Introduction: The Streaming Wars Heat Up

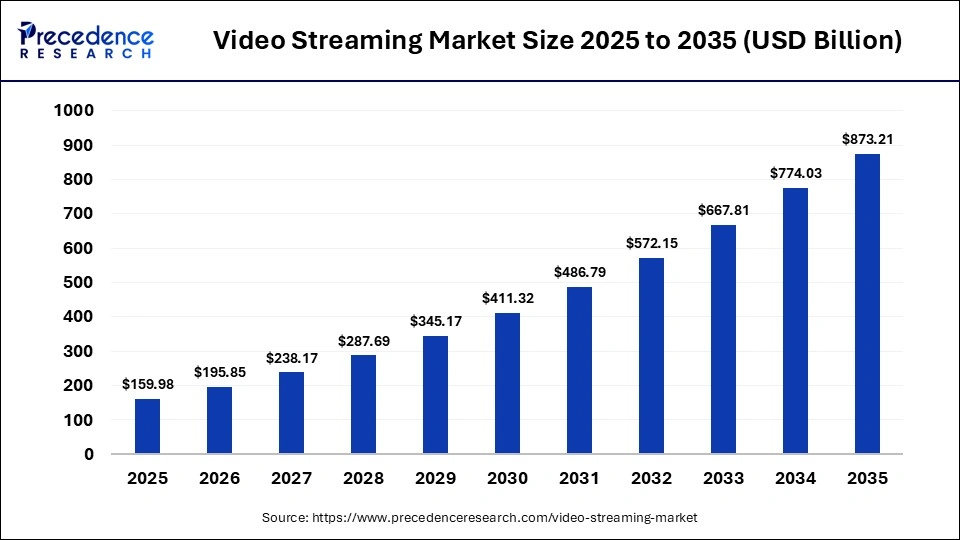

Roku just dropped some serious news. The company posted an

The streaming landscape has become almost unrecognizable from five years ago. Back then, everyone was asking: "Will streaming replace cable?" Now the question is different: "How many subscriptions can consumers actually afford before they cancel everything?" This is where Roku's bundle strategy becomes brilliant. The company isn't trying to compete directly with Netflix or Disney Plus. Instead, it's becoming the middleman—the platform that aggregates all these services and makes them easier to consume together.

What's happening at Roku mirrors a larger industry trend. Consumer spending on streaming has plateaued. Subscription fatigue is real. People are increasingly canceling services when they're done with a show and resubscribing later. The days of everyone maintaining five simultaneous subscriptions have passed. Bundle offerings are becoming the lifeline that keeps growth alive.

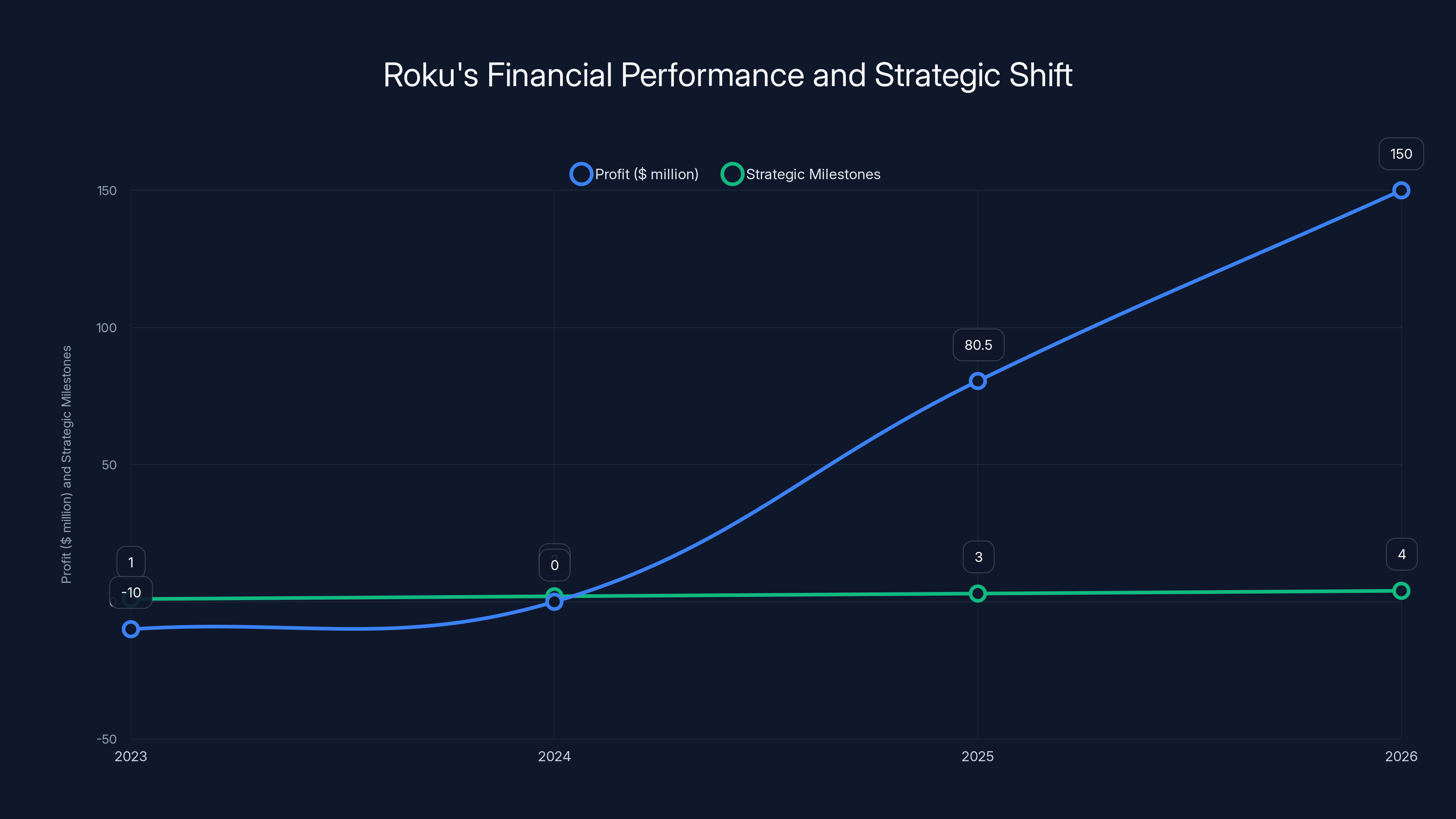

Roku's path to this moment is interesting. The company spent 2023 and 2024 cutting costs aggressively, right-sizing its workforce, and focusing on profitability instead of growth at any cost. That worked. Roku hit EBITDA breakeven a full year ahead of schedule. Now, with a lean operation generating strong margins, the company has room to invest strategically. And that strategy is clear: become essential infrastructure for the streaming era, not just a hardware maker.

The timing couldn't be better. Streaming services are raising prices across the board. Standard Netflix plans cost more. Disney Plus added ads and premium tiers. HBO Max bundled with Max Ads. Consumers are frustrated and confused. They're looking for clarity, value, and simplicity. Roku is betting it can deliver all three through bundles, its proprietary Howdy service expansion, and deeper partnerships.

But this strategy isn't without risk. Streaming bundles are commoditizing. Apple TV Plus started bundling with other Apple services. Amazon Prime Video is part of Prime. YouTube TV offers its own bundle. For Roku to succeed, it needs to do something different—something that makes its bundle so compelling that users actually prefer it to piecing together subscriptions individually.

This article breaks down Roku's strategy, the financial realities behind it, and what it means for the streaming industry. We'll explore the bundle model, look at the company's financial performance, examine the competitive landscape, and consider what comes next.

TL; DR

- Record profitability: Roku posted 116 million swing from the previous year's loss

- New bundle strategy: Launching streaming bundles in 2026 to capture cost-conscious consumers amid rising subscription prices

- Howdy expansion: Roku's ad-free streaming service is expanding beyond Roku devices to reach more users

- HBO Max success: Adding premium partners like HBO Max drove subscriber growth and demonstrated the viability of premium partnerships

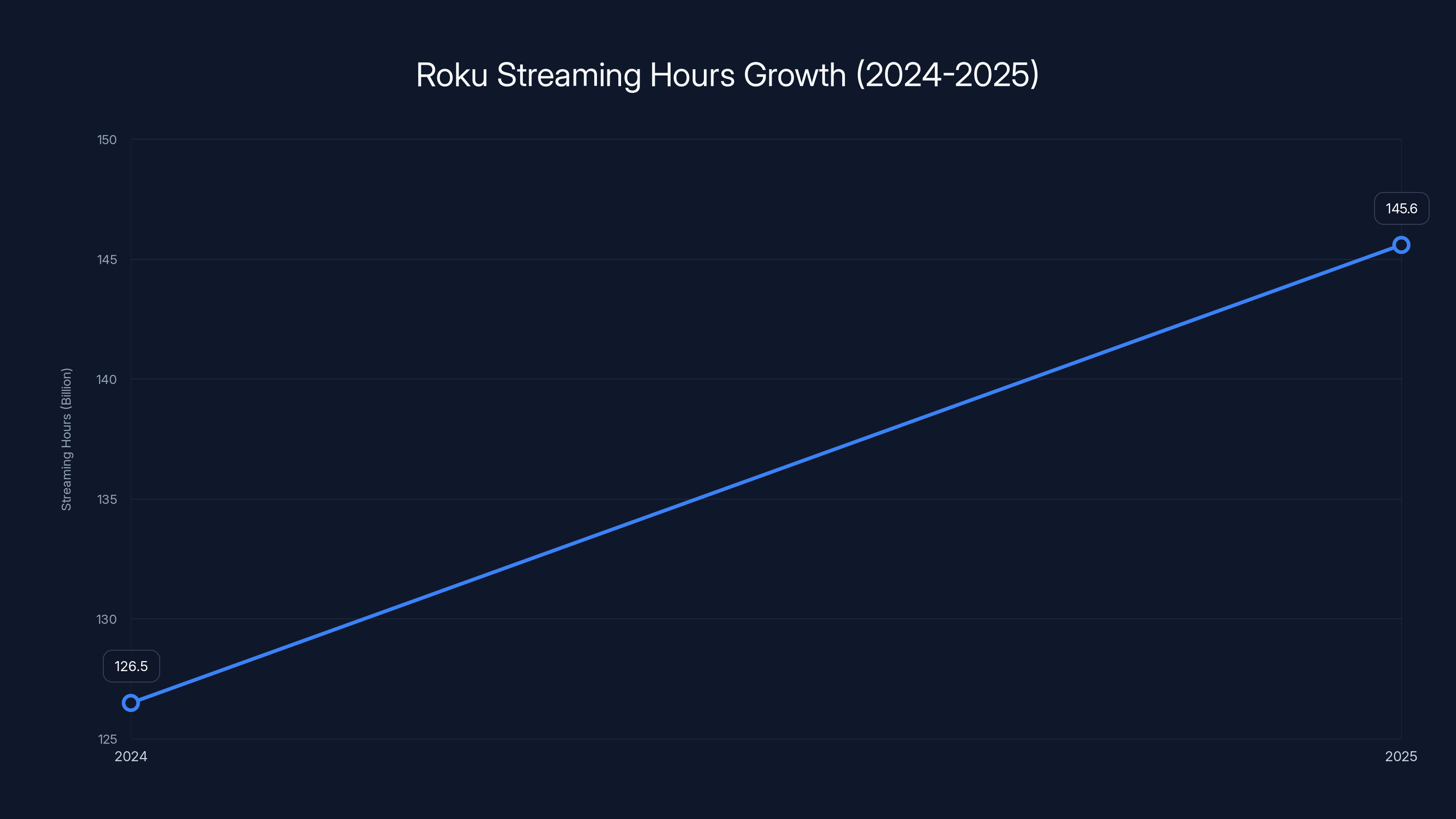

- Massive usage: Roku users streamed 145.6 billion hours in 2025, a 15% increase year-over-year

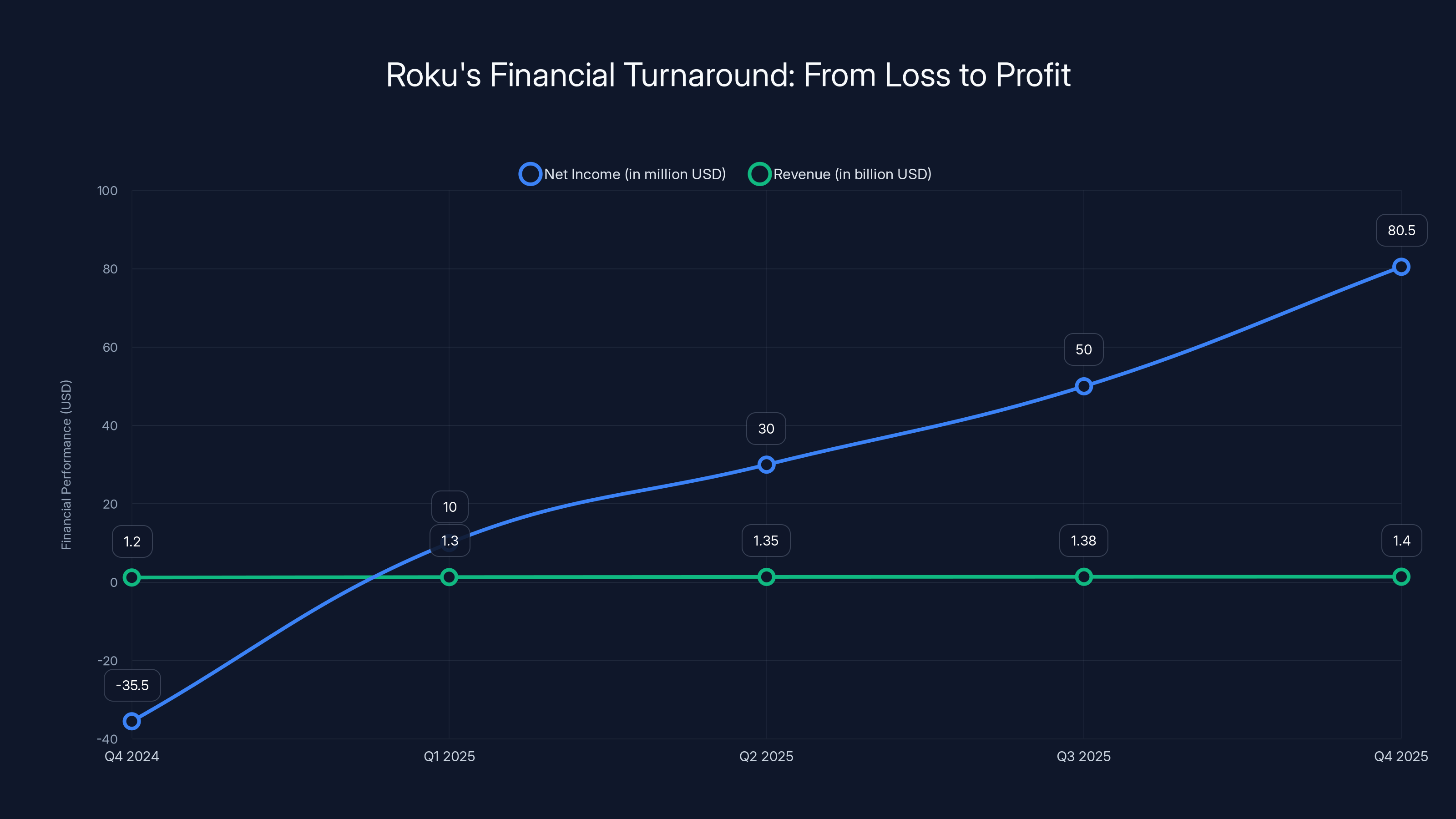

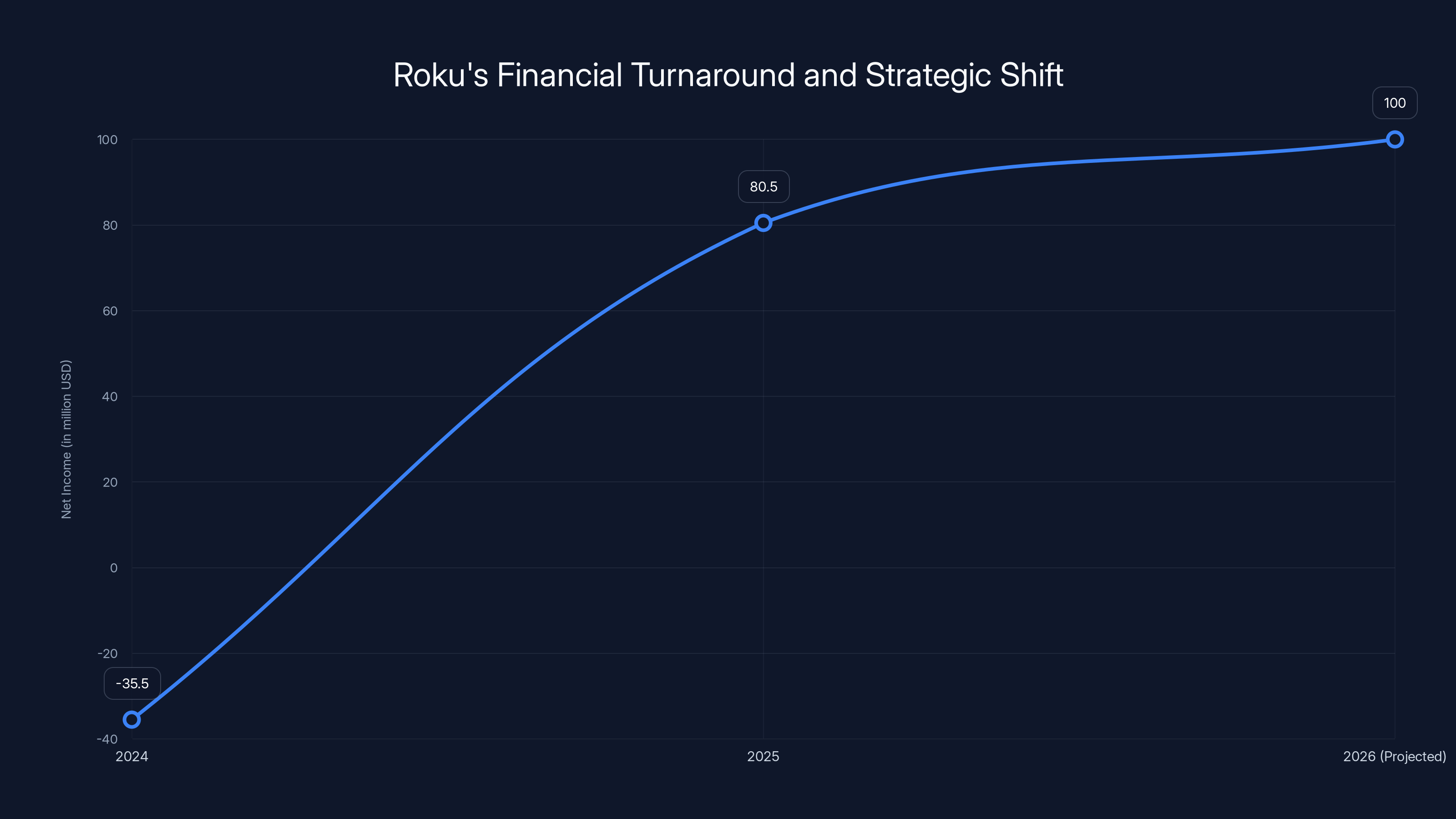

Roku's financial performance improved significantly from a

Understanding Roku's Financial Turnaround

From Loss to Profitability: The Numbers Behind the Comeback

Let's start with the raw financial performance because it tells a story worth understanding. In Q4 2024, Roku reported a

The magnitude of this swing matters. We're talking about a

Roku's gross profit margin tells the real story. With total revenue of $1.4 billion and operational focus, the company demonstrated that it could grow while maintaining pricing power. The company isn't slashing prices to gain customers. It's gaining customers because its platform actually works and its content strategy is working.

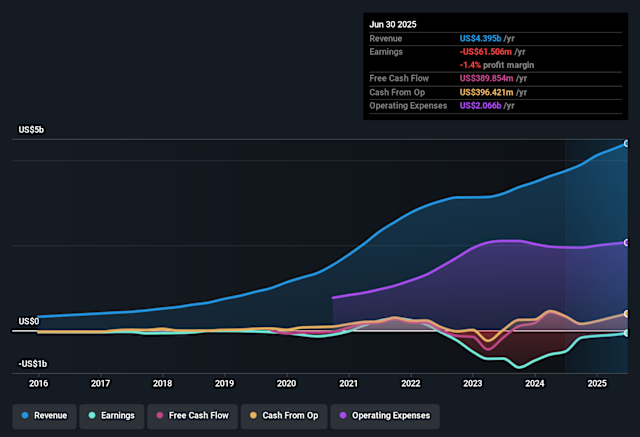

Looking at 2025 as a whole, Roku's trajectory becomes even more compelling. The company reported full-year 2025 revenue of $4.8 billion with strong platform revenue growth. This matters because platform revenue—the money Roku makes from advertising and subscriptions—is higher margin than hardware revenue. As Roku shifts the business mix toward more platform revenue, profitability naturally improves.

CEO Anthony Wood emphasized this point during investor calls, noting that the company achieved adjusted EBITDA breakeven a full year ahead of schedule in 2024. This wasn't luck. It was deliberate cost structure management combined with revenue focus. The company cut where it needed to, invested where it mattered, and waited for the business to mature.

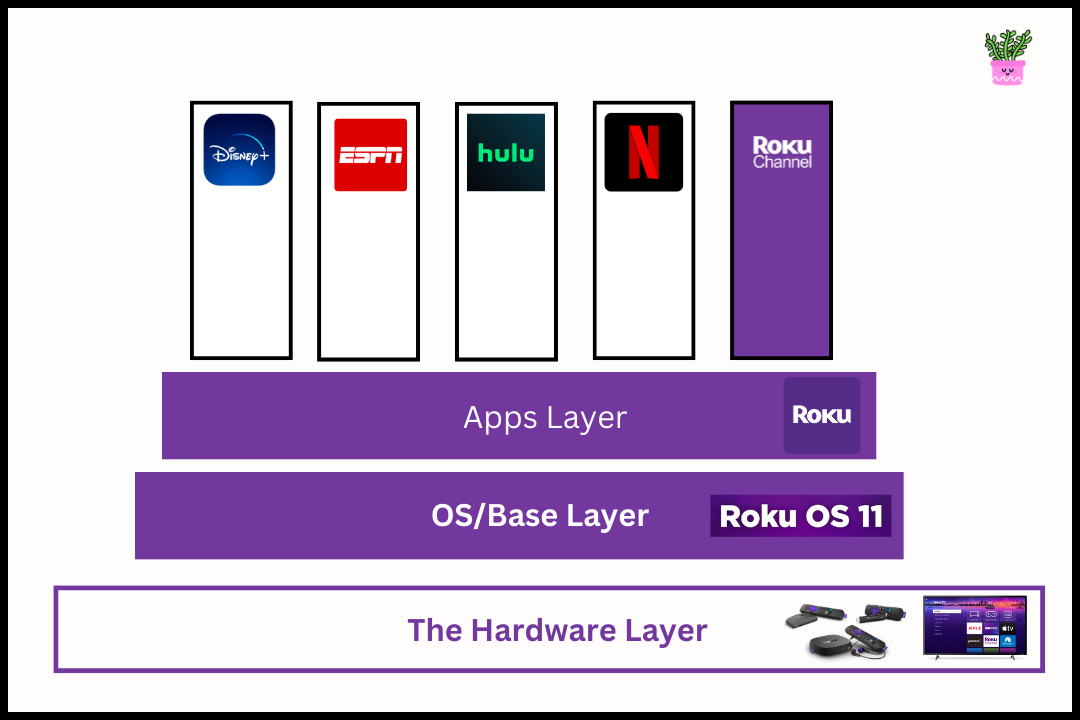

Platform Revenue vs. Hardware Revenue: The Margin Difference

Roku makes money in two primary ways: selling hardware (Roku streaming devices) and monetizing the platform through advertising and subscriptions. These two revenue streams have dramatically different economics.

Hardware revenue is thin. Roku devices have gotten cheaper and more commoditized. Competing with Amazon Fire TV, Apple TV, and Samsung's built-in smart TV platforms is brutal. Margins on hardware are typically in the single digits. The company makes maybe $5-10 per device when accounting for manufacturing, distribution, and marketing costs.

Platform revenue is where the real profit lives. When Roku serves an ad to someone watching content, that advertiser pays Roku directly. When someone subscribes to Howdy or another service through Roku's platform, Roku takes a cut. These transactions have much higher margins—often 60-70% or more after cost of goods sold.

For Roku, the strategic shift is obvious: move away from being a hardware company and become a platform company. This explains why the company is pushing Howdy expansion so aggressively. It explains why streaming bundles make sense. Both increase platform stickiness and platform monetization.

The company's 2026 guidance reflects this thinking. Roku is projecting total net revenue of

The Path Forward: 2026 Guidance and Growth Projections

Roku isn't just happy with current performance. The company is guiding for continued double-digit platform revenue growth while sustaining profitability. This is the sweet spot—growth that doesn't require burning cash.

For context, double-digit platform revenue growth at a $5.5 billion total revenue run rate means Roku expects platform revenue to grow 10-15% while overall revenue grows 10-15%. This suggests the company expects the mix shift to continue, with platform revenue becoming an increasingly larger piece of the total revenue pie.

What's remarkable is that the company is confident enough to give this guidance despite recession concerns, consumer spending pressure, and advertising market uncertainty. This suggests Roku's internal data shows strong demand signals. Users are engaging with the platform more, advertisers are spending, and subscription services are willing to partner.

Wood specifically noted during investor communication that the company is "confident in our ability to sustain double-digit platform revenue growth while continuing to grow profitability." This isn't typical language for a CEO unless the business actually supports it.

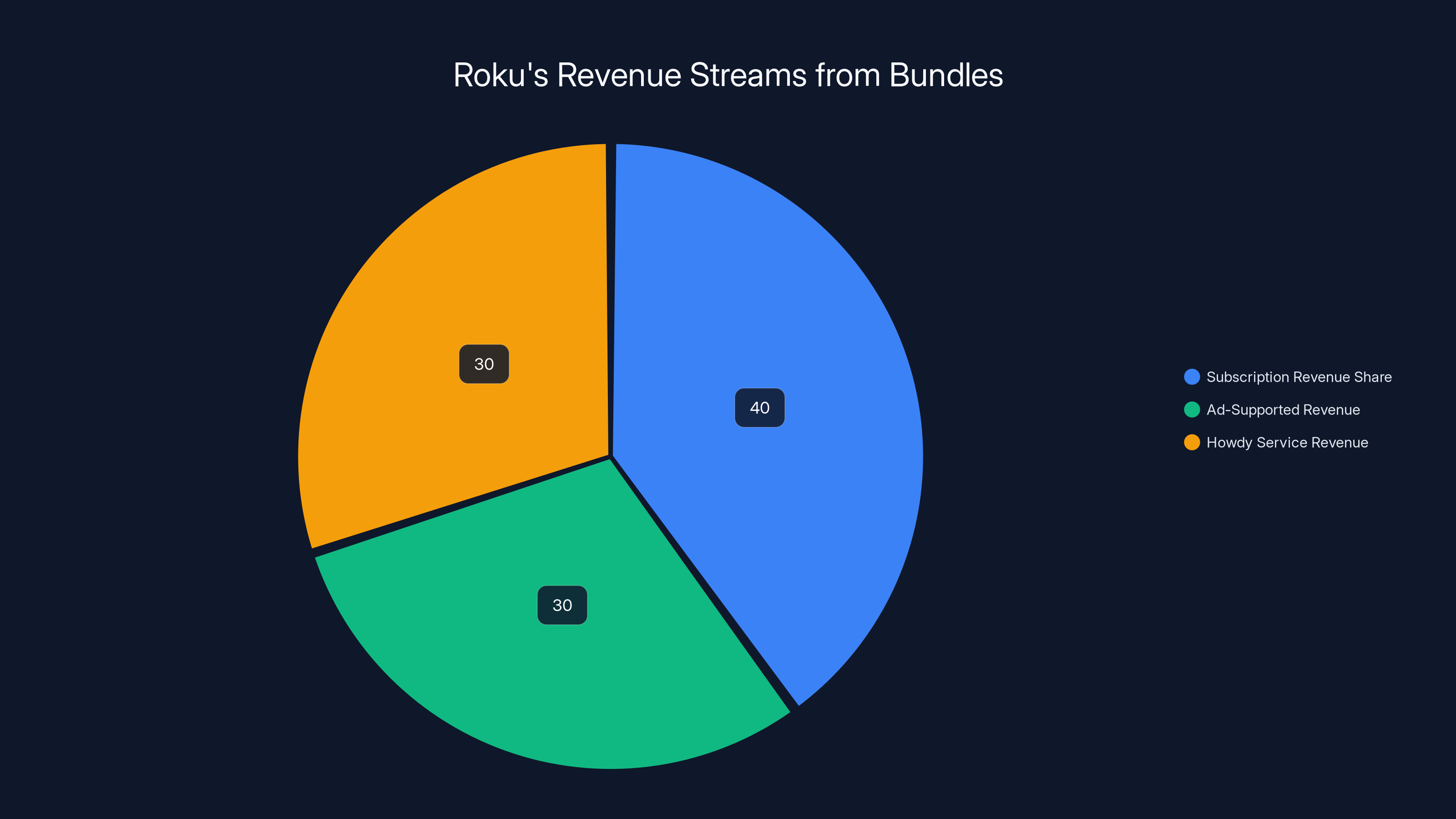

Roku's bundle strategy diversifies revenue through subscription shares, advertising, and its own service, with each contributing significantly. Estimated data.

The Bundle Strategy: Why Roku Is Going All-In

Why Bundles Make Sense in 2026

Streaming bundles aren't new. Cable companies offered bundles for decades. But there's something different about streaming bundles in 2026 compared to traditional bundles.

Traditional cable bundles worked because there was limited choice. You bought cable, you got what came with it. You wanted to choose? Too bad. Now? Choice is infinite. There are hundreds of streaming services. Consumers are overwhelmed. Bundles solve the paralysis problem.

Here's why this matters for Roku specifically. Roku sits at a unique position in the ecosystem. It's not owned by Netflix, Disney, or any major media company. It's platform-agnostic. It can partner with anyone. It has 100 million streaming households (nearly hitting that milestone officially). It controls the interface that people use to choose what to watch.

This is leverage. When Roku says "we're bundling these services together," it's not just aggregating subscriptions. It's using its platform position to reshape how consumers discover and access content. The bundle becomes the default path to consumption.

Consumer behavior research consistently shows that people choose the path of least resistance. If bundles are presented as the primary option, most will choose them. If choosing individual services requires extra steps, most won't bother. Roku understands this psychological dynamic and is structuring its interface to make bundles the natural choice.

The HBO Max Success Story

Roku didn't start the bundle strategy from scratch. The company tested it with HBO Max, and the results were compelling enough to justify expanding.

When Roku began offering HBO Max as an add-on through its platform, something interesting happened. Subscribers came. The company saw strong adoption among existing Howdy users. More importantly, the HBO Max integration drove incremental platform engagement. People who added HBO Max used the Roku platform more frequently, which meant more ad impressions and more monetization opportunity.

This is the flywheel effect that drives streaming platforms. More content options mean more engagement. More engagement means more ad inventory. More ad inventory means higher ARPU (average revenue per user). For Roku, HBO Max was the proof point that bundle expansion could actually work.

What's interesting is that HBO Max as an add-on to Howdy created a differentiated offering. Users get ad-free Howdy content plus premium HBO Max content for a combined price that's lower than HBO Max standalone. This is exactly the value proposition that resonates with cost-conscious consumers.

Roku CEO Anthony Wood specifically mentioned the HBO Max success as validation for the broader strategy. If one premium partner works, then adding more premium partners should compound the effect. This is smart strategy execution.

Competing Against Fatigue: The Real Problem Roku Is Solving

Subscription fatigue is real. Studies show that consumers are increasingly skeptical about adding new subscriptions. When asked why they don't subscribe to more services, the overwhelming response is: "Too expensive" and "Too many options."

Bundles solve both problems simultaneously. They reduce the number of decisions (you're choosing a bundle, not selecting individual services). They provide value perception (a bundle is presented as a deal, even if the underlying price is the same). They simplify the experience (everything you want is in one place, on one bill).

Roku's bundle approach specifically targets consumers who are considering cancellation or who are canceling services and re-subscribing seasonally. By bundling, Roku makes the value case more compelling. Instead of "Should I pay

The economics become hard to ignore. Most streaming services bundle basic ad-supported tiers together cheaply. Premium ad-free bundles can command higher prices. Roku can position itself as the curator of the right bundle for the right consumer.

Howdy: The Secret Weapon in Roku's Arsenal

What Is Howdy and Why Does It Matter

Howdy launched in 2024 as Roku's own streaming service. Unlike most streaming services, Howdy is ad-free and positioned as lean and focused. The company didn't try to compete with Netflix's library. Instead, Howdy offers a curated selection of content with a focus on value.

Howdy matters because it gives Roku something that it didn't have before: proprietary content. Hardware makers can't charge much for hardware if everyone else is making hardware. But if you own the content, you own the relationship with the user. Howdy changes Roku from a pure platform play into a content player.

More importantly, Howdy is the anchor for the bundle strategy. Howdy becomes the base layer. Then Roku adds HBO Max, potentially other premium services, and advertising-supported tiers. Consumers choose the bundle that matches their needs.

The company's decision to expand Howdy beyond Roku devices is telling. CEO Anthony Wood stated plainly: "We want to distribute it everywhere." This isn't about hardware lock-in. It's about building a streaming service that can compete anywhere. If Howdy is available on phones, tablets, smart TVs from other manufacturers, and web browsers, it becomes less about Roku hardware and more about Roku content and service.

This is a strategic maturation moment. Roku is moving from "we make the platform you watch on" to "we make the content you want to watch on any platform." That's a bigger business over time.

Expansion Beyond Roku Hardware

Historically, Roku made money when people bought Roku hardware. Now Roku is willing to cannibalize hardware sales if it means gaining users on Howdy and collecting their subscription revenue directly.

This is a classic platform maturation play. Amazon faced the same dynamic with Prime Video. It started on Fire TV devices but quickly realized it could make more money by being everywhere. Netflix started on Xbox and Play Station before realizing that smart TV apps mattered more than gaming consoles.

Roku's willingness to distribute Howdy everywhere suggests the company has run the economics and determined that direct-to-consumer subscription revenue (with much higher margins) outweighs hardware sales (with thin margins). This is the right calculation for a mature streaming platform.

The expansion also opens up new customer acquisition paths. Roku doesn't need to convince someone to buy a Roku device to get them to try Howdy. They can download the app on their existing device. This dramatically lowers the friction to trying the service.

The Monetization Model: Ad-Supported Tiers

Howdy launched as ad-free only, but the bundle strategy will likely include ad-supported tiers. Most premium streaming services have gone this route because ad-supported users are more valuable at scale than their subscription price suggests.

Here's the math. A standard streaming subscription might be

Roku understands this because advertising is its core business. The company has expertise in monetizing viewers. For Howdy, this means the ad-supported bundle option is probably the highest-margin offering Roku will make, even though it's priced lower than the ad-free option.

Consumers will self-select based on preferences. Price-sensitive consumers choose ad-supported. Premium consumers choose ad-free. Roku makes more money from price-sensitive consumers who choose ad-supported, which is a beautiful outcome. This is why tech companies love tiered pricing—it makes more money from budget-conscious consumers than it would from any single price point.

Roku users streamed 145.6 billion hours in 2025, marking a 15% increase from 2024. This growth highlights rising engagement, crucial for revenue sustainability.

The Competitive Landscape: Who Else Is Bundling

Apple's Bundle Strategy

Apple didn't invent bundling, but it perfected it. Apple One bundles Apple TV Plus with Apple Music, Apple Arcade, and i Cloud storage. The bundle costs less than buying each service separately, and it's deeply integrated into the Apple ecosystem.

Apple's advantage is ecosystem lock-in. Once you're in the Apple ecosystem, switching out is expensive. But Apple's weakness is that Apple TV Plus has limited content compared to Netflix, and Apple Music, while growing, isn't as dominant as Spotify.

Roku can't lock users into hardware the way Apple does, but Roku can be more open. Roku can offer bundles on any device. This is an advantage for reaching consumers who aren't in the Apple ecosystem or who don't want to be locked into one ecosystem.

Amazon's Prime Video Strategy

Amazon bundled Prime Video with Prime membership, which was brilliant strategically. For Amazon, the primary product is the shopping experience. Prime Video is the sticky service that keeps people renewing Prime.

But Amazon also learned that bundling Prime Video with third-party services works. Amazon Prime Video Channels lets users add HBO Max, Paramount Plus, and others directly within Prime Video. Amazon takes a cut of the subscription price, and users get one interface for managing multiple subscriptions.

This is actually closer to what Roku is doing than Apple's approach. Roku isn't forcing users into a proprietary ecosystem. It's allowing users to bundle services and manage them from one place. The difference is that Roku gets the data and the interface control, which is valuable for advertising and content recommendations.

Disney's Bundle Approach

Disney launched a strategic bundle combining Disney Plus, Hulu, and ESPN Plus. The company then realized that consumers wanted ad-free versions of these services, so it created a premium tier bundle that includes all three without ads.

Disney's advantage is content. The company owns an enormous catalog that spans families, adults, and sports fans. For consumers, Disney's bundle is attractive because it addresses multiple viewing needs.

But Disney's weakness is that it's bundling its own services. Consumers can't add Netflix or HBO Max to the Disney bundle. This means consumers who want diverse content still need multiple subscriptions. Roku's approach of being open to all services is an advantage here.

YouTube TV's Approach

YouTube TV is a live TV streaming service that offers a bundle of live channels. It's not quite the same as what Roku is doing (YouTube TV is the product itself, not an aggregator of other products), but it demonstrates that bundles work for linear TV watchers too.

YouTube TV users pay for one service and get hundreds of channels. YouTube then lets users add premium channel packages on top. It's a proven model that works at scale.

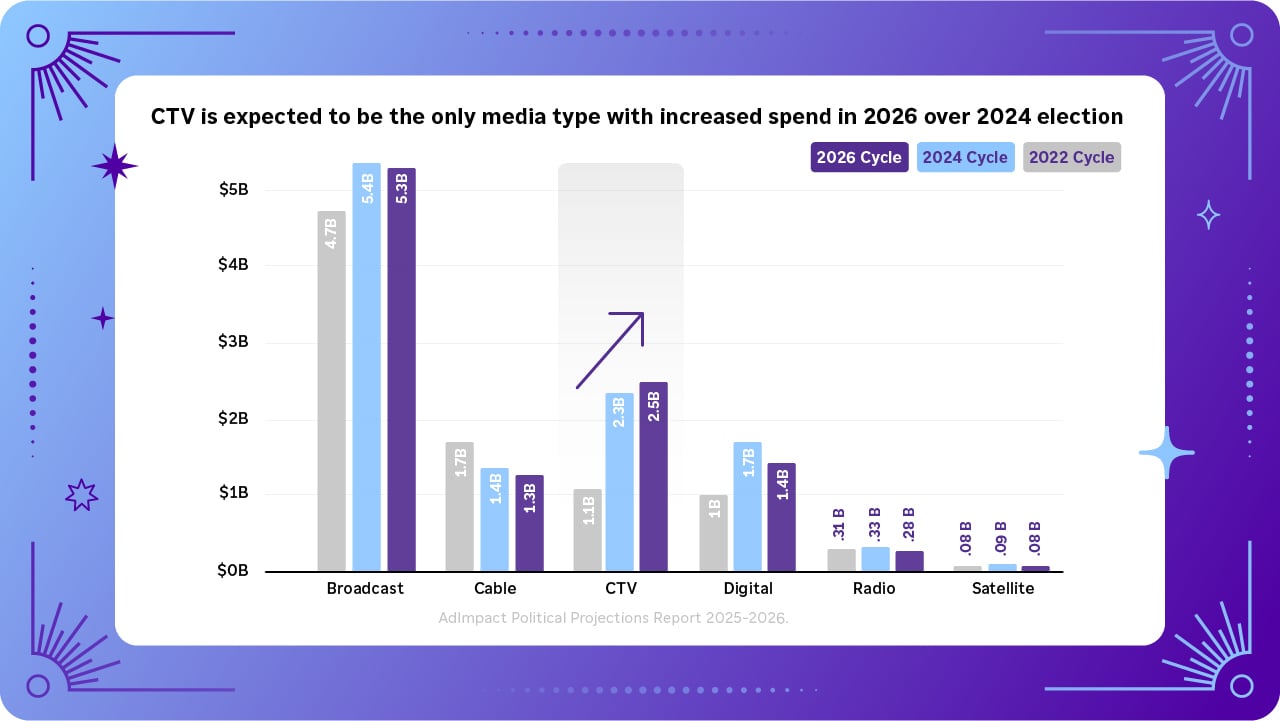

Advertising Opportunity in Bundled Environments

Why Bundles Are Better for Ad-Supported Tiers

Roku's core business is advertising. That's where the highest margins live. Bundled environments create more advertising opportunity than standalone services because they encourage users to explore content they might not have subscribed to individually.

Here's the psychological dynamic: If you subscribe to Netflix separately, you watch Netflix. If you subscribe to Netflix as part of a bundle, you're more likely to explore the other bundled services because they're already included in your subscription. This means more watch time across more services, which means more ad inventory.

For Roku, this is enormous leverage. The company can pitch to advertisers saying: "Buy ads from us in a bundled context where users are exploring multiple services, so you get more impressions and more diverse targeting." This is more valuable to advertisers than advertising in a standalone service where users are focused on one type of content.

Ad Targeting Improvements

Roku has been aggressively improving its ad targeting capabilities. The company has first-party data from 100 million households about what they watch, when they watch, and how they engage. This data is worth billions to advertisers.

In a bundled environment, Roku gets even more data signals. It sees not just what shows people watch, but what they're willing to pay for, what they explore but don't watch, and how they move between services. This is behavioral intelligence that's more valuable than surface-level view data.

Advertisers care about reaching people in the right context. Someone watching a cooking show is primed for a different ad experience than someone watching action movies. With bundles, Roku can offer context-aware advertising that's more effective and commands premium pricing.

Dynamic Pricing and Yield Optimization

As Roku consolidates more services into bundles, the company gains pricing power. Instead of negotiating ad rates separately for each service, Roku negotiates once across the entire bundle network.

This creates efficiency for advertisers (one negotiation instead of many) and efficiency for Roku (easier to sell, larger inventory to offer). More importantly, it creates leverage. Roku can offer volume discounts to advertisers willing to commit across the bundle, which drives higher volume at better margins.

Yield optimization—the practice of maximizing revenue per ad impression—becomes easier in a bundled context because Roku controls the entire user experience. The company can place ads more strategically, test different ad loads across services, and see what maximizes both user satisfaction and advertiser ROI.

Roku's revenue is projected to grow significantly by 2026, driven by strategic bundling and advertising. Estimated data.

Streaming Household Growth and Usage Metrics

The 145.6 Billion Hour Benchmark

Roku reported that users streamed 145.6 billion hours of content in 2025, a 15% increase from 2024. To put this in perspective, this is roughly 16.6 million years of content watched annually.

What's important about this metric is growth rate. Double-digit growth in engagement suggests that Roku is becoming a more central part of how people watch television. The platform isn't just maintaining users; it's getting more watch time from existing users and adding engaged new users.

For advertising purposes, more engagement means more ad impressions. If Roku can generate 15% more engagement year-over-year, and advertising rates stay flat or grow, revenue naturally compounds at better than top-line growth rates.

This is the kind of metric that institutional investors care about because it's a leading indicator of revenue sustainability. If engagement is growing, then revenue sustainability improves even if subscriber growth slows.

The 100 Million Streaming Household Milestone

Roku is nearing the milestone of 100 million streaming households. This is significant because 100 million is the scale at which a platform becomes impossible to ignore. It's comparable to Netflix's largest markets combined.

What's interesting is that Roku decided to report this figure less frequently. The company used to trumpet household numbers every quarter, but now it's becoming more selective. This suggests the company views subscriber growth as less important than revenue per user or profitability.

This shift in reporting focus is actually a sign of maturity. Young companies grow users at any cost. Mature companies optimize for profitability and revenue per user. Roku's decision to emphasize profitability metrics instead of growth metrics suggests the company believes it has reached scale and is now optimizing quality over quantity.

Regional and Demographic Trends

Within Roku's 100 million households, there's significant diversity. Different regions have different viewing habits. Different demographics have different content preferences and price sensitivity.

Bundles help Roku serve this diversity because the company can customize bundles for different segments. A bundle targeted at families might include Disney Plus and kids content. A bundle for sports fans might include ESPN Plus and premium sports channels. A budget bundle might be ad-supported only.

This segmentation is only possible at scale. Roku couldn't do this with 10 million households because the fixed costs of supporting multiple bundles would outweigh the benefit. At 100 million households, the math works. Roku can support 5-10 different bundles, each optimized for a different segment, and still achieve economies of scale.

The Economics of Content Partnerships

How Roku Splits Revenue With Partners

When Roku partners with HBO Max or other premium services, there's a revenue split. Typically, this means Roku takes a percentage (usually 30%, following the app store standard) and the service gets the rest.

But that's the simple version. The real negotiations are more complex. Roku might take a lower percentage if the service commits to promotional support. The service might accept a higher percentage if Roku guarantees placement in the featured section of the Roku interface.

For Roku, each new partnership adds inventory and content variety, which improves the platform's stickiness. For the service, each new distribution channel (Roku) is another path to customers at a cost Roku already pays (the platform fee). This is why most premium services are willing to distribute through Roku. The incremental cost is low.

Win-Win Dynamics

The HBO Max success demonstrates win-win dynamics. HBO Max gets access to Roku's 100 million households. Roku gets premium content that makes its platform more valuable. Users get a curated bundle that costs less than services separately.

This is the foundation of Roku's bundling strategy. The company isn't trying to negotiate lower prices from services or force unfavorable terms. It's creating a platform where everybody benefits.

Over time, this creates moat. Services that partner with Roku gain users. Services that don't partner with Roku lose competitiveness. Eventually, all major services will be on Roku not because they have to be, but because the opportunity cost of not being there is too high.

Roku's transition from survival to growth mode is marked by a $80.5 million profit in 2025, with further growth projected in 2026. Estimated data highlights strategic milestones like bundle introduction.

Market Positioning and Competitive Advantages

Roku's Unique Platform Position

Roku occupies a unique position in the streaming ecosystem. It's not owned by a media company like Netflix or Disney. It's not owned by a tech giant like Apple or Amazon. It's an independent platform company.

This independence is a strategic advantage. Roku can partner with anyone without conflict of interest. If Roku were owned by Netflix, it couldn't offer ESPN Plus as readily. If Roku were owned by Disney, it couldn't bundle competing services.

Independence also means Roku can stay neutral on content. The company doesn't care whether users watch original content from Howdy or original content from HBO Max. It just cares that users engage on the platform because that drives advertising revenue.

This neutrality is actually what makes Roku trustworthy to both users and partners. Users know Roku isn't biasing the interface to favor its own content. Partners know Roku isn't competing with them on original content strategy.

The Interface as a Moat

Roku controls the interface that 100 million households use every day to choose what to watch. This is more valuable than it seems.

The interface determines discoverability. Which services appear first? Which content is recommended? Which bundles are presented as the default? These interface decisions shape consumption, and consumption shapes engagement, which shapes revenue.

No streaming service can give Roku unfavorable placement because Roku controls the menu. No advertiser can ignore Roku advertising because Roku controls the screen that users see when they turn on the TV.

This interface control is a moat that competitors like Apple or Amazon also have, but Roku's moat is stronger because Roku doesn't compete on content. Apple TV Plus competes with HBO Max, which creates a conflict. Roku doesn't.

Data and Personalization Engines

Over a decade of operation, Roku has collected enormous amounts of data about viewing behavior. This data feeds personalization and recommendation engines that improve user experience.

Better recommendations mean more engagement, which means more ad impressions and higher ARPU. This is why Roku invests heavily in recommendation algorithms and machine learning.

In a bundled environment, personalization becomes even more valuable. Roku can recommend content from different bundled services based on past behavior. If you've watched a lot of action movies, Roku recommends action content from whatever service it comes from. This increases discovery and engagement across the entire bundle.

Challenges and Potential Headwinds

Fragmentation and Bundle Proliferation

One risk with the bundle strategy is that if every service offers bundles with different combinations, consumers end up confused rather than satisfied. Roku's success depends on offering a few compelling bundles rather than dozens of marginal options.

If the market fragments into too many bundles, value perception declines. Consumers know they're still paying for multiple services; the bundling just obscures the pricing structure. This is a real risk as more competitors enter the bundle game.

Roku's advantage is that the company can be selective about which services it bundles. The company doesn't have to bundle every service available. It can curate, which means the bundles will remain compelling rather than becoming diluted.

Advertising Market Sensitivity

Roku's high margins come from advertising revenue. If the advertising market softens—due to recession, reduced advertiser spending, or shifting media budgets—Roku's profitability could decline sharply.

Advertising revenue is cyclical and economically sensitive. In hard times, companies cut marketing budgets. This flows directly to streaming advertising platforms.

Roku has some protection from advertising cycles because subscription revenue is more stable. But the company's guidance for continued profitability depends partly on advertising expansion. If advertising slows, profitability could suffer.

Competition From Larger Platforms

Apple, Amazon, and Google all control streaming platforms. All three have more resources than Roku. All three could decide to bundle more aggressively, offer more preferential terms to services, or subsidize content more heavily.

Roku competes by being focused and smart, not by being big. But there's a risk that a larger competitor decides to dominate streaming bundles and uses its size to outcompete Roku.

The counterargument is that each of these larger companies is distracted by other priorities. Apple is focused on hardware and services for its ecosystem. Amazon is focused on commerce and logistics with Prime Video as the stickiness play. Google is focused on YouTube and search advertising.

Roku's entire focus is streaming. This focus advantage could persist even against larger competitors.

Roku's net income shifted from a

The Road to 2026 and Beyond

What Bundles Will Actually Look Like

Roku hasn't detailed exactly how the bundles will be structured, but industry patterns suggest a few likely scenarios.

The most probable scenario is a tier-based approach with three to five bundle options. A basic ad-supported bundle might include Howdy, ad-supported access to HBO Max, and one or two other services, priced around

Each bundle targets a different consumer segment: budget-conscious viewers, mainstream viewers, and premium viewers. Roku can then measure which segment has the highest lifetime value and adjust the bundle offerings accordingly.

The bundles will be promoted heavily within the Roku interface. New users will see bundle options prominently. Existing users will be prompted to upgrade from individual subscriptions to bundles if the bundle is better value.

Roku will likely do A/B testing on bundle combinations to see which combinations have the best conversion rates and lifetime value. The company will launch with maybe 3-5 bundles but will iterate quickly based on user behavior.

International Expansion

Roku's bundle strategy is strong in North America, but the company also operates internationally. The bundle strategy will likely expand to other regions as well, though the specific services included will vary based on local availability and consumer preferences.

In Europe, for example, a Roku bundle might include different services because content availability varies by country. In Asia, bundles might emphasize different content types based on cultural preferences.

International bundling is complex because content licensing is territorial. HBO Max isn't available everywhere. Neither is Disney Plus. Roku will need to customize bundles by region, which increases complexity but also creates tailored experiences that work better for local audiences.

The international upside is significant. If Roku can successfully bundle streaming services internationally, the addressable market expands dramatically. Most of the world's streaming growth is happening outside the US.

Partnership Pipeline

Roku CEO Anthony Wood mentioned "more premium streaming services following the successful addition of HBO Max." This suggests the company has an active pipeline of partnerships being negotiated.

Which services are likely partners? The obvious candidates include:

- Paramount Plus (CBS content, movies, originals)

- Peacock (NBC content, Olympics, sports)

- Apple TV Plus (premium originals)

- Amazon Prime Video (as an add-on)

- Netflix (less likely due to scale, but not impossible)

Each partnership brings a different value proposition to users. Paramount Plus would appeal to fans of CBS shows and movies. Peacock would appeal to sports fans. Apple TV Plus would appeal to fans of premium originals.

Roku's advantage in these negotiations is scale. The company has 100 million households. That's leverage in negotiating favorable revenue splits.

Implications for the Streaming Industry

The Great Consolidation

Streaming is consolidating. The era of consumers having dozens of simultaneous subscriptions is ending. The era of bundles and consolidation is beginning.

For consumers, this is generally positive. Bundles simplify choice and often provide better value than subscribing individually.

For streaming services, this is challenging. Services that can't bundle well or lack strong content will struggle. Services that bundles frequently are more likely to retain subscribers.

For platforms like Roku, this is the moment of maximum opportunity. Roku can become the primary interface for bundle discovery and management. If the company executes well, Roku becomes indispensable to the streaming ecosystem.

The Platform Wars

Streaming isn't about content anymore. It's about platforms. Netflix, Disney, and traditional media companies all have content. But they don't all have platforms.

Roku's strategy of becoming the platform for bundles is smart because platforms win in the long term. Platforms enable others. Platforms achieve scale faster. Platforms become valuable to advertisers and content creators.

Apple is competing in platforms through Apple TV. Amazon is competing through Prime Video and Fire TV. Google is competing through Android TV and Google TV. But Roku is the most neutral and focused on streaming bundles specifically.

The winner of the platform wars will be the company that best serves users (simplicity, value, content discovery), best serves content creators (distribution, monetization), and best serves advertisers (reach, targeting, measurement).

Roku's strategy addresses all three, which is why the bundle play is so compelling.

The Ad-Supported Future

Streaming is becoming more advertising-supported. Netflix added an ad tier. Disney Plus added an ad tier. HBO Max has an ad-supported option. The trend is clear.

Ad-supported tiers are profitable if engagement is high. Roku's expertise in advertising combined with Howdy's ad-supported options positions the company well for this trend.

Roku can offer ad-supported bundles that deliver strong ROI to advertisers while remaining affordable to consumers. This is the future of streaming, and Roku is positioned to dominate it.

Roku's Path Forward: Summary

Roku's 2026 strategy is clear: leverage platform dominance to aggregate streaming services into compelling bundles, drive profitability through advertising and subscriptions, and become essential infrastructure for streaming.

The company has the financial strength to execute. $80.5 million in Q4 net income provides capital for investment and partnerships. Double-digit platform revenue growth suggests demand for the company's offerings.

The market conditions are favorable. Consumer frustration with subscription costs is high. Advertisers want better targeting. Streaming services want more distribution. Roku can meet all these needs through bundling.

The risks exist. Advertising cycles, competition, and bundle fragmentation could all pressure results. But Roku's track record of execution and focus gives confidence that the company will navigate these challenges.

For consumers, Roku's bundles offer simplicity and value. For partners, Roku offers distribution at scale. For Roku itself, bundles offer profitability and growth. It's a strategy that could reshape streaming for years to come.

Use Case: Streamline how your team tracks streaming metrics and bundle performance data in one automated dashboard—no manual reporting needed.

Try Runable For Free

FAQ

What exactly is Roku's streaming bundle strategy?

Roku is launching streaming bundles in 2026 that combine multiple services (including its own Howdy ad-free service, HBO Max, and potentially others) at a bundled price point lower than subscribing to services individually. The strategy targets cost-conscious consumers and simplifies the streaming choice problem by presenting pre-curated bundles instead of requiring users to select individual services.

How does Roku make money from bundles?

Roku generates revenue through multiple streams: it takes a percentage of subscription revenue (typically 30%) from partner services included in bundles, it monetizes ad-supported bundle tiers with advertising revenue, and it collects full subscription revenue from its own Howdy service. This diversified revenue approach gives Roku higher profitability than it would achieve through hardware sales alone, as bundles emphasize platform engagement and advertising impressions rather than device sales.

Why did Roku report a $116 million swing in profitability?

Roku's profitability swing from a

How is Roku's bundle strategy different from Apple's or Amazon's?

Roku's bundle strategy is fundamentally different because Roku doesn't own the content or have ecosystem lock-in. Apple bundles its own services (Apple TV Plus, Music, Arcade) and uses hardware and ecosystem lock-in to drive adoption. Amazon bundles Prime Video with Prime membership to drive commerce. Roku, meanwhile, bundles services from multiple competitors (HBO Max, potentially Netflix, Paramount Plus) and remains agnostic about which services users prefer. This neutrality lets Roku scale partnerships faster and serve as a trusted platform for all streaming services.

What does expanding Howdy beyond Roku devices mean for the company's strategy?

Expanding Howdy beyond Roku devices signals that Roku is transitioning from a hardware-centric company to a platform and content company. By making Howdy available on phones, tablets, other smart TVs, and web browsers, Roku can build a direct subscription relationship with users regardless of what device they own. This dramatically expands the potential addressable market for Howdy and reduces Roku's dependence on hardware sales, which have lower margins. It's a strategic maturation that positions Roku to compete with Netflix, Disney Plus, and other standalone services.

How does Roku's bundle strategy address subscription fatigue?

Subscription fatigue occurs when consumers feel overwhelmed by choices and high costs. Roku's bundles address this by reducing decision complexity (choose one bundle instead of selecting individual services) and improving value perception (bundles present the combined services as a deal). This makes the streaming choice simpler and the value proposition clearer, which research shows increases consumer satisfaction and reduces cancellation rates. By solving the fatigue problem, Roku makes its platform stickier and more valuable to users.

What's the competitive advantage of Roku's 100 million streaming households?

Roku's 100 million household scale gives the company enormous leverage in partner negotiations. Services like HBO Max want access to 100 million potential customers. Advertisers want access to the detailed viewing data Roku has collected from 100 million households. Content creators want distribution at that scale. Roku's scale is a moat that competitors like Sling TV or YouTube TV find difficult to match. The company can negotiate favorable terms with partners because the opportunity cost of not being on Roku's platform is too high for most services.

Will Roku's bundles actually save consumers money?

That depends on which services a consumer actually watches. If a Roku bundle includes five services but you only use three, then yes, the bundle saves money. If the bundle includes only services you'd subscribe to anyway, the savings might be minimal. However, bundles typically incentivize users to explore services they might not have subscribed to individually because the marginal cost of trying additional bundled content is zero. This can increase watch time and satisfaction while reducing the per-service cost for consumers, creating a win-win scenario.

How does advertising in bundled environments work differently?

In bundled environments, users are exposed to more content from more services, which creates more advertising inventory and more context-aware ad opportunities. A user exploring content across five bundled services generates more ad impressions than a user focused on a single subscription. Additionally, Roku's knowledge of cross-service behavior lets the company offer advertisers better targeting and context. Instead of just advertising in one service, advertisers can reach users across the entire bundle based on their viewing patterns, which is more valuable and justifies premium pricing.

Conclusion: The Streaming Inflection Point

Roku has reached an inflection point. The company moved from survival mode (2023-2024) to growth and profitability mode (2025 onwards). The $80.5 million Q4 profit isn't just a number—it's validation that the business model works at scale.

The streaming bundle strategy is the logical next step. Consumer frustration with pricing and choice complexity is at a peak. Competition among streaming services has forced content spending so high that most services are losing money. Bundles solve these problems for everyone simultaneously.

For Roku, bundles represent an opportunity to deepen platform value, increase advertising inventory, and create new subscription revenue streams. For consumers, bundles simplify choice and often improve value. For streaming services, bundles increase distribution and retention.

The execution risk is real. Roku will need to carefully curate bundles, negotiate favorable terms with partners, and market the bundles effectively. But the company has demonstrated execution capability. The team that achieved profitability ahead of schedule can likely execute bundles effectively.

What's remarkable about Roku's strategy is that it doesn't require the company to own the best content. Roku doesn't need to out-Netflix Netflix or out-Disney Disney. Roku just needs to be the best platform for discovering and managing streaming bundles. That's a narrower, more achievable goal.

If Roku executes well, 2026 could be the year that streaming bundles become mainstream and Roku becomes indispensable infrastructure for the streaming ecosystem. The financial results suggest the company is positioned to make this happen.

For investors, the profitability inflection and bundle strategy represent compelling reasons to watch the company closely. For consumers, better bundles and simpler choices are coming. For streaming services, Roku's platform offers a proven path to more users at reasonable distribution costs.

The streaming wars were about content. The next chapter is about platforms. Roku is positioning itself to win that chapter.

Key Takeaways

- Roku achieved a remarkable 80.5 million net income in Q4 2025

- Streaming bundles address consumer subscription fatigue by simplifying choice and improving value perception through curation and combined pricing

- Roku's neutral platform position allows aggressive partnerships with competitors like HBO Max, unlike Apple or Amazon whose bundles prioritize their own content

- 145.6 billion hours of annual streaming engagement demonstrates Roku's platform scale, which provides leverage for content partnerships and advertising

- Expanding Howdy beyond Roku devices signals the company's transition from hardware manufacturer to content and platform provider competing with Netflix and Disney Plus

Related Articles

- Best Buy Presidents' Day Sale 2025: 50+ Top Tech Deals From $25.99

- Best Noise-Cancelling Earbuds for Every Budget [2025]

- Best Noise Cancelling Headphones 2025: Complete Guide for Every Budget

- Pinterest vs ChatGPT: Search Volume Claims Explained [2025]

- Apple Acquires Severance: What This $70M Deal Means for Streaming [2025]

- Presidents' Day Tech Sales 2026: Best Deals [2025]

![Roku's Streaming Bundle Strategy: How It Plans to Drive Profitability in 2026 [2025]](https://tryrunable.com/blog/roku-s-streaming-bundle-strategy-how-it-plans-to-drive-profi/image-1-1771002824231.png)