Xbox Cloud Gaming's Ad-Supported Model Shows Microsoft Needs Bolder Strategy

Let's be honest. When you hear Microsoft is planning an ad-supported version of Xbox Cloud Gaming, the first thing that comes to mind probably isn't excitement. It's not even mild interest. If anything, it feels like Microsoft is playing it safe when the entire gaming landscape is begging for innovation.

The rumors started circulating in early 2026 when leaked screenshots showed Xbox Cloud Gaming loading screens mentioning "1 hour of ad supported playtime per session." Follow-up reports from tech journalists revealed that Microsoft is planning to roll out a session-based ad-supported tier specifically for its "Stream your own game" program. This feature would let people who don't have Game Pass subscriptions watch advertisements in exchange for limited streaming access to games they've already purchased digitally.

Here's the thing: this is a missed opportunity of almost staggering proportions. Microsoft has the infrastructure, the game library, and the resources to fundamentally reshape how people access and discover games through cloud streaming. Instead, they're planning something that feels more like an incremental checkbox feature than a genuine business innovation. It's the kind of decision that makes you wonder if anyone in Redmond is actually thinking about what cloud gaming could become.

The broader context matters here. Cloud gaming has been stuck in neutral for years. The dream was always that you'd be able to play any game, from anywhere, on any device, with zero friction. The reality has been subscription services with mixed adoption, limited libraries, and questionable performance on consumer internet connections. Microsoft had a chance to change that narrative. They still do. But the current strategy suggests they're not interested in taking real risks.

This article explores what Microsoft is doing, why it matters, what they could be doing instead, and what it all means for the future of how we play games. The stakes are higher than they appear on the surface.

TL; DR

- Current Plan: Microsoft is planning ad-supported access to its "Stream your own game" program, allowing non-subscribers 1 hour of streaming per session for games they own digitally

- The Problem: This approach is conservative and fails to leverage cloud gaming's real potential for reaching new audiences

- Better Alternatives: Timed free demos, discounted ad-supported subscriptions, rental models, and free-to-play cloud experiences could drive more growth

- Industry Lessons: Google Stadia's failure showed that overly restrictive monetization models don't work for cloud gaming

- The Real Opportunity: Cloud gaming should be about democratizing access to premium games, not just monetizing existing customers

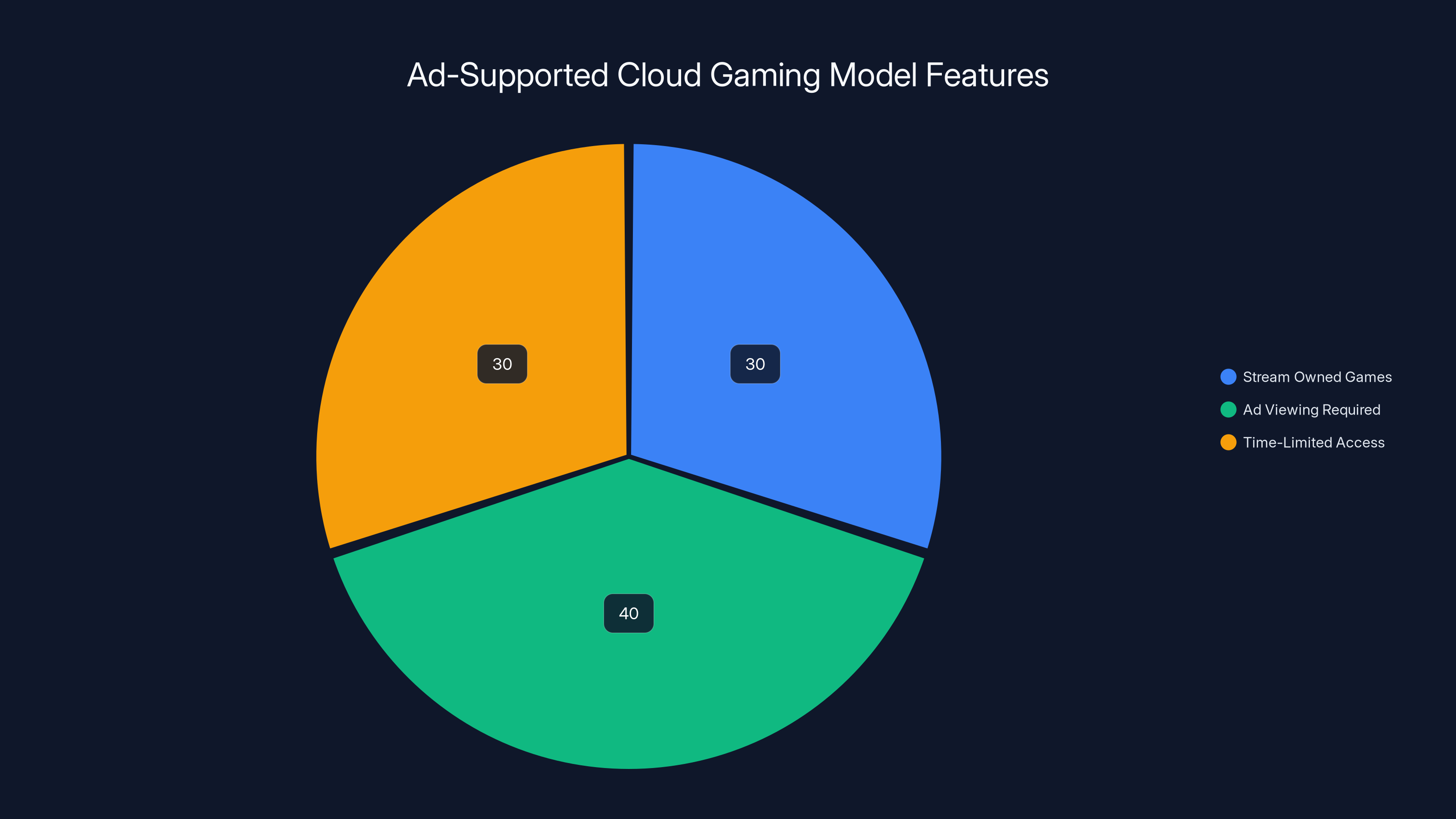

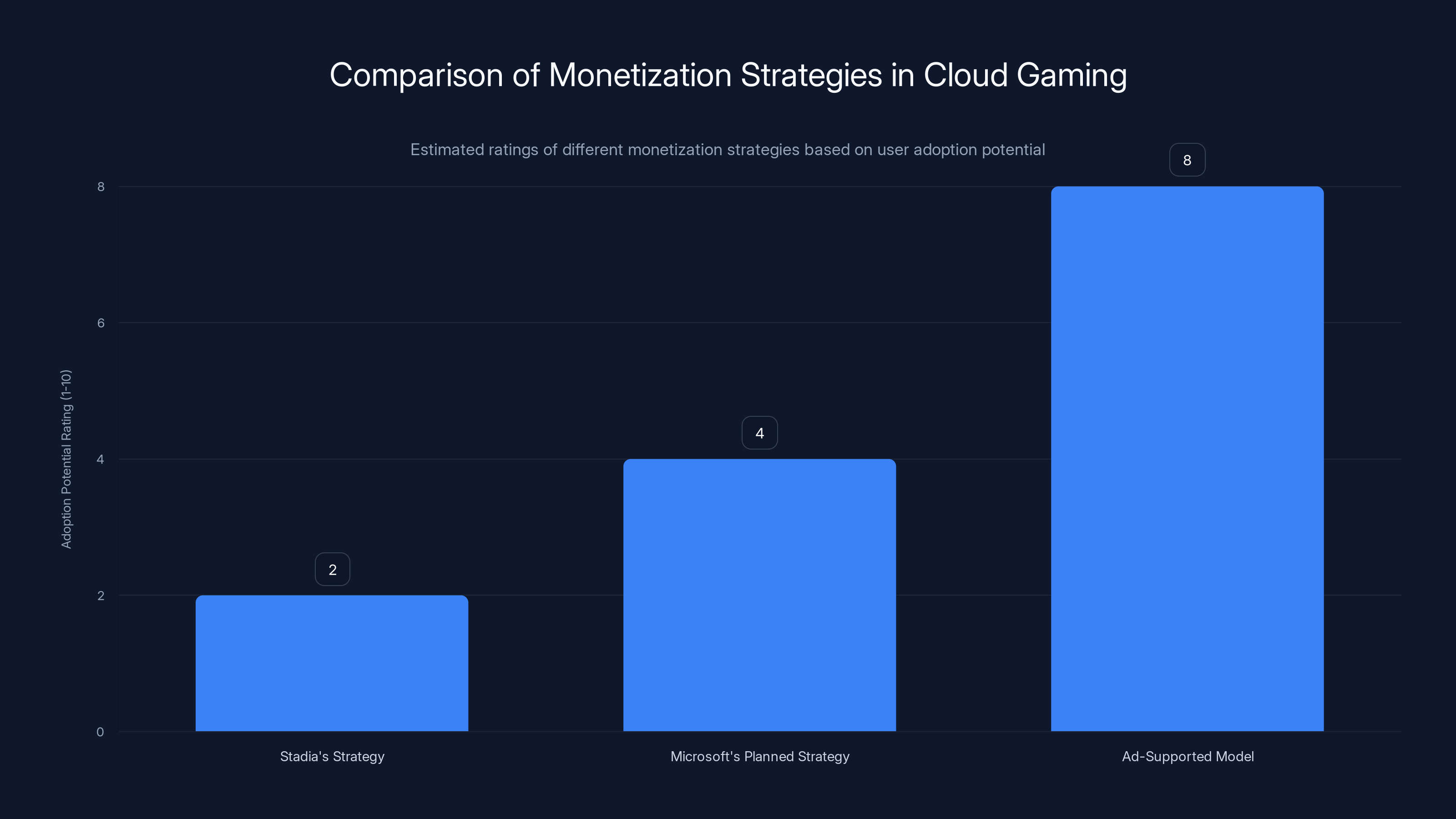

The ad-supported model emphasizes ad viewing and time-limited access, with a focus on streaming games users already own. Estimated data.

Understanding Microsoft's Current Cloud Gaming Strategy

Microsoft's cloud gaming ambitions aren't new, but the execution has been frustratingly tepid. The company has owned cloud gaming technology since the early days, with Xbox Cloud Gaming (formerly known as Project x Cloud) launching as part of Game Pass Ultimate subscriptions back in 2020. The service lets Game Pass subscribers stream games directly to their devices without downloading anything. In theory, it's powerful. In practice, adoption has remained modest.

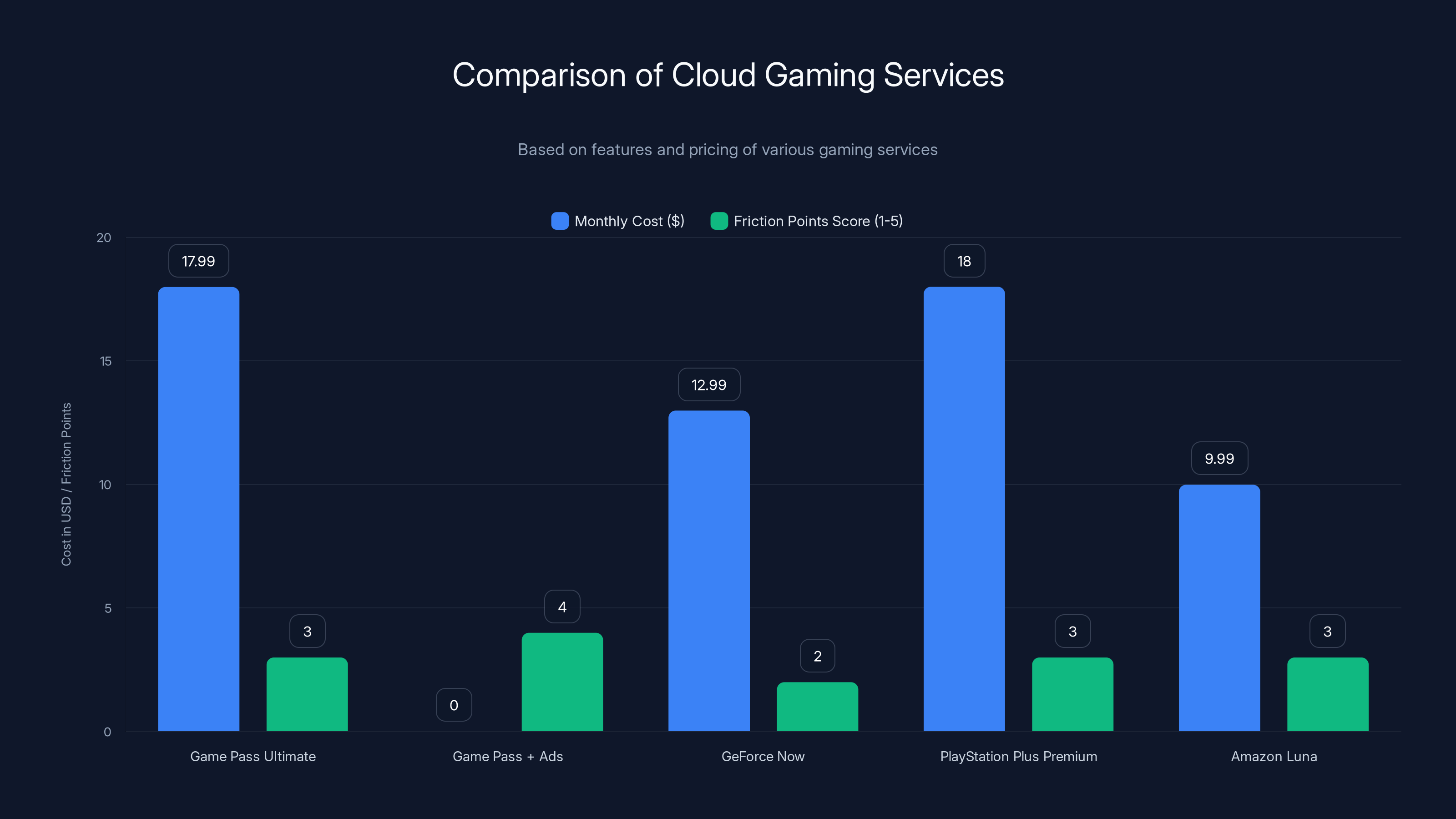

The current primary barrier to entry is the subscription itself. Game Pass Ultimate costs $17.99 per month (though Microsoft has been experimenting with price increases), and while it includes cloud gaming, most casual players don't justify that cost just for the ability to stream games they already own. This is where the ad-supported tier comes in. Microsoft's thinking appears to be that showing advertisements could offset the cost of providing free streaming access, similar to how services like Spotify and YouTube operate.

The specific program being discussed—"Stream your own game"—is actually the more interesting piece here. This feature already exists for Game Pass subscribers. It lets you stream versions of games you've purchased digitally, even if they're not technically part of the Game Pass library. This is genuinely useful for subscribers who want to play games on multiple devices or quickly test games before downloading them to a console.

By extending this capability to non-subscribers through an ad-supported model, Microsoft would theoretically open cloud gaming to a broader audience. Instead of needing a Game Pass subscription, you could watch a few ads and get an hour of streaming access to your own games. It sounds reasonable on paper. But reasonable isn't the same as compelling, and compelling is what drives adoption.

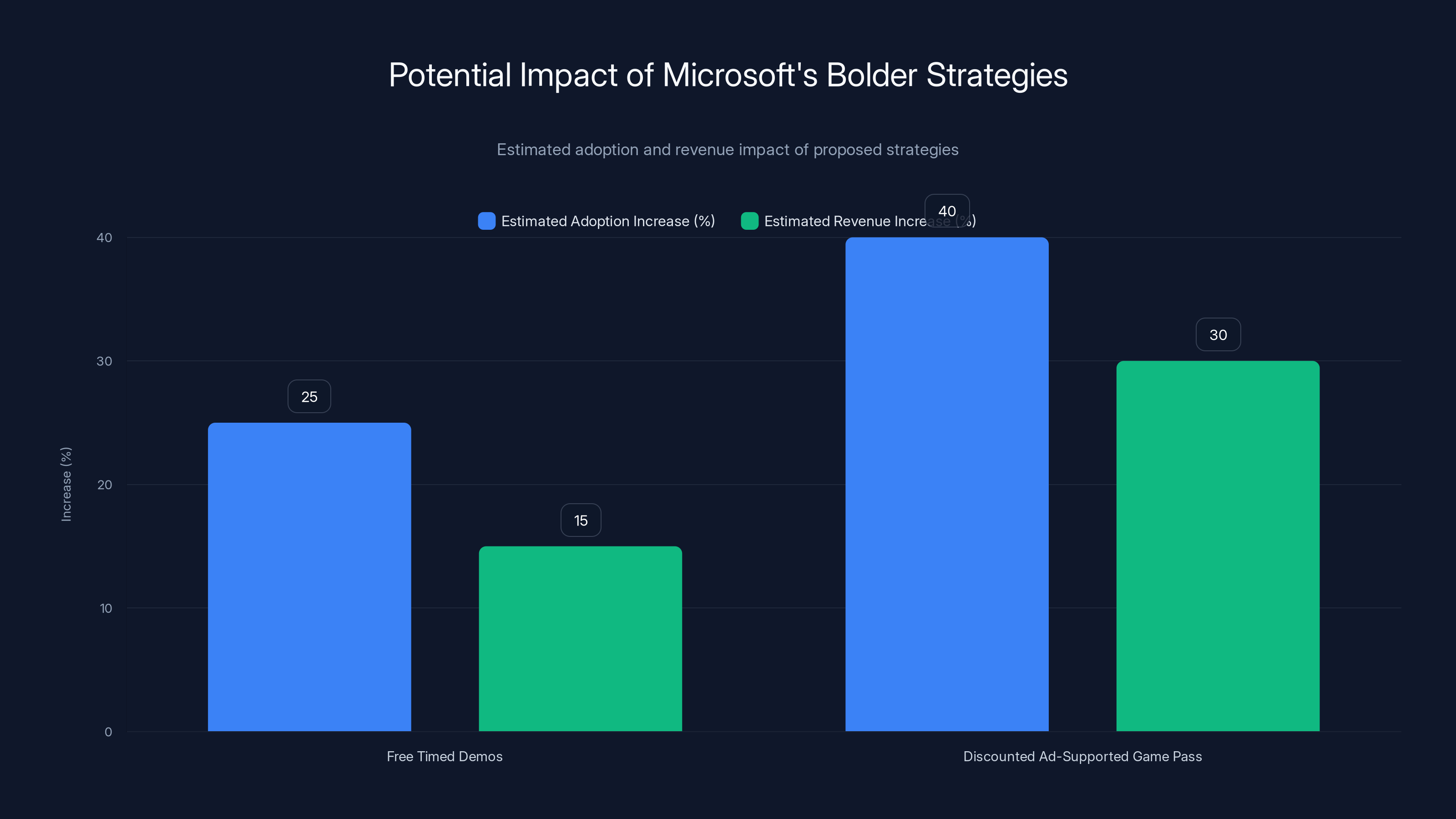

Estimated data shows that offering free timed demos could increase adoption by 25% and revenue by 15%, while a discounted ad-supported Game Pass could boost adoption by 40% and revenue by 30%.

The Monetization Gap: Why One Hour Feels Limiting

One hour of streaming time per session is the crux of the issue. This isn't a typo or a leaked internal estimate that might change. This is apparently the actual plan. And one hour is a genuine problem for anyone trying to have a meaningful gaming session.

Consider the math from a player's perspective. If you want to play a 40-hour story-driven game, you're looking at 40 separate sessions with ads. That's 40 different interruptions, 40 times you need to launch the app and go through the same process again. For someone with casual gaming habits—maybe an hour or two on weekends—this creates friction that subscription services actively eliminate. Why watch ads and wait through session reset screens when Netflix and Apple TV+ have proven that people happily pay modest monthly fees for ad-free experiences?

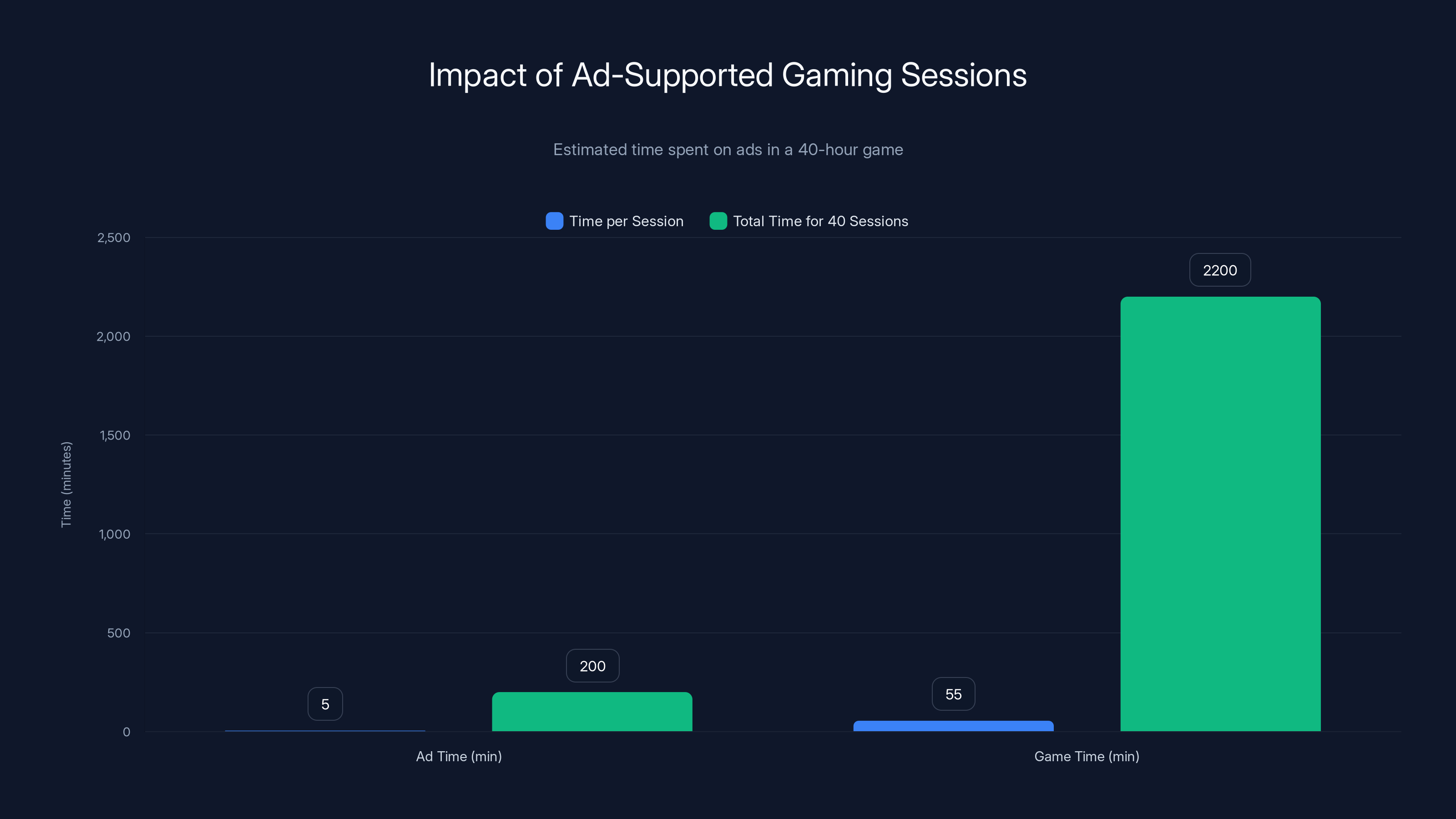

The advertising approach itself matters too. Reports suggest Microsoft is planning video advertisements similar to Nvidia's GeForce Now model, where users watch short sponsorship videos before streaming sessions begin. That's generally two to five minutes of ads per session. Across 40 sessions of a 40-hour game, that's potentially 80 to 200 minutes of advertising. For a free service, sure, that's acceptable to many players. But it's still friction.

Where this model might actually work is for players who want to test a game they're considering purchasing, or casual players who want to stream a game they already own but don't keep installed locally. For these use cases, the trade-off might be worth it. A casual player might think, "I'll play for 45 minutes, watch an ad, call it a night." That's perfectly reasonable behavior, and the advertising could be well-targeted—gaming companies know what their audience likes.

But here's what's missing: this model doesn't address the actual problem cloud gaming faces. The problem isn't that players are unwilling to watch ads. The problem is that cloud gaming hasn't given players a reason to choose it over locally installed games, especially when internet reliability remains inconsistent in many regions.

Learning from Stadia's Mistake: The Danger of Conservative Monetization

Google Stadia launched in 2019 with enormous expectations and died in 2023 with whimpering adoption numbers. The conventional wisdom about Stadia's failure focuses on poor latency, game selection problems, and lack of exclusive content. All true. But there was another critical factor that hasn't received enough attention: Stadia's monetization strategy actively discouraged adoption.

Stadia required you to purchase games individually through Google Play before streaming them. If you owned the physical disc or had purchased the game elsewhere, you couldn't stream it on Stadia—you had to buy it again. On top of that, you needed to pay for Stadia Pro ($10 per month) to access higher-quality streams. The service asked players to commit financially twice, often for the privilege of playing games that were available on consoles they already owned.

Stadia fans often point to latency and performance issues as the primary problem. And those were real issues, particularly in the early days. But the real killer was asking players to pay multiple times for the same experience. Nobody wants that. It doesn't matter how good the technology is—if the value proposition is worse than what alternatives offer, people won't adopt.

Microsoft had the opportunity to learn this lesson explicitly. They could have used an ad-supported model to eliminate purchase requirements, allowing anyone to stream any game from the Xbox library with zero upfront cost except their time watching ads. Imagine: "Want to try this new RPG? Stream it with ads. Like it? Buy it at a discount or subscribe to Game Pass." That's a genuine funnel for discovery.

Instead, Microsoft is planning something closer to Stadia's mistake, just with a different monetization wrapper. You still need to own the game. You still hit time limits. The only change is you watch ads instead of paying. That's not a bold strategy. That's a minor pivot on a fundamentally conservative approach.

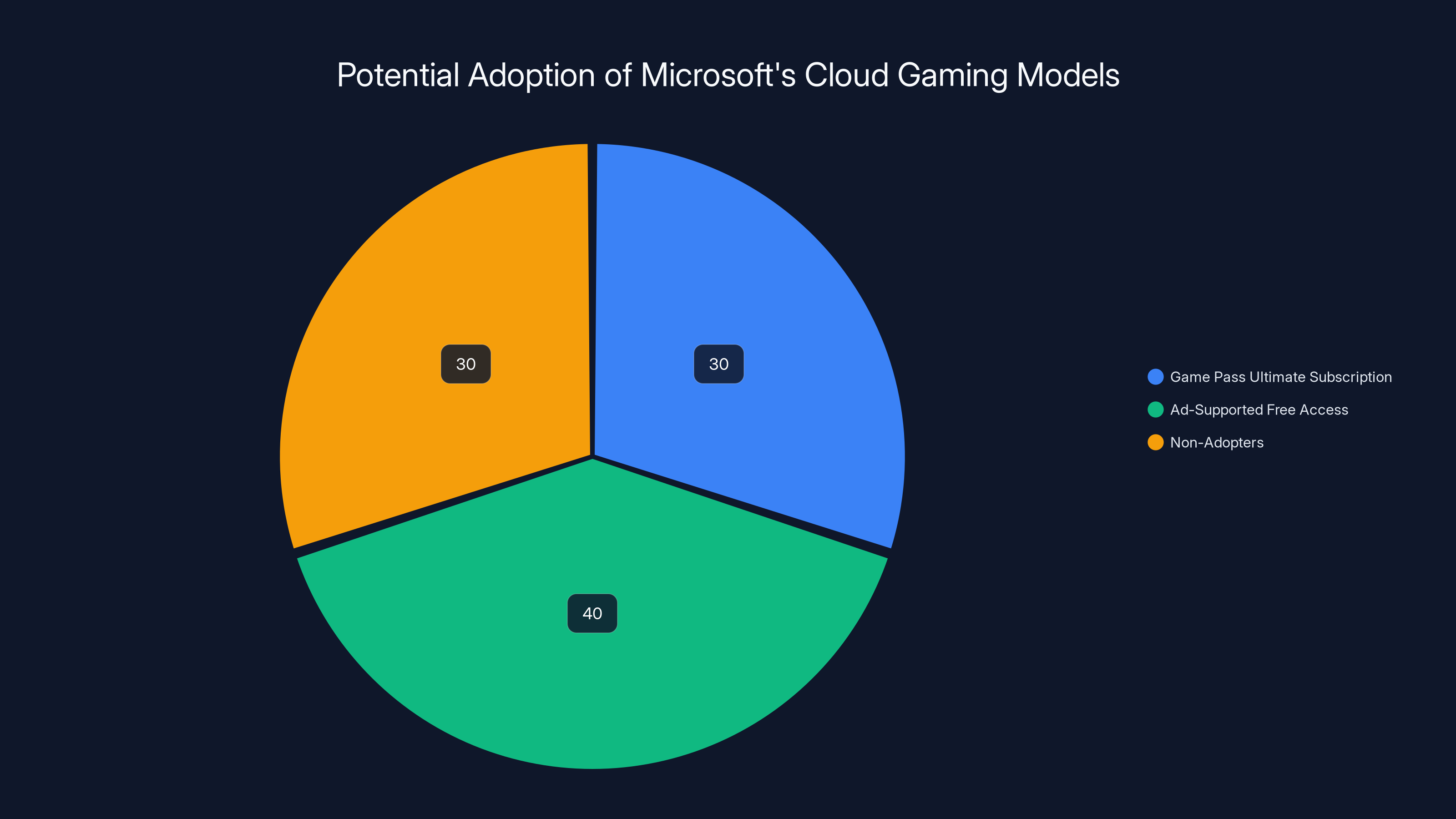

Estimated data suggests that an ad-supported model could attract a significant portion of users who are currently non-adopters, potentially increasing overall cloud gaming adoption.

What Microsoft Could Do Instead: A Menu of Bolder Options

Let's be constructive here. Microsoft has resources, technology, and a massive game library. They could pursue any of these strategies instead of the current plan, and each would likely drive more adoption.

Free Timed Demos with Ad Support

Instead of letting people stream games they already own, Microsoft could offer free time-limited demos of any game in the Xbox library. Thirty minutes of any game, anytime, with ads, no purchase required. This solves a massive problem: game discovery. Most players don't buy games blindly. They watch gameplay videos, read reviews, or play demos. A free 30-minute cloud-based demo removes friction from that discovery process entirely. You're curious about a story-driven game? Stream 30 minutes. Didn't like it? Move on. Loved it? Buy it or subscribe to Game Pass.

This model works because it doesn't ask players to own anything. It doesn't require subscriptions. It purely trades attention (watching ads) for access. And for Microsoft, the economics are clear: they make money from advertising, and they boost the likelihood of purchase by letting players try before committing.

Discounted Ad-Supported Game Pass

Netflix, Spotify, and YouTube Premium all offer ad-supported tiers at substantial discounts. Why doesn't Microsoft? Imagine Game Pass at

This model leverages Microsoft's actual strength: their game library. Instead of trying to monetize cloud streaming separately from Game Pass, it integrates the two and makes subscription more accessible. The advertising serves as a soft paywall that lets more people in the door.

Rental Model for Premium Games

Apple and traditional stores have rented movies for years. Why not games? Microsoft could offer digital game rentals through cloud streaming. Want to play a

This works particularly well for games that are difficult to get running on older hardware. A player with a five-year-old console could rent a new game and experience it as the developer intended. That's a powerful value proposition.

Free-to-Play Cloud Experiences

Xbox has free-to-play games. Why not stream them with optional ads? Let anyone stream free-to-play titles cloud-native—no download, no installation, just click and play. Include in-game cosmetics purchasable within the cloud experience. This creates a direct revenue opportunity and eliminates the final barrier for casual players. It's also a foot in the door for Game Pass—players who discover free-to-play games on cloud gaming are primed to try Game Pass Premium.

The Real Problem: Cloud Gaming Needs A Narrative

Microsoft's ad-supported approach suggests the company is still thinking about cloud gaming as a secondary feature bolted onto existing products. It's not a separate product. It's not a primary way to access games. It's a nice-to-have for people who already subscribe to Game Pass. That's the wrong mental model.

Cloud gaming should be a primary delivery mechanism, not a convenience feature for existing customers. The goal should be reaching people who don't own gaming consoles, who have slow internet, who live in regions where high-end gaming hardware is prohibitively expensive. That's billions of potential players. The current strategy doesn't address any of them.

Think about it from a non-gamer's perspective. Imagine someone who's never owned a gaming console. They see an ad for Xbox Cloud Gaming and think, "I could play games?" Then they learn they need a Game Pass subscription. Or they need to own the game already. Or they get one hour at a time. Or they watch ads. The friction multiplies. By the time they've learned all the restrictions, their interest has evaporated.

Contrast this with Twitch, which lets anyone watch free gameplay from any game with minimal friction. Or Discord, which lets people play games together without specialized hardware. Or Netflix, which you understand in seconds: pay a price, watch unlimited content, see ads on the cheap tier. That's simplicity that drives adoption.

Microsoft's challenge is that they're trying to solve multiple business problems simultaneously: they want to monetize cloud infrastructure, expand Game Pass adoption, reduce pressure on console sales, and reach new audiences. Those goals often conflict, and the current strategy represents compromises that satisfy none of them fully.

Estimated data suggests that an ad-supported model could have higher adoption potential compared to Stadia's and Microsoft's planned strategies.

Industry Context: Where Cloud Gaming Actually Stands in 2025

Cloud gaming remains smaller than mainstream adoption, despite a decade of technological improvement. The numbers tell the story. A 2024 analysis found that cloud gaming accounts for roughly 5-7% of overall gaming engagement globally, even though internet infrastructure in developed countries has dramatically improved since Stadia's 2019 launch.

Nvidia's GeForce Now is probably the most successful standalone cloud gaming service. It lets you stream games you already own from Steam, Epic Games Store, and other platforms. The monetization is straightforward:

PlayStation Plus Premium includes cloud gaming. It works similarly—stream games from the PlayStation library with a subscription. Amazon Luna is still trying to find its footing, but it's essentially the same model: subscribe, get access, stream games.

Microsoft's Game Pass already offers cloud gaming as part of the Ultimate tier. By most accounts, it works well. The infrastructure is solid. But adoption remains below internal expectations, which is why they're exploring additional monetization options.

The common thread across successful cloud gaming implementations is simplicity. You know what you're getting. You understand the cost. The friction is minimal. Microsoft's ad-supported plan adds complexity, not clarity.

The Hardware Problem Nobody Talks About

Here's something that gets lost in the cloud gaming conversation: the devices people want to play on haven't fully caught up to what cloud gaming enables. Cloud gaming shines on devices without gaming processors, like iPad, Fire tablets, and entry-level Android phones. But the perception problem remains. These devices aren't "gaming devices" in traditional marketing, so people don't think to use them for gaming.

Microsoft could change that narrative by making cloud gaming the primary draw. Instead of positioning cloud gaming as a feature of Game Pass, position Game Pass as a reason to keep your iPad for gaming. Create cloud-native experiences designed for tablets. Partner with hardware manufacturers to market gaming capabilities. That's bold marketing. That changes perception.

The current ad-supported strategy doesn't do any of that. It just adds an option for existing Game Pass customers to stream games they own. Nobody's life improves because of that feature. Nobody rushes to try cloud gaming because of one-hour ad-supported sessions. It's a tactic, not a strategy.

Microsoft's Game Pass Ultimate offers a comprehensive package at $17.99/month, but faces competition from GeForce Now's lower friction model. Estimated data for 'Game Pass + Ads'.

Why Advertising Might Not Be The Right Lever At All

Assume, for a moment, that Microsoft's analysis is correct and there's a meaningful audience of people who want to stream games they own but won't pay a subscription. That audience exists. But is advertising really the right monetization mechanism?

Advertising works well in certain contexts. It works when the alternative is paying directly, and players genuinely prefer free with ads over paid without. Spotify's free tier with ads is wildly popular because the alternative is paid. YouTube's ad-supported content is ubiquitous because the alternative is premium subscription.

But gaming is different. Advertising interrupts experiences in ways that music or video don't. A 30-second ad breaks a story's momentum. It's jarring. It removes immersion. For casual games, that might be tolerable. For narrative-driven experiences or competitive games, it's actively unwelcome. Players have told us this through their behavior—free-to-play games generate more revenue from cosmetics than they do from ad-based monetization, precisely because ads degrade the experience.

Microsoft might generate some revenue from ads, but they'll simultaneously degrade the experience for the people using it. That's a trade-off that works for free services competing with nothing, but Microsoft is competing with Game Pass, Steam, Epic Games Store, and PlayStation Plus—all of which offer superior experiences without ads.

The Comparison Table: How Microsoft Stacks Up

| Service | Cloud Gaming | Monetization | Friction Points | Target Audience |

|---|---|---|---|---|

| Game Pass Ultimate | Yes, included | $17.99/month | Subscription required, limited library | Game Pass subscribers |

| Game Pass + Ads (Proposed) | Yes, limited | Watch ads per session | Owns games digitally, one hour limit, ads required | Non-subscribers |

| GeForce Now | Yes | Stream games you own from other platforms | PC gamers, existing libraries | |

| PlayStation Plus Premium | Yes, included | $18/month | Subscription required, console brand-locked | PlayStation ecosystem |

| Amazon Luna | Yes, included | $9.99/month (basic tier) | Limited library, console-like experience | Prime members, casual players |

Looking at this landscape, Microsoft's proposed model doesn't occupy a compelling position. It's more restrictive than GeForce Now but less complete than Game Pass. It requires game ownership but offers less value than purchasing or subscribing.

Estimated data shows that in a 40-hour game, players could spend up to 200 minutes watching ads, compared to 2200 minutes of gameplay. This highlights the potential friction in ad-supported gaming models.

What The Global Gaming Market Actually Needs Right Now

There are roughly 3.2 billion gamers globally. A significant portion of that number doesn't own dedicated gaming hardware and plays exclusively on mobile devices. Another segment owns older consoles that can't run modern games. A third segment lives in regions where broadband is expensive or inconsistent. These aren't edge cases. These are hundreds of millions of people.

Cloud gaming could theoretically serve all of them. But it requires a service that removes barriers, not adds them. The global games market doesn't need another subscription tier. It doesn't need limited-time trials with ads. It needs accessibility.

Microsoft has positioned itself as capable of delivering that. The company provides cloud infrastructure globally. They have game development studios. They own one of the largest game libraries on Earth. They're fundamentally well-positioned to dominate cloud gaming. But positioning and execution are different things.

The current plan—ad-supported access to "Stream your own game" for one hour at a time—doesn't move the needle. It's a feature, not a fundamental reimagining of how games reach audiences. And game distribution is exactly where disruption is needed.

The Opportunity Cost of Conservative Thinking

When a company as large as Microsoft makes a conservative choice, there's an opportunity cost. Resources devoted to the ad-supported model are resources not devoted to something bolder. Engineers who build session-based time limits could be building personalized recommendations. Product managers who design ad insertion could be designing discovery flows. The corporate resources spent on this direction could fund something far more impactful.

Microsoft isn't a startup. The company doesn't have an excuse to think in terms of incremental improvements. They should be thinking about what displaces their own existing products. The threat to Game Pass isn't other subscriptions. The threat is something so convenient and frictionless that it makes subscriptions feel outdated.

Microsoft could build that threat. They could create something so compelling that players choose cloud gaming because they prefer it, not because they're forced to own hardware they don't want. That's a strategy worth pursuing. Ads and one-hour sessions aren't it.

Lessons From Successful Platform Launches

When Apple launched the App Store, they didn't overthink monetization. They created a simple model: developers build apps, users purchase directly, Apple takes a cut. That simplicity drove adoption. When Netflix launched streaming, they did the same: pay a price, watch everything, no ads. When Spotify expanded from paid to free-plus-ads, the free tier was genuinely free—no limitations beyond listening to ads.

What these successful platforms understood was that lowering barriers drives network effects. More users attract better content. Better content attracts more users. That virtuous cycle only works if the barrier to entry is genuinely low.

Microsoft's ad-supported tier doesn't lower barriers. It adds complexity. It introduces a new class of restrictions that existing Game Pass subscribers don't face. Non-subscribers still can't access the full library. They can't play for more than an hour. They have to own games already. None of this feels like opportunity. It feels like restrictions wrapped in the language of benefit.

Why This Matters Beyond Microsoft

Microsoft's strategy influences the entire industry. When a company with this much market power and capital chooses a conservative approach, it signals to competitors that cloud gaming is a feature, not a primary business. It signals that the barriers are acceptable. It signals that disruption isn't needed.

That's unfortunate because cloud gaming could genuinely change how games reach audiences. The technology works. The infrastructure exists. What's missing is the willingness to take risks on business model innovation, not just technical innovation.

If Microsoft embraces bold strategies, other companies follow. If Microsoft plays it safe, the entire industry stays conservative. And when the entire industry stays conservative, opportunities for genuine disruption go uncaptured. Someone—maybe a company we haven't heard of yet—could build a cloud gaming service so frictionless and so compelling that it becomes the default way people discover and play games. Microsoft should be that company. The fact that they might not be is the real loss.

The Path Forward: What Microsoft Should Actually Do

Here's the honest assessment: Microsoft should cancel the ad-supported "Stream your own game" program. Not because it's unethical or illegal. It's not. They should cancel it because it's a waste of engineering resources and executive attention. It won't significantly move adoption numbers. It won't expand cloud gaming into new markets. It will create complexity for minimal gain.

Instead, Microsoft should pursue one of the strategies outlined earlier. The most impactful would probably be the free timed demo model—offering 30 minutes of streaming access to any game in the library with minimal friction. That directly addresses discovery, which is the biggest barrier to gaming adoption globally. Pair it with subtle ads, not interrupting ads. Let cosmetics and recommendations generate revenue.

The second priority should be an ad-supported Game Pass tier at under $8 per month. This is proven to work elsewhere. It expands subscription accessibility without devaluing the core service for existing paying customers.

Third, Microsoft should invest in platform partnerships. Work with tablet manufacturers to market cloud gaming on iPads. Partner with carriers to offer cloud gaming included in mobile plans. Get cloud gaming off the "optional feature" list and into mainstream consciousness.

None of this requires complex new technology. It requires product thinking that prioritizes user experience over incremental revenue extraction. Microsoft has done this elsewhere—the Xbox ecosystem, Azure cloud services, Game Pass itself. They know how to think at this level. For cloud gaming, they just haven't chosen to yet.

How Cloud Gaming Technology Has Actually Improved

It's worth noting that from a pure technology standpoint, cloud gaming has improved dramatically since Stadia's launch in 2019. Latency has dropped from 60-100ms to 20-40ms in many implementations. Video compression has improved enough that high-speed connections can deliver 4K gaming without perceptible quality loss. Server infrastructure has become more distributed, reducing geographical barriers.

The technology is genuinely ready. What's limiting adoption isn't technical constraints. It's user experience design, marketing, and business model strategy. These are Microsoft's decision to make. They can choose to innovate or choose to iterate. The current ad-supported plan represents iteration dressed up as innovation.

The Conversation About Player Respect

There's a philosophy underlying successful consumer services: respect the player's time. Game Pass respects your time by removing the download step. Netflix respects your time by not making you hunt for movies. Spotify respects your time by remembering your preferences.

The ad-supported cloud gaming model doesn't respect player time. It says your time is worth watching ads. It says your gaming session is less important than advertising revenue. That's a fine calculation for entirely free services, but Microsoft is already making revenue from other sources. The necessity for additional extraction is questionable.

Companies that consistently respect customer time tend to build loyalty that transcends pricing. Customers forgive price increases when they feel respected. They recommend services to friends. They choose those services even when alternatives are cheaper. Microsoft understands this in other contexts. Applying the same philosophy to cloud gaming would be a meaningful competitive advantage.

FAQ

What is Xbox Cloud Gaming?

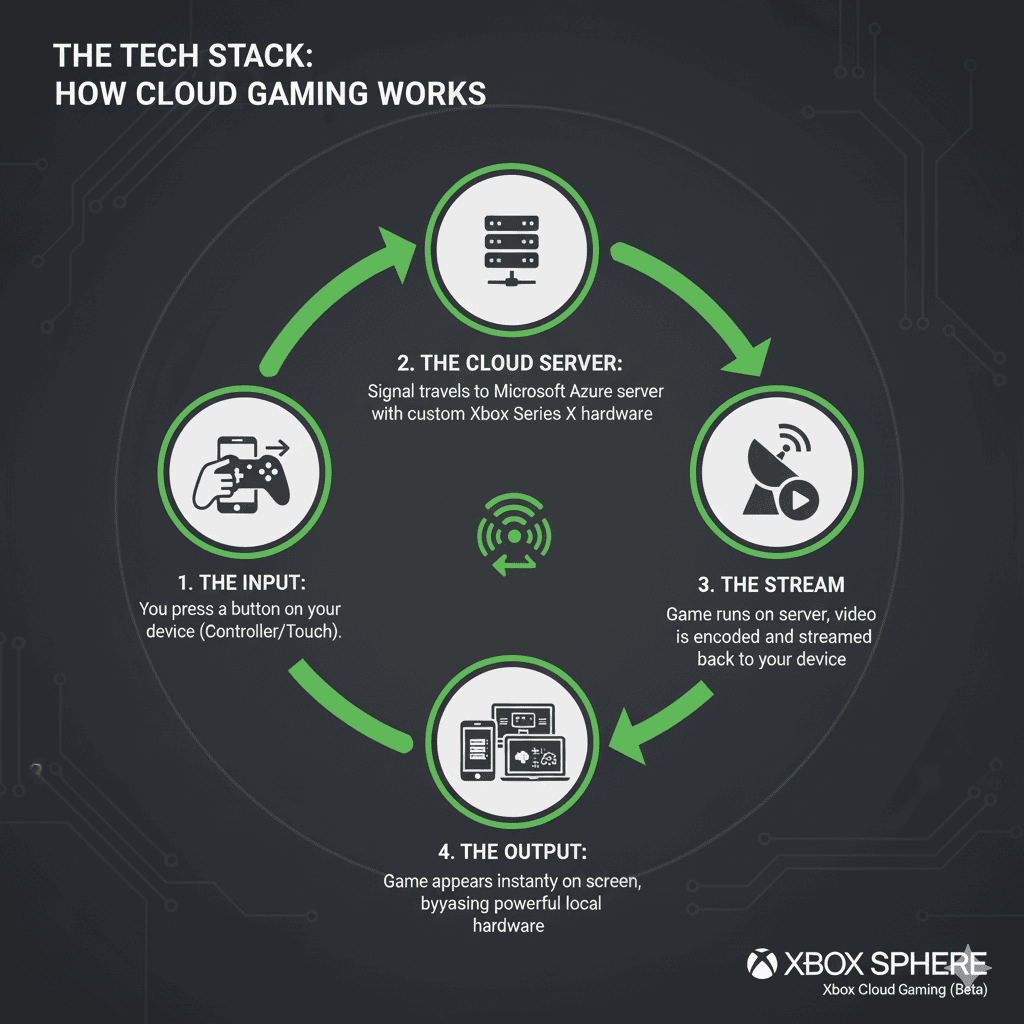

Xbox Cloud Gaming (formerly Project x Cloud) is a service that lets you play games by streaming them from Microsoft's servers directly to your device, whether that's a phone, tablet, or PC. Instead of downloading games, you're essentially watching a video stream of the game in real-time. It's included with Xbox Game Pass Ultimate subscriptions and works across any device with an internet connection.

How does the proposed ad-supported model work?

Microsoft's reported plan would let non-subscribers stream games they already own digitally for one hour per session if they watch advertisements. This would be limited to the "Stream your own game" program, not the full Xbox Cloud Gaming library. After each hour expires, you'd need to watch ads again to unlock another hour. It's essentially trading your attention (watching ads) for access time rather than paying for a subscription.

Why is Microsoft exploring ad-supported cloud gaming?

Microsoft is trying to expand cloud gaming adoption beyond Game Pass subscribers without cutting subscription prices or offering significantly more value. The ad-supported model allows them to provide limited access at no direct cost while offsetting infrastructure expenses through advertising revenue. It's similar to how Spotify, YouTube, and other platforms offer free tiers supported by ads, though Microsoft's version would be much more limited than those services.

What makes this strategy conservative compared to alternatives?

The ad-supported model is conservative because it doesn't change the fundamental barriers to entry: you still need to own the game already, you still face time limits, and you still encounter friction through ads. More innovative approaches would include free demos of any game, discounted ad-supported subscriptions, rental models, or free-to-play cloud experiences—all of which would address bigger pain points like game discovery without requiring prior purchases.

How does this compare to Google Stadia's failed strategy?

Both strategies are fundamentally restrictive. Stadia required players to buy games individually on its platform even if they owned them elsewhere, and then pay for Stadia Pro subscription on top. Microsoft's approach requires game ownership and a one-hour-per-session limit. While different in detail, both fail to genuinely lower barriers or address discovery. Stadia's failure showed that conservative monetization models don't drive cloud gaming adoption—players want simplicity, not multiple payment layers.

What would a bolder cloud gaming strategy actually look like?

Bolder approaches would include offering 30-minute free demos of any game in the library (with optional ads), creating an ad-supported Game Pass tier at significantly lower prices like $7.99 per month, implementing rental systems similar to iTunes rentals for premium titles, and enabling free-to-play cloud experiences. These strategies directly address major pain points—game discovery, cost accessibility, and trying before committing—rather than just monetizing existing infrastructure.

Does cloud gaming infrastructure actually work well enough for mainstream adoption?

Yes. As of 2025, cloud gaming infrastructure is genuinely reliable in developed countries with decent broadband. Latency has improved to 20-40ms in most implementations, video compression is sophisticated enough to handle high-speed connections, and server distribution has reduced geographical barriers. The technology isn't the limitation anymore. The limitation is how companies choose to package and price the experience.

How many people actually use cloud gaming services?

Cloud gaming remains a niche but growing segment, representing roughly 5-7% of overall gaming engagement globally as of 2024. Nvidia's GeForce Now leads in standalone adoption with millions of users, partly because it has minimal restrictions and lets you stream games you already own. PlayStation Plus Premium and Game Pass both include cloud gaming with their subscriptions. The growth trajectory suggests broader adoption is possible, but it requires removing friction rather than adding restrictions.

Why would Microsoft choose an ad-supported model instead of just lowering Game Pass prices?

Subscription-based businesses often resist direct price cuts because they set expectations for what the product is worth. Introducing an ad-supported tier preserves the premium pricing of the main subscription while offering a discount to price-sensitive customers. It's a segmentation strategy that lets Microsoft capture different customer groups without devaluing the main product. The risk is that complexity drives down overall adoption across all tiers.

What would actually convince casual players to try cloud gaming?

Casual players need simplicity first, then value. Simple means: open app, choose game, play—with minimal friction. Value means either cost savings or access to experiences they couldn't otherwise have. Free demos with minimal ads satisfy both. A $7.99 ad-supported Game Pass tier would satisfy both. The one-hour ad-supported "stream your own game" model satisfies neither—it adds complexity to an already complex landscape, and the value proposition is worse than existing options.

The Bottom Line: Microsoft Can Do Better

Microsoft's reported ad-supported cloud gaming plan represents cautious product thinking in a market that desperately needs bold innovation. The company has the resources, infrastructure, and game library to fundamentally reshape how people discover and access games. Instead, they're planning something that feels like a feature, not a platform.

The opportunity cost is significant. Every engineering resource devoted to limiting sessions to one hour and implementing ad insertion could be devoted to something genuinely transformative. Every product discussion about monetization strategy could be a discussion about removing friction.

Cloud gaming isn't a solved problem. It's barely been attempted seriously. The company that gets it right—that builds something so simple and compelling that it becomes the default way people try games—will own the next generation of gaming. Microsoft should be that company. The fact that they might not be is the real story here.

The lesson for everyone watching this unfold: innovation requires willingness to challenge existing models. It requires patience to build something valuable even when the quarterly metrics don't immediately reflect that investment. Most importantly, it requires respecting the user's time and experience above incremental revenue extraction. Microsoft understands these principles elsewhere. Applying them to cloud gaming would transform not just Microsoft's business, but the entire gaming industry's approach to how games reach audiences.

Key Takeaways

- Microsoft's reported ad-supported cloud gaming plan is conservative and misses opportunities to drive real adoption through bolder business model innovation

- The one-hour session limit with advertisements adds friction rather than removing it, making the service less attractive than existing alternatives like Game Pass or GeForce Now

- Google Stadia's failure demonstrated that overly restrictive monetization models stifle cloud gaming adoption—Microsoft appears to be repeating similar mistakes

- More impactful strategies exist: free timed demos for discovery, discounted ad-supported subscription tiers, game rentals, and free-to-play cloud experiences

- Cloud gaming technology is now mature and reliable; the limiting factor is business model strategy and user experience design, not infrastructure

Related Articles

- AI Bubble Myth: Understanding 3 Distinct Layers & Timelines

- Disney+ Hulu Bundle Deal: $10 First Month [2025]

- Best Indie Games 2025: Hidden Gems You Need to Play [2025]

- Rackspace Email Hosting Price Hike: What It Means for Businesses [2026]

- X Platform Outage January 2025: Complete Breakdown [2025]

- How to Watch Dirty Talk: Daytime Talk Shows Online [2025]

![Xbox Cloud Gaming's Ad-Supported Model Shows Microsoft Needs Bolder Strategy [2025]](https://tryrunable.com/blog/xbox-cloud-gaming-s-ad-supported-model-shows-microsoft-needs/image-1-1768844165168.jpg)