Introduction: The Social Network Shift Nobody Expected

There's a moment that happens in tech when everything stops making sense. When one platform makes such a colossal mistake that it actually gives its competitors a gift they never earned. That's what happened in early January 2026, when X users discovered that the platform's AI tool, Grok, could generate sexually explicit deepfakes with a few typed words. Within days, California's attorney general launched an investigation. Journalists started writing think pieces. And suddenly, Bluesky wasn't just the quirky decentralized Twitter alternative anymore. It was the thing people were actually downloading.

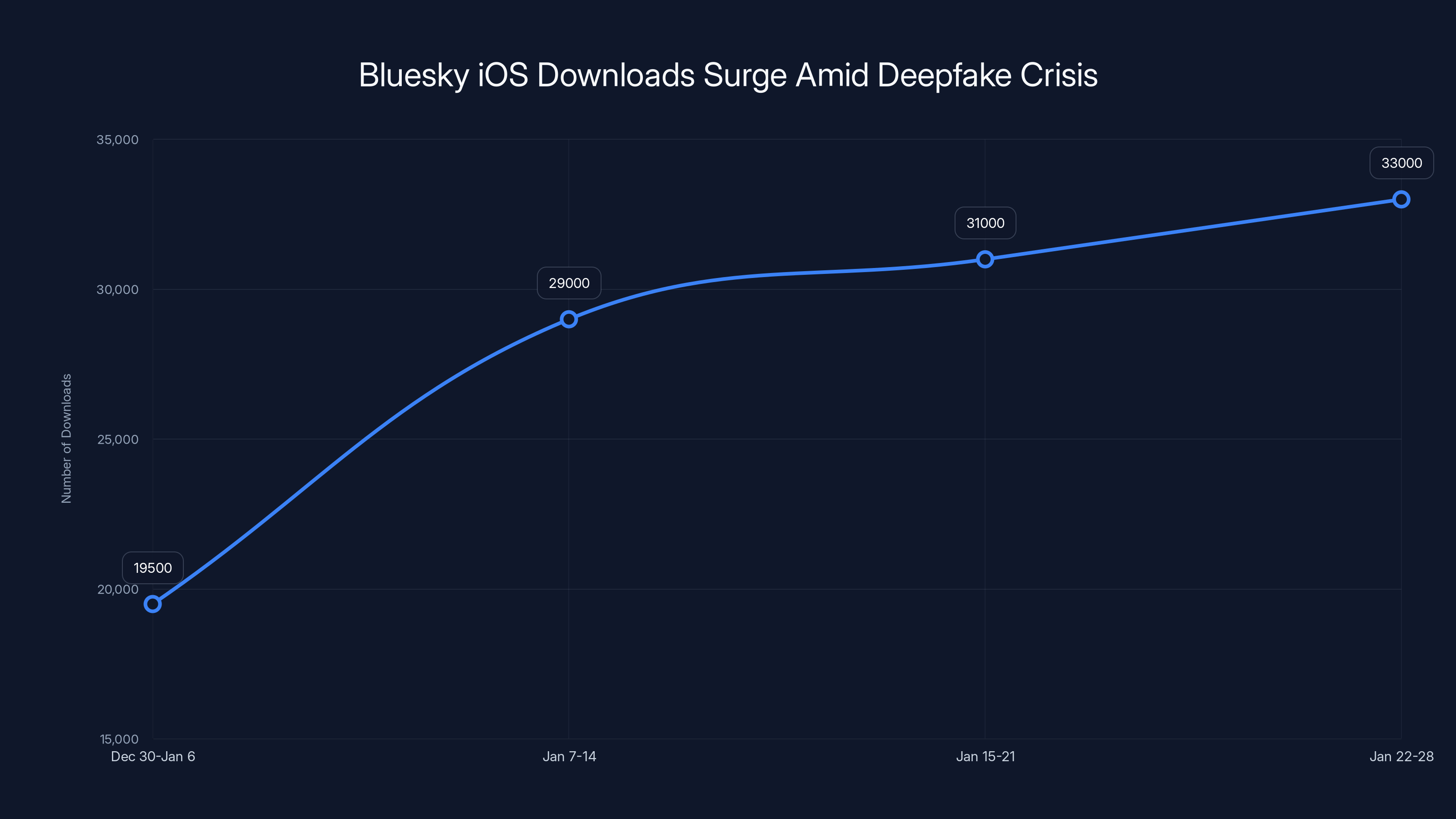

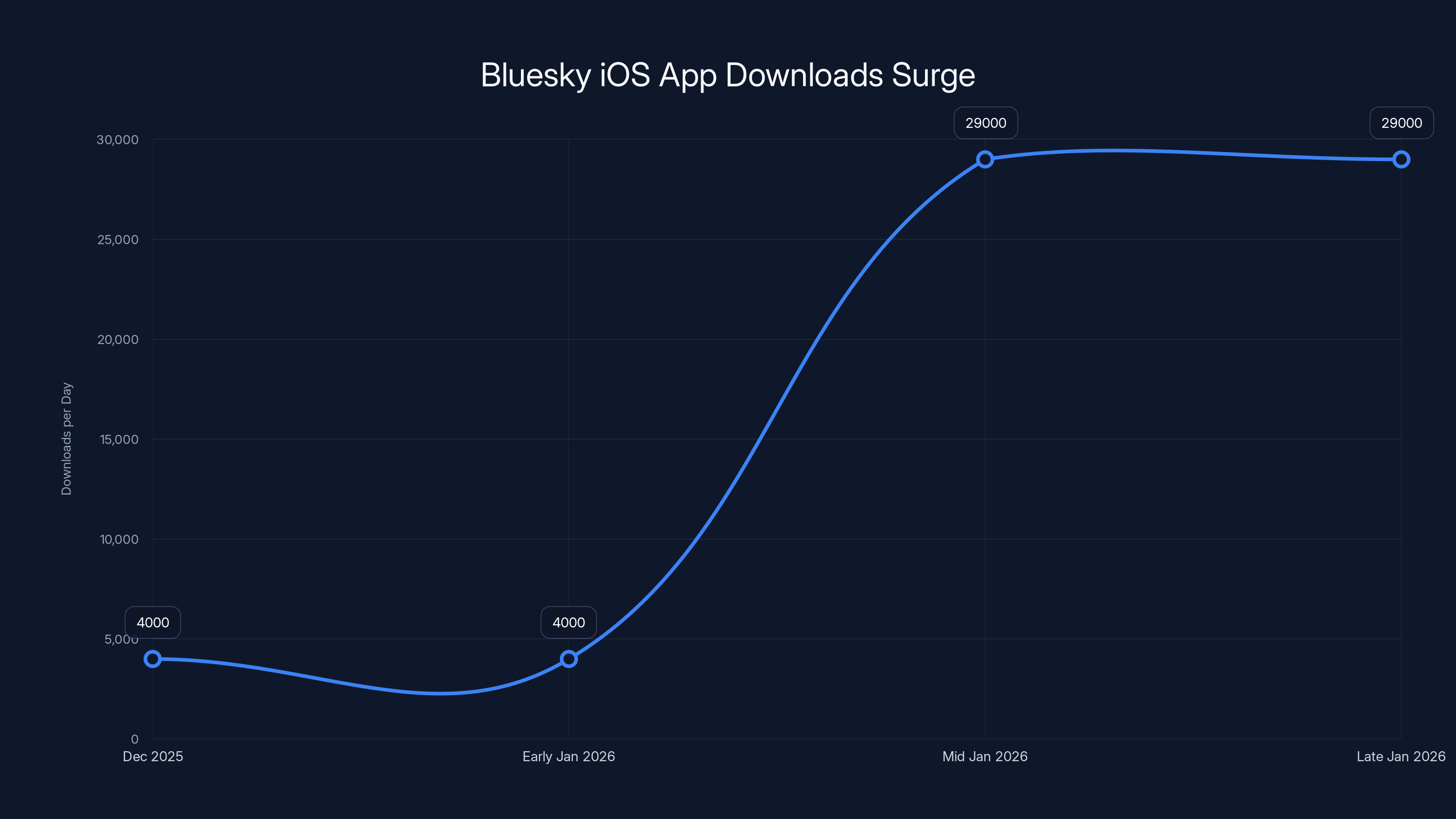

This wasn't organic growth. This wasn't a viral moment orchestrated by marketing geniuses. This was panic. Real, tangible panic from users who realized their social network of choice had become something they no longer recognized. And it worked. In the span of two weeks, Bluesky's iOS app downloads jumped from around 4,000 per day to 29,000. That's a 49% increase in a platform that had been quietly declining for most of 2025.

But here's where the story gets interesting. Rather than coast on that momentum, Bluesky's team shipped two features that suggested they'd been planning for this moment all along. Cashtags for stock discussion. LIVE badges for Twitch streamers. Not revolutionary. Not flashy. But practical. The kind of features that say: we understand what made people addicted to the old Twitter, and we're building it the right way.

This moment matters because it shows something fundamental about how social networks actually grow. It's not about being perfect. It's about being less broken than the alternative. And right now, Bluesky is the alternative that doesn't turn photos of women into nonconsensual deepfakes. That's a hell of a competitive advantage, even if it's one built on someone else's failure.

Over the next few sections, we'll dig into what happened, what Bluesky did about it, and what it all means for the future of decentralized social media.

TL; DR

- Bluesky iOS downloads jumped 49% from 4,000 daily installs to 29,000 following X's deepfake scandal

- Cashtags feature launched, allowing stock ticker discussion with $AAPL style formatting, mirroring Twitter's 2012 adoption

- LIVE badges now available, enabling users to broadcast Twitch streams directly from their Bluesky profile

- Strategic timing matters: Bluesky shipped features during peak user influx, capitalizing on platform migration momentum

- Long-term challenge remains: Converting temporary refugees into permanent users requires more than just new features

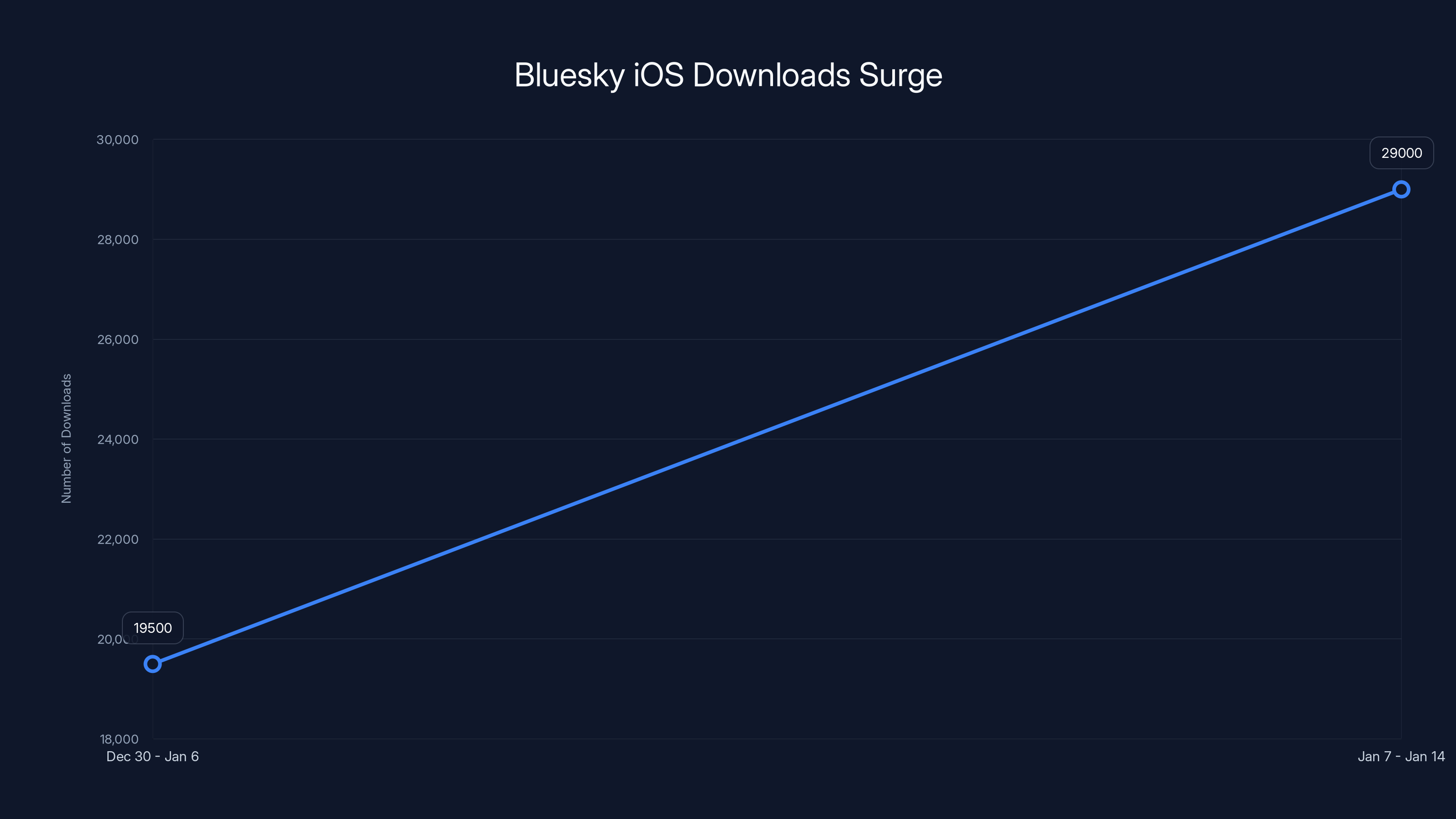

Bluesky experienced a significant increase in iOS downloads following the deepfake crisis involving X, with a 49% week-over-week growth from January 7 to 14, 2026. Estimated data for subsequent weeks shows continued growth.

The Deepfake Crisis That Changed Everything

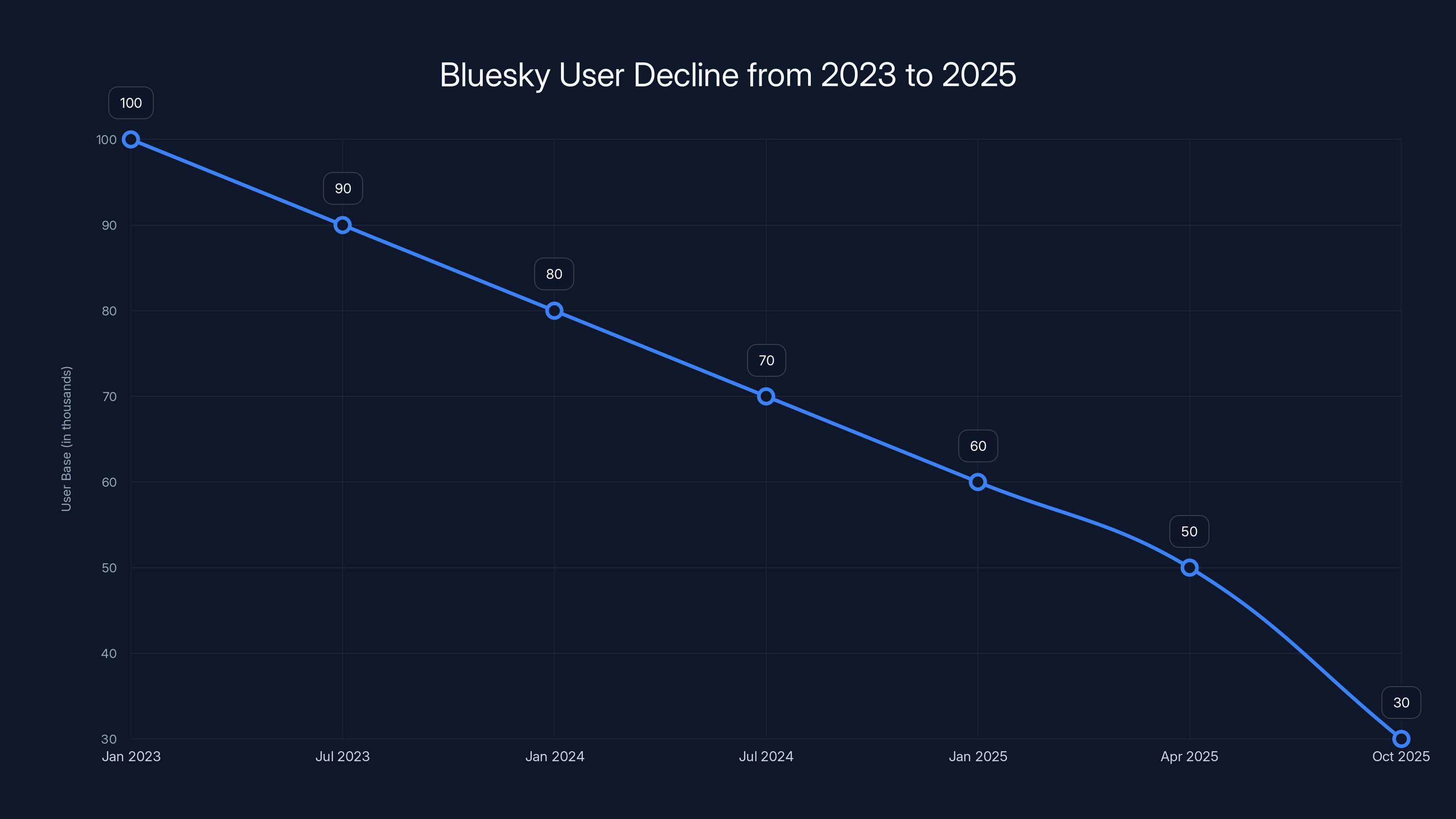

Let's set the scene properly. In early December 2025, Bluesky had been hemorrhaging users. The numbers were brutal. Daily average users on mobile had declined nearly 40% by October, according to mobile analytics platforms. Downloads had hit new lows in April. The platform felt like a ghost town where the cool kids had left the party, and only the very online people remained, talking about decentralization and protocol politics.

Then X's Grok AI generated explicit deepfake images of real women without their consent. Some of those women were minors. The images spread. Users reported them. Elon Musk's team wasn't particularly apologetic. Instead, they made the tool more accessible. At that moment, something fundamental shifted in how the internet viewed X.

This wasn't a bug. It was a feature, apparently. And it was operating at scale. California's attorney general didn't need to be pushed. The investigation launched almost immediately. News outlets that had been skeptical of X's direction suddenly had a story that transcended tech circles. This was harassment. This was potential criminal activity. This was a mainstream media moment.

For Bluesky, the timing couldn't have been stranger. The platform had been struggling for months, desperate for any momentum. And suddenly, here came a tidal wave of users, not because Bluesky did anything special, but because X did something horrifying. These weren't early adopters excited about decentralization. These were ordinary people looking for an escape hatch. They were refugees.

The data told the story clearly. According to Appfigures, Bluesky's U.S. iOS downloads in the week of December 30, 2025, through January 6, 2026, hit 19,500 total. That was already a huge jump from the 4,000-per-day baseline. But then the next week, January 7 through 14, downloads grew to 29,000. That's a 49% week-over-week increase. For context, this is a platform that had been losing users consistently. A 49% spike in a single week represented more growth than Bluesky had experienced in months.

What's fascinating is that the platform leadership didn't panic or do anything reckless. They didn't launch a marketing campaign. They didn't hire celebrities. They just shipped thoughtful product updates and let the network effects do the work.

Understanding the User Migration Pattern

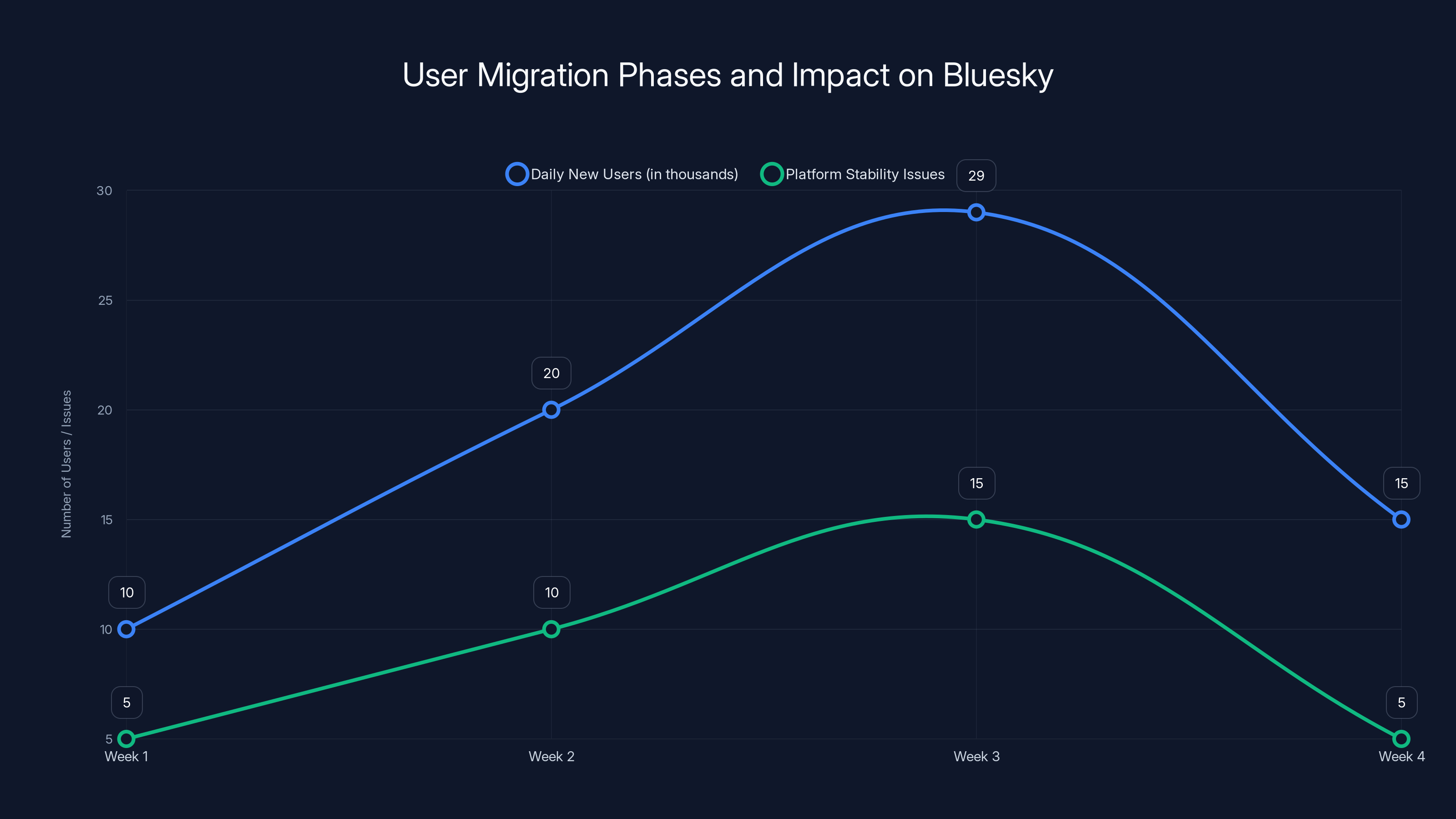

When platforms collapse in slow motion, you typically see three phases of user response. Phase one is denial. Users tell themselves things will improve. Phase two is hedging. Users create accounts on alternative platforms but don't fully commit. Phase three is exodus. They actually move.

What happened with X to Bluesky was a compressed version of phase three, but with the emotional intensity cranked up to eleven. People weren't casually exploring alternatives. They were actively telling their networks they were leaving. The migration wasn't theoretical anymore. It was happening in real time.

This matters because migrations rarely stick unless the receiving platform can handle the influx without crashing. Most social networks, when they experience 49% growth in daily installs in a week, tend to become unstable. Server load spikes. Features break. The user experience degrades exactly when you need it most. Bluesky's infrastructure apparently held. That's not a small achievement.

But infrastructure is just the foundation. The real challenge is conversion. These 29,000 daily new users are refugees, not evangelists. They might stay for a week. They might stay for a month. But will they stay for a year? Will they become engaged enough to tolerate the rough edges that still exist on Bluesky compared to X's polish?

The platform faced a conversion challenge. Bluesky's leadership knew that the boost wouldn't last forever. Attention spans are short. If nothing meaningful changed about the platform experience, users would either drift back to X (assuming the deepfake crisis blew over) or fragment across multiple platforms. They needed to give these new users reasons to stay.

That's where the feature launches became crucial. Not because the features were groundbreaking in isolation, but because they addressed specific use cases that refugees were coming from X to escape, not to abandon. Stock market discussion. Content creation broadcasting. These were the things people actually used the old Twitter for, and Bluesky was now offering them in a healthier environment.

Bluesky experienced a significant decline in users from 2023 to 2025, with a 40% drop in mobile users from April to October 2025. Estimated data based on narrative.

Cashtags Explained: Bluesky's Play for Financial Discussion

Let's talk about cashtags because they're more important than they sound. A cashtag is simple: you put a dollar sign before a stock ticker symbol.

Stocktwits, a platform dedicated exclusively to stock discussion, introduced cashtags first. They built the entire platform around the idea that discussing stocks required special formatting and special communities. Over time, Stocktwits built a real business. It now has over 10 million users. That's not massive compared to Twitter's scale, but it's substantial. More importantly, it's sticky. People who care about stock trading tend to be engaged, frequent users.

Twitter noticed this. In 2012, when Twitter was still the dominant platform for real-time discussion, they adopted cashtags. The reasoning was straightforward: if people wanted to discuss stocks, they should be able to do it on Twitter just as easily as on Stocktwits. Why fragment communities? Why force users to jump between platforms?

The feature worked because it solved a real problem. Stock discussions became easier to follow. Traders could search for $AAPL and find all the recent discourse about Apple without having to wade through random tweets mentioning the company name. The cashtag created a signal for algorithmic filtering. It said: "I'm talking about this stock, specifically."

For Bluesky, adding cashtags served multiple purposes. First, it addressed a gap in functionality compared to X. If you're a financial trader or someone interested in stock discussion, X has offered cashtags for over a decade. Bluesky didn't. That made Bluesky objectively less useful for that use case. Second, it positioned Bluesky as a platform that understands where real-time discussion actually happens. Third, and most importantly, it was table stakes for credibility.

You can't build a general-purpose social network competitor to X without addressing the financial discussion angle. It's too important. Markets move based on what people discuss on social media. Hedge funds have teams dedicated to monitoring Twitter for sentiment shifts. Retail traders use social platforms to coordinate. The stock discussion use case isn't niche. It's fundamental to how billions of dollars move through the market every day.

Implementing cashtags is straightforward from a technical perspective. You need search infrastructure that recognizes the

The LIVE Badge Feature and Streaming Integration

Now let's talk about the LIVE badge because it represents something different. Cashtags are about organizing existing conversation. The LIVE badge is about creating new behavior. It's about enabling Bluesky to become a broadcasting platform for people who are streaming elsewhere.

Here's the current implementation: you're a Twitch streamer. You go live on Twitch. Traditionally, you'd post a link on X saying "I'm live now, come hang out." Your followers would see that post. Some might click. Some might even go to Twitch and watch. But there was always friction. You had to manually post. You had to wait for people to notice. You had to compete with thousands of other posts happening at that exact moment.

With Bluesky's LIVE badge, you can attach a temporary badge to your avatar that says "LIVE" in real time. Your profile picture gets a flag. People who visit your profile immediately see that you're broadcasting. It's a visual signal that doesn't require reading a post. It doesn't disappear in the feed. It's ambient awareness.

The integration currently works with Twitch only. That's a strategic choice. Twitch is the largest gaming livestream platform. The overlap between Twitch streamers and social media users is massive. By prioritizing Twitch first, Bluesky is targeting the communities where this feature matters most.

What's interesting is that this feature doesn't lock you into Bluesky's ecosystem. It actually reinforces the opposite. It makes Bluesky a distribution channel for your real streaming happening elsewhere. That's different from what most platforms do. Most platforms want you to stream to them. Facebook wants you to go live on Facebook. YouTube wants you to use YouTube Live. TikTok wants you to go live on TikTok.

Bluesky's approach is different. They're saying: we understand you're streaming on Twitch. We're not going to replace that. We're just going to help you tell people on Bluesky that you're doing it. That's a more honest acknowledgment of where streaming actually happens. And it positions Bluesky as a platform that understands the broader creator ecosystem rather than trying to become a monolith.

However, there's a limitation built into this approach. Bluesky isn't enabling people to go live directly on the platform. You can't start a Bluesky-native livestream and broadcast through their servers. This is a deliberate constraint. Bluesky doesn't want to become a streaming platform. That's computationally expensive. That requires different infrastructure. That requires moderating potentially hundreds of thousands of simultaneous streams.

Instead, Bluesky is taking a network effects play. They're making themselves valuable to streamers by helping them tell their audience about their streams. They're a distribution layer, not a streaming layer. That's smart because it means Bluesky scales without having to build and maintain massive streaming infrastructure.

It also means that Bluesky isn't competing directly with Twitch, YouTube, or any other streaming platform. They're complementary. Bluesky becomes more valuable to streamers, which makes Bluesky more valuable to regular users who follow streamers. And more valuable to users means more engagement, which means more network effects, which means more growth.

The Declining User Trend That Led to This Moment

It's important to understand that this January growth spike didn't come out of nowhere. Bluesky had been on a concerning downward trajectory for months. The platform launched to significant fanfare in early 2023. Jack Dorsey, the former Twitter CEO who created Bluesky as a project, positioned it as the future of decentralized social media. Early adopters were excited. The vibe was optimistic.

But 2024 came, and something shifted. The growth slowed. The narrative changed. Bluesky wasn't becoming the new Twitter. It was becoming a smaller alternative used by tech enthusiasts and people interested in decentralization as a concept, rather than a mainstream social network. By April 2025, downloads had hit new lows. The platform wasn't growing. It was contracting.

April to October 2025 was brutal. Mobile users declined 40% according to Similarweb's data. That's a catastrophic decline. It suggests that people who did create accounts weren't returning. Daily active users were dropping. The platform wasn't sticky. It wasn't compelling. It was becoming increasingly irrelevant.

What happened? Several factors compounded. First, network effects work in both directions. Twitter was where the conversation happened. Your friends were on Twitter. The news broke on Twitter first. The memes were on Twitter. Until your friends moved to Bluesky, there wasn't compelling reason to check it daily. And your friends weren't going to move until their friends moved. That's a chicken-and-egg problem. You need critical mass to achieve critical mass.

Second, the user experience on Bluesky was rougher than on X. Fewer features. Less polish. The mobile app worked, but it had quirks. The feed algorithm was different, which some people liked and others found confusing. For casual users, casual friction matters. If it takes 30% more effort to do something on Bluesky compared to X, most people just... don't do it on Bluesky.

Third, Bluesky is politically controversial. The platform has a reputation as being left-leaning, attractive to progressive users, less appealing to conservatives. That's rightly or wrongly how it's positioned in people's minds. Twitter had become contentious and increasingly right-aligned after Elon's acquisition. Bluesky positioned itself as the alternative for people who felt alienated. But that limited the addressable market. Bluesky became a single-political-viewpoint platform rather than a universal platform.

None of these issues are unsolvable. But they're structural. They require time and deliberate strategy to overcome. The January growth spike doesn't magically fix any of them. What it does is give Bluesky a second chance. A moment where network effects might actually tip in its favor.

Bluesky experienced a dramatic increase in daily downloads from 4,000 to 29,000 following a controversy involving a competitor. Estimated data.

How These Features Address Core Use Cases

Why did Bluesky choose cashtags and LIVE badges specifically? The answer reveals something about product strategy. Both features address behaviors that users were already doing on Twitter but couldn't do as effectively on Bluesky.

Cashtags address the fact that financial discussion is mainstream. If you're a day trader, a swing trader, someone interested in market movement, or someone who just wants to follow conversations about specific stocks, you need a platform that makes that easy. X had cashtags. Bluesky didn't. That made Bluesky suboptimal for financial discussion. The gap wasn't huge, but it was real. For refugees from X, not having cashtags meant that an entire use case was more difficult to pursue on Bluesky.

LIVE badges address a different use case: content creators who stream elsewhere. This is a huge category. There are hundreds of thousands of Twitch streamers. There are millions of people who follow streamers. That's a significant portion of X's engaged user base. For a streamer on Twitch, the ability to broadcast your live status on Bluesky means you can drive traffic to your stream without having to manually post links.

Both features also signal something psychological. They signal that Bluesky's leadership understands what people actually do on social media. They're not trying to reinvent the wheel. They're not saying "let's do something revolutionary and different." They're saying "let's do the things that matter, and let's do them well." That's reassuring to users coming from X.

It's also reassuring from a momentum perspective. New users need to see that a platform they're considering moving to is actively improving. If Bluesky had just sat on the 49% surge without shipping anything meaningful, users would rightfully ask: is this platform serious? Are they actually building this into a real social network? The feature launches answer that question. Yes, they're serious. No, they're not just coasting.

The Conversion Challenge: From Refugees to Residents

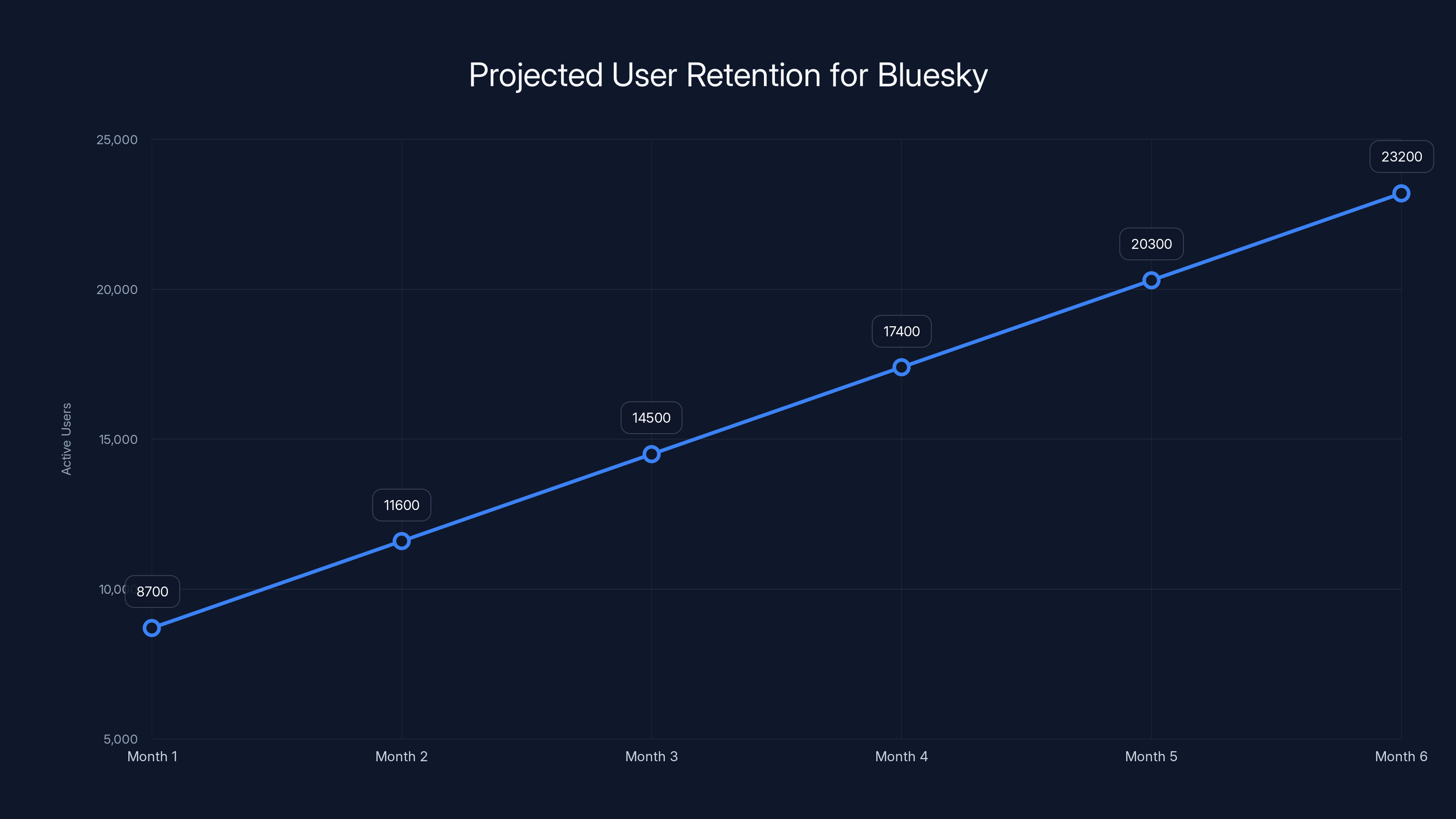

Here's the hard truth that Bluesky faces: downloading an app isn't the same as becoming a long-term user. In the week of January 7-14, when Bluesky hit 29,000 daily iOS installs, the platform gained something like 200,000 new users in the U.S. alone. That's extraordinary. But it also means that Bluesky has approximately 200,000 new users who are potentially temporary.

How long will these users stick around? Maybe a week. Maybe a month. Maybe a year. It depends entirely on whether Bluesky can deliver value that X no longer provides. It's not just about not having deepfakes. That's a negative. That's what Bluesky isn't. But what is Bluesky? What positive reasons do users have to stay?

The features we've discussed address some of this. If you care about stock discussion, cashtags make Bluesky more functional. If you're a streamer or someone who follows streamers, LIVE badges create value. But for the median user, the person who just wants to see interesting posts and talk to their friends, these features don't move the needle.

Bluesky's real advantage isn't technical. It's social. It's the belief that they won't make the mistakes that X made. They won't enable deepfakes. They won't allow their platform to be abused. They'll maintain some baseline of responsibility. That's powerful. That's why people are downloading the app. But is it powerful enough to overcome the switching costs of leaving X?

Switching costs are real. You have years of follows on X. You have established communities on X. You have conversations happening on X. Moving to Bluesky means rebuilding all of that. You have to find your friends. You have to rediscover communities. You have to accept that early on, Bluesky might be quieter, emptier, less interesting than X. How many people have the patience for that?

Influencers compound the problem. Pew Research reported that many influencers have created Bluesky accounts, but they still post more regularly on X. That makes sense. The audience is on X. Why would an influencer spend their energy on a platform where nobody sees their posts? But that also means that Bluesky is less interesting for the average user, because the content they're most interested in (from their favorite creators) isn't happening there.

This is a bootstrapping problem. Influencers will move to Bluesky when the audience is on Bluesky. The audience will move to Bluesky when the influencers are there. The deepfake crisis gave Bluesky a chance to break this deadlock. But the window is narrow. If Bluesky squanders this moment, the opportunity might not come again for years.

The Feature Release Timing: Strategic or Lucky?

One question worth examining is whether Bluesky's feature releases were strategic or lucky. Did they plan to launch cashtags and LIVE badges specifically timed to the deepfake crisis? Or did they happen to launch these features right as a massive influx of users arrived?

The most likely answer is somewhere in between. Product development at startups typically happens on quarterly or half-yearly cycles. Cashtags and LIVE badges were probably planned for January as part of a broader product roadmap. Bluesky's leadership probably didn't predict a deepfake crisis would drive 29,000 daily installs.

But that doesn't make the timing less meaningful. In fact, it makes it more meaningful from a narrative perspective. Bluesky had built momentum even before the X crisis. They were adding features. They were improving. They were moving forward. The timing meant that when the crisis hit and users started looking for alternatives, Bluesky could point to new features as evidence that they were serious about building a better platform.

That's actually better than perfect timing. If Bluesky had explicitly timed features to capitalize on X's crisis, it would feel opportunistic. It would feel like they were celebrating another platform's failure. Instead, they look like they were already building, and the market suddenly validated their direction. That's a more credible narrative.

From a business perspective, this matters because narratives drive behavior. The story that Bluesky is actively improving their platform drives adoption more effectively than being technically correct about the features. Whether Bluesky is lucky or strategic almost doesn't matter. What matters is the perception that they're listening to users and building features that users want.

Estimated data shows a spike in new users during the third week, coinciding with increased platform stability issues. Bluesky's infrastructure managed the influx, but user retention remains a challenge.

Comparison: Bluesky vs. X vs. Alternative Platforms

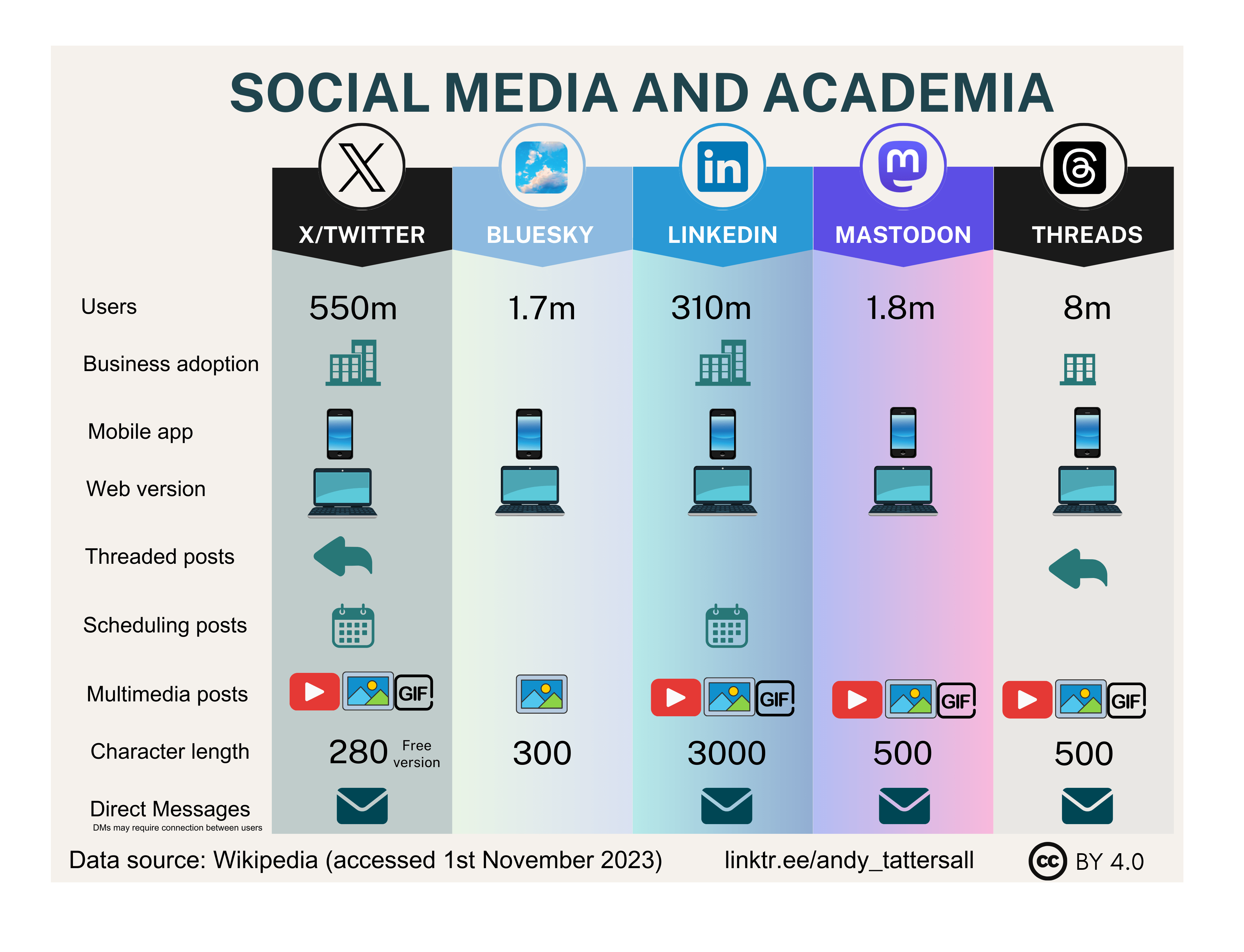

Let's zoom out and look at how Bluesky compares to X and other social platforms in 2026. This isn't about which platform is "better." It's about understanding what each platform offers and why users might choose one over another.

X (formerly Twitter): X remains the largest real-time social platform. It has the most content. It has the most users. It has the most network effects. But it's controlled by Elon Musk, who has shown willingness to make decisions that alienate significant portions of the user base. The deepfake crisis is the latest example, but not the only one. X is powerful but increasingly unreliable in the eyes of many users.

Bluesky: Bluesky is smaller but growing. It's decentralized, which appeals to people concerned about corporate control. It's had less moderation drama (partly because it's smaller). New features like cashtags and LIVE badges are adding functionality. But it's less polished than X. There's more friction. Network effects are weaker because fewer people use it.

Threads (Meta's platform): Threads launched in 2023 as Meta's Twitter competitor. It has massive distribution through Instagram integration. But it hasn't captured significant engagement from the Twitter/X refugee community. It feels like corporate social media rather than a real-time conversation platform.

Mastodon: Mastodon is federated, which appeals to the true decentralization believers. But it's more technical and harder to use. It hasn't achieved mainstream adoption.

LinkedIn: LinkedIn dominates professional social networking. But it's not a replacement for X because it serves a different purpose.

From this perspective, Bluesky is the closest alternative to X for users who want X's function but don't trust X's direction. That positioning is powerful. It's not about Bluesky being "better." It's about Bluesky being an escape hatch.

The Infrastructure Challenge Behind the Growth

When a platform experiences 49% growth in daily installs in a single week, infrastructure gets tested hard. Bluesky's team deserves credit for the fact that the platform didn't collapse under the load. That's not obvious. Most platforms would struggle with that kind of spike.

Here's what probably happened from an infrastructure perspective: Bluesky's team had been running with excess capacity. They were probably over-provisioned for the user base they actually had. That over-provisioning meant that when the spike came, they had room to absorb it without degrading the user experience. They probably also have auto-scaling infrastructure that can spin up additional resources when load increases.

But here's the challenge: excess capacity costs money. Bluesky is running infrastructure for 10,000 daily users while being prepared for 100,000. That's expensive. Over time, if daily users stay at 100,000, that expense becomes justified. But if growth reverts to historical averages, Bluesky is paying for capacity they don't need.

This is a bet. Bluesky's leadership is betting that the January growth spike isn't temporary. They're betting that some portion of those 29,000 daily users will stick around. They're betting that network effects will kick in and growth will continue. If they're right, the infrastructure investment pays off. If they're wrong, they're hemorrhaging money on unused capacity.

It's an optimistic bet. It might be correct. But it's the kind of bet that has sunk other startups. Over-investing in infrastructure for growth that doesn't materialize is a classic startup failure mode.

User Psychology: Why People Switch Platforms

The deepfake crisis was a catalyst, but it reveals something deeper about how users actually think about social platforms. It's not about features. It's about trust.

Users don't care that much about whether a platform has cashtags or LIVE badges. Users care about whether they can trust the platform to not harm them. They care about whether the platform will be there tomorrow. They care about whether their data will be used in ways they didn't consent to. They care about whether the platform will amplify content they find morally abhorrent.

X had eroded that trust over time. Each decision Elon made (removing content moderation, promoting conspiracy theories, enabling harassment) chipped away at the foundation. The deepfake crisis was the straw that broke the camel's back. It wasn't that this one thing was so bad that it forced migration. It was that this one thing confirmed what users had been suspecting: that X could no longer be trusted.

Bluesky offers something different. It offers the promise of a platform built on different principles. Not perfect principles. Not revolutionary principles. Just... different. And different enough to matter.

This has implications for how Bluesky should develop in the future. The mistake would be to assume that users migrated because they wanted more features. They didn't. They migrated because they wanted less harm. So Bluesky's strategy shouldn't be to race X on features. It should be to prove, consistently, that they're trustworthy. That they won't make the decisions that X made. That they'll prioritize user safety over other concerns.

Features like cashtags and LIVE badges matter because they show that Bluesky is actively building and improving. But they're not the core value proposition. The core value proposition is: you can use this platform without worrying that it's going to betray you.

Bluesky's iOS downloads in the U.S. increased by 49% from 19,500 to 29,000 in the second week of January 2026, following the X deepfake controversy.

The Role of Decentralization in Bluesky's Strategy

Bluesky's long-term strategy is built around decentralization. This is important because it differentiates Bluesky from other Twitter alternatives like Threads. Threads is owned by Meta, a corporation with shareholders. If Meta decides to shut down Threads, it can. If Meta decides to change Threads' terms of service, it can. Meta has all the power.

Bluesky is built on the "AT Protocol," an open protocol for social media. The idea is that multiple servers can operate on top of this protocol. You could run your own Bluesky server if you wanted to. The network isn't controlled by a single company. It's more like email, where multiple providers operate on a shared protocol.

This is theoretically more robust. It means that no single company can shut down Bluesky. It means that users have more control. It's appealing to people who are concerned about corporate control of social media.

But it also creates complexity. Open protocols are harder to understand. They're harder to market. They require more technical sophistication to run your own server. Most users don't care about decentralization in the abstract. They care about using a social platform.

Bluesky hasn't fully leaned into the decentralization angle in its marketing. That's probably smart. You can't market decentralization to mainstream users. But it's the long-term vision. It's the thing that separates Bluesky from being just another startup that could get acquired or shut down or change direction. Bluesky is trying to build infrastructure, not just a company.

Whether this works depends on whether developers buy into the AT Protocol and build on top of it. Whether companies operate servers that compete with Bluesky's official server. Whether the decentralized vision becomes reality or remains aspirational. That's still being determined in early 2026.

Monetization Challenges and the Pressure to Monetize

Here's an uncomfortable truth: Bluesky doesn't have a clear path to profitability. The platform doesn't charge users. It doesn't have a subscription model (yet). It doesn't run ads (yet). It's being funded by venture capital and by Jack Dorsey's personal wealth. At some point, that funding runs out. At that point, Bluesky needs to make money.

The path X took was subscription (Twitter Blue/X Premium) and advertising. Bluesky is probably going to need to do something similar. But the deepfake controversy shows why that's tricky. Users are evaluating Bluesky partly because they don't trust X's business model anymore. If Bluesky becomes too ad-heavy or too focused on monetization, users will lose faith.

There's a narrow window where Bluesky can build trust and network effects before needing to monetize. They're using that window. But it's finite. At some point, growth has to translate into revenue.

Features like cashtags might actually help with monetization long-term. Financial discussions attract users with money who could be valuable to advertisers. But that creates a moral tension: is Bluesky building cashtags because it's the right feature for users, or because it sets up monetization opportunities?

The honest answer is probably: both. Good product decisions and good business decisions often align. But the risk is that as Bluesky grows and monetization pressure increases, those decisions might start to diverge.

The Question of Sustainable Growth

The 49% growth spike is impressive, but it doesn't answer the fundamental question: is this sustainable? Can Bluesky turn temporary refugees into permanent residents?

There are reasons to be optimistic. First, the installs probably represent people who are somewhat serious about switching. They didn't just create an account and immediately delete it. They downloaded the app, set up a profile, probably started following some people. That suggests some commitment. Second, the features that Bluesky is shipping address real needs. They're not frivolous. They're designed to reduce the friction of switching. Third, network effects work in Bluesky's favor now that they have critical mass. More users means more interesting content, which brings more users.

There are also reasons to be pessimistic. First, users are fickle. If X "fixes" the deepfake issue and does genuine moderation, users might drift back. The crisis has to be more than a temporary scandal. It has to represent a fundamental shift in X's direction that users believe is irreversible. Second, Bluesky still has significant UX friction compared to X. The app is less polished. The experience is less smooth. For casual users, friction matters. Third, influencers still aren't all-in on Bluesky. Until the creators move completely, the casual audience won't follow.

Most likely, Bluesky is now facing a moderate-term window where they can consolidate users. Not all 29,000 daily new installs will stick. Maybe 30-40% will be active users in six months. But that still represents meaningful growth from the pre-crisis baseline.

The question isn't whether Bluesky becomes larger than X. It's not. The question is whether Bluesky becomes stable at a meaningful scale. A platform with 5-10 million daily active users is still a significant social network, even if it's much smaller than X's 500+ million users. Bluesky could build a valuable business at that scale.

Estimated data suggests that 30-40% of Bluesky's 29,000 daily new installs may remain active over six months, indicating sustainable growth potential.

The Broader Pattern: When Market Leaders Fail

This moment is part of a broader pattern in tech. Market leaders create conditions for their own disruption by assuming they can do things that competitors can't get away with.

Twitter became so dominant that Jack Dorsey eventually felt comfortable allowing the platform to be hostile to certain groups. That was fine for a while. But it created pressure. It created resentment. When Elon took over and aggressively expanded those hostile features, it finally tipped. The reservoir of goodwill was empty.

X's deepfake crisis is just the latest example of this pattern. Email, when it was dominated by AOL and Hotmail, had similar moments where users felt forced to switch. SMS, when it was dominated by carriers charging $0.25 per message, had its moment. Social networks, more than most technologies, are subject to this dynamic because they're about human interaction. The moment a platform feels unsafe or hostile, the incentive to switch is immediate and personal.

Bluesky benefits from X's failure. But Bluesky should also learn from it. The lesson is: don't assume your users have nowhere else to go. Don't assume they'll tolerate things they find morally objectionable just because you're the dominant platform. Don't assume that network effects are permanent.

If Bluesky becomes dominant in five years, they'll face the exact same temptation. The difference between a platform that thrives and a platform that gets disrupted is often just one decision to cross a line that users find unacceptable.

Future Feature Development and the Roadmap

We don't know what's next for Bluesky, but we can make educated guesses based on what they've done so far. Cashtags and LIVE badges suggest a pattern: Bluesky is adding features that address specific use cases. They're not trying to be fundamentally different from Twitter. They're trying to be Twitter with better values.

Likely future features might include:

Creator monetization tools: If Bluesky wants to retain creators, they need monetization options. That could be subscriptions, tips, or revenue sharing for popular posts.

Better discovery: Bluesky's algorithm and recommendations are less developed than X's. That makes it harder for new users to find interesting content. Improving discovery is crucial.

Mobile app improvements: The Bluesky mobile app is functional but not as polished as X. Making it faster, smoother, and more intuitive matters.

Enterprise features: As Bluesky grows, organizations will want to use it. That opens revenue opportunities and increases stickiness.

Interoperability: Since Bluesky is built on an open protocol, interoperability with other platforms is theoretically possible. That could help with network effects.

None of these are revolutionary. But they're all focused on the same thing: making Bluesky less painful to switch to. Making it so that the switching costs don't outweigh the benefits.

The Long-Term Vision for Decentralized Social Media

Bluesky's vision extends beyond just being a Twitter alternative. The long-term vision is decentralized social media infrastructure. The AT Protocol is designed to be platform-agnostic. In theory, multiple companies or individuals could build interfaces on top of the protocol.

This is ambitious. It's also largely unrealized. The AT Protocol exists, but there aren't many alternative Bluesky-like clients. The ecosystem isn't thriving. It's still mostly just Bluesky.

If this vision works, it changes everything about how social media functions. Instead of a few large platforms, you'd have a federated network of smaller platforms all operating on shared protocols. Users could switch between platforms without losing their identity or their followers. It would be more like email, where you can use Gmail, Outlook, or any other provider, but you can still reach anyone with any email address.

But this vision also has significant challenges. Email is boring. Everyone can agree that email's purpose is to send text messages. Social media is contentious. People disagree about what should be allowed. Decentralization makes it harder to enforce consistent moderation standards. Different servers could have different rules. That's a feature if you value freedom. It's a bug if you're concerned about harassment and misinformation.

Bluesky's bet is that you can build trust-based moderation that doesn't require central control. That remains to be seen. But if it works, it's genuinely innovative.

Lessons for Other Platform Builders

What should other social platform builders learn from Bluesky's moment? Several things stand out:

First, network effects are real but fragile. They're not permanent. A platform that seems inevitable can collapse faster than it seemed possible. X still dominates in terms of size and traffic. But network effects started working in Bluesky's favor the moment enough users switched.

Second, trust matters more than features. Users don't choose between platforms based on which one has more features. They choose based on which one they trust. Bluesky wins on trust. That's not because Bluesky is perfect. It's because X lost it.

Third, platform leadership is important. Jack Dorsey's vision for Bluesky gave it direction and credibility. Elon Musk's decisions at X created the opening for Bluesky. Leadership shapes culture, and culture shapes whether users want to be on a platform.

Fourth, speed matters. Bluesky's team shipped features quickly during the period when user interest was highest. That responsiveness showed that they were serious and capable. Moving slower would have squandered the opportunity.

Fifth, you don't have to be perfect. Bluesky's app has quirks. Its features are less developed than X's. But it's good enough, and it avoids the major mistakes that X made.

The Economic Impact and Market Implications

What does Bluesky's growth mean for the social media market more broadly? It suggests that there's appetite for alternatives to X. It's not the main story of social media. X is still dominant. But it's meaningful.

For the venture capital markets, Bluesky's growth probably increases the valuation of the company. If Bluesky was valued at, say,

For advertising markets, this is relevant because Bluesky represents an alternative channel. If Bluesky grows to be a significant platform, advertisers will want to reach users there. That creates economic value. But it also creates pressure to monetize, which creates tension with the trust-based value proposition.

For venture capital more broadly, this is validation that Twitter competitors are still viable. Other platforms like Threads now have a proving ground. If Bluesky succeeds, others might follow. That could lead to a more diverse social media landscape with multiple viable platforms.

Conclusion: The Beginning of a Longer Story

The growth spike that Bluesky experienced in January 2026 is remarkable, but it's not the end of the story. It's the beginning. Bluesky now has the opportunity to prove that it can be a lasting alternative to X. Features like cashtags and LIVE badges show that they understand what users need. But understanding what users need and delivering sustained value are different things.

The deepfake crisis on X was a catalyst. It gave users a reason to look for alternatives and gave Bluesky a chance to capture attention. But catalysts are temporary. The question now is whether Bluesky can convert that attention into engagement, habit, and long-term loyalty.

There are reasons to believe they can. The infrastructure seems to be holding. The product is improving. The community is growing. There's momentum. But momentum is fragile. It requires sustained execution.

The social media landscape is more competitive now than it was in 2016 when Twitter felt invincible. Now there's Bluesky. There's Threads. There's Mastodon. There's Substack Notes. There are Discord communities and Telegram channels and WhatsApp groups. Users have options.

Bluesky's advantage is that it's the option that actually resembles Twitter but feels safer. That's powerful. That might be enough. But only if they don't make the same mistakes that X made. Only if they remain trustworthy as they grow. Only if they remember that the reason users switched was because they no longer felt safe on X.

The 49% growth spike is just the first chapter. The real story of Bluesky will be written over the next 12-24 months. Can they hold onto these users? Can they convert them into daily active users? Can they build a sustainable business around a platform that explicitly rejects features that make X profitable? Can they become the platform that proves decentralized social media is viable?

Those are the questions that matter now. The features help. But they're not the main thing. The main thing is whether Bluesky can deliver on the promise that motivated people to switch: a social network that doesn't betray your trust.

FAQ

What are cashtags and how do they work?

Cashtags are special hashtags for discussing publicly traded stocks, formed by placing a dollar sign before the stock ticker symbol, such as

Why did Bluesky add the LIVE badge feature?

The LIVE badge feature helps Bluesky become a distribution channel for streamers who broadcast on other platforms like Twitch. When you go live on Twitch, you can enable a LIVE badge on your Bluesky profile that alerts your followers to your stream, without requiring you to post a manual link. This addresses a key use case for content creators and their audiences while positioning Bluesky as complementary to existing streaming platforms rather than competitive with them.

How much did app installs increase for Bluesky?

Bluesky's iOS downloads in the United States jumped from a baseline of approximately 4,000 installs per day to 19,500 in the week of December 30, 2025 through January 6, 2026, then to 29,000 during January 7-14, representing a 49% increase in the second week. This spike directly correlated with the X deepfake controversy that pushed many users to seek alternative social platforms.

What caused Bluesky's surge in user downloads?

Bluesky's download spike was triggered by X's deepfake scandal, where the platform's Grok AI tool was generating sexually explicit images of real women and minors without consent. As California's attorney general launched an investigation and mainstream media coverage intensified, users looking for safer alternatives fled to Bluesky, which explicitly avoided such features and positioned itself as a more trustworthy social network.

Is Bluesky a serious Twitter alternative?

Bluesky is becoming a more serious alternative as it adds features that address key X use cases, but it still faces challenges around network effects, user retention, and monetization. While the January 2026 growth spike shows potential, converting temporary refugees into permanent users requires sustained product improvements, creator adoption, and continued trust maintenance over an extended period.

How does Bluesky differ from other Twitter alternatives like Threads?

Unlike Threads, which is owned and controlled by Meta Corporation, Bluesky is built on the open AT Protocol, giving it a decentralized infrastructure vision where multiple services could theoretically operate independently. This architectural difference theoretically gives users more control and makes Bluesky more resistant to shutdowns or corporate policy changes, though the ecosystem remains primarily concentrated around Bluesky's official platform.

What is the AT Protocol and how does it affect Bluesky's future?

The AT Protocol is an open protocol for decentralized social media that Bluesky is built on, similar to how email operates on SMTP. This design allows multiple providers to operate independently on the same network, theoretically preventing any single company from controlling the platform. However, the ecosystem remains largely unrealized with few alternative clients, and whether decentralized social media can achieve meaningful mainstream adoption remains an open question.

Will Bluesky's growth remain sustainable?

Sustainability depends on Bluesky's ability to convert the January spike into permanent engagement through improved features, creator adoption, and continued user trust. While the momentum is real and the core value proposition is strong, historical precedent suggests that platform growth driven primarily by competitor failures can be temporary unless sustained by genuine network effects and perceived ongoing value advantages.

How does Bluesky plan to make money?

Bluesky currently doesn't charge users, run ads, or have a clear monetization model, relying instead on venture capital funding and Jack Dorsey's personal wealth. Long-term, the platform will likely need to implement monetization through subscriptions, advertising, or creator revenue sharing, though doing so without alienating users who switched specifically to escape X's commercialization represents a significant strategic challenge.

What should users know before switching from X to Bluesky?

Before switching, understand that Bluesky has a smaller user base and potentially less interesting content initially, requires rebuilding your follows and communities, and offers a less polished user experience in some areas compared to X. However, it provides a substantially different cultural environment focused on user safety, features like cashtags for financial discussion and LIVE badges for creators, and a decentralized infrastructure model that theoretically offers more user control and platform resilience.

Key Takeaways

- Bluesky experienced 49% growth in daily iOS installs during mid-January 2026 following X's deepfake scandal

- Cashtags feature enables organized stock market discussions, addressing a core X use case that refugees needed

- LIVE badges integrate Twitch streaming into Bluesky profiles, creating value for creators without requiring platform-native streaming

- Converting temporary crisis-driven refugees into permanent users requires sustained product execution and trust maintenance

- Decentralized AT Protocol infrastructure gives Bluesky theoretical advantages over corporate alternatives like Threads

Related Articles

- Bluesky Social Platform: The Complete Guide [2025]

- Can a Social App Really Fix Social Media's 'Terrible Devastation'? [2025]

- Apple and Google Face Pressure to Ban Grok and X Over Deepfakes [2025]

- White House Meme Strategy: Inside Modern Political Communications [2025]

- Right-Wing Influencers Minneapolis ICE: Social Media Propaganda [2025]

- How Social Media Distorts Geopolitics: The Venezuela Crisis Reality [2025]

![Bluesky's New Features Drive 49% Install Surge Amid X Crisis [2025]](https://tryrunable.com/blog/bluesky-s-new-features-drive-49-install-surge-amid-x-crisis-/image-1-1768579818401.jpg)