Apple's Historic Settlement with Brazil: What Just Changed for App Stores and Payments

Something genuinely significant happened in Brazil, and if you're paying attention to the future of mobile platforms, you should care. Apple just agreed to let third-party app stores run on iPhones and iPads in Brazil. Not just theoretically—with real enforcement mechanisms, specific fee structures, and a 105-day implementation deadline. This isn't the first time regulators have pushed back on Apple's ecosystem control, but it's one of the most concrete victories yet.

The Brazilian Administrative Council of Economic Defense (CADE) spent years investigating whether Apple's App Store practices were anticompetitive. They concluded that yes, they were. And instead of battling this out in court indefinitely, Apple decided to settle. The agreement opens doors that have been locked since the iPhone launched in 2007.

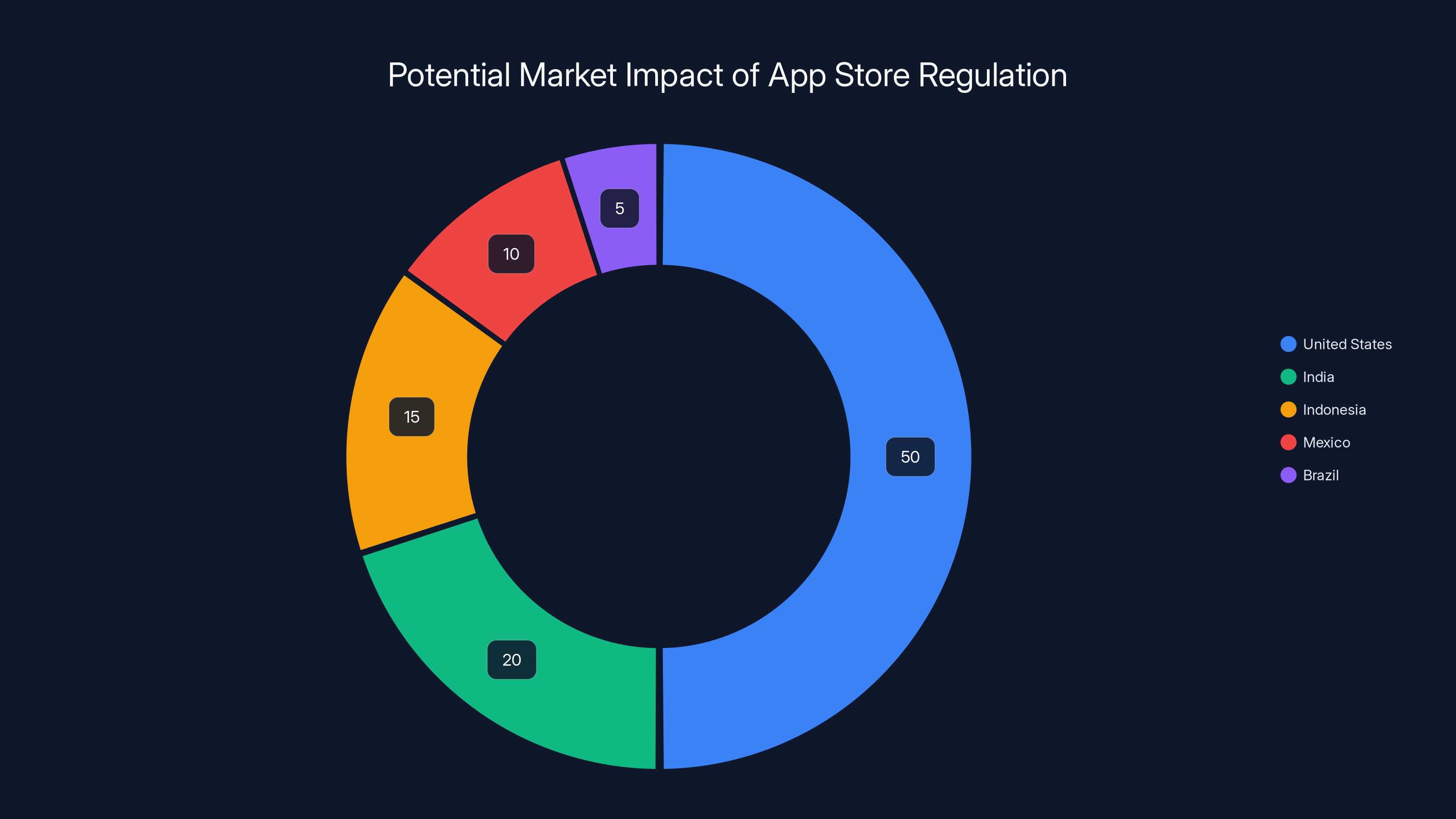

Here's what makes this moment important: it's not just about Brazil. This settlement sits alongside the EU's Digital Markets Act enforcement, the Epic Games lawsuit in the US, and similar investigations happening across Asia and Europe. Regulators worldwide are synchronizing their pressure on Apple's walled garden. Each victory creates a precedent. Each precedent makes the next fight easier for regulators—and more expensive for Apple to resist.

But here's the nuance everyone misses. This isn't a total victory for developers or consumers. Apple didn't lose. They pivoted. The new fee structure still captures value for Apple, just in different ways. Understanding those fee mechanisms—what they mean economically, strategically, and for the broader mobile ecosystem—requires getting into the actual details.

The Brazilian settlement matters because it shows what Apple will grudgingly accept when faced with coordinated regulatory pressure. And if you're building an app, running a startup, or investing in mobile platforms, the Brazil playbook is probably coming to your region too.

TL; DR

- CADE settlement requires Apple to allow third-party app stores on iOS devices in Brazil with neutral, objective warnings

- New fee structure creates three payment tiers: no fee for text-only external payment links, 15% for clickable buttons to external payment, 10–20% for Apple's payment system

- Additional 5% Core Technology Fee applies to all app downloads from third-party stores, offsetting lost commission revenue

- 105-day compliance deadline with potential fines up to $27 million for non-compliance

- Sets precedent for global App Store regulation, following EU Digital Markets Act and preceding US, UK, and Asian regulatory actions

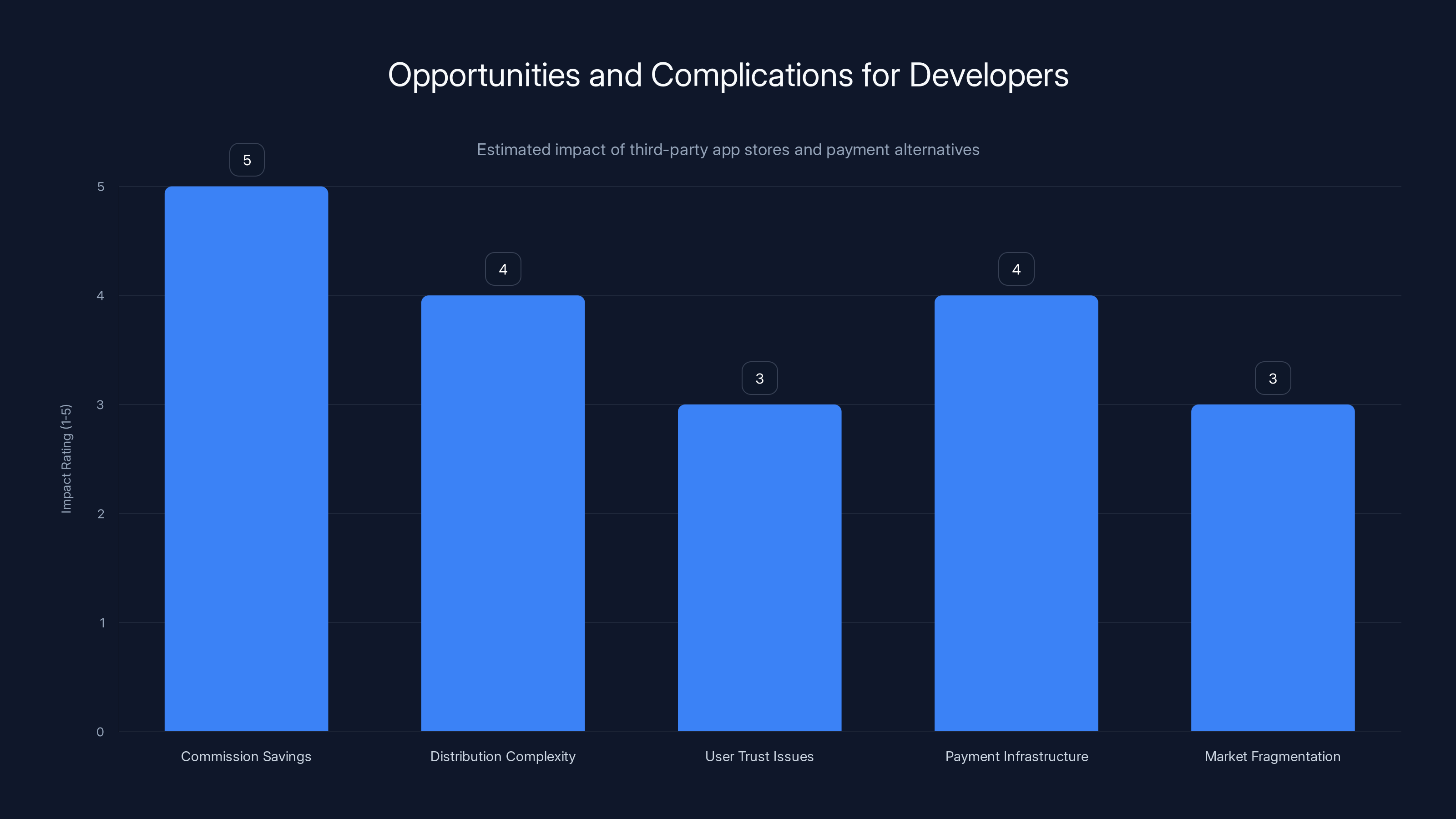

Developers can significantly benefit from commission savings, but face increased complexity in distribution and payment processing. (Estimated data)

The Brazilian Investigation: Years of Regulatory Scrutiny

CADE's investigation didn't start yesterday. For years, the Brazilian authority examined whether Apple's control over app distribution and payment processing violated competition law. The core allegation was straightforward: Apple forces developers to use its payment system, takes a cut off the top, prevents developers from steering users elsewhere, and blocks alternative app distribution channels. This created what economists call a "closed ecosystem" with no viable alternatives.

Why Brazil specifically? The country has roughly 90 million smartphone users, making it one of the world's largest mobile markets. Local developers have complained about Apple's fees eating into their revenue. Startups struggle with the 30% commission on in-app purchases (before the recent 15% tier was introduced for smaller developers). And Brazil's regulators, like many governments, grew concerned that a single foreign corporation controlled how millions of their citizens accessed software.

CADE's investigation examined whether Apple's policies violated Brazil's Competition Law. The questions were: Did Apple abuse a dominant position? Did it create barriers to entry? Did it unfairly restrict competition? Over the course of the investigation, Apple faced mounting pressure, similar to what it encountered in Europe, South Korea, and the United States.

What's striking is that Apple didn't fight this all the way. After years of investigation, the company negotiated a settlement. This signals something important about Apple's strategic calculus: at a certain point, fighting every regulator individually becomes more expensive and risky than making targeted concessions. The settlement reflects Apple's understanding that it cannot hold the line everywhere simultaneously.

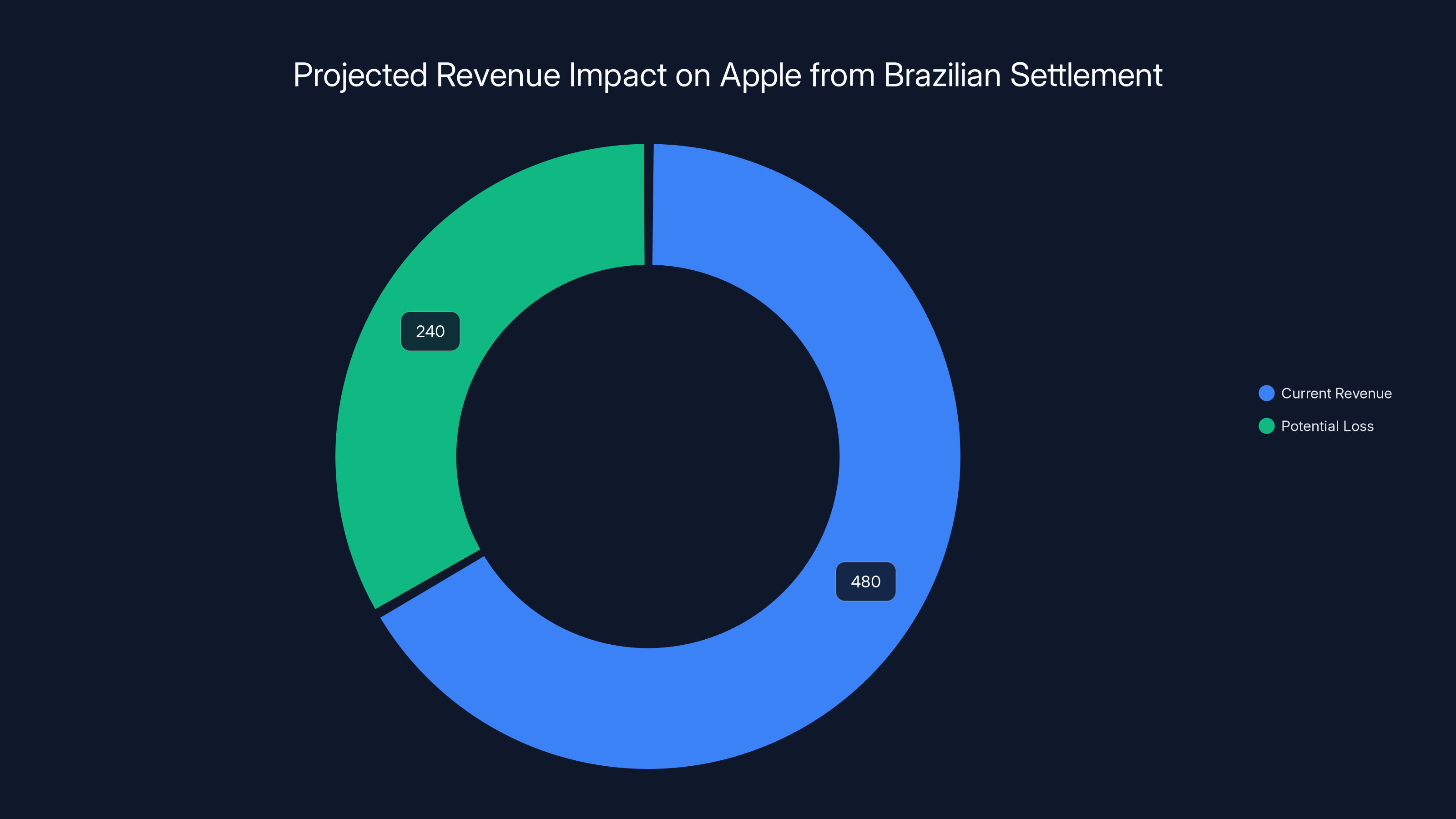

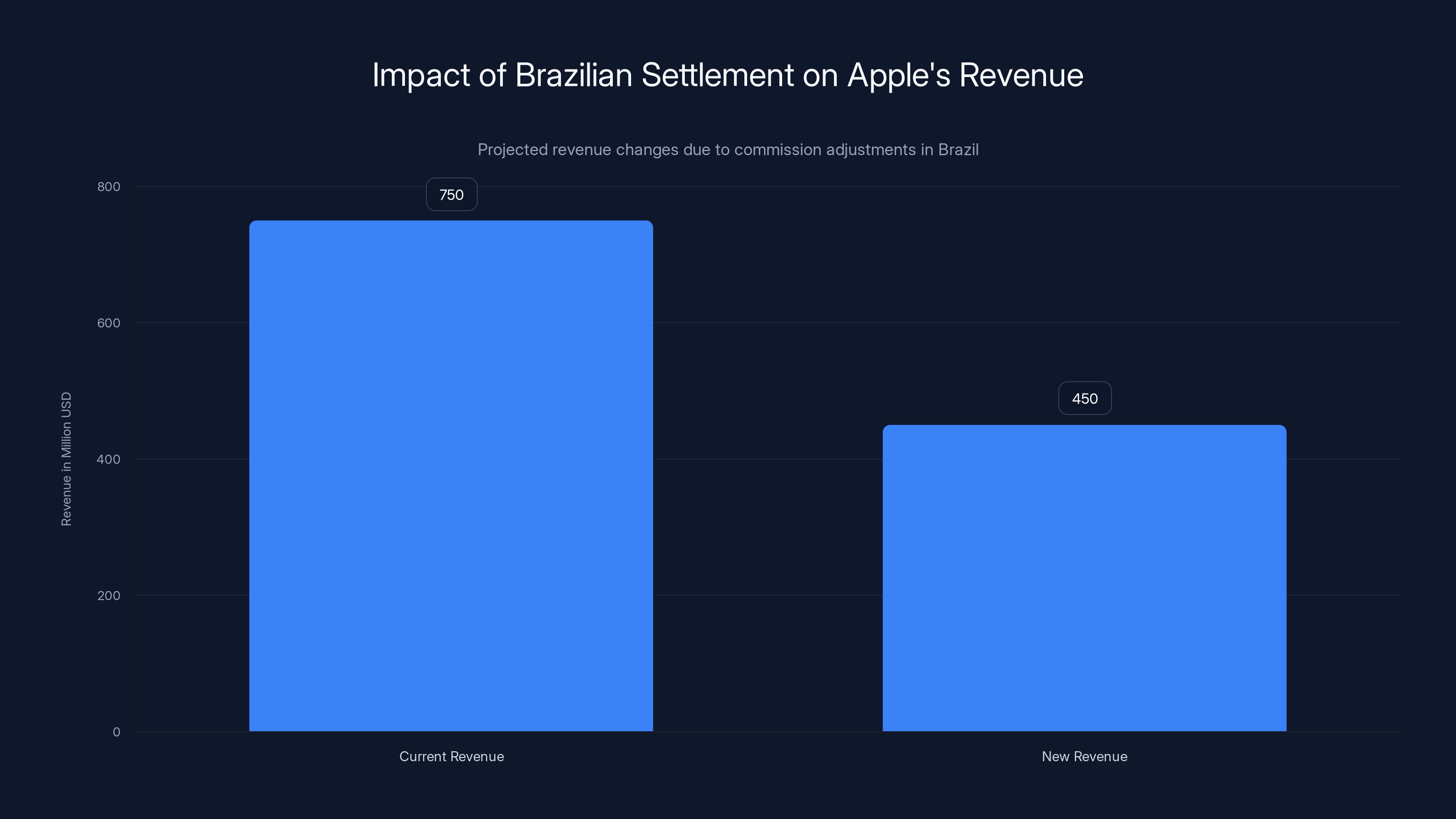

Apple's potential annual revenue loss from the Brazilian settlement is estimated at $240 million, which is about 50% of its current app store revenue in Brazil. (Estimated data)

The Core of the Settlement: Third-Party App Stores Now Permitted

The headline-grabbing part of the settlement is this: Apple must allow third-party app stores on iOS. Developers can now potentially distribute their apps through alternatives to Apple's App Store. This breaks a fundamental pillar of Apple's platform control.

But Apple gets to add caveats. When a user installs a third-party app store, Apple can display a warning. However—and this is the regulatory guardrail—the warning must be "neutral and objective." Apple can't say "WARNING: This will destroy your phone." It has to be factual. Something like "This app store is not reviewed by Apple" would likely pass, while "This is dangerous" would not.

Why does Apple care about warnings? Because third-party app stores might not implement Apple's security standards, app review processes, or privacy protections. Malware could slip through. Scams could flourish. Apple has legitimate concerns about user safety—though critics argue Apple exaggerates these risks to justify its monopoly.

The permission for third-party app stores fundamentally changes what developers can do. Instead of being forced through Apple's review process and payment system, developers can now publish directly through alternative channels. This could allow niche apps that Apple rejected (for any reason) to reach Brazilian users. It could let developers avoid paying Apple's commission entirely.

However, the Core Technology Fee (discussed below) means Apple still captures a cut from third-party app store downloads. The company isn't giving up revenue—it's restructuring how it captures it.

The Payment Processing Revolution: Links, Buttons, and Fee Tiers

The settlement's payment structure is where the economics get interesting. Apple created three distinct tiers, each with different implications for developers, users, and Apple's own revenue.

Tier 1: Text-Only External Payment Links (Zero Fee)

If a developer includes a text-only link directing users to pay outside the app (e.g., "Pay on our website"), Apple charges nothing. The developer captures 100% of revenue. This is Apple's nod to fairness—if you use the minimal technical footprint possible to point users elsewhere, you don't owe Apple anything.

The catch? Text-only links are clunky. Users have to leave the app, go to a browser, remember their login credentials, re-enter payment information. This friction causes many users to abandon the purchase. Real-world conversion data suggests text-only checkout experiences lose 40–60% of potential buyers compared to in-app checkout. So while the fee is zero, the revenue hit is severe.

Tier 2: Clickable Buttons to External Payment (15% Fee)

If a developer includes a clickable button or link that takes users to an external payment processor, Apple charges 15%. This is a middle ground. The experience is smoother than text links—users click a button and flow out to payment. Apple still gets a commission, but developers keep more than they would through Apple's direct payment system.

This tier is economically interesting because it forces a choice: accept the friction of text-only links for zero commission, or enjoy better user experience while paying Apple 15%. For most developers, 15% is acceptable if it means conversion rates stay high. An app might lose 5–10% of conversions moving from in-app checkout to a button redirect. The 15% fee plus slightly lower conversion might result in better net revenue than Apple's 30%.

Tier 3: Apple's Payment System (10% or 20%)

If developers use Apple's own payment system, Apple charges 10% or 20% depending on app category and business model. Small creators with under $1 million annual revenue pay 15%, while larger developers pay 30% (though Apple has introduced more granular tiers in other regions). This creates the strongest financial incentive to use Apple's system while theoretically allowing alternative payment methods.

The Core Technology Fee: The Hidden Revenue Recovery

Here's where Apple ensures it doesn't actually lose much money: the 5% Core Technology Fee applies to all app downloads from third-party app stores. Every app, regardless of how users pay, triggers this 5% charge on the developer. Apple frames this as compensation for the technology infrastructure—hosting, security, core OS features—that enables apps to run.

Economically, this is clever. A developer might choose a third-party store to avoid App Store review. But the 5% Core Tech Fee means they're still paying Apple. If users make in-app purchases through that third-party store's payment system, the developer saves commission. But the 5% fee still applies. Apple reduces its direct revenue exposure while maintaining a financial relationship with every app distributed.

Let's do some math. A hypothetical Brazilian app developer with $1 million annual revenue:

- Using Apple's App Store + Apple's payment system: 30% commission = $300,000 to Apple

- Using third-party store + text-only payment links: 5% Core Tech Fee = $50,000 to Apple

- Using third-party store + external payment button: 5% Core Tech Fee = $50,000 to Apple

Apple's revenue drops from

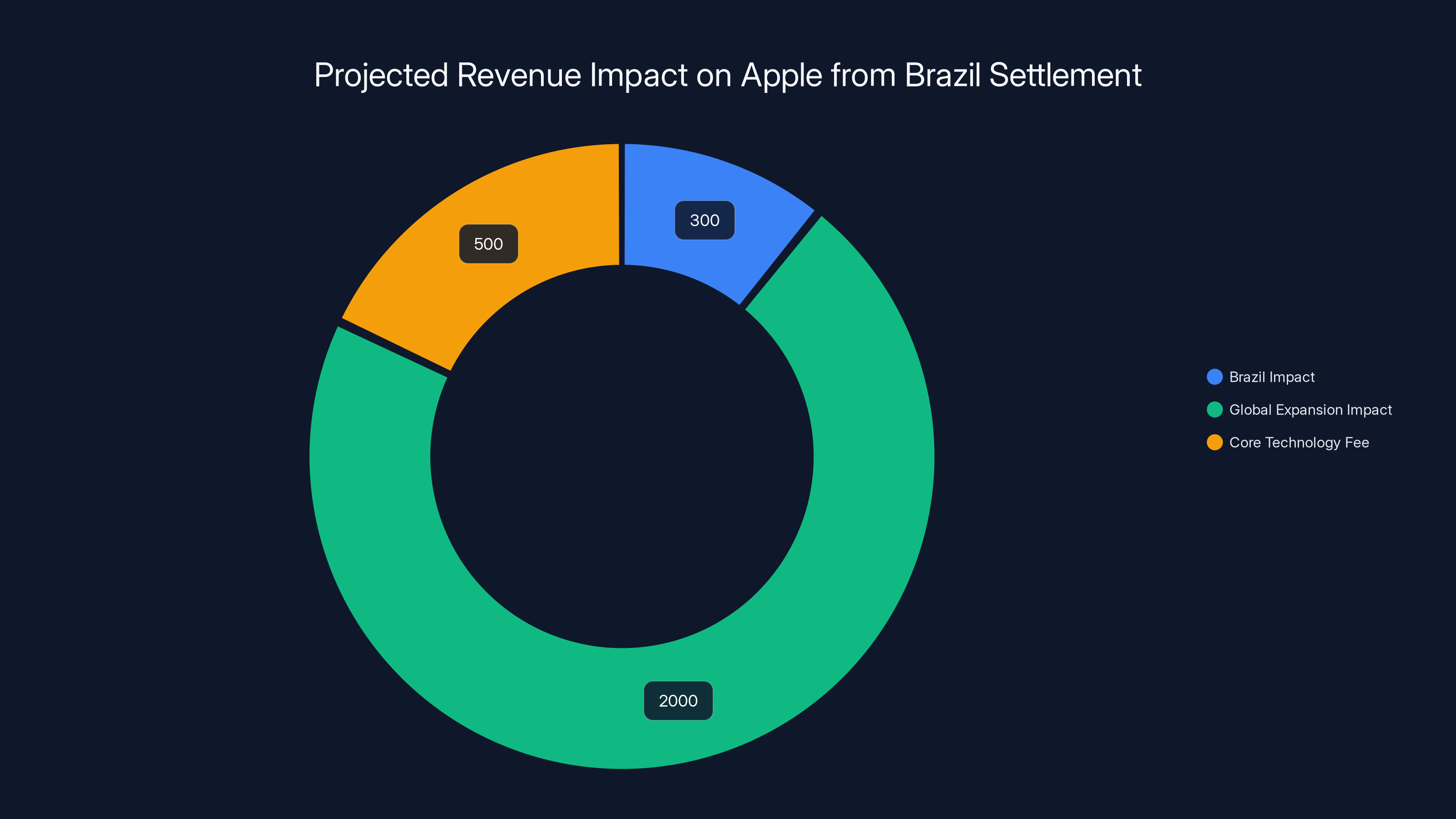

Estimated data shows Apple's revenue impact from Brazil's settlement could reach

How This Compares to Apple's EU Strategy

Brazil's settlement mirrors moves Apple made in Europe following the Digital Markets Act. The EU forced Apple to allow alternative app distribution and payment methods. Apple's response was to create a similar fee structure: alternatives to Apple's payment system incur lower commissions, but not zero. Smaller developers get slightly better terms. Third-party stores can exist, but Apple still captures value through technology fees.

The pattern suggests Apple has settled on a negotiating position: we'll allow competition, but competition won't be free. We'll take less of a percentage, but we'll apply it more broadly. We'll support payment alternatives, but they'll be fee-bearing.

Brazil's deal is essentially Apple copying its own EU playbook and applying it to Latin America. CADE likely modeled its demands on what the EU already achieved. This regulatory convergence means developers in different regions face increasingly similar rules. One framework, applied globally with minor regional tweaks.

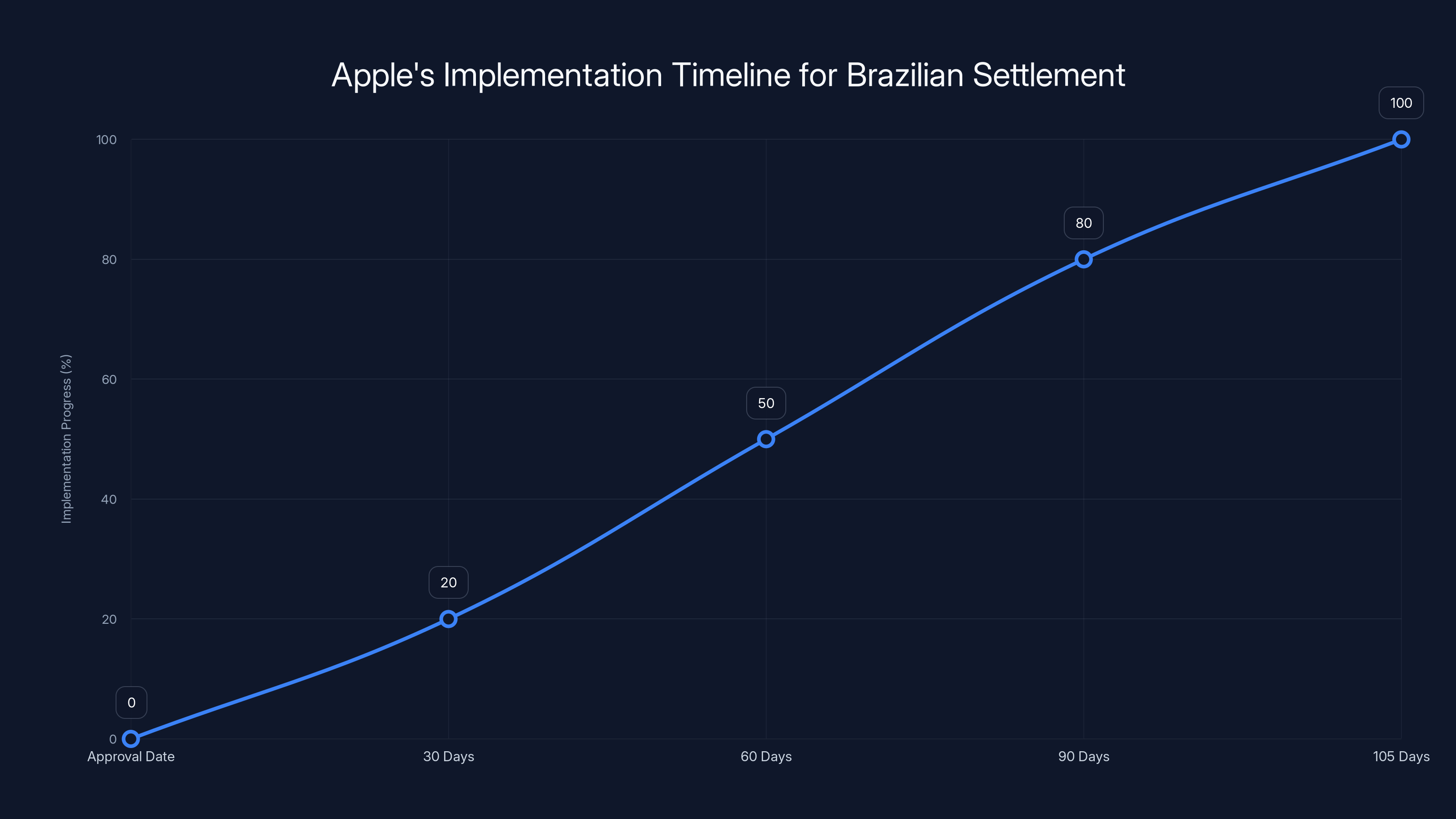

Implementation Timeline and Enforcement Mechanisms

Apple must comply within 105 days of the settlement's approval. That's roughly three and a half months. The company needs to:

- Implement technical infrastructure allowing third-party app store installation

- Build the warning system (neutral and objective)

- Integrate alternative payment processing options

- Adjust commission structures across all app categories

- Test and validate that everything works correctly

- Deploy updates to all affected iPhones and iPads in Brazil

This is operationally complex. Apple needs to modify iOS itself to permit third-party app stores. It needs to create a system that identifies which payment method a user selected. It needs to ensure accurate fee tracking and payment splitting. And it needs to do all this while maintaining security and preventing fraud.

If Apple misses the deadline or fails to comply properly, CADE can levy fines up to

Apple is incentivized to comply. And once Brazil has it working, other regulators will demand the same. "Why can Brazilians have third-party app stores but not us?" becomes a powerful argument for regulators in other countries.

The US market could see the largest impact from regulatory changes, potentially affecting up to 50% of Apple's app store revenue, followed by India and Indonesia. (Estimated data)

The Broader Regulatory Context: A Coordinated Attack on App Store Dominance

Brazil isn't unique in pressuring Apple. Simultaneous investigations and settlements are happening in multiple jurisdictions, creating a coordinated pressure campaign that makes resistance increasingly futile.

European Union (Digital Markets Act): The EU has been the most aggressive regulator. Apple was fined $587 million for violating DMA rules regarding steering and payment methods. The company is appealing but also implementing the required changes. EU rules now permit third-party app stores, alternative payment methods, and cross-sideloading of apps. Apple's latest iOS releases include these features.

United States (Epic Games Lawsuit): Epic Games sued Apple over in-app purchase commissions, arguing they're anticompetitive. The case is ongoing but has already influenced how Apple behaves. The company introduced a smaller developer tier with 15% commission and is allowing some alternative payment arrangements to avoid broader court-ordered changes. If Epic wins, US requirements could exceed even the EU's demands.

United Kingdom: The UK's Competition and Markets Authority is investigating App Store practices. It's likely to follow the EU's lead, potentially mandating similar third-party app store provisions.

South Korea: The country has already passed laws limiting app store commission rates and requiring payment alternative support. Apple implemented changes there ahead of other regions.

China: Apple has different arrangements in China due to government requirements. The company partnered with local payment processors and accepted specific regulatory terms. This proves Apple can operate under alternative payment frameworks when forced.

What's happening is a global regulatory consensus forming: Apple's current app store model, while profitable, violates competition principles. Regulators aren't all demanding identical changes, but they're pushing in the same direction. Brazil's settlement reflects this broader trend.

Apple is strategically trading revenue concentration for regulatory peace. Instead of fighting every battle globally, the company is making calculated concessions in key markets. This protects its core business (still selling iPhones) while allowing new competitive dynamics to emerge around app distribution and payments.

Implications for Developers: New Opportunities and Complications

For app developers, this settlement opens genuine opportunities. The ability to distribute through third-party app stores means less dependence on Apple's review process. Developers can ship updates faster, implement features Apple might reject, and potentially reach users who prefer alternative stores.

Payment alternatives are similarly liberating. A developer spending

But there are complications:

Fragmentation: Developers now need to support multiple distribution channels. Testing across different app stores is more work. Managing different versions and update schedules creates complexity. A smaller developer might find managing third-party store relationships more burdensome than Apple's single, consolidated process.

User Trust: Apple's app review, while frustrating for developers, is a feature for users. Third-party app stores might have weaker security standards. Users might install apps with malware or privacy violations. This isn't theoretical—Chinese app stores have well-documented problems with malicious apps.

Payment Infrastructure: Integrating external payment processing requires technical work. Developers need to handle payment validation, fraud detection, and refunds. Apple's system handles this automatically. Going external means building or licensing these capabilities separately.

Market Fragmentation: If some users install third-party app stores while others use Apple's, you have fragmented user bases with different capabilities. This complicates product management.

For established developers with resources, these challenges are manageable and well worth the commission savings. For solo developers or small teams, the overhead might not justify the savings. Apple's ecosystem has network effects and user trust that alternative stores must build.

The likely outcome: a two-tier ecosystem emerges. Premium, well-funded apps optimize for both Apple's store and third-party alternatives, capturing savings where possible. Smaller apps stick with Apple's store because the overhead isn't worth the savings. And some niche apps that Apple rejected find audiences through third-party stores.

Apple is expected to complete its compliance with Brazilian regulations within 105 days, with key milestones at 30, 60, and 90 days. Estimated data.

What Apple Loses and Gains Strategically

Apple is losing direct commission revenue. The 30% cut on in-app purchases will drop to 5% for developers who aggressively optimize for external payments. This is a significant revenue reduction.

But Apple gains something potentially more valuable: regulatory legitimacy and operational freedom. By accepting Brazilian demands now, Apple avoids prolonged litigation, appeals, and uncertainty. The company can point to settlements and say "We're working with regulators, not against them." This matters for corporate reputation and political relationships.

Apple also isolates its losses. Brazil's changes apply to Brazil. iPhones in other countries (where regulation hasn't forced changes) still route through Apple's app store exclusively. Apple's global revenue remains concentrated. Over time, more jurisdictions will demand Brazil-style changes, but Apple is implementing them selectively rather than globally all at once.

There's also a competitive advantage in being first mover on these changes. Apple learned how to support third-party app stores, alternative payments, and complex fee structures. When US or UK regulators demand similar changes, Apple already has the technical playbook and knows the operational implications. Competitors building app store alternatives for the first time will take longer.

Most strategically, Apple is maintaining control over device-level security and user experience. Third-party app stores can exist, but they run on Apple's OS. Apple still decides which apps are allowed in third-party stores, how warnings are displayed, and what security standards apply. The company isn't ceding control—it's redistributing responsibility to regulators and alternative app store operators.

The Fee Structure in Practice: Real-World Scenarios

Let's model how different developers might respond to the new Brazilian fee structure:

Scenario 1: Mobile Game Publisher

A Brazilian game company generates

With the settlement, the developer implements external payment:

- 50% of users stay in-app (familiar, seamless): Apple 30% = $750,000 to Apple

- 30% of users use the payment button option (better than text links): Apple 15% = $225,000 to Apple

- 20% of users go fully external (best for developer revenue): Apple 5% Core Tech + 0% payment = $50,000 to Apple

Total to Apple:

This is $475,000 more annually than before—a 14% revenue improvement. For the developer, promoting external payment becomes worthwhile.

Scenario 2: Subscription App

A productivity app (task management, note-taking) charges

With external payment button options, the developer might see:

- 30% of users stay in-app: 3,000 × 10,800

- 60% of users click external payment button: 6,000 × 10,800

- 10% of users fully external: 1,000 × 600

Total to Apple:

Savings are modest (2% improvement) because subscription retention and user experience benefit from simple in-app checkout. The developer probably keeps most users in-app even with alternatives available.

These scenarios show why Apple's fee structure works strategically. High-value, impulse-driven categories (games, in-app purchases) are more sensitive to commission rates and more likely to optimize externally. Subscription services, where user convenience matters most, tend to stick with Apple's system even with alternatives available.

Apple's revenue from Brazil could drop from

Competition and Innovation: What Third-Party App Stores Might Offer

With the regulatory door open, third-party app stores could emerge in Brazil. What would they offer that Apple's store doesn't?

Lower Commissions: A third-party store could undercut Apple by taking 10–15% commission instead of 30%. This alone attracts developers and reduces Apple's revenue per download. However, third-party stores still need to cover payment processing costs (~3%), customer support, fraud detection, and development. Taking 10% commission means operating on very thin margins unless you have huge volume.

Faster App Review: Apple's review process can take days or weeks. A third-party store with lighter review (basic malware scanning, no content curation) could ship apps faster. Developers could push daily updates and iterate rapidly. This appeals to developers who find Apple's process frustrating.

Different Content Policies: Apple has strict rules about certain app categories (gambling, adult content, certain political speech). A third-party store with more permissive policies could host apps Apple rejects. This is particularly relevant for regional apps in Brazil with local cultural contexts that might conflict with Apple's global guidelines.

Local Payment Methods: Brazil has unique payment infrastructure (Pix, boleto, installment purchasing). A local app store could integrate these natively. Apple's payment system prioritizes credit cards and some digital wallets but has limited local payment integration.

Regional Focus: A Brazilian app store could specialize in Brazilian developers and users, offering support in Portuguese, community features, and locally relevant discovery. This community aspect is powerful but hard to monetize efficiently.

However, building a viable third-party app store is expensive. You need payment processing, fraud detection, developer support, marketing, and user acquisition. You need to convince developers it's worth the effort to distribute there. You need to build user trust that your store is secure. Established platforms like Samsung Galaxy Store struggle with adoption despite hardware backing. A standalone Brazilian store would face similar challenges.

The most likely outcome is that no major third-party store emerges in Brazil specifically. Instead, developers might use existing alternative stores (like sideloading through progressive web apps, or using cross-platform stores that operate in multiple jurisdictions). The existence of the option matters more than actual third-party stores thriving. It's the regulatory credibility that counts.

Risks to Apple's Implementation and Compliance Challenges

Apple faces meaningful execution risks in implementing the Brazilian settlement:

Security Vulnerabilities: Opening iOS to third-party app stores and payment processors creates new attack surfaces. Malicious apps could steal credentials, intercept payments, or compromise user data. Apple's entire security brand depends on controlling this attack surface. If high-profile security incidents occur post-settlement, Apple faces massive reputational damage and regulatory backlash.

Fraud and Payment Processing: Third-party payment processors have weaker fraud detection than Apple's system. Chargebacks, payment reversals, and scams will likely increase. Apps distributed through third-party stores might face payment fraud rates 5–10x higher than Apple's system. Developers will complain. Regulators will scrutinize whether Apple properly warned users about fraud risks.

User Experience Degradation: Supporting multiple app stores, payment systems, and update mechanisms is complex. Users might encounter apps that work differently on different stores. Updates could sync poorly. Apple's brand depends on seamless experience. If third-party options create friction or inconsistency, users might blame Apple.

Competitive Retaliation: Amazon, Samsung, or other competitors might launch aggressive Brazilian app store campaigns. They could offer free or negative commissions to developers, losing money short-term to grab market share. This would pressure Apple's already-reduced commissions further.

Regulatory Scope Creep: CADE might interpret the settlement as requiring more than Apple implemented. Disagreements could lead to fines and additional enforcement actions. Apple's legal team must navigate ambiguous language carefully.

Technical Debt: Implementing these features takes engineering resources that Apple would otherwise spend on other iOS development. The opportunity cost might manifest in slower feature velocity for mainstream iOS development.

None of these risks are catastrophic, but collectively they represent meaningful operational challenges. Apple must execute flawlessly to avoid additional regulatory problems.

How This Affects the Global App Store Ecosystem

Brazil's settlement is a data point in a larger pattern. Regulators worldwide are increasingly skeptical of Apple's closed ecosystem. Here's how the dominos might fall:

United States: If US courts rule against Apple in the Epic Games case, the company might be forced to implement similar changes nationwide. This would dwarf the Brazilian settlement in economic impact (US app store revenue is 5–10x larger than Brazil's). Apple would fight a US court order, but the precedent from Brazil strengthens Epic's arguments.

Additional Markets: India, Indonesia, and Mexico have large mobile-first populations and growing regulatory sophistication. If India's competition authority (CCI) follows Brazil's lead, Apple faces implementation in another huge market. Each implementation forces the company to support the infrastructure, creating operational burden that compounds over time.

Android Implications: Google faces similar pressures on Android. Google Play takes 30% commission and restricts alternative billing methods. If Apple concedes ground to regulators, competitive pressure on Google intensifies. Google might proactively implement similar changes to avoid forced settlements. The entire mobile ecosystem becomes more competitive.

Enterprise Shift: Enterprises increasingly demand the ability to distribute custom apps without App Store review. They want to sideload internal tools, manage deployments, and control user experience. Third-party store frameworks could eventually serve enterprise needs, creating a parallel distribution system alongside consumer-focused stores.

The Brazilian settlement isn't isolated—it's part of a gradual restructuring of how mobile platforms operate globally. We're moving away from single-store monopolies toward multi-store marketplaces. This is economically significant. Commission compression reduces Apple's profitability per app transaction. But it increases overall mobile commerce volume by removing friction and lowering costs. The total market grows even as individual players' margins compress.

What Consumers Actually Get from This Change

It's worth asking: does this settlement benefit Brazilian iPhone users? The answer is complicated.

Potential Benefits:

- Access to apps Apple rejected but are otherwise harmless

- Slightly cheaper in-app purchases if developers pass on commission savings

- More payment method options (Pix, local cards, installments)

- Faster app updates if developers use third-party distribution

- Potentially more diverse app store policies reflecting local preferences

Potential Harms:

- Exposure to lower-quality apps without Apple's review standards

- Increased malware risk from less-vetted app stores

- Reduced privacy protections if alternative stores or payment processors are less careful

- Confusion about where to download apps and which store is legitimate

- Weaker support and customer service from third-party stores

Apple's core value proposition to consumers is security and user experience. The brand promise is "We review everything, control quality, and keep you safe." Third-party app stores undermine this promise. Users gain choice, but lose certainty.

For most consumers, these changes probably won't matter. They'll continue using Apple's official app store because it's familiar, integrated, and trusted. The option to use third-party stores exists for developers and power users who care about specific capabilities. The average iPhone user in Brazil won't notice the difference.

Where consumers might see tangible benefits: subscription apps and games where developers substantially lower prices in response to lower commission rates. A fitness app charging

The Financial Impact on Apple's Finances

Let's quantify the revenue hit Apple faces from the Brazilian settlement.

Brazil's app store market size is estimated at

If 30% of that volume moves to external payment at zero commission, and another 30% moves to the 15% button option:

- Current revenue (100% at 30%): $600–900M

- New revenue: 40% at 30% + 30% at 15% + 30% at 5% CTF = 12% + 4.5% + 1.5% = 18% effective rate

- New revenue: $360–540M

Revenue drops from

For Apple, this is significant but manageable. Brazil represents roughly 2–3% of Apple's total services revenue (which itself is only 20% of total revenue). A 50% cut in Brazil's app store commission, while painful, doesn't significantly impact Apple's consolidated financials.

However, the precedent is the real concern. If Brazil-style rules spread to the EU (already happening), US (possible), and Asia (emerging), Apple's services revenue from app store commissions could fall 30–50% globally. Services revenue is Apple's highest-margin business. A 50% reduction would impact earnings per share meaningfully, which drives stock valuation.

Investors are watching Brazil as a proxy for global regulatory risk. A smooth implementation suggests Apple can adapt without chaos. A messy rollout signals that supporting multiple distribution models is operationally hard, which creates risk in other markets.

What Comes Next: The Multi-Store Future

If the Brazilian model becomes the global norm, the mobile platform landscape shifts fundamentally. Instead of single-store monopolies, we get multi-store ecosystems. Apps appear in multiple places. Users have choices. Developers optimize across channels.

This is architecturally similar to Windows, where users can install software from Microsoft Store, Steam, Epic Games Store, or downloaded .exe files. Multiple distribution channels, multiple payment processors, varying quality standards. Windows isn't less secure than iOS—it's just different. Security requires user vigilance rather than vendor-enforced curation.

Apple will probably implement this architecture by creating an "Alternative App Store Gateway" in iOS. Third-party app store operators can register with Apple, undergo basic vetting, and distribute apps through their own stores. Apple maintains device-level security (sandboxing, permission controls) but doesn't control individual app store policies.

This hybrid model protects Apple's core security story while allowing regulatory compliance. "We maintain OS-level security. Individual app stores make their own curation choices. Users choose which stores to trust." It's a reasonable compromise that regulators have already accepted in Europe.

The practical result: by 2026–2027, the "app store monopoly" is functionally over. Not completely—Apple's official store remains dominant due to network effects and user familiarity. But the monopoly status is broken. Competition emerges in app distribution and payment processing. Margins compress. But overall market grows as new players enter.

This is the future that Brazil's settlement portends. Not revolution—evolution. The ecosystem doesn't collapse. Instead, it becomes more competitive and more complex. Developers get more options. Users get more choice. Apple gets lower margins but maintained control over the core OS.

Lessons for Other Platforms and Future Regulation

The Brazilian settlement sets a precedent that extends beyond Apple and app stores. Here are the lessons:

Lesson 1: Coordinated Regulation Works: Apple resisted for years until multiple regulators attacked simultaneously. When the EU, US courts, Brazil, and others pressured the company at once, resistance became futile. Companies can ignore single regulators. They cannot ignore coordinated ones.

Lesson 2: Fee Structures Can Preserve Revenue Despite Market Opening: Apple didn't lose control entirely. It restructured fees to capture value even as distribution opened. The lesson: regulatory victory doesn't mean developer victory. Smart companies can comply while preserving economic advantages.

Lesson 3: Implementation is Harder Than Regulation: Writing rules into law is easy. Implementing them without breaking things is hard. Apple must now execute complex technical changes while maintaining security and user experience. Regulators often underestimate implementation difficulty and the engineering costs of compliance.

Lesson 4: Regional Variance is Inevitable: Different jurisdictions will demand different things. Apple will end up supporting multiple regulatory frameworks simultaneously (EU's, Brazil's, US's, etc.). This complexity is a barrier to entry for competitors, creating an ironic advantage for the companies with resources to absorb it.

Lesson 5: Global Companies Must Accept Local Fragmentation: In the 2030s, truly global platforms cannot operate identically worldwide. Regulation creates inevitable fragmentation. Smart companies optimize for this upfront rather than resisting indefinitely.

These lessons apply to Google, Meta, Amazon, and other platforms facing similar regulatory scrutiny. They're watching Brazil and the EU carefully, learning what resistance costs and what adaptation requires.

FAQ

What exactly did Apple agree to in the Brazilian settlement?

Apple agreed to allow third-party app stores on iPhones in Brazil, support alternative payment methods, and implement new fee structures. Specifically: third-party app stores can be installed with Apple's neutral warnings; external payment links incur no fee (text-only) to 15% (button/clickable); Apple's own payment system remains at 10–20% commission; and a 5% Core Technology Fee applies to all third-party app store downloads. Apple must comply within 105 days.

Does this mean third-party app stores will definitely launch in Brazil?

Not necessarily. While Apple must allow them, building a viable third-party app store is expensive and complex. You need payment processing, fraud detection, developer support, and marketing. Most likely outcome is that very few third-party stores launch at scale. However, individual developers might sideload apps or use alternative distribution methods. The option existing is more important than major stores actually thriving.

Will this settlement apply to other countries?

Not automatically. The Brazilian settlement applies only to Brazil. However, other regulators (EU, US, UK, South Korea) are pursuing similar demands. Each jurisdiction might negotiate separately with Apple, leading to different implementation timelines and fee structures. Over time, Apple will probably support similar frameworks in multiple regions, but there won't be a single global change.

How much will this cost Apple financially?

Potential annual revenue loss from Brazil:

Does this settlement make iPhones less secure?

Potentially, yes. Apple's security model relies on controlling what apps run and how. Third-party app stores with weaker review standards could distribute apps with malware or privacy issues. However, iOS's sandboxing and permission controls provide baseline security regardless of app source. Overall security impact depends on how aggressively third-party stores lower their standards. Probably slightly riskier than App Store-only, but not dangerously so.

Are Android users affected by this settlement?

Not directly. This is an Apple settlement. However, Google faces similar regulatory pressure. The company might proactively make changes to Google Play (allowing alternative payment methods, lowering commission rates) to avoid similar forced settlements. The settlement creates competitive pressure on Google indirectly.

Will app prices drop as a result of lower commissions?

Some developers might lower prices to pass on savings from lower commission rates. However, most app pricing is driven by perceived value and market competition, not commission rates. Expect modest price reductions in high-competition categories (games, utilities) where developers are price-sensitive. Niche apps and services probably won't change prices significantly.

What happens if Apple doesn't comply by the 105-day deadline?

Brazil's CADE can levy fines up to

Can developers outside Brazil benefit from this settlement somehow?

Developers outside Brazil don't get these benefits automatically. However, the settlement creates precedent that other regulators use to justify similar demands. If you're a developer in the EU, US, or Asia, watch how Apple implements Brazil's changes. Similar options might come to your region within 12–24 months as other regulators follow suit.

Is this the end of Apple's app store monopoly?

No. Apple's official App Store remains dominant and beneficial for most developers and users. This settlement breaks the absolute monopoly by allowing alternatives, but doesn't eliminate Apple's market dominance. Think of it as moving from total monopoly (single store only) to oligopoly with one dominant player (multiple stores, one with 70%+ share). Apple retains significant control and advantages.

Conclusion: A Turning Point in Platform Economics

Apple's Brazilian settlement represents a watershed moment. Not because everything changes overnight—it doesn't—but because it signals the end of an era. The era where platforms could unilaterally control distribution, set commissions, and face minimal regulatory resistance is over.

What we're witnessing is a transition from platform monopoly to platform competition. Apple is grudgingly accepting that it cannot hold every line against every regulator simultaneously. Better to negotiate favorable terms with some regulators than fight all of them indefinitely and lose everything.

The new equilibrium looks like this: Apple controls the operating system, device security, and core user experience. But distribution and payment processing become more competitive. Developers get options. Regulators get legitimacy. Consumers get... well, mostly the same experience, but with lower prices in some categories and more choice for niche preferences.

For developers, this is genuinely good news. Lower commissions, more distribution options, and regulatory arbitrage opportunities create real value. A developer can now publish in Brazil through alternative channels and keep more revenue. That matters financially and operationally.

For Apple, this is a loss of absolute control but a gain in regulatory peace. The company survives and remains profitable. Services revenue doesn't collapse. The brand and user base remain intact. What changes is margin percentage, not fundamental viability.

For regulators, this is a proof of concept. Coordinated pressure works. Companies will concede if enough authorities demand the same thing simultaneously. This emboldens regulators in other regions to pursue similar demands.

The Brazilian settlement isn't the end of app store regulation—it's the beginning. We'll see similar frameworks emerge in the EU, possibly the US, potentially Asia. Each with slightly different terms, but all moving in the same direction: more competition, more choice, lower commissions, more complexity.

Welcome to the post-monopoly era of mobile platforms. It's more competitive, more regulated, and more complicated. But for everyone except Apple shareholders, it's probably an improvement.

Key Takeaways

- Brazil's CADE reached settlement with Apple allowing third-party app stores and alternative payment methods after years of investigation into anticompetitive practices

- Three-tier fee structure emerged: zero for text-only external payment links, 15% for clickable payment buttons, 10–20% for Apple's payment system, plus 5% Core Technology Fee for third-party store downloads

- Implementation deadline is 105 days from settlement approval with potential $27 million fines for non-compliance, making this enforcement credible and binding

- Precedent from EU Digital Markets Act shows this model can work and is already being adopted globally, with US, UK, and Asian investigations following similar trajectories

- Revenue impact to Apple is substantial (potentially $240–360 million annually from Brazil, scaling to billions if spread globally) but manageable, as the real importance is regulatory legitimacy and preventing worse outcomes

- Developer opportunities expand significantly with potential to save 10–25% on commission costs by using external payments while avoiding Apple's review process through third-party stores

- Consumer benefits are mixed: more app variety and potentially lower prices, but with security trade-offs as third-party stores may have lower vetting standards

- Global platform regulation is accelerating with coordinated pressure from multiple regulators proving more effective than individual corporate resistance, suggesting this framework will spread internationally

- Operational complexity increases for Apple requiring technical infrastructure, security controls, and fraud prevention across multiple distribution channels and payment systems simultaneously

Related Articles

- Xbox Game Pass & Gift Cards: Best Deals [2025]

- Why iPhone 17 Succeeded But Apple Must Upgrade the Base Model [2025]

- Watch Christmas Movies Anywhere with a VPN [2025]

- Best Currys Boxing Day Tech Deals 2025: Save Up to 40% [January]

- Luna Ring Gen 2 Review: Smart Ring Features and Performance [2025]

- Ricoh GR IV Review: The Pocket Camera That Changed Street Photography [2025]

![Apple's Brazil App Store Deal: Third-Party Stores and Payment Processing [2025]](https://tryrunable.com/blog/apple-s-brazil-app-store-deal-third-party-stores-and-payment/image-1-1766758218336.png)