The Quiet Unraveling of a16z's Diversity Push

In January 2025, a16z partner Kofi Ampadu sent a brief email to staff announcing his departure. The subject line read simply: "Closing My a16z Chapter." The message was graceful, reflective, and entirely predictable in its restraint. But what Ampadu didn't need to spell out was already clear to anyone paying attention to Silicon Valley's ongoing reckoning with diversity, equity, and inclusion.

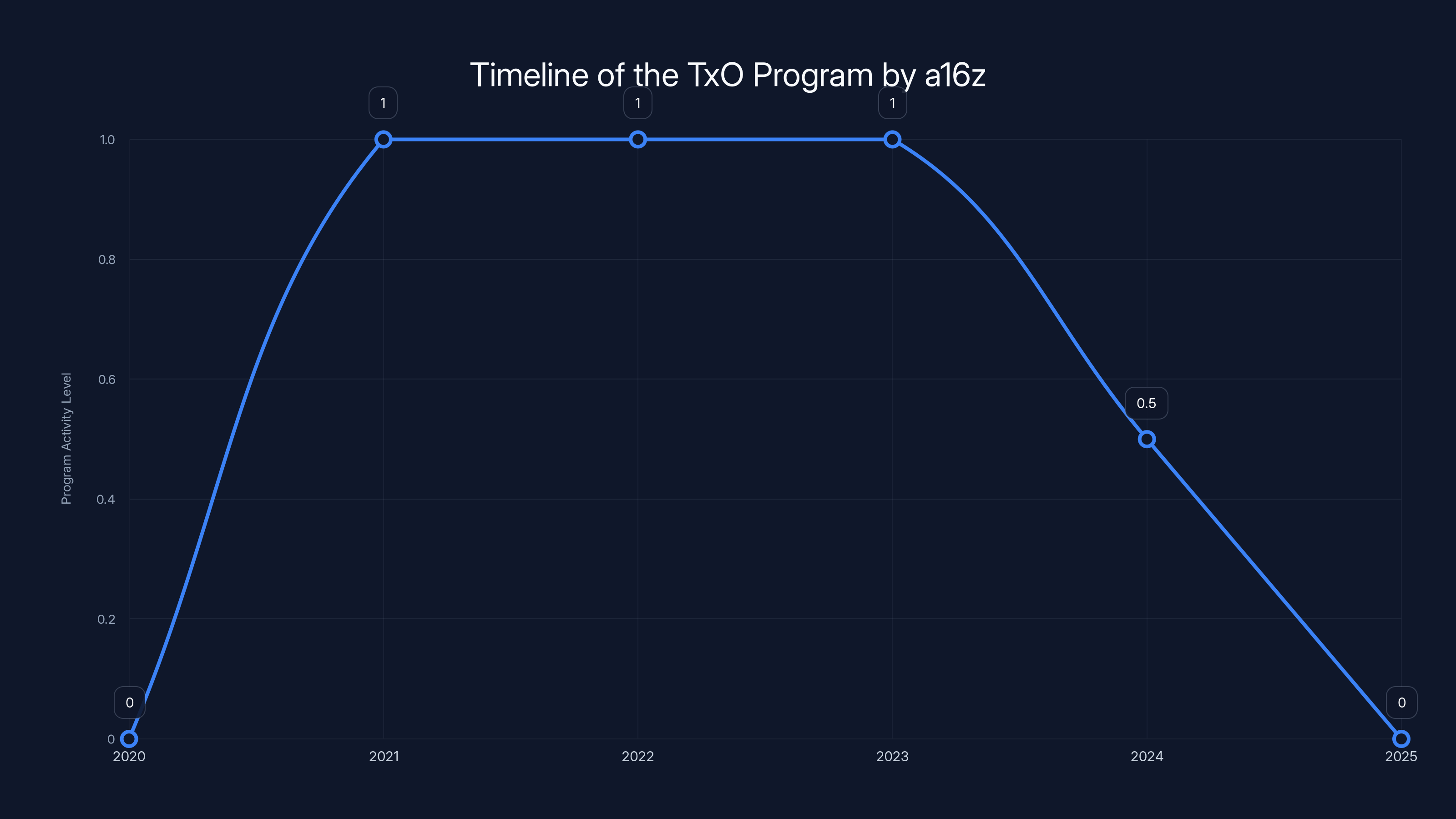

TxO (Talent x Opportunity) was supposed to be different. Launched in 2020 at the height of racial justice conversations in tech, the program aimed to identify founders who fell outside traditional venture networks. Instead of relying on pedigree proxies like Stanford degrees or Y Combinator acceptance letters, TxO investors sought exceptional founders being overlooked by the industry's existing filtering mechanisms. The program raised a $100 million fund, established a grant program for nonprofits supporting diverse entrepreneurs, and built a network that connected underserved founders with capital, mentorship, and legitimacy.

Then, in November 2024, a16z paused TxO indefinitely. Most staff were laid off. And now, five months later, the partner who shepherded the program through its entire four-year run has walked.

This isn't just about one fund or one person leaving a prestigious firm. It's a signal about something far larger: the systematic unwinding of Silicon Valley's public commitments to diversity. And it raises uncomfortable questions about whether those commitments were ever sustainable in the first place.

Understanding TxO: What It Was and Why It Mattered

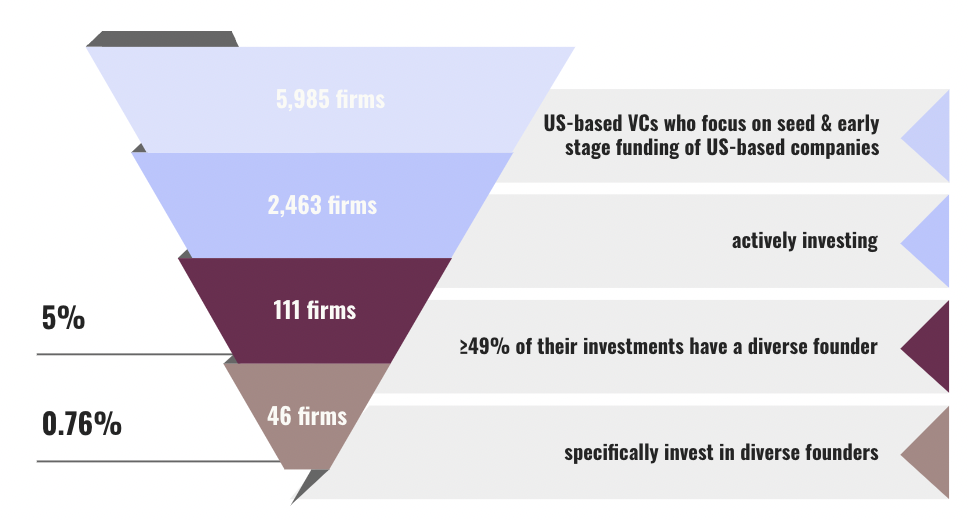

When TxO launched in 2020, venture capital was under immense pressure. The murder of George Floyd had sparked nationwide protests, as reported by WHYY. Tech companies were issuing diversity commitments. And the venture world, despite being one of the most homogeneous industries in America, couldn't ignore the scrutiny.

Into this environment came TxO, framed not as charity or corporate responsibility, but as a pure investment thesis. The premise was straightforward: exceptional founders exist outside the traditional networks that most venture capital relies on. Those networks are built on proximity, shared backgrounds, and existing relationships. If you only fund people who went to Stanford or attended the right conferences, you're missing talent. TxO's thesis was that this wasn't just morally defensible—it was more profitable.

Ampadu took over leading the program in 2021 after its initial founder, Nait Jones, stepped aside. Under Ampadu's leadership, TxO expanded significantly. The program invested in founders directly through its fund. It provided grants to nonprofits working on founder development. It created programming and networking events. Most importantly, it demonstrated that a major venture firm could organize around a different set of principles than the traditional "we find founders wherever they are" narrative that most VCs use to justify their increasingly narrow networks.

The program's structure was unusual and, in retrospect, somewhat fragile. Much of TxO's capital came through a donor-advised fund model. This meant that institutional donors could contribute capital with tax benefits, but a16z retained discretion over how that capital was deployed. This structure allowed TxO to operate semi-independently from a16z's traditional fund economics, which is why it could make "different" bets.

But it also meant TxO was structurally different from a16z's core business. When institutional pressure mounted, when ESG backlash accelerated, when the political climate shifted, that structural difference became a vulnerability rather than a feature.

The TxO program was active from 2020 to 2024, with a gradual decline leading to its pause in late 2024 and subsequent leader departure in early 2025.

Why November 2024 Changed Everything

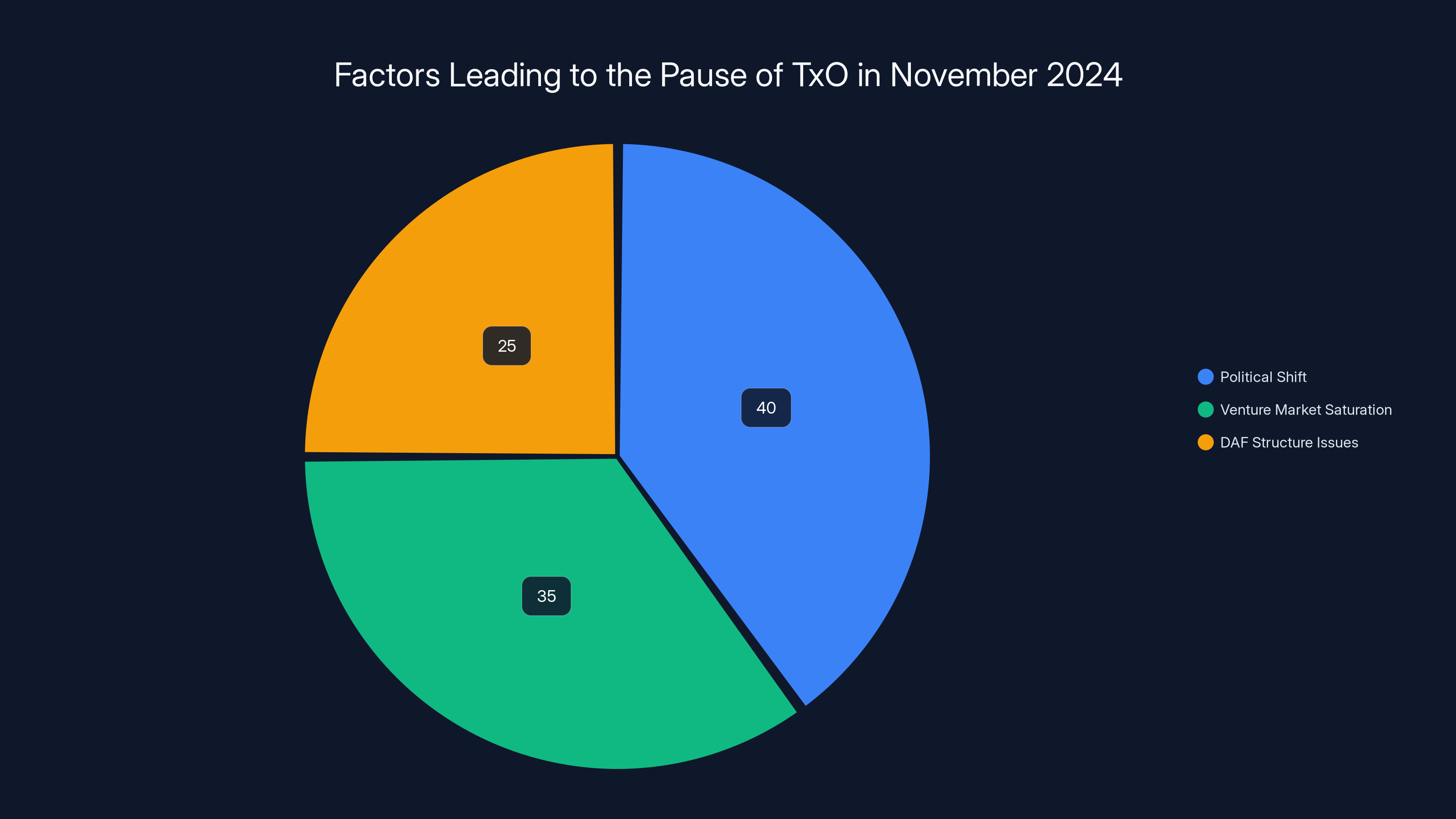

The pause of TxO didn't happen in isolation. It occurred in a specific moment when multiple pressures converged on diversity initiatives across Silicon Valley.

First, there was the broader political shift. By late 2024, ESG (Environmental, Social, and Governance) investing had become a politically charged term. Republican politicians began taking aim at venture firms funding diverse founders, characterizing it as "woke capitalism." Major institutional investors, sensing the political winds, began backing away from explicit diversity commitments.

Second, there was venture market saturation. The 2023-2024 period saw a significant tightening of venture capital. Valuations came down. The density of early-stage venture capital increased. In this environment, every dollar matters more. Thesis-driven strategies become harder to justify if they're not generating returns at the same rate as other strategies.

Third, there was the specific TxO donor-advised fund structure. As the political environment shifted, some of the institutional donors who had committed capital through the DAF model began asking harder questions about returns, impact, and whether this was the right vehicle for their money. When you're in a difficult political moment and depending on institutional goodwill, structural fragility becomes existential.

In November, a16z made the decision to pause TxO. The framing was neutral—the firm suggested it was pausing to "reassess." But as time passed, reassessment started looking a lot like a permanent pause.

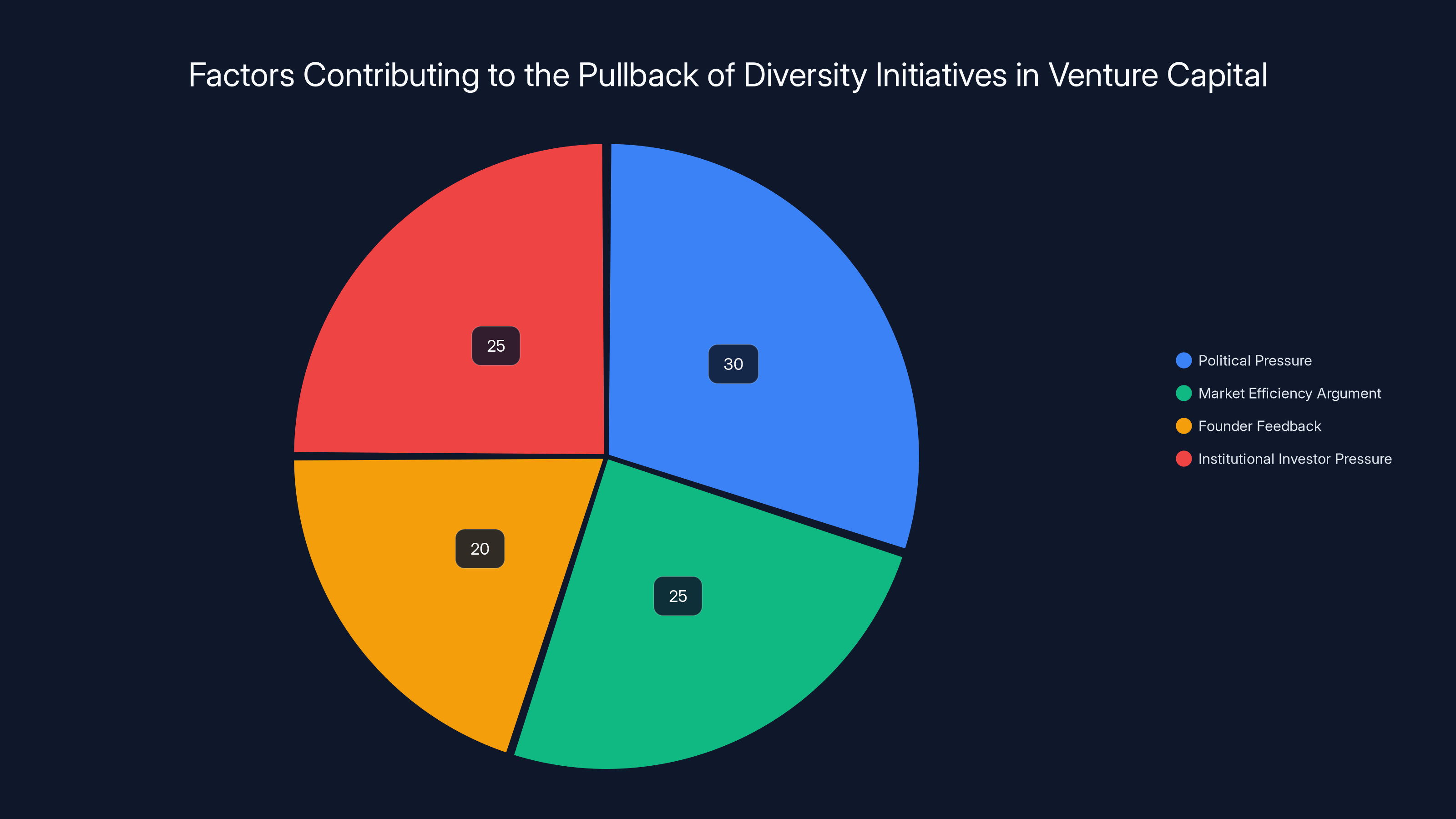

Estimated data shows that political pressure and institutional investor demands were the largest factors in the decline of diversity initiatives in venture capital during 2024.

The Broader Collapse of Venture's Diversity Push

A16z's retreat isn't unique. Across venture capital and tech, 2024 was the year of the diversity initiative pullback.

Lightspeed Venture Partners quietly shut down its diverse founders program. Sequoia Capital dissolved its efforts around founder diversity as explicitly stated goals. Scores of tech companies eliminated dedicated diversity roles. The narrative shifted from "we need more diversity" to "merit is colorblind and initiatives are unnecessary."

What happened? Several factors converged:

Political pressure: Conservative politicians and media outlets began characterizing diversity initiatives as discriminatory. This wasn't a new argument, but it gained enormous amplification in 2024. Some venture firms, concerned about their image or concerned about hypothetical legal challenges, began retreating.

Market efficiency argument: The case for diversity shifted from a moral imperative to a market efficiency argument (diverse teams perform better). When that efficiency argument is questioned or when near-term returns become more important than long-term performance, the entire case weakens.

Founder feedback: Some founders from underrepresented backgrounds reported feeling tokenized by diversity initiatives. Rather than addressing these concerns, some VCs used them as cover for shutting down programs entirely.

Institutional investor pressure: Some institutional LPs (pension funds, endowments) began signaling that they wanted VCs to focus "purely on returns" without explicit social impact goals. This created a false binary (you can't pursue both returns and diversity) that many firms accepted at face value.

The result is that by early 2025, most of venture capital's explicit diversity commitments had either been eliminated, reframed as "merit-based," or quietly shelved.

Why Ampadu's Departure Signals More Than Just Resignation

Ampadu's departure would be relatively unremarkable if TxO was still operating. Partners leave firms regularly. The timing and context matter.

Ampadu was clearly conflicted about his time at a16z. His resignation email speaks to genuine pride in the work he did identifying underserved founders. He talks about founders who "sharpened their ideas, raised capital, and grew into confident leaders." That's not pro forma language—that's someone who genuinely believed in the mission.

But his decision to leave immediately after the program paused suggests something important: he couldn't reconcile staying at a16z once the firm's structural commitment to TxO dissolved. He could have transitioned to another role at the firm. He could have stayed and accepted a traditional partner track. Instead, he walked.

This matters because a16z is one of the two or three most powerful venture capital firms in the world. If a dedicated, experienced partner who successfully led a $100 million fund and built infrastructure around founder diversity can't see a path forward at a16z, what does that say about the firm's future commitment to the space?

Ampadu's background makes his departure even more significant. He's a Ghana-born immigrant who studied at Northwestern and Columbia Business School. His entire personal story is built around being an outsider who succeeded despite structural barriers. TxO was personal for him in a way it might not be for other partners. For someone like Ampadu to decide that a16z isn't the place for him anymore is a strong signal about how seriously the firm is retreating from diversity work.

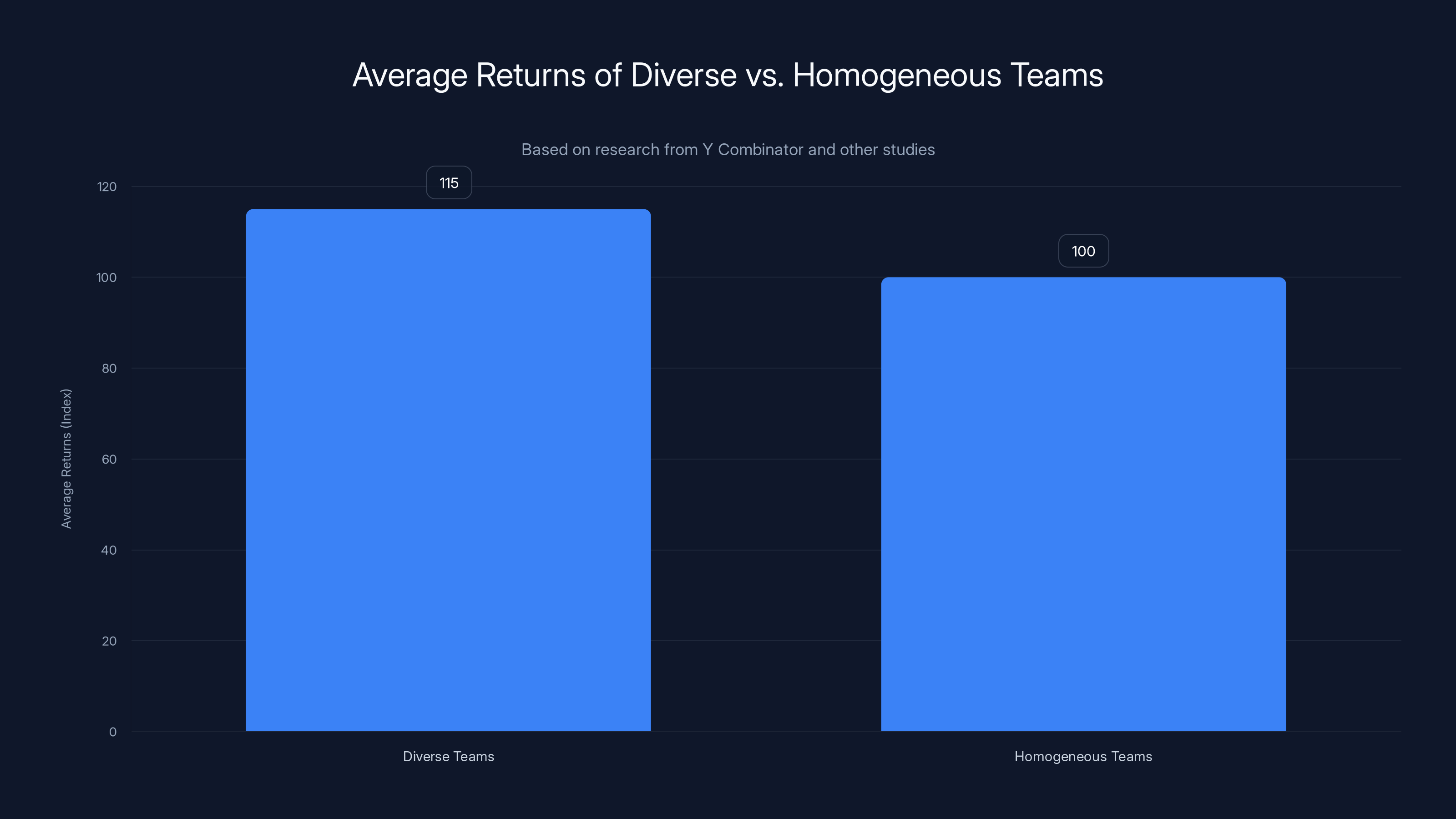

Diverse founding teams show a 10-15% higher average return compared to homogeneous teams, highlighting a marginal but notable advantage. (Estimated data)

What Actually Made TxO Different

To understand what's being lost, it's worth exploring what made TxO genuinely innovative in venture capital.

Most venture capital still operates on what we might call the "assumption network model." You assume that the best founders are in certain schools (Ivy League, Stanford, MIT). You assume they're in certain networks (Y Combinator, Plug and Play, 500 Startups). You assume they have certain backgrounds (tech experience, prior fundraising, connections). You then build your sourcing strategy around these assumptions. This isn't intentionally exclusionary—it's just how the industry optimized around information asymmetry. When information about founders was harder to come by, using proxies made sense.

But these proxies have broken down. The information asymmetry doesn't really exist anymore. You can find out about exceptional founders anywhere. The real question is whether you're actually looking.

TxO's genuinely different insight was this: we'll organize our search differently. We'll partner with organizations that work with entrepreneurs outside traditional networks. We'll go to different geographies. We'll look at founders who bootstrapped instead of doing traditional internships. We'll find talented founders who didn't follow the standard script.

This is harder. It requires more work. It requires cultural change within an organization. But it worked. TxO invested in founders who went on to raise significant capital, achieve meaningful exits, and build valuable companies. The returns were real.

What TxO represented wasn't that diversity is good (though it is). What it represented was that venture capital had been optimizing around proxies that no longer made sense. That there was a genuine market inefficiency. That someone was leaving money on the table by not looking in different places.

When a16z paused TxO, they weren't just pausing a diversity initiative. They were saying: "We don't actually believe there's a market inefficiency here anymore." Or more accurately: "We don't believe the returns from pursuing this inefficiency outweigh the political and institutional pressure we're facing."

The Economics of Founder Diversity

This is where it gets uncomfortable. The entire case for diversity-focused venture investing rests on a specific economic argument. Let's break it down.

The thesis is: founders from underrepresented backgrounds face structural barriers to fundraising. These barriers are not correlated with ability. Therefore, exceptional founders exist outside traditional networks. Therefore, VCs that can identify and invest in these founders will capture alpha (above-market returns).

This thesis has support. Research from Y Combinator, one of the most rigorous sources of data on early-stage venture, shows that diverse founding teams perform slightly better on average than homogeneous teams. Various studies have shown that women and non-white founders face higher bars for fundraising (they need to demonstrate more traction to raise capital). If they face higher bars but still get funded, that could mean they're genuinely better businesses.

But here's the catch: this advantage is marginal. We're talking about maybe 10-15% better returns on average, not 50% or 100%. And in venture capital, where power law distributions dominate (the top 1% of companies generate most returns), marginal advantages matter a lot less than people think.

Moreover, this advantage requires operational work. TxO required significant staff, infrastructure, relationships with nonprofits and organizations outside traditional VC networks, and specific expertise. That operational cost is real.

So in a market where:

- Interest rates are higher than they were in 2020

- Venture returns are under pressure

- LPs are scrutinizing fees

- Political pressure exists against diversity initiatives

- The marginal advantage is real but not massive

It becomes a legitimate business decision to shut down TxO, even if you believe in the thesis. The question is no longer "is there an opportunity here?" but "is this opportunity worth the operational burden and political costs?" For a16z, apparently, the answer shifted from yes to no.

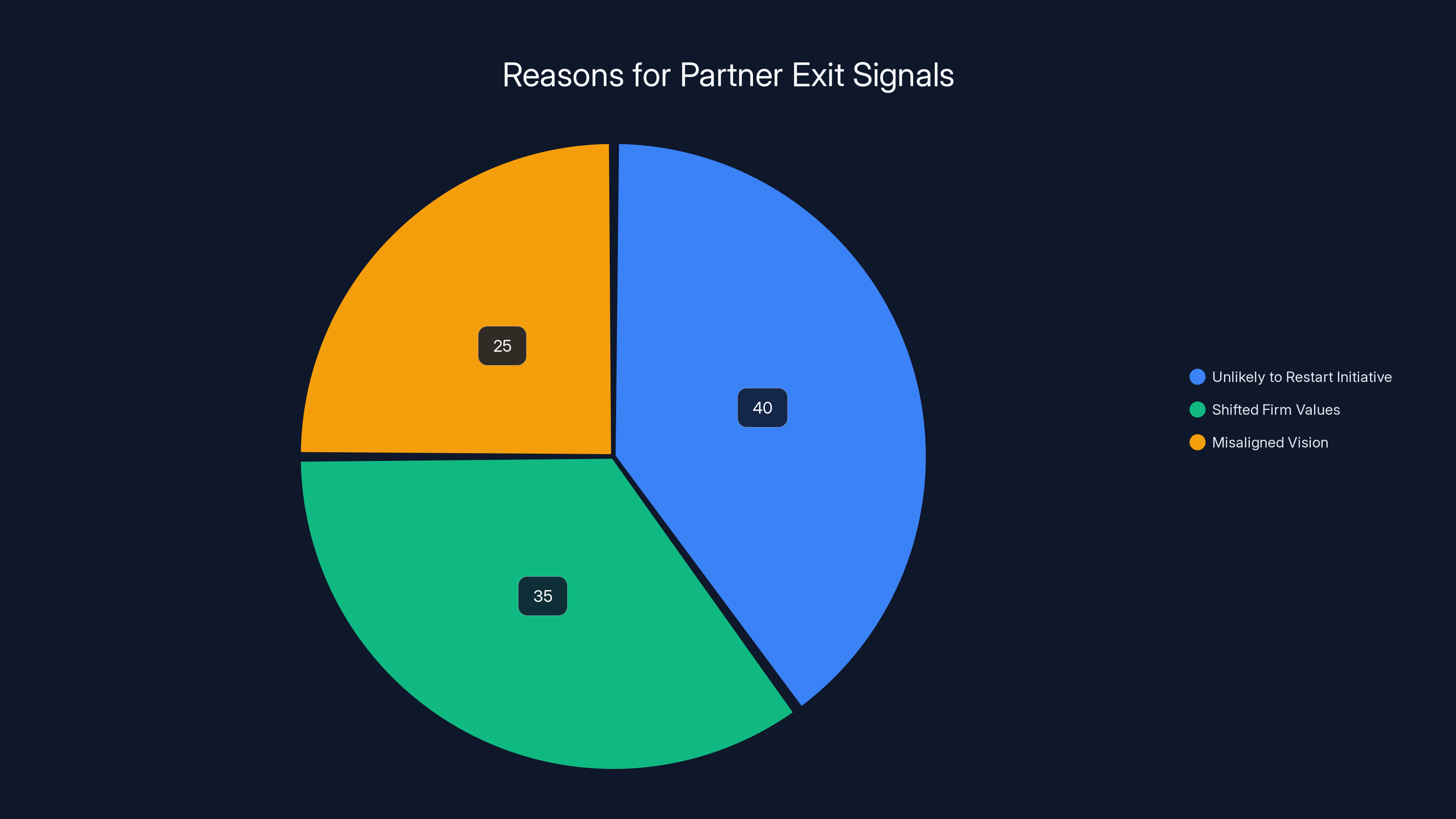

The decision to pause TxO was influenced by a combination of political shifts (40%), venture market saturation (35%), and issues with the donor-advised fund structure (25%). Estimated data.

What Happened to TxO Founders

One of the underreported aspects of TxO's pause is its impact on portfolio companies. What happens to founders in a fund when that fund effectively shuts down operations?

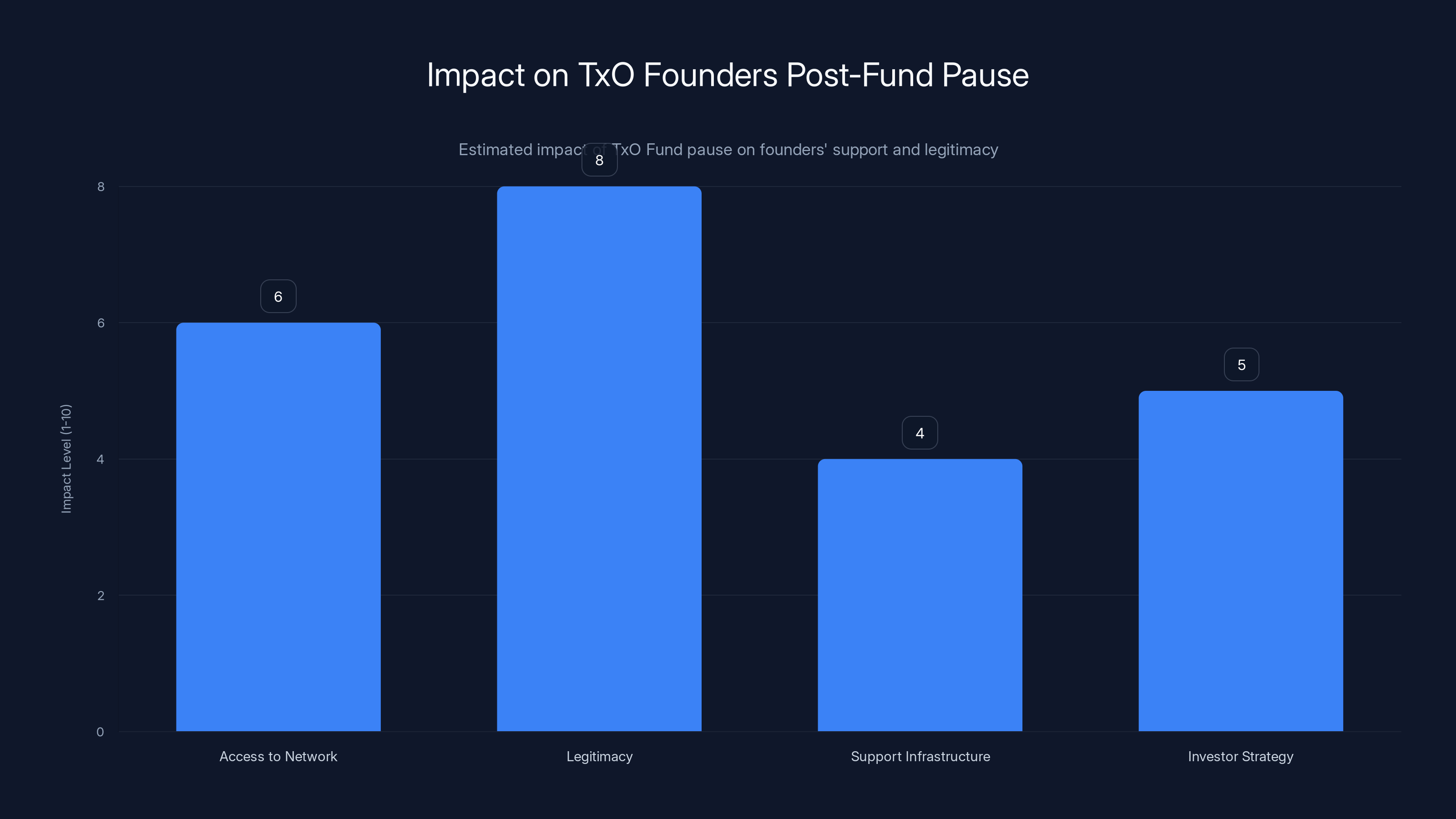

A16z initially promised continuity. Portfolio companies would still have access to the broader a16z network. They wouldn't be abandoned. But the reality of running a program with specific staff, specific relationships, and specific resources is that when that program pauses, some of those supports disappear.

The founders who benefited most from TxO weren't just the capital—it was the legitimacy. When a16z backed you, doors opened. Customers believed in you. Other investors would follow. Some of that legitimacy remains in the form of the a16z name, but the ongoing support infrastructure largely evaporates.

For many TxO founders, the period between the November 2024 pause and January 2025 was uncertain. Who do you call with questions? Who's leading your investor's strategy for your market? Who's introducing you to customers or partners? These relationships and infrastructure existed around TxO. When the fund paused, they didn't automatically transfer to a16z's traditional model.

Most TxO portfolio companies will be fine. They got the important thing: capital and legitimacy from a tier-one venture firm. But their experience since the pause has likely been different than if the fund had continued operating.

The Ideological Shift in Venture

Ampadu's departure and TxO's pause happen against a broader ideological shift in venture capital and tech more broadly.

For roughly 2015-2023, there was a consensus in tech leadership that diversity was both morally right and economically beneficial. It wasn't universal—plenty of people disagreed—but it was the dominant frame among founders, VCs, and tech executives. Diversity initiatives weren't political; they were standard business practice.

This consensus has fractured. The fracture has been relatively sudden. What changed?

Multiple factors:

Political organization: Conservative activists and media figures began systematically organizing against diversity initiatives. This created political costs that previously didn't exist. If you're a venture firm founder or a tech CEO, you now have to consider that supporting diversity initiatives might result in political opposition, which might affect your business, your reputation, or your family.

Backlash narrative: A counter-narrative emerged that diversity initiatives were themselves discriminatory. This narrative is debatable as applied to most diversity initiatives, but it provided cover for firms wanting to retreat. They could say: "We're just focusing on merit" rather than "We're backing away due to political pressure."

Business pressure: With higher interest rates and more scrutiny on venture returns, firms could justify shutting down programs that were economically marginal. Even if you believed in the cause, you could rationalize ending it as a business necessity.

Influencer effects: When high-status individuals (like Elon Musk, who's extremely hostile to diversity initiatives) take public stances against these programs, it creates permission structures for others to do the same.

The result is that the consensus has shifted. In early 2025, if you announced you were starting a founder diversity program, you'd likely face more skepticism than you would have in 2022. The political economy around this issue has changed.

Ampadu's departure reflects this broader shift. It's not that one person leaving changes the venture industry. It's that Ampadu's departure is one visible manifestation of a larger reorientation happening across the ecosystem.

Estimated data suggests that when a senior leader exits after an initiative pause, it's often due to a low likelihood of the initiative restarting, shifted firm values, or a misalignment in vision.

Lessons From TxO's Rise and Fall

If you're trying to understand what happened with TxO and what it means for the future of diversity in venture, several lessons emerge.

First lesson: Thesis durability depends on institutional foundation. TxO succeeded as long as it had institutional buy-in from a16z's leadership. That buy-in was real, but it wasn't deeply embedded in the firm's core structures. When external pressure increased, that buy-in evaporated relatively quickly. Compare this to something like Y Combinator's founder-first focus, which is embedded in the entire firm's structure and incentives. When your thesis is housed in a specific program rather than embedded in fundamental decisions, it's vulnerable.

Second lesson: Donor-advised fund structures are fragile under pressure. The fact that much of TxO's capital came through a donor-advised fund model, rather than from a16z's main fund, meant that TxO's capital was structurally different. This allowed flexibility initially, but it also meant TxO was subject to the preferences of institutional donors. When the political environment shifted, those donors became less committed. Building on fragile capital structures is always risky.

Third lesson: Return on investment metrics matter in a downturn. TxO likely had solid returns. But venture capital has power law distributions. You don't need a program to have solid returns—you need it to have exceptional returns. Once scrutiny increased and capital became more expensive, that solid returns argument wasn't sufficient. The program would have needed to demonstrate it was generating top-quartile returns to justify the operational cost and political friction.

Fourth lesson: Opposition accelerates suddenly. TxO went from being a celebrated part of a16z's portfolio to facing significant scrutiny over a very short timeframe. This should serve as a warning to anyone launching programs that depend on specific institutional or political environments. Those environments can shift faster than you'd expect.

The Founder Experience: Inside and Outside the Funnel

One way to think about what TxO represented is as an experiment in expanding the funnel of founders that venture capital considers.

Traditional venture capital, for efficiency reasons, has a narrow funnel. It looks for founders with certain characteristics. If you don't match those characteristics, you typically don't get capital. This works for venture capital because most capital goes to a small number of highly successful companies. If you can identify those companies with even slightly better accuracy than random, you succeed.

But this means the vast majority of competent entrepreneurs never get access to venture capital. They fund themselves, raise debt, or bootstrap. Some of them build valuable companies. Some of them could have built much larger companies with venture capital, but they never get the chance to even try because they didn't come from the right school or have the right network.

TxO was essentially saying: what if we actually expanded the funnel? What if we looked at more founders, even if each individual founder had a lower probability of success? Would the power law still allow us to find the mega-successful companies, but now with a larger sample to draw from?

The answer appears to be yes. TxO found successful founders. But the business case for continuing to do this seems, to a16z, to be marginal relative to the operational costs and political friction.

This has broader implications. It suggests that in harder business environments, venture capital naturally defaults to narrower filtering and more homogeneous founder populations. That's not because VCs are discriminatory. It's because narrow filtering is economically efficient when capital is expensive and you need higher returns.

The political question is whether that natural efficiency is acceptable. That's genuinely a values question that different people will answer differently.

Estimated data suggests that while legitimacy remains high, support infrastructure and investor strategy have been moderately impacted by the TxO fund pause.

What A16z's Retreat Means for Underserved Founders

One of the uncomfortable realities of TxO's pause is its implications for underserved founder populations.

A16z is a major player in venture capital. When the firm deprioritizes serving certain founder populations, it has ripple effects across the ecosystem. Other firms follow what the top firms do. When a16z paused TxO, it sent a signal: maybe diversity-focused venture investing isn't as important as we thought. Other firms took that signal seriously.

For underserved founders, this means:

Reduced access to top-tier capital: The funds that explicitly serve underserved founders are shrinking or disappearing. This doesn't mean capital has dried up entirely, but the capital available specifically through funds focused on underserved founders has become scarcer.

Reversion to founder networks: As dedicated programs disappear, capital allocation reverts to relationship-based networks. These networks tend to be more homogeneous. So indirectly, the pause of programs like TxO makes it harder for founders outside traditional networks to raise capital.

Legitimacy effects: Even for underserved founders who can raise capital, they're less likely to have a tier-one venture firm backing them. This affects customer adoption, employee recruitment, and future fundraising. The legitimacy signal of a16z backing is harder to replicate from smaller, less established firms.

Geographic concentration: TxO was explicit about working in geographies outside Silicon Valley. With the program paused, venture capital capital continues to concentrate in traditional tech hubs.

None of this is inevitable. Different venture firms could respond differently to the same pressures that led a16z to pause TxO. Some firms are actually doubling down on founder diversity work, seeing it as a market opportunity precisely because others are retreating. But the overall trend is clearly in the direction of less explicit focus on underserved founder populations.

The Role of Mission Creep and Scope Expansion

One factor that's rarely discussed in analyses of TxO is whether the program expanded too far, too fast.

When TxO launched in 2020, it was focused on identifying and funding underserved founders. That was a clear mandate. But over time, the program expanded. It launched a grant program for nonprofits. It built programming and events. It developed infrastructure for founder support. It became increasingly complex.

This scope expansion might have contributed to its vulnerability. When you're running a program with multiple components (funding, grants, programming, events), each component has its own costs and stakeholders. If funding has to be cut due to external pressure, you can't just cut the mission-core fund—you have to cut all the parts. But that creates more disruption and is more obviously a "failure" of the program.

Compare this to a simpler mandate: we find founders outside traditional networks and write checks. If that program had to be paused, it's lower friction.

This is a broader lesson for mission-driven initiatives: scope expansion and infrastructure growth can increase vulnerability. The most durable programs are often the ones that stay tightly focused on a core mandate rather than expanding to multiple initiatives.

Alternative Structures and Future Models

One question is whether TxO's model was the only way to serve underserved founder populations, or whether other structural approaches might be more durable.

Some possibilities:

Founder networks as core business: Rather than a separate fund, what if a16z organized part of its core business around identifying founders outside traditional networks? If it was embedded in the core model rather than as a separate program, it would be harder to pause.

LP-level structure: What if a16z had structured TxO to be more directly responsive to LP values? If TxO had been framed as a separate offering for LPs specifically interested in diverse founder investing, it would have had its own capital base and institutional support.

Regional focus models: What if instead of a centralized TxO program, a16z had regional teams focused on founder development in specific geographies? This would have been less visible and less politically fraught than a centralized "diversity" program.

Decentralized partner ownership: What if instead of being led by a single partner (Ampadu), the work around underserved founders had been distributed across multiple partners' incentives? This would have created broader institutional ownership.

None of these alternatives are obvious improvements. TxO's model had real advantages. But the fact that the current model proved vulnerable suggests that different structural approaches might have been more durable.

The Question of Values vs. Economics

Ultimately, TxO's pause raises a fundamental question about whether venture capital can pursue values that conflict with short-term economic efficiency.

The case for TxO was always partly economic (diverse founders have good returns) and partly values-based (venture capital should serve underserved populations). When times are good, these arguments align. Doing the right thing is also profitable.

But when times are hard and capital is expensive, these arguments diverge. Serving underserved founders is still the right thing to do, but it might be less profitable in the short term. In that scenario, what wins?

The answer from a16z's behavior is clear: short-term economics wins. When it got hard, when it got politically fraught, when returns were under scrutiny, the values argument proved insufficient.

This is sobering if you believe that venture capital should serve a broader mission than just maximizing returns for LPs. It suggests that values-driven missions in for-profit organizations are fundamentally vulnerable to economic pressure.

There are counter-examples. Some venture firms have maintained diversity programs even in harder times. But they're exceptions. The broader pattern is clear: when capital is tight and scrutiny is high, values-driven programs get paused.

The Political Economy of Venture Capital

One element that's often underexplored is the political economy of how venture capital relates to broader political and social movements.

In the 2015-2023 period, diversity and inclusion were politically neutral (actually, positively valenced) in venture capital. Supporting founders from underrepresented backgrounds was just good business.

But around 2023-2024, this shifted. Diversity became politically charged. Opposition to diversity initiatives became a major organizing focus for a significant political movement.

For venture capitalists, this created new costs. If you're explicitly focused on diverse founder investing, you're now on a political side in a way you weren't before. Some VCs decided those political costs were worth it. Others decided they weren't.

A16z made the latter choice. Rather than doubling down on TxO and defending it against political criticism, the firm chose to pause it and, effectively, exit the political fight.

This decision has costs. It means a16z is no longer a champion of founder diversity. It means the firm is aligned with a political movement that's actively hostile to these initiatives. But it also reduces political friction and allows the firm to focus on more politically neutral work.

The broader implication is clear: venture capital's diversity work is now politically contested. Funds and programs that want to continue will need to do so in the knowledge that they're fighting a political headwind. That's a new condition that didn't exist in 2023.

What Ampadu's Next Chapter Might Be

Ampadu's departure from a16z leaves the question: what's next?

There are several paths he might take:

Starting his own fund: Ampadu could raise his own fund focused on underserved founders. He has the experience, the track record, and the relationships. The challenge is capital. Raising a diversity-focused fund in 2025 is politically harder than it was in 2020. He'd be swimming against the current.

Operating/founding: Ampadu could go back to operating, joining or starting a company. This would allow him to step back from the political friction of diversity investing and just build something.

Nonprofit/philanthropic: Ampadu could move to the nonprofit or philanthropic sector, continuing the work of supporting diverse founders but outside the for-profit venture model. This would provide more insulation from market pressures, though less capital to deploy.

Another venture firm: Ampadu could join another venture firm, either in a diversity-focused role or in a more traditional partnership. Some firms are expanding diversity efforts specifically because others are retreating, seeing it as differentiation.

Whatever path Ampadu takes, his departure from a16z is unlikely to be the last we hear of him. He clearly cares deeply about the work of supporting underserved founders. He just apparently decided he can't do that work at a16z anymore.

The Broader Lesson for Mission-Driven Organizations

If there's a universal lesson from TxO's rise and fall, it applies to any organization trying to pursue values that might conflict with short-term efficiency:

Values-driven initiatives require either (1) deep structural embedding, (2) independent capital, or (3) powerful external constituency support. Without at least one of these three, values-driven work is vulnerable to being paused when times get hard or pressure increases.

TxO had some structural embedding—there were staff and processes dedicated to it. But it wasn't deeply embedded in core a16z business models. It had reasonably independent capital through the donor-advised fund model, but that independence proved fragile when institutional pressure increased. And it had external constituency support, but that support turned out to be political rather than durable, and when political winds shifted, the support evaporated.

This isn't unique to TxO. It's a general pattern: organizations pursuing missions that don't directly maximize short-term returns are vulnerable. This is true in philanthropy, nonprofits, and even some for-profits.

The implication is that if you care about long-term mission durability, you need to think carefully about structural embedding and capital independence. You can't rely on external political support or on the goodwill of leadership that might change.

FAQ

What was the TxO program?

Talent x Opportunity (TxO) was a venture capital fund and program launched by a16z in 2020 with the goal of identifying and supporting founders outside traditional venture networks. The program raised a $100 million fund, established grants for nonprofits supporting diverse founders, and built programming and networking infrastructure. It was led by Kofi Ampadu from 2021 until the program was paused in November 2024.

Why did a16z pause TxO?

A16z paused TxO in November 2024, citing a need to "reassess." While the firm hasn't provided detailed explanations, industry observers cite multiple factors: political pressure against diversity initiatives, scrutiny of venture returns, institutional investor preferences for "merit-based" approaches, and the structural fragility of the program's donor-advised fund model. The pause came alongside significant staff layoffs in the program.

What does Ampadu's departure mean for the future of the TxO program?

Ampadu's January 2025 departure strongly suggests that TxO is unlikely to restart. When the partner who led a program for four years leaves immediately after it's paused, it typically indicates the firm is no longer committed to restarting it. If TxO were expected to restart, Ampadu would likely have stayed in some capacity to lead that restart. His exit signals the end of the program.

What happened to TxO portfolio companies?

TxO portfolio companies retain a16z backing and access to the broader a16z network, but the dedicated support infrastructure that existed while TxO was operating is largely gone. Staff who worked directly with TxO companies were laid off. However, companies still benefit from the legitimacy of a16z investment and can access the firm's broader resources through traditional a16z partners.

Is venture capital moving away from diversity funding?

Yes. Across 2024 and into 2025, numerous venture firms have paused, restructured, or eliminated diversity-focused programs. This includes major firms like Lightspeed Venture Partners and Sequoia Capital. The trend reflects political pressure, institutional investor preferences, and economic scrutiny of venture programs, though some firms are actually expanding diversity work as others retreat.

What makes founder diversity economically important in venture?

Founders from underrepresented backgrounds face structural barriers to fundraising that aren't correlated with ability, creating a market inefficiency. Academic research suggests diverse founding teams perform 10-15% better on average than homogeneous teams. However, this advantage is marginal relative to venture's power law distribution, where the top 1% of companies generate most returns. This means the economic case for diversity is real but not overwhelming, making diversity programs vulnerable when other pressures increase.

What structural changes might have made TxO more durable?

Several structural changes could have made TxO more resilient: embedding diverse founder sourcing into a16z's core business model rather than as a separate program, building dedicated funding from multiple partners rather than a single leader, creating an independent fund structure less vulnerable to institutional donor pressure, or decentralizing the work geographically. Programs that depend on dedicated staff, centralized leadership, or fragile capital structures are inherently more vulnerable to pauses or termination.

How does TxO's pause affect underserved founders?

The pause reduces direct access to tier-one venture capital for underserved founders. It signals to the broader venture ecosystem that diversity-focused investing might not be a priority, potentially reducing allocation across the industry. It also concentrates venture capital more heavily in traditional networks and geographies. However, some venture firms are expanding diversity work in response to others retreating, creating new opportunities in specific firms.

Is founder diversity a values issue or an economics issue?

TxO was explicitly framed as both: supporting diverse founders is both the right thing to do and economically efficient. But when times get hard and scrutiny increases, these arguments diverge. The economics of diversity programs are real but marginal relative to venture's power law distribution, making them vulnerable when values and economics conflict. TxO's pause suggests that when pushed, at least some venture firms prioritize short-term economics over values.

What could replace TxO's model for supporting diverse founders?

Several models could serve similar functions: nonprofit organizations providing early-stage capital and support (less subject to market pressures), founder networks built by entrepreneurs themselves, alternative capital structures like rolling funds, or venture firms that embed diversity-focused sourcing into their core model rather than separate programs. The broader lesson is that values-driven ventures need either deep structural embedding, independent capital, or durable institutional support to survive periods of pressure.

The Path Forward

Kofi Ampadu's departure from a16z represents more than a single partner leaving a venture firm. It's a visible manifestation of a broader reorientation in venture capital, where explicit commitments to serving underserved founders are being reassessed and, in many cases, deprioritized.

This doesn't mean founder diversity is dead in venture capital. It means that the era of diversity as a politically neutral, institutionally supported venture priority is over. Going forward, supporting diverse founders will require explicitly choosing to do so against headwinds rather than with tailwinds.

Some venture firms will make that choice. They'll see the retreat of competitors as an opportunity to differentiate. They'll argue that diverse founder networks are genuine market inefficiencies that others are leaving on the table. They might be right.

But the dominant pattern is clear: venture capital, when faced with economic pressure and political headwinds, defaults to narrower founder sourcing. This is economically efficient and politically neutral. It just happens to concentrate capital in ways that advantage founders from dominant backgrounds.

For underserved founders, Ampadu's departure is a reminder that venture capital institutions, even those with leaders and structures explicitly focused on inclusion, are vulnerable to broader economic and political pressures. Building sustainable support for diverse founders likely requires thinking beyond venture capital—toward nonprofit models, alternative capital structures, and founder-to-founder networks that are less subject to market and political pressures.

Ampadu's email to a16z staff is graceful and reflective. But the reality it represents is less graceful: the venture industry's reckoning with founder diversity turned out to be shallower and more fragile than many believed. The next chapter will involve reckoning with that reality and building structures that can withstand pressure when values and economics diverge.

Key Takeaways

- Kofi Ampadu's departure from a16z signals the end of TxO, a $100M diversity-focused venture program that operated for four years

- Venture capital's retreat from diversity initiatives accelerated dramatically in 2024-2025 due to political pressure, institutional investor preferences, and economic scrutiny

- TxO's pause demonstrates how values-driven initiatives without deep structural embedding are vulnerable to short-term economic and political pressures

- The economics of diversity programs are real but marginal, making them easy targets when capital is expensive and returns are under pressure

- Multiple venture firms have now eliminated or significantly scaled back diversity initiatives, signaling an industry-wide shift away from explicit diversity commitments

Related Articles

- Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]

- TechCrunch Disrupt 2026: Your Complete Guide to Early Bird Deals & Networking [2025]

- Warren Demands OpenAI Bailout Guarantee: What's Really at Stake [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Once Upon a Farm IPO 2025: What Investors Need to Know [2025]

- Why Allbirds Closing Stores Signals Tech Culture's Biggest Shift [2025]

![Kofi Ampadu Leaves a16z: What TxO's Collapse Means for Founder Diversity [2025]](https://tryrunable.com/blog/kofi-ampadu-leaves-a16z-what-txo-s-collapse-means-for-founde/image-1-1769823429962.png)