Amazon Pharmacy Expands Same-Day Delivery: What You Need to Know

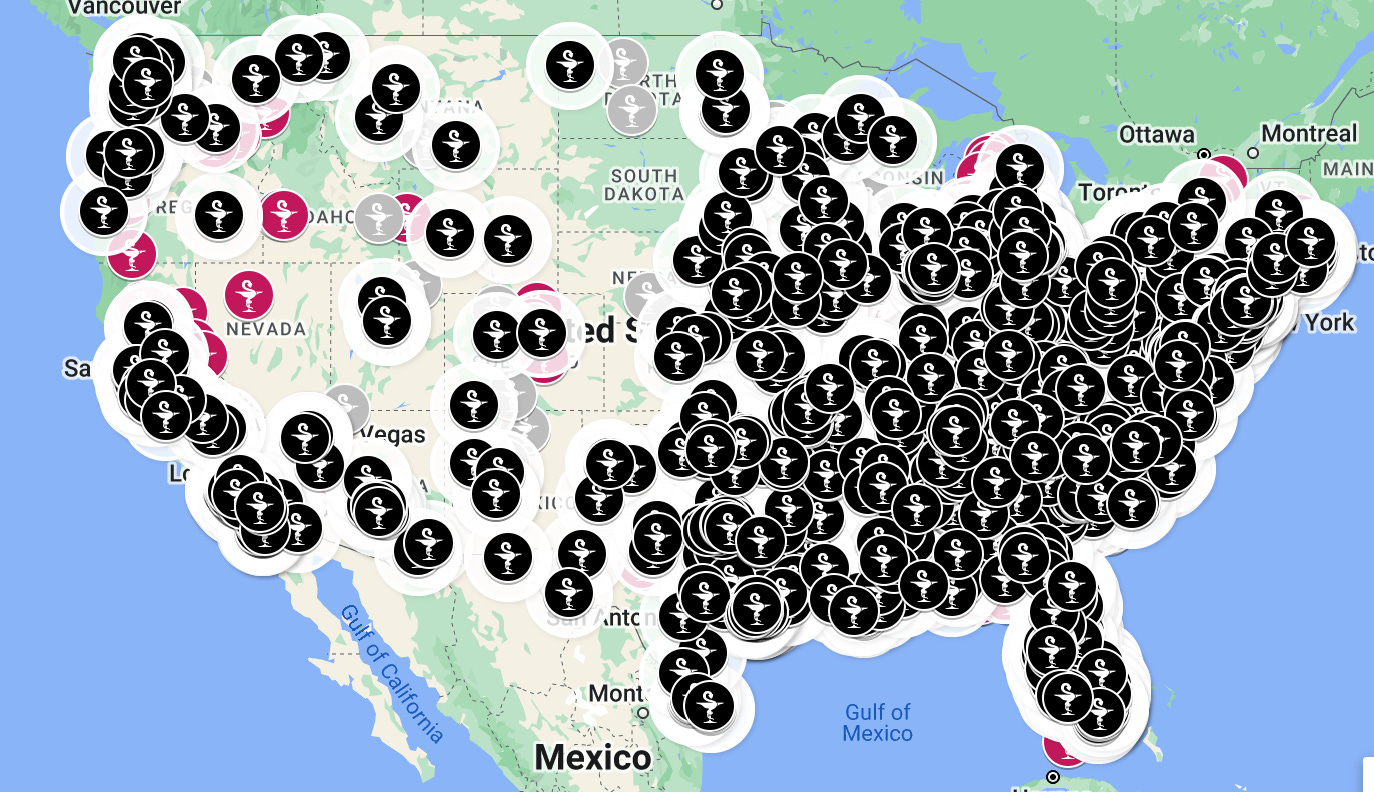

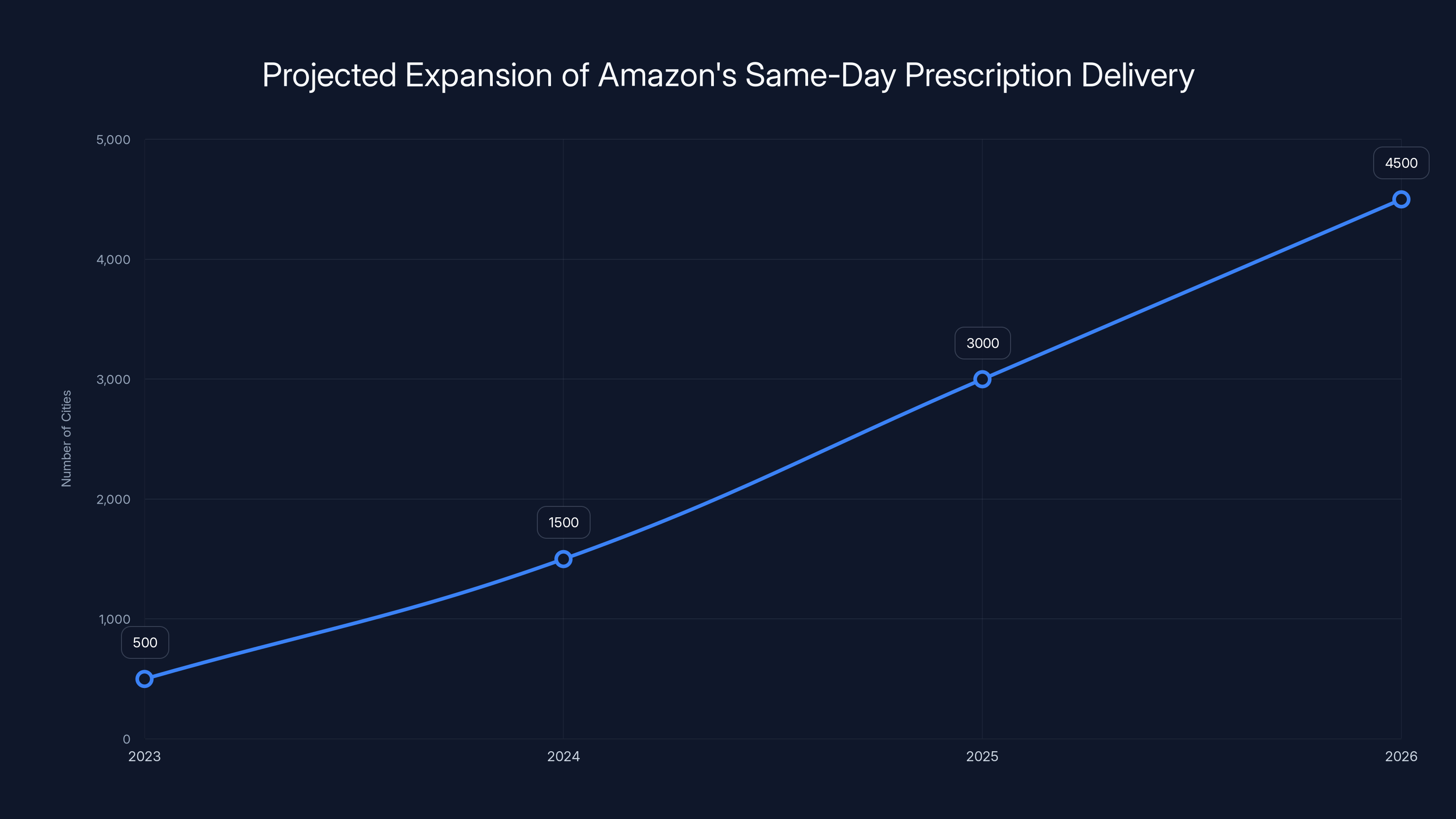

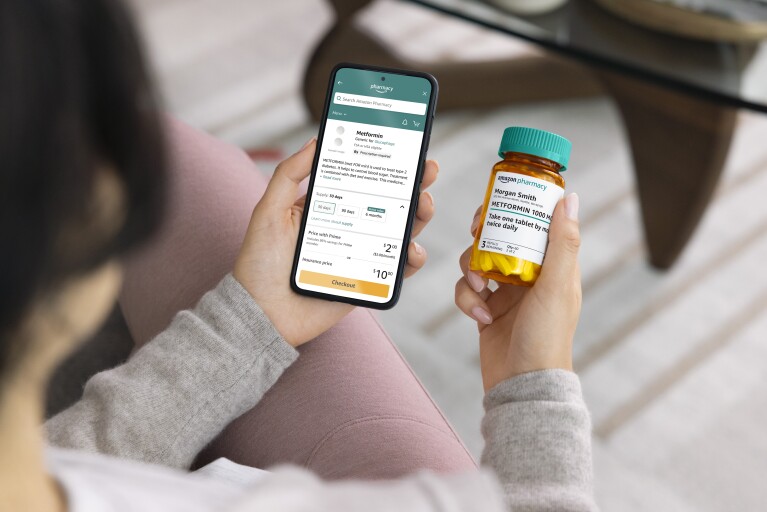

Amazon just made a massive move in healthcare delivery. The company announced it's bringing same-day prescription deliveries to nearly 4,500 new cities and towns across the United States by the end of 2026. That's not a small announcement. That's a fundamental shift in how millions of Americans could access their medications.

Let me break down why this matters. Right now, pharmacy closures are accelerating. Rural areas especially are losing access to brick-and-mortar pharmacies. People without cars can't get to drugstores. If you're managing multiple prescriptions and juggling a job, picking them up becomes another errand in an already packed day. Amazon Pharmacy is solving for all of this simultaneously.

The company originally launched Amazon Pharmacy back in 2020 with a two-day delivery model. Since then, it's been systematically expanding coverage and speed. Last year alone, Amazon pushed same-day delivery access to nearly half of all US residents. Now they're doubling down, making a commitment to reach states that have never had access, including Idaho and Massachusetts for the first time.

This expansion addresses a real healthcare crisis. According to industry analysis, the United States has lost thousands of independent pharmacies over the past decade. Chain pharmacy closures are accelerating too. Meanwhile, transportation barriers keep vulnerable populations from accessing medications. People in rural areas often drive 30+ minutes to the nearest pharmacy. Elderly patients without reliable transportation sometimes skip doses because getting to a pharmacy is too difficult. Mothers working multiple jobs can't take off to fill prescriptions during limited pharmacy hours.

What's clever about Amazon's approach is it doesn't just throw money at the problem. The company has built a distribution network specifically designed for pharmacy. They've created logistics infrastructure that works at the city level, not just major metro areas. They're using their existing fulfillment network, which already covers the entire country, to enable faster delivery times.

But here's the real question: How does this actually work at scale? And what does it mean for traditional pharmacy? And should you actually care about Amazon Pharmacy if you already have a pharmacy you like? We're going to dig into all of this.

TL; DR

- Amazon Pharmacy reaches 4,500 new cities by end of 2026, expanding same-day delivery access to regions previously underserved

- Idaho and Massachusetts get same-day access for the first time, marking significant geographic expansion into new states

- Pharmacy closures and healthcare access gaps are driving demand for alternative delivery models like Amazon's

- Fulfillment center strategy enables rapid same-day delivery by locating pharmacies within existing Amazon logistics hubs

- Rx Pass subscription ($5/month) expands to Medicare, creating affordable medication access for seniors and routine prescription users

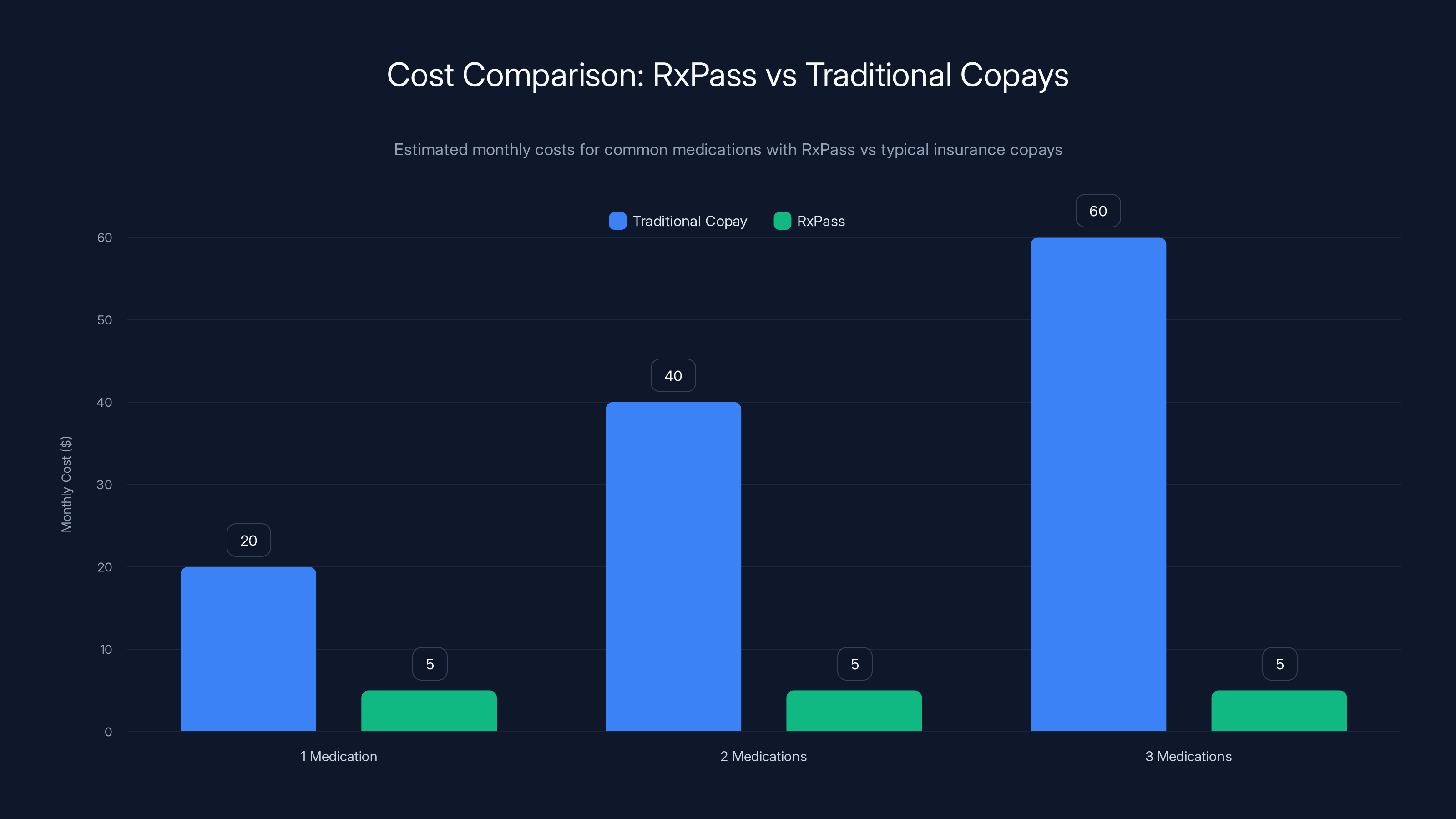

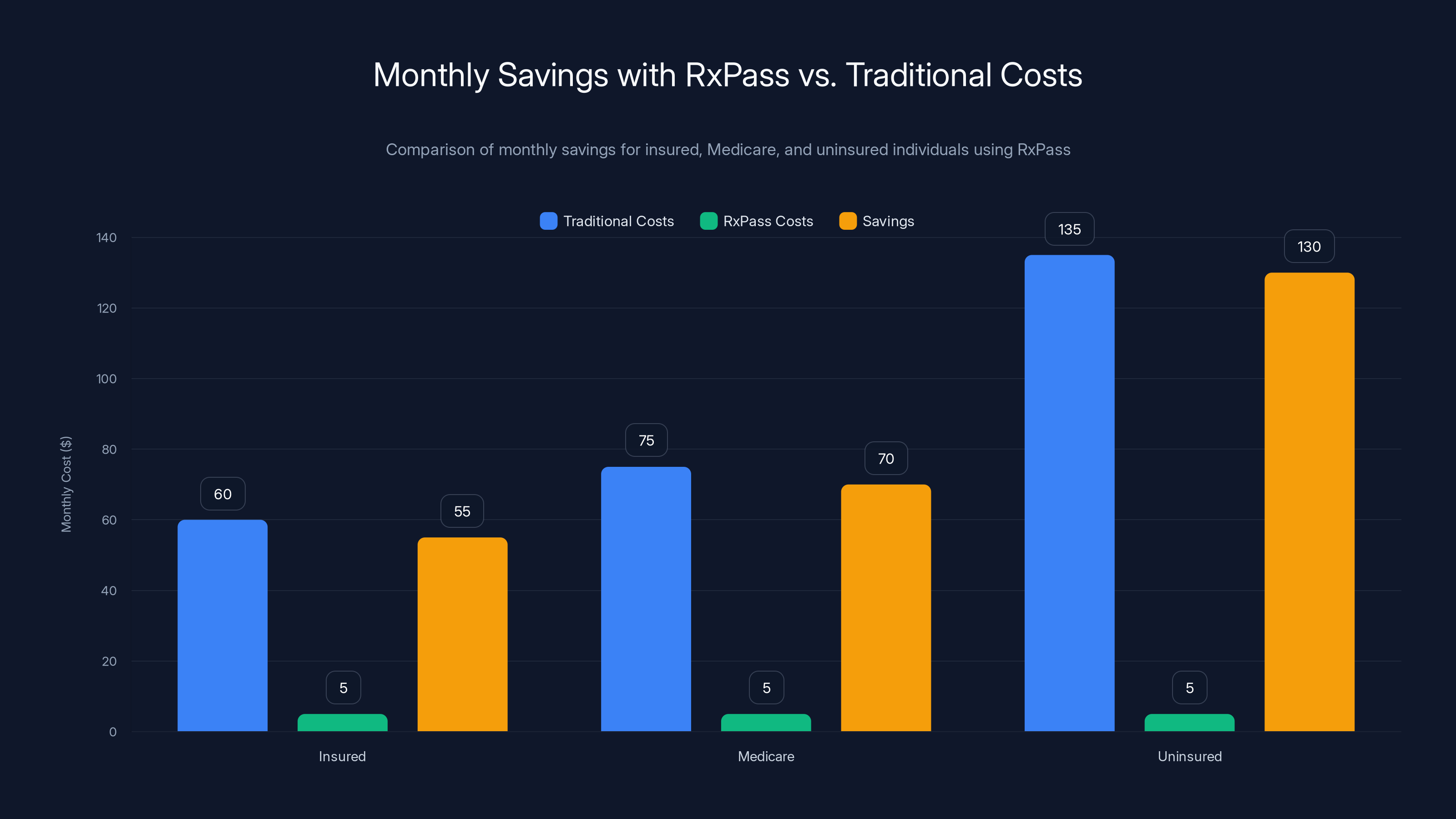

Estimated data shows Amazon Pharmacy can reduce costs significantly, especially for uninsured individuals, with potential savings of up to 80%.

The Current State of America's Pharmacy Crisis

To understand why Amazon Pharmacy's expansion matters, you need to understand the pharmacy landscape right now. It's not pretty.

Since 2010, the United States has lost over 5,000 independent pharmacies. These weren't corporate closures—these were small businesses, often run by families for generations, that couldn't compete with big chains or couldn't adapt to changing reimbursement models. The consolidation accelerated dramatically during the pandemic and hasn't slowed down.

Now the chains are closing too. In 2024 alone, CVS announced it would close around 900 stores. Walgreens committed to closing 1,200 locations. That's not a gradual shift—that's wholesale abandonment of entire geographic regions.

Where does this leave people? In rural America, a pharmacy closure can mean the nearest drugstore is 45 minutes away. In some cases, the nearest option is 90 minutes in either direction. If you're managing hypertension or diabetes, you can't skip your meds. But you also can't spend three hours driving to get a month's supply of prescriptions.

Urban areas have different problems. Pharmacies have reduced hours. Staffing is stretched. You'll stand in line for 45 minutes while one harried pharmacist handles everything. If your prescription isn't ready yet, you wasted your trip. If you can't get time off work, tough luck—the pharmacy closes at 6pm and you don't get home until 7.

Vulnerable populations bear the brunt of this crisis. Elderly people without reliable transportation skip doses or reduce doses to stretch prescriptions. People with disabilities find physical access difficult. Low-income families in pharmacy deserts make impossible choices between medication and other necessities.

This isn't just inconvenience. It's a public health problem. When people can't access medications reliably, health outcomes worsen. Hospital readmissions increase. Chronic conditions deteriorate. Medication adherence drops, which undoes the entire benefit of having the prescription in the first place.

Amazon Pharmacy didn't create this crisis, but they're positioned to actually address it. And that's what the 4,500 city expansion is really about.

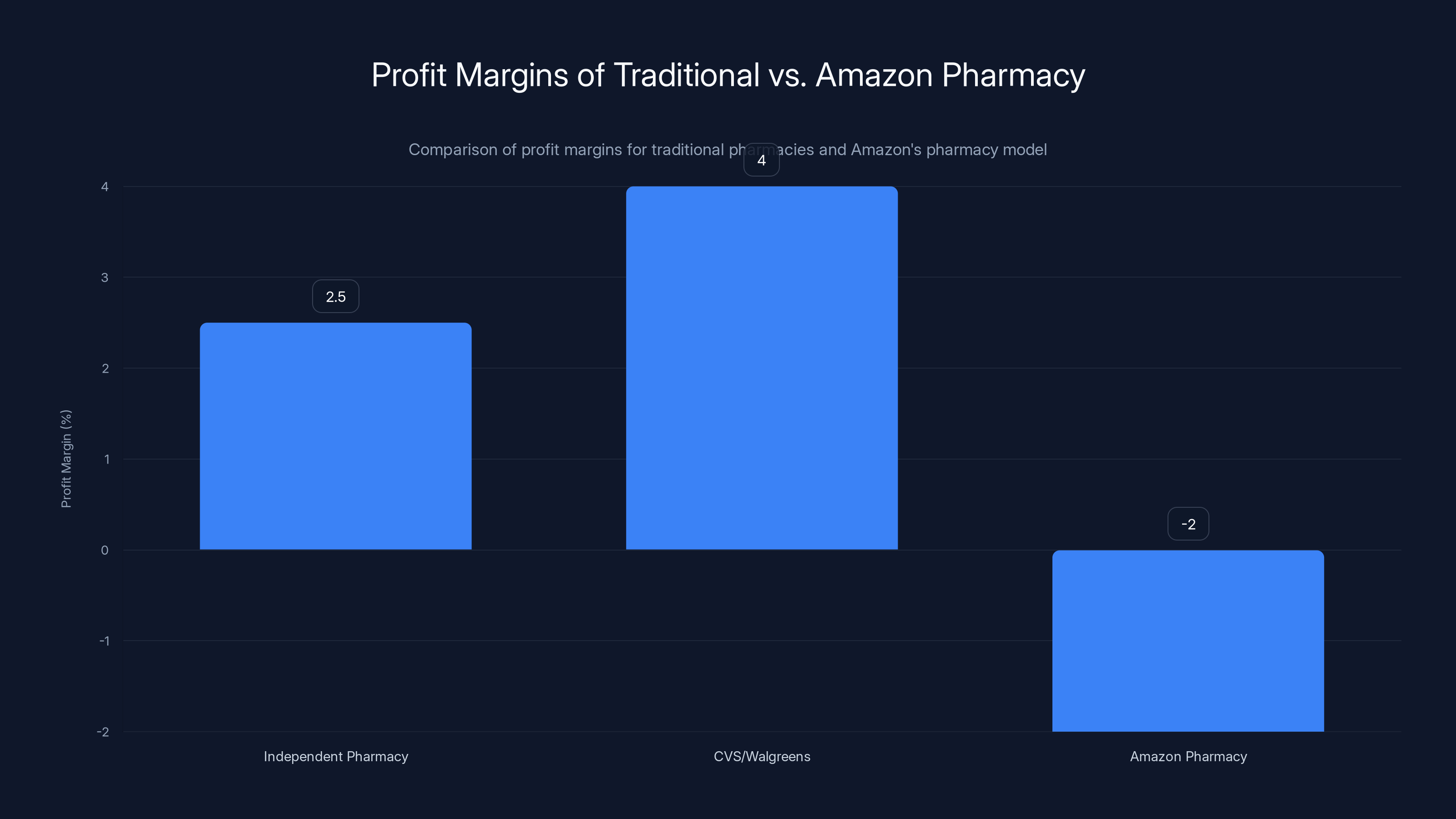

Traditional pharmacies like independents and CVS/Walgreens operate on thin profit margins (2-5%), whereas Amazon uses pharmacy as a loss leader with a -2% margin. Estimated data based on typical industry insights.

How Amazon Pharmacy Actually Works Behind the Scenes

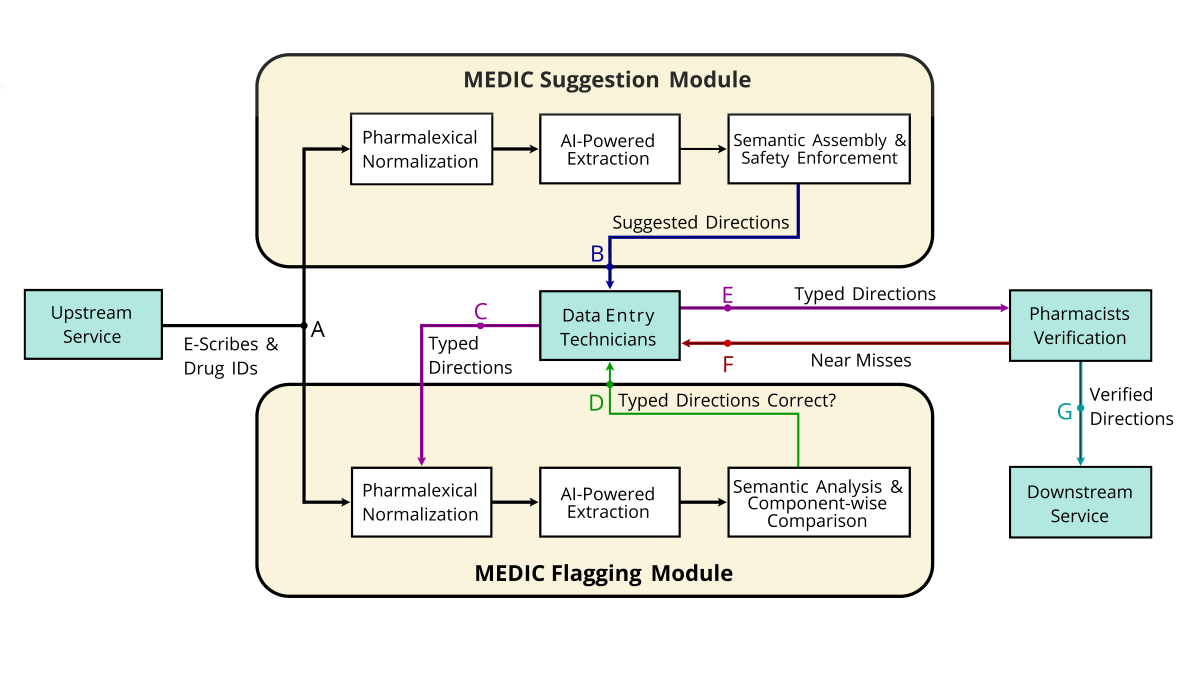

The logistics of prescription delivery aren't obvious if you've never thought about it. It's not like ordering a book from Amazon. Pharmaceuticals require special handling, cold chain management in some cases, and verification of prescriptions from licensed pharmacists. How does Amazon handle this at scale?

The answer is strategic placement of physical pharmacies. Amazon doesn't deliver every prescription from a central hub. Instead, they open small pharmacy operations inside their fulfillment centers. This is the genius of their model.

Here's how it works: Your doctor sends your prescription electronically to Amazon Pharmacy. Instead of going to a physical CVS or Walgreens, it routes to whichever Amazon fulfillment center is closest to you that has a pharmacy operation. That fulfillment center has licensed pharmacists on staff who fill your prescription. Then, instead of you having to go pick it up, Amazon's same-day delivery network gets it to your door by evening or next morning.

This model has huge advantages. First, it eliminates the pharmacy trip entirely. You don't have to plan around pharmacy hours. You don't have to drive anywhere. Second, it uses Amazon's existing logistics infrastructure, which is already optimized for speed. The fulfillment centers know how to move packages fast. They have drivers on the road all day anyway. Adding prescriptions is just more efficient utilization of what's already there.

Third, it creates density benefits. Once Amazon has invested in a pharmacy operation at a fulfillment center, that same operation serves hundreds of thousands of nearby residents. The fixed costs of licensing pharmacists and setting up the operation are spread across a huge customer base. This makes it more economical than traditional retail pharmacy, which relies on foot traffic.

Cold chain management isn't simple, though. Some medications require temperature control. Amazon has invested in special packaging and thermal management to handle this. It's not perfect—some medications genuinely need to stay in a climate-controlled environment. But for most prescriptions, standard insulated packaging with cooling elements works fine.

The prescription verification part is straightforward but crucial. Licensed pharmacists review every prescription before it ships. They check for interactions, verify dosages, confirm insurance coverage. This happens in the fulfillment center before the prescription is packaged. If there's an issue, they contact the customer to resolve it. Same job a retail pharmacist does, just in a different setting.

What surprised me when I started researching this is how much the logistics network matters. Amazon's same-day delivery capability doesn't exist in rural areas where there's no fulfillment center. It exists in cities with sufficient population density to justify logistics infrastructure. So when Amazon says they're expanding to 4,500 new cities, they're really saying they're expanding where they have fulfillment centers with pharmacy operations. You can't have same-day prescription delivery if the nearest Amazon facility is 200 miles away.

The New Cities and States Getting Same-Day Access

The announcement specifically calls out Idaho and Massachusetts as new states getting same-day delivery access for the first time. That's significant because it means Amazon Pharmacy has never operated same-day service in those states before.

Why these states? Idaho is interesting because it's rural, low-population-density, and has significant pharmacy access challenges. The Boise area has decent coverage, but rural Idaho has been underserved. Massachusetts is different—it's dense, affluent, but Amazon apparently didn't prioritize pharmacy same-day there until now. Boston has intense competition from traditional pharmacy and CVS/Walgreens, so Amazon may have decided to enter now that their network is more established.

The remaining 4,480+ cities haven't been announced individually, but you can infer them from where Amazon has fulfillment centers and where they're building new ones. The expansion is happening in waves as new fulfillment centers come online or existing ones get upgraded with pharmacy operations.

Geographically, I'd expect the biggest gains in underserved regions: parts of the Southwest, Mountain West, and upper Midwest where population is sparse but distances are huge. These are exactly the places where pharmacy closures hit hardest. A person in rural Montana might face a 90-minute drive to the pharmacy. Same-day Amazon delivery changes everything for them.

Urban expansion matters too. Not everyone in Manhattan can easily get to a pharmacy. Not everyone in Los Angeles can find a nearby store that's open during hours they're available. Layering Amazon Pharmacy onto existing urban areas increases choice and convenience.

The timing of expansion—completing by end of 2026—also reveals Amazon's confidence in the model. This isn't a cautious rollout. It's an aggressive push across nearly 4,500 cities in approximately 24 months. That requires capital, logistics expansion, and operational excellence. Amazon is betting heavily that this works.

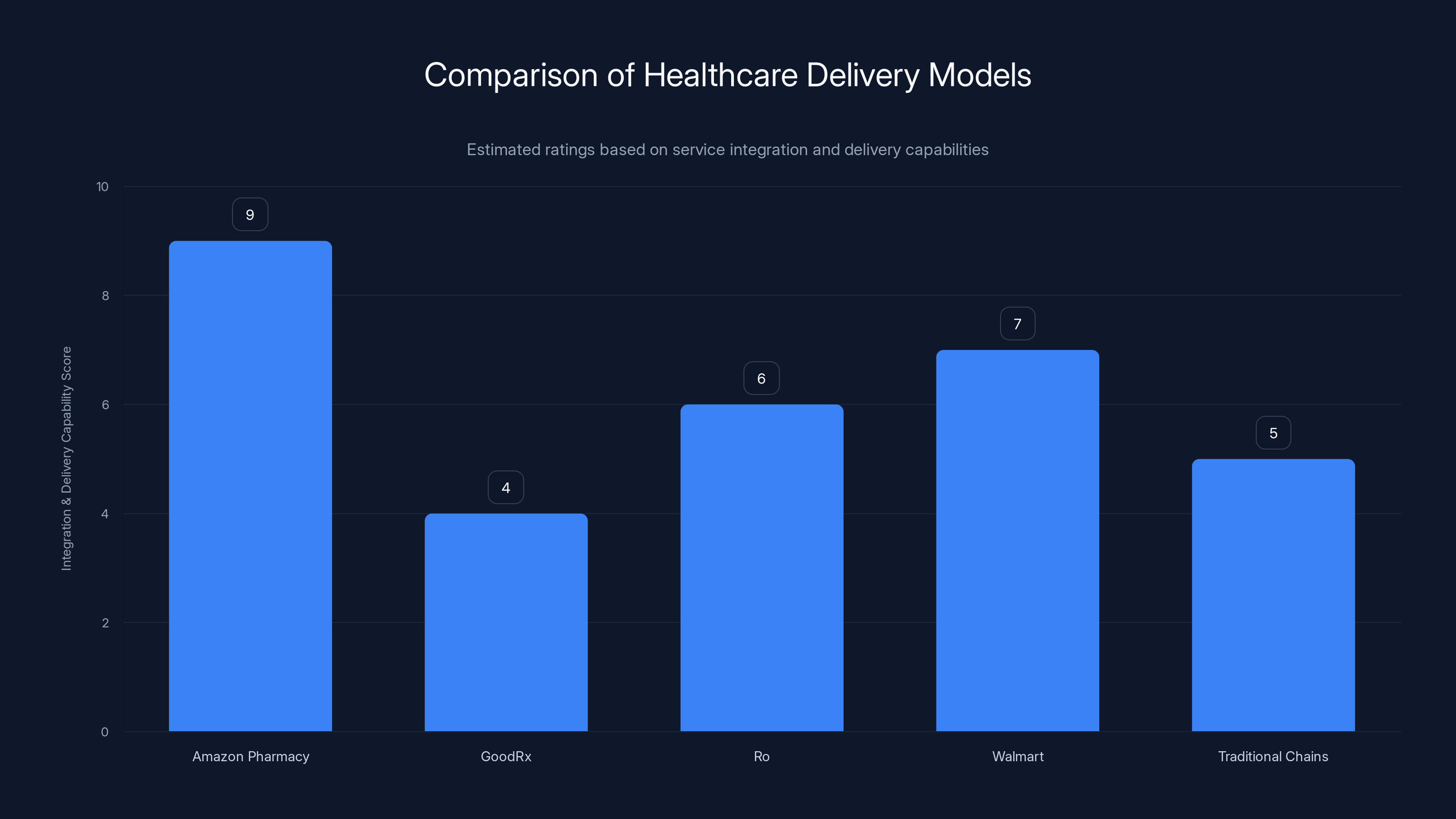

Amazon Pharmacy scores highest in integration and delivery capabilities due to its comprehensive infrastructure and strategic positioning. (Estimated data)

Rx Pass: The $5 Subscription That Changes the Game

Same-day delivery is one part of Amazon's pharmacy strategy. The other part is Rx Pass, and honestly, it might be even more important for most people.

Rx Pass is a separate subscription service (not part of Prime) that costs

What medications are included? Metformin for diabetes. Lisinopril for hypertension. Levothyroxine for thyroid problems. Atorvastatin for cholesterol. Sertraline for depression and anxiety. Albuterol inhalers. These aren't exotic drugs. They're the absolute most common medications Americans take. The conditions they treat—diabetes, hypertension, heart disease, depression, asthma—affect hundreds of millions of people.

Here's why this is revolutionary: Many people with insurance still pay high copays for these drugs. A medication copay of

It gets even better when you're managing multiple conditions. A person with diabetes, hypertension, and depression might be on metformin, lisinopril, and sertraline. Through insurance, that's maybe

Amazon launched Rx Pass in 2023, and it initially seemed like a gimmick. Surely it couldn't be sustainable at $5/month with unlimited access to medications. But Amazon's math works because they're playing on scale and margin. By capturing millions of customers and making those customers lock in to Amazon for pharmacy, Amazon builds habit and loyalty. Plus, they're negotiating prices with manufacturers from a position of massive scale. They're using the same negotiating power that makes them scary to traditional retailers.

What changed recently is Medicare approval. In 2024, Amazon got Rx Pass approved for Medicare recipients. This is huge. Medicare covers 65+ year-olds plus some disabled people—roughly 45 million Americans. Seniors are typically on the most medications. The average Medicare patient takes 5-6 prescription medications. Some take 15+. At

There are limitations, of course. Not every medication is included. Specialty drugs aren't covered. Recent brand-name drugs are usually excluded. Insurance negotiating power means Amazon gets the drugs cheaper by committing to large volumes of the most common ones. If you need something rare or newly approved, you'll still use traditional pharmacy or insurance.

But the breadth of coverage is honestly impressive for $5. You're covered for most routine prescriptions. The only people who truly benefit less are those taking specialty drugs or very new medications.

Why Traditional Pharmacies Are Struggling Against This Model

You might be wondering: Why can't CVS and Walgreens compete with this? The answer is structural economics.

Traditional pharmacy operates on razor-thin margins. A typical independent pharmacy makes about 2-3% profit margin on prescription sales. Chains like CVS and Walgreens aren't much better at maybe 3-5% margins. The volume is massive but the profitability per prescription is tiny. That's before accounting for front-store merchandise, staffing, real estate, and all the other costs.

Here's the math: An average prescription fills for

Amazon doesn't operate on the same economics. They don't need to make much money on pharmacy. What they need is to make pharmacy convenient enough that you buy other stuff from Amazon. That's the real business model. Pharmacy is a loss leader for Amazon Prime. If they lose

Traditional pharmacies can't compete with a loss leader from a trillion-dollar company. They'd go broke. So they're closing instead.

There's also technology. Amazon's infrastructure is built on data analytics, automation, and efficiency. They can predict demand, automate workflows, and minimize errors through scale. A local pharmacy can't compete with that. They have the same labor costs but a fraction of the volume.

Cold chain and delivery logistics were capital-intensive enough that pharmacy seemed like it would never be efficient at scale. Then Amazon solved it. Now it's just another logistics problem, and logistics is Amazon's core competency.

The final piece is customer stickiness. If your medications arrive at your door, why would you ever go to CVS again? You're locked in. Once you're locked in, Amazon has a customer they can cross-sell everything else to. CVS and Walgreens are competing for convenience. Amazon is competing for lifecycle integration.

RxPass offers significant savings compared to traditional insurance copays, with a flat rate of $5/month regardless of the number of medications. Estimated data based on typical copay ranges.

Healthcare Access in Underserved Communities

Let's zoom out from the business mechanics and think about what this actually means for people living in pharmacy deserts.

Rural America has been getting the short end of healthcare for decades. Rural hospitals are closing. Rural doctors are retiring and not being replaced. Rural communities lost population to urban migration. All of this hits healthcare infrastructure hard. Pharmacy is no exception.

Amazon Pharmacy same-day delivery is transformative for someone in rural Arkansas or rural Montana. Imagine you live 45 minutes from the nearest pharmacy. You're managing diabetes. Your script expires. Instead of planning a 90-minute round trip, you order on Amazon and it's at your door by evening. You don't have to take time off work. You don't have to spend money on gas. You don't have to plan around someone else's schedule.

This matters even more for elderly people. A rural senior on a fixed income might not drive long distances anymore. A 90-minute pharmacy trip is a production. But opening an Amazon package is something they can do from their home. Amazon Prime might already deliver their groceries. Adding pharmacy to that is natural.

There are equity implications too. Low-income people often have less flexibility in schedules. They work hourly jobs with irregular hours. Taking time off to go to the pharmacy means lost wages. They might not own a reliable car. Transportation is a genuine barrier. Same-day delivery removes that barrier.

People without insurance are also gaining an option. If you're uninsured and paying out-of-pocket for medications, retail pharmacy prices are brutal. A month's supply of metformin costs

Of course, Amazon Pharmacy isn't a substitute for actual healthcare. You still need a doctor to write the prescription. You still need a diagnosis. What Amazon Pharmacy does is solve the downstream problem of accessing medications once you have a prescription.

The expansion to 4,500 new cities disproportionately helps underserved areas because those are exactly the places that lost pharmacy access. Well-served urban and suburban areas already had options. Rural and small-town America didn't. The expansion is filling that gap.

Integration With Amazon Prime and Broader Ecosystem

Amazon Pharmacy doesn't exist in isolation. It's woven into the Amazon Prime ecosystem, and that's where the real power comes from.

Prime members get free two-day delivery on most Amazon purchases. Adding pharmacy to that is natural. You're already Prime. Your prescriptions arrive with the same reliability as your other Amazon purchases. Same tracking, same reliability standards.

But it goes deeper. Amazon Prime also includes Amazon Fresh and Whole Foods grocery delivery. Imagine this scenario: It's Monday morning. Your kid is sick. You order cold medicine from Amazon Pharmacy (same-day delivery). You also order ingredients for soup from Fresh. Everything arrives within hours. You don't have to go to the pharmacy. You don't have to go to the grocery store. You handle everything from home.

That's the ecosystem Amazon is building. Pharmacy is one node in a much larger network of services designed to mean you never have to leave home for routine errands.

Amazon also owns One Medical, a primary care clinic chain. In some cities, Amazon Pharmacy customers can pick up prescriptions from One Medical offices instead of waiting for delivery. This creates a hybrid model. Telehealth visit with your One Medical doctor, prescription written, walk downstairs to pick it up immediately, or have it delivered. That's genuinely convenient.

Amazon Web Services and Amazon's data infrastructure also play a role. All of this data—what prescriptions people need, when they need them, who's managing what conditions—is incredibly valuable for Amazon. It helps them optimize logistics, predict demand, and understand customer behavior. The prescription data is almost secondary to the insights it provides.

There's also potential integration with health insurance. Amazon is reportedly exploring health insurance products. If Amazon starts offering insurance and pharmacy together, they've basically vertical integrated healthcare delivery. You get health insurance from Amazon, primary care from One Medical, pharmacy from Amazon Pharmacy, and health products from Amazon Fresh. That's a complete healthcare ecosystem.

RxPass offers significant savings across different customer types, with uninsured individuals saving the most at $130/month. Estimated data.

Regulatory and Pharmacist Challenges

One thing that could complicate Amazon's expansion is regulation. Pharmacy is one of the most heavily regulated industries. Every state has different rules about who can own a pharmacy, how it can operate, licensing requirements for pharmacists, and delivery restrictions.

Amazon has navigated this so far by actually owning the pharmacy operations themselves. They employ licensed pharmacists. They follow state regulations meticulously. This is different from someone just drop-shipping drugs. Amazon is running actual pharmacy businesses with real pharmacists in each state.

But scaling to 4,500 cities requires hiring and training thousands more pharmacists. That's not trivial. Pharmacists aren't cheap. A licensed pharmacist makes

There's also a pharmacist shortage in the US. According to industry data, there are roughly 300,000 pharmacists in the US. If Amazon is absorbing thousands of them, traditional pharmacy loses talent. This could accelerate traditional pharmacy closures, which is ironic but probably benefits Amazon.

State regulations also create complexity. Some states have strict rules about telehealth prescriptions. Some require in-person doctor visits for certain medications. Some have different cold chain requirements. Amazon has to comply with all of this across 50 states.

One area where Amazon has flexibility is prescription verification. They don't need to verify prescriptions the same way traditional pharmacies do because they're doing it digitally. Electronic verification with the doctor's office is standard now. Amazon can verify a prescription in seconds without the paper back-and-forth traditional pharmacies deal with.

There's also potential regulatory risk. If medications are delivered incorrectly, if someone gets the wrong dose, if there's a supply chain problem, Amazon could face scrutiny from state pharmacy boards or federal regulators. They have to maintain the same standards as traditional pharmacy or face license revocation.

But I'll be honest: Amazon has shown they're serious about compliance. They haven't cut corners on pharmacy operations. They employ real pharmacists. They follow regulations. This isn't a get-rich-quick scheme. It's a long-term play on healthcare infrastructure.

Cost Economics: Who Saves Money and How Much

Let's talk actual savings because this is where it gets concrete.

For an insured person, savings depend on copay structure. If your insurance copay is

For a senior on Medicare, savings are similar. Average Medicare copays for maintenance medications are

For an uninsured person, the savings are more dramatic. Without insurance, that same person pays full retail price. A month's supply of metformin costs

There's also value in convenience that's harder to quantify. A pharmacy trip takes an hour including driving, parking, waiting in line. If you avoid that trip once per month, you're saving five hours per month or 60 hours per year. What's your time worth? If you value it at

Add convenience savings to prescription cost savings and an uninsured person could be saving $2,700+/year. That's meaningful for someone living paycheck to paycheck.

For Amazon, the unit economics work because they're operating at massive scale. They negotiate drug prices down because they're committing to huge volumes. They use existing delivery infrastructure so there's minimal incremental cost per prescription. They're willing to operate at lower margins because the goal is customer lock-in, not prescription profitability.

This is where traditional pharmacy gets trapped. They can't compete on price because their unit economics don't allow it. A Walgreens cannot operate at $5/month subscription for unlimited medications. They'd go bankrupt. So they're stuck charging higher prices and watching customers leave.

Amazon plans to expand its same-day prescription delivery to 4,500 cities by 2026, marking a significant shift in healthcare delivery. Estimated data.

The Timeline and Rollout Strategy

Amazon's committing to 4,500 cities by end of 2026. That's about two years away. What does the rollout timeline look like?

Amazon has been doing this incrementally. In 2020, Amazon Pharmacy launched with two-day delivery in select cities. In 2021-2022, they expanded to more cities and added next-day delivery options. In 2023-2024, they pushed same-day delivery to roughly half the US population. Now they're going from there to 4,500 cities.

The timeline suggests roughly 2,000-2,500 new same-day cities in 2025 and another 2,000-2,500 in 2026. That's aggressive but feasible given they've already done half the work.

The strategy appears to be fulfillment center expansion plus pharmacy buildout. Amazon is opening new fulfillment centers regularly. As each new one opens, they add pharmacy operations. Pharmacy doesn't require as much capital as general merchandise fulfillment. It's basically space, licensing, staffing, and supply chain.

They're also likely retrofitting existing fulfillment centers with pharmacy operations. This is cheaper than building new facilities. Take an existing 500,000 square foot fulfillment center, dedicate 5,000-10,000 square feet to pharmacy operations, staff it with pharmacists, and suddenly you've got pharmacy service for 500,000+ people.

The geographic priority is probably based on population density and existing gaps. High-density areas that don't yet have service get priority because they serve the most customers. Rural areas with severe pharmacy access gaps get priority because the need is greatest.

Amazon's announcement of Idaho and Massachusetts first suggests they're starting with low-hanging fruit—states where either the need is obvious or infrastructure is already mostly there. Full rollout will follow.

One thing to watch is whether Amazon hits the timeline. Tech companies often miss ambitious rollout targets. But Amazon has a good track record on logistics commitments. They tend to be conservative with public timelines and over-deliver. So I'd expect most of the 4,500 cities are live by end of 2026, possibly earlier.

Potential Challenges and Limitations

Despite the massive advantages, Amazon Pharmacy expansion isn't risk-free. There are real limitations and potential problems.

Cold chain management is harder than it sounds. Some medications genuinely need to stay at a specific temperature. Insulated packaging with cooling elements works for most cases, but if a package sits in a hot delivery truck for hours, or if Amazon's processes aren't perfect, medications could be compromised. One major cold chain failure could be disastrous for customer trust.

Prescription accuracy is another critical issue. Get a dose wrong or mix up medications and you have a serious problem. Amazon's processes are good, but at the scale they're operating, even a 0.01% error rate means mistakes affecting thousands of customers annually.

There's also network coverage limits. Amazon's same-day delivery only works where they have fulfillment centers. True rural America—places 200+ miles from any Amazon facility—still can't get same-day delivery. These areas need next-day or two-day options, which Amazon provides, but it's not the same as same-day.

Doctor relationships matter too. Some patients have doctors they trust who work at specific pharmacy networks. If a doctor is reluctant to use electronic prescribing to Amazon, that patient can't easily switch. This is changing generationally as newer doctors embrace e-prescribing, but it's still a friction point.

Insurance integration could be complicated. Some insurance plans don't cover Amazon Pharmacy. You'd need to check your specific coverage. If you have a weird insurance arrangement, you might not be able to use Amazon Pharmacy at all.

There's also competition. Other players are trying to solve similar problems. Good Rx is making pharmacy prices transparent. Ro and other telehealth platforms are handling prescription-to-delivery. Walmart is testing pharmacy delivery in some areas. Amazon isn't alone in seeing this opportunity.

Regulatory changes could also affect expansion. If Congress decides to regulate online pharmacy more strictly, or if state legislatures crack down, Amazon might have to slow down or adjust their model.

What This Means for Traditional Pharmacy

Let's be real: this is devastating for traditional pharmacy business models.

Independent pharmacists are already struggling. Local pharmacy ownership has become nearly impossible because you can't compete with chains on price or convenience. Now you can't compete with Amazon either. The best independent pharmacists are probably looking at exits or repositioning into specialized services.

Chain pharmacies like CVS and Walgreens are trying to transform into healthcare hubs—clinics, vaccinations, telehealth. This diversification makes sense because the prescription margin business isn't competitive anymore. But it requires capital investment that they can only partially fund from pharmacy profits. They're essentially self-disrupting.

Walgreens has been more aggressive about acknowledging this reality. They're closing stores explicitly to reduce their real estate footprint and focus on higher-volume locations. CVS is doing something similar but slower.

The one advantage traditional pharmacy has is physical presence. You can walk in, talk to a pharmacist, get advice. Amazon can't replicate that without physical locations, which would defeat the cost advantage. So there's probably a residual market for traditional pharmacy serving people who value that in-person interaction.

But the trend is clear. As Amazon expands, traditional pharmacy shrinks. In five years, traditional pharmacy will probably be smaller and more specialized. In ten years, it might be a niche business catering to people who specifically want human interaction over convenience.

International Expansion and Future Potential

The announcement is focused on US expansion, but Amazon has been exploring international pharmacy for years.

Amazon applied for pharmacy trademarks in the UK, Canada, and Australia back in 2020. They haven't launched pharmacy services in any of these countries yet, but the trademarks suggest they're planning to. The US is the first market, but it's unlikely to be the last.

International expansion could be even more impactful than US expansion because pharmacy systems in many countries are even more rigid and less convenient than the US. In the UK, you get prescriptions from NHS doctors and they go directly to the pharmacy. Physical pharmacy locations are required. Delivery isn't standard. Amazon Pharmacy could be revolutionary there.

Canada has similar structure to the US with independent and chain pharmacies, but they're even more regional. Amazon expansion in Canada could consolidate pharmacy in a way that doesn't exist currently.

Australia is interesting because it's geographically sparse with huge distances between cities. Same-day delivery is harder there than in the US, but that's exactly why it would be valuable. Remote parts of Australia struggle with pharmacy access even more than remote US areas.

The regulatory landscape is different everywhere, though. Each country has its own pharmacy regulations, drug approval processes, insurance systems. Amazon would have to navigate all of that. But given their resources and track record, international expansion seems likely within 3-5 years of completing US rollout.

Healthcare Data and Privacy Considerations

One thing that's worth thinking about is what happens to all this prescription data.

Every prescription filled through Amazon Pharmacy becomes part of Amazon's database. Amazon knows what medications you take, when you take them, how you refill them. Combined with your Amazon shopping history, Alexa interactions, and AWS data, Amazon builds an incredibly detailed health profile.

This data is valuable. Pharmaceutical companies want it. Insurance companies want it. Advertisers want it. Medical researchers want it. Amazon probably isn't selling it directly, but they might use it for their own purposes.

For example, Amazon could recommend health products based on your prescriptions. If you're taking a diabetes medication, Amazon could suggest glucose monitors, test strips, and dietary products. If you're taking a mental health medication, they could recommend relevant self-care products. This is targeted marketing, but it's also potentially helpful.

There's privacy risk though. What if data is breached? What if Amazon's policies change? What if regulators decide this data collection violates privacy laws? These aren't hypothetical concerns. Data breaches happen. Company policies change. Regulations evolve.

For now, prescription data from Amazon Pharmacy is probably handled carefully. Healthcare data is regulated, and violations are serious. But as Amazon Pharmacy grows and becomes more central to their business, the incentive to monetize that data increases.

This is something to be aware of if privacy is a concern for you. Using Amazon Pharmacy means trusting Amazon with sensitive health information.

Making the Switch: What You Need to Know

If you're considering switching from traditional pharmacy to Amazon Pharmacy, here's what you should know.

First, check if same-day delivery is available in your area. It's expanding to 4,500 cities, but it's not everywhere yet. Amazon Pharmacy's website has an availability checker.

Second, verify your insurance coverage. Some insurance plans work with Amazon Pharmacy. Some don't. You'll need to confirm before making the switch.

Third, check if your prescriptions are available. Amazon Pharmacy covers most common medications, but not everything. If you're on something unusual or brand-new, you might need to stick with traditional pharmacy for that one.

Fourth, consider Rx Pass if you're eligible. If you're on the medications they cover, Rx Pass is probably cheaper than your insurance copay or retail price.

Fifth, set up automatic refills if you switch. This ensures you never run out. Amazon can deliver before you run out if you set it up right.

Sixth, keep your doctor in the loop. Your doctor needs to know you're using Amazon Pharmacy so they can send prescriptions to the right place.

Seventh, consider hybrid approach. You don't have to switch everything at once. You could use Amazon Pharmacy for routine maintenance medications and traditional pharmacy for anything complicated.

The Bigger Picture: Healthcare Transformation

Amazon Pharmacy isn't just a convenience service. It's part of a larger transformation in how healthcare is delivered.

For decades, healthcare was tied to physical locations. You went to a hospital, a doctor's office, a pharmacy. These were separate businesses with limited integration. Technology and companies like Amazon are changing that.

Telehealth is decoupling doctor visits from physical location. You can see a doctor from home. Prescription delivery is decoupling pharmacy from physical location. You can get medications without going to a store. Remote monitoring is decoupling health tracking from doctor's visits.

What emerges from this is distributed healthcare. You stay home, healthcare comes to you. This is fundamentally more convenient and potentially more efficient.

Amazon's role is to integrate these pieces. Amazon Pharmacy + One Medical + Amazon Fresh + Alexa health monitoring could create a complete at-home healthcare ecosystem. You don't necessarily need to leave your house for routine healthcare needs anymore.

Traditional healthcare providers are adapting but slowly. CVS buying Aetna insurance was an attempt at integration, but it's nothing like what Amazon is building. Traditional providers were built for a different era when physical location and offline paperwork were necessary. Moving from that model to distributed, integrated healthcare is harder for them than for Amazon.

The long-term implications are significant. Healthcare becomes more accessible to people in underserved areas. Healthcare becomes more convenient for everyone. Healthcare becomes more data-driven because every interaction is digital and traceable. Whether that's ultimately good or bad depends on how the data is used.

Comparison With Other Healthcare Delivery Models

Amazon Pharmacy isn't the only way to solve the last-mile pharmacy problem, but it's arguably the most comprehensive.

Good Rx is a pricing transparency platform. They don't deliver medications, they just show you where to get them cheapest. This helps with cost but doesn't solve convenience or access problems.

Ro and other telehealth platforms handle doctor visits and prescription writing, but they partner with third-party pharmacies for fulfillment. They're not integrated end-to-end like Amazon.

Walmart's pharmacy delivery is similar to Amazon's but more limited geographically. Walmart doesn't have Amazon's logistics network, so they can't match the speed or coverage.

Traditional pharmacy chains offer delivery in some markets, but it's usually limited to areas near their stores. They can't compete on same-day speed if they're starting from a traditional retail location.

What makes Amazon unique is they have all the pieces: fulfillment infrastructure, last-mile delivery, customer data, financial resources, and the willingness to operate at lower margins for strategic positioning. Nobody else has all of those things.

FAQ

What is Amazon Pharmacy and how does it differ from traditional pharmacy?

Amazon Pharmacy is Amazon's prescription delivery service that operates through small pharmacy operations inside Amazon fulfillment centers. Unlike traditional pharmacies where you visit a physical store, Amazon Pharmacy delivers prescriptions directly to your home using Amazon's same-day delivery network in select cities. This eliminates the need to travel to a pharmacy and typically provides faster, more convenient access to medications. Amazon Pharmacy is integrated with Amazon Prime benefits and operates alongside Rx Pass, Amazon's subscription service for common medications.

When will same-day prescription delivery be available in my city?

Amazon Pharmacy same-day delivery is currently available in select cities across the US, with expansion to 4,500 new cities and towns planned by the end of 2026. To check if your area currently has same-day delivery available, visit the Amazon Pharmacy website and search your location. The company has specifically announced that Idaho and Massachusetts will be getting same-day delivery access for the first time as part of this expansion. Availability depends on proximity to Amazon fulfillment centers with pharmacy operations.

How much can I save by switching to Amazon Pharmacy?

Savings vary based on your insurance status and medications. For people with insurance copays, switching to Amazon Pharmacy often reduces costs by 50-80%. For example, if your copay is

Does insurance cover medications delivered through Amazon Pharmacy?

Most insurance plans, including Medicare, are covered by Amazon Pharmacy. However, coverage varies by specific insurance plan. You should verify with your insurance provider before switching to confirm that Amazon Pharmacy is included in your plan's network. Some medications may require prior authorization even through Amazon Pharmacy. Additionally, Amazon offers Rx Pass as an alternative if you want to avoid insurance entirely and simply pay $5/month for access to common medications.

What medications are included in Rx Pass?

Rx Pass covers over 50 common maintenance medications used to treat routine chronic conditions like diabetes, hypertension, depression, anxiety, asthma, and high cholesterol. Medications included are metformin, lisinopril, levothyroxine, atorvastatin, sertraline, and many others. Rx Pass does not cover specialty drugs, brand-name medications, or newly approved medications. For a complete and current list of covered medications, check the Rx Pass section of the Amazon Pharmacy website.

How does same-day delivery work if I live in a rural area?

Same-day delivery is only available in areas with nearby Amazon fulfillment centers that have pharmacy operations. Rural areas far from these facilities typically have access to next-day or two-day delivery instead. As Amazon expands to 4,500 new cities by 2026, many rural areas should gain same-day access, particularly in states like Idaho and Montana where pharmacy closures have created significant access gaps. If same-day isn't available, Amazon still offers convenient next-day delivery to most rural locations.

What happens if I'm not eligible for Amazon Prime? Can I still use Amazon Pharmacy?

Yes, you don't need an Amazon Prime membership to use Amazon Pharmacy. However, Prime members do get enhanced benefits like faster delivery on eligible prescriptions. You can order from Amazon Pharmacy with a regular Amazon account. If you use Rx Pass subscription, that's a separate product from Prime with its own subscription cost of $5/month.

How does Amazon ensure my prescriptions are filled correctly and safely?

Amazon employs licensed pharmacists at each fulfillment center with pharmacy operations. These pharmacists review every prescription before it's filled, checking for potential drug interactions, verifying correct dosages, and confirming insurance coverage. The pharmacists follow the same regulatory standards and verification processes as traditional retail pharmacies. Amazon also complies with state pharmacy regulations in each state where they operate, maintaining appropriate licensing and oversight.

Will Amazon Pharmacy replace traditional pharmacies?

While Amazon Pharmacy is expanding rapidly and provides compelling advantages in convenience and cost, traditional pharmacies will likely continue serving customers who value in-person interaction, complex medication counseling, or immediate access. However, the expansion to 4,500 cities will significantly reduce the market for traditional retail pharmacy, particularly in underserved areas. Many traditional pharmacies are adapting by shifting toward healthcare services like vaccinations and clinics rather than focusing primarily on prescription fills.

Is my prescription data private when I use Amazon Pharmacy?

Your prescription data through Amazon Pharmacy is protected under healthcare privacy regulations like HIPAA, and Amazon handles this data carefully because violations carry serious consequences. However, as with all Amazon services, you should be aware that prescription information combined with your other Amazon data creates a comprehensive health profile that Amazon maintains. Review Amazon's privacy policy for pharmacy services to understand exactly how your health data is used and protected.

Conclusion: The Future of Pharmacy Is at Your Door

Amazon's announcement to bring same-day prescription delivery to 4,500 new cities by end of 2026 is more than a business expansion. It's a structural shift in American healthcare delivery.

For most of the 20th century, pharmacy meant going to a store. You built a relationship with your pharmacist. You picked up prescriptions on a schedule. You took what time you had. Now that's changing. Pharmacy is becoming a digital, delivered service that comes to you.

This matters most for people underserved by traditional pharmacy. Rural residents facing hour-long drives. Urban workers unable to take time off for errands. Low-income people paying unsustainable drug prices. Elderly people without reliable transportation. Sick people who can't leave home. For all these groups, Amazon Pharmacy is genuinely transformative.

But it's worth being thoughtful about the tradeoffs. Amazon now knows your health data. You're increasingly locked into Amazon's ecosystem. Traditional pharmacy infrastructure is disappearing faster because of this competition. There are privacy and equity considerations worth thinking about.

None of that changes the fundamental appeal though. Same-day prescription delivery is more convenient than driving to a pharmacy. Rx Pass at $5/month is cheaper than copays. Having medications delivered alongside your other Amazon purchases is sensible integration.

If you live in one of the 4,500 new cities getting access by 2026, you'll have real choice for the first time. You can stick with traditional pharmacy if you prefer. Or you can switch to Amazon and gain the convenience advantage. That competitive pressure should help everyone—Amazon will drive prices down and service quality up, and traditional pharmacy will have to innovate faster to compete.

The prescription drug industry needed disruption. It was inefficient, expensive, and inconvenient. Amazon isn't the only force driving change, but they're the most capable. By end of 2026, nearly half of America will have access to same-day prescription delivery from Amazon. That's worth paying attention to.

Key Takeaways

- Amazon expands same-day prescription delivery to 4,500 cities by end of 2026, including new coverage in Idaho and Massachusetts

- RxPass subscription at $5/month provides unlimited access to 50+ common medications, creating massive cost savings for insured and uninsured patients

- Pharmacy closures across America have created dangerous access gaps that Amazon Pharmacy is uniquely positioned to fill through integrated logistics

- Same-day delivery eliminates transportation barriers for rural, elderly, and low-income populations struggling with pharmacy access

- Amazon's healthcare ecosystem integration (pharmacy + OneMedical + Prime) is fundamentally changing how medications are delivered and healthcare is accessed

- Traditional retail pharmacy faces existential pressure as Amazon leverages massive scale, data, and logistics advantages they cannot match

Related Articles

- StreamFast SSD Technology: The Future of Storage Without FTL [2025]

- Trenchant Exploit Sale to Russian Broker: How a Defense Contractor Employee Sold Hacking Tools [2025]

- Samsung Galaxy S26 Trade-In Deal: Get Up to $900 Credit [2025]

- Threads' Dear Algo: How AI Personalization is Changing Social Media

- 40 Best Presidents Day Tech Deals You Can Shop Now [2025]

- Deleted Doorbell Footage Recovery: What the Guthrie Case Reveals About Cloud Privacy

![Amazon Pharmacy Same-Day Delivery Expansion to 4,500 Cities [2026]](https://tryrunable.com/blog/amazon-pharmacy-same-day-delivery-expansion-to-4-500-cities-/image-1-1770838616290.jpg)