Introduction: Understanding Experian's Role in Modern Finance

Experian stands as one of the three major credit reporting agencies that fundamentally shape financial outcomes for hundreds of millions of people worldwide. Yet despite its enormous influence, most people know surprisingly little about how this company operates, what data it collects, or how it uses that information to make decisions that affect loan approvals, rental applications, job offers, and countless other life-changing moments. This knowledge gap creates a perception problem that extends beyond simple misunderstanding—it fuels skepticism about whether large data companies can be trusted with sensitive financial information, especially as they increasingly deploy artificial intelligence systems to process and analyze that data.

The comparison to Palantir, mentioned by Experian's technology leadership, is particularly telling. When a credit reporting agency feels compelled to publicly distinguish itself from a company known for surveillance-grade analytics, it suggests a credibility crisis lurking beneath the surface. Yet the reality of Experian's business is far more complex than most critics acknowledge. The company operates within a highly regulated framework, subject to federal and state laws that govern how credit data can be collected, stored, used, and disclosed. The Fair Credit Reporting Act, the Gramm-Leach-Bliley Act, and numerous state privacy laws create boundaries around what even the largest data companies can legally do.

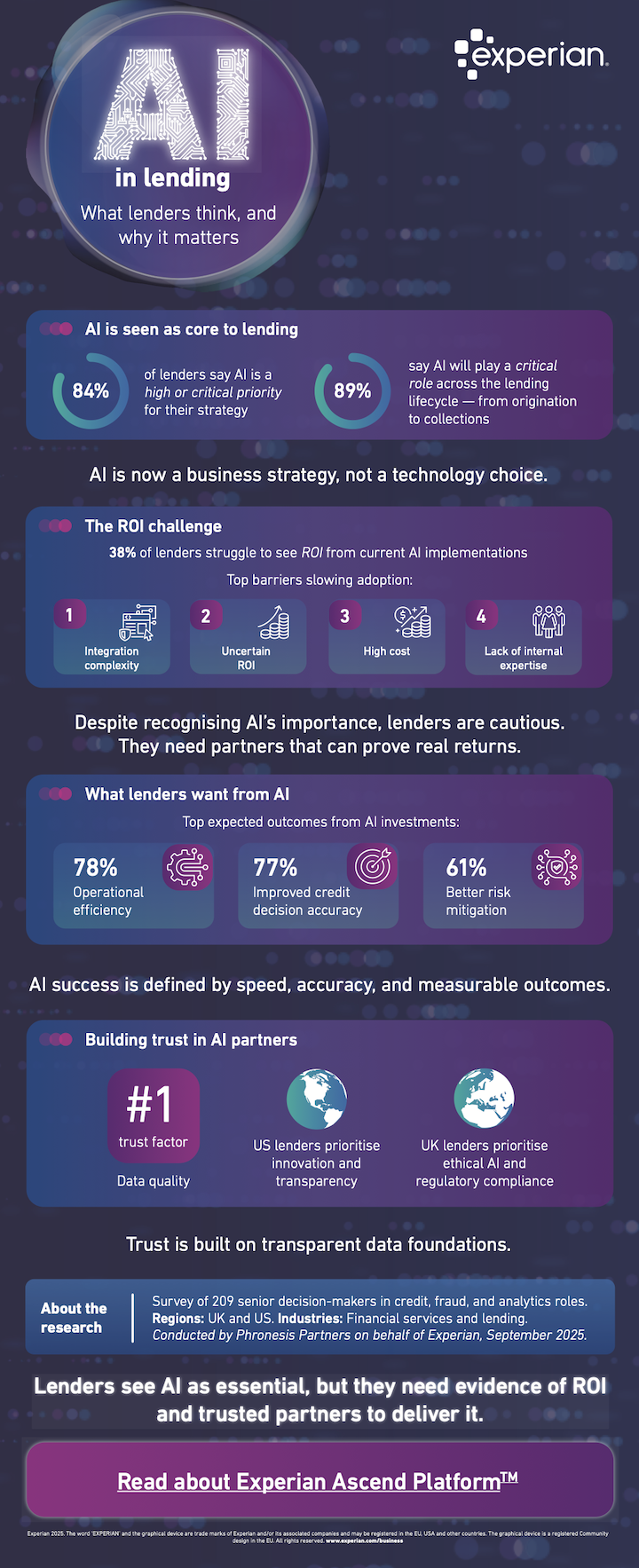

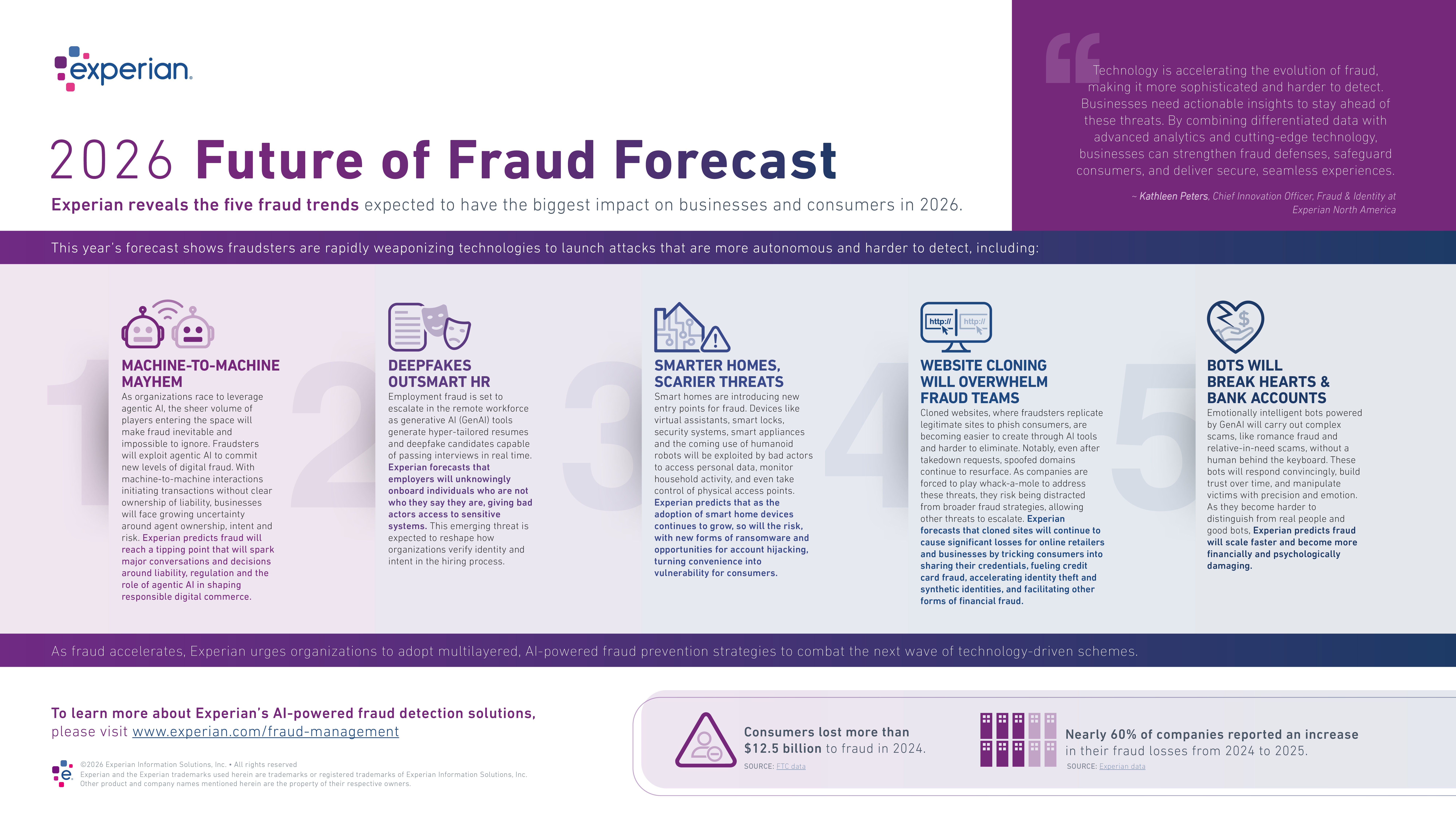

What makes 2025 particularly significant for Experian is the convergence of multiple transformative forces. Artificial intelligence capabilities have advanced dramatically, creating both opportunities and risks for how credit scoring and risk assessment can be conducted. Consumer privacy expectations have shifted, with regulatory bodies worldwide implementing stricter data protection requirements. Economic volatility has made credit risk assessment more important and more difficult simultaneously. And public scrutiny of algorithmic decision-making has intensified, with particular attention paid to how AI systems might perpetuate or even amplify existing biases in lending and financial services.

This comprehensive exploration examines Experian's technology strategy, its approach to integrating AI into core business processes, the genuine tensions between innovation and responsibility, and the practical questions that emerge when a company handling data on virtually everyone in the economy attempts to modernize while maintaining public trust. By understanding Experian's perspective on these issues, along with the legitimate concerns raised by critics, we can better appreciate the nuanced challenges facing data-driven businesses in the AI era.

The Credit Reporting Ecosystem: How Experian Functions

The Three-Company Oligopoly

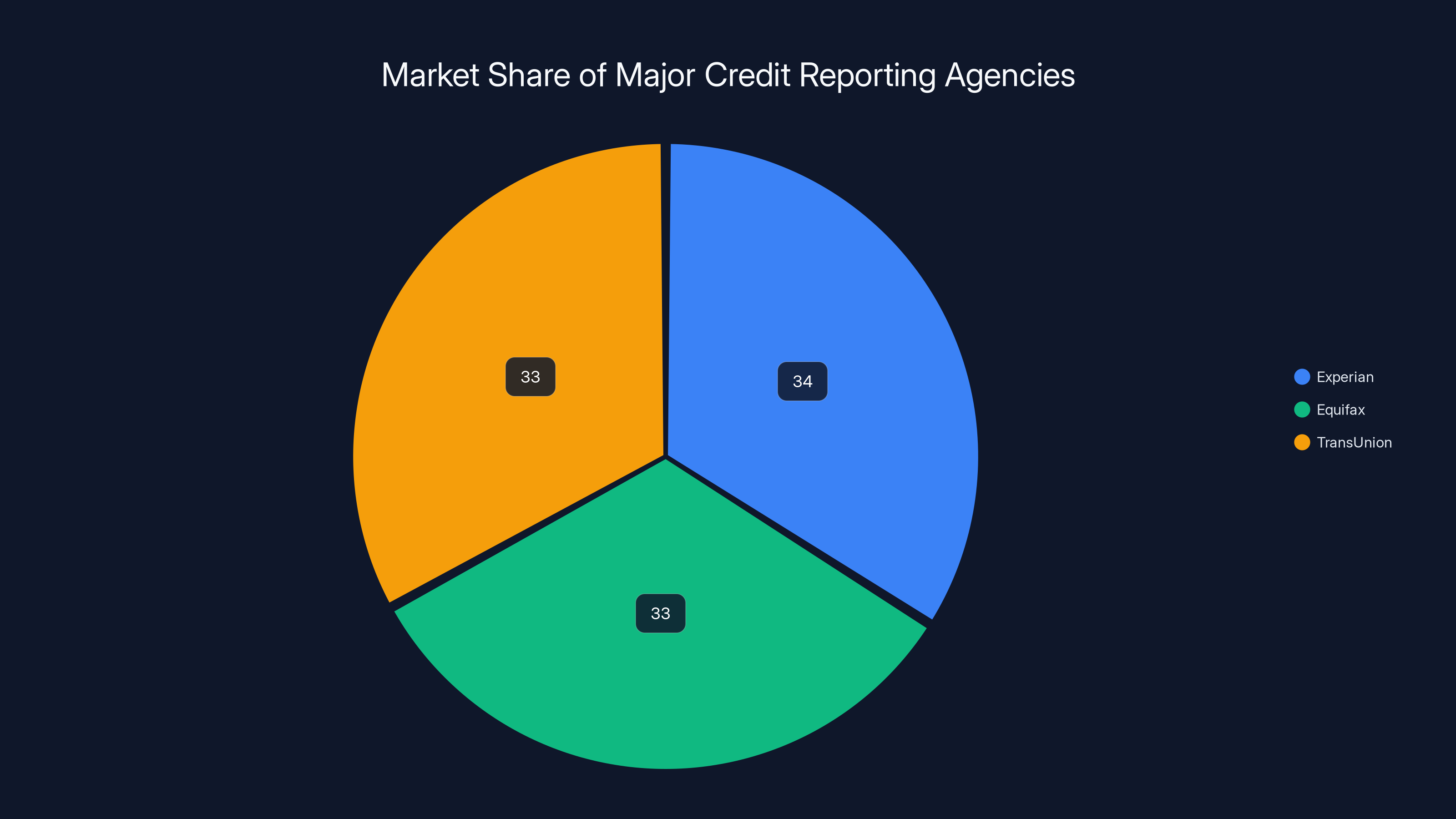

The United States credit reporting system relies on three dominant players: Experian, Equifax, and Trans Union. These companies don't lend money directly, nor do they set credit policy. Instead, they function as information intermediaries, collecting financial data from banks, credit card companies, mortgage lenders, utilities, and other creditors. This data—payment history, outstanding balances, credit inquiries, delinquencies, and numerous other signals—gets aggregated into credit reports and distilled into credit scores that lenders use to make decisions.

What distinguishes this oligopoly from typical competitive markets is the complete lack of consumer choice. If you want to participate in the formal economy, there's no option to select which credit agency receives your information or how they use it. Your financial behavior gets reported to these three companies whether you consent or not. This lack of agency creates an inherent tension between the legal framework that permits this data collection and the ethical questions about whether permission granted through government regulation is the same as genuine consent.

Experian's particular position within this ecosystem gives it influence over financial outcomes for approximately 220 million consumers in the United States alone, with additional operations in Canada, Mexico, Brazil, and across Europe, Asia, and other regions. The company employs sophisticated data scientists, engineers, and risk modeling experts to process hundreds of millions of data points daily, generating insights that inform lending decisions worth trillions of dollars annually.

Data Sources and Collection Methods

Experian collects data from multiple sources operating at different points in the financial system. Primary sources include tradelines reported by creditors—credit card companies, banks, mortgage lenders, auto financing companies, and student loan servicers. These sources provide information about active accounts, payment history, credit limits, and outstanding balances. Experian also maintains data about public records including bankruptcies, tax liens, and court judgments, though the role of these items in credit scoring has diminished significantly over the past decade.

Beyond traditional credit data, Experian has expanded into alternative data sources that provide signals about creditworthiness for populations underrepresented in traditional credit markets. Utility payment history, rental payments, mobile phone bills, and insurance premium payments can all be incorporated into alternative scoring models. This expansion addresses a real problem—millions of people, particularly younger adults and immigrants, have limited credit histories despite demonstrating responsible financial behavior. Alternative data helps create more complete pictures of financial responsibility.

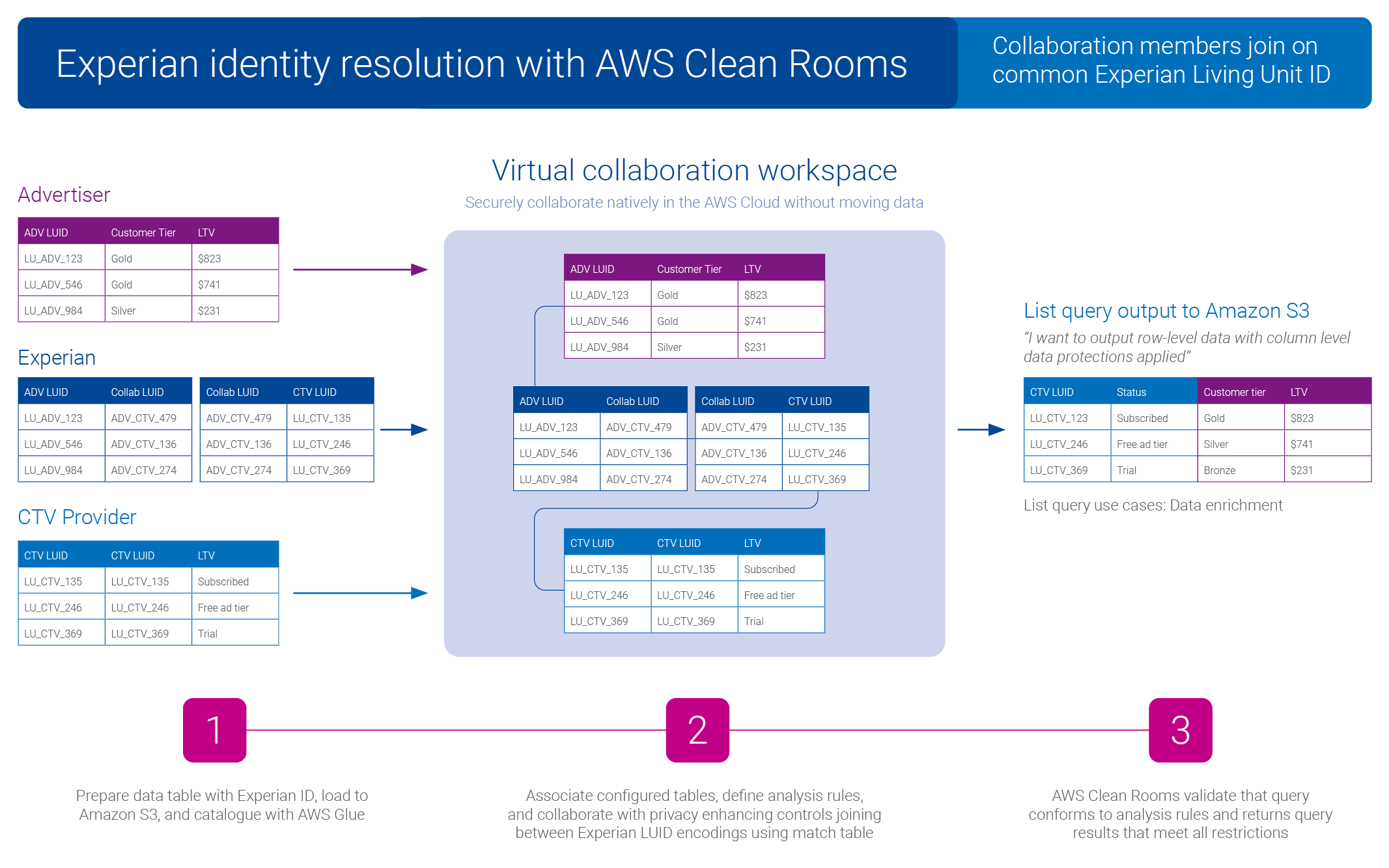

The sophistication of Experian's data infrastructure reveals itself in the company's ability to link disparate data points into unified consumer profiles. When you apply for credit, Experian doesn't just pull your historical payment records. The company's systems perform extensive identity resolution, matching your current application to any previous records under different names, addresses, or variations. This process prevents fraud and duplicate accounts, but it also concentrates significant power in Experian's ability to determine who you are in the financial system.

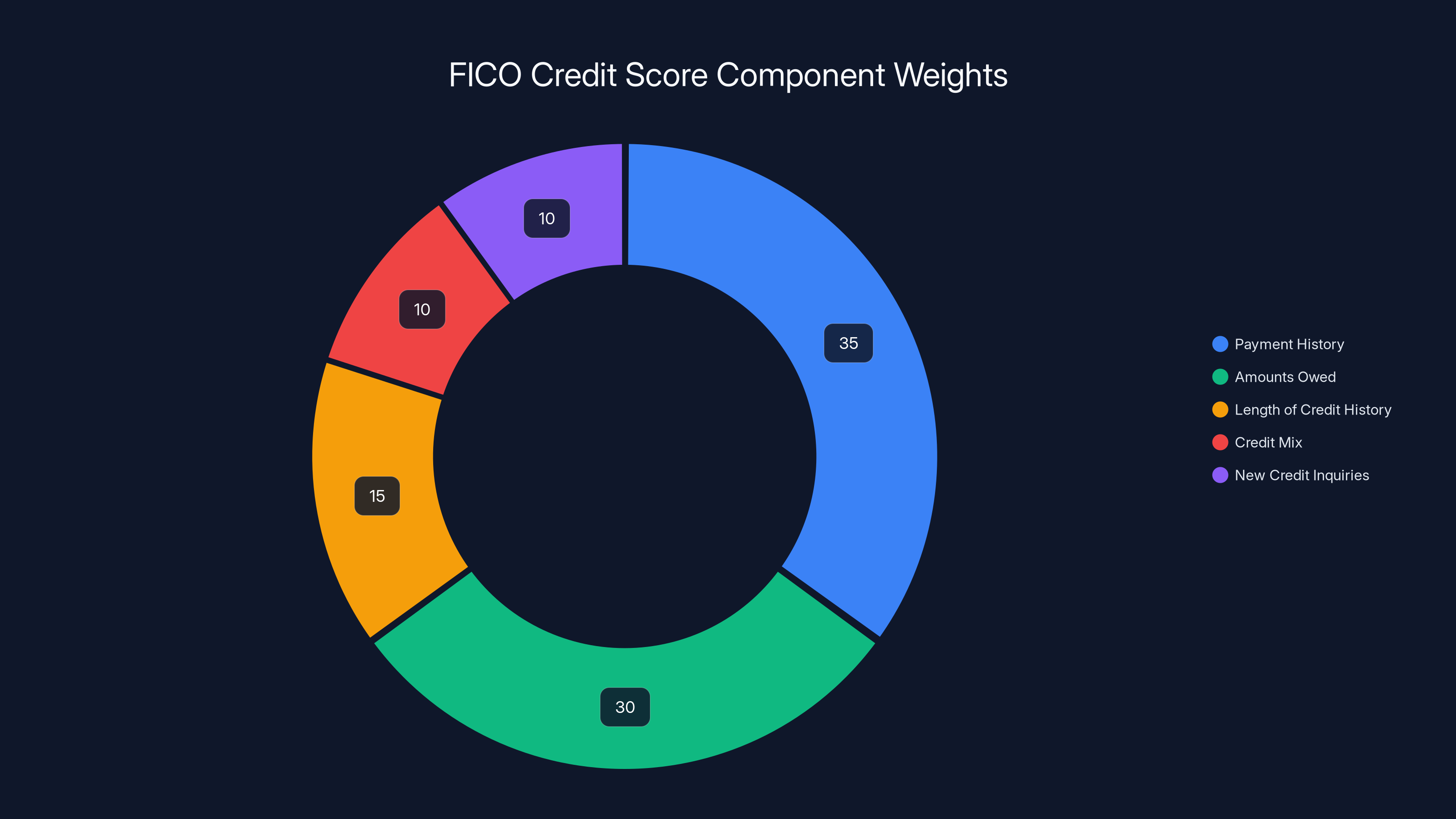

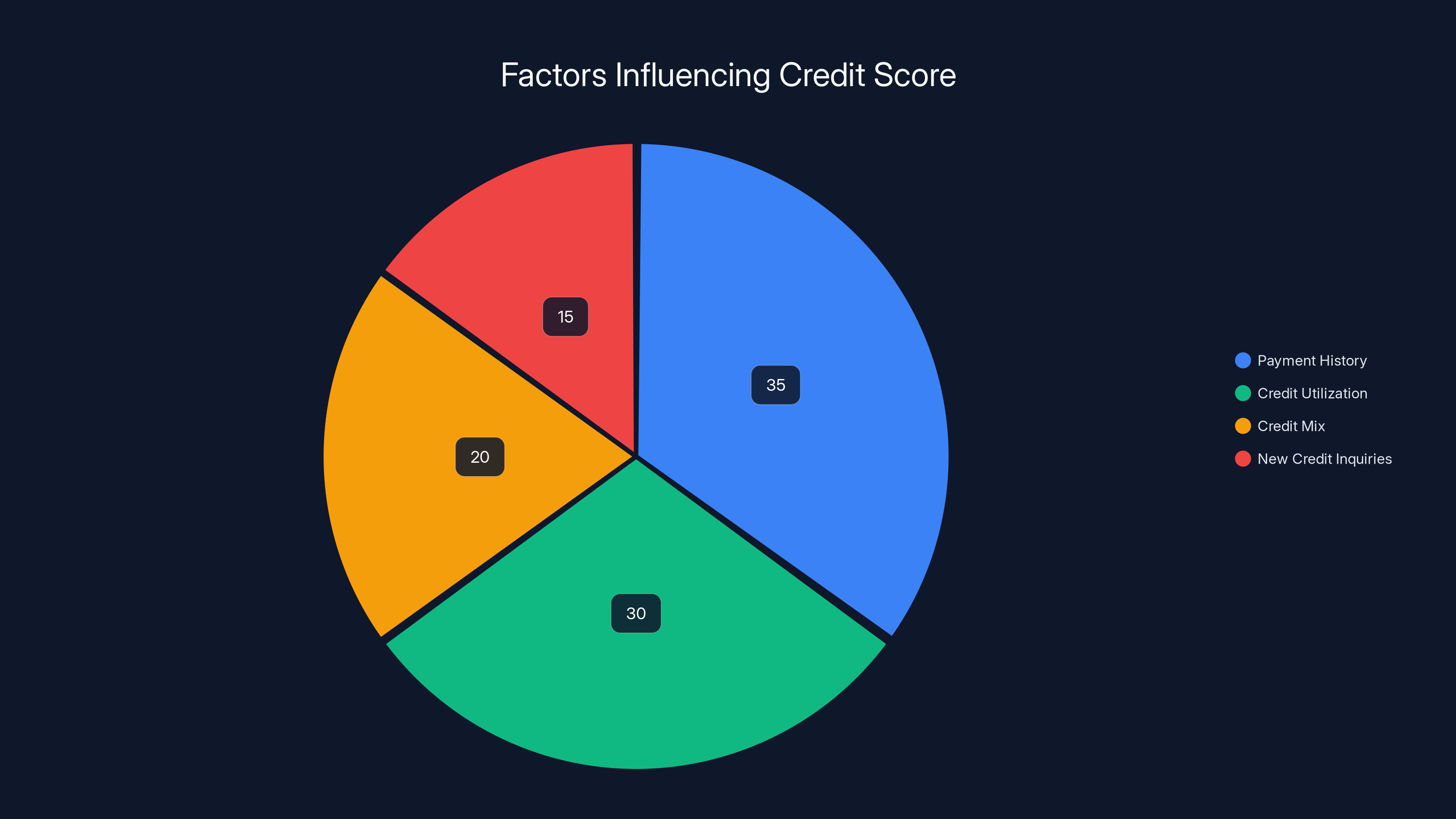

The FICO credit score is primarily influenced by payment history (35%) and amounts owed (30%), with other factors like credit history length, credit mix, and new inquiries contributing less.

The Credit Score: From Simple Calculation to Complex Algorithm

How Credit Scores Work

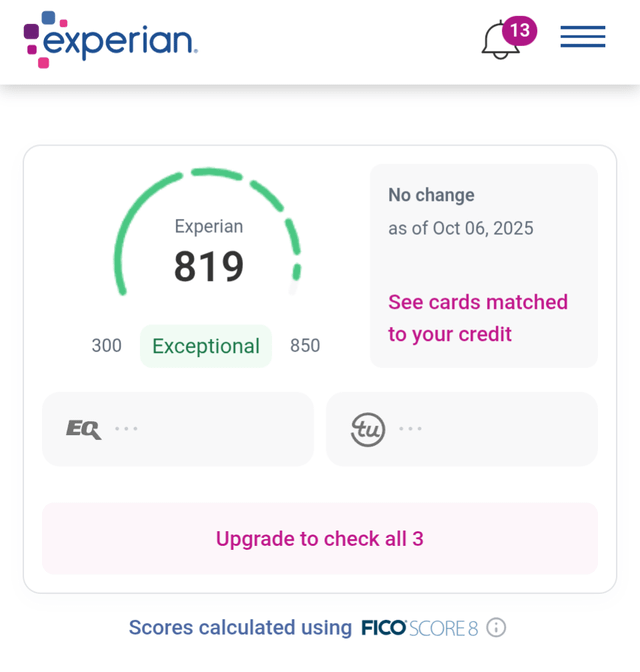

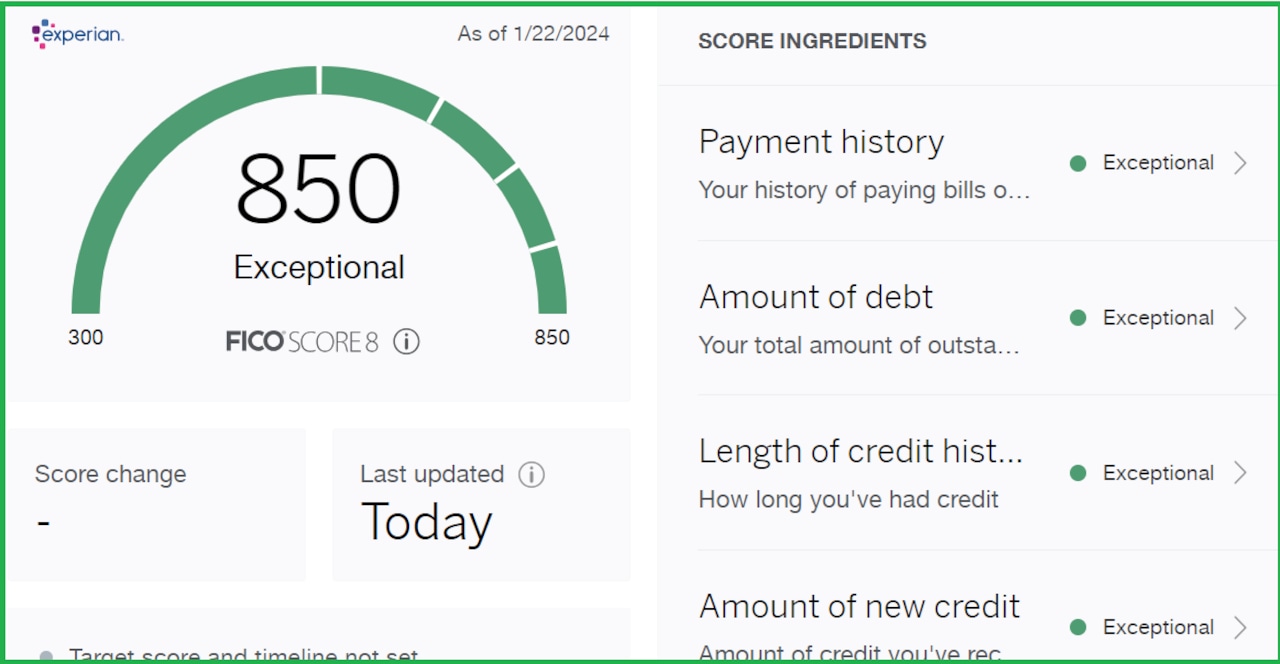

Credit scores represent a compression of complex financial behavior into a three-digit number, typically ranging from 300 to 850. The most widely used score, the FICO score developed by Fair Isaac Corporation, weights factors as follows: 35% payment history, 30% amounts owed, 15% length of credit history, 10% credit mix, and 10% new credit inquiries. This weighting reflects decades of research correlating financial behavior with default risk.

The elegance of credit scores lies in their ability to standardize risk assessment across millions of lending decisions. Rather than requiring individual lenders to conduct extensive analysis of each applicant's financial situation, the credit score provides a single metric that condenses relevant information. This standardization has democratized lending by making it possible for smaller lenders to price credit appropriately and for loans to be sold in secondary markets to investors who rely on credit scores to assess portfolios.

However, credit scores also introduce systematic exclusions and limitations. The score weights factors that correlate with past creditworthiness, but correlation doesn't capture the full complexity of financial responsibility. A person with an excellent credit score might become unable to pay due to job loss, health crisis, or other life disruptions that traditional credit history doesn't predict. Conversely, someone with a lower score might have defaulted years ago due to circumstances that no longer apply.

The Tension Between Fairness and Predictive Accuracy

One of the most challenging aspects of credit scoring involves the inherent tension between statistical accuracy and fairness. A model that predicts default risk most accurately might systematically disadvantage certain groups if those groups have different default patterns due to historical discrimination, systemic barriers, or other non-merit factors. Experian and other credit bureaus face constant pressure to improve model accuracy while simultaneously defending against charges that their scores perpetuate discrimination.

The distinction between causation and correlation becomes crucial here. If historical data shows that certain demographic groups have higher default rates, incorporating that information into a predictive model would improve accuracy—but using demographic information directly violates fair lending laws. The challenge becomes how to design models that don't use prohibited characteristics as direct inputs but also don't inadvertently recreate discriminatory patterns through proxy variables that correlate with protected characteristics.

Experian's approach to this challenge involves regular bias audits, model testing across demographic groups, and transparency about how scores are calculated. But perfect fairness remains mathematically elusive. Every algorithm involves tradeoffs between different types of errors—false positives that deny credit to creditworthy borrowers versus false negatives that extend credit to those who will default. Distributing those errors fairly across population groups creates mathematical constraints that might reduce overall accuracy.

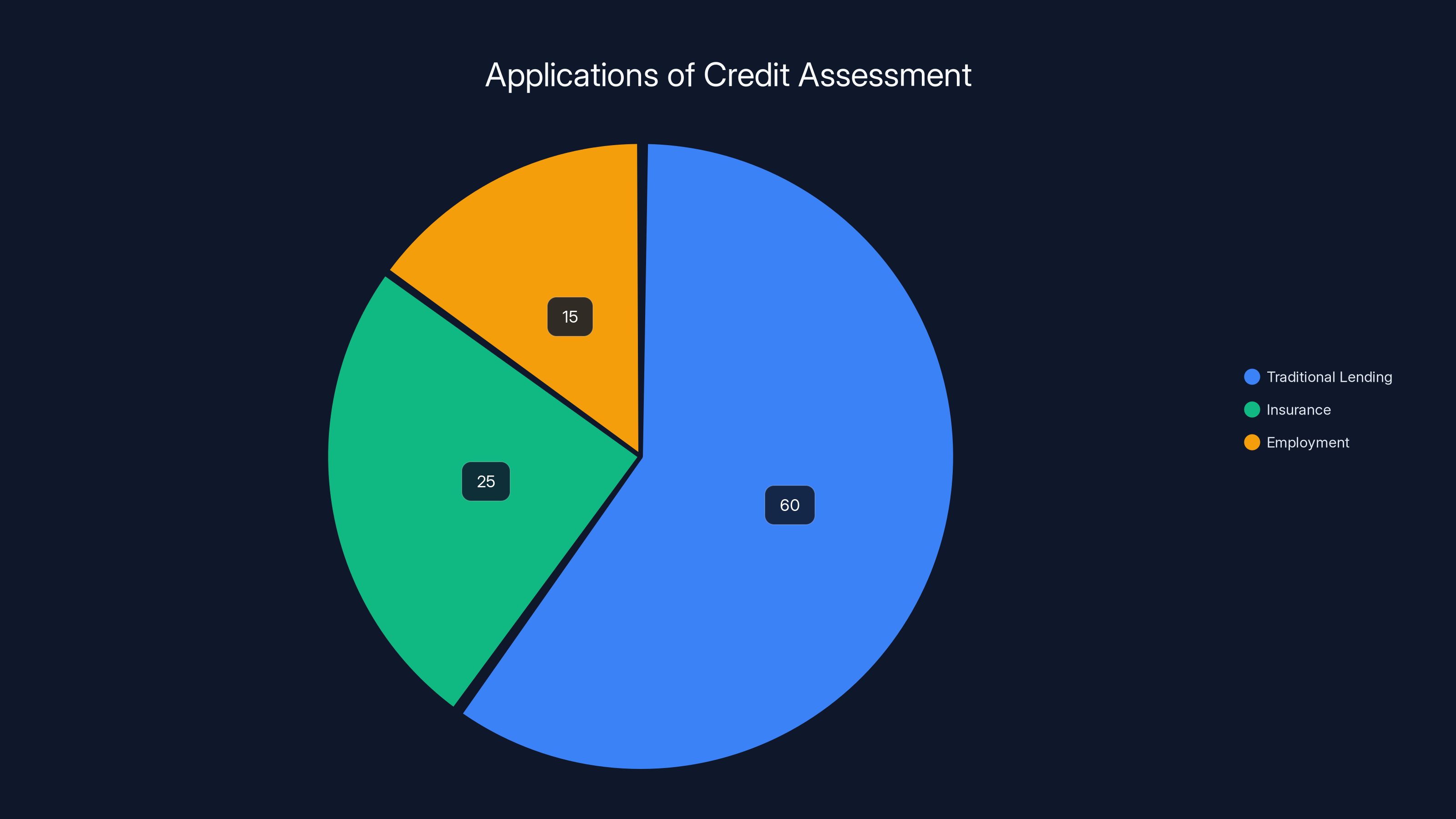

Credit assessment is primarily used in traditional lending (60%), with insurance (25%) and employment (15%) also significant. Estimated data.

Artificial Intelligence: Opportunities and Risks in Credit Assessment

The AI Integration Landscape

Experian's integration of artificial intelligence into credit assessment and risk modeling represents one of the most significant technological shifts in the company's history. AI systems promise to identify patterns in vast datasets that traditional models might miss, potentially improving both accuracy and fairness. Machine learning algorithms can incorporate hundreds of variables simultaneously, discovering nonlinear relationships and interactions that human analysts couldn't easily conceptualize.

The practical applications span across Experian's business: AI assists in identity verification and fraud detection, analyzes alternative data sources to generate credit scores for credit-invisible populations, powers risk assessment for lending decisions, and helps automate customer service interactions. Each application offers potential benefits but also introduces new risks that must be carefully managed.

Consider fraud detection as an example. AI systems can analyze transaction patterns, device information, and behavioral signals to identify fraudulent activity far more quickly than manual review processes. A traditional rule-based system might flag transactions that exceed normal spending patterns, but an AI system can detect subtle inconsistencies that don't trigger simple rules—unusual combinations of transaction types, geographic inconsistencies, device fingerprinting mismatches, and dozens of other signals. This improved accuracy benefits both consumers and institutions by preventing fraud losses.

Yet this same capability also introduces risks. AI systems operating on encrypted data or in ways that obscure their decision logic can make determinations that impact consumers without clear explanations of why. If an AI system flags a transaction as fraudulent or denies credit based on complex pattern matching, the consumer faces a black box decision that's difficult to challenge or correct.

The Hallucination Problem in High-Stakes Decisions

One of the most significant risks with generative AI systems involves their tendency to generate plausible-sounding but false information—what researchers call hallucinations. For applications like creative writing or brainstorming, hallucinations might be tolerable or even valuable. For credit decisions that affect someone's ability to obtain housing, transportation, or education, hallucinations represent an unacceptable failure mode.

The challenge becomes even more acute when considering how AI systems might be used in customer-facing applications or credit decisioning. A large language model might generate explanations for why credit was denied, but those explanations could contain inaccurate information about the applicant's history or current financial situation. The plausibility of the generated text—the fact that it reads well and sounds authoritative—could make it more persuasive than accurate but less eloquent explanations.

Experian's approach to managing this risk involves maintaining human oversight in high-stakes decisions, using AI primarily as a tool that augments human judgment rather than replacing it. Credit decisions that significantly impact consumers might be made by loan officers who use AI-generated analyses as input, rather than algorithms making determinations autonomously. This approach preserves accountability while capturing some of AI's analytical benefits.

However, this hybrid approach introduces its own complexities. Research on human-AI collaboration shows that humans tend to over-rely on algorithmic recommendations, treating them as more objective or reliable than they actually are. A loan officer presented with an AI risk assessment might be unduly influenced by it, not sufficiently considering contradictory information or using their own judgment to override algorithmic recommendations when appropriate.

Bias, Discrimination, and Algorithmic Fairness

The question of whether AI systems can be designed to make fair credit decisions touches on fundamental challenges in algorithmic fairness. One simple truth deserves emphasis: the fairness problem in machine learning isn't primarily a technology problem. It's an economics and ethics problem that technology can't fully solve.

Consider a concrete example. Suppose Experian develops an AI model to assess credit risk for applicants with limited credit history. The model incorporates alternative data sources: rental payment history, utility payments, employment verification. The model is trained on historical data showing what happened to borrowers with these characteristics. But historical data reflects past biases and discriminatory practices in lending. If lenders historically approved certain groups at higher rates or extended more favorable terms to preferred populations, that historical bias gets encoded in the training data.

When the AI model learns from this biased data, it learns that certain characteristics correlated with success—success that was partly determined by discriminatory lending practices. The model might recommend lower credit limits or higher interest rates for groups that historically received worse treatment, not because the model is intentionally biased, but because it's learned accurate patterns from biased historical data.

Experian's defenses against this problem include using fairness constraints during model training, monitoring predictions across demographic groups for disparate impact, conducting regular audits, and engaging with regulators and civil rights organizations. But these measures can only partially mitigate a fundamental problem: using historical data to predict future outcomes will inherit past inequities unless explicitly designed otherwise.

Privacy and Data Security: The Foundation of Trust

The Privacy Paradox: Regulation Versus Reality

Experian operates under a complex regulatory framework that governs what data can be collected, how it can be used, and what rights consumers have to access and correct their information. The Fair Credit Reporting Act provides the primary federal framework, establishing that credit reporting agencies must maintain accurate information and providing consumers with rights to dispute inaccurate information. State privacy laws like California's Consumer Privacy Act add additional requirements, and global operations must comply with the EU's General Data Protection Regulation.

Yet a paradox exists at the heart of this regulatory regime: the law permits extensive data collection and use that many consumers would find objectionable if they fully understood it. Experian can collect data about your financial behavior, compile it into reports that get shared with lenders, employers, and other parties, all without explicit, informed consent. The legal framework treats participation in the financial system as implicit consent to credit reporting.

This distinction between legal permission and genuine consent creates the tension that critics point to when questioning Experian's legitimacy. Yes, Experian operates within legal boundaries. Yes, consumers technically have rights to opt out of certain uses and to access their information. But the practical reality is that most consumers have never reviewed their credit report, don't fully understand how their information is used, and can't realistically function in the economy without participating in the Experian system.

Security: Protecting Massive Data Assets

Experian's 2015 data breach, in which hackers accessed personal information on 15 million consumers, serves as a stark reminder of the security challenges inherent in operating massive centralized databases of sensitive financial information. The breach exposed names, Social Security numbers, birthdates, and addresses—information that can be used for identity theft and fraud. For consumers affected, the breach created years of credit monitoring and heightened fraud risk.

Since that breach, Experian has invested substantially in security infrastructure, incident response procedures, and data protection measures. The company employs security teams monitoring for threats continuously, implements encryption and access controls, and conducts regular security assessments. These investments have become table stakes for any company handling sensitive data at scale.

However, security remains a perpetual challenge as threats evolve and bad actors develop new techniques. The tension involves balancing the accessibility needed for legitimate business operations against the security required to protect sensitive information. Creating completely isolated systems that are impossible to breach would also make them difficult for authorized personnel to access for legitimate purposes. Experian must find a practical middle ground.

Transparency and Consumer Rights

Experian provides consumers with the ability to access their credit reports, dispute inaccurate information, and opt out of certain uses of their data. Under federal law, consumers can access one free credit report annually from each of the three major credit bureaus through Annual Credit Report.com. Consumers can also place fraud alerts or credit freezes on their files to prevent unauthorized access.

Yet transparency remains incomplete. Most consumers don't understand exactly what information Experian maintains about them or how that information influences decisions affecting their lives. Many consumers have never seen their own credit report. Others dispute information but find the dispute process frustrating and ineffective. The combination of legal rights that are difficult to exercise in practice and information that's technically accessible but practically opaque creates barriers to meaningful consumer control.

Experian's efforts to improve transparency include providing more detailed explanations of credit score factors, expanding access to free credit monitoring, and investing in consumer education. But structural limitations remain. The company's business model depends on having information that's valuable to lenders and other institutions. The more transparent Experian is with consumers about exactly how their information is used, the more people might object or try to opt out. There's an inherent tension between transparency that would satisfy critics and transparency that would threaten the business model.

Experian, Equifax, and TransUnion share the U.S. credit reporting market almost equally, each handling data for millions of consumers. Estimated data.

The Alternative Data Revolution: Expanding Beyond Traditional Credit

From Credit-Invisible to Credit-Informed

One of Experian's significant contributions to financial inclusion involves expanding credit assessment beyond traditional credit history. Millions of people—immigrants, young adults, lower-income populations—have limited credit histories despite demonstrating responsible financial behavior through utility payments, rental payments, and employment. Traditional credit scoring excludes these populations, making it difficult for them to access credit at reasonable terms.

Alternative data sources can address this exclusion by incorporating signals of financial responsibility that traditional systems ignore. When Experian includes rental payment history in credit assessment, for example, it creates scoring models that can evaluate consumers with limited credit history more fairly. A person with perfect utility and rental payment records but limited formal credit might receive a reasonable credit score rather than being penalized for lack of traditional credit history.

The expansion of alternative data has already demonstrated measurable impact. Studies show that incorporating utility payment history and other alternative data can improve approval rates for consumers with limited credit history while maintaining similar default rates compared to traditional credit-based lending. This suggests that traditional credit scoring was too restrictive, denying credit to creditworthy borrowers simply because their financial responsibility happened to occur outside the traditional credit system.

The Complexity of Alternative Scoring

However, alternative data scoring introduces new complexities and risks that shouldn't be overlooked. First, alternative data is less standardized than traditional credit data. Utility companies, rental management companies, and other sources report data differently, using different formats, different definitions of what constitutes payment behavior, and different levels of accuracy. Consolidating and standardizing this diverse data requires sophisticated matching algorithms and data quality processes.

Second, alternative data might correlate with creditworthiness differently across different populations. A pattern that indicates financial responsibility for one demographic group might have different meaning for another. For example, rental payment behavior might correlate more strongly with loan repayment in some neighborhoods than others due to differences in eviction processes, tenant protections, or other structural factors. Designing alternative scoring models that improve fairness rather than perpetuating it requires careful analysis.

Third, alternative data creates privacy concerns. As Experian expands the types of information it collects, it increases the amount of financial surveillance affecting everyday consumer behavior. Someone's utility company reporting their payment data to a credit bureau might be surprising to them. The expansion of credit bureaus' data collection authority, even for beneficial purposes like improving financial inclusion, also expands the types of data corporations can systematically collect about consumers.

Regulatory Landscape: Compliance, Scrutiny, and Future Direction

The Fair Credit Reporting Act Framework

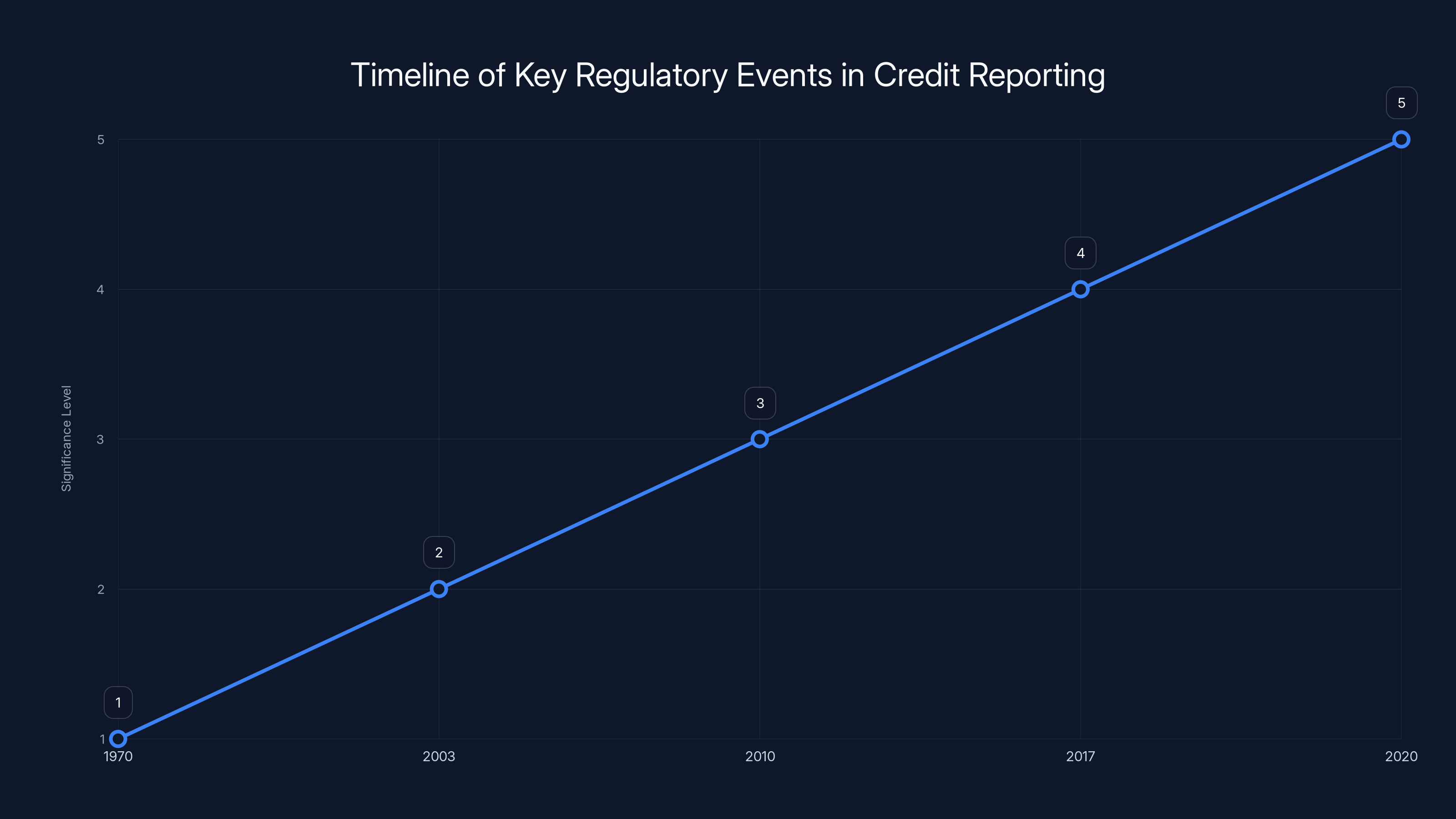

The Fair Credit Reporting Act, passed in 1970, established the primary regulatory framework governing credit reporting agencies in the United States. The law sets requirements for accuracy, establishes consumer rights to access and dispute information, and requires proper procedures for handling disputes. The FCRA has been amended multiple times, including the addition of the Fair and Accurate Credit Transactions Act in 2003, which created the annual free credit report right and established fraud alert procedures.

Within this framework, credit bureaus must maintain accurate information, investigate consumer disputes, and correct inaccurate data. The law also restricts what information can be reported—for example, negative information generally must be removed from reports after seven years (longer for bankruptcies), and credit inquiries have specific validity periods. These rules attempt to balance creditors' need for information with consumers' interests in being judged on recent behavior rather than long-past mistakes.

Yet enforcement of these requirements has been inconsistent. The Consumer Financial Protection Bureau, created in 2010, has authority to enforce FCRA requirements against credit bureaus and can pursue enforcement actions when violations are identified. In 2017, the CFPB took action against Equifax following the major data breach, resulting in a $700 million settlement that established requirements for improved data security and consumer notification. These enforcement actions signal regulatory willingness to hold credit bureaus accountable for violations.

Emerging Privacy Regulations

Beyond the FCRA, credit bureaus face increasing requirements under state privacy laws. California's Consumer Privacy Act, effective since 2020, grants consumers rights to know what data is collected, to delete data, to opt out of selling data, and to be informed of data breaches. Similar laws are being adopted in other states, and international operations must comply with the EU's GDPR, which establishes even more stringent privacy requirements including data minimization and purpose limitation principles.

These newer privacy laws shift from the FCRA's approach of establishing consumer rights to access and correct information toward a more restrictive model that limits data collection itself. GDPR's core principle of data minimization, for example, suggests collecting only data necessary for specific purposes—a significant constraint for companies like Experian that have traditionally collected as much data as possible to identify patterns and develop new products.

The regulatory landscape appears to be moving toward stricter privacy requirements and more active enforcement. Regulators worldwide are questioning whether massive centralized data collection creates risks proportionate to the benefits. Consumer advocacy groups are arguing for more substantial privacy rights and greater restrictions on credit bureau activities. This regulatory trajectory could significantly constrain how Experian operates in the future.

The AI Accountability Question

A newer regulatory question involves accountability for algorithmic decisions. When AI systems make or significantly influence credit decisions, who bears responsibility if those decisions are unfair or discriminatory? Is it the technology company that developed the AI, the credit bureau that uses it, or the lender that makes the final decision based on AI analysis?

Regulators worldwide are beginning to establish frameworks addressing algorithmic accountability. The EU's AI Act, for example, classifies credit scoring and other high-stakes decisions as "high-risk" uses of AI requiring documentation, human oversight, accuracy testing, and other safeguards. These requirements will likely spread to other jurisdictions, with regulatory frameworks increasingly focused on how AI systems are validated and monitored in production environments.

The timeline highlights significant regulatory events impacting credit reporting, from the FCRA's inception in 1970 to the introduction of California's Consumer Privacy Act in 2020. Estimated data.

Experian's Technology Strategy: Building the Modern Credit Platform

Cloud Infrastructure and Scalability

Experian's technology infrastructure has undergone significant modernization to handle the scale and speed of modern financial operations. The company has shifted from legacy on-premises systems toward cloud-based infrastructure that provides greater flexibility, scalability, and the ability to integrate new technologies more rapidly.

Cloud-based systems allow Experian to process credit inquiries in real time, maintaining responsiveness to the millions of credit requests generated daily while simultaneously managing the historical data and computational complexity of credit modeling. A lender requesting a credit decision receives results in seconds rather than days, creating the user experience that modern lending platforms require.

This infrastructure also enables integration with AI and machine learning systems that require substantial computational resources. Training machine learning models on hundreds of millions of consumer records, testing models across various scenarios, and deploying models to production systems all depend on cloud infrastructure that can scale to handle these computational demands.

However, cloud infrastructure also introduces new security and governance challenges. Data moving across cloud systems, data stored in cloud environments, and access to cloud-based systems all require sophisticated security controls. Experian must ensure that cloud providers maintain security standards meeting its regulatory requirements, and must implement additional security controls as needed.

The Evolution Toward APIs and Real-Time Decision-Making

Traditional credit reporting involved batch processes where credit bureaus collected data periodically, updated consumer files, and generated reports that might be days or weeks old by the time lenders used them. Modern platforms operate in real time, with data flowing continuously and decisions being made immediately.

Experian has invested substantially in API-based architectures that allow lenders, businesses, and other parties to integrate directly with Experian systems rather than requesting reports through batch processes. An online retailer evaluating whether to offer financing can make a real-time credit decision, accessing current credit information instantly rather than requesting a separate report. A mortgage lender can incorporate credit information into the application process seamlessly rather than in a separate step.

This shift toward real-time decision-making creates efficiency benefits but also introduces complexity. Real-time systems require sophisticated data synchronization to ensure consistency across the thousands of points where data is accessed. They require rapid response times that demand careful system optimization. They increase the number of times consumer data is accessed, creating additional privacy and security considerations.

Investment in Data Science and AI Engineering

Experian has been aggressively recruiting top talent in data science, machine learning engineering, and AI research. The company sponsors research partnerships with universities, participates in industry conferences focused on machine learning and data science, and maintains dedicated AI research teams exploring frontier applications.

This investment in AI capability extends beyond simple implementation of existing techniques. Experian is researching novel approaches to handling missing data, testing new fairness algorithms, exploring how to incorporate alternative data sources into credit assessment, and investigating how generative AI might be used responsibly in customer service and analytical applications.

The underlying motivation is clear: AI and machine learning represent the future of competitive advantage in data-driven industries. Companies that develop superior AI capabilities earlier will maintain competitive advantages in areas like accuracy of credit assessment, speed of decision-making, and ability to develop new products. Experian's investment in this area positions the company to maintain relevance as credit assessment evolves.

The Debate: Is Experian a Data Surveillance Company?

The Company's Self-Perception

Experian's leadership strongly rejects comparisons to surveillance companies like Palantir. From Experian's perspective, the company is a credit reporting service that operates within a highly regulated framework designed to balance creditor needs for information with consumer privacy rights. The data Experian collects comes from voluntary disclosures by consumers to financial institutions, reports from creditors about account activity, and public records. Experian isn't conducting surveillance in the traditional sense—installing cameras, tracking location, or intercepting communications.

Moreover, Experian argues that its operations directly benefit consumers by making credit available and making lending more fair and efficient. Without credit bureaus providing creditor information, lenders would have to conduct expensive investigations into each borrower's creditworthiness, making credit more expensive and less accessible. Credit scores have democratized lending by making it possible for smaller lenders and new loan products to emerge. Credit bureaus prevent fraud and identity theft by identifying suspicious applications.

From this perspective, the distinction Experian draws—that it's not Palantir—makes sense. Palantir focuses on predictive analytics and surveillance for intelligence and law enforcement applications, often involving invasive data collection and analysis intended to predict criminal activity or identify suspicious behavior patterns. Experian operates in a commercial context where both parties (the lender and the potential borrower) want the information to facilitate their transaction.

The Skeptics' Counterargument

Critics of Experian and other credit bureaus argue that the company functions as a surveillance apparatus regardless of how it defines itself. The company maintains detailed records about millions of people's financial behavior, compiling information without explicit consent, and sharing that information with numerous third parties who use it to make decisions affecting people's lives.

The fact that data collection is nominally voluntary—because creditors report information about accounts that consumers voluntarily open—doesn't fully address the surveillance concern. A person who wants to participate in the economy can't realistically opt out of credit reporting. The consent, from this perspective, is coerced by the economic structure: participate in credit reporting or forfeit the ability to function in modern financial systems.

Moreover, as Experian's data collection expands beyond traditional credit information to include utility payments, rental histories, and potentially other alternative data, the company moves closer to comprehensive financial surveillance. The expansion of data sources creates more complete pictures of consumers' financial lives, allowing more detailed inferences and predictions about behavior.

The appropriate distinction might be less about whether the company intends surveillance and more about the effects and implications of its operations. Even if Experian doesn't consider itself a surveillance company, the effects of its operations—comprehensive tracking of financial behavior, use of that information to make decisions affecting life opportunities, limited consumer control over what information is collected—create surveillance-like conditions.

The Consent Question

The debate ultimately centers on what consent means in contexts where participation is practically mandatory. Experian argues that consumers can opt out of credit reporting and that the Fair Credit Reporting Act provides substantial rights. Critics respond that meaningful opt-out would require foregoing the ability to rent apartments, get jobs, or access credit—effectively impossible for most people.

This tension between legal rights and practical constraints reflects a broader challenge in data regulation. Laws can establish rights to opt out or restrict data use, but if exercising those rights requires major life disruptions, the rights remain theoretical rather than practical. A consumer can technically opt out of Experian data sharing, but doing so might prevent them from getting a mortgage, which for many people isn't a realistic choice.

Resolving this tension might require regulatory approaches that go beyond individual consent and rights. Rather than relying on consumers to exercise rights they may not know they have, regulations could establish default restrictions on what data can be collected and how it can be used, with collection permitted only for specific, demonstrable purposes. Europe's GDPR approaches this through data minimization and purpose limitation principles that restrict collection and use regardless of consent.

Payment history is the most significant factor affecting credit scores, followed by credit utilization. Estimated data based on typical credit scoring models.

Use Cases and Applications: Where Credit Assessment Matters

Traditional Lending: Mortgages, Auto Finance, and Credit Cards

The original and still dominant use case for credit information involves making lending decisions. When someone applies for a mortgage, car loan, or credit card, lenders want to assess the probability of repayment. Credit scores and credit reports provide statistical information about past behavior that correlates with future default risk. Lenders use this information to decide whether to approve the application and, if approving, what interest rate to charge.

This application demonstrates both the value and the concerns about credit assessment. Value: A lender that can accurately price credit risk can offer better terms to low-risk borrowers and price appropriately for higher-risk borrowers, making lending more efficient. Concern: A person's ability to access credit depends partly on factors beyond their control—past discrimination affecting credit-invisible populations, errors in their credit report, or temporary hardship they've overcome. Using historical credit information to predict future behavior relies on the assumption that past behavior predicts future behavior, which isn't always true.

Insurance and Employment Applications

Beyond lending, credit information has expanded into other contexts. Insurance companies use credit information in some states to set insurance rates, operating under research suggesting that credit behavior correlates with insurance claim likelihood. This application extends credit information into domains far removed from lending, affecting insurance costs for people based on financial behavior.

Employment screening represents another controversial expansion of credit reporting. Some employers request credit reports when evaluating job applicants, particularly for positions involving financial responsibility or access to assets. The theory is that credit behavior might predict workplace performance or trustworthiness. Critics argue that this application goes well beyond the original purpose of credit assessment and might perpetuate discrimination by disadvantaging people facing financial hardship.

These expansions of credit reporting into new domains illustrate the regulatory challenge: once comprehensive financial data is collected and centralized, it has value for many potential uses beyond the original purpose. Restricting uses is possible, but difficult to enforce and creates incentives for workarounds.

The Emerging Opportunity: Fintech and Alternative Lending

Fintech companies and alternative lenders increasingly rely on credit information while also exploring alternatives to traditional credit scores. Online lenders might use traditional credit data as one input while also incorporating alternative data, transaction history, and other signals. This diversification of lending approaches could improve credit access for underserved populations while reducing dependence on any single company.

For Experian, this trend creates both opportunities and challenges. Opportunity: Diverse lending approaches might create demand for more specialized credit data and analytics. Challenge: Lending platforms that reduce dependence on traditional credit scores reduce Experian's leverage in the market.

The Fair Lending Question: Discrimination and Protected Characteristics

Legal Boundaries and Fair Lending Law

Fair lending law prohibits credit decisions based on protected characteristics including race, color, religion, national origin, sex, marital status, age (with limited exceptions), and receipt of public assistance. The law applies to lenders directly, but also to credit providers like Experian whose information lenders use. If Experian's credit scores have disparate impact on protected groups—meaning the scores result in systematically lower approval rates or higher interest rates for certain groups—Experian could face legal liability.

The challenge involves distinguishing between discrimination and legitimate risk assessment. If historical data shows that certain groups have higher default rates, is it discrimination to use that information in credit assessment? Or is it accurate risk assessment? The legal answer involves concepts like "business necessity" and "legitimate business purpose." An information source might be permissible if it accurately predicts risk, even if it has disparate impact, unless a less discriminatory alternative exists.

Proxy Variables and Indirect Discrimination

One of the most subtle challenges in fair lending involves proxy variables that correlate with protected characteristics without explicitly using those characteristics. For example, zip code correlates with race due to residential segregation. Using zip code in credit decisions might have disparate impact on racial minorities not because the algorithm is intentionally racist, but because zip code serves as a proxy for race.

Detecting and eliminating proxy discrimination is difficult. It requires constant vigilance, regular bias audits, and sophisticated analysis to identify which variables might be serving as proxies for protected characteristics. A variable might be legitimate in some contexts and problematic in others depending on what relationship it's actually capturing.

Experian's approach involves conducting regular bias audits of credit scores, testing whether scores have different predictive power or different accuracy across demographic groups, and adjusting models if proxy discrimination is detected. But the fundamental challenge remains: designing models that make fair decisions while also accurately predicting risk is mathematically complex and doesn't have perfect solutions.

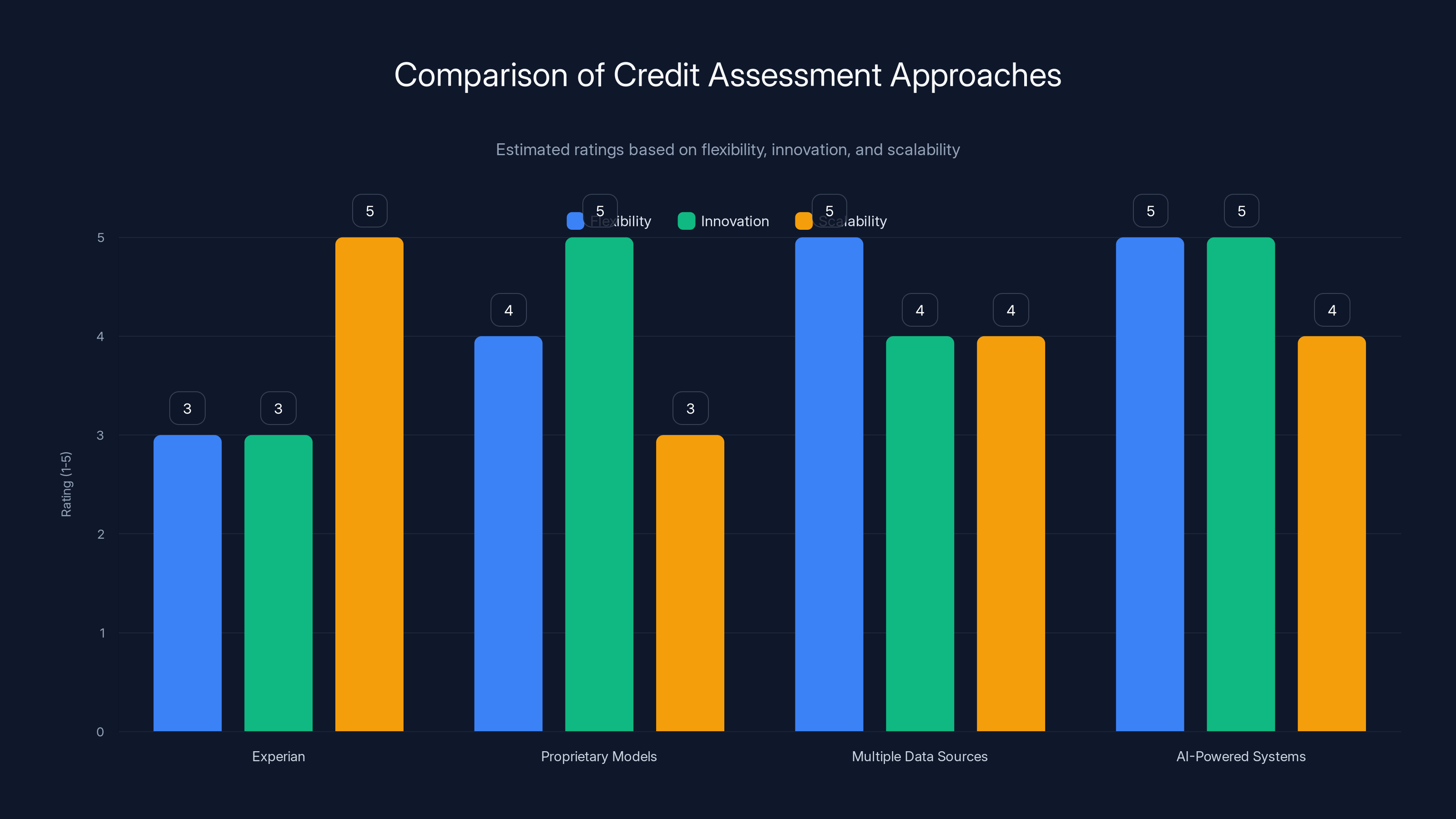

This chart compares various credit assessment approaches based on flexibility, innovation, and scalability. While Experian excels in scalability, alternative approaches like AI-powered systems offer greater flexibility and innovation. (Estimated data)

The Road Ahead: How Credit Reporting Adapts to Regulation and Technology

Regulatory Pressure and Market Response

Experian faces increasing regulatory pressure on multiple fronts: stricter privacy requirements, algorithmic accountability mandates, fair lending enforcement, and consumer rights expansions. These pressures are likely to accelerate as policymakers worldwide focus more attention on data-driven decision-making and its fairness implications.

The company's responses to these pressures will shape not just Experian but the entire industry. If Experian proactively implements strong privacy protections and bias testing, it might establish industry standards that competitors must match. If Experian resists regulation aggressively, it might invite more aggressive regulatory intervention. The company's choices in navigating this landscape will determine whether credit reporting evolves gradually with industry cooperation or through more disruptive regulatory intervention.

The Potential for Disruption

Alternative approaches to credit assessment could disrupt the traditional credit reporting model. Fintech companies building lending platforms that rely on alternative data, transaction analysis, and behavioral signals rather than traditional credit reports are essentially creating alternatives to credit bureaus. If these alternatives prove effective and gain market share, they could reduce Experian's dominance.

Blockchain-based approaches that put consumers more directly in control of their financial data, with cryptographic tools to prove creditworthiness without relying on centralized credit bureaus, represent even more radical alternatives. These approaches are still largely theoretical, but the potential exists for fundamentally different approaches to credit assessment that don't rely on the Experian model.

Moreover, as regulation becomes stricter, new entrants with stronger privacy and fairness practices from inception might have competitive advantages over established companies like Experian burdened by legacy systems and practices.

The Importance of Trust and Transparency

Ultimately, Experian's long-term viability depends on maintaining public trust and demonstrating that the company deserves the power it wields. This requires going beyond legal compliance to embrace genuine transparency, substantive fairness in algorithmic decision-making, and meaningful consumer control over personal data.

The company's defensive framing—"we're not Palantir"—isn't sufficient to address skepticism about whether massive centralized data collection and analysis is appropriate. More constructive approaches might include supporting regulatory frameworks that balance competitive benefits of credit assessment with privacy protection, investing in tools that give consumers genuine agency over their information, and proactively addressing fairness concerns even before regulators mandate action.

Practical Implications: What This Means for Consumers

Understanding Your Credit Report

For most people, the practical implications of understanding Experian's business and operations center on how it affects their own credit reports and scores. Everyone has credit reports maintained by the three credit bureaus, whether or not they've ever actively engaged with these companies. These reports contain information that directly affects major financial decisions—mortgage approval, interest rates, rental applications, and potentially employment opportunities.

Taking control of your credit begins with access. Federal law entitles you to one free credit report annually from each major bureau. Reviewing these reports allows you to identify errors, catch signs of fraud or identity theft, and understand what information is being used to assess your creditworthiness. Disputes of inaccurate information must be investigated by the bureau and, if substantiated, corrected.

Beyond understanding reports, consumers can actively manage their credit behavior to improve their credit score. Payment history matters most, so on-time payments for all obligations directly improve creditworthiness. Keeping outstanding balances low relative to available credit (utilization ratio) helps. Maintaining diverse types of credit (credit cards, installment loans, mortgage) and limiting new credit inquiries also factor into scores. These behaviors demonstrate financial responsibility in ways credit bureaus can measure and reward.

Protecting Privacy and Identity

In an era of increasing data breaches and identity theft, protecting yourself against fraudulent use of your credit involves proactive measures. Placing a fraud alert on your credit file alerts creditors to verify your identity before extending new credit in your name. Credit freezes completely prevent new credit from being issued without your explicit consent, providing more comprehensive protection at the cost of requiring more active management whenever you apply for legitimate credit.

Beyond credit monitoring, overall digital hygiene protects against identity theft. Using strong, unique passwords for financial accounts, enabling two-factor authentication where available, monitoring financial accounts regularly for fraudulent activity, and being cautious about sharing sensitive information all reduce identity theft risk. The centralized data that Experian maintains means identity theft can be particularly consequential, so preventive measures are worthwhile.

The Broader Context of Data Privacy

Experian is part of a broader ecosystem of data collection and analysis that affects your financial life. Credit bureaus collect and aggregate information, but so do data brokers, marketing companies, insurance companies, and numerous other entities. Understanding this broader landscape helps contextualize Experian's role and informs decisions about what data to share and with whom.

At a societal level, engaging with the regulatory debate about credit reporting, privacy, and algorithmic accountability affects the future landscape. Supporting policies that establish consumer rights, ensure fair lending practices, and maintain data security helps shape how companies like Experian will operate in the future. Public pressure, consumer advocacy, and political engagement ultimately determine whether Experian evolves to be more trustworthy or whether regulatory intervention becomes necessary.

Comparing Approaches: Credit Assessment in a Competitive Market

Experian's Market Position

Experian dominates credit reporting in the United States as one of three major bureaus, giving it substantial market power. This dominant position creates advantages—scale economics, extensive historical data, widespread relationships with lenders—but also creates vulnerability if competitors emerge or regulations shift against the traditional model.

The company's response to competitive and regulatory pressures has involved investing in technology, expanding into adjacent areas like identity verification and fraud detection, and integrating AI into core products. These investments position Experian to maintain relevance as markets evolve. For organizations looking at credit decisioning and risk assessment solutions, Experian provides proven products with scale and regulatory compliance built in.

However, Experian's size and dominance also make it a target for regulation and public criticism. Smaller competitors operating in niche markets might enjoy advantages in terms of flexibility and ability to implement innovative approaches without managing the complexity of legacy systems serving millions of clients.

Alternative Approaches Worth Considering

For teams building modern credit or risk assessment platforms, Experian represents one approach but not the only approach. Alternative strategies include: building proprietary risk models using your own customer data, leveraging multiple data sources instead of relying on a single credit bureau, incorporating alternative data that might be more predictive for specific lending contexts, or using AI-powered decision systems that adapt to specific lending strategies.

Teams prioritizing cost-effective automation and AI-powered analysis might explore AI-driven platforms for document analysis, report generation, and workflow automation. Some of these platforms, like those focused on data science and analytics automation, can help teams build and manage custom risk models efficiently. For organizations wanting to reduce friction in credit assessment processes, automation tools that handle document processing and decision workflows can improve speed and consistency.

The key consideration involves matching your approach to your specific needs. If you're a large financial institution needing comprehensive credit data at scale, Experian remains a critical partner. If you're a fintech company building a lending platform with specific requirements, custom approaches leveraging alternative data and your own analytics might provide better alignment with your strategy.

The Ethical Foundation: Responsibility Beyond Regulation

The Case for Responsible Data Stewardship

Experian's leadership defends the company's operations by pointing to regulatory compliance and consumer rights. These defenses are legitimate—Experian does operate within legal boundaries, and does provide consumers with access and dispute rights. But as the company's technology leadership acknowledges, the real question isn't whether the company complies with minimum legal requirements. It's whether the company can be trusted as a responsible steward of sensitive data that affects fundamental life outcomes.

This requires going beyond legal compliance to embrace genuine responsibility. Responsibility means proactively identifying where algorithms might perpetuate bias, not waiting for regulators or lawsuits to force action. It means being transparent about how information is used and what inferences are drawn, not obscuring decision logic in proprietary algorithms. It means prioritizing accuracy and fairness even when doing so reduces profitability. It means being honest about what data can and cannot predict.

The challenge facing Experian is demonstrating that this kind of responsibility guides its operations, not just its public statements. Consumers and regulators understandably skeptical of a company built on controlling the financial information that determines their economic opportunities need to see sustained evidence that the company deserves that power.

The Broader Stakes

The question of whether Experian can be trusted with its power extends beyond the company itself to shape how society approaches data-driven decision-making. If Experian demonstrates that massive financial data aggregation can be managed responsibly, it builds confidence in other data-driven systems. If Experian is revealed to have misused data or caused harm despite regulations intended to prevent such harm, it fuels skepticism about whether algorithmic decision-making can ever be sufficiently fair and trustworthy.

This makes Experian's choices about how to evolve its technology, integrate AI responsibly, and engage with fairness concerns consequential for the entire tech industry. The company's decisions on these fronts are being watched not just by consumers and regulators, but by policymakers worldwide trying to determine what kinds of data-driven businesses should be permitted and how they should be governed.

Technological Integration and Workflow Optimization

How Modern Platforms Handle Complex Data Pipelines

Experian's integration of AI and modern technology into credit assessment involves sophisticated data pipeline architecture. Data flows continuously from creditors, public records, alternative data sources, and other inputs into Experian's systems. This data must be cleaned, standardized, matched to consumer records, stored securely, and made available for analysis and decision-making.

The complexity of these pipelines is immense. Matching data from multiple sources to unified consumer records requires identity resolution algorithms that can handle name variations, address changes, middle names, and other variations in how people present themselves across different institutions. Data quality management ensures that errors or inconsistencies don't propagate through the system. Version control and auditing track changes to data, enabling compliance with regulatory requirements and supporting dispute investigation.

For organizations building their own systems, understanding how to design data pipelines that maintain accuracy, security, and regulatory compliance while also supporting rapid decision-making and continuous improvement is essential. Modern approaches emphasize automation, quality assurance at every step, and monitoring systems that detect anomalies or errors. The complexity Experian has built over decades can serve as both inspiration and cautionary tale about the challenges of operating at massive scale.

Workflow Automation in Financial Decision-Making

Experian's operations involve thousands of daily decisions about credit approval, dispute resolution, fraud detection, and other financial determinations. Automating these workflows improves efficiency and consistency while also reducing the chance of human error. However, inappropriate automation—automating decisions that should involve human judgment, or failing to properly oversee automated systems—creates risks.

The balance Experian must strike involves using automation to improve efficiency while maintaining appropriate human oversight for decisions with significant consumer impact. Routine determinations like minor disputes that clearly require correction can be fully automated. Determinations involving credit denial or major decisions affecting consumer financial access should involve human review and the ability for consumers to explain their perspective to a human decision-maker, not just an algorithm.

Workflow automation also applies to internal operations: processing disputes, investigating fraud, generating reports for regulatory compliance, and managing customer service interactions. Automating these internal workflows improves efficiency and reduces the cost per transaction, ultimately benefiting both Experian and consumers through faster service and better resource allocation.

The Future of Credit and Financial Decision-Making

Decentralized and Distributed Approaches

One significant direction for the future of credit assessment involves more decentralized approaches that don't depend on a single centralized company. Distributed ledger technologies and cryptographic tools could enable borrowers to prove creditworthiness without relying on Experian to maintain and control that information. Self-sovereign identity systems could give individuals control over what identity information is shared and with whom.

These approaches remain largely experimental but represent potentially significant disruption to the traditional credit reporting model. If successful, they could reduce the power of centralized credit bureaus while giving consumers more agency. However, they also face challenges: matching historical credit information to distributed systems, ensuring that cryptographic proofs are as reliable as centralized databases, and overcoming network effects that favor existing established systems.

Artificial Intelligence and Predictive Modeling

AI's role in credit assessment will likely continue expanding, with machine learning systems becoming more sophisticated and capable of identifying patterns that simpler models miss. However, the trajectory also depends on whether AI capabilities prove to be as transformative as enthusiasts hope and whether regulatory approaches successfully address fairness and transparency concerns.

One likely development involves AI systems handling increasing amounts of the analytical work while maintaining clearer human oversight of final decisions, particularly decisions that significantly affect consumers. Instead of black-box algorithms making autonomous determinations, AI serves as a tool that augments human decision-making, providing analysis and recommendations that humans evaluate and decide upon.

Privacy-Preserving Technologies

Technologies that enable analysis of financial data while preserving privacy—differential privacy, federated learning, secure computation—could reshape how credit assessment works. Rather than centralizing all data in one place, these approaches allow analysis and model-building across distributed data sources while maintaining privacy.

For Experian, privacy-preserving technologies could address privacy concerns by limiting what the company needs to centralize. For example, rather than centralizing all utility payment data, federated learning approaches could build credit models across decentralized utility data without centralizing it. This could provide some of the benefits of Experian's analysis while reducing privacy risks.

Key Takeaways and Recommendations

Experian's position as a dominant credit reporting agency gives the company enormous power over financial outcomes for millions of people. This power is exercised within a legal regulatory framework, but the question of whether legal compliance is sufficient for responsible data stewardship remains contested.

The company's integration of artificial intelligence into credit assessment offers opportunities to improve accuracy and fairness, but also introduces new risks of bias, errors, and decisions that disproportionately harm consumers. Managing these risks requires going beyond regulatory compliance to embrace genuine responsibility and transparency.

For consumers, understanding Experian's role in credit assessment and taking active steps to monitor credit reports, protect identity, and engage with the broader policy questions about data regulation is important. For policymakers, the challenge involves establishing regulatory frameworks that balance the efficiency benefits of credit reporting with legitimate privacy and fairness concerns. For innovators, Experian's dominance suggests both opportunities to build alternatives and challenges in displacing an entrenched system with scale advantages.

The way Experian evolves in response to technological change, regulatory pressure, and public skepticism will likely influence how society approaches algorithmic decision-making more broadly. The company's choices about AI integration, fairness practices, transparency, and consumer control will determine whether centralized data-driven decision-making can be trusted or whether more fundamental changes to how credit assessment works become necessary.

FAQ

What is Experian and how does it fit into the credit system?

Experian is one of three major credit reporting agencies that collect financial data on consumers and use that data to generate credit reports and credit scores. These scores and reports are widely used by lenders, landlords, employers, and other parties to assess creditworthiness and financial responsibility. Experian operates as an intermediary in the financial system, collecting data from creditors and other sources and distributing that information to institutions that need it to make decisions.

How does Experian collect data about consumers?

Experian collects data from multiple sources including creditors like banks and credit card companies that report account information, public records including bankruptcies and tax liens, and increasingly alternative data sources such as utility payments, rental payments, and mobile phone bills. When you open a credit account or make financial transactions, information about your behavior gets reported to credit bureaus. Experian consolidates this data into consumer files and uses it to generate credit reports.

What are the benefits of credit scoring and why do we need it?

Credit scoring enables lenders to assess risk efficiently, making lending faster, cheaper, and more accessible. Without standardized credit scores, lenders would need to conduct expensive individual investigations of each applicant, making credit less available and more expensive. Credit scores also prevent fraud and help lenders make more consistent decisions. However, these benefits must be balanced against privacy concerns and the potential for credit scores to perpetuate discrimination or exclude people from financial opportunities.

How do Experian and other credit bureaus use artificial intelligence?

Experian uses AI and machine learning in multiple applications including fraud detection, credit scoring, identity verification, and risk assessment. AI systems can analyze vast amounts of data to identify patterns and make predictions more accurately than traditional models. However, AI also introduces risks including potential bias if trained on biased historical data, lack of transparency in how decisions are made, and the possibility of errors that disproportionately harm certain populations.

What rights do consumers have regarding their credit information?

Under the Fair Credit Reporting Act and related laws, consumers have the right to access their credit reports, dispute inaccurate information, place fraud alerts or credit freezes on their files, and opt out of certain uses of their information. Consumers can access free credit reports annually from each major bureau through Annual Credit Report.com. However, exercising these rights requires active engagement, and most consumers have limited practical alternatives to participating in the Experian system.

How does Experian address fairness and discrimination concerns?

Experian conducts regular bias audits of credit scores, tests whether scores have different accuracy or predictive power across demographic groups, and adjusts models if discrimination is detected. The company also complies with fair lending laws that prohibit credit decisions based on protected characteristics. However, the fundamental challenge of using historical data to predict future outcomes while avoiding perpetuation of past discrimination remains difficult, and critics question whether Experian's efforts are sufficient to address systemic fairness concerns.

What is the difference between Experian and a surveillance company like Palantir?

Experian operates in a commercial lending context where both lenders and borrowers have interest in sharing credit information to facilitate transactions, whereas Palantir focuses on intelligence and surveillance for government agencies. However, critics argue that the practical effects of Experian's operations—comprehensive financial data collection, use of that data to make decisions affecting people's lives, limited consumer control—create surveillance-like conditions regardless of Experian's intentions or legal authority.

What are the privacy risks of centralized credit reporting?

Centralized credit reporting creates a single point of failure where a data breach could expose sensitive financial information on millions of people. Centralized control also concentrates power in the hands of companies that control what data is collected, how it is analyzed, and how it is used. The expansion of credit reporting to include alternative data sources like utility payments and rental history increases the scope of financial surveillance affecting everyday consumer behavior.

What alternatives to traditional credit scoring exist or are emerging?

Alternative approaches to credit assessment include fintech companies using transaction history and alternative data, decentralized systems using blockchain and cryptography, and AI-powered platforms that can build custom risk models for specific lending contexts. These approaches could reduce dependence on Experian while potentially offering better alignment with specific lending strategies. However, established systems have significant network effects and scale advantages that make displacement difficult.

How should Experian balance innovation with responsibility?

Experian should go beyond minimum legal compliance to embrace genuine responsibility, including proactive identification and correction of algorithmic bias, transparency about how credit information is used, meaningful consumer control over personal data, and honest communication about what credit scores can and cannot predict. This requires resisting financial incentives to maximize data collection and use in favor of approaches that build consumer trust. The company's choices on these questions will influence broader societal approaches to data-driven decision-making.

Related Articles

- AMI Labs: Inside Yann LeCun's World Model Startup [2025]

- Tesla's Dojo Supercomputer Restart: What Musk's AI Vision Really Means [2025]

- EU Investigation xAI Grok Deepfakes: Regulatory Impact & Compliance Guide

- Capital One Acquires Brex: Fintech Disruption & Strategic Alternatives

- Apple's Siri AI Chatbot Revolution: What Changed & Alternatives

- Apple's AI Chatbot Siri: Complete Guide & Alternatives 2026