The Unexpected Return of a Storage Legend: Conner at CES 2026

When you walk through the halls of CES 2026, you might see a name you haven't heard in decades: Conner. For anyone who lived through the personal computer revolution of the late 1980s and early 1990s, that name hits different. Conner Peripherals wasn't just another storage company—it was one of the architects of modern computing, the company that helped establish the 3.5-inch hard drive format that defined an entire era of desktop computing.

But here's the plot twist: the Conner making a surprise appearance at CES 2026 isn't returning with spinning disks and mechanical drives. Instead, it's bringing portable SSDs, external backup drives for smartphones, and hybrid storage devices that combine charging functionality with data protection. It's a fascinating case study in how legacy brands navigate radical industry shifts, and it raises some genuinely interesting questions about whether nostalgia and heritage can matter in a market that moves forward at breakneck speed.

When I first heard about Conner's comeback, my immediate reaction was skepticism. The storage industry is brutally competitive. We're talking about a crowded marketplace where companies like Samsung, Western Digital, SanDisk, and Seagate have spent decades building customer loyalty and retail relationships. A brand that's been absent for 20+ years would have to do something pretty remarkable just to get noticed. Yet here we are, and Conner is betting that its name and history still carry weight.

This article explores what Conner's resurrection means for the storage industry, the strategy behind the comeback, and whether other legendary brands might follow suit. We'll dig into the company's history, what made it matter in the first place, and whether a brand can really trade on nostalgia in 2026. We'll also look at the broader trend of legacy tech brands attempting comebacks, and what actually works (and what doesn't) when companies try to reclaim lost market share.

TL; DR

- Conner Peripherals, a 1980s-1990s storage pioneer, is making a surprise comeback at CES 2026 with portable SSD products instead of traditional hard drives

- The company originally pioneered the 3.5-inch hard drive format that became the standard for desktop PCs, making it a genuinely important historical figure in computing

- Conner's new strategy focuses on mobile-first, portable storage products aimed at smartphone users and content creators, not desktop systems

- The comeback includes external SSDs, smartphone backup devices, and hybrid charger-storage hybrids, targeting convenience and portability over raw capacity

- Crowdfunding platforms will play a key role in the initial launch, suggesting a focus on early adopters and enthusiasts rather than mass-market distribution

- The return raises broader questions about whether legacy brands still matter and whether companies like Maxtor, Iomega, and Sy Quest might attempt similar revivals

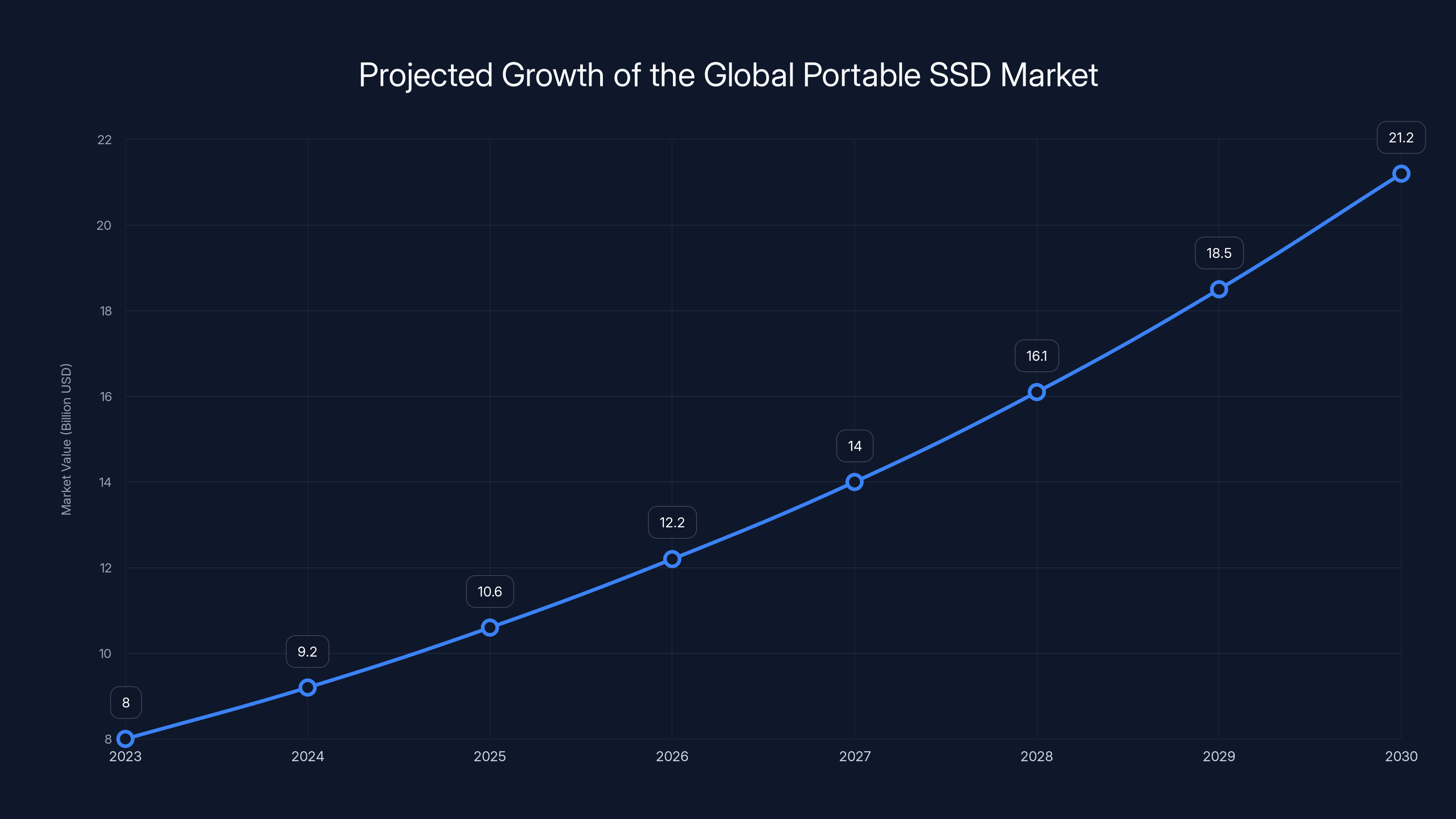

The global portable SSD market is projected to grow from

Who Was Conner, and Why Should You Care?

Let me be clear: Conner wasn't just another storage company. When Conner Peripherals was founded in 1986, it entered a market that was still figuring out what personal computers actually needed. Hard drives at that time were expensive, fragile, and unreliable. They were also huge. If you wanted storage capacity, you were dealing with drives that occupied serious real estate in a computer's chassis.

Conner's breakthrough was developing compact hard drives that could fit into smaller form factors. The company became instrumental in establishing the 3.5-inch drive as the industry standard for desktop computers. That might sound like a minor technical achievement, but it wasn't. This decision shaped computing for decades. Every desktop PC you owned from the 1990s through the 2010s likely had a 3.5-inch drive inside it. That's Conner's fingerprint on the industry.

By the late 1980s and early 1990s, Conner was one of the big names in storage. If you were buying a PC, there was a solid chance it came with a Conner drive inside. The company grew rapidly, acquired other storage companies, and at its peak was one of the major players in the hard drive market. Conner wasn't just successful—it was defining the standards that everyone else followed.

But then the world changed. And when it changed, Conner couldn't keep up.

The hard drive industry went through massive consolidation in the 1990s and 2000s. Companies merged, acquired competitors, went bankrupt. Conner eventually lost its independence. The brand name effectively disappeared from consumer consciousness. For most people under the age of 40, the name Conner probably means nothing. It's like asking someone to name a dial-up internet provider—technically interesting, historically significant, but functionally irrelevant to modern life.

So why come back? The answer probably comes down to a combination of factors: the value of established brand equity, the resurgence of interest in retro tech, and the genuine reality that Conner's heritage actually means something to the people who lived through that era of computing. The company betting on a comeback likely figures that if they can establish a foothold in the portable storage market, they can build on that nostalgia and credibility to expand.

The Portable Storage Market: Why Conner Is Aiming Here

Conner's decision to re-enter the market through portable storage is smart strategy, not nostalgia-driven delusion. The portable storage market has grown substantially over the past decade, and it's fundamentally different from the desktop hard drive market where Conner made its name.

Let's look at the numbers. The global portable SSD market was valued at approximately $8 billion in 2023 and is expected to grow at a compound annual growth rate of around 15-18% through 2030. That growth trajectory is driven by several factors: increased smartphone usage, larger file sizes (especially for video and photography), the rise of remote work and content creation, and the simple reality that people want fast, reliable backup solutions they can carry in their pocket.

The smartphone backup market is particularly interesting. As phone storage capacities have increased, so too have the sizes of the files people store. A 4K video can be 1-2 GB per minute. A high-resolution photo library can consume tens of gigabytes. Cloud storage solves part of this problem, but not everyone wants to trust all their data to cloud services. They want physical control. They want a portable drive they can plug into their phone, quickly back up their most important files, and then carry with them.

This is where Conner is targeting. The company is positioning itself as a bridge between smartphones and reliable, portable storage. The product lineup they showed at CES 2026 includes several variations on this theme: external SSDs designed specifically for mobile use, backup drives optimized for smartphone connectivity, and hybrid devices that combine storage with battery charging (so you can back up your photos while you're also topping up your phone's battery).

The strategy makes sense because the portable storage market is less dominated by massive incumbents than the desktop drive market is. Yes, Samsung and Western Digital have products here too. But there's more room for differentiation, more room for smaller players to compete, and more opportunity for a brand with heritage to position itself as a trustworthy option.

Conner Peripherals is focusing heavily on portable SSDs and smartphone backup devices as part of their market re-entry strategy, emphasizing convenience and portability over traditional storage solutions. Estimated data.

Conner's CES 2026 Product Strategy: Mobility Over Capacity

The products Conner revealed at CES 2026 tell us something important about how the company is thinking about its comeback. These aren't drives designed to compete with high-capacity external storage solutions. They're not aimed at video editors working with massive 8K libraries or photographers with decades of archive footage. Instead, they're focused on the everyday user who wants convenient, portable backup and storage expansion for their mobile devices.

The product categories break down into several distinct use cases:

Mobile-First External SSDs: These are compact, lightweight drives typically ranging from 256GB to 2TB, designed to plug directly into smartphones and tablets via USB-C or Lightning connectors. They're formatted to work with iOS and Android without requiring special software. The focus is on speed and portability—you want to be able to quickly back up a day's worth of photos or videos, then drop the drive back in your pocket.

Smartphone Backup Devices: These are smaller, often featuring simplified interfaces and automatic detection when connected to a phone. Some models might include a built-in SD card reader, allowing users to immediately back up photos from cameras or SD cards before transferring them to their phone. The idea is convenience: plug it in, back up, move on.

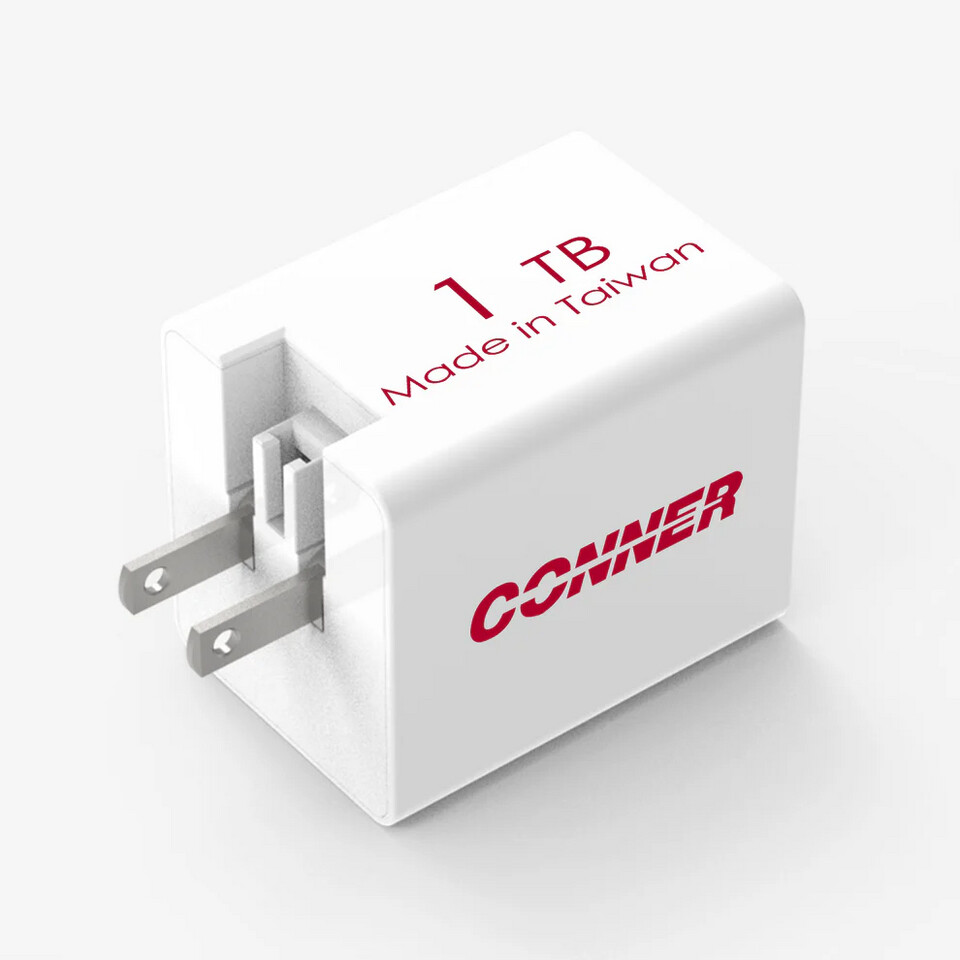

Hybrid Charger-Storage Devices: This is perhaps the cleverest product category in Conner's lineup. These devices combine fast-charging capability with onboard storage. You plug one into your phone to charge it while simultaneously backing up photos or video. It's a solution to a real problem—people want to back up their data, but they don't want to sacrifice charging capability or deal with two separate cables and adapters.

Multi-Format Readers: Some Conner products integrate SD card readers, USB-A adapters, and micro USB support, acknowledging that users often need to transfer data from multiple sources (cameras, old phones, USB drives, etc.) into their primary device.

The emphasis across all these products is on convenience and portability rather than raw capacity or performance. Conner isn't claiming to have the fastest portable SSD on the market. They're not promoting terabyte capacities. Instead, they're positioning themselves as the practical choice for people who want reliable backup and storage expansion without complexity or bulk.

This positioning makes sense given the market dynamics. A significant portion of smartphone users don't have immediate access to cloud backup services (due to storage costs, data privacy concerns, or simply not trusting cloud providers with their photos and videos). They need a physical solution. Conner is betting that they can own a meaningful slice of that market by emphasizing reliability, ease of use, and heritage credibility.

The Crowdfunding Strategy: Testing the Market, Building Early Adopters

One of the most revealing aspects of Conner's comeback strategy is the decision to launch initial products through crowdfunding platforms like Kickstarter and Indiegogo rather than going directly to retail distribution.

This isn't a weakness or a sign the company lacks confidence. It's actually a very smart market validation strategy. Here's why:

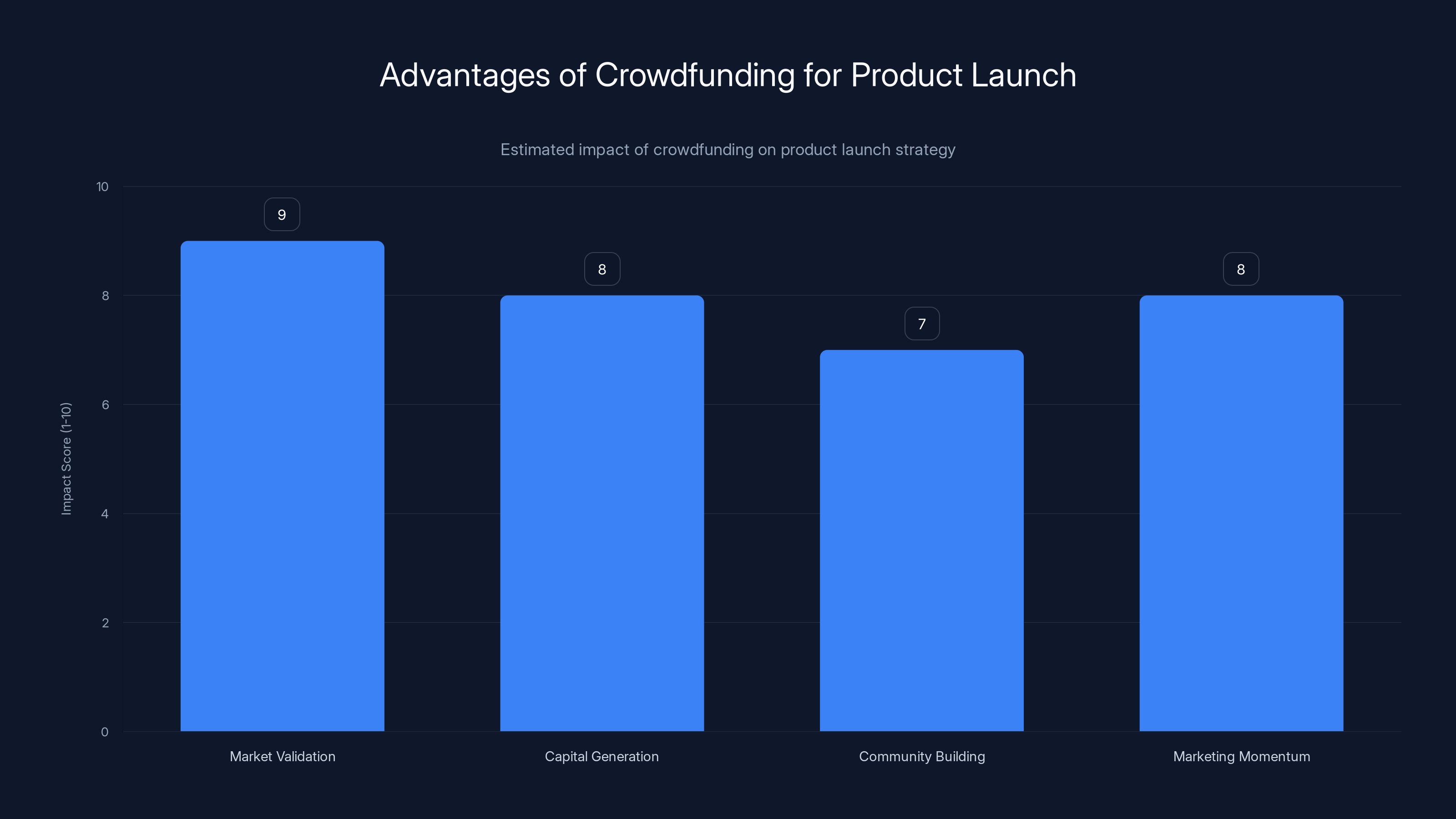

Crowdfunding gives Conner several advantages. First, it allows them to test product-market fit before committing to large-scale manufacturing. The founders can see which product variations actually resonate with consumers, what pricing people are willing to accept, and whether the Conner brand name still carries enough weight to drive purchasing decisions.

Second, crowdfunding provides capital for initial production runs without requiring massive upfront investment or external funding. This is important for a company making a comeback—you want to validate demand before you bet the farm on it.

Third, crowdfunding creates a built-in community of early adopters who become advocates and feedback sources. These are people who care enough about the product to back it before it's widely available. They're engaged, invested (literally), and likely to provide valuable feedback about what's working and what needs improvement.

Fourth, crowdfunding generates marketing momentum. Every successful crowdfunding campaign becomes a story: "Legendary 1980s storage brand raises $2 million on Kickstarter for comeback products." That's exactly the kind of narrative that gets picked up by tech media and resonates with nostalgic consumers.

Historically, crowdfunding has been a launching pad for storage products. Crucial's MX500 SSD got its start partly through direct-to-consumer models before becoming a mass-market product. Samsung's earlier portable drives benefited from crowdfunded adoption models. Conner is following a playbook that has worked for others.

The risk with this approach is that crowdfunding can also highlight weaknesses. If the product has problems, if shipping is delayed, if the company's customer service is subpar, those issues will immediately become apparent to the most vocal and visible customers. But Conner is presumably aware of those risks and has accounted for them in their planning.

The Broader Question: Can Legacy Brands Still Matter?

Conner's comeback raises a genuinely interesting question that extends far beyond this one company: do legacy tech brands still matter in 2026, or are they just nostalgic curiosities?

There are compelling arguments on both sides.

The case for legacy brands mattering: Brand reputation and reliability carry real value, especially for hardware products. When you're buying a storage device, you want to trust that it will reliably protect your data. A company with decades of manufacturing history, engineering expertise, and a track record of reliability has credibility advantages over a completely unknown startup. Conner's heritage literally means "this company figured out how to build reliable storage at scale." That's not nothing.

Additionally, there's genuine consumer interest in retro tech and nostalgic brands. This has been demonstrated repeatedly across different product categories. Retro gaming consoles, vintage computer revivals, and nostalgia-driven products have all found successful market niches. If Conner can tap into that nostalgia while delivering genuinely useful products, they have an advantage.

There's also the practical consideration that Conner's original market still exists. The people who remember Conner from the 1980s and 1990s are now in their 50s, 60s, and 70s—demographics that actually have disposable income and often appreciate quality and reliability. They're not the biggest market segment, but they're a real one.

The case against legacy brands: The technology industry moves fast. What mattered 20 years ago often doesn't matter today. Consumer loyalty is fragmented across dozens of brands. Younger consumers have no emotional connection to Conner and will judge the company purely on product quality and price. In a crowded market, a legacy brand without current distribution, marketing reach, or retail relationships starts from zero against established competitors.

Moreover, re-entering a market after a long absence means rebuilding everything: supply chains, manufacturing relationships, quality assurance processes, customer support infrastructure. The company can't simply rely on brand memory to carry it through the execution phase.

The historical precedent is mixed. Some legacy brands have successfully returned: Polaroid tried a comeback with instant cameras and had moderate success. Kodak attempted various digital pivots with limited success. Commodore (the computer brand) has had multiple failed comeback attempts. There's no guarantee that brand heritage translates into modern market success.

The nuanced reality: Brand legacy matters, but only if it's paired with excellent execution, compelling products, and thoughtful market positioning. Conner has positioned itself in a growing market segment (portable mobile storage) rather than trying to revive the desktop hard drive business where it originally competed. That's smart strategy. They're leveraging heritage and credibility while targeting a market segment that's less dominated by massive incumbents.

The company's success will ultimately depend on whether their portable storage products are actually good. Are they reliable? Are they faster and more convenient than alternatives? Do they offer genuine value over competitors? If the answer to those questions is yes, then Conner's legacy becomes an asset—a reason to trust the company. If the products are mediocre, the heritage becomes irrelevant.

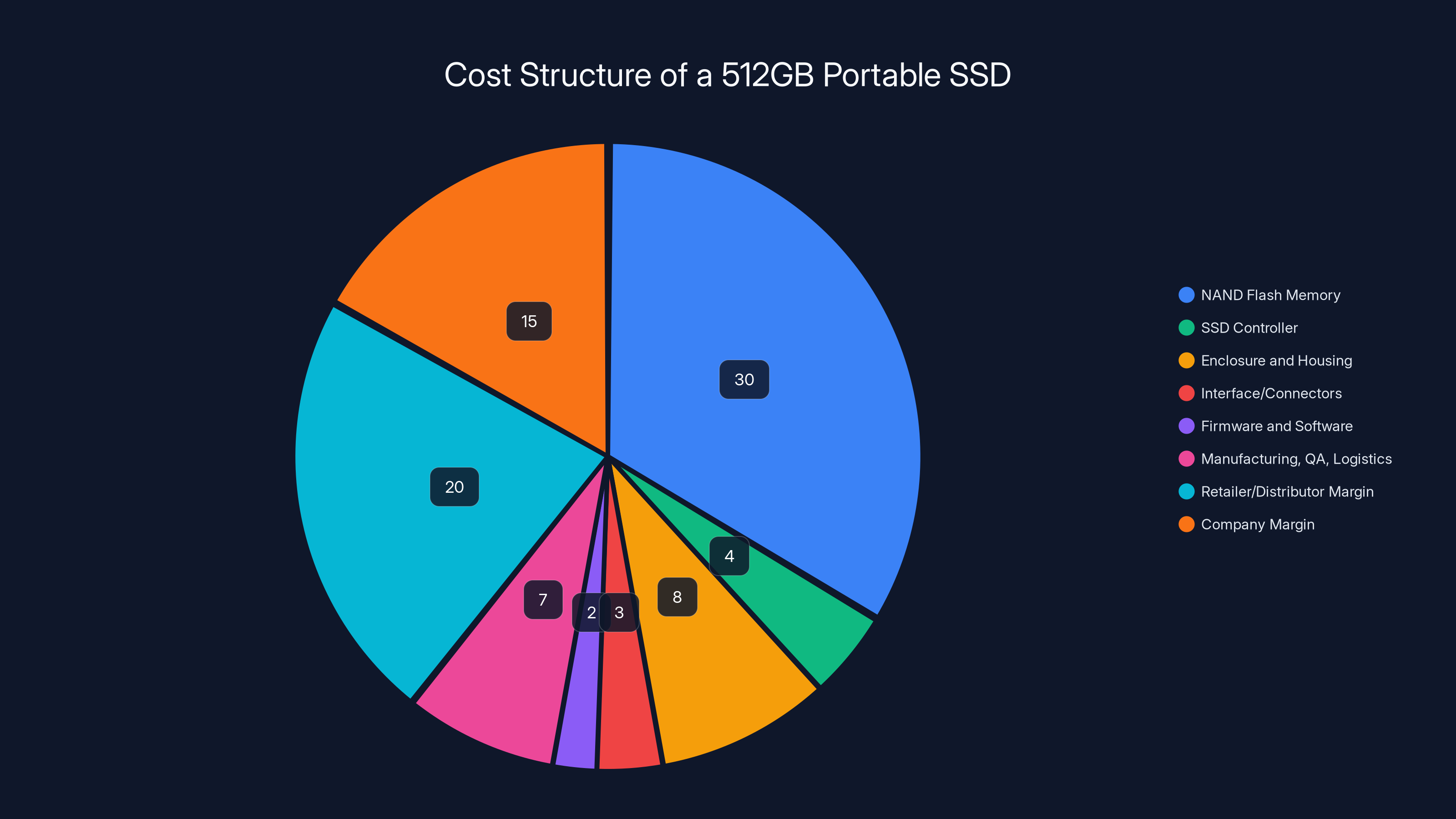

The cost structure of a 512GB portable SSD shows significant portions allocated to NAND Flash Memory and retailer/distributor margins, highlighting the industry's tight margin pressures.

What Made Conner Great in the First Place: The 3.5-Inch Story

To understand why Conner's comeback might resonate with certain audiences, we need to understand what made the company genuinely important in the first place. It wasn't just that Conner made hard drives. Lots of companies made hard drives. It was that Conner helped define the standards that everyone else followed.

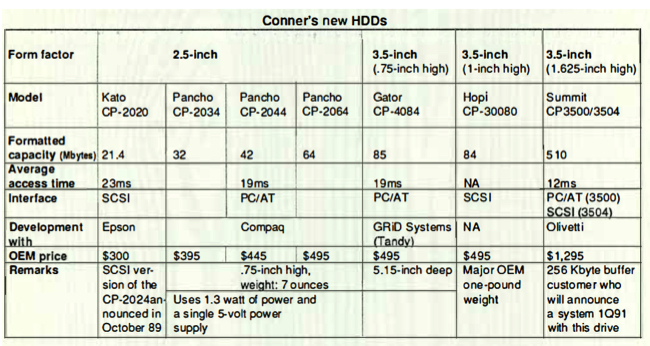

In the mid-1980s, hard drive form factors were fragmented. Computers used 5.25-inch drives (the same size as floppy drives), 3.5-inch drives, 2.5-inch drives, and other variations. Manufacturers were still figuring out what the optimal size was for different applications. There was no consensus.

Conner and a few other companies (most notably Quantum Corporation) began aggressively developing 3.5-inch drives that were optimized for desktop computers. These drives hit the sweet spot between capacity, speed, cost, and physical size. A 3.5-inch drive was large enough to achieve good capacity (by 1990 standards), compact enough to fit in a standard desktop case, and could be manufactured cost-effectively at scale.

As the IBM PC and its clones became the dominant computing platform, the 3.5-inch hard drive format became the standard. By the early 1990s, if you bought a desktop computer, it almost certainly had a 3.5-inch hard drive inside. Conner was one of the primary architects of that standardization, which meant enormous market opportunity.

Being instrumental in establishing an industry standard is genuinely valuable. It means your company becomes synonymous with the solution. When PC manufacturers needed hard drives, they thought of Conner. When consumers needed to upgrade their drive, Conner was often their choice.

This historical significance is probably a major reason why the Conner brand still carries weight with people who lived through that era. The company didn't just make products—it helped shape the computing infrastructure that defined the digital revolution. That's not nostalgia. That's historical importance.

The Competitive Landscape: What Conner Is Up Against

Let's be realistic about Conner's competitive position. The portable storage market in 2026 is dominated by established players with massive advantages: capital, distribution networks, brand recognition, and manufacturing expertise.

Samsung holds a significant market share in portable SSDs, leveraging their vertical integration from NAND flash memory production through finished consumer products. They have retail relationships, marketing budgets, and supply chain efficiency that Conner will struggle to match.

Western Digital and SanDisk (now both part of the same parent company) control a substantial portion of the external storage market. They've built customer loyalty through reliability and widespread availability.

Seagate manufactures a full range of portable drives and has deep OEM relationships.

Smaller competitors like Crucial, Intel, Kingston, and others have established their own niches and customer loyalty.

Beyond storage manufacturers, Conner also faces competition from cloud storage services (Google Drive, iCloud, OneDrive, Dropbox) that offer data backup without requiring physical devices. These services aren't direct competitors in the traditional sense, but they do serve some of the same use cases.

So Conner isn't entering a market with room for everybody. They're trying to carve out space in a segment where quality competitors already have established positions.

Conner's competitive advantages, such as they are, would need to come from:

-

Superior product design for mobile use: Creating devices that are genuinely more convenient and reliable for smartphone users than existing solutions.

-

Aggressive pricing: Entering the market at price points that undercut competitors while maintaining reasonable margins.

-

Brand differentiation: Leveraging heritage and reliability messaging to stand out in a crowded field.

-

Specialized ecosystems: Perhaps building integrations or software that make Conner devices particularly convenient for specific use cases (photographers, video creators, etc.).

The company needs at least one or two of these advantages to stick. If Conner is entering the market at similar price points with similar performance to existing competitors, while offering no unique features or value proposition, the comeback will fail regardless of historical significance.

Legacy Tech Brands and the Comeback Question: Could Maxtor, Iomega, or Sy Quest Be Next?

Conner's comeback opens up a fascinating question: are other legendary storage brands also looking at potential comebacks?

Maxtor was one of the dominant hard drive manufacturers of the 1990s and 2000s. The company acquired several competitors and was eventually purchased by Seagate in 2001. The Maxtor brand continued to exist for several years as a Seagate sub-brand before eventually being phased out. A Maxtor comeback would probably target external drives or specialized storage, similar to Conner's strategy.

Iomega was famous for the Zip drive, an early removable storage solution that was incredibly popular in the 1990s. Zip drives preceded USB flash drives by years and were beloved by creative professionals. Iomega eventually struggled as USB flash drives became ubiquitous. The company was acquired by Lenovo in 2010. An Iomega comeback would probably focus on nostalgia-driven retro Zip drives or, more practically, portable storage solutions marketed with retro branding.

Sy Quest manufactured removable storage drives that competed with Iomega. The company didn't survive the rise of USB flash drives and was acquired in the mid-2000s. A Sy Quest comeback would face similar challenges to Iomega.

Quantum was another legendary storage manufacturer from the 1980s-1990s era. The company eventually focused on tape storage and data backup before being acquired.

The reality is that most of these brands are now owned by larger corporations (Seagate owns Maxtor, Lenovo owns Iomega, etc.). For a true comeback to happen, the parent company would need to either license the brand to an independent manufacturer or divest it to a startup. That's possible but not particularly common.

Conner's situation was unique because the brand wasn't actively used by a large corporation. It was dormant—owned by some entity but not actively marketed or developed. This created an opportunity for whoever currently owns the brand to authorize a revival or for an independent company to license it.

Whether other brands will follow Conner's path depends on several factors: Is there genuine consumer interest? Can the new products be genuinely competitive? Are the legal/licensing arrangements clear enough to make the comeback viable? These are high bars to clear.

That said, if Conner's comeback succeeds, we'll probably see increased interest in other legacy brand revivals. Success breeds imitation in tech marketing.

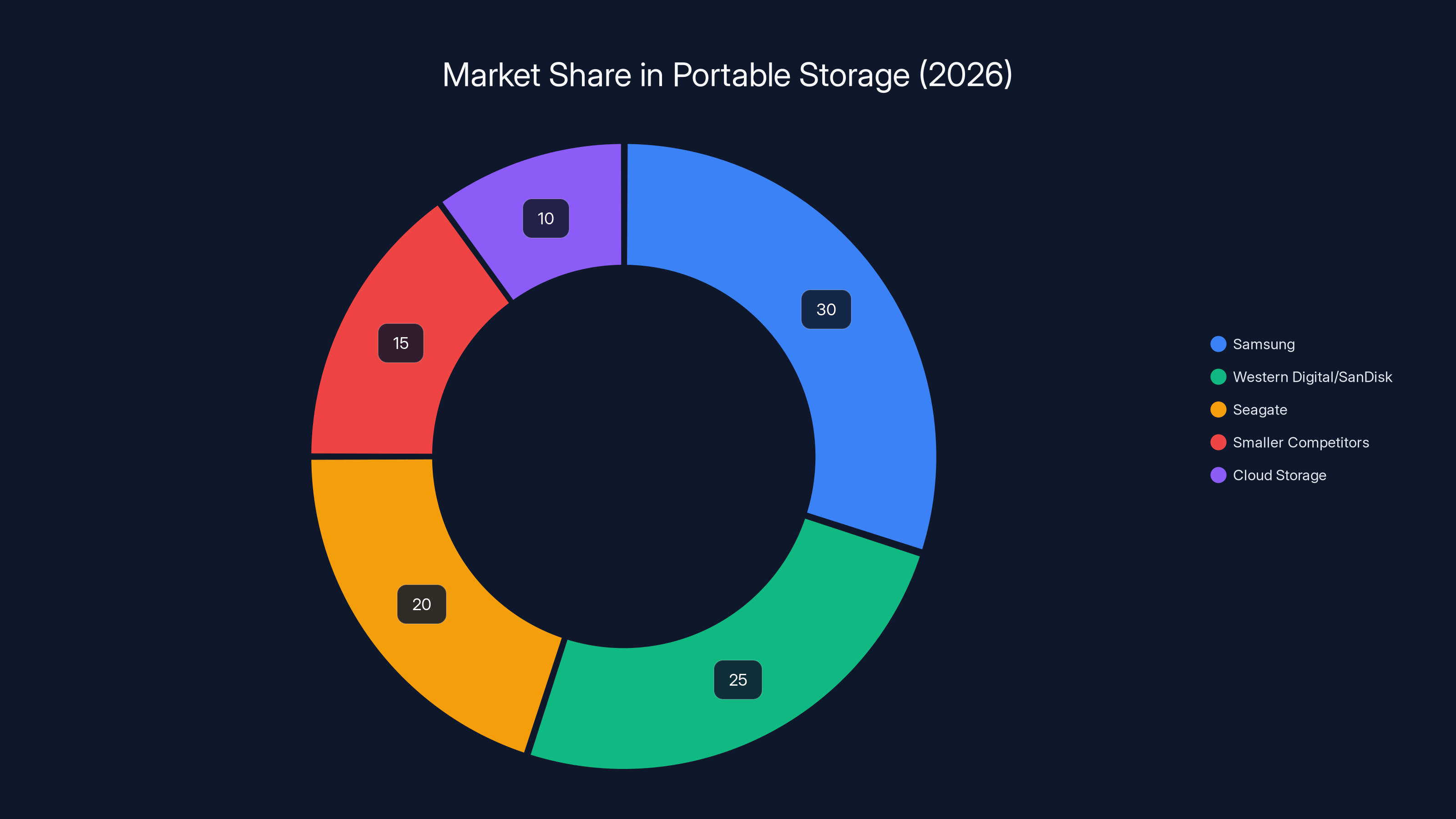

Samsung leads the portable storage market with an estimated 30% share, followed by Western Digital/SanDisk at 25%. Cloud storage services account for about 10% of the market. (Estimated data)

The Role of Nostalgia in Tech Marketing: Is It Sustainable?

One fundamental question underlying Conner's comeback is whether nostalgia can actually drive sustained business success, or whether it's just a momentary marketing angle.

Nostalgia is a powerful emotional driver. People feel genuine affection for products and brands from their past. When you remember using a Conner hard drive in your first PC, backing up important files on an Iomega Zip drive, or using a Sy Quest cartridge to transport files to a colleague's studio, those memories carry emotional weight. Companies can absolutely leverage that.

But emotional appeal only takes you so far. Nostalgia might drive initial purchases from people who remember the original brand. It might get media coverage and generate social media buzz. But it won't sustain long-term business success if the products aren't genuinely good.

Connie's comeback needs to function on two levels simultaneously:

-

Emotional/nostalgic level: Appeal to people who remember Conner and want to support the brand's return.

-

Practical/functional level: Deliver products that are genuinely useful, reliable, and competitive on price and performance.

If the company focuses too heavily on nostalgia and neglects the practical side, the comeback will be a curiosity that generates a bit of sales before fading. If the company focuses too heavily on functional competition without leveraging the nostalgic appeal, they lose the advantage they actually have.

The most sustainable strategy involves using nostalgia as a differentiator and trust signal while delivering products that stand on their own technical merit. "Conner, a company with 40 years of storage expertise, is now bringing that knowledge to modern portable storage." That's a compelling message. But only if the portable storage is actually good.

Historical precedent suggests that nostalgia-driven products can succeed in specific market niches. Retro gaming consoles (Nintendo Switch playing 1980s games, classic Atari revivals) have found sustainable business success. Vintage-inspired watches, cameras, and audio equipment command premium prices. But these products succeed because they combine authentic design inspiration with genuine quality and functionality. They're not just trying to ride nostalgia—they're building real products informed by historical design principles.

Conner needs to approach its comeback the same way: leveraging heritage as credibility, but building genuinely competitive modern products.

Storage Industry Trends That Created the Opportunity for Conner's Return

Conner's comeback didn't happen in a vacuum. Several significant trends in the storage industry created the conditions that make a Conner revival plausible in 2026.

The shift from capacity competition to convenience competition: For decades, the storage industry competed primarily on capacity and speed. Who could pack the most terabytes into a drive? Whose interface was fastest? But that competition has largely been won. Modern SSDs offer massive capacity, and transfer speeds are bottlenecked by USB or interface limitations rather than drive limitations. This shift opens space for companies to compete on convenience, portability, and specialized use cases rather than raw specifications.

The fragmentation of mobile storage needs: As smartphones became more powerful and people began using them for serious work (photography, video, document creation), the need for reliable external storage grew. But the mobile storage market is fragmented—different users need different solutions. A professional photographer needs different storage than someone who just wants to backup their phone periodically. This fragmentation creates niches where specialized manufacturers can compete.

The explosion of content creation: The rise of TikTok, YouTube, Instagram Reels, and other platforms means more people are creating and storing large video and photo files. These creators need portable, reliable storage solutions. They represent a growing market segment with specific needs.

Cloud storage limitations: While cloud storage has grown tremendously, it hasn't solved all problems. Privacy concerns, storage costs at scale, reliance on internet connectivity, and the inconvenience of managing multiple cloud accounts have driven some users to prefer physical storage for critical files.

The success of niche storage manufacturers: Companies like Crucial, Sabrent, and others have shown that you don't need to be a massive incumbent to succeed in storage. If you have good products and smart positioning, you can capture meaningful market share.

These trends don't guarantee Conner's success, but they do create an environment where a well-executed comeback could work.

Technical Specifications: What Modern Portable Storage Actually Needs

For Conner's products to be competitive in 2026, they need to meet certain technical specifications that modern portable storage users expect. Let's look at what actually matters:

Interface and Connectivity: Users expect USB 3.1 (Gen 2) or Thunderbolt 3/4 connectivity for reasonable transfer speeds. For smartphone use, USB-C is essential, with Lightning compatibility for iPhone users. The days of USB 2.0 backward compatibility are largely over—modern storage needs modern interfaces.

Transfer Speed: Modern portable SSDs should deliver sustained write speeds of at least 400-500 MB/s for USB 3.1, and faster for Thunderbolt. This is important when backing up large video files. Slower speeds mean waiting, and waiting is friction that discourages actual backup behavior.

Capacity Options: Reasonable capacity tiers (256GB, 512GB, 1TB, 2TB) give users choices based on their actual needs. Most people don't need massive external drives for mobile backup, so focusing on reasonable, practical capacities makes sense.

Durability and Reliability: Portable drives get banged around. Users expect them to survive drops from reasonable heights, handle temperature extremes, and resist physical damage. Ratings like shock resistance (up to 2-3 meters drop survivability) matter.

Temperature and Environment Tolerance: Storage devices need to function across temperature ranges (0 to 60°C is typical), handle varying humidity, and maintain data integrity across diverse conditions.

Power Requirements: For mobile use, products should be able to function without external power if possible, or with minimal power draw. A device that requires constant external power source is less convenient for portable use.

Software and Compatibility: Products need to "just work" across iOS, Android, Windows, and macOS without requiring special software installation. Automatic backup features and simple interface options matter.

Security Features: Encryption, password protection, and secure erasure functionality are increasingly expected, especially for mobile devices where data sensitivity is high.

Conner's portable storage products need to meet these specifications to be competitive. If they're underpowered in any of these areas, they'll struggle against competitors who've optimized for them.

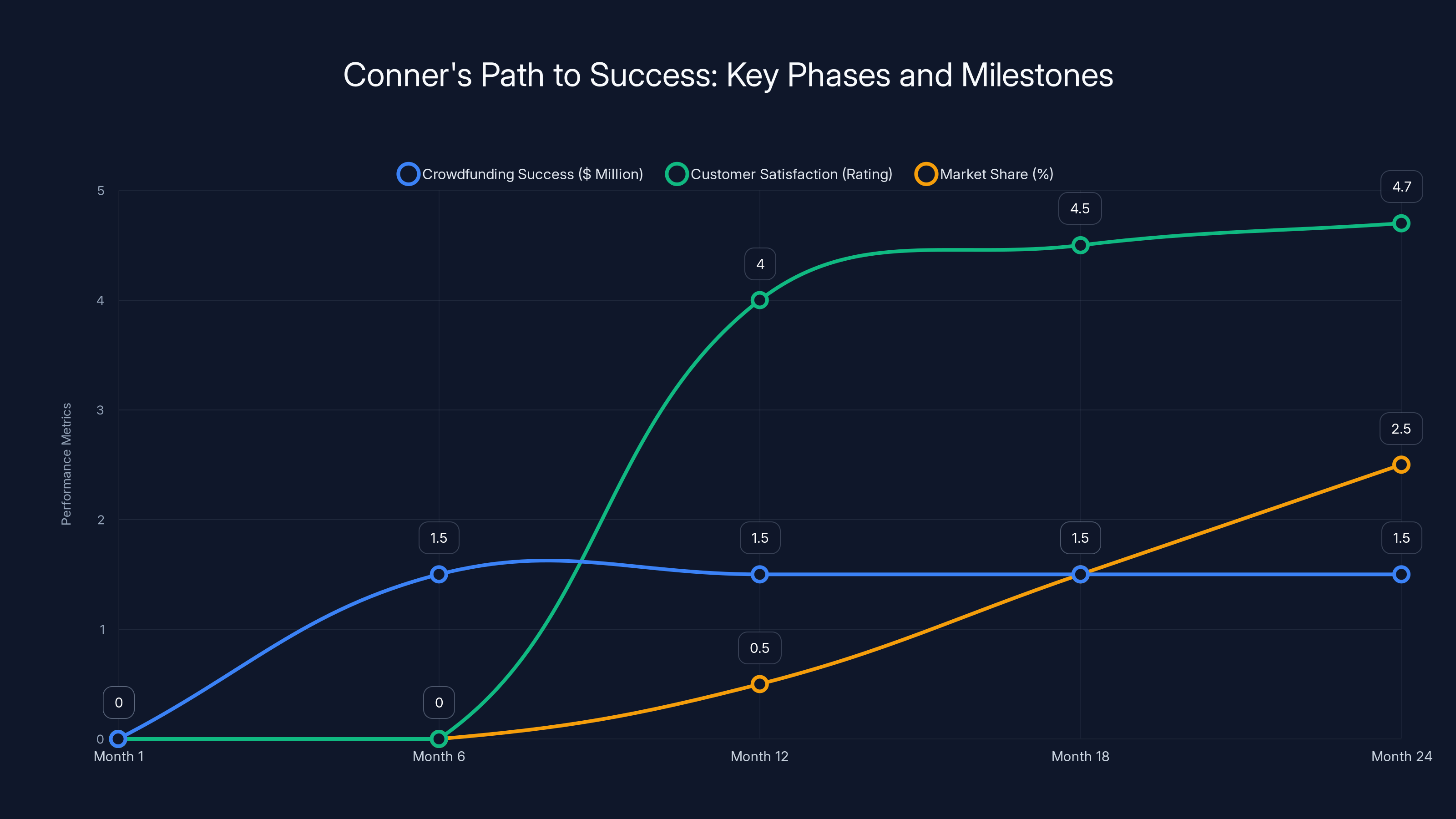

Conner's success involves clearing key phases: crowdfunding, manufacturing, market expansion, and achieving profitability. Estimated data suggests growing market share and customer satisfaction over 24 months.

The Economics of Portable Storage: Margin Pressures and Scale Requirements

Understanding why Conner chose to return to storage requires understanding the economics of the industry. Portable storage is a competitive market with real margin pressures.

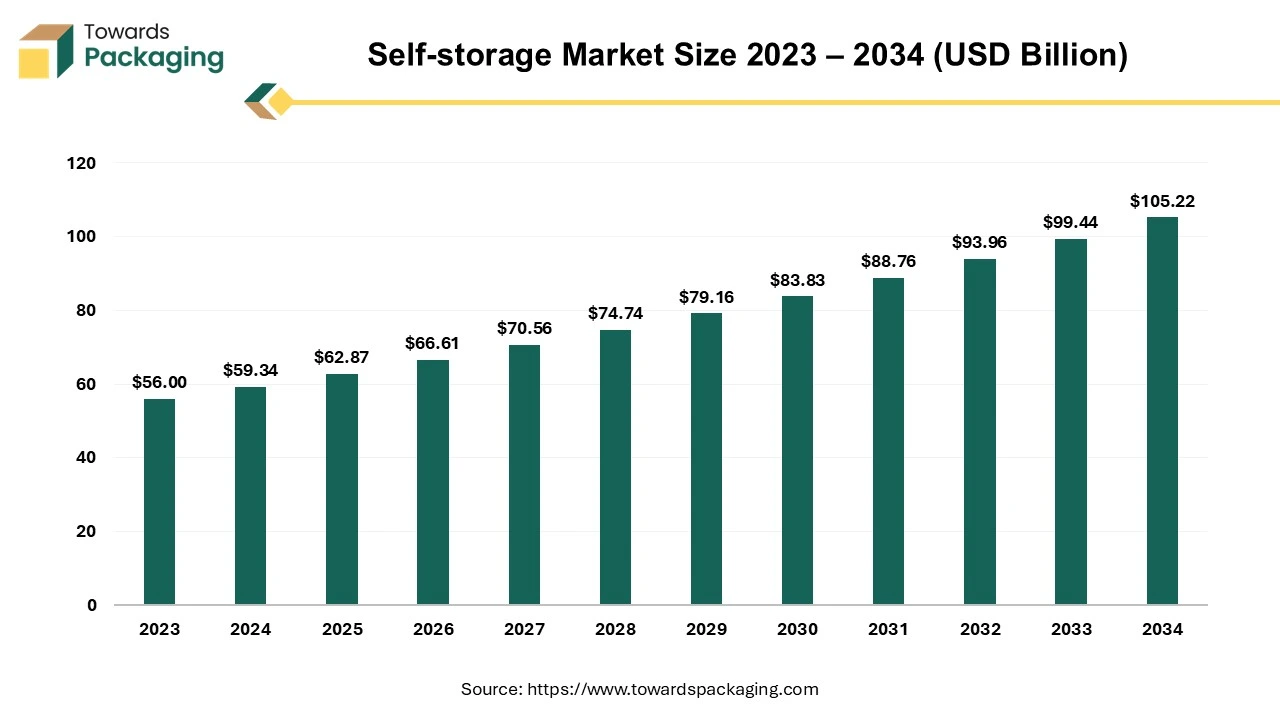

Consider the cost structure for a portable SSD:

- NAND Flash Memory: $20-40 per 512GB, depending on type and volume

- SSD Controller: $2-5

- Enclosure and Housing: $5-10

- Interface/Connectors: $2-3

- Firmware and Software: $1-2 (development and licensing costs amortized)

- Manufacturing, QA, Logistics: $5-8

- Margin for retailer/distributor: 20-30%

- Company margin: 15-25%

A 512GB external SSD selling for

This tight margin structure means that success requires either:

- Scale: Manufacturing at high volumes to reduce per-unit costs

- Efficiency: Optimizing supply chain and manufacturing to outperform competitors

- Differentiation: Selling at premium prices by offering unique features or superior positioning

Conner doesn't have scale advantages. They're re-entering the market without existing manufacturing relationships or established distribution. Their initial production volumes will be small, which means higher per-unit costs than established competitors.

This is why the crowdfunding strategy makes sense. Crowdfunding allows Conner to validate demand and secure funding before committing to expensive manufacturing infrastructure. It also gives them the opportunity to prove operational competence before attempting to compete on scale.

The economic reality is that Conner will likely need to find success in either premium positioning (selling at higher prices to consumers who value heritage and reliability) or in specialized niches (targeting specific use cases like professional photography or video creation) rather than trying to compete on price with Samsung or Western Digital.

What Conner's Leadership Says About Strategic Direction

Conner's CEO Jaci Jin made a public statement about the company's direction: "Conner helped define the early era of personal storage, and we are thrilled to bring that legacy back to life. As digital content expands and mobility becomes essential, our mission remains the same as what Conner's was decades ago: deliver dependable, forward-thinking storage solutions that empower people to protect and manage their data effortlessly."

This statement reveals several strategic priorities:

Legacy and Credibility: The emphasis on Conner's historical role in personal computing. This isn't a company trying to hide its age—it's explicitly leveraging it.

Mobile-First Positioning: The explicit mention of "mobility" signals that this isn't a return to desktop storage. The company is placing its bets in the portable, mobile-centric market.

Data Protection and Management: Rather than competing on raw capacity or speed specs, the focus is on the outcome users care about: keeping their data safe and accessible.

User Empowerment: The language emphasizes giving users control over their data ("empower people to protect and manage") rather than pushing them toward cloud or service-based solutions. This subtly positions Conner against cloud storage services, appealing to users concerned about data privacy.

Forward-Thinking: The company is explicitly positioning itself as innovative, not just nostalgic. They're not trying to recreate the past—they're building on past excellence while applying modern thinking.

This positioning is smart. It threads the needle between nostalgia and modernity, between heritage and innovation. If the company can execute on these strategic ideas, they have a chance. If execution falters or products disappoint, the strategy becomes irrelevant.

Market Reception and Early Indicators

CES 2026's reception of Conner's return was notably mixed, which is probably realistic. Tech media outlets covered the comeback with a mixture of genuine interest and skepticism. The narrative was generally "it's a fun comeback story, but will it actually work?" That's fair.

Social media reaction from people who remember Conner from the original era was generally positive. People in their 50s, 60s, and beyond who remember building their first computers with Conner drives expressed enthusiasm. But interest from younger demographics was minimal—which makes sense, since the Conner brand means nothing to them.

The real test will come when actual products reach market. Will they ship on time? Will they work reliably? Will prices be competitive? Will the quality justify the heritage messaging? These execution questions matter far more than the enthusiastic reception at CES.

Historically, heritage comebacks that succeed are those where execution matches the marketing. Polaroid's comeback to instant photography worked because they actually made decent instant cameras. Nintendo's NES Classic succeeded because it was well-engineered, reliable, and packed with genuine game library value. Conner needs similar execution excellence.

Crowdfunding offers significant advantages such as market validation and capital generation, crucial for Conner's comeback strategy. Estimated data.

Lessons from Other Legacy Brand Comebacks: What Actually Works

Looking at how other legacy tech brands have attempted comebacks provides useful lessons for evaluating Conner's chances.

Polaroid's Return: Polaroid attempted multiple comebacks after the company struggled financially in the early 2000s. The brand licensed its name to various manufacturers and attempted to revive instant photography. Some initiatives succeeded (the Fujifilm Instax instant camera line, which uses Polaroid branding, has been reasonably successful). Others failed. The lesson: licensing heritage to competent manufacturers can work, but execution by whoever makes the product matters enormously.

Atari's Retro Consoles: Atari licensed its name to AtGames to produce retro game consoles playing classic Atari games. These have had moderate success, particularly with nostalgic consumers. The lesson: nostalgia alone doesn't guarantee success, but in niche markets (retro gaming enthusiasts), it can be sufficient if paired with decent product quality.

Commodore's Failed Revivals: Multiple attempts to revive Commodore as a computer brand have failed spectacularly. Despite the legendary status of the original Commodore 64 and Amiga computers, attempts to bring back the brand with new products have never gained traction. The lesson: heritage doesn't transfer across too radical a product shift. If you're trying to return a computer brand with a completely different type of product, you lose the credibility advantage.

Kodak's Struggle: Kodak attempted multiple pivots to stay relevant (digital cameras, printer ink, professional imaging services) after film photography collapsed. The company survived but lost market leadership. The lesson: even with heritage and strong engineering, if you don't adapt to industry shifts, you lose relevance.

Conner's comeback is positioning itself somewhere in the middle of these precedents. It's not a radical product shift (storage is still storage), but it's a significant format and use case shift (from desktop drives to portable). It's licensing its heritage to build credibility but needs to deliver genuinely competitive products. These are manageable challenges if execution is strong.

The Data Privacy Angle: Why Some Users Prefer Physical Storage

One advantage Conner has that isn't often discussed is growing consumer concern about cloud storage privacy. For certain users and certain use cases, physical storage devices offer advantages that cloud services don't.

Consider the typical cloud storage experience: You upload files to Google Drive, Microsoft OneDrive, Apple iCloud, Dropbox, or a similar service. These files live on servers owned and operated by the company. The company has access to your data (or at least the ability to access it with proper authorization). Your files are subject to the company's terms of service, privacy policy, and legal obligations.

For some users, this is fine. They trust the company, appreciate the convenience, and don't mind the trade-off. But for others—particularly those handling sensitive work, financial data, medical records, or other private information—the idea of storing critical data on someone else's servers is uncomfortable.

Portable external storage offers an alternative: You control the device physically. You control where it's stored. You control who has access. You're not subject to cloud service terms of service or privacy policies. Your data is yours, completely.

This is a genuine advantage that Conner could emphasize more explicitly. "Keep your data under your control" or "Your data, your device, your decision" are compelling messages for users concerned about privacy.

The growth of privacy concerns (driven by data breaches, privacy scandals, and regulatory changes like GDPR) has created renewed interest in local, physical storage solutions. Conner entering the market as "the reliable physical storage option" alongside cloud services could be a genuine value proposition.

Manufacturing and Supply Chain Considerations

Bringing products to market requires manufacturing and supply chain relationships that Conner won't have after 20 years away from the industry.

Manufacturing modern SSDs requires sophisticated facilities and expertise. Conner can't manufacture these devices themselves—they'll need to partner with contract manufacturers (likely companies like ODMs in Taiwan, South Korea, or China that specialize in storage device manufacturing).

Choosing the right manufacturing partner is critical. The partner needs:

- Expertise in SSD manufacturing

- Quality assurance processes that can maintain reliability standards

- Supply chain relationships for NAND flash memory and controllers

- Scalability to ramp production based on demand

- Responsiveness to design changes and customization

Conner isn't starting entirely from scratch—legacy manufacturing relationships might still exist or could be recreated. But the company will need to navigate a complex global supply chain where every component source and logistics partner has changed dramatically since the company last operated.

This is genuinely difficult execution. If Conner ships products with quality issues, warranty failures, or fulfillment delays, the comeback is damaged. Brand heritage won't protect them if they can't deliver reliable products and service.

The crowdfunding approach helps here too: it allows Conner to validate with smaller initial production runs rather than betting everything on large-scale manufacturing that they haven't run in decades.

Regulatory and Compliance Landscape for Storage Devices

Returning to the consumer storage market also means navigating modern regulatory requirements that didn't exist (or were different) when Conner last operated.

In the United States, consumer storage devices must comply with FCC regulations for electromagnetic emissions and interference. In Europe, they must meet CE marking requirements and GDPR-compliant handling of personal data. Energy efficiency regulations (like Energy Star compliance) affect how devices are marketed and what power consumption they can claim.

Data security regulations are increasingly important. For devices marketed to handle personal data, there are emerging regulatory requirements around data protection standards, encryption capabilities, and security certifications.

Environmental compliance includes proper handling of electronic waste (RoHS regulations in Europe, WEEE compliance for disposal). Battery regulations (if any of Conner's devices include batteries for charging functionality) add complexity.

These regulatory requirements aren't insurmountable, but they represent barriers to entry that don't exist in emerging markets and create complexity that established manufacturers have already solved. Conner needs to navigate this regulatory landscape correctly or face recalls, compliance actions, or product delays.

The Path Forward: What Success Actually Looks Like

For Conner's comeback to be considered successful, the company needs to clear several hurdles:

Phase 1 (Months 1-6): Crowdfunding and Validation

- Successfully fund products on crowdfunding platforms (targeting at least $1-2 million in backing)

- Demonstrate genuine consumer interest (not just nostalgia interest, but actual purchase commitments)

- Validate product design and feature choices based on crowdfunding feedback

Phase 2 (Months 6-12): Manufacturing and Fulfillment

- Deliver crowdfunded products on time and with high quality

- Generate positive customer reviews and word-of-mouth

- Establish manufacturing and supply chain relationships that can scale

Phase 3 (Months 12-24): Market Expansion

- Expand into retail distribution (online retailers like Amazon, B&H Photo; potentially specialty stores)

- Launch marketing campaigns emphasizing reliability and heritage

- Expand product line based on customer feedback

Phase 4 (Year 2+): Scale and Profitability

- Achieve profitable operations at reasonable production volumes

- Establish sustainable market position in portable storage niche

- Build reputation as reliable, innovative manufacturer

Success doesn't mean Conner becomes a major market player again. It means the company finds a sustainable niche, builds genuine customer loyalty based on product quality, and potentially expands from there. Even capturing 2-3% of the portable SSD market would be commercially viable.

Failure looks like: products ship late or with quality issues, customer satisfaction is low, crowdfunding campaigns underperform, or the company can't achieve profitable manufacturing.

FAQ

What was Conner Peripherals originally known for?

Conner Peripherals, founded in 1986, was a pioneering hard drive manufacturer that played a crucial role in establishing the 3.5-inch hard drive format as the industry standard for desktop personal computers. The company was one of the major storage players throughout the late 1980s and 1990s, helping define the era of personal computing storage. After industry consolidation and the rise of flash storage, the brand essentially disappeared from consumer consciousness for several decades.

Why is Conner returning in 2026 instead of staying dormant?

Conner is returning because several market conditions align favorably: the portable storage market is growing rapidly (15-18% annually), smartphone users increasingly need reliable backup solutions, and there's diminished competition in the mobile-first portable storage segment compared to traditional external drives. Additionally, nostalgia-driven tech products have proven successful in certain niches, and the company likely sees an opportunity to leverage its heritage brand equity to establish credibility in a growing market.

What products is Conner planning to release?

Conner's initial product lineup focuses on portable storage solutions rather than traditional hard drives. Products include compact external SSDs designed for smartphones and tablets, smartphone backup devices with simplified interfaces, hybrid charger-storage devices that combine data backup with battery charging functionality, and some models with integrated SD card readers. The emphasis is on convenience and portability rather than raw capacity.

How does Conner's comeback compare to other legacy tech brands?

Conner's strategy differs from some previous legacy brand attempts in that it's pivoting to a different product category (portable storage instead of desktop drives) while maintaining the core business of being a reliable storage provider. This is more successful than attempts to completely reinvent brands (like trying to bring back Commodore as a computer manufacturer). The approach is comparable to Polaroid's successful pivot to instant photography nostalgia or Nintendo's successful retro console strategy, where heritage is leveraged while adapting to modern market realities.

Is crowdfunding a smart approach for Conner's comeback?

Yes, crowdfunding serves multiple strategic purposes for Conner. It validates market demand before expensive manufacturing commitments, provides capital for initial production without external funding, creates a community of engaged early adopters, and generates media narrative momentum. Crowdfunding is particularly appropriate for a heritage brand re-entering the market with new product categories, as it allows testing and iteration before scaling.

What competitive advantages does Conner have in portable storage?

Conner's primary advantages are heritage credibility (40 years of storage engineering reputation), the ability to position as a privacy-focused alternative to cloud storage, and focus on underserved mobile storage niches rather than competing head-to-head with incumbents on capacity or price. The company's disadvantages include lack of current manufacturing relationships, no retail distribution, small production scale, and the reality that younger consumers have no emotional connection to the brand.

Could other legacy storage brands like Maxtor or Iomega also make comebacks?

It's possible but less likely than Conner's comeback because most legacy storage brands are owned by larger corporations (Seagate owns Maxtor, Lenovo owns Iomega) who control the intellectual property and have less incentive to revive dormant brands. Conner's situation was unique because the brand was not actively controlled by a major manufacturer, creating opportunity for a revival. However, if Conner succeeds, it might encourage parent companies to license other legacy brands for comeback products.

What would cause Conner's comeback to fail?

Failure scenarios include: products shipping late or with quality issues, customer satisfaction being poor (leading to negative reviews), crowdfunding campaigns underperforming and demonstrating lack of real market interest, inability to achieve competitive manufacturing costs, supply chain problems, or finding that actual customers want the products but can't find them through distribution channels. Heritage brand status doesn't protect against execution failures.

How does physical portable storage compare to cloud storage for backup?

Physical portable storage offers advantages in privacy (data stays under your physical control), no recurring costs, independence from internet connectivity, and no service dependency. Cloud storage offers advantages in accessibility (accessible from any device with internet), automatic backup functionality, geographic redundancy, and not having to physically carry a device. The best approach often combines both: use cloud for convenient automatic backup, physical storage for security-sensitive or archival data.

What should consumers look for in portable SSDs?

Key considerations include: USB interface speed (USB 3.1 Gen 2 or Thunderbolt preferred), smartphone compatibility (USB-C for Android, Lightning for iOS), sustained transfer speeds (400+ MB/s is reasonable), appropriate capacity for your needs (256GB-2TB covers most use cases), durability ratings, encryption and security features, and whether the product requires external power. For mobile use specifically, prioritize compact size, light weight, and reliable smartphone compatibility over maximum capacity.

Conclusion: A Test Case for Legacy Brands in the Modern Tech Market

Conner's return to the consumer storage market in 2026 is more than just a nostalgic callback to the 1980s and 1990s. It's a genuine test case for whether legacy tech brands can matter in a modern market, whether heritage and credibility count for anything against entrenched competitors, and whether the tech industry's obsession with newness and innovation might be missing something about the value of reliability and proven expertise.

The company's strategy is smart: pivot to a growing market segment (portable mobile storage) where competition is fierce but fragmented, leverage heritage for credibility without relying solely on nostalgia, use crowdfunding to validate demand and manage risk, and focus on execution excellence rather than marketing hype. These are all moves that increase the probability of success.

But success is far from guaranteed. The portable storage market is crowded, competition is intense, and execution difficulty is high. Conner will need to deliver reliably, price competitively (but not so cheaply that they can't maintain margins), and build genuine customer loyalty based on product quality rather than brand nostalgia alone.

If Conner succeeds, we'll probably see increased interest in other legacy brand revivals. The precedent would suggest that it's possible to return to markets you once dominated, provided you don't try to compete on the same terms as before and you genuinely deliver superior products. If Conner fails, it might discourage other attempts, and the question of whether legacy brands can matter in tech will remain unanswered for another decade.

What makes Conner's comeback genuinely interesting—beyond the nostalgic appeal—is that it reveals something about the technology market's blind spots. We've been so focused on cloud storage, on maximizing capacity, on achieving the fastest specs, that we may have overlooked the genuine value of physical, local, privacy-respecting storage devices managed by companies with proven track records in reliability. Conner isn't trying to reinvent storage. It's trying to be the company that actually delivers on the promise of reliable, dependable, forward-thinking data protection. In a world increasingly concerned about privacy and data ownership, that's not a bad positioning.

The next few months will tell whether nostalgia plus smart strategy plus decent execution equals a viable comeback, or whether the tech industry has simply moved too far from its past to ever genuinely look back. For anyone who remembers Conner from the original era, watching the company's return is fascinatingly personal. For everyone else, it's worth paying attention to: the outcome will reveal something important about how tech brands actually work in 2026 and beyond.

Key Takeaways

- Conner Peripherals, a legendary 1980s hard drive pioneer, is making a surprise comeback at CES 2026 with portable SSD products instead of traditional desktop drives

- The company originally pioneered the 3.5-inch hard drive format that became the industry standard, giving it genuine historical importance and credibility

- Conner's new strategy focuses on mobile-first portable storage for smartphone users rather than competing in the legacy desktop hard drive market

- The portable storage market is growing at 15-18% annually, and fragmented competition creates opportunities for well-executed new entrants

- Crowdfunding will play a key role in initial launch, allowing Conner to validate demand and build customer relationships before attempting mass-market distribution

- Success depends on product execution quality, not brand nostalgia alone—heritage credibility helps but won't overcome poor engineering or service failures

- The comeback raises questions about whether other legendary storage brands (Maxtor, Iomega, SyQuest) might attempt similar revivals

Related Articles

- Dreame Cyber X Robot Vacuum: Stair-Climbing Innovation [2025]

- Dreame Cyber 10 Ultra: Robot Vacuum With Mechanical Arm [2026]

- CES 2026: Why EVs Lost to Robotaxis & AI – Industry Shift Explained

- Home Robots in 2026: Why Specialized Bots Beat the Robot Butler Dream [2026]

- The Wildest Tech at CES 2026: From AI Pandas to Holographic Anime [2026]

- Wi-Fi 8 is Coming in 2026 (And You Probably Aren't Ready) [2025]

![Conner's Storage Comeback at CES 2026: HDD Pioneer Pivots to Portable SSDs [2025]](https://tryrunable.com/blog/conner-s-storage-comeback-at-ces-2026-hdd-pioneer-pivots-to-/image-1-1767739338227.jpg)