Stellantis Is in a Crisis of Its Own Making: The $26.5 Billion Reckoning

Let's be honest. Stellantis just took one of the most brutal hits in automotive history, and nobody saw it coming because, well, everyone was looking in the wrong direction.

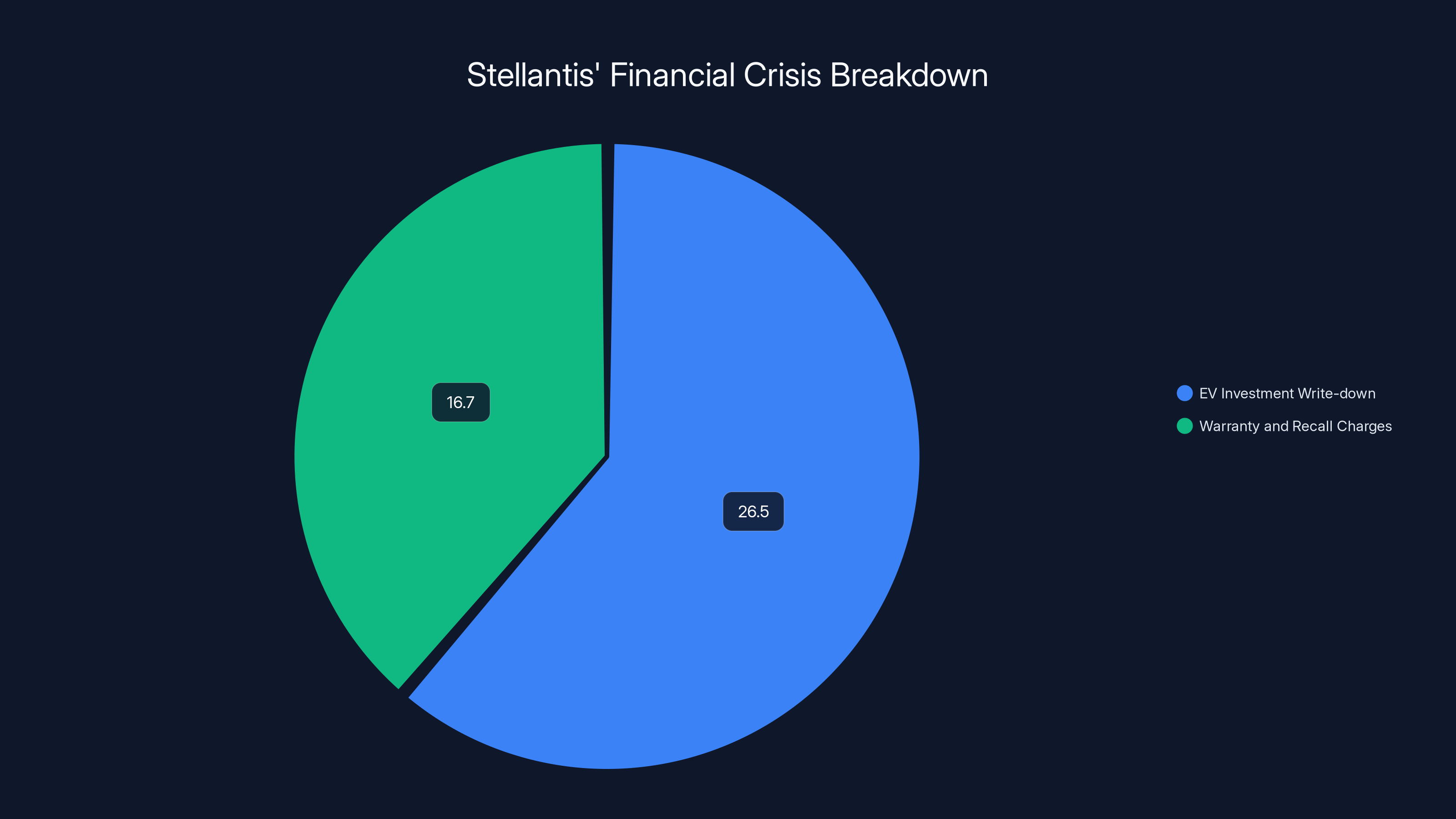

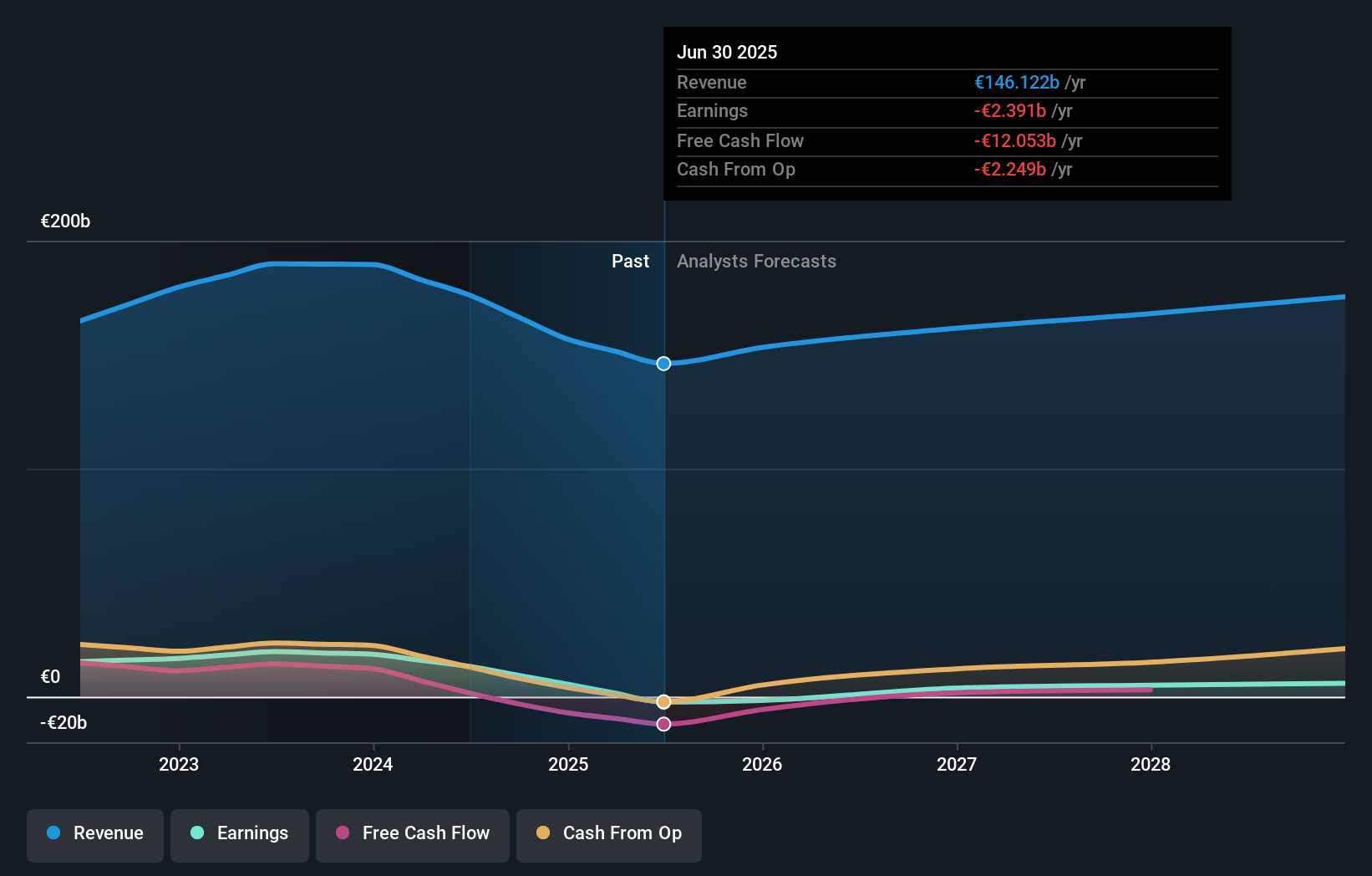

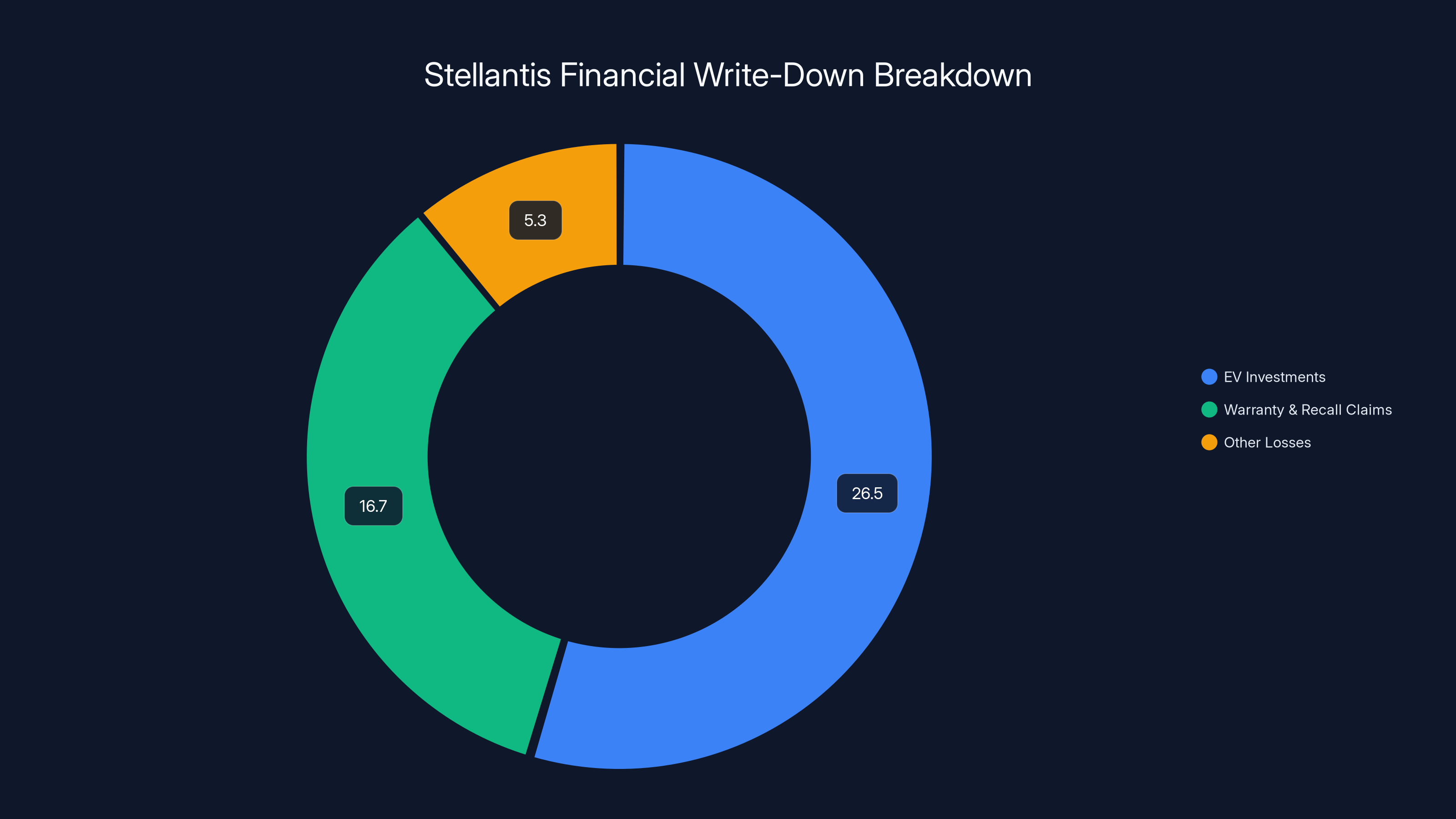

The parent company of Jeep, Dodge, Chrysler, and Ram just announced a staggering $26.5 billion write-down tied largely to its failed electric vehicle investments. To put that in perspective, that's roughly equivalent to the entire annual revenue of many mid-sized car manufacturers. It's not just a number on a balance sheet. It wiped 25 percent off the company's stock value overnight. Investors didn't just lose confidence. They lost faith that leadership knows what it's doing.

But here's what makes this crisis different from General Motors'

There's more. On top of the EV catastrophe, Stellantis also took a $16.7 billion charge for warranty and recall claims. That's not some small accounting adjustment. That's evidence of systemic quality problems that have been ignored, under-resourced, and ultimately exploded in management's face. Among the most embarrassing cases: a recall of 320,000 Jeep 4xe plug-in hybrids for battery-fire risks. A battery fire risk. In 2025. That's not a minor defect. That's a ticking time bomb in customers' driveways.

The deeper issue isn't just that Stellantis misjudged the EV market. It's that the company has been living off legacy brands and customer loyalty for so long that it forgot it actually needs to innovate, invest in technology, and deliver quality products. The company's identity became trapped in its past: muscle cars, pickup trucks, and the kind of vehicles that don't require sophisticated engineering or long-term planning.

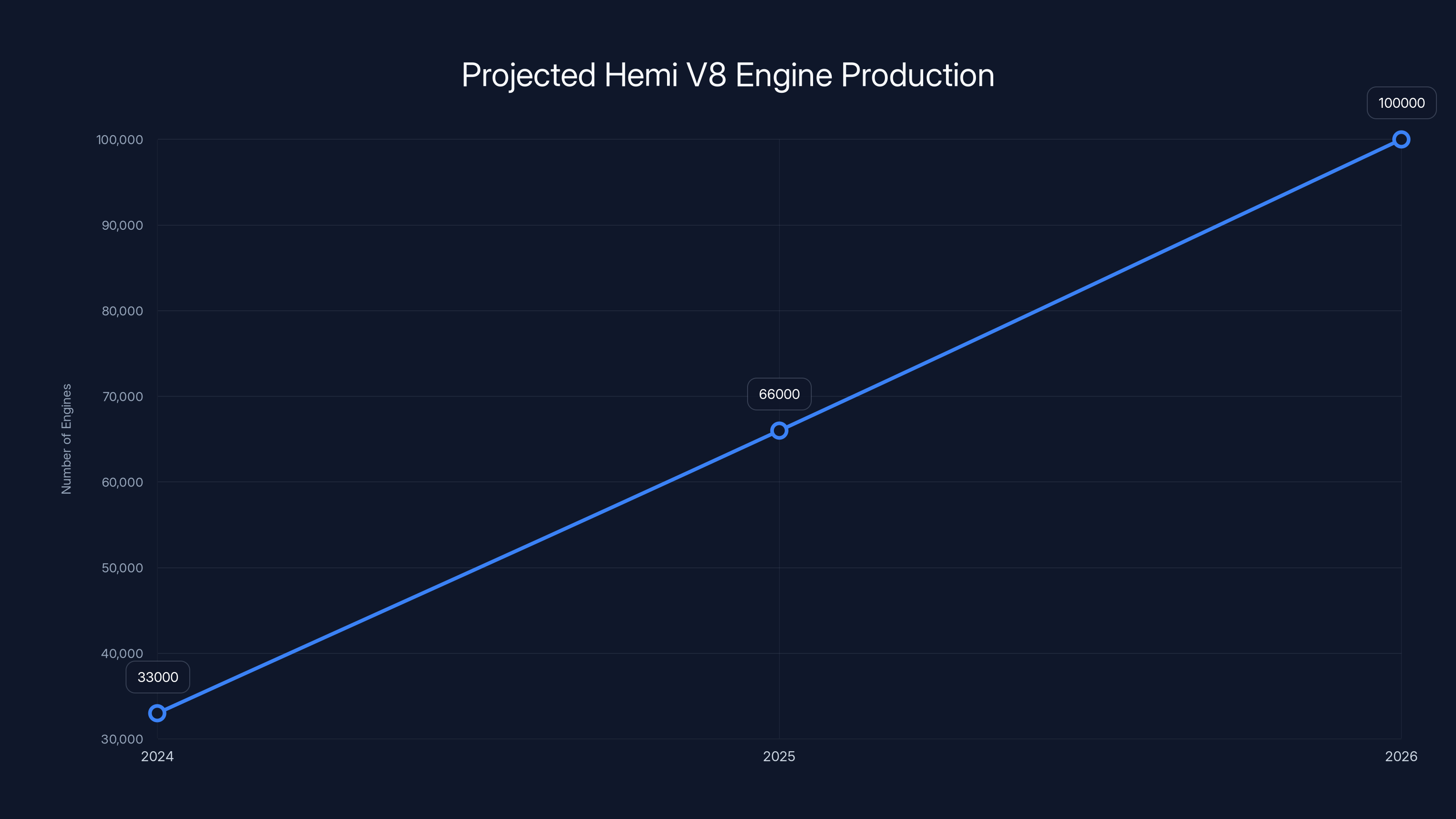

Now, as electric vehicles face unexpected headwinds, as regulatory pressures ease under a new political climate, and as consumer preferences shift back toward traditional powertrains, Stellantis sees a lifeline. The company is doubling down on Hemi V8 engines, planning to triple output from its Mexican factory to 100,000 units in 2026. And sure, demand is there right now. Customers do want these vehicles. Executives are practically salivating at the prospect of higher profit margins from powerful engines and no EV complexity.

But that's exactly the kind of short-term thinking that got Stellantis here in the first place.

This article breaks down how one of the world's largest automakers engineered its own crisis, what went wrong with its EV strategy, why quality control became a catastrophe, and whether the company can actually recover before the pendulum swings back and leaves it stranded again.

TL; DR

- **Stellantis wrote down 16.7 billion in warranty and recall charges

- Quality failures compounded the crisis: 320,000 Jeep 4xe recall for battery fire risks and systematic warranty issues cost the company billions

- Product strategy was fundamentally wrong: Overpriced EVs like the Jeep Recon ($67,000+) and failed experiments like the Wagoneer S couldn't compete with Tesla or attract mass-market buyers

- The company is doubling down on gas engines again, tripling Hemi V8 output despite knowing this strategy failed before

- Recovery requires abandoning quick-fix mentality: Stellantis needs affordable passenger cars, genuine technology investment, and quality commitment to survive the next regulatory cycle

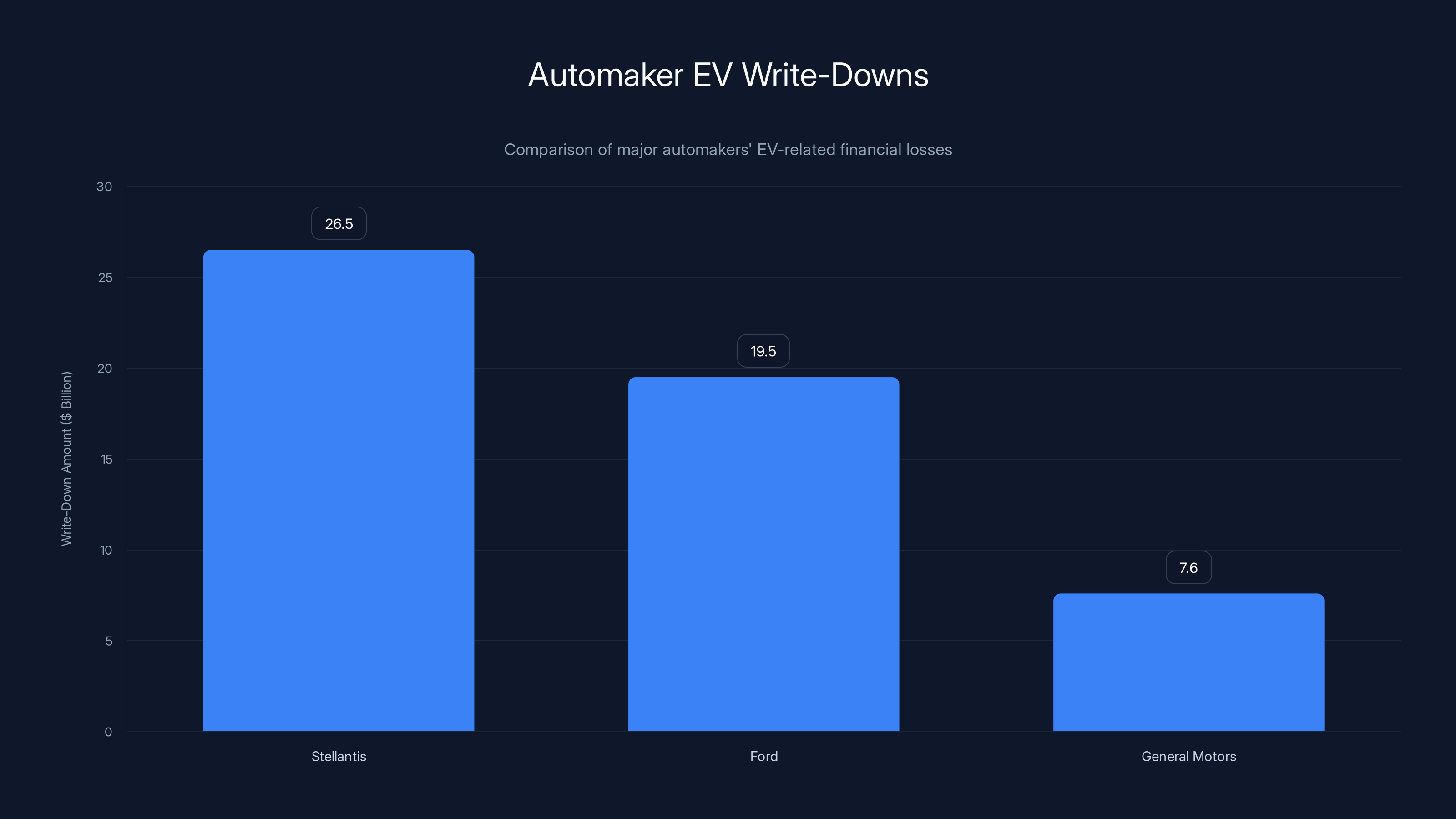

Stellantis faced significant financial losses, with

Understanding the Magnitude of Stellantis' EV Disaster

When a company takes a $26.5 billion write-down, most people don't really understand what that means. Let's break it down into language that actually makes sense.

This isn't just a quarterly loss. This is Stellantis admitting that roughly $26.5 billion of capital, resources, manufacturing investments, and strategic bets were fundamentally wrong. The company spent years, dedicated factories, engineering teams, and shareholder money building electric vehicles that the market didn't want. Now it has to acknowledge that failure on the books.

To contextualize this further: $26.5 billion is nearly 30 times Stellantis' annual net income in a good year. This isn't something the company can earn back in a decade of normal profitability. This is a genuine reset of the company's balance sheet, and it happened because leadership failed to understand where the market was going or how to build products customers actually wanted to buy.

What's particularly damning is that Stellantis wasn't alone in misjudging the EV transition. General Motors, Ford, Toyota, and virtually every major automaker made bullish EV bets that didn't pan out exactly as planned. The difference is that Stellantis' losses are disproportionately large relative to its market position and scale. That suggests not just bad timing, but bad execution.

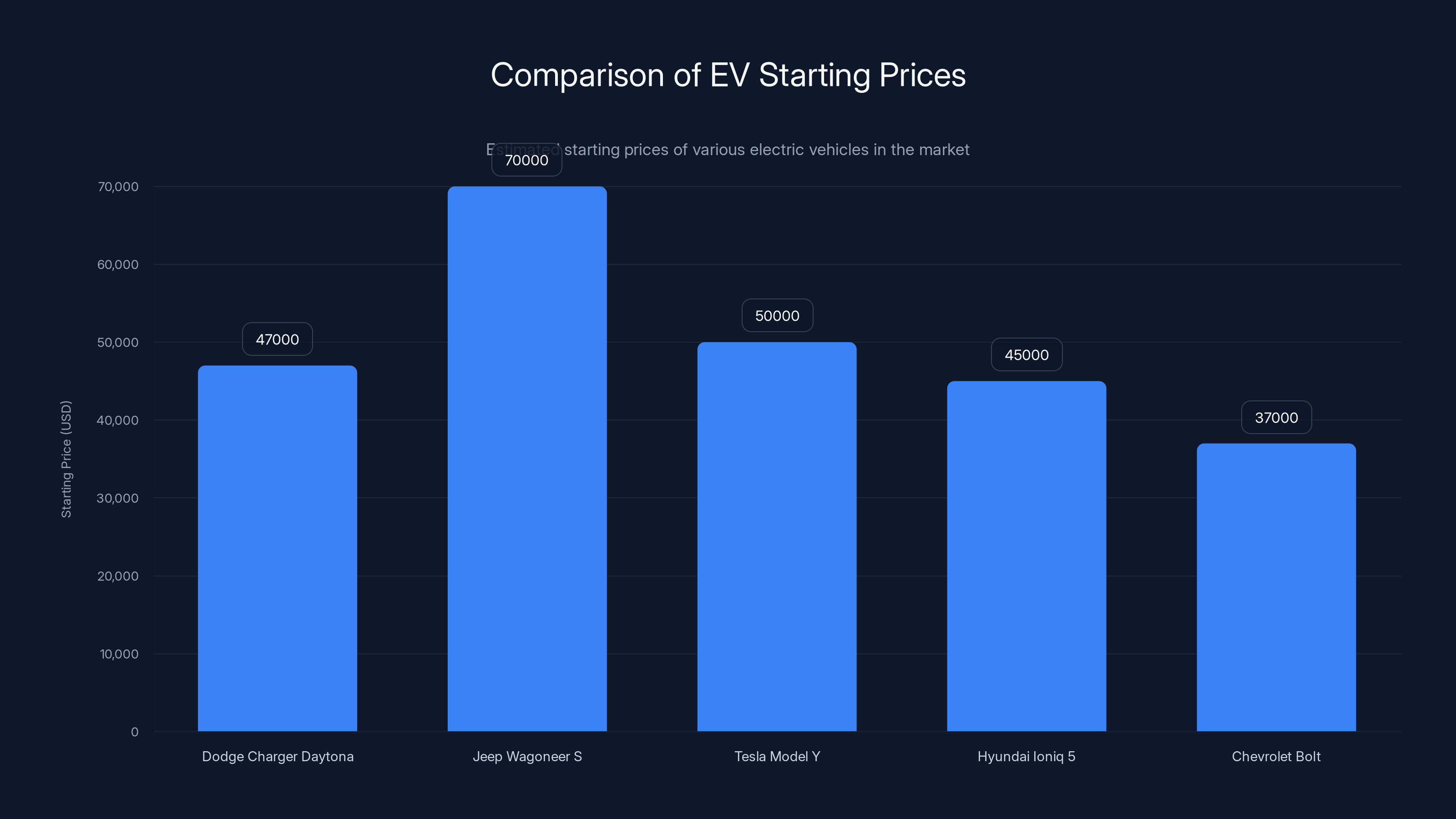

The company's EV lineup in North America included some genuinely ambitious vehicles. The Dodge Charger Daytona was supposed to be the muscle car for the electric age, a spiritual successor to legendary Mopar performance. The Jeep Wagoneer S was positioned as a premium electric SUV that would lure luxury buyers. The Jeep Recon was designed to take on the Tesla Model Y and other premium compact SUVs.

None of them worked. Not at scale. Not at the price points Stellantis needed to achieve profitability.

Stellantis plans to triple its Hemi V8 engine production by 2026, increasing from 33,000 units in 2024 to 100,000 units. This reflects a strategic focus on high-margin vehicles despite EV losses.

The EV Product Failures That Triggered the Crisis

Here's the thing about building electric vehicles: if you're not willing to embrace the full engineering and manufacturing challenge, you're not going to win. Half-measures don't work. Token efforts don't work. And Stellantis approached the EV transition like it was treating it as a compliance checkbox rather than a genuine business strategy.

Take the Dodge Charger Daytona. This was Dodge's answer to the question, "How do we keep selling performance cars when everybody's moving to electric?" The concept was sound. Dodge has a 75-year legacy of high-performance vehicles, and there's definitely a market for electric performance cars. But the execution was flawed from the start.

The Charger Daytona, in its pure electric form, couldn't deliver the visceral, emotional experience that defines Dodge. It was quick in a straight line, but it lacked the cultural weight of gas-powered Mopar history. More importantly, it was expensive. Starting prices hovered around

Dodge eventually added a plug-in hybrid version with a traditional V8, essentially admitting that the pure electric strategy had failed. That's not product development. That's backtracking.

The Jeep Wagoneer S was an even more expensive failure. This vehicle was supposed to be Jeep's luxury electric SUV, a vehicle that would attract wealthy buyers who wanted premium cabin finishes, advanced technology, and performance. The problem: it started at over $70,000 with options, and the market didn't bite.

Why? Because at that price point, customers were comparing it to the Chevrolet GMC Sierra Denali EV, the BMW iX, the Mercedes EQE, and yes, the Tesla Model Y. Jeep's luxury EV lacked the brand prestige, the proven reliability, the charging network integration, and the pure performance credentials to justify the premium pricing. It was a vehicle designed by accountants trying to maximize margin on a niche platform, not by engineers and designers trying to create something genuinely desirable.

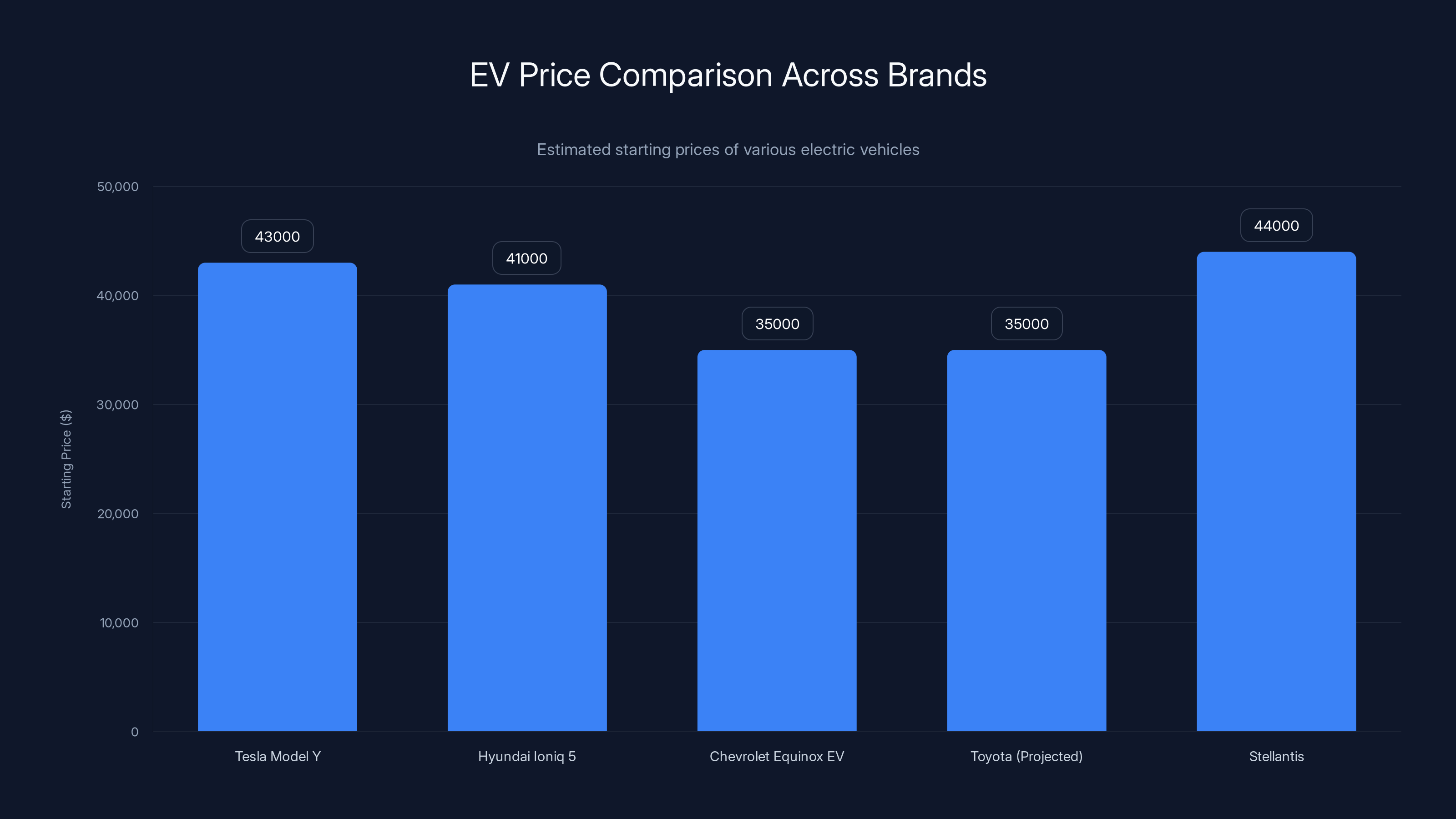

The Jeep Recon represents Stellantis' latest attempt at cracking the mass-market electric SUV segment. The target is clear: Tesla Model Y buyers who want a traditional SUV shape with modern electric performance. The price is ambitious: starting around $67,000. But here's the problem: by the time this vehicle reaches showrooms, customers will already have spent a year or more researching alternatives. Tesla will have released new Model Y variants. Hyundai will have updated the Ioniq 5. Volkswagen will have refreshed the ID.4. Stellantis is always entering races that started months ago.

Quality Control Collapse: The Warranty Crisis That Killed Confidence

Here's what makes Stellantis' situation genuinely dangerous: the company didn't just fail at building products customers wanted. It failed at building reliable products, period.

The $16.7 billion warranty and recall charge isn't just a number. It's evidence that Stellantis' manufacturing, quality control, and engineering standards have deteriorated to dangerous levels. This isn't one product with one defect. This is systemic failure across multiple vehicles, platforms, and product lines.

The most visible catastrophe is the Jeep 4xe plug-in hybrid recall affecting 320,000 vehicles. The issue: battery fire risk. Let that sink in for a moment. Customers parked their vehicles in garages, driveways, and parking structures, and some of them caught fire due to battery issues. That's not a minor warranty claim. That's a safety crisis that undermines customer confidence in the entire Jeep brand.

Why did this happen? Because Stellantis apparently didn't adequately test battery thermal management systems, cooling protocols, or failure scenarios before shipping hundreds of thousands of vehicles to customers. That's not a small oversight. That's a fundamental failure of engineering discipline and quality assurance.

But the 4xe issue is just the most visible example. Stellantis has been hammered by warranty claims on transmission issues, electrical gremlins, interior rattles, paint defects, and a host of other problems that suggest the company's manufacturing facilities aren't holding tight enough quality standards. When you're writing down billions in warranty costs, that's not just product defect. That's an organizational problem.

The warranty crisis creates a vicious cycle. Customers hear about 320,000 Jeep 4xe fires and automatically lose confidence in Stellantis' quality standards. They wonder, "What else might break?" This perception spreads through social media, YouTube reviews, and word-of-mouth, making it harder for Stellantis to sell vehicles even if quality has improved. Trust, once lost, takes years to rebuild.

Meanwhile, competitors like Toyota, Honda, BMW, and even Tesla have built reputations for relative reliability. When a customer is comparing a Jeep versus a Toyota 4Runner, both at similar price points, the warranty crisis tips the scales decisively. Toyota's vehicles might cost a bit more or have less cutting-edge technology, but customers know they're less likely to spend three weeks in the dealership for recalls and repairs.

This explains why Stellantis needs to make such massive warranty provisions. The company has been shipping products for years without adequate quality controls, and now it's facing the financial consequences. It's paying the debt for years of under-investment in quality engineering and manufacturing rigor.

The Dodge Charger Daytona and Jeep Wagoneer S faced challenges in the EV market due to their high starting prices compared to competitors like the Tesla Model Y and Hyundai Ioniq 5. Estimated data.

Strategic Miscalculation: The EV Investment That Wasn't

When Stellantis announced its EV strategy, it had all the right talking points. "Electrification is the future." "We're investing $X billion in electric vehicle development." "By 2030, electric vehicles will represent Y percent of sales." It sounded ambitious. It sounded strategic. It sounded like the company was taking the transition seriously.

Except it didn't invest the way it needed to.

Building competitive electric vehicles requires fundamentally different engineering, supply chains, manufacturing processes, and talent. Tesla invested in gigafactories specifically designed for battery assembly and EV production. Volkswagen spent billions retooling factories across Europe. General Motors rebuilt its supply chain to secure battery materials and bring production in-house.

Stellantis? The company tried to retrofit existing platforms, use existing supply chains, and apply lessons learned from gasoline-powered vehicles to electric powertrains. That approach doesn't work. Electric vehicles aren't just gasoline cars without engines. They require entirely different architectures, weight distribution, cooling systems, structural engineering, and software integration.

When Stellantis' EV products reached the market, they showed signs of this half-hearted engineering approach. The Charger Daytona felt like a rebodied Dodge sedan adapted for electric power, not a purpose-built electric performance vehicle designed from ground up around EV architecture. The Wagoneer S felt like a premium SUV with an electric drivetrain bolted on, not a vehicle conceived and engineered as an electric-first platform.

This shows up in the customer experience. Range feels compromised. Acceleration feels disconnected from the driving experience. Interior technology feels like it was ported from gasoline-powered Jeeps rather than built specifically for EV owners who expect modern software and connectivity.

The strategic miscalculation goes deeper, though. Stellantis has a portfolio of powerful brands: Jeep, Ram, Dodge, Chrysler, Fiat, Peugeot, and others. These brands have distinct identities and customer bases. Instead of developing EV strategies tailored to each brand's strengths and customer expectations, Stellantis seemed to approach EVs as a generic compliance exercise. Build some electric vehicles. Put them on dealer lots. Hope customers respond.

But here's what Stellantis missed: different brands need different EV strategies. Jeep's customers care about capability, off-road performance, and iconic design. Ram's customers want hauling power and dependability. Dodge's customers want performance and emotional connection. Chrysler's customers want luxury and refinement. Each of these segments has specific EV solutions they'd respond to, but Stellantis treated them all like variations on the same problem.

That's not strategy. That's delegation gone wrong.

The Hemi V8 Bet: Doubling Down on Yesterday's Wins

Now here's where the story gets interesting, and also deeply troubling.

After announcing $26.5 billion in EV losses, Stellantis is responding by tripling production of Hemi V8 engines. The company plans to ship 100,000 Hemi engines from its Saltillo, Mexico factory in 2026, up from roughly 33,000 in 2024. These engines will power Ram 1500 pickups, Jeep Wranglers, and other high-margin vehicles.

On one level, this makes immediate business sense. Demand for large pickups and SUVs with powerful engines is strong right now. Customers are still willing to pay premium prices for performance and capability. Margins on Hemi-powered vehicles are significantly higher than on electric vehicles because the engineering and manufacturing are mature, the supply chains are optimized, and there are no battery cost surprises.

From a quarterly earnings perspective, this strategy works. Stellantis can ship more profitable vehicles, improve near-term margins, and return money to shareholders. The company's board and investors might feel relieved that at least some part of the business is performing.

But this is exactly the kind of short-term thinking that got Stellantis into crisis in the first place.

The regulatory environment, even if it softens in the near term, will inevitably shift back toward stricter emissions standards, fuel economy requirements, and EV mandates. Every major government that has set EV targets—the EU, China, California—is moving forward with those mandates despite political headwinds. It's not a matter of if these standards return, but when.

When they do, Stellantis will be stuck. The company will have invested in expanding Hemi production, built new supply chains, and trained workers specifically for high-volume V8 output. And then demand will crater again as regulations require fewer gas-powered vehicles.

This is the same cycle Stellantis has repeated for decades. Invest in what works today. Ignore warnings about what's coming tomorrow. Cash in on short-term profits. Then panic when the market shifts.

Dodge has played this game before with less catastrophic consequences, but the pattern is identical. Muscle cars die. Dodge doubles down on muscle cars. Muscle cars live again. Dodge celebrates. Then market conditions change and Dodge is caught unprepared.

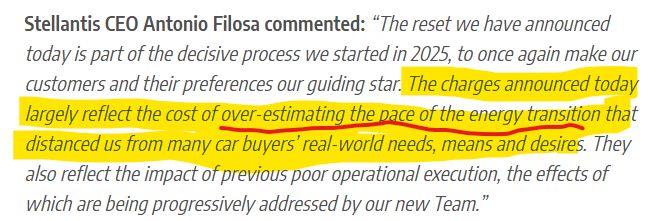

Stellantis' leadership, particularly CEO Antonio Filosa, has publicly stated that the company is taking a "mix" approach, using the Trump administration's regulatory flexibility to optimize the balance between EV and internal combustion vehicles. "More flexibility," Filosa said, "allows us to choose a mix between ICE and electric versions... and this will mean additional profit to us."

That's true in the short term. But it's also the exact rationale that led to the $26.5 billion write-down in the first place. The company thought it had flexibility. It thought it could hedge its bets. It thought it could play both sides.

Instead, it ended up underinvesting in both.

Stellantis' EVs start at a higher price point compared to competitors, missing the affordable segment in the

Why Stellantis Is More Vulnerable Than Competitors

General Motors also wrote down

The answer comes down to fundamental business stability and technological leadership.

General Motors, despite its EV losses, is the market leader in North America. The company owns the Chevrolet brand, which has massive scale, loyal customers, and dealer networks across every region. GM also has other divisions (GMC, Cadillac, Buick) that generate strong profits and give the company financial flexibility. When GM takes a $7.6 billion hit, it's painful, but the core business is strong enough to absorb it.

Ford has similar structural advantages. Despite losing $19.5 billion, Ford owns the F-150, one of the most profitable vehicles in the world. The company has loyal customers, a strong dealer network, and diversified product lines. Ford's losses hurt, but Ford's core truck business can generate enough cash to fund recovery.

Stellantis? The company's core profitability depends on Ram pickups and Jeep SUVs. Those are strong vehicles with loyal customers, but they're also heavy, truck-based platforms that don't transition easily to electric powertrains. Stellantis doesn't have a comparable volume brand like Chevrolet to fall back on. Peugeot and Fiat are strong in Europe, but Europe's EV market is also saturated and competitive.

Moreover, Stellantis lacks the technological edge that might help it recover. Tesla dominates battery technology and autonomous driving. GM has invested heavily in electric platforms and battery supply chains. Volkswagen has massive scale in Europe and Asia. Even Ford has stronger partnerships with technology companies and better access to chip suppliers and battery materials.

Stellantis is competing in an increasingly technology-intensive industry without owning the fundamental technologies that matter: battery chemistry, autonomous driving, software platforms, or charging infrastructure.

The company also lacks the brand prestige that insulates premium automakers. BMW, Mercedes, and Audi can charge premium prices for electric vehicles because of the brand heritage and perceived quality. Stellantis' brands, while iconic in their own right, don't command that kind of premium in the luxury segment. A Jeep Wagoneer S has to compete on value and features, not brand prestige. That's a harder sales proposition.

Finally, Stellantis is geographically concentrated in North America and Europe, missing the scale opportunities that Tesla and Chinese EV makers enjoy in Asia. While Tesla, BYD, and others have achieved massive volumes in China, Stellantis has struggled to build competitive positions there.

Product Development Timelines: The Perpetual Lag

One reason Stellantis' EV products feel outdated is because they often are. The company's development cycles have extended dramatically, and by the time vehicles reach production, the market has moved on.

Consider the Jeep Recon, which Stellantis is positioning as a Tesla Model Y competitor. The Recon was first announced in concept form years ago. The production version has been in development for what feels like forever. Meanwhile, Tesla has launched two generations of refreshed Model Y variants, adjusted pricing multiple times, and improved charging infrastructure dramatically.

When customers finally see the production Jeep Recon, they'll compare it to a Tesla Model Y that's been refined through thousands of customer feedback cycles, supported by a proprietary charging network, and priced with full knowledge of current market conditions. The Jeep Recon will be playing catch-up from day one.

This product development lag isn't unique to Stellantis, but it's particularly acute because the company competes against companies that have far superior supply chains, manufacturing agility, and product development cadence. Tesla can redesign an entire vehicle platform in months. Traditional automakers take years.

Stellantis' development processes are inherited from Chrysler's legacy structure, which was designed for vehicle lifecycles of 5-7 years. But in the EV era, a 2-year development cycle isn't enough. Customers want constant iteration, software updates, and product improvements. Stellantis' processes can't deliver that pace.

Stellantis' $26.5 billion write-down is primarily due to failed EV investments and warranty claims, highlighting systemic issues. Estimated data.

The Role of Platform Fragmentation

Here's a problem that flies under the radar but explains a lot about why Stellantis' EV efforts have been so expensive and inefficient.

Stellantis operates multiple platforms: CUSW for Ram trucks, JL for Jeep, LY for Chrysler, and various others inherited from different manufacturers. Each platform has its own engineering requirements, tooling, and manufacturing specifications. When Stellantis tries to build electric vehicles, it has to develop and adapt these platforms independently.

Compare that to Tesla, which has a single platform architecture (the skateboard platform with modular battery packs) that can be adapted for different vehicle sizes and shapes. Or GM, which is consolidating on the Ultium battery platform for most electric vehicles. Or Volkswagen, which built the MEB platform specifically for mass-market electric vehicles.

Stellantis' fragmented platform strategy means the company has to duplicate engineering work, duplicate supply chains, and duplicate manufacturing tooling. That's not just inefficient. It's expensive. It's a hidden cost driver that explains part of why Stellantis' EV costs have been so high and why profitability has been so elusive.

Fixing this would require massive consolidation: choosing a primary platform, retiring others, and retooling factories. That's a multi-billion dollar investment that Stellantis' financials can't support right now.

Consumer Perception and Brand Damage

One casualty of Stellantis' EV failure that doesn't show up on balance sheets is brand damage and consumer confidence erosion.

When Dodge had to admit that its flagship Charger Daytona EV wasn't selling well and add a gas engine version, it sent a clear signal to consumers: "Even Dodge doesn't believe in this electric vehicle." That message ripples through the market and makes it harder to sell any Stellantis EV product.

Similarly, when Jeep announced a 320,000-vehicle recall for battery fire risk, it raised fundamental questions about the company's quality standards and engineering competence. Did Jeep not test these vehicles? Did engineers miss obvious thermal management issues? Did manufacturing quality vary so much that batteries from certain production runs are defective?

Consumers internalize these stories. They become part of the brand narrative. For decades to come, people will remember that Stellantis had to recall over 300,000 vehicles for battery fires. That's not something you overcome with a few successful product launches.

The brand damage extends across the entire portfolio. Potential Jeep Recon buyers will think about the 4xe recall. Ram pickup customers will worry about manufacturing quality. Chrysler's luxury positioning is undermined when the company is known for quality issues and failed products.

Brand reputation is worth billions in terms of pricing power, customer loyalty, and dealer network strength. By shipping products with quality issues and then failing to deliver competitive EV alternatives, Stellantis has eroded decades of brand equity.

Recovering from that damage is harder than recovering from financial losses because it requires not just good products but genuinely exceptional products that make customers forget about past failures.

Stellantis faced the largest EV write-down at $26.5 billion, surpassing Ford and General Motors, highlighting significant strategic missteps.

The Supply Chain Vulnerability

Stellantis' supplier relationships and supply chain resilience also played a role in the EV crisis.

Electric vehicles depend on batteries, and batteries depend on lithium, cobalt, nickel, and other materials with volatile pricing and constrained supply. Tesla solved this problem partly by investing in battery manufacturing directly and partly by securing long-term supply contracts. Volkswagen invested in battery partnerships and mining partnerships to secure materials.

Stellantis' approach was... less proactive. The company relied on existing suppliers and negotiated supply agreements reactively. When battery costs spiked and supply became constrained, Stellantis was exposed.

Meanwhile, Chinese EV makers like BYD integrated backward into battery production, securing battery costs and supply availability. Tesla did the same. Traditional automakers that didn't make this integration have been at a cost disadvantage.

Stellantis doesn't have the cash reserves or manufacturing footprint to build battery factories. The company is trying to outsource battery supply while maintaining competitive pricing and profitability. That's a losing equation when competitors own their supply chains.

Regulatory Tailwinds Creating False Confidence

Stellantis' leadership seems to believe that the current regulatory environment, which is softening toward EVs, represents a permanent shift.

Under the Trump administration and with Republicans controlling Congress, pollution and fuel economy regulations are being relaxed. Companies are being given more flexibility in how they meet environmental requirements. EV mandates are being delayed or rolled back. This creates a temporary window where companies can focus on profitable internal combustion vehicles.

Stellantis is positioning itself to capture this temporary advantage, planning to maximize profits from Hemi-powered vehicles while stricter regulations are off the table.

But this is a misreading of the long-term trajectory. Here's what will happen: the political climate will shift again. Democratic administrations will likely re-impose stricter EV mandates. California, which has its own regulatory authority, will continue pushing toward electric vehicles. The EU will maintain its EV timelines. China will accelerate EV adoption.

When that happens, Stellantis will be caught holding inventory of high-emission vehicles that nobody wants. The company will have extended production runs on Hemi engines just as demand craters. Factories will sit idle. Dealer lots will overflow with gas-powered vehicles nobody wants.

This is the trap that legacy automakers fall into repeatedly: they confuse temporary regulatory relief with permanent market conditions. They optimize for the current quarter rather than the next decade. By the time they realize their mistake, it's too late to adjust.

The Affordability Gap That Nobody's Fixing

One of the most glaring problems with Stellantis' EV strategy is that the company hasn't developed affordable, competitive electric vehicles for mass-market buyers.

Tesla's Model Y starts around

Stellantis' EV lineup is entirely above

This is a catastrophic strategic error. The future EV market, where most volume and growth will occur, is in the

The reason Stellantis hasn't developed affordable EVs is likely because doing so requires either significantly lower costs or lower margins. The company can't rationalize building a $35,000 EV when it costs nearly that much in battery and electric drivetrain components, leaving minimal gross margin. So instead, Stellantis has abandoned that segment and allowed competitors to own it.

This sets up a vicious cycle: without high-volume affordable vehicles, Stellantis can't achieve manufacturing scale and cost reductions. Without cost reductions, it can't profitably build affordable vehicles. Meanwhile, competitors are scaling rapidly, driving down costs, and making it even harder for Stellantis to enter the market competitively.

By the time regulations force the issue and Stellantis must compete in the affordable EV market, the company will be years behind competitors with established supply chains, proven designs, and loyal customers.

Global Context: Stellantis Is Losing Worldwide

The crisis isn't limited to North America. Stellantis is struggling globally, though for different reasons in different regions.

In Europe, the company's brands (Peugeot, Fiat, Citroën) are competing against established players like Volkswagen, BMW, Mercedes, Renault, and local Chinese competitors. The European EV market is saturated, margins are compressed, and Stellantis is fighting for market share without clear product differentiation or cost advantages.

Peugeot and Fiat once had strong prestige in Europe, but that brand equity has eroded. Customers choosing between a Peugeot 408 EV and a Tesla Model 3 or BMW i3 are increasingly choosing the alternatives. Fiat's revival with vehicles like the new 600 is admirable, but it's not enough to offset structural disadvantages.

In Asia, Stellantis is essentially absent. The company doesn't have meaningful market share in China, Japan, or Southeast Asia, where electric vehicle adoption is fastest. Chinese EV makers like BYD, NIO, and XPeng are scaling rapidly. Tesla has captured the premium segment. Traditional Japanese automakers are launching competitive EVs. Stellantis has almost no presence.

This global weakness explains why the company's financial situation is so precarious. While Tesla, VW, and Chinese EV makers are scaling EV production worldwide, Stellantis is focused primarily on North America, where competition is fierce and margins are thin.

What Genuine Recovery Would Actually Require

Let's be clear about what Stellantis would need to do to actually recover from this crisis, not just paper over it temporarily.

First, the company needs to abandon the quick-fix mentality entirely. Tripling Hemi production might boost profits for 2-3 years, but it guarantees future pain. Stellantis should instead commit to a genuine electric vehicle strategy with affordable, competitive products in the mass-market segment.

Second, Stellantis needs to invest massively in product development, manufacturing capability, and technology. Building a $35,000 competitive EV requires investment in battery manufacturing, electric drivetrain engineering, and software development. This can't be done on the cheap.

Third, Stellantis needs to fix quality. The $16.7 billion warranty charge is unconscionable. The company should commit to delivering quality at parity with or better than competitors. That requires investment in manufacturing facilities, quality control systems, and engineering discipline.

Fourth, Stellantis needs to consolidate platforms and rationalize its brand portfolio. Trying to support EVs on 5+ legacy platforms is financially unsustainable. The company should choose its core platforms, retire others, and retool factories accordingly.

Fifth, Stellantis should consider strategic partnerships or mergers to gain technology, scale, or geographic presence. The company is too weak to compete independently against Tesla, VW, GM, BYD, and others. A merger with another struggling automaker or a partnership with a technology leader might improve odds of recovery.

None of this is easy. All of it requires investment, organizational change, and willingness to sacrifice short-term profits for long-term survival.

Based on current leadership commentary, Stellantis shows little willingness to do any of this. Instead, the company is leaning into Hemi engines and hoping that regulatory relief gives it more time.

That's not a recovery strategy. That's how companies become irrelevant.

Lessons for Other Automakers

Stellantis' crisis offers harsh lessons for competitors that should pay attention.

First: You can't hedge your bets. Trying to compete in both electric and traditional vehicles with half-measures guarantees failure in both. You need to commit fully to one strategy and execute brilliantly.

Second: Technology and cost discipline matter enormously. Automakers without owned battery manufacturing, software platforms, or supply chain integration will struggle. Competitors who own the fundamental technologies will win.

Third: Quality is non-negotiable. Warranty charges undermine brand equity, limit pricing power, and create financial liabilities. Companies can't afford to ship products with defects or inadequate engineering.

Fourth: Product development speed is critical. Vehicles that take 5-7 years to develop by the time they reach market are obsolete. Competitors with faster development cycles will capture customers.

Fifth: Global presence matters. Companies confined to single regions or limited geographies can't achieve necessary scale. Future winners will have strong positions in North America, Europe, China, and Asia.

Stellantis is weak in all of these areas. That's why the company is in crisis.

The Path Forward (And Why It's Difficult)

Stellantis might recover. Stranger things have happened in the automotive industry. But recovery requires brutal honesty about the company's position and willingness to make painful decisions.

The company has strong brands (Jeep, Ram, Chrysler) with loyal customers. It has manufacturing facilities and dealer networks. It has cash, though much of it is now earmarked for warranty reserves and losses.

But none of this is sufficient if the company continues down the current path. Loyalty to legacy products and legacy powertrains might generate profits for another 2-3 years, but by 2027-2030, when regulations inevitably tighten again, Stellantis will be unprepared.

The irony is that Stellantis had time to prepare. The company could have invested in electric vehicle development years ago. It could have built battery manufacturing capability. It could have hired talent and built engineering competence. Instead, it took a short-term approach, optimized for 2024 profits, and ignored the future.

Now the company is trying to recover from that shortsightedness while competitors pull further ahead. Every quarter that Stellantis spends tripling Hemi production is a quarter that Tesla, VW, GM, and Chinese makers are spending scaling electric vehicle production and driving down costs.

The likelihood of genuine recovery is low without dramatic leadership change and strategic reorientation. That might come through board pressure, a merger, or a new CEO. But as long as the current approach persists, Stellantis will keep writing down billions, losing market share to better-positioned competitors, and facing obsolescence when the market inevitably shifts back toward electric vehicles.

FAQ

What is the scope of Stellantis' financial crisis?

Stellantis announced a combined

Why did Stellantis' EV products fail to compete in the market?

Stellantis' EV lineup was overpriced and underengineered compared to competitors. The Dodge Charger Daytona lacked the emotional connection of legacy muscle cars, the Jeep Wagoneer S couldn't justify

What role did quality control failures play in the crisis?

The $16.7 billion warranty and recall provision reveals systemic quality failures. The 320,000-unit Jeep 4xe battery fire recall is the most visible example, but the company also faced widespread warranty claims for transmission issues, electrical problems, and manufacturing defects. These failures eroded customer confidence, damaged brand reputation, and created massive financial liabilities that compound the EV losses.

Is Stellantis' strategy to increase Hemi V8 production sustainable long-term?

Tripling Hemi V8 output to 100,000 units in 2026 generates short-term profits but violates fundamental strategic principles. The company is optimizing for current market conditions while ignoring the inevitable regulatory tightening that will reduce demand for high-emission vehicles. This approach has already backfired once, suggesting leadership hasn't learned from previous cycles and continues prioritizing quarterly earnings over long-term viability.

How does Stellantis' situation compare to other automakers facing similar EV losses?

While General Motors wrote down

What would genuine recovery require from Stellantis?

True recovery requires: (1) Abandoning the quick-fix mentality and committing fully to electric vehicles, (2) Massive investment in battery manufacturing, electric drivetrain engineering, and software development to compete on cost and capability, (3) Systematic quality improvements to rebuild customer trust and reduce warranty liabilities, (4) Platform consolidation to reduce engineering duplication and manufacturing complexity, and (5) Potential strategic partnerships or merger to gain technology scale or geographic presence in growth markets like China and Asia. Current leadership commentary suggests unwillingness to make these necessary changes.

Why hasn't Stellantis developed affordable electric vehicles to compete in the mass market?

Affordable EVs (

What happens to Stellantis if regulatory standards tighten toward electric vehicles again?

If stricter EV mandates return, Stellantis will be unprepared with competitive products in the segments where growth occurs. The company will have extended Hemi V8 production exactly when demand collapses due to regulatory requirements. Dealer lots will overflow with high-emission vehicles consumers can't buy. Factories will sit idle while competitors scale EV production. This scenario has played out before in Stellantis' history (witness Dodge's struggles with muscle cars) and the company appears to be repeating the same mistakes without learning.

Conclusion: A Reckoning Years in the Making

Stellantis' crisis isn't a sudden shock. It's the inevitable result of decades of short-term thinking, half-measures, and strategic hedging that left the company exposed when markets shifted. The

The tragedy is that Stellantis had advantages. Strong brands. Loyal customers. Manufacturing scale. Capital. The company could have invested in electric vehicles years ago. It could have built battery manufacturing capability when costs were lower. It could have committed to quality standards that would have prevented the warranty disaster.

Instead, Stellantis took the path of least resistance. Made more gas engines. Squeezed more margin. Deferred difficult decisions. Now the company is trying to recover from that strategy while competitors pull ahead.

The most damning part of Stellantis' situation is that leadership seems to have learned nothing. Rather than confront fundamental weaknesses in product development, cost structure, and quality, CEO Antonio Filosa is praising political leaders for regulatory relief that will temporarily extend the life of gas-powered vehicles. The company is tripling Hemi production, not doubling down on electric vehicle development. It's betting on regulatory flexibility rather than investing in technological superiority.

This is how once-great companies become irrelevant. Not through external forces, but through choices made by leaders who prioritize today's profits over tomorrow's survival. Stellantis had a chance to transform. Instead, it's maximizing the harvest from a dying market.

The financial markets have noticed. Stock prices have reflected the reality that Stellantis is vulnerable. Long-term investors are questioning whether the company can compete against Tesla, Volkswagen, General Motors, BYD, and others who are investing far more aggressively in the future.

Recovery is still possible. But it requires brutal honesty, massive investment, leadership change, and willingness to sacrifice short-term profits for long-term viability. Based on everything leadership has said and done, Stellantis shows no indication of making these necessary choices.

The next three to five years will determine whether Stellantis becomes a case study in automotive recovery or a cautionary tale about what happens when legacy automakers fail to adapt.

Key Takeaways

- Stellantis took a combined 26.5 billion EV write-down + $16.7 billion warranty charges), the largest among major automakers

- Quality failures including 320,000 Jeep 4xe battery fire recall undermined customer trust and created massive financial liabilities

- EV product strategy failed because vehicles were overpriced (70,000+), arrived late to market, and lacked technological differentiation versus Tesla and VW

- Tripling Hemi V8 production despite EV losses demonstrates the same short-term thinking that caused the crisis and guarantees future pain when regulations inevitably tighten

- Recovery requires abandoning quick-fix mentality and committing to affordable mass-market EVs, quality improvements, and technology investment that current leadership shows no willingness to make

Related Articles

- America's EV Crisis: How Detroit Lost the Electric Vehicle Race [2025]

- Tesla Stops Using 'Autopilot' in California: What Changed [2025]

- 7 Biggest Tech News Stories This Week [February 2026]

- AI Governance & Data Privacy: Why Operational Discipline Matters [2025]

- Apple iPhone Air MagSafe Battery Pack: Complete Guide [2025]

- Figure Data Breach: What Happened to 967,000 Customers [2025]

![Stellantis Crisis: How a $26.5B EV Bet Went Wrong [2025]](https://tryrunable.com/blog/stellantis-crisis-how-a-26-5b-ev-bet-went-wrong-2025/image-1-1771681123951.jpg)