The Dangerous Truth About High-Deductible Health Plans and Cancer Survival

Imagine getting diagnosed with cancer, then realizing your insurance plan requires you to pay $7,500 out of pocket before coverage kicks in. For millions of Americans, this isn't hypothetical. It's their reality.

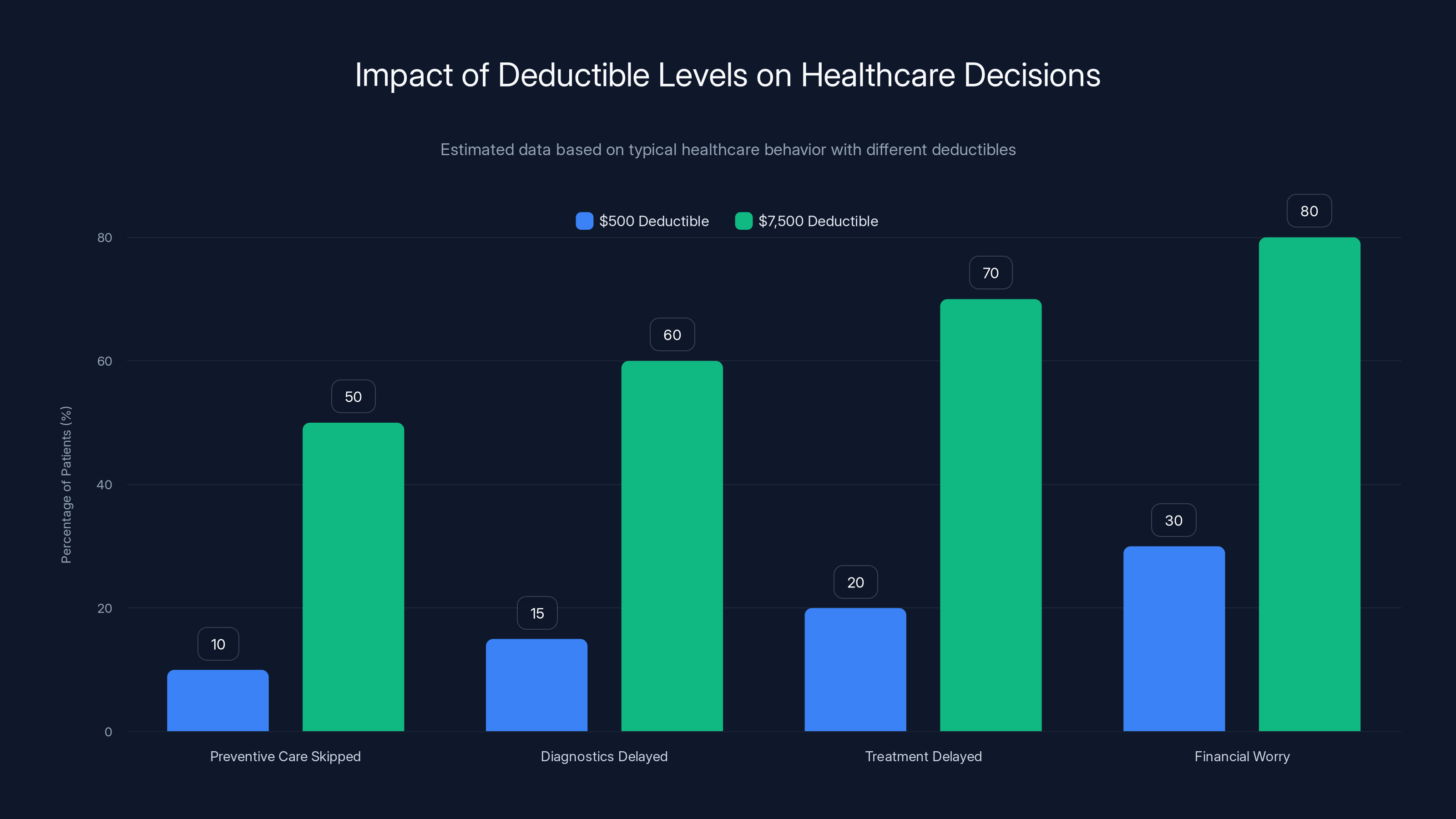

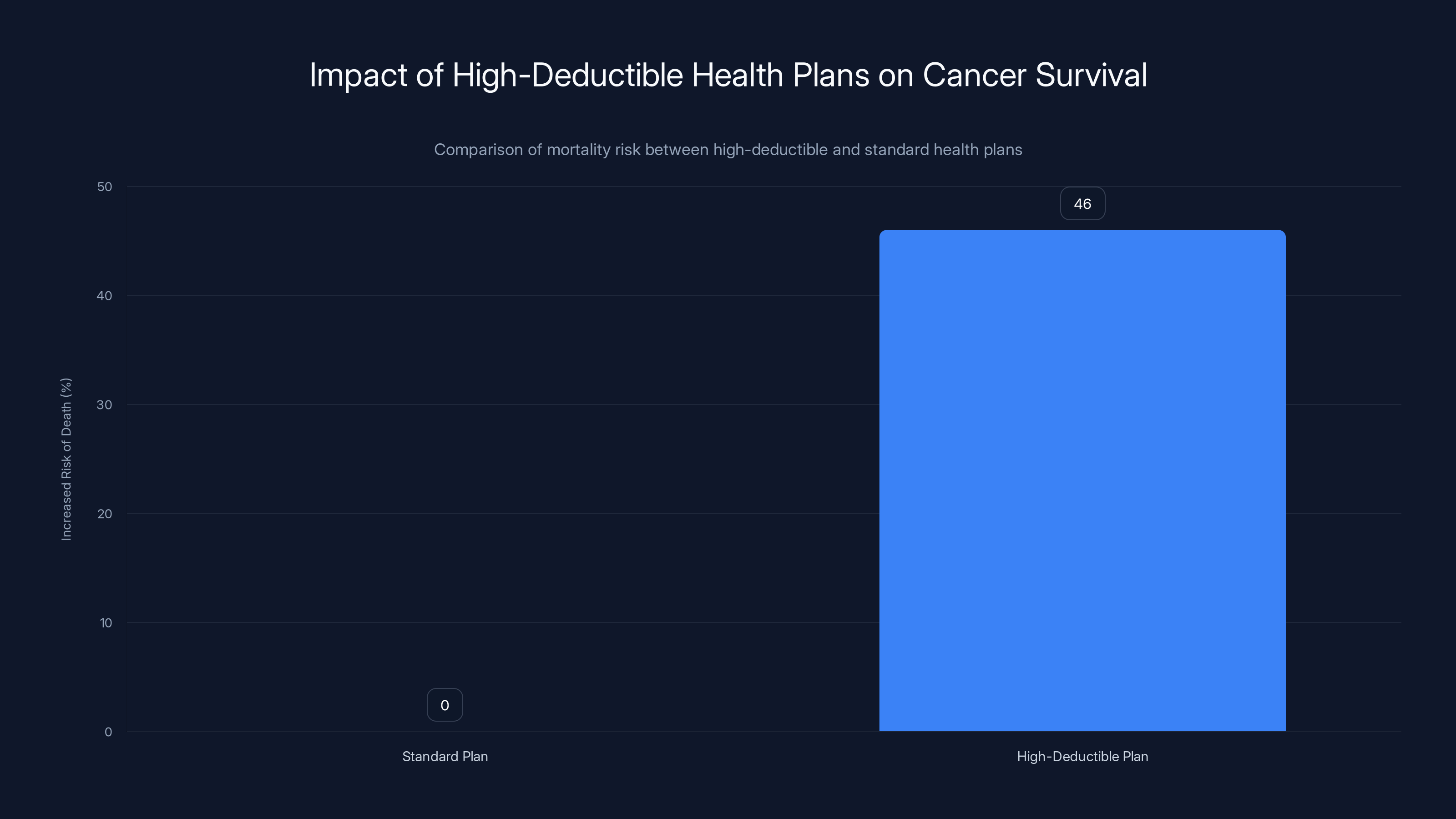

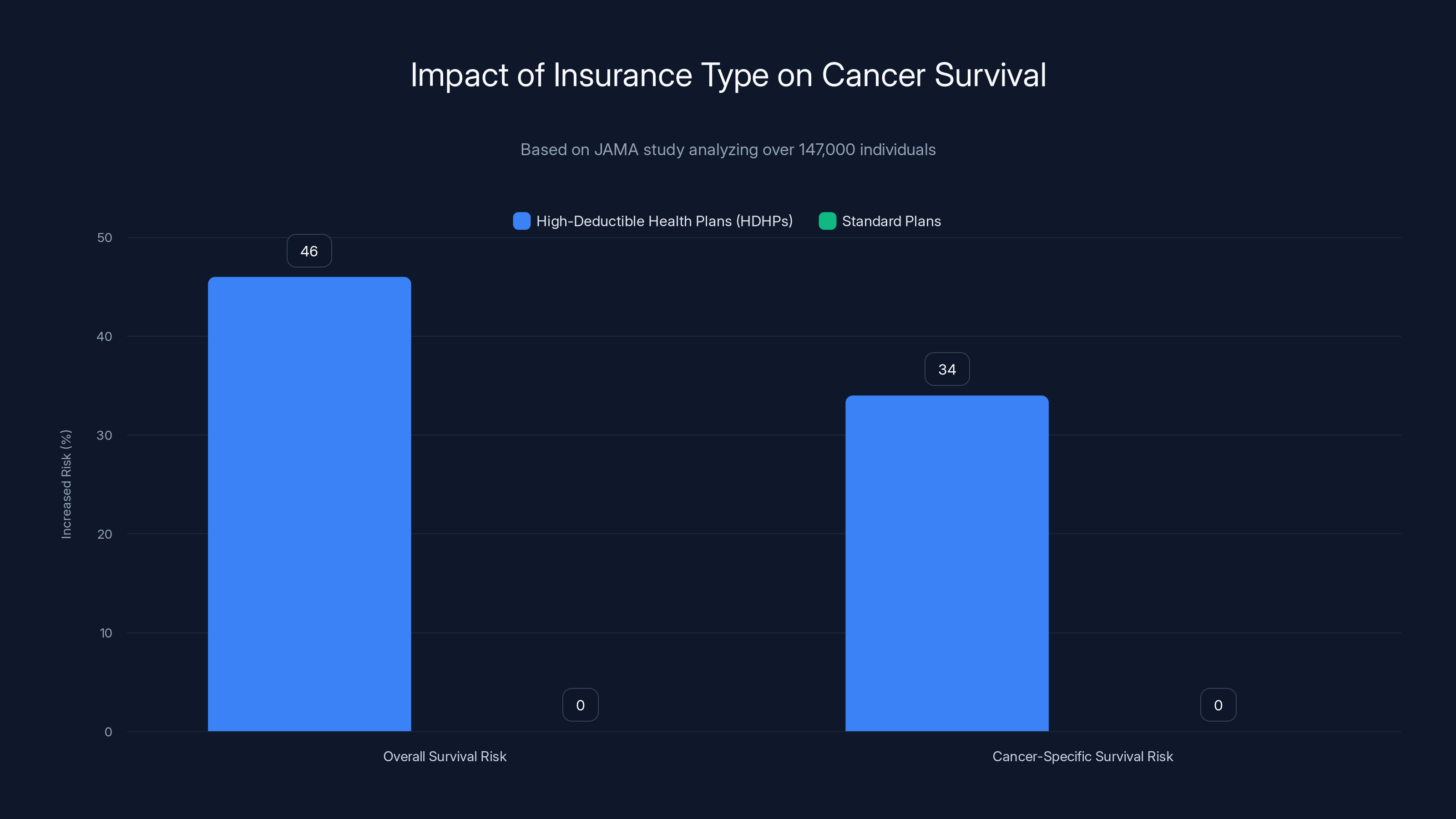

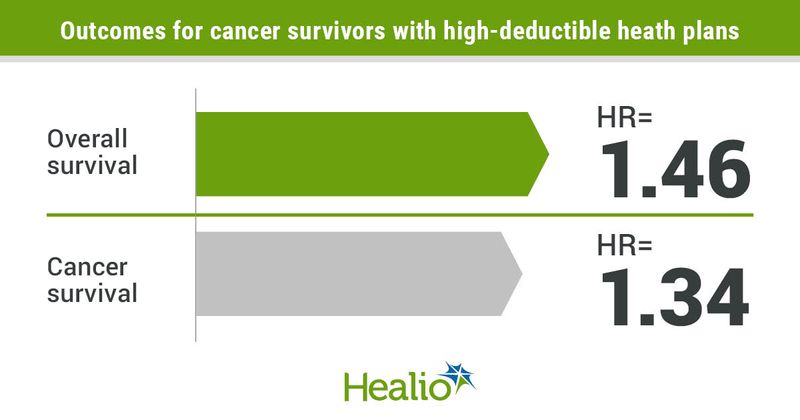

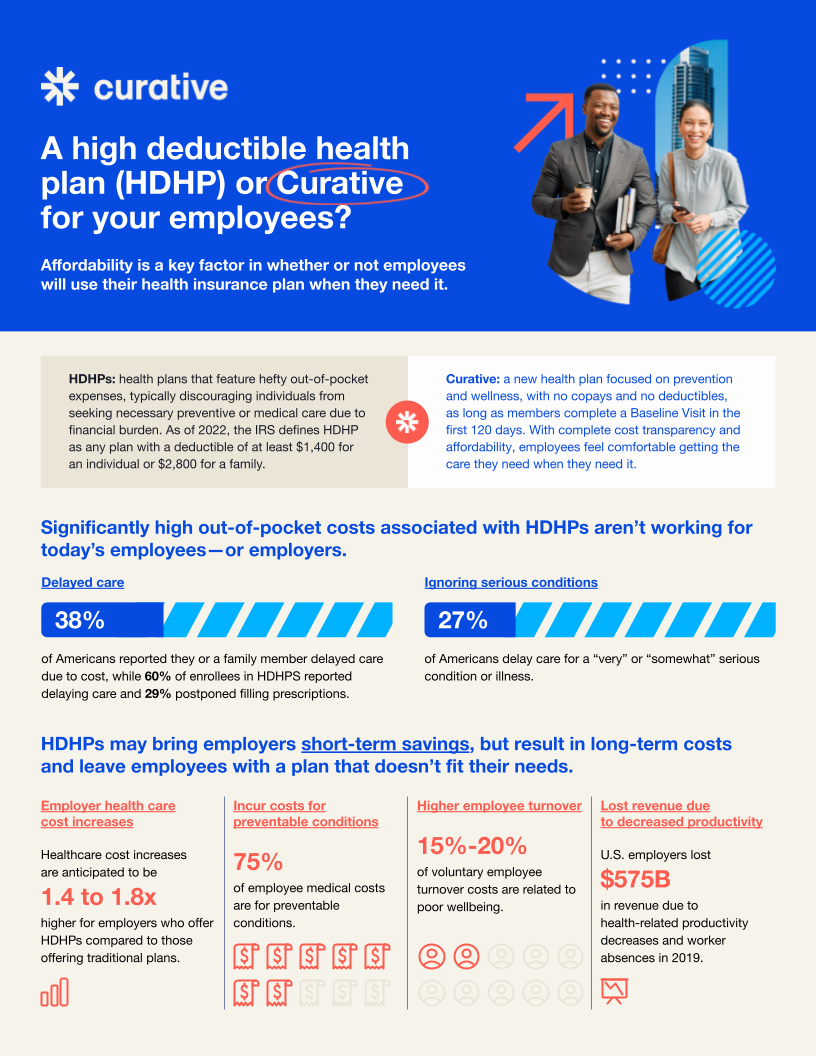

A groundbreaking study published in JAMA Network Open has revealed something patients and doctors have long suspected but never had solid data to prove: high-deductible health plans literally cost lives. The research found that cancer patients with high-deductible plans face a 46% increased risk of death compared to those with standard coverage. Let that sink in. We're not talking about convenience or comfort here. We're talking about survival rates.

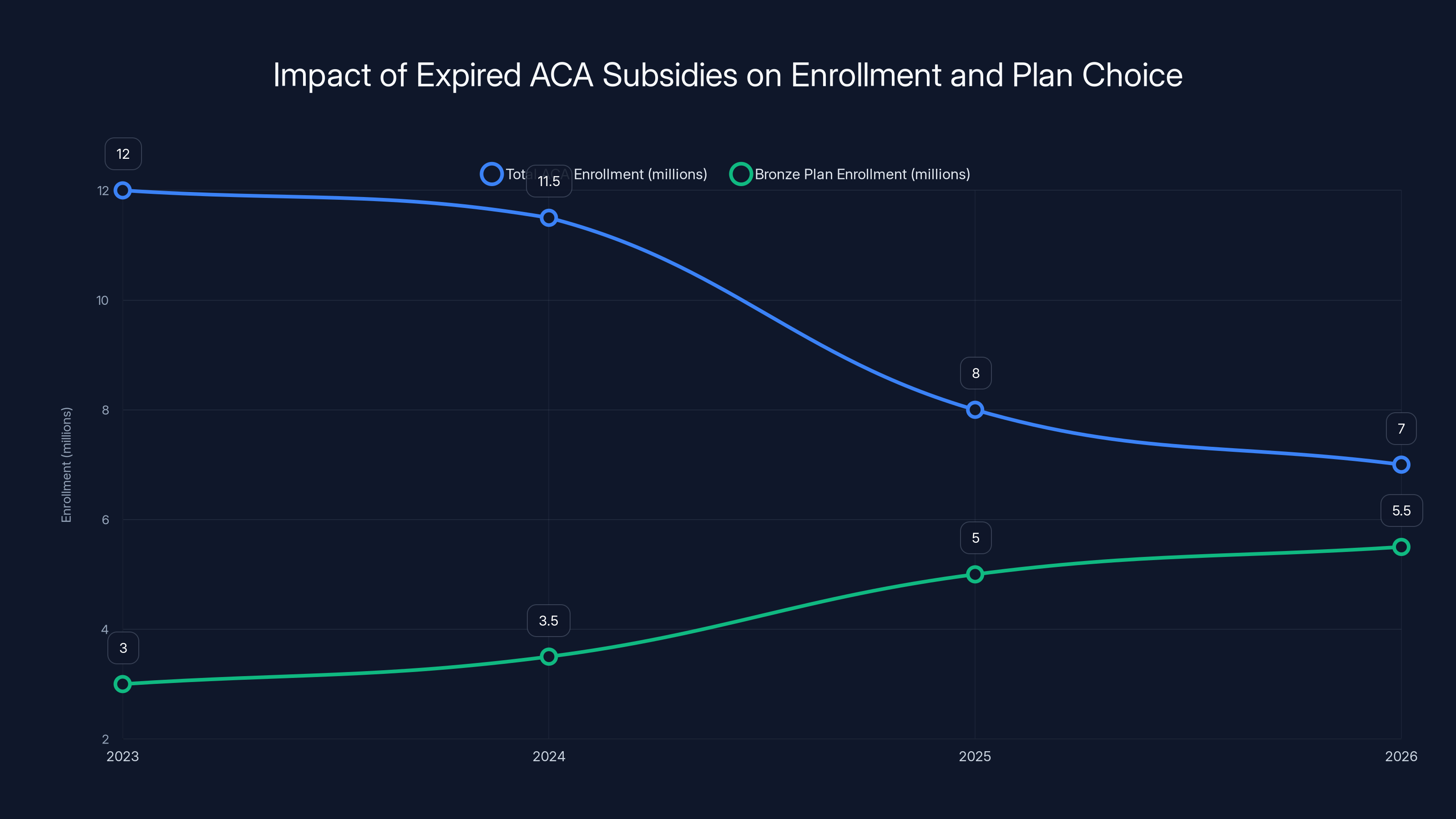

The timing couldn't be worse. Congress allowed critical ACA (Affordable Care Act) tax credits to expire in 2025, forcing millions of Americans to make an impossible choice: pay double for insurance they can barely afford or accept higher deductibles they can't navigate. Early enrollment data shows people are choosing the latter, opting for bronze plans that sound affordable until they get sick.

This isn't just a healthcare policy debate anymore. It's a mortality issue. And the gap between those who can afford care and those who can't is literally widening.

Let's break down what's happening, why it matters, and what you should do about it.

TL; DR

- High-deductible plans increase cancer death risk by 46%: Cancer patients on HDHPs face significantly worse survival outcomes than those with standard plans

- Cost avoidance kills: People skip treatments, delay diagnostics, and avoid necessary care when facing high out-of-pocket costs

- ACA credits gone, problems multiplying: Loss of tax credits means millions are forced into high-deductible plans they can't afford

- Cancer patients report extreme financial worry: Those on HDHPs experience significantly higher financial stress than standard plan holders

- The real cost isn't the premium: Bronze plans look cheap monthly until you need actual care and face thousands in deductibles

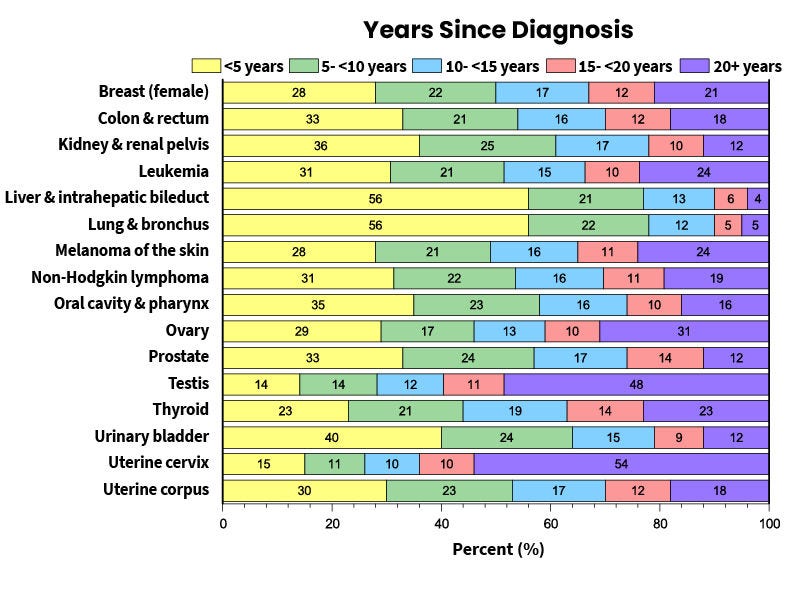

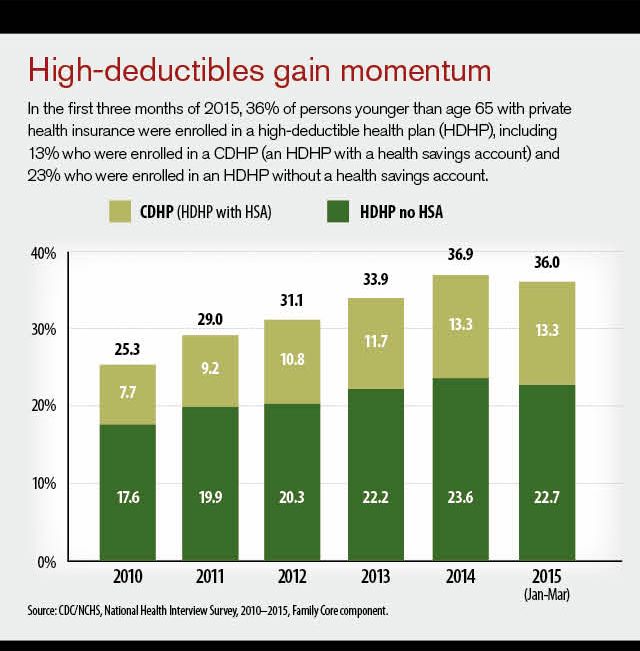

High-deductible plans cover approximately 35% of the insured population, with this number expected to grow due to ACA subsidy changes. Estimated data.

Understanding High-Deductible Health Plans: What They Really Are

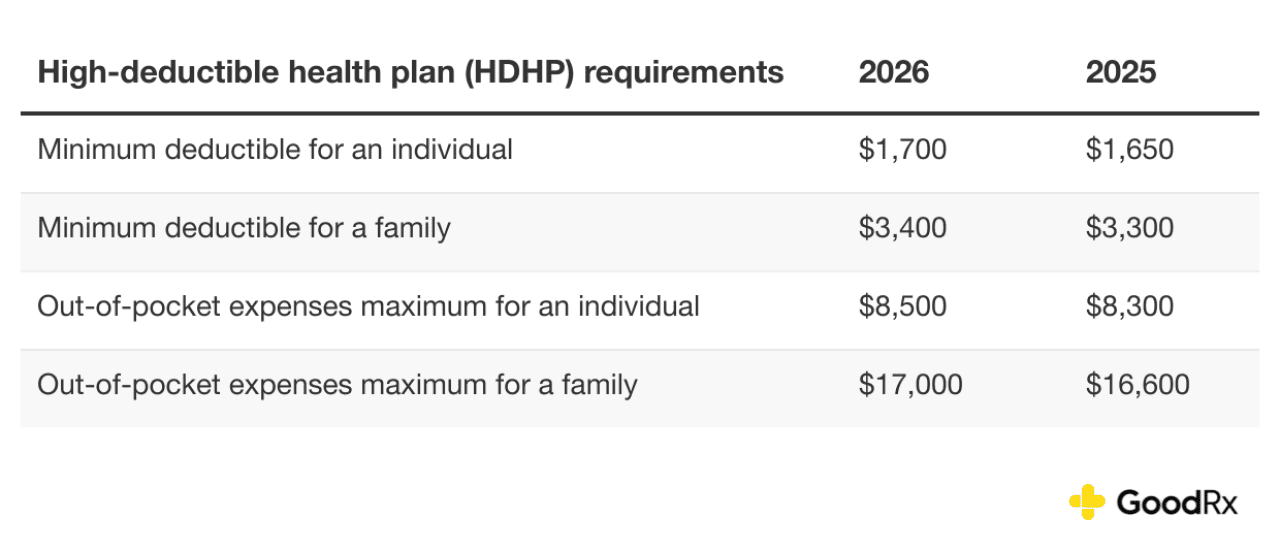

A high-deductible health plan (HDHP) sounds straightforward until you actually need it. The basic premise is simple: you pay lower monthly premiums in exchange for higher out-of-pocket costs when you need care.

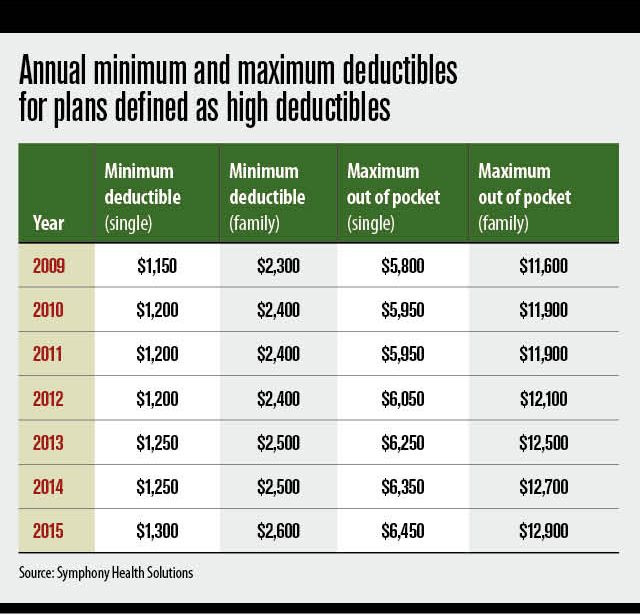

For context, the study defined HDHPs as plans with deductibles of

Think about what that means. If you get a cancer diagnosis in January, you're paying the first

The insurance industry loves these plans. Lower premiums mean more people sign up. From their perspective, they've transferred the financial risk directly to patients. From the patient's perspective, they've made a bet that they won't get seriously ill.

For healthy people, that bet often works. You pay low premiums, use minimal care, and come out ahead. But the moment something serious happens, the math flips completely.

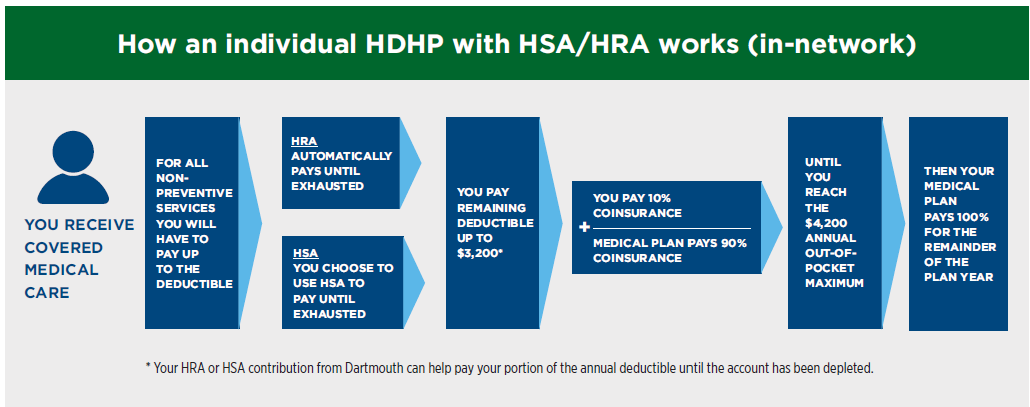

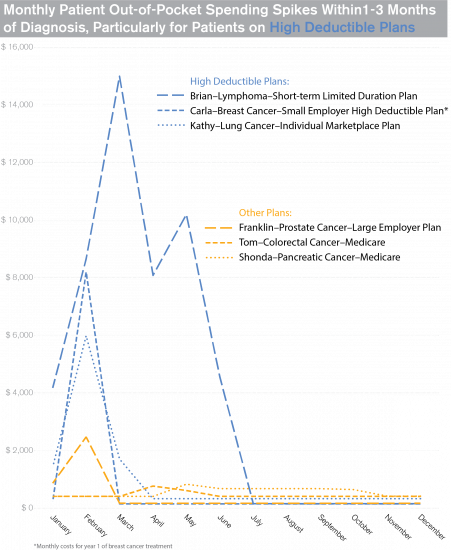

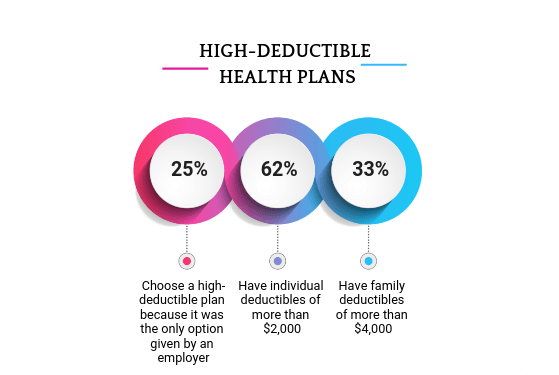

Patients with high-deductible plans are significantly more likely to skip preventive care, delay diagnostics and treatments, and experience financial worry. Estimated data highlights the stark contrast in healthcare decisions based on deductible levels.

The JAMA Study: What the Research Actually Found

The research team, led by Justin Barnes at Mayo Clinic in Rochester, Minnesota, conducted one of the most comprehensive analyses of how insurance type affects cancer survival. Their methodology was solid, which is why the results are so alarming.

The study analyzed health survey data from a nationally representative sample of over 147,000 people. Of those, nearly 9,800 had been diagnosed with cancer, and approximately 2,300 of the cancer patients had high-deductible plans. They also tracked over 37,000 people without cancer diagnoses who had HDHPs, providing a control group.

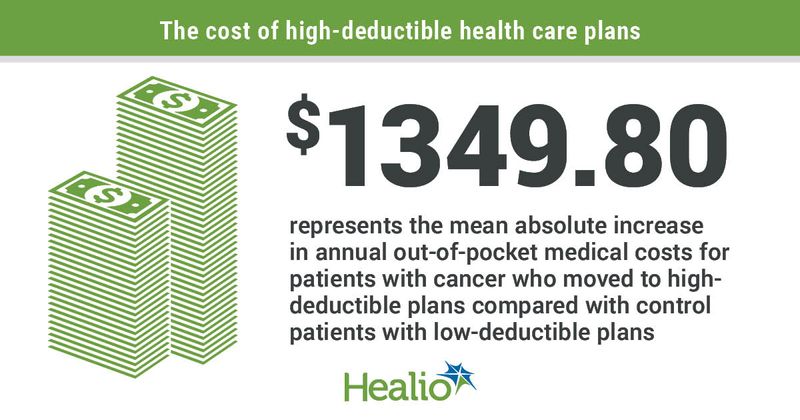

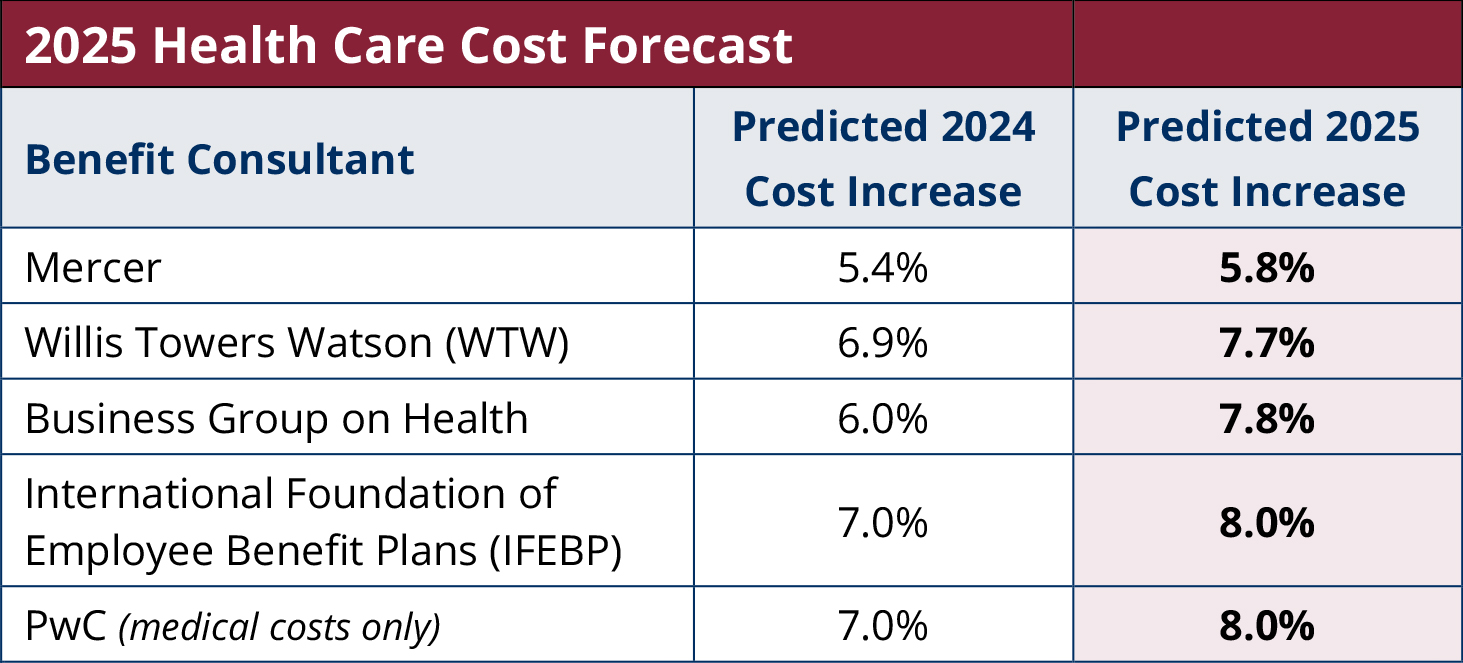

After adjusting for demographic factors and baseline health status, the results were stark:

- Overall survival: Cancer patients on HDHPs had a 46% higher risk of death compared to those on standard plans

- Cancer-specific survival: The risk increased 34% higher when looking at deaths specifically caused by cancer

- Financial stress: Cancer patients on HDHPs reported significantly more financial worry than those on standard plans

- HSA status didn't matter: Whether a plan included a health savings account made no difference in survival outcomes

What really stood out was the control group finding. People without cancer diagnoses who had HDHPs showed no increased mortality risk. This suggests the problem isn't the plans themselves for generally healthy people, but rather the collision between high deductibles and serious illness. It's the perfect storm: the moment you need care most, the plan makes that care hardest to access.

The study controlled for important variables like age, race, ethnicity, education level, income, smoking status, and existing health conditions. They didn't just compare crude numbers. They looked at apples to apples. And even with all that adjustment, the mortality gap remained stark.

Why High Costs Lead to Deadly Delays

The mechanism behind this mortality increase isn't mysterious. It's devastatingly simple: people avoid care they can't afford.

When you're facing a

In cancer, timing is everything. A tumor caught at stage one has radically different survival rates than the same tumor caught at stage three or four. Every month of delay can shift outcomes dramatically.

Consider a patient with early warning signs of breast cancer. With a standard plan, they make an appointment, get the mammogram, and if something's found, treatment starts quickly. With a high-deductible plan, they might delay that mammogram because they're worried about the cost. By the time they finally go in, the cancer has progressed. Now they need more aggressive treatment, face worse odds, and end up paying more total anyway.

The irony is brutal: the people trying to save money on their insurance premium end up spending way more on care and get worse outcomes. It's false economy at a fundamental level.

Research has consistently shown that high deductibles lead to medical avoidance. People with high-deductible plans are more likely to skip preventive care, delay treatments, and avoid necessary diagnostics. For cancer patients, this isn't just inconvenient. It's lethal.

One key insight from the JAMA study: cancer patients on HDHPs reported more financial worry than others. This psychological stress itself can affect health outcomes, delaying care-seeking behavior even further. The anxiety becomes part of the disease.

Estimated data shows a sharp decline in total ACA enrollment after subsidies expired in 2025, with a concurrent rise in bronze plan enrollment as people opt for cheaper plans.

The ACA Crisis: How We Got Here

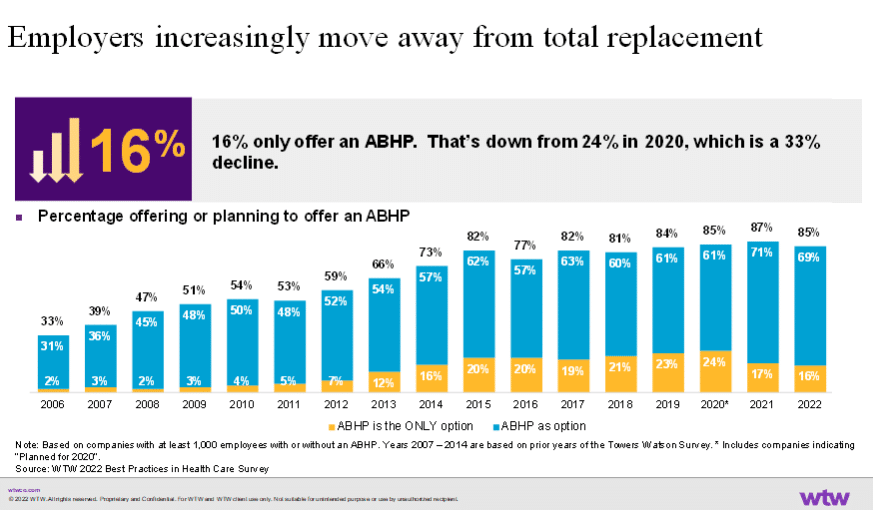

To understand the current insurance landscape, you need to understand what just happened politically. The Affordable Care Act created a marketplace where people without employer coverage could buy plans directly. It worked reasonably well for a decade and a half because Congress authorized enhanced tax credits that reduced premiums for lower and middle-income people.

Then Congress didn't extend those credits. In 2025, those subsidies expired.

The result was immediate and devastating. ACA marketplace premiums more than doubled overnight for many people. Monthly costs that were manageable became impossible. A person making

Faced with this choice, people made rational economic decisions. They either dropped coverage entirely or downgraded to bronze plans, the cheapest options available. Bronze plans come with high deductibles. Very high deductibles. This is exactly the kind of plan structure the JAMA study found to be dangerous.

Early 2025 enrollment data shows the pattern playing out in real time. Fewer people are enrolling overall (because they're priced out), and those who are enrolling are increasingly choosing bronze plans. This is the exact demographic shift that creates the health crisis the research identifies.

So we're entering a period where more people have less insurance security than at any point in the recent past. The policy environment has essentially forced more people into the exact insurance structures that kill cancer patients faster.

The Financial Reality: What High Deductibles Actually Cost

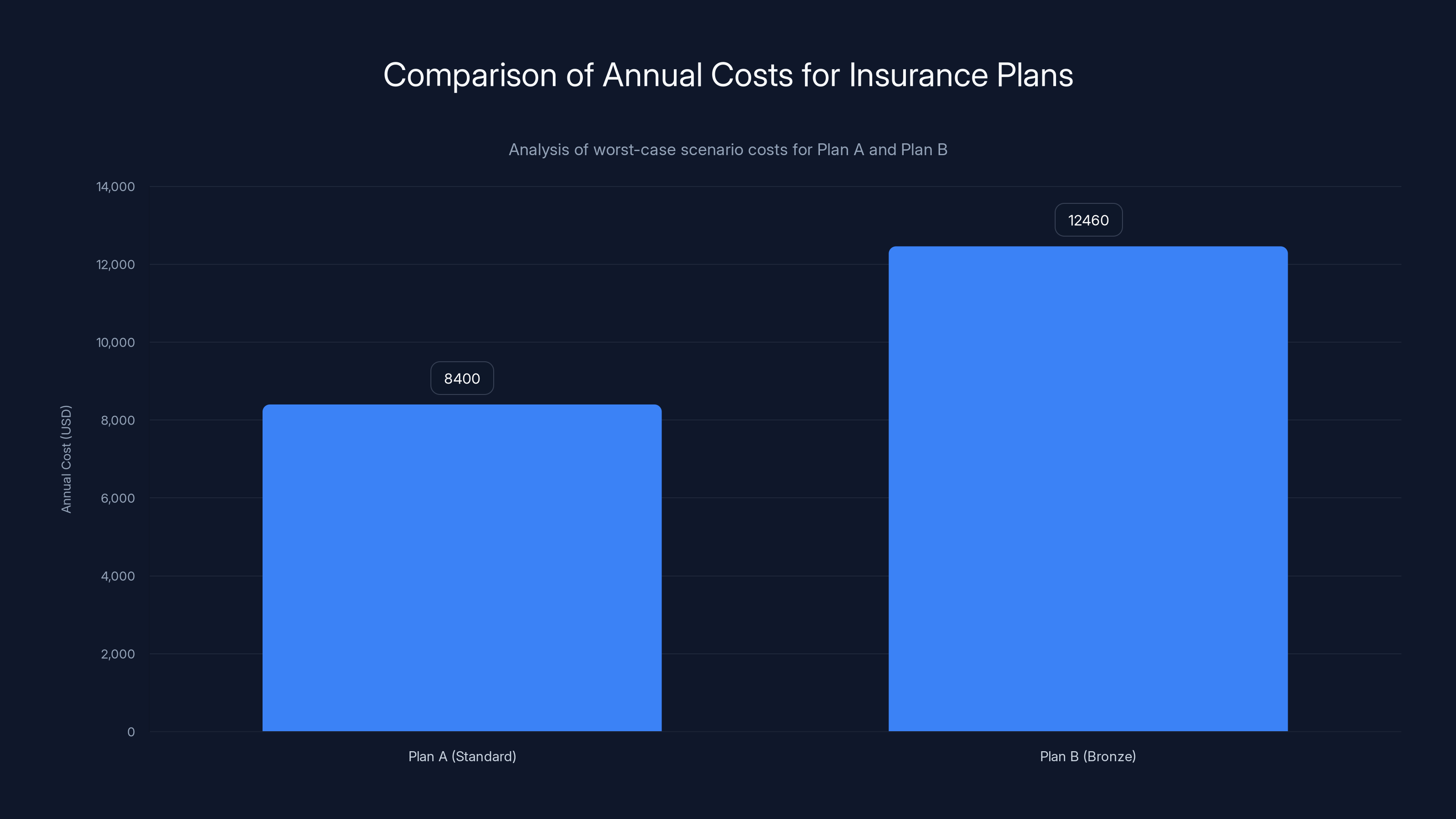

People often look at insurance shopping wrong. They see a monthly premium and assume that's the cost. It's not. The real cost is the total out-of-pocket maximum, which is what you actually pay in a worst-case scenario.

Let's work through a realistic example. A 45-year-old gets quoted two plans:

Plan A (Standard):

- Monthly premium: $450

- Deductible: $500

- Out-of-pocket maximum: $3,000

- Annual cost worst case: 3,000 = $8,400

Plan B (Bronze/High-Deductible):

- Monthly premium: $280

- Deductible: $7,500

- Out-of-pocket maximum: $9,100

- Annual cost worst case: 9,100 = $12,460

The bronze plan saved

Now add cancer to this equation. Cancer treatment costs average

The financial stress itself becomes a health factor. Cancer patients on high-deductible plans reported extreme financial worry in the JAMA study. That stress affects sleep, nutrition, mental health, and medication compliance. It compounds the medical problem with a financial problem.

Plan B offers lower monthly premiums but results in a higher annual cost in a worst-case scenario, costing $4,060 more than Plan A.

Cancer Patients Face Impossible Choices

Here's what a cancer diagnosis looks like for someone on a high-deductible plan:

You get the diagnosis in January. You need surgery, chemotherapy, radiation, and ongoing monitoring. Your deductible is $7,500. Your copays for specialty care are 20%. Medications cost hundreds per month.

You're already stressed about the diagnosis itself, scared about survival, worried about your family. Now you add this financial calculation to every decision:

"Can we afford the surgery right now, or should we wait until next year when the deductible resets?"

"Do I take the oncologist's preferred treatment option that costs more, or accept something cheaper?"

"Can we afford the preventive CT scan that monitors for recurrence?"

"What if the cancer comes back in November? We'll have paid the full deductible, and there's only two months left in the year."

These aren't hypothetical concerns. They're the daily reality for cancer patients on high-deductible plans. And the research shows these financial calculations literally kill people.

The JAMA study notes that cancer patients on HDHPs weren't necessarily skipping treatment entirely. But they were likely delaying treatment, choosing cheaper options, or skipping follow-up care. Each of these decisions subtly worsens outcomes.

There's also the complexity of cancer care. You might need to see multiple specialists, undergo multiple procedures, try different medications. With a standard plan, cost is a background concern. With a high-deductible plan, every specialist appointment, every test, every medication is a financial decision point. That decision fatigue itself affects health outcomes.

The Preventive Care Problem: Catching Cancer Early

Cancer screening is expensive and preventive by nature. If you have a high deductible, you're less likely to get screened. That's not just a suspicion. It's documented in healthcare data.

When a 50-year-old woman has a standard plan, she gets her colonoscopy covered as preventive care, usually with no cost-sharing. She gets the mammogram. She gets the routine checkups. If something concerning shows up, she follows up immediately.

When she has a high-deductible plan, the calculation changes. Even though prevention is theoretically covered without a deductible in most plans, the reality is more complex. She might be worried about follow-up costs if something's found. Or she might simply delay because the appointment requires time off work and she's already stressed about money.

The result is clear in cancer statistics: people with high-deductible plans are diagnosed at later stages. Later stage at diagnosis means worse survival rates, which matches exactly what the JAMA study found.

This creates a vicious cycle. High deductibles lead to lower screening rates, which lead to later diagnoses, which require more expensive treatment, which the patient can't afford, leading to worse outcomes. The cheap insurance plan ends up costing more in total medical spending while producing worse health results.

Cancer patients with high-deductible health plans face a 46% increased risk of death compared to those with standard coverage. Estimated data highlights the critical impact of insurance plan choice on survival.

Who's Actually Affected by This Crisis

The people most vulnerable to this insurance problem are those who can least afford it. The JAMA study included demographic data that tells this story clearly.

Lower-income Americans are most likely to choose high-deductible plans because they can't afford the higher premiums of standard plans. They're also disproportionately likely to be diagnosed with cancer at later stages, already a known disparity in American medicine. Combine these factors and you've created a perfect storm: people least able to afford high out-of-pocket costs get the insurance that requires them.

Black Americans and Hispanic Americans have worse cancer survival rates than white Americans, a disparity that starts with access to screening and early detection. High-deductible plans make this worse by adding a financial barrier on top of existing healthcare disparities.

Working-age adults without employer coverage are particularly vulnerable. They're the primary market for ACA plans, exactly the plans that are now becoming high-deductible due to the tax credit expiration. Someone laid off from their job, someone working freelance or gig economy jobs, someone between jobs, faces the brutal choice between unaffordable premiums and unaffordable deductibles.

Parents are especially hit hard. The average family deductible on bronze plans exceeds

The Broader Health Impact: Beyond Cancer

While the JAMA study focused on cancer, the principles apply to other serious conditions. Diabetes management, heart disease treatment, arthritis care, and chronic illness management all require consistent medical engagement. High deductibles undermine that consistency.

People with high-deductible plans skip the preventive care for diabetes (regular monitoring and medications) that prevents complications. They delay heart attack treatment because they're worried about cost. They avoid arthritis medication that maintains function and prevents disability.

What makes cancer unique in the study is that it's both common enough to analyze statistically and immediately life-threatening. You can't just skip cancer treatment. But many people do delay treatment or downgrade to cheaper options, and the study shows that matters.

For other serious conditions, the effects might be less dramatic but equally important. Someone with uncontrolled diabetes might avoid the specialist visit that prevents kidney failure. Someone with heart disease might skip the medication adjustment that prevents a heart attack.

The real health crisis is probably broader than cancer alone, even though the JAMA study quantifies it specifically for cancer patients.

Cancer patients on high-deductible health plans face significantly higher mortality risks compared to those on standard plans, with a 46% higher overall risk and a 34% higher cancer-specific risk.

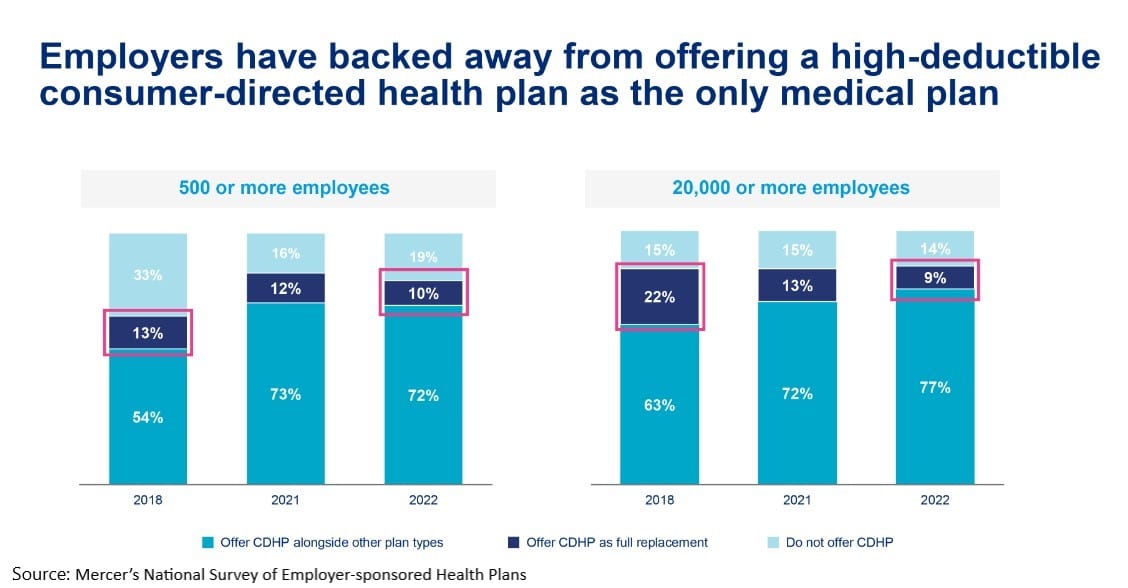

The Insurance Industry Perspective: Why Deductibles Keep Rising

From the insurance industry's perspective, high-deductible plans make perfect sense. They reduce the insurer's financial risk and shift it to patients. The insurer's profit margin is more stable when they're not paying for care directly.

High deductibles also reduce moral hazard, insurance industry jargon for the phenomenon where having insurance makes people use more healthcare. If you pay nothing for a doctor's visit, you might go too often. If you pay the first $7,500, you'll be more selective.

From a pure risk management perspective, insurers prefer this. They'd prefer even higher deductibles. The reason deductibles are "only"

But from a public health perspective, high deductibles are a disaster. They shift cost burden to the moment when people are least able to bear it (when sick), reducing healthcare quality outcomes while appearing to reduce costs on paper.

The insurance industry argues that high-deductible plans with HSAs actually encourage smarter healthcare spending. They point to lower overall utilization as evidence of success. But the JAMA study suggests they should look at outcomes, not just utilization. Using less healthcare that kills you is not success.

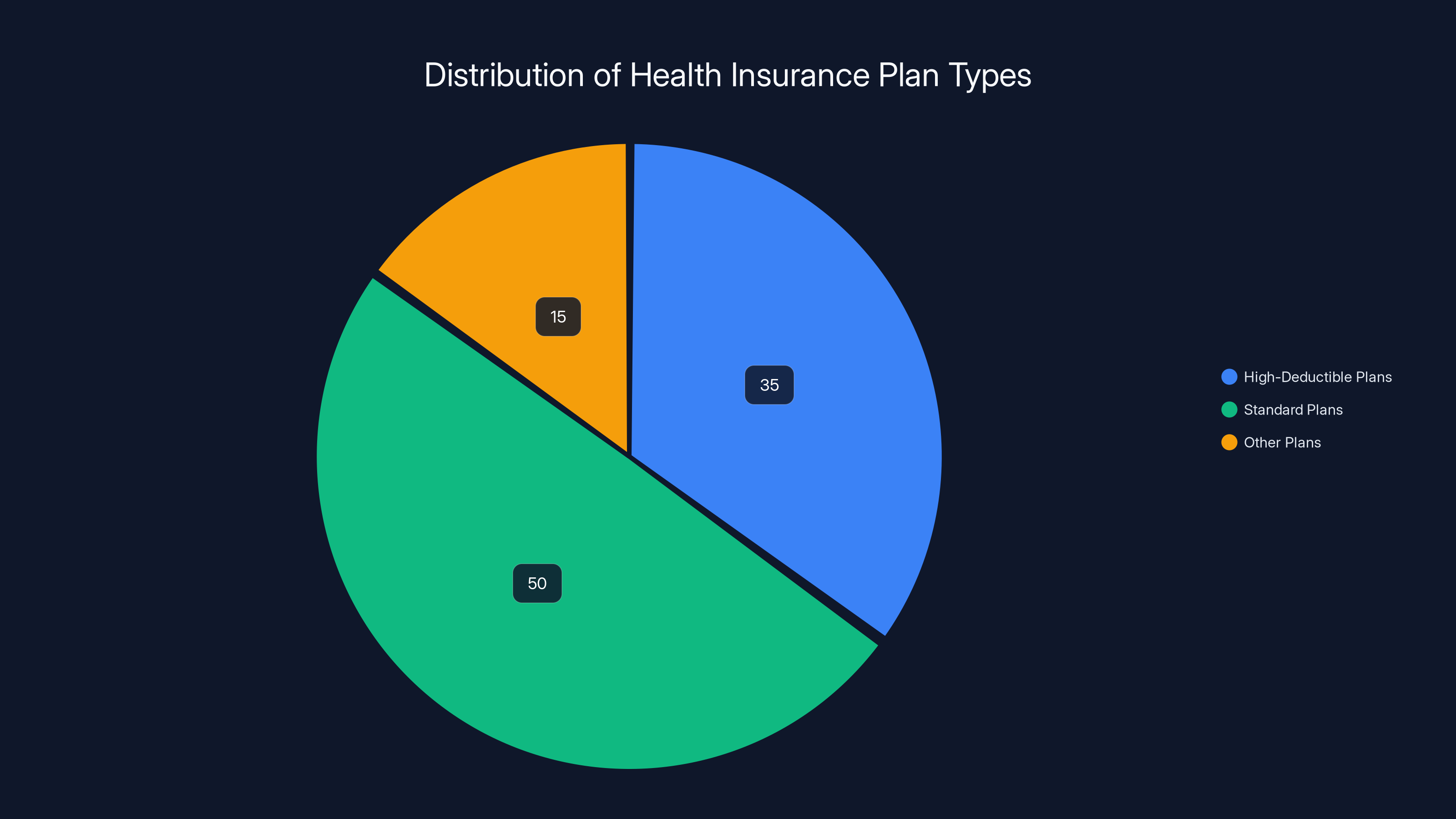

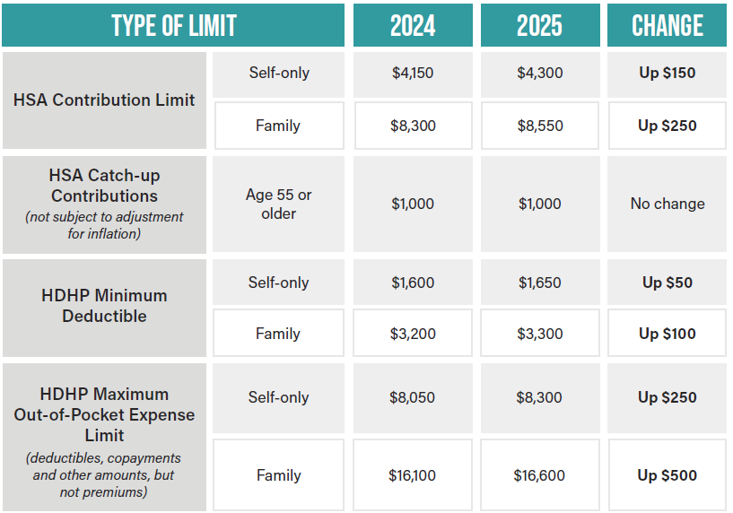

Health Savings Accounts: The Missing Piece

One interesting finding from the JAMA study was that health savings accounts didn't help. HSAs are special accounts where you can save pre-tax money specifically for medical expenses. They're often promoted as the solution to high-deductible plans.

The logic sounds good: you need a high deductible? Here's an account where you can save money to pay it tax-free. It's a clever financial tool. But the study found it made no difference in cancer survival.

Why? Probably because the fundamental problem isn't having savings available. It's that the person is sick and needs care now, and that care costs thousands of dollars. Even if you have an HSA, you might be reluctant to deplete your savings. You might have used it for previous medical expenses. You might need that money for rent and food.

The psychological and practical barriers to care aren't solved by having a savings account. If anything, HSA participation might screen for people with enough financial stability that they have disposable income to save, which is already correlated with better health outcomes for other reasons.

This is an important finding because policy makers often cite HSAs as the solution to high-deductible plans. But that solution doesn't work for cancer patients, and probably doesn't work for other seriously ill patients either.

Policy Solutions and What Could Work

The JAMA researchers concluded by calling for several policy changes. Let's break down what might actually help:

Cap deductibles for seriously ill patients: If you're diagnosed with a condition like cancer, your insurance company could be required to reduce your deductible for the rest of that year. This seems straightforward and would directly address the problem.

Increase ACA subsidies: The expired tax credits were making insurance actually affordable for millions of people. Restoring and expanding those subsidies would mean fewer people are forced into high-deductible plans in the first place.

Require no-cost cancer screenings with real follow-up: Preventive care is theoretically free, but the cost of follow-up procedures still applies. Removing that barrier for serious diagnoses would catch more cancers early.

Create rapid access programs: Similar to emergency rooms, create programs where cancer patients can get immediate care without the deductible barrier, then sort out payment afterward.

Expand Medicaid: People with serious illnesses disproportionately qualify for Medicaid. Expanding Medicaid coverage would remove them from the high-deductible plan problem entirely.

Public option insurance: A government-administered insurance option could offer more reasonable deductibles and cost structure, forcing private insurers to compete on value rather than just lower premiums.

The common thread: these solutions all recognize that high deductibles harm health outcomes and that the financial barrier to care is unacceptable when people are seriously ill.

What Cancer Patients Should Do Right Now

If you're diagnosed with cancer and have a high-deductible plan, here's what you actually need to do:

First: Don't let cost delay treatment. The cost of delayed cancer treatment is always higher than the cost of treatment itself. Get the medical care you need.

Second: Understand your plan completely. Know your deductible, your out-of-pocket maximum, which specialists are covered, which hospitals are in-network. Call your insurance company. Get written confirmation of coverage before procedures.

Third: Ask your oncology team about financial assistance. Most cancer centers have social workers and financial counselors who help patients navigate these issues. They know about patient assistance programs, hospital charity care, and payment plans.

Fourth: Look into pharmaceutical patient assistance programs. Drug companies often provide free medication for uninsured or underinsured patients. If your treatment requires expensive drugs, ask your doctor if the manufacturer offers assistance.

Fifth: Investigate nonprofit organizations. American Cancer Society, Cancer Care, Cancer Support Community, and dozens of other nonprofits help with financial costs of cancer treatment. Many will help with deductibles specifically.

Sixth: If you qualify for Medicaid, apply immediately. Some states have programs specifically for cancer patients. You might be able to switch insurance in the middle of the year.

Seventh: Negotiate bills. Hospital bills are negotiable. If you're facing a large out-of-pocket cost, ask for an itemized bill and negotiate with the hospital's financial department. Many hospitals will reduce bills significantly if you ask.

The Broader System Problem: Why This Keeps Happening

The deeper issue is that American healthcare is built on the assumption that healthcare is a consumer good, something people shop for and price-compare like they would cars or smartphones. This works fine until you need actual healthcare, at which point you have no negotiating power and can't afford to shop around.

High-deductible plans are the logical endpoint of this thinking. If healthcare is a market good, then let patients be price-sensitive. Make them pay for care directly and they'll shop for value.

But cancer isn't a market good. You can't shop for it. You can't decide to get cancer from a cheap provider. You can't negotiate a discount on cancer. The entire market-based framework breaks down immediately when you're seriously ill.

Every other developed nation has rejected this framework. They treat healthcare as a public good, not a market commodity. The results are dramatic: better health outcomes, lower cost per capita, and universal coverage.

The United States has tried to thread the needle, creating a partially public (Medicaid, Medicare), partially private (employer insurance, ACA marketplace) system that pleases neither economics nor ethics. We spend more than any other nation per capita and get worse outcomes than peer nations.

High-deductible plans are just the latest manifestation of a fundamentally broken system. Until we address that system-level problem, we'll keep creating insurance structures that kill people while claiming to save money.

Looking Forward: What 2025 Might Bring

The expiration of ACA tax credits was not inevitable. Congress could extend them immediately if there was political will. But as this article is being written, that doesn't appear likely.

What probably will happen is that more people will enroll in bronze plans, more will skip insurance entirely, and health outcomes will get worse. We'll see healthcare disparities widen. We'll see more late-stage cancer diagnoses. We'll see more preventable deaths.

Eventually, the human cost will become impossible to ignore. Someone high-profile will tell the story of a loved one who died because they couldn't afford cancer treatment on a high-deductible plan, and it will spark a political reckoning.

Or Congress will do the math and realize that paying for ACA subsidies is cheaper than paying for the social costs of millions of uninsured or underinsured people. It's not obvious which scenario is more likely.

In the meantime, the JAMA study is clear: high-deductible plans are dangerous. Not just financially, but medically. They kill cancer patients. And until the policy environment changes, more people will face this impossible situation.

FAQ

What does a high-deductible health plan mean?

A high-deductible health plan (HDHP) is an insurance plan where you pay lower monthly premiums in exchange for higher out-of-pocket costs when you need care. You must pay a large amount out of your own pocket (the deductible) before your insurance company starts covering medical expenses. For example, a plan with a

How do high deductibles affect cancer patients differently?

The JAMA Network Open study found that cancer patients on high-deductible plans face a 46% higher risk of death compared to those on standard plans. This is because cancer requires intensive, ongoing treatment that cancer patients can't afford to delay. High deductibles force cancer patients to make impossible choices between paying for treatment and paying for necessities like rent and food. They delay treatments, skip follow-up appointments, and avoid necessary diagnostics because of cost concerns.

Why is the ACA credit expiration making this worse?

The American Rescue Plan temporarily expanded ACA tax credits that reduced insurance premiums for millions of people. When Congress failed to extend these credits in 2025, premiums more than doubled for many ACA marketplace enrollees. To afford any coverage at all, people are forced to choose high-deductible bronze plans. Early enrollment data shows this is exactly what's happening, meaning millions more people are entering high-deductible plans they can't manage.

What percentage of people actually have high-deductible plans?

According to current data, high-deductible plans cover roughly 30-35% of the insured population in the United States. This number is growing as insurers push these plans and as the ACA subsidy expiration forces people into cheaper bronze plans. For ACA marketplace plans specifically, bronze plans (which are high-deductible) are increasingly popular due to lower monthly premiums.

Do health savings accounts (HSAs) actually help with high deductibles?

The JAMA study found that having an HSA made no difference in cancer survival rates. While HSAs allow you to save pre-tax money for medical expenses, they don't solve the fundamental problem: people often don't have enough savings to cover high deductibles, and having a savings account doesn't reduce the psychological and practical barriers to seeking care when seriously ill. HSAs work only for people who already have disposable income to save.

What should someone do if diagnosed with cancer on a high-deductible plan?

Get care immediately and don't let cost delay treatment. Contact your hospital's financial counseling department, ask your oncology team about patient assistance programs, investigate pharmaceutical company assistance programs if you're on expensive medications, look into nonprofit organizations like American Cancer Society or Cancer Care that help with medical costs, apply for Medicaid if you qualify, and negotiate hospital bills (they're often negotiable). Most important: get the treatment you need and address financing afterward.

Can Congress fix this problem quickly?

Congress could restore ACA tax credits immediately through legislation, which would allow millions of people to afford standard plans instead of being forced into high-deductible plans. They could also cap deductibles for seriously ill patients, expand Medicaid, or create a public option insurance plan. The question is political will, not technical feasibility. All of these solutions have precedent and could be implemented relatively quickly.

What's the difference between a deductible and an out-of-pocket maximum?

A deductible is the amount you must pay before your insurance starts covering costs. An out-of-pocket maximum is the total amount you'll pay in a year, including deductibles, copays, and coinsurance. Once you reach your out-of-pocket maximum, insurance covers 100% of remaining costs for the rest of that year. The out-of-pocket maximum is the real worst-case cost ceiling. For example, a plan might have a

Are bronze ACA plans the same as high-deductible plans?

Bronze ACA plans are designed as high-deductible plans. They're the cheapest tier of ACA marketplace insurance, covering only about 60% of average healthcare costs. Bronze plans are increasingly popular since the ACA tax credit expiration because they have lower monthly premiums, even though they require much higher out-of-pocket costs. If you're shopping on the ACA marketplace, bronze plans are almost always high-deductible plans.

What's the mortality difference between high-deductible and standard plans for cancer patients?

According to the JAMA Network Open study, cancer patients on high-deductible plans have a 46% higher overall risk of death and a 34% higher cancer-specific mortality risk compared to cancer patients on standard plans. To put this in perspective, if a particular cancer has a 70% five-year survival rate with standard insurance, the same cancer might have a survival rate around 65% for patients on high-deductible plans. The difference compounds across the entire population to represent thousands of preventable deaths annually.

Key Takeaways

The research is clear: high-deductible health plans are literally killing cancer patients. The financial barriers to care created by these plans delay treatment, reduce preventive screening, and force impossible choices between medical care and basic necessities.

The problem is getting worse, not better. The expiration of ACA tax credits in 2025 is forcing millions of people into exactly the kinds of high-deductible plans that the JAMA study identified as dangerous. More people with less insurance security entering the exact system structure that harms health outcomes.

This isn't just a healthcare policy debate anymore. It's a public health crisis. The human cost of financial barriers to cancer care is measurable, quantifiable, and growing.

If you're facing a cancer diagnosis on a high-deductible plan, remember: your life is worth more than the cost of treatment. Seek care, ask for help, and address financing afterward. If you're involved in healthcare policy, remember: these aren't just statistics. They represent people who die because they couldn't afford treatment. If you're a voter or citizen, remember: this system is a choice. Other countries have made different choices and get better outcomes. Ours is fixable if there's political will to fix it.

Related Articles

- Apple Acquires Q.AI for $2B: What This Means for AI Competition [2025]

- Artificial Lung Machine Kept Patient Alive 48 Hours Without Lungs [2025]

- Why Costco Is Removing RAM from Display PCs: Retail Theft Crisis [2025]

- Resident Evil Requiem Switch 2 microSD Card: Worth $140? [2025]

- Mark Zuckerberg's AI Social Media Vision: The Future of Meta's Content Strategy [2025]

- Best Android Phones [2026]: Top Picks for Every Budget

![High-Deductible Health Plans and Cancer Mortality: The Hidden Cost [2025]](https://tryrunable.com/blog/high-deductible-health-plans-and-cancer-mortality-the-hidden/image-1-1769729852801.jpg)