The ASUS ROG Xbox Ally X Price Hike Explained: What's Actually Happening

Something changed overnight in the handheld gaming market, and nobody's talking about it directly. The ASUS ROG Xbox Ally X just got significantly more expensive in multiple regions, and the reason isn't marketing strategy or demand. It's something far more insidious: a global memory and storage crisis that's quietly reshaping the entire consumer electronics industry.

Let me break down what happened. In Australia, the Ally X climbed from AU

Here's the really telling part: the base-model Ally with 16GB of RAM didn't see these price hikes in either region. Only the Ally X, which packs 24GB of RAM and 1TB of storage, got the bump. That's not coincidence. That's a clear signal that memory and storage components are the culprit.

I've covered hardware pricing for years, and this pattern is becoming impossible to ignore. We're in the middle of a legitimate supply crisis in RAM and NAND flash storage, and it's rippling through every consumer electronics category simultaneously. Handheld gaming devices, laptops, desktops, data centers, AI servers—everything needs memory right now. And there simply isn't enough to go around.

The worst part? If you think these price hikes are isolated incidents, you're not paying attention. This is the opening move in a much larger reshuffling of handheld gaming prices globally. By the end of 2025, I'd be shocked if we haven't seen similar adjustments across Europe, North America, and other regions. The question isn't whether your local Ally X price will increase—it's when.

Understanding the Global RAM Crisis: Why This Is Happening Right Now

The Perfect Storm of Demand

Memory pricing doesn't move in isolation. It responds to macroeconomic pressure, and right now, that pressure is coming from multiple directions simultaneously.

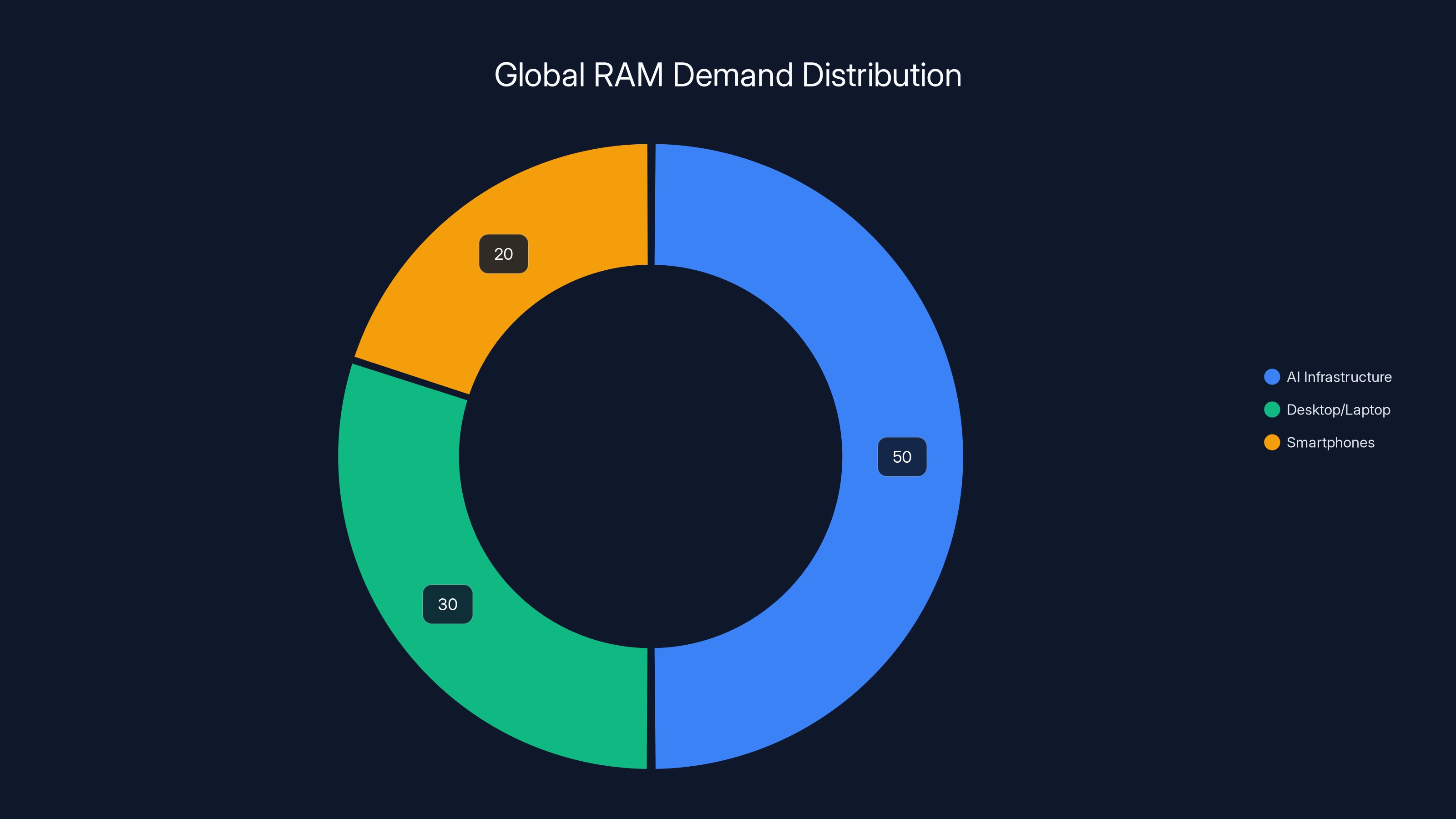

First, there's the AI infrastructure explosion. Data centers are ordering RAM in quantities that dwarf consumer demand. NVIDIA, Microsoft Azure, Google Cloud, and virtually every tech company scrambling to build AI capabilities are placing massive orders for high-bandwidth memory (HBM) and enterprise-grade DDR5 RAM. These orders are locked in with massive price premiums, which means manufacturers are incentivized to prioritize them.

Second, there's the desktop and laptop market heating up simultaneously. Apple's new Mac Book Pro lines are launching with aggressive memory configurations. Dell and Lenovo are both reporting that memory costs are driving up their average system prices. Everyone's upgrading their RAM spec sheets, and manufacturers are being forced to choose: do you allocate limited memory supply to consumer laptops or to a few high-margin enterprise deals?

Third, there's smartphone demand. The Galaxy S25 and other flagship phones released in early 2025 are shipping with 12GB, 16GB, and even 24GB of RAM. Every flagship phone now competes with handheld gaming devices for the same memory pools.

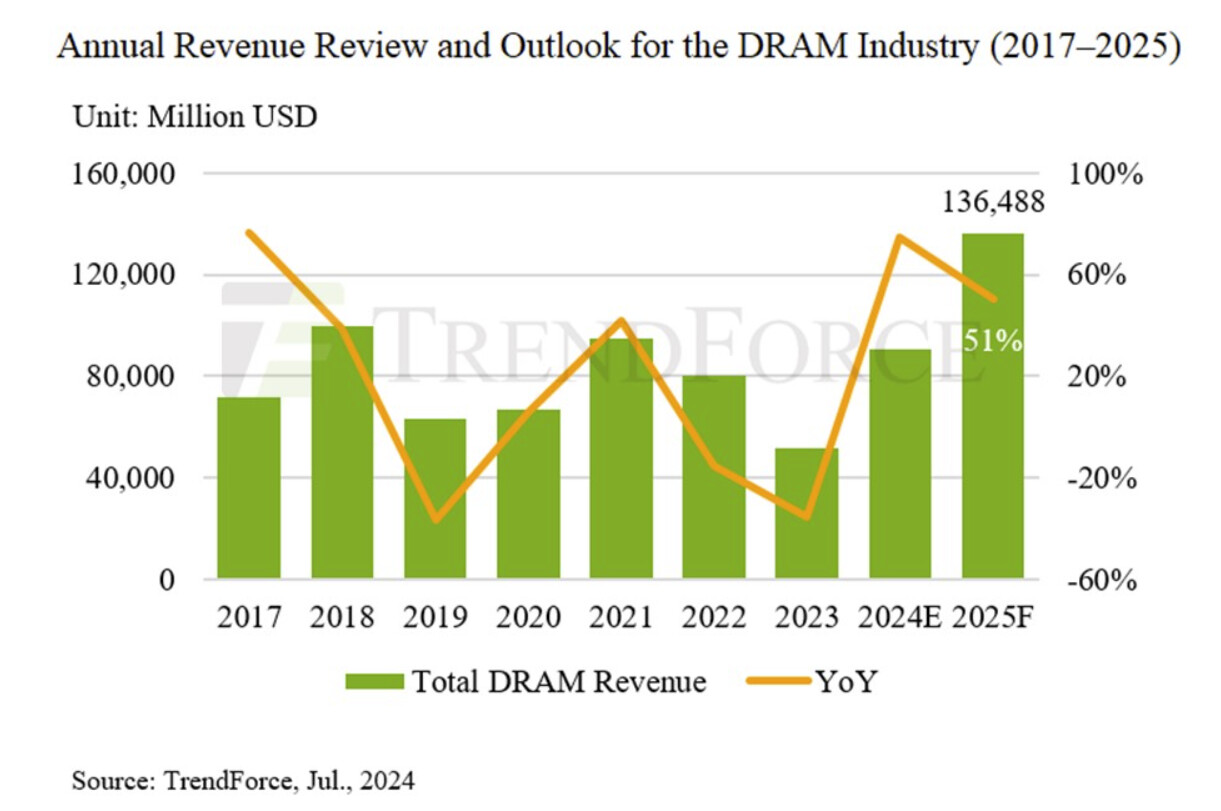

Historical Precedent: When Memory Crises Reshape Markets

This isn't the first time memory shortages have forced price adjustments across the consumer hardware market. Back in 2017-2018, when DRAM prices spiked due to demand from cryptocurrency mining operations and data center expansion, we saw similar patterns. Corsair, Kingston, and other memory manufacturers reported that their consumer product lines were being squeezed by enterprise demand. Laptop and desktop prices climbed across the board.

Then in 2021-2022, semiconductor shortages hit during the post-pandemic supply chain chaos. Everything from GPUs to SSDs became constrained. NAND flash storage, which the Ally X depends on for its 1TB drive, became particularly scarce and expensive.

What's different this time is the scale and the consolidation of demand. AI infrastructure buildout isn't like cryptocurrency mining—it's not a speculative bubble that might pop overnight. Companies are making multi-year commitments to purchase memory. They're locking in supply chains. And they're willing to pay premium prices to ensure they get what they need.

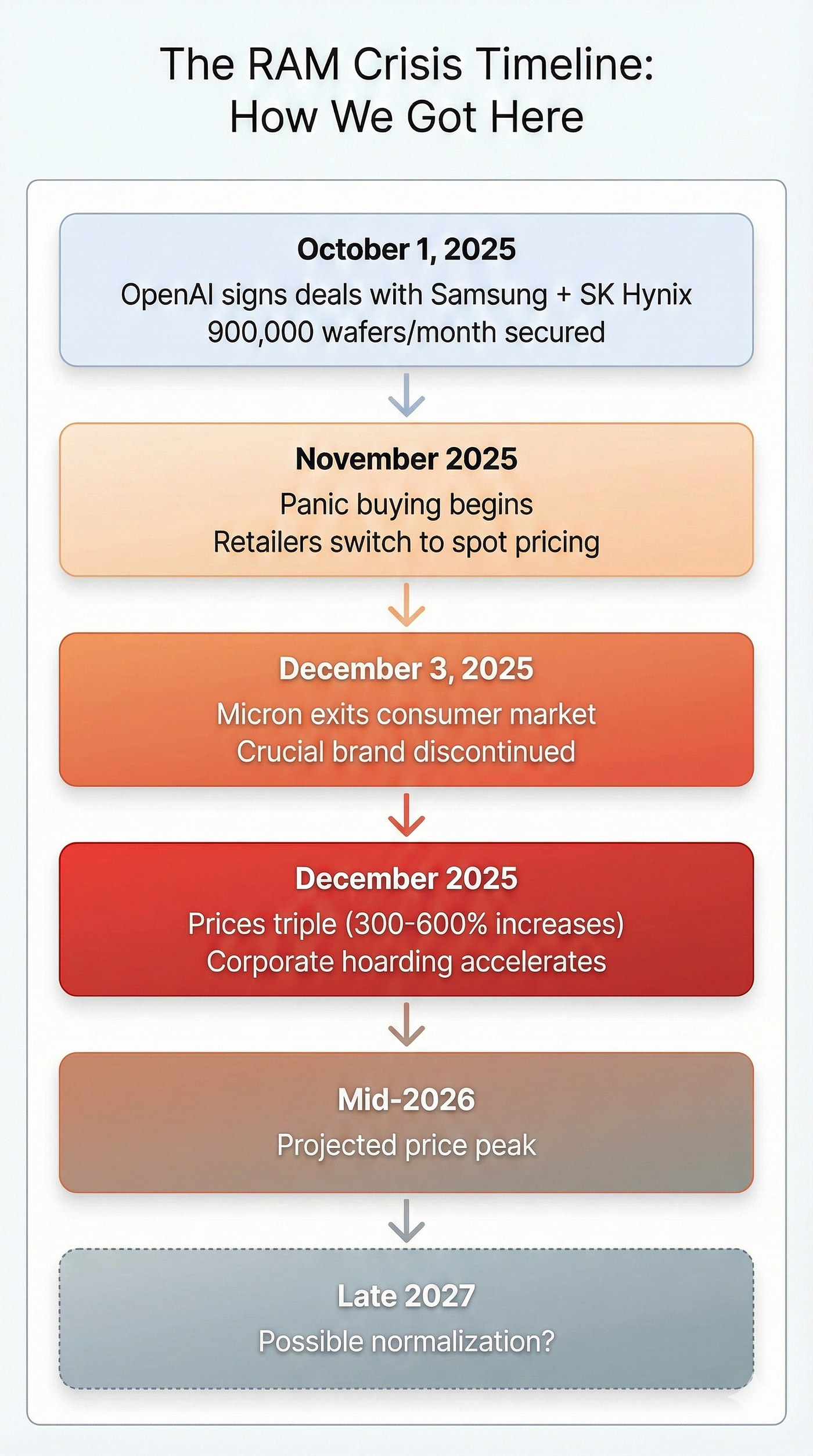

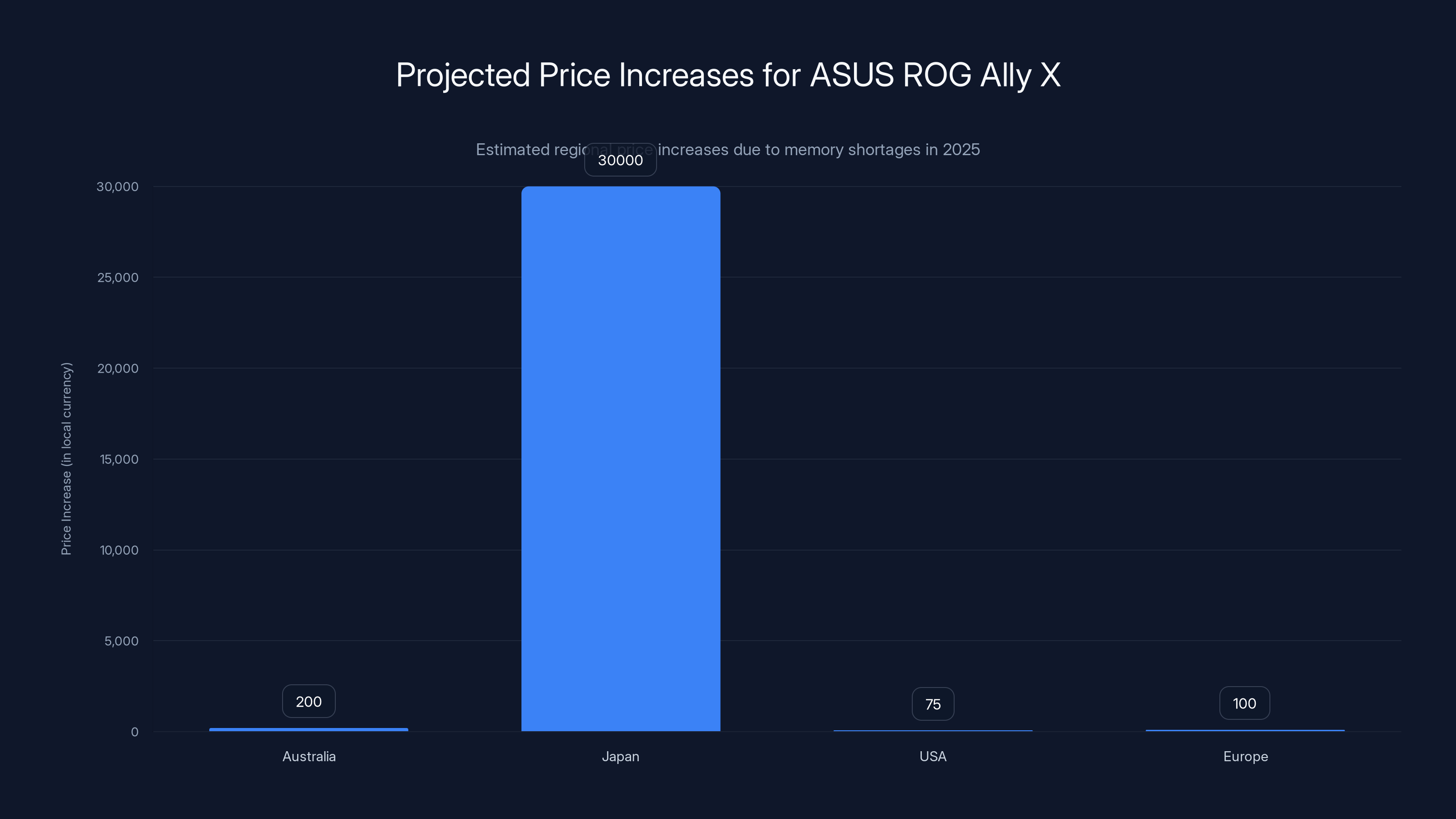

Estimated data shows that ASUS ROG Ally X prices are expected to increase by AU

The ASUS ROG Ally X Specifically: Why This Handheld Is Vulnerable

The 24GB RAM Differentiator

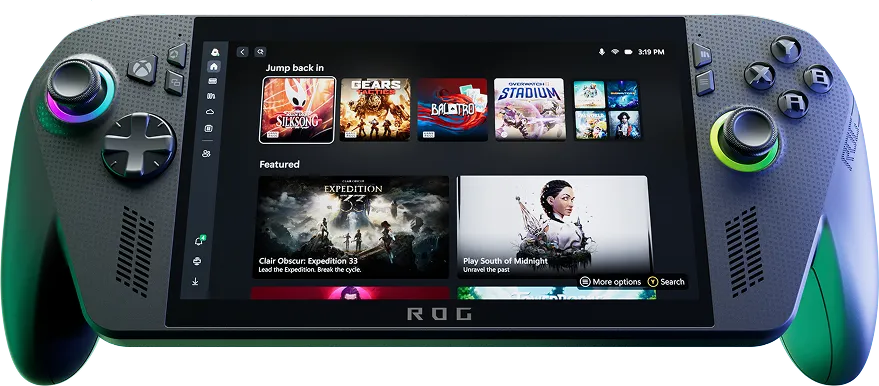

The Ally X's price increase is specifically tied to its memory configuration. At 24GB of RAM, the Ally X is aggressive for a handheld. That configuration was a bold choice when ASUS and Microsoft launched it.

Why 24GB? Gaming is only part of the equation. That memory capacity is intended to support cloud gaming scenarios, more complex GPU operations, and future-proofing against game demands scaling up. It's a specification designed to make the Ally X relevant for two-three years of upcoming software. But it also means the Ally X uses 8GB more memory than the base Ally—and in a supply-constrained environment, that 8GB difference translates directly to higher sourcing costs.

Manufacturers work with tiered memory pricing. A 16GB kit from a memory supplier costs X dollars. A 24GB kit doesn't cost X+Y dollars—it often costs more than that because it's a less common configuration and requires different component combinations. When memory becomes expensive, these cost curves get steeper.

The Storage Equation

The Ally X also includes 1TB of storage versus the base model's 512GB. That doubled storage capacity is another area where pricing has moved dramatically. NAND flash storage prices are tied partially to the same geopolitical factors affecting DRAM—semiconductor manufacturing capacity in Taiwan and South Korea, trade tensions, and competing demand from every electronics manufacturer on Earth.

When you bundle 24GB RAM plus 1TB storage together, you're talking about a device that's materially more expensive to source than it was six months ago. The AU$200 price increase in Australia? That's not profit margin expansion. That's ASUS and Microsoft passing through actual component cost increases to consumers.

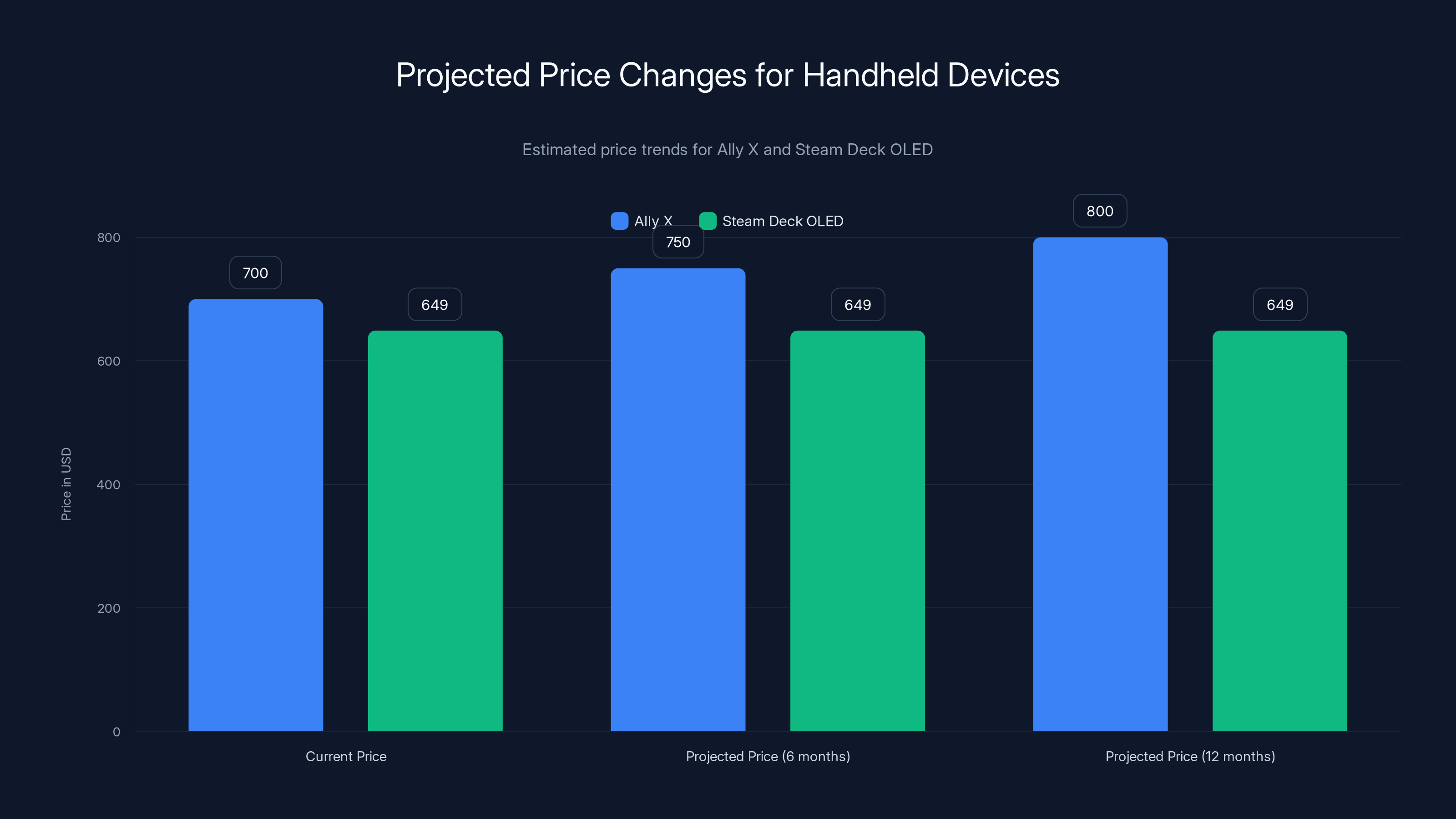

Estimated data suggests ASUS ROG Ally X prices could increase by $50-150 in Western markets by mid-2025 due to global supply constraints.

How This Connects to the Broader Hardware Ecosystem

The Steam Deck OLED Stock Situation

Valve's Steam Deck OLED has become intermittently out of stock in multiple regions despite being a proven, mature product. That shouldn't happen for a device that's been on the market for over a year. It shouldn't happen unless there's genuine supply constraint preventing Valve from fulfilling demand.

The Steam Deck OLED uses a custom AMD APU coupled with standard DDR5 memory. When you can't reliably source memory, you can't reliably manufacture the device. It's that simple.

Valve's strategy has been to gradually increase production and fill global supply. But a memory crisis doesn't work gradually—it works in waves. Valve gets an allocation of memory from its suppliers, builds devices, sells them, then has to wait for the next allocation. In between, the product goes out of stock.

Nintendo Switch 2 Implications

The Nintendo Switch 2 is launching into this environment. Nintendo reportedly pushed back some production schedules last year, and industry analysts have speculated about whether memory constraints played a role. If they did, then the Switch 2's launch inventory might be more limited than consumers expect. You might see artificial scarcity not because demand is insane, but because the device uses memory components that are tied up in other supply chains.

The Play Station 6 Delay Rumor

The speculation that Sony is considering pushing the Play Station 6 from 2027 to 2029 sounds like rumor, but it tracks with the memory crisis logic perfectly. If you're Sony and you're trying to decide whether to launch a new console in 2027, and you're seeing data center demand consuming memory supply and prices remaining elevated, you might strategically delay. Why launch a console into a supply constraint where you can't manufacture enough units and profit margins are squeezed?

Regional Price Adjustments: The Pattern We Should Expect

Why Australia First?

Australia is often the first market where manufacturers test price adjustments. The Australian consumer electronics market is large enough to be meaningful but small enough that pricing changes don't trigger immediate global conversations. It's a testing ground.

If ASUS and Microsoft increase Ally X prices in Australia without significant backlash, they gather data that suggests similar increases will work in other regions. Australian gaming forums matter, but they don't dominate global discourse like US or UK communities do.

Why Japan Second?

Japan is Nintendo's home market and a major handheld gaming region. Japanese consumers expect premium pricing for gaming hardware. They're more willing to accept price increases than markets where price competition is fiercer. It's another strategic region for testing.

Where Increases Are Coming Next

Based on these patterns, I'd expect to see Ally X price increases announced for:

- United Kingdom and Europe: Mid-2025, probably framed as a "regional adjustment due to component costs"

- Canada: Likely within 60-90 days of UK/EU increases

- United States: Potentially the last market to see increases, possibly bundled with some marketing narrative about new features or supply stabilization claims

The order matters. Companies roll out price increases in smaller markets first, observe the reception, then implement them in their largest markets last. By the time the US sees a price increase, it's already become normal in four other regions.

AI infrastructure is estimated to consume 50% of global RAM demand, driven by data center expansions. Desktop/laptop and smartphone sectors follow with 30% and 20% respectively. Estimated data.

The Financial Math Behind Component Cost Increases

How Memory Costs Flow Through to Retail Price

Let's do some math on what a AU$200 increase actually represents.

The ASUS ROG Ally X's Bill of Materials (BOM)—the cost of all components—is estimated to be around

If memory and storage costs increased by

Manufacturers typically absorb some cost increases through margin compression, then pass the rest to retail. If ASUS and Microsoft are passing through 100% of the memory cost increase (unlikely but possible in a tight supply situation), you'd expect roughly a 11-17% retail price increase. The AU

In other words, the AU$200 price increase represents ASUS and Microsoft saying: "We're not absorbing any of this cost increase. The supply constraint is real enough that we're passing it 100% to consumers." That's a strong signal about how tight component supplies actually are.

How This Differs from Previous Price Hikes

When console manufacturers increased prices in 2022 (Play Station 5, Xbox Series X), they framed it as addressing component and energy costs. But those increases happened after already-sold-out demand, during a time when supply was supposedly increasing. The price hikes felt like profit-taking.

This time feels different. The Ally X wasn't in crazy high demand before the price increase. The announcement of a price increase doesn't suggest supply is loosening—it suggests supply is still broken. This is the behavior of a manufacturer protecting margins while dealing with real supply constraint, not artificial scarcity pricing.

The AI Infrastructure Demand Problem

Why AI Training Consumes So Much Memory

Large language models and other AI systems require enormous memory footprints. A single training run of a frontier model like Claude 3 or GPT-4 requires thousands of GPUs with high-bandwidth memory. Each GPU has 24GB to 80GB of memory. The math gets ugly fast.

Then there's inference—running the model for actual users. Every user query to Chat GPT or Claude requires that the model stay in memory. At scale, with millions of concurrent users, data centers need absurd amounts of memory just to keep latency reasonable.

The Supply Allocation Problem

Memory manufacturers like SK Hynix and Samsung have to allocate limited production capacity. They can produce:

- High-bandwidth memory for AI infrastructure (sells for premium prices, enormous order quantities)

- Consumer DDR5 RAM (mid-range pricing, large order quantities)

- NAND flash storage (various capacities and speed tiers)

- Memory for mobile devices

- Legacy memory products

They have to decide how much of their fabrication capacity goes to each category. When AI infrastructure demand is exploding and those customers are willing to pay premium prices, the supply curve bends toward enterprise.

Estimated data shows Ally X prices are likely to increase over the next year, while Steam Deck OLED prices remain stable due to cost absorption by Valve.

Impact on Console and Handheld Gaming Markets

The Pricing Power Question

Here's the really interesting question: does a price increase on the Ally X actually hurt sales, or does it have enough brand loyalty and differentiation to absorb the increase?

The Ally X is the only high-end Windows-based handheld currently available in meaningful quantities. The Pimax Portal and other alternatives are either not widely distributed or lack the game compatibility. If you want a handheld that plays full Windows games and runs Steam natively, the Ally X is basically your only mainstream option.

That gives ASUS and Microsoft some pricing power. Consumers might grumble about the AU$1,799 price, but if it's the only option in that performance category, some will still buy.

Compare that to the Steam Deck, which has direct competition from newer handhelds and can't increase price as aggressively without losing market share to alternatives.

The Domino Effect on Other Devices

When one manufacturer increases prices due to component costs, it creates a sort of floor beneath the market. Other manufacturers can claim "well, component costs are up, so we're raising prices too." It becomes cover for across-the-board price increases.

Watch for Steam Deck OLED pricing to potentially increase in regions where it hasn't already been hiked. Watch for Nintendo Switch 2 pricing (whatever it is) to potentially increase at launch or shortly after. Watch for gaming laptop pricing to climb further. The Ally X price increase doesn't exist in isolation—it's the first domino in what might be a 6-12 month wave of gaming hardware price increases.

Scalping and Secondary Market Implications

Why Memory Shortages Encourage Scalping

When official retail prices increase to

Scalpers watch for price inconsistencies across regions and channels. If the US price stays at

The Steam Deck OLED Stock Scenario

Valve's intermittent Steam Deck OLED stock situation actually discourages scalping because the product keeps coming back in stock. If something's perpetually out of stock, resale prices climb. But if it goes in and out of stock unpredictably, resellers can't reliably profit. The stock situation is annoying for consumers but actually beneficial for MSRP.

If the Ally X gets harder to find due to memory allocation problems, secondary market prices will increase. People willing to pay AUD

The ASUS ROG Xbox Ally X experienced a significant price increase due to a global memory and storage crisis, with a AU$200 increase in Australia and a 30,000 yen increase in Japan.

Predictions for the Remainder of 2025

Memory Pricing Trajectory

Memory prices are unlikely to decrease significantly before mid-to-late 2025. The AI infrastructure buildout has multi-year horizons. Data centers are locked into long-term memory contracts. Consumer electronics manufacturers will face supply constraints for handheld gaming, laptops, and other memory-heavy devices through at least Q3.

There's a possibility of some relief in Q4 when some new memory fabs come online and previous orders get fulfilled, but that relief might be partial and temporary.

Expected Regional Price Increases

International Ally X price increases in the US and Europe are likely by late Q2 or early Q3 2025. I'd estimate

Competitor Responses

Valve will probably hold Steam Deck OLED pricing but might face ongoing stock challenges. Nintendo might use memory constraints as justification for a higher Switch 2 launch price than industry analysts predicted. Sony might indeed delay PS6 launch into 2028 or 2029 territory.

What Consumers Should Do Right Now

If You're Considering an Ally X Purchase

The honest analysis: prices are likely going up, not down. If you're interested in a high-performance Windows handheld, waiting probably means paying more later. The only scenario where waiting makes sense is if you're hoping for a new product launch that offers better value—like Lenovo or another manufacturer releasing a Windows handheld competitor. That could theoretically create pricing pressure on ASUS.

But that's not guaranteed. You might wait six months and find the Ally X costs even more, with no new alternatives available.

If You're A Steam Deck Person

The Steam Deck OLED at its current $649 price is relatively insulated from increases because Valve has already absorbed some cost increases. But stock will probably remain intermittently tight. If you want a Steam Deck OLED, check your regional store consistently. It'll likely be back in stock periodically throughout 2025.

General Handheld Shopping Strategy

Base models with 512GB storage and 16GB RAM might offer genuinely better value than higher-tier configurations right now. The cost curve for upgrading storage and memory has become much steeper due to supply constraints. You might be better off buying a base model and upgrading storage with a fast Micro SD card if you need more space.

The Bigger Picture: Why This Matters Beyond Gaming

The Cost of AI Infrastructure

When consumers pay AU

Supply Chain Fragility

The entire electronics industry has become dependent on a handful of memory manufacturers and foundries in Asia. Taiwan, South Korea, and Japan produce the vast majority of global memory capacity. Any disruption to those supply chains—geopolitical tension, natural disaster, manufacturing problems—cascades through consumer electronics pricing worldwide.

The Ally X price increase is a visible symptom of a deeper fragility in global supply chains. It's a reminder that consumer electronics pricing is ultimately determined by industrial production constraints thousands of miles away.

The AI Bubble Risk

If AI infrastructure investment slows down—if the current AI boom doesn't deliver returns on investment as quickly as investors hope—memory demand from data centers could drop precipitously. That would flood the market with available memory supply, potentially causing memory prices to crash.

When that happens (if it happens), we might see handheld prices drop rapidly. Consumers who bought at AU

Expert Insights and Industry Context

Memory Market Forecasts

Industry analysts tracking memory pricing have noted that the current supply tension is unprecedented in its specificity. Previous memory shortages affected entire market segments uniformly. This shortage is concentrated in high-performance memory used by data centers and AI infrastructure, creating this weird situation where some memory types are in abundance while others are scarce.

Manufacturer Positioning

ASUS and Microsoft's decision to implement the price increase without massive marketing justification is strategic. They're not trying to hide it or make excuses. They're stating it as fact: supply changed, price adjusted. This matter-of-fact approach suggests they expect other manufacturers will follow, normalizing the new price structure.

That's different from how companies approached the 2022 console price increases, which came with detailed explanations about energy costs and component supply. This time, it's just: prices go up. Supply is tight. Business as usual in a supply-constrained environment.

FAQ

Why is the ASUS ROG Ally X getting price increases?

The price increases on the ASUS ROG Ally X are directly tied to global memory and storage shortages. The Ally X's 24GB of RAM and 1TB storage configuration has become more expensive to source due to competing demand from AI infrastructure, data centers, and other electronics manufacturers. Memory manufacturers are prioritizing high-margin enterprise orders over consumer products, creating scarcity in consumer-grade components.

How much will the ASUS ROG Ally X cost in other regions?

Based on the pattern of increases in Australia (AU

Is now a good time to buy the ASUS ROG Ally X?

If you're interested in a high-performance Windows handheld, purchasing before additional price increases occur is probably the better financial decision. Waiting is unlikely to result in price decreases given the current supply environment, and regional price increases are expected to roll out through 2025. However, if you're flexible on specs, a base-model Ally with 16GB RAM might offer better value than the premium-priced Ally X.

How does the memory shortage affect other gaming handhelds?

The memory shortage affects all gaming handhelds that use similar components, though impacts vary by device. The Steam Deck OLED has experienced intermittent stock shortages despite being a mature product, indicating supply constraints. Nintendo Switch 2 launches into this constrained environment, potentially affecting launch inventory and pricing. The shortage broadly increases manufacturing costs for any device using consumer-grade DDR5 memory or NAND flash storage.

Why do handheld manufacturers prioritize the Ally X for price increases?

Manufacturers typically increase prices on their highest-tier, highest-margin products first because these segments are less price-sensitive. Consumers choosing between a base Ally X at

When will memory prices stabilize?

Memory prices are unlikely to show significant decreases before mid-to-late 2025, depending on how aggressively AI infrastructure buildout continues and whether new memory manufacturing capacity comes online. Some relief might appear in Q4 2025 when additional fabs from Samsung and SK Hynix ramp production, but stabilization might take into 2026. If AI infrastructure investment slows, memory prices could crash relatively quickly, potentially making current-price purchases look expensive in retrospect.

Should I wait for the Nintendo Switch 2 or buy an Ally X now?

This depends on your gaming preferences and budget. The Switch 2 will focus on Nintendo's first-party game library and will likely be cheaper than the Ally X. The Ally X excels at playing full PC games and leveraging your existing Steam library. If you want Nintendo exclusives, wait for Switch 2. If you want the broadest game library compatibility and don't mind Windows, the Ally X is compelling despite the higher price—but expect to potentially find it cheaper in other regions before global prices normalize upward.

How does the memory shortage connect to AI?

Data centers building AI infrastructure (servers for Open AI, Anthropic, Google, Microsoft, etc.) are ordering memory in unprecedented quantities. These enterprise customers receive priority allocation from memory manufacturers because they're willing to pay premium prices and commit to large, long-term orders. This leaves limited consumer-grade memory available for devices like the Ally X, causing shortages and price increases in the consumer market.

Conclusion: The Real Story Behind the Numbers

The ASUS ROG Ally X price increases in Australia and Japan aren't flukes or regional anomalies. They're the visible manifestation of a global supply crisis that's reshaping electronics pricing across every segment. When you strip away the details, here's what's actually happening:

Memory is expensive right now because the world is simultaneously trying to build AI infrastructure at massive scale while also launching new consumer devices that use similar components. There simply isn't enough memory available to satisfy everyone at the prices manufacturers and consumers were expecting six months ago.

ASUS and Microsoft made a business decision: pass the cost increases through to consumers via the Ally X price hike. They couldn't absorb the costs without crushing margins, and they couldn't increase production without more available memory. So they did what any company facing a supply constraint does—they raised prices.

Will this pattern repeat in other regions? Almost certainly. The economic logic that justified price increases in Australia and Japan applies equally to Europe and North America. Expect Ally X prices to increase $50-150 across most Western markets by mid-2025. Expect competitors to follow suit with their own adjustments. Expect the entire handheld gaming market to shift upward by roughly 10-15% before supply constraints ease.

The broader lesson is less comforting: consumer electronics pricing is increasingly determined by factors completely outside consumers' control. Global supply chains, geopolitical tensions, data center buildout, and industrial allocation decisions in Asia all feed into what you pay for a gaming handheld in Australia or Europe. Understanding those hidden factors is the only way to make informed purchasing decisions.

If you're shopping for a handheld, don't expect prices to fall. They probably won't until memory supplies genuinely loosen up, and there's no guarantee that happens in 2025. Buy when you're ready to use the device, not when you think prices might drop. And watch regional pricing carefully—sometimes waiting a few weeks and importing from a different market can save you significant money while the global price structure continues adjusting.

The RAM crisis is real. The price increases are just beginning. And they're coming to a region near you soon.

Key Takeaways

- ASUS ROG Ally X prices jumped AU$200 in Australia and 30,000 yen in Japan due to memory and storage component shortages

- The 24GB RAM and 1TB storage configuration in the Ally X is specifically targeted by cost increases, while base models remain at original prices

- Global AI infrastructure buildout is consuming memory supply at unprecedented scales, prioritizing data center demand over consumer products

- Regional price increases typically roll out in waves starting with smaller markets like Australia and Japan before reaching North America and Europe

- Expect similar price increases across all gaming handhelds, laptops, and consumer electronics through mid-to-late 2025 as memory supplies remain constrained

- Component cost analysis shows the AU$200 increase represents roughly 11-17% of material costs being passed directly to consumers without manufacturer margin absorption

- Memory shortages are creating stock challenges for competitors like Steam Deck OLED and threaten Nintendo Switch 2 launch availability and pricing

- The supply constraint is structural and tied to Taiwan and South Korea manufacturing capacity bottlenecks, likely to persist through Q3-Q4 2025

- Secondary market and gray import pricing may offer temporary savings before global price normalization occurs across regions

Related Articles

- RAM Shortage 2026: Why Your Devices Will Cost More [2025]

- Skyrim Switch 2 Patch Fixes Performance Issues with 60FPS Mode [2025]

- Best Portable Bluetooth Speakers [2026]

- How Long Do You Keep Your Phone Before Upgrading? [2025]

- Agentic AI & Supply Chain Foresight: Turning Volatility Into Strategy [2025]

- Steam Deck Out of Stock: RAM Shortage Impact [2025]

![ASUS ROG Xbox Ally X Price Hike: The RAM Crisis Impact [2025]](https://tryrunable.com/blog/asus-rog-xbox-ally-x-price-hike-the-ram-crisis-impact-2025/image-1-1771511996350.jpg)