What the Epstein Files Actually Tell Us About Silicon Valley's Inner Circle

When the Department of Justice released over 2,000 documents related to convicted sex offender Jeffrey Epstein in January 2024, most people focused on the headline-grabbing names. But buried in thousands of pages of email correspondence, meeting notes, and financial records was something equally revealing about how power operates in Silicon Valley: a meticulously detailed list of one of tech's most influential figures' dietary restrictions.

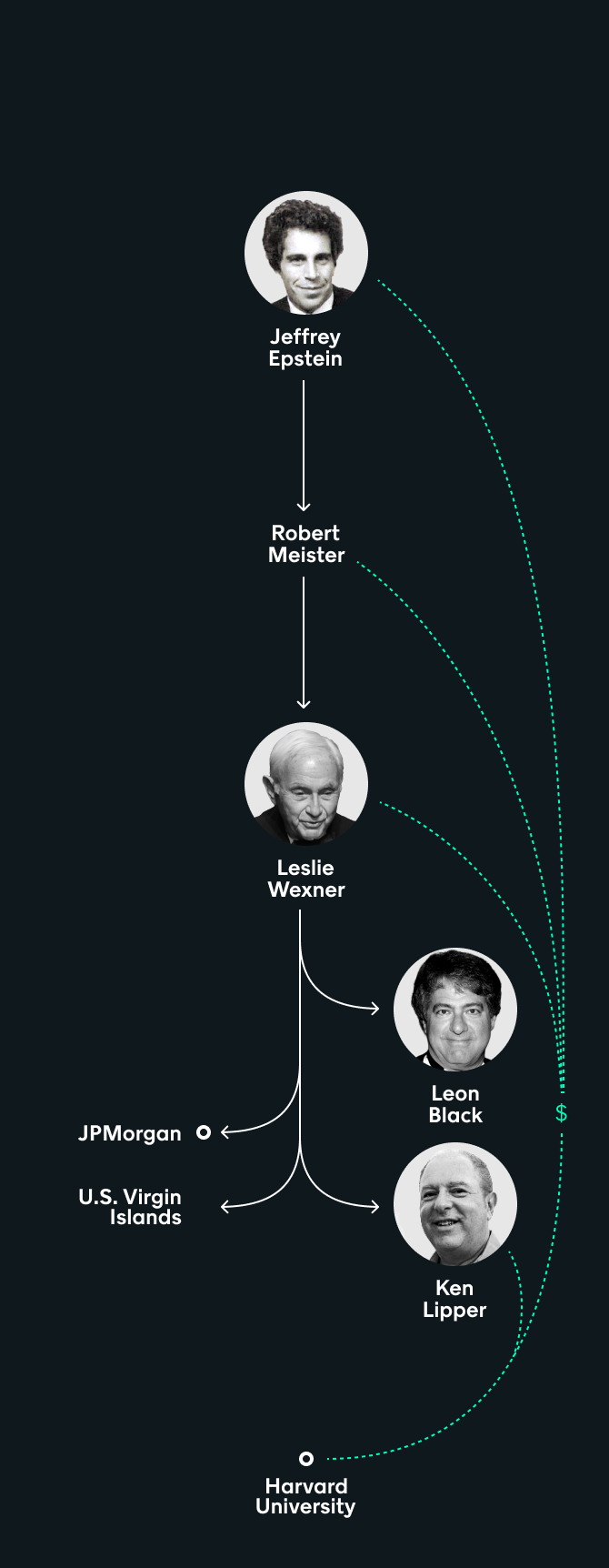

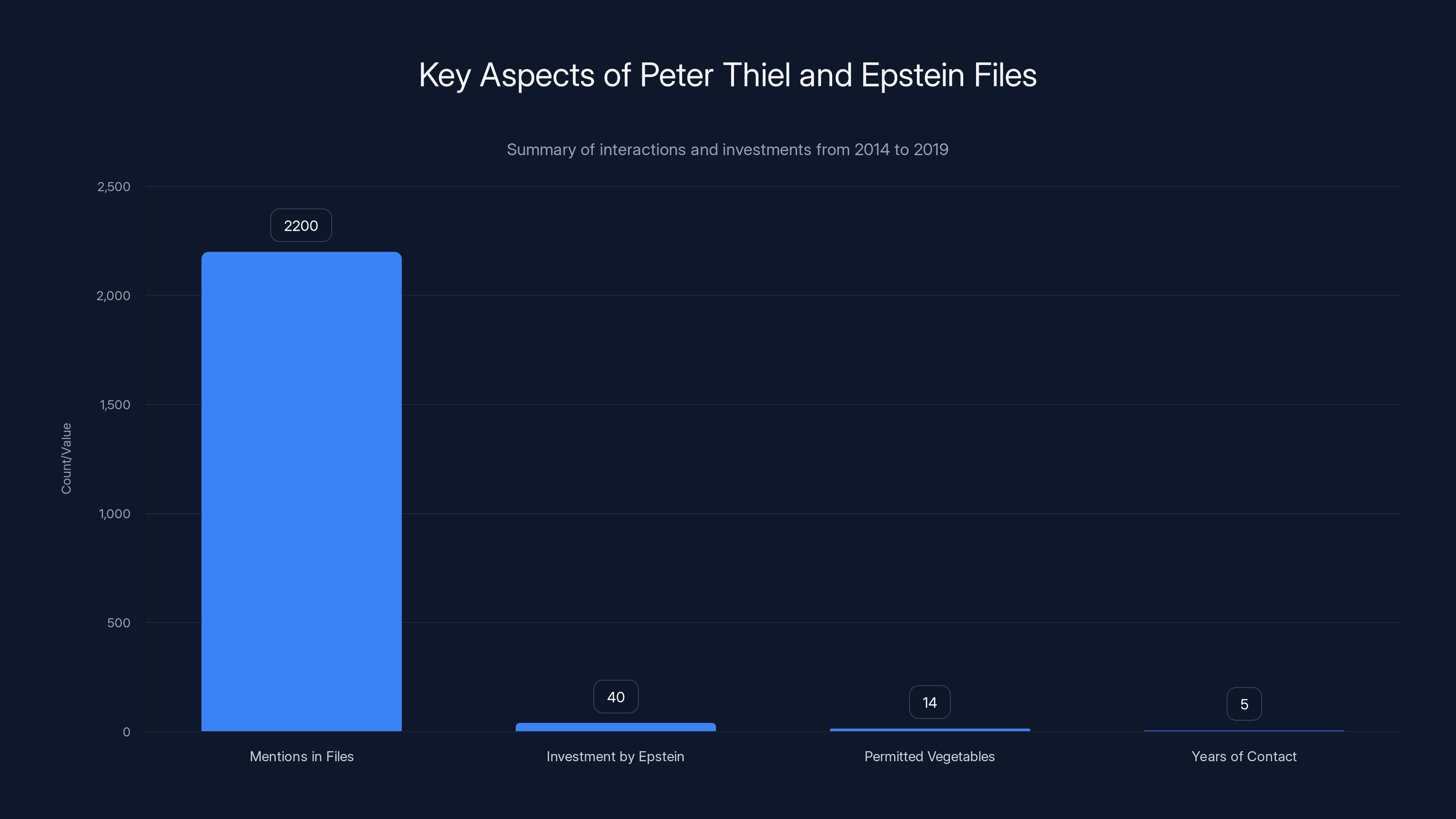

Peter Thiel, the billionaire venture capitalist and co-founder of PayPal and Palantir Technologies, appears at least 2,200 times across the released documents. And not in the way you might expect. Rather than being implicated in any wrongdoing, Thiel's presence in the files tells a different story entirely, one about how wealthy and powerful men maintain networks, schedule meals, and obsess over the details of their daily lives, even when those details seem almost absurdly specific.

The files reveal something uncomfortable about Silicon Valley's ecosystem: even after Epstein's 2008 guilty plea for solicitation of prostitution and procurement of minors, prominent figures continued meeting with him. Between 2014 and 2017, Thiel and Epstein exchanged messages arranging lunches and calls. But what makes this story particularly strange is not the meetings themselves, but what those meetings required. A single email from Thiel's assistant reveals an obsessive approach to food that extends far beyond typical dietary preferences. It's a window into how the ultra-wealthy actually live, and how they expect the world to accommodate them.

This article examines the Epstein files through the lens of what they reveal about power, influence, and the hidden networks that connect Silicon Valley's most prominent figures. It's not just about controversial associations, though that matters. It's about understanding how wealth and influence create invisible structures that shape business, philanthropy, and governance in America.

TL; DR

- Peter Thiel appears 2,200+ times in newly released Epstein files, demonstrating extensive communications between 2014 and 2017

- Thiel's dietary restrictions were extraordinarily detailed, including approved sushi types, 14 permitted vegetables, zero approved fruits, and strict avoidance of dairy, grains, and sugar

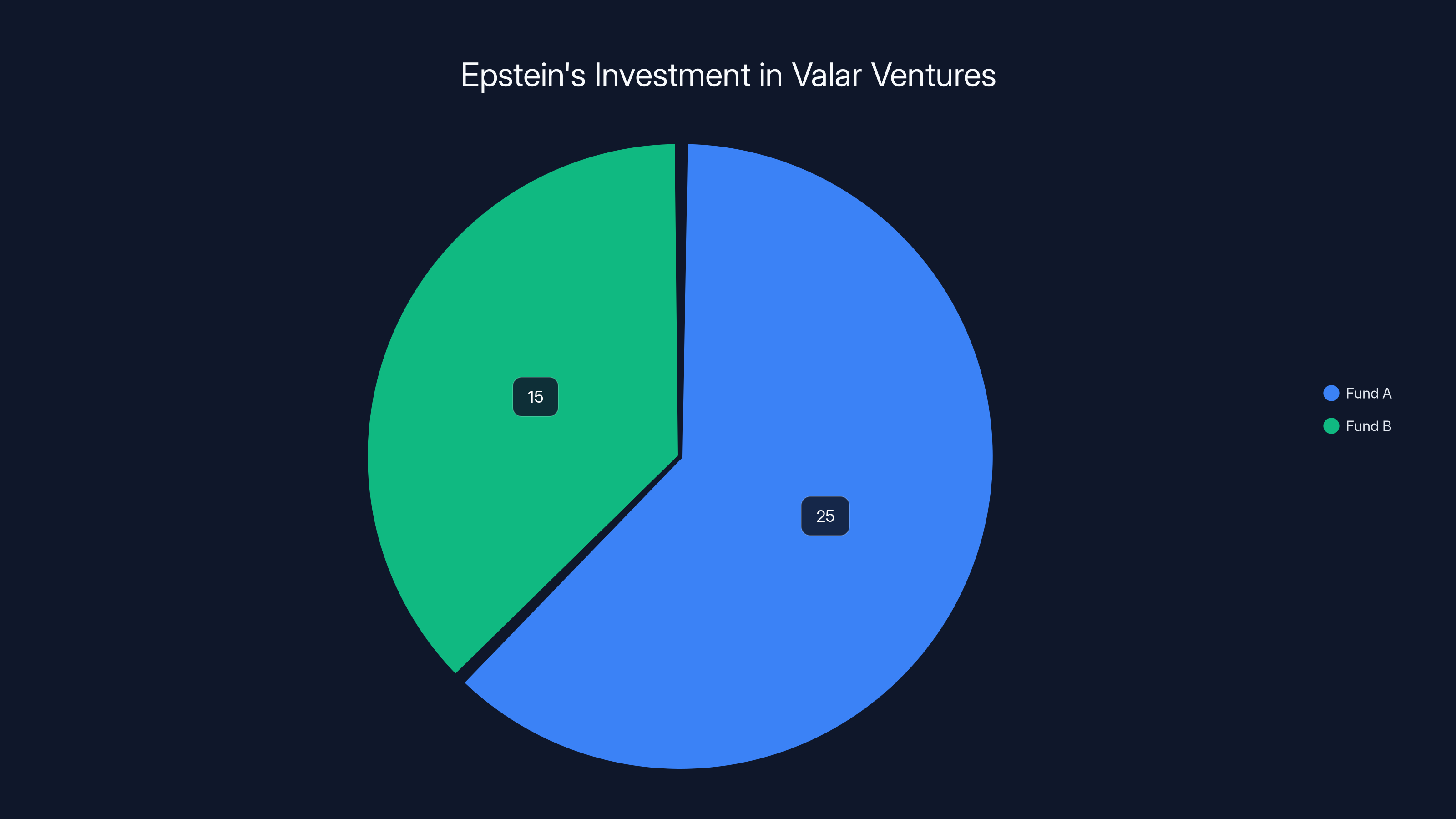

- Epstein invested $40 million in Valar Ventures, one of Thiel's investment firms, in 2015 and 2016

- The files reveal ongoing contact between the two men even after Epstein's 2008 guilty plea, continuing as recently as January 2019

- Silicon Valley's elite maintained relationships with Epstein years after his conviction, raising questions about accountability and vetting in venture capital networks

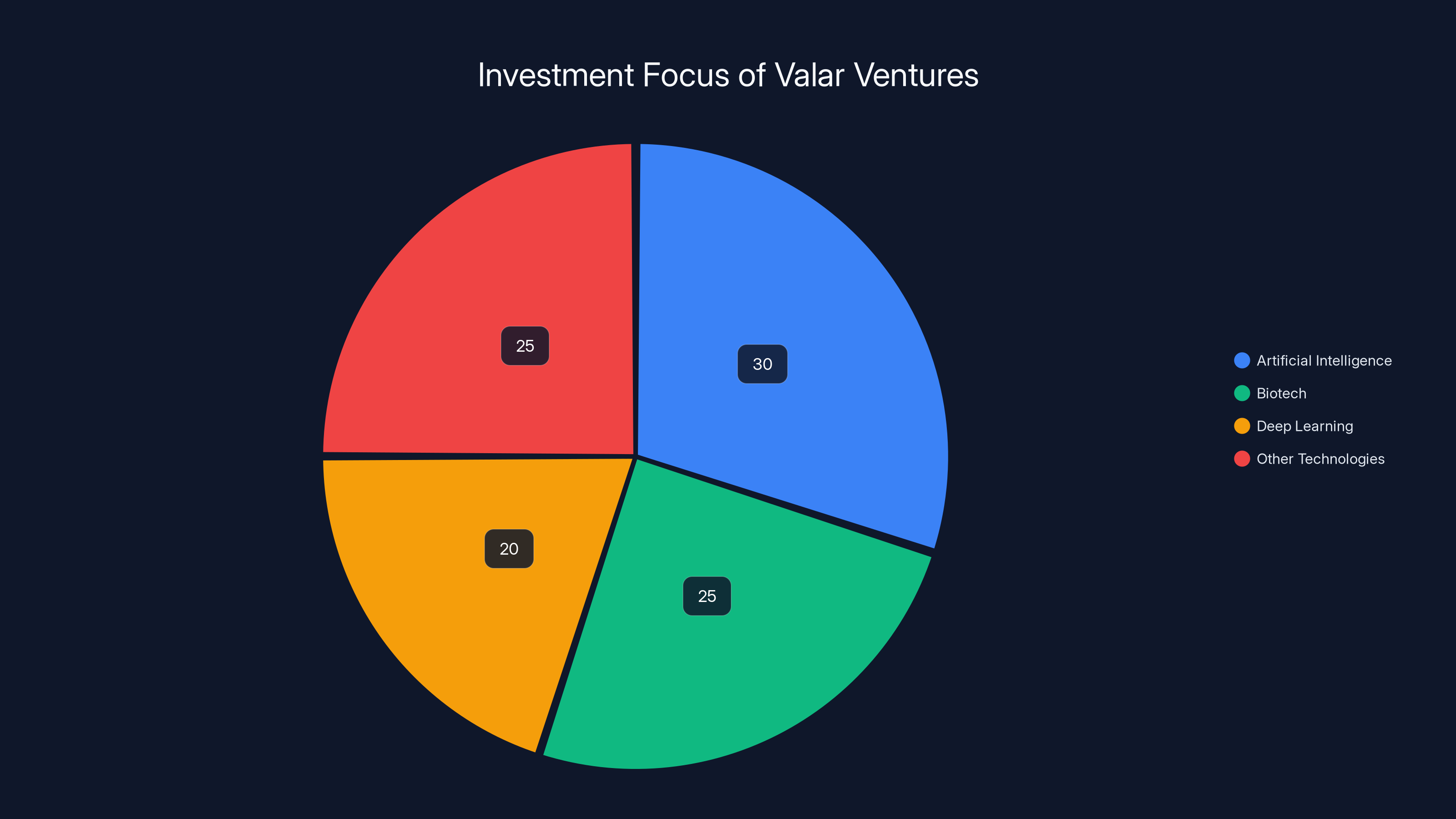

Estimated data showing Valar Ventures' focus on AI, Biotech, and Deep Learning, reflecting its commitment to cutting-edge technology sectors.

The Scale of Thiel and Epstein's Documented Communication

When you first hear that someone appears 2,200 times in a released document set, your mind probably jumps to something dramatic, something incriminating. The reality is more mundane and, in some ways, more revealing. These weren't secret meetings plotting unethical ventures. They were scheduling messages. "What are you up to on Friday?" Thiel wrote to Epstein on April 5, 2016. "Should we try for lunch?"

That's it. That's the kind of communication filling these files. Two wealthy men trying to find time in their calendars to eat together. But the frequency and consistency of these messages tells you something important: Thiel and Epstein maintained an active relationship. They weren't distant acquaintances who ran into each other at industry events. They were regularly trying to coordinate face-to-face meetings.

The timeline matters here. Epstein had pleaded guilty in 2008 to solicitation of prostitution and procurement of minors to engage in prostitution. By that time, his reputation was already damaged, his business ostracized by most of the financial world. Yet more than six years later, Thiel was still reaching out, still trying to schedule lunches, still maintaining what appeared to be a cordial business relationship.

This wasn't unusual in Silicon Valley during that period. The venture capital world had largely moved on from Epstein's conviction, at least in terms of his ability to remain connected to power. He'd done his time (a notoriously lenient sentence of 13 months), and in the circles where Thiel operated, past legal troubles didn't necessarily disqualify you from ongoing business dealings.

What's particularly striking is that Thiel himself had become one of the most powerful figures in technology venture capital by this point. He'd made billions from PayPal and Palantir. He was a major political figure, openly supporting Donald Trump when most of Silicon Valley remained hostile to his campaign. Thiel didn't need Epstein's money or connections. Yet the emails show Thiel was still the one initiating contact, still the one suggesting meetings.

The files also reveal that Epstein was equally eager to maintain the relationship. In audio recordings included in the released documents, Epstein discusses Thiel with other powerful figures, including former Israeli Prime Minister Ehud Barak. In one recording, Epstein mentions he's hoping to meet Thiel the following week, though he noticeably mispronounces Palantir as "Pallentier," which is somewhat amusing given the man's extensive financial portfolio.

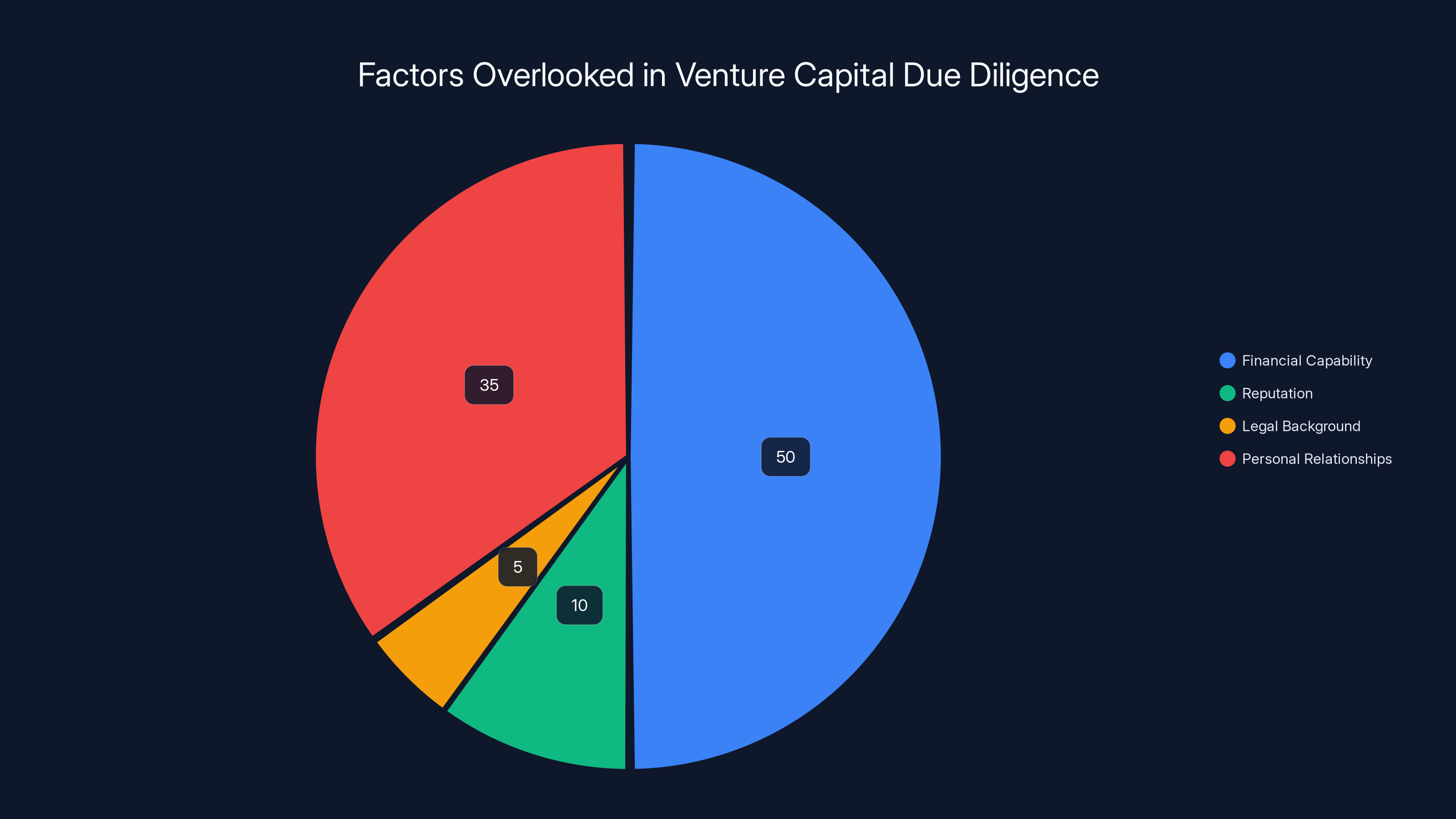

Estimated data suggests that financial capability often overshadows other critical factors like legal background and reputation in venture capital due diligence.

Understanding Epstein's Financial Relationship with Thiel's Ventures

The relationship between Epstein and Thiel wasn't purely social. Financial records show that in 2015 and 2016, Epstein invested $40 million in two funds managed by Valar Ventures, one of Thiel's investment vehicles. That's a significant commitment of capital, the kind of investment that typically involves detailed due diligence, multiple meetings, and ongoing communication.

Valar Ventures is an interesting fund to understand in this context. It focuses on early-stage technology companies, often in the deep-tech space. The fund invests across multiple continents and has backed companies in artificial intelligence, biotech, and other emerging sectors. Having someone like Epstein, despite his legal history, put $40 million into the fund suggests that Thiel was either not concerned about Epstein's reputation or believed the reputational risk was worth the capital.

This raises an important question about how venture capital conducts due diligence on limited partners. In most legitimate venture funds, bringing in a new investor of Epstein's profile would require board approval, investor consent, and extensive background checking. The fact that this happened in 2015 and 2016, years after Epstein's conviction, indicates either remarkable carelessness or a calculated decision that the investment was worth any potential controversy.

The timing is also worth noting. By 2015, the venture capital industry was becoming increasingly conscious of reputational issues. The years following 2015 saw multiple prominent venture capitalists face accusations of sexual harassment and misconduct, ultimately leading to broader conversations about power dynamics and accountability in the industry. Yet despite this shifting climate, Thiel apparently saw no issue with accepting tens of millions of dollars from Epstein.

It's important to note that Thiel himself hasn't been accused of any wrongdoing related to Epstein or any other matter covered in these files. The relationship appears to have been professional and financial, though the nature of that relationship has never been fully explained by either party. Thiel did not immediately respond to requests for comment when these files were released.

The Bizarre World of Peter Thiel's Dietary Restrictions

Here's where the story gets genuinely strange. On February 3, 2016, Alisa Bekins, who served as Thiel's chief of staff and senior executive assistant, sent an email with the subject line "Meeting - Feb 4 - 9:30 AM - Peter Thiel dietary restrictions - CONFIDENTIAL." The email was forwarded to Epstein, though parts of the correspondence were redacted in the initial release.

However, subsequent releases by the DOJ included less redacted versions of the same email chain, giving us a remarkably detailed window into exactly what Peter Thiel will and won't eat. And it's nothing short of obsessive.

Thiel's approved foods list is incredibly restrictive. For sushi and proteins alone, his assistant compiled a list of about two dozen acceptable options: kaki oysters, bass, nigiri, beef, octopus, catfish, sashimi, chicken, scallops, eggs, sea urchin, lamb, seabass, perch, spicy tuna with avocado, squid, turkey, sweet shrimp, whitefish, tobiko, tuna, yellowtail, and trout.

For vegetables, the list is similarly detailed: artichoke, avocado, beets, broccoli, Brussels sprouts, cabbage, carrots, cucumber, garlic, olives, onions, peppers, and salad greens. That's a relatively healthy selection, though notably restrictive. But here's the kicker: zero approved fruits. None. Not even berries, not even watermelon on a hot day. Fruit was apparently completely off the table.

The prohibited foods list is even more telling: no dairy, no fruits, no gluten, no grains, no ketchup, no mayonnaise, no mushrooms, no processed foods, no soy sauce, no sugar, and no tomato or vinegar. This is essentially a paleo diet taken to an extreme. Nuts are permitted, but only if they're unsalted and unroasted. Most fresh herbs and olive oil are allowed.

For breakfast, there's only one option listed: "Egg whites or greens/salad with some form of protein (Steak etc)." That's it. That's the approved breakfast menu for one of the world's most powerful venture capitalists.

What's absolutely fascinating about this list is the level of detail required to communicate it. Thiel's assistant felt it necessary to be incredibly specific about what Thiel would and wouldn't eat. This wasn't a simple "I'm paleo" or "I don't eat gluten" statement. This was a comprehensive, itemized menu that apparently needed to be sent ahead to anyone planning to share a meal with him.

The question this raises is: why? Why would such an incredibly detailed dietary specification need to be sent to Epstein? Was Thiel planning to eat at Epstein's home? Was Epstein planning a catered meal? The files don't make this clear, which adds another layer of mystery to the whole situation.

Peter Thiel is mentioned at least 2,200 times in the Epstein files, primarily in scheduling communications and meeting arrangements.

What This Dietary Restriction Reveals About Extreme Wealth

On the surface, Thiel's dietary restrictions might seem like just another example of a billionaire's peculiar habits. But they actually reveal something important about how extreme wealth functions in practice. When you're wealthy enough, you don't just get to have preferences. You get to have requirements, and everyone around you adapts to accommodate them.

Consider what it takes to execute a dietary plan this restrictive. You need someone dedicated to understanding and communicating your preferences. You need restaurants, caterers, and personal chefs who are willing and able to accommodate very specific requirements. You need to have the kind of influence where restaurants will specially prepare your meals without complaint, even if those meals fall well outside their normal menu.

Most people who follow restrictive diets have to be flexible sometimes. They go to a restaurant and find only one option that fits their requirements. They attend a work lunch and make do with what's available. Thiel apparently doesn't operate that way. His dietary restrictions are absolute, and the world adapts around them.

This speaks to a broader reality about extreme wealth: it creates a kind of reality distortion field. Normal constraints don't apply. When you're a billionaire, you don't compromise on your preferences because there's always someone willing to accommodate you. A restaurant wants your business and your money. An executive assistant works for you specifically to handle details like this. A man you're about to have lunch with wants to maintain the relationship badly enough that he'll have whatever food you want served.

Thiel's dietary restrictions also suggest something about his worldview. The list indicates a paleo-inspired, low-carb, low-sugar approach to nutrition. This aligns with Silicon Valley's broader obsession with biohacking and optimizing human performance. For wealthy tech entrepreneurs, diet isn't just about sustenance or health, it's about efficiency, about treating the body as a machine that can be optimized through precise inputs.

The avoidance of processed foods, grains, and sugar suggests someone who's deeply engaged with nutritional science and alternative health approaches. Whether this is scientifically justified or simply reflects the wellness trends popular among the ultra-wealthy is debatable. But what's clear is that Thiel has committed seriously to this approach, to the point where he requires anyone hosting him to fully understand and accommodate his restrictions.

Why These Details Matter for Understanding Silicon Valley Power Dynamics

You might be asking: who cares what Peter Thiel eats? In isolation, his dietary preferences are a trivial matter. But in context, they reveal something profound about how power works in Silicon Valley and among the ultra-wealthy more broadly.

These details matter because they humanize the powerful in a specific way. We often think of billionaires and venture capitalists as abstract figures making big decisions that affect millions of people. But they're also just people with very specific preferences and demands. Thiel doesn't just want to be rich. He wants the world organized around his preferences, his standards, his worldview.

The fact that Epstein was expected to understand and accommodate Thiel's dietary requirements speaks to the power dynamic between them, despite Epstein's having money and the legal history. Thiel was the one being accommodated. Thiel was the one whose preferences mattered. The message embedded in that email about dietary restrictions is: when you want access to Peter Thiel, you conform to his standards, not the other way around.

This also reveals something about how Silicon Valley networks operate. These aren't formal institutional relationships where everything is documented and standardized. They're personal relationships between powerful individuals who maintain ongoing contact, sometimes for unclear reasons. Thiel and Epstein apparently didn't have a single major business project together, yet they maintained communication for years. Why? Perhaps for the simple reason that they were both part of a certain world, and in that world, you maintain your relationships with other powerful people, even if the benefits aren't immediately obvious.

The dietary restrictions email is particularly revealing because it shows how these relationships involve intense logistical coordination. Someone has to track these details. Someone has to remember that Peter Thiel only eats certain kinds of sushi and will never eat fruit. Someone has to ensure that when meetings happen, the food is correct. This invisible labor of accommodation is part of what enables the ultra-wealthy to maintain their networks and their preferences.

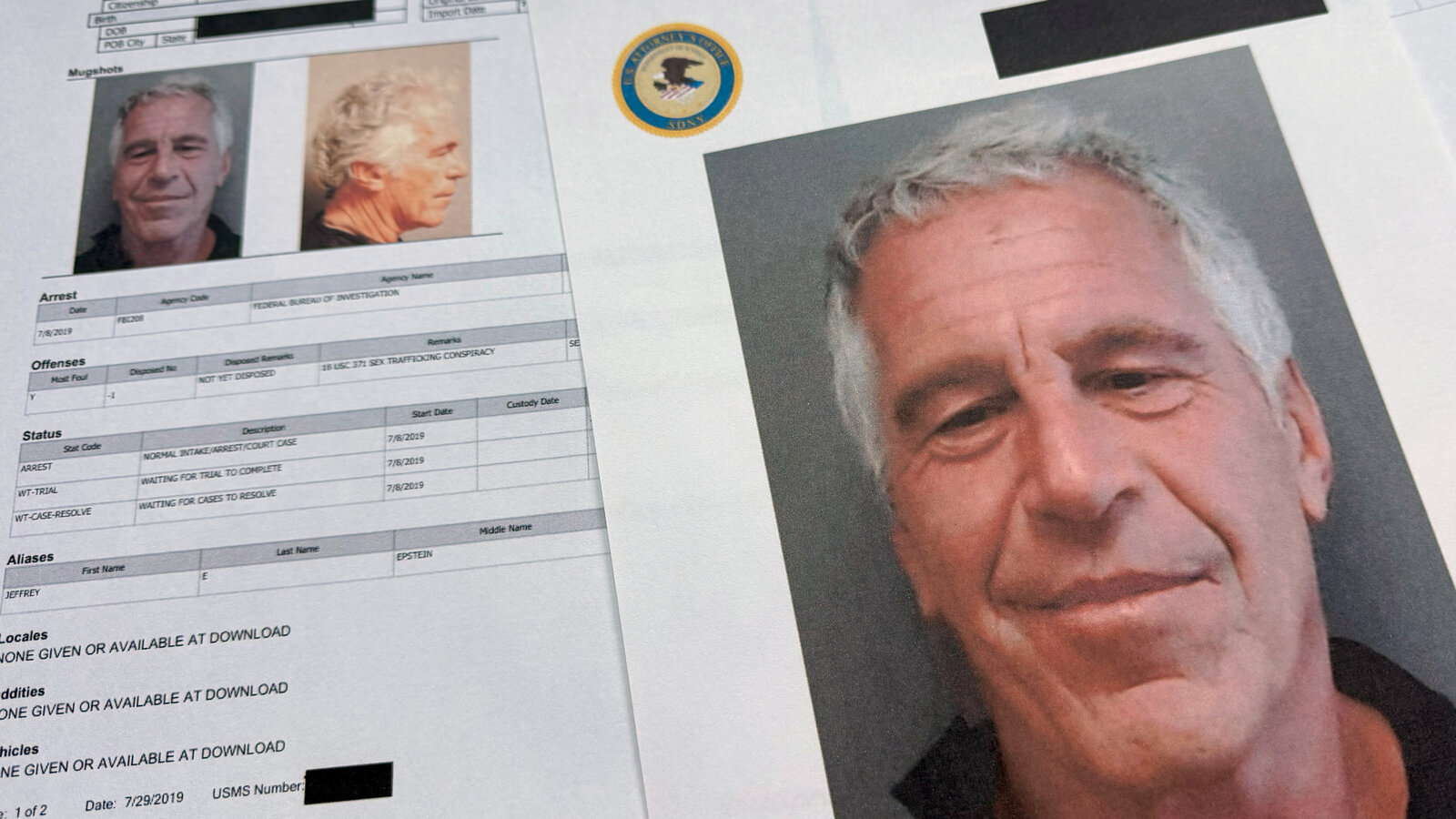

The chart highlights the extensive mentions of Peter Thiel in Epstein files, Epstein's $40 million investment in Thiel's firm, Thiel's detailed dietary restrictions, and the years of contact between Thiel and Epstein.

The Broader Context of Silicon Valley's Epstein Connections

Thiel was not the only prominent Silicon Valley figure to appear in the Epstein files. The released documents reveal that Epstein maintained relationships with numerous figures in tech, finance, and media. This suggests that Epstein's penetration into Silicon Valley was deeper and more extensive than previously understood.

What makes Thiel's case particularly notable is both his prominence and the apparent consistency of their relationship. Thiel wasn't just someone Epstein met once at a party. He was someone Epstein maintained ongoing communication with, arranged meetings with, and received significant investments from.

The question this raises is: how did Epstein maintain such an extensive network despite his 2008 conviction? Part of the answer is that the conviction wasn't treated as seriously in certain circles as it might have been. Epstein served a short sentence, and in the years immediately following, he was able to rebuild his reputation among certain wealthy and influential people.

Another part of the answer is that in circles of extreme wealth, legal history is often treated as something separate from business relationships. Someone might have a criminal conviction and still be considered a legitimate business partner if they have capital to deploy. The venture capital world operates on relationships and trust, and Epstein apparently had enough of both to continue accessing deals and partnerships years after his conviction.

It's worth noting that the relationships revealed in these files occurred between 2014 and 2017, well before the Epstein case became a major public scandal again following his 2019 arrest on new charges. At that time, there was less public awareness of the details of his original conviction and his activities. Once Epstein's arrest and subsequent death in custody made international headlines, the reputational cost of maintaining a relationship with him became untenable.

Understanding Paleo and Extreme Dietary Restriction in Tech Culture

Thiel's dietary choices align with a broader trend among tech entrepreneurs and venture capitalists: the adoption of paleo, keto, and other restrictive dietary approaches as part of a larger biohacking philosophy. This isn't unique to Thiel, though his approach appears particularly extreme.

The paleo diet, based on the idea of eating foods that would have been available to paleolithic humans, gained significant popularity in tech circles starting around 2010. The logic is appealing to the tech mindset: humans evolved over millions of years eating certain foods, modern agriculture is relatively recent, therefore modern foods aren't what our bodies are optimized for. If you want peak performance, go back to basics.

For Thiel specifically, his approach seems to be paleo with additional restrictions, particularly around fruit. The absence of fruit from his approved foods list is notable because it's more restrictive than typical paleo, which generally allows fruit. This suggests Thiel may be following a more extreme low-carb or ketogenic approach, where the goal is to minimize carbohydrate intake as much as possible.

This dietary philosophy reflects a particular worldview about health, performance, and the nature of the body. It treats the body as a machine that can be optimized through precise nutritional inputs. It suggests skepticism toward modern food systems and conventional nutritional advice. It's also, worth noting, a dietary approach that requires significant resources to maintain. You can't eat paleo effectively on a tight budget in a food desert. You need access to quality proteins, fresh vegetables, and the ability to avoid processed foods, all of which cost money.

The tech industry's obsession with dietary optimization also reflects a broader obsession with life extension and enhancing human capabilities. Thiel himself has been open about his interest in longevity and has invested in anti-aging research. His dietary approach fits within this larger framework of optimizing every aspect of life for maximum performance and longevity.

What's interesting is how his dietary restrictions became a requirement for others to accommodate. In most walks of life, if you have dietary restrictions, you work around them yourself. You bring your own food, you research restaurants ahead of time, you communicate your needs and adapt. But at Thiel's level, the assumption appears to be that others will adapt to accommodate your needs, not the other way around.

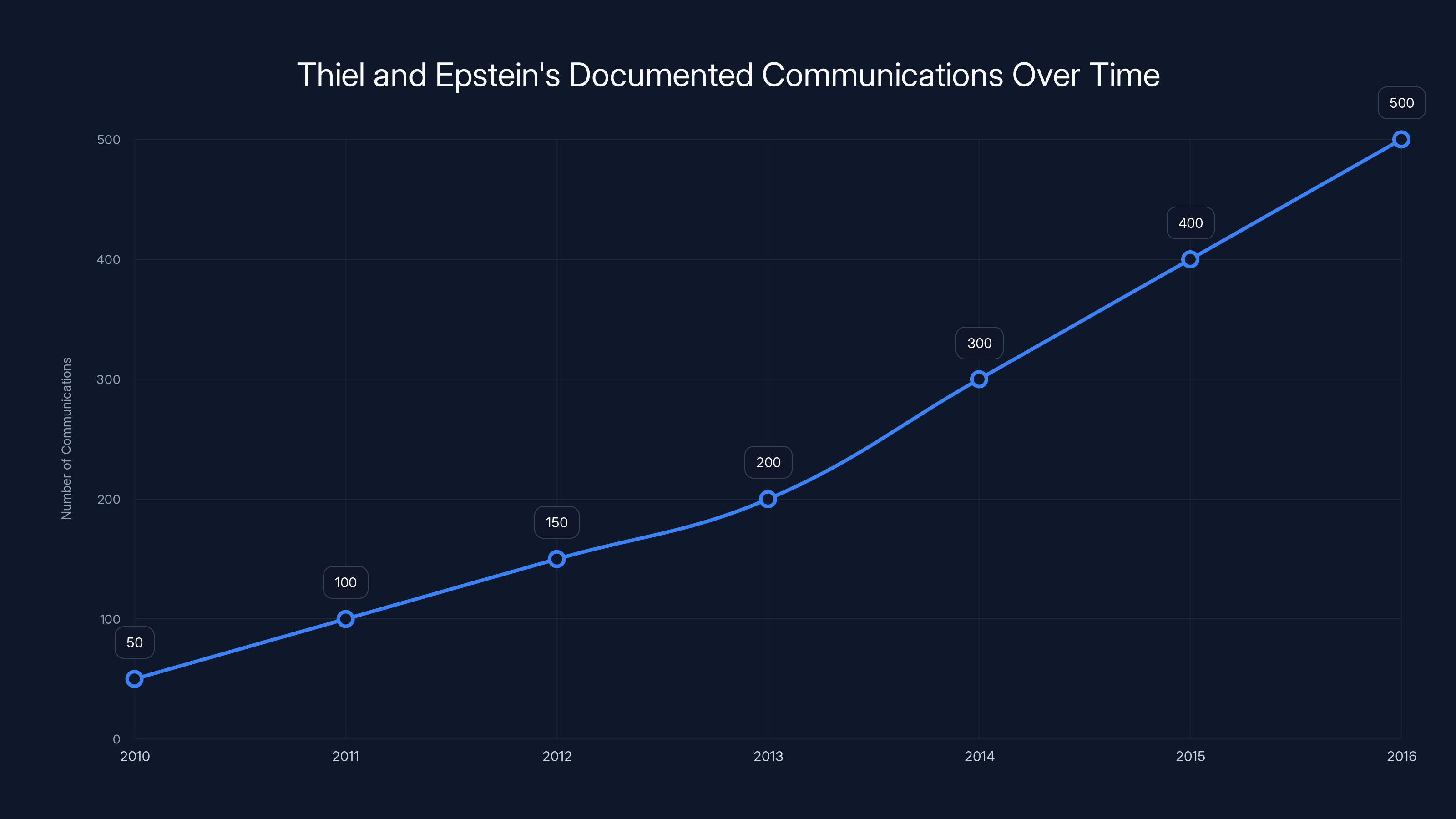

The estimated data shows a steady increase in communication between Thiel and Epstein, peaking in 2016. This suggests an active relationship despite Epstein's past legal issues. Estimated data.

How Email Coordination Reveals Power Structures in Venture Capital

The February 2016 email from Thiel's assistant reveals something important about how the venture capital industry actually functions on a day-to-day basis. The carefully itemized list of acceptable foods, the specific sushi varieties, the detailed prohibition list, all of this had to be communicated somehow. Someone had to compile this information and send it to Epstein.

This email is a perfect example of the invisible labor that goes into maintaining relationships among the ultra-wealthy. Someone in Thiel's organization has to track these details. That person, Alisa Bekins, is a senior executive, which means she's likely highly compensated and influential within Thiel's organizations. Yet part of her responsibility is managing what her boss will and won't eat.

The fact that this email was marked "CONFIDENTIAL" is also interesting. Why would a list of acceptable foods be confidential? The simple answer is that high-net-worth individuals often treat their personal details, including dietary preferences, as proprietary information. They don't want the world knowing they follow such a restrictive diet, or they want to maintain control over how that information is shared.

The email was forwarded to Epstein, which means he received detailed instructions about what to serve if Thiel was going to be at his residence or at a meal they were hosting together. This level of coordination suggests Epstein was expecting to host Thiel, and wanted to ensure the meal would be satisfactory. It's a concrete demonstration of the deference shown to high-status individuals in these networks.

This also demonstrates how venture capital networks function at a personal level. These relationships aren't managed by institutional systems where everything is standardized and documented. They're personal relationships between individual decision-makers. When Thiel wants to meet Epstein, his assistant coordinates the details. When Epstein agrees to the meeting, he has to figure out what to serve Thiel. There's no institution managing this. It's entirely personal, which also means there's very little oversight or accountability.

The Red Flags Nobody Apparently Noticed

Looking back at these communications with what we now know about Epstein, it's striking how normalized the relationship appears. Here's a man with a conviction for crimes against minors, maintaining ongoing communication with one of Silicon Valley's most prominent figures, receiving tens of millions of dollars in investments, and apparently being accommodated with the same deference shown to any other wealthy investor.

The question this raises is: where was the due diligence? When Epstein invested $40 million in Valar Ventures, didn't anyone ask why a convicted sex offender was putting money into the fund? The answer is probably that the due diligence was done, but it didn't matter. In venture capital, if someone has money and wants to invest it, you take the money. The reputational implications are considered a secondary concern.

This speaks to a fundamental problem with how the venture capital industry operates. It's largely self-policing, with very limited oversight. There's no regulatory body ensuring that funds conduct proper background checks on their investors. There's no requirement to publicly disclose who's investing in your fund. Everything is private, confidential, and handled through personal relationships.

The consequence is that someone like Epstein could maintain access to the highest levels of Silicon Valley despite a public criminal conviction. As long as he had money to invest, as long as he wanted to maintain relationships with powerful people, as long as he was discreet about it, he could continue operating in these circles.

Thiel's apparent comfort with maintaining a relationship with Epstein also suggests something about how people in power view accountability. Epstein had been convicted. He had served time. As far as people like Thiel were concerned, the matter was settled. The past was past. What mattered now was whether he could be a useful business partner. This attitude, while troubling in retrospect, was apparently not uncommon in Silicon Valley circles during this period.

Epstein invested

Timeline of Thiel-Epstein Communications: A Chronological View

Tracking when Thiel and Epstein were in communication provides useful context about their relationship. The emails don't start immediately after Epstein's release from prison. Instead, they begin several years into Epstein's post-conviction period, in the mid-2010s. This timing is worth noting because it suggests Thiel didn't maintain contact from before Epstein's conviction.

The communications intensify around 2015-2016, precisely when Epstein was making his substantial investments in Valar Ventures. This timing is not coincidental. The financial relationship between the two men appears to have driven much of the communication. Thiel and Epstein needed to meet to discuss investments, to review fund performance, to maintain their business relationship.

By 2017, the frequency of communications seems to have declined somewhat, though they continued. The files indicate that as recently as January 2019, just months before Epstein's arrest, the two men were still in communication and discussing potential meetings.

This timeline matters because it shows the relationship lasted for several years, maintained consistent contact, and was only interrupted by Epstein's death in custody in August 2019. There was no point where Thiel apparently decided the relationship was problematic or cut off contact. The relationship continued until circumstances forced an end.

The timing also means that Thiel was maintaining a relationship with Epstein during a period when sexual assault allegations against other powerful men in tech were beginning to surface. The #MeToo movement started in 2017. Cases against prominent venture capitalists and tech leaders began emerging in 2017-2018. Yet despite this shifting climate, Thiel apparently saw no reason to distance himself from Epstein.

What Epstein Apparently Thought About Peter Thiel

One of the more revealing pieces of evidence in the files is a recording of Epstein discussing Thiel with former Israeli Prime Minister Ehud Barak. In this conversation, Epstein expresses both respect and some degree of confusion about Thiel's personality.

Epstein mentions to Barak that he's hoping to meet Thiel the following week. He also notes that he's familiar with Palantir, though he demonstrates his unfamiliarity by mispronouncing it as "Pallentier." For a man who had invested $40 million in Thiel's fund, Epstein's casual approach to pronouncing the name of Thiel's most famous company is somewhat telling.

More interestingly, Epstein speculates to Barak that Thiel might put Barak on the board of Palantir. This is significant because it suggests Epstein was thinking about how to leverage his relationship with Thiel, and possibly how to leverage it for Barak's benefit. This indicates Epstein saw value in maintaining the relationship with Thiel, at least partially because of Thiel's ability to provide access and opportunities.

Epstein also mentions that Thiel "sort of jumps around and acts really strange, like he's on drugs." This comment is interesting for several reasons. First, it suggests Epstein's perception of Thiel as somewhat erratic or unusual in his behavior. Second, Barak apparently agrees with this assessment. This indicates that Thiel's reputation in these circles was that of someone a bit unpredictable, someone who didn't follow normal social norms.

This perception of Thiel as strange or unusual is worth considering in context. Thiel has always been someone who presents himself as thinking differently, not following the crowd, having unconventional views. Part of his appeal to his investors and followers is that he claims to see things others don't. So when Epstein and Barak discuss Thiel as jumping around and acting strange, they might be picking up on something real about his personality, or they might simply be reacting to Thiel's deliberate cultivation of an image as someone unconventional.

The Investment: $40 Million and What It Represented

Epstein's decision to invest $40 million in Valar Ventures is the most concrete evidence of his engagement with Thiel's world. This wasn't a small check. This was a substantial commitment of capital that would have required real due diligence and analysis.

Valar Ventures, founded in 2011, focuses on early-stage technology companies operating at the frontier of what's technically possible. The fund has backed companies in artificial intelligence, biotech, deep learning, and other cutting-edge fields. By the time Epstein invested, Valar had already established itself as one of the more sophisticated tech investment vehicles operating in Silicon Valley.

Why did Epstein want to invest in Valar? The files don't explicitly say. The simplest explanation is that Epstein, despite his legal troubles, still wanted to maintain exposure to the highest-growth sectors of the economy. Tech companies were where the enormous returns were being generated. Having access to a top-tier fund like Valar, managed by someone as prominent as Thiel, would have been an attractive investment opportunity.

The investment also represented something else: a way for Epstein to remain part of the world he wanted to stay connected to. By investing in Valar, Epstein was essentially buying access to Thiel's network, Thiel's deal flow, and Thiel's insights into where technology was heading. This kind of investment is often as much about the relationships and access you gain as it is about the financial returns.

For Thiel and Valar, accepting $40 million from Epstein presumably meant that the fund was confident in its ability to generate returns that would justify the reputational concerns of taking money from someone with Epstein's history. It also suggests that the fund didn't consider Epstein's background disqualifying.

This decision to accept Epstein's capital has aged poorly, obviously. Once Epstein's 2019 arrest and the subsequent revelations about the extent of his crimes became public, having his name associated with Valar Ventures became a liability. It's unclear what happened to that $40 million or what the fund's relationship with Epstein's capital became after his death.

Comparing Silicon Valley's Response to Power and Accountability

One of the most striking aspects of the Epstein files is how they reveal the gap between Silicon Valley's public values and its actual practices when it comes to accountability and vetting powerful individuals.

Publicly, Silicon Valley presents itself as meritocratic, as willing to take chances on unconventional people with great ideas. But the Epstein files reveal that this openness also extends to people with documented criminal histories, as long as they have money and access. The venture capital world explicitly values financial returns over other considerations, and this is on full display in these documents.

Compare this to how Silicon Valley responded to other scandals during the same period. When evidence of sexual harassment emerged at various tech companies, the industry responded with outrage and calls for reform. Yet at the same time, prominent figures were maintaining business relationships with Epstein, a man convicted of crimes against minors.

This contradiction suggests that Silicon Valley's response to allegations or crimes is situational. If a scandal threatens the broad legitimacy of the tech industry, there's a sharp response. But if a scandal can be compartmentalized, if it doesn't threaten the fundamental model of how venture capital operates, it can be overlooked.

Thiel's apparent comfort with maintaining a relationship with Epstein is also worth understanding in the context of Thiel's broader political positions. Thiel has been openly critical of what he sees as excessive legal constraints on powerful people. He's expressed skepticism about various legal institutions. He's also been willing to maintain relationships with people across the political spectrum, regardless of controversy, as long as he sees strategic value in those relationships.

This attitude, which Thiel would probably frame as pragmatic or clear-eyed about power, can also be understood as a form of moral relativism. If everyone is somewhat compromised, and if power is ultimately what matters, then the specific legal history of your business partners is a secondary concern.

The Security and Privacy Implications of These Disclosures

The fact that Thiel's detailed dietary restrictions were documented and shared in emails that eventually became public records raises important questions about privacy, security, and documentation practices among the ultra-wealthy.

Why was this information documented at all? Why did Thiel's assistant put detailed dietary information in writing and then email it to Epstein? In a world of alternative communication methods, encrypted messages, and phone calls, why would something marked "CONFIDENTIAL" be sent via email?

The answer is probably that systems and procedures were less sophisticated than we might assume. Thiel's organization likely handled confidential communications the way many organizations did in the mid-2010s: through email marked confidential, with the assumption that email systems were secure. Obviously, they weren't. The emails ended up in Epstein's files, and then in the hands of federal investigators, and then in the public domain.

This also raises the question of data retention. Epstein apparently kept detailed records of everything. He saved emails, recorded conversations, documented investments, and preserved detailed information about his relationships with powerful people. This is actually not that unusual. Someone engaged in financial and business activities often needs to keep detailed records for various reasons.

But it does mean that every confidential detail about Thiel's preferences, every personal note, every scheduling detail became part of Epstein's archive. And ultimately, it became available to anyone seeking to understand the nature of their relationship.

For anyone maintaining sensitive business relationships or dealing with confidential matters, the lesson is clear: don't assume that detailed information about your preferences and practices will remain private. If you document it, there's a risk it could become public, whether through legal proceedings, hacks, or other means.

Connecting the Dots: What the Files Reveal About Network Formation Among the Ultra-Wealthy

Beyond the specific details about Thiel and Epstein, the broader set of Epstein files reveals something important about how networks form and operate among the ultra-wealthy and powerful.

First, these networks are not centralized or formal. There's no organization called "The Super-Rich Club" that anyone officially joins. Instead, networks form through a series of personal introductions, shared interests, and overlapping circles. Epstein was able to maintain access to this world because he was introduced to people, because he had money, and because he was willing to invest in what interested the people around him.

Second, these networks prioritize discretion and confidentiality. Many of the communications in the Epstein files are marked confidential or sensitive. People who operate at this level don't want their business dealings, their personal preferences, or their relationships to be publicly known. This desire for privacy creates a kind of mutual interest in maintaining secrecy, which can sometimes lead to turning a blind eye to issues that might otherwise be problematic.

Third, these networks are often unvetted in ways we might assume they would be. You'd think that before bringing someone like Epstein into a fund, extensive background checks would occur. And presumably they did, on some level. But the results of those checks, which would have revealed Epstein's criminal history, apparently didn't disqualify him. This suggests that either the background checks were not thorough, or the results were evaluated in a way that didn't find them disqualifying.

Fourth, these networks operate largely outside formal institutional oversight. Venture capital funds are not regulated with the same level of scrutiny as banks or other financial institutions. This creates an environment where decisions about who to work with and whose money to accept can be made on a somewhat ad hoc basis.

Finally, these networks are often characterized by mutual benefit that's not always explicitly documented. Epstein invested money in Valar Ventures. What did he get in return? Access, certainly. Potentially information and insights about where technology was heading. Potentially opportunities to invest in other companies or make other deals. But this isn't formalized in a way that's clearly documented. It's implicit in the relationship.

What Happened After: The End of the Thiel-Epstein Relationship

The Epstein files document communications between the two men continuing into January 2019. However, Epstein was arrested in July 2019 and died in custody in August 2019. This marks the end of any documented contact between the two men.

When Epstein's arrest made international headlines and the scope of the allegations against him became clear, Thiel and Valar Ventures faced a choice about how to respond. There's no public record of Thiel making any statement about his relationship with Epstein or about the investments Epstein had made in Valar Ventures.

The lack of public statement is itself interesting. Thiel is typically willing to speak publicly on controversial topics. Yet when faced with questions about his relationship with Epstein, he apparently chose silence.

This silence stands in contrast to how other prominent figures responded when their connections to Epstein became public knowledge. Some issued statements distancing themselves from Epstein, claiming they had no knowledge of his activities, or offering other explanations for their relationships with him.

Thiel's apparent choice to not publicly comment on the relationship is worth noting. It could be interpreted as a simple preference for privacy, a legal strategy recommended by counsel, or a reflection of Thiel's general disdain for public explanation or justification of his decisions.

Regardless of the motivation, the result is that Thiel's relationship with Epstein has remained somewhat ambiguous and unexplained. The public knows they communicated regularly, met for meals, and engaged in financial dealings. But we don't have a clear understanding of why Thiel valued the relationship or what he thought about the controversy when it erupted.

Lessons for Institutional Oversight and Due Diligence in Venture Capital

The Epstein files offer several important lessons for how venture capital and other industries might improve their due diligence and oversight practices.

First, public criminal history should be a serious consideration in investor vetting. Obviously, people deserve rehabilitation and second chances. But if someone has been convicted of crimes involving violence, exploitation, or financial fraud, that's relevant information that should factor into decisions about whether to work with that person in significant financial capacities.

Second, there should be a separation between investment decisions and personal relationships. The fact that Thiel and Epstein apparently maintained a friendship alongside their financial relationship suggests that personal affinity influenced business decisions. While personal relationships inevitably play a role in venture capital, decision-making bodies should have checks and balances to ensure those relationships don't override better judgment.

Third, there should be greater transparency about who is investing in major funds and how those decisions are made. The fact that a $40 million investment from a convicted sex offender could be accepted with apparently minimal public scrutiny is troubling. If fund managers were required to publicly disclose significant investors and explain their vetting processes, this kind of situation might be avoided.

Fourth, there's value in building institutional processes and documentation that go beyond personal relationships and email chains. The Epstein files show a system operating on personal communication and individual decision-making with minimal institutional oversight. Stronger institutional frameworks, with documented approval processes and clear standards, might prevent situations like this.

Finally, there's value in building cultures where people feel comfortable questioning decisions they find problematic. In many organizations, if a junior person had concerns about accepting a large investment from someone with Epstein's background, would they have felt comfortable raising those concerns? Or would they have assumed the decision had already been made at a higher level and that speaking up would be unwelcome?

FAQ

What are the Epstein files and why were they released?

The Epstein files are thousands of documents related to Jeffrey Epstein that were released by the Department of Justice in January 2024. They were released as part of a legal process following the opening of Epstein's estate records and in response to public records requests. The files include emails, financial records, meeting notes, and other documentation that reveal the extent of Epstein's network and business relationships, including with prominent figures in Silicon Valley.

How many times does Peter Thiel appear in the released documents?

Peter Thiel appears at least 2,200 times throughout the Epstein files released by the DOJ. However, these references don't necessarily indicate involvement in wrongdoing. Most of the mentions relate to scheduling communications, meeting arrangements, and financial transactions between the two men.

What were Peter Thiel's dietary restrictions?

According to documents released in the Epstein files, Thiel followed an extremely restrictive diet that included approved sushi varieties and proteins, fourteen specific vegetables, no fruits whatsoever, and prohibitions on dairy, grains, sugar, processed foods, and certain condiments. The restrictions were so detailed that his assistant compiled a comprehensive list to share with people hosting meals for him.

Why did Epstein invest in Valar Ventures?

The exact motivations aren't explicitly stated in the released documents, but Epstein invested $40 million in two funds managed by Valar Ventures in 2015 and 2016. Such investments typically provide access to deal flow, investment insights, and relationships with prominent figures in the venture capital world. Epstein likely valued both the potential financial returns and the access to Thiel's network and understanding of emerging technologies.

What does this reveal about Silicon Valley's vetting practices?

The fact that Epstein was able to invest significant capital in a prominent venture fund despite his 2008 conviction suggests that venture capital's due diligence processes may not adequately weight criminal history against other factors like available capital and potential returns. The situation demonstrates how venture capital operates largely outside formal institutional oversight, allowing individual decision-makers to weigh reputational risks differently than public companies or regulated financial institutions might.

Did Peter Thiel do anything wrong according to these files?

The released documents do not indicate that Thiel engaged in any wrongdoing. His communications with Epstein appear to be business and social in nature. However, Thiel's willingness to maintain a business relationship with someone who had been convicted of crimes against minors has raised questions about judgment and accountability among Silicon Valley's elite.

How long did Thiel and Epstein maintain contact?

According to the files, Thiel and Epstein communicated regularly between at least 2014 and January 2019, when Epstein was arrested. The communications appear to have been most frequent during 2015-2016, coinciding with Epstein's major investments in Valar Ventures. The relationship ended only with Epstein's death in custody in August 2019.

What was the nature of Thiel and Epstein's relationship?

Based on the released files, the relationship appears to have been primarily financial and business-oriented, centered around Epstein's investments in Thiel's venture funds and occasional social meetings and meals. While they communicated regularly and appeared to maintain a cordial relationship, the specific details of what drew them together or what they discussed beyond scheduling are not fully documented in the released materials.

Why has Peter Thiel not publicly commented on these revelations?

Thiel has not issued public statements explaining his relationship with Epstein or his decision to accept Epstein's investments. This silence could reflect a preference for privacy, legal counsel recommending non-disclosure, or Thiel's general approach of not publicly justifying his business decisions or personal associations. The lack of explanation has contributed to the ambiguity surrounding the relationship.

What should investors and fund managers learn from these files?

The Epstein files suggest several lessons for venture capital and other investment industries: the importance of rigorous, consistent vetting of all investors regardless of capital size; the need to weigh criminal history appropriately in investment decisions; the value of institutional oversight rather than purely personal decision-making; and the importance of transparency about who invests in major funds and how those decisions are made.

The Takeaway: Power, Networks, and Accountability in Silicon Valley

When the dust settled on the initial release of Epstein's files, much of the media attention focused on celebrity names and dramatic revelations. But the story of Peter Thiel and his extensive documented communications with Epstein offers something equally important: insight into how power operates in Silicon Valley, and how networks of wealthy and influential people actually function in practice.

Thiel and Epstein apparently didn't have a single major business project that unified them. They didn't co-found a company or pursue any shared venture. Instead, they had a financial relationship through Valar Ventures and maintained periodic social contact. Yet that was enough to keep them in communication for years.

This tells us something important about elite networks in tech and finance. They're held together by a combination of financial interest, personal affinity, and the simple desire to maintain access to other powerful people. The relationships are often informal, documented through email and casual meetings rather than formal contracts or institutional arrangements.

What's particularly striking is that this relationship continued even after Epstein's criminal history was public knowledge. There was no moment where Thiel apparently decided the relationship was too problematic to continue. Instead, the relationship persisted until Epstein's 2019 arrest forced a reckoning.

This raises uncomfortable questions about accountability and judgment at the highest levels of Silicon Valley. If someone as prominent as Thiel, with all the resources and advice at his disposal, could maintain a business relationship with someone of Epstein's profile, what does that say about the judgment and vetting processes throughout the industry?

The dietary restrictions email provides an almost comedic counterpoint to this darker story. Here we see the obsessive attention to detail that ultra-wealthy individuals demand, the invisible labor required to accommodate their preferences, and the power dynamics embedded in something as simple as planning a meal. Thiel's world is one where his dietary needs are so important that they need to be documented, shared, and accommodated by others. It's a world where preferences become requirements, and requirements become the responsibility of everyone else.

Ultimately, the Epstein files don't prove that Thiel did anything wrong. But they do reveal a great deal about how power operates when it's concentrated in the hands of a few people operating largely outside institutional oversight. They reveal the kinds of relationships that flourish in environments where financial success is the primary metric and where the well-connected are largely insulated from normal consequences.

For anyone seeking to understand Silicon Valley, not as it presents itself publicly but as it actually operates, the Epstein files are an essential primary source. They pull back the curtain on networks that normally operate in darkness, revealing the scheduling, the coordination, the financial transactions, and the odd personal details that characterize relationships among the ultra-wealthy.

The question for the venture capital industry and for Silicon Valley more broadly is whether these revelations will lead to any meaningful changes in how due diligence is conducted, how investment decisions are made, and how accountability is enforced. Or whether, as has so often been the case, the industry will absorb the controversy and continue operating much as before, perhaps with slightly more careful documentation but fundamentally unchanged in its structure and incentives.

Based on the history of how Silicon Valley responds to revelations of this kind, the cynical answer would be the latter. But the story of Thiel and Epstein, and the obsessive dietary restrictions that somehow ended up in federal documents, suggests there's still much to be learned about how power actually works, and perhaps reason to hope that greater transparency might eventually drive greater accountability.

Key Takeaways

- Peter Thiel appears 2,200+ times in released Epstein documents, revealing years of regular communication and meetings between 2014-2019

- Thiel's dietary restrictions were extraordinarily specific, prohibiting all fruits while allowing only 20+ sushi varieties and 14 vegetables

- Epstein invested $40 million in Valar Ventures in 2015-2016, suggesting venture capital accepted controversial investors based on capital availability

- Silicon Valley's venture capital operates with minimal institutional oversight, allowing major investment decisions to be made on personal relationship basis

- The relationship between Thiel and Epstein continued even after Epstein's public conviction, raising questions about industry judgment and accountability

Related Articles

- Tech Elites in the Epstein Files: What the 3.5M Documents Reveal [2025]

- Student Startup Accelerators: How Breakthrough Ventures is Reshaping Founder Funding [2025]

- Bill Gates Epstein Files Accusations Explained [2025]

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

- Kofi Ampadu Leaves a16z: What TxO's Collapse Means for Founder Diversity [2025]

- Energy-Based Models: The Next Frontier in AI Beyond LLMs [2025]