The End of an Era: Asus Exits the Smartphone Market

Remember when Asus was making some of the boldest phones on the planet? The company that gave us the nutty ROG Phone line, with their side-mounted charging ports and vapor cooling chambers, just quietly stepped out of the smartphone game entirely.

It's not a temporary hiatus. It's not a strategic pivot. Asus is done making phones. Period.

In 2025, the company made the decision to discontinue both its ROG gaming phone line and the Zenfone consumer smartphone series. No new models are coming this year, next year, or—honestly—maybe ever. For a company that spent nearly two decades building phones, this is enormous. The ROG Phone 8 and Zenfone 11 Ultra will be the last of their kind.

This isn't just tech news. It's a watershed moment for an entire category of Android phones that dared to be weird when everyone else was playing it safe. The ROG phones weren't just specifications on paper—they were experimental platforms where Asus tried things nobody else would touch. Side triggers. Landscape gaming modes. Modular accessories that actually made sense. Now all that innovation is dead.

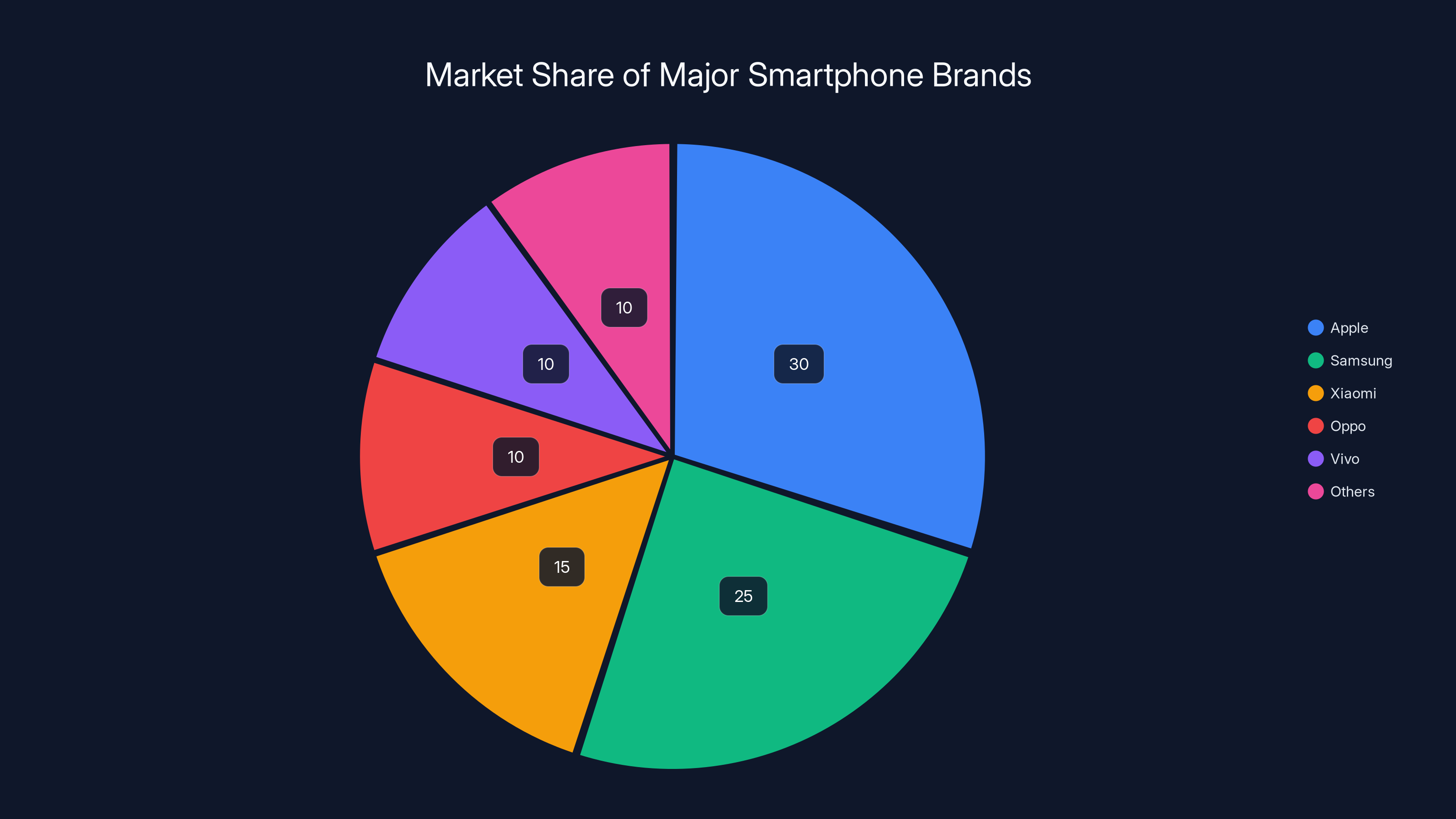

The smartphone market has become ruthlessly consolidating. You've got Apple dominating premium devices. Samsung controlling the middle and top. Google slowly climbing with the Pixel line. OnePlus, Xiaomi, and others are carving out niches. But there's increasingly no room for a company like Asus, which was never quite sure if it wanted to be a gaming-focused brand or a mainstream player.

TL; DR

- Asus has completely exited smartphone manufacturing with no new ROG phones or Zenfones planned for 2025, 2026, or beyond

- The ROG Phone 8 and Zenfone 11 Ultra are the final models, marking the end of over 15 years of smartphone production

- Market consolidation is the culprit: Apple, Samsung, and Google control roughly 70% of global smartphone revenue

- Gaming phones are a niche that barely moves the needle for major manufacturers anymore

- Asus is refocusing on laptops and other computing devices where they're genuinely competitive and profitable

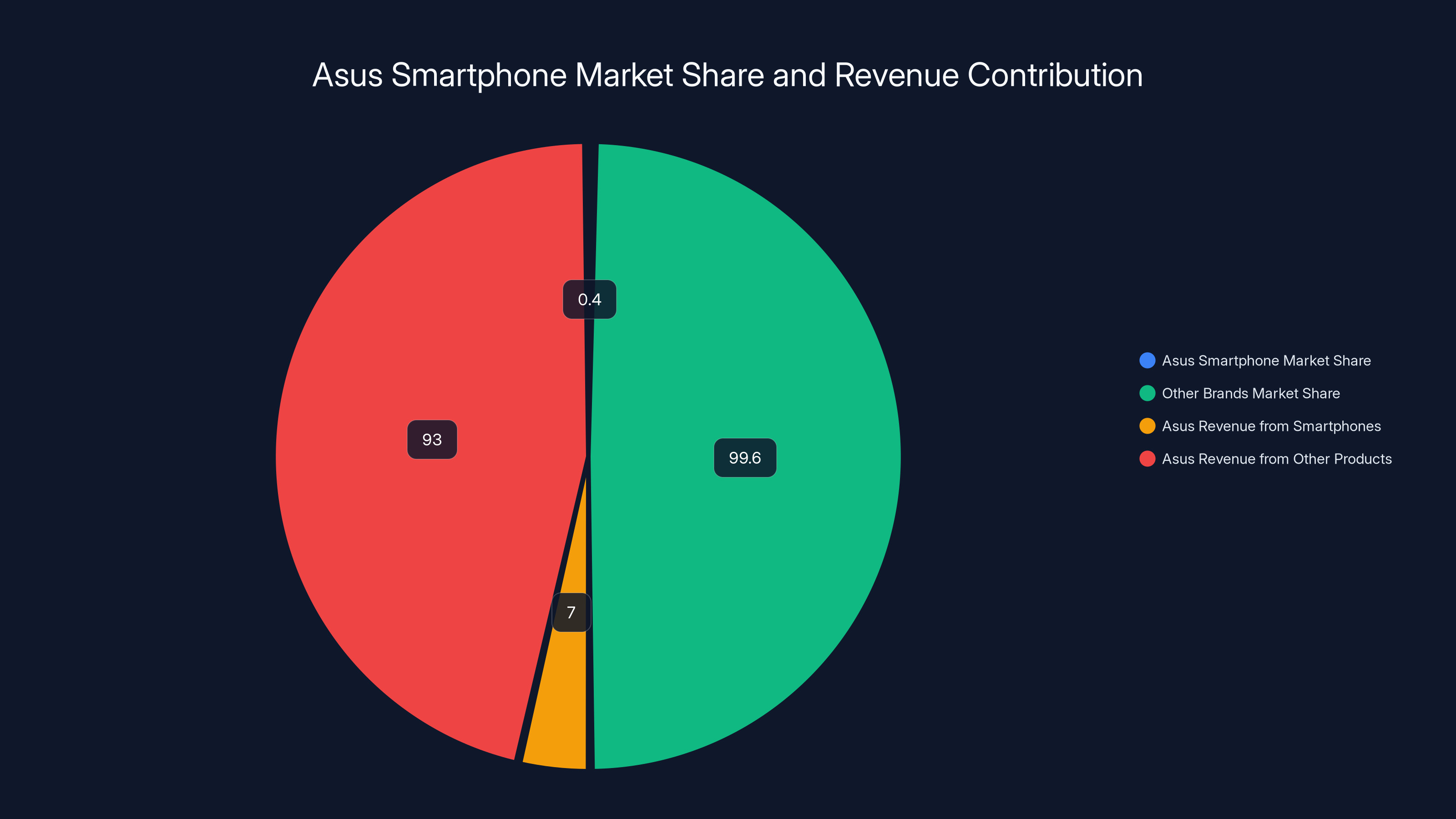

Asus captured a mere 0.4% of the smartphone market in 2024, while smartphones contributed only 7% to Asus's total revenue, highlighting their declining significance. (Estimated data)

Why Asus Made This Decision

Let's be blunt about this. Asus's phone business wasn't just declining—it was increasingly irrelevant to the company's bottom line.

Consider the market reality. In 2024, smartphone shipments totaled around 1.2 billion units globally. Asus managed to capture maybe 0.3% to 0.5% of that market, which translates to roughly 3-6 million phones shipped annually. That sounds like a lot until you realize Samsung ships 70+ million phones per year and Apple ships 55+ million.

Asus's total revenue from smartphones was likely in the range of

The ROG phone line specifically had an even smaller addressable market. Gaming phones appeal to a subset of gamers who are willing to pay premium prices for cooling systems, high refresh rates, and gaming-specific features. That's maybe 5-10 million units globally per year across all competitors. When Asus was selling ROG phones in the 500K-1 million unit range annually, the margins had to be exceptional to justify the R&D investment. But as competition increased, prices compressed, and fewer people actually cared about those innovations, the math stopped working.

The real killer was profitability. Smartphones have the lowest margins in consumer electronics—typically 5-15% for Android phones, lower for budget models. Asus could make higher margins on laptop GPUs, motherboards, and gaming peripherals. Why spend engineering resources, supply chain management, and marketing dollars on a phone business that was lucky to break even?

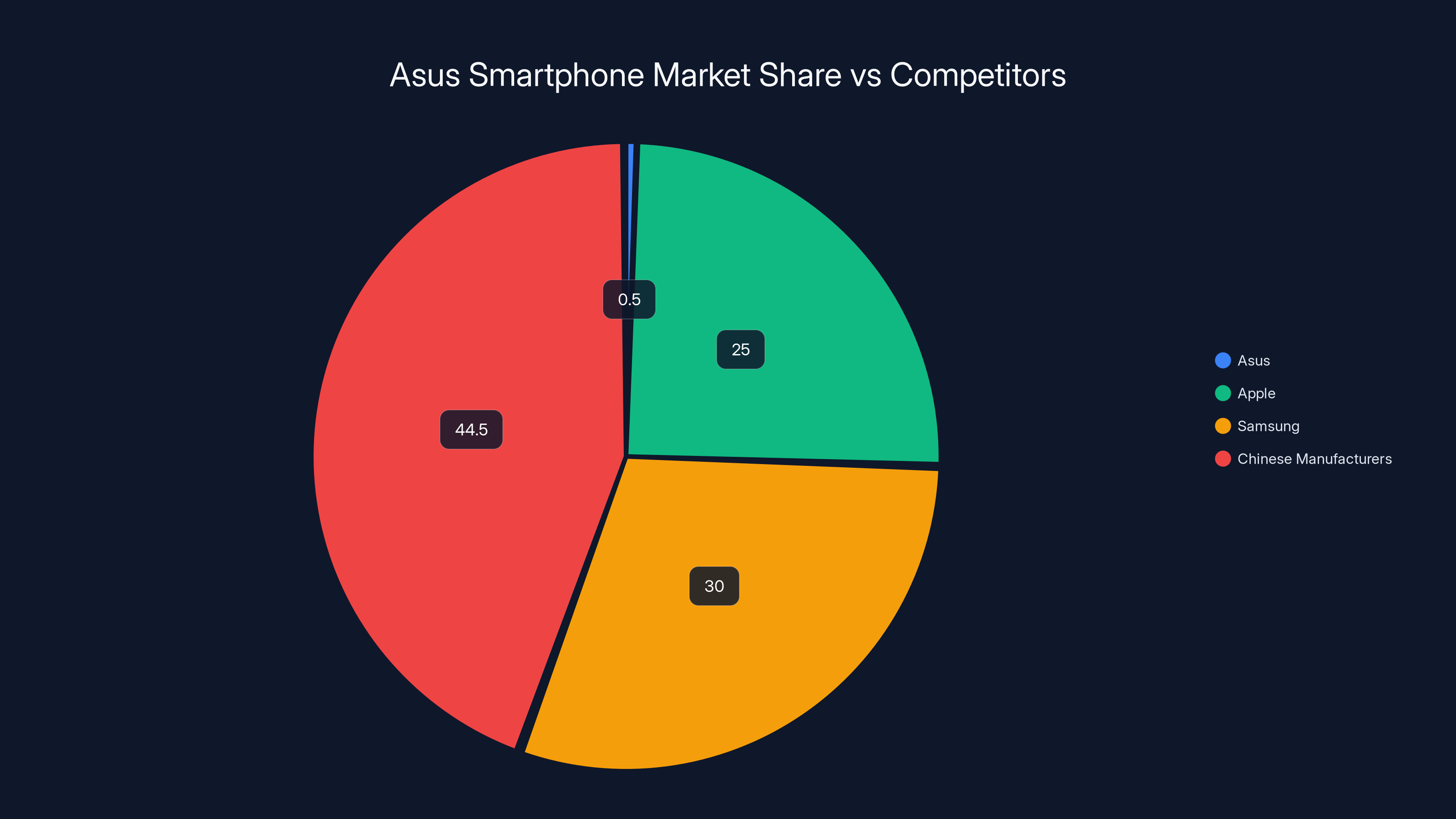

Estimated data shows Asus capturing less than 0.5% of global smartphone shipments, overshadowed by major players like Apple, Samsung, and Chinese manufacturers.

The Global Smartphone Market is Consolidating Ruthlessly

This isn't just an Asus problem. It's the entire trajectory of the smartphone industry over the past decade.

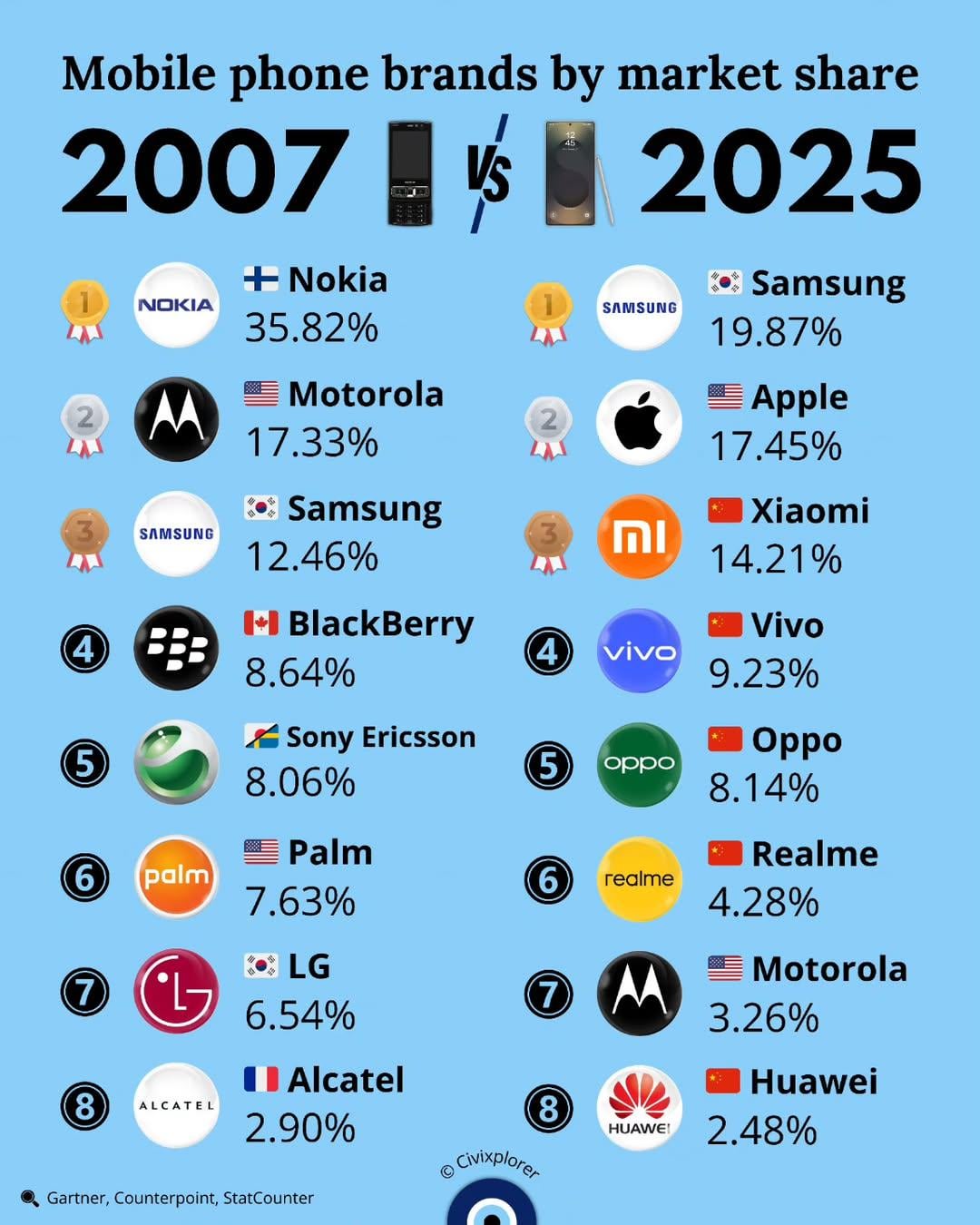

In 2015, there were dozens of phone manufacturers with meaningful market share. HTC, Motorola, LG, Huawei, ZTE, Blackberry (remember?), and countless regional players were all fighting for space. The market was fragmented, healthy, and full of experimentation.

By 2025, the market has consolidated dramatically. Here's the math:

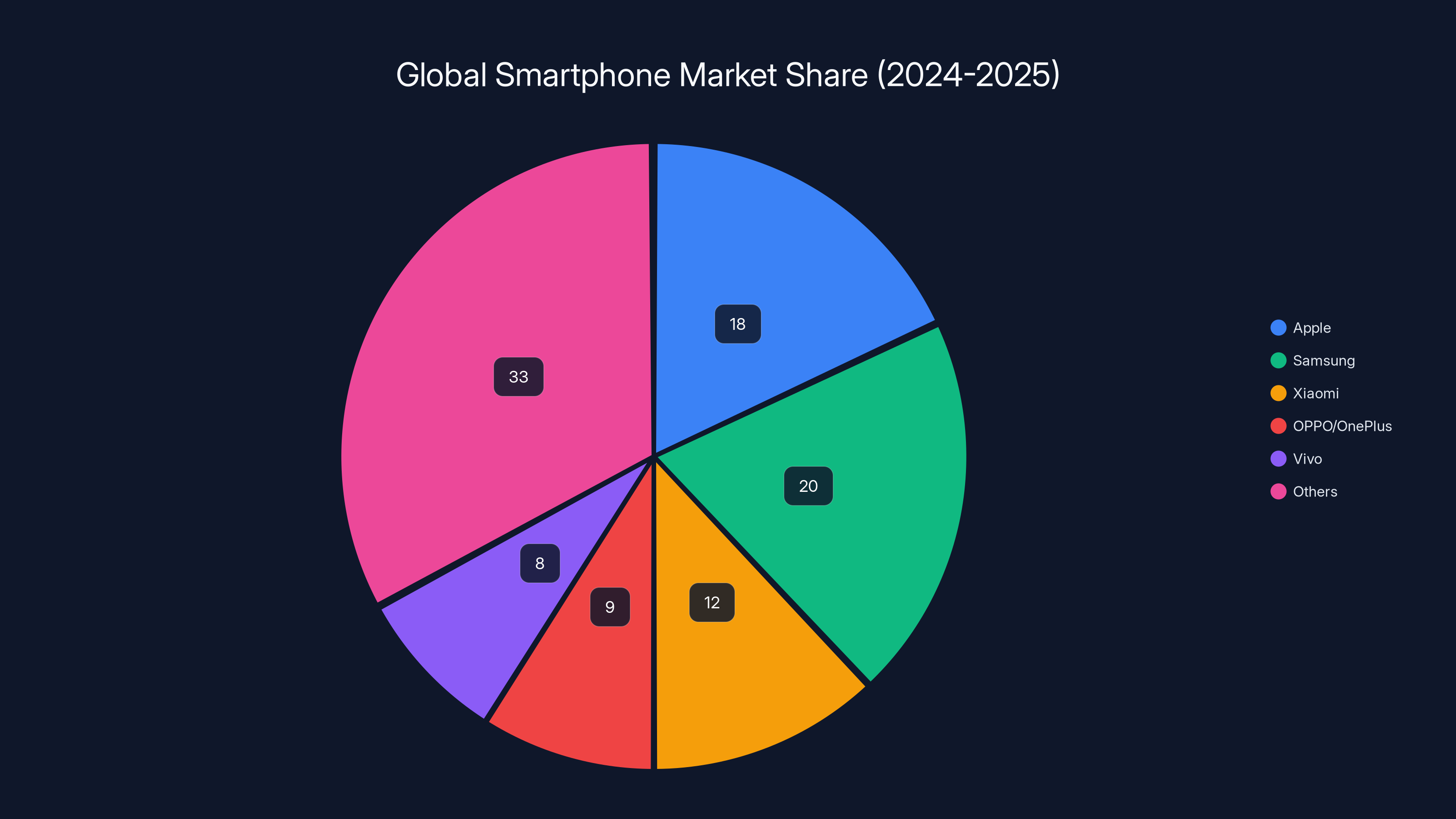

Top 5 phone makers by market share (2024-2025):

- Apple - ~18% of global shipments, ~45% of revenue

- Samsung - ~20% of global shipments, ~20% of revenue

- Xiaomi - ~12% of global shipments, ~8% of revenue

- OPPO/One Plus - ~9% of global shipments, ~6% of revenue

- Vivo - ~8% of global shipments, ~4% of revenue

These five companies control roughly 70% of the global smartphone market. Everyone else—including Asus, Motorola (owned by Lenovo), Honor, Realme, and hundreds of others—fight for the remaining 30%.

When you control less than 0.5% of a market, and the infrastructure costs are massive (manufacturing plants, supply chain, R&D, customer service, warranty processing), it's genuinely difficult to be profitable. Asus looked at the numbers, ran the projections, and realized the business was becoming a cash drain rather than a cash generator.

There's also the brutal reality of Android fragmentation. Unlike Apple, which controls both hardware and software, Asus had to build phones on top of Android, dealing with Google's ecosystem, competing with manufacturer customizations from Samsung, One Plus, and Xiaomi, and constantly worrying about software updates and security patches. Samsung's One UI is excellent. Asus's Zen UI... wasn't on that level. When your software experience can't match competitors and your hardware margins are thin, exiting starts to look logical.

The ROG Phone: A Gaming Phone That Was Way Ahead of Its Time

Let's talk about what Asus did well with the ROG line, because they genuinely innovated in ways most manufacturers wouldn't touch.

The original ROG Phone launched in 2018. It wasn't the first gaming phone—that honor goes to Razer, which released gaming phones even earlier. But Asus's approach was more radical. They said: "What if we built a phone specifically around the idea that games need different thermal management, different trigger placement, and different processing priorities than normal phones?"

The results were actually impressive:

ROG Phone signature features:

- Vapor cooling chamber: A copper vapor chamber that dissipated heat away from the processor, keeping the phone cool even during intense gaming sessions. This was expensive to manufacture and genuinely useful.

- Aero Active Cooler: An accessory fan that clipped onto the phone and provided active cooling. It looked ridiculous and worked surprisingly well.

- Side-mounted triggers: Instead of virtual buttons overlaid on the screen, ROG phones had mechanical triggers on the side that mapped to specific games. Real tactile feedback.

- High refresh displays: 120 Hz and 144 Hz refresh rates years before most manufacturers offered them.

- Landscape-first design: The camera placement and design assumed you'd play games in landscape mode, not portrait.

- RGB lighting: Because gaming phones need RGB everything, apparently.

Here's the thing: these features actually made sense. If you were seriously gaming on a phone in 2018-2022, an ROG phone delivered a better experience than a regular flagship. The cooling meant your phone didn't throttle performance. The side triggers meant you had actual haptic feedback. The high refresh rate made games look buttery smooth.

But by 2023-2024, something changed. Regular flagships started copying the good ideas. Samsung's Galaxy S24 Ultra included better cooling. Gaming phones became less about radical differentiation and more about iterative improvements. The Zenfone line, meanwhile, was Asus's attempt to be a mainstream player competing with Samsung and Google. It never quite found its footing.

When margins compressed and differentiation blurred, the ROG line's reason for existing disappeared. By the ROG Phone 8 generation, Asus was mostly chasing specs that everyone else already had. The magic was gone.

The top 5 smartphone manufacturers control 70% of the market, leaving 30% for all other brands combined. Estimated data shows significant market consolidation.

What Happened to the Zenfone Line?

The Zenfone story is a bit different. ROG phones were always niche—Asus knew that. But Zenfones were supposed to be mainstream, competitive, and profitable.

In the early days (2014-2018), Zenfones occupied an interesting space. They were stylish, reasonably priced, and offered good specs for the money. The Zenfone 5 and Zenfone 6 got decent reviews. They were never the best phones, but they were solid alternatives to Motorola, One Plus, and Xiaomi in many markets.

But here's where Asus stumbled: they were competing in a space where the competition was absolutely relentless. Xiaomi was (and is) incredible at value-for-money phones. One Plus built fanatical fans willing to wait for new releases. Motorola had brand recognition in the West. Samsung had everything—performance, software, marketing budget, distribution.

Asus didn't have a compelling differentiator for the mainstream market. They tried to highlight design (the Zenfone phones were actually quite good-looking), but design doesn't sell phones the way marketing, brand recognition, and software optimization do. By 2022-2023, Zenfone was gradually losing market share in every region.

The Zenfone 11 Ultra was actually a pretty good phone. Solid processor, good display, decent camera. But nobody cared. It wasn't revolutionary like the best Samsung flagships. It wasn't cheap like Xiaomi. It wasn't cutting-edge like Pixel. It was just... fine. And fine doesn't make sense when you're burning R&D money in a commoditized market.

Market Concentration and the Death of Niche Phone Makers

Asus's exit isn't an isolated event. It's part of a larger pattern where smartphone manufacturing is consolidating around a handful of global players, plus some regional powerhouses in India, China, and Southeast Asia.

Think about who's already gone or mostly gone:

- HTC: Once a powerhouse, especially in premium Android phones. Now essentially nonexistent.

- LG: Had a massive phone business with the V-series flagships and G-series phones. Exited entirely in 2021.

- BlackBerry: Dominated business phones until it didn't. Completely gone.

- Motorola: Owned by Lenovo, now a budget/mid-range brand mostly in India and select other markets.

- Sony Ericsson: Exited the consumer market years ago.

Even manufacturers with strong positions are struggling. One Plus, which was growing rapidly 5-6 years ago, has lost momentum. Huawei, which was massive, got decimated by US sanctions and lack of Google Play. ZTE narrowly survived but remains marginal.

This consolidation reflects deeper economic truths about the smartphone market:

-

Massive R&D costs: Developing a competitive flagship requires

1B+ in annual R&D, plus billions more in manufacturing infrastructure, supply chain development, and marketing. -

Low margins for non-leaders: If you're not in the top 3-5, you're competing on price, and price competition destroys margins. Apple and Samsung can afford R&D because they command premium prices. Everyone else fights for scraps.

-

Software matters more than ever: A phone's software experience is increasingly what differentiates it. Samsung's One UI, Apple's iOS, Google's Pixel Experience—these are sophisticated, well-funded ecosystems. Asus's Zen UI couldn't match them.

-

Advertising and brand power drive sales: Most people buy phones based on brand recognition and perception. Apple has insane brand loyalty. Samsung has decades of consumer electronics credibility. Google is Google. Asus? For phones, Asus had no brand advantage.

-

Channel conflict and distribution: Selling phones requires access to carrier networks, retail locations, online marketplaces. Asus had none of this infrastructure built up. Getting retail shelf space costs money. Getting carrier partnerships costs money and leverage.

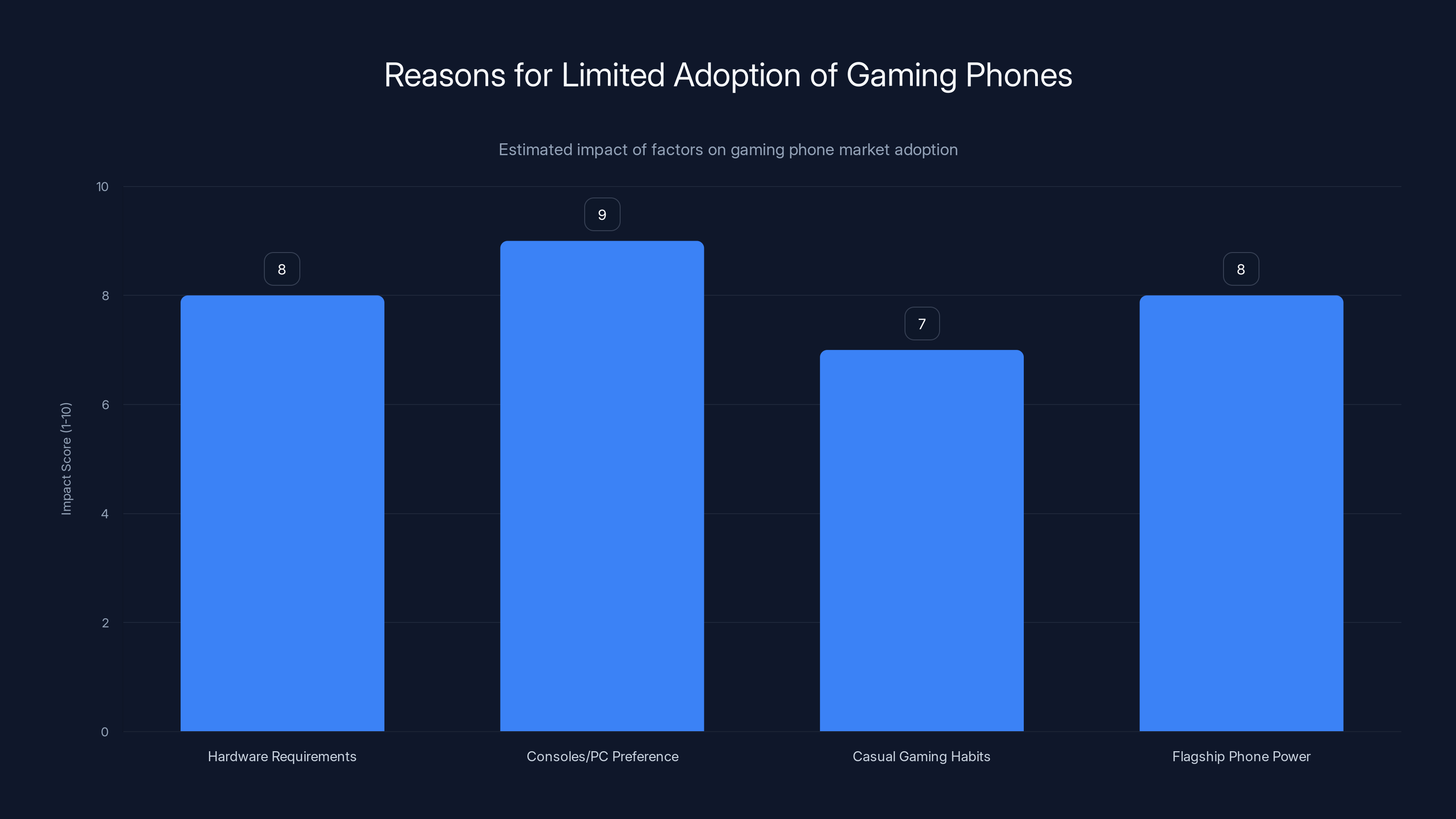

The limited adoption of gaming phones is primarily due to the sufficiency of budget phones for popular games, preference for consoles/PCs for serious gaming, casual gaming habits, and the power of flagship phones. (Estimated data)

The Gaming Phone Category Never Took Off as Expected

Here's an uncomfortable truth for Asus: gaming phones were supposed to be the future. They weren't.

In 2018-2020, there was genuine excitement about gaming phones. The assumption was that mobile gaming would grow into a massive market, and dedicated gaming phones would capture that opportunity. Asus wasn't alone in this bet. Razer made gaming phones. Xiaomi made the Black Shark series. Even Samsung briefly flirted with gaming phone variants.

Mobile gaming did grow massive—revenues hit $100+ billion annually. But here's what didn't happen: people didn't buy specialized gaming phones in large numbers.

Why? Several reasons:

1. Most mobile games don't require premium hardware: Candy Crush, Clash of Clans, Pokémon Go, Among Us—these are the most-played mobile games globally. They run on ancient hardware. A

2. Consoles and PCs are better for serious gaming: If you want hardcore gaming, you use a PlayStation 5, Xbox Series X, or gaming PC. The latency, controller experience, and processing power are simply better. Mobile phones can't compete on those fronts.

3. Most people play casual games in casual moments: Mobile gaming is a "waiting for the bus" or "lying in bed" activity for most users. Dedicated gaming features like side triggers and vapor cooling don't matter for Candy Crush.

4. Flagship phones are already powerful enough: By 2023, even a regular flagship (Samsung S24, iPhone 15 Pro, Pixel 8) could handle any mobile game at high settings with zero throttling. The gap between a gaming phone and a flagship became negligible.

Razer's gaming phones are still around, mostly in Asia, but they're niche. Black Shark is still made by Xiaomi, but barely publicized in most markets. The gaming phone category turned out to be a dead-end in terms of volume and profitability.

Asus saw the writing on the wall. The ROG phone line wasn't going to grow into the billion-unit category they'd hoped for. It was always going to be a niche. Eventually, that niche became too small to justify.

What About Asus's Mobile Device Strategy Now?

Here's where it gets interesting. Asus isn't exiting mobile—they're just exiting phones.

Asus still makes tablets, particularly gaming tablets aimed at a similar audience. The Asus ROG Pad and regular Zenfold tablets are still in production. Tablets are a smaller market than phones, but the company can be more profitable per unit on tablets because they're positioned as premium productivity and gaming devices.

Asus is also doubling down on what it actually dominates: gaming laptops and accessories. The ROG brand continues to expand in laptops, where Asus has genuine market credibility and share. ROG laptops compete directly with Alienware, Razer, and other gaming brands, and Asus has done well in that space.

The company is essentially saying: "We can't win in phones anymore. But we can win in laptops, tablets, and gaming peripherals. Let's focus there."

This is a logical retrenchment. It's not a failure of execution—Asus made good phones and innovative ROG devices. It's a failure of the market to be large enough or differentiated enough for them to win at scale.

Apple and Samsung dominate the smartphone market, holding over 50% combined share. Smaller brands struggle to compete due to high R&D costs and low margins. (Estimated data)

What Alternatives Do Gaming Phone Enthusiasts Have?

If you loved ROG phones for their innovation and gaming focus, what are your options now?

1. Razer Phone series: Razer still makes gaming phones, though they're harder to find in most Western markets. The latest models include mechanical triggers similar to ROG phones, high refresh displays, and aggressive cooling. They're pricey and availability is limited, but they're the closest spiritual successor to ROG phones.

2. Samsung Galaxy S24 Ultra: Samsung's flagship is more powerful than any ROG phone, has excellent cooling, and runs the latest Android with Samsung's optimization. It's overkill for games but excellent for everything else. Price: $1,299 and up.

3. POCO F6 Pro or other Xiaomi gaming-focused devices: Xiaomi's Black Shark series continues in some markets, and the POCO F6 Pro offers excellent specs at a lower price point than Samsung. Not as gaming-focused as ROG was, but solid.

4. One Plus 13: One Plus remains focused on raw performance and fast software. Good for gaming, though less specialized than ROG phones were.

5. Nothing Phone 2: Unusual design, interesting software experiments. Not gaming-focused but interesting for enthusiasts who want something different.

6. Google Pixel 9 Pro XL: The best pure Android experience. Excellent performance, and Google's computational photography is top-tier. Not cheap, not gaming-focused, but incredibly capable.

Honestly? If you want a gaming-focused phone, your best bet is probably a Razer phone if you can find one, or a regular flagship like the Samsung S24 Ultra or Pixel 9. The specialized gaming phone category is functionally dead.

The Larger Lesson: Why Manufacturers Are Exiting Hardware Categories

Asus's exit from phones is part of a broader pattern we're seeing across the tech industry. Hardware is hard. It requires massive capital investment, complex supply chains, high manufacturing expertise, and sustained market demand. When you can't achieve scale or differentiation, hardware businesses become money-losing propositions.

We're seeing this across multiple categories:

Tablets: Once thought to be the future, tablets are now dominated by Apple (iPad) and Samsung, with everyone else fighting for remnants. Asus actually still does well with tablets, but many competitors have exited.

Gaming PCs: Used to be dozens of manufacturers. Now it's really Alienware, ASUS ROG, Razer, and a few others.

Smartwatches: Almost entirely dominated by Apple Watch, Samsung Galaxy Watch, and Garmin for fitness. Everyone else has exited.

VR headsets: Meta essentially has the consumer market; everyone else is gone or marginal.

The pattern is consistent: hardware consolidation around profitable leaders and niche players. If you can't win at scale or command premium pricing, you exit.

The Smartphone Market's Future Without Asus

So what does the smartphone market look like without Asus phones?

Honestly? Not much different. Asus commanded such a small market share that their absence creates almost no vacuum. It's not like HTC exiting, which left a gap in premium Android phones that Google eventually filled with Pixel. It's not like LG, which had meaningful share in the US market.

Asus phones were always somewhat invisible. Most consumers didn't notice they existed. Enthusiasts and gadget lovers noticed. But the mainstream? For most people, the choice was always Apple, Samsung, or maybe One Plus/Xiaomi. Asus was never on the list.

The smartphone market will continue consolidating. We'll probably see Motorola exiting eventually (it barely survives now). We might see One Plus gradually absorbed more into Oppo. Xiaomi might eventually focus only on budget and mid-range, abandoning flagship ambitions. Honor (the Huawei spin-off) is trying to grow but facing headwinds.

Eventually, we'll probably be left with:

- Apple (premium only, complete control)

- Samsung (entire range, market leader)

- Google (premium focused, growing)

- One Plus/Oppo/Vivo (Chinese conglomerate value/mid-range)

- Xiaomi (value/budget focused)

- Motorola (budget, if it survives)

- Regional players in India, Southeast Asia, etc.

That's it. Maybe 6-8 major players globally, with dozens of regional players in specific markets. The days of dozens of competitive global phone manufacturers are over.

What Asus Investors and Stakeholders Should Know

From a business perspective, Asus's decision is sensible. But it does signal something important about the company's strategic positioning.

Asus was always a "Jack of all trades, master of none" company. They made phones, tablets, laptops, desktops, motherboards, graphics cards, monitors, routers, peripherals, and about fifteen other things. This diversification provides stability—if one market is down, another is up. But it also means no single business gets the focus and investment needed to dominate.

Meanwhile, specialized competitors like Apple, Samsung, and Razer go deep on fewer categories and build incredible products and brands. Asus's brand strength is in gaming peripherals and laptops. Their brand in phones was never strong enough to overcome the structural challenges.

Moving forward, Asus is essentially admitting that phones aren't part of their core strategy anymore. They'll focus on:

- Gaming laptops and desktops (ROG brand)

- Business and consumer laptops (Vivobook, ZenBook)

- Motherboards and graphics cards (for PC enthusiasts)

- Tablets (still profitable and differentiated)

- Gaming monitors and peripherals

This is actually a smart portfolio. These are categories where Asus has genuine brand recognition and market position. Trying to maintain a phone business that captures 0.3% of the market makes no financial sense.

The 2025-2026 Smartphone Landscape Without New Asus Phones

For those wondering what flagship phones will actually be released in 2025-2026 now that Asus is out:

Expected 2025 Launches:

- Apple iPhone 17 Pro/Max: Expected fall 2025

- Samsung Galaxy S25 Ultra: Expected early 2025

- Google Pixel 10 Pro: Expected fall 2025

- One Plus 13T: Expected mid-2025

- Xiaomi 15 Ultra: Expected late 2024/early 2025

- Razer Phone (new generation): Possibly mid-2025

- Motorola Edge 60 Pro: Possibly 2025

You'll notice Asus isn't on that list anymore. The flagship space will be divided among the players who already have strong positions.

FAQ

Why did Asus completely abandon smartphones?

Asus exited the smartphone market because profitability had become untenable. The company was capturing less than 0.5% of global smartphone shipments, while competing against Apple, Samsung, and Chinese manufacturers with significant cost and R&D advantages. Smartphones represent low margins (5-15% for Android phones) compared to Asus's laptop and gaming peripheral businesses. With declining market share and no clear path to profitability, Asus concluded that smartphone manufacturing consumed capital and resources that could be better deployed in more competitive business segments.

Are the ROG Phone 8 and Zenfone 11 Ultra the absolute last models?

Yes, these are the final phones Asus will ever release. The company has officially ended smartphone manufacturing and has no plans to re-enter the market. While strategic decisions can change over time, Asus's current internal planning shows no pathway back to phone production. The ROG Phone 8 and Zenfone 11 Ultra represent the end of Asus's 15+ year involvement in the smartphone market.

Could Asus return to phones in the future?

Technically possible, but highly unlikely. For Asus to return, the smartphone market would need to fundamentally change in ways that created opportunity for smaller manufacturers. This might include new form factors (foldable phones becoming dominant), new use cases (augmented reality phones), or a market fragmentation that hasn't happened since the mid-2010s. Given current consolidation trends, the opposite is more likely—further market concentration among fewer players.

What should existing ROG phone and Zenfone users do?

Existing owners should focus on maximizing the lifespan of their current devices through good maintenance and protection. For those considering upgrades, alternatives include Samsung's Galaxy S24 Ultra (premium, powerful flagship), Razer phones (if available, closest gaming-focused alternative), or Google Pixel 9 series (best pure Android experience). Most modern flagships have sufficient gaming performance that specialized gaming features matter less than they did when ROG phones were competitive.

Why can't smaller manufacturers compete in smartphones anymore?

Smartphone manufacturing has become a scale-dependent business. The top five manufacturers control 70% of the global market, giving them leverage with suppliers, economies of scale in manufacturing, and budget to invest billions in R&D annually. Smaller manufacturers like Asus face disadvantages: higher per-unit costs, lower brand recognition, difficulty accessing retail distribution, and less bargaining power with component suppliers. With thin margins across the entire market, profitability for a company with less than 1% share becomes nearly impossible without extreme cost-cutting or radical differentiation.

Will the Zenfone and ROG phone brands return on other devices?

Yes, partially. Asus continues the ROG brand on laptops, tablets, gaming monitors, and peripherals where they remain competitive. The Zenfone name might eventually appear on future tablets or other devices, though there are no confirmed plans. The smartphone-specific product lines are permanently discontinued, but the brand heritage might be used for other product categories.

What impact does Asus's exit have on consumers?

The immediate impact is limited since Asus captured a small market share. However, it represents a broader consolidation that reduces consumer choice and innovation. Gaming-focused phone features will become rarer as the gaming phone category shrinks. For consumers, this means fewer differentiated options and more reliance on mainstream flagships from Samsung, Apple, and Google. The innovative experimentation that ROG phones represented is increasingly rare in the market.

How does this compare to other manufacturer exits?

Asus's exit is less impactful than LG's (which had significant market share in the US), but similar to HTC's gradual fade. Unlike HTC, Asus maintains a strong brand and products in other categories, so this is a portfolio simplification rather than company-wide failure. The pattern reflects the broader smartphone industry trend toward consolidation around profitable leaders and elimination of mid-tier competitors.

The Bottom Line: Smartphones Aren't for Everyone Anymore

Asus's exit from smartphones marks an important inflection point. It's not just a business decision—it's an admission that the smartphone market has matured into a consolidation phase that favors only the largest, most resourced, or most specialized manufacturers.

The smartphone category that once had dozens of competitive manufacturers globally now has maybe 5-8 that matter. The market is increasingly bifurcated between ultra-premium (Apple), mainstream (Samsung, One Plus, Xiaomi), and regional players. There's almost no room for a generalist like Asus.

For consumers, this means less choice and less experimentation. The radical innovations that companies like Asus attempted—vapor cooling, side triggers, gaming-specific features—will become rarer. Phones will increasingly converge around a standard set of features, with differentiation happening mainly through software and ecosystem lock-in rather than hardware innovation.

The Asus story is ultimately about the reality of hardware markets in the 2020s. Building phones is genuinely difficult. Selling them at profit margins sufficient to justify R&D investment is even harder. Unless you have the scale of Apple, the brand power of Samsung, the ecosystem of Google, or a clear niche (Razer in gaming, One Plus in early adopters), the economics don't work.

Asus made a rational choice. They looked at the numbers, recognized that the phone business was consuming resources without generating returns, and redeployed those resources to areas where the company could win. That's not a failure of execution or innovation. That's capitalism working as intended—resources flowing to their most productive uses.

The era of Asus making phones is over. For those who loved what ROG did with mobile gaming, and those who appreciated what Zenfone attempted as a mainstream alternative, the loss is real. But for Asus as a company, it's probably the right move. And that's the uncomfortable truth about hardware in 2025: being good at making products isn't enough anymore. You have to be great, at scale, and profitably.

Asus is choosing to be great at the things they can actually win at. Everything else has to go.

Key Takeaways

- Asus has completely discontinued smartphone manufacturing with no new ROG or Zenfone phones planned for 2025, 2026, or beyond

- Market consolidation has concentrated 70% of smartphone revenue among Apple, Samsung, and Chinese manufacturers, leaving no room for smaller players

- Gaming phones failed to capture the volume manufacturers hoped, with most mobile gamers preferring cheap casual games or premium mainstream flagships

- Asus was capturing less than 0.5% global market share while burning R&D money, making the business economically indefensible

- The smartphone industry has consolidated from dozens of global manufacturers (2015) to roughly 5-8 major competitors (2025)

Related Articles

- CES 2026: Why AI Integration Matters More Than AI Hype [2025]

- OLED Brightness Battle: 4,500 Nits Claims Explained [2025]

- Kodiak and Bosch Partner to Scale Autonomous Truck Technology [2025]

- Covenant Health Breach Exposes 500K Patients: What Happened [2025]

- CRISPR Gene Editing for Flu: The Future of Antiviral Treatment [2025]

- Best Meditation Apps 2026: Complete Guide & Alternatives

![Asus ROG Phones and Zenfones Discontinued: What Happened [2025]](https://tryrunable.com/blog/asus-rog-phones-and-zenfones-discontinued-what-happened-2025/image-1-1767614887098.jpg)