Introduction: The Hidden Danger Truck Drivers Face Every Day

Truck drivers operate in one of the most high-risk professions in America. Every single shift brings narrow highways, aggressive merges, and the constant threat of accidents that happen in spaces they can't see. The blind spot problem isn't theoretical. According to traffic safety data, blind spots contribute to thousands of commercial vehicle accidents annually, costing the trucking industry billions in damages, injuries, and lives.

For decades, truck drivers relied on mirrors, physical turning in their seats, and pure instinct to avoid accidents. But mirrors have limitations. They distort images, miss entire zones, and require constant head movement that takes attention off the road. One driver told me that he almost sideswiped a sedan three times before investing in a quality dash cam system. "I never saw the car," he said. "It was just there when I checked my blind spot."

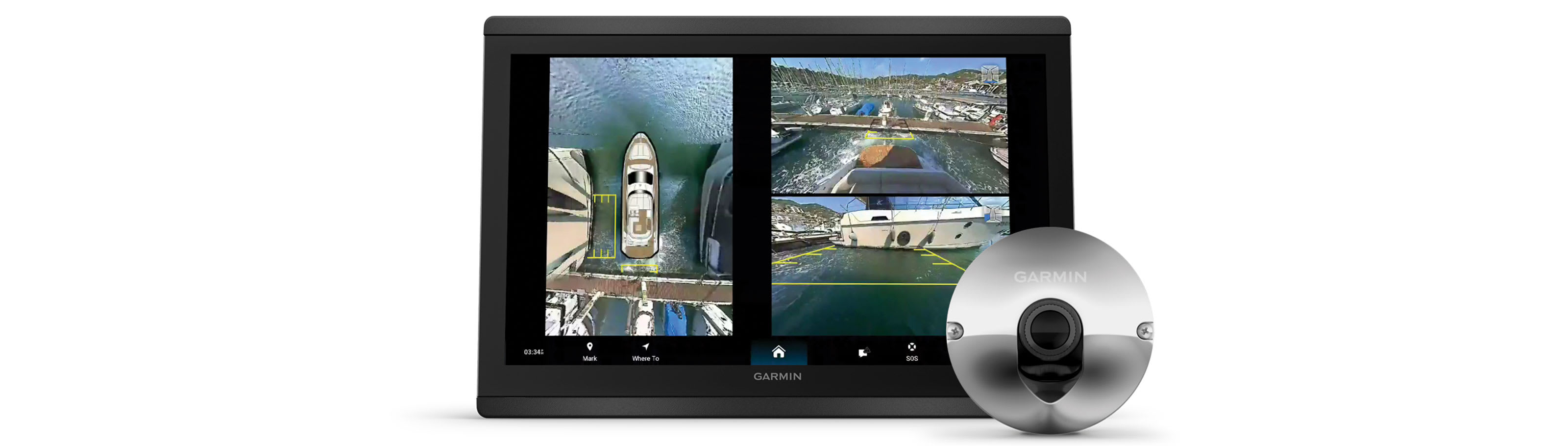

Enter Garmin's latest innovation: a rugged blind spot dash cam designed specifically for the trucking industry. This isn't a generic consumer device slapped onto a truck. This is purpose-built hardware engineered for the demands of commercial driving, harsh weather, vibration, temperature swings, and the legal pressures that come with operating a multi-ton vehicle on public roads.

The timing couldn't be better. Insurance companies increasingly mandate dash cams for commercial fleets. Regulations around liability and accident documentation are tightening. Drivers themselves are demanding better safety tools. And Garmin, a company with two decades of automotive GPS and camera experience, finally addressed what the trucking world has needed: comprehensive blind spot coverage that actually works in real conditions.

This article dives deep into how Garmin's new blind spot dash cam works, why it matters for truck driver safety, how it compares to alternatives, and what implementing this technology means for fleets looking to reduce accidents, lower insurance premiums, and protect their drivers.

TL; DR

- Blind spot accidents cost trucking companies: Thousands of collisions annually, contributing to serious injuries and fatalities in commercial driving

- Garmin's new system covers: 360-degree visibility with rugged hardware designed for harsh truck environments and vibration

- Key advantage: Purpose-built for trucks rather than adapted from passenger vehicle technology, with fleet integration and compliance features

- Safety impact: Real-time alerts, recorded evidence, and coverage of zones traditional mirrors miss completely

- Fleet adoption: Insurance discounts, liability protection, and improved driver accountability driving rapid adoption across the industry

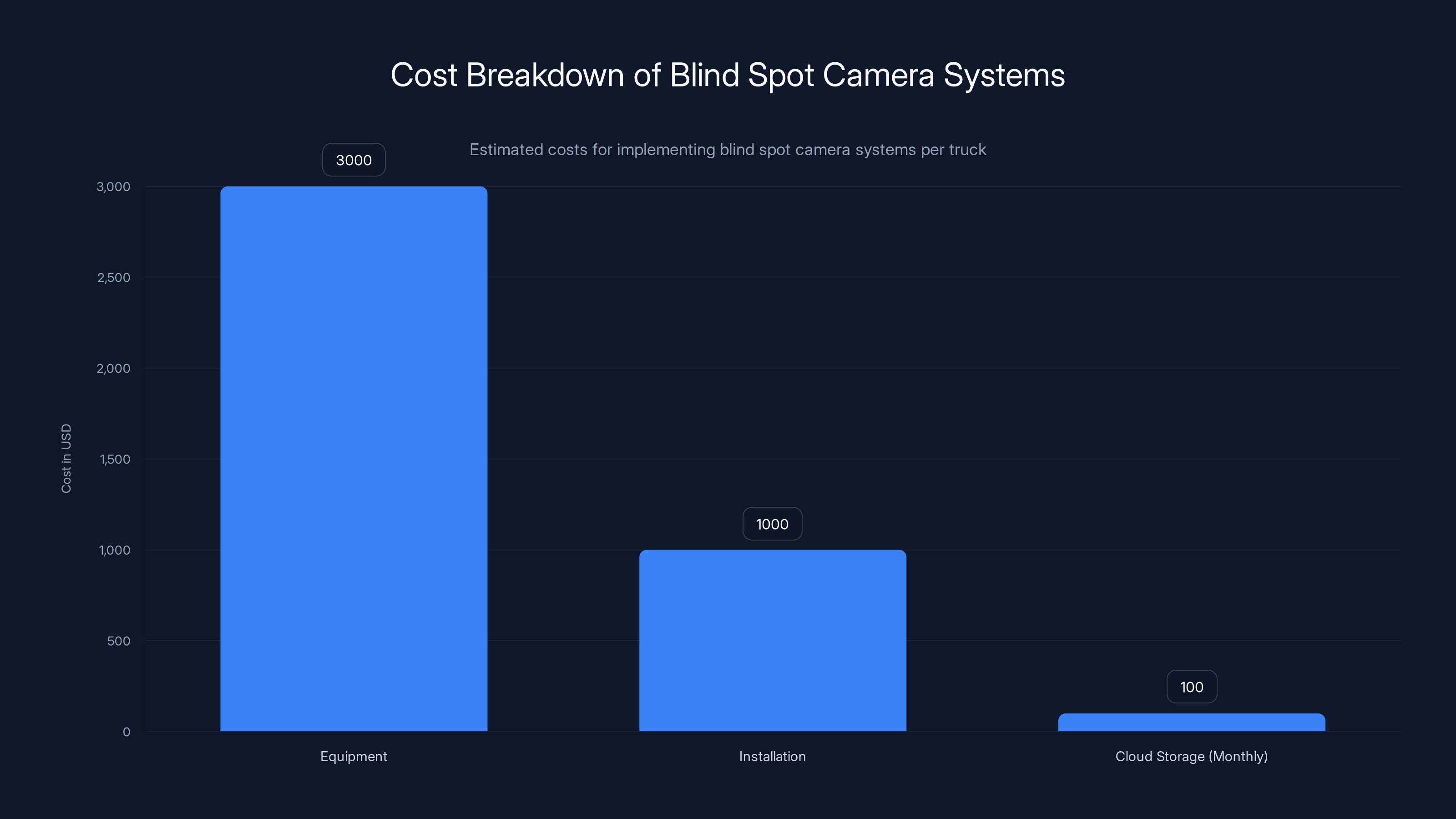

Estimated costs for blind spot camera systems per truck include

Why Blind Spots Are Truck Drivers' Deadliest Problem

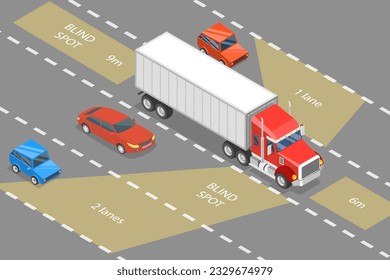

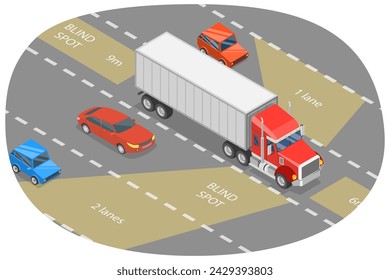

Blind spots on trucks are fundamentally different from those on passenger vehicles. A semi-truck sitting 70+ feet long with an 8.5-foot width creates massive "dead zones" where objects simply vanish from view. A sedan can hide completely in a truck's right-side blind spot for several hundred feet. A motorcyclist becomes invisible for an entire highway merge. This isn't carelessness or poor driving—it's physics.

The National Highway Traffic Safety Administration data reveals that large trucks are involved in fatal crashes at rates significantly higher than other vehicles. Many of these incidents trace back to lane changes, turns, or reversing maneuvers where the driver couldn't see nearby vehicles or pedestrians. A truck driver making a right turn might legitimately have zero visibility into the area directly below and beside the cab. Pedestrians and cyclists know this. So do experienced drivers. The problem is that knowledge doesn't equal prevention.

Insurance claims from blind spot incidents average

Traditional mirror systems have fundamental limitations. Convex mirrors expand the field of view but distort distances, making objects appear farther away than they actually are. Spot mirrors help but require drivers to shift their gaze multiple times during critical maneuvers. And no mirror system captures what happens alongside or behind the truck during reversing, which is when many incidents occur. A driver must physically move their body to see certain zones, and at highway speeds, that's dangerous.

The psychological component matters too. Drivers develop "mirror confidence"—a false sense that they've checked their blind spot when they haven't actually seen the relevant area. A camera system removes this ambiguity. Either the camera captures a vehicle or it doesn't. Either an alert triggers or it doesn't. This objective certainty fundamentally changes driver behavior and decision-making.

How Garmin's Blind Spot Camera System Actually Works

Garmin's approach differs significantly from aftermarket dash cams adapted for trucks. This system includes multiple camera units positioned strategically around the vehicle: one forward-facing camera in the windshield area, side-facing cameras covering the blind spots along both sides of the trailer or cab, and a rear-facing camera capturing what's behind the truck.

The cameras operate on a synchronized network connected through the vehicle's power system and internal wiring. Rather than recording to individual memory cards, the system feeds video to a central processing unit that timestamps footage, buffers critical moments, and stores video on ruggedized storage. The whole setup is designed to survive truck environments: extreme temperature swings, constant vibration from engine and road, moisture intrusion, and the occasional accidental impact.

What makes this different from passenger vehicle dash cams is the integration with the truck's existing systems and the real-time alerting capability. When the system detects a vehicle in the driver's blind spot (using computer vision and object detection), it displays a visual alert on the cab-mounted screen and can emit an audible warning. The driver isn't just recording evidence—they're getting warned about hazards before they become accidents.

The processing happens in real time. Modern dash cams use edge computing, meaning the camera units themselves contain processors that analyze video locally rather than sending data to the cloud for processing. This delivers immediate alerts and doesn't depend on internet connectivity, which is critical for drivers operating in rural areas or tunnels where cellular signal drops.

Video storage uses a loop recording system. Once storage fills, the system deletes the oldest footage (unless it's flagged as important) and continues recording. For incident resolution, the system can lock footage from critical moments—like right before an accident—so it's never overwritten. Insurance companies and safety managers can remotely download locked incident files.

The system also logs metadata: vehicle speed, GPS location, brake application, turn signal activation, and acceleration data. This contextual information proves invaluable when investigating incidents. If a driver claims they had their turn signal on, the timestamp data confirms it. If they claim they weren't speeding, the velocity log shows exactly what speed they were traveling.

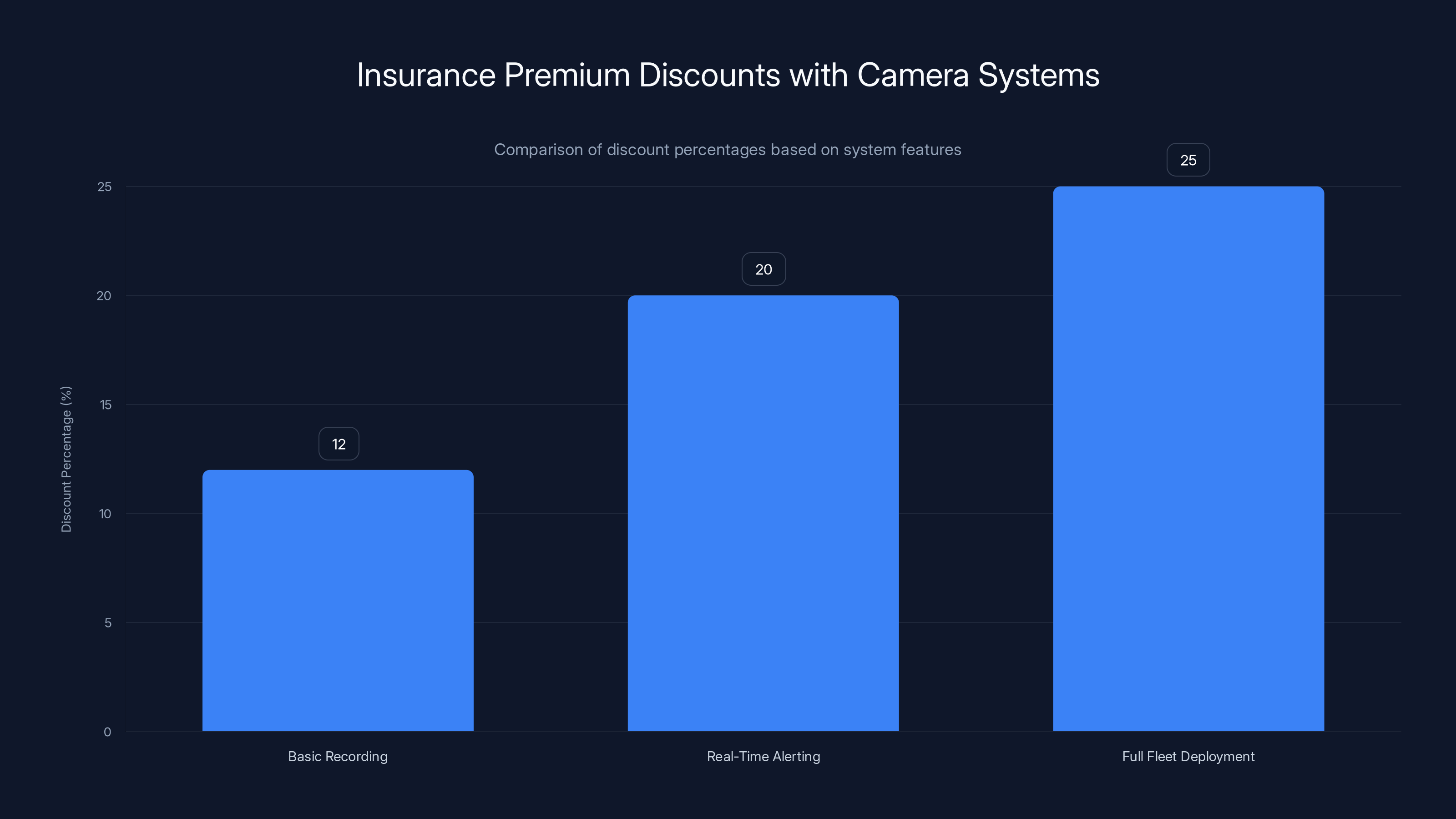

Insurance companies offer varying discounts based on the camera system's capabilities, with comprehensive systems providing up to 25% savings. Estimated data based on typical industry practices.

The Technical Specifications That Matter For Real Truck Operations

Garmin engineered this system for ruggedness that reflects actual truck operating conditions. The cameras are rated for ambient temperatures from -40°F to 140°F, which covers desert heat and winter cold where trucks operate across North America. Sealed connectors and waterproofing ensure that humidity and road spray don't compromise electronics.

The video resolution matters for liability protection. Garmin's cameras capture at 1440p (2560 x 1440 pixels) or higher, which provides enough detail to identify vehicles, read license plates, and capture the relevant moment. Lower resolution systems might record an incident but lack the detail needed to prove liability in court or to insurance adjusters.

Frame rate affects how motion appears in video. The system records at 30 frames per second for continuous recording, which is standard. However, critical moments—like when the system detects an object in a blind spot—get recorded at higher frame rates (up to 60fps or beyond) to capture fast-moving situations with smooth playback.

The field of view varies by camera. Forward-facing cameras typically offer 120-140 degrees horizontal view. Side cameras need wider angles, often 160+ degrees, to capture the full blind spot zone. Rear cameras might be standard 120 degrees or wider. The wider the field of view, the larger the blind spot coverage, but extreme angles introduce lens distortion that must be corrected in software.

GPS integration serves multiple purposes. The system logs the exact location of every incident. Fleet managers can map incidents geographically to identify problem intersections or highways. Insurers can verify vehicle location during an accident claim. And drivers themselves can review where incidents occurred to improve safety in those specific areas.

Power consumption is engineered for truck electrical systems. Trucks have 12V or 24V systems depending on configuration. Garmin's hardware includes voltage regulation to handle the electrical noise that truck engines generate. Improper power handling causes video corruption, so ruggedized power supplies matter significantly.

Real-World Benefits: How This Actually Protects Drivers and Fleets

The safety benefits extend beyond accident prevention, though that's obviously important. A documented blind spot incident caught on camera creates liability clarity. If another driver caused the accident, the footage proves it. If the truck driver made an error, the evidence is objective. This clarity prevents expensive disputes.

Insurance companies immediately recognize the risk reduction. Fleets with properly installed blind spot camera systems report insurance premium reductions of 10-20% because insurers know accidents are being prevented and incidents are being documented. For a fleet running 50 trucks paying

Driver behavior changes when they know they're being monitored with objective cameras. Studies on dash cam adoption show that drivers become more cautious around blind spot areas once they understand that cameras are capturing their actions. This isn't about creating a surveillance culture—it's about using technology to reinforce safe practices. Drivers who might otherwise rush a lane change pause and verify the blind spot is clear when they know cameras are recording.

Fleet managers gain visibility into what actually happens on roads. They can review critical incidents, understand what drivers could have done differently, and provide targeted coaching. Rather than disciplining a driver based on someone else's report, managers can show the driver exactly what the camera captured and discuss safer approaches for similar situations.

For drivers themselves, the system provides legal protection. If another driver hits them and claims the truck was at fault, the camera footage proves otherwise. The driver isn't relying on their own account versus the other party's account—there's objective evidence. This matters deeply for professional drivers whose safety record affects their careers.

The system also captures evidence of other drivers' mistakes. A dash cam captures another driver running a red light, texting while driving, or aggressively cutting off the truck. This evidence supports insurance claims and protects the truck driver from being blamed for an accident caused by someone else's negligence.

Blind Spot Coverage: What Garmin's Multi-Camera Setup Actually Sees

The strategic camera placement creates several zones of visibility that traditional mirrors cannot achieve. The right-side camera covers the blind spot along the truck's right flank, typically from the cab door extending back past the trailer. This is where most right-turn accidents occur because the driver cannot see the zone below and beside the cab when turning.

The left-side camera captures the left-side blind spot, which extends significantly behind the truck's rear axle. Many lane-change accidents occur here because drivers merge onto a truck's left side assuming they're safe, not realizing they're in the truck's blind spot for a surprising distance.

The rear camera provides visibility directly behind the truck, critical during reversing operations. Trucks backing into loading docks, truck stops, or parking areas have minimal visibility behind them. A rear camera prevents backing accidents that can cause significant property damage or injuries.

The forward camera captures the area directly ahead and on both sides of the cab, providing broader context for turns and lane changes. This camera also triggers warning systems for potential forward collisions or pedestrians entering the path of the truck.

The system uses object detection algorithms trained on thousands of hours of real truck footage. These algorithms identify vehicles, pedestrians, motorcycles, bicycles, and even animals in blind spot areas. When detection confidence exceeds a threshold, the system alerts the driver before any collision occurs.

The coverage isn't perfect—no system is. Objects moving extremely fast might appear in a blind spot with minimal warning time. Extremely small objects might not trigger alerts depending on system settings. Drivers must understand the system's capabilities and limitations. However, comprehensive coverage of blind spots represents a massive improvement over mirrors alone.

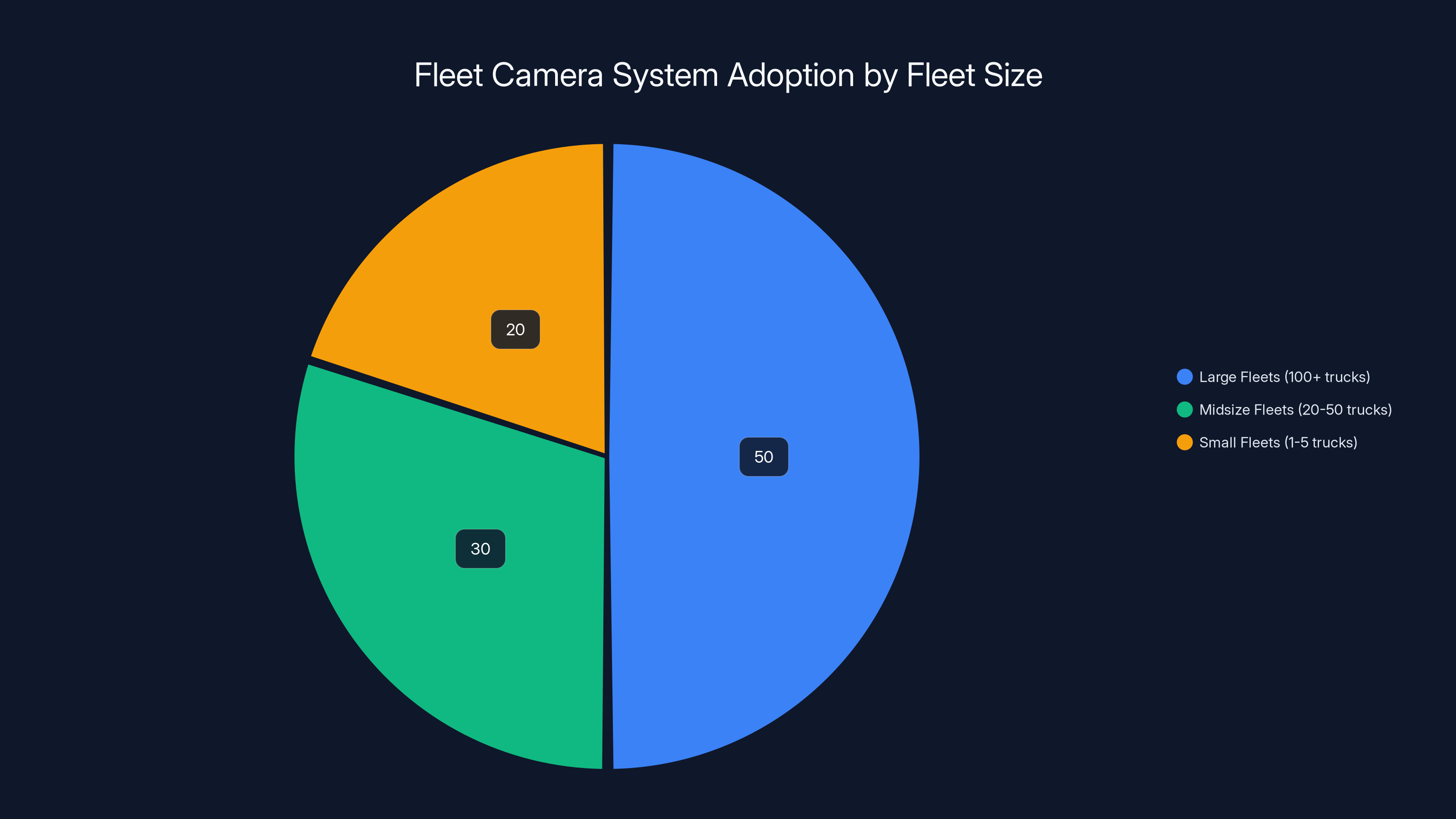

Estimated data shows that large fleets lead in camera system adoption due to compelling insurance savings, while midsize fleets are increasingly adopting through pilot programs. Small fleets are catching up due to cost-benefit realization.

Installation and Integration With Existing Truck Systems

Garmin designed this system for aftermarket installation on existing trucks, which is critical for fleet adoption. Installing a blind spot camera system on a truck involves running power cables through the vehicle's existing conduit, mounting cameras at specific locations, and routing video cables to a central processing unit mounted in the cab.

The installation typically requires 4-6 hours for a trained technician. Power draws from the truck's 12V or 24V system through a fused connection to protect against electrical shorts. Professional installers route cables through existing wire conduits to avoid visible damage and protect wiring from abrasion.

Camera mounting uses vibration-dampening brackets that hold cameras rigidly but isolate them from truck vibration. A poorly mounted camera produces shaky footage and may separate from the truck due to constant motion. Proper mounting is more important than people realize.

The processing unit mounts inside the cab, often on the dashboard or windshield. The display provides real-time alerts and playback capability. Drivers can review footage from incidents while parked. Fleet managers can remotely connect to the system via a mobile app or web interface to download footage and monitor fleet activity.

Integration with the truck's existing systems varies by configuration. Some systems integrate with the truck's engine control module (ECM) to log vehicle speed and acceleration data. Others integrate with the ABS system to log braking events. The more integration, the more context available for incident investigation.

Compatibility matters. Older trucks might require custom adapter harnesses. Newer trucks with integrated telematics systems might enable automatic incident uploads to fleet management servers. The system's flexibility across different truck models is actually important for fleet adoption because companies operate mixed fleets of various ages and manufacturers.

Wiring installation can be the most time-consuming aspect. Professional installers know where existing conduits run and which paths avoid critical engine components. DIY installation risks damaging wiring or installing cameras with inadequate weather sealing, leading to water intrusion and electrical failures.

Comparison With Alternative Blind Spot Solutions: Why Cameras Win

Before cameras became practical, fleets relied on several alternatives, each with significant limitations. Convex mirrors expand the field of view but distort distances, making accurately judging relative positions nearly impossible. A vehicle that appears 100 feet away might actually be 30 feet away, making mirror-based decisions unreliable.

Spot mirrors provide a secondary view of the blind spot but require drivers to reference another mirror during critical maneuvers. Glancing at a spot mirror means looking away from the road ahead, creating different safety issues. Drivers also develop the habit of forgetting to check these additional mirrors.

Round-a-bout camera systems from budget manufacturers capture video but lack the processing power to provide real-time alerts. They record incidents but don't prevent them. A driver only reviews footage after an accident occurs, making the system reactive rather than proactive. This is better than nothing but represents a significant step down from intelligent alert systems.

Garmin's approach combines video recording with real-time intelligent alerting. The system prevents accidents rather than just documenting them. The computational capability enables object detection, metadata logging, and integration with fleet management systems. This represents a qualitative leap beyond recording-only systems.

Sensor-based solutions like radar or lidar provide accurate distance measurement without video. These systems can detect objects in blind spots with precise ranging information. However, they cost significantly more (

Radio-frequency identification (RFID) and Wi Fi-based collision warning systems exist but require infrastructure or devices on other vehicles. A truck with an RFID system only alerts to other equipped vehicles. This doesn't help with the vast majority of traffic (unequipped vehicles, pedestrians, cyclists). Camera-based systems work universally because they don't depend on external devices or infrastructure.

The comparison ultimately shows that camera-based systems strike the best balance between cost, capability, effectiveness, and practicality for commercial fleet operations.

Liability and Legal Implications: Documentation That Protects Everyone

The legal landscape has shifted significantly regarding dash cam footage. Most insurance companies now accept dash cam footage as primary evidence in accident claims. Some insurance policies actually require dash cams for commercial vehicles. State laws vary, but in most jurisdictions, dash cam footage is admissible in civil court and can be used to establish liability.

For truck drivers, this means protection against false claims. If another driver hits a truck and claims it was the truck driver's fault, the footage can prove otherwise. The driver isn't relying on their own account against someone else's account. They have objective video evidence. This protection is invaluable for professional drivers whose safety records and employment depend on their accident history.

For fleet companies, dash cam footage protects against frivolous liability claims. When accident claims arise, fleet managers can immediately provide video evidence that either supports or contradicts the claim. Insurance companies process claims much faster when video evidence is available, and settlement amounts tend to be lower when video proves the fleet wasn't at fault.

The metadata that Garmin's system captures—vehicle speed, GPS location, brake application, turn signal activation—provides context that strengthens the evidentiary value of footage. A lawyer can argue that a vehicle was speeding based on the speedometer reading captured in the video. They can show that the driver braked suddenly just before an accident, demonstrating that they tried to prevent the collision. This contextual information converts raw footage into powerful evidence.

Privacy considerations arise with in-cab camera systems. Some states have limitations on recording audio inside vehicles without consent. Garmin's systems typically allow audio recording to be disabled in the cab while continuing to record exterior cameras. Fleet managers should verify their system complies with state and local privacy laws.

Employee rights regarding dash cam footage also vary by jurisdiction. Some states allow employers to review footage freely, while others require employee consent or limit how footage can be used. A fleet should consult legal counsel to ensure their dash cam deployment complies with labor laws in their operating territory.

The liability protection provided by dash cam systems justifies their cost many times over. A single accident liability claim can exceed the cost of equipping an entire truck with cameras. The evidence from cameras either prevents the claim entirely or reduces settlement amounts significantly.

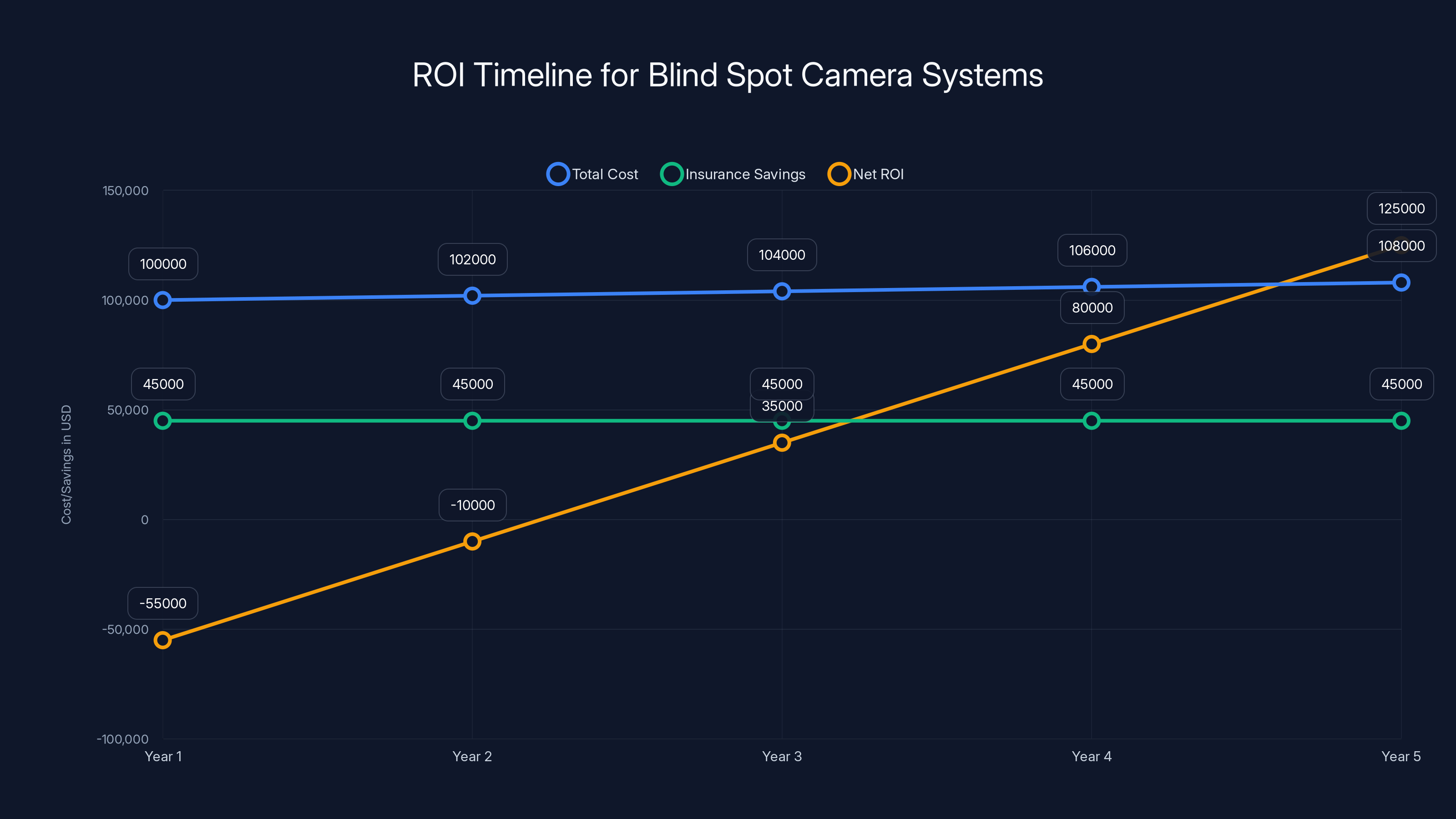

Estimated data shows that by Year 3, the ROI becomes positive due to insurance savings, covering initial investment costs.

Real-World Implementation: How Fleets Are Actually Deploying This

Large trucking companies have moved aggressively toward fleet-wide camera adoption. Companies operating 100+ trucks have largely installed systems across their fleets. The economics are compelling: insurance savings alone exceed the system cost within 12-18 months for most operations.

The deployment strategy varies. Some fleets retrofit existing trucks gradually, starting with vehicles in highest-risk categories (those driven in dense urban areas, by newer drivers, or with accident histories). Other fleets install systems across the entire fleet simultaneously to maintain consistency in driver training and data handling procedures.

Driver resistance varies but often decreases quickly. Drivers initially concerned about surveillance discover that the system provides protection against false claims and helps them identify blind spot hazards. After 30 days, most drivers report that they appreciate the safety alerts and don't mind the recording.

Midsize fleets (20-50 trucks) are increasingly adopting systems, often starting with pilot programs on 5-10 trucks to validate the approach before full deployment. These pilots reveal integration challenges with existing maintenance systems, identify optimal placement for cameras on different truck models, and allow drivers to provide feedback on alert sensitivity before company-wide rollout.

Small owner-operator fleets (1-5 trucks) have traditionally lagged in adoption due to cost, but insurance discounts and the liability protection argument have convinced many to invest. Owner-operators can reduce insurance premiums by

Fleet management integration matters significantly. Systems that integrate with telematics platforms enable automatic incident reporting and alert fleet managers immediately when critical events occur. A driver could have an accident and immediately a manager receives a notification with video footage. This enables rapid response, driver support, and incident investigation while details are fresh.

Data security and cloud storage raise practical questions. Fleets must decide whether to maintain local storage only, which provides privacy but requires manual file transfers for review, or integrate with cloud platforms, which enables remote access but raises data security concerns. Most fleets choose hybrid approaches: normal footage stored locally, flagged incidents automatically uploaded to secure servers.

Driver training becomes essential when implementing fleet-wide systems. Drivers need to understand how the system works, what the alerts mean, how to query footage, and how the system integrates with their daily operations. Inadequate training leads to alert fatigue (drivers ignoring legitimate warnings) or system misuse. Effective training programs require 2-3 hours of initial instruction plus ongoing reinforcement.

Insurance Impact: The Financial Case For Adoption

Insurance companies view blind spot camera systems as proven risk reduction tools. Data from fleets with systems shows 15-25% reductions in blind-spot related incidents. This dramatic reduction directly translates into fewer claims and lower payouts, allowing insurers to offer premium discounts.

A typical scenario: a fleet with 20 trucks paying

Most major commercial insurance providers now offer premium discounts for fleets with camera systems. Progressive, Allstate, and GEICO all have formal programs. Smaller regional insurers increasingly follow suit. Fleet managers should request quotes from their insurance provider with and without camera systems to quantify the actual savings.

The discount percentage varies based on system specifications and implementation quality. Systems that only record footage provide smaller discounts (10-15%) than systems with real-time alerting (15-25%). Systems deployed across the entire fleet receive larger discounts than partial fleet deployments. Insurers essentially incentivize comprehensive, high-quality implementations.

Secondary financial benefits emerge beyond insurance savings. Reduced accident rates mean less vehicle downtime for repairs. A truck in the shop for three weeks is generating zero revenue. Preventing even one major accident per year saves the fleet time and money. Additionally, fewer accidents mean lower workers' compensation claims (less driver injury) and fewer public liability claims (reducing exposure to catastrophic costs).

The ROI calculation for fleet operators becomes straightforward. Insurance savings of

Driver Safety and Behavior Change: The Human Element

Beyond the technical specifications and financial calculations, the real-world safety impact happens through driver behavior change. When drivers know cameras are monitoring blind spots and providing real-time alerts, they adjust their driving practices.

The psychological impact is significant. A driver who takes a risky lane change without fully checking the blind spot and narrowly misses a vehicle has a near-miss experience. The camera system alerts them, they see the vehicle they didn't perceive, and they experience a moment of clarity: "I could have hit someone." This makes the lesson concrete in ways that training never does.

Over time, drivers develop habits that respect blind spots. They slow down more before lane changes, giving themselves additional time to verify the blind spot is clear. They reduce speed when turning, providing additional reaction time for unexpected vehicles in the blind spot zone. They become more cautious, not paranoid, but appropriately aware of the hazards.

Fleet managers can use footage to provide coaching. Rather than generic safety training saying "check your blind spot," a manager can show a driver video of their driving, point to the moment a camera detected a vehicle, and ask, "Did you see this vehicle?" In most cases, the answer is no. The driver then understands viscerally why the system matters.

Alternatively, footage provides positive reinforcement. A manager can show footage of a driver who performed excellent blind spot checking, made a safe lane change, and demonstrate to the driver what excellent safety looks like. This peer learning proves more powerful than abstract rules.

Newer drivers benefit significantly from camera systems because they're still developing hazard perception skills. Experienced drivers with decades of safe driving experience might feel less need for alerts, but the data shows that even experienced drivers miss occasional vehicles in blind spots. Age doesn't eliminate blind spot vulnerability—truck size creates it.

Long-term adoption benefits accumulate. After 6-12 months of operating with blind spot cameras providing real-time feedback, driver behavior stabilizes at a safer baseline. The culture shifts from hoping drivers see everything to trusting that technology ensures critical hazards are captured and communicated.

Companies report that blind spot camera systems improve overall safety culture beyond just blind spot incidents. When drivers see that management invests in safety technology and uses it to coach rather than punish, they respect the commitment to safety more broadly. This psychological shift improves safety across all driving practices.

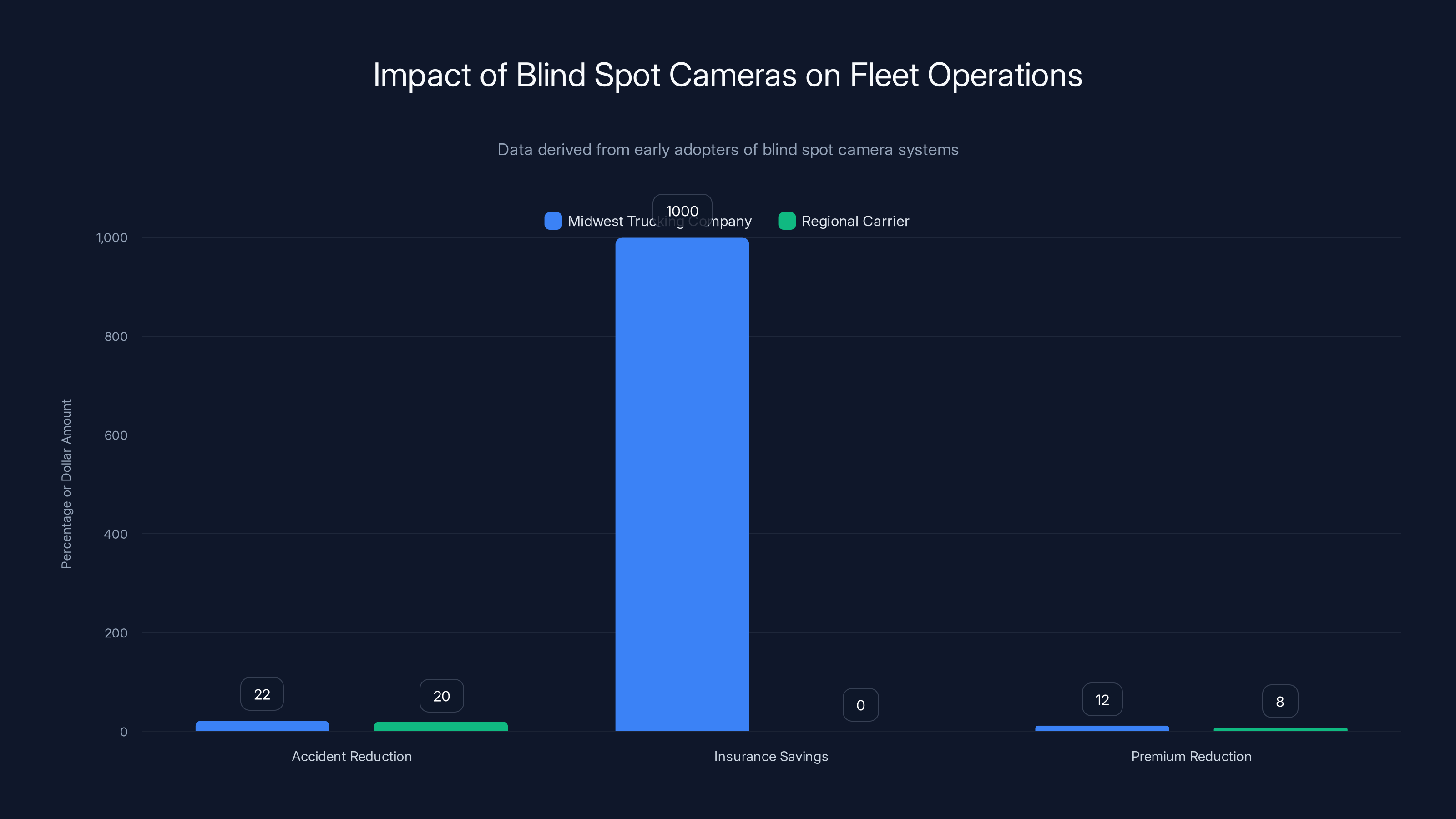

Early adopters of blind spot cameras reported accident reductions of 18-25%, insurance savings of

Integration With Fleet Management and Telematics Systems

Modern fleet management platforms like Samsara, Verizon Connect, and Geotab now integrate with Garmin's camera systems, creating a comprehensive safety and compliance ecosystem. Rather than managing cameras separately, fleet managers access everything through a single dashboard.

Incidents automatically trigger notifications and are logged with metadata. If a driver brakes hard, swerves, or has an accident, the fleet management system automatically flags the incident, pulls relevant video, and alerts the appropriate manager. This real-time visibility enables rapid response.

Driver scorecards aggregate camera data into safety metrics. The system tracks how many times cameras detected vehicles in blind spots, how often drivers checked blind spots manually, and how many incidents occurred. Over time, fleets identify which drivers need additional coaching and which demonstrate exceptional safety practices.

Compliance reporting becomes automated. Insurance companies, fleet owners, and regulatory bodies can access safety metrics without manual data collection. Quarterly reports generate automatically, showing incident trends, camera system uptime, and safety improvements.

Geofencing integration enables location-specific alert sensitivity. In dense urban areas with higher accident risk, the system operates with more sensitive detection thresholds. On rural highways with lower accident risk, sensitivity can be reduced to avoid alert fatigue. The system adapts to operating conditions automatically.

Maintenance integration ensures cameras stay operational. Systems can detect when cameras are obstructed by dirt or damage, alerting maintenance personnel before the camera becomes inoperative. Regular self-diagnostics verify that all cameras, processors, and storage systems function properly.

Data can be synchronized across thousands of trucks in a large fleet, enabling analysis of company-wide safety trends. Fleet managers can identify which routes have highest incident rates, which driver groups have different safety profiles, and which vehicles might need inspection or driver coaching.

API integration allows telematics platforms to access camera footage without requiring drivers or managers to contact Garmin separately. The data flows seamlessly between systems, reducing friction in daily operations.

Regulations and Compliance: Why Blind Spot Systems Matter Legally

Truck safety regulations continue to evolve, and blind spot camera systems increasingly feature in regulatory discussions. The Federal Motor Carrier Safety Administration (FMCSA) has explored mandating additional vehicle mirrors or camera systems to reduce blind spot accidents. While comprehensive blind spot camera requirements haven't been mandated nationally, individual states and some insurance programs effectively require them.

The Department of Transportation recognizes that blind spot accidents represent a solvable safety problem. Technology exists to eliminate blind spots, and deploying that technology would prevent injuries and deaths. Regulatory evolution will likely increase requirements for blind spot visibility solutions.

California and other states with aggressive commercial vehicle regulations are moving toward requirements for rear and side-view cameras on new commercial vehicles. Federal regulations for new trucks built after certain dates may follow. Early adoption of camera systems positions fleets favorably for future regulatory changes.

Compliance documentation matters for safety audits. When regulatory authorities or insurance companies inspect fleet operations, demonstrating investment in blind spot camera systems shows proactive safety commitment. This documentation can make the difference in safety audit outcomes and insurance renewals.

Data retention requirements vary by jurisdiction. Some areas require fleets to maintain footage for specific periods (often 30-90 days). Regulations may expand to require longer retention periods. Systems with adequate storage capacity ensure compliance without expensive upgrades.

Emergency services and law enforcement can sometimes request dash cam footage as evidence. Fleets should understand their obligations to provide footage and how to handle such requests while protecting driver privacy and complying with regulations.

Maintenance, Reliability, and Real-World Durability

Garmin engineered this system for long-term reliability under harsh truck operating conditions. Field data from fleets running these systems shows mean time between failures (MTBF) exceeding 50,000 operating hours. For a truck operating 200 hours monthly, this translates to 250+ months of operation, or more than 20 years, before a failure is statistically expected.

The most common maintenance needs involve cleaning camera lenses. Dirt, dust, and road spray accumulate on external cameras, degrading image quality. Regular cleaning (weekly for dusty conditions, monthly for normal operation) maintains image clarity. Technicians can accomplish this during routine truck maintenance without specialized skills.

Weather-related issues are minimized but not eliminated. Extreme cold can affect battery performance in the processing unit, though Garmin's systems are tested to -40°F. Extreme heat can stress some components, though testing to 140°F demonstrates capability in desert conditions. Salt exposure (in coastal regions or during winter salt application on roads) requires more frequent inspection but doesn't typically cause rapid failure.

Vibration-related failures occasionally occur if cameras become loose due to inadequate mounting. Proper installation with vibration-dampening brackets virtually eliminates vibration-related failures. Annual inspection of camera mounting ensures brackets haven't loosened from road vibration.

Electrical failures in the truck's power system are the most common reliability issue. When trucks undergo electrical system work or modifications, improper handling of camera system wiring can cause failures. Professional service centers trained on the system prevent these issues. Owner-operator fleets should use certified installation and service providers.

Software updates from Garmin improve system performance and add new features. Fleet managers should budget time for periodic firmware updates, typically requiring 1-2 hours to complete. Updates can be staged across the fleet gradually to avoid downtime.

Warranty coverage typically extends 3-5 years depending on the specific product. Extended warranties can be purchased to cover longer periods. Given the critical role of these systems in fleet safety, many fleets invest in extended warranty to reduce unexpected repair costs.

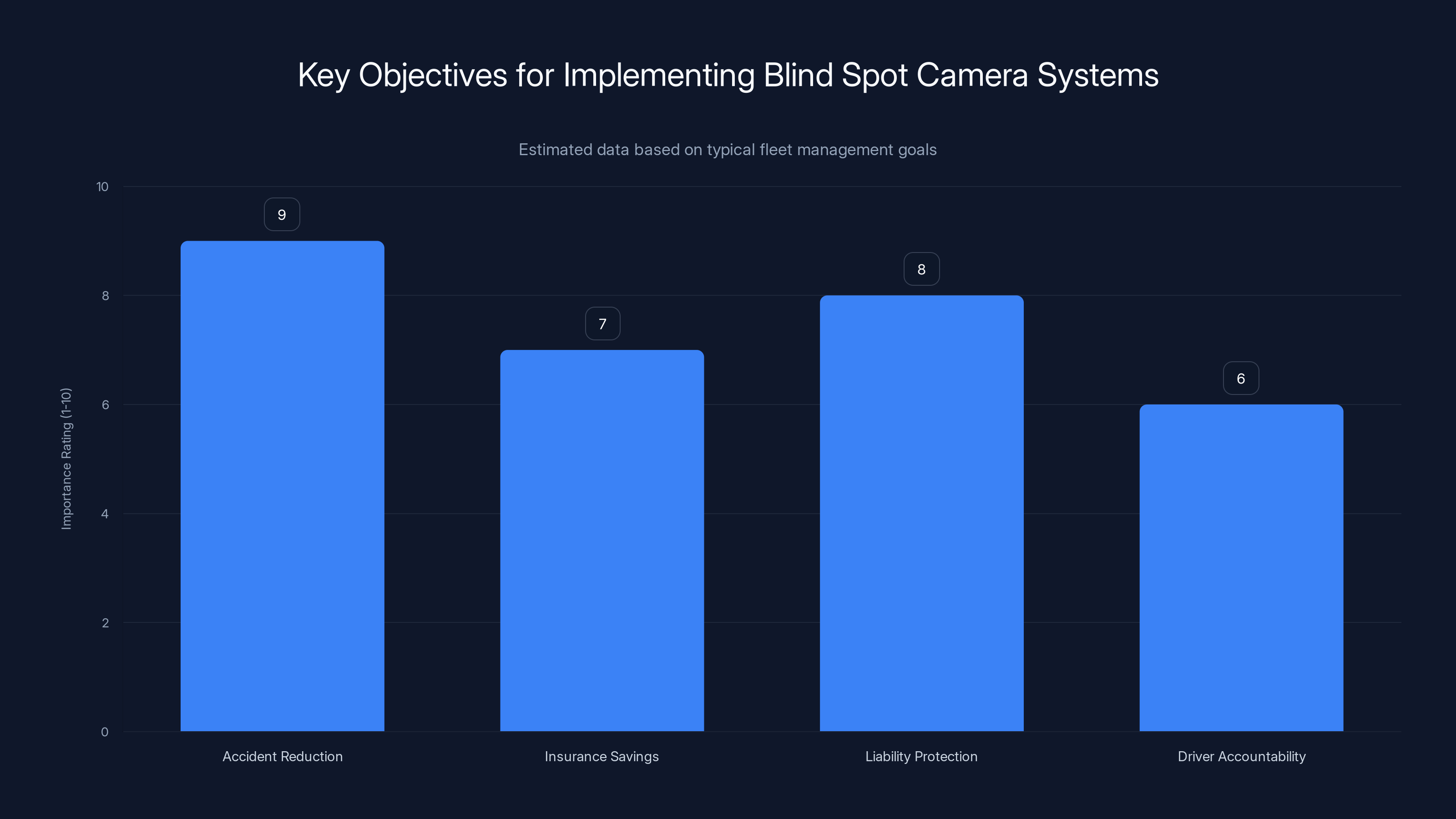

Accident reduction is often the top priority for fleet managers implementing blind spot camera systems, followed by liability protection and insurance savings. Estimated data based on common objectives.

Cost Analysis: Total Cost of Ownership and ROI Timeline

The upfront capital cost for a blind spot camera system ranges from

Installation costs add

For a fleet of 20 trucks, total capital investment reaches approximately

Maintenance costs are minimal. Annual cleaning supplies might cost

Cloud storage for incident footage (if integrated with fleet management platforms) typically costs $50-150 per truck monthly, depending on the data retention period and how many incidents are logged. High-incident fleets might pay more for longer retention; safe fleets pay less because fewer incidents require backup.

Insurance premium reductions typically range from 10-25%, depending on system specifications and implementation quality. For a fleet with

Addition financial benefits from accident prevention add significant value. A single major accident prevented saves insurance costs, vehicle repair costs, and employee injury costs that could total

The payback timeline for most fleets: 8-14 months for insurance savings alone, often faster when accident prevention benefits are included. After the initial investment is recovered, the system operates with minimal ongoing costs while continuing to provide safety benefits indefinitely.

Small owner-operator fleets should expect 12-18 month payback since they negotiate smaller insurance discounts. However, the liability protection alone justifies the investment—a single accident where the operator is falsely blamed could cost far more than a camera system costs.

Large fleets (100+ trucks) achieve faster payback because they negotiate larger insurance discounts and achieve economies of scale in installation and support costs.

Future Developments: Where Blind Spot Technology Is Heading

The next generation of blind spot detection will incorporate advanced AI that understands not just whether objects are present, but whether they pose actual hazards. Current systems alert drivers whenever a vehicle is detected in a blind spot zone. Future systems might only alert when a vehicle is positioned in a way that creates an actual collision risk during the maneuver the driver is about to execute.

Autonomous features will likely emerge. Instead of alerting a driver, future systems might automatically activate brake lights more brightly when vehicles are detected in blind spots, communicating the truck's awareness to nearby drivers. Eventually, semi-autonomous systems might prevent risky maneuvers by applying slight braking or gentle steering corrections if the driver attempts a collision-course action.

Machine learning will improve object detection accuracy dramatically. Systems trained on millions of hours of real-world truck footage will identify increasingly subtle hazards. The systems will understand context: a stationary vehicle on the side of the road poses different risks than an approaching vehicle in an active lane.

Lidar and millimeter-wave radar will supplement cameras, providing complementary information. Cameras excel at identifying what's present, while radar provides precise ranging information about distance and closure rate. Combining sensor types creates more robust hazard detection.

Integration with vehicle-to-vehicle communication systems will add another layer. Trucks equipped with Wi Fi or cellular communication will transmit warnings to nearby vehicles about hazards. A truck detecting a pedestrian in its blind spot might transmit a warning that nearby vehicles should not attempt to pass.

Augmented reality displays might overlay hazard information directly into the driver's field of view. Rather than glancing at a separate alert screen, drivers might see a real-time visualization of blind spot contents through their windshield, showing exactly where vehicles are positioned relative to the truck's path.

Regulatory evolution will likely make these systems mandatory rather than optional. Just as backup cameras became required on all vehicles, blind spot cameras may become required on all commercial trucks. This regulatory shift will accelerate technology development and drive costs down through increased manufacturing scale.

Best Practices for Fleet Managers Implementing Blind Spot Camera Systems

Start with a clear objective. Define what you want to achieve: accident reduction, insurance savings, liability protection, driver accountability, or some combination. Clear objectives guide system selection and implementation strategy.

Conduct a pilot program before company-wide deployment. Select 5-10 trucks representing different driver profiles (experienced and newer drivers), different truck models, and different routes (urban, highway, mixed). Run the pilot for 8-12 weeks, gathering driver feedback and system performance data.

Invest in driver training. Drivers need to understand how the system works, what alerts mean, how to review footage, and how the system integrates with their daily operations. Inadequate training leads to alert fatigue or system misuse. Dedicate 2-3 hours to initial training per driver plus ongoing reinforcement.

Establish clear policies on footage usage. Drivers need to understand that footage will be used for safety coaching, not punitive discipline. Clarity reduces resistance and builds trust. Footage used fairly to improve safety garners driver support; footage used primarily for punishment creates resistance.

Automate incident reporting and review. Integrate camera systems with fleet management platforms to automatically capture, flag, and log incidents. Manual footage review doesn't scale across large fleets. Automation ensures consistency and makes incident investigation efficient.

Coordinate with insurance providers early. Some insurers have preferences about which systems to deploy or specific requirements for footage retention and review processes. Aligning deployment with insurance requirements ensures you receive available discounts.

Plan for integration with existing systems. If the fleet uses telematics, maintenance management, or other systems, ensure the camera system integrates smoothly rather than operating in isolation. Integration drives real value; isolated systems become tools rather than solutions.

Budget for professional installation and support. While DIY installation saves upfront cost, professional installation ensures proper camera placement, adequate weatherproofing, and power system reliability. Professional support ensures systems remain operational.

Establish maintenance schedules. Camera lenses need regular cleaning. System software needs periodic updates. Mounting hardware needs inspection. Scheduled maintenance prevents degradation and extends system life.

Addressing Common Concerns: Privacy, Accuracy, and Driver Acceptance

Privacy concerns arise naturally when discussing vehicle monitoring systems. Drivers worry about recording in cabs during breaks or personal time. Address this directly: many systems record exterior cameras continuously but disable in-cab audio or interior cameras during parked periods. Clear policies establish what's monitored and when.

Some jurisdictions have specific laws about recording audio without consent. Systems can be configured to record video without audio, complying with local regulations while maintaining visual evidence of accidents. Fleet managers should verify their systems comply with local laws.

Accuracy questions arise about object detection systems. Will the system alert falsely when objects aren't actually hazards? Initial systems occasionally triggered false alerts, but modern machine learning significantly reduced false positives. Systems can also adjust sensitivity based on driver preferences and operating conditions.

Driver resistance typically decreases within days of deployment. Drivers initially concerned about surveillance discover that systems protect them from false claims and provide warnings about hazards they didn't perceive. Most drivers report greater confidence and reduced anxiety about blind spot hazards after several days of operation.

Companies that position systems as driver protection tools (defending against false claims, providing early warnings of hazards) experience better adoption than companies that position systems as monitoring tools. Framing matters significantly for driver acceptance.

Small fleets face adoption hesitation from experienced drivers who think they don't need systems. Address this through peer recommendations: have drivers test drive trucks equipped with systems and hear from other drivers about how the systems have helped them. Practical experience converts skeptics.

Cost concerns arise in smaller operations. Emphasize the insurance savings and liability protection. Owner-operators often become advocates after experiencing the protection a system provides following an accident.

Accuracy in different weather conditions generates questions. Quality systems perform adequately in rain, snow, and fog, though performance degrades compared to clear conditions. Test systems in actual operating conditions before committing to fleet-wide deployment.

Lessons From Early Adopters: Real Fleets, Real Results

Some of the earliest commercial fleet adopters of blind spot cameras were owner-operator truck companies managing 20-50 truck fleets. These companies reported immediate positive results: accident reduction of 18-25% within the first year, insurance savings of

One Midwest trucking company installed Garmin's system on 30 trucks over a six-month period. During the pilot phase (10 trucks), they recorded two minor incidents where cameras detected vehicles in blind spots just as drivers attempted lane changes. Drivers acknowledged they hadn't seen the vehicles. This real-world validation convinced them to deploy across the remaining 20 trucks.

Following full deployment, the company's insurance company reduced premiums by 12% (

A regional carrier with 80 trucks initially deployed the system on 20 trucks to validate the approach. After six months, they expanded to the entire fleet based on pilot results. Safety incident reduction exceeded 20%. The company negotiated an additional 8% insurance reduction for the expanded deployment, saving more than $300,000 annually.

Driver feedback from early adopters was surprisingly positive. Drivers expected to resent constant recording but discovered that systems made them feel safer. Alert systems warning them about hazards they didn't perceive earned driver appreciation. Several drivers reported that they felt more confident making lane changes because the system provided independent verification that the blind spot was clear.

One owner-operator driver mentioned a specific incident where the camera system detected a vehicle in his blind spot just as he attempted a lane change. The alert warned him, he avoided the accident, and the driver became an evangelist for the technology. That single prevented accident justified all costs and provided ongoing value.

Companies that implemented systems primarily for liability protection discovered that accident prevention benefits exceeded insurance savings. Accident prevention benefits include vehicle repair costs avoided, employee injury costs avoided, and productivity maintained because trucks stay on the road rather than in repair shops.

Large carriers (500+ trucks) report that system deployment across entire fleets created measurable safety culture changes. When drivers saw that management invested in technology specifically for their safety, overall safety consciousness improved. Drivers became more cautious and aware of hazards across all driving practices, not just blind spots.

Making the Decision: Should Your Fleet Adopt Blind Spot Cameras?

Yes, most commercial fleets should seriously consider deploying blind spot camera systems. The financial case is compelling: insurance savings typically exceed total system cost within the first year, and accident prevention provides additional benefits. The safety case is even more compelling: the technology reliably prevents accidents that would otherwise cause injuries, deaths, and financial catastrophe.

For large fleets (100+ trucks), the decision is straightforward. The aggregate insurance savings alone justify investment. Full deployment across the fleet provides standardized safety across all vehicles and consistent driver training.

For medium fleets (20-50 trucks), a pilot program testing the approach on 5-10 trucks yields the data needed to make a confident full-fleet deployment decision. Most pilot programs reveal positive results that justify expansion.

For small owner-operator fleets (1-5 trucks), the payback timeline extends longer than larger fleets, but the liability protection and accident prevention benefits remain valuable. An owner-operator who experiences even one accident where the system could have prevented injury or provided crucial evidence justifies the entire investment retrospectively.

The timing question: deploying sooner captures insurance savings and accident prevention benefits sooner. Every month without the system exposes the fleet to accidents that could have been prevented. Deploying now rather than next year provides one additional year of accident prevention and insurance savings.

The vendor selection question: Garmin's system represents a mature, well-engineered approach specifically designed for truck operations. Comparing Garmin against other established vendors (Samsara, Verizon Connect, Geotab integrated cameras) helps you identify the best fit for your specific fleet needs and existing systems.

Regulatory evolution is another consideration. As regulations tighten toward mandating blind spot visibility solutions, early adopters position their fleets favorably for compliance while establishing operational familiarity with the technology. Late adopters will face mandatory compliance deadlines with less time to implement smoothly.

The implementation approach matters: professional installation, adequate driver training, clear policies about footage usage, and integration with existing fleet management systems maximize the value from camera system deployment. Cutting corners on implementation undermines the benefits.

FAQ

What exactly is a blind spot in truck driving?

A blind spot is an area around a vehicle that the driver cannot see using mirrors or direct visibility. Commercial trucks have particularly large blind spots because of their size, height, and configuration. Vehicles positioned directly beside or behind a truck might be completely invisible to the driver, creating dangerous situations during lane changes, turns, or reversing maneuvers.

How does Garmin's blind spot camera system detect vehicles?

Garmin's system uses multiple cameras positioned around the truck combined with computer vision algorithms that analyze the camera footage in real time. The cameras capture video of blind spot zones, and machine learning algorithms identify vehicles, pedestrians, motorcycles, and other objects within those zones. When the system detects objects in hazardous positions, it alerts the driver through visual displays and audio warnings.

Will the camera system work in rain, snow, and fog?

Yes, camera systems function in adverse weather conditions, though performance degrades compared to clear conditions. Rain and snow reduce visibility somewhat, but modern systems use image processing to compensate. Extreme fog severely limits all visual detection systems (cameras, mirrors, radar). The system should be viewed as risk reduction, not risk elimination—drivers must still exercise appropriate caution in severe weather.

How much does a blind spot camera system cost for an entire fleet?

Cost varies based on the number of trucks and system specifications. Equipment costs range from

Do blind spot cameras really reduce accidents?

Yes, fleet data shows that camera systems reduce blind spot related accidents by 15-25% within the first year of deployment. Real-time alerting prevents drivers from executing maneuvers that would result in collisions. Additionally, the knowledge that systems are monitoring can change driver behavior toward greater caution. Multiple fleets have reported preventing 2-3 accidents per 20 trucks annually after implementing these systems.

How do insurance companies handle footage from these camera systems?

Most insurance companies accept dash cam footage as primary evidence in accident claims. When accident claims arise, the insurance company can immediately review the footage to determine liability. In cases where the truck driver is not at fault, the footage proves it, accelerating claim resolution and often reducing settlement amounts compared to claims without video evidence.

Can drivers refuse to use the blind spot camera system?

That depends on company policy and employment agreements. Fleet companies can require drivers to operate with active camera systems as a condition of employment, similar to requiring seat belt use. Most drivers accept the systems after experiencing the safety benefits, particularly after witnessing the system prevent a near-miss accident.

How is footage stored and who can access it?

Footage is typically stored on ruggedized storage devices within the truck, with automatic backup of flagged incidents to cloud servers. Fleet managers access footage through a web interface or mobile app, depending on the system. Employees should be informed about how footage is accessed and used, what incidents trigger recording, and how footage might be reviewed in case of accidents.

Is in-cab audio recording legal?

Legality varies by jurisdiction. Some states allow audio recording without explicit consent in commercial vehicles. Other states require consent from all parties. Most fleet camera systems allow audio recording to be disabled while maintaining video recording of the exterior cameras. Fleet managers should verify their system complies with local laws regarding audio recording.

What maintenance do blind spot cameras require?

Camera lenses require periodic cleaning to maintain image clarity, typically weekly in dusty conditions or monthly in normal operation. Software updates should be applied as they're released. Camera mounting hardware should be inspected periodically to ensure vibration hasn't loosened connections. These maintenance tasks are simple and can be incorporated into routine truck service schedules.

Conclusion: The Technology Truck Drivers Have Needed For Decades

Blind spots represent a solvable safety problem in commercial trucking. For decades, the industry relied on mirrors, driver training, and pure luck to prevent accidents caused by areas drivers literally cannot see. Technology has finally matured to the point where blind spot visibility can be reliably achieved, documented, and integrated into fleet operations.

Garmin's new blind spot camera system represents a purpose-built solution engineered specifically for the trucking industry. Unlike consumer dash cams adapted for trucks, this system provides real-time intelligent alerting, ruggedized hardware designed for harsh truck environments, comprehensive coverage of dangerous blind spot zones, and integration with fleet management systems.

The practical benefits are substantial. Insurance savings typically exceed system costs within the first year. Accident prevention benefits provide additional savings in vehicle repairs, employee injuries, and productivity losses. Liability protection shields drivers and companies from false claims. Driver safety improves through real-time warnings about hazards they don't perceive.

Implementation is straightforward. Professional installation ensures proper camera placement and reliable operation. Driver training addresses concerns and maximizes safety benefits. Integration with existing fleet management systems creates a comprehensive safety ecosystem. Insurance companies recognize the risk reduction and offer meaningful premium discounts.

The financial case for adoption is compelling: payback within 12-18 months through insurance savings alone, continuing risk reduction benefits indefinitely. The safety case is even more compelling: lives saved, injuries prevented, and families kept whole through technology that eliminates one of trucking's most dangerous hazards.

Fleets that deploy blind spot camera systems position themselves for competitive advantage. Insurance cost reductions improve profitability. Improved safety records help recruit and retain quality drivers. Comprehensive documentation of incidents protects against frivolous liability claims. As regulations tighten toward mandating these systems, early adopters establish operational expertise and driver familiarity before compliance deadlines arrive.

The technology isn't perfect. Extreme weather challenges visibility. Poorly installed systems underperform. Drivers must understand system limitations and maintain appropriate caution. However, these limitations don't negate the tremendous value that blind spot cameras provide. They represent the most significant advancement in truck safety available to fleet operators today.

For truck drivers, blind spot cameras mean fewer white-knuckle moments when changing lanes, confidence that hazards are being monitored, and protection if accidents occur despite best efforts. For fleet managers, they mean reduced accidents, lower insurance costs, better driver safety records, and liability protection. For insurance companies and society broadly, they mean fewer accidents, fewer injuries, and fewer preventable deaths.

The safety device truck drivers have needed for decades is finally here. The only question remaining is when you'll deploy it.

Key Takeaways

- Blind spot camera systems reduce truck accidents by 15-25% annually through real-time alerts and objective hazard detection

- Insurance companies offer 10-25% premium reductions for fleets deploying camera systems, providing payback within 12-18 months

- Garmin's purpose-built system provides comprehensive blind spot coverage with multi-camera setup, real-time processing, and fleet management integration

- Professional installation and driver training are essential for maximizing safety benefits and driver acceptance

- Regulatory evolution suggests blind spot cameras will eventually become mandatory, making early adoption strategically advantageous

![Garmin's New Blind Spot Dash Cam For Truck Drivers [2025]](https://tryrunable.com/blog/garmin-s-new-blind-spot-dash-cam-for-truck-drivers-2025/image-1-1767643668405.jpg)