Ethos Insurance IPO 2026: Inside the First Tech IPO of the Year

Ethos Technologies just pulled off something most startups dream about but never achieve. After years building quietly in the insurance tech space, it's becoming the first technology company to hit the public markets in 2026. Not because it had to raise money in a panic. Not because investors forced its hand. But because the business actually works.

This is the story of how a company that was once the hottest ticket in venture capital—backed by Sequoia, Accel, and celebrity investors ranging from Will Smith to Jay Z—survived the AI hype cycle, stayed profitable when others burned cash, and positioned itself for a meaningful IPO in an era when tech exits feel increasingly rare.

But here's what makes Ethos interesting. It's not the typical Silicon Valley origin story. The company targets a market that's decidedly non-sexy: life insurance. It's not building AI agents or blockchain infrastructure or quantum computing. It's making it easier for people to buy term life insurance through software. And that boring focus? That's exactly why it worked.

Let's dig into what Ethos is doing, why its IPO matters, and what it tells us about the state of venture capital, profitability, and tech exits in 2026.

TL; DR

- IPO Valuation: Ethos priced at 20 per share, valuing the company at $1.26 billion at the high end as reported by Reuters.

- Revenue & Profitability: Generated 46.6 million in net income, according to Coverager.

- Investor Lineup: Backed by Sequoia, Accel, GV (Alphabet's venture arm), Soft Bank, and General Catalyst, plus celebrity investors.

- Capital Raised: Total fundraising peaked at 2.7 billion valuation, as noted by TechCrunch.

- Market Timing: First tech IPO of 2026, signaling potential thaw in public market appetite for technology companies.

Ethos Technologies' profitability is driven by strong unit economics, strategic partnerships, high customer retention, and disciplined spending. Estimated data based on business insights.

What Is Ethos, and Why Does It Matter?

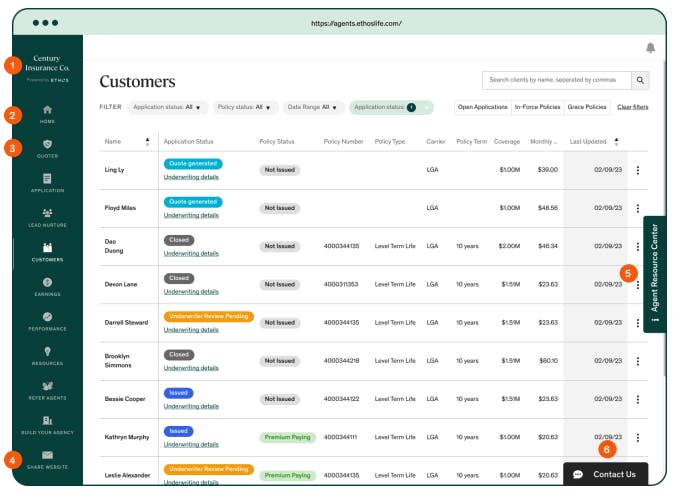

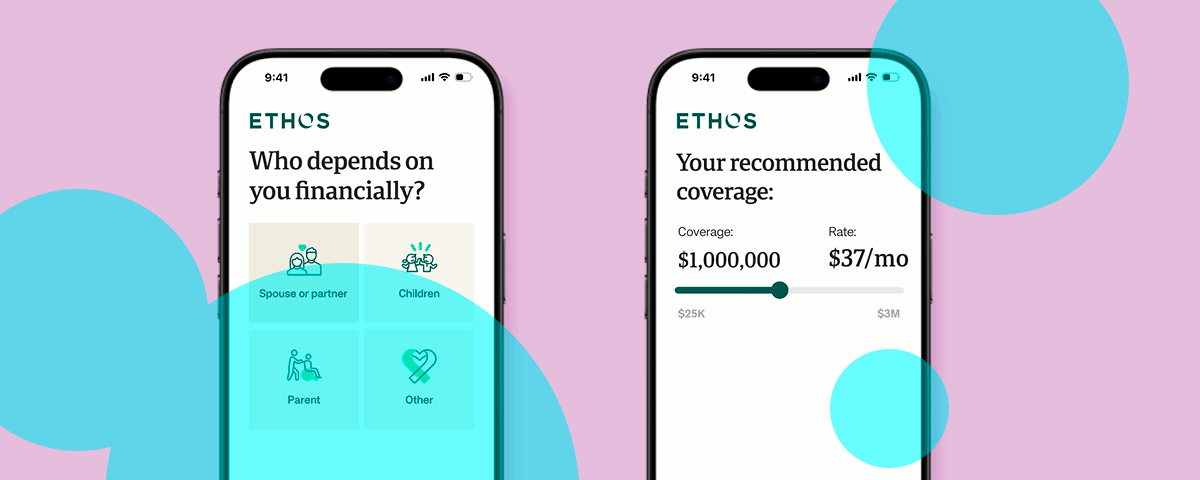

Ethos sells software that makes buying life insurance actually manageable. Think of it as the Stripe of insurance, except instead of handling payments, it's handling the entire customer journey from quote to underwriting to policy issuance.

Traditional life insurance is broken by design. You call an agent, they ask you forty questions, you get put on hold, someone else calls you back, you schedule a medical exam, you wait weeks for underwriting, and then maybe—maybe—you get approved. The whole process can take three months. For a commodity product. That customers desperately need but actively avoid because the friction is unbearable.

Ethos built software that compressed that into something reasonable. You answer questions online. The system runs underwriting automatically. You get an answer in days, not months. That's not revolutionary by tech standards. But for an industry that hasn't fundamentally changed its distribution model since the 1980s, it's a wedge.

The company doesn't sell insurance itself—it's a software platform that life insurance companies use to reach customers more efficiently. Think of it as infrastructure play disguised as a customer-facing app. The insurance companies keep the policies and the premiums. Ethos gets paid for handling the distribution and servicing technology.

Why should you care? Because Ethos is the clearest signal yet that venture capital's bet on "boring" software—the kind that solves real operational problems instead of chasing AI hype—is starting to pay off in concrete ways. Profitability. Sustainable revenue. An IPO without a ten-figure valuation or a narrative that requires you to squint and imagine the future really hard.

The Ethos Timeline: From Startup Darling to Quiet Profitability

Ethos wasn't always moving quietly. In 2018, when the company announced its Series B funding, it flexed an investor roster that read like a Forbes 400 guest list.

Will Smith's family office backed the company. So did Robert Downey Jr., Kevin Durant, and Jay Z. This was during the era when celebrity money signaled credibility, when a Hollywood power list meant your startup had officially made it. The round valued the company at roughly $200 million at that time. For a software company in the insurance space, that was validation.

But the real blowout came in 2021. After four years of solid execution, Ethos raised massive funding rounds that culminated in the company hitting a

Ethos was on track to become another venture-backed unicorn with unlimited runway. Then the world changed.

2022 and 2023 were brutal for venture capital. Funding dried up. Investors suddenly cared about profitability again. Companies that had been burning $50 million per year had to figure out how to actually make money. Ethos faced the same pressure as everyone else. But unlike many of its peer cohort, it had a significant advantage: a real business model with real customers paying real money.

So instead of doing another massive fundraise, Ethos basically stopped fundraising. The company went into optimization mode. According to Simply Wall St, it completed only small fundraises after 2021. The focus shifted from growth at any cost to building a sustainable, profitable enterprise.

And it worked. By the time Ethos was preparing its IPO documents, the company had achieved profitability and sustained it for years. That's the rarest achievement in venture capital: a company that was once chasing the unicorn label and now simply building a real business.

Fairly priced IPOs, like Ethos, are expected to have a better long-term market performance with a score of 70, compared to underpriced (50) and overpriced (30) IPOs. (Estimated data)

Financial Performance: The Numbers That Matter

Here's where Ethos's story gets concrete. The company disclosed its financial performance in its IPO filings, and the numbers tell a story that's actually rare for venture-backed tech companies going public.

In the nine months ending September 30, 2025, Ethos generated

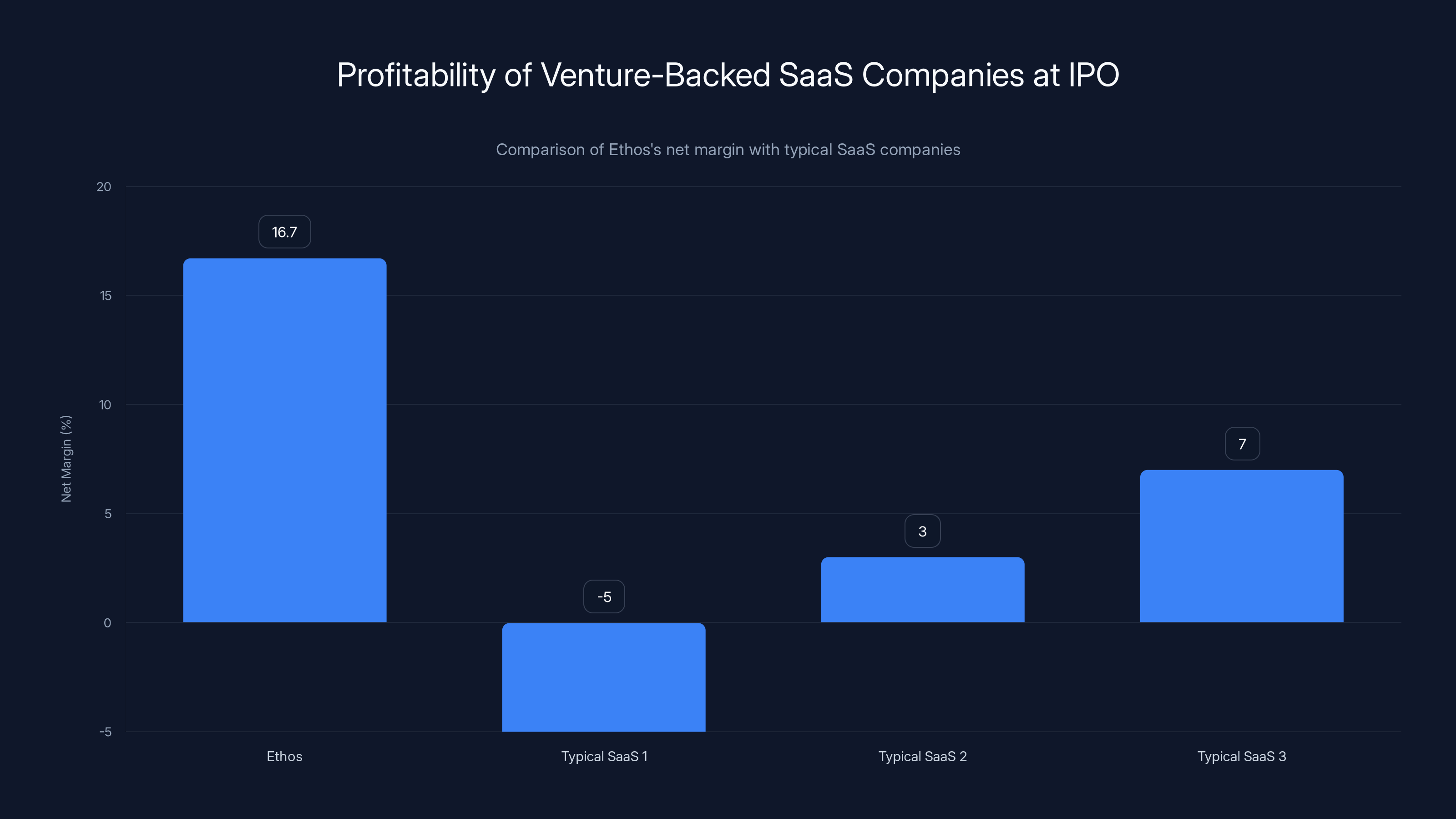

To put that in perspective, consider where the venture-backed SaaS companies that went public in the past decade landed on profitability:

- Most were unprofitable at IPO

- Many didn't achieve profitability for years after going public

- When they did become profitable, margins were typically 5-10%, not 17%

Ethos didn't just achieve profitability. It achieved it at a scale and margin that suggests an actual working business model, not a temporarily profitable quarter before returning to "growth mode."

The revenue figure is also telling.

Now, the obvious question: if Ethos is this profitable, why go public at all? Why not just stay private and keep running the business?

There are several reasons. First, it signals achievement. Public markets validate your model in a way that private rounds don't. Second, it provides liquidity for early investors and employees who've been waiting years to get returns on their bets. Third, a public currency (stock) makes it easier to acquire other companies or incentivize talent. And fourth, going public when you're profitable and actually winning is rare enough that it's worth doing.

The IPO Structure: Pricing, Valuation, and Capital Raised

Ethos priced its IPO in the range of

The IPO is expected to raise

Notably, both Sequoia and Accel—two of the most prestigious venture firms backing the company—are not selling shares in the IPO. That's an important signal. When early investors hold their stock through IPO and beyond, it suggests confidence that the company's best days are ahead, not behind.

The valuation is modest by today's standards. At

But here's the thing about going public at a "lower" valuation than your private peak: it's actually better for the company long-term. It means investors aren't expecting unrealistic growth. It means there's room to surprise on the upside. And it means your employees who received stock options at higher strike prices might actually see meaningful returns.

For Ethos, assuming

Who's Behind Ethos: The Investor Lineup

Ethos's cap table reads like a masterclass in venture capital relationships. The company is backed by the tier-one firms that actually matter: Sequoia, Accel, General Catalyst, and Soft Bank. Plus Alphabet's venture fund (GV) and Heroic Ventures.

That's not a random collection. Sequoia and Accel are the two most respected venture firms in the world, known for backing companies like Google, Airbnb, Stripe, and Figma. When both firms invest in your Series A or B, it's a signal that they believe your market is real and your execution is credible.

Soft Bank brings scale and international ambition. GV brings credibility and relationships across Google's ecosystem. General Catalyst brings operational expertise and energy sector connections (which matters for insurance companies). Heroic Ventures adds strategic insight into the insurance industry.

This isn't a cap table assembled through luck or celebrity appeal. This is a cap table built through credible venture capital execution over multiple funding rounds.

The celebrity investors—Will Smith, Robert Downey Jr., Kevin Durant, Jay Z—mattered more in 2018 when the company first announced them. That kind of star power moved the needle on brand recognition and cultural relevance. Today, celebrity investors are table stakes at any hot venture deal. They're not the reason Ethos succeeded. But they didn't hurt.

Ethos achieved a 16.7% net margin at IPO, significantly higher than typical SaaS companies which often have negative or single-digit margins.

The Insurance Tech Market: Why This Matters Beyond Ethos

Ethos's IPO isn't just a story about one company. It's a story about an entire sector that venture capital bet on heavily and then largely abandoned during the AI hype cycle.

Insurance technology seemed like an obvious disruption target. Insurance is massive ($1.5 trillion globally), heavily regulated (creating barriers to entry), manually intensive (creating efficiency opportunities), and dominated by legacy players with outdated technology.

In the mid-2010s, a whole wave of insurance tech startups launched. Lemonade went after renters and homeowners insurance. Root went after auto insurance. Ethos went after life insurance. All of them had the same narrative: software would disrupt insurance by removing friction, improving customer experience, and lowering costs.

Some of it worked. Lemonade went public in 2020 and is now a genuine player in the insurance market, though it's had profitability challenges. Root went public in 2020 as well, but struggled significantly as insurance risk proved harder to model than expected.

Ethos took a different path. Instead of trying to become an insurance company itself, it stayed focused on being the distribution platform. That decision—to work with the insurance industry rather than against it—proved strategically brilliant. It avoided regulatory complexity, avoided insurance underwriting risk, and focused purely on what Ethos did better than anyone: making it frictionless for customers to buy life insurance online.

The lesson here extends beyond insurance. When disruption narratives collide with regulatory reality and incumbent incumbency, the companies that win are often the ones that find a complementary position rather than a direct replacement position.

Profitability at Scale: The Rare Achievement

Back to the core question: why is Ethos's profitability so meaningful?

Because profitability at scale is genuinely rare in venture-backed software companies, especially those that go public. Here's the typical trajectory:

- Startup phase: Company loses money while building product and acquiring customers

- Growth phase: Company scales revenue but continues losing money, often at an accelerating rate, because it's investing heavily in sales, marketing, and product development

- Inflection point: Company reaches a massive scale (often $100+ million in revenue) and suddenly realizes it needs to optimize for profitability

- Profitability: After optimizing, company becomes marginally profitable, typically at 5-10% net margins

Ethos skipped several steps in that playbook. The company did go through an aggressive growth phase from 2018-2021. But when the venture capital market tightened, instead of forcing an IPO while still unprofitable, the company doubled down on profitability and optimization.

The result: a company that's now profitable at 16.7% net margins while still growing. That's the holy grail of venture-backed business models.

Why is margin rate so important? Because it tells you whether the business model actually works or whether the company is just successfully masking the fact that its unit economics are broken.

Consider these scenarios:

- Company A: 50 million net income (unprofitable)

- Company B: 15 million net income (5% margin)

- Company C: 50 million net income (17% margin)

All three have the same top-line revenue. Only one (Company C, which is Ethos) has a business model that actually works at scale. That's why Ethos's IPO valuation, while lower than its private peak, is actually more credible.

The Market Reception: What IPO Price Expectations Tell Us

The fact that Ethos is pricing at

For the past two years, the public markets have been hostile to venture-backed tech companies. Too many unprofitable companies went public at inflated valuations, then crashed when they couldn't deliver on growth expectations. Public market investors got burned and became skeptical of the venture capital model itself.

But skepticism creates opportunity. If you're a venture-backed company that's actually profitable, actually scaling revenue, and actually has a credible path to increasing earnings, the public markets suddenly look interested again. The pendulum swings from "show me growth" to "show me profitability." Ethos is positioned perfectly at that inflection point.

The

Ethos (Company C) achieves a 16.7% net income margin, outperforming peers by optimizing for profitability at scale. Estimated data.

Timing Considerations: Why 2026 Matters

Why is Ethos going public in early 2026 specifically? It's not random.

The IPO calendar for 2025 was actually decent for venture-backed tech companies. Companies like TPG, Vistra, and others went public. But most of those aren't typical Silicon Valley venture plays. Ethos's decision to go public in early 2026 suggests the company's management and board believed the window was favorable.

Several factors likely influenced timing:

Regulatory clarity: Insurance regulations around digital distribution have stabilized. State regulators now understand how digital insurance companies operate and have created a framework that works for companies like Ethos.

Market receptiveness: As we discussed, public market appetite for profitable, well-executed software companies has recovered. 2026 feels less binary (either "unicorn" or "failure") and more nuanced ("good company, fair valuation").

Competitive positioning: Earlier life insurance companies going public might have constrained how investors value Ethos. By being the first major insurance tech IPO of 2026, Ethos sets the valuation benchmark.

Runway and optionality: At $46.6 million in quarterly net income, Ethos has more than enough cash generation to fund operations indefinitely. The IPO is strategic, not desperate. That's a position of strength.

Founder/investor optionality: Five years after hitting $2.7 billion valuation, founders and early investors have capital gains sitting in paper. An IPO provides a partial liquidity event while allowing founders to maintain upside if the company performs well.

Lessons for Venture Capital and Startups

Ethos's trajectory offers several lessons for anyone building or investing in venture-backed companies.

First: Boring is underrated. Everyone in venture capital wants to be part of the next revolutionary platform or paradigm-shifting technology. Ethos proved that you can build a hugely successful company in the unsexy business of life insurance technology. The best businesses often solve problems people desperately need solved, even if they don't excite venture investors initially.

Second: Profitability is a feature, not a constraint. For years, the venture capital narrative has been "growth at any cost." Ethos demonstrated that profitability at scale is actually a competitive advantage. When you're profitable, you control your own destiny. You don't need to raise capital on someone else's timeline. That provides strategic flexibility that unprofitable companies simply don't have.

Third: Strategic positioning matters more than being first. Ethos didn't invent digital life insurance. Other companies tried. But Ethos found the right position in the value chain (distribution infrastructure, not insurance company itself) and executed better. First-mover advantage matters less than right-positioning and superior execution.

Fourth: The venture capital cycle is real, and flexibility is valuable. Companies that can thrive in multiple market conditions—high-growth VC markets and tight profitability-focused markets—are structurally advantaged. Ethos made decisions that allowed it to succeed in both environments.

Fifth: Investor quality matters. Having Sequoia and Accel on your cap table opened doors that matter. But more importantly, those firms stayed committed through market cycles and didn't abandon Ethos when the venture capital market tightened. That loyalty matters.

The Broader Tech IPO Context

Ethos's IPO happens against a backdrop where venture-backed tech IPOs have been exceptionally rare. The last few years saw only a handful of meaningful tech company IPOs, and many of them disappointed.

We Work's failed IPO attempt in 2019 traumatized public market investors. Uber and Lyft went public at insane valuations and then crashed. Robinhood's IPO seemed like a hit until the company faced regulatory pressure. Even successful companies like Airbnb and Door Dash went public at valuations that seemed reasonable in retrospect only because the companies kept growing.

In that context, an IPO from a profitable, sustainable, capital-efficient company is genuinely refreshing. Ethos isn't trying to convince you of a moonshot future. It's trying to convince you it has a real business that works and will keep working.

That positioning might not excite some venture capital traditionalists who still believe every billion-dollar company should be a potential trillion-dollar opportunity. But public market investors increasingly find that approach credible, especially after the last five years proved that sustainable, profitable growth is actually rare and valuable.

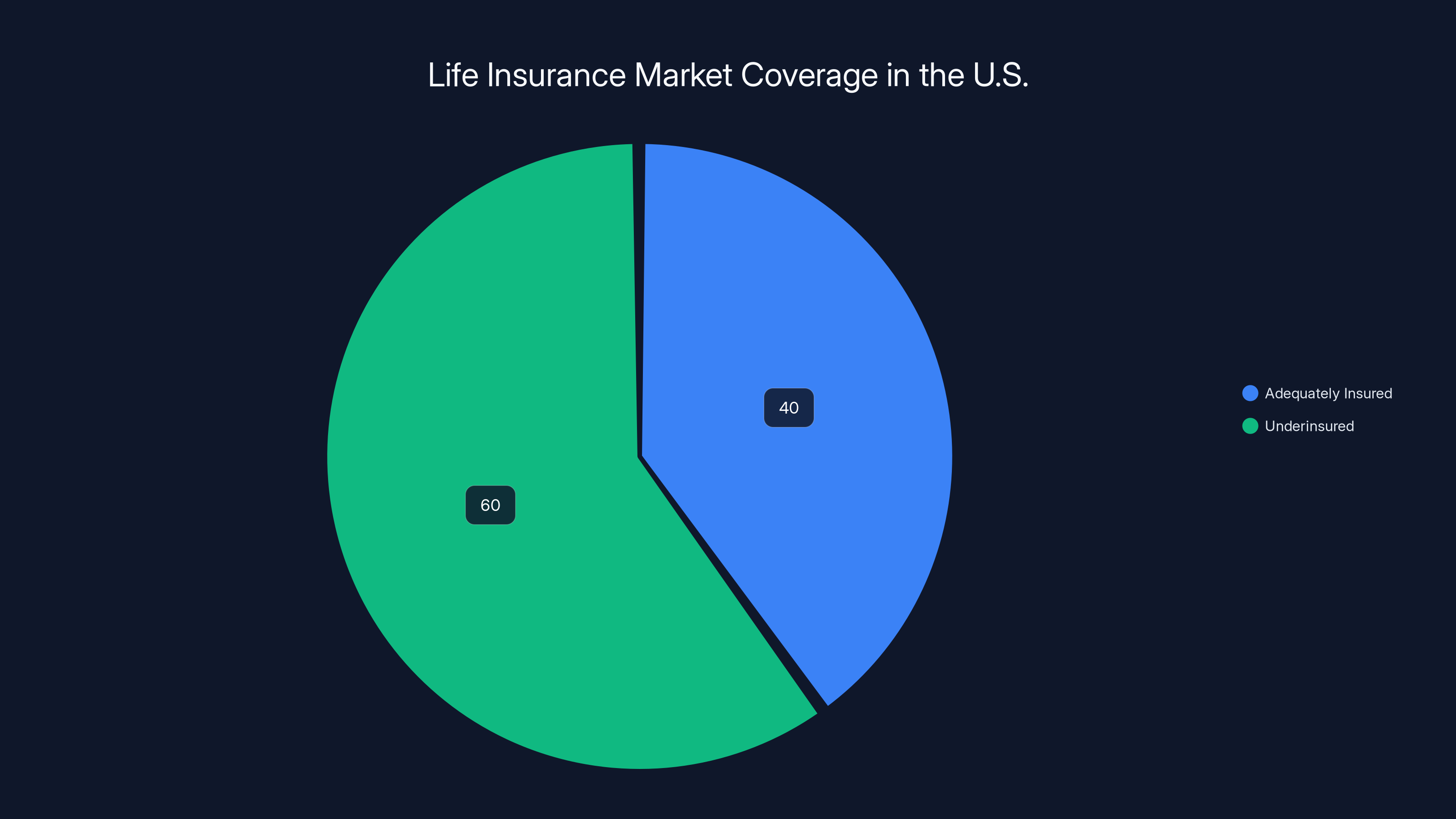

Approximately 60% of American adults are underinsured, highlighting a significant market opportunity for digital-first life insurance solutions. Estimated data.

Competitive Landscape: Other Life Insurance Tech Players

Ethos operates in a competitive space, though it's not an overcrowded one. Several companies target different segments of the life insurance market.

Ladder built a digital life insurance platform targeting younger customers with simplified underwriting. However, Ladder struggled with unit economics and was acquired by Nomad in 2021, suggesting the market had consolidation challenges.

LISA (formerly Life Insurance Spot) built a comparison platform and marketplace for life insurance. But the company faced challenges scaling and retained a lower profile than Ethos.

Haven Life (owned by Mass Mutual) and Policy Genius represent the larger incumbents that tried to digitize insurance distribution. Both have significant venture backing and brand recognition, but they're caught between being platforms and being insurance companies, which creates organizational complexity.

Ethos's advantage has been staying focused on being a platform that insurance companies use, not trying to also become an insurance company itself. That strategic clarity allowed the company to move faster, stay lean, and avoid the regulatory complexities that plague companies trying to do both.

The Path Forward: Post-IPO Challenges

Going public solves some problems but creates new ones. Ethos will now face public market scrutiny, earnings expectations, and competitive pressure from larger players.

Earnings expectations: Quarterly earnings calls mean analysts will scrutinize revenue growth, margin expansion, customer acquisition cost, lifetime value, and retention metrics. The company needs to maintain growth while improving profitability—a balance that's harder to manage publicly than privately.

Competitive response: Larger incumbents (the insurance companies themselves, or fintech platforms adding insurance) might invest heavily to compete with Ethos. Going public raises Ethos's profile, which could trigger competitive responses.

Integration complexity: As a public company, Ethos might face pressure to acquire or integrate complementary capabilities. Successfully integrating acquisitions while maintaining the core business is notoriously difficult.

Regulatory risk: Insurance regulation at the state level is fragmented. As Ethos scales, navigating an increasingly complex regulatory landscape will require investment in legal and compliance infrastructure.

But these are good problems to have. They're the problems of a company that's won its initial market battle and now faces the challenge of scaling while maintaining its positioning.

What This Signals About Venture Capital's Future

Ethos's IPO is part of a broader trend: the gradual separation of venture capital into two distinct ecosystems.

Ecosystem 1 is the AI/mega-scale ecosystem where companies need massive capital, pursue TAM expansion, and operate on venture capital timelines (raise every 18-24 months, either grow exponentially or fail).

Ecosystem 2 is the sustainable business ecosystem where companies are profitable or path-to-profitable, serve defined markets, and can operate independently of future capital raises.

For years, venture capital pretended these ecosystems didn't exist. Every software company was supposed to be a potential mega-unicorn. But increasingly, venture capital is accepting that not every great business is a venture capital business. Some businesses are better served by private equity, strategic investors, or IPO routes that don't require moonshot narratives.

Ethos is comfortable in Ecosystem 2. It's a great business that solves a real problem and generates real returns. But it's not a venture capital home run in the way that Stripe or Figma might be. The venture returns are solid, but not life-changing for the fund.

That's actually healthy. It means venture capital is starting to diversify its portfolio beyond just "bet the entire fund on the next Uber." Ethos is proof that venture capital can have returns without requiring 100x capital appreciation.

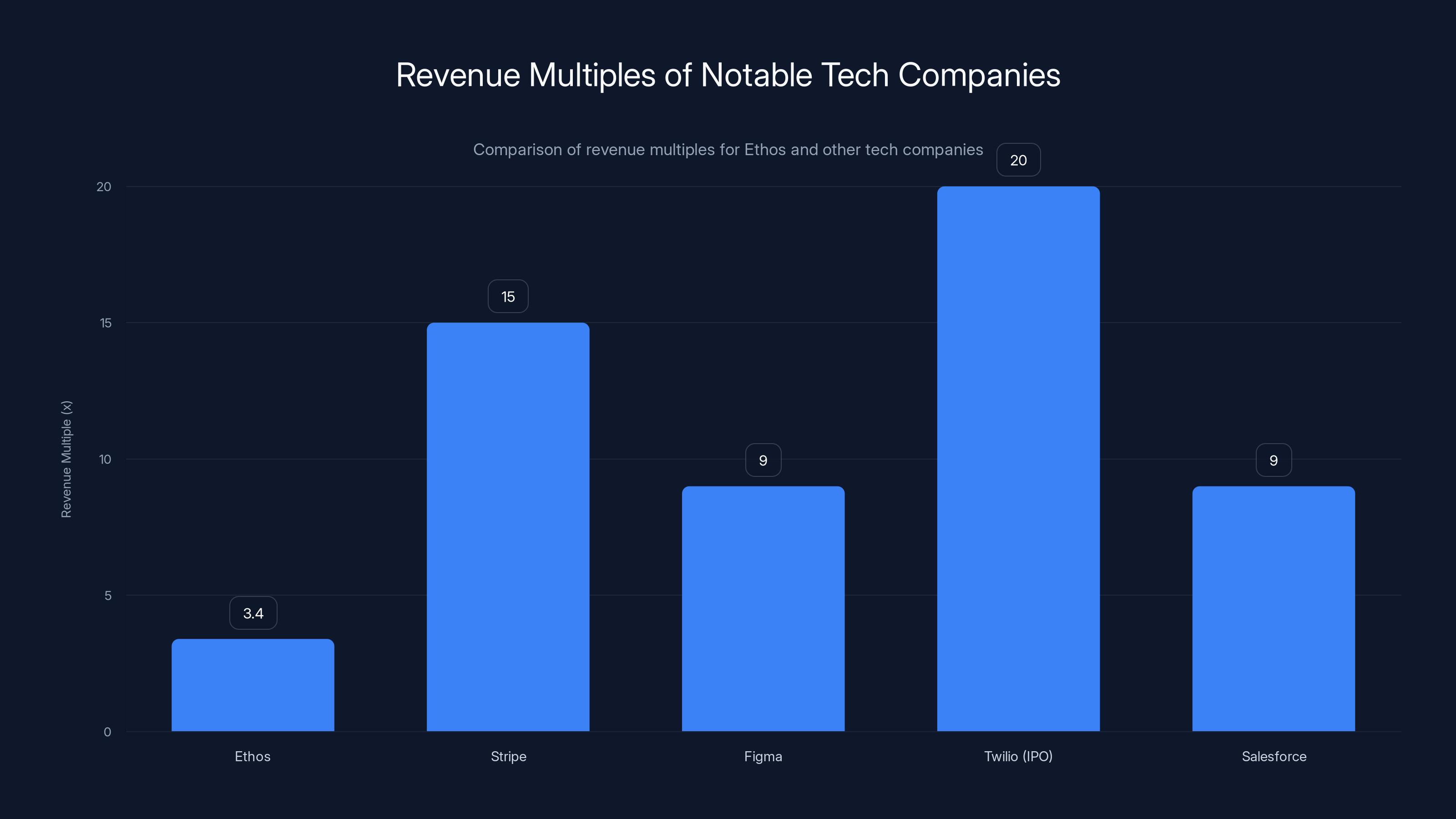

Ethos's valuation at 3.4x revenue is modest compared to other tech companies like Stripe and Twilio, which have seen much higher multiples. Estimated data for Figma and Salesforce.

The Life Insurance Market Opportunity

Despite digitization progress, the life insurance market remains massively underpenetrated, particularly among younger and middle-income demographics.

Currently, approximately 60% of American adults lack adequate life insurance coverage. The reasons are simple: friction in the purchase process, lack of awareness, and outdated distribution models that don't reach digital-first consumers.

The addressable market for Ethos is substantial. Even capturing a small percentage of the millions of underinsured Americans could drive enormous revenue growth. Ethos currently generates ~

That creates runway for Ethos to grow meaningfully while staying focused on its core competency: making life insurance easy to buy online.

For U. S. life insurance:

Ethos's $370 million in annual revenue represents roughly 5% of a conservative estimate of TAM. There's meaningful room to grow.

Investor Expectations and Valuation Reality

At

For comparison:

- Stripe was valued at roughly 15x revenue at its last private valuation before IPO discussions

- Figma was valued at roughly 8-10x revenue at its peak private valuation

- Twilio went public at roughly 20x revenue and has since compressed to 2-3x revenue

- Salesforce trades at roughly 8-10x revenue historically

Ethos's 3.4x revenue multiple reflects realistic expectations. The company isn't a platform that will own every transaction in a category. It's a meaningful infrastructure player in the life insurance distribution ecosystem. That positioning deserves a solid multiple, but not a premium multiple.

For investors, the question is whether Ethos can maintain 15-20% revenue growth while improving margins beyond 17%. If the company can do that, the valuation multiple expands and early shareholders benefit. If the company decelerates to 10% growth and margins compress to 12%, the multiple likely compresses as well.

The Sequoia and Accel Playbook

It's worth noting that Sequoia and Accel are not selling shares in the Ethos IPO. That's intentional and meaningful.

When top-tier venture firms hold through IPO, it signals confidence that the company's best days are ahead. It's also a capital management decision—these firms have massive funds and don't need to exit every position at IPO. They can hold stakes and benefit from the company's continuing growth.

The playbook both firms have executed in recent years is: find companies solving real problems with real unit economics, support them through market cycles, wait for eventual liquidity events, and then hold the public positions. That approach generated extraordinary returns for both firms.

Ethos represents that playbook in action: a company that wasn't the sexiest pitch in 2016, but executed better than competitors and proved to have sustainable unit economics. Both firms recognized that and supported it through tough times.

What About Profitability Sustainability?

One fair question: is Ethos's profitability real, or is it the result of cutting corners and underinvesting?

Based on the disclosed revenue and margin figures, Ethos is generating meaningful cash flow. A 16.7% net margin on

That level of profitability is sustainable in one of two ways:

Scenario 1: The company has optimized its core business so well that it can operate profitably at current scale, and future growth (via product expansion, market expansion, or customer expansion) flows to the bottom line.

Scenario 2: The company is profitable now but will need to reinvest heavily to maintain growth, which will compress future margins.

Given the insurance tech market is still growing and Ethos's market position is strong, Scenario 1 seems more likely. But that's the core question public market investors will focus on: can Ethos grow revenue while maintaining or expanding margins, or will growth require sacrificing profitability?

The Broader Narrative: When Venture Works as Designed

Ethos's story is actually a refreshing counterpoint to the typical venture narrative we hear.

Most venture capital stories follow this pattern: founder has a moonshot idea, raises capital, grows explosively, either becomes a massive success (Uber, Airbnb, Stripe) or crashes spectacularly (We Work, Theranos). The narrative is binary: huge success or dramatic failure.

Ethos represents the quieter, arguably more important outcome: a company that was successful by ordinary business standards, attracted venture capital backing, navigated market cycles, and now is going public with real profitability. It's not a unicorn. It's not a moonshot. It's a good business.

And it's arguably more valuable than either extreme. Moonshots provide outsized returns when they work but destroy capital when they don't. Modest, profitable businesses provide reliable returns and teach us how venture capital should actually function.

Ethos is that example.

FAQ

What is Ethos Technologies?

Ethos Technologies is a software platform that streamlines the life insurance purchase process. The company provides digital distribution infrastructure that allows customers to quote, apply for, and purchase life insurance online through its platform and partner insurance companies. Ethos generates revenue through a combination of direct customer interactions and partnerships with insurance companies, achieving significant profitability at scale.

How does Ethos make money?

Ethos operates as a distribution and servicing platform for life insurance. The company partners with insurance companies to deliver customers through its digital platform. Ethos generates revenue through transaction fees, customer servicing fees, and platform licensing arrangements. Unlike insurance companies themselves, Ethos doesn't assume underwriting risk or hold customer premiums—it focuses purely on removing friction from the distribution process.

Why is Ethos profitable when many venture-backed software companies aren't?

Ethos achieved profitability through a combination of factors: strong unit economics built into the business model, a partnership structure with insurance companies rather than direct insurance provision (avoiding regulatory complexity and underwriting risk), customer retention and lifetime value superior to customer acquisition costs, and disciplined spending discipline after 2021 when the venture capital market tightened. The company prioritized profitability over growth at any cost, positioning it favorably compared to venture-backed peers.

What does Ethos's IPO valuation tell us about the market?

Ethos's valuation at $1.26 billion (3.4x revenue) reflects a return to realistic market expectations for venture-backed software companies. The company isn't valued as a moonshot or unicorn—it's valued as a successful, profitable software company with sustainable business model. This signals that public markets are shifting from requiring growth at any cost to appreciating profitability and unit economics.

How does Ethos compete against larger insurance companies?

Ethos doesn't compete directly against insurance companies. Instead, it partners with them by providing superior distribution technology. Insurance companies benefit from Ethos's platform because it reaches digital-first customers more efficiently than traditional channels. Ethos's competitive advantages include superior user experience, faster underwriting, lower operational cost per transaction, and technology infrastructure that large incumbents either lack or are too entrenched in legacy systems to build quickly.

What challenges will Ethos face as a public company?

Key challenges include managing earnings expectations while maintaining growth rates, responding to competitive threats from larger incumbents investing in digital capabilities, navigating complex state-level insurance regulations as the company scales geographically, and integrating potential acquisitions while maintaining core operational discipline. Additionally, the company must balance shareholder return expectations with investments needed to maintain competitive positioning and market growth.

Is the life insurance market large enough for Ethos to sustain growth?

Yes. The global life insurance market exceeds

Why didn't early investors cash out when Ethos hit $2.7 billion valuation in 2021?

Sequoia and Accel, the lead early investors, didn't sell at the private peak because they recognized sustainable value creation and believed the company's growth trajectory was intact. Holding through IPO is a capital deployment strategy—these firms have massive funds and benefit from staying invested in winners. It also signals confidence to the market about the company's future prospects.

Conclusion: A Signal for What Works in Venture Capital

Ethos Technologies going public in 2026 might seem like a straightforward business story. A profitable software company in insurance tech is heading to the public markets. Decent story. Good outcome for investors.

But the deeper significance is about what Ethos represents in the broader venture capital ecosystem.

For the past decade, venture capital chased moonshots. Every software company was supposed to be the next Stripe, Airbnb, or Uber. The narrative was that you either built a $100 billion business or you failed. Anything in between was considered mediocre.

Ethos proved that narrative was incomplete. A company can be extraordinary without being a moonshot. It can generate real economic value, real profits, real returns to investors, and real solutions to real problems without requiring a narrative about reshaping entire industries.

The life insurance distribution market didn't change because Ethos existed. But Ethos made it better, more efficient, more accessible. That's not revolutionary. But it's valuable.

And in 2026, when venture capital has been sufficiently humbled by unprofitable companies, inflated valuations, and public market disappointments, that kind of value seems increasingly rare and increasingly appreciated.

Ethos's IPO isn't the story of the next world-changing company. It's the story of a really good company doing what venture capital is supposed to do: find talented teams, provide capital and support, and help them build something valuable.

That's the signal Ethos is sending. Not "look at this moonshot." But "look at what venture capital can build when it focuses on real business fundamentals."

In 2026, that message might be more important than any moonshot narrative could be.

Key Takeaways

- Ethos Technologies becomes the first major tech IPO of 2026 at 18-$20 per share

- The company achieved rare venture profitability: 46.6M net income (16.7% margin) over nine months

- Ethos raised 2.7B peak valuation before resetting to realistic $1.26B IPO valuation

- Backed by tier-one VCs (Sequoia, Accel, GV, SoftBank) plus celebrity investors, signaling credibility and operator focus

- The company's success demonstrates venture capital value in 'boring' industries when focused on real unit economics and sustainable growth

- At 3.4x revenue multiple, Ethos positions as practical software company rather than moonshot platform, reflecting market maturity toward profitability metrics

![Ethos Insurance IPO 2026: Inside the First Tech IPO of the Year [2026]](https://tryrunable.com/blog/ethos-insurance-ipo-2026-inside-the-first-tech-ipo-of-the-ye/image-1-1768954021435.jpg)