AI Budget Is the Only Growth Lever Left for SaaS in 2026

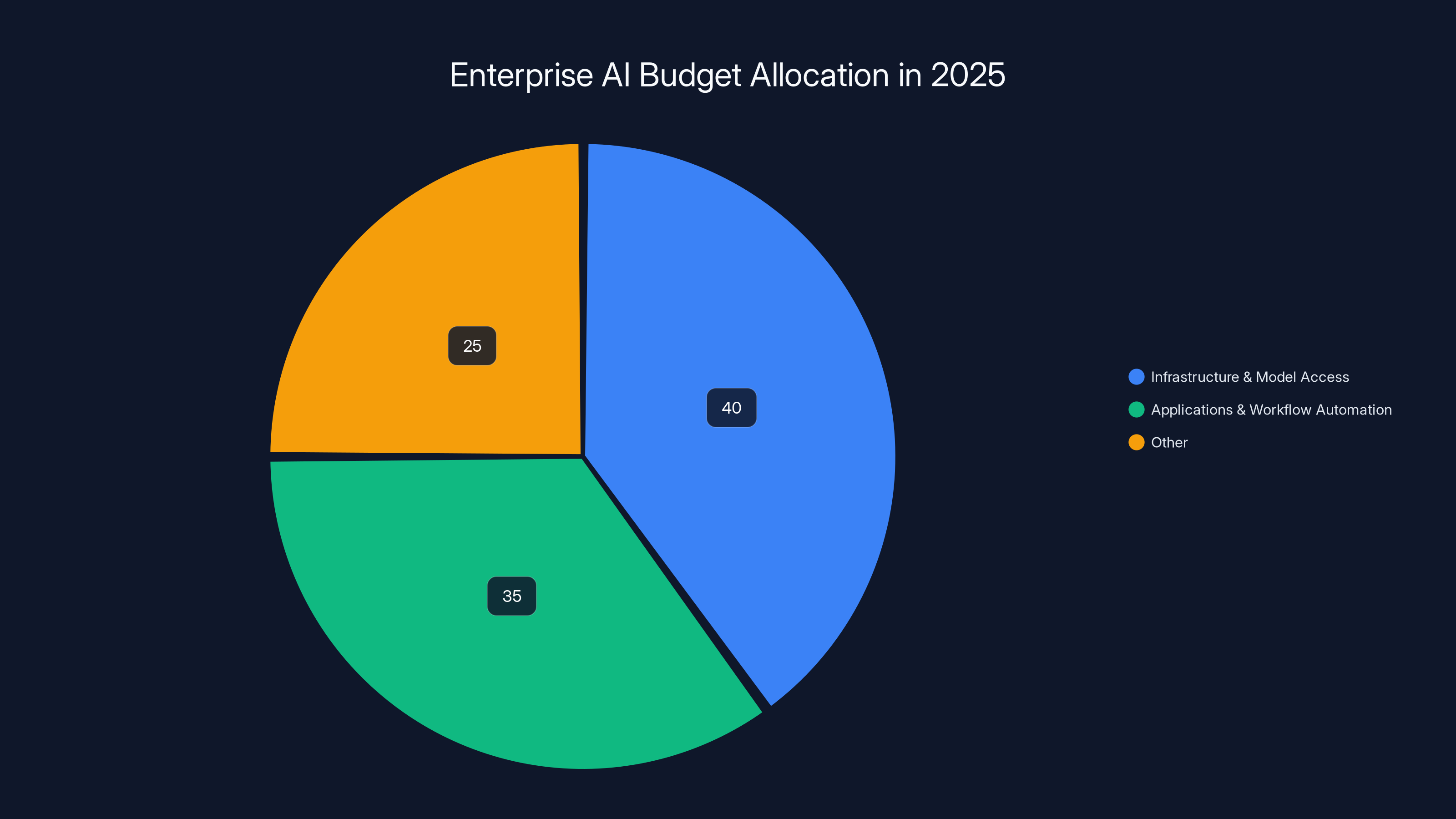

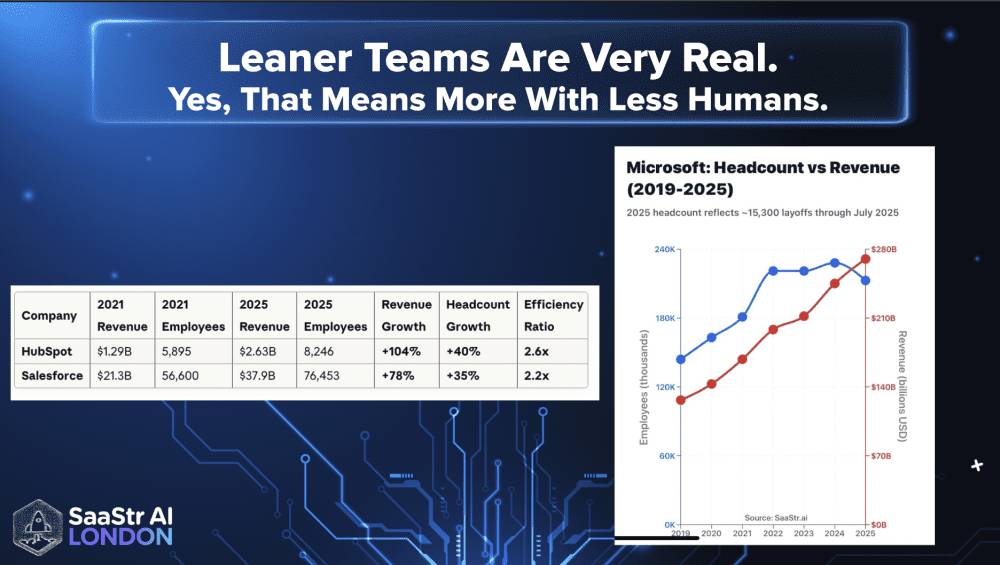

You've probably noticed something weird happened in 2025. The SaaS companies that built specifically for AI didn't just outperform—they obliterated traditional software vendors. Palantir hit 63% revenue growth with 51% operating margins. Cloudflare climbed 80%. Meanwhile, HubSpot tanked 51%. Atlassian dropped 36%. Bill.com fell 43%.

That's not random market noise. That's a fundamental shift in how enterprise budgets work.

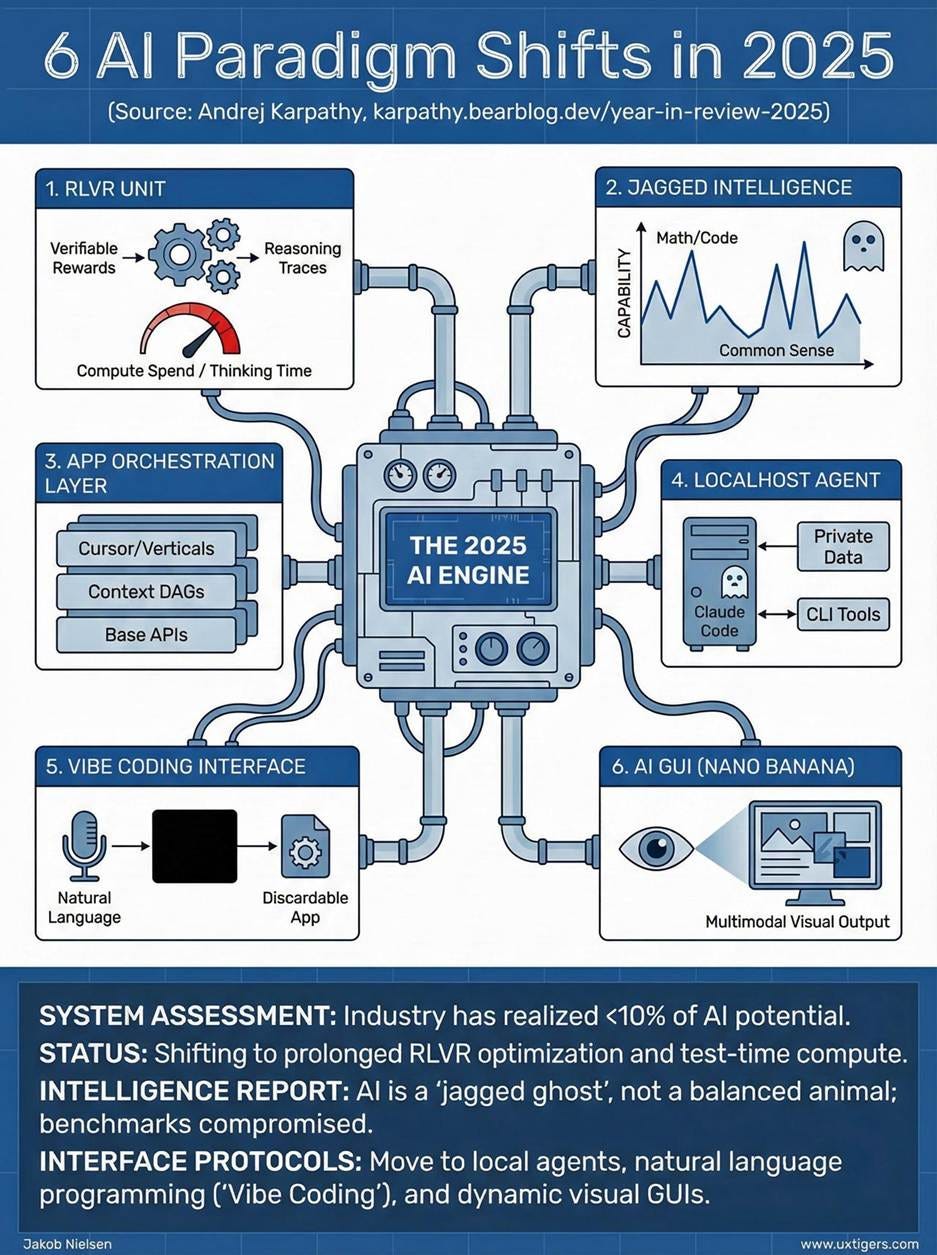

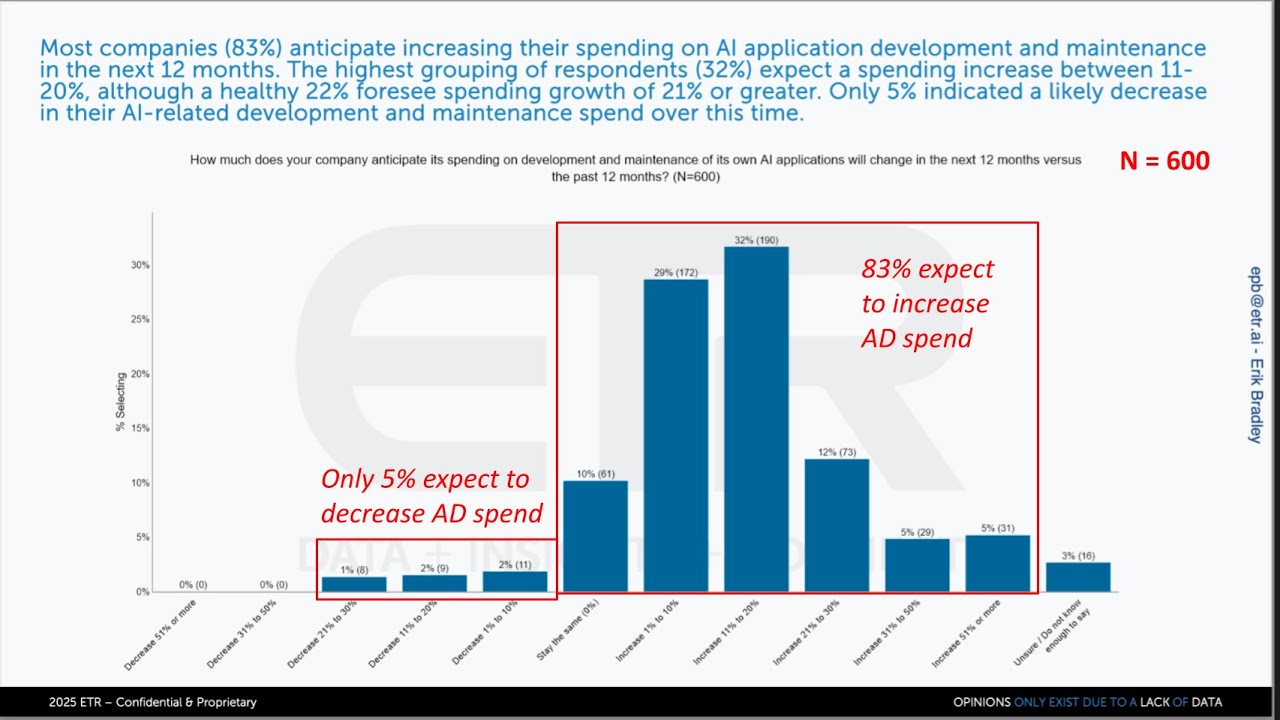

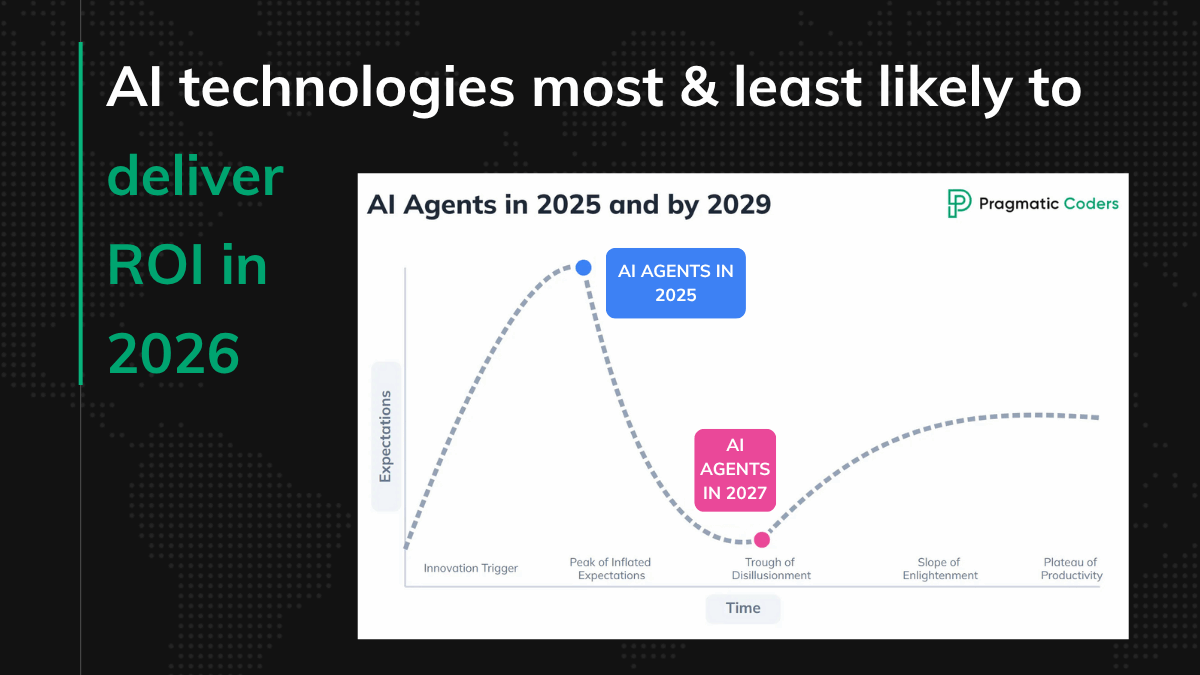

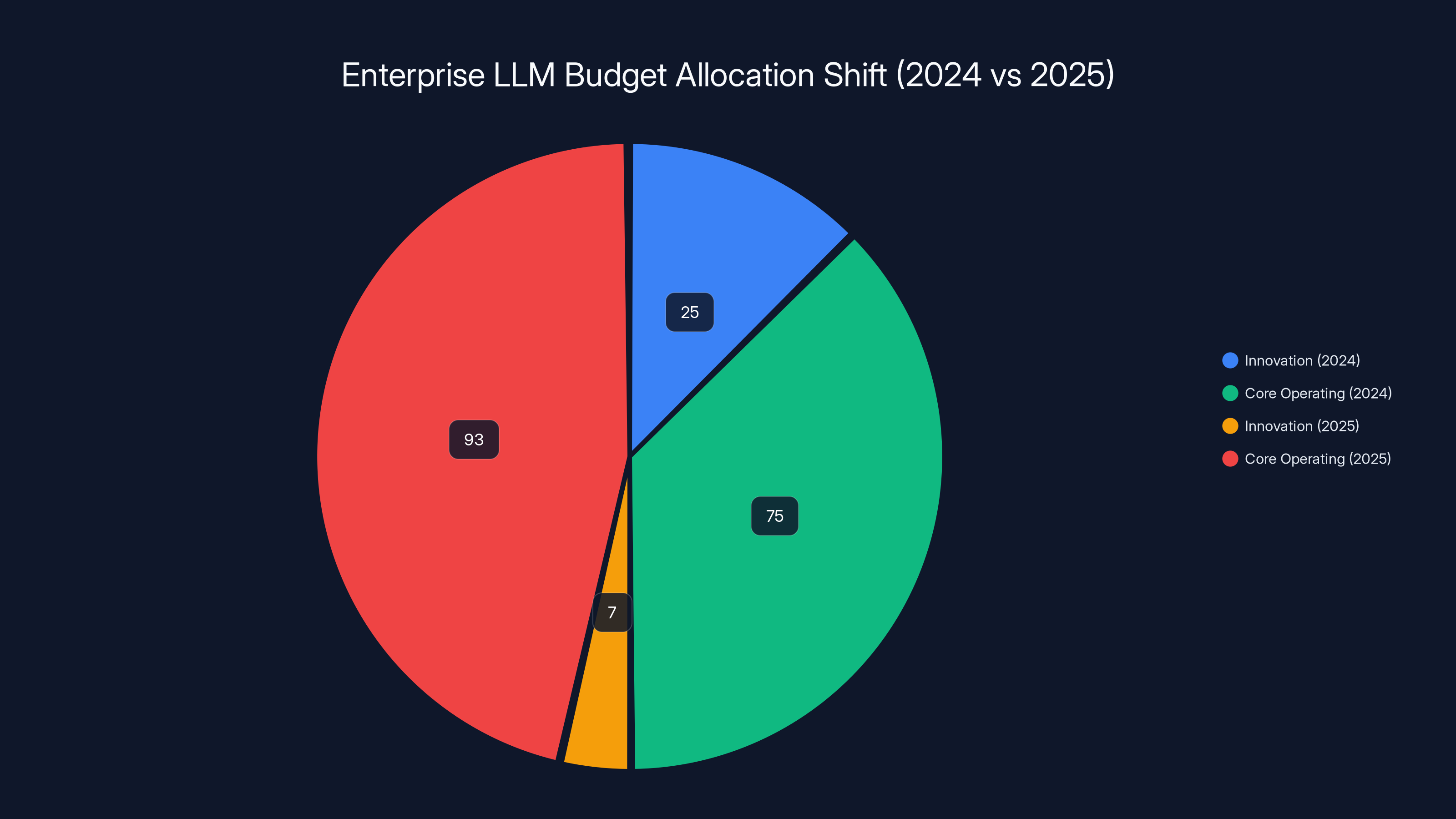

Here's what's actually happening: AI stopped being an "innovation fund" line item in 2024. It became core IT spending in 2025. And in 2026? It's becoming the only growth budget that matters. The enterprise money isn't shifting toward better CRMs or work management platforms anymore. It's flowing toward companies solving mission-critical AI problems.

I've spent the last month digging through CIO surveys, analyst reports, and earnings calls from the companies that are winning. The pattern is unmistakable. And if you're building B2B software right now, ignoring this shift is existential.

Let's talk about what the data actually shows, why traditional SaaS is struggling, and what the companies winning in AI are doing differently. More importantly, if you haven't tapped into AI budget yet, we need to talk about whether 2026 is your last chance.

TL; DR

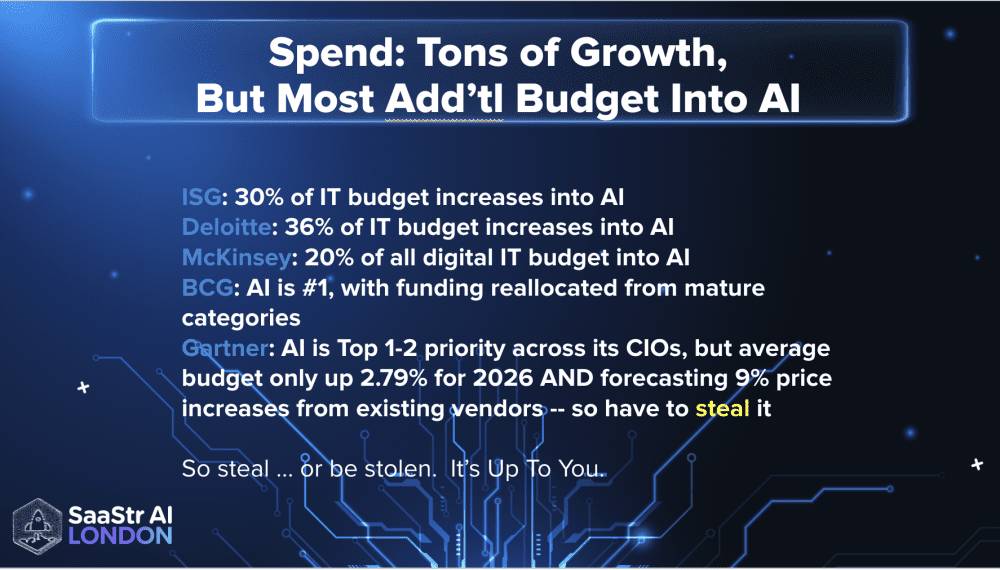

- Enterprise AI budgets are growing 5.7% while overall IT spending rises just 1.8%, capturing 30% of all IT budget increases

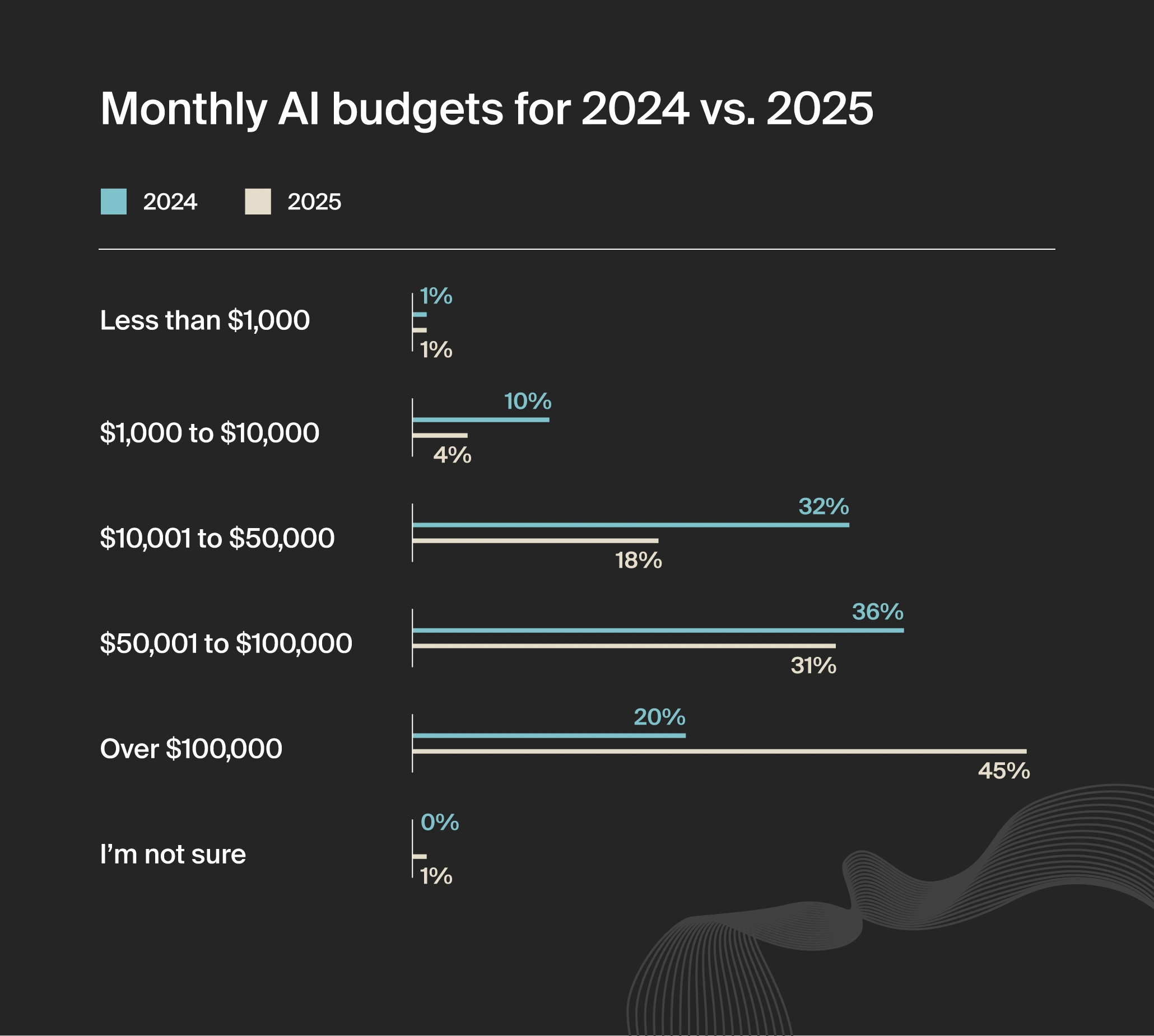

- Innovation budgets dropped from 25% to 7% of LLM spending—AI is now a core operating expense, not an experiment

- The market is pricing in this reality: Palantir up 142%, Cloudflare up 80%, versus HubSpot down 51%, Atlassian down 34%

- The budget math is brutal: Average IT budgets grow 2.79% while vendor prices rise 9%, forcing companies to steal budget from somewhere else

- Winners are AI-native, not AI-adjacent: They build autonomous agents and AI operating systems, not chatbots bolted onto legacy products

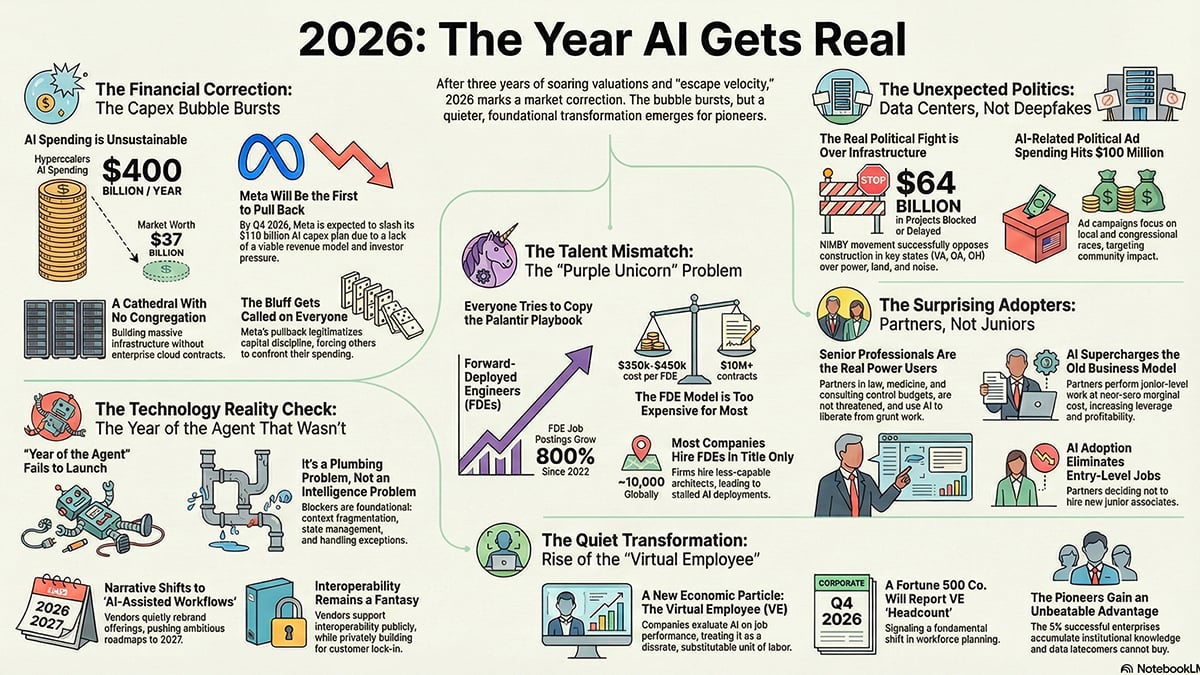

In 2025, 40% of enterprise AI budgets are allocated to infrastructure and model access, 35% to applications and workflow automation, and 25% to other areas. Estimated data.

The Enterprise Budget Shift Nobody's Talking About

Here's the real moment that changed everything. Andreessen Horowitz surveyed 100 enterprise CIOs in late 2024 and 2025. The finding? Enterprise leaders expect an average of 75% growth in LLM budgets over the next year. One CIO said it plainly: "What I spent in 2023 I now spend in a week."

That's not hyperbole. That's operational reality.

But the part that matters for B2B founders is hidden in the details. In 2024, innovation budgets accounted for 25% of all LLM spending. Those are your blue-sky projects. Experiments. Nice-to-haves. By 2025, that number had collapsed to just 7%. The remaining 93% is core operating expense.

What does that mean? It means CIOs aren't asking "Should we invest in AI?" anymore. They're asking "How fast can we deploy AI across our business?" The question changed from exploratory to mandatory.

Let's look at what the data says about where this money is actually flowing. ISG Research tracked IT budget allocation across enterprises. Overall IT budgets? Up 1.8% year-over-year. That's basically inflation. You're not getting richer. You're standing still.

AI budgets? Up 5.7%. Nearly a quarter of enterprises are planning increases above 10%. The math is stark: AI spending is capturing 30% of the total IT budget increase despite being a fraction of overall spend.

Gartner projects global AI spending will approach

Now comes the brutal part of the math. Average IT budget increases sit at 2.79% annually. But average vendor price increases are running at 9%. That means companies are underwater before they even think about buying anything new. Where do they find budget for AI initiatives? They steal it from somewhere else. Your existing vendor stack.

That's the real question for 2026: Are you stealing budget from your competitors? Or are your competitors stealing budget from you?

In 2025, AI-native and infrastructure companies like Palantir and Cloudflare saw significant stock price increases, while traditional SaaS companies like HubSpot and Bill.com experienced declines. Estimated data.

The 2025 Stock Market Told the Real Story

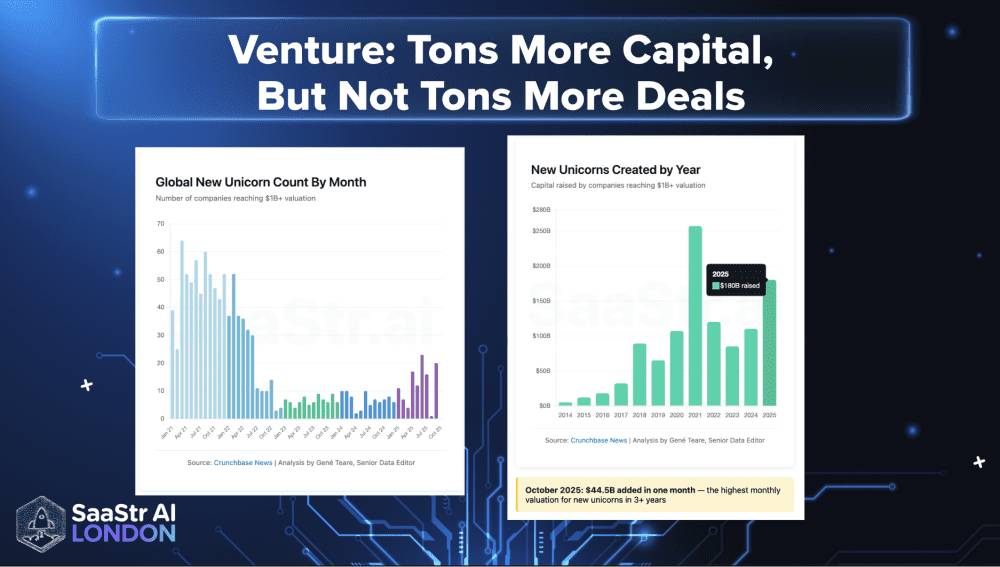

You want to know what happens when you tap into AI budget? Look at the public markets. The divergence in 2025 is the clearest signal we've seen in a decade.

The Winners: AI-Native and Infrastructure

Palantir (PLTR): Up 142% in 2025. Revenue growth accelerated from 12.7% in Q2 2023 (the quarter they launched AIP, their AI platform) to 44% year-over-year by mid-2025. Q3 showed 63% revenue growth with 51% operating margins. Free cash flow crossed $1 billion in trailing twelve months. The company is now the template for what AI-native means financially.

Cloudflare (NET): Up 80%. Their edge computing network is now the infrastructure layer for AI inference. Every major tech company running AI at scale is using edge networks to reduce latency. Cloudflare positioned itself perfectly.

Mongo DB (MDB): Up 70%. Document databases are the optimal structure for AI training data and vector storage. Mongo DB became essential infrastructure for companies building AI applications.

Snowflake (SNOW): Up 45-50%. Data infrastructure is AI infrastructure. The more data companies can unify and process, the better their AI models perform. Snowflake captures this value.

Crowd Strike (CRWD): Up 51%. Security is non-discretionary. Every CIO would cut marketing budget before cutting security. And cyber threats are evolving faster than humans can respond. AI-powered security is now mandatory.

The Losers: Traditional SaaS and SMB-Focused

HubSpot (HUBS): Down 51%. They're the leading SMB CRM and marketing automation platform. Small business budgets didn't expand in 2025. Enterprises upgraded to more sophisticated platforms.

Bill.com (BILL): Down 43%. SMB financial operations software. Again, SMB budget constraints and churn risk.

Monday.com (MNDY): Down 36%. Work management platform targeting mid-market and SMB. Good product, but not solving AI-native problems.

Atlassian (TEAM): Down 34%. Developer tools company. They're adding AI features, but not building AI-native products from scratch. It feels bolted on.

Salesforce (CRM): Down 31%. The largest enterprise CRM. Caught between legacy revenue and new AI initiatives. Their Einstein AI products haven't driven meaningful adoption yet.

ServiceNow (NOW): Down 26%. This one's interesting because they're actually building real AI agents, but the market is still skeptical. We'll see if this turns around in 2026.

The valuation multiple difference is staggering. High-growth AI companies trading at 15-20x revenue. Slow-growth traditional SaaS trading at 3-5x revenue. That's a 4-6x multiple compression. The market is definitively pricing in the AI budget shift.

What the Winners Are Actually Doing Differently

Palantir: The AI-Native Operating System

Palantir's transformation is the clearest template we have. In Q2 2023, they were a specialized government contractor with slowing growth. Revenue growth was 12.7%. Not bad, but not exciting. Then they launched AIP (Artificial Intelligence Platform).

AIP wasn't a chatbot. It wasn't adding "AI" to their existing product. It was a completely rethought operating system built for AI. The platform let customers take their messy data and turn it into actionable intelligence without writing code.

By H1 2025, revenue growth had accelerated to 44% year-over-year. Net income hit

Palantir's CFO explained the unit economics shift: With AIP, they went from 3-5 year sales cycles to 6-12 month cycles. Land-and-expand became dramatically more efficient. A customer would buy AIP for one use case, then add three more use cases within 90 days.

Their CTO Shyam Sankar captured the underlying insight: "The models are converging while pricing for inference is dropping significantly. This only strengthens our conviction that the value is in the application and workflow layer."

Translation: The AI models are commoditizing. Everyone has access to GPT-4, Claude, and open source models. The differentiation is no longer the model. It's what you build on top of it. The application layer. The workflows. That's where the value captures.

Palantir understood this in 2023 and built accordingly. By 2025, they were monetizing the insight.

ServiceNow: Enterprise Agents at Scale

ServiceNow is the cloud platform for enterprise workflows. ITSM, HR, finance operations, etc. They're not as flashy as Palantir, but their Q3 2025 performance tells a story.

What changed? They shipped autonomous AI agents.

Specifically, their "Xanadu" and "Yokohama" platform releases introduced agents that could resolve complex IT outages without human intervention. An agent could see a server down, identify the root cause, check dependencies, decide on fixes, and execute them. All automatically. Human IT teams were suddenly spending 70% less time on routine incidents.

For HR, they built agents that could process employee requests ("I need a workspace in Denver") end-to-end. Checking inventory, getting approvals, ordering equipment, scheduling setup. No human touch needed.

That's not "adding AI" to ServiceNow. That's fundamentally changing how enterprises operate their backend. And enterprises will pay premium prices for that.

Their net dollar retention hit 130%. That's expansion revenue. Customers aren't just renewing. They're adding agents. Adding automation. Growing their footprint.

Stripe and Embedded Finance: The Hidden Template

Stripe didn't build AI-native products. But they captured AI budget through infrastructure. When enterprises decided they needed to embed payments and financial workflows into their apps, Stripe was the only scalable option.

The lesson applies to AI too. If you're an infrastructure layer that AI applications need to build on top of, you're capturing AI budget indirectly. Payment processing is the parallel. Every e-commerce platform needs Stripe, so Stripe captures a percentage of all e-commerce revenue growth.

Mongo DB captured this in data infrastructure. Cloudflare captured it in edge compute. If you can position yourself as essential infrastructure for AI applications, you're capturing AI budget even if your product doesn't feel like "AI."

Becoming an AI infrastructure layer is estimated to have the highest impact for B2B SaaS companies in 2026, followed by automating their own category and consolidating through acquisitions. Estimated data.

The Budget Battleground: Where Enterprises Are Actually Reallocating Money

Here's something most analyst reports get wrong. They talk about AI budgets growing in absolute dollars. Sure, that's happening. But the real story is where budgets are being cut to fund AI.

Gartner data shows enterprises aren't getting 30% bigger budgets. They're reallocating within flat or slightly growing total IT budgets. That means for every dollar going to AI infrastructure and AI-native SaaS, a dollar is being cut from legacy systems.

Where is the cutting happening? Legacy CRM maintenance. On-premise server management. Tier-2 and tier-3 SaaS platforms that weren't critical. Renewal after renewal, purchasing departments are asking: "Can we drop this? Can we consolidate into something that does more?"

If you're a tier-2 player in your category, 2026 is your extinction risk year. Budget holders are consolidating. They want fewer vendors doing more. And those "more" things better include AI.

The winners in 2026 will be:

- AI-first category creators that define new workflows (autonomous agents, AI orchestration, decision automation)

- Essential infrastructure for AI scale (vector databases, inference infrastructure, training platforms)

- Irreplaceable integrations between legacy systems and new AI workflows (migration platforms, API management, data integration)

- Tier-one consolidators that bundle multiple functions (ServiceNow has ITSM + HR + Finance with AI; Salesforce is trying this with Einstein)

Everyone else? They're vulnerable to cuts.

The SMB Problem

Here's why companies like HubSpot and Bill.com are struggling. SMB budgets didn't expand. They contracted. Small business cash flow was tighter in 2025 than 2024. They're not buying more software. They're consolidating to fewer vendors.

And here's the brutal part: If HubSpot's CRM loses a customer because they consolidated to Salesforce (and Salesforce has Einstein AI agents), HubSpot doesn't get a second chance. That customer isn't churning back.

The SMB market will fragment. Larger SMBs with AI-specific budget will move to enterprise platforms. Smaller SMBs will consolidate to cheaper, simpler tools. The mid-market of SaaS is hollowing out.

AI Budget Allocation Frameworks: What Enterprises Are Actually Buying

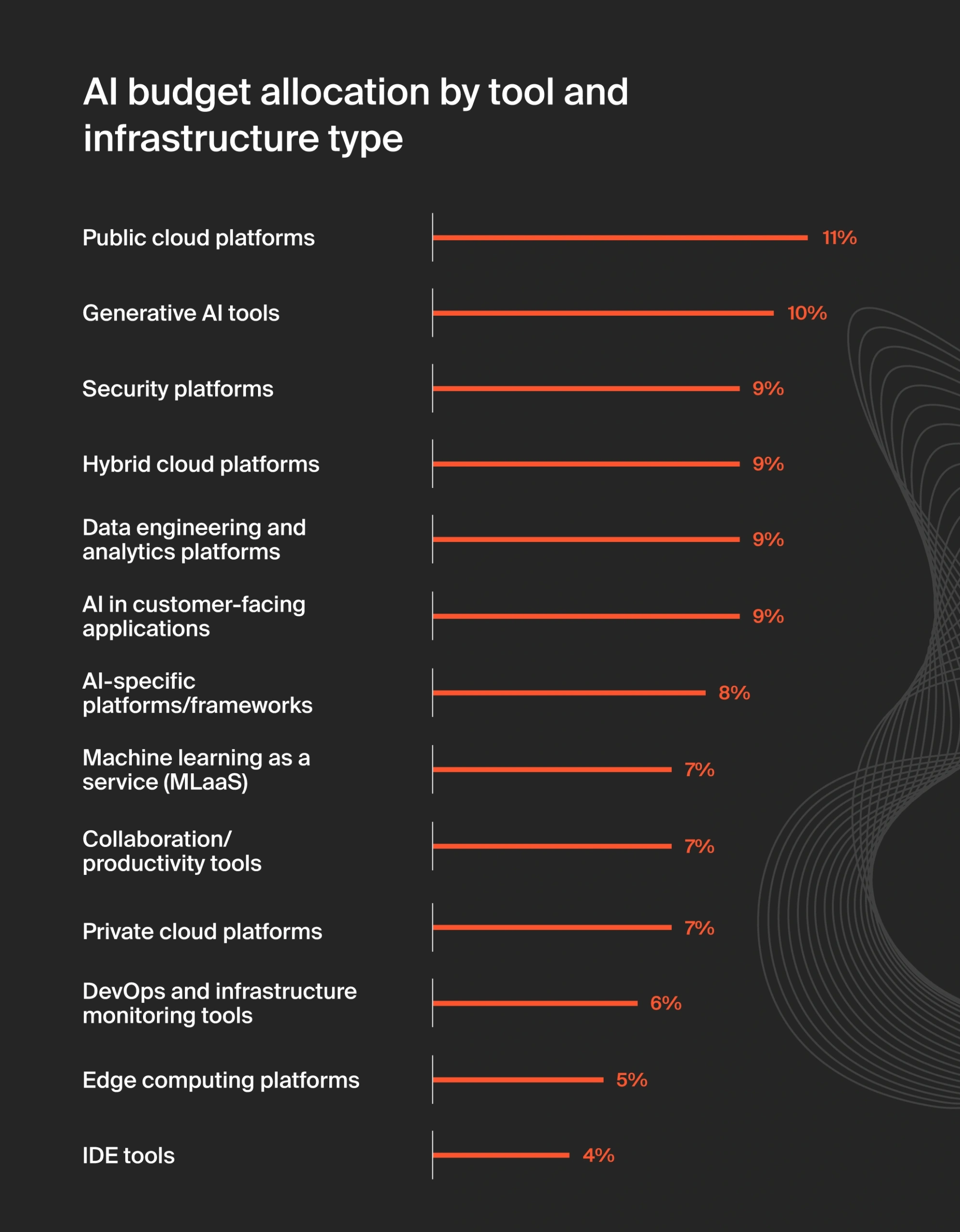

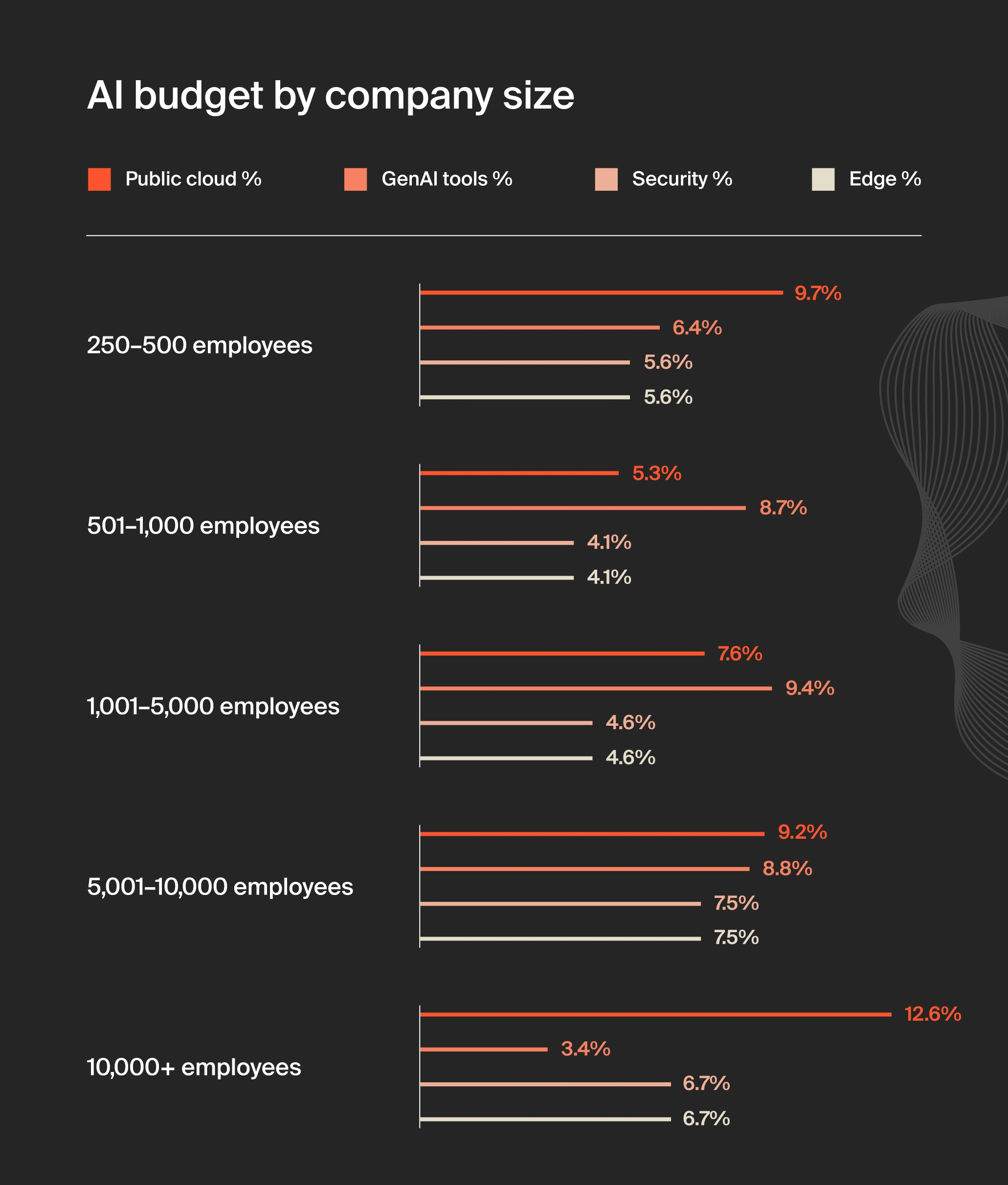

So where is the 75% growth in AI spending actually going? Let's break down the allocation based on CIO surveys and buyer interviews.

40% Infrastructure and Model Access

This includes:

- GPU infrastructure (cloud GPU rentals from AWS, GCP, Azure)

- LLM API access (OpenAI credits, Claude API, Vertex AI)

- Vector databases (Pinecone, Weaviate, Milvus)

- Training frameworks (Hugging Face, MLflow, Ray)

This category is pure commodity spending. The buyer doesn't care if they use OpenAI or Claude or Google's models. They care about cost and inference speed. The winner here is whoever offers the best infrastructure economics.

For B2B SaaS founders, this is a hard category to win in unless you're already a major cloud provider.

35% Applications and Workflow Automation

This is the big one. Enterprises are buying:

- Autonomous agents (ServiceNow agents, Palantir AIP, custom agent frameworks)

- Document processing (intelligent document extraction, contract analysis, policy extraction)

- Customer service automation (AI agents that handle 60-70% of support tickets)

- Sales automation (AI that qualifies leads, suggests deals, drafts emails)

- Operations automation (AI that monitors infrastructure, suggests optimizations, automates fixes)

This is where B2B SaaS companies are winning. If your product can genuinely automate something that previously required humans or was done manually, you're capturing AI budget.

Palantir, ServiceNow, and the category leaders are all winning here. They're not selling "AI." They're selling "your operations run 30% cheaper because intelligent agents do the boring parts."

20% Governance and Risk

Enterprises learned the hard way that unsupervised AI is dangerous. They're spending on:

- Monitoring and observability (watching AI model behavior, detecting drift, catching hallucinations)

- Compliance and audit (proving to regulators that AI decisions aren't discriminatory)

- Fine-tuning and alignment (making AI models behave consistently with company values)

- Data governance (managing training data, lineage, privacy)

This category is where companies like DataRobot, Humantic, and specialized monitoring platforms are winning. It's boring but mandatory.

5% Experimentation and Innovation

This is the last 5%. The blue-sky research. The "what if we used AI for this crazy idea?" budget. It's dropped from 25% to 5% because enterprises got serious. No more experiments without a clear business case.

Palantir's revenue growth accelerated from 12.7% in Q2 2023 to 63% in Q3 2025, driven by their AI-Native Operating System, AIP.

The Brutal Math: Why Your Existing Pricing Doesn't Work Anymore

Here's the thing nobody talks about. Enterprises got hit with a pricing pinch in 2024 and 2025.

Analyze the math:

- Average IT budget increase: 2.79%

- Average vendor price increase: 9%

- Compression: 6.21% per year

If you have a customer spending $100K per year on your software, they expected maybe a 5% price increase at renewal. You're asking for 9%. They're absorbing that once. Twice? They're looking for alternatives.

Multiply that across a portfolio of 50-100 vendors, and suddenly enterprises are spending 30-50% more on software just to maintain the same capabilities.

Where do they find this money? Two places:

- Cut vendors

- Consolidate to larger players

Option 1 is a risk because you lose functionality. Option 2 hurts because you lose negotiating leverage, but at least you consolidate vendor management.

For B2B SaaS companies with less than $500M ARR, this is your extinction test. Can you grow faster than 9% annually in revenue per customer? Or are you facing churn?

Here's where AI budget becomes relevant. If you can position your product as solving an AI-enabled workflow that saves money (fewer people, faster processes, better decisions), you're not asking for 9% price increases. You're asking for 25-30% because you're delivering 3-5x the value.

Palantir's playbook: They don't tell customers "AI-native platform costs 15% more." They say "This agent replaces $2M of headcount, so let's split the savings 50-50." Suddenly, the software looks cheap.

ServiceNow did the same with autonomous agents. Don't price it as "add-on functionality." Price it as "we eliminated 40% of your IT team's routine work. Now you can redeploy those people to strategic work."

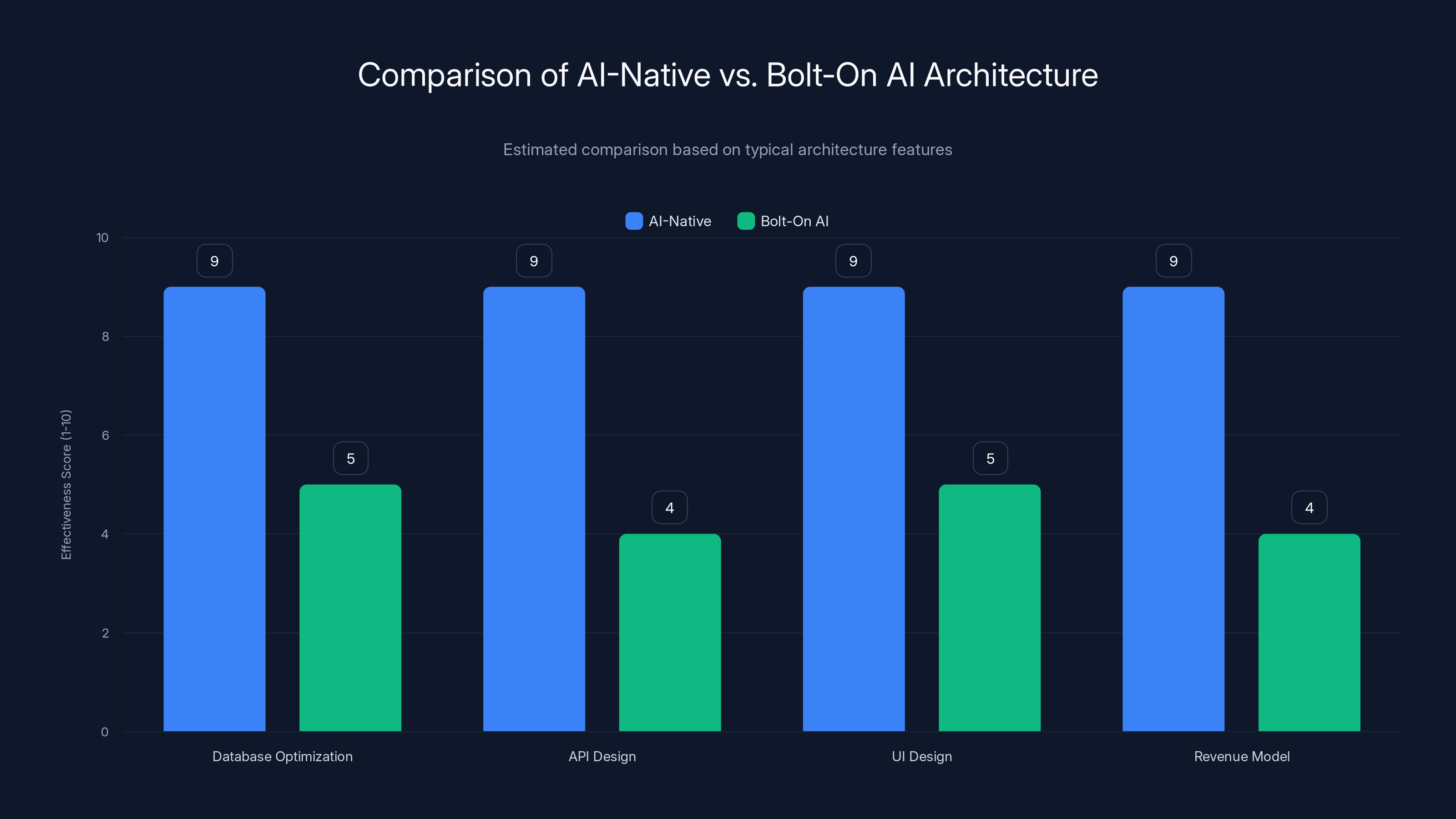

The Product Architecture Question: AI-Native vs. Bolt-On

Now let's get technical about what separates the winners from the losers.

AI-Native Architecture

Palantir's AIP and ServiceNow's agents are AI-native. That means:

-

The database structure is optimized for AI: Data is stored in ways that make training and inference fast. Vector embeddings are first-class citizens, not afterthoughts.

-

The API is designed for autonomous workflows: The product can operate without human input. An agent can be trained to take actions, check results, and iterate.

-

The UI assumes AI assistance: Instead of 50-click workflows, the interface expects AI to predict intent. "You probably want to do X. Should I do it?"

-

Revenue compounds on automation: The more you use the product, the more AI automates, the more value it delivers, the more you spend. It's a virtuous cycle. Not a zero-sum pricing negotiation.

When you build this way from day one, every architectural decision reinforces automation and scale. The product gets better and cheaper as you use it more. Your unit economics improve.

Bolt-On AI

Most existing SaaS companies added AI like this:

- Plug in an LLM API: "We'll use OpenAI's models."

- Add a chat interface: "Here's an AI assistant you can ask questions."

- Fine-tune some features: "AI-powered search," "AI-powered recommendations."

- Market it as "AI-powered": "New AI features coming soon!"

The catch: This doesn't change the unit economics. You're still charging $5K/month for ITSM software. Now it just has a chat bubble. The customer still needs humans to do 80% of the work.

Palantir and ServiceNow took the same infrastructure and data your existing tool has. But they completely reimagined what the product does with it. They don't just help humans work faster. They let machines work instead of humans.

That's the architecture gap. And it's not easily fixable by adding features to existing products.

AI-Native architectures significantly outperform Bolt-On AI in database optimization, API and UI design, and revenue models. Estimated data based on typical architecture features.

What You Need to Do in 2026: The Playbook

Okay, if you're a B2B SaaS founder or executive reading this, here's what you should actually be doing.

If You Have an Existing Product

Option 1: Become an AI Infrastructure Layer

Don't try to compete with Palantir or ServiceNow on autonomous agents. Instead, ask: What infrastructure do AI-native companies need that we could become?

If you're a CRM, don't try to build an autonomous sales agent from scratch. Instead, become the integration layer between Salesforce and autonomous AI agents. Enterprises will need a way to sync data, verify decisions, maintain control.

If you're a data warehouse, become essential for AI training and inference. Make vector storage native. Make data lineage automatic. Make it easy for teams to experiment with AI on your data.

Option 2: Automate Your Own Category

If you own market share in a category, use AI to make your category more efficient. Don't add a chatbot. Ask: "What if the entire workflow was autonomous?"

For HR software, that's autonomous agents handling onboarding, benefits enrollment, leave management. For expense management, that's autonomous approval workflows and fraud detection. For marketing, that's autonomous campaign optimization and personalization.

You know the workflows. You have the data. You have the relationships. You can move faster than a startup building from scratch. But you have to commit to rearchitecting, not just patching.

Option 3: Consolidate and Acquire

If you're too small to win alone, acquire an AI company and integrate. Integrate their AI team, not just their code. Let them rebuild your product properly.

This is the ServiceNow playbook. They've acquired AI startups (Service Titan acquired Tenant Base, which had AI hiring). They're integrating these teams to rearchitect core products.

If You're Building Something New

Start with an AI-Native Architecture

Don't start with a SaaS template and add AI. Start with what autonomous workflows need to exist.

Ask:

- What problem do I solve by automating this workflow completely?

- What data do I need to train and deploy the AI?

- What guardrails and human oversight do I need to add for safety?

- How do I price based on the value created (time saved, headcount replaced, decisions improved)?

Build the product around those questions, not around traditional SaaS UI/UX patterns.

Price for Value Delivered, Not Hours Used

Traditional SaaS pricing is often usage-based or per-user. AI-native should be value-based.

- Instead of: "$500 per user per month"

- Price as: "$50K per 1000 hours automated per month"

Or:

- Instead of: "$10K base + overage fees"

- Price as: "3M of headcount"

This aligns you with customer value. They're happy to pay because they're getting massive returns.

Build for Enterprise From Day One

Don't start with SMB and move up. Start with enterprise use cases. Enterprise has the budget (75% AI growth). Enterprise can absorb the complexity of AI. Enterprise wants autonomous workflows, not chatbots.

Once you've proved the product in enterprise, SMB becomes a secondary market using a cheaper tier. But you'll never move from SMB to enterprise successfully. The product architecture is wrong.

For Existing Leadership Teams

Your Board Will Ask This Question in 2026

"If our customers' AI budgets are growing 75% and our product isn't capturing any of that, where will we be in three years?"

Have an answer before they ask.

You need a specific, board-ready plan for how your 2026-2027 roadmap captures AI budget. Not "we're adding AI features." Specific revenue streams from AI.

Ask Your Sales Team These Questions

- What percentage of RFP conversations mention AI automation requirements? (If it's under 40%, you're behind.)

- Are customers asking us to integrate with AI infrastructure or autonomous agents? (If yes, you have a moat. Build it.)

- Are we winning or losing deals to AI-native competitors? (If losing, your architecture is the problem.)

- Can we quantify the time/cost savings our product delivers? (If not, you can't justify premium pricing in 2026.)

Start Recruiting AI Engineering

If you don't have deep AI/ML engineering talent on your product and engineering teams, you're already behind. The good AI engineers are expensive and in short supply. Start recruiting now. Offer equity. Offer technical leadership. Get them on board with your AI strategy for 2026.

The Competitive Landscape: Who Wins in Each Category

Let's be specific about what the 2026 winners look like in different categories.

Enterprise Infrastructure & Data

Winner: Palantir, Databricks, Scale AI

These companies own the data layer. Every AI system needs data. These companies make it usable at scale. Their 2026 revenue will be dominated by AI use cases.

Autonomous Agents for Operations

Winner: ServiceNow, Workato, Zapier

Services businesses (IT, HR, Finance) have massive overhead in routing tickets, processing requests, and handling exceptions. Autonomous agents cut 40-60% of routine work. The market will pay for this.

Data Infrastructure for AI

Winner: Mongo DB, Snowflake, Databricks, Weaviate

AI-native applications need different database architectures. Vector stores, time-series optimization, document search. The database providers who optimize for AI win.

Edge Computing and AI Inference

Winner: Cloudflare, Fastly, Lambda Labs

Running AI inference in centralized data centers is expensive and slow. Edge inference is the future. Companies that make edge AI infrastructure will capture this market.

The Losing Category: Tier-2 SMB SaaS

This is the brutal category. Companies like HubSpot, Monday.com, Atlassian built great products for SMBs and mid-market. But in 2026:

- SMB budgets are tightening (economic uncertainty)

- Consolidation pressure is increasing (large vendors bundling more)

- Customers are demanding AI automation (which costs engineering resources)

- Price increases aren't sustainable (budget pressure)

The winners in this space will either:

- Consolidate upward to enterprise (very hard)

- Pivot to a specific vertical with deep AI automation (possible, but requires rearchitecting)

- Get acquired by a larger platform (most likely)

There aren't many other outcomes.

In 2024, innovation projects made up 25% of LLM budgets, but by 2025, this dropped to 7%, with core operating expenses dominating at 93%. Estimated data.

Real Customer Stories: How the 75% AI Budget Growth Actually Happens

Let me give you a real conversation I had with a Fortune 500 CIO at a conference.

Before: They were spending $2.5M annually on vendor software for their back-office operations (ITSM, HR, Finance, Procurement). Legacy systems required roughly 45 people to manage: ticket routing, request processing, approval workflows, escalations.

Problem: Their CEO mandated a 15% cost reduction. They couldn't cut headcount without service degradation. But they also couldn't accept their vendor bills going up 9% again.

The Shift: They heard about ServiceNow's autonomous agents. A pilot project: "Can we automate 50% of IT ticket routing?"

Result: 8 weeks to deploy, 60% of tickets now routed by AI, human team handles complex escalations. Internal cost to maintain the automation? About 2 people instead of 8.

Budget Realignment:

- Current spend: $2.5M software

- Proposed budget: $3.8M (includes AI infrastructure, automation tuning, governance oversight)

- Headcount reduction: 15 people saved from operations (salary + benefits = $1.8M)

- Net savings: $1.5M

Outcome: They signed a 3-year deal with ServiceNow for

This is happening in 100s of enterprises in 2026. The budget shift looks magical until you understand it's actually ROI-driven. Enterprises aren't just spending more on AI. They're shifting budgets because AI delivers dramatic payback.

The Uncomfortable Truth: If You're Not in an AI Story by Mid-2026, You're Probably Done

I don't say this to scare anyone. I say it because the data supports it.

The enterprise budget shift is structural, not cyclical. AI isn't a trend that might go away. It's the structural replacement of human-driven processes with autonomous systems. That's happening in every enterprise, in every department.

Companies that don't have a credible AI story in their sales conversations will face compounding headwinds:

- Q2 2026: Deals start slipping because prospects ask "How does this integrate with our AI workflow?"

- Q3 2026: Win rates drop below 25% because competitors have AI-native alternatives

- Q4 2026: Customer churn accelerates as budget holders consolidate to AI-first vendors

- 2027: You're trying to raise a Series C+ round with negative growth, and nobody wants to fund a legacy SaaS company

I've seen this pattern before. It happened to every traditional on-premise software company when cloud SaaS took over. It happened to single-player tools when collaboration tools took over. It's happening again with AI.

The timeline is faster this time. The budget shift happened in 18 months instead of 5 years. The stock market is already pricing it in. Your customers are already asking about it.

Here's the opportunity: If you act in Q1 2026, you still have a window. You have engineering resources, you have customer relationships, you have existing revenue to fund the transition. If you wait until Q3 2026, you're already three quarters behind.

How to Diagnose Your AI Budget Readiness

Here's a quick diagnostic framework. If you answer "no" to more than two of these questions, your 2026 is at risk.

Product & Engineering:

- Does your product have a native AI integration (or will it, by Q1 2026)?

- Can you articulate the specific AI workflow your product enables?

- Do your engineers understand vector databases, model inference, and autonomous agents?

- Have you experimented with your own product using AI agents (eating your own dog food)?

Sales & GTM:

- Are your sales conversations mentioning AI 30%+ of the time (not by accident, but because it's in your story)?

- Do you have specific ROI metrics for the time/cost savings your AI implementation delivers?

- Have you won any deals specifically because of your AI capabilities (not just despite lack thereof)?

- Can your sales team articulate the competitive difference between your product and AI-native competitors?

Finance & Strategy:

- Have you modeled the impact of 25% customer churn if you don't have a credible AI story?

- Do you have a specific roadmap for capturing AI budget in 2026? (Board-ready, not just engineering roadmap)

- Have you analyzed which of your customers' AI budgets you could capture by solving their automation needs?

- Are you planning recruiting/hiring for AI engineering talent?

Executive Alignment:

- Does your CEO/board understand that the enterprise budget shift is structural, not cyclical?

- Is your leadership team unified on the AI strategy, or are there differing opinions?

- Do you have executive sponsorship for major rearchitecting work that won't show returns for 12-18 months?

- Can you articulate your 2026 AI story to customers in one sentence?

If you scored:

- 12-16 yes: You're well-positioned. You have work to do, but you're on the right path.

- 8-11 yes: You're behind. Q1 2026 is crunch time. You need to make decisions quickly.

- 4-7 yes: You're at real risk. This needs board-level attention urgently.

- 0-3 yes: You have a structural problem. Waiting won't fix it. You need a bold move.

The Path Forward: What to Do Monday Morning

If this resonates, here's your action plan for January 2026.

Week 1: Honest Diagnosis

Gather your leadership team and answer the diagnostic questions above. Be honest. If you're at risk, admit it. Denial is your biggest enemy.

Week 2: Customer Listening

Call 10 of your largest customers. Ask them:

- What percentage of your IT budget is going to AI in 2026?

- What AI workflows are you prioritizing?

- Is our product helping you with those workflows?

- If not, what would need to change for it to help?

Their answers will tell you everything about your realistic options.

Week 3: Competitive Analysis

Find your top 3 AI-native competitors. Study their architecture. Understand their pricing. Talk to customers who switched to them. You need to know exactly how you're behind, not just that you are.

Week 4: Build Your AI Story

Based on weeks 1-3, pick your play:

- Infrastructure layer? Automation? Consolidation? Vertical focus?

- Get specific. You should be able to pitch it to your board in 5 minutes.

Month 2: Mobilize

If you need to hire, start now. If you need to rearchitect, get engineering unblocked. If you need to acquire, start conversations. Don't wait for perfect clarity. Start moving.

Month 3: Go to Market

Test your AI story with customers. Get feedback. Iterate. The customer feedback loop is more important than perfection.

The enterprises that grew fastest in 2025 didn't have perfect AI products. They had clear AI stories and customers willing to take small risks on new capabilities. They iterated fast based on customer feedback.

The Ending That Isn't Actually an Ending

So can you really grow in 2026 if you aren't tapping into AI budget?

Probably not.

But here's the thing: It's not 2024 anymore. The budget has shifted. The enterprises have committed. The winning playbooks are now visible.

If you're reading this in Q4 2025 or Q1 2026, you're not too late. The market is still moving. There's still opportunity. But the window is small.

In six months, the market will have settled. The winners will be obvious. The losers will be losing deals, customers will be churning, and the board meetings will get uncomfortable. Right now, you can still influence which bucket you land in.

Palantir, ServiceNow, Cloudflare, and the other winners aren't smarter than you. They're not better capitalized than you. They just made their AI bets when the window was still open.

The window is still open. Not for much longer. But still open.

Make your move. Now.

FAQ

What is the current enterprise AI budget growth rate compared to overall IT spending?

Enterprise AI budgets are growing 5.7% year-over-year according to ISG Research, while overall IT spending is rising just 1.8%. This means AI is capturing roughly 30% of all IT budget increases despite being a fraction of total spending. The most significant shift is that AI budgets went from being 25% innovation spending in 2024 to just 7% in 2025, meaning 93% of AI spending is now core operating expense rather than experimental budget.

How did the stock market reveal the winners and losers in the AI budget shift?

Companies with AI-native architectures like Palantir saw 142% stock price growth in 2025, Cloudflare gained 80%, and Mongo DB rose 70%. Meanwhile, traditional SaaS vendors like HubSpot fell 51%, Atlassian dropped 34%, and Bill.com declined 43%. This 4-6x valuation multiple difference reflects the market pricing in the structural shift toward AI-first companies. The stock performance correlates directly with whether companies are capturing AI budget or losing budget share to competitors.

What's the difference between AI-native and bolt-on AI architecture?

AI-native architecture means the entire product is designed around autonomous workflows from the ground up, with optimized data structures, APIs designed for automation, and revenue that compounds on automation effectiveness. Bolt-on AI means adding chatbots or AI features to existing products without fundamental rearchitecting. Winners like Palantir and ServiceNow built AI-native. Losers added bolt-on features. The difference in outcomes is dramatic: AI-native companies see 40-60% revenue growth with 50%+ operating margins, while bolt-on players struggle to maintain growth.

Where is the 75% enterprise AI budget growth actually going?

The allocation breaks down roughly as: 40% to infrastructure and model access (GPUs, LLM APIs, vector databases), 35% to applications and workflow automation (autonomous agents, document processing, customer service automation), 20% to governance and risk management (monitoring, compliance, fine-tuning), and 5% to experimentation and innovation. B2B SaaS companies are winning primarily in the applications and workflow automation bucket, which is where autonomous agents and process automation create the most customer value.

Why are SMB-focused SaaS companies struggling while enterprise-focused AI companies are thriving?

SMB budgets contracted in 2024-2025 due to economic tightness, while enterprise IT budgets for AI actually expanded. Additionally, SMBs want cheaper, simpler solutions and aren't willing to pay premium prices for AI automation. Enterprise customers, by contrast, have clear ROI cases (replacing expensive headcount) and will pay premium prices for solutions that deliver measurable savings. SMB SaaS companies also weren't positioned to capture AI budget because their products were optimized for low cost, not automation complexity.

What specific ROI metrics should enterprises expect from AI automation in 2026?

Based on real deployments, enterprises typically see 40-70% reduction in routine work for operations (IT, HR, Finance). For a typical 500-person company with a 45-person operations team, autonomous agents reduce that to roughly 15-20 people. At

How should existing SaaS companies position themselves to capture AI budget without completely rebuilding?

The most realistic path is to become an essential infrastructure layer for AI workflows rather than competing head-to-head with AI-native companies. For example, a CRM could become the data integration layer that autonomous agents need to access customer data safely. A data warehouse could optimize for vector storage and AI training workflows. A workflow platform could become the orchestration layer between legacy systems and autonomous agents. This positions you as necessary infrastructure that AI-first companies need to build on, without requiring complete rearchitecting of your core product.

What's the timeline for when companies without an AI story will face real business impact?

Based on analyst reports and CIO surveys, the impact timeline is: Q1-Q2 2026 (deals start slipping as customers ask about AI integration), Q3 2026 (win rates drop as customers consolidate to AI vendors), Q4 2026 (customer churn accelerates), and 2027 (compounding growth problems make fundraising extremely difficult). Companies that don't have a credible AI story shipping by Q2 2026 will face severe competitive pressure by Q3. The window for action is essentially Q1 2026.

Should SMB SaaS companies try to move upmarket to enterprise to capture AI budget?

Generally not recommended. Moving upmarket requires rearchitecting your entire product, sales motion, support infrastructure, and pricing model. You'll likely fail by trying to be both SMB-focused and enterprise-focused. Better options are: (1) specialize deeply in AI automation for a specific SMB vertical, (2) get acquired by an enterprise platform that can integrate your customer base, or (3) build a new product from scratch targeting enterprise. Trying to retrofit SMB products for enterprise rarely works.

How do I quantify the AI automation value my product delivers to justify premium pricing in 2026?

The formula is: (number of employees eliminated × fully-loaded cost per employee) + (time saved × hourly cost) - (AI infrastructure costs) = total annual value. For example, an autonomous agent replacing 3 FTEs at

Your move. The window is still open, but not for much longer.

Key Takeaways

- Enterprise AI budgets grew 5.7% in 2025 while overall IT spending rose just 1.8%, creating a structural budget shift toward AI that will accelerate in 2026

- The stock market priced this shift dramatically: Palantir up 142%, Cloudflare up 80%, versus HubSpot down 51%, Atlassian down 34%, showing the market values AI-native execution

- Innovation budgets collapsed from 25% to 7% of AI spending, meaning AI is now core operating expense, not experimentation—enterprises are past the 'testing' phase

- Winners built AI-native architectures from scratch (Palantir, ServiceNow) while losers bolted AI onto existing products, creating 10x performance differences

- Enterprise customers will reallocate 40-60% of operations budgets away from traditional vendors to fund AI automation, making 2026 the inflection year for SaaS survival

Related Articles

- Best Apps of 2025: Top 5 Must-Have Tools for Productivity [2025]

- CIOs Must Lead AI Experimentation, Not Just Govern It [2025]

- Trump's Offshore Wind Pause Faces Legal Challenge: Data Center Power Demand Crisis [2025]

- 5 AI Trends That Changed My Life [2025]

- AI Data Center Boom vs Infrastructure Projects: The Resource War [2025]

![AI Budget Is the Only Growth Lever Left for SaaS in 2026 [2025]](https://tryrunable.com/blog/ai-budget-is-the-only-growth-lever-left-for-saas-in-2026-202/image-1-1767022698255.jpg)