Crunchyroll Price Hikes: Inside Sony's Anime Streaming Strategy [2025]

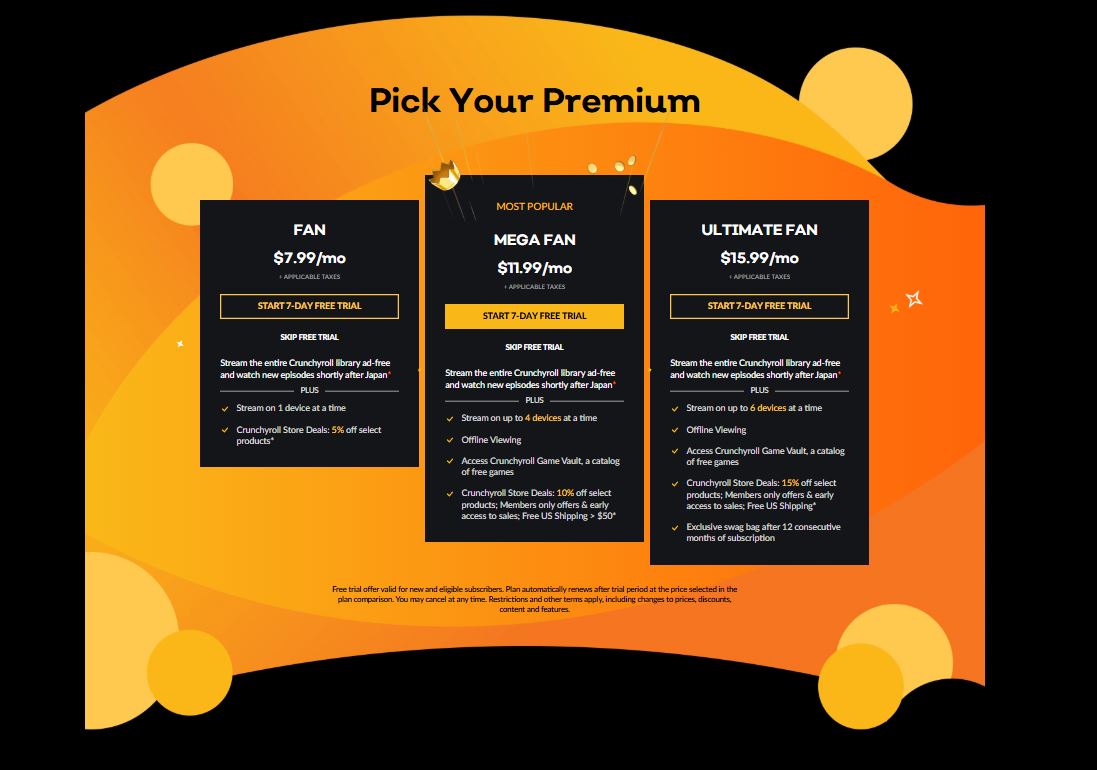

It happened again. Just weeks after Crunchyroll killed its free tier entirely, Sony announced price increases across every remaining subscription tier. The cheapest plan jumped from

Here's what makes this move particularly striking: this isn't the first price hike under Sony's watch. The company bought Crunchyroll from AT&T back in 2020 for an undisclosed sum, inheriting a massive platform with 3 million paying subscribers and 197 million free users. Fast forward to today, and that same platform now requires payment, charges more per month, and represents something fundamentally different than what customers signed up for.

This story reveals something bigger than one streaming service's pricing decisions. It's about how large corporations systematically consolidate markets, eliminate free alternatives, and capture customers with limited escape routes. It's about what happens when a niche service scales beyond its original mission. And it's about the broader streaming wars, where fewer companies control more content, and subscribers increasingly feel the squeeze.

Over the past six years, Crunchyroll has become a case study in how corporate ownership transforms beloved products. Sony's moves tell us something important about the future of streaming itself. Where does anime fandom go when the primary home for anime streaming becomes increasingly expensive? What happens when consolidation means there's nowhere else to turn? And why should anyone care about what happens to one streaming service when there are dozens of competitors?

The answers matter. They affect millions of anime viewers, they signal how tech giants treat acquisitions, and they hint at where streaming will go next. Let's dig in.

The Timeline: How Crunchyroll Got Here

Understanding where Crunchyroll stands today requires understanding the journey it took to get there. The service didn't start as a premium platform under Sony management. It started as something scrappier, more grassroots, more aligned with the communities that used it.

When Sony acquired Crunchyroll from AT&T in 2020, the platform looked fundamentally different. Free accounts were core to the business model. Yes, they came with advertisements and limited catalog access, but they existed. For many anime fans, especially younger viewers and those in regions with lower purchasing power, the free tier meant access to content they otherwise couldn't afford. That free tier represented something: recognition that anime fandom had price-sensitive audiences who valued access over advertising.

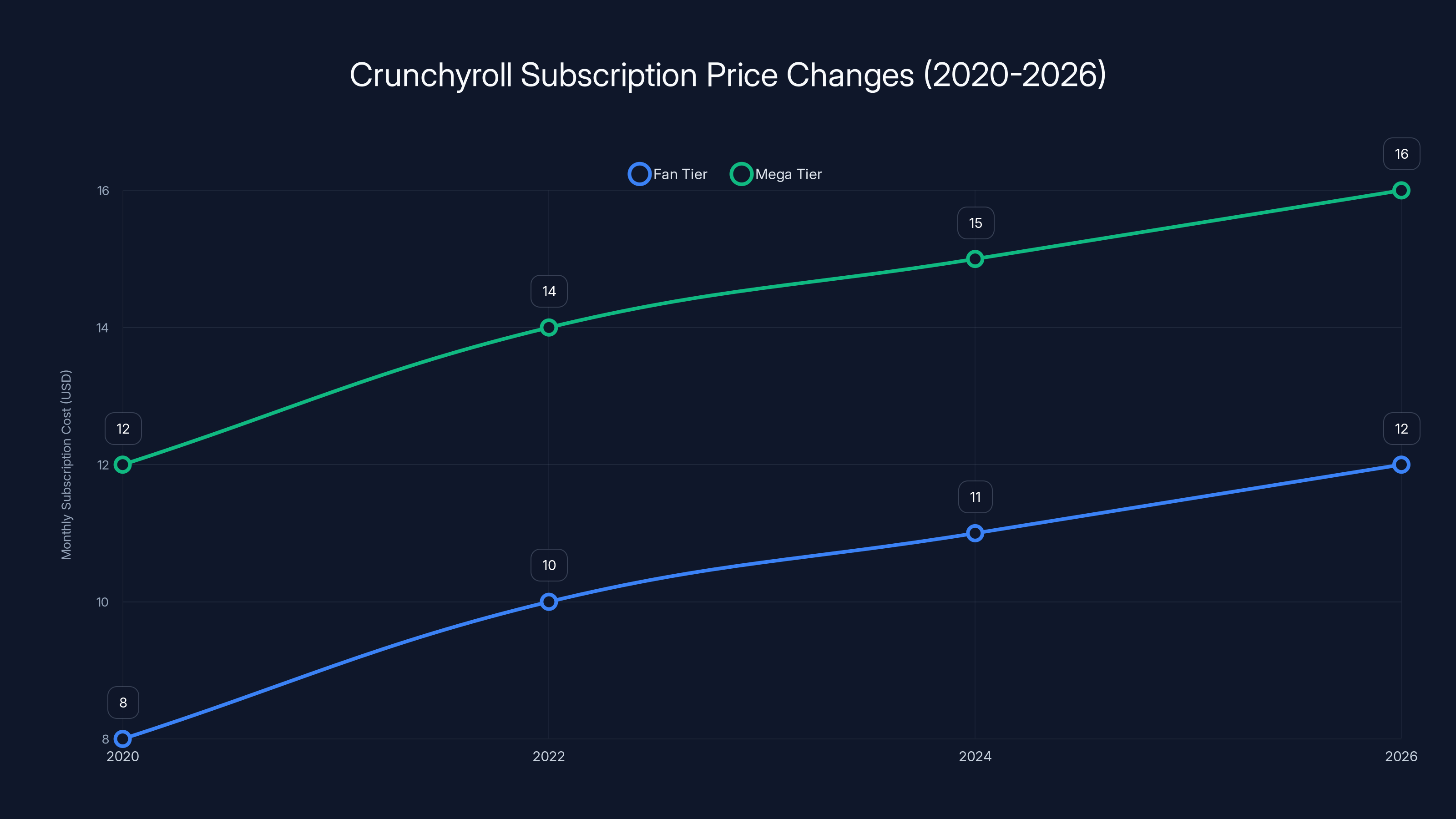

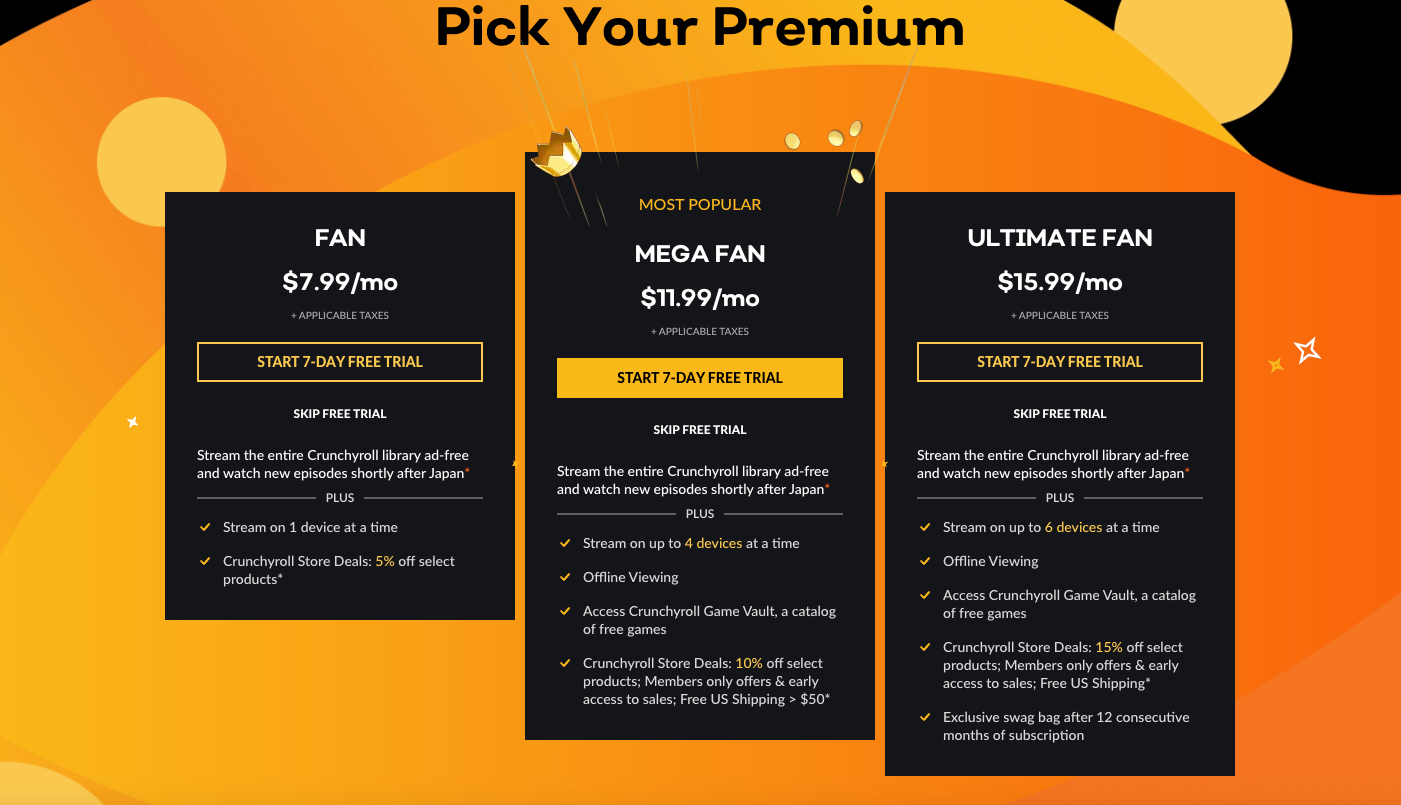

The early years under Sony were relatively quiet on the pricing front. Crunchyroll maintained its tier structure at

Then things shifted. In May 2024, Sony raised prices again. The Mega tier went from

The real hammer drop came at the end of 2025. On December 31st, Crunchyroll eliminated its free tier entirely. No more ad-supported option. No more entry point for budget-conscious fans. The decision came weeks before the latest price increase announcement, creating a one-two punch that hit existing subscribers in the wallet and locked out potential new customers.

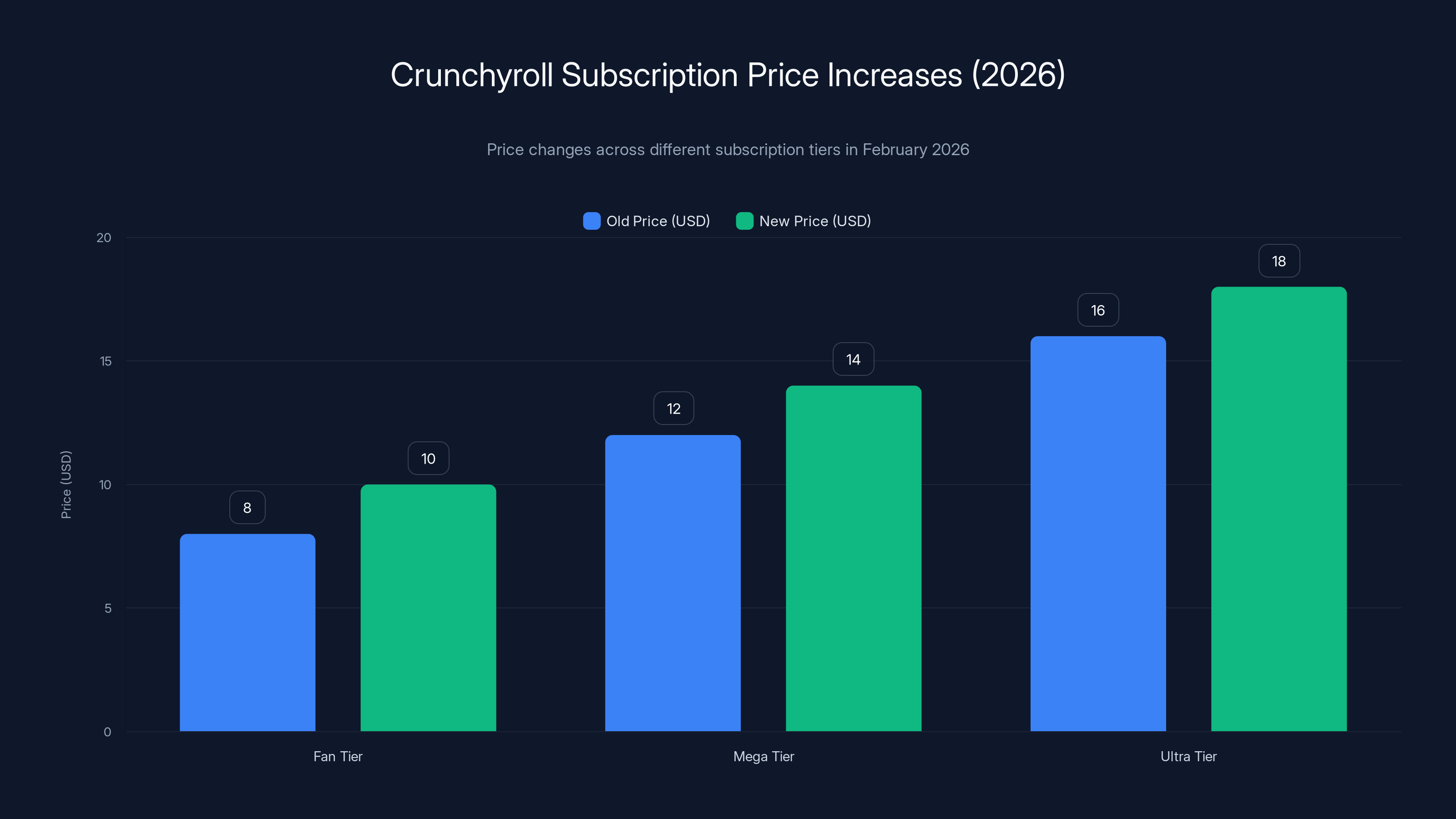

Now in February 2026, prices climbed again. Up to 20 percent increases across the board. The pattern is clear: each decision builds on the last. Eliminate the free tier, raise prices, justify it with new features.

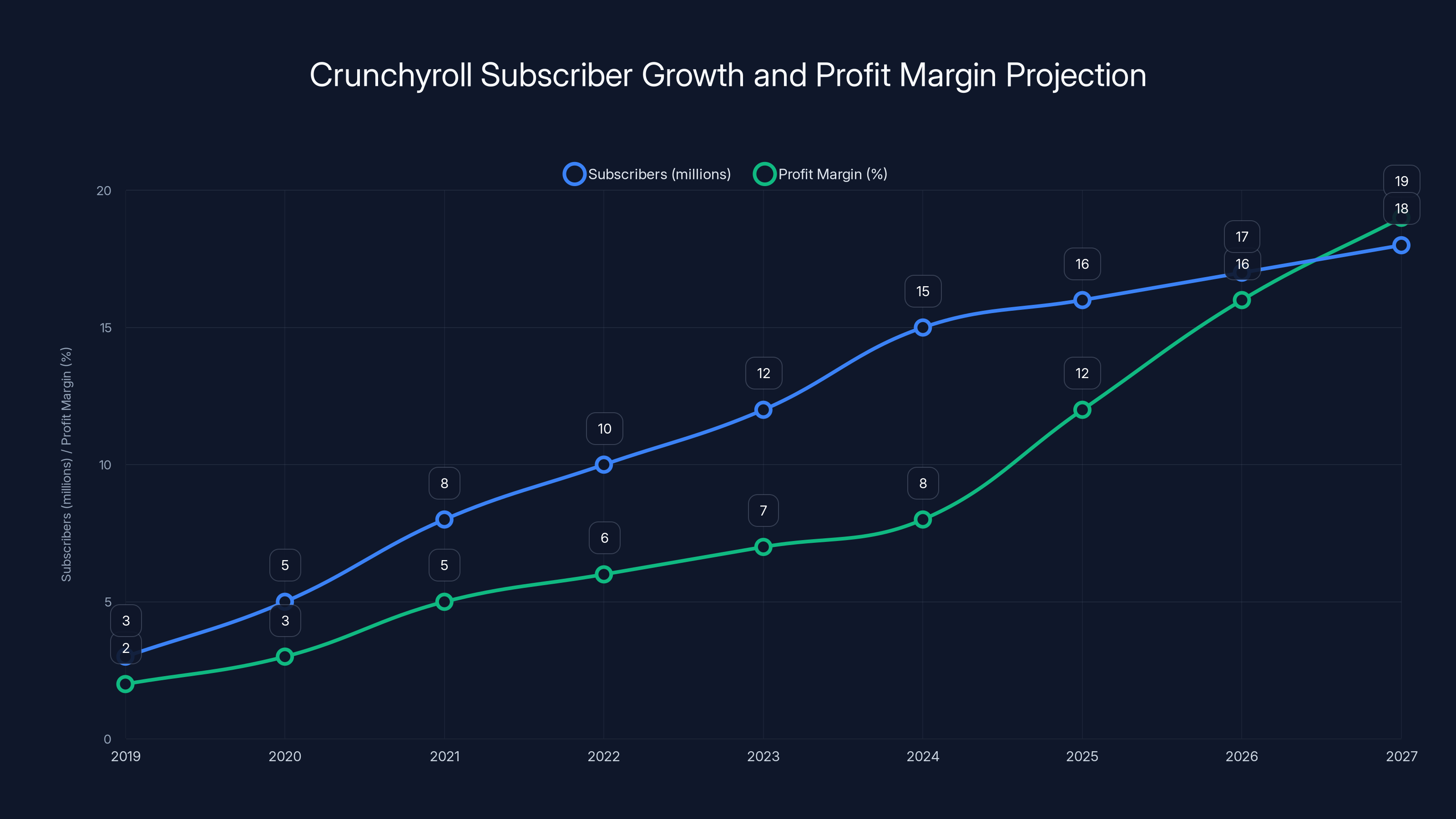

Crunchyroll's subscriber base grew from 3 million to an estimated 18 million by 2027, while profit margins are projected to increase from 8% in 2024 to 19% by 2027, highlighting strategic growth through pricing and cost management.

The Math Behind Sony's Strategy

Why would a company deliberately anger subscribers by raising prices weeks after eliminating free access? The answer lies in understanding how streaming economics work, what Sony's financial incentives are, and how market consolidation enables these decisions.

Let's start with the numbers. When Sony bought Crunchyroll, the service had 3 million paid subscribers. According to recent reports from Variety, that number has grown to over 15 million. That's a 400 percent increase in five years. Meanwhile, Crunchyroll's profit margins have expanded dramatically. Bernstein Research analysts estimated that Crunchyroll's profit margin hit 8 percent in the third quarter of 2024. More significantly, analysts projected that margin would more than double to around 17-20 percent by 2027.

Think about what those numbers mean. An 8 percent profit margin isn't spectacular for a mature streaming service. It's actually on the thin side. But a margin that doubles in three years? That's the kind of trajectory that justifies aggressive moves to investors. That's the kind of growth narrative that makes quarterly earnings calls exciting.

Here's the financial formula underlying these decisions:

Sony can improve this equation two ways: increase revenue per subscriber or cut costs. Eliminating the free tier does both. It removes the lowest-revenue customers while keeping infrastructure costs relatively flat. Raising prices increases revenue per subscriber directly. Combining these moves creates a leverage effect that's mathematically powerful.

Consider this scenario: if Crunchyroll has 15 million subscribers paying an average of

For context, that's a bigger impact than most cost-cutting initiatives. It's the streaming equivalent of printing money.

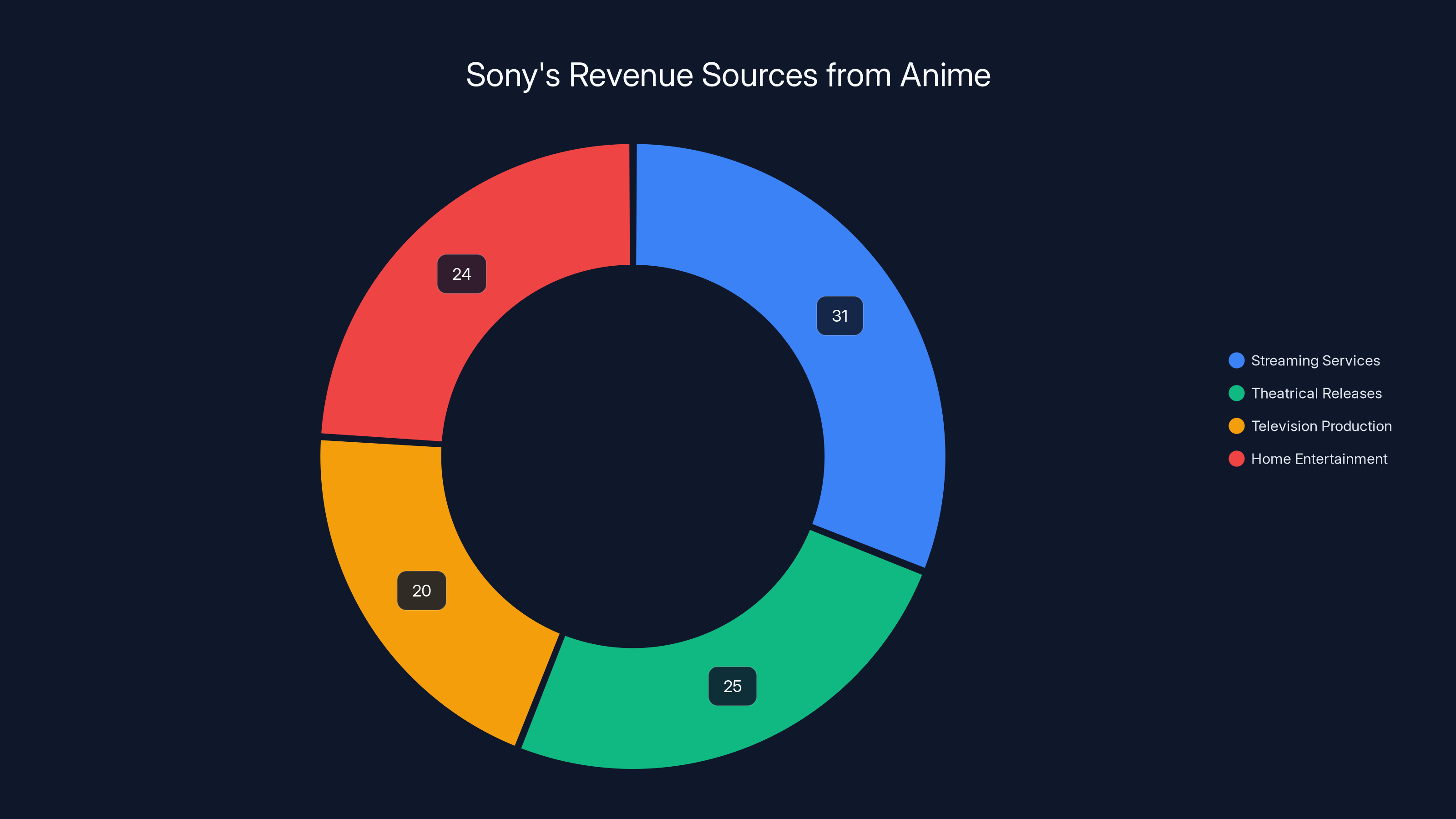

But there's another layer to the strategy. Sony doesn't report Crunchyroll's financials separately. The service gets buried in "Sony Pictures" reports, which includes everything from theatrical releases to television production. What we know comes from analyst estimates and scattered Sony disclosures. That opacity matters. It means Sony can pursue aggressive pricing strategies without detailed public scrutiny of the specific business unit's performance.

Compare this to Netflix or Disney, which report streaming subscriber numbers and ARPU (average revenue per user) quarterly. Those companies face immediate investor backlash if subscriber numbers drop. Sony's Crunchyroll faces no such transparency requirement. That freedom enables the kind of aggressive moves we're seeing.

Estimated data shows a consistent increase in Crunchyroll subscription prices, with the Fan tier rising from

Market Consolidation: Crunchyroll and Netflix's Dominance

Here's the uncomfortable truth about streaming markets: they naturally consolidate. A few massive players dominate while smaller competitors struggle to survive. Anime streaming is case in point.

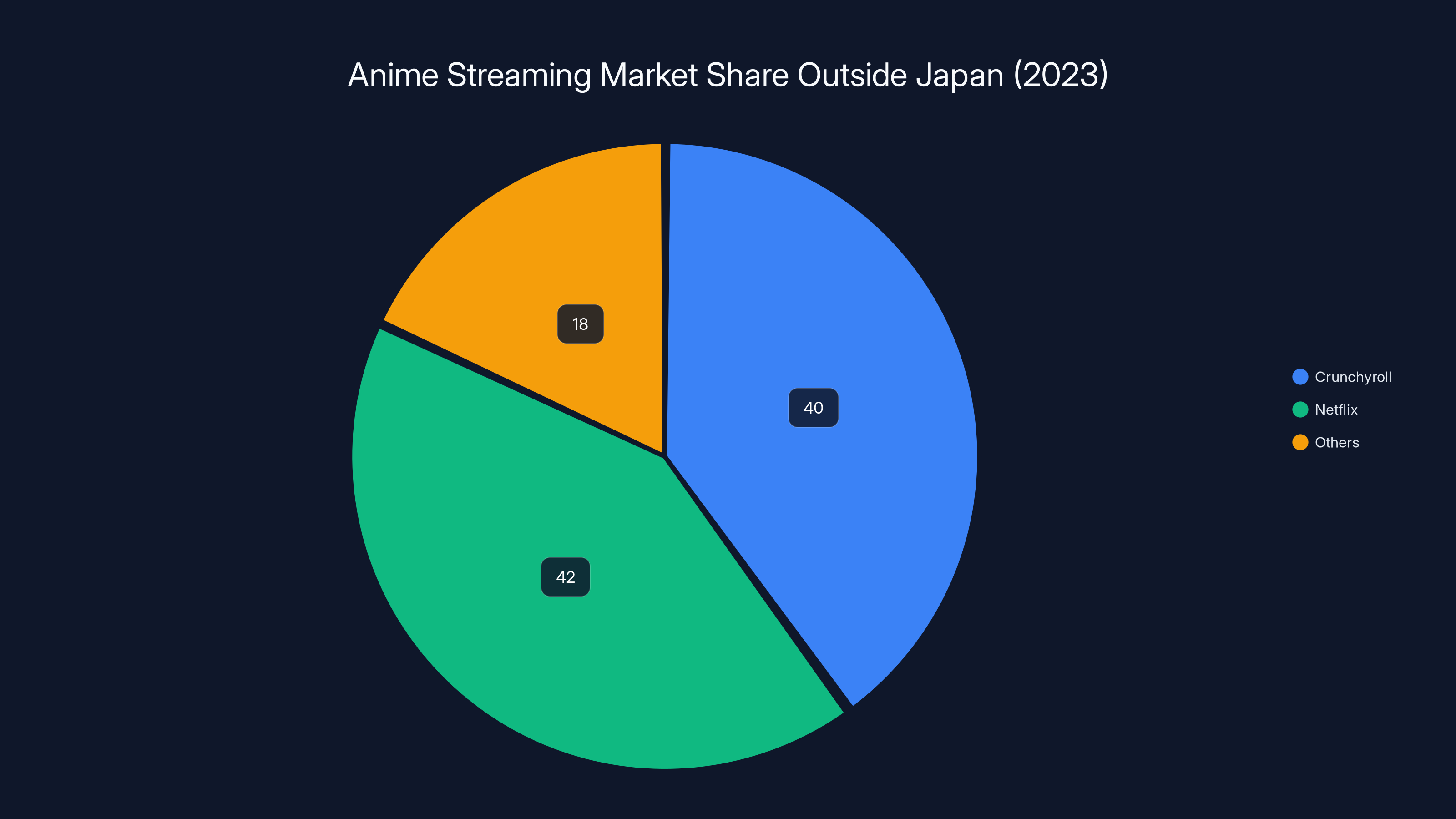

According to Bernstein Research's 2023 analysis, Crunchyroll and Netflix controlled 82 percent of the overseas anime streaming market outside Japan. Crunchyroll held 40 percent. Netflix held 42 percent. That means every other anime streaming service in the world combined for just 18 percent. Two companies. 82 percent of the market. That's consolidation.

How did we get here? It started with mergers. Sony bought Funimation in 2017, then Crunchyroll in 2020, then shut down Funimation in 2024. Each move consolidated previously competing services. Netflix, meanwhile, never competed directly in anime for years. The company existed but wasn't a primary anime destination. That changed as Netflix invested heavily in anime original series and licensed catalog content. Now Netflix is a top-two anime platform.

Smaller competitors like HIDIVE, which focuses on niche and independent anime, operate in the margins. They have passionate audiences but lack the resources, content budgets, or subscriber scale of the giants. A viewer interested in mainstream anime, new releases, and popular series? Crunchyroll or Netflix are realistically the only options. That's not a market. That's a duopoly.

Why does consolidation matter for pricing? Because it eliminates the primary check on price increases: customer exit. In a competitive market with many options, raising prices pushes customers to competitors. In a duopoly, customers have two choices: pay more or stop using the service. Many choose to pay.

Sony understands this perfectly. The company spent six years building content, integrating systems, and growing the subscriber base. It deliberately eliminated Funimation to consolidate users. Now, with Netflix as the only real competitor and a massive head start in anime, Crunchyroll operates in a position of significant market power.

The math of this works out simply. If 10 percent of Crunchyroll subscribers would switch to Netflix due to a price increase, but 90 percent stay, the company nets a positive revenue result. As long as the switching cost is below the price increase, it makes economic sense. And for anime fans with existing watchlists on Crunchyroll, sunk content libraries, and saved preferences? Switching costs are meaningful.

What Sony Did After the Acquisition: The Pattern

Sony's approach to Crunchyroll follows a predictable pattern common to big tech companies acquiring smaller, beloved products. The pattern typically goes: 1) stabilize and integrate, 2) eliminate competitors, 3) optimize for profit. Understanding this pattern helps explain not just Crunchyroll's moves, but what we should expect from future Sony acquisitions.

Phase one was integration. When Sony bought Crunchyroll, the service had its own systems, content library, and subscriber infrastructure. Sony's job was consolidating these overlapping services without destroying what made them valuable. That meant keeping Crunchyroll and Funimation running separately for a few years while working on backend integration.

Phase two was consolidation. In 2024, Sony merged Funimation into Crunchyroll and shut down the Funimation platform entirely. This move had real consequences for customers. Funimation subscribers had to move to Crunchyroll. And here's where it gets ugly: Funimation had previously marketed digital libraries as available "forever, but there are some restrictions." When Sony migrated accounts, some digital content simply vanished. Customers lost access to purchases they thought were permanent. They received no refunds.

This consolidation move was financially smart. Sony eliminated duplicate infrastructure costs, unified the subscriber base under one platform, and forced Funimation users to adopt Crunchyroll pricing. But it destroyed goodwill in the process. Long-time Funimation users suddenly found their libraries incomplete and faced higher prices than they'd previously paid for comparable service.

Phase three is ongoing optimization. The free tier elimination and price increases represent phase three in full force. Sony is now optimizing Crunchyroll for maximum profitability. Each decision makes economic sense in isolation: free users require infrastructure but generate minimal revenue, so eliminate them. Subscribers demonstrate strong willingness to pay by switching from Funimation, so raise prices. New features (profile management, skip intros) justify price increases to public-facing messaging.

Sony is also acquiring aggressively in anime beyond Crunchyroll. The company's anime production company Aniplex announced it bought Egg Firm on the same day as the price increase announcement. Egg Firm is a smaller anime production studio. This acquisition signals Sony's continued strategy of consolidating the entire anime ecosystem, not just distribution but also production.

That's the fuller picture of Sony's approach. It's not random pricing adjustments. It's a systematic consolidation strategy designed to position Sony as the dominant player across anime distribution, content creation, and production. Each acquisition makes that position stronger.

Crunchyroll increased its subscription prices by approximately 20% across all tiers in February 2026, impacting both new and existing subscribers.

The Subscriber Impact: Who Pays the Price

Understanding the business strategy is important. But what actually happens to the people using Crunchyroll? Who feels the pain of these increases, and why should anyone care?

Start with the basic math. A

This matters because anime fandom isn't concentrated in wealthy countries. Anime has massive audiences in Southeast Asia, Latin America, and Eastern Europe. Crunchyroll specifically built its subscriber base internationally. Removing the free tier and raising prices simultaneously signals that Sony values existing premium subscribers in wealthy markets far more than it values new user acquisition in developing markets.

For existing subscribers, the impact varies by region and tier. The Fan tier (basic plan) went from

There's also an emotional component. Subscribers feel the double-punch of eliminating free access and raising prices in quick succession. It creates a narrative of a service that no longer values accessibility or building community. It feels extractive. Companies spend millions on brand loyalty. Crunchyroll just damaged theirs with a one-two punch to the wallet.

What's the likely result? Some subscribers will churn. How many? That depends on elasticity. Economics would predict that a 20 percent price increase causes customer loss in the 5-10 percent range for services with limited competition. For a company as consolidated as Crunchyroll with limited alternatives, that percentage might be lower. But even 5 percent churn from a 15 million subscriber base represents 750,000 lost customers.

Alternatively, most subscribers might stay put. Netflix, which also raised prices aggressively in recent years, did see subscriber losses but maintained most of its base. Streaming services have learned that existing subscribers have high switching costs. Many stay even with price increases. If Crunchyroll retains 95 percent of subscribers while raising average revenue per user, it's a financial win even with some churn.

The real losers are potential customers: anime fans who haven't signed up yet, who were using the free tier to explore before committing, who were evaluating whether Crunchyroll's library was worth paying for. Those people now face a $10 commitment with no trial option. Some will pirate anime instead. Some will use Netflix's anime catalog despite its limitations. Some will simply watch less anime. Sony's pricing strategy optimizes for existing customers at the cost of future market growth.

The Justification: New Features and "Value Added"

When companies raise prices, they never just say "we need more profit." Instead, they announce new features that justify the increase. Crunchyroll's announcement pointed to several: teen profiles with PIN protection, multiple user profiles, the ability to skip intro and outro sequences, and expanded device compatibility.

Let's evaluate these justifications honestly. Teen profiles and PIN protection are basic parental controls that should frankly be standard on any streaming service in 2026. Netflix has offered multi-profile accounts for years. They're not new. They're table stakes.

Skip intro and outro functionality is genuinely useful for people watching series. You save roughly 1-2 minutes per episode. Over a 13-episode season, that's 13-26 minutes of saved time. For heavy watchers, that's valuable. But is it worth

Multiple user profiles, again, have been standard on streaming services since the Netflix era. These are quality-of-life features that should be included by default. They cost Crunchyroll almost nothing to implement and maintain compared to the revenue generated by price increases.

Expanded device compatibility is the only genuinely meaningful improvement in this list. More devices mean more flexibility. Some users genuinely value this. But again, for how much? This feature costs infrastructure but not dramatically more than the previous implementation.

What's absent from Crunchyroll's justification? New content announcements. No mention of expanded licensing agreements. No specific data on new titles. No commitment to more original anime productions. No faster simulcasts (releasing anime the same day as Japan, which fans have requested for years). The feature list is basically quality-of-life improvements on existing infrastructure, not expansion of the actual content that makes Crunchyroll valuable.

This matters because Crunchyroll's core value proposition is content. You pay for Crunchyroll because it has anime you want to watch. You don't pay for skip-intro functionality (though that's nice). You pay for access to a catalog of shows. Yet the price increase announcement includes almost nothing about content expansion.

That's the tell. It suggests to subscribers that Sony is raising prices not because it's investing more in what they value, but because it can. Because competition is limited. Because the market will bear it. That's not necessarily a lie, but it's a gap between messaging and reality that damages trust.

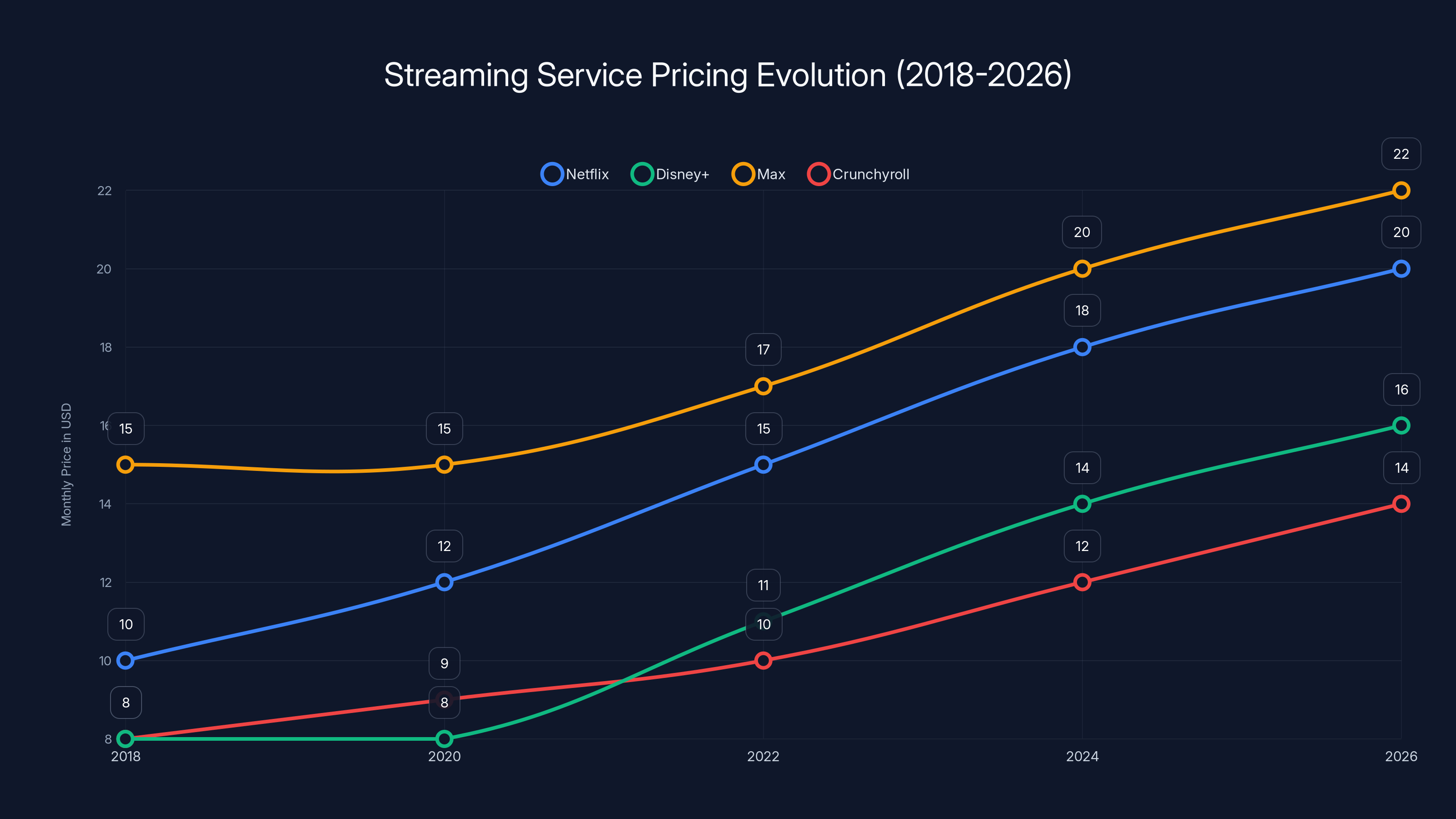

Estimated data shows a consistent upward trend in streaming service prices from 2018 to 2026, reflecting the industry's shift towards higher pricing strategies.

The Broader Streaming Wars Context

Crunchyroll's price increases don't exist in isolation. They're part of a larger recalibration across the entire streaming industry. Netflix, Disney+, Max, and others have all raised prices in the past 18 months. The streaming market that once promised cheap alternatives to cable is now becoming cable: bundled, expensive, and concentrated among a few providers.

Netflix's pricing strategy is particularly instructive. The company spent years sacrificing profit for subscriber growth. It raised prices incrementally but consistently. When Netflix cracked down on password sharing in 2023, subscribers predicted massive churn. What happened instead? Most subscribers accepted the change. The streaming market learned an important lesson: existing customers will absorb significant price increases and feature restrictions if switching costs are high.

Disney+ followed a similar playbook. The service launched at

What's different about Crunchyroll is that Sony didn't go through the subscriber growth phase of investment. The company bought an existing service with an established subscriber base, eliminated competitors, and immediately optimized pricing. That's a shorter cycle than Netflix's gradual approach, and it suggests Sony prioritizes near-term profitability over long-term subscriber growth.

The bigger picture is that the streaming wars have largely concluded. The early promise of the streaming era was unlimited, affordable entertainment. What emerged instead was exactly what economists predicted: natural consolidation toward two or three dominant players, higher prices as services achieved market power, and increasingly sophisticated tactics to lock in subscribers.

Crunchyroll represents this shift vividly. A niche service built by and for anime fans is now optimized for shareholder returns. That's not inherently wrong. Companies exist to generate profit. But it represents a shift from "building community" to "extracting value from existing community."

Anime as a Profit Center

Why is Sony willing to risk subscriber relations by pushing prices and eliminating free access? Because anime has become genuinely lucrative for the company.

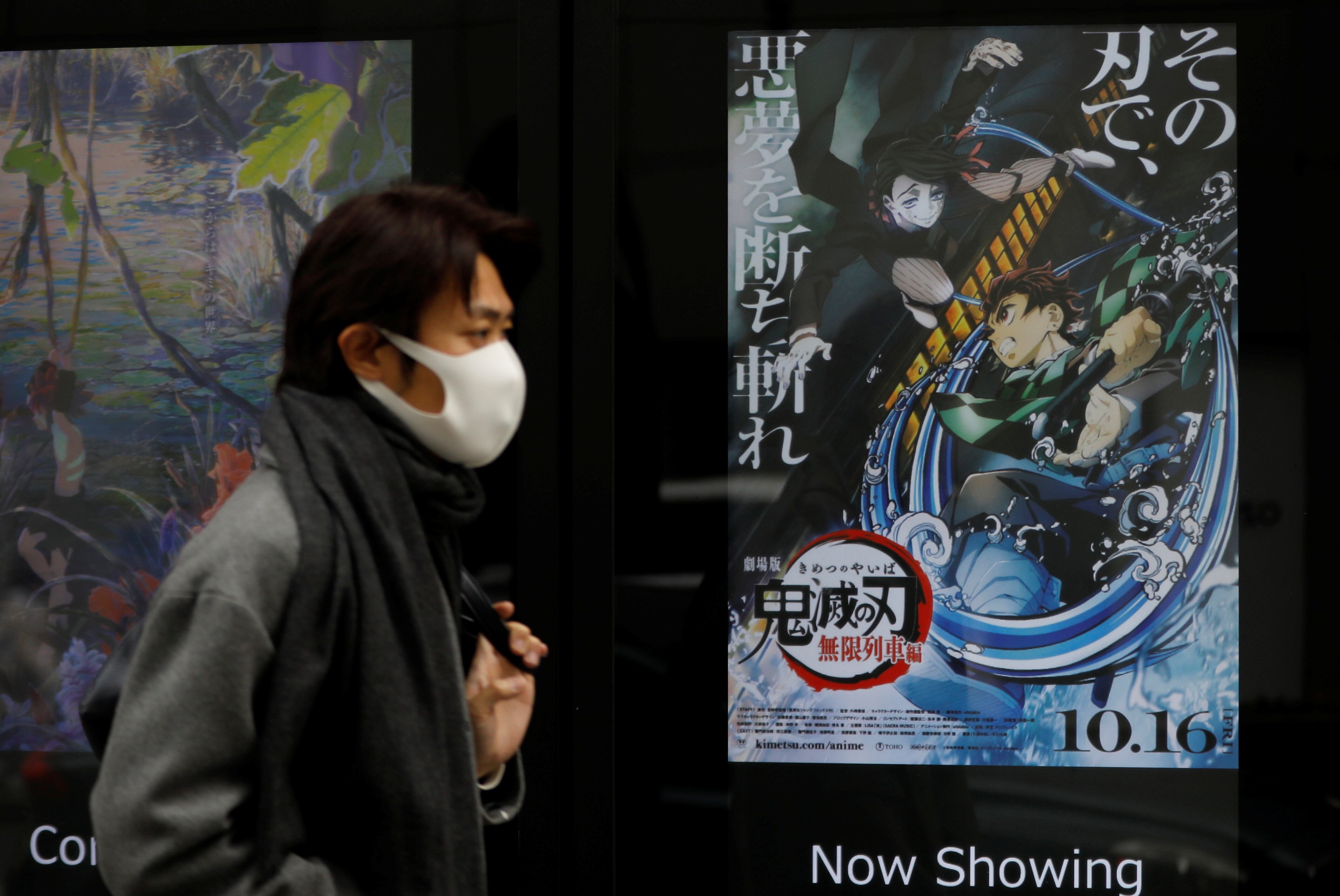

Consider the numbers: anime that was niche in Western markets 15 years ago is now mainstream. Shows like "Attack on Titan," "Demon Slayer," and "Jujutsu Kaisen" attract millions of Western viewers. The anime industry globally generates over $20 billion in revenue annually, with international markets representing a rapidly growing slice.

For Sony specifically, anime is an increasingly important profit center. According to financial reports, streaming services represent 31 percent of sales for Sony Pictures. That's more than theatrical releases, television production, and home entertainment combined. Anime is a core driver of streaming growth. The fact that Crunchyroll is profitable and has margin expansion potential makes it strategically valuable beyond typical streamer economics.

Sony also owns Aniplex, an anime production studio, and its associated companies. The corporation benefits not just from distributing anime but from producing it, syndicating it across platforms, and creating merchandising opportunities. That vertically integrated position means Sony captures value at multiple points in the anime value chain. A subscriber to Crunchyroll isn't just paying for distribution. They're supporting Sony's entire anime ecosystem.

This ecosystem power means Sony can accept short-term subscriber loss for longer-term margin expansion. Even if Crunchyroll loses 10 percent of subscribers due to price increases, the remaining 90 percent paying higher prices generates more total revenue. Sony can live with that trade-off, especially since losing subscribers to piracy or HIDIVE (which can't offer the same content investment) doesn't threaten the core business.

Moreover, Sony is buying into the long-term growth thesis around anime. The company invests as if anime's popularity in Western markets will continue growing. Each year, more people watch anime. Each year, they're willing to pay more for quality access. Crunchyroll's pricing strategy reflects confidence in that trajectory.

Crunchyroll and Netflix dominate the anime streaming market outside Japan, holding a combined 82% share, leaving only 18% for other competitors.

Consumer Alternatives: What Anime Fans Can Actually Do

So if you're a Crunchyroll subscriber frustrated by price increases, what are your options? More limited than you'd hope.

Netflix remains the primary alternative. The platform has invested heavily in anime licensing and original anime production. Shows like "Cyberpunk: Edgerunners" and "Splinter Cell: Chaos Theory" demonstrate Netflix's anime commitment. However, Netflix's anime selection remains narrower than Crunchyroll's. If you're watching obscure titles or specific anime styles, Netflix might not have what you want. Netflix's anime algorithm is also weaker than Crunchyroll's, which was purpose-built for anime discovery.

HIDIVE is the scrappy alternative. The service specializes in niche, independent, and underrepresented anime. It costs less than Crunchyroll and serves communities that prefer experimental work over mainstream hits. The drawback is obvious: if you want to watch popular series that just premiered, HIDIVE might not have them. It's a good secondary service but a poor primary option for mainstream viewers.

Some streaming services offer anime as part of broader content libraries. Max includes various anime titles. Apple TV+ has invested in anime production. Amazon Prime Video includes anime through various channels. But none of these offers Crunchyroll's focused experience or comprehensive anime library. They're better as supplements than primary services.

For anything outside these options, viewers face piracy or simply watching less anime. Some percentage definitely chooses piracy. Some portion probably accepts the price increase. Some might rotate subscriptions: subscribe for a month to watch a specific series, then cancel until the next season. Crunchyroll's inability to prevent password sharing (unlike Netflix) also means some users share accounts, reducing paid subscriptions from larger households.

The lack of appealing alternatives is itself a feature of Sony's strategy. By owning Crunchyroll, consolidating Funimation, and ensuring Netflix focuses on mainstream hits, Sony created a situation where there's no good escape hatch. Anime fans who want comprehensive access and regular new releases realistically have one primary option. That captive market dynamic is what enables the pricing strategy.

What consumers can do is pressure Sony indirectly. Reduce usage, subscribe only for certain months, switch to Netflix's anime selection where possible, and use free legal alternatives like YouTube (which hosts various anime legally). But none of these create meaningful competition pressure. The market structure just doesn't allow it.

What This Means for the Future of Streaming

Crunchyroll's price increases and free tier elimination represent a template for how streaming services will operate going forward. It's not unique to anime. This pattern will repeat across all streaming sectors.

The template is: 1) acquire market position through aggressive pricing or acquisition, 2) eliminate lower-margin offerings (free tiers), 3) consolidate competitors, 4) raise prices as switching costs accumulate. Each step is rational from a profit maximization perspective. Collectively, they describe an industry settling into mature, consolidation-driven economics.

The alternative would be continued competition, maintained free tiers, and prices held low. But that alternative doesn't survive investor pressure. Streaming services that sacrifice profit for subscriber growth get punished by investors. Services that optimize pricing toward profitability get rewarded. Sony is behaving exactly as financial markets incentivize it to behave.

For consumers, this means accepting that the streaming era's early promise is largely obsolete. The brief window where Netflix, YouTube, and others competed fiercely on price and quality is closing. What remains is oligopolistic pricing, strategic content bundling, and services that optimize for profitability once critical mass is achieved.

This isn't necessarily bad. Profitable streaming services can actually invest in content better than financially stressed services. Netflix's current anime library is stronger than Crunchyroll's because Netflix has stable revenue. But profitability-focused pricing does mean higher costs for consumers and reduced options for budget-conscious viewers.

The broader implication is that investors and markets have learned to value profitable mature streaming services more than growth-focused startups. That shift is permanent. You won't see another wave of disruption from streaming startups because the economics don't work. Building a streaming service is expensive. Breaking into consolidated markets is nearly impossible. The logical outcome is consolidation continues until only 2-3 dominant services remain in most markets.

Anime streaming shows this dynamic with particular clarity because anime is so concentrated (Crunchyroll and Netflix). Other genres will follow the same path. Expect fewer streaming services, higher prices, and more bundling. It's not a conspiracy. It's market structure settling into its natural equilibrium.

Streaming services, driven by anime, account for 31% of Sony Pictures' sales, surpassing other revenue sources. Estimated data.

The Consolidation Concern: Fewer Choices, More Power

Why should people care that Crunchyroll is consolidating anime streaming? Because consolidated markets are bad for consumers. Economics textbooks teach this in chapter one.

In competitive markets, price increases are checked by customer exit. If Crunchyroll raises prices 20 percent, customers move to alternatives. That threat keeps prices reasonable. In concentrated markets (duopoly or monopoly), exit isn't credible. You either pay the new price or don't use the service. That dynamic enables aggressive pricing.

Consolidation also reduces investment incentives. When two companies control 82 percent of a market, they have less reason to invest heavily in competing for users. Why spend aggressively to win market share when you already own the market? The result is that consolidated markets often see slower innovation and lower investment than competitive markets.

For anime specifically, consolidation means fewer companies can afford to license anime or fund original productions. Crunchyroll and Netflix can support expensive licensing agreements because they have scale. Smaller competitors can't. Over time, this reinforces the consolidation: as content concentrates with the largest players, consumers follow, making those players larger and more able to afford expensive content.

It's a virtuous cycle for large players and a vicious cycle for competitors. In competitive markets, this cycle is broken by new entrants offering better alternatives. In consolidated markets, new entrants can't gain traction. The result is stagnant market structure where the large players maintain dominance indefinitely.

Sony clearly understands this. The company's strategy of acquiring competitors and consolidating them isn't accidental. It's a direct effort to create this dynamic. Once Crunchyroll owns the market, Sony can extract more value without worrying about competition. That's rational from a business perspective, but it's exactly the kind of consolidation that benefits corporations at consumer expense.

The regulatory question is whether this consolidation should be challenged. Antitrust authorities could theoretically block acquisitions or mandate breakups. But the bar for intervention is high. Crunchyroll and Netflix control 82 percent of overseas anime streaming, but they don't control the entire entertainment streaming market. From a regulatory perspective, consumers have alternatives (they could watch non-anime content). That makes challenging consolidation difficult from an antitrust standpoint.

Also, anime is only one genre within broader streaming. Netflix isn't exclusively an anime service. Crunchyroll is increasingly becoming one, but it started as a general anime service that now serves a broader niche audience. The regulatory challenge of breaking up Crunchyroll or preventing its pricing moves is substantial.

Realistic change would come from one of two directions: new competitors with sufficient funding to challenge the duopoly, or regulatory action that mandates interoperability (allowing content from multiple services to appear in a unified interface). Neither seems likely in the near term.

Sony's Broader Acquisition Strategy and What It Signals

Crunchyroll is one piece of Sony's larger strategy to dominate entertainment streaming. Understanding the pattern helps predict what comes next.

Sony spent the 2020s acquiring content and distribution properties: Crunchyroll (2020), Funimation integration, and now Egg Firm (2026). Each acquisition consolidates the market and gives Sony more leverage with customers and content creators. Sony's overall strategy seems to be owning multiple points in the value chain: production (Aniplex and acquired studios), content aggregation and licensing (Crunchyroll), and streaming distribution (PlayStation, Plus, and streaming apps).

This vertical integration is powerful. Sony can make decisions that benefit different parts of its ecosystem simultaneously. Raising Crunchyroll prices might hurt the streaming subscriber experience, but it increases profit that funds anime production at Aniplex. Anime fans feel both pressures at once.

The implication for future acquisitions is straightforward: expect consolidation to continue and pricing to rise. Sony signals confidence in this strategy by announcing the Egg Firm acquisition on the same day as the price increase. The company isn't hiding its consolidation approach. It's executing openly.

For consumers and competitors, this should be a warning. If you're a smaller anime service provider, Sony is signaling that consolidation and acquisition are core strategic tools. If you're a content creator, Sony's vertical integration means you're now competing with your distributor (and losing that competition). If you're a consumer, Sony's strategy means fewer options and higher prices as consolidation completes.

The Path Forward: What Happens Next

So what comes next for Crunchyroll and anime streaming? Several scenarios seem plausible.

Scenario one is continued consolidation. Sony uses profits from Crunchyroll to fund more acquisitions. Anime becomes even more concentrated under Sony's control. Prices rise further as consolidation deepens. This scenario seems most likely based on current trajectories.

Scenario two is subscriber defection and piracy growth. Anime fans, frustrated by prices and limited alternatives, shift to piracy or stop watching. This would limit Sony's revenue growth even if profit margins improve. The risk here is that piracy could grow faster than Sony anticipates, eating into subscriber revenue. This scenario puts a limit on how far Sony can push prices before customer experience deteriorates.

Scenario three is regulatory intervention. Antitrust authorities decide consolidation has gone too far and break up Crunchyroll or prevent Sony from raising prices further. This seems unlikely in the current regulatory environment but possible if consolidation becomes egregious.

Scenario four is new competition. A well-funded startup or existing tech giant (Apple, Amazon, Meta) decides anime streaming is valuable and invests heavily in competing. This could break Sony's market power. But it requires believing that a company willing to spend billions can enter a market where Sony and Netflix already dominate. The bar is high.

Most likely, we'll see scenario one with elements of scenario two: continued consolidation and pricing increases, but also some subscriber loss and piracy growth that limits Sony's ambitions. The company will optimize at the margins, raising prices as much as market conditions allow, consolidating where possible, and investing strategically in content that justifies price increases to core audiences.

For anime fans specifically, expect: higher prices (this is just the beginning), slower free/ad-supported tier offerings (they're becoming obsolete), more exclusive content locked behind paywalls, and continued consolidation of competitors. The days of cheap, accessible anime streaming are ending. What comes next is oligopolistic pricing and content scarcity.

Lessons for Other Markets and Industries

Crunchyroll's evolution from scrappy startup to Sony subsidiary to aggressively priced oligopolist contains lessons beyond anime. This pattern repeats in industries where network effects and scale create winner-take-most dynamics.

Social media followed the same path. Facebook (now Meta) acquired Instagram and WhatsApp to eliminate competitors. Once consolidated, the company raised prices and added advertising and paid features. User experience degraded, but alternatives didn't exist. The market structure locked in Meta's dominance.

Cloud computing is consolidating similarly. Amazon Web Services, Microsoft Azure, and Google Cloud dominate. Smaller competitors struggle to compete. Pricing rises as consolidation deepens. If you need cloud services, you have limited choices.

Even in spaces that seem competitive, consolidation eventually arrives. Ride-sharing in most cities is dominated by Uber or Lyft. Food delivery is dominated by DoorDash, Uber Eats, or Grubhub. These markets looked competitive early on. Now they're consolidated.

The pattern is: 1) market opens with many competitors, 2) winner-take-most dynamics emerge (network effects, scale advantages, data advantages), 3) large player consolidates competition through acquisition, 4) consolidation enables pricing power, 5) prices rise and features degrade. The cycle is remarkably consistent across industries.

For consumers, the lesson is clear: if you like a product, watch carefully when large companies acquire it. That's often the beginning of the end for the user experience you enjoyed. The company that acquired it isn't trying to maintain the product that attracted you. It's trying to optimize the product to maximize profit. Those goals diverge quickly.

TL; DR

- Crunchyroll raised prices by up to 20% in February 2026, just weeks after eliminating its free tier entirely, affecting millions of anime fans globally

- Sony's consolidation strategy is working financially: analyst estimates project Crunchyroll's profit margin will more than double from 8% to 17-20% by 2027, justifying aggressive pricing

- The anime streaming market is now a duopoly: Crunchyroll (40%) and Netflix (42%) control 82% of overseas anime streaming, leaving smaller competitors like HIDIVE fighting for scraps

- Feature justifications ring hollow: new features like skip-intro and multi-profiles are table-stakes standard across streaming services, not innovations that justify double-digit price hikes

- Consolidation is permanent and ongoing: Sony recently acquired Egg Firm anime studio while integrating Funimation, signaling continued dominance building in both production and distribution

- Bottom line: Crunchyroll evolved from a community-focused anime service to a profit-optimized subsidiary of a multinational corporation. Subscribers should expect continued price increases as consolidation deepens and competition diminishes. This pattern will repeat across other streaming markets.

FAQ

Why did Crunchyroll eliminate its free tier?

Crunchyroll eliminated its free tier to optimize revenue per user. Free users generated minimal revenue while consuming infrastructure costs. By removing the free tier, Sony forced decision-makers to either commit to paid subscription or stop using the service. This move especially benefited Sony's profit margins while cutting off price-sensitive customers, particularly in developing markets.

How much did Crunchyroll prices increase in 2026?

Crunchyroll raised prices by approximately 20% across all tiers in February 2026. The Fan tier (basic plan) jumped from

What is Sony's overall strategy with Crunchyroll?

Sony's strategy involves consolidating anime distribution and production. The company acquired Crunchyroll from AT&T in 2020, merged competing Funimation into Crunchyroll in 2024, and continued acquiring anime production studios like Egg Firm. The goal is vertical integration: owning production (Aniplex), distribution (Crunchyroll), and content, giving Sony power to raise prices as customer alternatives disappear.

Why doesn't Netflix compete directly with Crunchyroll on anime?

Netflix competes in anime but focuses on mainstream content and original productions rather than comprehensive anime library curation. Crunchyroll's specialized focus on anime, updated interface, and discovery features still give it advantages for dedicated anime fans. Netflix is competitive for casual viewers but not a replacement for serious anime enthusiasts seeking obscure or niche content.

What are the realistic alternatives to Crunchyroll for anime fans?

Realistic alternatives are limited. Netflix offers anime but with narrower selection. HIDIVE specializes in niche and independent anime at lower costs but lacks mainstream content. Some anime appears on Max, Apple TV+, and Amazon Prime Video as part of broader libraries. For viewers seeking comprehensive mainstream anime access, Crunchyroll remains the only practical option, which is exactly why Sony can justify price increases.

Could regulators break up Crunchyroll or prevent Sony's price increases?

Regulatory intervention is theoretically possible but unlikely in the near term. Antitrust authorities would need to prove that Sony's consolidation substantially reduces competition in a relevant market. Since Crunchyroll is only one part of broader entertainment streaming, and Netflix remains a major competitor, the regulatory bar for intervention is high. Also, anime is a relatively small segment of the overall streaming market, making it low priority for regulators.

What happened to my Funimation library when Sony merged it into Crunchyroll?

When Sony migrated Funimation accounts to Crunchyroll, some digital content from user libraries didn't transfer. Subscribers lost access to purchases they believed were permanent based on Funimation's original marketing. Sony provided no refunds for lost access. This move signaled that digital media ownership claims are conditional and subject to change when companies restructure services.

Is piracy likely to increase due to Crunchyroll price hikes?

Price increases typically drive piracy growth, especially when legitimate alternatives are limited. As Crunchyroll becomes more expensive and free options disappear, some percentage of viewers will switch to piracy rather than pay $10-18 monthly. However, piracy growth is difficult to quantify and monitor. Sony likely factors some piracy increase into its financial models and accepts it as a cost of optimization.

How does Crunchyroll's consolidation compare to other industries?

Crunchyroll's pattern mirrors consolidation across streaming, social media, cloud computing, and ride-sharing. Markets start competitive, network effects and scale advantages favor large players, large companies acquire competitors to consolidate, and consolidation enables pricing power and reduced innovation. This pattern is nearly universal in digital platform markets. Understanding it helps predict future pricing and service degradation across industries.

What's the difference between Crunchyroll's profit margin and its revenue?

Revenue is total money Crunchyroll collects from subscribers. Profit margin is the percentage of revenue remaining after paying content costs, infrastructure, and other expenses. When analysts estimate Crunchyroll's profit margin at 8% in 2024 rising to 17-20% by 2027, they mean that from every dollar in revenue, 8 cents are profit today but 17-20 cents will be profit in 2027. This improvement justifies aggressive pricing to investors even if it harms subscriber experience.

The Bigger Picture: Streaming's Consolidation Cycle

Crunchyroll's story is just one chapter in a longer narrative about how streaming services mature from growth-focused insurgents into profit-optimized oligopolists. The early streaming era promised disruption: cheaper, better access to entertainment than traditional cable. That promise is largely obsolete.

What replaced it is consolidation. Fewer companies control more content. Prices rise to cable-like levels. Innovation slows as competition diminishes. Switching costs lock in customers. Services optimize for existing subscribers rather than attracting new ones. This is the inevitable endpoint of winner-take-most markets.

The fact that Sony's strategy includes continued consolidation (acquiring Egg Firm), pricing optimization (the increases we're seeing), and vertical integration (owning production and distribution) signals that the company isn't done extracting value from anime fans. Expect higher prices, fewer free options, and more exclusive content over the next few years.

For anime fans, that's frustrating. For Sony shareholders, it's excellent. For the broader streaming industry, it's a signal that the consolidation cycle is accelerating and the window for competition has largely closed.

The lesson isn't specific to anime. It applies to any digital platform market where scale advantages are significant. Watch for consolidation. Watch for price increases after consolidation. And understand that the services you love today might become services you resent tomorrow. That's not a bug in the consolidation story. It's the feature.

Key Takeaways

- Sony's Crunchyroll owns 40% of overseas anime streaming; with Netflix's 42%, they control 82% of the market, creating a consolidation scenario that enables aggressive pricing

- Crunchyroll's profit margins are projected to more than double from 8% to 17-20% by 2027, justifying the company's elimination of free tiers and price increases despite subscriber frustration

- Market consolidation follows a predictable pattern: initial competition, winner-take-most dynamics emerge, large players acquire competitors, consolidation enables pricing increases, innovation slows as growth saturates

- The features Crunchyroll highlighted to justify price increases (skip-intro, multiple profiles, PIN protection) are industry-standard table stakes, not innovations deserving double-digit price hikes

- Anime fans have limited practical alternatives beyond Crunchyroll; Netflix offers weaker selection, HIDIVE focuses on niche content, and SVOD consolidation ensures Sony maintains pricing power

Related Articles

- The 24 Best Movies on Amazon Prime Video [2025]

- Apple's Patreon Subscription Billing Mandate: What Creators Need to Know [2025]

- NBA League Pass Premium 2025: Complete Streaming Guide [2025]

- T-Mobile Better Value Plan: Netflix, Hulu & Savings Guide [2025]

- How to Watch The Fall and Rise of Reggie Dinkins Online [2025]

- Xbox Cloud Gaming's Ad-Supported Model Shows Microsoft Needs Bolder Strategy [2025]

![Crunchyroll Price Hikes: Inside Sony's Anime Streaming Strategy [2025]](https://tryrunable.com/blog/crunchyroll-price-hikes-inside-sony-s-anime-streaming-strate/image-1-1770073660658.jpg)