RAM Shortage 2026: Why Your Devices Will Cost More

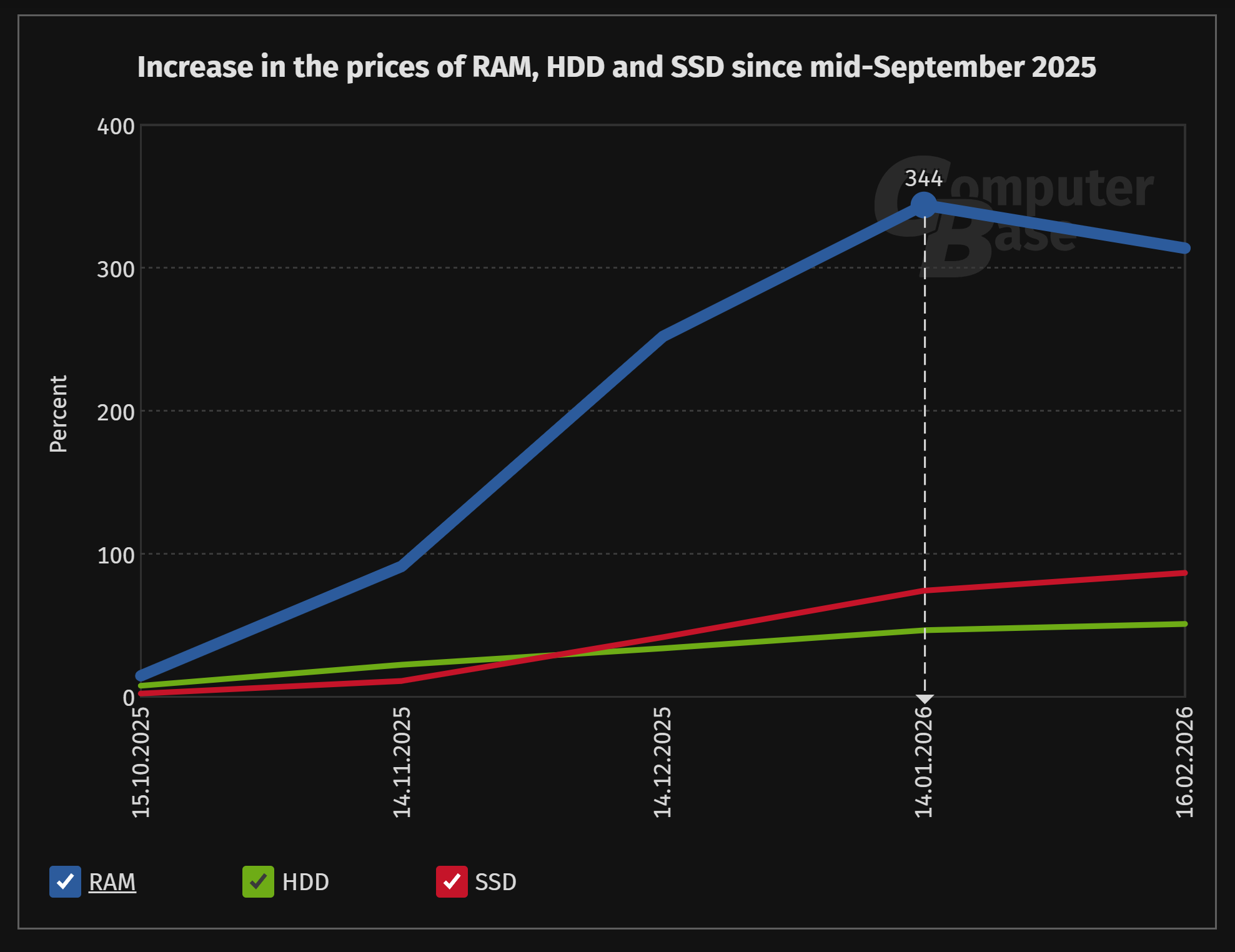

You've probably heard the headlines. RAM prices have tripled. Quadrupled. In some cases, sextupled. AI companies are hoovering up memory chips faster than manufacturers can produce them, and the shortage is only getting worse.

But here's what most people miss: this isn't just about desktop computer builders anymore. This is about your phone. Your next laptop. Your gaming console. Your router. Everything.

If you're planning to buy almost any device in 2026, you should expect to pay more. If you're not planning to buy, well, you'll still feel it indirectly. Because when millions of people across the world are forced to spend more on upgrades, that ripples through entire economic chains. Less discretionary spending elsewhere. Companies cutting costs in other areas. Delayed product launches. Canceled projects.

The RAM crisis is real. It's here now. And it's about to hit you in ways you probably haven't considered.

TL; DR

- RAM prices have tripled to sextupled depending on chip type, with AI companies consuming massive quantities

- Phones will get 8% more expensive on average, with budget phones seeing even steeper price hikes

- Flagship phones will stagnate at 12GB RAM instead of upgrading to 16GB, giving you less for your money

- Consoles, laptops, routers, and AI devices will all face shortages, delays, or higher costs through 2026

- Only three companies produce most RAM, and they're all prioritizing AI demand over consumer devices

- No immediate relief is coming manufacturers won't restore normal supply until late 2026 or beyond

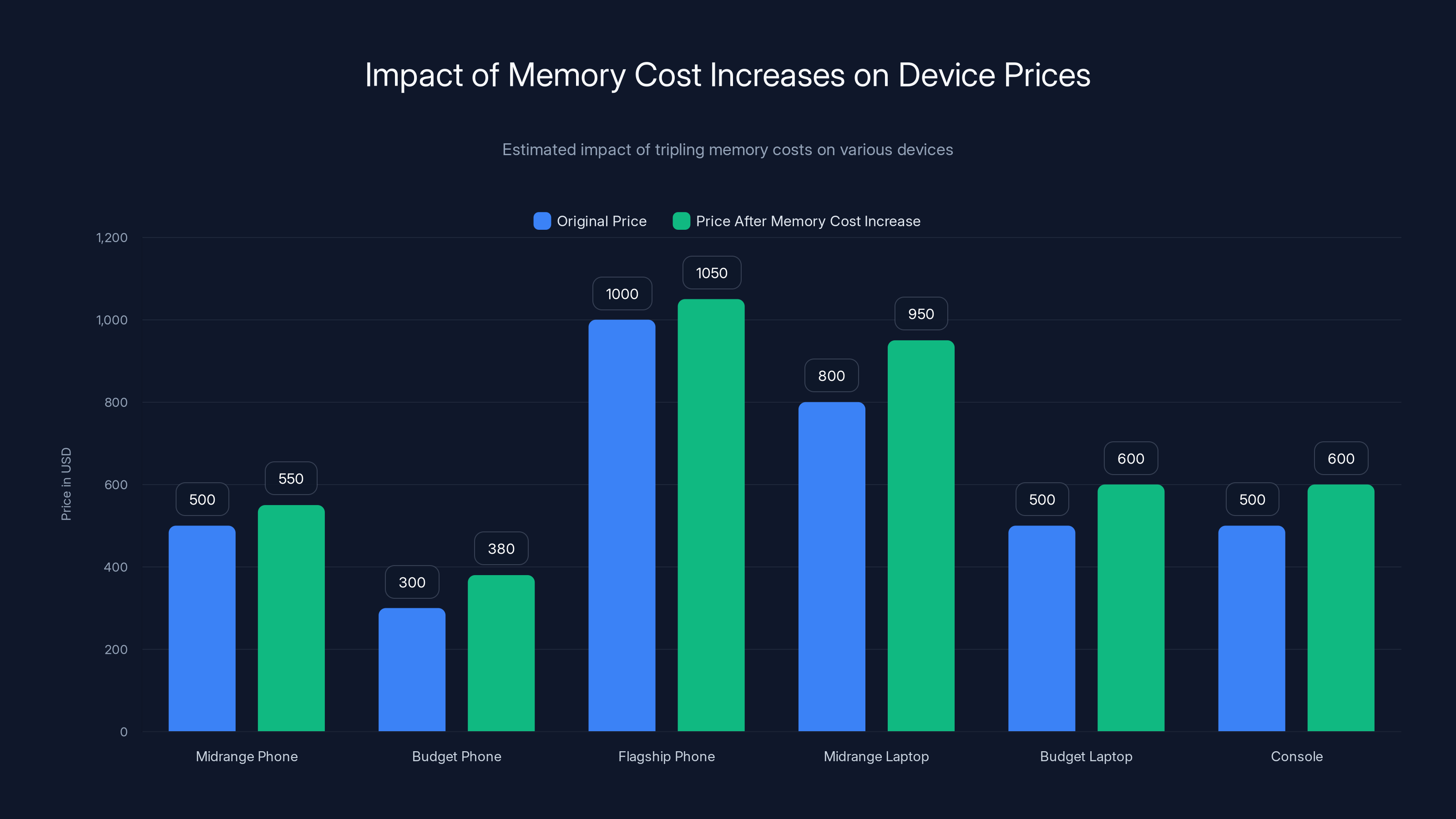

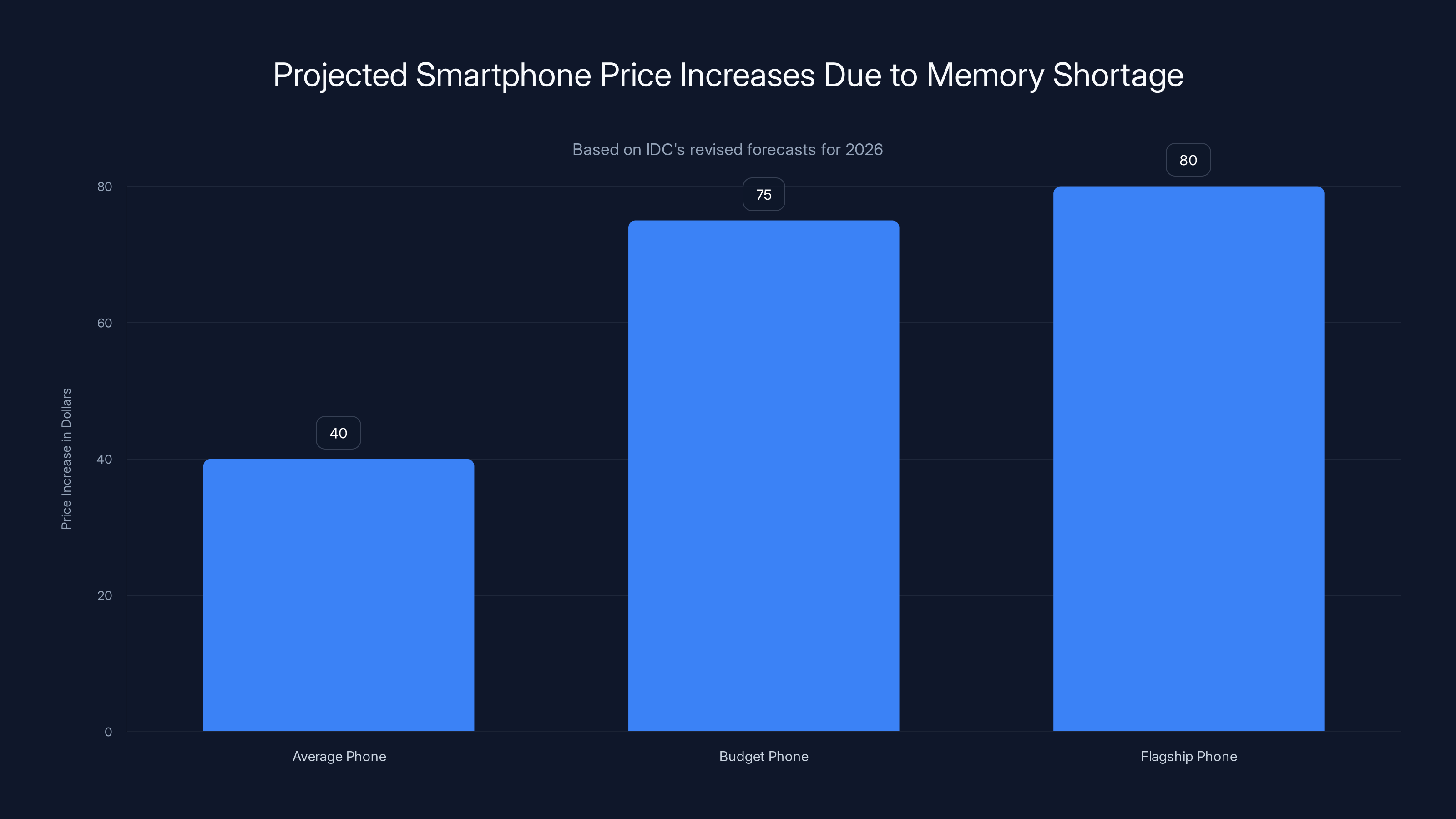

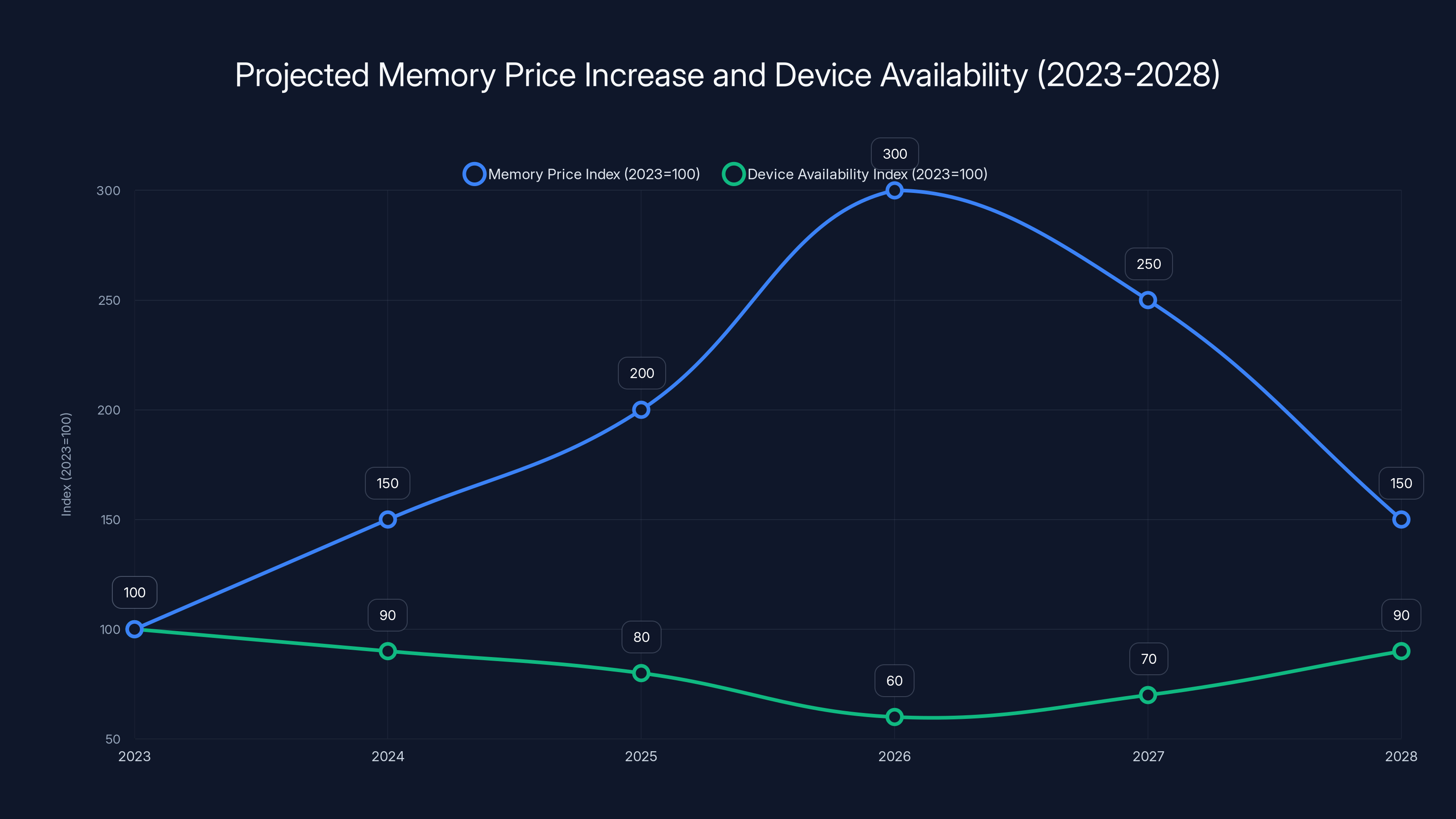

Estimated data shows that tripling memory costs can lead to significant price increases across devices, with budget phones and laptops being the most affected.

Understanding the RAM Crisis: Why This Matters More Than You Think

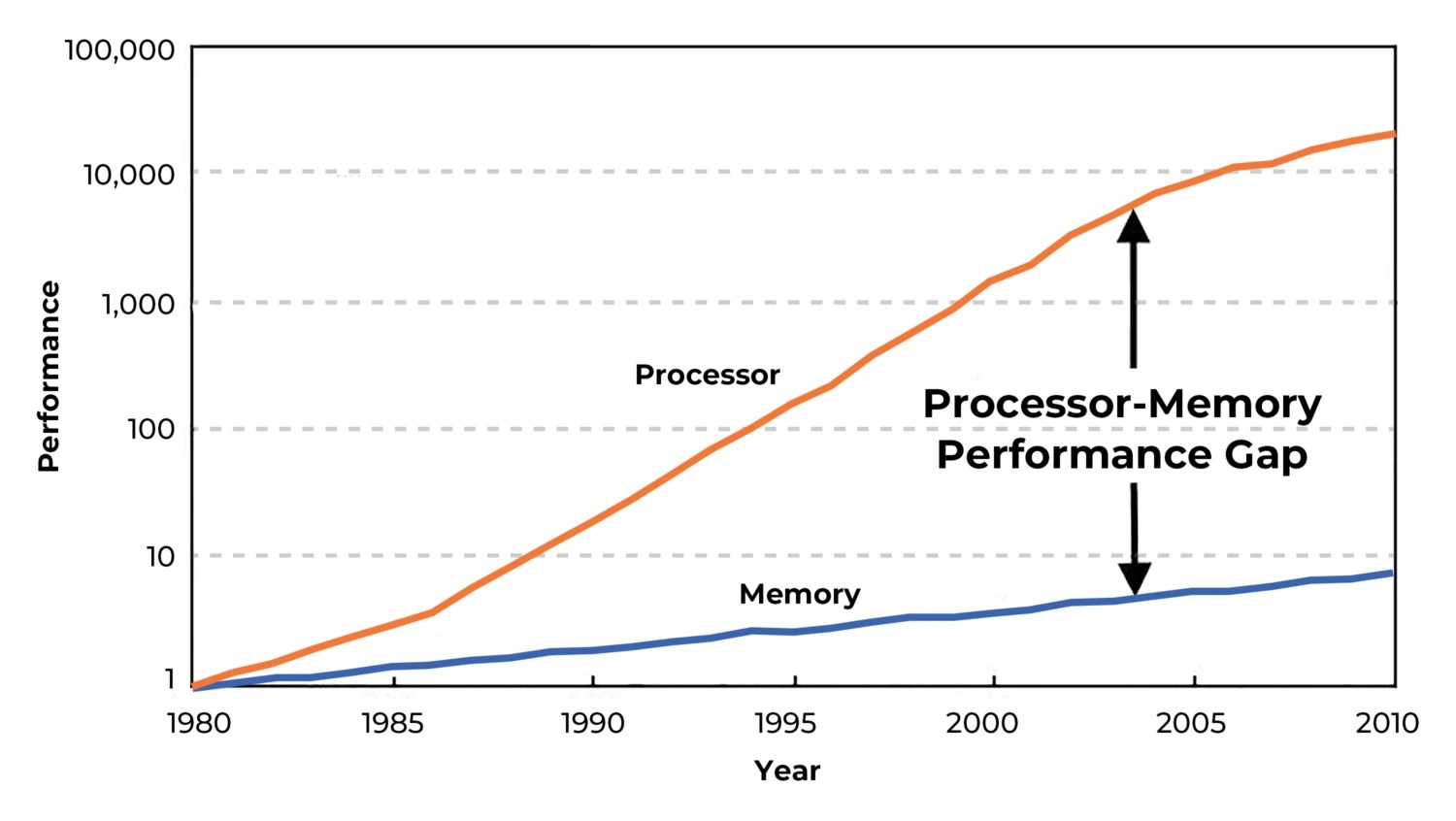

RAM is the short-term memory of any device. It's what lets your phone juggle apps, your laptop handle browser tabs, your console render graphics in real-time. Without sufficient RAM, devices slow down, crash, or fail completely.

For decades, RAM was cheap and abundant. Manufacturers packed more of it into devices without significant cost increases. Competition kept prices low. Supply exceeded demand most years.

Then AI happened.

Companies like OpenAI, Google, Meta, and Amazon started building massive data centers filled with GPUs and specialized chips that needed obscene amounts of RAM. We're talking about millions of gigabytes per facility. A single large language model training run can consume more memory than all the phones produced in a year combined.

Suddenly, demand skyrocketed. And supply couldn't keep up.

The problem is structural. Memory production is controlled by three major manufacturers: SK Hynix, Samsung, and Micron. These companies decide where to allocate their production capacity. They can make DRAM for consumer laptops, or LPDDR5X for phones, or HBM (high-bandwidth memory) for AI chips. There's limited capacity overall, and right now, AI is paying premium prices.

Why wouldn't they prioritize it? AI companies are spending billions on memory. They're not price-sensitive. They need it now. Meanwhile, phone manufacturers are used to negotiating hard on pricing and waiting for inventory. The choice is obvious from a business perspective.

But that choice cascades through the entire technology ecosystem.

How Severe Is the Shortage Actually?

Let's talk numbers, because this gets real fast.

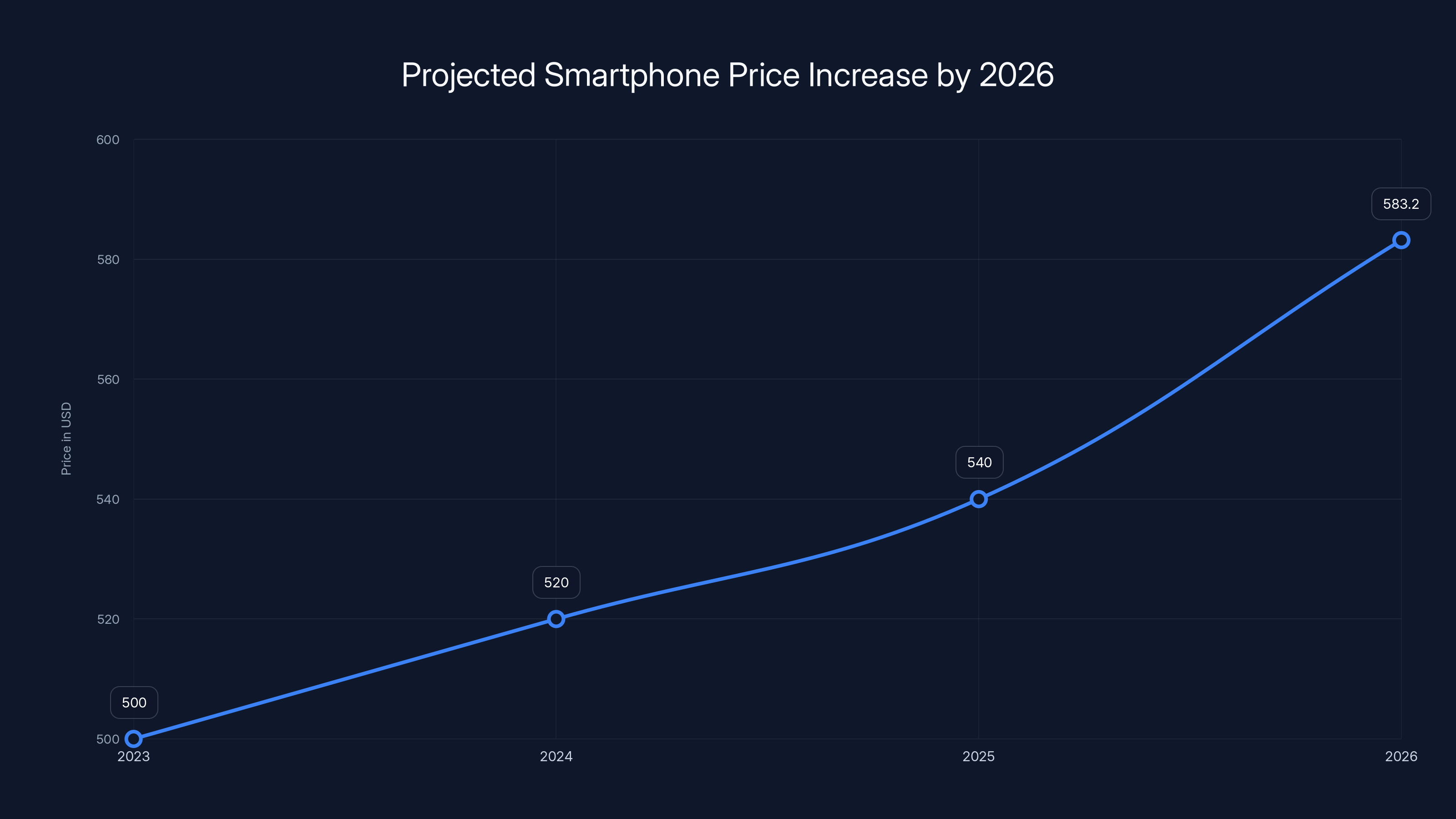

IDC researchers have been tracking this closely. When the shortage first became obvious in late 2024, they predicted phone prices might increase by about $9 per device on average. That seemed manageable, right? A minor bump.

Then reality set in. As the shortage intensified, IDC revised their forecast. Now they're predicting an 8 percent average price increase for smartphones in 2026. On a

We're talking about phones that used to cost

And that's just the phones themselves. The real disaster is what manufacturers are doing to offset memory costs. Since they can't get enough RAM, they're making strategic cuts:

Stagnant specs despite higher prices. Qualcomm, the dominant smartphone chipmaker, warned that flagship phones in 2026 will likely stick at 12GB of RAM instead of upgrading to 16GB. You're paying more for the same specs as last year.

Fewer phones overall. Qualcomm's CEO explicitly said that OEMs (phone manufacturers) are reducing their build plans. They're making fewer phones because they can't source enough memory. That means less competition, less choice, and higher prices for the units that do exist.

Premium consolidation. Cheaper models are getting axed entirely. Manufacturers are shifting focus to high-margin premium phones because they need the profit to offset memory costs. Budget-conscious buyers are getting priced out of the market.

Omdia research manager Le Xuan Chiew summed it up perfectly: vendors are "prioritizing profitability while expanding alternative revenue streams." Translation: expect fewer phones, higher prices, and more pressure to buy accessories and services.

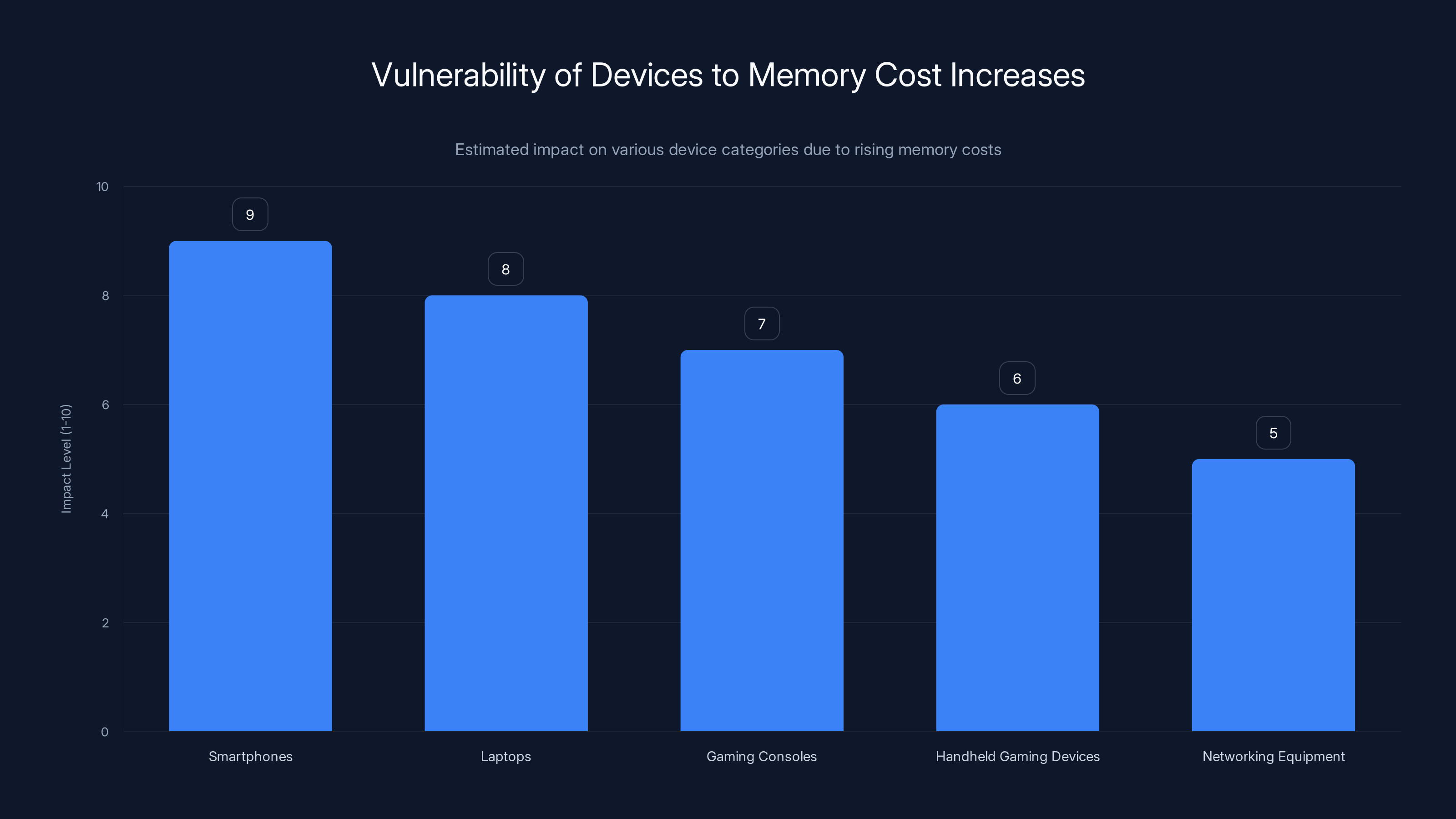

Smartphones are the most vulnerable to rising memory costs, followed by laptops and gaming consoles. Estimated data based on current trends.

Which Devices Are Most Vulnerable?

Pretty much everything. But some categories will get hit harder than others.

Smartphones (most vulnerable). This is the canary in the coal mine. Memory represents 15 to 20 percent of a midrange phone's material cost, and 10 to 15 percent of a flagship. When that component doubles or triples in price, manufacturers have two choices: eat the cost or pass it to consumers. They're choosing the latter.

Google just launched a Pixel 10A with zero improvements and the same mediocre 8GB of RAM as its predecessor. Even Apple, which typically bullies suppliers on pricing, is feeling pressure. The company can't even maintain its usual supply chain dominance when AI companies are writing checks for billions of dollars worth of memory.

Laptops (heavily impacted). A laptop needs 8GB to 32GB of DRAM depending on the model. High-end workstations need even more. Manufacturers have already started raising prices. Expect to pay

Gaming consoles (severe delays likely). The Play Station 6 has been rumored for 2028, but many analysts now expect a 2029 launch because of memory availability. Nintendo and Xbox are facing similar pressures. Consoles need fast, specialized memory, and there's not much of it available right now. If you're waiting for next-gen gaming, prepare for a longer wait than usual.

Handheld gaming devices. The Steam Machine, Valve's rumored handheld, faces reported delays. Competitors like the ROG Ally and similar devices are also scarce. These require low-power memory that's especially contested in the AI era.

Networking equipment (underrated impact). Your router, your modem, your Wi Fi 6E access points all need memory. ISPs are facing shortages on rental equipment. If you need a new router in 2026, either buy before the shortage peaks or expect to wait months and pay premium prices if you're renting from your provider.

Automotive systems (sneaky impact). Modern cars have computers everywhere. Infotainment systems, driver assistance features, EV battery management, navigation. As vehicles become more sophisticated, they need more RAM. Electric vehicle manufacturers are especially impacted because they need cutting-edge memory for autonomous driving systems.

Smart home devices (broader than you'd think). AI companies aren't just buying memory for cloud services. They're also embedding AI directly into consumer devices. Smart speakers, security cameras, smart displays all need more memory to run local AI models. Expect less availability and higher prices on these categories too.

Why Only Three Companies Control This Mess

This is the fundamental problem that makes the shortage so severe: SK Hynix, Samsung, and Micron produce roughly 95 percent of all DRAM globally. There are no meaningful competitors. There's no "just switch to another supplier" option.

This consolidation happened over decades. Smaller manufacturers couldn't compete on price and scale, so they exited the market. What's left is a duopoly with one strong third player.

Under normal circumstances, this isn't catastrophic. Competition between the three keeps prices reasonable, and all three have incentive to maximize production because volume drives profit. But the AI boom broke that equilibrium.

When customers are willing to pay 5x or 10x the normal price for memory, manufacturers are rational to prioritize those customers. AI companies need massive amounts of HBM, which is expensive to produce but generates premium margins. Meanwhile, consumer DRAM is commoditized and competitive. Why make cheap, high-volume RAM when you can make expensive, high-margin AI memory?

SK Hynix is particularly focused on AI. The company has stated publicly that it's reallocating capacity from consumer products toward HBM and enterprise memory. Samsung is doing the same. Micron is slightly more balanced, but still shifting significantly toward high-margin products.

The companies claim they're ramping production overall. And they are. But ramping is slow. Building new fabs takes 5 to 7 years and costs billions of dollars. You can't just flip a switch and manufacture more memory next quarter. New capacity coming online in 2027 might help, but 2026 will be brutal.

The Price Mechanics: How This Translates to Your Wallet

Memory costs cascade through device pricing in predictable ways, but the impact varies by product category.

Smartphone pricing model. A midrange phone (around

Budget phones are worse. A

Flagship phones are slightly insulated because they have more margin to work with. But they're not immune. You're still getting stagnant specs at higher prices because memory availability is the constraint.

Laptop economics. High-end laptops need 32GB or 64GB of RAM. That's

This is especially brutal because laptop manufacturing has thin margins compared to phones. A manufacturer might make only

Console economics (the worst case). A console like PS5 has roughly

This is also why next-gen consoles are getting delayed. Publishers and manufacturers won't launch without healthy margins because consoles are sold at near-cost or slight loss as a strategy to drive software sales. If you're already losing money on hardware, you need that software margin to be substantial.

Smartphone prices are expected to increase by approximately 8% annually, reaching an average of $583.2 by 2026. Estimated data based on IDC predictions.

Qualcomm's Warning: A Bellwether for the Entire Industry

Qualcomm is the most important bellwether here because the company sits between memory manufacturers and phone OEMs. When Qualcomm talks about the market, it's speaking from a position of unique visibility.

At its February 2025 earnings call, CEO Cristiano Amon was blunt: "Unfortunately, I think that the whole sector is impacted by memory."

He continued: "Industry-wide memory shortage and price increases are likely to define the overall scale of the handset industry through the fiscal year."

Translation: The entire phone industry is being constrained by memory availability in 2026. Fewer phones will be sold. The phones that are sold will be more expensive. That's not speculation. That's what the data is showing.

Amon also noted that OEMs are taking action: "OEMs are very likely to prioritize premium and high-tier," essentially saying manufacturers are abandoning budget and mid-range categories to focus on higher-margin products.

The company's CFO added another piece: "We've seen several OEMs, especially in China, take actions to reduce their handset build plans and channel inventory." In other words, manufacturers are preparing for scarcity by reducing production and trying to manage what limited inventory they can secure.

This matters because Qualcomm isn't trying to scare anyone. The company makes money on every chip sold, regardless of price. If anything, higher prices are good for Qualcomm because it means higher-margin devices. Amon is being candid because the situation is that severe.

The Apple Pressure Point

Even Apple, the company that famously bullies suppliers and maintains tight control over its supply chain, is feeling the pressure.

Apple has historically been able to negotiate better prices than competitors because of its scale and supplier leverage. The company dictates terms. Suppliers either agree or lose Apple's business, which is massive.

But you can't negotiate AI money away. When Samsung or SK Hynix can sell memory to an AI company at 10x the standard price, Apple's negotiating power doesn't matter. The supplier is rationally choosing the AI buyer.

This is why Apple hasn't been able to maintain its usual aggressive price positioning. The company is being forced to accept higher component costs, which means either accepting lower margins or raising prices. Apple always chooses to raise prices.

When Apple struggles with supply chain leverage, every other manufacturer is in an even worse position. If the world's most powerful tech company can't force suppliers to prioritize its needs, nobody can.

What About Samsung, SK Hynix, and Micron's Expansion Plans?

All three major manufacturers have announced capacity expansions. The question is whether those expansions will arrive in time to help, or whether they'll just be too late.

SK Hynix is building new fabs in South Korea and investing in existing facilities. The company has stated it wants to increase overall production, but it's specifically emphasizing HBM and enterprise memory. Consumer DRAM is the lowest priority.

Samsung is similarly focused on premium memory products. The company has the most diversified portfolio (phones, displays, memory), so it has some flexibility, but it's still prioritizing high-margin products.

Micron is probably the most focused on consumer DRAM, but even Micron is shifting toward high-margin categories. The company has announced expansions in Japan and is working on advanced nodes, but these take time.

Here's the brutal reality: even if manufacturers expand capacity dramatically, new production capacity won't come online meaningfully until late 2026 or 2027. Building a new fab takes 5 to 7 years. Expanding existing facilities takes 18 to 24 months. We're already in early 2026. The fab expansions announced in 2024 and 2025 might start helping in Q4 2026, but for most of the year, shortage conditions will persist.

Some relief might come if AI demand stabilizes. Companies have been ordering enormous quantities of memory, but that demand might plateau. Once the latest generation of models is trained and deployed, spending could cool. That might free up some capacity for consumer products. But that's speculative. Demand could easily intensify as companies train new models and deploy AI more broadly.

Estimated data shows budget phones may see higher price increases due to memory shortages, with average increases of

The Smartphone Category Gets Specific: What's Actually Changing

Phones are the most visible impact point, so let's go deep on what's actually changing.

RAM stagnation. The biggest immediate impact is that flagship phones are stuck at their current RAM levels instead of upgrading. Last year, the standard was 12GB for Pro models, with some phones going to 16GB or 24GB. In 2026, flagships will likely stay at 12GB. This is a significant regression from a consumer perspective. You're paying more for the same specs.

Budget category disappearance. Phones under

Mid-range consolidation. The $400-700 range is where most phones will be available in 2026. This is more profitable than budget, but less expensive than premium. Manufacturers will focus inventory here.

Premium abundance (relatively). High-end phones ($1,000+) will still be available, but at higher prices. These have good margins, so manufacturers can still make money even with higher memory costs. However, specs won't improve much because memory allocation is constrained.

Regional differences. Chinese manufacturers will struggle more than Apple and Samsung because they have less negotiating power with memory suppliers. We're already seeing this pattern. Chinese brands are either raising prices aggressively or reducing production. Some have even exited the global market to focus on domestic sales where they have more influence.

All of this adds up to a market with fewer choices, higher prices, and stagnant innovation. Consumers lose in every dimension.

Collateral Damage: Indirect Effects You Haven't Considered

The phone impact is obvious. But there are secondary and tertiary effects that are equally important.

Data center expansion delays. Companies building new cloud infrastructure need cheap off-the-shelf memory for servers. When memory gets expensive, data center buildouts slow down. This has implications for AI infrastructure rollouts, cloud service expansions, and everything dependent on data centers. A company that was planning to build three new facilities might build only one until memory prices normalize.

Automotive electrification slowdown. EVs need memory for battery management systems, autonomous driving stacks, and infotainment. When memory gets expensive, EV manufacturers face higher costs. Some might delay launches or reduce production. This slows the transition to electric vehicles.

Io T fragmentation. The Internet of Things was supposed to explode with smart devices everywhere. But connected devices need memory, and it's getting expensive. Many Io T startups might abandon plans because the economics no longer work. This consolidates the market toward big players who can absorb the costs.

PC gaming slowdown. Gaming PC builders rely on available, affordable memory for high-end systems. When memory is expensive and scarce, fewer gaming PCs get built. This could slow adoption of new GPUs and gaming technology generally.

Industrial equipment delays. Farm tractors, factory robots, medical devices, power grid infrastructure. Everything modern has computers with memory. When memory is scarce and expensive, equipment upgrades get delayed. Entire industries are affected.

Software bloat reaches practical limits. Developers have been writing increasingly bloated software because memory was cheap. At some point, if memory is expensive, this changes economics. We might see more efficient software development, actually a positive from a technical perspective, but it requires significant restructuring.

None of these impacts are catastrophic on their own, but together they slow technological progress and innovation across basically every industry.

Timeline: When Does This Get Better?

This is the most important question, and unfortunately, the answer is: not soon.

Q1-Q2 2026: This is peak shortage. Memory prices will likely remain elevated. Manufacturers will be desperate for inventory. Consumers will see the highest prices and fewest options.

Q3 2026: Some relief might emerge if new production capacity comes online ahead of schedule or if AI demand moderates. But this is optimistic. More likely, shortages persist but stabilize.

Q4 2026: New fab production might start contributing meaningfully. Memory prices might begin a slow decline. But they won't return to 2024 levels quickly.

2027: Gradually, as new capacity accumulates, supply-demand balance improves. Memory prices decline toward historical norms. Device specs and prices stabilize.

2028+: Normal market conditions return. Memory is cheap again. Device prices decline. Innovation accelerates. Consumers get better specs at lower prices.

This timeline assumes no major disruptions. If there's a geopolitical crisis affecting chip manufacturing, or if AI demand intensifies beyond current projections, the timeline stretches. If memory demand softens faster than expected, relief comes sooner. But based on current trajectories, expect elevated prices and limited availability through 2026, with gradual improvement starting in Q4 2026.

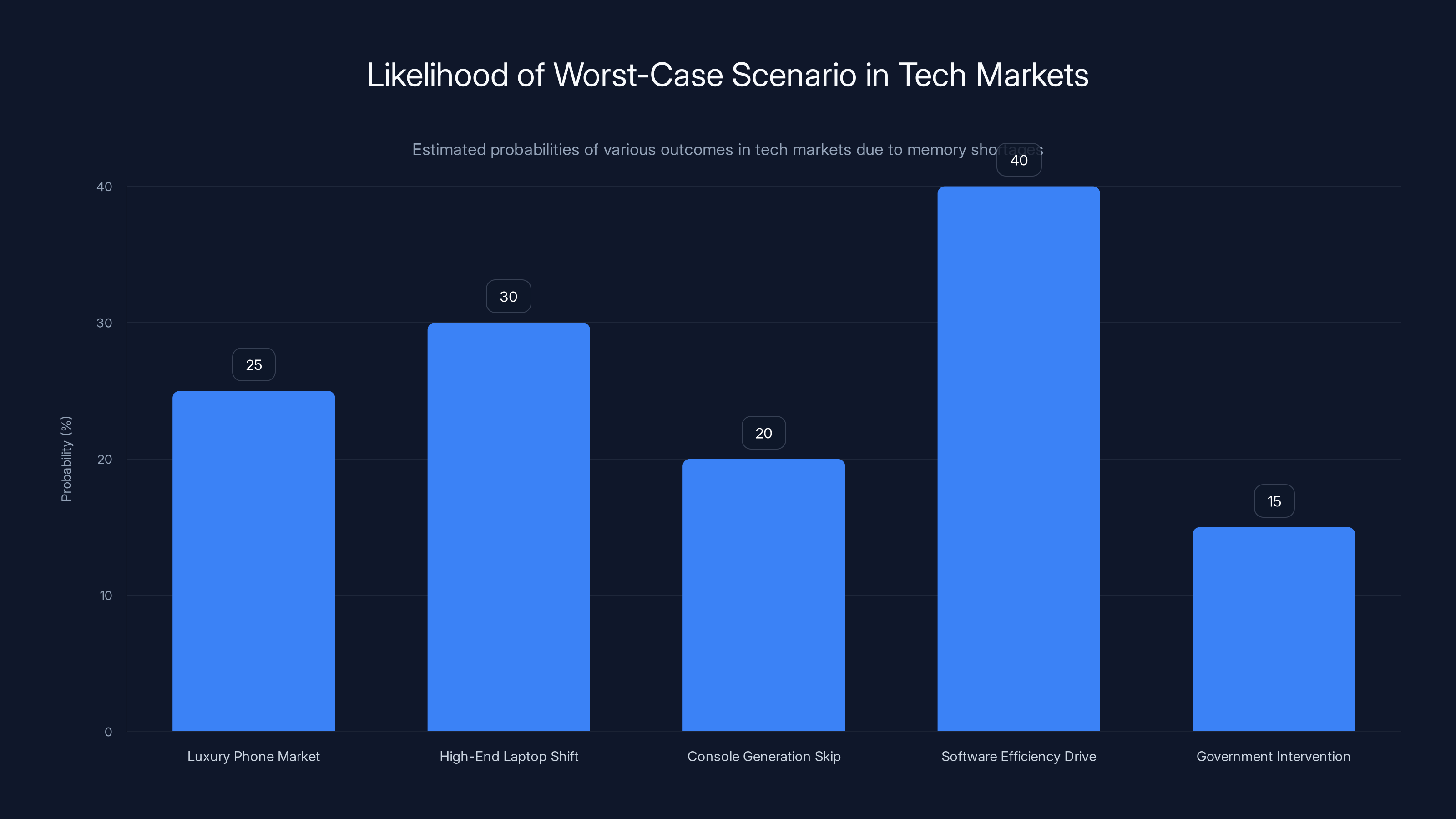

Estimated probabilities suggest a significant chance of shifts towards luxury markets and high-end products, with a notable drive towards software efficiency. Estimated data based on scenario analysis.

What Can You Actually Do About It?

You can't fix a global supply chain problem as an individual. But you can make smarter decisions about your own purchasing.

Buy before the crisis peaks. If you need a new device, buy it in Q1 2026 if possible. Early inventory will be less affected by peak memory prices. Once manufacturers sell through Q1 stock, subsequent inventory will be more expensive.

Consider older generations. Last year's phone, laptop, or device might be a smarter buy than this year's model. You'll pay less and get similar specs. If upgrading from a three-year-old device, even the older generation will feel like an upgrade.

Buy used strategically. The second-hand market might actually improve in 2026 because people are upgrading less (due to cost). Used device prices might actually decline or stabilize, making them an excellent value compared to new devices.

Delay if you can. If your current device still works, keep using it. By waiting until Q4 2026 or 2027, you'll have better selection and lower prices. This is the best strategy if you have the patience.

Focus on durability. When choosing a device, prioritize build quality and repairability. A more durable device that lasts an extra two years is worth paying more for when upgrade prices are elevated.

Avoid bleeding-edge specs. Don't pay a premium for the latest and greatest. You won't notice the difference between 12GB and 16GB of RAM in most use cases. Focus on what you actually need, not what's "best."

Check return policies carefully. If you buy in 2026 and prices drop significantly by year-end, you might want to return and rebuy. Make sure you understand the return window.

Negotiate business purchases. If you're a business buying multiple devices, negotiate hard. Suppliers will cut deals to lock in volume, even during shortages. This doesn't apply to consumer purchases, but it's worth knowing.

The Broader Economic Implications

This isn't just about paying more for your phone. The RAM shortage has real macroeconomic implications.

Inflation contribution. Consumer electronics prices rising means consumer price indices increase, which could affect monetary policy decisions. This contributes to persistent inflation in ways that aren't easily reversed.

Disposable income squeeze. When people spend more on devices, they spend less on other things. Entertainment, dining, travel. Small businesses dependent on consumer discretionary spending will feel this indirectly.

Business investment slowdown. Companies delaying infrastructure upgrades because memory is expensive means less capex spending, which slows economic growth.

Inequality widening. Budget device categories disappearing means lower-income consumers have fewer options. The smartphone becomes more of a luxury, less of a necessity. Digital access inequality increases.

Innovation drag. Companies delaying product launches because of memory constraints means slower technological progress. New features, new capabilities, new categories get delayed. We don't see the next generation of innovation.

Supply chain fragility exposed. The shortage reveals how vulnerable technology supply chains are to demand shocks. This might spur governments to invest in domestic manufacturing capacity, which has long-term implications.

None of this is catastrophic on a global economic level. But the cumulative effects slow progress and create friction.

Learning From History: Past Shortages and How They Resolved

RAM shortages have happened before. Understanding history helps contextualize the current situation.

The 2008 financial crisis RAM spike. Memory prices spiked dramatically during the 2008 crisis as credit markets froze. Manufacturers couldn't finance production. Prices roughly doubled. The shortage lasted about 18 months until credit markets unfroze. Lesson: credit availability can be as important as manufacturing capacity.

The 2011 Thailand flooding crisis. Thailand produces a significant portion of hard drives and memory components. Flooding knocked out factories for months. Memory prices rose 40-50%. The shortage lasted until new capacity came online 6 months later. Lesson: natural disasters can disrupt supply chains quickly, and recovery takes months.

The 2017-2018 smartphone RAM shortage. Memory became tight when flagship phones started requiring 6GB and 8GB. Prices rose 20-30%. The shortage lasted about a year until manufacturers ramped capacity. Lesson: when demand shifts suddenly, supply takes time to catch up.

The COVID pandemic memory crunch. In 2020-2021, pandemic-driven demand for electronics created memory shortages. Prices rose, and shortages lasted 18-24 months. But crucially, governments didn't hoard memory (unlike with other commodities), so recovery was somewhat faster. Lesson: government intervention can accelerate or delay recovery.

The current shortage is different from all of these because:

-

The demand source (AI) is unlimited in scale. These previous shortages were driven by consumer demand, which has natural limits. AI demand could grow for years.

-

Manufacturers are actively deprioritizing consumer segments rather than being forced to by supply constraints. This is a business choice, making recovery slower.

-

The shortage affects virtually every device category simultaneously, creating systemic friction rather than isolated disruptions.

-

Geopolitical tensions around chip manufacturing add uncertainty that didn't exist in previous cycles.

So while history suggests shortages eventually resolve, there's no guarantee this one follows the same pattern or timeline.

Memory prices are projected to peak in 2026, tripling from 2023 levels, while device availability drops significantly. Recovery is expected by 2028. (Estimated data)

What Manufacturers Are Saying (And What They're Not Saying)

Manufacturers are being cagey about the shortage, which tells you how serious it is. When things are fine, executives talk about growth and innovation. When things are constrained, they use careful language.

Here's what they're actually saying:

SK Hynix: "We're focusing on high-margin products and managing supply carefully." Translation: we're abandoning consumer products to chase AI profits.

Samsung: "Memory demand is robust across all segments." Translation: we can't meet demand, so we're rationing.

Micron: "We're balanced between consumer and data center." Translation: we're skewing toward data center because margins are better.

Apple: "We work closely with our suppliers." Translation: we're struggling to secure enough memory and pretending everything is fine.

Qualcomm: "Memory constraints will define the handset market through 2026." Translation: the entire industry is constrained, and nothing will change soon.

Samsung Mobile: "We're optimizing our portfolio." Translation: we're killing budget phones and focusing on high-margin models.

Notice what they're not saying? They're not saying "we're adding manufacturing capacity," "supply is normalizing," or "prices will come down." They're using gentle language about "optimization" and "focusing on growth segments." Corporate speak for "things are tight and will stay that way."

The AI Companies' Perspective: Why They're Justified in Hoarding

From an AI company's perspective, the memory allocation makes perfect sense. Don't hate the player, understand the game.

AI companies are in a race. First-mover advantage in large language models is massive. The company that gets to the best model first gains billions in value. Training a model requires enormous computational resources, and memory is a critical bottleneck.

If you're Open AI or Google, and you can buy memory at any price to train a better model faster, you're rationally going to do it. The upside is worth billions. A few hundred million dollars in memory costs is trivial compared to that potential payoff.

Moreover, the cost of memory is a rounding error in AI company budgets. A

Consumer device manufacturers, by contrast, are price-sensitive. A

This asymmetry is why manufacturers are ceding memory to AI companies. The AI companies will outbid them every time. It's rational economics. But it's brutal for consumers.

Contingency Planning for Worst-Case Scenarios

What if the shortage gets worse instead of better? What if memory prices keep rising through 2027? It's unlikely, but worth considering.

Worst-case scenario implications:

Phones become functionally luxury items. Budget and mid-range categories disappear entirely. Only wealthy consumers can afford upgrades. This creates a two-tier market: old devices and expensive new devices.

Laptop production shifts entirely to high-end workstations and gaming systems. Regular laptops for office work become scarce, forcing businesses to extend hardware cycles significantly.

Consoles skip generations entirely. If the PS6 costs $1,500 due to memory costs, nobody buys it. Publishers might skip the generation entirely, extending PS5 support indefinitely.

Software development becomes constrained. If devices have limited memory, developers can't write bloated software. This actually drives innovation in software efficiency, which is good long-term but disruptive short-term.

Governments might intervene. Subsidies for memory production, tariffs on AI companies, or forced allocation rules could change the game entirely. This is possible but politically complicated.

How likely is worst-case? Probably 20-30%. Most likely scenario is gradual improvement throughout 2026 with normalization by 2027. But acknowledging worst-case helps you prepare.

Smart Buying Strategy for Different Device Categories

Different devices have different implications for the shortage.

Smartphones: Buy now if you need an upgrade. Early 2026 inventory is less affected. Avoid flagship innovations because they're not coming. Get the best value in the mid-range ($400-600 category). Plan to keep your phone 4 years instead of 3 years to spread costs.

Laptops: If you use a laptop for work, don't delay if your current machine is struggling. Buy a professional-grade laptop that will last longer. Sacrifice features for durability. Entry-level laptops are disappearing, so you might need to spend more but get a better machine that outlasts the shortage period.

Gaming devices: Wait if you can. Gaming laptops and handheld systems will face shortages, but they're less essential than phones and laptops. By waiting until Q4 2026, you'll have better availability. If you can't wait, buy a previous-generation gaming system rather than new models.

Tablets: Surprisingly, tablets might be insulated from the shortage relative to phones because demand is lower. If you need a tablet, 2026 is a reasonable time to buy. You'll see price increases, but availability is better than phones.

Smart home devices: These are discretionary. Skip buying in 2026. Wait until 2027 when memory abundance returns. You won't miss much in that year.

Routers and networking gear: Buy before June 2026 if you need new equipment. ISP rental fees are going up, so buying often makes economic sense anyway.

The Role of Geopolitics in the Shortage

Memory manufacturing is geographically concentrated. SK Hynix is South Korean. Samsung is South Korean. Micron is American but manufactures globally. This concentration creates geopolitical risk.

Tensions between US and China could disrupt supply. Sanctions on tech exports could strain memory availability. Taiwan produces some memory components, and any disruption there would cascade globally.

Governments are aware of this vulnerability. There's political pressure to build domestic memory manufacturing capacity in the US and Europe. Subsidies for memory fabs are being discussed. This could lead to:

Multi-year supply agreements where countries guarantee memory supply. Prices could vary by region as governments protect domestic manufacturers.

Domestic manufacturing inefficiencies. US-made memory might cost more than overseas production, effectively raising prices for American consumers even as supply improves.

Splitting of supply chains. The global memory market could fragment into US-aligned, China-aligned, and neutral zones, reducing overall efficiency.

None of this is certain, but geopolitical factors are increasingly important in chip manufacturing. The shortage gives governments leverage to make strategic decisions.

What This Means for Device Longevity

One silver lining: if devices are more expensive, they'll need to last longer. This drives demand for durability and repairability.

Think about it: if you're paying

Manufacturers will be forced to prioritize durability. Shorter product cycles become less viable when devices are expensive. This could actually improve device quality and reduce electronic waste.

It's a strange benefit to a supply shortage, but it's real. Scarcity drives value, and value drives quality.

The Path Forward: What Comes After the Shortage

Shortagess end. This one will too. The question is what the technology market looks like after it does.

Memory abundance return (2027-2028). As new fab capacity comes online, memory becomes cheap again. Prices crash. Manufacturers compete aggressively on price, driving down device costs.

Spec wars resume (2028+). Once memory is cheap, manufacturers resume the upgrade cycle. 16GB becomes standard, then 32GB. Flagship phones get even more RAM. Innovation accelerates.

Budget category resurrection. Once margins are better, manufacturers resurrect budget phones and budget laptops. Consumer choice expands dramatically.

Software bloat returns. With cheap memory again, developers stop optimizing. Software becomes less efficient. Cycle continues.

AI normalization. As AI training becomes routine rather than novel, demand for specialized memory moderates. AI and consumer electronics share the supply chain more equally.

The shortage will feel like a historical blip in retrospect. But the lessons about supply chain vulnerability, geopolitical dependencies, and market concentration will linger. Hopefully.

FAQ

How much more will phones cost in 2026?

The average smartphone will cost about 8 percent more in 2026 compared to 2025, according to IDC analysts. That means a

Will the RAM shortage affect gaming consoles?

Yes, significantly. The Play Station 6 has been rumored for 2028, but many industry analysts now expect a 2029 launch due to memory availability constraints. Nintendo and Xbox face similar pressures. Consoles need specialized high-speed memory that's especially scarce in the AI era, making delays likely unless manufacturers are willing to launch at significant losses.

When will memory prices return to normal?

Memory prices are unlikely to normalize until late 2026 at the earliest, with full normalization possibly extending into 2027. This depends on new manufacturing capacity coming online as scheduled and AI demand moderating or stabilizing. If either of these conditions fail, the shortage could extend beyond 2027.

What devices should I avoid buying in 2026?

Avoid buying discretionary smart home devices, handheld gaming systems (unless absolutely necessary), and VR equipment in early-to-mid 2026. These categories face severe memory shortages and price premiums. Basic smartphones, laptops, and tablets are more necessary purchases, so buying them sooner rather than later makes more sense.

Why are AI companies hoarding memory when consumer devices need it?

AI companies are willing to pay premium prices far exceeding what consumer device manufacturers pay. When memory suppliers can sell the same capacity to an AI company at 5-10x the price, they rationally choose the AI buyer. It's pure economics. Consumer device manufacturers can't outbid AI companies, so they lose access to memory inventory.

Should I buy a device before or after Q2 2026?

If you need a device, buying before mid-2026 gives you access to inventory produced before memory prices peaked. After Q2, manufacturers will be buying memory at elevated prices, which increases device costs. However, if you can wait until Q4 2026 or 2027, you'll get better prices and more selection as memory becomes more abundant.

Will memory shortages affect internet routers and ISP equipment?

Yes. Routers, modems, and networking equipment all require memory. ISPs are facing shortages on rental equipment, and if you need to replace your router in 2026, expect higher prices and limited availability. Buying your own equipment rather than renting from your ISP becomes even more economical in 2026.

What's the relationship between AI demand and consumer electronics memory shortage?

AI companies need enormous quantities of specialized HBM memory to train and run large language models. This demand is so profitable for memory manufacturers that they're reallocating capacity from consumer DRAM toward AI products. Consumer devices like phones, laptops, and tablets use standard DRAM, which is now less profitable to produce, so manufacturers deprioritize it. This isn't a capacity constraint so much as a profit-margin-driven allocation decision.

Can governments intervene to fix the RAM shortage?

Governments have limited direct ability to increase memory supply quickly because building new fabs takes 5-7 years. However, governments can provide subsidies to accelerate expansions, impose restrictions on AI companies' memory purchases, or create tariffs favoring domestic manufacturers. Some of these interventions are being discussed but remain politically complex. Any government action would take months to implement and wouldn't impact 2026 supply meaningfully.

What's the best strategy for buying during the shortage?

The best strategy depends on your device category. For phones: buy now if you need an upgrade, accept higher prices, and plan to keep devices longer. For laptops: buy professional-grade machines that will outlast the shortage period rather than budget options. For gaming devices: wait until Q4 2026 if possible. For smart home devices: delay purchases until 2027. Across all categories, prioritize durability and repairability since expensive devices need to last longer.

Conclusion: Preparing for Higher Prices and Fewer Choices

The RAM shortage is real. It's hitting now. And it's going to affect basically every device you buy in 2026.

Here's what we know for certain: memory prices have tripled to sextupled. Manufacturers are choosing to prioritize AI customers over consumer device makers because the profit is better. Phones will cost more and have stagnant specs. Laptops are getting expensive and scarce. Consoles are facing delays. Basically everything with a computer inside will be affected.

Here's what we don't know: how long it lasts. The most optimistic scenario has memory normalizing by late 2026. The most pessimistic extends the shortage into 2027 or beyond. But under any reasonable scenario, 2026 is a rough year for tech device pricing and availability.

The good news: this is temporary. Supply chain problems resolve. Manufacturers expand capacity. Memory eventually becomes cheap again. Probably by 2028, things will feel normal. The shortage will be a historical blip.

But that doesn't help you buying a device in 2026.

Your best move is to be intentional about purchasing. Buy what you need now if your current device is failing. Delay discretionary purchases if you can. Prioritize durability over features. Keep devices longer. Accept that you're paying a shortage tax and make peace with it.

Because the alternative is waiting 18+ months hoping things improve. Sometimes waiting is right. Sometimes buying now is right. Your specific situation determines which.

But either way, know what you're getting into. Device costs are going up in 2026. Selection is going down. Specs are stagnating. This is the environment we're operating in, and understanding it helps you make smarter purchasing decisions.

Key Takeaways

- RAM prices have tripled to sextupled globally as AI companies consume massive memory quantities

- Smartphone costs will increase 8% on average, with budget phones ($300) disappearing entirely

- PlayStation 6 launch delayed to 2029, with Nintendo and Xbox facing similar memory constraints

- Only three companies control 95% of memory production, all prioritizing AI over consumer devices

- Supply-demand balance won't normalize until late 2026 at earliest, possibly extending to 2027

- Qualcomm CEO warns memory shortage will 'define the handset industry' through 2026

- Flagship phones staying at 12GB RAM instead of upgrading to 16GB due to cost constraints

- Indirect impacts include data center expansion delays, automotive electrification slowdown, and IoT fragmentation

Related Articles

- RAM Shortage Crisis 2026: How Memory Scarcity Could Bankrupt Companies [2025]

- Steam Deck OLED Out of Stock: The RAM Crisis Explained [2025]

- Steam Deck Out of Stock 2026: What RAMaggedon Means [2025]

- John Carmack's Fiber Optic Memory: Could Cables Replace RAM? [2025]

- AI Memory Crisis: Why DRAM is the New GPU Bottleneck [2025]

- PlayStation 6 Release Delayed, Switch 2 Pricing Hike: AI Memory Crisis [2025]

![RAM Shortage 2026: Why Your Devices Will Cost More [2025]](https://tryrunable.com/blog/ram-shortage-2026-why-your-devices-will-cost-more-2025/image-1-1771508435218.jpg)