Tech Crunch Disrupt 2026: Your Complete Guide to Early Bird Savings and Maximum Networking ROI

You've got seven days. That's it. After February 27 at 11:59 p.m. PT, the lowest ticket prices for Tech Crunch Disrupt 2026 vanish forever, and prices jump significantly. If you're serious about scaling your startup, sourcing your next investment, or understanding where the tech industry is actually heading, this is your window.

I'm not going to oversell you with hype. Disrupt has earned its reputation over nearly two decades by doing one thing exceptionally well: bringing together the right people at the right time, in the right place. When you're surrounded by 10,000 founders, investors, and operators all focused on the same three-day goal, things happen. Deals close. Partnerships form. Directions shift.

But here's the real question: Is Disrupt worth the investment, and more importantly, how do you maximize your return on those ticket dollars? This guide walks you through everything you need to know about attending Disrupt 2026, from the pricing breakdown to the actual ROI calculation, plus the strategies that make the difference between showing up and truly connecting.

TL; DR

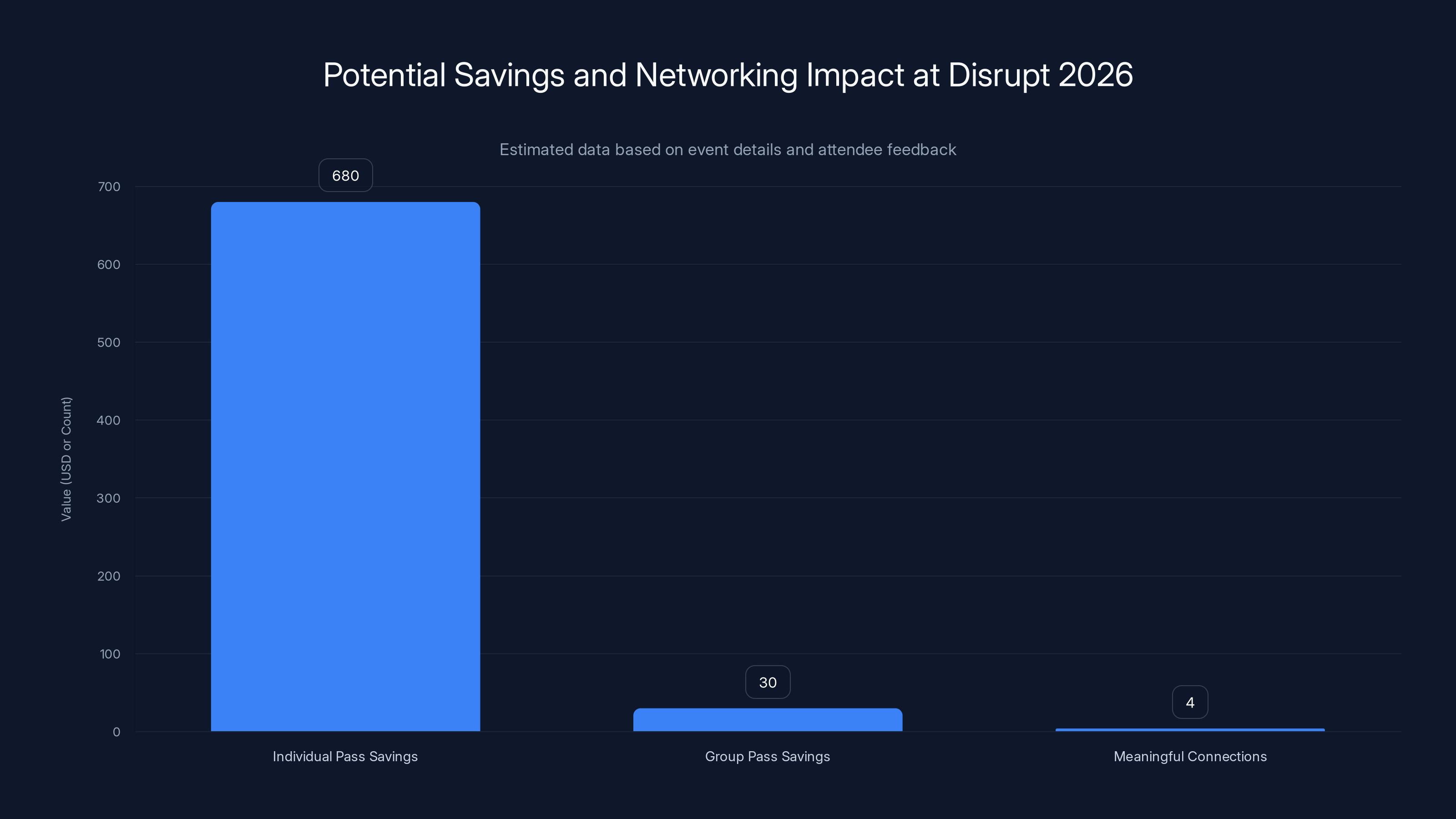

- Super Early Bird pricing ends February 27: Save up to $680 on individual passes and 30% on group passes as noted in TechCrunch's announcement.

- Event Details: October 13-15, 2026 at Moscone West in San Francisco with 10,000+ attendees

- Key Value: Access to 300+ exhibiting startups, Startup Battlefield 200 (with $100K equity-free prize), and high-caliber speakers from Google Cloud, Netflix, Waymo

- Networking Focus: Disrupt is engineered specifically for deal-making and strategic connections, not just panels

- ROI Opportunity: Average attendees report 3-5 meaningful connections that lead to partnerships, hires, or investments

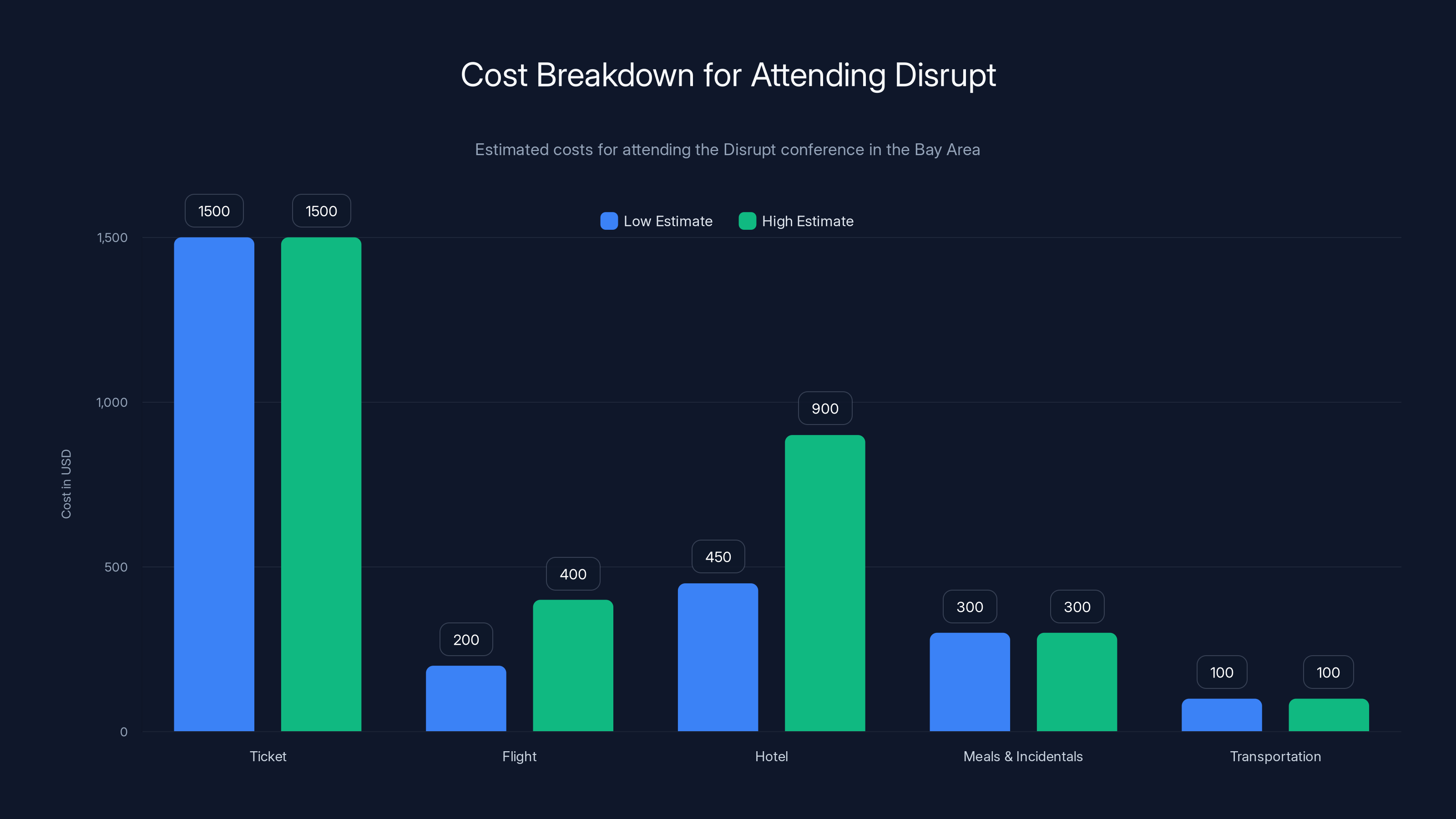

Estimated total costs for attending Disrupt range from

Understanding Tech Crunch Disrupt: What Makes It Different

Disrupt isn't just another tech conference. If you've attended a few industry events, you know the difference. Most conferences feel like you're watching the industry. Disrupt feels like you're inside it.

The event has been running since 2007, when it was literally a two-day gathering of startups and founders in a parking lot-style setup. Back then, nobody knew what they were doing. Now, nearly two decades later, Disrupt has become the barometer for what's emerging in tech. When a startup pitches on the Disrupt stage, the investment world pays attention. When a CTO shares insights from Netflix or Google Cloud, the room listens because they know it's not marketing fluff.

What makes Disrupt structurally different from other conferences comes down to three core elements: curated attendee mix, engineered networking, and high-signal content.

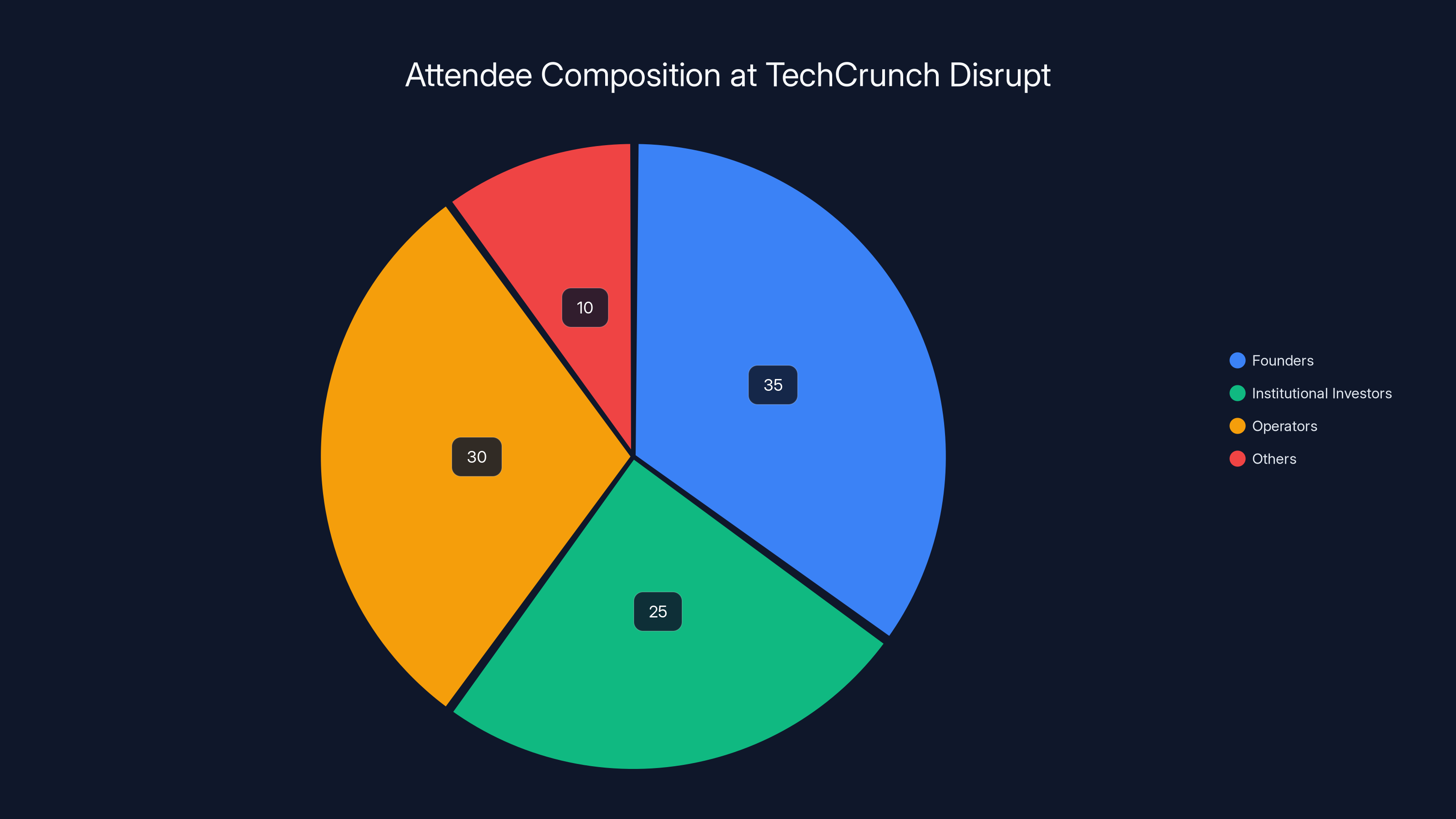

First, the attendee composition matters more than you'd think. Unlike massive conferences where you end up with 40% tourism and 60% genuine business attendees, Disrupt's 10,000 people are carefully selected. You get serious founders (the ones actually building revenue-generating businesses), institutional investors (venture partners with check-writing authority), and operators from the world's most innovative companies. That mix creates natural deal flow.

Second, the format is specifically designed to force connection, not just enable it. There's a reason the Startup Battlefield gets so much attention. Watching 200 pre-vetted startups pitch in a compressed format (companies get 60 seconds on stage plus Q&A) creates urgency. You see something interesting, you track down the founder in the hallway. You exchange contact info. You schedule a follow-up. The format works.

Third, the speaker lineup isn't about celebrity for celebrity's sake. Previous Disrupt speakers have included founders and executives who've actually moved needles: Matt Mullenweg from WordPress, investors like Elad Gil, founders building the next generation of AI and biotech companies, and operators from companies like Netflix, Google Cloud, and Waymo. These aren't people who show up to read pre-written speeches. They engage with real questions and share tactical insights.

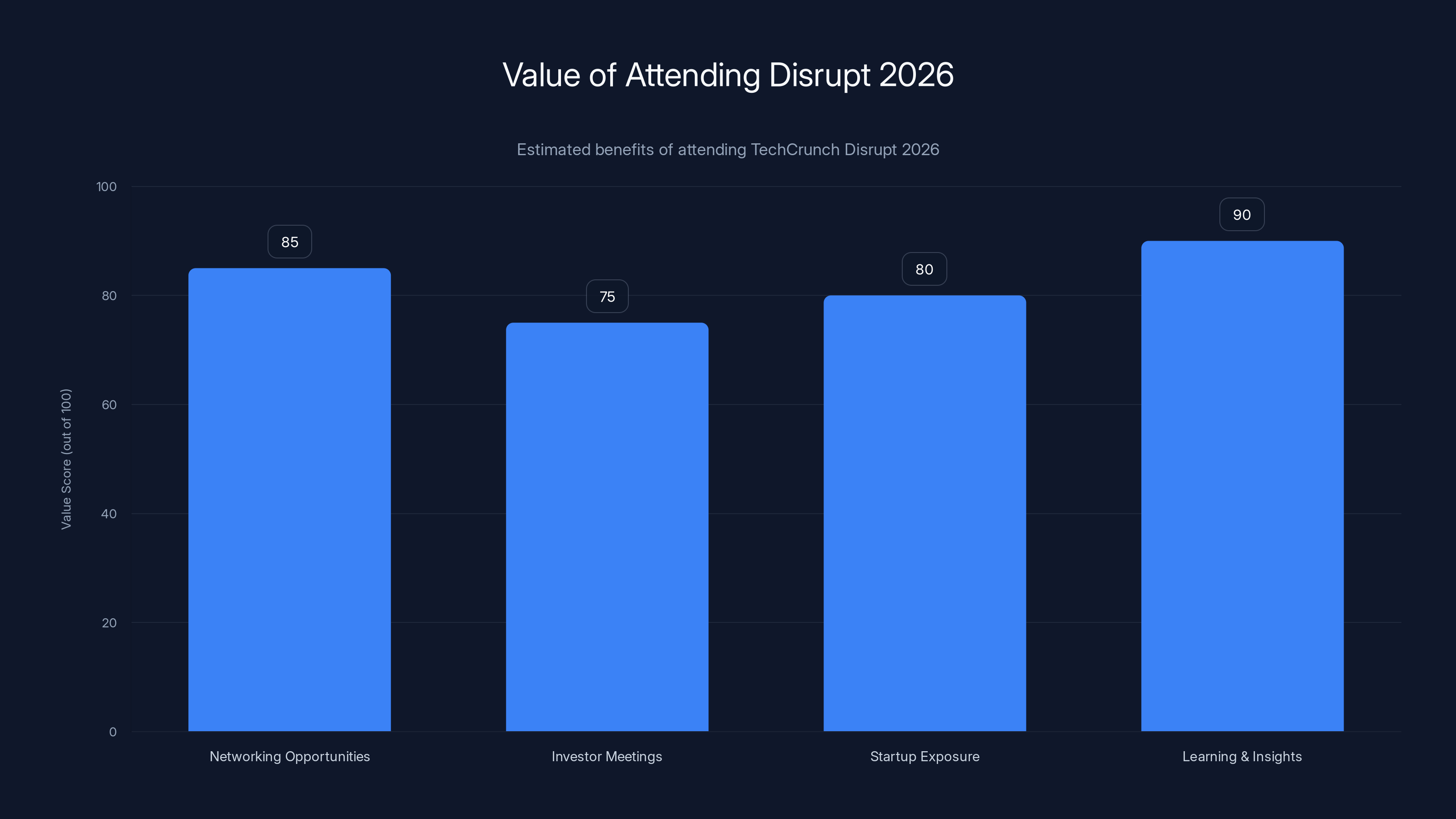

Attending Disrupt 2026 offers high value in networking and learning, with scores above 75 in all categories. Estimated data based on typical event feedback.

The Pricing Structure: What You're Actually Paying For

Let's break down the economics because understanding what you're paying for is the first step to getting ROI.

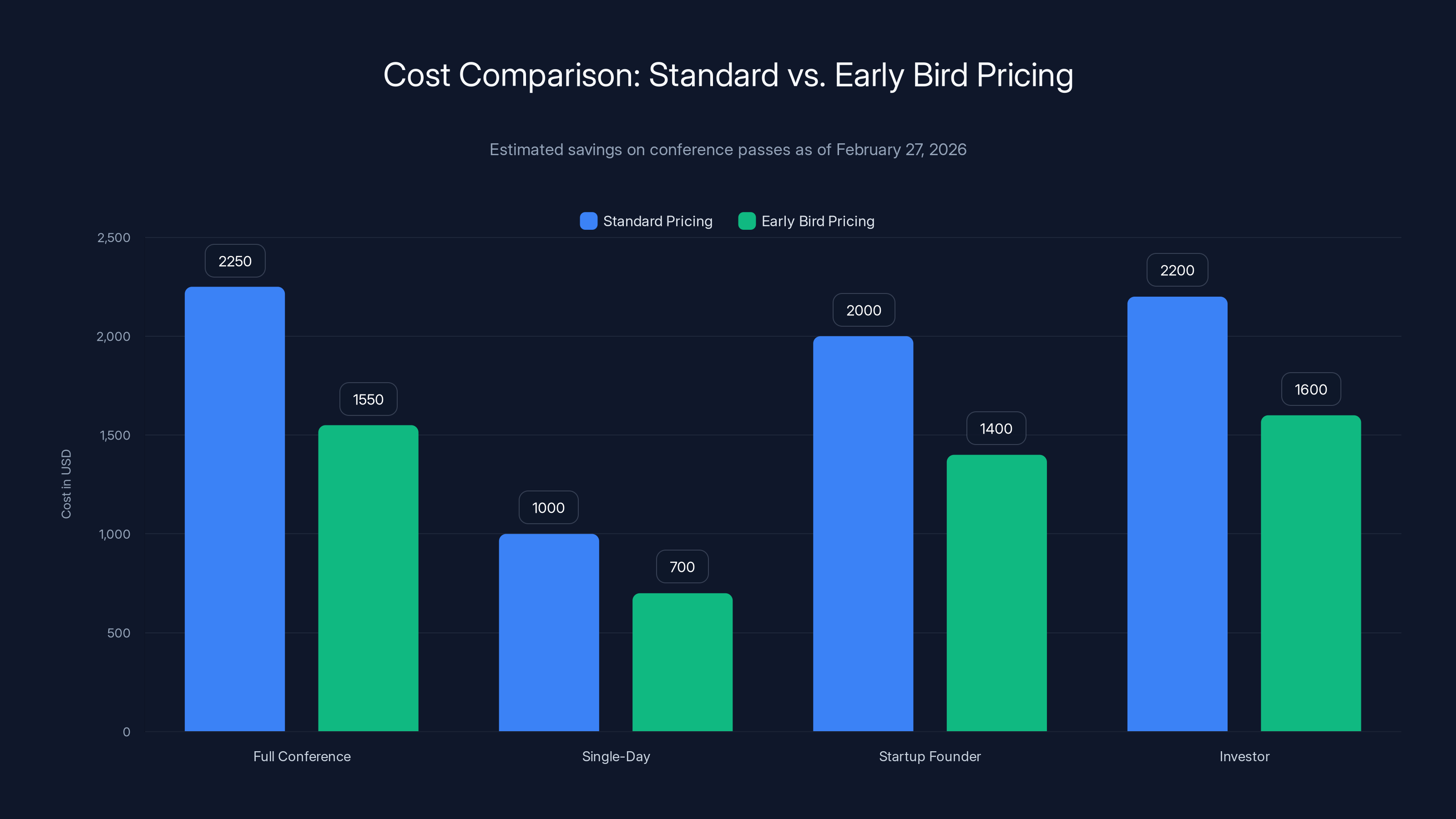

As of February 27, 2026, the Super Early Bird pricing tiers look like this:

Individual Passes: The early bird rate offers significant savings compared to standard pricing. The exact numbers depend on pass type (full conference, single-day, startup founder, investor), but the headline is accurate: you're looking at up to $680 in savings if you lock in before the deadline.

To put that in perspective, full conference passes at standard pricing typically run

Group Passes: If you're attending with colleagues, the group discount structure becomes relevant. Up to 30% off group passes means a company sending four people saves roughly

Pass Types: Different passes serve different purposes. A founder pass focuses on pitching and investor meetings. An investor pass unlocks different networking areas and one-on-one meeting slots. A general pass gives you access to the full conference. Choose based on your primary objective.

Here's the thing most people don't calculate: the ticket price is only part of the total investment. You need to factor in travel (flights to San Francisco), accommodation (hotels run

Where ROI gets interesting is when you work backward from the value of a single meaningful connection. If you're a founder and one conversation at Disrupt leads to a Series A term sheet, the $680 you saved on a ticket is literally invisible. If you're an investor and you find your next portfolio company during Startup Battlefield, same story.

That's why the pricing structure, while important, is less important than your strategy for using the three days.

What Happens at Disrupt: A Day-by-Day Breakdown

Walking into Moscone West during Disrupt is disorienting at first. The space is huge. There are parallel tracks happening simultaneously. Everyone looks busy and important. But once you understand the actual structure, it becomes navigable.

The Startup Battlefield: The Centerpiece

The Startup Battlefield is genuinely the heart of Disrupt. Two hundred pre-selected startups pitch in front of investors, press, and attendees. Each company gets 60 seconds on stage to present, followed by Q&A. One company wins a $100,000 equity-free prize, but that's not really the point. The point is that Battlefield creates structured deal flow.

Investors know to be in the room for Battlefield because they know the startups have been vetted by Tech Crunch's team. The startups know they're pitching in front of an audience that actually has decision-making power. The press knows which companies to follow up with afterward.

As an attendee, if you're serious about sourcing your next investment, Battlefield should be your anchor point. You watch the pitches, take notes on the ones that resonate, and then find those founders during networking sessions. Same dynamic applies if you're a founder looking for cofounders or early team members. You see how other founders pitch and communicate under pressure. You can identify talent.

The Expo Floor: 300+ Companies

The expo floor is the secondary engine. Three hundred exhibiting startups, each with booth space, giving live demos, meeting attendees. It's overwhelming if you try to work the entire floor, so don't. Instead, identify your target companies before the event (Tech Crunch publishes the exhibitor list well in advance), map them, and hit them strategically.

Plan for three to five minutes per booth. Ask specific questions. Collect contact info. Most importantly, don't waste time on companies that aren't relevant to your objectives. The expo floor works best when you're surgical about it.

Main Stage Content: The Speakers

The keynote and main stage talks run throughout all three days. This is where you get the curated insights from companies and leaders actually doing interesting work. Previous years have featured Google Cloud executives talking about infrastructure trends, Netflix leaders discussing user experience at scale, and founders discussing lessons learned building billion-dollar companies.

The production value is high, but the real value comes from the Q&A and the informal conversations that happen afterward. A Netflix executive drops an insight about their approach to personalization. You think, "We could apply that to our product." You track down the executive afterward, exchange information, and potentially build a relationship.

Attend the talks selectively. Don't try to hit every session. Pick the ones that directly address your strategic focus, take notes, and prioritize the conversations that follow.

Networking Sessions: Where Deals Actually Happen

Disrupt schedules dedicated networking times, but the real networking happens in the spaces between scheduled sessions. Hallways, coffee breaks, dinner, drinks after the conference ends for the day. This is where the actual business gets done.

Bring plenty of business cards. More importantly, have a clear 30-second description of what you do and what you're looking for. If you're a founder, you're raising capital or hiring. If you're an investor, you're sourcing deals. If you're an operator, you're looking for job opportunities or companies to advise. Make it clear so people know whether they want to continue the conversation.

Logistics: Getting Around and Staying Sane

Moscone West is a massive venue. Bring comfortable shoes. The event runs all day, so plan your schedule in advance: which keynotes, which Battlefield sessions, which expo booths, which networking times.

Use the Disrupt app (Tech Crunch typically provides one) to check speaker bios, startup profiles, and attendee lists before arrival. This preparation cuts your wasted time dramatically.

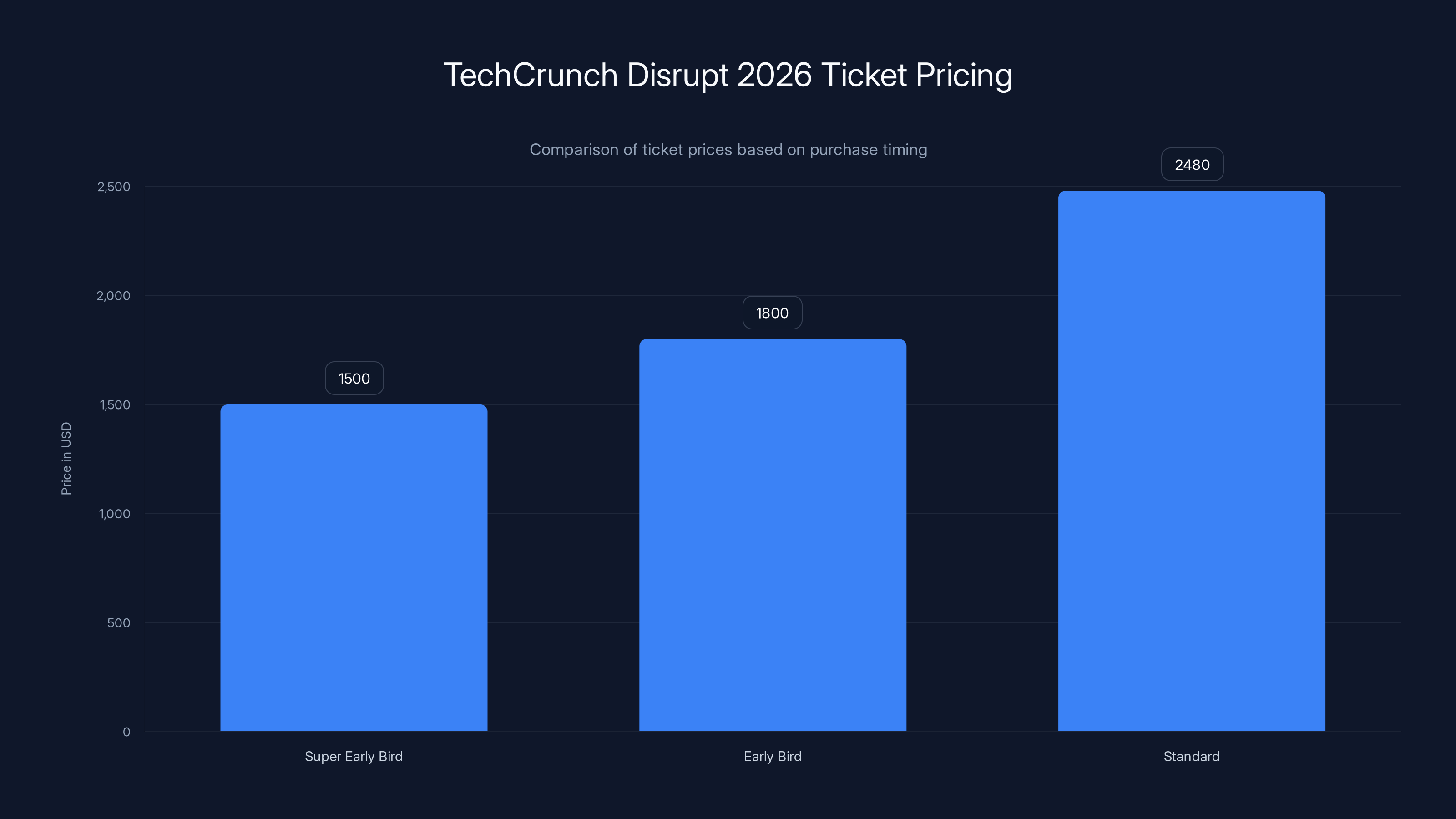

Ticket prices for TechCrunch Disrupt 2026 increase significantly after the Super Early Bird period, with Standard pricing reaching up to $680 more.

Maximizing Your ROI: Strategic Approaches for Different Attendee Types

The value you get from Disrupt depends entirely on what you're trying to accomplish. Let me break down specific strategies based on attendee type.

For Founders Raising Capital

If you're a founder and you're raising, Disrupt is a target-rich environment. Institutional investors attend specifically to source deals.

Strategy one: Get on the Startup Battlefield if possible. If your startup has been selected, great. The exposure and investor conversations that follow are worth massive amounts of outbound networking.

If you're not on Battlefield, strategy two is to work the investor meetings and networking sessions strategically. Before the event, identify which investors will be attending. Most large VCs send partners to Disrupt. Use the attendee list to target them. Schedule meetings if possible. If not, engineer hallway conversations.

Strategy three is the expo floor. Some VCs visit booths. Others don't. But your potential customers, partners, and employees are definitely there. If you're not yet institutional-investor-ready, building strategic relationships with other founders and operators can be equally valuable.

One tactical note: Have your pitch deck on your phone, your cap table accessible, and your product demo ready. Conversations move fast. You might get 10 minutes with someone important. Be prepared to use it.

For Investors and Scouts

If you're an investor, your primary value is Battlefield plus the expo floor. Watch all of Battlefield. Take detailed notes. Identify your top 10 companies to follow up with. Schedule demo meetings with them during the event or immediately after.

Second priority is the main stage talks. They're good for understanding what's top-of-mind in the ecosystem and identifying interesting trends.

Third is working the attendee list. Other investors, operators, and scouts attend. Building relationships with fellow investors (especially those focused on different sectors) creates future deal flow and co-investment opportunities.

Plan for high volume. You should be planning 20 to 30 meaningful conversations across the three days if you're serious about sourcing.

For Operators and Employees

If you're working at an established company or looking to join one, the value proposition is different. You're not sourcing deals. You're understanding trends, identifying companies worth following, and potentially meeting future colleagues or cofounders.

Focus on the main stage talks and a curated selection of expo floor companies. Build relationships with founders and early-stage operators. Some of them will eventually become your peers or network for future opportunities.

The three-day immersion in the most interesting parts of the tech ecosystem is genuinely valuable, regardless of immediate transactional benefit.

The Speakers and Thought Leadership: Who Shows Up and Why

Previous Disrupt speaker rosters have included names that actually matter in tech. Not celebrity entrepreneurs who sell course modules and have 500K Twitter followers. Actual builders.

WordPress co-founder Matt Mullenweg has shared insights about open-source business models and the future of web infrastructure. Elad Gil, an investor and operator who's been involved with companies like Google, Airbnb, and Color Genomics, has discussed scaling from zero to product-market fit. Founders at companies like Phia (founded by Phoebe Gates and Sophia Kianni) have talked about building in emerging spaces.

The throughline is straightforward: the speakers are people doing something interesting and have lessons worth learning. They're not there to promote themselves. They're there to share what they've learned.

Beyond individual speakers, the companies represented are equally significant. Google Cloud executives discussing infrastructure trends. Netflix leaders talking about personalization and user engagement at scale. Waymo sharing insights about autonomous vehicles and real-world testing. These aren't theoretical discussions. They're organizations that have built products used by hundreds of millions of people.

The content value is real, but it's not the main event. The main event is what happens in the conversations that follow and the connections you make as a result of understanding what these speakers and companies are focused on.

Early bird pricing offers substantial savings, with up to $680 off for individual passes and significant discounts for group passes. Estimated data based on typical pricing structures.

The Startup Battlefield: What Really Happens When a Company Wins

The Startup Battlefield crown matters less than you might think.

Winning the $100,000 prize is excellent, especially for an early-stage company. But the real value of Battlefield participation—winning or losing—is exposure and investor conversations.

Companies that pitch at Battlefield get press coverage from Tech Crunch. That's worth significant value in terms of brand awareness. They get hundreds of conversation requests from investors, potential hires, and strategic partners. Post-event, many Battlefield companies close funding rounds within weeks or months because they've been vetted and introduced to capital sources.

But here's the piece most people miss: even companies that don't win Battlefield get material value from participation. An early-stage company that pitches and gets good investor feedback, makes a dozen meaningful connections, and gets mentioned in tech press has moved the needle dramatically.

As an attendee, Battlefield is your opportunity to see pre-vetted companies at the moment they're pitching to institutional capital. That's valuable signal. If you're a founder, you see what resonates with investors. If you're an investor, you see the best the ecosystem has to offer, pre-filtered by Tech Crunch's selection process.

Networking Deep Dive: How to Actually Connect at Disrupt

Most people approach networking at large conferences wrong. They show up with no strategy, try to meet everyone, have dozens of shallow conversations, and leave with a stack of business cards they never follow up on.

That's not how Disrupt works best.

Pre-Event Research: The Foundation

Before you arrive, spend two to three hours on preparation. Download the attendee list. Identify specific people you want to meet. Check the Startup Battlefield companies and the expo floor exhibitors. Identify which companies are strategically relevant.

This sounds tedious, but it eliminates the paralysis that comes from walking into a 10,000-person conference with no direction. You know who you're looking for. You know what companies you care about. You have a map.

The Three Tiers of Meetings

Divide your networking into three tiers:

Tier one: Must-meet people. These are specific individuals you absolutely need to connect with. Venture partners at firms you're raising from. Founders you admire. Executives from companies you want to partner with. Aim for five to ten tier-one meetings. Schedule them in advance if possible.

Tier two: High-priority exploration. Companies or people relevant to your strategic objectives but where you don't have a specific meeting. Work the expo floor. Attend relevant talks and approach speakers afterward. Aim for fifteen to twenty tier-two conversations.

Tier three: Serendipitous connections. Someone interesting at a networking session. A founder with a company you'd never heard of but found fascinating. These often turn into the most valuable relationships because they're unexpected.

That structure prevents you from either being too scattered or too rigid. You have guardrails but also flexibility.

The Hallway Track: Where the Real Work Happens

In the tech industry, there's a concept called the "hallway track." It's the conversations that happen outside the formal sessions. Someone you met at a keynote. A founder you spotted at the expo floor. A fellow investor at a networking reception.

The hallway track at Disrupt is deliberately engineered to be valuable. The schedule includes gaps specifically for networking. The venue is designed with plenty of open space. The organizers know that some of the best conversations happen between formal sessions.

Most importantly, everyone at Disrupt is hyper-aware that the hallway track matters. That changes the dynamic. People are genuinely interested in conversations. They're not defensive. They're not trying to escape. They're actively looking to connect.

Follow-Up: The Multiplier Effect

Meeting someone at Disrupt means nothing if you don't follow up. And most people don't. They collect business cards, promise to stay in touch, and then nothing happens.

Here's the systematic approach: Send a follow-up message within 24 hours of the conversation. Reference something specific about your conversation. Be clear about the next step. Don't wait weeks. The momentum is real in those first 24 to 48 hours.

If there's a natural next step (demo, call, collaboration), suggest it explicitly. Don't be vague. Be specific and easy to say yes to.

That discipline—the immediate follow-up, the specific next step—is what transforms Disrupt from a networking event into a relationship-building accelerant. Most people skip this step. If you don't, you'll see results that most attendees never realize.

Attendees can save up to $680 on individual passes and make 3-5 meaningful connections, enhancing ROI. Estimated data based on event details.

Pricing Breakdown: Making the Numbers Work

Let's be direct about the economics of attending Disrupt.

The Ticket Itself

Super Early Bird pricing (ending February 27) offers the lowest rates of the year. Based on typical conference pricing, you're looking at:

- Full conference pass (Early Bird): roughly 1,800 depending on tier

- Single-day pass: roughly 600

- Startup founder pass: typically discounted 40% to 50% from standard rates

- Group passes: up to 30% off when you bring four or more people

After the Super Early Bird deadline, prices increase, potentially by

The math for a team is straightforward. Four people on early bird passes at

The True Cost of Attendance

But the ticket is only one line item. Here's the full cost structure for a Bay Area attendee (all numbers are estimates, adjust for your location):

- Ticket: $1,500

- Flight: 400 (or $0 if local)

- Hotel: 900 (three nights at300 per night)

- Meals and incidentals: $300

- Transportation (rideshares, parking): $100

Total for out-of-state attendee: roughly

For a team of four, you're looking at

Calculating ROI

ROI from a networking event is hard to quantify with precision. You can't measure in the way you'd measure a marketing campaign or a software implementation. But you can estimate.

Consider a founder raising a Series A. The value of meeting a single venture partner at your target firm is enormous. If that meeting leads to a term sheet, the entire cost of Disrupt disappears into rounding error. Even if that meeting leads to a warm introduction to another investor who eventually funds the company, the ROI is massive.

Consider an investor looking for deals. If Disrupt exposure leads to you investing in a company that returns 10x, the ticket cost and travel expenses are laughably small relative to the return.

Consider an operator joining an interesting startup. If a conversation at Disrupt leads to a role that pays $150,000 per year more than your current position, the cost of attending has paid for itself within the first month.

These aren't theoretical. These outcomes happen at Disrupt regularly.

Even in less dramatic scenarios, the value accumulates. You make three to five meaningful professional relationships. Each of those relationships has potential value over time: job opportunities, customer introductions, partnership possibilities, knowledge sharing. Over a 10-year horizon, any single one of those relationships could be worth

The early bird savings ($680 for an individual, more for a team) amplifies that ROI. You're getting the same access and opportunity but paying less. It's free money if you attend.

Trends to Expect at Disrupt 2026: What's on the Radar

Disrupt serves as a barometer for what's actually happening in tech, not what the hype cycle thinks is happening. Based on what's been building momentum heading into 2026, here's what to expect.

AI Is Deeply Embedded, Not Novel

By October 2026, AI is no longer the headline story. It's the infrastructure story. You'll see AI applied to every vertical: healthcare diagnostics, financial services optimization, supply chain logistics, customer service, creative tools. The companies doing interesting work aren't the ones shouting about their AI. They're the ones using AI to build something specific and valuable.

Expect to see founders and companies focused on productization, not just model development. How do you take AI capability and turn it into something users actually pay for? That's the challenge. That's what Disrupt companies are solving.

Infrastructure Scaling Becomes Urgent

As AI applications become more demanding, the infrastructure layer becomes the constraint. Companies focused on inference optimization, distributed computing, energy-efficient training, and data pipeline management will be prominent. These aren't sexy pitches, but they're essential. The Disrupt audience gets that.

Climate Tech, Biotech, and Hardware Are Legitimate

For years, Disrupt tilted heavily toward software and consumer internet. That's shifting. Energy transition, climate solutions, biotechnology, and hardware companies are increasingly visible and funded. Expect a robust representation of companies building physical products or solving hardware-constrained problems.

Vertically Integrated Solutions

Companies that own the entire stack—from data collection to model training to end-user application—are gaining relative advantage over point solutions. Disrupt will feature companies that recognized this dynamic early and built vertically.

International Expansion and Non-US Capital

There's been a gradual but consistent shift in venture capital toward non-US sources and internationally focused companies. You'll see founders from outside the US, capital from Asia and Europe, and companies building globally from day one. The ecosystem is diversifying.

Understanding these currents before you arrive helps you navigate the event more effectively. You know which talks to prioritize. You know which companies to seek out. You know what questions to ask.

TechCrunch Disrupt features a curated mix of attendees, with a significant portion being serious founders, institutional investors, and operators from innovative companies. Estimated data.

Logistics and Practical Considerations

Moscone West in San Francisco is a well-run venue, but attending Disrupt still requires planning.

Travel and Accommodation

Book your flights early. October is shoulder season in the San Francisco Bay Area, so flights are reasonably priced but accommodation gets tight. I'd recommend booking hotels immediately after your ticket purchase. The inventory fills up.

Alternatively, if you're on a tight budget, look at accommodation in Oakland or San Jose and take BART into San Francisco. It's a 20-minute to 45-minute commute but saves

Packing and Logistics

Bring comfortable shoes. You'll be on your feet for hours walking the expo floor and navigating the venue. Bring a small backpack or bag. You'll collect swag, business cards, and notes. Bring a portable charger. Your phone battery dies by afternoon if you're actively working.

Dress for business casual. Not business formal. Disrupt is tech, so full suits are rare. But jeans and a t-shirt reads as too casual unless that's genuinely your default.

Schedule Your Meals

The venue has food, but it's pricey and the lines are long during peak times. Pre-plan where you're eating lunch. The hotels nearby have restaurants. There are plenty of options within a 10-minute walk of Moscone West.

Breakfast before you arrive at the venue. You'll be sharp and focused rather than standing in a coffee line at 9 a.m. when you should be at the opening keynote.

Phone and Data

The venue Wi Fi is generally good but gets congested during peak hours. Don't rely entirely on it. Make sure your phone plan has adequate data.

Apps and Tools

Tech Crunch typically provides an official Disrupt app. Download it before you arrive. It's invaluable for schedules, speaker bios, startup profiles, and attendee directory.

Use your phone's notes app or a tool like Evernote to record conversation summaries immediately after each conversation. It's easy to forget details if you're meeting dozens of people.

Previous Disrupt Speakers and Insight into Caliber

Understanding the speaker caliber helps you understand whether Disrupt is worth your time.

Previous speakers have included WordPress co-founder Matt Mullenweg, who's one of the most influential people in open-source software and web infrastructure. Elad Gil, who's been deeply involved with companies like Google, Airbnb, and Color Genomics, bringing operational and investor perspective from multiple domains.

Founders like Phoebe Gates and Sophia Kianni, who co-founded Phia and are building in the health and wellness space, share tactical insights about building from zero.

Executives from Netflix have discussed personalization, user engagement, and the unique challenges of scaling to hundreds of millions of users. Google Cloud leaders discuss infrastructure trends and enterprise adoption. Waymo executives share insights into autonomous vehicle development and real-world testing.

The pattern is consistent: speakers are chosen because they're actually building or leading something interesting. Not because they're famous. Not because they have a book to promote. Because they have insights worth hearing.

That's different from most conferences, where the speaker selection is more about marquee names than actual substance.

Attend the talks you're genuinely interested in. Skip the ones that don't align with your focus. The content is recorded and made available after the event anyway, so you're not missing information by being selective.

The Investor Perspective: How Capital Flows at Disrupt

If you're raising money, understanding how investors approach Disrupt helps you strategy your participation.

Venture partners attend Disrupt specifically to source deals. It's a compressed version of their normal workflow. Instead of reviewing thousands of inbound pitch decks, they get to see the curated set of companies on Startup Battlefield and can network with founders and other investors.

For investors, Disrupt serves multiple functions:

-

Deal sourcing: Meeting founders before they're well-known. The earlier you encounter an interesting founder, the more negotiating leverage you have when terms eventually get discussed.

-

Due diligence acceleration: Seeing a company pitch on stage with an auditorium watching is actually a signal. How do they respond to tough questions? Do they have conviction or are they uncertain? It's a real-time evaluation tool.

-

Network building: Other investors attend. Building relationships with other investors (especially those focused on different sectors) creates co-investment opportunities and expands deal flow in the future.

-

Trend spotting: The aggregate of all companies pitching indicates what the entrepreneur ecosystem is working on. That's valuable signal for where capital should flow.

The dynamic means that if you're a founder, every conversation you have with an investor at Disrupt carries real weight. They've made a deliberate choice to be there. They're actively in deal mode. The probability of productive conversation is higher than at a random networking event.

The flip side: don't waste investor time with a company that's not ready. If you haven't achieved product-market fit or some clear traction signal, you're not a good fit for institutional capital yet. Be realistic about your stage.

The Startup Ecosystem Perspective: What Disrupt Reveals

Beyond the tactical networking and the specific deals that close, Disrupt serves as a mirror for the overall health and direction of the startup ecosystem.

The sectors represented, the funding amounts being discussed, the types of problems being solved, the geographical distribution of founders—all of it provides genuine signal about what's happening in tech.

For example, if in 2026 you see a significant representation of companies solving energy and sustainability problems, it indicates that capital has flowed into that space. If you see a dominance of enterprise software companies, it tells you something about where founder attention is focused.

This matters because it helps you calibrate whether your own company is working on something with sufficient market interest and capital availability. Are you in a crowded space where every investor has already seen 30 variations of your idea? Or are you in an emerging area where you're still among the early movers?

Disrupt provides that visibility in real time. The 10,000 attendees and 300 exhibiting startups form a cross-section of what the ecosystem thinks is important.

Decision Point: Is Disrupt Worth Your Personal Investment?

Here's the honest answer to whether you should attend: It depends on your situation and what you're trying to accomplish.

You should attend if:

- You're raising capital and need access to institutional investors. Disrupt is a concentrated source of investors actively looking to deploy capital.

- You're sourcing deals and want to see the highest-quality pre-vetted startups in one place. Battlefield alone justifies the cost.

- You're working on something early-stage and need to understand what the market is interested in. The trends on display are real.

- You're an operator wanting to understand emerging trends across the ecosystem. The talk content and company mix provide valuable signal.

- You're looking to build or accelerate your professional network in tech. The attendee quality is genuinely high.

You should skip it if:

- You're bootstrapped and profitable and have no capital or hiring needs. The ROI is lower if you're not actively looking to transact.

- You're early stage but still figuring out your product. You'll be at a disadvantage and probably should focus on shipping rather than networking.

- You're not willing to put in the networking work. If you attend passively and just watch talks, you're wasting the ticket.

- You can't afford the full cost including travel and accommodation. There's no point attending if it puts financial stress on your company or personal situation.

For most founders and investors, the calculus skews toward attending. The early bird savings take the pressure off the decision. You're paying less and getting the same access.

Your Early Bird Action Items: Don't Leave This to Chance

If you've decided to attend, here's your action checklist in order:

-

Register immediately for Super Early Bird pricing (by February 27). Don't wait. Every day you delay increases the chance you forget or something comes up.

-

Book your flight and accommodation within 24 hours of registration. October fills up. You want options.

-

Review the attendee list once you're registered. Identify specific people and companies you want to meet. Start researching them. Most of this is public information.

-

Download the Disrupt app closer to the event (it typically goes live a few weeks before October). Familiarize yourself with the schedule and startup profiles.

-

Prep your pitch or description of what you do and what you're looking for. This should be conversational, not a formal elevator pitch. Practice it enough that it's natural.

-

Schedule tier-one meetings in advance if possible. Use the attendee list or LinkedIn to reach out to specific people you want to meet.

-

Plan your venue navigation. Which talks matter to you? Which parts of the expo floor? Which networking sessions? Have a rough itinerary.

-

Prepare your follow-up system. Decide in advance how you'll document conversations and who you'll follow up with and when.

FAQ

What is Tech Crunch Disrupt?

Tech Crunch Disrupt is an annual three-day conference and startup pitch competition held in San Francisco. It brings together approximately 10,000 founders, investors, operators, and tech industry professionals. The event features the Startup Battlefield competition (200 pre-vetted startups pitching for capital), keynote speakers from major tech companies, an expo floor with 300+ participating startups, and structured networking opportunities designed to facilitate deal flow and professional connections.

When and where is Tech Crunch Disrupt 2026 happening?

Tech Crunch Disrupt 2026 takes place October 13-15, 2026 at Moscone West in San Francisco, California. This is the same venue that has hosted the conference for many years, providing a large, well-designed space for the 10,000+ attendees and the various conference sessions, pitches, and networking areas.

How much are Tech Crunch Disrupt 2026 tickets?

Super Early Bird pricing (available through February 27) offers the lowest rates of the year, with individual passes ranging from approximately

What is the Startup Battlefield competition at Disrupt?

Startup Battlefield is the centerpiece event of Disrupt where 200 pre-selected early-stage companies pitch their businesses on stage in front of investors, media, and attendees. Each company receives 60 seconds to present followed by Q&A with judges. The winning company receives a $100,000 equity-free prize, but the primary value for all participating companies comes from investor exposure, media coverage, and the hundreds of business development conversations that result from participation.

Is it worth the cost to attend Tech Crunch Disrupt?

Attending Disrupt is generally worth the investment if you're actively fundraising, sourcing investment opportunities, or looking to build meaningful professional relationships in tech. The early bird pricing through February 27 makes it more attractive by saving

How should I prepare for attending Tech Crunch Disrupt 2026?

Prepare by registering early for Super Early Bird pricing, booking travel and accommodation immediately afterward, reviewing the attendee list and startup exhibitor list in advance, identifying specific people and companies you want to meet, and researching them before the event. Create a rough schedule of talks and Battlefield sessions aligned with your interests, prepare a concise description of your business and what you're looking for, and set up a system for documenting conversations and scheduling follow-ups. Most importantly, approach Disrupt as a working conference, not a passive observation opportunity. Your ROI depends entirely on the effort you invest.

What type of companies typically pitch at Startup Battlefield?

Startup Battlefield features 200 pre-selected early-stage companies across diverse sectors. In recent years, representation has increasingly included AI applications, enterprise software, climate and energy solutions, biotech, healthcare, and consumer-focused startups. Companies are selected by Tech Crunch's team based on their technology, team quality, and potential impact. The mix of companies pitching reflects current trends in the broader venture-backed startup ecosystem and provides strong signal about where capital and entrepreneur attention are concentrated.

Final Thoughts: The True Value of Seven Days

You have seven days to make a decision about Super Early Bird pricing. Pragmatically speaking, this is a high-signal deadline. Tech Crunch has run this event for nearly two decades. The pricing structure is real. The early bird discount is real. The savings ($680 per individual pass, 30% off group passes) are genuine.

But the real deadline isn't February 27. It's the moment you realize you're missing access to opportunities you should be pursuing.

Disrupt works because it compresses into three days what normally takes months. You meet investors who would usually take weeks to secure a conversation with. You see 200 pre-vetted startups instead of sorting through thousands of inbound pitches. You hear from operators and leaders who are shaping the future of technology. You build a network in an accelerated timeframe.

That compression has value. Not just the network value, but also the psychological impact. When you're surrounded by people thinking about the same challenges, working on the same problems, pursuing the same opportunities, something shifts. Your thinking becomes sharper. Your convictions strengthen. Your sense of what's possible expands.

The ticket price matters, but it's not the deciding factor. The deciding factor is whether attending aligns with your current objectives and whether you're willing to work the event strategically.

If you're raising capital, scaling a company, sourcing investments, or building your network in tech, Disrupt 2026 is worth your time and money. The early bird savings make the decision easier.

If you're still deciding, use these seven days to talk to people who've attended previous Disrupts. Ask them what they got out of it. Ask them what they'd do differently. The pattern you'll hear is consistent: the attendees who got real value were the ones who had clear objectives, did pre-event research, and worked the networking systematically.

There are only so many moments in your career when you can compress months of relationship-building and market learning into three days in the same city. Disrupt is one of those moments. The early bird pricing window is seven days. After that, the price goes up, and the decision becomes harder.

Make your choice. Lock it in. Commit to showing up and working the event strategically.

Your future network—and potentially your future as a founder or investor—might depend on it.

Key Takeaways

- Super Early Bird pricing for TechCrunch Disrupt 2026 (October 13-15) expires February 27, saving up to $680 per individual ticket and 30% on group passes

- Disrupt brings 10,000 founders, investors, and operators together with structured deal flow through Startup Battlefield, expo floor, and engineered networking

- ROI calculation depends on your role: founders raising capital and investors sourcing deals typically see the highest returns on event investment

- Success at Disrupt requires pre-event research, strategic networking prioritization, and systematic follow-up within 24 hours of conversations

- Previous speakers include WordPress co-founder Matt Mullenweg, investor Elad Gil, and executives from Google Cloud, Netflix, and Waymo, indicating high-quality content and network access

Related Articles

- Neo's Low-Dilution Accelerator Model: Reshaping Founder Economics [2025]

- Google I/O 2026: May 19-20 Dates, What to Expect [2025]

- Thrive Capital's $10B Fund: What It Means for AI and Venture Capital [2026]

- InScope Raises $14.5M to Automate Financial Reporting [2025]

- General Catalyst's $5B India Bet: What It Means for AI & Startups [2025]

- Joseph C. Belden Innovation Award 2026: Complete Guide to Winning Scaling Perks [2026]

![TechCrunch Disrupt 2026: Your Complete Guide to Early Bird Savings [2025]](https://tryrunable.com/blog/techcrunch-disrupt-2026-your-complete-guide-to-early-bird-sa/image-1-1771688330502.png)