efficiency than pyrometallurgical (high-heat) processes. The recovered materials can be used to manufacture new batteries, closing the loop.

What makes this genuinely noteworthy is the scalability angle. Citrus is grown globally. Agricultural waste from fruit processing is abundant. This isn't some exotic process dependent on rare equipment or impossible-to-source materials. It's elegantly simple, which is why I think it has real legs.

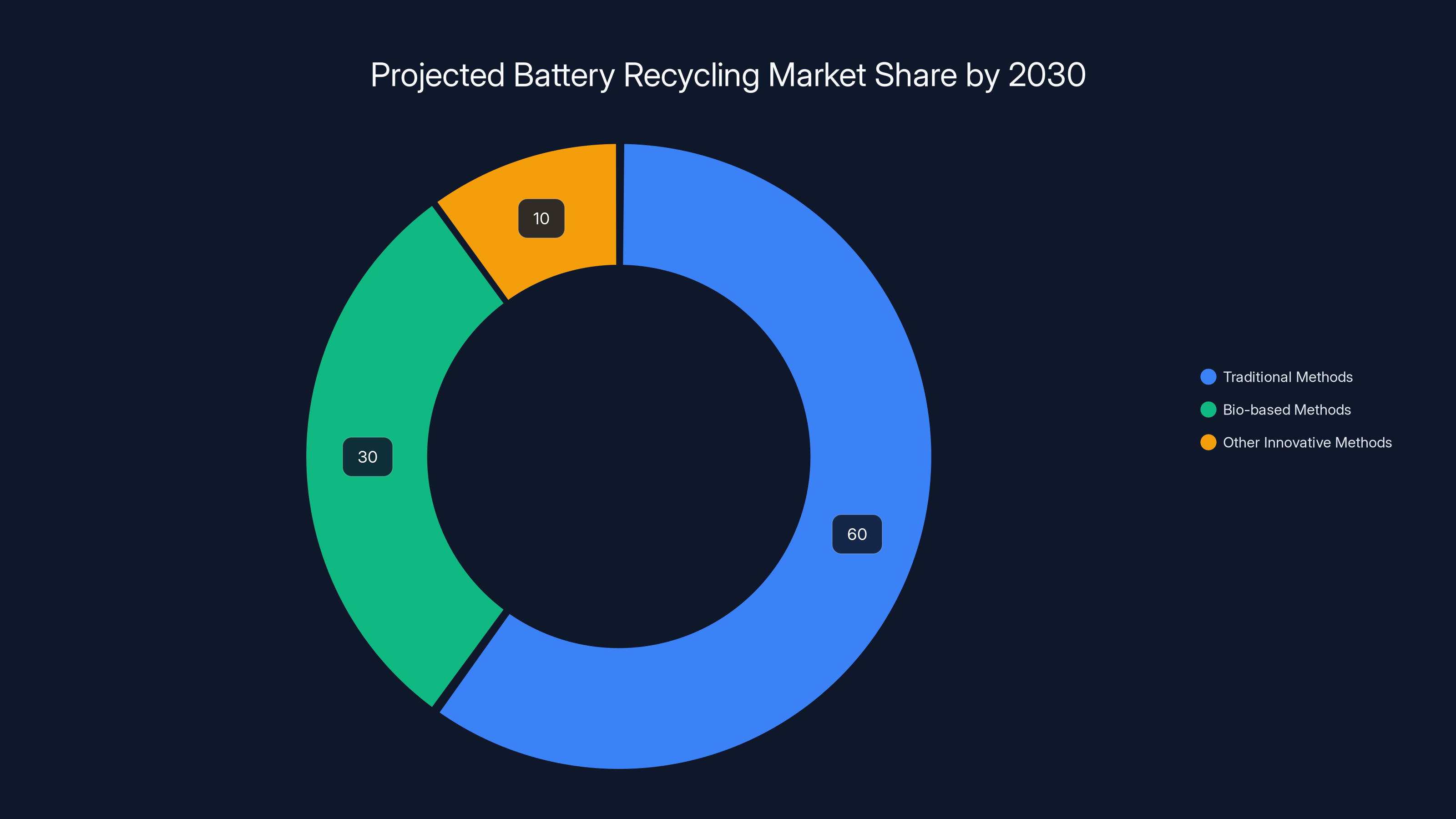

The battery recycling market is projected to hit $25 billion by 2030. Ara Bat is positioning itself to capture significant share by making the process actually economical.

Aruna Revolution: Rethinking the Menstrual Pad

Wait, how does this fit into clean tech? Stay with me.

Aruna Revolution makes compostable menstrual pads from agricultural by-products. This is a circular economy play, not a traditional energy story, but it's worth understanding because it illustrates a broader clean tech principle: taking waste material and converting it into consumer goods.

Conventional menstrual pads are mostly plastic and synthetic materials. That means they take 400+ years to decompose and end up in landfills or oceans. Aruna flipped the model. They use agricultural waste (things that would otherwise be burned or dumped) and transformed them into a product that works well and decomposes in months.

The sustainability angle is obvious. The business angle is this: menstrual products are a massive, recurring consumption category. Billions of units are sold yearly. If you can make them compostable without sacrificing performance, you've got a distribution advantage and margin play. Companies will switch for both environmental AND commercial reasons.

This is instructive because it shows how clean tech isn't just about energy and emissions. It's about rethinking materials and consumption patterns across every category.

By 2030, bio-based recycling methods like AraBat's could capture 30% of the $25 billion battery recycling market, highlighting a significant shift towards more sustainable practices. (Estimated data)

Gas-to-Value: Converting Waste Into Resources

This is one of my favorite emerging categories in clean tech. The concept is straightforward: industrial facilities produce massive amounts of waste gases (methane, CO₂, other byproducts). Instead of releasing them or burning them, what if you converted them into valuable chemicals or fuels?

That's not just environmental storytelling. That's profitable circularity.

Carbon Bridge: Fermentation Tech for Gas Conversion

Carbon Bridge builds bioreactors that use microbial gas fermentation to transform waste gases like methane and CO₂ into valuable molecules. They're essentially using engineered bacteria to do the chemical conversion work.

Here's why this is clever: traditional chemical synthesis of molecules requires extreme temperatures, high pressure, and lots of energy. Microbial fermentation works at room temperature in a contained environment. Lower energy input means lower cost and smaller carbon footprint.

The molecules they're targeting—things like methanol, formic acid, and other platform chemicals—are worth thousands of dollars per ton. Waste gas becomes feedstock. The economics flip from "we need to manage this waste" to "we can monetize this waste."

Carbon Bridge claims their technology is more efficient than competing methods. What I want to see: real-world performance data, not just lab benchmarks. But the underlying concept is sound, and the market opportunity is massive. Industrial facilities globally are desperate for economical waste gas solutions.

Kaio Labs: AI-Powered CO₂ Transformation

Kaio Labs takes a different approach: they develop CO₂ conversion technologies with an AI twist. Their process transforms waste carbon dioxide into valuable chemicals like carbon monoxide, formic acid, and ethylene.

The AI angle is important here. Chemical synthesis is complex. There are thousands of variables: temperature, pressure, catalysts, reaction time, etc. Traditional chemistry discovery is slow—you run experiments, analyze results, iterate. AI accelerates that cycle. Kaio uses machine learning to automate the discovery process, identifying optimal reaction conditions faster than human chemists.

This matters because it changes the unit economics. Faster discovery means faster path to commercialization. It means you can iterate toward higher yields and lower costs more efficiently.

The target molecules (carbon monoxide is a precursor for fuels and chemicals; formic acid is used in agriculture and manufacturing; ethylene is the world's most-produced chemical) have enormous markets. If Kaio can scale their CO₂ conversion to become cheaper than current production methods, they've got a business.

Building Materials Go Carbon Negative

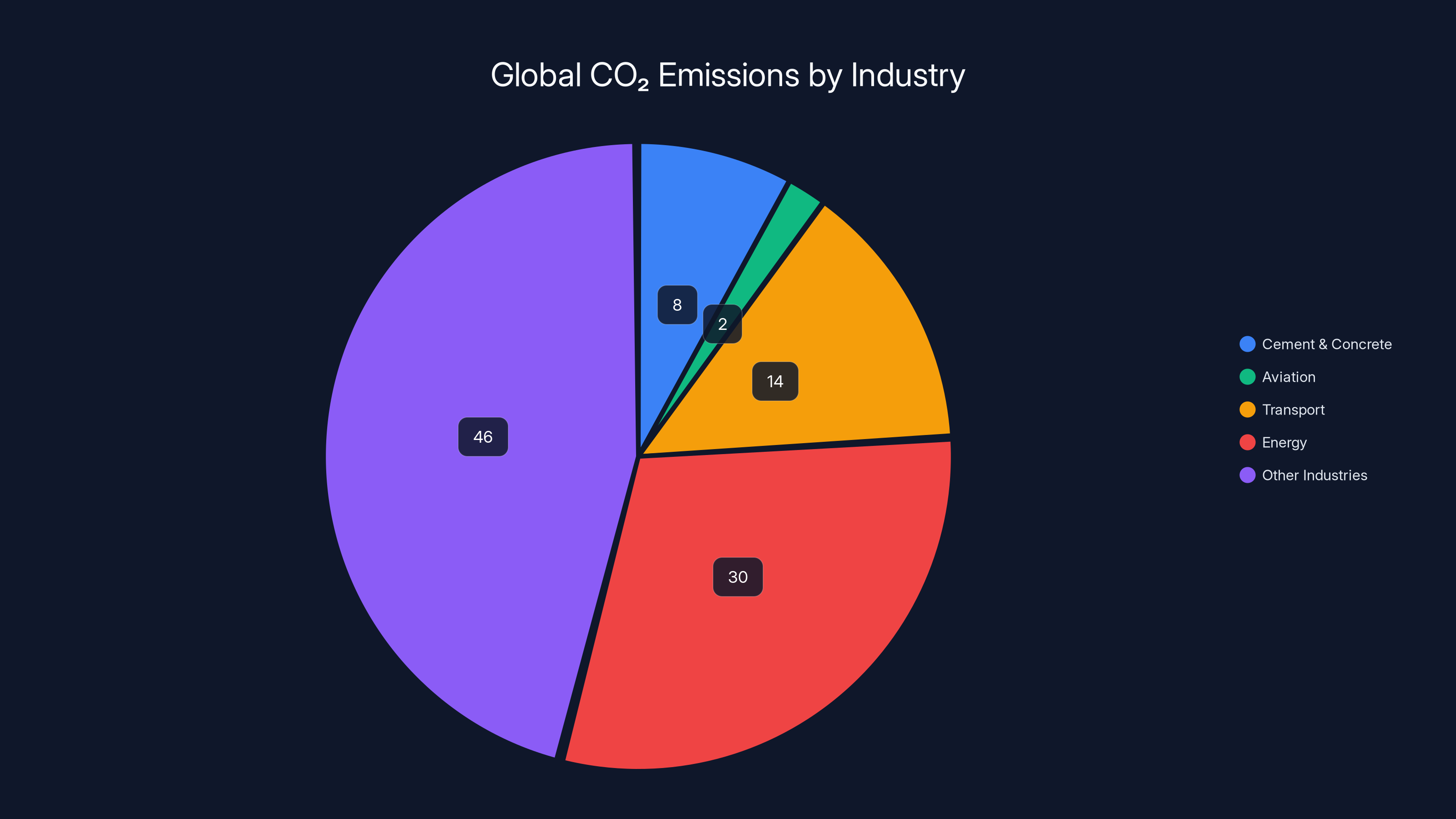

Cement and concrete account for roughly 8% of global CO₂ emissions. That's more than aviation. It's a huge problem hiding in plain sight because everyone sees buildings, but nobody thinks about the carbon cost of the materials inside them.

Clean tech companies are tackling this from multiple angles. Some are replacing cement. Others are making cement itself less carbon-intensive. The most ambitious? Making it carbon negative.

Carbon Negative Solutions: AI Cement from Industrial Waste

Carbon Negative Solutions does something genuinely clever: they use an AI-powered platform to convert industrial wastes and minerals into cement. The key differentiator is their process makes the resulting cement carbon negative.

So here's how this works in practice: industrial facilities produce mineral waste. That waste would normally end up in a landfill. Carbon Negative takes that waste, processes it (here's where AI comes in, optimizing the conversion), and produces cement that sequesters more carbon than was emitted during its creation.

But there's a commercial catch: they designed it so their cement works with standard equipment. Concrete plants don't need to retrofit anything. Construction companies can use it immediately. That removes a massive adoption friction.

The cement market is $4+ trillion annually. Even capturing a tiny percentage of that market as it shifts toward lower-carbon options could be enormous. The company's claiming affordability plus carbon-negative properties. If that's real, adoption is a question of awareness and distribution, not performance.

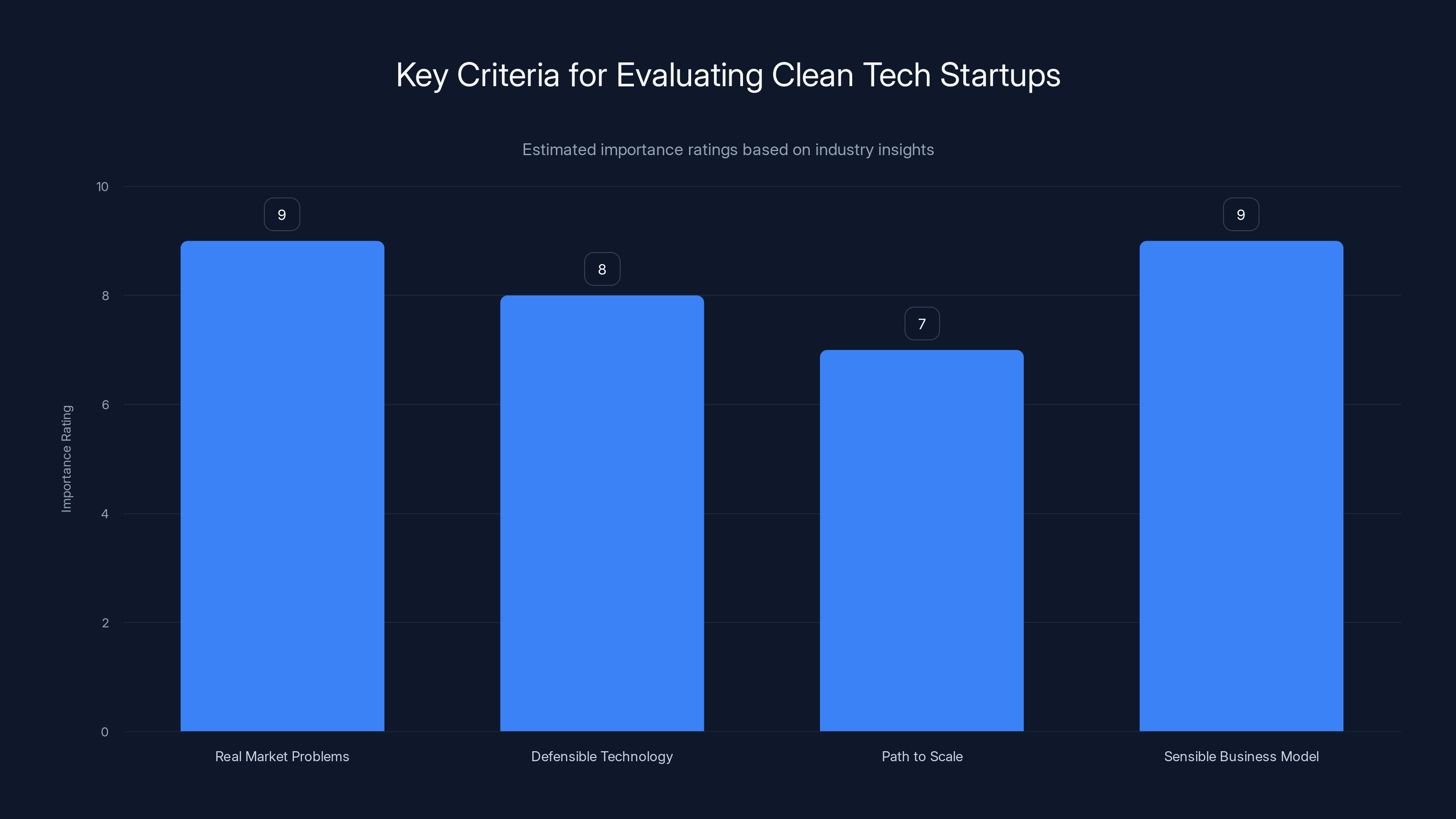

Real market problems and a sensible business model are top criteria for evaluating clean tech startups, followed closely by defensible technology and scalability. Estimated data.

The Energy Grid Goes Intelligent: AI-Powered Optimization

Electricity grids are notoriously inefficient. Power plants generate capacity. Some of that gets used. Some gets wasted. Demand fluctuates throughout the day. Supply sometimes doesn't match demand. It's a scheduling and visibility problem.

AI and real-time data are starting to solve this.

COI Energy: Enterprise Energy Trading Platform

COI Energy built something that shouldn't work but does: a marketplace where enterprises can buy and sell excess energy capacity. Think of it like Airbnb for electricity.

Here's the scenario: a large office campus might have reserved 10 megawatts of power capacity but typically only uses 8. During certain hours, they use even less. Meanwhile, another facility nearby is operating at maximum capacity or paying demand charges for reserved power they don't use.

COI Energy's platform lets them trade. Campus A sells unused capacity to Campus B. Both save money. The grid becomes more efficient because reserved power is actually being used instead of sitting idle.

But the platform does something else too: it gives enterprises predictive insights into their energy needs. Machine learning analyzes historical usage patterns and forecasts future demand. That intelligence lets facilities optimize their operations and negotiate better rates.

The value prop is straightforward: save on energy costs, improve grid efficiency, reduce strain on infrastructure. It's not revolutionary technology, but it's practical business logic applied to energy markets. Those tend to scale well.

Coral: AI Carbon Accounting That Doesn't Lie

Every big company now talks about their carbon footprint. Most of them are making it up. Not intentionally malicious, but ESG reporting is a mess. Data comes from different sources, methodologies vary, and tracking is manual and error-prone.

Coral built an AI-powered platform that automates carbon accounting and reporting. They integrate with your energy, supply chain, and operations data, automatically calculate your energy footprint, and generate reports.

But here's the clever part: they use blockchain to trace carbon credits. When you offset emissions through carbon credit purchases, those credits are tracked on-chain. It creates accountability. It's harder to fraudulently claim you've offset emissions if it's verifiable on a distributed ledger.

For enterprises, this solves a real problem: doing ESG reporting accurately and defensibly. For regulators and stakeholders, it means carbon claims are actually verifiable. That's valuable infrastructure in a world moving toward mandatory climate disclosure.

The EV Charging Infrastructure Gap

Electric vehicles are growing exponentially, but charging infrastructure is lagging. One major bottleneck: the software and hardware that manages charging networks is fragmented, expensive, and often incompatible with older infrastructure.

Emobi: Cloud Platform for Universal EV Charging

Emobi built an AI-powered cloud platform that handles EV charging across networks, even legacy hardware. This solves a genuine problem in the EV space.

Here's why this matters: charging networks have older equipment. Installing new hardware across thousands of locations is expensive and slow. Emobi's software can integrate with legacy systems, adding intelligence and features without requiring hardware replacement.

Their platform handles the complex logistics: secure automatic charging, load balancing, payment processing, user management. It's the operational backbone that makes charging networks functional.

The addressable market is huge. Every charging network provider needs software. Every network is scrambling to scale. Emobi's positioned to be the infrastructure layer that powers that growth.

Cement and concrete account for 8% of global CO₂ emissions, surpassing aviation. Estimated data highlights the significant impact of building materials on emissions.

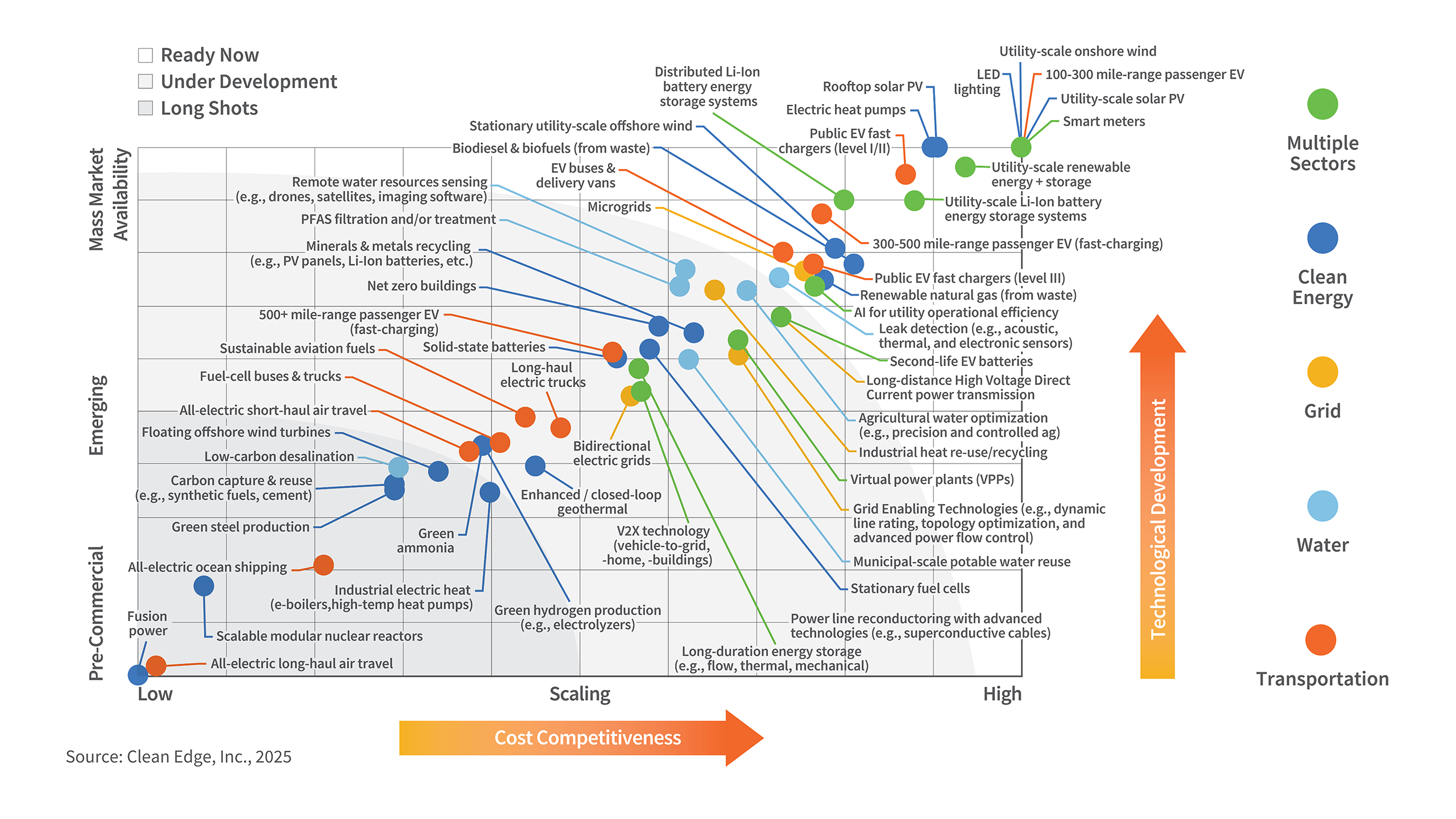

Energy Storage: Beyond Batteries

Lithium-ion batteries have been revolutionary, but they're not the only way to store energy. Some startups are exploring alternatives that could offer better performance, lower cost, or specific advantages for certain applications.

Eny Gy: Ultracapacitors That Actually Work

Eny Gy makes ultracapacitors—devices that sit somewhere between a conventional capacitor and a battery in terms of energy storage capability. They charge and discharge faster than batteries but typically store less energy.

Why would that be useful? Ultracapacitors excel in applications where you need rapid charge/discharge cycles and high power output. Think regenerative braking in vehicles, grid stabilization, or power backup systems.

Eny Gy's innovation: they've engineered ultracapacitors with doubled energy density compared to alternatives while keeping costs competitive. They're using activated carbon electrodes and optimized electrolytes to achieve this.

If their performance claims are real, they've opened up new use cases. Traditional ultracapacitors were too weak for many applications. Doubled energy density changes the math.

Hy Watts: Hydrogen Storage Plus Fuel Cells

Hy Watts supplies modular systems for on-site industrial power generation. Their offering: "Power-Plant-in-a-Box." It integrates hydrogen storage with reversible fuel cells.

Here's how it works: hydrogen is stored. When you need power, the fuel cell converts hydrogen into electricity with water as the only byproduct (zero emissions). When you have excess power, the system can reverse the process, using electricity to generate hydrogen from water and store it.

They're positioning this at data centers and industrial facilities. The value prop: zero-emission, off-grid electricity at lower cost than battery storage.

The catch with hydrogen: storage, distribution, and efficiency losses. Hydrogen has lower energy density than other fuels. It's harder to store and transport. But for stationary power applications, those limitations are less critical. You're not trying to power a vehicle; you're generating electricity at a fixed location.

If their cost structure is genuinely lower than large-scale battery installations, they've got a real business.

Battery Innovation: Performance Leaps and Cost Reductions

Battery technology is advancing on multiple fronts. Some companies are working on new materials. Others are optimizing manufacturing. The improvements compound: better chemistry plus better engineering equals dramatically better batteries.

HKG Energy: Silicon Materials for Battery Revolution

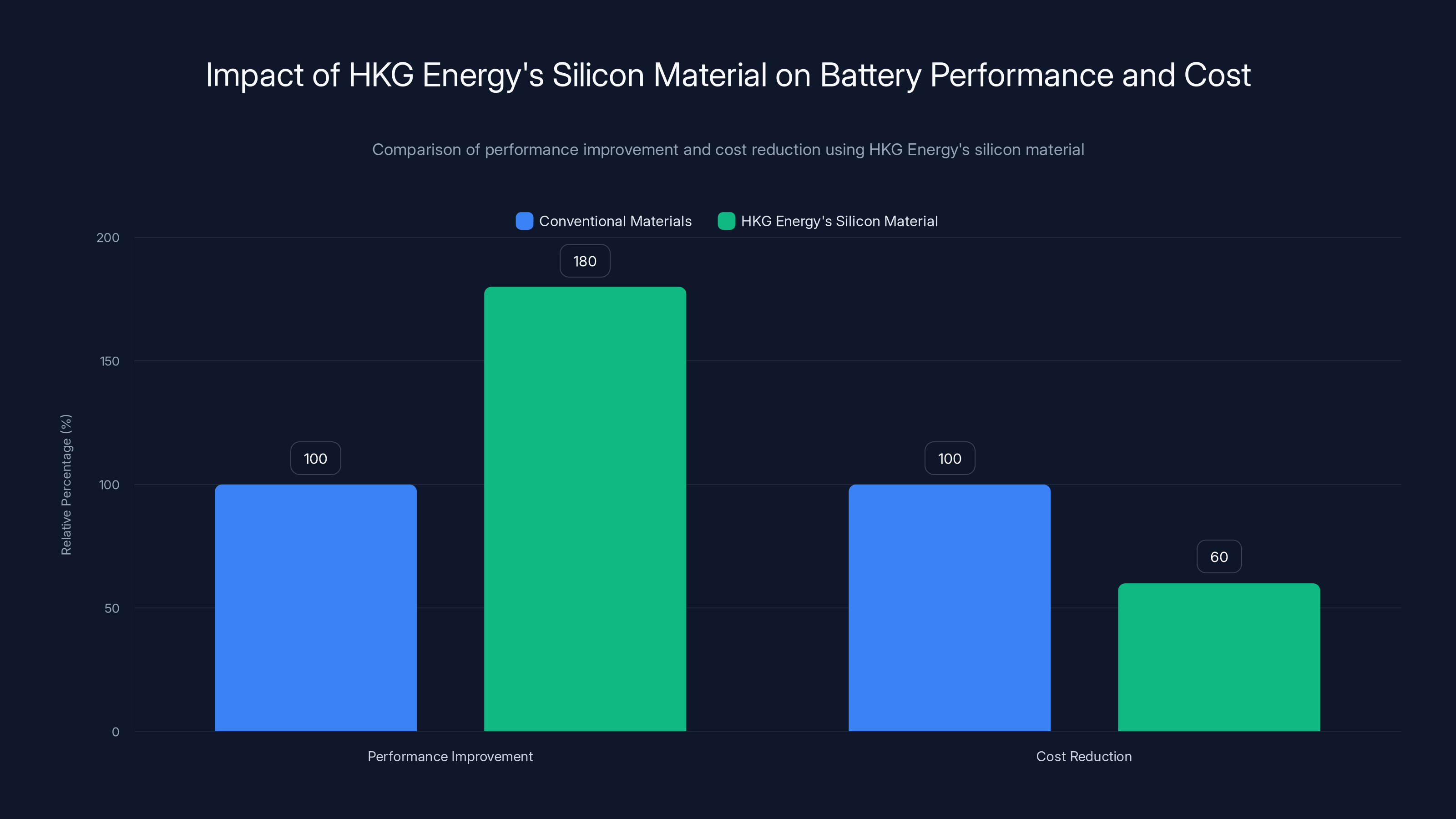

HKG Energy has developed next-generation silicon material for lithium-ion batteries. Their material increases battery performance by 80% while costing up to 40% less than conventional alternatives.

Why silicon? It has high theoretical energy density. But traditional silicon anodes have issues: they expand and contract during charge/discharge cycles, degrading performance over time. HKG has apparently solved that problem with their material formulation.

If those numbers are real (80% performance improvement, 40% cost reduction), adoption would be explosive. Battery manufacturers would switch immediately. OEMs like Tesla, Volkswagen, and others would want this material for their cells.

The key question: can they scale manufacturing? Lab results are interesting. Manufacturing at commercial scale with consistent quality is the real test.

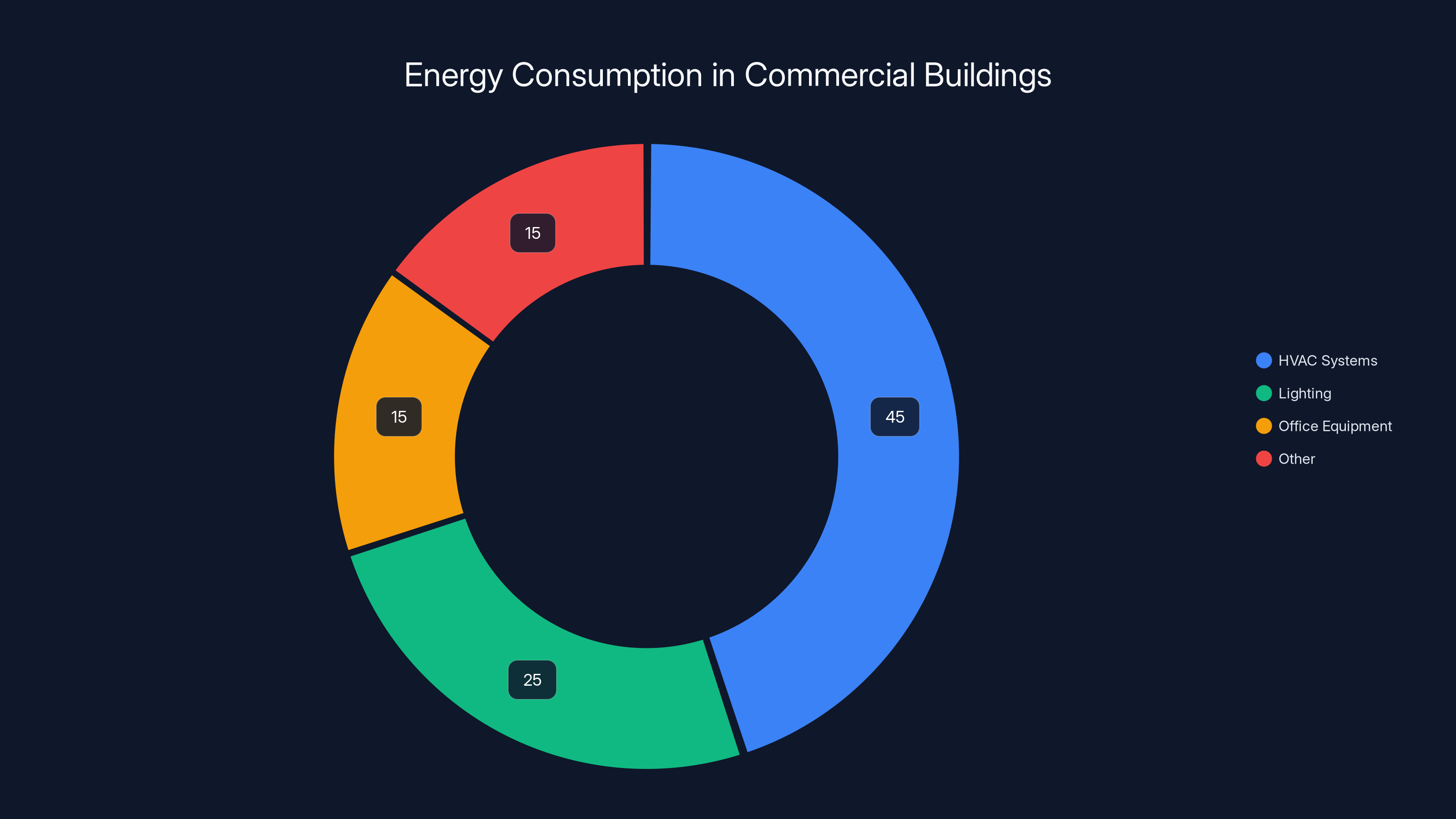

HVAC systems account for approximately 45% of energy consumption in commercial buildings, highlighting their significant impact on overall energy use. Estimated data based on typical office environments.

Home Energy: Making Efficiency Personal

Most energy efficiency initiatives target big buildings and industrial facilities. But residential energy use is massive—homes account for roughly 20% of energy consumption in developed countries. Making homes more efficient could move the needle significantly.

Home Boost: DIY Energy Audits That Actually Work

Home Boost offers a do-it-yourself energy assessment system. They ship homeowners custom hardware that couples with a smartphone app to scan the home and identify energy inefficiencies.

Here's the workflow: homeowner receives the hardware. They use the app to scan their house (the hardware has thermal imaging or similar tech). The scan identifies where heat is escaping, where windows are leaky, where insulation is failing. Then home energy experts review the data and generate a report with specific recommendations.

The value: homeowners get detailed energy efficiency information without paying for an expensive professional audit. They find out where their energy is going and what they can do about it.

The business model: Home Boost sells the hardware and charges for the expert review and report. Alternatively, they could bundle partnerships with contractors or rebate programs.

The market is substantial. Most homeowners have no idea where they're wasting energy. Better information drives behavior change and home improvement investments. Both benefit Home Boost.

Advanced HVAC: Aerospace Engineering Meets Climate Control

Heating and cooling account for roughly 40% of global energy consumption. Making HVAC systems more efficient has outsized impact on overall energy use.

Helix Earth: Spacecraft Tech for Building Efficiency

Helix Earth created products from liquid-gas chemistry originally designed for spacecraft. They've adapted this technology for ultra-efficient HVAC and carbon capture systems for buildings.

Why aerospace technology for buildings? Space systems operate under extreme constraints: weight matters, efficiency is critical, reliability is non-negotiable. That drives innovation that translates to exceptional performance.

Helix Earth's systems are far more energy-efficient than conventional HVAC and can be retrofitted to commercial rooftops. They're also claiming affordability, which is key for adoption. If you need to rip out existing systems, costs balloon. Retrofit-compatible solutions have a scaling advantage.

The market: buildings globally consume enormous energy for heating and cooling. Even small efficiency improvements scale to massive energy savings. Helix Earth's positioned to capture some of that opportunity.

HKG Energy's silicon material offers an 80% performance improvement and a 40% cost reduction compared to conventional battery materials, potentially revolutionizing the battery industry. Estimated data based on reported improvements.

Intelligent Waste Management and Recycling

Recycling is broken in most places. People sort waste imperfectly. Contamination rates are high. Recycling facilities have to re-sort and re-process, which defeats the purpose. AI and robotics could fix this.

Ganiga: AI Garbage Bins That Sort Themselves

Ganiga makes an AI and robotics-powered garbage bin called Hoooly that recognizes and sorts recyclables. Essentially, it's a smart trash can with computer vision and mechanical sorting.

Here's the workflow: you throw stuff in the bin. The AI camera identifies what you threw. Mechanical sorters separate it into the right category. Different waste streams go to different containers within the bin.

They're selling this to enterprise campuses, airports, and industrial sites—places with high waste volumes and existing ESG commitments. The value: dramatic improvement in recycling rates. Contamination drops because the AI is sorting, not humans. It generates analytics that help with ESG reporting.

The economics need to work out: the bin needs to be cheaper to operate than manual sorting while delivering better results. If that's true, adoption scales quickly. If it's just another expense with incremental benefit, adoption stalls.

But the concept is sound. Automation in waste management has been underexplored relative to other categories.

On-Site Power Generation: Fuel Cells and Beyond

Traditional grids are centralized. Power plants in one location, distributed through transmission lines to distant users. There's inefficiency built into that architecture. On-site generation eliminates transmission losses and gives facilities independence from grid fluctuations.

Gemini: Fuel Cells for Data Center Power

Gemini has developed fuel cell technology that generates power on-site by converting gas into electricity without combustion. They're targeting data centers specifically.

Why data centers? They consume enormous amounts of power (roughly 1-2% of global electricity). They run 24/7. They're in fixed locations (not mobile). They can absorb capital-intensive on-site generation systems if payback periods are reasonable.

Gemini's claiming their systems can be deployed in months versus the years needed to upgrade conventional grid infrastructure. That's a major advantage. Data centers needing additional capacity can't wait years for grid upgrades. Fast deployment matters.

If their fuel cells are efficient, reliable, and cheaper than grid expansion or battery backup, they've got a compelling pitch. Data centers are also willing to try emerging tech if it solves a pressing problem.

The Startup Landscape: What Makes a Clean Tech Company Deserve Your Attention

With 22 startups in this space, you might wonder: what criteria actually matters when evaluating clean tech companies? After looking at these, patterns emerge.

Real market problems, not hypothetical ones: The best companies solve problems that are costing organizations money right now. Ara Bat addresses battery recycling as EV markets grow and battery waste accumulates. Coral addresses ESG reporting requirements that are becoming mandatory. COI Energy addresses energy costs that are genuine budget pressures. Solve something expensive, and you have a path to revenue.

Defensible technology, not hype: Some of these companies have genuinely novel approaches. Bio-based battery recycling. AI-powered chemical discovery. Aerospace-derived HVAC tech. Others are more about optimization and software. Both can work, but defensibility matters. If your competitive advantage is hard to replicate, you have time to build moat. If it's purely operational excellence, you're always vulnerable.

Reasonable path to scale: A brilliant technology that requires specialized expertise and exotic materials for every unit won't scale. The best startups here have figured out how to manufacture at scale, integrate with existing infrastructure, or leverage abundant resources. Citrus peels are abundant. Hydrogen production is understood. Legacy charging hardware is everywhere. Working within those constraints is smarter than inventing entirely new supply chains.

Business model that makes sense: This might sound obvious, but many clean tech startups have sustainability models that only work if subsidies or regulations force adoption. The best ones here have actual customers willing to pay because the economics make sense. Data centers will pay for efficient on-site power. Enterprises will pay for energy marketplace platforms. These aren't altruistic purchases.

Future Opportunities: Where Clean Tech is Heading

Looking at these 22 companies collectively, a few trends are worth noting for anyone investing, building, or just interested in the space.

Circular economy is moving from concept to infrastructure: These startups aren't just talking about circular economy principles. They're building systems that make circularity economical. Taking waste and turning it into input for new products. The software and logistics are getting better, which makes it viable at scale.

AI is becoming standard, not differentiation: Most of these companies are using machine learning for something: optimizing chemical reactions, managing energy grids, analyzing home efficiency, automating waste sorting. AI is becoming the baseline capability. Companies that use it well will win; those that don't will lose.

Energy's moving distributed: Big centralized power plants and grids are efficient at one thing: amortizing capital costs across many users. But distributed generation (on-site power, local renewable sources, local storage) is becoming technically feasible and economically sensible. Companies enabling distributed energy have tailwinds.

Materials innovation is back: For years, clean tech meant software and services. But real impact requires better materials. Better batteries (HKG). Better cement (Carbon Negative). Better recycling processes (Ara Bat). These companies are proving materials innovation still matters and can drive defensible advantages.

Startups are addressing specific bottlenecks, not broad categories: Nobody here is trying to "solve energy" or "eliminate emissions." They're solving specific problems: recovering metals from batteries, optimizing energy grids, improving HVAC efficiency, automating recycling. Specificity is smart. You can build a business around a specific problem. Broad "save the planet" missions are purpose, not business models.

How to Evaluate Clean Tech Companies: A Framework

If you're making investment decisions, considering job offers, or just trying to understand which companies have real potential, here's a framework that works.

Ask about unit economics: What's the cost per unit or per transaction? How does that compare to existing solutions? Are they claiming to be cheaper, faster, better, or some combination? Extraordinary claims require extraordinary evidence. Ask for data.

Understand their defensibility: What prevents a larger company from copying their approach? Is it patented technology? Is it a network effect (like an energy trading platform that's valuable with more participants)? Is it first-mover advantage in a category? Defensibility determines long-term viability.

Evaluate the team: Clean tech requires deep expertise. Battery chemistry experts. Regulatory knowledge. Manufacturing experience. Do the founders and early team have real experience in their domain, or are they outsiders betting on a concept? Domain expertise matters for execution.

Check the timing: Is the market actually ready for this solution? Are regulations shifting to require it? Are customer pain points acute enough to drive adoption? Sometimes great tech is too early. Sometimes it's perfectly timed. Timing is luck and strategy combined.

Calculate the TAM realistically: Total addressable market matters, but companies often overestimate it. Battery recycling isn't the entire battery market, it's the recycled battery market. Home energy efficiency isn't all residential energy, it's the portion willing to invest in upgrades. Reasonable TAM estimates matter more than optimistic ones.

The Broader Impact: Why This Matters Beyond Business

Okay, so here's the thing. These companies aren't just building businesses. They're genuinely trying to reduce emissions, improve efficiency, and shift how we produce and consume energy. That matters.

Climate change is real. Energy efficiency improvements, renewable transition, and circular economy principles are part of solving it. Startups scaling these solutions faster than traditional industries can move is legitimately valuable.

But I'll be honest: startups aren't going to solve climate change alone. What they can do is prove new approaches work, develop technologies at scale, and force incumbents to innovate faster. When a startup shows that bio-based battery recycling works better and costs less, traditional recyclers have to adapt. When on-site power generation becomes cheaper than grid expansion, utilities have to rethink their infrastructure. When AI can optimize grids and carbon accounting, adoption becomes the question, not viability.

That's the real value of companies like these. They're expanding the toolkit and proving what's possible. That shifts what's inevitable.

Key Takeaways: What Matters

If you take nothing else from this, remember these points:

Battery recycling is scaling: As EV adoption grows, battery waste will become a massive resource if it's managed right. Companies like Ara Bat are showing it can be done cleanly and profitably.

AI is optimizing energy systems: From grid management to chemical discovery to carbon accounting, machine learning is making energy systems smarter and more efficient.

Circular economy is real business: Turning waste into input isn't just environmentally sound; it's economically rational when you remove the toxic, expensive steps from the process.

Specificity wins: Companies solving specific problems (EV charging, energy trading, waste sorting) outperform companies trying to fix broad categories.

Materials matter: New battery chemistries, sustainable building materials, and advanced HVAC tech prove that innovation in materials still drives competitive advantage.

On-site generation is becoming viable: Distributed power generation is moving from niche to mainstream as technology improves and costs drop.

FAQ

What exactly is the Tech Crunch Startup Battlefield?

The TechCrunch Startup Battlefield is an annual pitch competition where thousands of startups apply to compete. The most promising applicants are whittled down to 200 "Battlefield 200" companies, and the top 20 among those get to pitch on stage at Tech Crunch Disrupt for the chance to win the Startup Battlefield Cup and $100,000 in prize money. The remaining 180 companies compete in their own category competitions. It's one of the most selective startup showcases in the industry.

Why does clean tech matter as a category?

Clean tech and energy solutions address some of the most pressing global challenges: climate change, energy efficiency, resource scarcity, and waste management. Companies in this space aren't just building profitable businesses; they're developing technologies that can meaningfully reduce emissions and resource consumption at scale. Additionally, the economic opportunity is enormous as governments mandate climate disclosures, transition to renewables, and companies invest in sustainability.

How are these startups different from established energy companies?

These startups are typically focused on specific technical innovations or novel business models rather than broad infrastructure ownership. Established energy companies operate grids and power plants; startups often solve specific bottlenecks (battery recycling, energy optimization, waste conversion). Startups can also move faster, iterate quicker, and adopt new technologies without legacy infrastructure constraints. However, they lack the capital and distribution advantages of larger companies, so success depends on solving problems that customers urgently need solved.

What's the business model for most of these clean tech startups?

It varies. Some sell hardware (Hoooly trash bins, charging controllers, HVAC systems). Some offer software platforms (energy trading, carbon accounting). Some provide services (energy audits, battery recycling). The best ones have identified a customer segment with an acute problem they're willing to pay to solve. Subsidies and regulations help, but products that make economic sense without external incentives have higher survival rates.

How long does it typically take for a clean tech startup to become profitable?

It depends heavily on the specific business. Software-based solutions (energy trading, carbon accounting) can become profitable relatively quickly if they achieve customer adoption. Hardware-intensive solutions that require manufacturing scaling or infrastructure installation take much longer. Battery recycling startups, for instance, might need 3-5 years to build scale before profitability. Understanding whether a company has adequate funding runway for their business model matters more than generalized timelines.

What regulatory or market changes are helping these startups succeed?

Mandatory ESG reporting requirements are pushing companies to track and reduce their carbon footprints, creating demand for solutions like carbon accounting and energy optimization platforms. EV adoption is creating massive quantities of battery waste, which makes battery recycling increasingly valuable. Building efficiency codes are tightening. Energy grids are becoming more regulated to accommodate renewable integration. Government incentives and subsidies for renewable energy and efficient systems help, but the underlying economics increasingly favor these solutions even without them.

Which of these startup categories has the most potential?

Battery technology and recycling probably have the largest addressable market given the exponential growth in EV adoption and energy storage deployment. But energy grid optimization and carbon accounting are high-value, sticky software businesses with lower capital requirements and faster paths to profitability. Materials innovation in HVAC and building efficiency also addresses massive consumption categories with lots of room for improvement. The honest answer: multiple categories will produce successful companies at scale.

How can I learn more about investing in or joining these startups?

Most of these companies will update their information following Tech Crunch Disrupt, including funding status and hiring plans. If you're investor-curious, review their pitch decks and financial metrics. If you're job-seeking, most startups post open positions on their websites, Wellfound (formerly Angel List), and Linked In. The clean tech space is competitive for talent, so strong execution and genuine interest in the problem space matter more than credentials.

Conclusion: The Clean Tech Moment Is Here

Twenty-two startups out of thousands. That's the throughput of Tech Crunch's Startup Battlefield for clean tech and energy. Each one solved a specific problem well enough to catch investors' attention. Each one has founders who genuinely believe their approach could move the needle on emissions, efficiency, or resource consumption.

Are they all going to succeed? No. Some will run out of funding. Some will discover their market isn't ready. Some will face regulatory hurdles or competitive pressure they didn't anticipate. That's startup life.

But collectively, they're proof that the clean tech and energy space isn't theoretical anymore. It's not just environmentally motivated. It's increasingly economical. Companies are profitable or on paths to profitability solving real problems for real customers.

When I look at what Ara Bat's doing with bio-based battery recycling, or how COI Energy is optimizing energy trading, or the way Coral's automating carbon accounting, I see pieces of infrastructure that large-scale sustainable energy systems need. Some of these companies will become the plumbing that makes the transition to clean energy actually work.

The most interesting part? Most of them aren't trying to save the world. They're trying to build profitable businesses that happen to have positive environmental impact. That alignment—where profitability and sustainability go together—is where real change happens. Subsidies create distortions. Altruism runs out of funding. But businesses that make money while solving environmental problems? Those scale.

If you care about clean tech, you should watch these companies. If you're building in this space, you should study what they're doing right. If you're investing, the density of genuine innovation in this category is higher than most sectors.

The clean tech revolution isn't coming in some distant future. It's happening right now. These 22 companies are part of it.

Try Runable to Automate Your Energy and Sustainability Reports

Use Case: Automatically generate weekly sustainability reports from operational data, energy metrics, and carbon accounting systems without manual compilation.

Try Runable For Free

![22 Top Clean Tech & Energy Startups Disrupting 2025 [Guide]](https://tryrunable.com/blog/22-top-clean-tech-energy-startups-disrupting-2025-guide/image-1-1766851561053.jpg)