The Quiet Revolution Nobody's Talking About

Apple just made a decision that should have Hollywood sweating. Starting in 2026, every single film produced by the tech giant will skip theaters entirely and launch straight to Apple TV Plus. No red carpets. No box office numbers. No IMAX releases. Just direct-to-streaming.

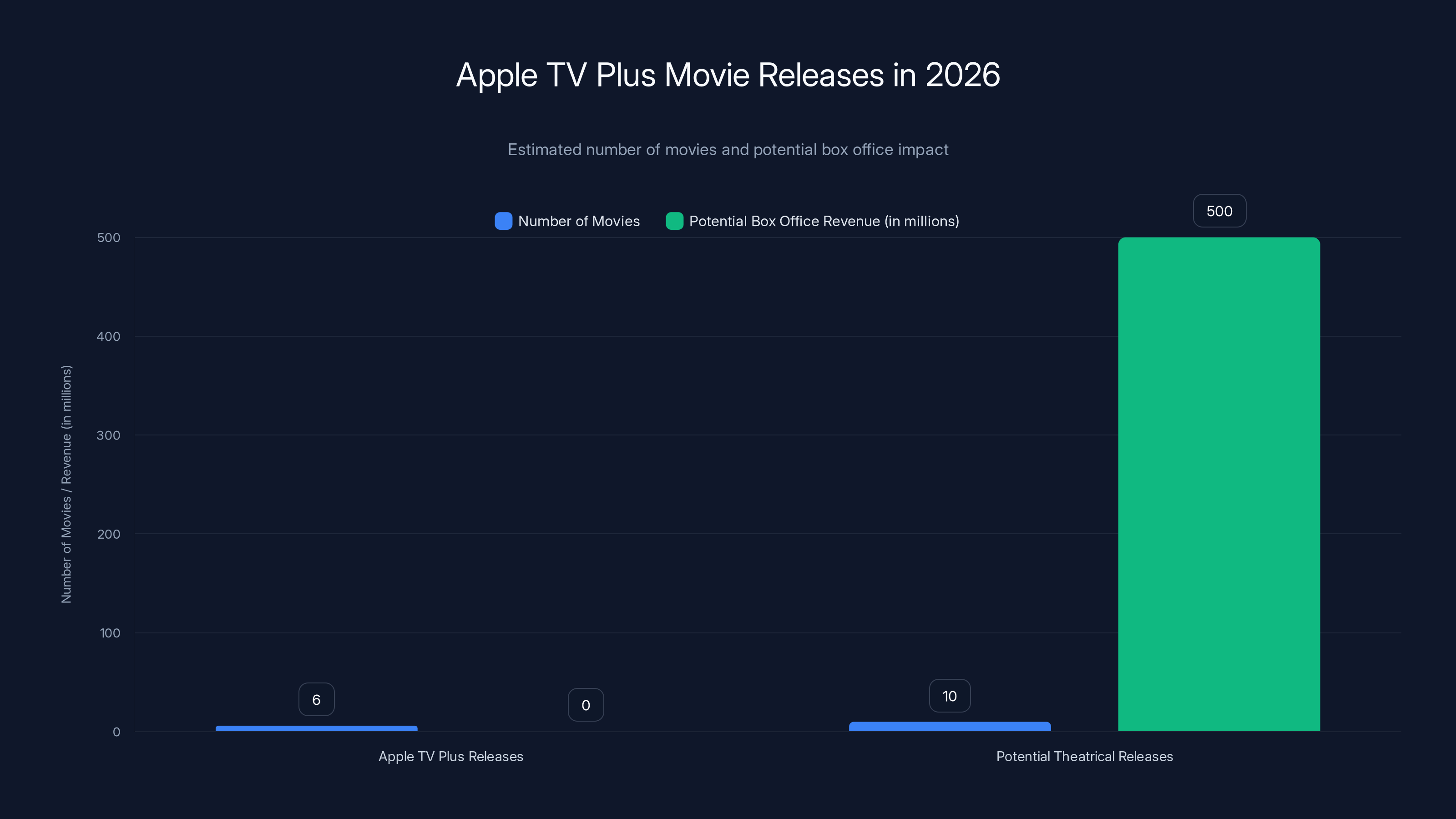

On the surface, it sounds smart. Streaming is where the money is, right? But dig deeper, and you'll find a strategy that feels half-baked, especially when you consider what Apple has in the pipeline. According to Macworld, there are only six confirmed Apple TV movies launching in 2026. That's not a lot. And some of those titles could genuinely compete with theatrical blockbusters. We're talking about potential hits that could draw massive audiences to cinemas.

The timing is bizarre. Hollywood's theatrical market has spent three years clawing back from the pandemic. Audiences are cautiously returning to multiplexes. Box office numbers are stabilizing. And right when the recovery is gaining momentum, Apple decides to completely abandon theaters.

Here's the real tension: Apple has the cash to build a proper film studio. They've got the technology. They've got the platform. But streaming-only releases mean sacrificing a revenue stream that could fund bigger, bolder projects. It's like Netflix signing prestige directors, only to release everything in the 9 PM algorithm slot.

Let me walk you through why this matters, how Apple got here, and what happens next.

Understanding Apple's Streaming Ambitions

Apple TV Plus launched in November 2019, right into the teeth of the pandemic. The service had exactly eight original shows and movies available at launch. It was undersized compared to Netflix and Disney Plus, but Apple had something those competitors didn't: the world's richest company backing it with unlimited capital.

The strategy was patient. Apple didn't chase subscribers aggressively with debt-funded content budgets like Netflix did. Instead, they invested in prestige. They signed big-name directors. They won awards. "Ted Lasso" became a cultural phenomenon. "Severance" earned critical acclaim. Apple TV Plus positioned itself as the premium option, the place where serious creators go.

But the film side remained choppy. Apple released theatrical films like "The Tragedy of Macbeth," "CODA," and "Killers of the Flower Moon." Some went to theaters first. Others skipped theatrical entirely. There was no clear strategy, just ad-hoc decisions that changed based on each project's needs.

Now, Apple's trying to impose order. The new rule: streaming-first, always. No exceptions. It's meant to streamline decision-making and eliminate the friction of coordinating theatrical and streaming releases simultaneously.

But here's what nobody's saying out loud: this decision probably has less to do with creative philosophy and more to do with cost management. Theatrical releases require marketing budgets that rival the production cost. You need to coordinate with theater chains. You're competing for screens during crowded release windows. It's complicated, expensive, and increasingly unpredictable.

Streaming-only solves those problems. You control the entire customer experience. Marketing happens on your own platforms where you own the distribution. There's no middleman taking a cut. From a pure business standpoint, it's more efficient.

But efficiency isn't the same as success. And Apple's about to test that distinction.

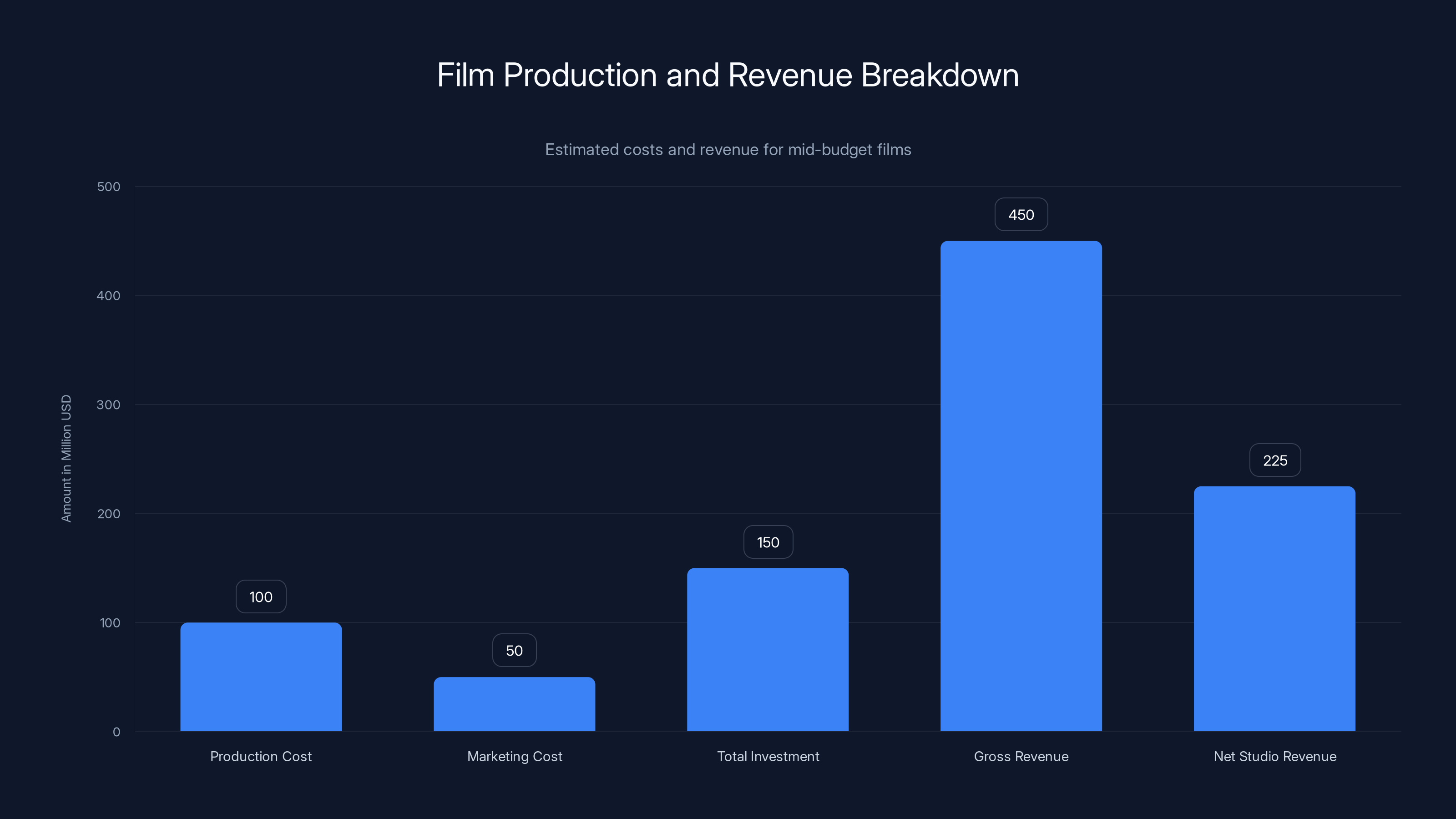

A mid-budget film typically requires a

The 2026 Slate: Six Films That Could Change Everything

Apple's got six confirmed movies coming to Apple TV Plus in 2026. That number alone is striking. Six films for an entire year across a platform with 150 million subscribers. For comparison, Netflix is releasing roughly 40 to 50 films annually. Disney Plus gets priority access to all Disney, Pixar, Marvel, and Lucasfilm productions.

So what are these six films? That's the million-dollar question, because some of them could be legitimately huge.

There's speculation that films in the vein of "Barbie," "Marty Supreme," and new "Karate Kid" installments could be among Apple's 2026 releases. If that's true, we're talking about franchises and concepts that traditionally perform well theatrically. "Barbie" grossed $1.4 billion worldwide. The "Karate Kid" franchise has been revived with significant commercial success. These aren't small movies.

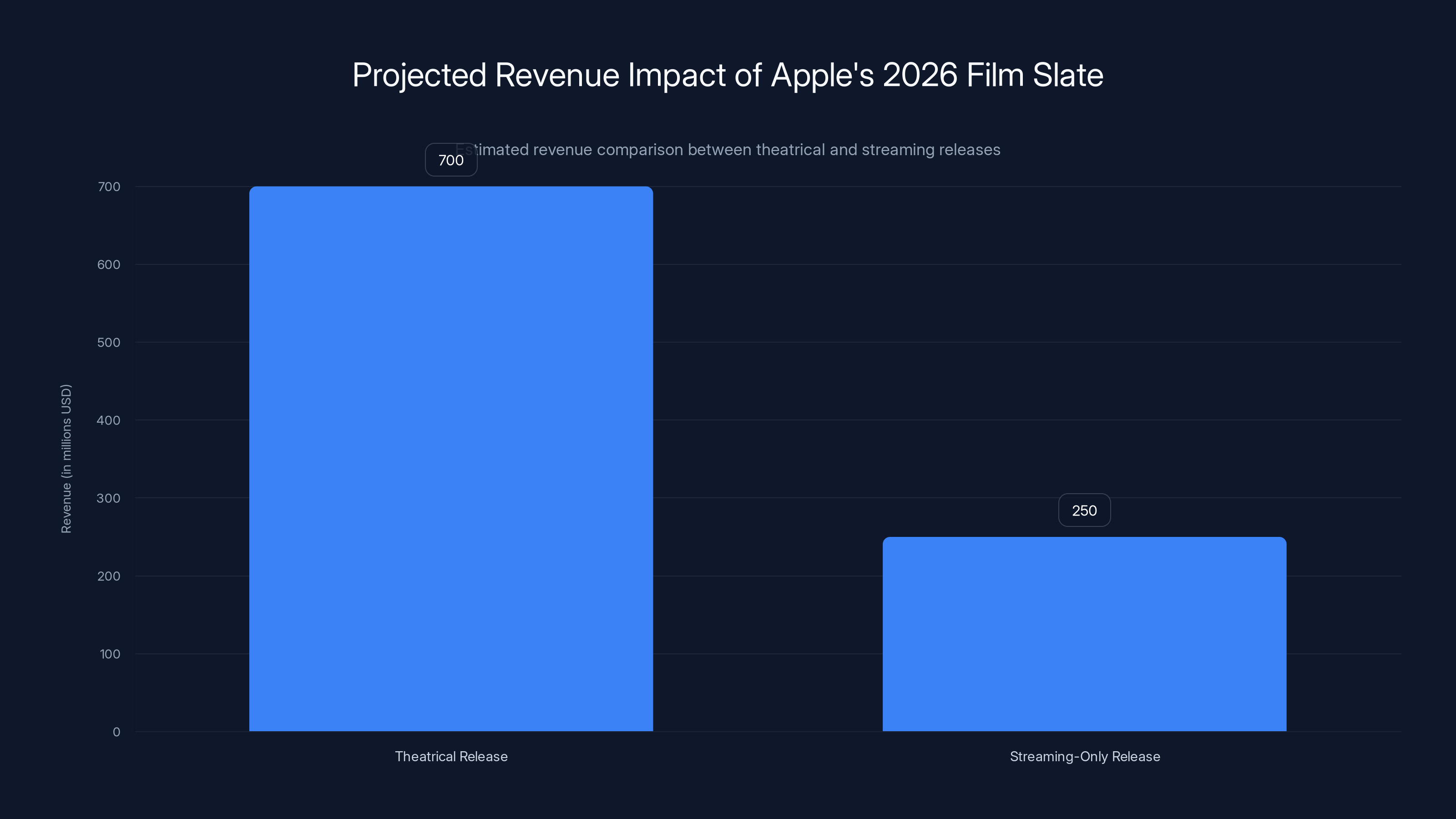

Skipping theaters means Apple avoids sharing that revenue with theater chains. But it also means Apple gives up international theatrical markets that can account for 50 to 60 percent of a blockbuster's revenue. A film that could gross

That's not a hypothetical either. Studies have shown that exclusive, high-profile content drives subscription growth. But there's a ceiling to that growth. At some point, you're cannibalizing your own revenue.

Let's say Apple's 2026 slate includes two genuine blockbuster-level films. What's the ROI on those films if they're streaming-only? What's the licensing revenue they could have generated in international markets? What's the merchandise opportunity? What's the television series spin-off potential?

All of that becomes more complicated when you're not proving commercial viability through box office numbers. Without theatrical performance data, Apple can't pitch these franchises to other studios for sequels or derivative content.

Estimated data suggests theatrical releases could generate significantly higher revenue compared to streaming-only releases, highlighting the trade-off Apple faces.

Why Theaters Matter More Than You Think

There's a persistent myth in media that theatrical is dying. Streaming killed it. Audiences don't want to go to cinemas anymore. It's an old distribution model heading for the graveyard.

None of that is actually true. What's true is more nuanced.

Theatrical revenue has stabilized. Box office in the United States hit

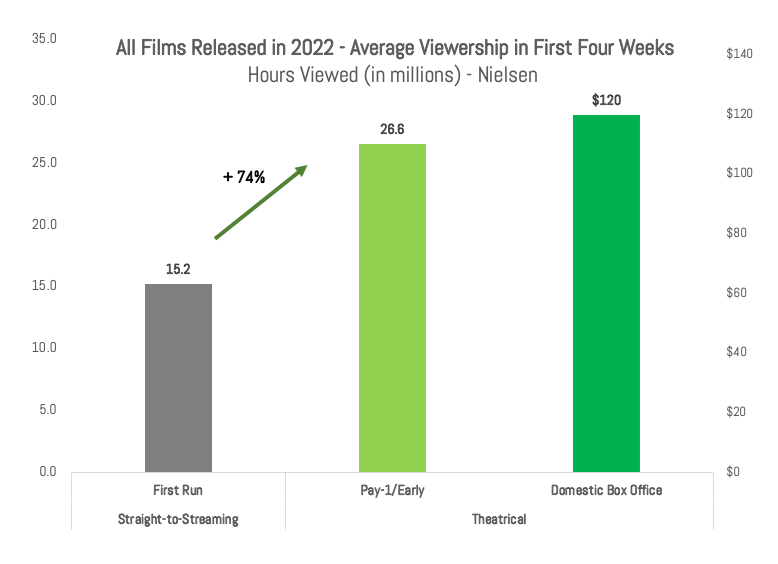

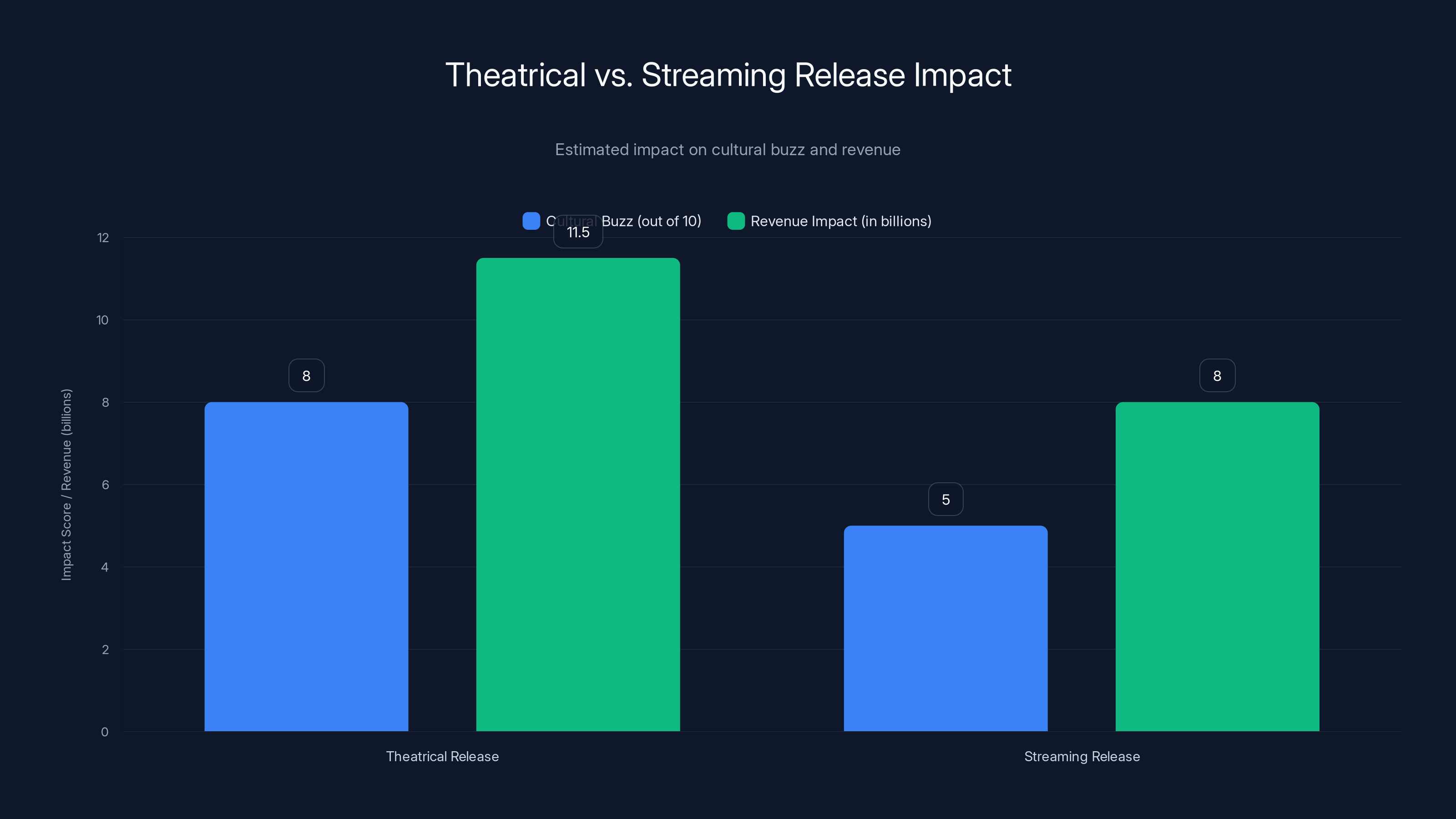

Here's what matters: theatrical releases create a cultural moment that streaming can't replicate. Opening weekend. Word-of-mouth buzz. Social media saturation. These events drive conversation in ways that algorithmic releases don't. A film released on a streamer just shows up in your feed. A theatrical release is an event.

That event is marketing. It's organic, earned media. It's the difference between a film being a hit and a film being a cultural phenomenon. Netflix has learned this lesson repeatedly. They've started experimenting with theatrical releases for their biggest films because streaming-only wasn't maximizing their potential.

Apple's moving in the opposite direction. They're betting that the cultural moment isn't worth the theatrical infrastructure. That's a bet against accumulated industry wisdom.

There's also the perception problem. If Apple TV releases all its major films exclusively on the streaming service, casual viewers will adapt quickly. But industry professionals notice. Filmmakers notice. Audiences who value the theatrical experience notice. You're not just losing box office revenue; you're losing prestige. You're admitting that your platform is secondary to the cinematic experience.

Compare this to how Netflix positioned its theatrical releases. "Don't Look Up" played in theaters first. "Glass Onion" had a limited theatrical window. Netflix was saying: this is so good, it deserves the big screen. Apple's saying: this is streaming-only, so we don't need the big screen. That's a different message entirely.

The Financial Reality: What Does the Math Actually Say?

Let's break down the economics with actual numbers.

A mid-budget film costs

If a film performs at the median level for a major studio tentpole, it grosses

For a streaming-only release, Apple captures the full value of the subscriber's monthly fee plus any downstream revenue from merchandise, licensing, or franchise extensions. But here's the problem: you can't attach a direct revenue number to "I kept my subscription for this film." You can measure aggregate subscriber growth, but not incremental revenue per film.

This is why Netflix started reporting engagement metrics instead of pure subscriber numbers. They needed a way to justify spending on content without proving direct revenue causality.

Apple has that same challenge. They need to demonstrate that streaming-only releases drive enough subscription value to justify the production cost. For a

Is that realistic? Maybe. Apple TV Plus has 150 million subscribers at an average revenue of roughly

But here's where it gets dicey: Apple can't isolate the value of an individual film. They can see aggregate subscriber trends, but they can't tell you precisely how many people kept their subscription because of one specific movie. That uncertainty makes it harder to justify increasingly expensive productions.

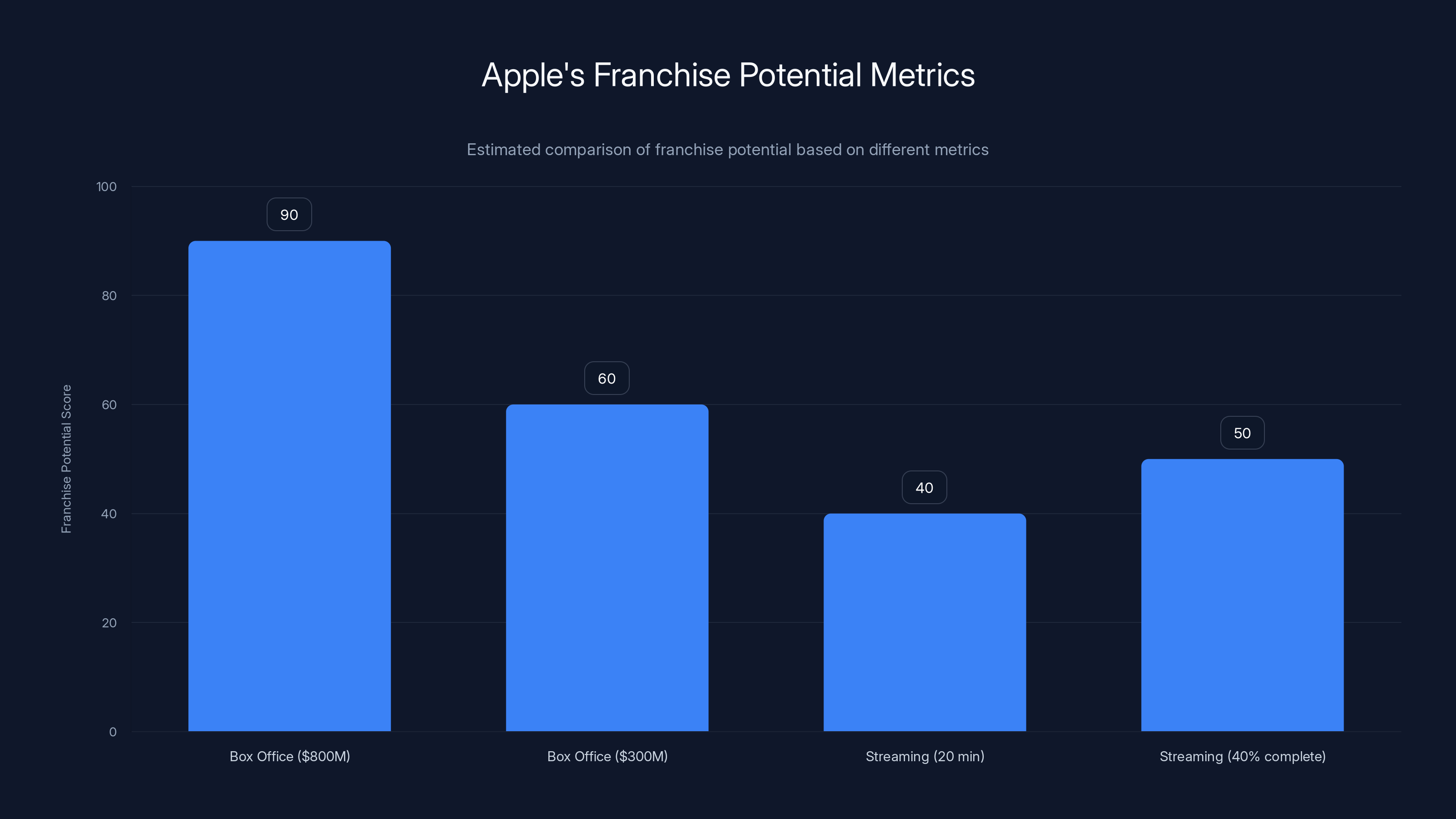

Estimated data shows that box office performance provides clearer franchise potential compared to streaming metrics, highlighting Apple's vulnerability in relying solely on streaming data.

The Barbie Problem: When a Film Is Too Big for Streaming

Let's use "Barbie" as a case study, even though we don't have confirmation it's coming to Apple TV.

"Barbie" didn't gross $1.4 billion because of marketing efficiency. It grossed that much because the theatrical experience was part of the cultural conversation. The pink aesthetic. The big-screen spectacle. The opening weekend phenomenon. People went specifically to experience it in a theater.

Imagine "Barbie" launching on Apple TV Plus instead. The film is still good. The director is still talented. But the opening moment doesn't have the same energy. There's no global box office race. There's no proving that the film resonated widely enough to justify the investment.

Apple would make money. Some percentage of Apple TV Plus subscribers would watch it. But Apple would leave several hundred million dollars on the table. More importantly, Apple would sacrifice the proof point that demonstrates the film's cultural relevance.

That matters for sequels. If "Barbie 2" is greenlit and another streaming service bids on it, Apple's streaming-only release of the original is a weak negotiating position. Apple can't point to box office numbers as proof of commercial viability. They can only say: "We think people watched it."

Now multiply that problem across multiple franchises. Multiply it across a dozen hypothetical sequels that never happen because the original didn't generate theatrical proof of concept.

This is where Apple's strategy starts to look short-sighted. They're optimizing for immediate streaming subscriber value at the expense of long-term franchise development. That's a trade Apple might not fully appreciate until they're locked out of premium licensing deals because their films don't have theatrical track records.

The Franchise Angle: Where Apple Gets Vulnerable

Apple doesn't want to be in the business of producing standalone films. Nobody does. The real money is in franchises. It's in building universes. It's in creating intellectual property that generates sequels, spin-offs, merchandise, theme park attractions, and licensing deals.

Theatrical performance is how you prove a franchise has legs. Box office numbers are the industry's lingua franca. A film that grosses

Apple's executives want these films to be successful. So they'll interpret engagement data generously. A film watched for 20 minutes by millions of users might get counted as a success. A film completed by 40 percent of viewers might be considered a hit. There's no objective standard.

Compare that to a theatrical release where the standard is simple: did the film make money? Did it perform relative to expectations? Was it profitable? That clarity makes decision-making easier and removes corporate politics from greenlighting conversations.

Apple's losing that clarity. And in a industry where billions of dollars ride on franchise decisions, clarity matters.

Let's also consider the international dimension. A theatrical release lets Apple build franchise popularity in international markets independently. Merchandising in Japan. Licensing in South Korea. These revenue streams require that the film has demonstrated cultural relevance in those markets.

Streaming metrics don't translate the same way. A film that's popular on Apple TV in the United States might be completely unknown in international markets where Apple TV doesn't have dominant distribution. Theatrical releases would create local awareness and local revenue opportunities.

Apple's choosing not to pursue those opportunities. That's the strategic choice that's hardest to defend.

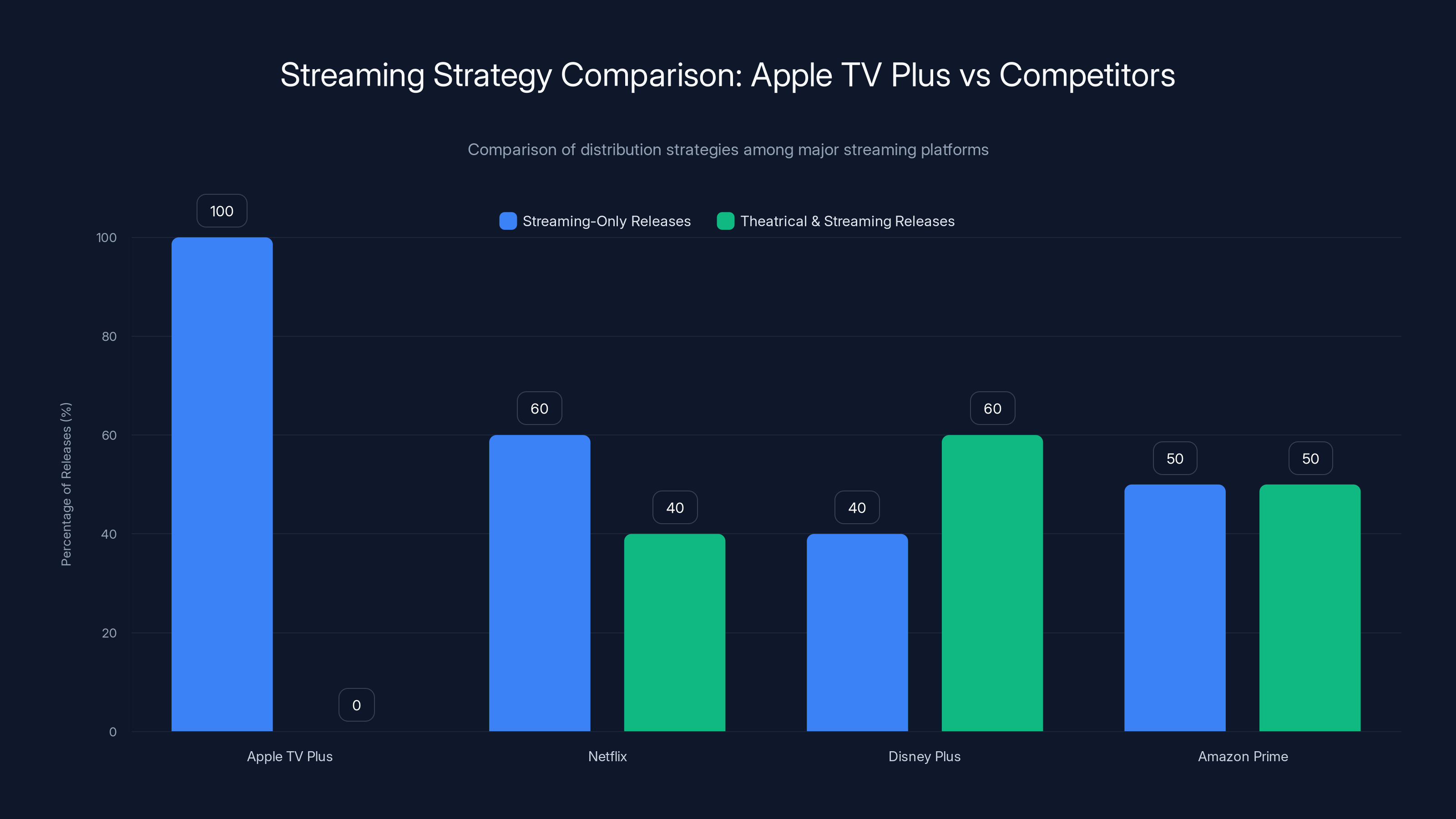

Apple TV Plus adopts a 100% streaming-only strategy, unlike competitors who balance between theatrical and streaming releases. Estimated data based on typical industry practices.

The 2026 Slate: What We Know and What We're Guessing

Apple hasn't released a comprehensive list of its 2026 films. That's strategic. It keeps audience attention distributed over time instead of concentrated on a specific release window.

But industry reporting suggests several categories of films are in development.

First, there are the prestige projects. Apple will continue to attract top-tier directors. Think of films with budgets in the

These prestige films aren't the problem. They probably belong on Apple TV Plus. They're not tent-pole franchises. They're films that built reputations for Netflix and prestige streaming platforms. Apple can lean into this positioning.

Second, there are the franchise films and tentpoles. If "Barbie," "Karate Kid," or "Marty Supreme" are in the mix, these are the films that create tension with a streaming-only strategy. These are the films that could generate blockbuster-level revenue if released theatrically.

Third, there are the commercial films with commercial directors. Not prestige, not franchise, but calculated to perform well with a specific audience. Apple will likely have a few of these.

The mix matters. If Apple's 2026 slate is 80 percent prestige and 20 percent tentpole, the streaming-only strategy is fine. But if the slate is reversed, Apple's making a mistake.

The problem is we don't know the actual mix. Apple's being deliberately opaque about its slate. That opacity is itself a signal that Apple isn't fully confident in this strategy.

Why Streaming-First Seems Like the Future (But Probably Isn't)

There's a compelling narrative that streaming is inevitably the future of film. Audiences are watching more content on screens. Theaters are expensive. Streaming platforms are efficient. Therefore, theatrical will eventually disappear.

The narrative is intuitive. It's also probably wrong.

What's actually happening is that different types of content require different distribution strategies. A prestige drama with limited appeal might perform better on a streaming platform where the audience finds it through discovery algorithms. A tentpole spectacle with broad appeal performs better theatrically where the opening weekend event drives cultural conversation.

The most successful media companies (Disney, Warner Bros.) are embracing both. They're releasing certain films theatrically and others directly to streaming. They're optimizing each release for where that specific film will succeed.

Apple's imposing a one-size-fits-all strategy. That's almost certainly a mistake.

The other assumption Apple seems to be making is that theatrical is declining. But theatrical isn't declining. It's recalibrating. Audiences are more selective about which films they see in theaters. They don't want to pay theater prices for mid-budget dramas. They do want to pay theater prices for spectacles.

Apple's removing its biggest spectacles from that equation. That's not taking advantage of theatrical's future. That's abandoning it.

Apple plans to release only 6 movies directly to Apple TV Plus in 2026, potentially missing out on an estimated $500 million in box office revenue from theatrical releases. Estimated data.

The Competitive Landscape: How Netflix, Disney, and Amazon Are Different

Netflix, Disney Plus, and Amazon Prime all have more balanced strategies than Apple's new approach.

Netflix spends roughly $17 billion annually on content. Of that, only a small percentage goes to theatrical releases. But Netflix carefully selects which films get theatrical windows. "Glass Onion: A Knives Out Mystery" got a theatrical release because it was tentpole-level content. Other films go straight to streaming.

That's portfolio management. It's not a blanket policy. It's a film-by-film decision based on the specific project.

Disney is the master of this. Disney releases tentpole franchises theatrically and streams other content. Marvel blockbusters get theatrical windows. Prestige films from acquisitions might go straight to Disney Plus. Television budgets hit Disney Plus first.

Amazon Prime is similar. They release tentpoles like "The Lord of the Rings: The Rings of Power" with theatrical/streaming hybrids and reserve streaming-only for content that doesn't require theatrical distribution.

Apple's policy is more draconian. It's less portfolio management and more ideological commitment to streaming-only.

The question is whether Apple's strategic commitment is based on genuine business analysis or on a desire to maximize perceived value of the Apple TV Plus subscription. If it's the latter, Apple might be overestimating subscriber value at the expense of long-term franchise development and revenue diversification.

The Risk Profile: What Could Go Wrong

Scenario one: Apple releases a potential tentpole franchise film exclusively on Apple TV Plus. The film is good. Audiences watch it. But there's no theatrical track record to validate the franchise's viability. The sequel pitch to other studios gets rejected because Apple can't prove commercial success. The franchise ends after one film.

Scenario two: Apple releases exclusive content that drives some subscriber growth. But the growth plateaus at lower levels than expected because the content isn't generating the cultural moment that theatrical releases create. Apple realizes streaming-only wasn't the right strategy but has already locked in expensive multi-year production commitments.

Scenario three: International markets develop stronger preferences for theatrical experiences. Apple's streaming-only strategy limits international growth and licensing opportunities. Apple finds itself with strong content but limited distribution options in high-value markets.

Scenario four: A major tentpole film released by Apple TV Plus underperforms on the platform. Without theatrical release data, there's no way to assess whether the film was actually unsuccessful or whether Apple's platform just isn't optimized for promoting tentpole content. Apple struggles to determine whether to continue investing in this type of content.

All of these scenarios are plausible. None of them are catastrophic for Apple. But collectively, they suggest that a blanket streaming-only policy might create more problems than it solves.

Theatrical releases generate higher cultural buzz and revenue compared to streaming releases, highlighting the importance of cinema for creating cultural moments. Estimated data.

What About the Audience? Do Viewers Even Care?

Here's an overlooked aspect of this entire discussion: audience preferences.

Survey data consistently shows that audiences value theatrical experiences for certain types of content. Action films, spectacles, franchises, and event-driven releases still pull viewers to theaters. Drama and smaller independent films can succeed on streaming.

Apple's strategy ignores that segmentation. It's essentially saying: we think all our content should be on streaming, regardless of what the audience prefers for different genres.

That's a bold bet against consumer behavior. Consumers have demonstrated clear preferences over decades. Spectacles work better in theaters. Smaller stories work better on home screens. That's not going to change because Apple decides it's inconvenient.

Apple could be pleasantly surprised. Maybe audiences don't care as much about theatrical experiences as historical data suggests. Maybe the Apple TV Plus platform becomes such a cultural phenomenon that exclusive content attracts subscribers regardless of distribution strategy.

But that's betting against decades of data about how media consumption actually works. It's possible. It's not probable.

The Global Dimension: Untapped International Markets

Apple TV Plus has less penetration in international markets than Netflix or Disney Plus. That's partly a function of pricing and partly a function of availability. Apple's streaming service isn't available everywhere. Theatrical distribution would help Apple build brand awareness in markets where Apple TV Plus isn't yet dominant.

Instead, Apple's going exclusively digital. That means Apple's relying entirely on digital marketing and word-of-mouth in international markets. That's a weaker position than theatrical could provide.

Consider India, where Apple TV Plus has limited market share. A film released theatrically in India builds audience awareness and brand identity in a market where Apple doesn't yet dominate. A film released exclusively on Apple TV Plus disappears in a market where Apple's platform has minimal presence.

Apple's decision to go streaming-first in 2026 essentially cedes international theatrical markets to competitors. Disney, Warner Bros., Netflix, and others will continue releasing tentpoles theatrically and capturing that revenue and brand-building opportunity.

Apple's betting that the cost savings of streaming-only distribution will offset the lost international theatrical revenue. That's a calculation that doesn't seem to account for market realities in regions where Apple doesn't have platform dominance.

The Production Angle: What This Means for Filmmakers

Apple's new policy also sends a signal to filmmakers. It's a signal that Apple TV Plus might not be the right home for projects designed to be theatrical experiences.

Top-tier directors and producers have choices about where to develop their projects. If Apple is committed to streaming-only, filmmakers planning tentpole productions will take their projects to studios with theatrical commitments. That limits the talent pool available to Apple TV Plus.

Over time, Apple TV Plus might become a platform known for prestige television and streaming-native content, not for tentpole films. That's not necessarily bad, but it's a narrower position than Apple probably wants.

Streamers that maintain flexibility about distribution—releasing some films theatrically and others directly to streaming—attract broader talent. Filmmakers know their project will be released in the format that makes the most sense for that specific film.

Apple's imposing a one-size-fits-all approach. That limits optionality for both Apple and the creators working with the platform.

Economic Models: Beyond the Subscription

Apple has a huge advantage over traditional studios: they own a consumer platform with 2 billion+ users globally. They can sell content, subscriptions, devices, and services in an integrated ecosystem that's nearly impossible for pure-play studios to replicate.

But that advantage doesn't automatically make streaming-only the right decision.

Theatrical release is a separate economic model that generates distinct revenue streams: ticket sales, merchandise, international licensing, franchise development, and cultural proof points. Streaming-only is a single model: subscription value.

Apple's consolidating multiple revenue streams into one. That's more efficient from an operational perspective. It's also more risky because you're putting all your eggs in the subscription value basket.

A more diversified approach—some films theatrical, some streaming-only—would let Apple capture value from multiple streams. A tentpole film released theatrically could generate box office revenue, merchandise revenue, franchise development value, and subscriber acquisition value. A prestige film released exclusively on Apple TV Plus captures only subscription value.

Optimizing each film for the most valuable distribution model would almost certainly generate more total revenue than a blanket streaming-only policy.

Apple's making a strategic choice to prioritize operational simplicity over revenue diversification. That might look smart in the short term. It's harder to defend in the long term.

The Inevitable Pivot: When Will Apple Change Course?

I'd bet Apple changes this policy within three years.

Not because the policy is obviously bad now, but because Apple will accumulate data showing that certain films would have been more valuable with theatrical releases. When a potential blockbuster underperforms on the streaming platform, when a franchise film fails to get greenlit for a sequel because of weak theatrical validation, when international markets prove harder to penetrate without theatrical presence, Apple will reconsider.

At that point, Apple will probably reposition. They'll argue that market conditions changed. They'll start releasing select films theatrically. They'll point to new franchise successes as evidence that theatrical is valuable.

What Apple probably won't do is admit that the original streaming-only policy was flawed. That's not how corporations communicate strategic reversals. They'll frame it as evolution and optimization.

But internally, I suspect Apple's already having conversations about this. The policy went into effect. Now, teams at Apple are modeling scenarios where theatrical release would have generated better outcomes. Those conversations will eventually bubble up to decision-makers.

The question is whether that realization comes before or after Apple misses opportunities that competitors capture. Given that the policy just went into effect in 2025, Apple probably has two to three years before accumulated data makes the case for change compelling.

What This Means for Apple TV Plus Subscribers

If you're an Apple TV Plus subscriber, the 2026 slate could be either great or disappointing depending on your preferences.

If you prefer prestige television and prestige film, Apple TV Plus remains an excellent service. The platform is investing heavily in this category, and streaming-only doesn't materially affect that strategy.

If you prefer tentpole films and franchises, 2026 might disappoint. Apple's best tentpole candidates are going straight to streaming. Whether that's a positive or negative depends on your preferences about how you consume that content.

Some subscribers will be thrilled to have exclusive access to major franchises on their home screen. No theater trip required. No worrying about theatrical showtimes. Just press play whenever.

Other subscribers will feel like they're missing the intended experience. A Marvel-level film designed for spectacle might feel diminished on a home screen, no matter how good the home theater setup is.

Apple's betting more subscribers fall into the first camp. The data will tell whether that bet was right.

Industry Precedent: What History Says

There's surprisingly little precedent for a major studio committing to streaming-only for all theatrical-caliber content. That's worth paying attention to.

Netflix has the biggest streaming operation and the largest content budget. Netflix hasn't gone streaming-only for tentpoles. Disney hasn't. Amazon hasn't. No major media company has committed to this strategy.

That might be because major media companies understand something Apple is about to learn: streaming-only optimization is different from theatrical optimization. They require different marketing strategies, different release timing, different engagement metrics. A single company can do both. A single company probably shouldn't mandate one for all content.

Apple's about to become the first major company to test this thesis at scale. The industry will watch closely. If it works, others might follow. If it doesn't, Apple will have provided a cautionary tale.

Given the historical precedent, I'm skeptical this works. But I'm willing to see what the data says.

The Bottom Line: Smart Strategy or Strategic Mistake?

Apple's streaming-first policy is operationally efficient and strategically risky.

It's efficient because it simplifies decision-making, reduces marketing complexity, and eliminates coordination costs between theatrical and streaming releases. Apple spends less time debating theatrical vs. streaming and more time focused on optimizing content for the platform.

It's risky because it sacrifices revenue streams, franchise development, international market penetration, and the cultural moment that theatrical releases create. Apple's betting that the lost revenue is worth less than the saved costs and complications.

That bet probably doesn't pay off for tentpole-level films. It probably pays off for prestige content. Apple's challenge is that they're applying one rule to both.

The smart strategy would be portfolio management. Prestige films? Streaming-only. Tentpoles? Theatrical. Franchise tentpoles with significant international potential? Theatrical with streaming windows. Mid-budget commercial films? Case-by-case analysis.

Apple's not doing that. Apple's imposing a blanket policy. That's simpler from an operational perspective. It's almost certainly suboptimal from a revenue perspective.

Will Apple change course? Probably. Will they admit they were wrong? Definitely not. Will the 2026 slate prove whether this strategy works? Absolutely.

Watch carefully. Apple's about to run an experiment that the entire industry will learn from, regardless of outcome.

FAQ

What does "streaming-first" mean for Apple TV Plus?

Streaming-first means that Apple TV Plus will release all theatrical-caliber films exclusively on the Apple TV Plus streaming platform, skipping theatrical cinema releases entirely. Instead of a film opening in movie theaters and then coming to streaming later, the film launches directly on Apple TV Plus for subscribers to watch at home.

Why is Apple switching to a streaming-first strategy?

Apple is switching to streaming-first primarily to simplify decision-making and reduce operational complexity. Theatrical releases require extensive marketing budgets, coordination with cinema chains, release window management, and separate revenue-sharing agreements. Streaming-only eliminates these complications and allows Apple to control the entire distribution experience through its own platform, while presumably maximizing subscriber acquisition and retention.

Is the 2026 Apple TV Plus movie slate actually good?

The confirmed slate includes six films, though specific titles haven't been officially announced. Industry reports suggest potential releases include films in the vein of major franchises like "Barbie," "Marty Supreme," and "Karate Kid," which would be significant titles. However, without an official announced slate, the actual quality and commercial potential of these specific projects remains uncertain and speculative.

How does Apple TV's strategy compare to Netflix and Disney Plus?

Netflix, Disney Plus, and Amazon Prime maintain more flexible distribution strategies. They release select tentpole films theatrically while streaming others exclusively, depending on each film's specific requirements. Disney uses theatrical for Marvel and major franchises while streaming prestige content. Apple's committing to streaming-only across the board, which is a more restrictive approach than its competitors use.

Could Apple TV's streaming-first strategy hurt franchise development?

Yes, potentially. Theatrical performance provides objective proof of a film's commercial viability, which studios use to greenlight sequels and spin-offs. Streaming metrics are more ambiguous and harder to compare across platforms. Without theatrical track records, Apple might struggle to justify franchise sequels to external partners or to determine internally whether a film's performance warrants continuation, potentially limiting franchise potential.

What happens to international markets with Apple TV's strategy?

Streaming-only distribution limits Apple TV's presence in international markets where theatrical releases would build brand awareness and local revenue opportunities. Theatrical releases create cultural moments and local merchandising opportunities that streaming-only approaches can't replicate. Apple essentially cedes international theatrical markets to competitors like Disney, Warner Bros., and Netflix in regions where Apple TV Plus has limited platform penetration.

Will Apple stick with streaming-first or change its policy?

Based on industry precedent and historical strategic reversals by major media companies, Apple will likely pivot within two to three years when accumulated data shows that certain films would have generated more value with theatrical releases. However, Apple will probably reframe this shift as evolution rather than admitting the original policy was flawed, as corporations typically do with strategic reversals.

How does this affect consumers and subscribers?

For subscribers who prefer prestige television and smaller films, Apple TV Plus remains an excellent choice. For subscribers who want tentpole franchises on the big screen, 2026 might disappoint since major films will be streaming-only. Some viewers will appreciate exclusive access on home screens, while others will feel the intended experience is diminished without theatrical exhibition, particularly for spectacle-driven content.

Could other studios follow Apple's streaming-first approach?

Unlikely in the near term. No major media company (Netflix, Disney, Amazon, Warner Bros.) has committed to blanket streaming-only policies for all theatrical-caliber content. The precedent suggests media companies understand that different content types require different distribution strategies. Apple's approach is experimental, and industry outcomes will determine whether others follow.

What's the long-term financial impact of streaming-first for Apple?

Streaming-only is operationally efficient but economically risky. It consolidates multiple revenue streams (theatrical, merchandise, licensing, franchise development) into a single subscription value stream. While Apple saves on theatrical marketing and distribution costs, they sacrifice international theatrical revenue, franchise validation, and merchandising opportunities that could generate significant long-term value, particularly for tentpole-level films.

Key Takeaways

- Apple TV Plus committing to streaming-only releases for all 2026 films, eliminating theatrical distribution entirely

- Six confirmed films in 2026 slate could include blockbuster franchises like Barbie, Karate Kid, and Marty Supreme

- Streaming-only strategy sacrifices theatrical revenue, international merchandising, and franchise validation opportunities

- No major media company has implemented blanket streaming-only policies; Netflix, Disney, and Amazon maintain flexible strategies

- Apple will likely pivot within three years when data shows theatrical-level films underperformed without cinema releases

Related Articles

- Roku's Streaming Bundle Strategy: How It Plans to Drive Profitability in 2026 [2025]

- The Mandalorian Movie: Jon Favreau's Vision for the Big Screen [2025]

- Virgin River Season 7 Trailer Breakdown: Why This Storyline Is Rage Bait [2025]

- Amazon's Melania Documentary Box Office Collapse: Why Theatrical Release Failed [2025]

- Spotify's Song Stories Feature vs YouTube Music's Free Tier Changes [2025]

- Chris Hemsworth Crime 101 Stunts: Director Reveals Truth [2025]

![Apple TV's Streaming-First Gamble in 2026: Why Theaters Are Worried [2025]](https://tryrunable.com/blog/apple-tv-s-streaming-first-gamble-in-2026-why-theaters-are-w/image-1-1771029332814.jpg)