Beyond Leather: The Future of Luxury Car Seat Materials

Walk into a luxury car showroom in America, and you'll find the same story repeated across every brand: leather. Genuine leather. Upgraded leather. Premium leather with quilting and accent stitching. The material has dominated luxury automotive interiors for decades, so deeply embedded in consumer expectations that suggesting alternatives feels almost radical. Yet something's shifting in the global automotive market. While European manufacturers quietly introduce premium textile interiors in their latest electric vehicles, American brands remain conspicuously absent from this conversation. It's not because the technology doesn't exist. It's not because the materials aren't available. It's because American automakers believe, with remarkable consistency, that we don't want it.

That belief might be worth questioning.

The story of why leather became the default luxury material is surprisingly straightforward. Leather signaled wealth and craftsmanship. It was durable, relatively easy to clean, and it conveyed permanence. In a car interior, these qualities mattered. But the assumptions underlying those preferences were formed in a different era. Climate control wasn't universal. Cars didn't last as long. Sustainability wasn't part of the conversation. Today's luxury car buyer faces different tradeoffs. Environmental consciousness has moved from niche concern to mainstream value. Electric vehicles demand rethinking of every component, including what touches your skin eight hours a week. New textile technologies can match or exceed leather's durability while offering entirely different aesthetic possibilities. Yet despite these shifts, the American luxury market remains locked in material tradition.

This isn't the first time American car buyers have been offered different choices than their global counterparts. Federal Motor Vehicle Safety Standards mandate side reflectors absent from European vehicles. American headlight regulations lag behind international standards. We don't get the smaller-engine versions of German luxury cars. We miss out on wagon versions of sedans like the Audi A6 Avant. The pattern is consistent: American regulations, American preferences, or American assumptions about preferences dictate what reaches showrooms here. The textile interior issue fits neatly into this established framework. But unlike headlight technology or engine displacement, this decision isn't driven by regulation. It's driven by perception.

Understanding why requires looking at what European manufacturers have already learned, what American buyers actually want versus what automakers think they want, and what the future of car interiors might look like if we moved beyond assumptions.

TL; DR

- European EVs Lead: BMW's i7, Audi A6 e-tron, and other premium vehicles already feature sustainable textile interiors, unavailable to American consumers

- American Resistance: Manufacturers cite customer preference for leather, but consumer research suggests demand for premium alternatives is stronger than automakers believe

- Textile Technology Advances: Modern synthetic textiles rival leather in durability and cleanability while offering weight savings, sustainability benefits, and design flexibility

- Market Opportunity: Cadillac's Optiq demonstrates American consumers value innovative material choices when positioned as design-forward rather than compromise

- The Gap: American buyers experience fewer choices not due to capability gaps but due to automaker assumptions about preferences

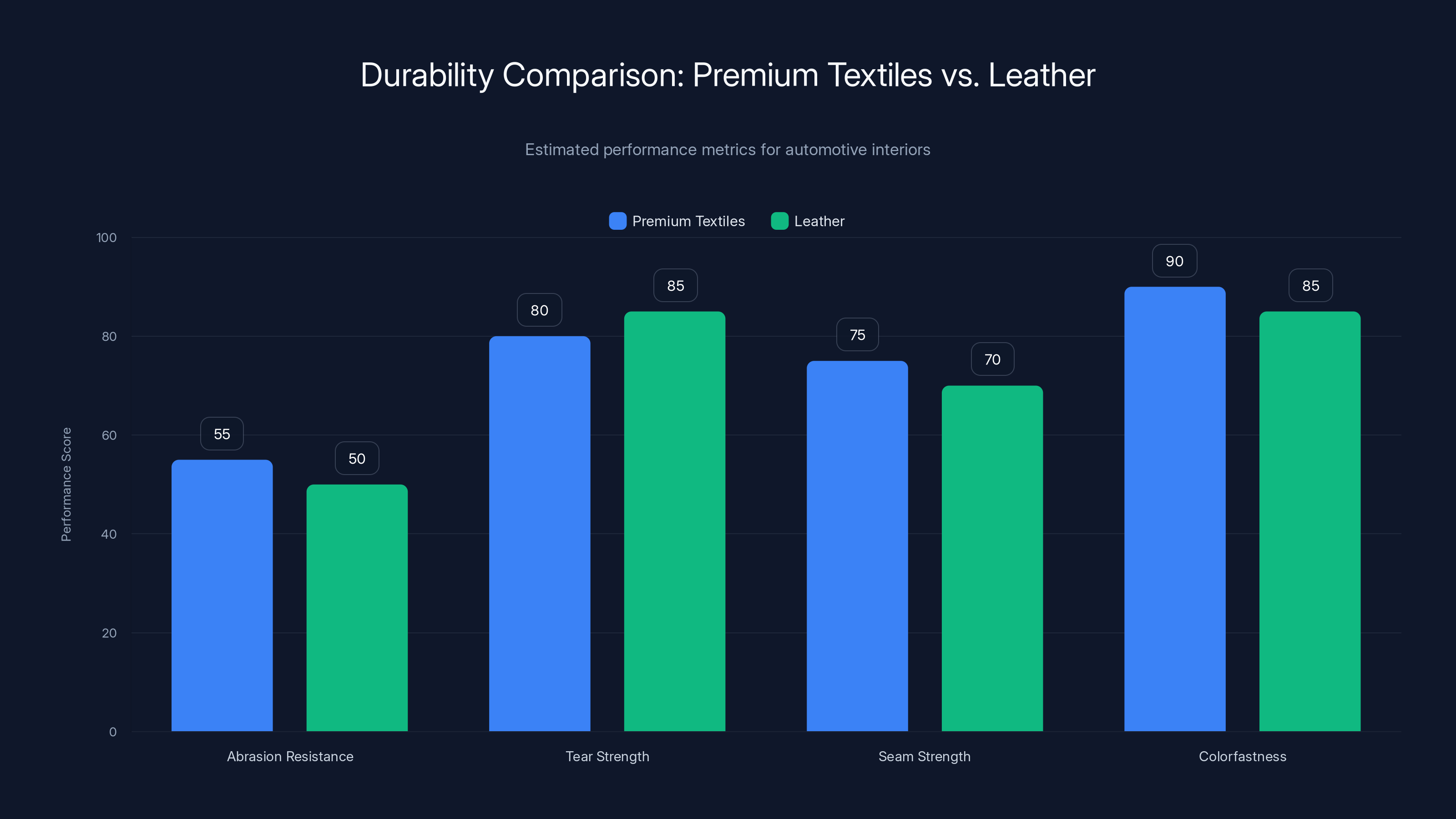

Premium automotive textiles show comparable or superior performance to leather in key durability metrics. Estimated data based on typical industry standards.

The Designer's Vision That Never Shipped

Gordon Murray is not someone who thinks like other car designers. His career was built on obsessive weight optimization. As the chief designer behind McLaren's Formula 1 program, he developed an almost religious conviction about keeping mass minimized. Every gram mattered. Every component had to justify its existence. When Murray imagined designing a four-door sedan, he brought this obsession with him.

His conclusion was striking: use wool instead of leather.

The logic was pure engineer's reasoning. Wool made quality suits and coats. It was lighter than leather. It was sustainable. It conveyed luxury through craftsmanship rather than animal hide. In the mid-1990s, when Car Magazine published this vision, it read like science fiction. A four-door McLaren with wool seats? The idea was so far ahead of consumer expectations that it never moved beyond the conceptual stage. That McLaren sedan never materialized. Murray's company, Gordon Murray Automotive, builds hypercars that start at over $3 million each, not family sedans.

But the idea never died.

Thirty years later, manufacturers have proven Murray was onto something. BMW's i7, the flagship electric luxury sedan that debuted in 2022, features an interior trimmed in premium cashmere wool. The material feels extraordinary. It's soft in a way that leather, despite its reputation for luxury, can't quite match. It breathes differently. It ages differently. It reads as something beyond the default luxury material choice. The i7's interior became a statement that premium vehicles could use something other than leather and still feel expensive, exclusive, and desirable.

The BMW i7 represents a full philosophical shift in how to approach luxury. Weight savings matter more than ever in electric vehicles because every kilogram impacts range. Sustainability concerns are no longer peripheral to luxury positioning but central to it. Design novelty and differentiation are increasingly valuable as vehicles become more technologically similar. A textile interior accomplishes all three goals simultaneously.

But here's the catch: you can't buy an i7 with that cashmere wool interior in America.

This isn't a regional limitation due to safety standards or regulatory requirements. BMW chooses not to offer it. When asked why, the company's response reveals the core assumption driving these decisions: American customers prefer leather alternatives.

Modern automotive textiles typically withstand over 50,000 abrasion cycles, comparable to high-quality leather, highlighting their durability and suitability for automotive applications.

What Manufacturers Think You Want

When BMW and Audi explain their decisions to avoid offering textile interiors in the American market, they cite the same reasoning: customer preference. The explanations are remarkably consistent. A BMW spokesperson told automotive journalists that customers are satisfied with synthetic alternatives like SensaTec and Veganza. An Audi USA spokesperson pointed to the practical advantages of leather and leather-like materials: they're easier to clean, and clothes don't cling to fabric the way they do with textiles, making entry and exit easier.

These aren't frivolous concerns. They're genuine usability considerations that resonate with how people actually use cars. Clothing clinging to fabric seats is an annoyance. Leather is genuinely easier to wipe clean. But the conclusions manufacturers draw from these observations reveal a particular view of American consumers: we prefer convenience and proven materials over innovation and sustainability.

Audi specifically noted that while they "applaud the sustainable factor of cloth seats," American customers continue to prefer leather in luxury vehicles. The word "continue" is interesting. It assumes this preference is stable, unchanging, a bedrock truth about the American market. It treats leather preference as a fixed point rather than something that might evolve, especially as electric vehicles reframe what "luxury" means.

BMW's perspective is similarly revealing. The company says it "continuously evaluates market trends, industry developments, and customer feedback." Yet their conclusion is that demand has focused on "more premium options like Alcantara and microfiber rather than traditional cloth." This frames the conversation as though textile alternatives are inherently less premium than leather. A premium fabric is acceptable. Basic fabric is not. The hierarchy is built into the vocabulary.

What's missing from these explanations is any acknowledgment that American preferences might differ from actual consumer research. What's missing is curiosity about whether customers reject textile interiors because they've truly evaluated them or because they've never been offered them. The automotive industry has long understood that people often can't articulate what they want until they experience it. Yet when it comes to interior materials, manufacturers seem to treat preferences as fixed and knowable without testing.

The Audi representative's comments about clothes clinging to fabric reveal another assumption: that textile means traditional woven cloth like you'd find in a 1987 economy sedan. Modern textile technology is entirely different. The materials used in European luxury EVs aren't the cloth of your grandmother's upholstery. They're engineered substances with synthetic components, specialized weaves, and surface treatments designed to prevent clinging while improving durability. Audi knows this. Yet the explanation defaults to generic fabric concerns.

This gap between what manufacturers claim customers want and what customers might actually want if given real options is where the story gets interesting.

The Data That Doesn't Match the Narrative

Every year, Auto Pacific conducts an extensive survey of over 18,000 people planning to purchase or lease a new vehicle. The research firm specifically asks about upholstery preferences, including leather and animal-free alternatives. The data is robust enough to examine preferences across multiple luxury brands. If American customers genuinely prefer leather to the point of rejecting textile alternatives, that preference should be measurable and dramatic.

It isn't.

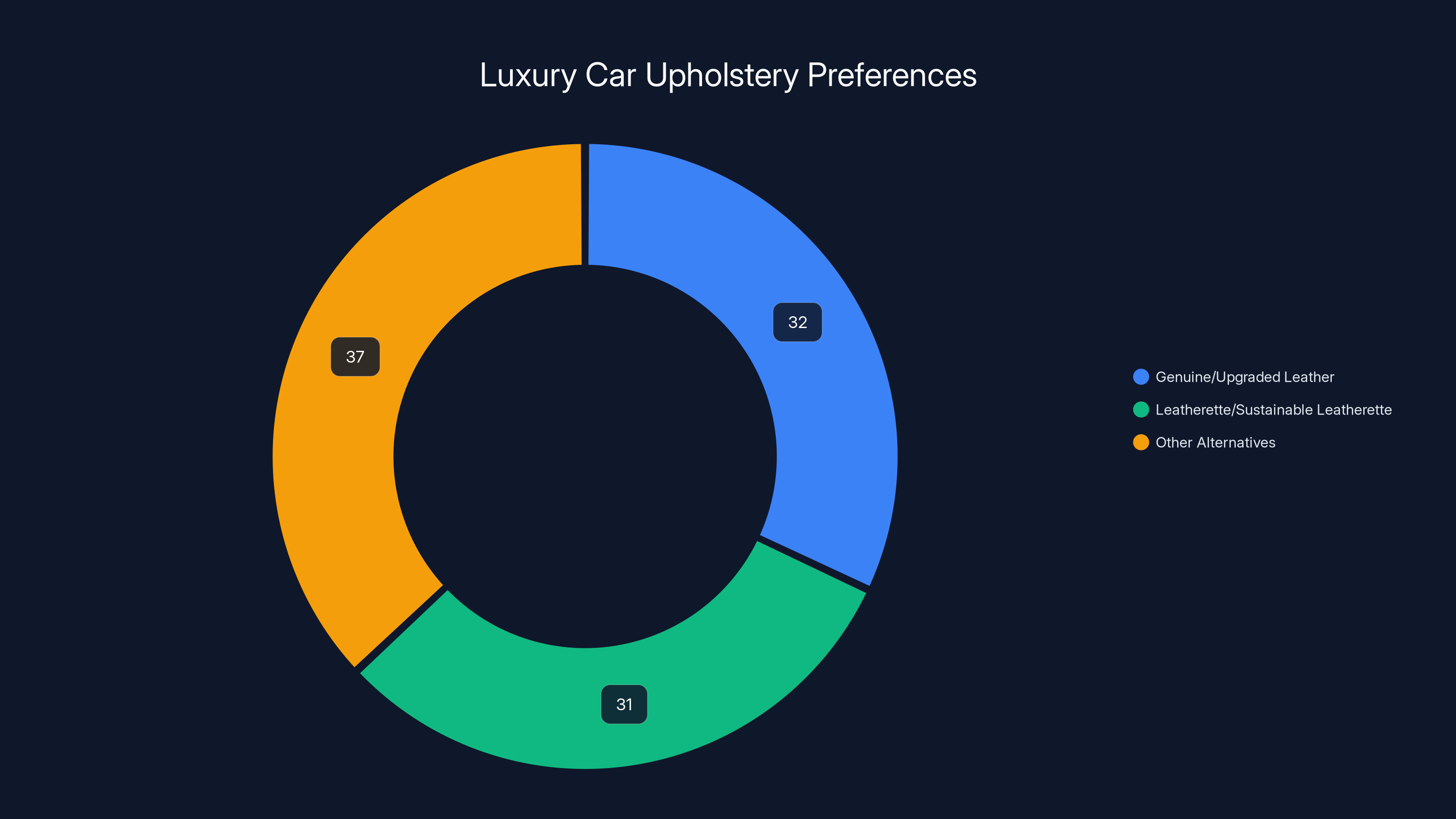

According to Robby De Graff, manager of product and consumer insights at Auto Pacific, the pattern is consistent but nuanced. Among luxury car shoppers, demand for genuine leather or upgraded leather is strongest. That's expected. But when the conversation shifts to alternatives, demand doesn't collapse. It remains substantial. Among potential Aston Martin buyers, 32 percent want genuine or upgraded leather. Thirty-one percent would accept leatherette or sustainable leatherette materials. That's an 18-to-17 split on two options. The difference is negligible.

The data becomes even more interesting when examining other luxury brands. Moving down the price ladder within the luxury segment, to brands like Cadillac, Lexus, Porsche, and Mercedes-Benz, the differences between leather and alternative material preference widen. But "widen" doesn't mean they become dealbreakers. It means preferences become more distributed. Some customers want leather. Some want premium alternatives. Some are willing to consider sustainable options.

The most revealing insight from Auto Pacific's research is that demand isn't binary. Customers don't split into "leather loyalists" and everyone else. Instead, preferences exist on a spectrum. This suggests that how materials are presented, positioned, and explained to consumers matters significantly. A textile described as "sustainable cloth" might be rejected. That same textile described as "premium wool comparable to luxury fashion" might be accepted. Framing shapes perception.

Cadillac understood this better than most American luxury brands. The company's new Optiq electric crossover features textiles made from recycled materials. Rather than positioning these as compromises or environmental gestures, Cadillac positioned them as design choices connected to modern fashion and interior design trends. Jennifer Widrick, director of global colors, materials, and finishes at General Motors Design, explained the philosophy: "Cadillac specifically uses fabric as a distinct element to reinforce quality detailing, a connection to fashion, and interior design trends."

This framing changes everything. Fabric isn't a substitute for leather. Fabric is a design strategy. It's something intentional. It's connected to fashion, a domain where textile expertise runs deep. Widrick continued: "Fabric provides added depth through multiple color yarns in precise constructions on surfaces that would otherwise be one color. Customers recognize these details as synonymous with quality and modernity."

The Optiq's textile interior wasn't presented as "we couldn't afford leather" or "we chose the sustainable option." It was presented as a deliberate design choice that creates visual and tactile depth leather can't match. And consumer response has been positive. Cadillac discovered what European manufacturers already knew: American customers will embrace textile interiors if they're positioned correctly.

This gap between what manufacturers claim customers want and what consumer research actually reveals deserves scrutiny. Are manufacturers making decisions based on comprehensive market research? Or are they defaulting to assumptions formed decades ago, now embedded in brand positioning and engineering decisions so deeply that nobody bothers to question them?

Among Aston Martin buyers, preferences for genuine leather and alternatives are nearly balanced, highlighting a nuanced demand for upholstery materials. Estimated data for other alternatives.

The European Examples: What We're Missing

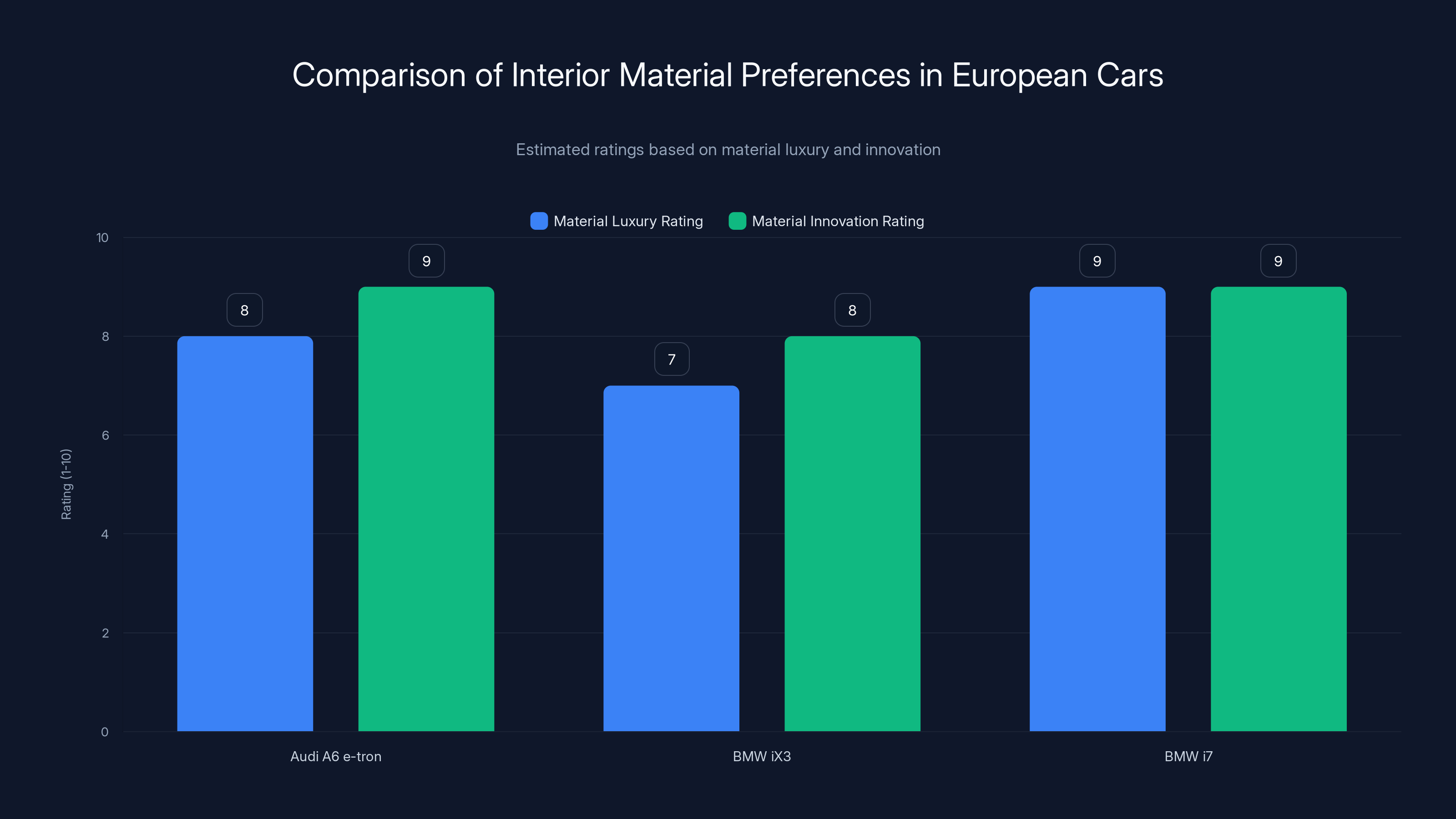

If you want to see what American consumers could experience if manufacturers chose differently, you need to look at what's already shipping in Europe. The Audi A6 e-tron and the BMW iX3 both offer premium textile interiors absolutely unavailable to American customers. These aren't budget compromises or sustainability gestures. They're premium material choices that position the vehicle as modern and design-forward.

Audi's approach with the A6 e-tron features engineered textiles that combine synthetic fibers with natural components. The material feels entirely different from traditional leather. It's lighter, which matters for an electric vehicle's range. It's more breathable, which affects comfort in warm climates. It ages differently. A leather seat darkens and develops patina. A textile seat maintains consistency while developing wear patterns that can actually become more interesting visually over time. The material choice reflects different assumptions about what luxury means in an electric future.

BMW's approach, particularly with the i7's cashmere wool interior, represents perhaps the most explicit statement that natural textiles can feel more luxurious than leather. Cashmere is expensive. It's associated with high fashion. It requires care and maintenance. But it feels extraordinary. Running your hand across a cashmere interior is an experience leather struggles to match. BMW positioned this material not as a compromise but as an evolution in luxury. The message is clear: premium vehicles can use premium textiles.

Both examples share something crucial: intentional design. The textiles aren't presented as "more sustainable leather alternatives." They're presented as materials chosen for specific reasons. The designers know why they selected these materials, and they communicate that reasoning. Customers experience the material as a deliberate choice, not a substitution.

The fact that these options don't come to America suggests manufacturers aren't convinced the American market will respond to them. But it might suggest something else: manufacturers aren't willing to invest in the educational effort required to shift perception. Creating premium textile interiors is more complex than sourcing leather alternatives. It requires design work. It requires explaining the choice to consumers. It requires confidence in your customers' willingness to embrace something different.

American manufacturers, by contrast, have decided that the safe choice is continuing with leather and leather-like alternatives. It's a decision rooted in risk aversion. Why gamble on shifting preferences when leather sells? Why invest in educating consumers about new materials when existing materials are already accepted?

But this reasoning assumes customer preferences are fixed. It assumes the market won't shift. It assumes that offering no choice is equivalent to understanding what customers want.

The Physics and Engineering of Modern Textile Materials

To understand why manufacturers might be missing an opportunity, it helps to understand what modern textile technology actually is. The textiles available for automotive use today bear almost no resemblance to cloth from even a decade ago. These are engineered materials designed to specifications as rigorous as leather.

Modern automotive textiles typically combine synthetic fibers with durability treatments applied at the molecular level. A typical construction might use polyester or nylon base fibers with specialized weaves designed to resist snagging, pilling, and wear. Stain resistance is engineered through chemical coatings that make the fibers resistant to moisture and oils without creating a waterproof barrier that reduces breathability.

The mathematics of fabric durability is worth understanding. Leather's resistance to wear comes from the hide's density and protein structure. Textile durability comes from fiber strength and weave tightness. A metric called "thread count" measures fibers per inch; higher counts generally indicate durability. But thread count alone doesn't determine longevity. Fiber type matters. Fiber diameter matters. Weave pattern matters. Treatment matters.

Modern premium textiles designed for automotive use undergo rigorous testing. Abrasion resistance is measured through cycles where a material is rubbed with a standardized surface; automotive-grade textiles often exceed 50,000 cycles before visible wear. Leather, by comparison, typically performs in the 40,000-to-80,000-cycle range, depending on the hide's quality. The overlap is substantial.

Tear resistance is another key metric. Materials undergo tests where a measured force is applied to a slit, and engineers measure how far the material tears before stopping. Modern automotive textiles are engineered to meet or exceed leather's performance here. Seam strength matters equally. The stitching that holds the material to foam and frame is where failures typically occur, not in the material itself.

Colorfastness is critical for automotive interiors where direct sunlight is constant. Both leather and premium textiles fade under UV exposure. But engineered textiles can be treated with UV absorbers that actually outperform leather's natural resistance. This is measurable through standardized tests where samples are exposed to controlled UV light for hundreds of hours and evaluated for color change.

The breathability question that manufacturers often cite actually demonstrates textiles' advantage. Leather breathes, but not uniformly. Textiles' permeability can be engineered. A material can be designed to allow moisture vapor transmission at a specific rate, optimized for comfort. This is measured in g/m²/24hr, the grams of water vapor transmitted per square meter per day. Premium automotive textiles can be engineered for optimal breathability while leather's breathability is determined by the hide's inherent structure.

Care and cleaning present another interesting difference. Leather requires conditioners. Its oils deplete over time, and the material benefits from periodic treatment. Textiles don't require conditioning. A stain-resistant treated textile requires cleaning, but not the ongoing maintenance leather demands. This might seem like an advantage for leather, but from a consumer perspective, it's the opposite. Fewer maintenance requirements mean less ongoing cost and effort.

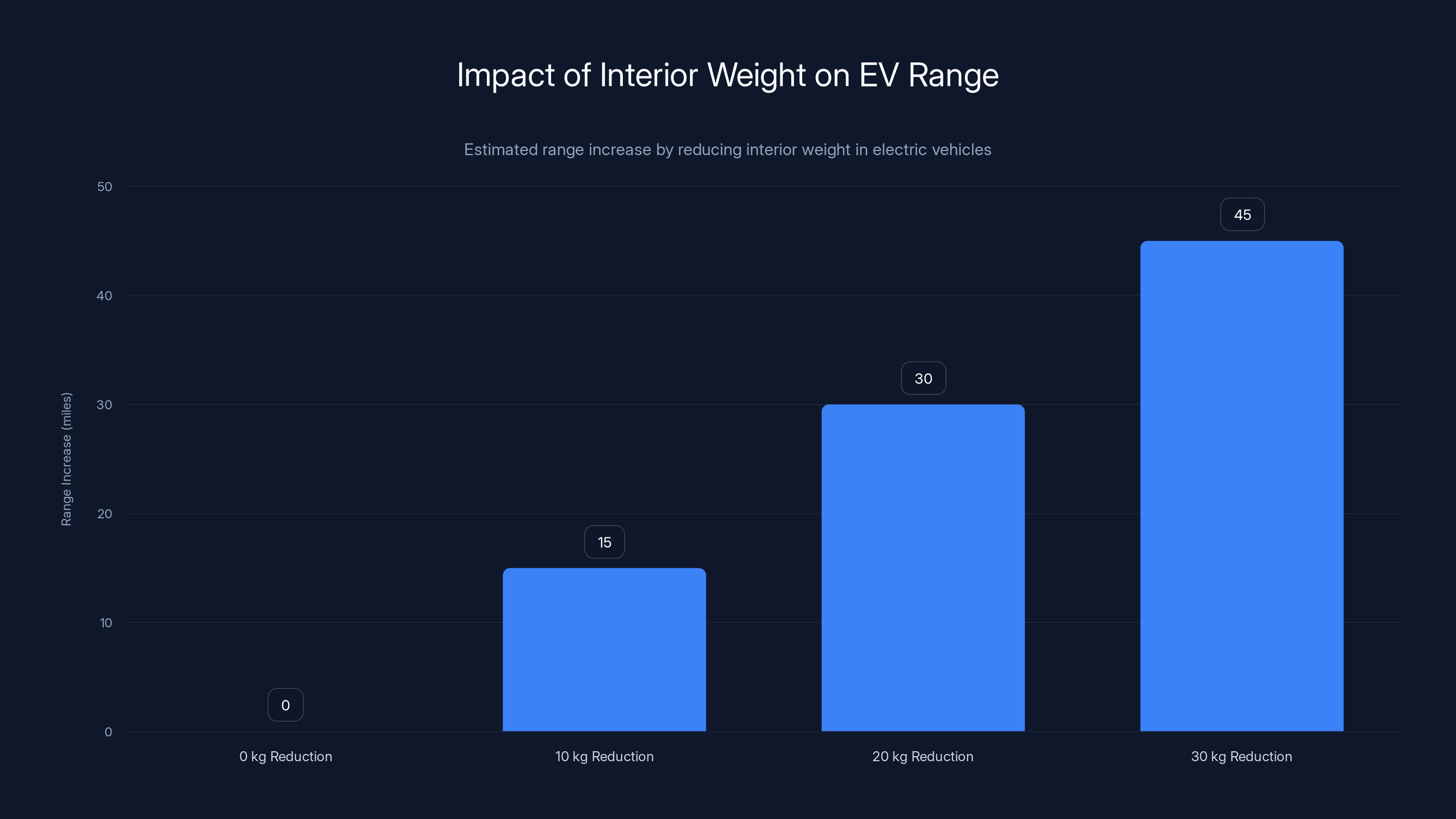

The weight difference is significant, especially for electric vehicles. Leather hides are dense. A complete leather interior, including the hide weight and the structural backing materials, typically weighs more than an equivalent textile interior. For a vehicle with a 300-mile electric range, reducing interior weight by 10 kilograms could translate to 15 additional miles of range. For electric vehicles, this is meaningful.

From a pure engineering perspective, modern premium textiles rival leather across nearly every performance metric. In some cases, they exceed it. Yet the perception remains that leather is the default luxury material and textiles are alternatives. This perception isn't based on performance data. It's based on tradition.

Reducing interior weight by 10 kg can increase an electric vehicle's range by approximately 15 to 20 miles. This highlights the engineering advantage of lighter materials like textiles over traditional leather. Estimated data.

The Sustainability Argument That Shouldn't Be Oversold

One reason manufacturers mention when discussing textile alternatives is sustainability. Environmental impact is increasingly part of luxury positioning. But here's where the conversation often goes wrong: the sustainability argument, while real, isn't the strongest case for textile interiors.

Leather production does have environmental costs. Tanning processes require chemicals. Cattle ranching has land use impacts. Transporting hides from processing facilities adds carbon. These are legitimate concerns. But switching from animal leather to synthetic textiles doesn't necessarily reduce environmental impact. Synthetic fibers come from petroleum. Their production consumes energy. Dyeing textiles requires water and chemicals. The environmental calculus isn't simple.

Where sustainability becomes more compelling is with textiles made from recycled materials. Cadillac's approach in the Optiq uses fabrics constructed from recycled plastic and other reclaimed fibers. Taking waste products and transforming them into premium interior materials is genuinely impressive. It reduces the demand for virgin petroleum. It addresses the growing problem of plastic waste. The environmental benefit is clear.

But here's the critical insight: even this approach shouldn't be framed as a sacrifice for sustainability. The material should be framed as what it is: a modern, thoughtfully designed interior choice. Customers don't want to feel like they're compromising for the environment. They want to feel like they're making a sophisticated choice.

When BMW explains why it doesn't offer the i7's cashmere wool interior in America, mentioning sustainability seems secondary to the preference argument. This might be a mistake. The strongest case for premium textile interiors isn't "they're better for the planet." It's "they're better in every way that matters to you: lighter weight for better range, superior comfort, advanced engineering, and a modern aesthetic." Environmental benefit is the nice additional feature, not the primary selling point.

Manufacturers who lead on this transition will be those who understand that Americans want to feel like they're making forward-thinking choices, not sacrificing for causes. Position textiles as the future of luxury, and customers respond. Position them as environmental compromises, and you reinforce the assumption that they're inferior alternatives.

Interior Design Trends and the Fashion Connection

Luxury cars aren't just vehicles; they're rolling interior design statements. The companies that understand this best make choices that connect to broader design trends, particularly in fashion and architecture. This is where textile interiors have enormous potential that manufacturers haven't fully explored.

In fashion, natural textiles have undergone a renaissance. After decades of synthetics dominating, high-end fashion has reasserted the value of wool, linen, cotton, and specialized blends. These materials are positioned as sophisticated, premium choices that age beautifully and develop character. The same positioning could apply to automotive interiors. A textile interior that visibly improves with age, developing a patina of wear that actually becomes more interesting, is more sophisticated than leather that darkens uniformly and loses definition.

Architectural interiors have similarly embraced textiles in new ways. Modern luxury hotels feature textile walls and ceiling treatments that create depth and texture impossible with leather or other rigid materials. These designs work because texture creates visual interest. Fabric's ability to catch light differently depending on angle, to show depth through multiple yarn colors, and to develop subtle patterns creates richness that uniform leather can't match.

Automotive designers could apply these principles. Imagine an interior where the dashboard features a textile with subtle geometric patterns created through precise yarn placement. Imagine seat bolsters in textured material that's visually distinctive from smooth surfaces. Imagine using color variation through yarn construction to create designs that couldn't exist in leather. This is what Cadillac is doing in the Optiq, treating fabric as a design element rather than a material compromise.

Manufacturers who position textile interiors as connected to contemporary design movements will have an easier time shifting perception. The conversation becomes: "This interior reflects modern design thinking, similar to what you see in luxury architecture and fashion." Instead of: "This is a sustainable alternative to leather." The first positioning adds prestige. The second positions the choice as altruistic.

The opportunity here is substantial. As young luxury buyers, increasingly influenced by design-forward values and environmental consciousness, become more dominant in the market, their preferences differ from previous generations. They don't have the same deep attachment to leather as a luxury signifier. They're open to materials positioned as modern and thoughtful. Manufacturers who recognize this shift earliest will reap the positioning benefits of being seen as design leaders.

Audi and BMW models in Europe showcase high luxury and innovation ratings for their textile interiors, highlighting a shift from traditional leather. Estimated data.

Weight, Range, and the Electric Vehicle Advantage

Electric vehicles have fundamentally altered the equation for interior materials. Every kilogram matters. This is where textile interiors shift from being a preference question to being an engineering question.

Consider a typical luxury sedan interior. The leather or leather-like trim, including the hide or synthetic, the backing materials, and the structural reinforcement, contributes significant mass. A complete leather interior in a traditional sedan might weigh 40 to 50 kilograms. This seems abstract until you consider what it means for an electric vehicle.

A typical EV might have a battery pack weighing 400 to 600 kilograms, providing 300 to 400 miles of range. Battery energy density is measured in watt-hours per kilogram. If a battery pack achieves 150 watt-hours per kilogram, then every kilogram of mass saved elsewhere translates directly to range. The math is straightforward: reduce interior mass by 10 kilograms, and you increase effective range by approximately 15 to 20 miles, depending on driving conditions and the specific vehicle.

For consumers, 15 to 20 additional miles of range is meaningful. It reduces the frequency of charging. It increases the vehicle's practical usefulness. In regions where charging infrastructure is sparse, it matters. A textile interior, being lighter than leather, contributes to this advantage. It's not just an aesthetic choice; it's an engineering benefit.

But here's what's interesting: manufacturers don't market this advantage. When discussing interior materials for electric vehicles, companies emphasize sustainability or design. They rarely discuss the range implication. This seems like a missed opportunity. American consumers care about range. A manufacturer that positions a lighter textile interior as "adding 20 miles to your electric range" would likely generate interest. Position it as "sustainable alternative to leather" and you're fighting uphill.

The weight advantage compounds when you consider the complete vehicle. Lighter interiors reduce the mass that the suspension must support. They allow for more efficient climate control systems because there's less mass to heat or cool. They reduce stress on motors and batteries. These effects are small individually but significant collectively.

For the new generation of luxury electric vehicles that manufacturers are launching, this advantage will only increase. As battery technology improves and enables longer ranges, the comparison between vehicles becomes sharper. A vehicle that's 10 kilograms lighter in the interior is a vehicle that goes further, charges less frequently, or provides more cargo space given the same range. That's a competitive advantage that manufacturers should emphasize more explicitly.

The Cadillac Optiq: Proof That American Consumers Are Ready

If you need evidence that American luxury car buyers are ready to embrace textile interiors, the response to Cadillac's new Optiq electric crossover provides it. The vehicle features textiles made from recycled materials in prominent places, including center console trim and various interior surfaces. Cadillac didn't present this as a sustainability compromise. It presented it as a design choice reflecting modern luxury values.

The Optiq's textile interior uses multiple yarn colors woven together in precise patterns to create visual depth. This design approach accomplishes something leather can't: it shows intentional craft. The weaving pattern is visible. The material construction is evident. It reads as thoughtful rather than standard.

More importantly, consumer feedback on the Optiq suggests people are responding positively to this approach. They're not rejecting it because it's not leather. They're appreciating it as a distinct design choice. This validates what Cadillac's design team understood: how you position the material matters more than what the material is.

Jennifer Widrick's comment about layering and customer appreciation of detailing reveals the real strategy here. The comparison isn't leather versus textile. The comparison is between generic surfaces and thoughtfully designed surfaces. Leather applied without consideration is just leather. Textile applied thoughtfully is craft. That's the positioning difference.

The Optiq demonstrates that American manufacturers can offer textile interiors successfully, even in the luxury segment. The question isn't whether consumers will accept them. The question is whether other manufacturers have the design confidence and marketing willingness to make the shift. Cadillac apparently does. BMW and Audi clearly don't, at least not in the American market.

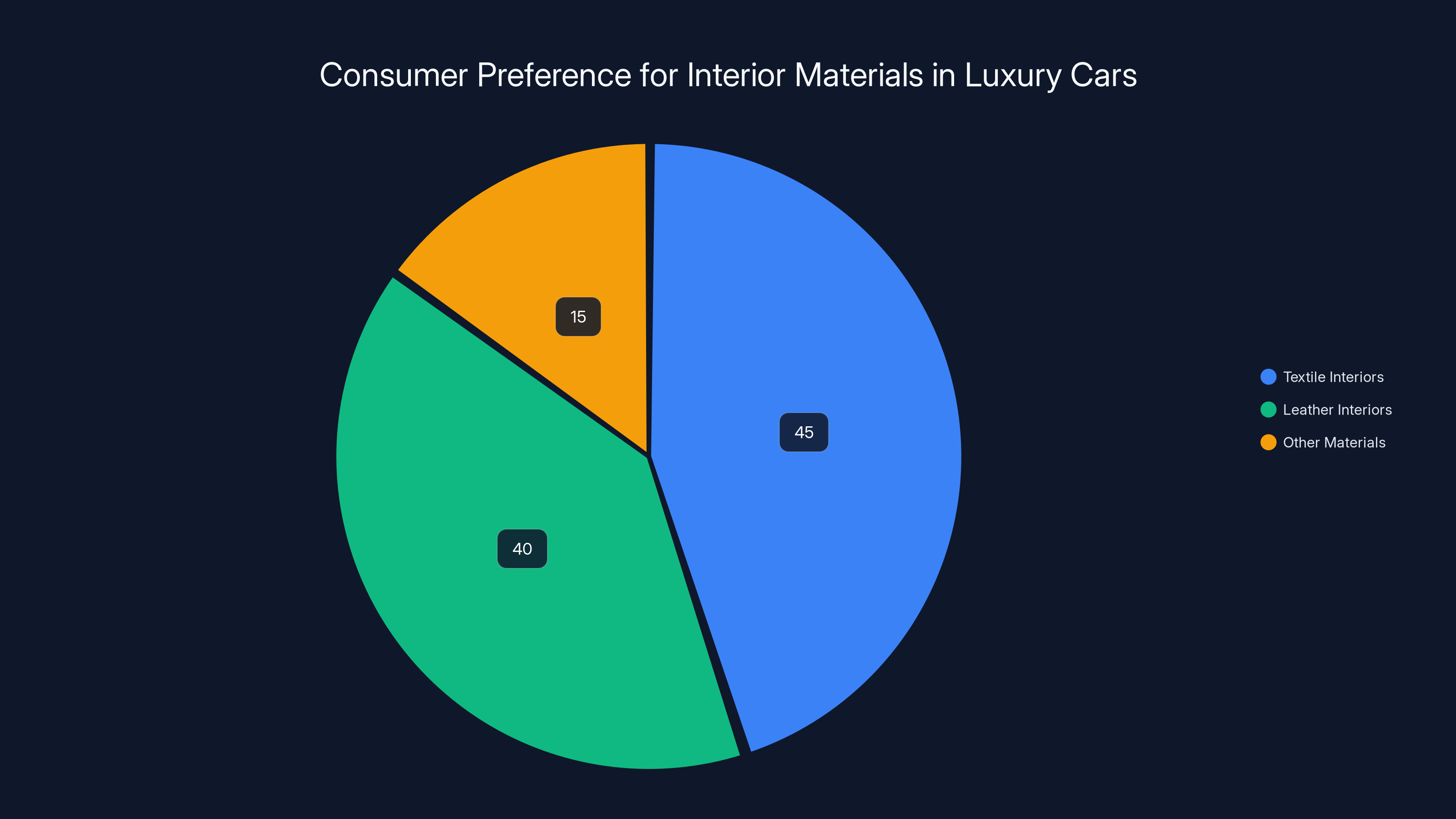

Estimated data suggests a growing preference for textile interiors in luxury cars, with 45% of consumers favoring them over traditional leather, indicating a shift in luxury design values.

Why Manufacturers Resist Innovation in Markets They Understand

There's a psychological and organizational reason why manufacturers resist offering premium textile interiors in America while doing so in Europe. It's rooted in how companies manage risk in established markets versus markets where they're positioning themselves as innovators.

In Europe, BMW and Audi can position textile interiors in electric vehicles as part of a broader innovation strategy. The market there has a different relationship with luxury. European consumers have shown willingness to adopt new technologies and materials. Offering textiles there is consistent with the brands' positioning as forward-thinking. The risk is lower because the market environment supports innovation.

In America, brands have established associations. Cadillac is the American luxury brand that can play with innovation. BMW is the premium performance brand. Audi is the technological innovator among the German luxury brands. These brand positions are stable because of decades of consistent messaging. Shifting those positions requires retraining consumer perception. That requires investment and confidence. It requires willingness to lead rather than follow.

Another factor is market size and revenue importance. The American luxury market is vast and generates enormous profit. The risk of misjudging this market is substantial. A European manufacturer might believe that testing new interior materials in a European market is a reasonable calculated risk. Testing them in the American market, with all its profit importance, is riskier. From a corporate perspective, this makes sense. From a market innovation perspective, it's conservative.

The final factor is institutional inertia. Every major manufacturer has decades of knowledge about leather supply chains, leather suppliers, leather finishing techniques, and leather pricing. Leather is the default. Proposing something else means proposing to rebuild some part of the supply chain, to establish new supplier relationships, to develop new finishing and quality control standards. For companies managing enormous supply chains with thousands of variables, adding a new material category requires organizational change. That's expensive and complicated. It's easier to maintain existing practices.

But this explanation also reveals the opportunity. The company that decides to invest in premium textile interiors in the American market will gain a competitive advantage. They'll be seen as design-forward. They'll attract consumers who want to feel like they're driving something innovative. They'll capture market share from companies still defaulting to leather. That advantage is real, but it requires being first. It requires confidence in your market understanding. It requires design leadership.

The Practical Concerns That Don't Actually Hold Up

When manufacturers explain their reluctance to offer textile interiors, they cite practical concerns. Clothes clinging to fabric. Easier cleaning with leather. These are real concerns for some consumers. But examining them closely reveals they're not actually obstacles.

The clinging concern reflects experiences with traditional woven cloth. A polyester shirt will catch on unfinished fabric. But automotive textiles aren't unfinished. They're treated with specialized coatings that reduce friction. Modern automotive textiles are engineered to prevent clinging. Test this for yourself: take a piece of untreated cotton and one of treated automotive textile, and try to snag clothing on them. The difference is obvious. The treated material simply doesn't catch.

The cleaning concern is also somewhat overstated. Leather requires cleaning just like textiles do. Spill coffee on leather, and you need to clean it immediately before it absorbs. Spill coffee on stain-resistant treated textile, and you wipe it up. In terms of maintenance, textiles actually require less care because they don't require the periodic conditioning leather needs. For the average consumer, textiles are easier to maintain.

Yet these practical concerns, even though they don't hold up to scrutiny, influence designer and engineer decisions. They're brought up in meetings when someone suggests exploring textile options. They're cited to stakeholders as reasons to maintain leather. They accumulate into a culture of leather as default.

What's needed is for manufacturers to actually put the textiles in customers' hands. Let them experience the material. Let them understand that modern textiles solve the problems old textiles had. Let them appreciate the design differentiation. Once people experience quality-engineered textiles in a luxury vehicle, the objections diminish substantially. The problem is that manufacturers won't invest in this education.

Looking Forward: What the Next Five Years Might Hold

The automotive industry is undergoing one of its most significant transformations in decades. Electric powertrains are becoming standard. Interior technology is evolving rapidly. Design philosophies are shifting. In this environment of change, interior material choices will gradually shift too.

The first shift will likely come from luxury electric vehicle makers who need to differentiate themselves. As Tesla, Lucid, and other EV-native manufacturers establish what luxury means in an electric context, they're freed from the assumption that leather is required. Some of these manufacturers are already exploring alternative materials. As they succeed, traditional manufacturers will follow.

The second shift will come from generational change. As buyers under 40 become the dominant luxury car market, their material preferences differ from previous generations. They grew up with diverse interior materials in premium products. They have less attachment to leather as a luxury signifier. They're open to innovation. As this generation's purchasing power increases, their preferences will influence what manufacturers offer.

The third shift will come from regulation. As environmental standards tighten and life-cycle assessment becomes more important in vehicle certification, the advantages of lighter, more recyclable interior materials will become harder to ignore. Regulations might eventually require manufacturers to offer vehicles with lower interior material impacts. This would accelerate adoption.

Manufacturers who get ahead of these shifts will benefit. Those who wait until they're forced will lose the positioning advantage of being seen as innovators. Cadillac is already getting ahead with the Optiq. Other American brands will need to follow.

Interestingly, this might be the moment when American manufacturers finally leapfrog their European counterparts. European brands are offering textile interiors in Europe while restricting them in America. That's asymmetrical positioning. An American manufacturer that offered premium textile interiors across all markets would be positioned as more globally consistent and more confident in the material's quality. That's a subtle but meaningful positioning advantage.

The most interesting possibility is that American manufacturers might eventually embrace textile interiors more enthusiastically than European brands. American companies often have less historical attachment to existing materials and design languages. Once they decide to move, they can move decisively. European brands, with stronger brand heritage tied to specific material traditions, might struggle more with the transition.

But that's speculation. What's clear is that the current American reluctance to offer premium textile interiors is driven by risk aversion, not by technical limitations or genuine consumer preferences. It's a temporary position that will eventually shift.

The Larger Pattern: American Markets and Global Options

The textile interior situation is part of a broader pattern where American car buyers get fewer options than buyers in other major markets. This pattern extends across countless categories: engine displacements, transmission types, body styles, technology packages, and yes, interior materials. There's a consistent theme: manufacturers assume American preferences are fixed and restrict options accordingly.

But this pattern might be self-reinforcing. Manufacturers don't offer certain options in America, so American consumers never learn to value them. Then manufacturers cite the lack of demand for the missing options. The cycle continues.

With interior materials, it's possible to break this cycle. One manufacturer deciding to offer premium textile interiors broadly in America, explaining the choice confidently, and backing it with strong design, could shift perception rapidly. The market wouldn't need to be educated for years. The education could happen through experience. Drive the vehicle. Feel the material. Understand the choice. Accept it.

What's required is manufacturer confidence. Confidence that American consumers can appreciate innovation. Confidence that design leadership matters. Confidence that being first to market with something new is an advantage, not a risk. These are the attitudes that separate companies that shape markets from companies that follow them.

The textile interior question is ultimately a question about who American luxury car manufacturers think their customers are. Do they think we're conservative and locked into preferences? Do they think we're incapable of appreciating new materials and design directions? Or do they think we're ready for what the best designers in the world are creating?

Based on Cadillac's approach with the Optiq, at least one American manufacturer has decided we're ready. The rest will catch up eventually. The only question is how long that takes.

The Manufacturing Complexity Nobody Discusses

Beyond marketing and consumer preference, there's a legitimate manufacturing complexity that manufacturers rarely discuss: the infrastructure requirements for scaling new materials. While this doesn't explain the American reluctance entirely, it's part of the equation.

Leather has established supply chains. Tanneries operate globally. Finished hides are sourced from a network of suppliers. Quality standards are understood. Finishing specifications are known. Manufacturing plants know how to work with leather: cutting, stitching, bonding to foam and structure. The infrastructure is mature.

Textiles for automotive use require different infrastructure. While textile manufacturing exists globally, automotive-grade textiles with specific performance characteristics are produced by specialized suppliers. Working with these materials requires different tooling in manufacturing plants. Different application techniques might be required. Workers need different training. Quality control requires different testing protocols.

For a global automaker to introduce premium textiles across all markets simultaneously would require coordinating this change across dozens of manufacturing plants. For a company to introduce them only in certain markets means maintaining parallel supply chains and manufacturing processes. That's more complicated than simply deciding to offer the material.

This is where a company like Cadillac, manufacturing in a single country with a smaller production volume, has an advantage. The coordination required is less complex. A global manufacturer like BMW would need to decide: do we redesign our supply chain globally? Do we create parallel systems? Do we introduce the change gradually, region by region?

For a company like BMW with enormous established relationships with leather suppliers, moving away from leather has real organizational costs. This doesn't justify maintaining the restriction in America. It explains why it persists. To change it, BMW would need to make a strategic decision that this material shift is important enough to justify the complexity. So far, the company hasn't made that decision for the American market.

Interestingly, this suggests that American companies might have an advantage in being first to scale premium textiles broadly. They have simpler supply chains in some cases. They have less historical infrastructure invested in leather. They can move faster. Again, Cadillac is ahead here.

FAQ

What are premium automotive textile interiors?

Premium automotive textiles are engineered fabrics designed specifically for vehicle interiors, featuring synthetic or natural fibers treated to meet automotive durability standards. These materials are designed to match or exceed leather's performance in abrasion resistance, tear strength, and colorfastness while offering advantages in weight, breathability, and design flexibility. Unlike traditional cloth upholstery, modern automotive textiles are stain-resistant, durable enough for daily use, and engineered to prevent clothing from snagging during entry and exit.

Why aren't textile interiors available in American luxury cars?

American manufacturers restrict premium textile interiors primarily due to assumptions about customer preferences rather than technical limitations. Companies like BMW and Audi cite consumer preference for leather and leather-like alternatives when explaining why these materials don't reach the American market. However, consumer research suggests the resistance is less strong than manufacturers believe. Cadillac's success with textile interiors in the new Optiq demonstrates that American consumers will embrace these materials when positioned as intentional design choices rather than compromises.

How do premium textiles compare to leather in durability?

Modern premium automotive textiles rival leather in durability across nearly every measured metric. Abrasion resistance testing shows automotive textiles often exceeding 50,000 cycles before visible wear, comparable to quality leather. Tear resistance, seam strength, and colorfastness are all engineered to meet or exceed leather performance. The key difference is that textile durability is engineered through fiber selection and treatment, while leather durability depends on hide quality. For most metrics relevant to automotive use, premium textiles are at least equivalent to leather.

What are the weight advantages of textile interiors in electric vehicles?

Textile interiors are typically 10 to 15 kilograms lighter than comparable leather interiors, including the hide weight and structural backing materials. For an electric vehicle, this weight reduction translates to approximately 15 to 20 additional miles of range, depending on driving conditions and battery specifications. This advantage is significant for consumer use because it directly impacts charging frequency and practical vehicle range. Additionally, lighter interiors reduce the mass suspension systems must support and decrease climate control system demands.

How do manufacturers justify not offering textile options in America?

Manufacturers cite three main justifications: customer preference for leather, practical concerns about clothing snagging on textiles, and cleaning ease with leather versus fabric. However, these justifications don't hold up to detailed scrutiny. Modern automotive textiles are treated to prevent snagging and actually require less maintenance than leather. Consumer research shows preference for leather is strong but not overwhelming, with substantial percentages willing to accept premium alternatives. The real barrier appears to be manufacturer risk aversion in established markets rather than genuine technical or market limitations.

Are textile interiors sustainable alternatives to leather?

Textile interiors can be more sustainable than leather, particularly when manufactured from recycled materials, but sustainability isn't automatically guaranteed. Synthetic textiles derive from petroleum, requiring energy-intensive production. However, textiles made from recycled plastic and other reclaimed fibers genuinely reduce environmental impact. The strongest positioning for textile interiors shouldn't emphasize sustainability as a primary benefit but rather frame the materials as modern, intentionally designed choices that happen to offer environmental advantages alongside performance benefits.

What is the Cadillac Optiq's approach to textile interiors?

Cadillac's Optiq features textiles made from recycled materials used intentionally as design elements throughout the interior, including center console trim. Rather than positioning textiles as sustainable alternatives to leather, Cadillac frames them as reflecting modern design trends, providing visual depth through multiple yarn colors in precise weaving patterns. The design approach emphasizes craft and intentionality, showing that American consumers respond positively to textile interiors when positioned as forward-thinking design choices rather than compromises. Consumer response to the Optiq suggests American buyers are ready for this material shift.

What's stopping other American manufacturers from adopting textile interiors?

Three factors create resistance: organizational inertia rooted in established leather supply chains, risk aversion regarding changes to major market positions, and the manufacturing complexity of integrating new material infrastructure across global production networks. These factors are solvable through management decisions but require perceiving the change as strategically important. Additionally, manufacturers haven't yet invested in the market education required to shift consumer perception. Once a company decides textile interiors represent design leadership rather than risk, the barriers become manageable.

How might this situation change in the next five years?

The automotive industry is undergoing rapid transformation driven by electric vehicle adoption, generational shifts in buyer preferences, and evolving regulatory requirements. Multiple forces will likely accelerate textile interior adoption in America: luxury EV manufacturers establishing new luxury definitions, younger buyers with less attachment to leather as a luxury signifier becoming dominant purchasers, regulatory pressures favoring lighter and more recyclable materials, and competitive positioning advantages for early movers. Manufacturers who adopt premium textiles across their product lines will be positioned as design leaders, potentially gaining market share from competitors still defaulting to leather.

Why do European buyers have access to options American buyers don't?

European manufacturers position textile interiors in European markets as part of a forward-thinking innovation strategy aligned with the region's environmental values and design consciousness. These markets support material innovation more readily. In the American market, manufacturers take a more conservative approach, assuming customer preferences are fixed and resistant to change. This creates an asymmetrical situation where the same manufacturer offers different options in different regions. This pattern reflects perceived market risk rather than actual technical limitations or genuine preference differences.

Conclusion: The Wait Isn't Inevitable

American luxury car buyers are being denied options that European buyers take for granted. Premium textile interiors that designers at BMW and Audi have developed, refined, and successfully implemented in their home markets are restricted from the American market not because of regulatory requirements, technical limitations, or genuine consumer preference, but because manufacturers have decided it's too risky to offer them here.

This decision is defensible from a certain perspective. Why introduce something new in the largest luxury market when the traditional approach still sells vehicles? Why invest in educating consumers about new materials when leather continues to satisfy expectations? Why spend resources on manufacturing complexity when established processes work?

These are reasonable questions from the perspective of risk management. But they're bad questions from the perspective of market leadership. The companies that innovate, that take calculated risks, that educate markets about new possibilities, are the companies that define luxury for future generations. The companies that default to traditional approaches because they're proven lose the opportunity to shape perception.

Cadillac has already recognized this. The company is positioning textile interiors as part of what American luxury means in the electric future. That's leadership. Other manufacturers will follow. The only question is how quickly.

The story of Gordon Murray's imagined four-door McLaren with wool seats, a fantasy from 30 years ago, seems less fantastical now. Top designers at major manufacturers have proven that premium vehicles can use premium textiles. The technology exists. The design possibilities exist. The consumer willingness exists, even if manufacturers don't entirely believe it yet.

What's missing is simply the decision to do it. That decision will eventually come. Until then, American consumers will continue to experience luxury car interiors as a more limited palette than their global counterparts. That's not because options don't exist. It's because manufacturers have chosen to restrict them.

That choice, it seems, is worth reconsidering.

Key Takeaways

- BMW and Audi offer premium textile interiors in European EVs but restrict them from American markets due to perceived consumer preference for leather—not technical limitations

- Modern automotive textiles match or exceed leather durability in abrasion, tear resistance, and colorfastness while offering 10-15kg weight savings critical for EV range

- Consumer research reveals 30-40% of luxury car buyers accept leather alternatives, contradicting manufacturer claims that demand for textiles is negligible

- Cadillac's Optiq proves American consumers embrace textile interiors when positioned as intentional design choices reflecting modern fashion and interior design trends

- Textile interiors could add 15-20 miles of electric vehicle range through weight reduction alone, yet manufacturers rarely market this advantage to consumers

Related Articles

- Singapore's Telecom Crisis: UNC3886 Breaches All Four Major Carriers [2025]

- InkPad One vs Kindle Scribe: Linux E-Reader Showdown [2025]

- Can Sleep Trackers Detect Sleep Apnea? [2025]

- Wacom MovinkPad 11 Review: The Portable Drawing Tablet [2025]

- Resident Evil 5 Remake Rumors Debunked: Why That ESRB Rating Isn't New [2025]

- Jessie Diggins' Winter Olympics 2026 Starter Pack [2025]

![Beyond Leather: The Future of Luxury Car Seat Materials [2025]](https://tryrunable.com/blog/beyond-leather-the-future-of-luxury-car-seat-materials-2025/image-1-1770813517044.jpg)