Introduction: The Robotaxi Moment We've Been Waiting For

For years, autonomous vehicles lived in that weird limbo between "coming soon" and "probably never." We'd hear the promises, see the demos, and then watch nothing happen. Then suddenly Waymo did something nobody else managed: it actually started charging people to ride in driverless cars. No asterisks, no safety drivers in the front seat, just you and a robot driving you around San Francisco.

Now Waymo raised $16 billion to do it everywhere.

This isn't some seed round or a "we're hiring" announcement dressed up as news. This is major institutional money—Dragoneer, Sequoia Capital, Silver Lake, and others—betting that autonomous vehicles have finally stopped being tomorrow's problem and become today's business. The valuation hit $126 billion. For context, that's more than Ford, and Waymo doesn't manufacture cars. It manufactures the software that drives them.

But here's what matters: Waymo just proved something the entire industry has been betting on since the iPhone was announced. You can actually make money from self-driving cars. Not in theory. Not in some perfectly simulated environment. In actual cities, with actual passengers, in actual traffic, during actual rush hour.

The $16 billion isn't just cash. It's validation. It's the entire venture capital world saying "yeah, this works." And that changes everything about what comes next.

This article breaks down what Waymo's historic funding round means for autonomous vehicles, the transportation industry, cities and infrastructure, competing companies, and your future commute. We'll look at the real business model, the technical challenges that money actually solves, what happens to companies like Tesla and Amazon in this new landscape, and why this moment matters more than the hype typically suggests.

TL; DR

- Waymo raised 126 billion valuation, making it one of the largest funding rounds in autonomous vehicle history

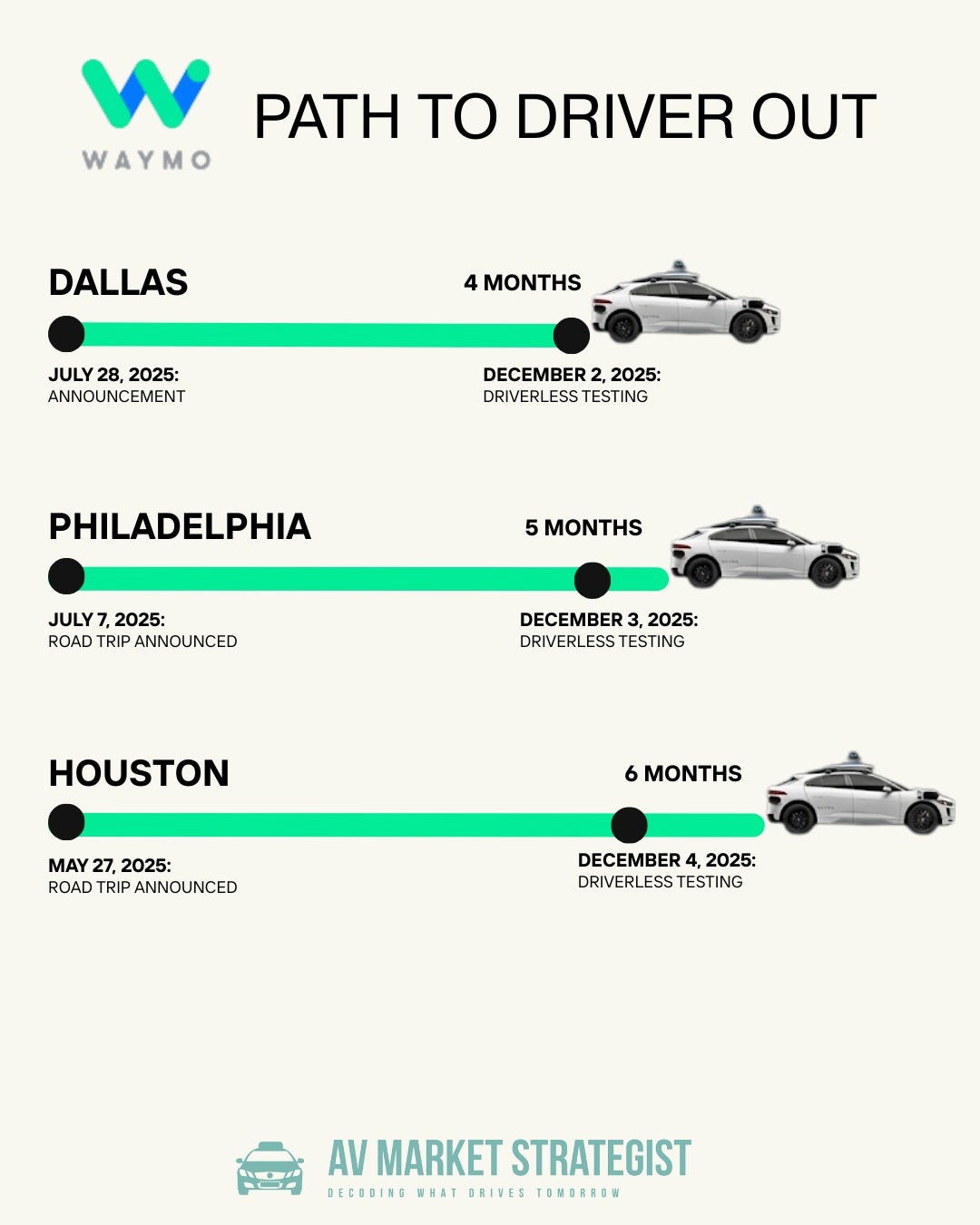

- The company operates 2,500+ robotaxis in six U.S. cities and plans to launch in 20+ new cities in 2026

- Global expansion includes New York City, London, and Tokyo, marking the first major international push

- Key investors include Dragoneer, Sequoia Capital, DST Global, and returning backers like Andreessen Horowitz and Silver Lake

- Competing companies like Tesla and Amazon are still years behind, giving Waymo critical market advantage

- The valuation jump from 126 billion (2025) shows explosive market confidence in fully autonomous ridesharing

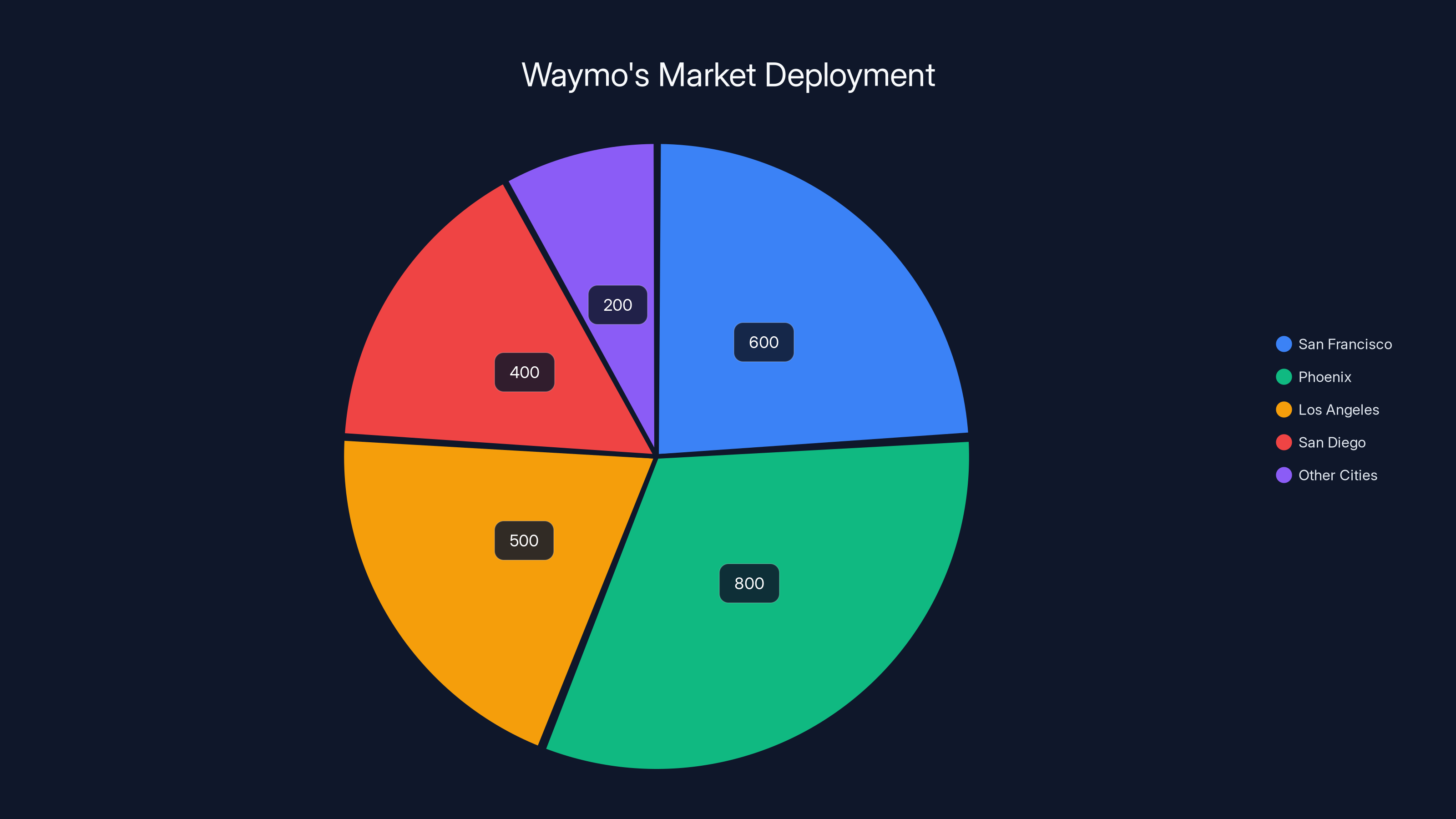

Waymo has deployed over 2,500 fully driverless vehicles, with Phoenix having the largest share. Estimated data based on primary markets.

What Waymo Actually Does (And Why It Matters)

Waymo started as Google's moonshot lab project called Google Self-Driving Car. That was 2009. Google's founders and executives wanted a moonshot—something ambitious enough that if it worked, it would reshape transportation forever. Most moonshots fail. This one didn't.

But Waymo isn't just a tech company that built cool software. It became an entire transportation service. The company built a fleet management operation, a remote operations center where human operators monitor driverless cars, a customer app, a pricing model, and actual routes where you can book a ride tomorrow and it will arrive without a human driver.

That distinction matters because most autonomous vehicle companies are still stuck in the "we have cool software" phase. Tesla has Autopilot and Full Self-Driving beta. Cruise (owned by General Motors) was operating a fleet but hit regulatory and safety issues. Amazon's Zoox is running free rides in Phoenix and Las Vegas. Waymo actually charges money and operates at scale.

The current Waymo operation looks like this:

- 2,500+ fully driverless vehicles deployed across six U.S. cities

- San Francisco, Phoenix, Los Angeles, and San Diego as primary markets

- Recently expanded to other metropolitan areas

- 100% driverless operation with no safety driver in the vehicle

- Remote operations center with human operators monitoring all trips

- Waymo One app where you book rides like Uber or Lyft

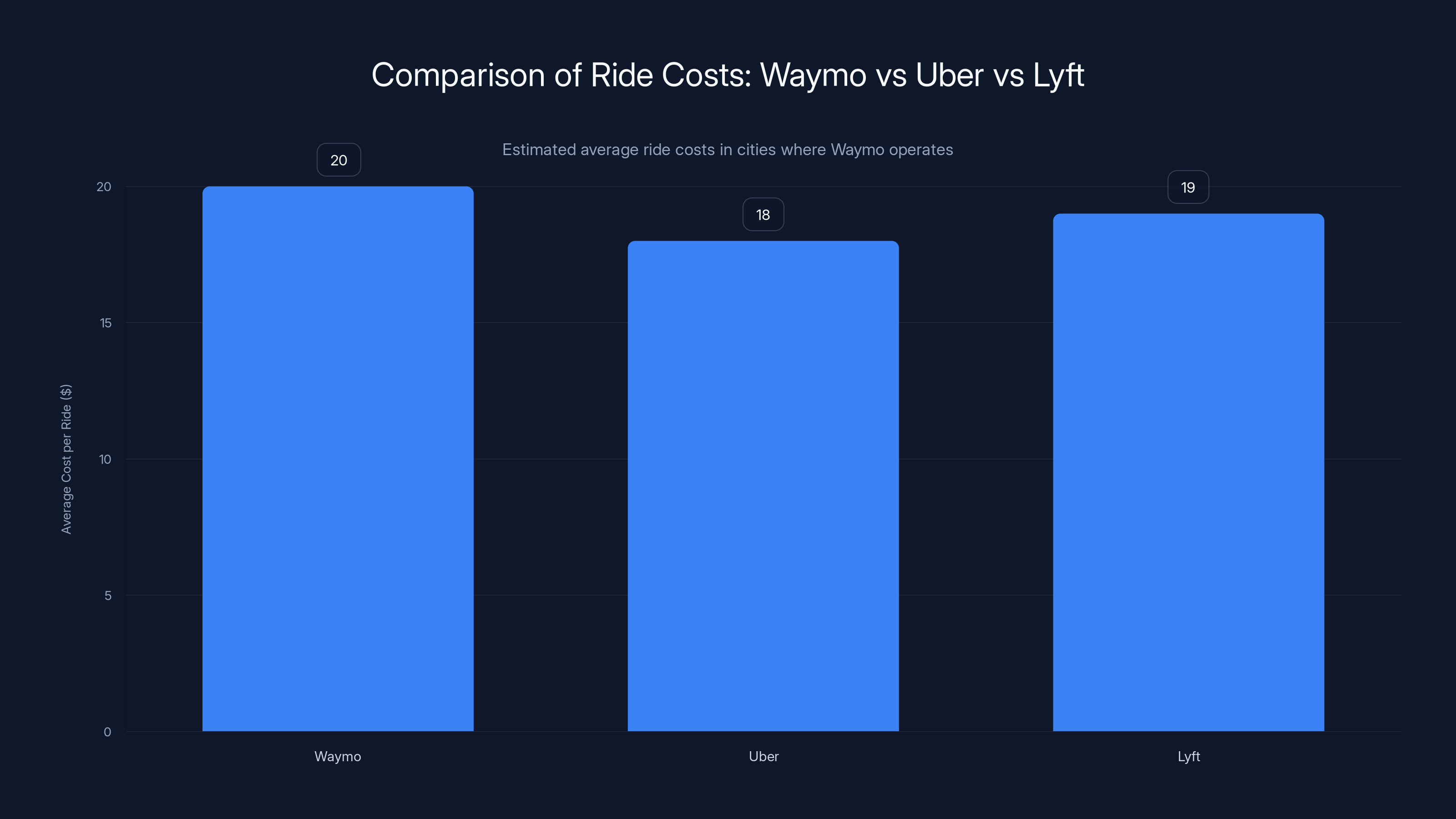

- Pricing comparable to traditional rideshare, though the exact rates vary by market

The company didn't build this by accident. It took 16 years of development, hundreds of millions in losses, constant regulatory battles, sensor technology breakthroughs, AI improvements, and pure stubbornness.

The technology underneath is staggeringly complex. Each Waymo vehicle is equipped with lidar (light detection and ranging), radar, cameras, and multiple redundant computer systems. The lidar alone can cost

Waymo's 16-year journey got boring around year 8, when it seemed like nothing would ever happen. Then suddenly in 2023-2024, everything accelerated. The company started charging for rides. Cities approved operations. Passengers got comfortable. Revenue started flowing. And investors noticed.

The $16 Billion Funding Round: Who, What, When, and Why

Waymo's fundraising round wasn't one of those stories where a company desperately needs capital to survive. This wasn't desperation money. This was opportunity money. Dragoneer Investment Group led the round, which is a signal in itself. Dragoneer specializes in late-stage investments in private companies before they go public. They're not investing in ideas or promises. They invest in businesses with proven revenue, clear unit economics, and a path to public markets.

The investor list reads like a who's who of venture capital and institutional money:

New investors bringing fresh capital:

- Dragoneer Investment Group (lead investor)

- Sequoia Capital

- DST Global

Returning investors who've been with Waymo for years:

- Andreessen Horowitz (a16z)

- Abu Dhabi sovereign fund Mubadala

- Fidelity Management and Research Company

- Silver Lake (tech-focused private equity)

- Tiger Global

- Temasek (Singapore sovereign wealth fund)

- T. Rowe Price

- Perry Creek Capital

That's a mix of venture capitalists, sovereign wealth funds, and established financial institutions. Each investor class sees something different in Waymo. VCs see the tech bet. Sovereign wealth funds see the strategic importance of autonomous transportation in their countries. Established financial firms see stable, long-term return potential.

The valuation jump is stunning. Waymo raised

First, the business model proved viable. Waymo isn't burning cash on speculative research anymore. It has revenue. It has passengers. It has demand exceeding supply in some markets. When investors can see a clear path from current operations to profitability, valuations expand dramatically.

Second, regulatory clarity improved. Cities started approving operations instead of blocking them. California gave Waymo expanded permits. Other states are opening up. Investors hate regulatory uncertainty more than almost anything, because you can't model around unknowns. Waymo demonstrating safety and winning over regulators turned a risk variable into an opportunity variable.

Third, the competitive landscape shifted. Other companies promised autonomous fleets in 2023. It's 2025, and most haven't delivered. Waymo's being first to market while competitors are still battling technical problems and regulation gives it an enormous moat. First mover in autonomous ridesharing might be an advantage that lasts decades.

Waymo said it would use the funding for three specific things: deploying more vehicles, expanding to new cities, and establishing international operations. That's the exact right use of capital for a company in this position. You're not funding R&D anymore. You're funding growth and operations.

Waymo's ride costs are generally comparable to Uber and Lyft, averaging around $15-25 per trip. Estimated data based on current market trends.

Global Expansion: The Next Frontier

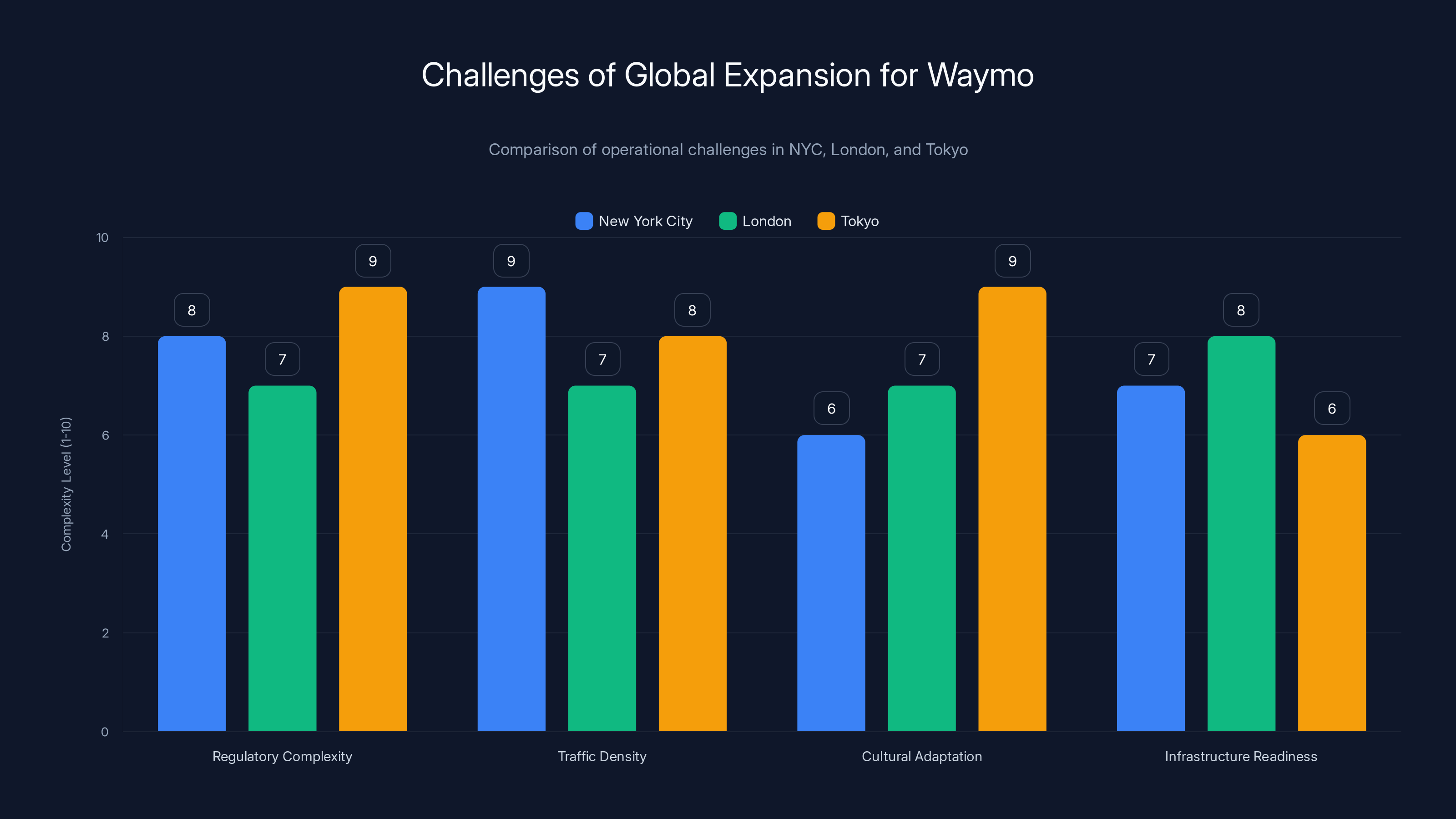

For the first time, Waymo is thinking beyond the United States. The company announced plans to operate in New York City, London, and Tokyo. These aren't small markets. These are three of the world's most valuable, most congested, most complex transportation markets.

New York City is the obvious first choice internationally because it's basically a U.S. city with different regulations. The market is huge—millions of daily trips, fierce demand, terrible traffic. NYC already has a vibrant app-based ridesharing market through Uber and Lyft. The regulatory framework exists. The infrastructure is there. But operating autonomous vehicles in Manhattan is genuinely harder than San Francisco. The streets are narrower, pedestrian density is higher, taxi regulations are more complex, and street chaos is actually more chaotic.

London represents Waymo's push into the UK and Europe. The UK has been increasingly robotaxi-friendly, with regulatory frameworks that actually invite innovation rather than block it. London's Transport for London agency has been open to autonomous testing and operations. The market is sophisticated, wealthy, and has established ridesharing demand. But left-hand driving, different road rules, different pedestrian behavior, and UK-specific regulations make it genuinely different from U.S. operations.

Tokyo is the moonshot move. Japan is robotics-obsessed. The country invested heavily in autonomous research. Tokyo is wealth city with enormous elderly population who could benefit from driverless transportation. But Japan is also famously cautious about technology rollouts, has unique traffic patterns, and cultural expectations around service quality that U.S. competitors might not fully understand. Waymo expanding to Tokyo signals it's not just a U.S. company anymore.

Global expansion is why the $16 billion matters. Operating internationally requires different vehicles (left-hand drive for UK), localized AI models trained on different driving patterns, new regulatory negotiations in every region, hiring local teams, and building operations infrastructure from scratch in each market. You can't copy-paste your San Francisco playbook to London. The money funds all that rebuilding.

The 20+ city goal for 2026 in the U.S. alone is ambitious. That's 20 more cities beyond the six where Waymo already operates. If Waymo executes, by 2027 it could be operating in 26+ U.S. cities plus international markets. That would represent roughly 20-30% of major U.S. metropolitan areas, giving the company enormous network effects and brand dominance.

But here's the risk: expansion requires execution. Waymo has to convince new cities it's safe. It has to convince regulators. It has to build operations centers in each region. It has to hire and train staff. It has to debug problems that don't exist in San Francisco but show up in Denver (altitude), Miami (humidity), or Chicago (winter). Money helps, but execution is harder.

The Vehicle Economics: Why Robotaxis Don't Need to Be Cheaper

One of the most common misconceptions about autonomous vehicles is that they only make sense if they're cheaper than human drivers. That's backwards. They make sense if they're better overall.

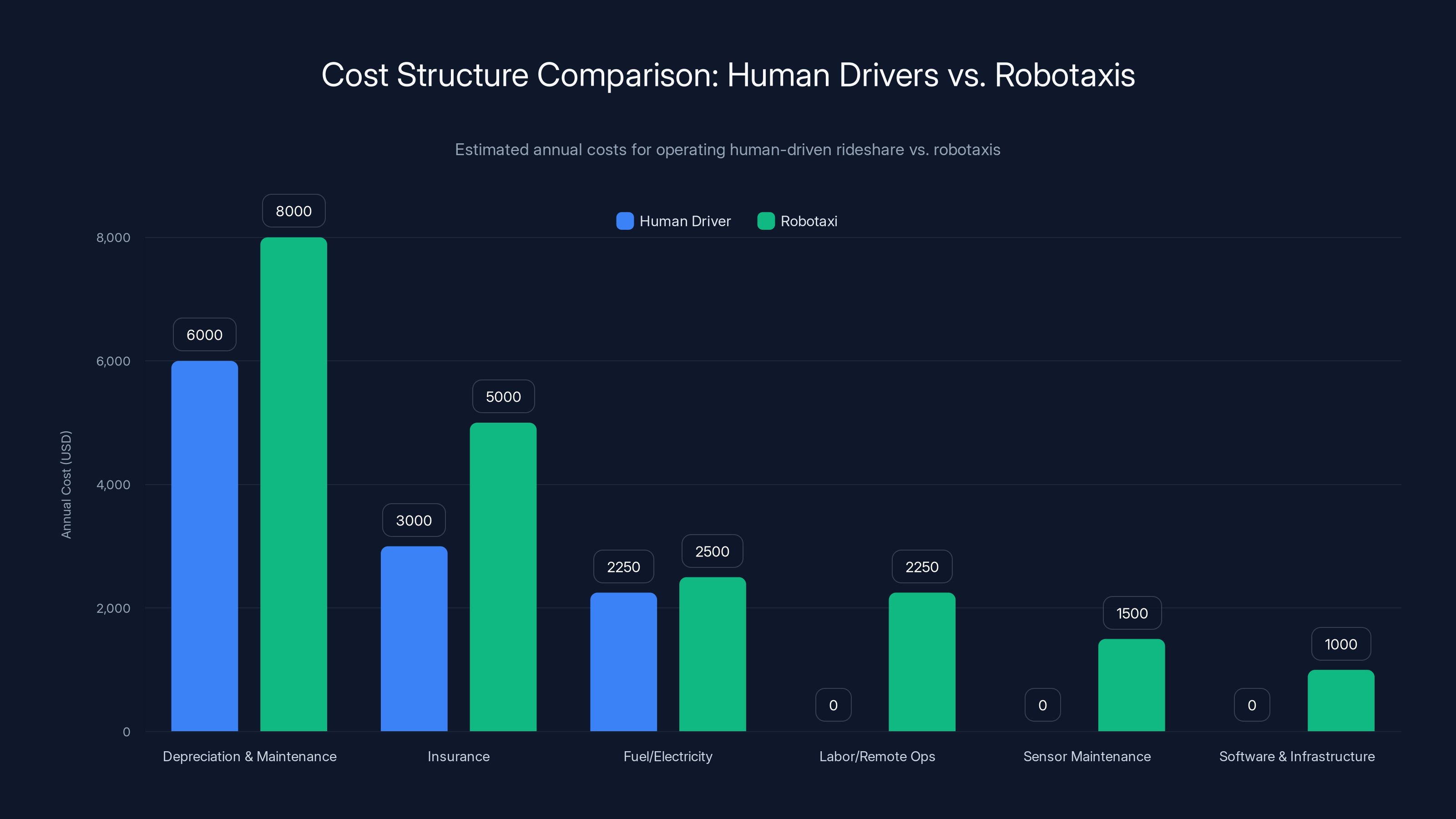

Let's do some math. An Uber or Lyft driver in a major U.S. city makes roughly

Human driver cost structure:

- Hourly wage or per-trip commission: $15-25/hour

- Vehicle depreciation and maintenance: $4,000-8,000/year

- Insurance (commercial rideshare): $2,000-4,000/year

- Fuel or electricity: $1,500-3,000/year

- Deadhead miles (driving empty between rides): 20-30% inefficiency

- Driver benefits, taxes, regulatory overhead: 15-25% overhead

Robotaxi cost structure:

- Vehicle depreciation and maintenance: $6,000-10,000/year (higher due to sensor costs)

- Insurance: $4,000-6,000/year (robotaxi-specific, still being underwritten)

- Electricity: $2,000-3,000/year

- Remote operations center labor: $1,500-3,000/year (one operator manages 40-80 vehicles)

- Sensor maintenance and calibration: $1,000-2,000/year

- Software and infrastructure: $500-1,500/year

- No deadhead inefficiency: vehicles route themselves optimally

- 24/7 operation: 16-24 hour daily utilization vs. 8 hours for human drivers

The math gets interesting when you factor in utilization. A human driver works 8 hours a day. A Waymo robotaxi can operate 16-24 hours a day. That means you generate 2-3x more revenue per vehicle. The vehicle that costs 20-30% more to operate can generate 2-3x more revenue because it works longer hours.

There's also zero safety driver fatigue. Human drivers' reaction times degrade after 6-8 hours of work. Robotaxis don't fatigue. That means fewer accidents, fewer injuries, fewer insurance claims, and less regulatory pressure.

Waymo doesn't need to undercut Uber's prices to be profitable. It needs to be reliable, available, and not crash. If Waymo charges the same price as Uber but with 3x the vehicle utilization and 50% lower per-trip labor costs, the unit economics work. The company makes money. Investors get returns. The business scales.

This is why the $16 billion is transformative. It's not just capital. It's capital that lets Waymo buy more vehicles (the expensive part), deploy them in more cities (the operational part), and reach that critical mass where the economics become undeniable. Once you have 5,000-10,000 robotaxis operating across multiple cities, the data gets so obvious that regulation and competitor response can't catch up.

Safety: The Foundation of Everything

You can have the best technology and the smartest investors, but if your robots crash into things, you're done. Safety isn't a feature. It's the foundation.

Waymo has focused obsessively on safety since day one. The company's first autonomous vehicle was developed for the blind, actually, because if you're designing a car for someone who can't see, you have to make safety so good that sighted people also feel confident. That ethos stuck.

Waymo's safety data is legitimately impressive. The company's driverless vehicles have been involved in very few accidents, and almost none that were Waymo's fault. Compare that to human drivers: Americans are involved in about 6 million car accidents per year. That's roughly 16,000 per day. Waymo's actual number of incidents? Orders of magnitude smaller.

But here's where it gets complicated. Regulators and the public don't just care about raw accident statistics. They care about different types of accidents, severity, and who causes them. A robotaxi hitting a parked car is different than a robotaxi hitting a child. Last year, Waymo had an incident in Santa Monica where a vehicle struck a child with minor injuries. That single incident triggered a National Highway Traffic Safety Administration investigation. One accident with a child. Meanwhile, human drivers hit children every week and it barely makes the news.

That double standard is actually appropriate, because our tolerance for AI accidents is different than our tolerance for human accidents. We expect fallibility from humans. We don't expect it from machines. Waymo has to be not just safer than human drivers—it probably has to be dramatically safer to overcome that bias.

Waymo addresses this by being transparent about safety. The company publishes safety reports. It invites regulators to observe operations. It works with cities on safety protocols. It voluntarily pauses operations when issues emerge. This transparency is both a genuine commitment to safety and a smart business move—if Waymo can convince regulators and the public that it's the safest transportation option available, that becomes a competitive moat nobody can match.

The $16 billion partly funds safety infrastructure: better sensors, redundant computer systems, more sophisticated monitoring, and faster iteration on edge cases (weird situations where the system might fail). Money here directly translates to fewer accidents, which translates to regulatory approval, which translates to market expansion.

Estimated data shows that each city presents unique challenges for Waymo's global expansion, with Tokyo having the highest cultural adaptation complexity and NYC facing the highest traffic density issues.

The Competitive Landscape: Why Waymo's Lead Matters

Waymo isn't the only company betting on autonomous ridesharing. It's just the only one that's actually doing it at scale.

Tesla has been promising autonomous vehicles for a decade. Full Self-Driving beta exists, but it still requires a human driver paying attention and ready to take over at any moment. Tesla's "autonomy" is currently conditional. Elon Musk promises a robotaxi fleet is coming, but promises and products are different things. The company keeps moving the goalpost. Every time you think it might happen, the timeline gets pushed again. Until Tesla actually deploys vehicles without a safety driver, it's not in the same category as Waymo.

The betting markets reflect this. Waymo just proved it can do fully driverless ridesharing at scale. Tesla hasn't proven it. That gap means Waymo gets investment capital and regulatory approval that Tesla doesn't get. Waymo gets cities saying "yes." Tesla gets cities saying "let's see." That gap compounds over time.

Amazon's Zoox is running free robotaxi rides in Phoenix and Las Vegas. The vehicles look cool. The operations exist. But free rides aren't a business model. Zoox hasn't demonstrated that passengers will pay, that the company can operate profitably, or that regulators will approve expansion. Amazon has enough money to operate a fleet as a loss leader for years, but that's not the same as proving a business works. Until Zoox charges money and operates profitably, it's a research project, not a transportation service.

General Motors' Cruise was running autonomous rides in San Francisco but hit regulatory and incident issues. The company paused operations and faced significant regulatory scrutiny. As of now, Cruise is rebuilding, but the moment is slipping. When Waymo was moving forward, Cruise had setbacks. That's the kind of thing you can't recover from easily in this market. Momentum matters.

Aurora, Mobileye, Lyft's own autonomous efforts, and others are all developing autonomous technology, but none have deployed commercial robotaxi services at scale. They're still in the R&D and testing phase. That puts them years behind Waymo.

Waymo's competitive advantage isn't some secret technology that nobody else can replicate. It's:

- Regulatory approval: Cities and states have already approved Waymo operations. They'll need to re-approve competitors.

- Operational know-how: Waymo learned what works and what doesn't through actual operations. That's worth billions.

- Driving data: The company has 20 million miles of actual driving data in its systems. That data trains the AI. More data = better AI = fewer edge cases.

- Network effects: Waymo operates in 6 cities today. By next year, 26+. That network effect means more passengers, more feedback, better service. Competitors are still in single cities.

- Investor confidence: Waymo's $16 billion round signals to the market that autonomous ridesharing works. That makes it easier for Waymo to raise more capital and harder for competitors to convince investors to bet against Waymo's lead.

The competitive gap is probably widening, not narrowing. Waymo has the cash, the approval, the data, and the momentum. Competitors have hope and investor interest, but hope doesn't beat execution. By the time competitors catch up technically, Waymo will have already dominated the first 10-20 markets, built incredible operational expertise, and integrated so deeply into city infrastructure that switching costs are enormous.

Infrastructure and City Planning: The Hidden Opportunities

Most people think about robotaxis as just cars without drivers. That's wrong. Robotaxis are an infrastructure play.

When Waymo deploys vehicles across a city, it creates data about traffic patterns, congestion points, accident-prone intersections, and infrastructure weaknesses. This data is gold for city planners. Cities can use it to redesign streets, add lanes, improve signals, and reduce congestion. Waymo can share this data (anonymously) with cities to help improve urban planning.

Robotaxis also change how cities need to manage pickups and dropoffs. Uber and Lyft created new congestion by allowing unpredictable dropoff and pickup points. Cities had to create new loading zones. With robotaxis, cities can work with Waymo to designate specific zones and manage flow better. The coordination between city and service provider becomes much tighter because there's a single company to coordinate with, and that company cares about city optimization because it directly affects its operations.

There's also the parking problem. American cities dedicated about 14% of total land area to parking for cars that sit unused 95% of the time. With robotaxis operating 16-24 hours a day, you need way fewer vehicles to serve the same demand. Fewer vehicles means less parking demand. Less parking demand means cities can reclaim that land for housing, parks, or commerce. That's a massive urban planning opportunity.

NYC could theoretically reduce parking demand by 60-80% if most ridesharing trips were served by robotaxis instead of human drivers. That's not hypothetical. It's direct math: fewer vehicles × fewer hours parked = more land available. A city that can repurpose 10% of its parking infrastructure for housing or public space gains enormous economic value.

Waymo's global expansion into cities like London and Tokyo is partly about transportation and partly about urban planning. Waymo understands that cities that embrace autonomous vehicles will see better traffic flow, better air quality (since all Waymo vehicles are electric), less parking congestion, and better data about how transportation actually works.

The $16 billion funds not just more vehicles but also the relationships with city governments, the infrastructure planning, the data sharing, and the coordination layers. This is why Waymo is more than a taxi company. It's a transportation infrastructure provider.

The Environmental Impact: Electric Vehicles at Scale

Waymo's fleet is entirely electric. Every vehicle is powered by batteries, charged at depots, and produces zero emissions. For a city like San Francisco or Los Angeles, that's meaningful air quality improvement.

Let's do the math. San Francisco has roughly 300,000 daily Uber/Lyft rides. If even 50% of those shifted to Waymo robotaxis, that's 150,000 daily trips with zero emissions instead of being served by gas-powered human-driven cars. The air quality improvement would be measurable in months.

But the environmental story is more complex than just "no tailpipe emissions." You have to account for:

- Electricity grid mix: Is the power coming from renewable sources or fossil fuels? (California is increasingly renewable, so Waymo vehicles charging there are cleaner than the same vehicles charging in coal-heavy states.)

- Manufacturing emissions: Electric vehicles require battery production, which is energy-intensive. But over a vehicle's lifetime, the emissions are recouped.

- Vehicle utilization: A vehicle that operates 24 hours a day spreads its manufacturing emissions over 3x more miles than a vehicle that operates 8 hours a day.

- Traffic reduction: Fewer vehicles on roads means less congestion, which means less fuel consumption by remaining gas vehicles.

The net environmental impact of a fully deployed robotaxi network is dramatically positive, but not immediately. It's a multi-year play. Waymo's push into 20+ new cities and international markets means the company is betting that the environmental argument is compelling enough to justify expansion and investment. That's probably correct—cities care about air quality, carbon reduction, and being perceived as future-forward.

Robotaxis have higher upfront costs but can operate longer hours, potentially generating 2-3x more revenue. Estimated data.

Business Model: How Waymo Actually Makes Money

Waymo operates under a simple business model: per-trip revenue minus per-trip cost equals profit.

The company charges passengers roughly

But here's where the math improves: Waymo operates at higher utilization than human drivers. A human Uber driver might do 20-30 trips per day. A Waymo vehicle could do 40-60 trips per day because:

- No human fatigue limits

- More efficient routing (AI figures out best routes automatically)

- Faster pickup/dropoff (no socializing, no payment friction)

- 16-24 hour operation (not just 8 hours)

If a Waymo vehicle does 50 trips per day instead of 25, and each trip has a

That's the path to profitability. Not cheaper per-trip pricing, but higher utilization and efficiency.

The $16 billion in funding accelerates the path to profitability by funding fleet expansion. More vehicles means more trips means more revenue means higher fixed-cost leverage. Waymo's software, infrastructure, and operations are largely fixed costs. Adding vehicles is cheap compared to the revenue they generate. This is classic SaaS (Software-as-a-Service) unit economics applied to transportation.

Waymo has no plans to go public immediately. The company will likely stay private while optimizing for profitability and demonstrating unit economics across multiple cities. Once Waymo can show that the business model works in 10+ cities and scales predictably, a public offering becomes the natural next step. That's probably 2-3 years away, which is perfect timing for investors who want returns.

Regulatory Challenges and the Path Forward

Autonomous vehicle regulation is still being written. There's no federal autonomous vehicle law in the United States. Instead, individual states and cities have created patchwork rules that companies must navigate.

Waymo has been smart about regulation. The company started in California, which is robotaxi-friendly. California has clear rules: you need a permit, you need insurance, you need to demonstrate safety, and you need to operate transparently. Waymo met all those requirements and got approved. The company then expanded to Arizona, Texas, Nevada, and other states with varying regulatory frameworks.

Each state and city has different requirements:

- Permit process length: varies from 3 months to 2+ years

- Safety demonstration: some require extensive testing, others less so

- Insurance requirements: some have specific autonomous vehicle insurance thresholds

- Liability framework: who's responsible when a robotaxi crashes? The owner? The company? The manufacturer?

- Fare regulation: some cities regulate rideshare prices, others don't

- Service territory: some cities restrict operations to specific zones

Waymo's advantage is that it's operating and proving itself, which makes regulators more comfortable. When the next company applies for a permit, regulators can point to Waymo's safety record and say "yeah, we're comfortable with this." That makes approval easier and faster.

The international expansion to London and Tokyo involves different regulatory challenges:

UK/London: The UK is actually quite robotaxi-friendly. The country has had experimental autonomous vehicle programs and is actively working on regulation. Left-hand driving is the main technical challenge. Regulatory approval is probably the easiest of the three new markets.

Japan/Tokyo: Japan is robotics-obsessed but also extremely cautious about technology adoption. The company will need to run extensive pilot programs, demonstrate impeccable safety, and build relationships with local regulators. The process could take 2-3 years longer than London.

The $16 billion includes a significant portion dedicated to regulatory and legal work. Waymo doesn't just deploy vehicles. It works with cities on legislation, helps draft regulations, conducts public education campaigns, and manages the political side of expansion. That costs money and requires specialized expertise.

The Remote Operations Center: The Unsexy Part That Actually Matters

Everybody focuses on the robotaxi itself—the cool hardware, the sensors, the autonomous driving. But the real operation happens in a control center somewhere.

Waymo operates a remote operations center where human monitors watch the vehicles on cameras and through data feeds. When a vehicle encounters a situation it can't handle (a rare event, but it happens), the remote operator can take control or provide guidance. This isn't a safety driver sitting in the passenger seat. It's a person in a control room managing dozens of vehicles simultaneously.

The remote operations center is:

- 24/7 staffed: vehicles operate all the time, so the center operates all the time

- Distributed: likely across multiple locations for redundancy

- High-tech: complex displays, vehicle data feeds, camera streams, communication systems

- Skilled staff: hiring and training people to monitor autonomous vehicles is non-trivial

- Expanding: as Waymo expands to 26+ cities, the remote ops center has to expand proportionally

The remote operations center is why Waymo's expansion is capital-intensive. You can't just copy the San Francisco remote ops setup and apply it to New York. You need new people, new infrastructure, new local coordination, and new communication systems. That's expensive and takes time to set up properly.

But here's why it matters: the remote operations center is a potential moat. Once Waymo has trained thousands of people to monitor autonomous vehicles, has the infrastructure built out, and has the processes optimized, competitors will have to build something similar from scratch. You can't hire Waymo's operational experts in bulk—they're already employed. You'd have to train your own people, which takes time.

Most people don't think about the remote operations center because it's boring. No cool sensors, no impressive algorithms, just people watching screens. But logistics companies will tell you: the unglamorous operational backend is often what separates winners from losers in a competitive market.

Waymo's profit potential doubles from

The Path to Profitability: Timeline and Milestones

Waymo will likely reach profitability within 3-5 years based on current trajectory. Here's the rough path:

2025-2026: Rapid expansion phase. Deploy the new capital into fleet expansion and new city launches. Goal: 20+ new U.S. cities, launch in international markets. Financial goal: break even on unit economics in existing markets while investing in new ones. The company will burn cash overall but demonstrate positive unit economics.

2026-2027: Scale phase. Reach 10,000+ vehicles in 20+ U.S. cities. Establish profitable operations in London and Tokyo. Hire and train remote operations staff in multiple regions. Financial goal: significant positive gross margin per trip, with overall company profitability depending on how much they invest in new markets.

2027-2028: Market dominance phase. Establish Waymo as the obvious robotaxi leader in North America and early-stage international markets. Competitors like Tesla and others will either have deployed their own services (unlikely) or ceded market to Waymo (more likely). Financial goal: profitable overall operations with significant free cash flow.

2028-2030: Potential IPO window. By then, Waymo will have 3-5 years of profitable operations data, clear unit economics, demonstrated scalability, and a dominant market position. These are exactly the conditions that make a IPO attractive. A public Waymo could be valued at $200-400 billion depending on market conditions and how dominant the company has become.

This timeline is ambitious but achievable based on what Waymo has already demonstrated. The company proved that autonomous ridesharing works. Now it's just a matter of capital allocation and execution.

What This Means for Uber, Lyft, and Traditional Rideshare

Uber and Lyft built their businesses on the assumption of unlimited cheap driver labor. That assumption is eroding. Driver pay has increased. Regulations have tightened. Driver shortage has emerged in some markets. Those tailwinds that made Uber and Lyft work are turning into headwinds.

Robotaxis are the obvious threat to traditional rideshare. If Waymo can operate robotaxis at lower cost per trip while offering better safety, reliability, and availability, passengers will choose Waymo. It's that simple.

Both Uber and Lyft are aware of this threat and have invested in autonomous vehicle technology. Uber acquired Otto (an autonomous truck company) and invested in self-driving research. Lyft has partnerships with autonomous vehicle companies. But neither company is close to operating autonomous rideshare at scale.

What's likely to happen:

Scenario 1 (Most likely): Waymo becomes the autonomous rideshare leader. Uber and Lyft continue operating human driver rideshare for years, gradually losing market share to Waymo. Eventually, Uber and Lyft shift to being platforms that include both human drivers and autonomous vehicles, with autonomous vehicles becoming the primary option in major cities. This is similar to what happened when ride-sharing disrupted taxi companies—the taxi companies didn't disappear, but they got marginalized.

Scenario 2: Uber and Lyft successfully develop or partner for autonomous vehicle deployment and maintain market share. This seems unlikely because they're so far behind, but not impossible. If Uber could acquire autonomous technology and deploy it quickly, it could compete. The problem is that acquisition and deployment both take time, and Waymo is moving now.

Scenario 3: Tesla solves autonomous driving faster than expected and deploys a robotaxi network that competes with Waymo. This would disrupt the entire market. But based on 16 years of promises from Tesla, this seems unlikely in the near term (2-5 years). Beyond 5 years, it's possible.

Most likely, Waymo becomes the dominant autonomous rideshare player while Uber and Lyft fight for human driver market share, which will slowly erode. That's a significant threat to Uber and Lyft's long-term business models. You notice Uber has been investing in freight, delivery, and other revenue streams? That's partly because the executives know autonomous vehicles are coming and they need diversification.

The Investor Perspective: Why $126 Billion Makes Sense

To someone not steeped in venture capital and late-stage investing, a

Here's the logic:

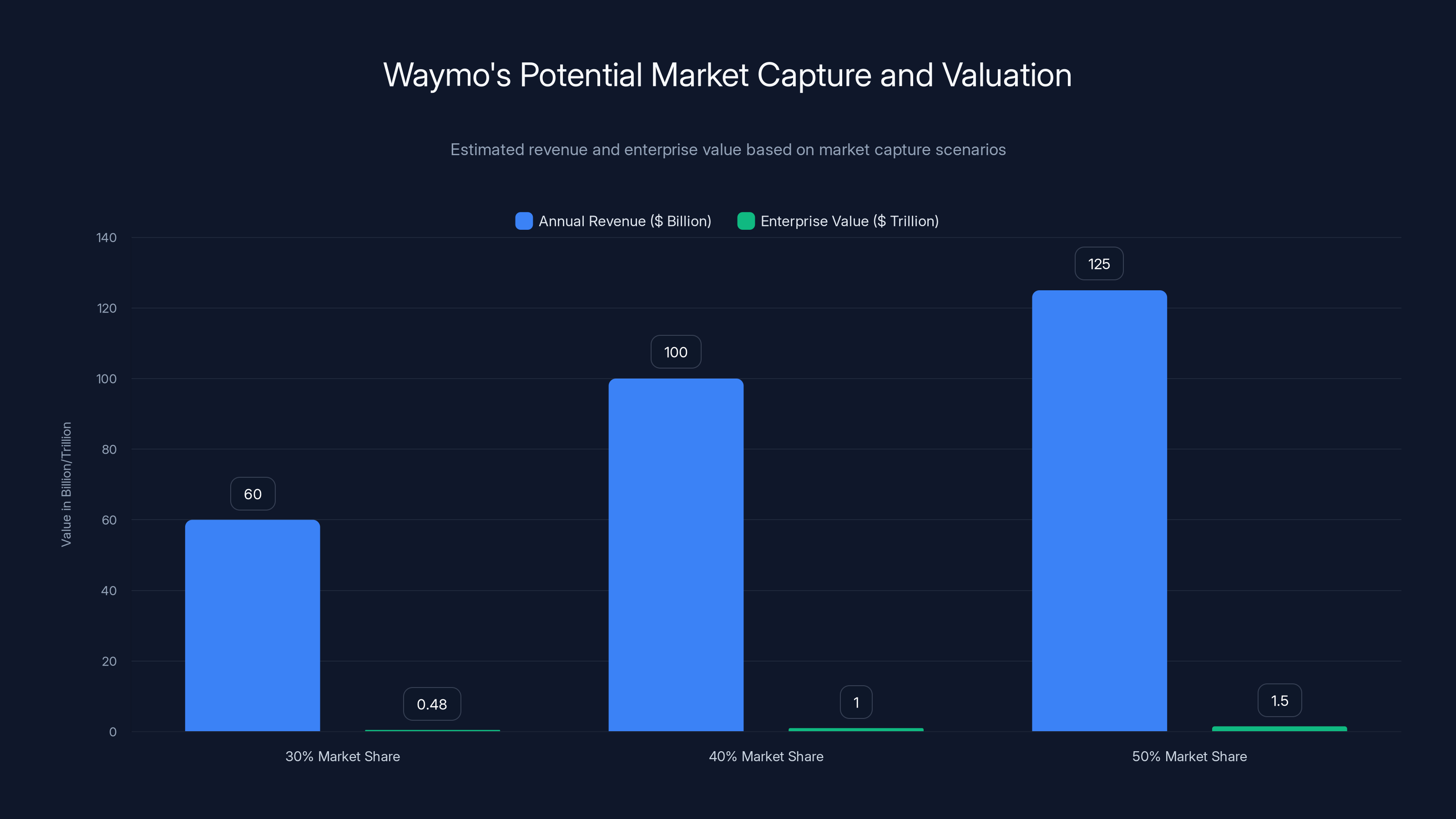

Total addressable market calculation:

- U.S. rideshare market: ~$100 billion annually

- Global rideshare market: ~$200-250 billion annually

- If Waymo captures 30-50% of the market over 10 years: $60-125 billion in annual revenue

- Typical enterprise software multiples: 6-10x revenue

- High-growth autonomous companies: 10-15x revenue multiples

- Conservative estimate: 480B enterprise value

- Optimistic estimate: 1.5 trillion enterprise value

Using those calculations, a $126 billion valuation is conservative if you believe Waymo can capture 30%+ of the global rideshare market. If you think it can capture 50%+ and get higher multiples, the valuation could be higher.

Investors are betting that:

- Autonomous rideshare becomes a $200+ billion annual industry

- Waymo's first-mover advantage and current lead are worth 30-50% market share

- The company reaches profitability and grows free cash flow substantially

- A public market valuation could hit $300-500 billion or higher

Those are large bets, but not unreasonable given what Waymo has already accomplished. The company has proven the technology works, passengers will use it, and cities will approve it. The remaining question is execution and scale. The $16 billion is betting that Waymo nails execution.

Estimated data shows Waymo's potential revenue and valuation based on capturing 30-50% of the global rideshare market. A 30% share could lead to a

Risks: What Could Go Wrong

Waymo's path isn't risk-free. Several things could derail the expansion or collapse the valuation.

Regulatory backlash: If a Waymo vehicle causes a serious accident or fatality, regulators could pause or cancel approvals. This would be devastating. The company has been lucky so far—very few serious incidents. But luck eventually runs out, and one bad accident could change the regulatory landscape dramatically.

Competitor breakthrough: If Tesla or another company suddenly solves autonomous driving better than Waymo, the competitive advantage disappears. This seems unlikely based on current evidence, but technology surprises happen.

Safety concerns: Public perception is fragile. If pedestrians and passengers lose confidence in safety, demand drops. Waymo has been good at transparency, but one viral accident video could undo years of brand building.

Economic downturn: If the economy goes into recession, ride-sharing demand drops. Waymo's growth would slow. The $126 billion valuation is based on strong future demand. A severe recession could reduce that forecast.

Operational execution failures: Expanding to 26+ cities is hard. It's possible Waymo could execute poorly in new cities, hit unexpected technical challenges, or discover that its San Francisco playbook doesn't generalize. Any of those failures would slow expansion.

International regulatory challenges: London and Tokyo regulatory approval could take longer or be harder than expected. If Waymo underestimated the time and cost to enter these markets, it could drain capital and slow U.S. expansion.

Technology limitations: There might be genuine autonomous driving problems that are harder than Waymo anticipated. Winter driving, certain weather conditions, or edge cases that don't appear in testing might limit the geographic scope of operations.

These risks are real, but they're priced into the $126 billion valuation. Investors aren't assuming 100% probability of success. They're assigning a probability (maybe 40-60%) to successful global expansion and weighting it against the total addressable market.

The Broader Implications: Transportation's Future Is Autonomous

Waymo's $16 billion funding round is a moment. It's the moment when autonomous ridesharing stopped being an interesting experiment and became an inevitable future.

For decades, transportation was dominated by human drivers. Taxis, rideshare, trucking—all human-controlled. That era is ending. Over the next 10-20 years, autonomous vehicles will become the primary way people get around in major cities. That's not speculation. It's math. Autonomous vehicles are better at the job. They're safer, more efficient, cheaper at scale, and don't need rest.

Waymo isn't just building a company. It's building the infrastructure for a new era of transportation. Every robotaxi deployed, every city approved, every safety record broken, every mile driven—these all make the transition to autonomous transportation more inevitable.

The downstream implications are enormous:

For cities: Better air quality, less congestion, more parking reclaimed for development, better data about transportation patterns.

For workers: Driver jobs will decline. Trucking jobs will disappear. Taxi drivers will be obsolete. But new jobs will emerge in remote operations, maintenance, software development, and vehicle management. The transition will be painful for people whose skills don't transfer.

For consumers: Cheaper transportation (long term), better safety, more availability. The main cost is loss of privacy (you're tracked everywhere) and loss of car ownership culture (you might stop owning a car and just use robotaxis).

For the environment: Significant improvement in air quality and carbon emissions, especially as the electricity grid becomes cleaner.

For insurance companies: Disruption. As autonomous vehicles become safer, insurance costs drop dramatically. Insurance companies that depend on current car insurance models will need to adapt.

For tech companies: A new tech platform emerges. Waymo is building an operating system for transportation, similar to how iOS and Android are operating systems for phones. That platform could be worth trillions over 20 years.

Waymo's $16 billion is not just capital. It's an acceleration of the inevitable. The company is using that money to arrive at the future faster than competitors. In 5-10 years, we'll look back at 2025 and recognize it as the inflection point where autonomous ridesharing became mainstream.

What Happens Next: A 24-Month Forecast

Based on Waymo's track record and the capital now available, here's what's likely to happen in the next 24 months:

Months 1-6 (Immediate):

- Fleet expansion: Order 5,000+ new vehicles (likely a mix of Jaguar vehicles and Google vehicles)

- City announcements: Announce operations in 10+ new U.S. cities

- International prep: Begin regulatory discussions in London and Tokyo

- Hiring: Ramp up hiring for remote operations, engineering, and city operations staff

Months 6-12 (Mid-term):

- Early city launches: Begin operations in 5-10 new cities (likely Denver, Miami, Seattle, Portland, Austin, etc.)

- International launches: Begin actual robotaxi operations in London (most likely) and possibly Singapore

- Profitability: Demonstrate full profitability in existing markets (San Francisco, Phoenix, LA, San Diego, Las Vegas)

- Competitor response: Uber and Lyft announce autonomous vehicle partnerships or acceleration

Months 12-24 (Next year):

- Scale-up: Reach 10,000+ vehicles operating across 15-20 U.S. cities

- Tokyo launch: Begin operations in Tokyo if regulatory approval is granted

- Feature expansion: Potentially expand into other services like autonomous delivery or last-mile logistics

- Market dynamics: Rideshare pricing in Waymo markets drops as the company price-competes on efficiency, not desperation

- Investor updates: Continue to demonstrate profitable unit economics and market dominance

By the end of 2026, Waymo will likely be operating in 20-25 cities globally with 8,000-10,000 vehicles, generating

Conclusion: The Robotaxi Era Has Arrived

Waymo's $16 billion funding round is a watershed moment. Not because of the money itself, but because of what the money represents: validation that autonomous ridesharing is a real, profitable, scalable business. The era of speculation is over. The era of execution has begun.

For 16 years, Waymo built the technology, navigated regulation, and proved the concept. For the last 1-2 years, the company validated the business model. Now, with

The implications extend far beyond Waymo or even autonomous vehicles. This round signals that the future of transportation is software-driven, not hardware-driven. It signals that cities will embrace autonomous technology because the benefits (safety, efficiency, cleanliness) are too large to ignore. It signals that driver-based rideshare is entering its decline phase, like taxi companies 15 years ago.

For investors who backed Waymo since the beginning, this round is a massive validation. For competitors who promised autonomous vehicles but didn't deliver, this round is a warning. For cities considering autonomous vehicle regulation, this round is proof it works. For the public, this round means your next rideshare trip might be in a driverless car sooner than you thought.

The robotaxi era hasn't just arrived. It's been here, operating profitably in six cities, with 2,500 vehicles, carrying hundreds of thousands of passengers. Waymo just got the capital to make it everyone's reality. Watch the next 24 months closely. The future of transportation is being built right now, and Waymo owns the lead.

FAQ

What exactly is Waymo?

Waymo is a self-driving car company that operates a commercial robotaxi service where passengers can book driverless rides through an app. The company was originally Google's self-driving car project before becoming an independent subsidiary under Google's parent company Alphabet. Today, Waymo operates fully autonomous vehicles without human safety drivers in six U.S. cities.

How does Waymo's autonomous driving technology work?

Waymo's vehicles use a combination of lidar (light detection and ranging), radar, cameras, and sophisticated AI algorithms to perceive their environment and make driving decisions. Each vehicle has multiple redundant computer systems so that if one fails, others take over. The vehicles also communicate with Waymo's remote operations center, where human monitors can observe operations and intervene if the vehicle encounters a situation it can't handle autonomously.

Why is the $16 billion funding round significant?

The funding round validates that autonomous ridesharing is a profitable, scalable business. It shows that major institutional investors—including sovereign wealth funds and leading venture firms—believe Waymo can dominate a multi-trillion-dollar transportation market. The round also provides capital for the company to expand from 6 cities to 20+ cities and launch internationally in markets like London and Tokyo.

How much does a Waymo ride cost compared to Uber or Lyft?

Waymo pricing is generally comparable to Uber and Lyft in cities where it operates, with fares typically ranging from $15-25 per trip depending on distance and time of day. Long-term, Waymo's higher vehicle utilization and lower labor costs should enable lower prices, but currently the company prices competitively rather than aggressively undercutting human-driven rideshare.

When will Waymo operate in my city?

Waymo plans to launch in 20+ new U.S. cities in 2026. The company hasn't officially announced which cities will get service first, but candidates likely include Denver, Austin, Miami, Portland, Dallas, and other major metropolitan areas. International launches in London and Tokyo are also planned. You can check Waymo's website for official expansion announcements.

Is Waymo safer than human drivers?

Based on available data, Waymo's fully autonomous vehicles have been involved in very few accidents, and most incidents that did occur were not Waymo's fault. However, Waymo hasn't published comprehensive safety data that directly compares its incident rate to human drivers. The company does undergo regular safety audits and regulatory oversight. That said, autonomous vehicles are held to a higher safety standard than human drivers because public tolerance for AI accidents is lower than tolerance for human driver errors.

What's the difference between Waymo and Tesla's autonomous driving?

Waymo operates fully autonomous, driverless vehicles in commercial service where passengers can book rides and the vehicle operates without any human driver. Tesla's Full Self-Driving (FSD) requires a human driver to monitor and be ready to take control at any moment. Tesla has not yet deployed a commercial robotaxi service comparable to Waymo. This is a significant difference—Waymo has already solved the "last mile" of autonomous driving by operating profitably with customers. Tesla has not.

How does Waymo make money from robotaxis?

Waymo charges passengers per trip (similar to Uber or Lyft). The revenue per trip minus the cost per trip equals profit. Waymo's vehicles operate 16-24 hours per day, generating multiple trips and spreading fixed costs (vehicle depreciation, sensors, insurance) across many more miles than human-driven cars. This high utilization is the key to profitability—Waymo doesn't need to charge less; it needs to operate more efficiently.

Could autonomous vehicles put millions of drivers out of work?

Yes. Over 3+ million people in the U.S. drive for a living (truck drivers, taxi drivers, Uber/Lyft drivers, delivery drivers). As autonomous vehicles take over these jobs, significant job displacement will occur. However, new jobs in vehicle maintenance, remote operations, software development, and transportation management will emerge. The transition period will be painful for people whose skills don't transfer, and retraining programs will be necessary.

What are the main risks to Waymo's expansion plan?

Key risks include: regulatory backlash from a serious autonomous vehicle accident, competitive breakthroughs by Tesla or other companies, public safety concerns if confidence drops, operational execution failures in new cities, unexpected technical limitations (winter driving, specific weather), and challenges with international regulatory approval. These risks are significant, but they're factored into the $126 billion valuation.

Will robotaxis replace personal car ownership?

In major cities where robotaxi services are available and affordable, many people will likely stop owning cars and instead use robotaxi services when needed. This would be similar to how urban residents in major cities often don't own cars because taxis and rideshare are more convenient and cost-effective. However, in suburban and rural areas where robotaxi density is low, personal car ownership will likely remain dominant.

More in Transportation

Waymo's funding round is part of a broader transformation of transportation technology. The autonomous vehicle space continues to evolve rapidly, with implications for urban planning, labor markets, environmental sustainability, and public safety. Follow developments in autonomous vehicles, electric transportation, and smart city infrastructure for deeper understanding of how transportation is changing.

Key Takeaways

- Waymo's 126 billion valuation validates autonomous ridesharing as a profitable, scalable business

- The company operates 2,500+ fully driverless vehicles in six U.S. cities and plans 20+ additional city launches in 2026

- Global expansion to New York, London, and Tokyo signals Waymo's shift from regional to worldwide autonomous transportation provider

- Robotaxis achieve profitability through 2.5-3x higher vehicle utilization (16-24 hours daily vs 8 hours for human drivers), not lower pricing

- Waymo's 16-year lead, operational expertise, regulatory approvals, and driving data create nearly insurmountable competitive moat against Tesla and others

- Path to profitability is 3-5 years; potential IPO window opens 2028-2030 with valuations possibly reaching $300B-500B+ if execution succeeds

- Autonomous ridesharing will significantly displace human driver jobs (3+ million workers) but create new opportunities in operations and maintenance

- First-mover advantage in autonomous ridesharing is likely to compound, making Waymo the dominant player for the next decade

Related Articles

- Waymo's $16B Funding Round: The Future of Autonomous Mobility [2025]

- Waymo at SFO: How Robotaxis Are Reshaping Airport Transport [2025]

- Waymo Robotaxi Hits Child Near School: What Happened & Safety Implications [2025]

- Is Tesla Still a Car Company? The EV Giant's Pivot to AI and Robotics [2025]

- Waymo Robotaxi Strikes Child Near School: What We Know [2025]

- Tesla Kills Model S and X Production: The Shift to Humanoid Robots [2025]

![Waymo's $16 Billion Funding Round: The Future of Robotaxis [2025]](https://tryrunable.com/blog/waymo-s-16-billion-funding-round-the-future-of-robotaxis-202/image-1-1770073938211.jpg)