The Freemium Paradox in the Age of AI

Freemium is having a moment. Not because it's new. Not because it suddenly works better. It's having a moment because AI companies have finally proven the math at a scale we've never seen before.

But here's the uncomfortable truth that everyone's glossing over: freemium doesn't work for most companies. It never has. And even in the golden age of AI, it still doesn't.

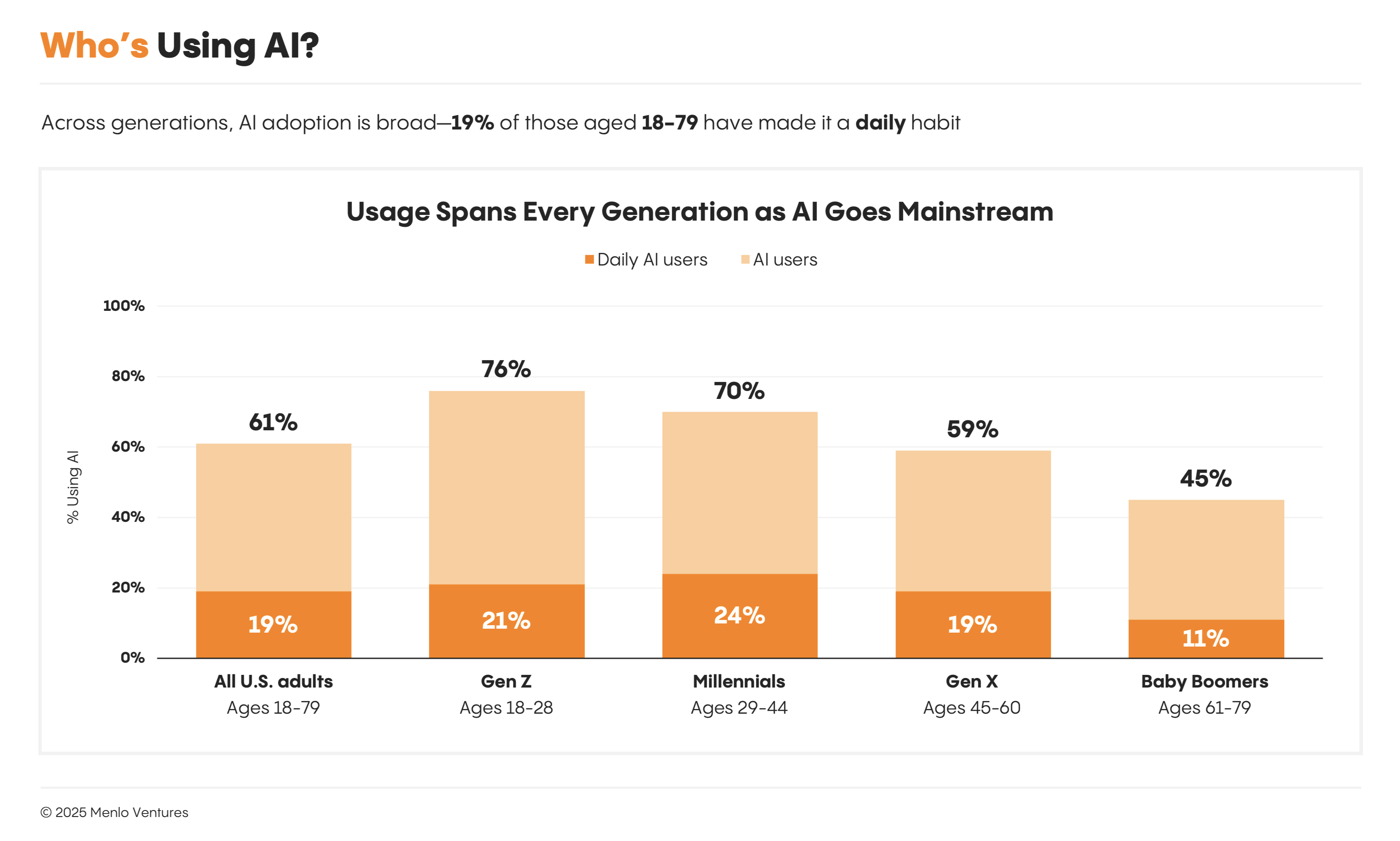

I know that sounds harsh. And counterintuitive. Chat GPT has 800 million weekly active users. Perplexity hit 30 million monthly active users in months. Google Gemini crossed 650 million monthly active users by mid-2025. These are numbers that would've been unimaginable for SaaS a decade ago.

But those companies aren't special because freemium works. They're special because they have something so fundamentally useful, so foundational, that hundreds of millions of people will use it for free. And even then, their conversion rates hover around 2-5%.

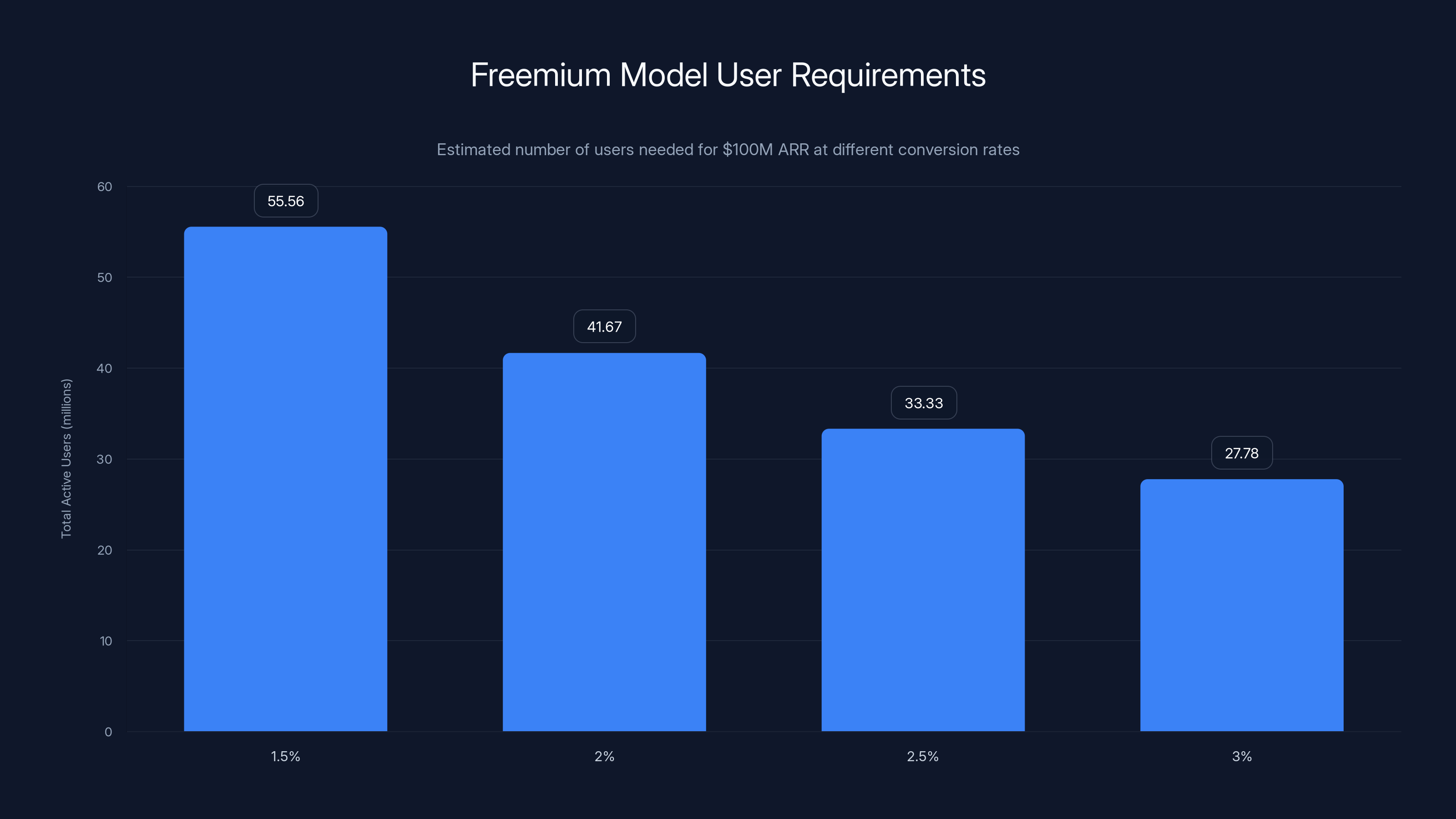

That's the insight nobody wants to hear: freemium requires a staggering number of users to generate real revenue. It's not a growth hack. It's not a distribution shortcut. It's a math problem with a minimum viable scale that most companies can't reach.

I built partly freemium products that hundreds of millions of people used. I've watched the AI explosion happen in real-time. And I've learned something that every founder trying to build the next Chat GPT needs to understand: freemium is back, but the requirements are more brutal than ever.

TL; DR

- The Math is Unforgiving: To hit 10/month per user, you need 50 million active users

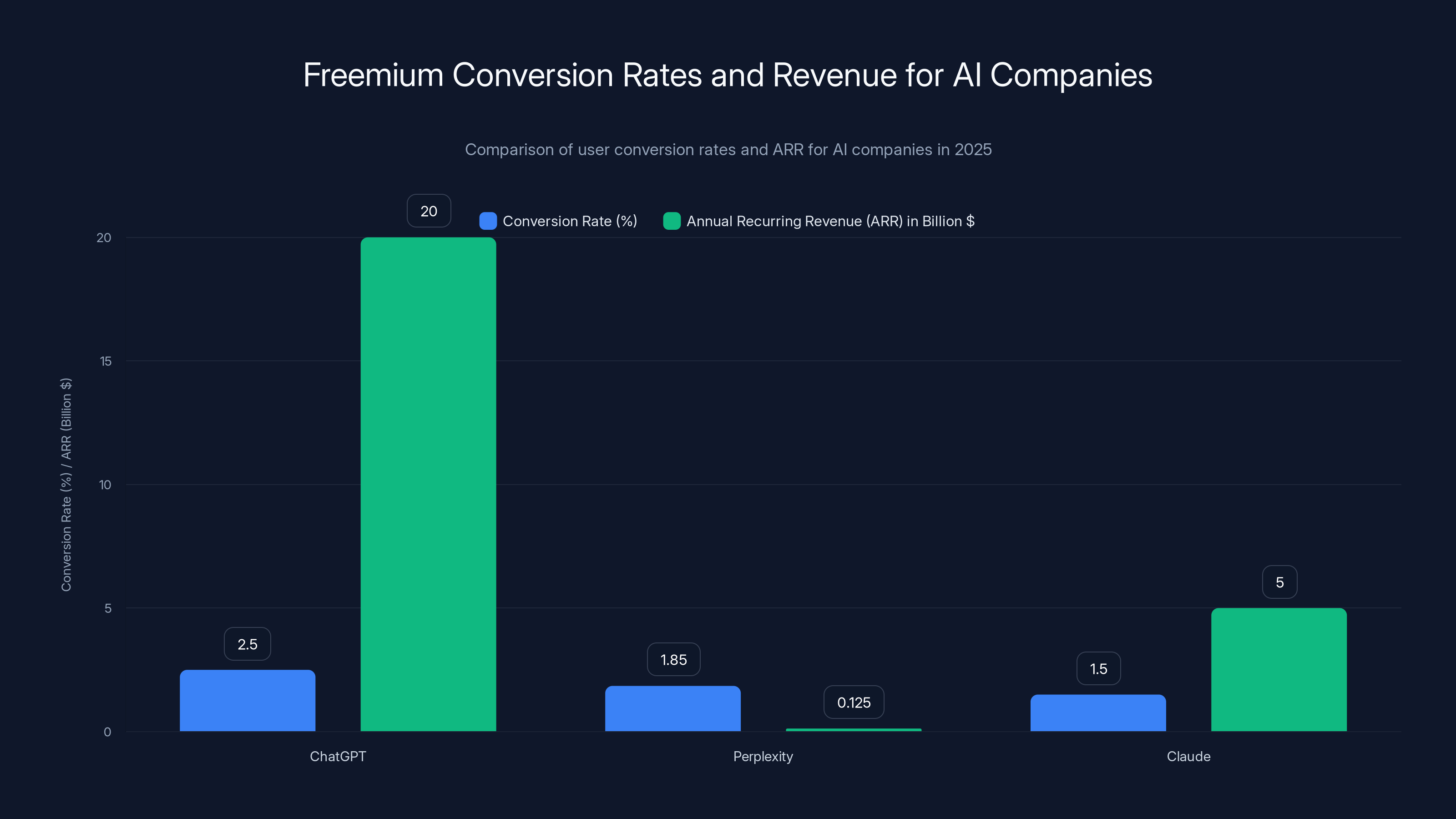

- AI Leaders Prove It: Chat GPT (100-150M ARR), and Claude ($5B ARR) all followed the same conversion pattern

- Freemium Has Massive Requirements: Not millions of users—tens of millions of engaged, active, regularly-using users

- If You Have Thousands, Not Millions: Sell it. Direct sales, enterprise, SMB motion—anything but freemium

- The Runway Problem: Building to 50 million users takes longer than almost any startup's funding can support

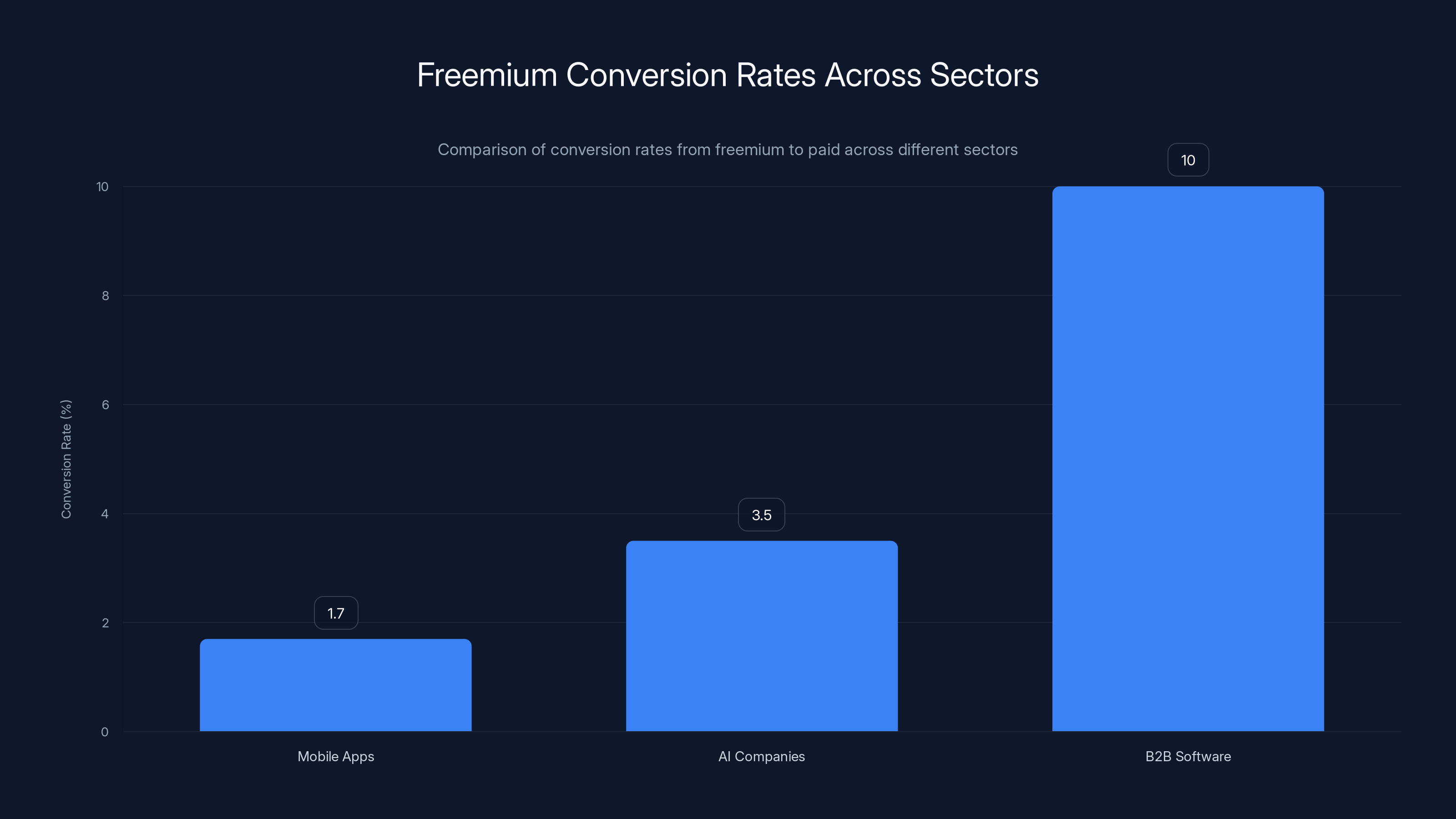

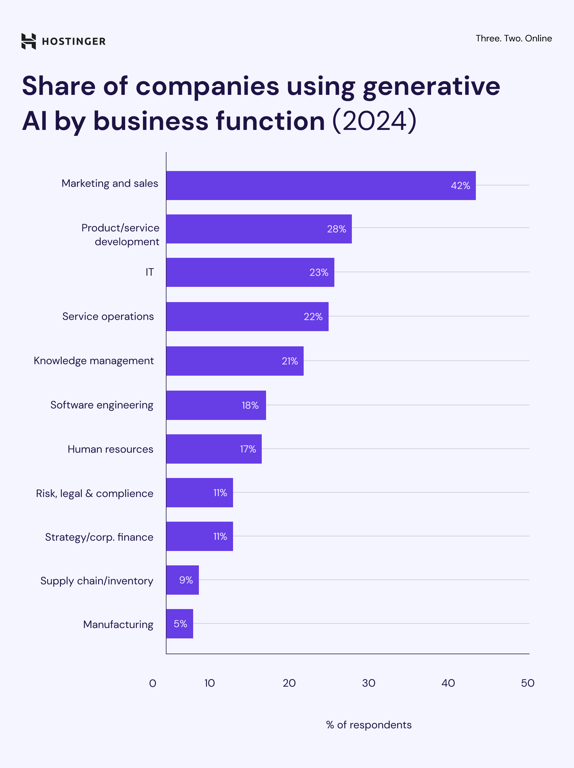

AI companies like ChatGPT have higher conversion rates (2-5%) compared to mobile apps (1.7%), but B2B software can achieve even higher rates (5-15%). Estimated data.

Understanding the Freemium Math That Actually Works

Let me walk you through the calculation, because this is where most founders get it wrong.

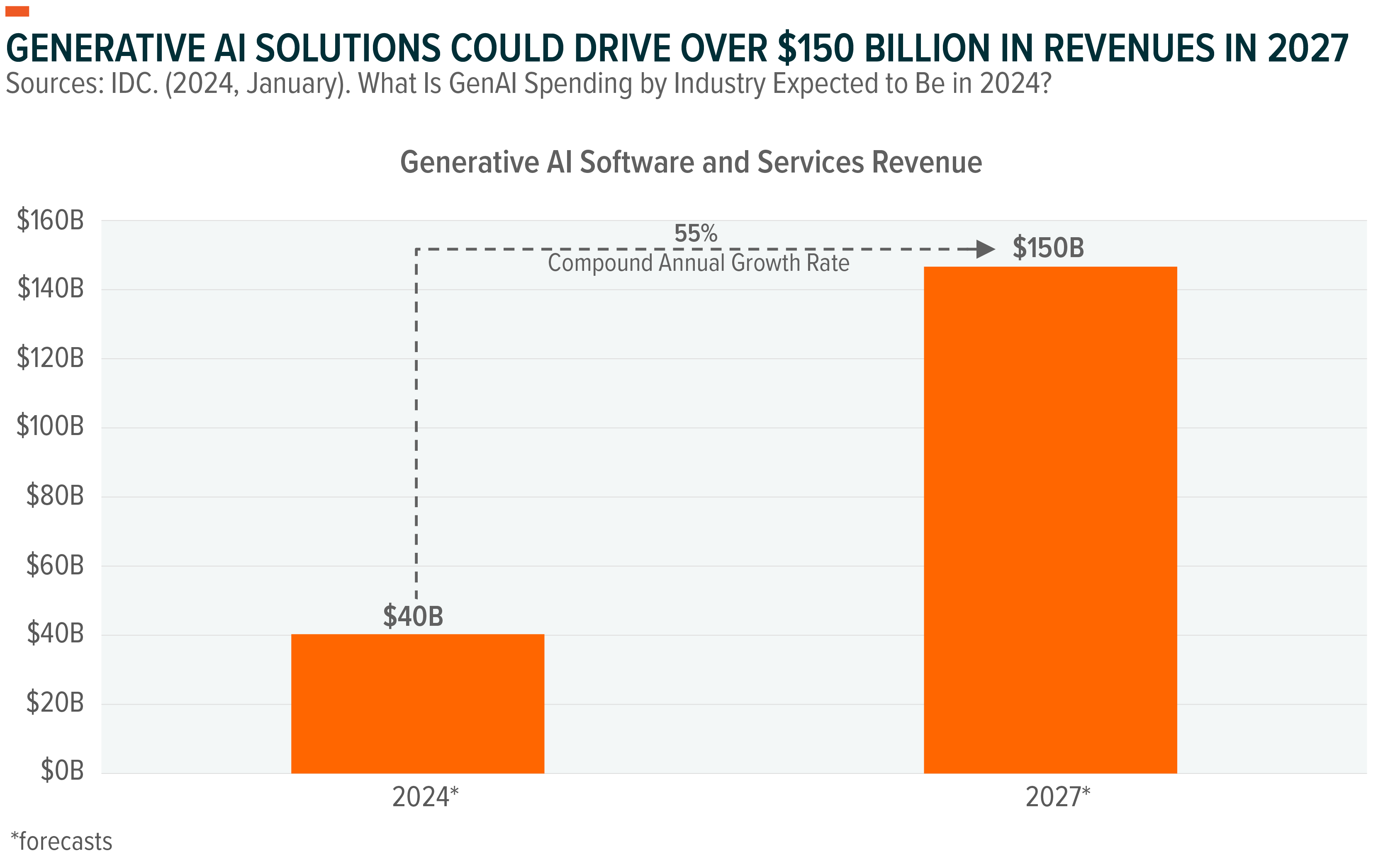

Assume you're building an AI product. You want to hit $100 million in annual recurring revenue (ARR). That's when people start taking you seriously. That's when you can potentially go public. That's when you have real staying power.

Assume you charge $10 per month for your paid tier. That's reasonable for a B2B SaaS product aimed at small teams. Not enterprise pricing. Not consumer pricing. Just middle-of-the-road SaaS.

Here's the formula:

To hit $100 million:

So you need roughly 833,000 paying customers at

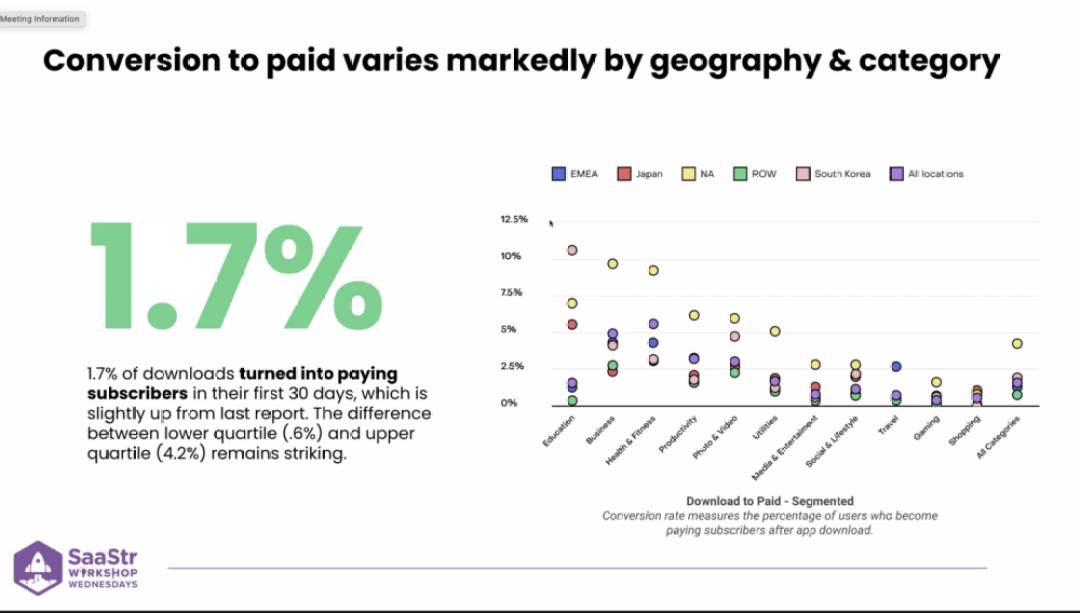

Now, here's where freemium enters the equation. If your conversion rate from free-to-paid is 2% (and data from Revenue Cat, which processes payments for 34% of all mobile subscription apps, shows the average is 1.7%), then:

You need roughly 42 million active users to hit $100 million ARR with a 2% conversion rate.

But let's be realistic. Not all 42 million users will be "active" in the way that matters. Some will sign up and never come back. Some will use you once and churn. Real conversion rates account for this, but real engagement rates are even more brutal.

Revenue Cat's data and the AI companies' numbers suggest you actually need somewhere between 40-50 million genuinely active, regularly-engaging users to make freemium work at that scale.

That's not a typo. That's not pessimism. That's just math.

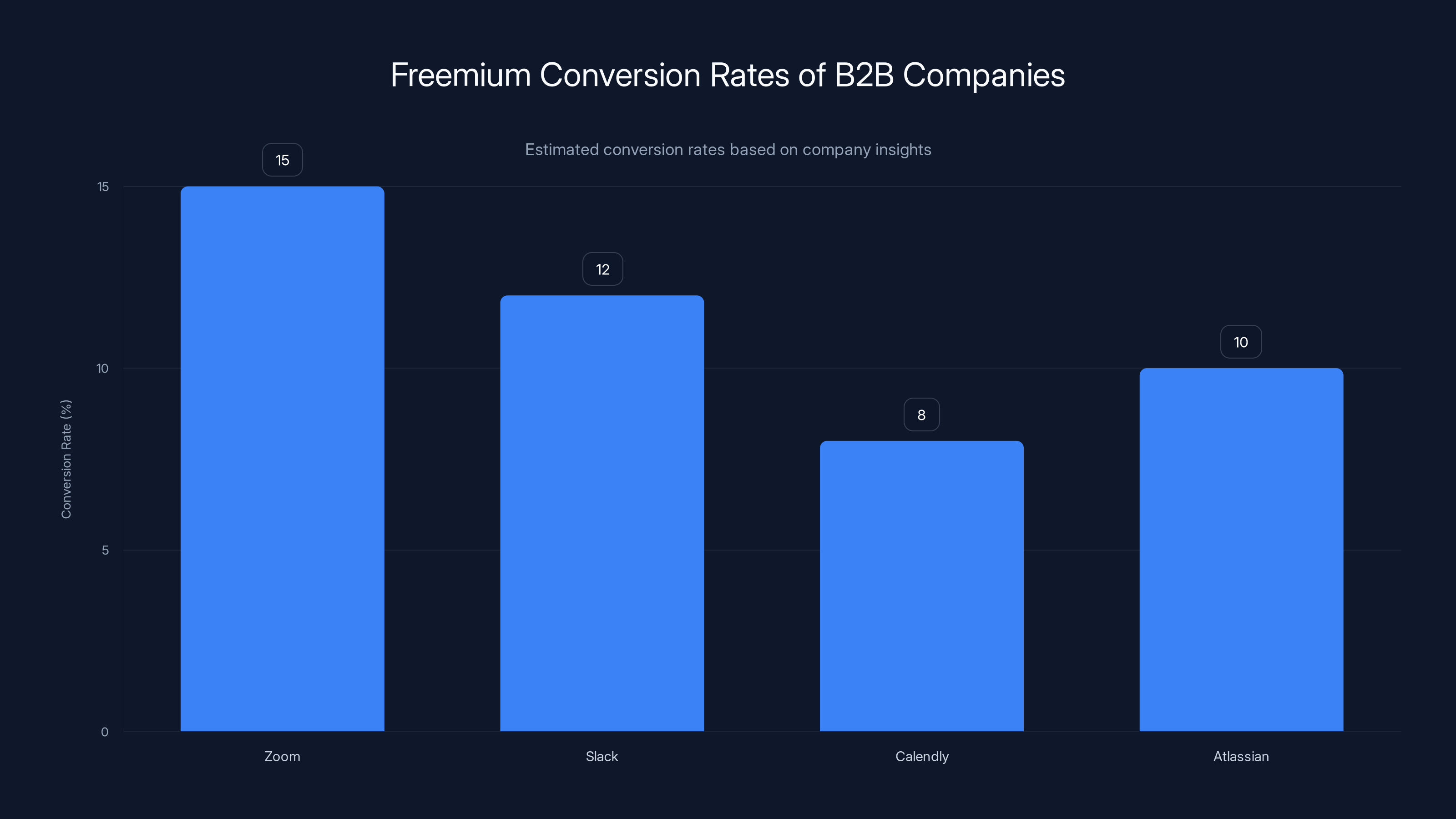

Zoom leads with an estimated 15% conversion rate due to its strategic free tier limitations, while Calendly's universal appeal results in an 8% conversion rate. Estimated data.

How AI Companies Are Actually Running the Numbers

Let's look at the companies that are getting freemium right in 2025. Because they're not just successful—they're brutally transparent about their numbers.

Chat GPT: The Gold Standard of Freemium

Chat GPT has 800 million weekly active users. That's the baseline. Every week, 800 million people open Chat GPT and use it.

From that massive base, they have approximately 12-15 million paid subscribers across Chat GPT Plus (

That's a conversion rate of approximately 2% on a weekly basis. Maybe 3% if you measure monthly.

Open AI's revenue hit $20 billion in ARR exiting 2025, mostly from API usage and enterprise deals, but also from these paid subscriptions. But here's what's staggering: they needed 800 million weekly active users to get there. Not 8 million. Not 80 million. 800 million.

Perplexity: Proving the Model Works

Perplexity AI hit 30 million monthly active users and generated

Do the math on their conversion rate:

If they have roughly 500,000 to 600,000 paying subscribers (based on their ARR and pricing), that's a conversion rate between 1.7% and 2% of their 30 million monthly active users.

Same number. Different product. Same underlying math.

Claude by Anthropic: The Enterprise Play

Anthropic's Claude reached 30 million monthly active users with

Their freemium tier (Claude.ai free) is real, but it's a gateway to enterprise deals. The conversion rate from free web users to enterprise customers is different, but the principle is identical: you need a massive base to generate concentrated revenue from the top.

Midjourney: Freemium Without Venture Capital

Midjourney hit $500 million in revenue in 2025 with 20+ million registered users. They did it with a team of roughly 100 employees and zero external funding.

Their subscription model is different—they use credits and tiered monthly passes, not a single freemium offering. But the math is the same. They reached 20 million users, converted a small percentage to paid, and built a $500 million company on that foundation.

The difference? They built something so valuable (image generation) that millions of people were willing to pay. And they did it lean, without burning through venture capital waiting for that user base to materialize.

The Brutal Timeline Problem Nobody Talks About

Let's say you're a founder who just raised a Series A. You have $15 million. You're building an AI product. You've done the math. You know you need 50 million users to make freemium work.

How long does that take?

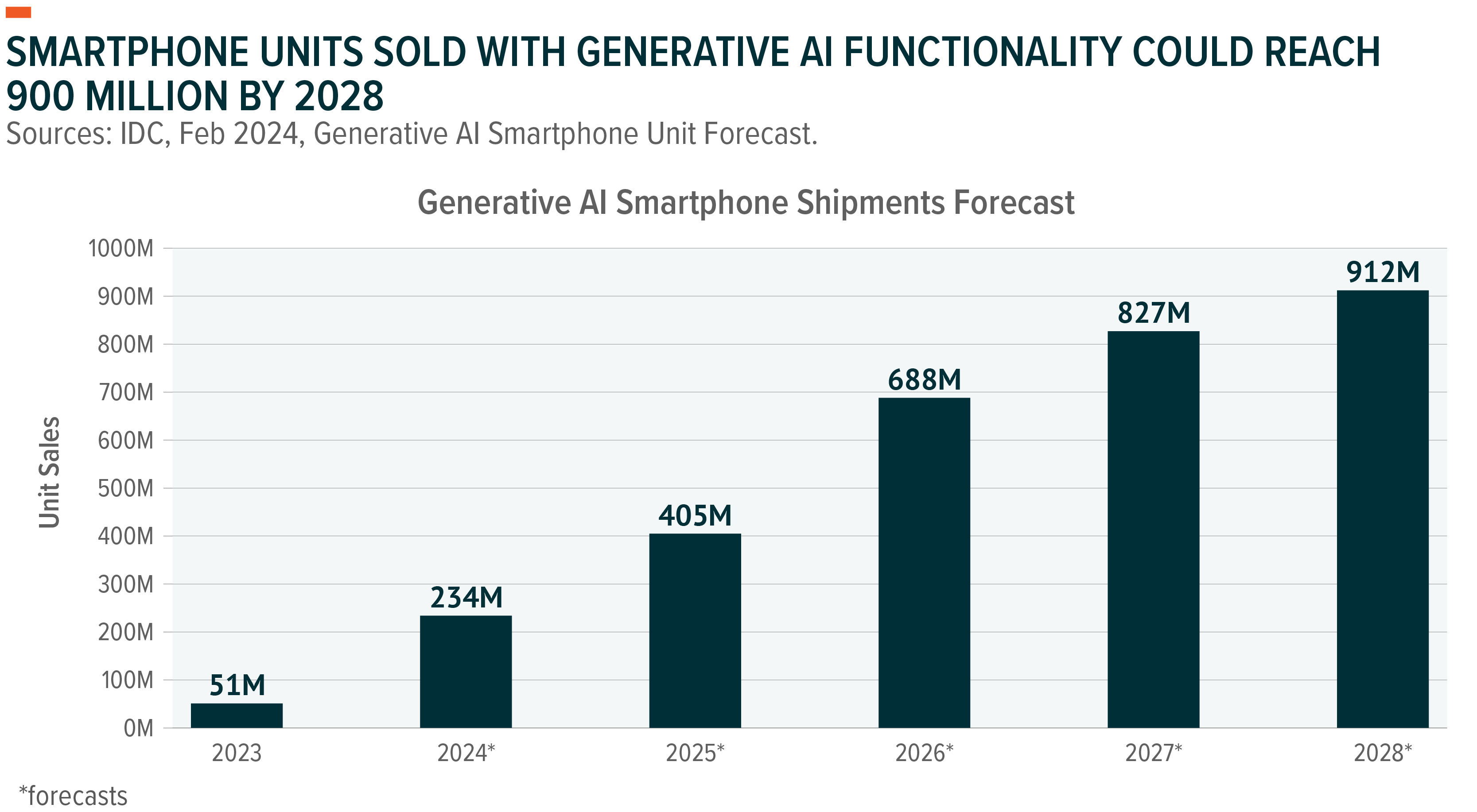

Chat GPT took roughly 2 months to hit 1 million users. That's insane velocity. But Chat GPT was released into a market that had been waiting for a consumer-friendly AI interface for years. And it went viral in ways that products simply don't anymore.

For a more realistic timeline, look at Perplexity. They took about 18 months to hit 30 million monthly active users from launch in 2023. That's aggressive growth. But they had:

- A clear use case (better search with AI)

- Perfect timing (search disillusionment was real)

- Deep technical founder credibility

- Product-market fit almost immediately

For a typical AI startup, you're looking at 3-5 years to reach 50 million active users, assuming everything goes perfectly.

Your Series A runway?

Now do the math: can you reach 50 million users in 2-3 years while burning cash?

For 99% of companies, the answer is no.

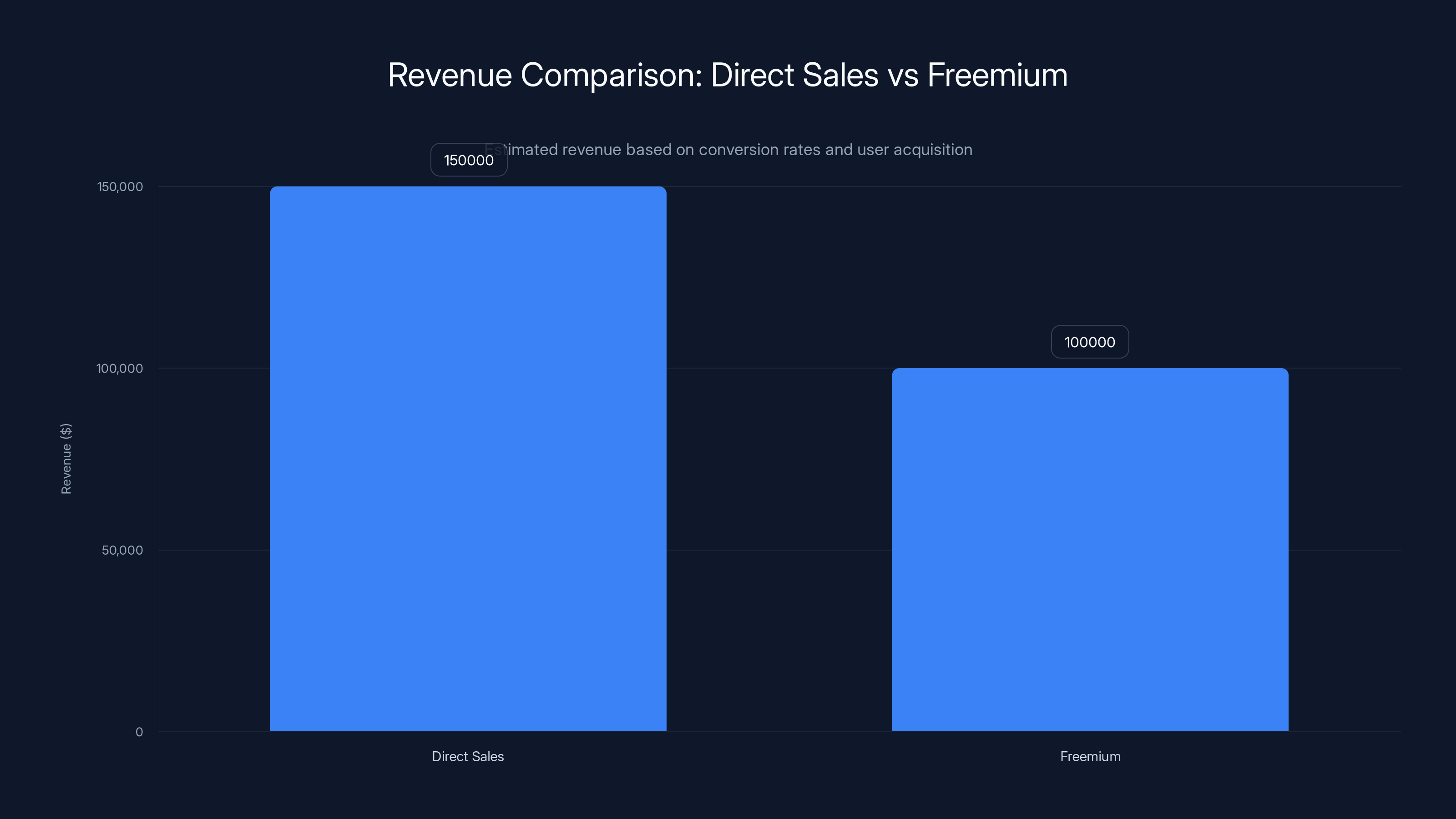

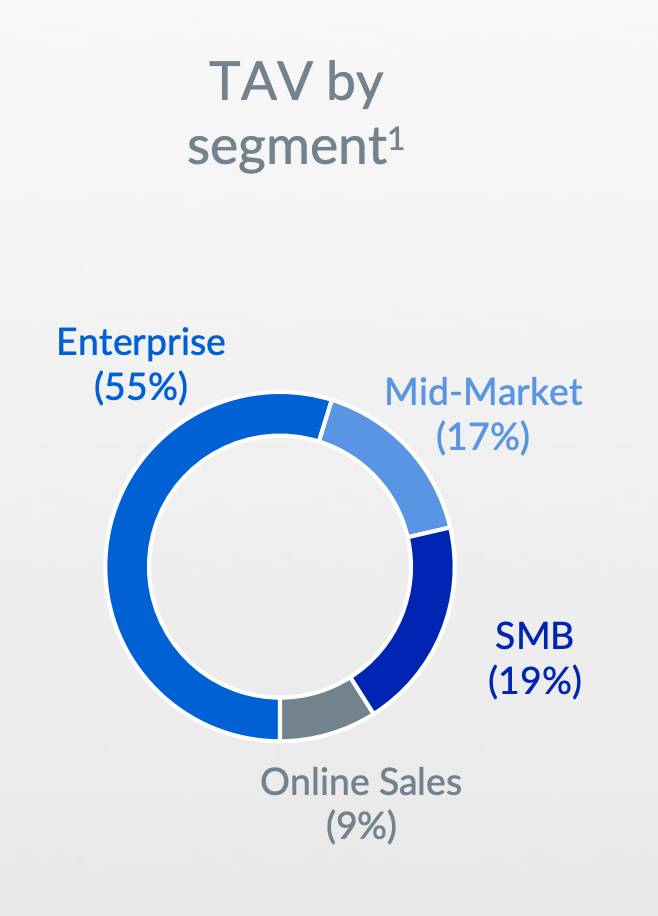

Direct sales generates more revenue (

When Freemium Actually Makes Sense (And When It Doesn't)

Freemium isn't bad. Freemium isn't dead. But freemium is a strategic choice, not a default.

It makes sense if:

You're Building Something Fundamentally Useful

Not features. Not incrementally better. Fundamentally useful in a way that hundreds of millions of people will recognize and adopt without needing to be convinced.

Search. Email. Chat. Writing. Image generation. Video creation. These are use cases where free adoption makes sense because the value is undeniable and immediate.

If you're building a team collaboration tool or a data analytics platform, the value is more niche. Freemium becomes much harder because your addressable market is smaller.

You Have Distribution That Doesn't Require Sales

Freemium works when growth is viral or organic. It works when users tell other users. It works when the product spreads because people can't not tell their friends about it.

If you need a sales team to explain your value, freemium is expensive. You'll spend more on sales to convert 2% of users than you would on landing pages and case studies to convert 40% of warm leads through direct sales.

You Have the Runway to Reach Critical Scale

You need 3-5 years and enough capital to burn through that growth phase without revenue pressure. If you need to be profitable in year two, freemium is a trap.

When Freemium Doesn't Make Sense:

You're Building B2B Software

Enterprise software, mid-market SaaS, B2B tools—these have slower adoption curves and smaller addressable markets. Your total addressable market might be 100,000 companies. Even if you convert 10% to free users, that's only 10,000. A 2% conversion rate from there gets you 200 paying customers.

That math doesn't work. Just sell.

You Have Strong Sales Motion

If you're good at sales, if you have founder-led sales that's converting inbound leads at 20-40%, freemium is friction. You're giving away what you could sell.

Your Onboarding Requires Hand-Holding

If your product needs a demo, setup help, or education to get value, freemium is inefficient. People won't stick around long enough to realize the value, so your conversion rate will be abysmal.

The New B2B Freemium Winners: The Exception That Proves the Rule

There are B2B freemium success stories. They're important because they show the math works differently at different scales.

Zoom

Zoom's free tier lets you host unlimited meetings up to 40 minutes. They built a $100 billion+ company on top of freemium, and here's why: the free tier had massive distribution. Every company on Earth wanted to use video conferencing. They didn't need convincing.

But Zoom also had a killer conversion insight: once you're doing client calls, you can't stay on the 40-minute timer. The free tier creates a "pain point" that drives conversion.

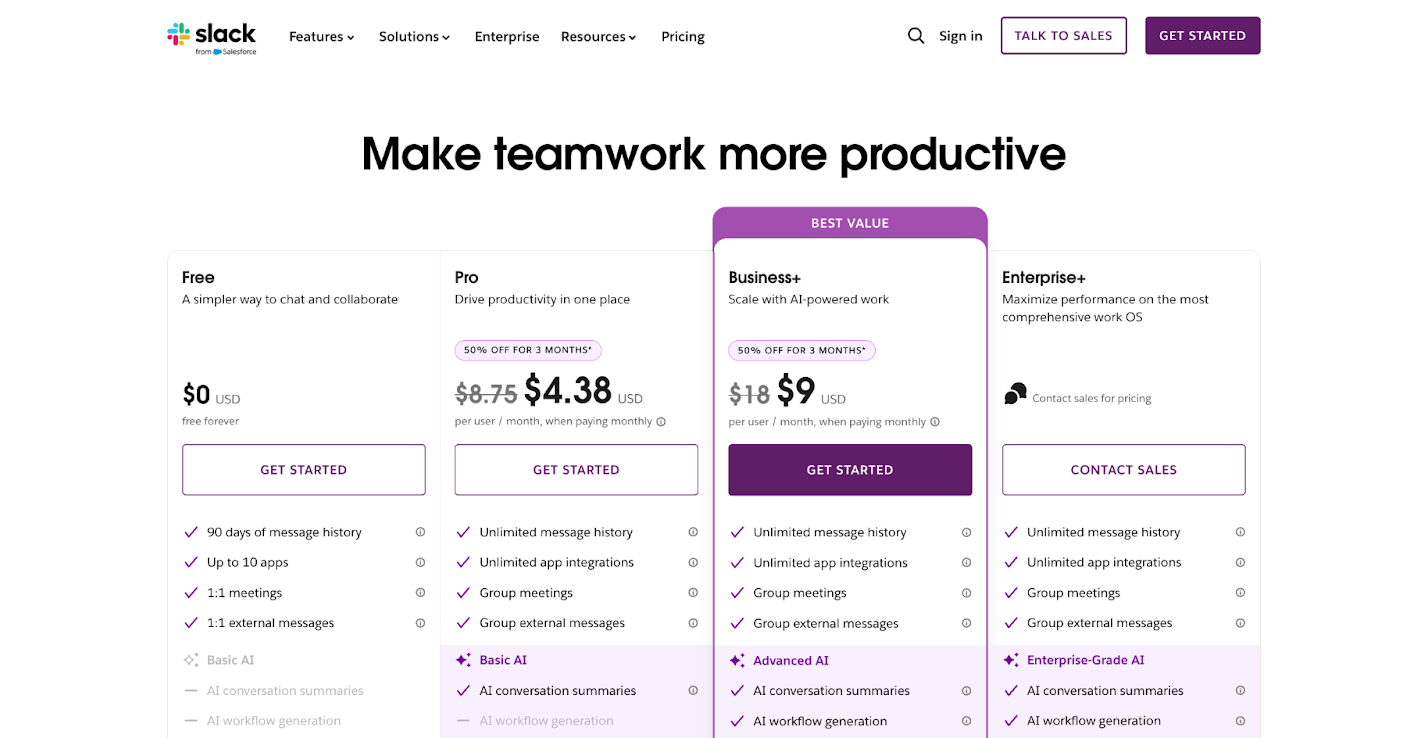

Slack

Slack's free tier lets teams collaborate with unlimited users, but with message history limits. Again, once you're using Slack, you quickly need the full history. The free tier converts naturally because it reveals the gap between free and paid.

Calendly

Calendly hit

Why? Because scheduling is a universal need. Everyone has a calendar problem. And the free version works fine until you need integrations, custom branding, or advanced features.

Atlassian's New Freemium Editions

Atlassian famously built their empire without freemium. But in 2024, they added free tiers to several products and saw a 3x increase in sign-ups.

What changed? They realized that small teams were trying alternatives because they couldn't afford enterprise pricing. The free tier converted many of those teams to paid as they grew.

But here's the key: Atlassian already had brand recognition, trust, and an installed base. They didn't need to go viral. They just needed to convert their existing market.

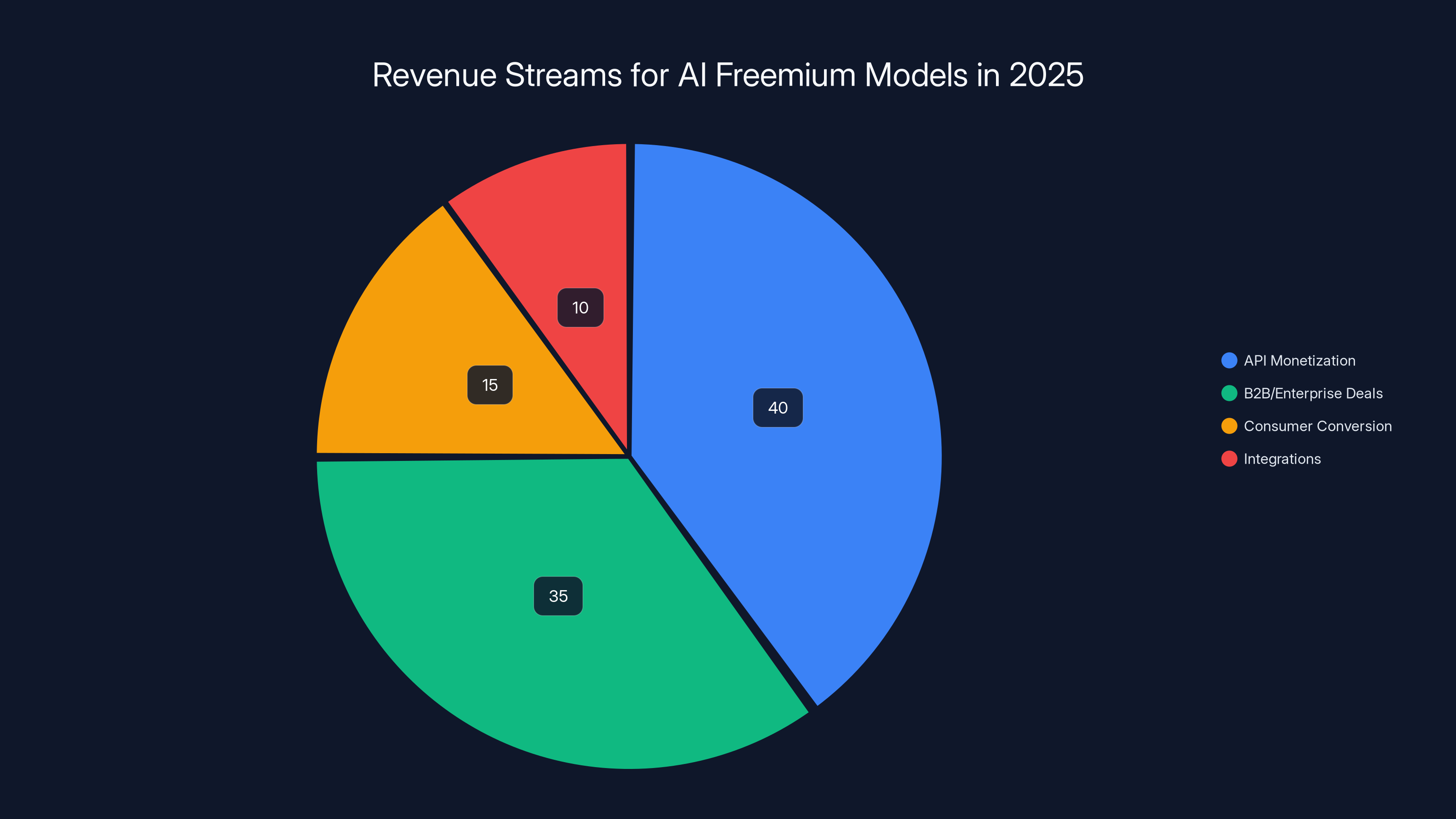

In 2025, AI companies using freemium models are projected to generate the largest portion of their revenue from API monetization and B2B/enterprise deals. Consumer conversion and integrations contribute smaller shares. (Estimated data)

The Runway Math: Why Most Startups Fail at Freemium

Let's take a real scenario. You're a founder at a stealth AI startup. You just closed a Series A for

You have 10 months of runway.

Your goal is to hit 50 million users in that time and prove freemium works.

You'd need to add roughly 5 million users per month. That's insane velocity. Even Chat GPT took 2 months to hit 1 million users.

But let's say you're lucky. You build something incredible. In 8 months, you hit 10 million users.

You've burned through

Your conversion rate is 2%. You have 200,000 paying customers. At

Sound great? On paper, yes. But in practice, you're now in a race against time. You need your next funding round to close within weeks to bridge the gap between burn rate and revenue growth.

If that round doesn't happen—if investors see potential but aren't convinced yet—you're out of money.

This is why so many freemium companies either:

- Pivot to a hybrid model (freemium + enterprise sales)

- Extend their freemium tier to generate some early revenue (like Discord did with Nitro)

- Shut down the free tier entirely and focus on paid users (like Twitter did by paywalling API access)

The companies that succeed at pure freemium are the ones with:

- Venture capital that will support them through the 3-5 year growth phase

- Product-market fit so strong that growth is organic and viral

- Founders with enough credibility to raise continuously as the company scales

Most startups don't have all three.

The Hybrid Model: How Smart Companies Are Playing It

Most successful modern SaaS companies aren't pure freemium. They're hybrid.

Hybrid freemium means:

- Free tier for self-serve users and small teams

- Paid tier for growing teams

- Enterprise sales for large organizations

This works better because it generates revenue at every stage of the customer journey, not just at the viral-adoption stage.

Notion

Notion famously gave away their entire product for free for years. They had millions of users. But they didn't have meaningful revenue.

Then they introduced paid tiers for power users and teams. Now they have $1 billion in annual recurring revenue (as of 2024) with a much smaller user base than Chat GPT or Perplexity.

Why? Because their conversion rate is higher. They converted creators and early power users at 5-10% rates instead of 2%.

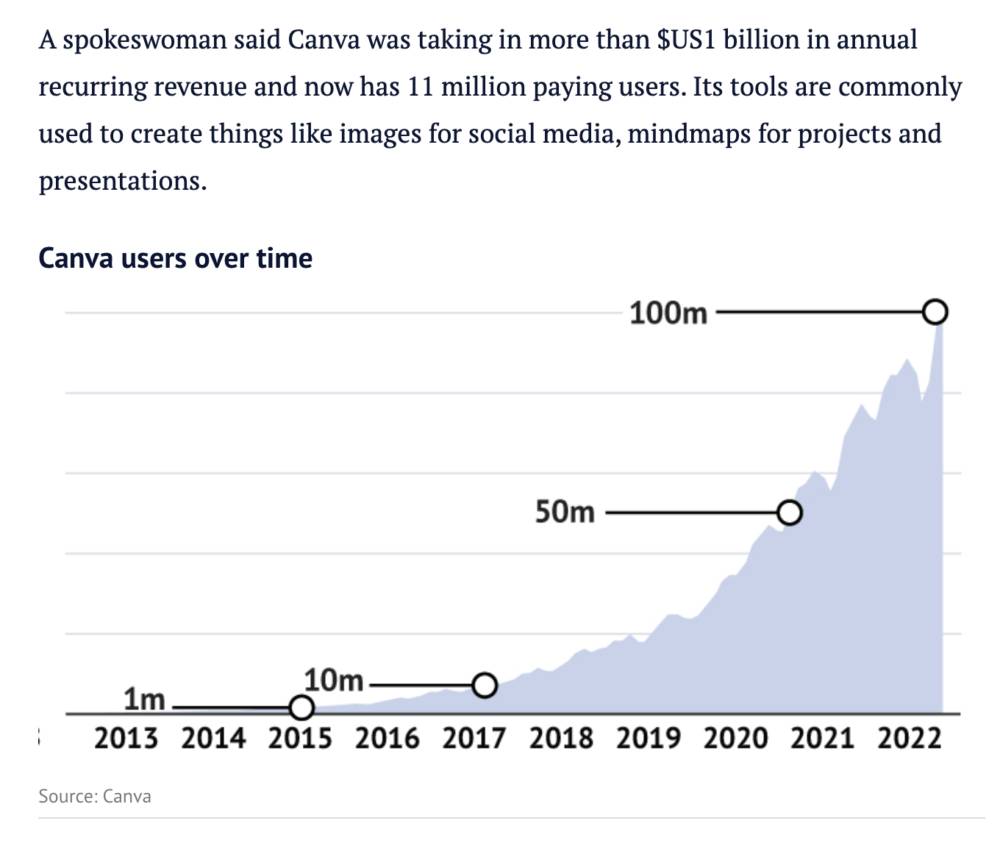

Canva

Canva built a free design tool that grew to billions of monthly active users. But they also have a paid tier (Canva Pro, $180/year) and enterprise offerings.

Their business is profitable at a much smaller conversion rate because their total addressable market is huge. Even a 1% conversion from billions of users is hundreds of millions of dollars in revenue.

Figma

Figma launched with a free tier and still offers one. But their real revenue comes from teams paying $144+ per editor per month for professional features.

The free tier is admission. The paid tier is where the money is.

To achieve

Why Direct Sales Beats Freemium for Most B2B Companies

I'm going to say something controversial: if you're building B2B software and you're not already at massive scale (10+ million users), you should probably skip freemium and go straight to direct sales.

Here's why:

Sales efficiency beats marketing efficiency for B2B

A direct sales motion where you close 30% of qualified leads is worth more than a freemium funnel that converts 2% of users. The CAC payback period is better. The predictability is better. The unit economics are better.

Consider this scenario:

- B2B company using direct sales: 100 inbound leads per month, 30% conversion, 150,000/month

- B2B freemium company: 10,000 free signups per month, 2% conversion, 100,000/month

The direct sales company generates more revenue with less infrastructure. They don't need to scale to 50 million users. They just need to reach 300 qualified leads per month.

Freemium increases complexity

Freemium companies need to manage:

- Free tier UX (making it valuable enough to keep people engaged)

- Paid tier UX (making the upgrade obvious and painless)

- Paywall placement (when do you interrupt free users?)

- Feature gating (which features live behind paid?)

- Churn management (why are free users leaving?)

Direct sales companies need to manage:

- Sales conversations

- Implementation

- Customer success

It's simpler. It's easier to scale. It generates revenue immediately.

Freemium only works if growth is viral

If you're doing outbound sales, retargeting, content marketing, and paid ads to drive user acquisition, you're essentially paying for users. You might as well charge them from day one.

Freemium only saves money if growth is organic and viral. If you're paying for growth anyway, the math breaks down immediately.

The Enterprise Play: How Companies Like Notion Scale Past Freemium

Once you've built a freemium company with millions of users, the next challenge is extracting real revenue.

The pattern that works:

Phase 1: Go Viral

- Build something so useful that millions adopt it for free

- Focus on engagement and retention, not monetization

- Growth is primarily organic and viral

Phase 2: Layer On Monetization

- Add a paid tier for power users (works well with 2-10% conversion rates)

- Add team features that drive upgrade economics

- Add integrations and advanced features that enterprise cares about

Phase 3: Add Enterprise Sales

- Once you have 1000+ power users or 10,000+ free users, enterprise buyers are looking at you

- Assign a sales person or two to those high-value leads

- Build features for enterprises (SSO, advanced permissions, audit logs)

Phase 4: Hybrid Economics

- Free users generate network effects and social proof

- Paid users generate margin

- Enterprise customers generate revenue that funds growth

Notion followed this playbook perfectly. So did Slack, Zoom, and Figma.

The key insight: don't optimize for freemium conversion rate early. Optimize for engagement. Build the size first. Monetize the scale later.

ChatGPT leads with a higher conversion rate and ARR, highlighting its successful freemium model. Estimated data for conversion rates.

The Revenue Reality for AI Freemium in 2025

I want to be brutally honest about what's actually happening in the AI space right now.

Yes, freemium is back. Yes, AI companies are proving it works at massive scale. But most of those companies are:

- Burning massive amounts of capital (Open AI's compute costs are in the hundreds of millions per year)

- Not actually profitable on the freemium model alone (API revenue and enterprise deals are where the money comes from)

- Backed by patient capital (VCs, strategic investors, or self-funded) willing to support 3-5 year runways

- Operating in genuinely new categories where competition is minimal and growth is viral

If you're building a point solution in AI—a better code editor, a better writing tool, a better data analysis platform—you're not building in the same conditions as Chat GPT.

Your addressable market is smaller. Your viral coefficient is lower. Your conversion rate will be the same (1.7-2% at best), which means you need 10-100x more users to hit the same revenue.

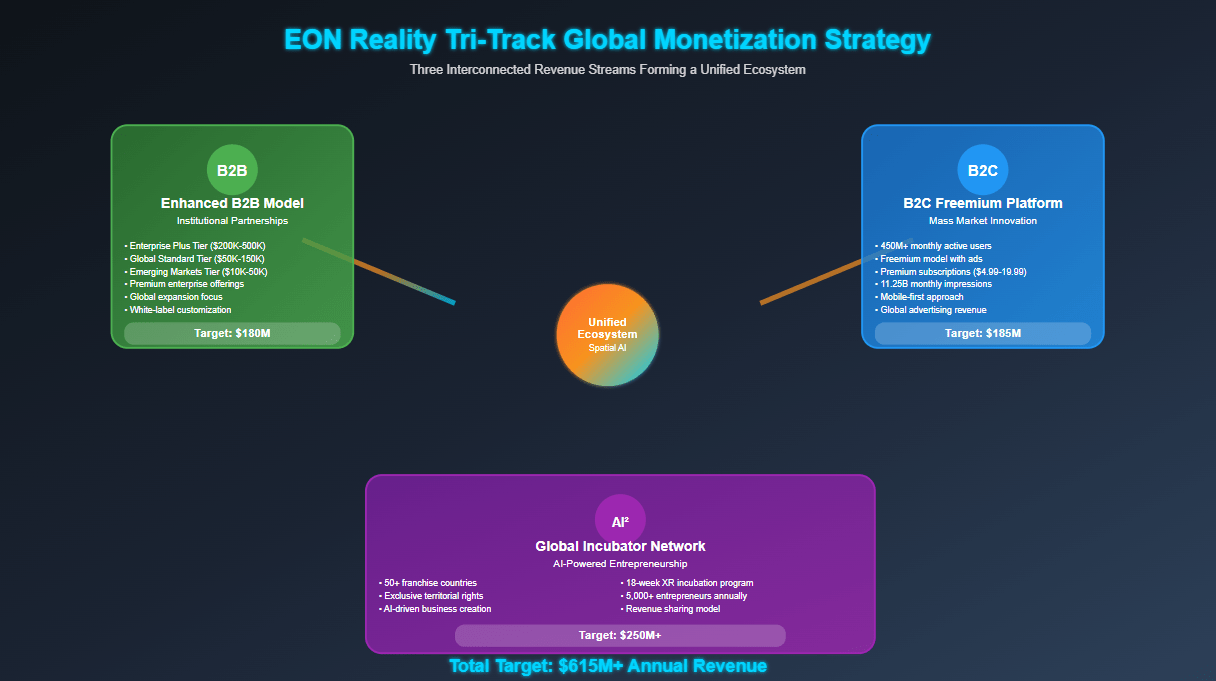

This is why so many AI startups are moving toward:

- Freemium + API monetization (charge developers for API access, give away the consumer product)

- Freemium + B2B/enterprise (free for individuals, expensive for teams)

- Freemium + integrations (free core tool, paid integrations with other services)

These hybrid models work because they generate revenue from multiple sources, not just consumer conversion.

The 50 Million User Question: Is It Even Achievable?

Let me zoom out and ask the real question: how many companies will ever reach 50 million active users?

Not registered users. Not downloads. Active users who use your product with regularity.

Looking at the global landscape:

- Browsers: Chrome (1.6 billion), Safari (1.2 billion), Firefox (200 million)

- Email: Gmail (1.8 billion), Outlook (400 million)

- Social: Facebook (3 billion), WhatsApp (2 billion), TikTok (1.5 billion)

- Messaging: WeChat (1.3 billion), Telegram (800 million)

- Search: Google (5.6 billion), Bing (350 million)

- Video: YouTube (2.5 billion), TikTok (1.5 billion)

- Maps: Google Maps (1.5 billion)

- AI: Chat GPT (800 million weekly), Claude (30 million monthly), Perplexity (30 million monthly)

There are maybe 30-40 products globally that have ever achieved 50 million active users.

Most of them took decades to build. Most of them operated in genuinely new categories. Most of them had network effects that made them more valuable as more people joined.

If you're a founder evaluating a freemium model, you should ask yourself honestly: does my product have any chance of reaching that list?

If the answer is "no" or "maybe," then freemium is probably the wrong choice.

Practical Framework: Should You Choose Freemium?

Here's a decision framework to work through with your team:

Question 1: Is your product fundamentally useful without monetization?

Not nice-to-have. Fundamentally useful. Something people will use and tell others about.

If yes, continue. If no, freemium won't work.

Question 2: Is your total addressable market 100+ million people?

Not your initial target market. Your total addressable market.

If no, you probably can't reach 50 million users ever. Skip freemium.

Question 3: Is growth primarily organic or viral?

Are you paying for acquisition? If yes, you're essentially paying for users you're not charging. The math breaks down.

If growth is organic, continue.

Question 4: Do you have 3+ years of runway?

Can you burn cash for 3+ years without meaningful revenue? If no, freemium is risky.

Question 5: Are you willing to be patient on monetization?

Freemium requires you to optimize for growth first, revenue second. Can you live with that?

If you answer "yes" to all five, freemium might work.

If you answer "no" to any one, consider direct sales or a hybrid model instead.

Looking Forward: What Changes in 2025-2026?

The AI boom has given freemium a new lease on life. But I expect the next 18 months to show us which companies can actually sustain it.

My predictions:

Consolidation: Many AI freemium startups will either get acquired or die. The ones that can't reach 10 million users in 18 months will run out of runway.

Monetization pressure: Companies will move aggressively toward monetization. Free tier limitations will get tighter. Pricing will go up. The "always free" promise will disappear.

Enterprise focus: The real money is in enterprise. More companies will shift focus from consumer growth to B2B2C models (free for consumers, expensive for enterprises).

API economies: Successful freemium companies will layer API monetization on top of free products. The free tier becomes the acquisition channel; the API becomes the revenue.

Hybrid becomes standard: Pure freemium will become rare. Freemium + paid tier + enterprise + API will become the default.

These aren't pessimistic predictions. They're just realistic ones based on what actually works at scale.

The Bottom Line: When to Freemium, When to Sell

Here's my honest take after watching this industry evolve for fifteen years:

Freemium is not a growth hack. It's not a shortcut. It's not the modern default.

Freemium is a specific business model choice that works brilliantly for a tiny number of companies that happen to:

- Build something so fundamentally useful that hundreds of millions of people want it

- Have growth that's primarily organic and viral

- Have the capital and patience to reach 50 million+ users before monetizing

- Operate in genuinely new categories where competition is minimal

For everyone else—and that's 99% of startups—direct sales, SMB SaaS, or freemium + hybrid models are better choices.

The math doesn't lie. Conversion rates haven't changed. The only thing that's changed is that a few AI companies have built products so useful that 50 million people actually want them.

Don't confuse their success with your situation.

If you have thousands of users, not millions, sell. If you're doing paid acquisition, sell. If you have limited runway, sell. If you're building B2B software, sell.

Freemium isn't failing. But it's also not the answer for most of you.

You'll do better with a model that generates revenue from day one while you build the product that might, someday, deserve to be free.

FAQ

What is freemium and how does it work as a business model?

Freemium is a business model where users access a basic version of a product for free, with the option to upgrade to a paid premium version that includes additional features or functionality. The free tier generates user acquisition and engagement, while the paid tier generates revenue. The model works best when the free tier is valuable enough to retain users but limited enough to create clear reasons for upgrading.

How much revenue do AI companies actually make from freemium?

AI leaders like Chat GPT generate

What conversion rate should I expect from freemium to paid?

Industry data from Revenue Cat, which processes payments for 34% of all mobile subscription apps, shows an average free-to-paid conversion rate of 1.7%. AI companies like Chat GPT achieve 2-5% conversion rates. B2B and enterprise software can achieve higher rates (5-15%) because their addressable market is smaller and more concentrated. The key is that these rates require massive user bases to generate meaningful revenue.

How many active users do I need for freemium to work as a revenue model?

To reach

When should I choose freemium over direct sales?

Choose freemium if your product is fundamentally useful to hundreds of millions of people, growth is primarily organic and viral, you have 3+ years of runway, and your total addressable market exceeds 100 million users. Choose direct sales if you're building B2B software, your growth requires paid acquisition, you need revenue within 18-24 months, or your TAM is smaller. Most companies should start with direct sales and add freemium later if growth becomes viral.

What's the difference between freemium and a free trial?

Freemium offers a permanently free version of the product with limited features, designed for ongoing use by free users. A free trial offers full access to the product for a limited time (usually 14-30 days) before requiring payment. Free trials convert at higher rates (10-30%) but require more aggressive follow-up and sales. Freemium converts at lower rates (1-5%) but generates continuous engagement and requires less sales infrastructure.

How do successful companies like Notion and Slack use freemium?

Notion and Slack both use hybrid freemium models. They offer free tiers that provide genuine value (unlimited users at Slack, all features with limits at Notion) to build massive user bases. They then monetize through paid tiers for power users and premium features. Slack's free tier is limited by message history; Notion's free tier is limited by integrations and advanced features. Both companies take a long view on monetization, prioritizing growth first and revenue second.

What are the biggest mistakes companies make with freemium?

The most common mistakes are: (1) launching freemium before reaching product-market fit, (2) underestimating the runway required to reach 50 million users, (3) making the free tier too valuable, eliminating reasons to upgrade, (4) not investing in viral/organic growth and instead relying on paid acquisition, (5) monetizing too early and limiting the free tier before building sufficient scale, and (6) assuming freemium works for niche or B2B products where the TAM is small.

How should I think about pricing for my freemium model?

For consumer freemium, pricing typically ranges from

Conclusion: The Freemium Reality Check

Freemium is having a legitimate renaissance in 2025. It's not going away. But the conditions for it to work have become clearer, not looser.

You need a massive addressable market. You need viral growth. You need capital patience. You need to build something genuinely useful.

If you have all of those things, freemium can work brilliantly. It can build billion-dollar companies with minimal sales infrastructure.

But most of you don't have all of those things. Most of you have a good idea, some early users, and a need to generate revenue within 18-24 months.

For that situation, freemium is often the wrong choice. Direct sales works better. Hybrid models work better. Sometimes even straight freemium-to-enterprise (free consumer tier, expensive enterprise) works better than trying to convert consumers at a 2% rate.

The burden is on you to do the math. Not the marketing math. Not the growth math. The revenue math.

How many users do you need? How long will it take to reach that scale? How much capital does that require? What's your burn rate in the meantime?

If those numbers work, freemium is brilliant. Build it, grow it, and let the 2% conversion do its work across millions of users.

If those numbers don't work, sell instead. You'll have a more sustainable business and better unit economics.

The AI boom has proven one thing: freemium works. But it's also proven that freemium works differently—and much harder—than most people expect. Make sure you're not just following the trend. Make sure you're actually playing a game you can win.

Key Takeaways

- To hit 10/month, you need ~50 million active users—not millions, but tens of millions

- ChatGPT (800M users, 2-5% conversion), Perplexity (30M users, 2% conversion), and Claude prove the math is consistent even at massive scale

- Freemium requires 3-5 years of runway and capital to reach critical scale; most Series A startups can only sustain 10-18 months

- For B2B companies with thousands of users, direct sales typically generates better unit economics than freemium's 2% conversion

- Hybrid models (free + paid tiers + enterprise) outperform pure freemium by generating revenue at every customer lifecycle stage

- Only 30-40 products globally have ever achieved 50 million active users; freemium is not viable for most startups that can't reach that scale

![Freemium for AI Products: The 50 Million User Reality [2025]](https://tryrunable.com/blog/freemium-for-ai-products-the-50-million-user-reality-2025/image-1-1768405285629.jpg)