How Student Startup Accelerators Are Changing the Funding Game

Here's a reality that doesn't get enough attention: Some of the brightest entrepreneurial minds in America are sitting in dorm rooms right now with ideas that could change industries, but they're broke. They're building in coffee shops between lectures, debugging code at 2 AM before exams, and reaching out to every angel investor they know—which, if you're a 19-year-old from Iowa, might be nobody.

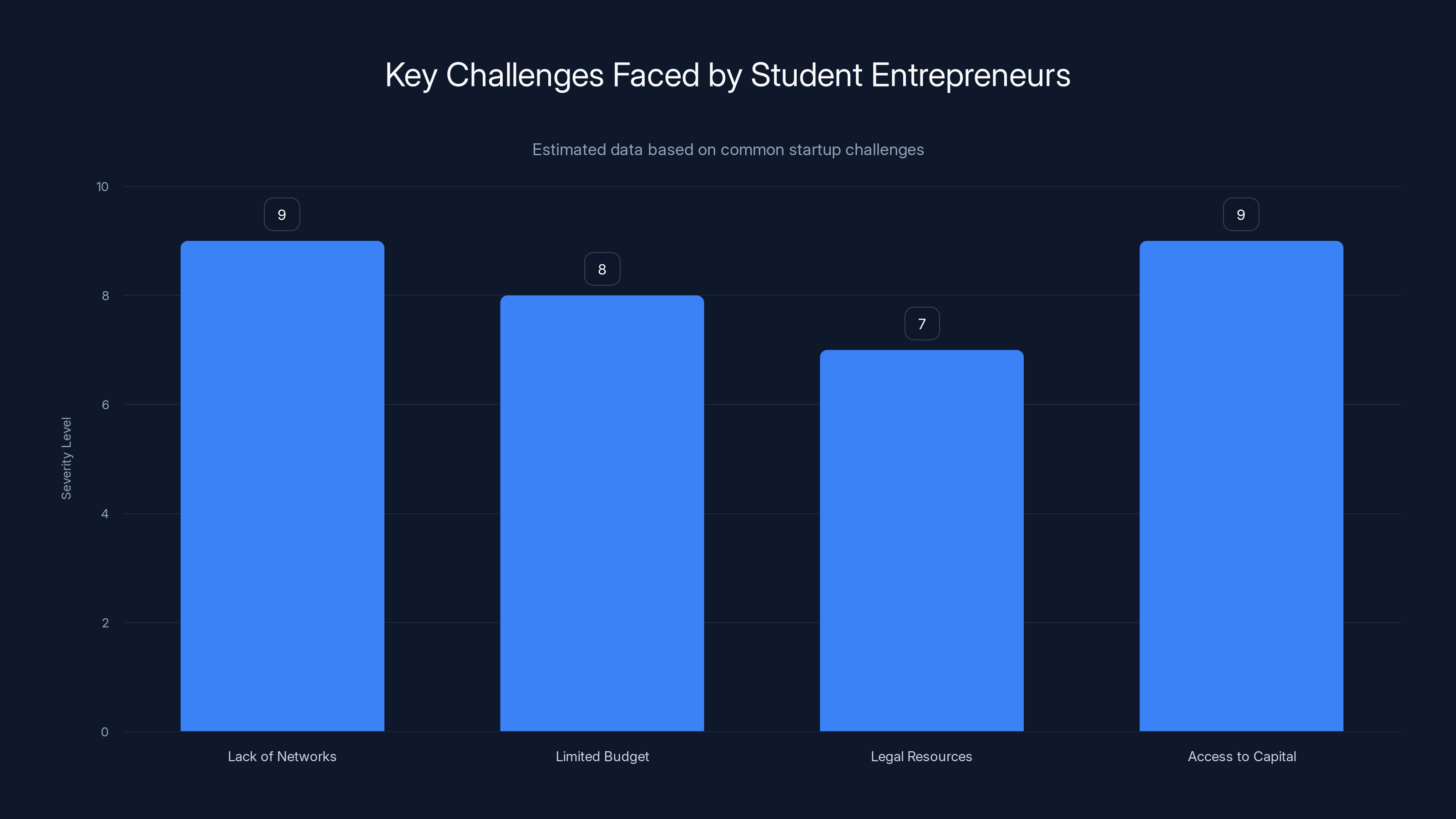

This isn't a new problem. For decades, student founders have faced an almost mythical barrier to entry in the startup world. They lack the networks. They don't have the operating budget to survive the first three months. They can't afford fancy legal help or access to enterprise computing resources. Most importantly, they're competing for the same venture capital as thirty-year-olds with seven exits under their belt.

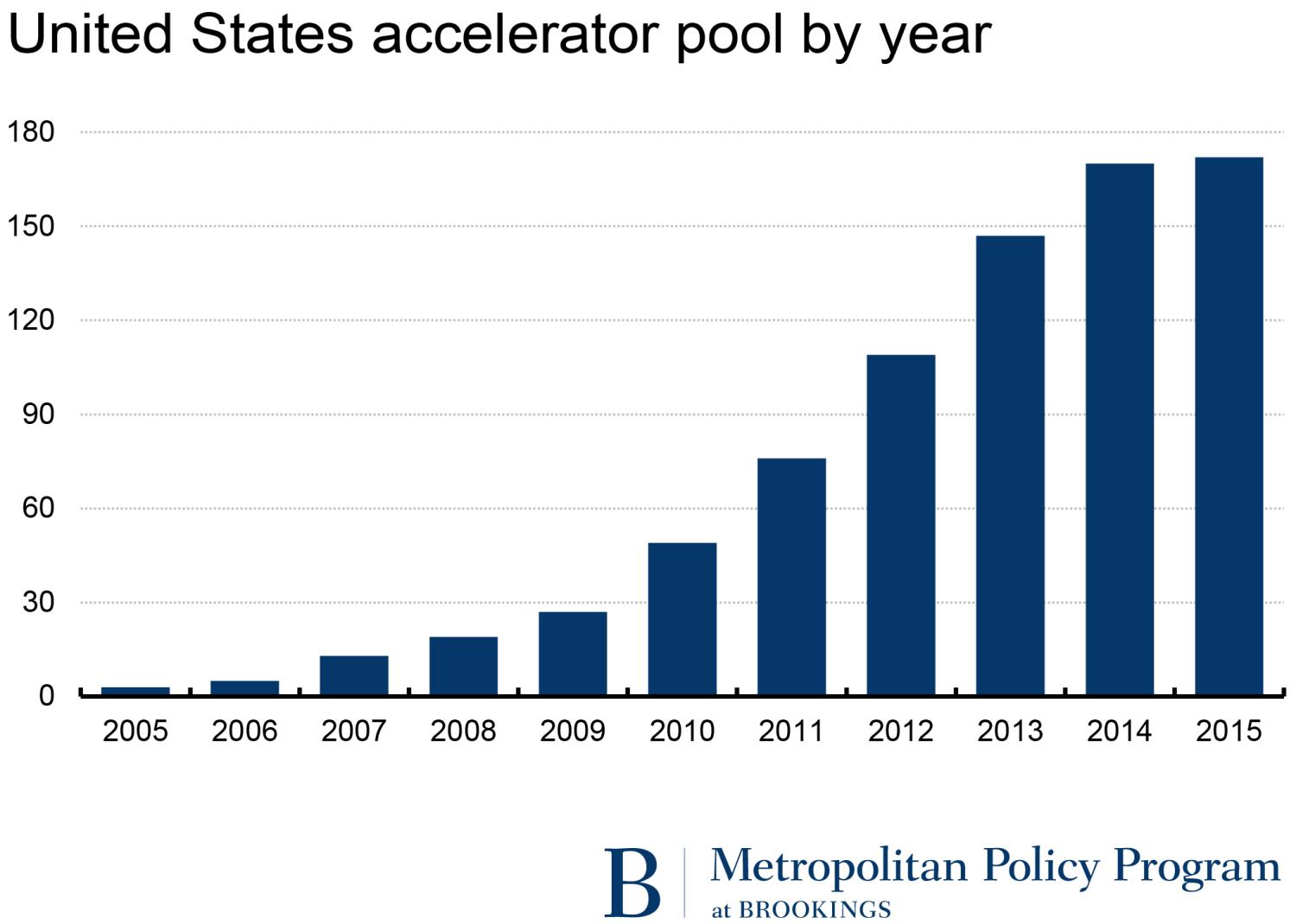

That's why when two Stanford students named Roman Scott and Itbaan Nafi raised $2 million to launch Breakthrough Ventures, something meaningful actually happened. This isn't just another accelerator program tacked onto a university's ecosystem. This is a deliberate attempt to create an entirely different pathway for student entrepreneurs—one that acknowledges their unique constraints and builds a program around solving them.

The startup accelerator space is crowded. TechCrunch covers new accelerators launching constantly. But most of them target seasoned founders with existing traction. Breakthrough is explicitly built "for student founders by student founders," which sounds like marketing language until you realize what that actually means operationally. It means the program designers understand late-night debugging sessions because they're having them too. It means they know that a student's definition of success might include graduating without debt. It means they've built something that works with student schedules, not against them.

The timing matters, too. We're in a weird moment in tech where everyone's talking about democratizing access to tools—whether that's AI, cloud computing, or capital. But the conversation often stops at founders who already have six figures in the bank. Breakthrough is taking that democratization argument and pointing it backward, to the people who need it most. People who haven't had a chance yet.

What makes this story worth paying attention to isn't just the $2 million. It's what that money represents: a structural acknowledgment that the existing accelerator ecosystem has a massive blind spot. And it's worth understanding what Breakthrough is actually doing differently, because the model they're building might be the template other universities copy over the next few years.

The Funding Gap That Nobody Wanted to Acknowledge

Let's establish something first: Student founders don't lack talent. They lack capital. There's a specific reason for that distinction.

When a typical VC thinks about pre-seed funding, they're looking for founders who can demonstrate traction. A product with users. Revenue, ideally. Some indicator that the market wants what they're building. But here's the problem with that framework when applied to college students: Traction requires capital to achieve. You can't build a user base if you can't afford AWS. You can't hire engineers if you're paying back student loans. You can't afford to move to San Francisco (or keep living where you are) while you validate an idea.

This creates a circular dependency. You need capital to get traction, but investors want traction to give you capital. Student founders are trapped on the wrong side of that equation.

The data backs this up, though exact figures are hard to pin down since most student startups never make it into official funding databases. But anecdotally, venture capitalists spend almost no time reviewing student founder applications. Why? Because the filtering heuristic is simple: "If they were a real founder, they wouldn't be in school." That's not a formal policy anywhere, but it's the water that VCs swim in. It's baked into how the industry works.

The existing Stanford ecosystem actually proved this point accidentally. Scott and Nafi started hosting Demo Days at Stanford back in 2024, basically as an experiment. They brought together students who were working on early-stage projects. What happened next surprised nobody in retrospect but apparently surprised the university: Students crushed it. They had momentum. They had solid ideas. They had energy that reads as authenticity in a room full of professional pitches.

Students from other universities noticed. They wanted in. The program grew. And suddenly the co-founders realized they were sitting on something that could scale beyond one campus.

That's when the fundraising began. They approached investors who "get it"—firms like Mayfair and Collide Capital. But they also went to Stanford founder alumni. This is smart. You're pitching to people who remember being in exactly this position, who remember the frustration of waiting three years before someone would take their idea seriously.

$2 million from that kind of pool isn't random. It's validation that the funding gap is real, that it matters, and that the model to close it is worth betting on.

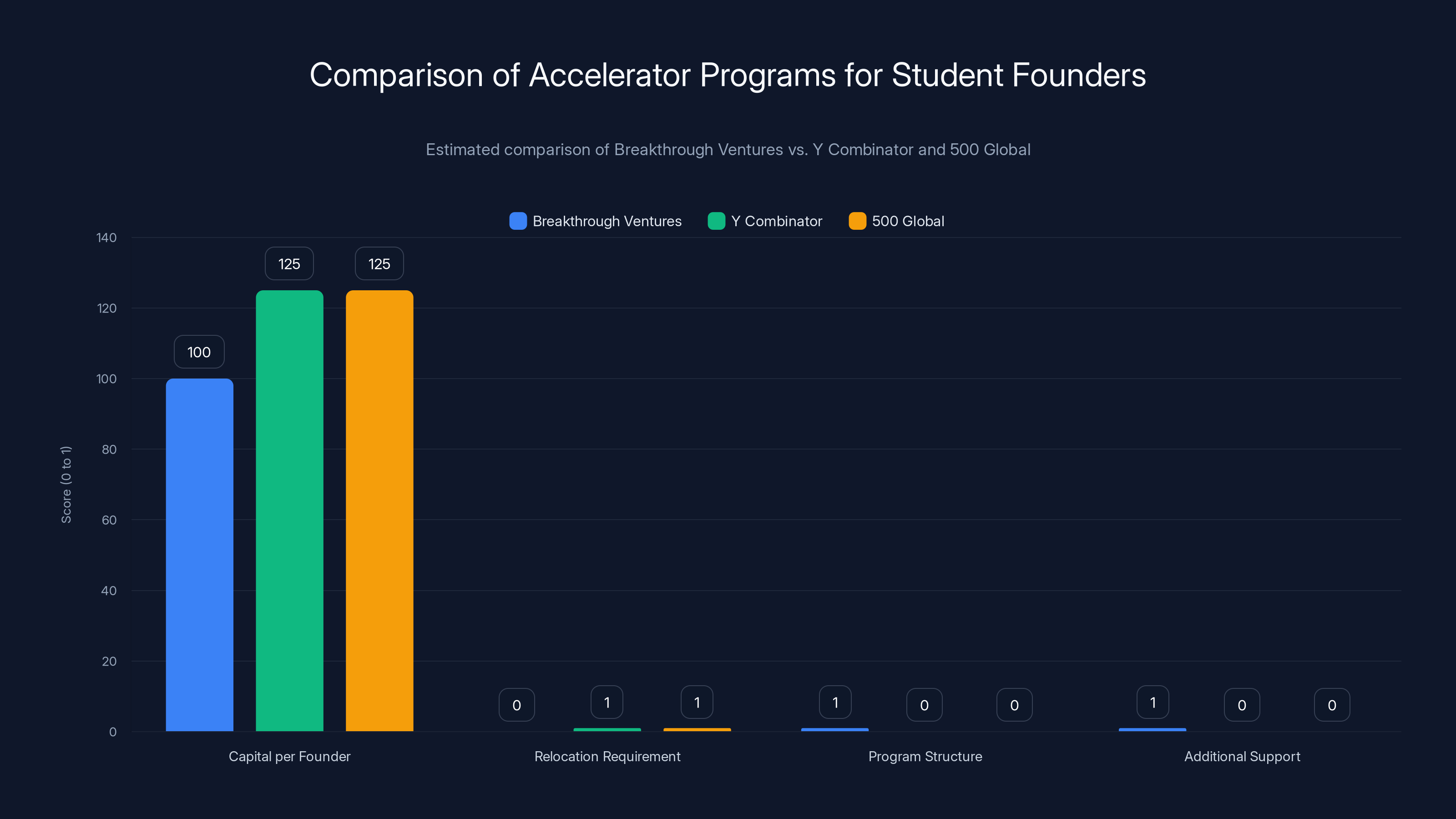

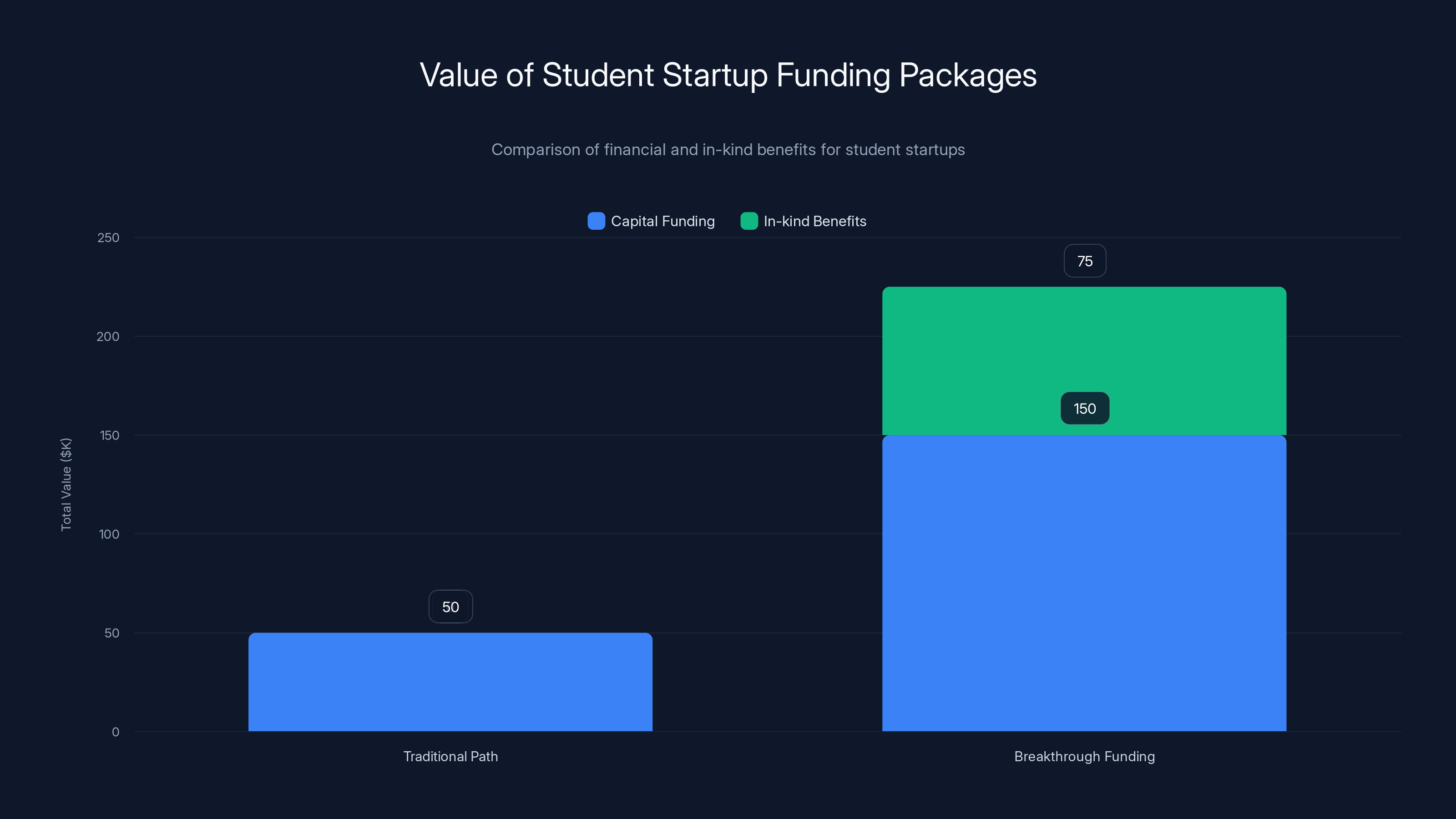

Breakthrough Ventures provides significant capital without relocation, tailored for student founders, unlike Y Combinator and 500 Global. Estimated data.

Understanding the Breakthrough Model: What They're Actually Building

Let's talk specifics, because this is where the program gets interesting. Breakthrough isn't a traditional accelerator in the sense that you probably understand the term.

When you think of accelerators, you think of Y Combinator: Founders move to the Bay Area for three months, work intensively on their company, take a small amount of capital (typically $125K), and participate in a demo day where they pitch to hundreds of investors. It's a sprint. It's compressed. It's designed to create momentum fast.

Breakthrough is taking a different approach. They're running what they call a "hybrid model." This means in-person meetups at major VC firms in different cities, culminating in a Demo Day at Stanford. So instead of asking student founders to abandon their lives for three months, Breakthrough comes to them. Or rather, it meets them halfway.

Here's what that actually means for a student founder in, say, Austin or Chicago or Boston: You apply to the program. You get access to the network. You get connected with mentors (and they're not generic startup mentors—they're people like Tekedra Mawakana, Waymo's CEO, who's specifically participating). You get compute credits through Microsoft and the Nvidia Inception program. You get legal support, which for a college student is absolutely critical and often prohibitively expensive.

And here's the funding structure: You get up to

Let's do the math on what this means. A solo founder working on an idea gets

Compare that to the typical pre-seed environment where founders are scrounging for $50K total from angel investors, and you start to see why this matters.

Student Startup Culture vs. Traditional Startup Culture

Here's something that gets overlooked in most discussions about startup accelerators: The environment you're accelerating in matters as much as the capital you're getting.

In traditional startup accelerators, you're surrounded by professional operators. People who've already quit their jobs. People who've taken the leap. That creates a very specific psychological environment. There's a particular flavor of confidence mixed with desperation. Everyone has skin in the game. Everyone has rent to pay. Everyone is operating from a mindset of "this has to work."

Student founders are operating from a different baseline. You have a backup option: Finish your degree. Go get a normal job. This isn't a life-or-death situation in the way it is for a 28-year-old who quit their Facebook job to start a company. And that actually might be healthy. It might reduce the pressure to cut corners, to oversell, to make unwise decisions because failure means homelessness.

But there's a culture gap. Students might feel isolated in a room of professional founders. They might feel like they don't belong. Or they might be competing for attention and resources from people who are more experienced, more credentialed, more "legitimate."

Breakthrough specifically designed their program to eliminate that friction. By bringing together other student founders, by creating a program structure that's purpose-built for students, they're creating an environment where you don't have to apologize for being in school. Where people understand that your constraints are different.

This is the "by student founders for student founders" thing in practice. It's not just messaging. It's structural.

Nafi said something revealing in an interview: "We've nailed the student-founder experience to a T. Hence why we offer the resources we do and have structured the program in this way. Students really feel like we get them, and that's because we are students."

That's not false modesty. That's product thinking. You build better for your end user when you are your end user.

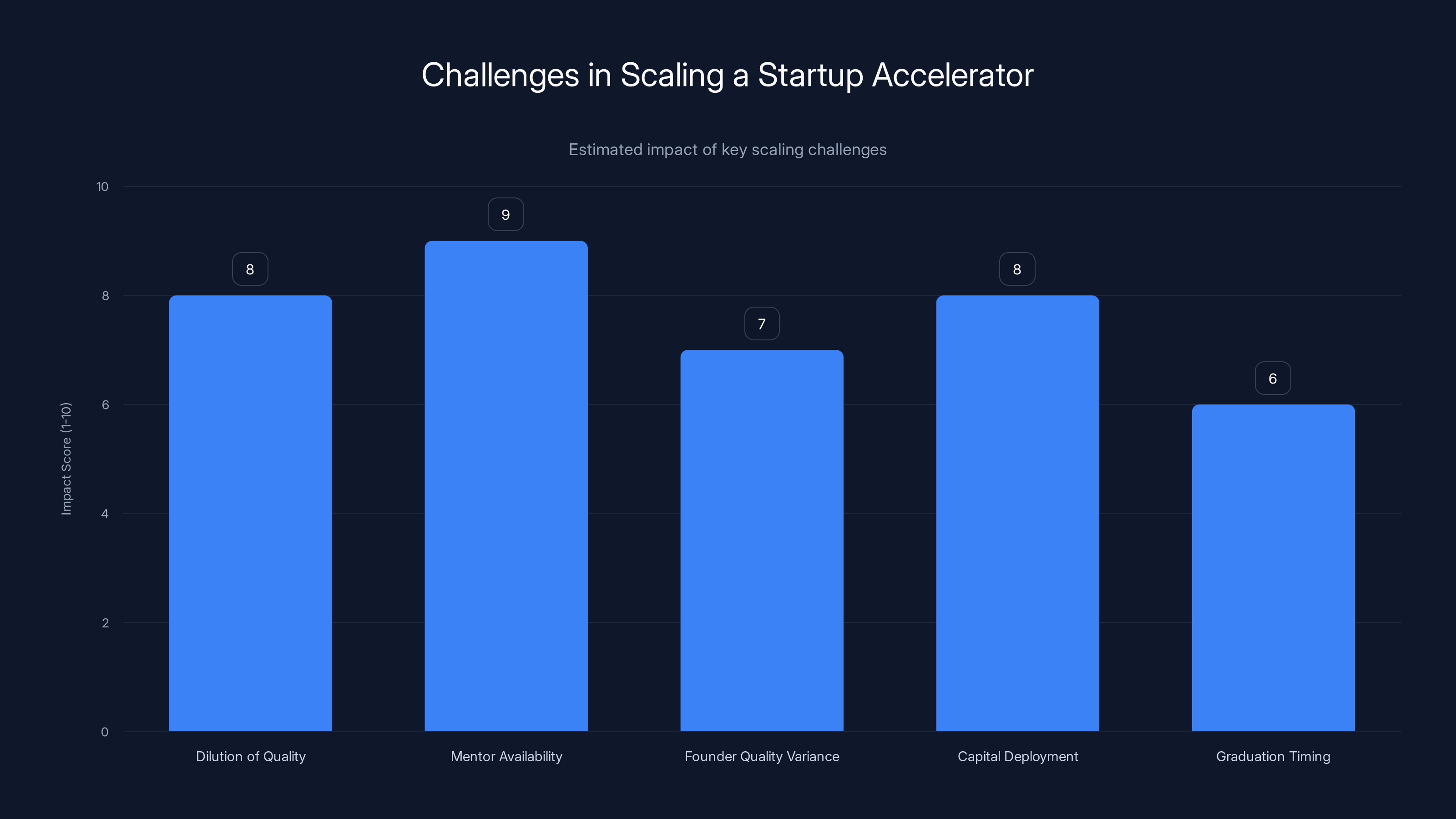

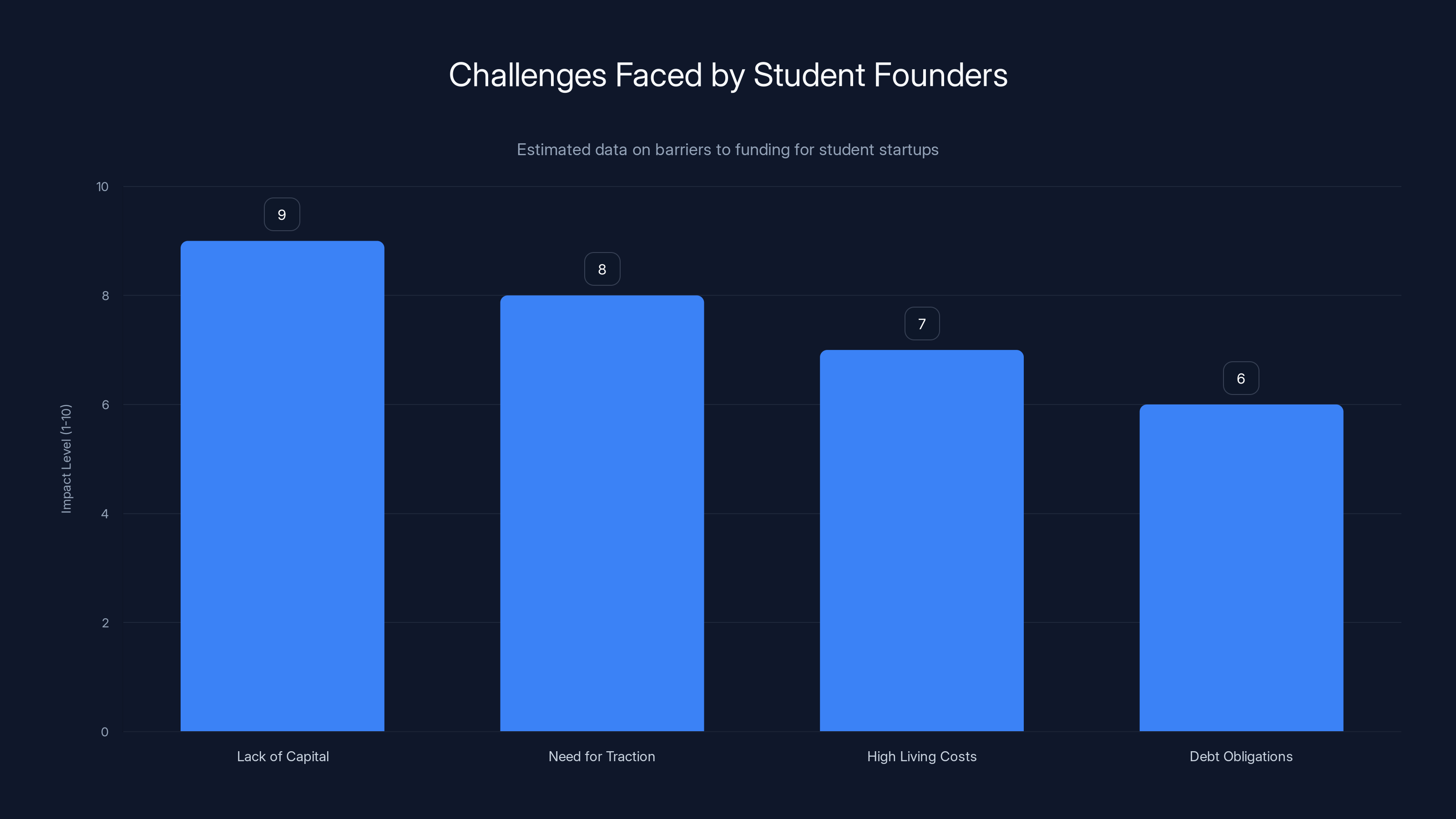

Student entrepreneurs face significant challenges, primarily in networking and accessing capital, with severity levels estimated to be 8 or higher.

Competitive Landscape: Other University Accelerators

Breakthrough is launching into a space that already has players. This isn't a virgin market. But it's also not saturated.

Let's look at what exists:

Free Ventures at UC Berkeley: This is probably the closest analog to Breakthrough. Free Ventures provides pre-seed funding specifically for Berkeley students. They've been doing this for a few years. They're focused on seed-stage companies and provide connections to mentors and investors. They have less capital per company than Breakthrough and a smaller overall fund, but they've built something legitimate. The model proves student accelerators can work at scale.

MIT Sandbox Innovation Fund: MIT's version is more focused on innovation and R&D than pure venture founding. They're looking for moonshots, deep tech, the kind of stuff that might not have a clear commercial path but has massive impact potential. It's a different positioning than Breakthrough. They're looking for PhD students and researchers as often as they're looking for traditional founders.

Stanford Start X: This one is interesting because it's based at Breakthrough's home campus. Start X is more of a network and alumni group than a traditional accelerator. It provides mentorship and connections but doesn't provide as much direct capital. It's been around longer and has a strong reputation among startup insiders.

Launch Pad: Also at Stanford, focused on helping students turn research and IP into companies. Again, more research-focused than market-focused.

Cardinal Ventures: Stanford's venture fund, but focused more on faculty research and graduate student projects.

Here's what stands out about Breakthrough: They're explicitly nationwide. Most university accelerators are siloed to their campus or their region. Berkeley's Free Ventures is for Berkeley students. MIT's sandbox is for MIT people. Stanford's programs are for Stanford. Breakthrough looked at that and said, "What if we connected the best student founders from everywhere?" That's different.

They're also significantly better capitalized than most student accelerator programs. $2 million means they can fund somewhere between 20 and 100 companies depending on check size. That's a meaningful number.

The Economics of Student Startup Funding

Let's talk money in a more systematic way, because the funding economics here are actually interesting.

A typical angel investor writes checks for

On a $50K seed round, you've got six to ten months of runway. Not great, but workable for validation.

Breakthrough is giving students

Compare that to the traditional path: Founder bootstraps, works part-time, saves money, finally scrapes together

The time value of accelerating matters. Getting

There's also the non-capital benefits. Compute credits through Microsoft Azure and Nvidia are actually substantial. If you're building an AI company, those credits could be worth

So the total value of the package is probably

Why Now? The Broader Context of Student Entrepreneurship

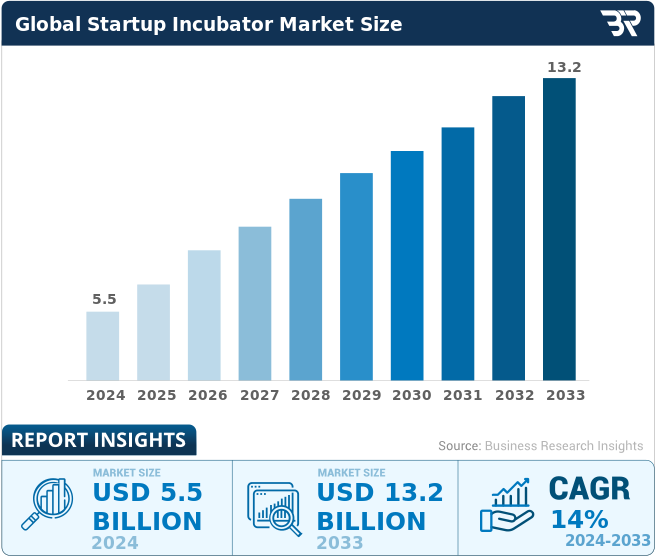

Breakthrough didn't launch in a vacuum. They launched into a very specific moment in the startup ecosystem.

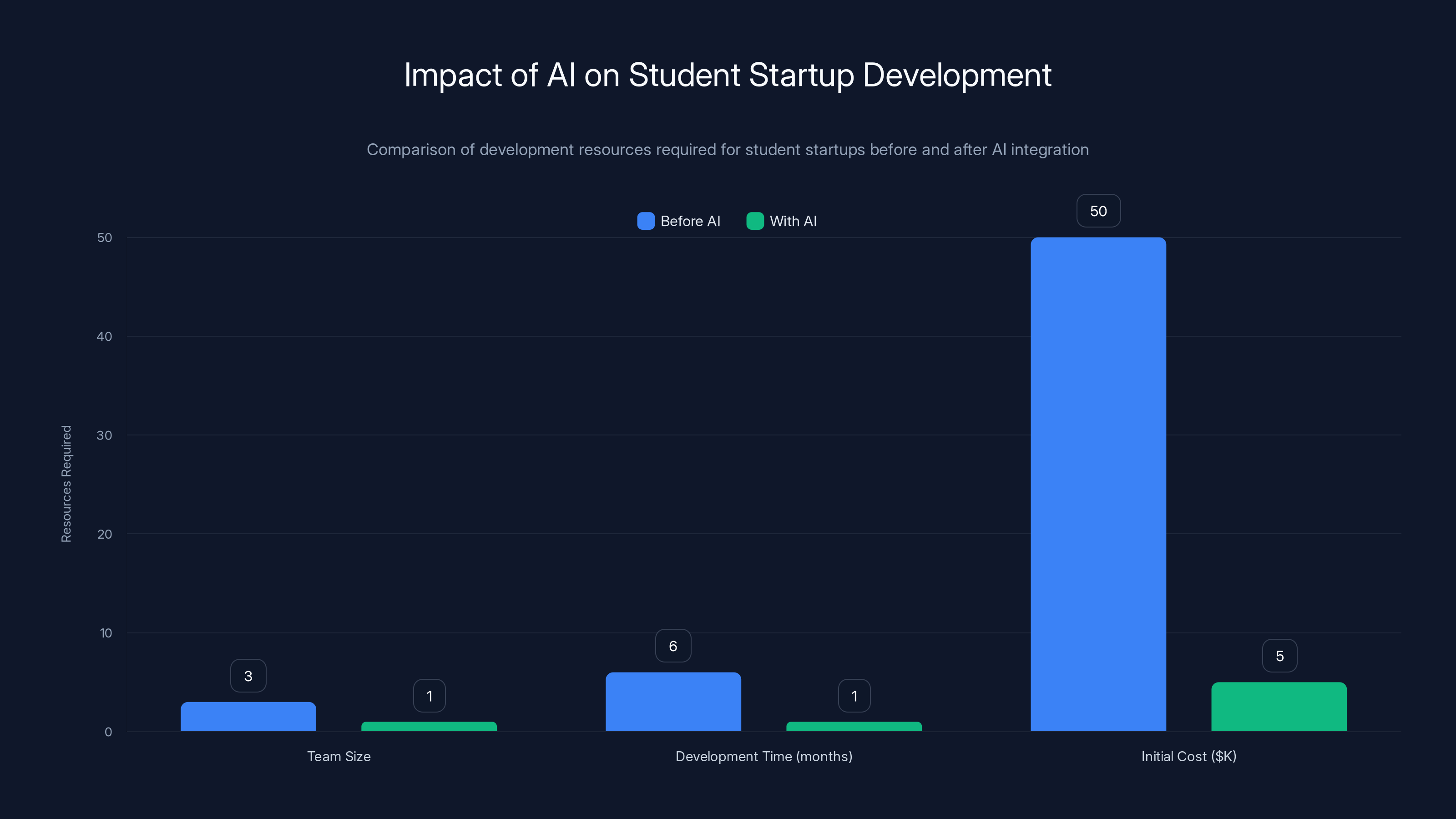

First, there's the AI moment. Suddenly, a student with coding skills can build applications that would have required a team of engineers five years ago. The barrier to entry for certain types of startups has collapsed. A smart CS student can build a meaningful product alone. That changes everything about student founder viability.

Second, there's economic anxiety. Nafi explicitly mentioned this: "We hope to uplift as many stories as possible to inspire many more across the world to pursue entrepreneurship not only to change their communities, but also gain economic stability for themselves and their families." Translation: Young people are worried about their futures. Employment is uncertain. Student debt is crushing. Entrepreneurship looks appealing not as a moonshot but as a practical path to economic security.

Third, there's a recognition that the traditional VC pathway has exclusionary elements. It's hard to break in if you're from the wrong zip code, went to the wrong school, or don't have existing connections. Student accelerators are one attempted solution to that: Level the playing field by catching people early, before the compounding effects of inequality lock them out.

Fourth, there's proven product-market fit for the model. Free Ventures at Berkeley isn't hypothetical. They've funded companies. Some are working. Some aren't. But the model is validated. Breakthrough is betting that they can run the same playbook at scale and across more universities.

Fifth, there's founder talent at universities that's being overlooked. How many Facebook-sized companies have started in dorm rooms and never made it past the dorm room stage simply because the founders didn't know how to fundraise, didn't have legal help, didn't have access to computing resources? That's just waste from a societal perspective.

The timing is right. The need is real. The model is proven. The capital is available. That's why Breakthrough happened now.

Breakthrough funding offers significantly higher value, combining

Mentorship and Network Effects

Let's talk about the mentorship component, because it's actually the thing that might matter more than the capital.

Money you can replace. You can bootstrap. You can hustle for angel funding. You can get a part-time job to fund your startup (it's slower, but it's possible). Mentorship from the right person at the right time? You can't replace that. You can't buy it directly. You can only access it if you know the right people.

Breakthrough is bringing in mentors like Tekedra Mawakana, Waymo's CEO. That's not a random impressive name. Waymo is one of the most technically ambitious autonomous vehicle companies in the world. Mawakana has been through scaling challenges that most founders will never face. What she knows about operations, about managing through uncertainty, about building durable teams—that's incredibly valuable.

But it's also selective. She's going to work with maybe a handful of companies through Breakthrough. How do they choose which ones? Probably the ones that most clearly need her specific expertise and have the best chance of actually listening to it.

This is network effects at work. By assembling a strong cohort of student founders, Breakthrough makes it attractive for high-quality mentors to participate. Those mentors improve the founders. The improved founders raise more capital and build better companies. Success stories attract more mentors. The cycle compounds.

Free Ventures works the same way. They've got established connections at Berkeley and in the Bay Area startup ecosystem. Quality mentors show up because they trust the filtering. They've seen companies graduate from the program and succeed.

Breakthrough is trying to build that trust at scale across multiple universities. It's harder. But if they pull it off, the returns are higher.

Compute Credits and Infrastructure Access

Here's something that gets overlooked when people discuss startup funding: Software companies have changed. Ten years ago, if you were building a software company, your cost structure was mostly people. People to code, people to sell, people to support customers. Infrastructure was cheap relative to headcount.

Now? If you're building an AI company, or a data processing company, or anything that needs serious compute resources, infrastructure costs can be massive. Training models on GPUs is expensive. Running inference at scale on good hardware is expensive. You can't really get around it if that's your business model.

Microsoft Azure and Nvidia providing credits means student founders aren't blocked by this. They can actually afford to experiment. They can run experiments that would cost thousands of dollars. They can iterate on ML models without that being a limiting factor.

This is probably more important than people realize. It's the difference between "I have an idea for an AI company" and "I can actually build an AI company." The infrastructure access makes it real.

And there's a business logic here too. Microsoft and Nvidia benefit from student founders succeeding. If 20% of Breakthrough's portfolio companies grow into meaningful businesses, and most of them are still using Azure or Nvidia hardware, then those credits created long-term revenue. It's a smart investment for them even if many companies fail.

The Waymo credits are the same logic. Waymo benefits from early exposure to smart people working on problems related to autonomous vehicles, robotics, and perception systems. They're essentially getting first look at early-stage founder talent.

The Demo Day Strategy and Investor Connections

Breakthrough is culminating their program with a Demo Day at Stanford. That's deliberate.

Stanford's location matters. Silicon Valley is still, despite everything, where most venture capital is concentrated. By holding the Demo Day there, they're making it convenient for investors to show up. Travel is five minutes for Bay Area VCs, not an expensive flight.

But Stanford itself is also a signal. Stanford-branded events have weight in venture capital. Investors will show up partly because it's Stanford, partly because the Breakthrough brand is new and worth understanding.

The Demo Day format—which is standard across accelerators—works because it creates a forcing function. You're pitching to a room of investors simultaneously. It creates competitive pressure. It creates FOMO. "If I don't fund this company and my peer does, and it becomes the next thing, I look stupid."

For student founders, Demo Days are critical. They're the moment when the startup ecosystem pays attention. For most of these companies, it's the first time they're pitching to real investors in any formal setting. Some will likely raise follow-on rounds immediately after. Others will get traction signals but not funding, which is valuable information. Some will realize their idea doesn't resonate and pivot.

The Demo Day is also a networking moment. Founders meet each other. Mentors meet potential employees. Investors meet founders they don't fund but might partner with on other companies. It's a compressed social experience that normally takes years to accumulate.

Breakthrough is smart to build this into the program. It's the culmination. It's the moment the cohort becomes real.

Estimated data suggests mentor availability and capital deployment are the most critical challenges when scaling a startup accelerator.

Comparing to International Student Accelerators

Just for context, it's worth knowing that the US isn't the only country building accelerators for student founders. But we're ahead of most peers.

In the UK, there are programs like the Oxford Foundry and Cambridge Judge, which provide mentorship and space but less direct capital. In India, there are programs like E-Cell at various IITs, which are more about experience and networking than funding. In Europe, most countries have government-backed startup programs that include students, but they're typically more grant-focused than venture-focused.

The US model—venture capital from private investors betting on outcomes—is still the most aggressive. That's both good and bad. Good because it attracts capital and attention. Bad because it creates pressure to exit, to scale, to pursue venture-scale outcomes, which not every founder wants.

Breakthrough is building something that's specifically American in its approach: Private capital, outcome-oriented, network-rich, but with an explicit acknowledgment that student founders have different constraints.

This model is probably going to spread. We'll see imitations at other universities. We'll probably see regional versions. The fact that Breakthrough is nationwide suggests there's interest in aggregating talent from multiple schools rather than siloing it to single campuses.

Legal Structure and Founder Ownership

One thing I want to highlight that usually gets glossed over: The legal structure matters enormously for founders.

When you take a $100K grant, how is that structured? Is it a SAFE? Is it a convertible note? Is it an equity grant? Is it truly a grant with no strings attached? The answer completely changes the founder's situation.

Nafi mentioned that Breakthrough provides legal support. That's actually critical because incorporating a company, dealing with equity, handling vesting schedules, structuring a grant vs. an investment—these are complex things. Most 20-year-olds don't know how to navigate this. Having a lawyer help them understand their options is invaluable.

The best accelerators make sure you understand what you're agreeing to. The worst take advantage of founder naivety. Breakthrough's emphasis on legal support suggests they're thinking about this.

Also, the potential $50K follow-on investment: What are the terms? Are they SAFEs (Simple Agreements for Future Equity)? Are they priced rounds? The answer matters enormously for how much equity you're giving up. Transparent terms are a mark of a well-run accelerator.

How Student Founders Can Maximize Accelerator Value

If you're a student founder and you're considering Breakthrough or similar programs, here's what actually matters:

First: Use the compute credits aggressively. Don't be conservative. These are free. Experiment. Run the models you've been putting off. Test the infrastructure that seemed too expensive. Front-load the experimentation.

Second: Pick mentors strategically. You have limited time with high-quality mentors. Don't waste it on generic "how to pitch" advice. Focus mentorship on specific problems: How do I structure this technical decision? How do I think about this market opportunity? How do I handle this founder conflict?

Third: Use the cohort. The other founders in the program are potentially your best resource. Some will become co-founders on different projects. Some will become investors in each other's companies later. Some will just be smart people to stress-test ideas with. Treat them like gold.

Fourth: Understand the capital structure completely. Ask lawyers and experienced mentors about equity implications. Know exactly what you're giving away and what you're keeping.

Fifth: Be realistic about Demo Day. It's great marketing and a forcing function to finish building, but it's not the only way to raise capital. The relationships you build with mentors and other founders might matter more than the Demo Day pitch.

AI tools have significantly reduced the resources required for student startups, enabling solo founders to develop MVPs faster and cheaper. Estimated data based on typical startup requirements.

Scaling Challenges: How Breakthrough Could Fail

Let's be honest about the risks here. Scaling a startup accelerator is not trivial, and there are specific ways this could go wrong:

Dilution of quality: As you expand beyond Stanford, you might lose the cultural coherence that makes the program work. Stanford has specific advantages (brand, proximity to capital, founder density). Other universities don't. How do you maintain standards across different geographies?

Mentor availability: Tekedra Mawakana can't mentor 100 companies. High-quality mentors are scarce. As you scale, you risk having to settle for lower-quality mentorship, which defeats the purpose.

Founder quality variance: Stanford has a concentration of talented founders partly because of self-selection and partly because of the school's resources. Other universities won't have the same density. How do you maintain a high bar across different schools?

Capital deployment efficiency:

Founder graduation timing: University semesters create awkward timing constraints. You can't run a cohort program the same way if half the founders need to graduate in May and the other half graduate in December.

These are solvable problems, but they're real. Breakthrough is attacking a legitimate market gap, but execution at scale is where most accelerators stumble.

The Broader Trend: Unbundling VC

Breakthrough fits into a larger trend: venture capital is unbundling.

Traditionally, venture capital did everything: provided capital, provided mentorship, provided network introductions, provided credibility. VCs were gatekeepers.

Increasingly, those functions are separating. You have platforms that aggregate mentors (like Sapling or GLG). You have networks that connect founders (like Alpha Lab or 500 Global). You have capital providers that don't need to provide mentorship (like micro-VCs or syndicates).

Breakthrough is operating in that disaggregated world. They're assembling capital (from specialized investors), mentorship (from specific high-value people), infrastructure (from Microsoft and Nvidia), and network (from their cohort and investor connections). They're not trying to be a full-service VC. They're building a specialist product.

This is probably the future of startup funding generally. Specialists beat generalists when the market gets sophisticated enough. Breakthrough is betting that the "student founder" segment is sophisticated enough to support a specialist.

Future Outlook: What's Next for Breakthrough and Student Funding

If Breakthrough succeeds at deploying $2 million and producing decent outcomes, what's next?

Probably a second fund. The standard playbook is prove it with

They might also expand geographically, adding local teams or partner organizations in other regions. Running the entire program from Stanford doesn't scale forever.

They'll probably strengthen the investor relationships. Right now they've got participation from some VCs and founder alumni. As the portfolio produces winners, that attracts more investors. Success breeds capital.

They might also start to see companies raising larger follow-on rounds from external investors. If companies graduate from Breakthrough and raise $1M seed rounds from traditional VCs, that creates proof points that then attract more founders and more mentors.

The broader trend is likely that student accelerators become table stakes at major universities over the next five to ten years. It'll be abnormal for a top school to not have a dedicated program for student founders. The question is whether they'll all be venture-backed like Breakthrough or more grant-funded.

Nafi's vision is to make Breakthrough "the hub for Gen Z entrepreneurship and thought leadership." That's ambitious. But if they pull it off, it becomes much bigger than just a fund. It becomes a cultural force. It becomes the place smart young people go when they have ideas.

Student founders face significant barriers, primarily due to lack of capital and the need for traction, which are critical for securing VC funding. Estimated data based on anecdotal evidence.

Lessons for Other Accelerators and Universities

What can other programs learn from what Breakthrough is doing?

First: The founder-led model works. Having founders run accelerators for founders creates authenticity that's hard to fake. Students believe that Nafi and Scott get it because they literally are it.

Second: Be specific about your founder persona. The best accelerators are sharply focused. Y Combinator wasn't great at everything. They were great for SaaS founders. Breakthrough is great for student founders. That specificity is a feature, not a limitation.

Third: Don't try to replicate Silicon Valley exactly. There's been a tendency for universities to try to import the Stanford experience. Breakthrough isn't doing that. They're building something adapted to student constraints. It's different and better for their target market.

Fourth: Infrastructure and compute matter more than people realize. By including cloud credits and hardware access, Breakthrough is solving a real problem that most pre-seed capital ignores.

Fifth: Demo Days create accountability and momentum. It's worth making this central to the experience, not peripheral.

Sixth: Tap existing networks. Breakthrough went to Stanford founder alumni and investors who understand the opportunity. That was smart fundraising and also validation of the idea.

Actionable Takeaways for Student Founders

If you're a student and you're thinking about starting a company, here's what to actually do based on what we know about how this ecosystem is shifting:

First, apply to Breakthrough or similar programs in your region. The landscape is changing. These programs exist now. Use them.

Second, don't wait to have the perfect idea. Apply with something real you're working on, even if it's rough. Accelerators are for iterating, not for having everything figured out.

Third, think about what you'd do with $100K in compute credits and legal support, because those might matter more to your success than the cash.

Fourth, lean into your student status. You have advantages you don't realize: flexibility, density of smart people around you, exemption from having to show immediate traction. Use those.

Fifth, start networking with other founders now. Many of your most important future relationships are probably people in similar programs or situations to you right now.

The Role of AI in Student Startup Viability

It's worth highlighting something that isn't explicit in the Breakthrough story but is obviously true: AI has completely changed what's possible for a solo student founder.

Five years ago, if you were a student founder with an idea for a software product, you needed a team. You needed at least one backend engineer and one frontend engineer. You needed a designer. You needed probably six months and $50K to build something useful.

Now? You can build a decent MVP alone in a month with a few thousand dollars using GPT-4 API, no-code tools, and existing infrastructure. The barrier to entry has collapsed.

This matters to Breakthrough's thesis. Student founders are now genuinely competitive at the pre-seed stage in ways they weren't before. They can actually build faster than experienced teams because experienced teams have legacy code and institutional constraints.

Breakthrough is probably going to fund a lot of AI companies. That's where the opportunities are for solo or pair founders. That's where speed of execution matters more than team size.

This also means Breakthrough's

Conclusion: Why This Matters for the Future of Venture Capital

Okay, so let's zoom out. Why does a $2 million accelerator for student founders matter?

Because it's a data point in a larger story about how venture capital is evolving. For decades, venture capital has been concentrated in a few cities, controlled by a few firms, filtered through a few gatekeepers. That's been changing gradually, then suddenly.

Now you have founder syndicates pooling capital. You have accelerators like Breakthrough that are explicitly designed to bypass traditional gate-keeping. You have tools that let founders from anywhere bootstrap to success. You have founders in second and third-tier cities raising meaningful capital.

Breakthrough is one move in that direction. It's saying: We're going to explicitly look at talent that the traditional VC system overlooks. We're going to build infrastructure for founders that traditional VCs ignore. We're going to democratize access to capital, mentorship, and network.

Will they succeed? Probably yes, at least partially. The fund is well-structured, the founders seem thoughtful, the thesis is sound, and the timing is right. They might not deploy $2M perfectly. Some of the companies will fail. Some of the mentors will be less helpful than hoped. But overall, this probably works.

And when it works, we'll see more of it. Other universities will launch similar programs. The

That's the real shift happening here. It's not that Breakthrough is the biggest accelerator or the first of its kind. It's that Breakthrough is a symptom of structural change in how capital finds founders. The old gatekeeping is eroding. New infrastructure is being built. The next generation of founders will have access to capital and networks that previous generations couldn't even imagine.

For founders currently in school, that's incredibly good timing. Apply. Build. Ship. The system is now built to support you.

FAQ

What exactly is an accelerator program for student founders?

An accelerator program for student founders is a structured program that provides capital, mentorship, infrastructure, and network access specifically designed for college students and recent graduates who are starting companies. Unlike traditional VCs that focus on more experienced founders, these programs acknowledge that student founders have different constraints—they might still be in school, they have limited network access, and they lack capital. Breakthrough Ventures provides up to $100,000 in grants, plus compute credits, legal support, and mentorship from experienced founders and operators.

How does Breakthrough Ventures differ from other accelerators like Y Combinator or 500 Global?

Breakthrough Ventures is specifically designed for student founders, whereas traditional accelerators like Y Combinator focus on experienced founders and small teams that can relocate. Breakthrough uses a hybrid model where founders don't need to move to the Bay Area—instead, they participate in meetups with local VC firms and culminate in a Stanford Demo Day. Breakthrough also explicitly structures its program around student constraints and provides significantly more capital per founder (

How much funding can a student founder get from Breakthrough Ventures?

Student founders can receive up to

Who runs Breakthrough Ventures and what are their credentials?

Breakthrough Ventures was founded by Roman Scott and Itbaan Nafi, both Stanford students. Scott received his undergraduate degree from Stanford in 2024 and earned a master's degree there the following year. Nafi is a master's candidate at Stanford. The program was built after they started hosting popular Demo Days at Stanford in 2024, where they noticed strong founder talent among the student population. They brought on Raihan Ahmed to lead the accelerator operations. The investor list includes firms like Mayfair and Collide Capital, plus a significant number of Stanford founder alumni.

What types of companies is Breakthrough Ventures looking to fund?

Breakthrough Ventures is accepting applications across multiple sectors including AI, health, consumer, deep tech, and sustainability companies. The fund doesn't restrict focus to particular verticals but rather evaluates companies based on founder potential, market opportunity, and execution ability. Early stage companies with strong founders but minimal traction are ideal candidates—the program is designed to help founders validate their ideas and achieve market fit.

How competitive is getting into Breakthrough Ventures?

The exact acceptance rate for Breakthrough Ventures hasn't been publicly disclosed, but given that they're aiming to fund 100 companies over three years with a $2 million fund, they're probably accepting 30-40 companies per cohort if applications follow typical accelerator patterns. This suggests acceptance rates in the 5-15% range, similar to other selective accelerators. The process evaluates founder backgrounds, the quality of the founding team, and the fundamentals of the business idea. Being a student at any university in the US makes you eligible—you don't need to attend Stanford.

Can you apply to Breakthrough Ventures if you're not at Stanford?

Yes, absolutely. Breakthrough Ventures is explicitly designed as a nationwide program. Applications are open to college students and recent graduates from universities across the US, not just Stanford. This is one of the key differentiators from Stanford's own accelerator programs like Start X or Launch Pad, which are primarily for Stanford students. The hybrid program model with local VC firm meetups is specifically designed to serve students from different geographies without requiring them to relocate.

What happens at the Breakthrough Ventures Demo Day?

The Demo Day is the culmination of the accelerator program where student founders pitch their companies to a room of investors. This creates a concentrated moment of investor attention and potential capital raise. Companies that show strong momentum might receive follow-on investment immediately after Demo Day. Even companies that don't raise at Demo Day get valuable investor feedback and often acquire customer leads or partnership opportunities. The Demo Day is held at Stanford, which is strategically chosen to minimize travel time for Bay Area investors and benefit from Stanford's brand reputation.

TL; DR

- Student funding gap is real: Most traditional VCs overlook student founders because of perceived constraints, but the funding gap leaves talented founders without capital or mentorship

- Breakthrough Ventures addresses this explicitly: 100K grants (not loans), compute credits, legal support, and mentorship specifically for student founders nationwide

- Model is proven but at scale: Similar programs exist at UC Berkeley (Free Ventures) and MIT (Sandbox Innovation Fund), but Breakthrough is the first nationwide student-focused accelerator with significant venture capital backing

- Timing matters for founders: AI tools have dramatically reduced barrier to entry for student founders—you can now build meaningful MVPs solo in weeks, making pre-seed funding from programs like Breakthrough genuinely useful

- Broader trend: This represents democratization of venture capital—moving from gated city-based model to programs explicitly designed for underserved founder demographics

- Bottom line: If you're a student with an idea, the funding landscape is actively shifting to support you—apply to Breakthrough or similar regional programs

Key Takeaways

- Breakthrough Ventures addresses a real funding gap for student founders that traditional VCs ignore—providing $100K+ grants specifically for college students

- AI tools have reduced barrier to entry for student founders, making pre-seed capital from programs like this genuinely deployable for building real products

- The hybrid model (local VC meetups + Stanford Demo Day) is specifically designed around student constraints, removing the requirement to relocate

- Nationwide scope distinguishes Breakthrough from university-specific programs at UC Berkeley, MIT, and Stanford—creates talent density across multiple schools

- Success of this model will likely drive replication—expect more student-focused accelerators as venture capital continues to democratize and specialize

Related Articles

- Kofi Ampadu Leaves a16z: What TxO's Collapse Means for Founder Diversity [2025]

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

- Warren Demands OpenAI Bailout Guarantee: What's Really at Stake [2025]

- Tesla's $2B xAI Investment: What It Means for AI and Robotics [2025]

- Once Upon a Farm IPO 2025: What Investors Need to Know [2025]

- Why Allbirds Closing Stores Signals Tech Culture's Biggest Shift [2025]

![Student Startup Accelerators: How Breakthrough Ventures is Reshaping Founder Funding [2025]](https://tryrunable.com/blog/student-startup-accelerators-how-breakthrough-ventures-is-re/image-1-1770066549883.jpg)