Introduction: Reading Between the Earnings Reports

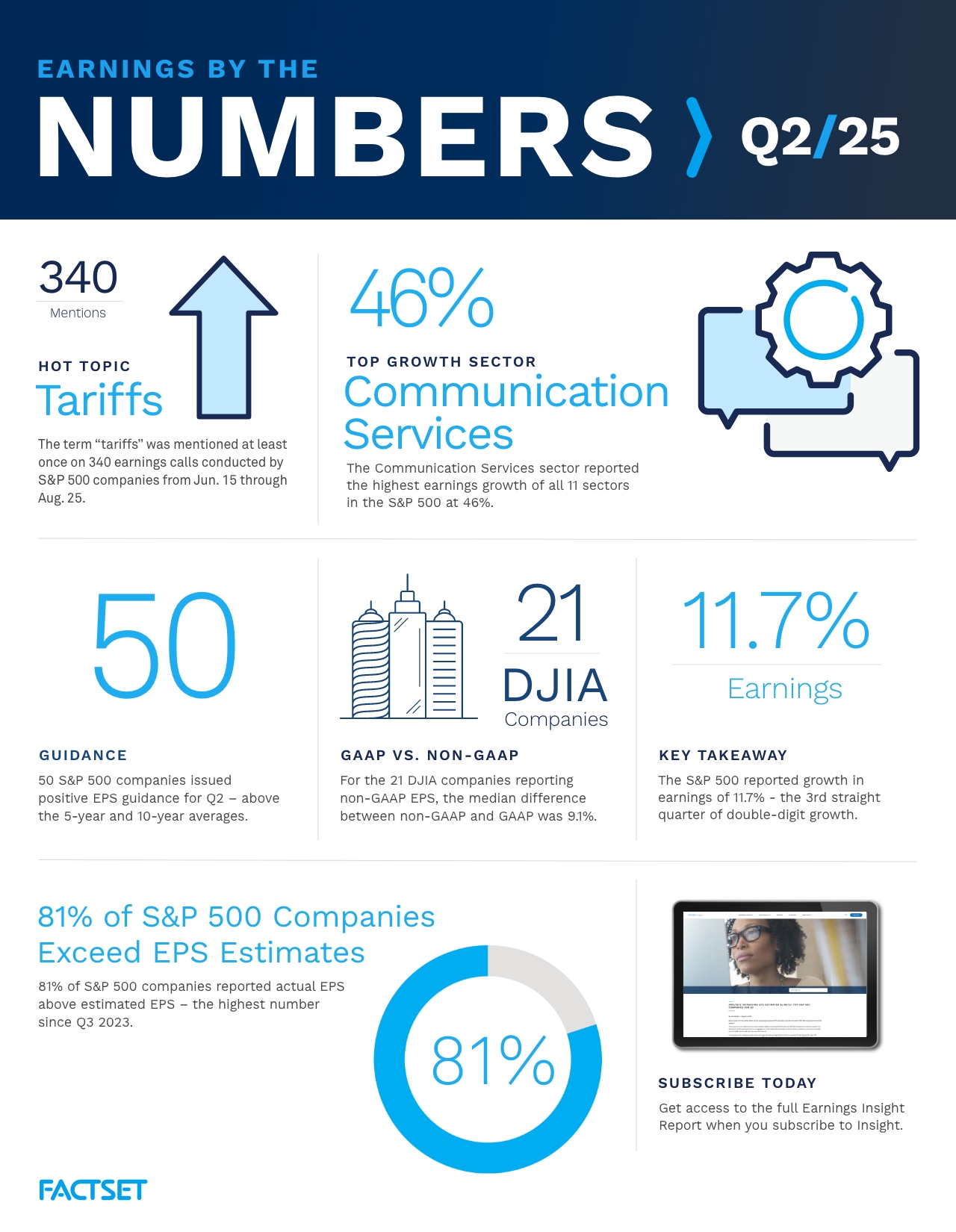

Every quarter, hundreds of public companies report earnings. Most of them are noise. But occasionally, you get a data point that cuts through all the messaging, marketing spin, and aspirational guidance to reveal something true about how buyers actually behave.

This happened recently when two of the most influential research firms in enterprise technology released their latest financial results. These aren't flashy consumer companies chasing viral moments. They're infrastructure plays. They exist in the unglamorous business of selling research, analysis, and strategy consulting to the decision-makers at large organizations. Their customers are C-suite executives, heads of IT, marketing leaders, and purchasing committees at Fortune 500 companies.

When these research firms struggle, it's not because of execution problems or product quality issues. It's because the people buying their services are pulling back. And when enterprise buyers pull back, it ripples across the entire B2B ecosystem.

The numbers tell a stark story. One company saw its stock price collapse roughly 71% from its recent peak. Another reported guidance for the next year that actually projects further revenue decline. Both reported significant workforce reductions. Both are restructuring core business operations. And both are grappling with existential questions about their value proposition in an era of free AI tools.

For anyone building or selling B2B software, services, or solutions, these signals matter more than any analyst report or market forecast. They're direct indicators of where enterprise budgets actually are, what's getting cut, what's getting protected, and what buying committees actually care about right now.

Let's break down what's actually happening, what it means for B2B spending, and where the real opportunities and threats are hiding in plain sight.

TL; DR

- Stock prices collapsed: One research giant down 71% from peak, another trading at 105M market cap** despite $400M revenue

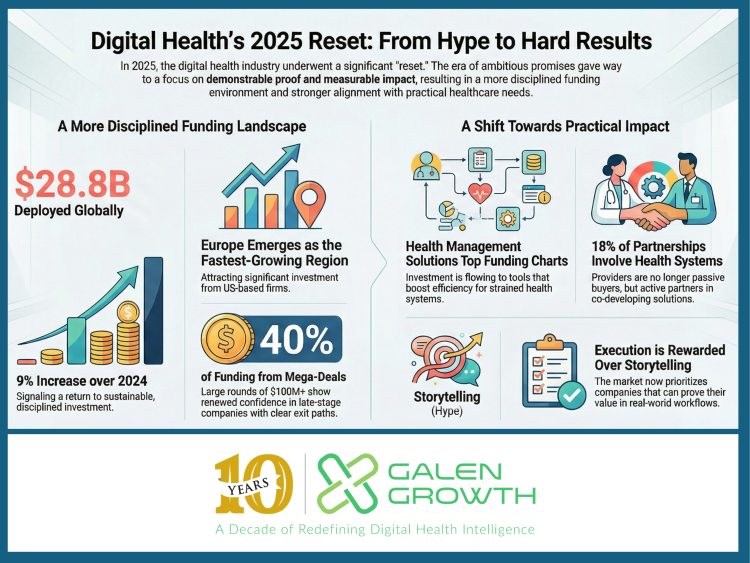

- Guidance turned negative: 2026 projections show further 8-13% revenue declines with no recovery expected

- Consulting revenue crashed: Down 12.8-16% year-over-year as enterprises pause transformation projects

- Buying cycles extended dramatically: Decision timelines stretched with higher approval authority and more stakeholder scrutiny

- AI is compressing existing value: Free tools threaten traditional research subscriptions, forcing repositioning toward proprietary insights

- Events becoming smaller: Multi-day conferences shifting to regional forums; one company saw events revenue drop 29%

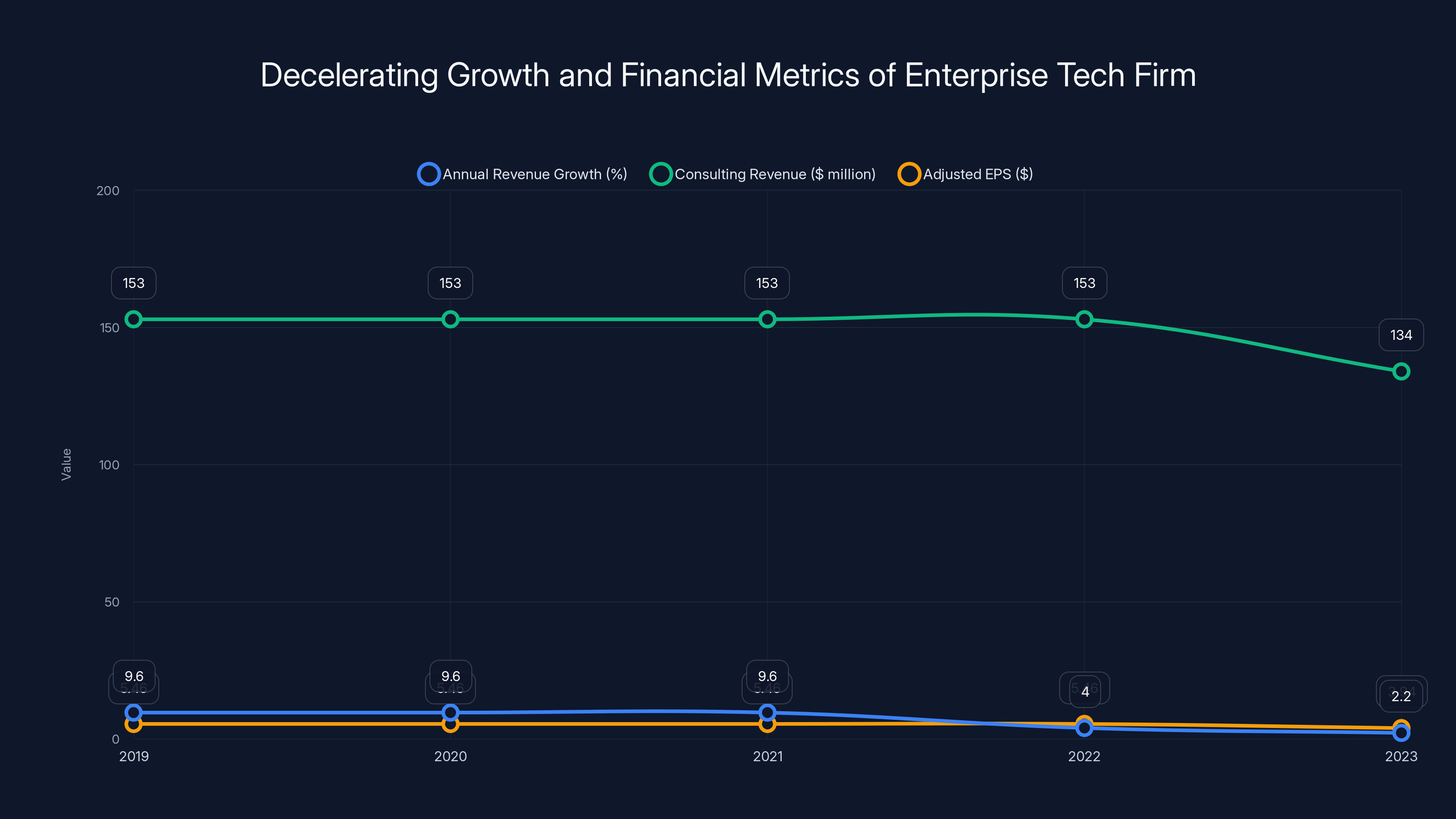

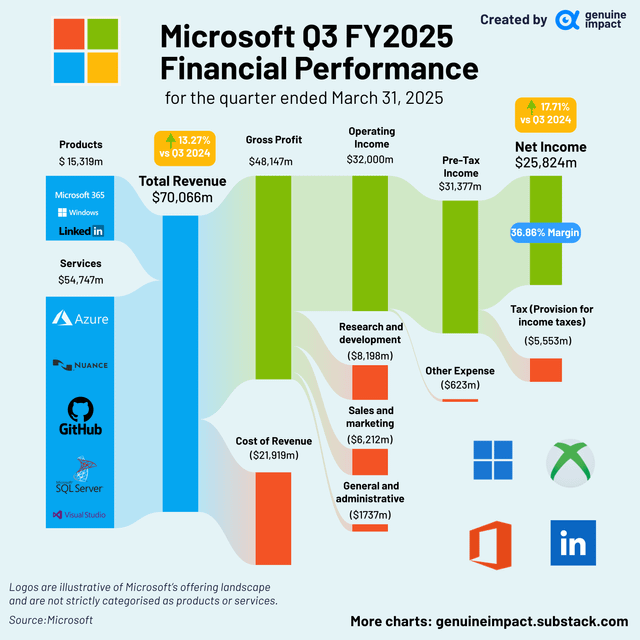

The enterprise tech firm experienced a significant slowdown in revenue growth, a decline in consulting revenue, and a drop in EPS, indicating financial challenges. Estimated data for 2019-2022 based on historical growth rates.

The Raw Numbers: What the Earnings Reports Actually Showed

When you strip away the corporate speak and focus on what actually happened, the data is clear. These aren't subtle declines or natural market fluctuations. These are significant contractions from companies operating in the heart of enterprise technology spending.

The First Giant's Financial Reality

The larger research firm reported full-year revenue of $6.5 billion. That sounds substantial until you examine the growth rate. They delivered just 4% year-over-year growth. This is dramatically slower than their historical average of 9.6% annually over the prior five-year period. More concerning is the trajectory. The growth rate is decelerating, not stabilizing or rebounding.

Drill deeper into the quarters, and you see deceleration getting worse as the year progressed. By Q4, they could only manage 2.2% growth. That's barely above inflation.

The consulting division, which should be growing as companies need strategic help navigating AI and digital transformation, actually contracted. Consulting revenue fell from

Their Global Contract Value, which is a leading indicator of future revenue, grew only 0.8%. Strip out U.S. federal government contracts, and organic growth in their core markets sits at 4%. For context, federal contracts are often countercyclical and don't reflect commercial market health.

Earnings per share tells the efficiency story. They reported adjusted EPS of

The 2026 guidance was particularly telling. The company projected revenue of at least

The Second Giant's More Dramatic Situation

The second research firm reported

Consulting, which represents a significant revenue stream, fell 9% for the full year. In Q4 specifically, consulting declined 16%. The strategic consulting business, which typically commands premium pricing, saw bookings collapse more than 50% in 2025. The company made the strategic decision to exit this business entirely rather than trying to salvage it.

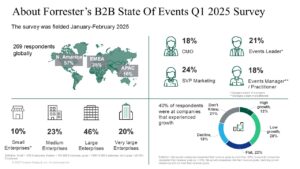

Events revenue dropped 29% for the full year to $13.1 million. This is particularly important because events are direct customer engagement opportunities that drive renewal rates and brand loyalty.

Their contract value metric, which tracks future revenue visibility, fell 6% to $292.4 million. This is among the most concerning signals because it suggests the pipeline for 2026 is already constrained.

The company reported a GAAP net loss of

The stock price tells the story. Trading in the

The company responded with an 8% workforce reduction and a complete restructuring of its business model, moving from multi-day conferences to regional forums.

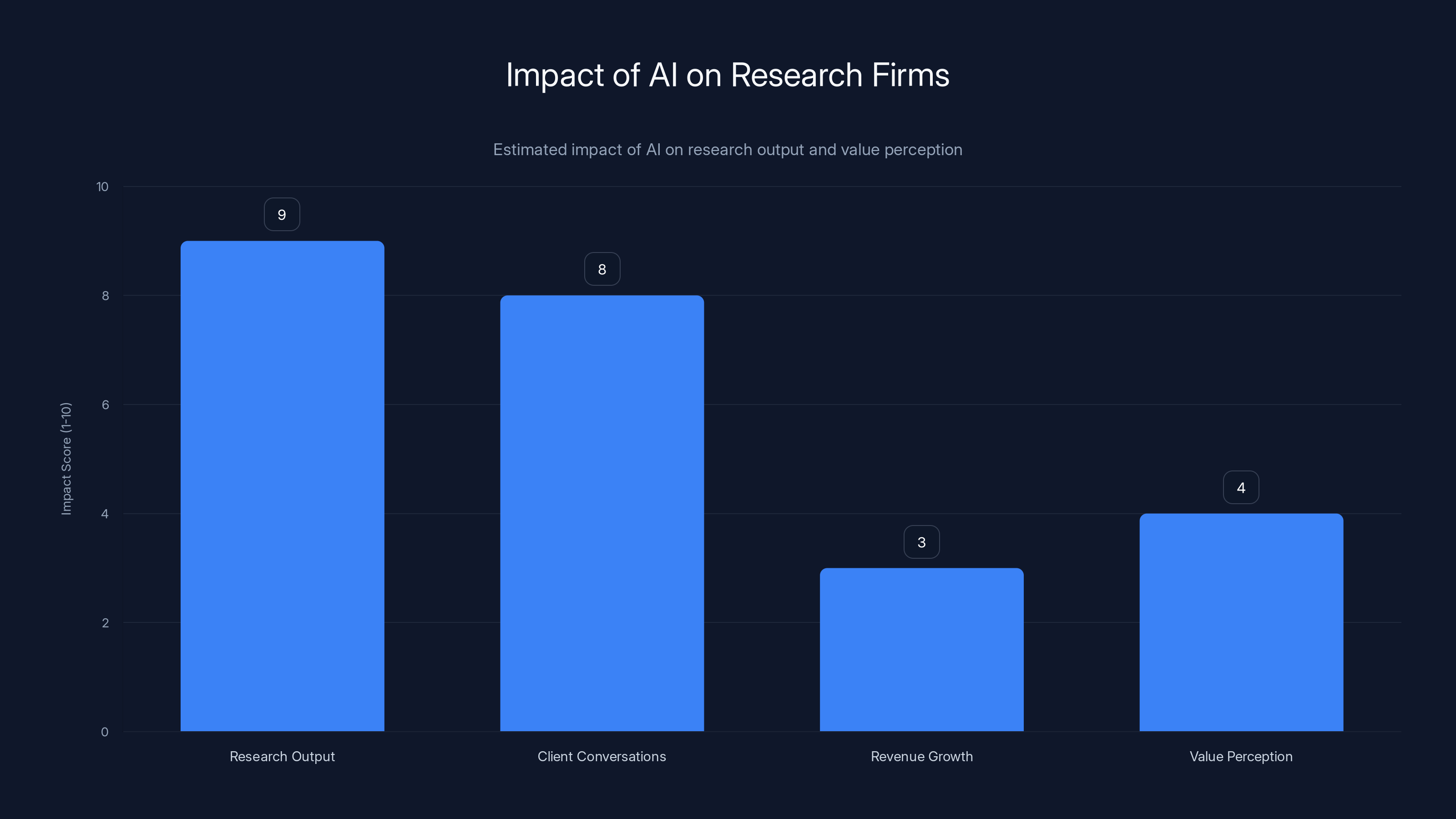

AI significantly boosts research output and client engagement but struggles to translate into revenue growth and perceived value. (Estimated data)

Why These Companies Matter: They're Not Just Research Firms

Most people look at these earnings reports and think, "Okay, these are research companies. Maybe less demand for research right now." That misses the actual insight. These firms are far more important as proxies for enterprise spending than as individual companies.

They Sell Directly Into Corporate Budgets

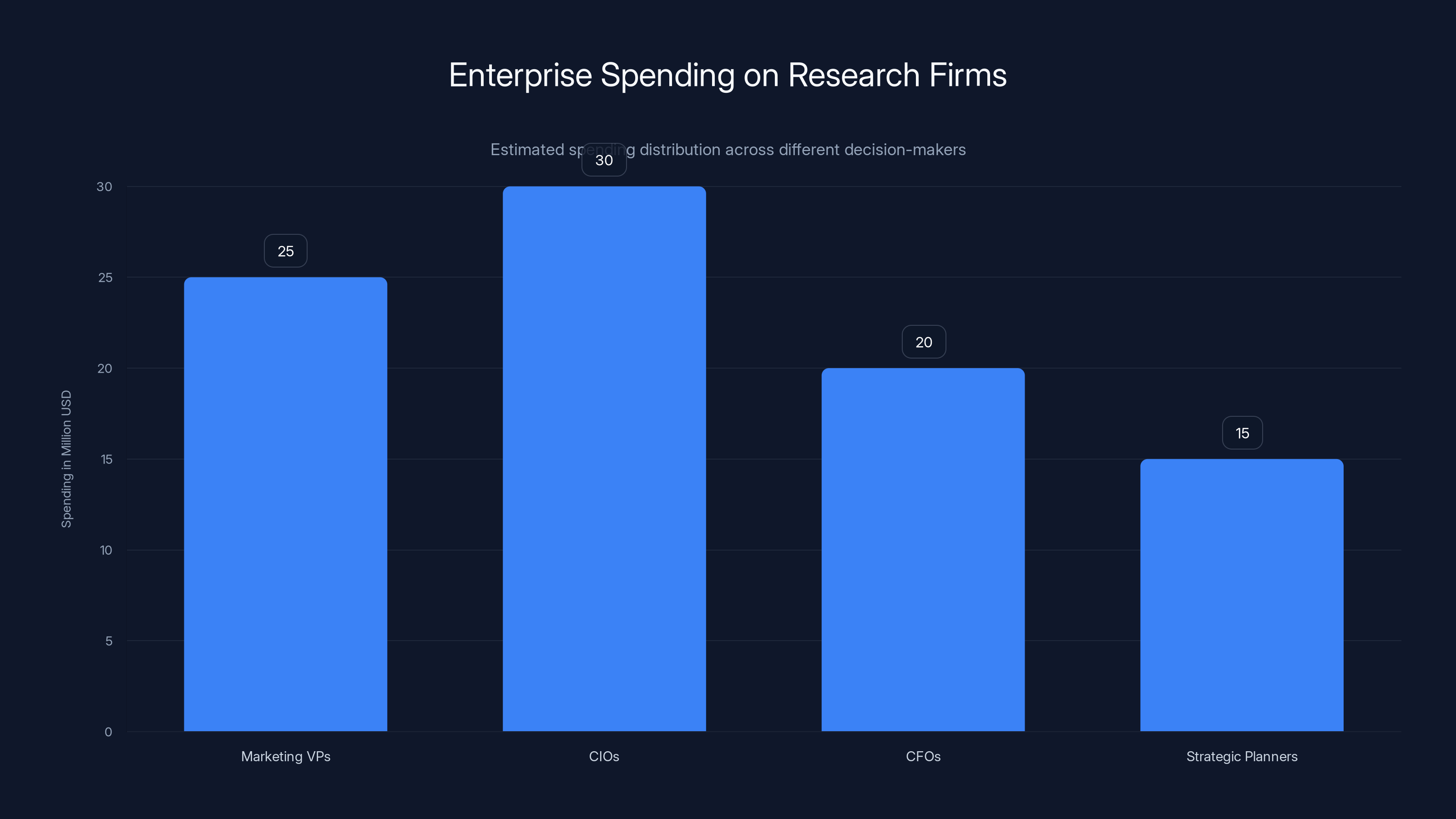

Gartner and Forrester don't sell to consumers or small businesses. Their customers are the same people making major technology purchasing decisions at enterprises. They're VPs of marketing buying research to inform their martech stack decisions. They're CIOs purchasing analyst reports on infrastructure vendors. They're CFOs evaluating whether to hire consultants for operational transformation. They're heads of strategic planning contracting for market analysis and competitive intelligence.

When these decision-makers have budgets and confidence, they spend on research. It's not essential—nobody dies if they don't buy research—but it's part of how large organizations operate. It's the infrastructure that supports intelligent decision-making.

When these same decision-makers get squeezed on budget, when their CFO tells them to cut discretionary spend, or when they decide to pause new initiatives, research and analysis are among the first things that get cut. They're not stopping cloud migration or network infrastructure because those are operational necessities. But they might pause a transformation project, and if they pause a transformation project, they don't need consulting and strategy research.

They're Highly Dependent on Multi-Year Contracts

These firms operate on contract value models. Customers sign multi-year agreements. Annual contract value expands as customers add seats and products. The Global Contract Value number matters because it's future revenue already committed. When that metric flatlines or declines, it signals customers are not renewing or are renewing at lower dollar amounts.

Both companies reported contract value growth in the 0-6% range. For firms with pricing power and market dominance, this is weak. It suggests pricing power is limited. Customers are negotiating harder. Some customers are not renewing.

They Operate in a Highly Discretionary Spending Category

Unlike essential software or infrastructure, research subscriptions and consulting can be deferred. If a company needs to manage cash, they can cancel their analyst subscription for 6 months. They can stop hiring external consultants. They can pause their annual user conference.

The fact that both companies are seeing significant contraction means enterprises are actively choosing to defer these investments. It's not a supply constraint or a competitive loss. It's discretionary spend being cut.

Extended Buying Cycles: The New Reality

During earnings calls, leadership explicitly described what's happening in their customer base. The themes are remarkably consistent with what sales leaders across B2B companies report.

Deal Approval Authority Has Shifted Upward

In previous market cycles, a director could approve a research subscription or a consulting engagement. Maybe a VP could approve it without needing sign-off from their boss. That's changed. Now, purchases that would have been routine are getting escalated. A $100,000 consulting project now needs C-suite approval. A renewal that was automatic now requires justification.

This creates friction in the sales process. It's not that the customer doesn't want the product or service. It's that the approval structure has changed. More stakeholders need to agree. Each stakeholder has their own concerns and timelines.

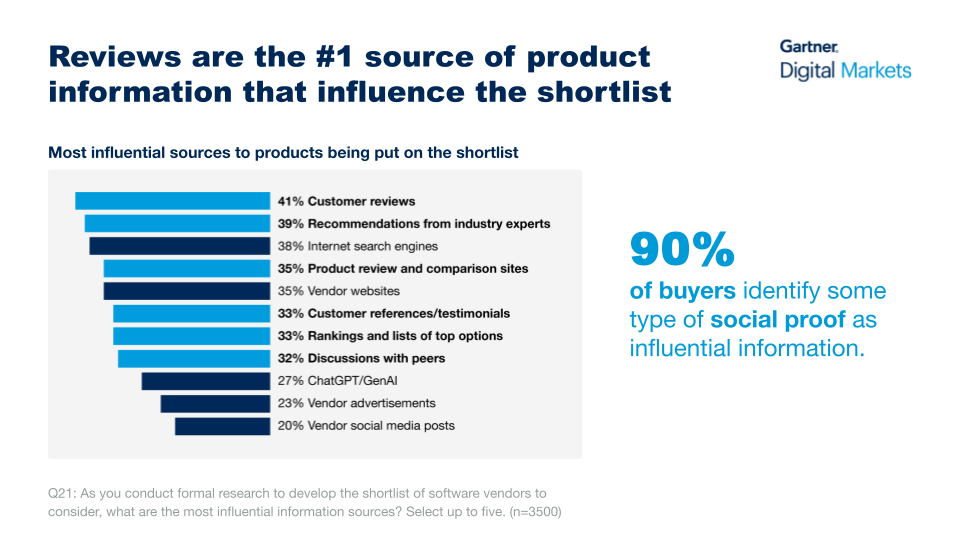

Scrutiny on ROI Is Intensive

Customers are asking harder questions about what they'll actually get from purchasing research or consulting. They want to see how the investment connects to business outcomes. They want case studies and proof points. They want to understand what will change if they buy versus if they don't.

For firms selling research and analysis, this is actually a difficult position. How do you quantify the value of better strategic decisions? How do you prove that decision X was better because you had research backing it? Some of the value is inherently subjective and long-term.

But enterprises aren't accepting that anymore. They want concrete outcomes.

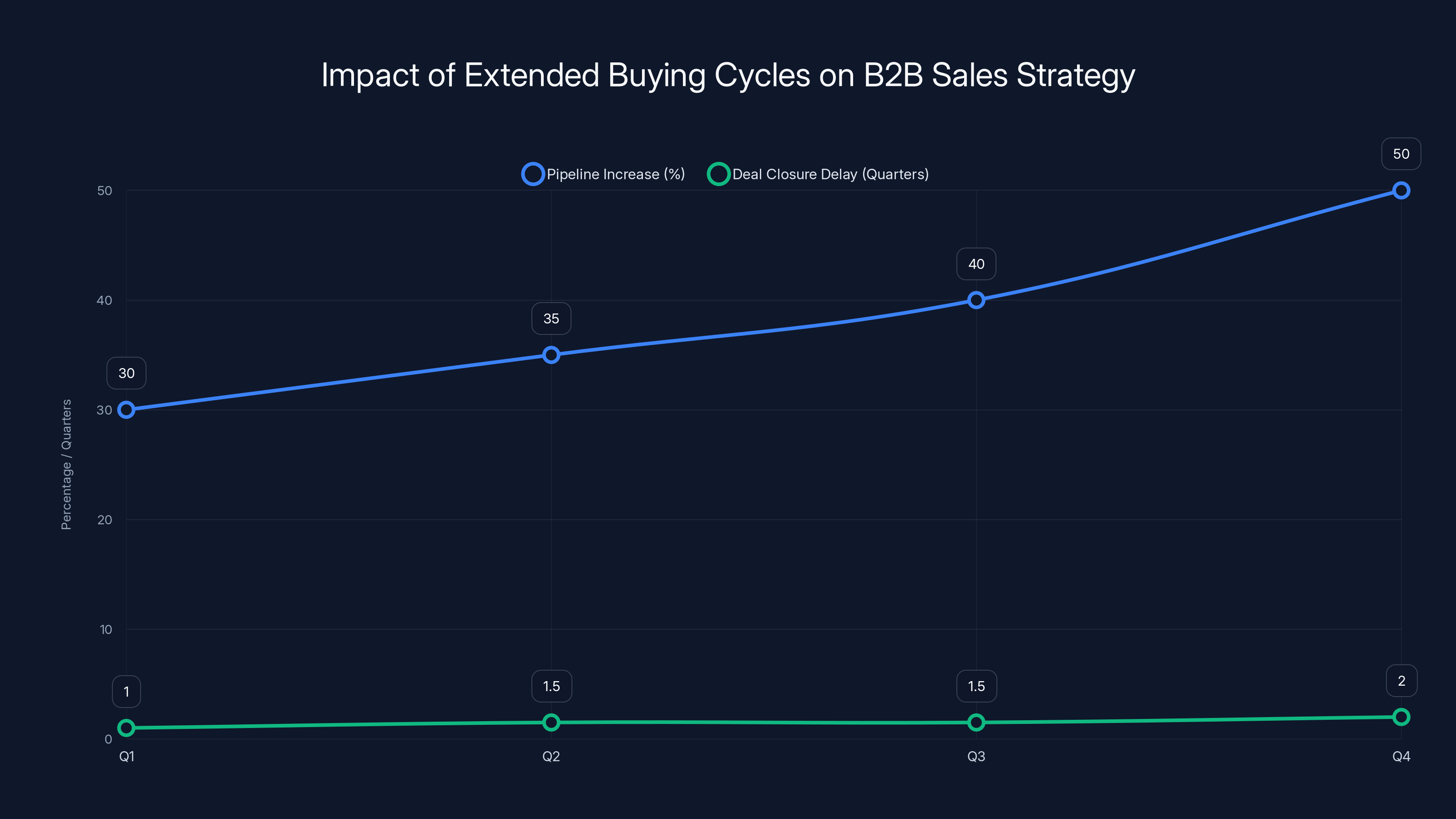

Timeline Stretching Is Systemic

Instead of contracts being signed in 30-60 days, they're stretching to 90-120 days. Some prospects that looked close early in the year aren't closing until late in the year, if at all. This compresses revenue recognition into fewer months, making forecasting harder.

Many B2B sales leaders report similar dynamics. A deal that used to close in Q1 is now closing in Q2. A Q2 deal is now Q3. The prospects haven't disappeared. The desire hasn't disappeared. But the timeline has stretched.

When timelines stretch, what often happens is that priority drops. Something more urgent comes along. Budget gets reallocated. The deal that seemed certain gets questioned again. By the time the extended timeline ends, it's not certain anymore.

Customers Are Actively Deferring Spending

Both firms highlighted that customers are "slowing and deferring everything possible." This isn't just about extended cycles. It's about active decisions to pause discretionary spending.

A company might say, "We're not canceling our contract, but we're not expanding it right now. We're going to pause that new consulting project until next year. We're not taking on new initiatives."

For founders and sales leaders, this is the critical insight. It's not that customers don't have budget. Most enterprises with any size do. It's that they're being very conservative about how they deploy that budget.

Extended buying cycles require a 30-50% increase in sales pipeline and expect deal closures to be delayed by 1-2 quarters. Estimated data.

Consulting Collapse: What It Reveals About Strategic Initiatives

If you want a signal about how risk-averse enterprises have become, look at the consulting numbers. Both firms reported significant consulting declines.

Transformation Projects Are Paused

When companies hire consulting firms, they're typically doing one of a few things. They're executing a major technology migration. They're reorganizing go-to-market strategy. They're transforming a business process. They're evaluating make-versus-buy for a major system. These are all strategic, expensive, multi-month or multi-quarter projects.

When consulting demand falls off, it signals that these projects are being paused. Companies are saying, "We have enough on our plate executing what we already committed to. We're not starting anything new until we finish what's in progress."

This creates a multiplier effect. The consulting firm doesn't get the revenue. But the software vendor that would have been selected as part of the consulting engagement also doesn't get the deal. The systems integrator doesn't get the work. Everyone downstream is affected.

Strategy Work Is Getting Deferred

One firm explicitly noted that strategic consulting bookings fell over 50% in 2025. They responded by sunsetting their entire strategy consulting practice. This is a strategic decision that they can't sustain that business profitably when bookings are halved.

When strategy consulting is cut, it usually means companies are in execution mode. They're not asking, "Should we enter this market?" They're not asking, "Should we reorganize our go-to-market?" They're asking, "How do we make our current strategy work with current resources?"

For B2B SaaS companies, this means enterprises are very focused on optimizing their current technology stack before buying anything new. They're trying to get more value from what they already have. They're not looking for transformational solutions. They're looking for optimizations and improvements to current systems.

The AI Paradox: Opportunity and Threat Simultaneously

Both firms are acutely aware that artificial intelligence is simultaneously creating massive demand for insights and threatening their core business model.

AI Exploded Their Research Output

One firm noted producing over 6,000 AI-related research documents and conducting more than 200,000 client conversations about AI in a single year. The demand for AI-related research is real and significant. Executives want to understand implications. They want benchmarks. They want use cases. They want implementation frameworks.

The research firms responded by rapidly building out AI research capabilities. They're producing guides on AI implementation, comparative analysis of AI vendors, best practices for responsible AI deployment. They're hosting webinars and conferences focused on AI. They're consulting with clients on AI strategy.

But here's the problem: this massive output doesn't necessarily translate to revenue growth.

Free Tools Are Compressing Their Value

Enterprise buyers now have access to advanced AI chatbots, code generators, and research tools for free or at very low cost. If you want to understand how to use AI, you can ask a free chatbot. You can prompt it to write implementation frameworks. You can get it to generate use cases. You don't need a research subscription for that.

This creates a fundamental value compression problem. The research firm's core value proposition was, "We have proprietary research that you can't get anywhere else." But AI tools are democratizing research. They're making it available to everyone.

One firm's leadership responded to this by arguing that their real value isn't the research documents themselves. It's the ability to talk to the people who created the research. It's their proprietary data and original analysis. It's the human expertise behind the research.

That might be true, but the market doesn't seem to be buying it yet. The stock prices suggest investors aren't convinced that proprietary research services can maintain pricing power against AI-enabled alternatives.

They're Building AI-Native Products

Both firms are launching AI-powered products and capabilities. One launched a self-service AI offering in mid-2025 that generated over $5 million in bookings within a few months and reportedly shortened sales cycles by nearly 50%.

This is significant because it shows that buyers do want AI-enhanced research products. The firm that deployed this faster and more effectively appears to be gaining traction with it.

But the challenge is clear: AI-native products have lower barriers to entry. The pricing power is lower than traditional research subscriptions. The margins are potentially lower. You have to do significantly more volume to make up for lower price points per customer.

Contract Value growth outpaces revenue growth, indicating future revenue potential despite current slower revenue increases. Estimated data based on typical industry trends.

Events Are Becoming Experiences, Not Just Gatherings

Both firms operate major conference events. Both saw significant challenges with their events business. One firm saw Q4 events revenue grow 13.9%, but this was driven by pricing and premium offerings, not attendance growth. The other firm saw events revenue decline 29%.

Multi-Day Conferences Are Becoming Unaffordable

For an enterprise attendee, a three-day conference requires time away from the office, travel costs, hotel accommodations, and the cost of the conference itself. When budgets get tight, this becomes hard to justify.

One firm is restructuring from multi-day conferences to regional forums. These are smaller, more targeted, lower-cost events. They're betting that they can maintain brand presence and customer engagement with more frequent, smaller events rather than one or two massive annual conferences.

This makes sense from a customer economics perspective. But it changes the business model. A series of regional forums generates different revenue than a multi-day megaconference.

In-Person Meetings Maintain Surprising Value

Despite all the concerns about travel and budgets, in-person events remain valuable. One firm actually highlighted conferences as a bright spot. The reason is simple: enterprises still value personal relationships. They want to meet customers. They want face-to-face conversations. They want the informal networking that happens at conferences.

For B2B companies, this is important. Even as everything goes digital and remote, there's still value in periodic in-person engagement. Events might look different, but they're not going away.

Virtual Won't Fully Replace Physical

During the pandemic, both firms experimented heavily with virtual events. They learned that virtual events have lower engagement and lower customer satisfaction. The one firm that kept its events business as a growth driver maintained it by focusing on premium in-person experiences.

The lesson: you can't just move an in-person conference online and expect it to work. Virtual events have their own economics and value proposition. If you're going to do them, they need to be designed as virtual experiences, not online versions of physical conferences.

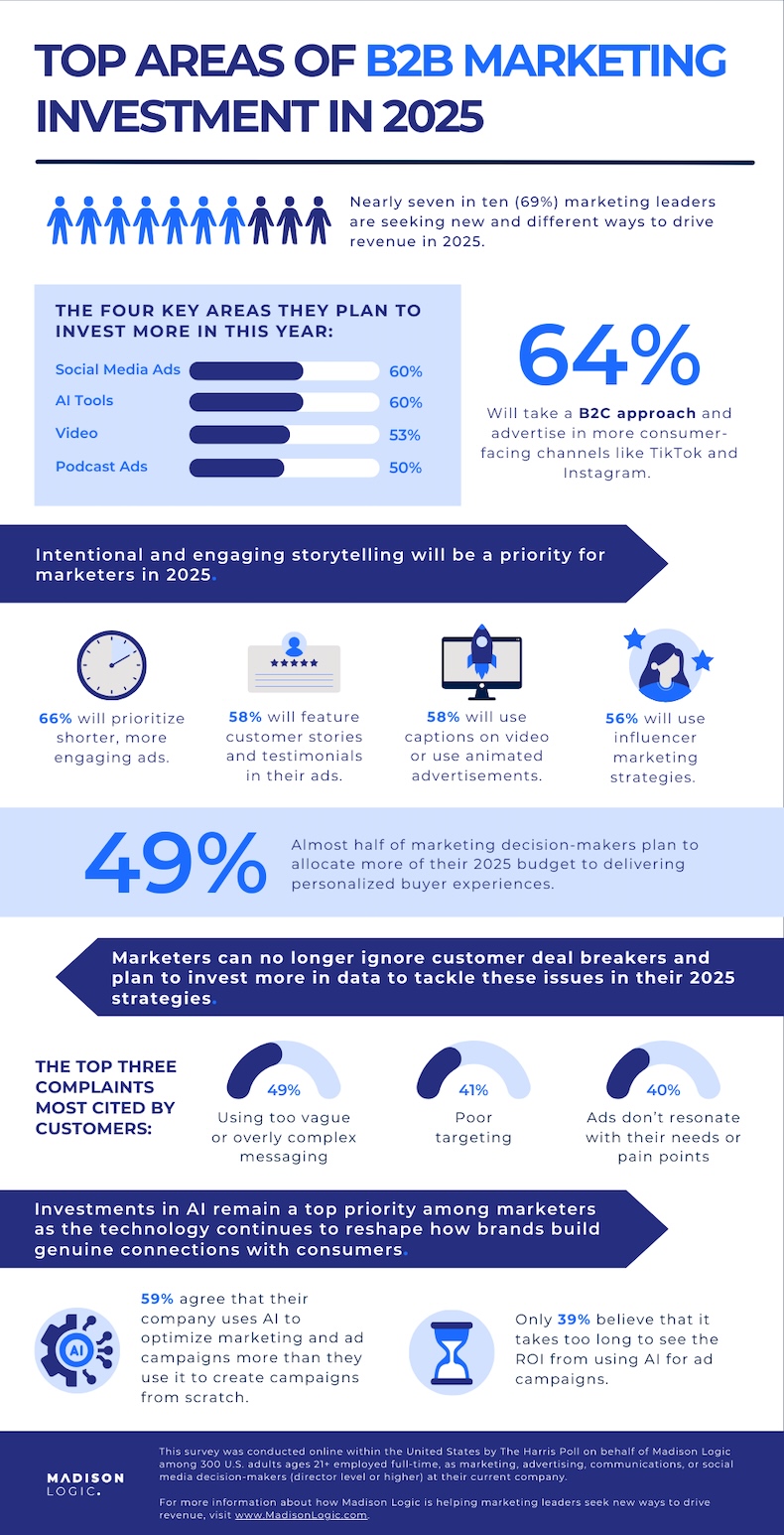

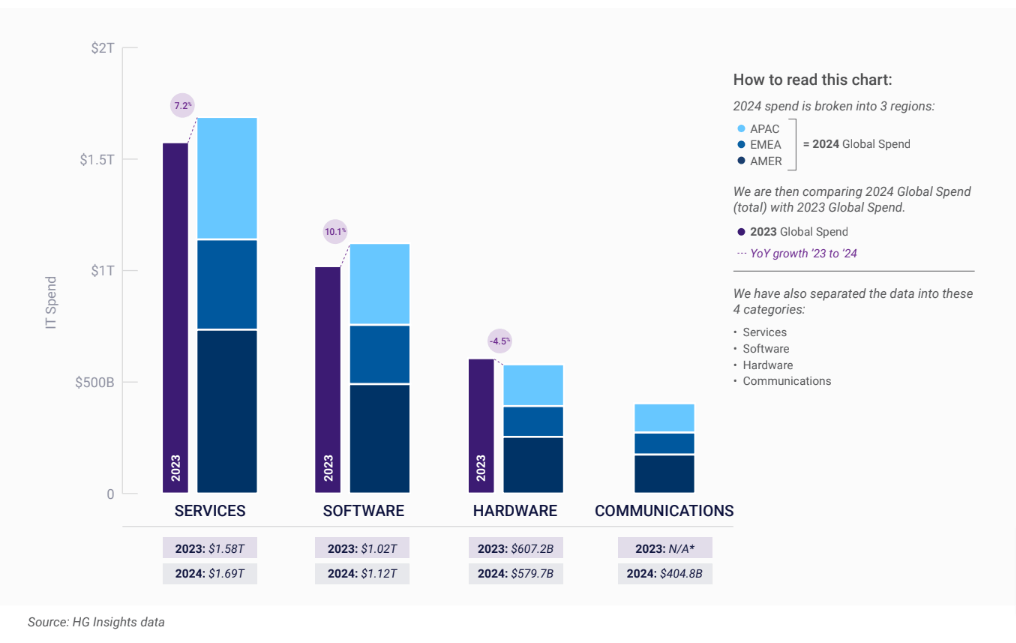

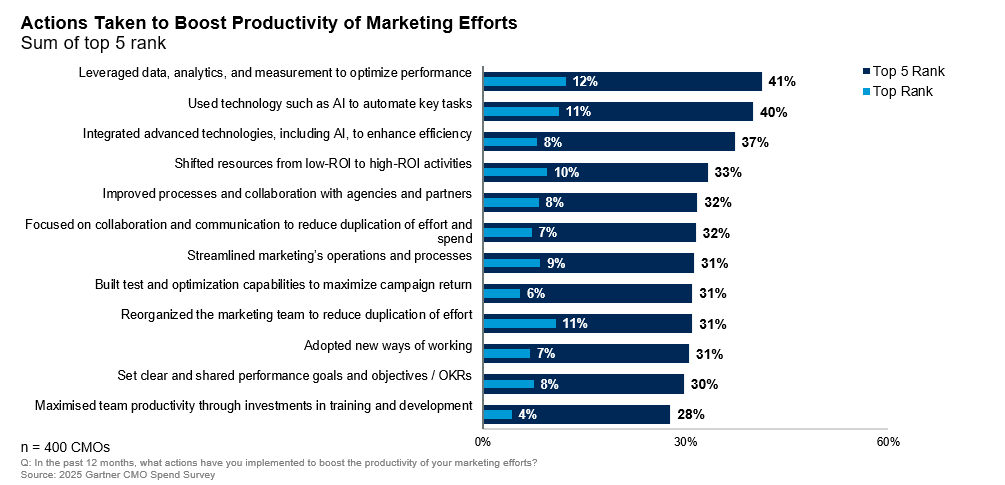

What This Means for B2B Sales and Marketing Spending

Research firms sell to the same budget holders who make decisions about marketing technology, sales enablement, and business intelligence tools. When research firm revenue declines, it often signals broader constraints on B2B technology spending.

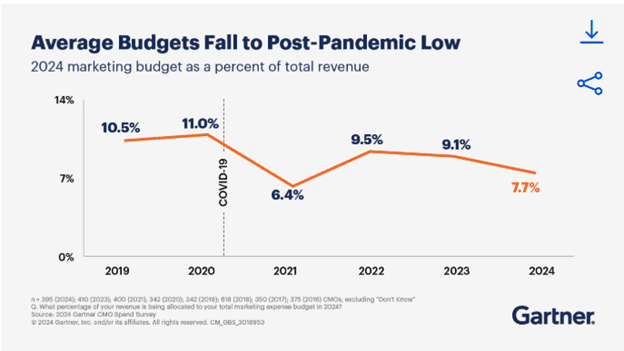

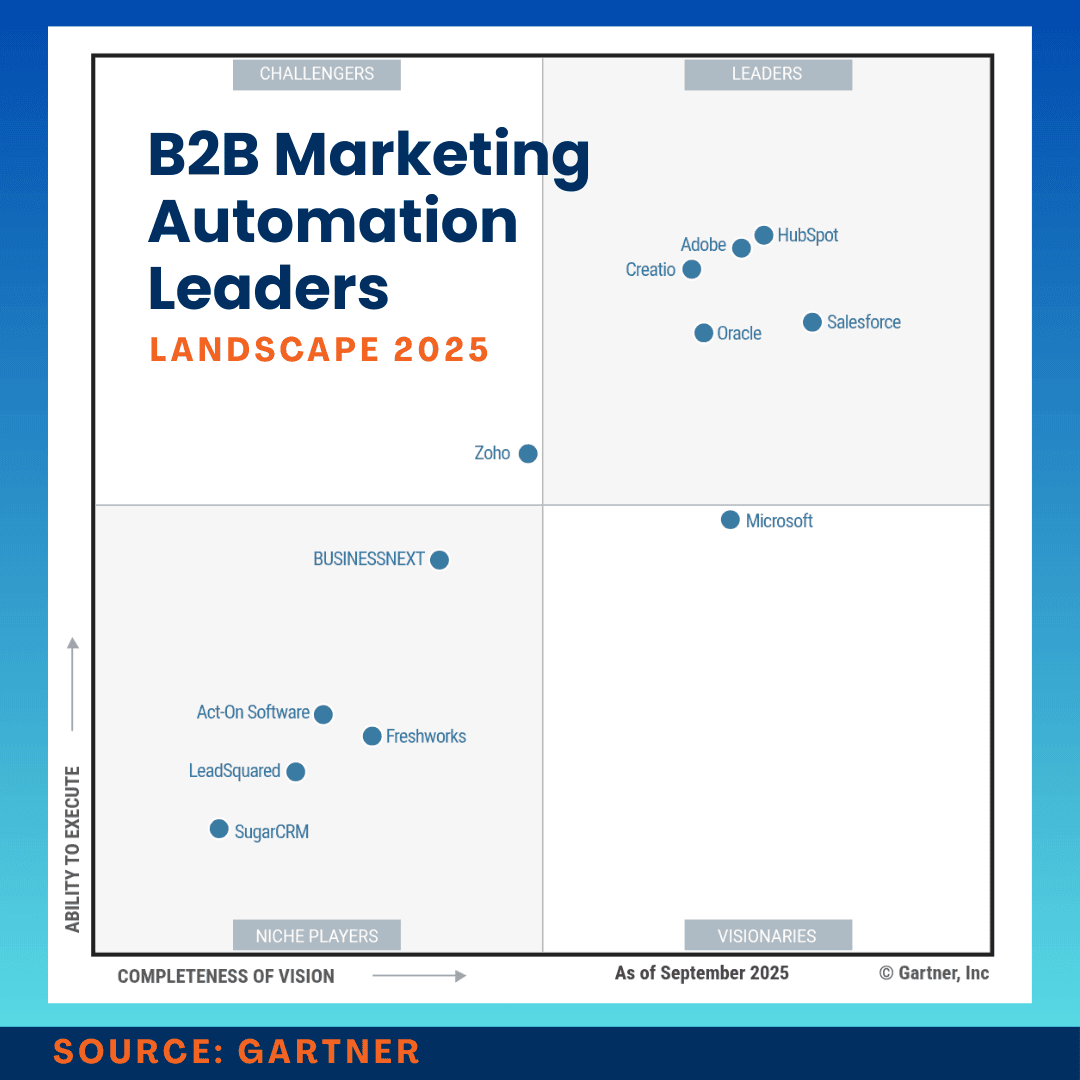

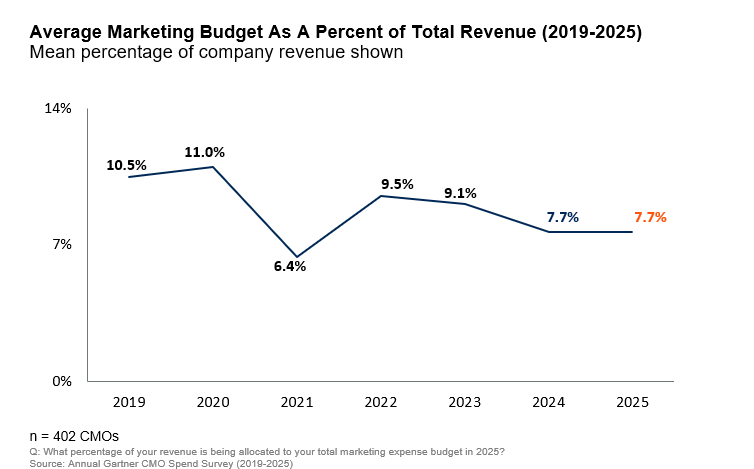

Martech Budgets Are Flattening

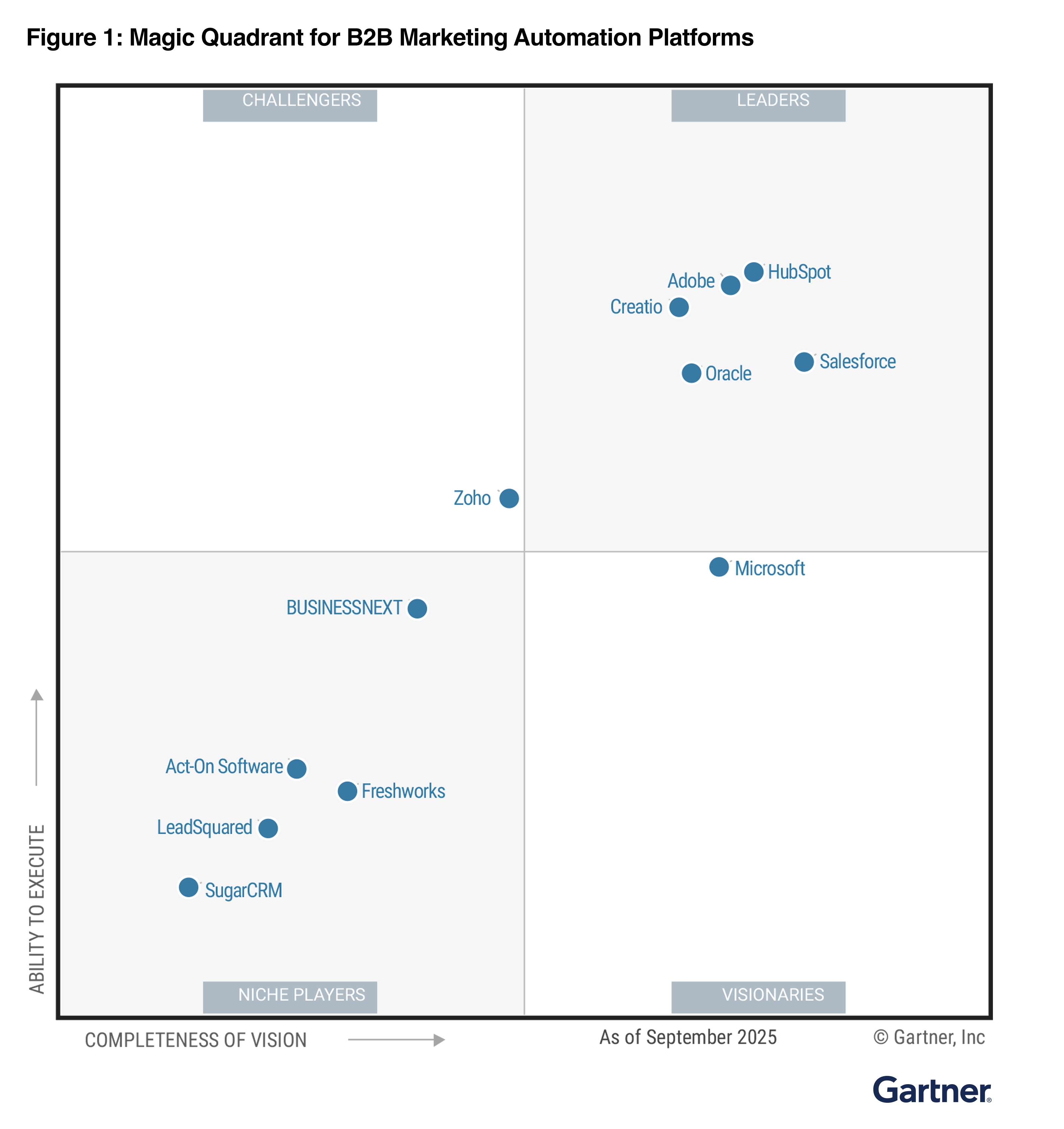

Marketing departments are doing more with existing technology stacks. They're not rushing to buy the latest AI-powered email platform. They're not replacing their marketing automation system because a new competitor showed up. They're optimizing what they have.

This means marketing technology vendors are facing harder sales cycles. Proof points are more important. ROI requirements are stricter. Competitive displacement is harder.

Sales Productivity Tools Are Defensive

Sales organizations are buying tools that help them do more with less. They're not as interested in flashy new platforms. They want practical tools that improve productivity, reduce friction, or help with forecasting and pipeline management.

Tools that help existing sales processes work better are getting bought. Tools that require significant change management and retraining are getting deferred.

Data and Analytics Are Prioritized Over Novelty

Enterprises want to understand what's working in their current systems. They want dashboards and analytics that help them make decisions. They want tools that integrate with what they already have rather than replacing it.

This favors analytics platforms, data integration tools, and business intelligence solutions over entirely new category creation.

Estimated data shows CIOs lead in spending on research, reflecting their critical role in technology decisions. Estimated data.

The Contract Value Metric: Your Leading Indicator

One number matters more than any other for predicting future enterprise technology spending: Global Contract Value (CV).

Why CV Matters More Than Revenue

Revenue can be manipulated through timing, one-time deals, and accounting policies. Contract Value is forward-looking. It's the committed, recurring revenue that's already been signed and will be recognized in future periods.

When CV grows but revenue grows slower, it means good things are coming but there's a timing lag. When CV declines, even if revenue is still growing, it signals trouble ahead.

Both research firms reported CV growth in the 0-6% range. That's anemic. For firms with dominant market positions and pricing power, this suggests that customer loyalty is declining or customer budgets are being reduced.

What Flat CV Tells You

When contract value barely grows year-over-year, it means:

- Customers are not expanding. They're not buying more products or adding more users.

- Price increases are small or customers are negotiating them down.

- Churn might be increasing. Customers leaving offset new customer acquisition.

- Customers are consolidating vendors. They're choosing one firm's solution over another rather than buying multiple solutions.

All of these point to a constrained market.

Organic Growth Within CV

One firm stripped out U.S. federal government contracts from CV to show organic commercial growth of 4%. This is important because federal contracts are often countercyclical and don't reflect commercial market dynamics.

Organic commercial growth of 4% for a market leader in a growing category (AI-related research is growing!) is weak. It suggests that even with significant tailwinds, the firm is struggling to grow with existing customers.

What Happens When Discretionary Spending Tightens: Cascading Effects

When large research firms report declining revenue, it's not just their problem. It cascades through the entire B2B technology ecosystem.

Consulting Firms Feel It First

When research demand drops, consulting demand drops shortly after. Companies pull back on transformation projects. When consulting demand drops, hardware and software vendors feel it because large consulting projects often include significant technology purchases.

A consulting firm might recommend a new CRM system as part of a sales transformation project. Without the transformation project, there's no CRM purchase. The software vendor loses a deal.

Marketing and Training Programs Shrink

When companies aren't doing transformation projects, they reduce spending on training and enablement. They don't send as many people to conferences. They don't buy as many online learning subscriptions. They don't hire external trainers to teach their teams new systems.

Training and enablement vendors see demand decline.

Vendor Consolidation Accelerates

When budgets tighten, companies rationalize their vendor base. They choose one email platform instead of maintaining two. They pick one analytics tool instead of multiple point solutions. They negotiate harder with vendors to justify each relationship.

This benefits large, established vendors with dominant market positions. It hurts newer or specialized vendors.

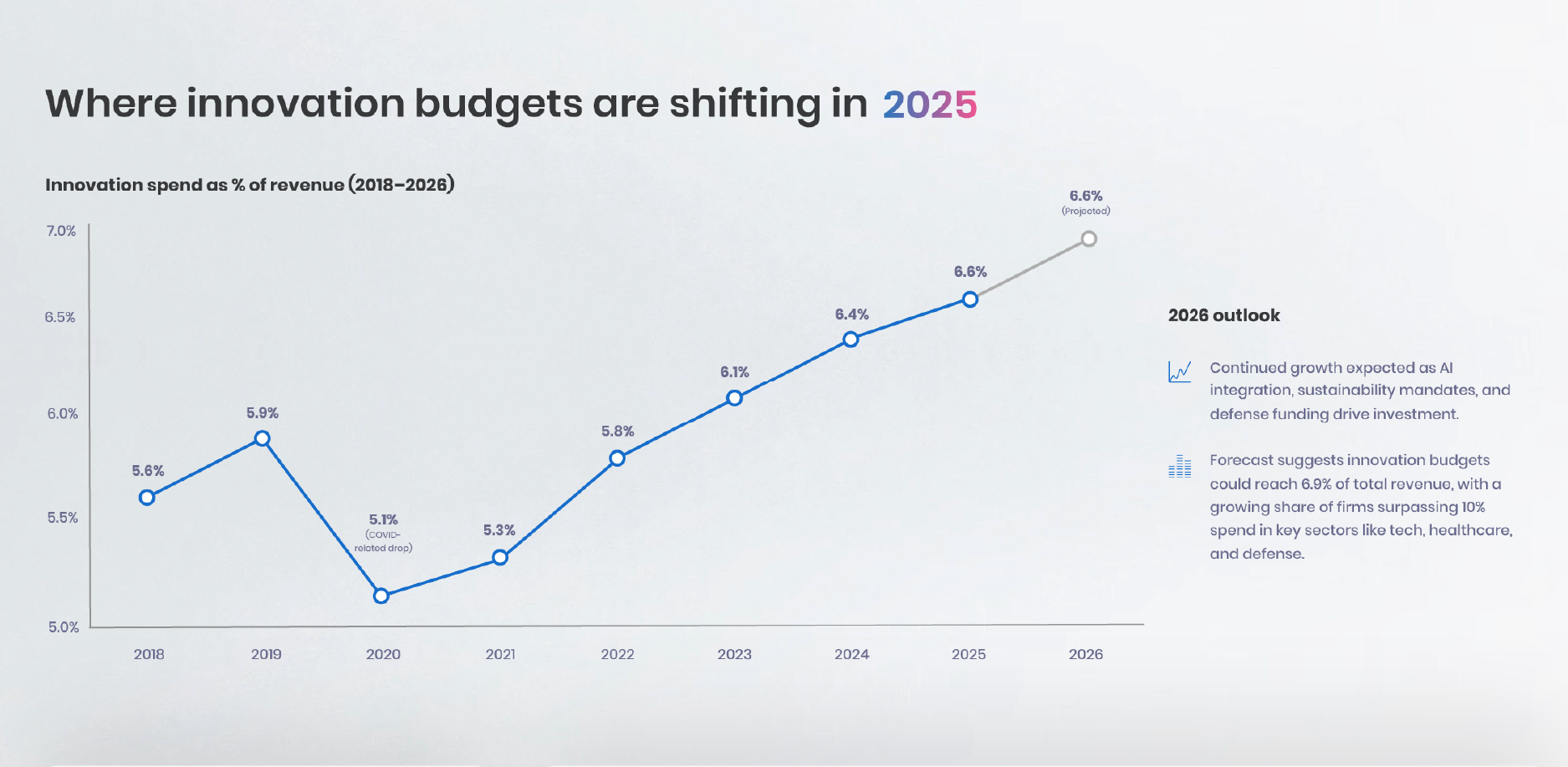

Innovation Investment Slows

Companies reduce R&D spending. They delay product launches. They cut headcount in engineering and product teams. This leads to a slowdown in innovation across the industry.

When research firms are cutting back, it's partly because their customers are investing less in understanding market trends and emerging technologies. That usually precedes a general slowdown in R&D investment across industries.

B2B leaders face significant challenges, with ROI conversations being crucial (Impact Score: 9). Estimated data based on industry trends.

What Buyers Actually Want Right Now

Given the spending constraints and changing dynamics, what are enterprises actually prioritizing?

Operational Efficiency and Cost Reduction

Companies want tools that help them do more with less. They want automation that reduces headcount. They want insights that help them eliminate waste. They want anything that moves the needle on efficiency metrics.

A tool that saves time or reduces the need for headcount has a much easier sales cycle than a tool that opens up new opportunities.

Faster Time to Value

Enterprises don't want to spend six months implementing a system. They want solutions they can deploy and see value from quickly. They want solutions that work with their existing systems rather than requiring integration projects.

The shorter the implementation timeline, the easier the sale.

Vendor Consolidation Support

Companies want solutions that play well with their existing technology stack. They want APIs that integrate easily. They want solutions that reduce the total number of vendors they have to manage.

A solution that can integrate with their existing systems is more valuable than a standalone solution that requires additional infrastructure.

Proof of ROI

Enterprise buyers want case studies and examples of ROI. They want benchmarks from similar companies. They want to understand exactly how the tool will impact their business.

They're not buying on vision or potential. They're buying on demonstrated results.

Lower Commitment Risk

Companies prefer solutions they can pilot before full deployment. They want proof of concept engagements. They want vendor flexibility on licensing and term commitments.

A solution with a lower barrier to entry and lower commitment risk is more likely to be purchased than one that requires a large upfront commitment.

Workforce Reductions: A Sign of Deeper Issues

Both research firms announced workforce reductions (8% for one, smaller percentage for the other). This isn't just cost-cutting. It's a structural response to changing business realities.

Sales and Marketing Headcount Remains

When firms reduce headcount, they typically protect sales and marketing because those teams directly generate revenue. Reductions usually hit operations, support, and sometimes product teams.

When a research firm cuts 8% of headcount, they're likely preserving sales effectiveness while reducing costs elsewhere. This suggests they believe they can maintain or grow revenue with a leaner operation.

But it also suggests they don't expect to grow fast. If they expected growth, they'd be hiring in sales.

Research Production Becomes More Efficient

Both firms are using AI to improve research production. They can generate research documents faster. They can analyze data more efficiently. They can customize research for specific customer segments more easily.

This creates a transition. Fewer human researchers can produce more research output. The quality and depth might change, but the quantity increases. This is good for margins but might impact perceived value.

Support and Implementation Scale Down

With smaller implementation teams, firms can serve fewer new customers. Implementation cycles get longer or more complex. Customer onboarding becomes a constraint.

For customers, this might mean slower time to value. For vendors, this might mean fewer customers but potentially higher customer satisfaction per implementation.

The Geographic Dimension: International Markets Slowing Faster

Both firms reported that international markets are slowing faster than U.S. markets. One firm noted that when stripping out U.S. federal contracts, organic growth was only 4%. This suggests U.S. commercial markets are better than international.

Why International Is Slowing Faster

Europe is dealing with economic uncertainty, regulatory complexity, and slower GDP growth. Asia-Pacific markets have their own pressures. Emerging markets are facing currency challenges. The dollar is strong, which makes U.S. technology more expensive internationally.

For B2B vendors, this means the best growth opportunities remain in the United States, at least in the near term.

Currency Headwinds Are Real

When a U.S. company has revenue in euros or other international currencies, and the dollar strengthens, reported revenue in dollars doesn't grow as fast even if local currency revenue is flat or growing slightly.

Both firms cited FX headwinds as a factor in their performance. This is partly real market dynamics and partly currency math.

What the Market Is Actually Pricing In

Stock prices reflect what markets believe will happen, not what has happened. The dramatic stock price declines for these firms suggest markets are pricing in significant additional challenges.

Market Cap to Revenue Ratios Are Compressed

When a company with nearly

This suggests markets believe one of a few things: (1) the business will shrink significantly further, (2) margins will compress severely, (3) growth will remain negative for years, or (4) the business model is fundamentally broken.

The larger firm at

Forward Guidance Matters More Than Current Performance

The guidance for next year was worse than the current year. One firm guided for revenue below current levels. This tells markets that management doesn't expect improvement. The deck is stacked against growth at least for the next 12 months.

When guidance is negative, stock prices react strongly because investors are pricing in extended weakness.

The Opportunity in Discretionary Pullback

While this all sounds negative for B2B spending, there are actually opportunities hidden in the constraints.

Companies That Solve Urgent Problems Still Get Funded

When budgets tighten, the bar for purchasing decisions rises but it doesn't go to zero. Companies still buy solutions that solve urgent, quantifiable problems.

A tool that reduces cost or eliminates a bottleneck is still getting bought. It just requires much clearer ROI justification.

Competitive Displacement Gets Harder But Isn't Impossible

Displacing an incumbent vendor is harder when budgets are tight because the switching costs and implementation costs look larger. But if your solution is materially better or significantly cheaper, displacement still happens.

The bar for "better" just got higher.

Companies Are Willing to Take Pilots Seriously

When budgets are constrained, companies want to test before committing. This actually creates opportunity for vendors willing to do pilot programs and proof of concepts.

You might not get a large deal immediately, but you can get a pilot that proves value. Pilots convert to full deployment at higher rates than traditional sales cycles when they succeed.

What This Means for B2B Founders and Leaders

If you're building or selling B2B technology, the earnings reports from these research giants should inform how you think about sales, marketing, and product strategy.

Sales Cycles Will Be Longer

Plan for longer deal cycles. What used to close in 90 days might now take 120-180 days. Build your pipeline accordingly. Don't expect deals to hit their original expected close dates.

Build buffer into your forecast. If management thinks a deal will close in Q1, assume it might slip to Q2.

Budget Approval Authority Has Shifted

Understand who actually makes decisions at your target accounts. The person who seemed to be the decision-maker might need approval from three levels up. Build relationships at multiple levels of the organization.

Don't assume a signature means a deal. Understand the political and approval dynamics at your customer organizations.

ROI Conversations Are Non-Negotiable

If you can't articulate clear ROI for your solution, you won't get funded. Develop case studies. Calculate time to payback. Show how your solution impacts the customer's financial statements.

Generic value propositions don't work anymore. Customers want specific, quantifiable outcomes.

Cheaper Alternatives Are More Credible

If you're competing against an expensive incumbent, the price advantage is more credible now than it was 18 months ago. Companies are actively looking to reduce costs. A solution that does 80% of what an expensive competitor does at 40% of the cost is very attractive.

Free or Low-Cost Pilots Improve Win Rates

If you can get a prospect to run a pilot before committing to a large deal, you're significantly more likely to win. Remove friction from the pilot stage. Make it easy for prospects to test your solution.

Pilots are your best competitive weapon in a budget-constrained environment.

How B2B Spending Cycles Typically Play Out

When enterprise spending tightens, there's usually a cycle to how it plays out.

Phase 1: Denial (Current Phase)

Companies and vendors assume the tightening is temporary. They maintain spending but scrutinize deals more carefully. Deal cycles extend but deal volume stays relatively stable.

Phase 2: Adjustment

Companies actively cut discretionary spending. They reduce headcount. They pause projects. Deal volume drops. Remaining deals get smaller.

Phase 3: Recovery

Markets stabilize. Companies that survived the downturn start investing again. Deal sizes grow. Growth returns, usually driven by pent-up demand.

Based on the earnings reports, we appear to be between Phase 1 and Phase 2. Deal cycles have extended significantly. Customers are actively deferring projects. This suggests Phase 2 dynamics (active adjustment) are beginning.

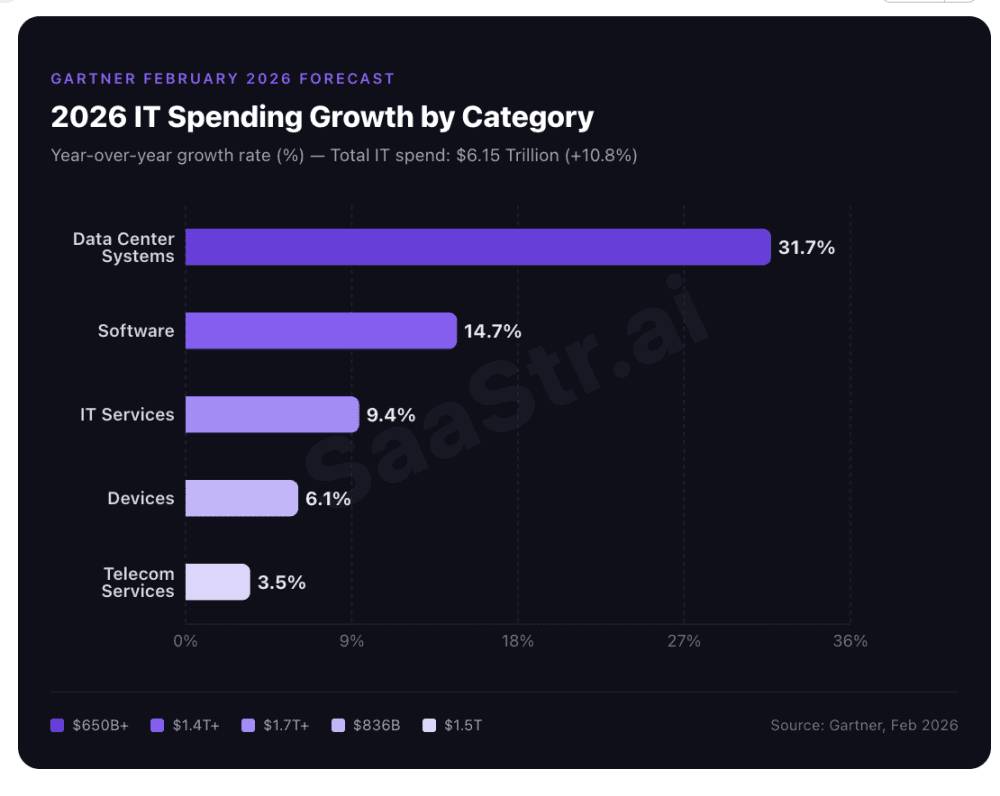

Plotting the 2026 Forecast

Both firms guided for 2026 with weak or negative growth. This suggests management consensus that improvement won't come in 2026.

For B2B companies, this is important context. If the largest research firms in the industry are guiding down, it's reasonable to assume that enterprise IT and marketing budgets will remain constrained through 2026.

This doesn't mean a recession or crash. It means a period of modest growth with much more competitive selling and higher proof-point requirements.

Planning for Slower Growth

If you're building a B2B company, plan for 2026 with the assumption that deal cycles will stretch and deal sizes will be smaller. Build more pipeline than you normally would. Close more pilots. Develop more case studies.

Success in 2026 goes to companies that can win with efficiency. That might mean lower average deal size but higher win rates. That might mean longer sales cycles but higher conversion rates.

Efficiency Becomes Competitive Advantage

Companies that can close deals faster and with lower customer acquisition costs will outperform. Companies that require long, expensive sales processes will struggle.

Builder, founder, and sales leader priorities should shift toward efficiency and lean selling processes.

FAQ

What is contract value and why does it matter for predicting spending trends?

Contract value represents the total dollar amount of signed, active contracts that haven't yet expired. It matters because it's a forward-looking indicator of future revenue. When contract value declines, it signals that customers are not expanding relationships, are renewing at lower amounts, or are churning. For forecasting enterprise spending, contract value is often more reliable than current revenue because it shows what customers have already committed to.

How do extended buying cycles affect B2B sales strategy?

Extended buying cycles require changes across the entire sales process. Sales teams need to manage longer forecast timelines with more buffer for slippage. They need to build relationships at multiple organizational levels since approval authority has shifted upward. Deal sizes might remain the same but individual stakeholders have lower purchase authority, requiring consensus among more people. Sales organizations should increase pipeline by 30-50% to account for extended timelines and expect deals to close one or two quarters later than historical norms.

Why is consulting revenue declining when AI and digital transformation should be increasing demand?

Consulting revenue is declining because companies are pausing transformation projects, not because demand for transformation doesn't exist. When budgets tighten, companies often halt new strategic initiatives to focus on executing current commitments. They reduce spending on strategic consulting because it's discretionary, even though they continue spending on maintaining operational systems. The paradox is that while interest in AI is high, companies aren't funding the transformation projects that would require consulting support to implement AI-driven changes.

What does AI mean for traditional research subscription models?

AI creates both opportunity and threat for research firms. The opportunity is that demand for AI-related research and guidance is massive. The threat is that free AI tools can generate similar content, compressing the value proposition of paid research subscriptions. Research firms are responding by positioning proprietary data, access to expert analysts, and original research as their core value. However, the stock market doesn't yet believe this positioning justifies premium pricing, as evidenced by depressed stock valuations.

How should B2B companies adjust their sales and marketing strategy during periods of constrained enterprise spending?

During constrained spending periods, B2B companies should focus on operational efficiency proof points over growth opportunity narratives. Develop detailed case studies showing ROI and time to payback. Increase pilot program offerings to lower the barrier to purchase decisions. Extend sales pipelines to account for longer cycles. Build relationships at multiple levels of customer organizations since approval authority has shifted upward. Lower deal size expectations while increasing deal volume. Prioritize customers with clear, urgent problems over those with strategic visions but no immediate pain.

What is the difference between current revenue growth and contract value growth, and why do both matter?

Current revenue reflects deals that have closed and are being recognized. Contract value reflects deals that have been signed but revenue hasn't been recognized yet. In growing companies, contract value growth is usually higher than revenue growth because the company is booking more deals than it's recognizing revenue on. When contract value growth slows down while revenue growth continues, it's often a warning sign that future revenue growth will slow. Both metrics matter because revenue growth is what's happening now and contract value growth predicts what will happen next quarter and beyond.

Should B2B companies raise prices or lower prices during budget-constrained periods?

It depends on your competitive position and product value. For market leaders with strong differentiation, modest price increases might stick, but they'll result in lower volume. For competitive products without strong differentiation, price reductions might make sense if they help you gain market share or win competitive displacement deals. Many companies are finding success with lower-priced tiers or pilot pricing that gets customers in the door at lower cost with the goal of expansion later when budgets loosen. The key is ensuring ROI justification regardless of price level.

How does customer concentration in enterprise markets affect revenue predictability during downturns?

High customer concentration is risky during downturns because when one major customer cuts spending or delays a contract renewal, it has significant impact on total revenue. Companies that rely on a few large customers see more volatility. During budget-constrained periods, large customers are more likely to renegotiate terms, demand price reductions, or delay expansions. Diversification across many mid-market customers provides more stability because no single customer represents enough revenue to create crisis-level impact if they reduce spending.

Why are events shifting from multi-day conferences to regional formats?

Multi-day conferences have high cost for attendees in terms of travel, accommodation, and time away from office. When budgets tighten, many companies can't justify these costs. Regional formats are smaller, lower-cost, and shorter duration, making them more affordable and easier to attend. They also allow for more frequent engagement throughout the year rather than one or two major events. The tradeoff is lower attendance per event and potentially lower perceived brand prestige, but the lower cost and higher frequency often maintain relationships better than large annual conferences.

What leading indicators should B2B companies monitor to predict changes in enterprise spending?

Monitor your largest customers' consulting and professional services spending, as drops in that spending often precede broader budget constraints. Track your sales cycle length month-over-month. When average sales cycle extends by 20-30%, it's often a sign that budget constraints are tightening. Watch for increased requests for pilots and proof of concepts instead of direct purchases. Monitor how many deals require escalation to C-level approval. Track customer churn in discretionary spending categories. Watch analyst firm earnings reports and guidance as early indicators of enterprise technology spending trends.

Final Perspective: What Happens Next

The earnings reports from these research firms represent a snapshot of enterprise technology spending in a period of uncertainty and budget constraint. They're not predicting a crash. They're showing a market in transition.

For enterprise buyers, it means careful budgeting, extended decision timelines, and focus on quantifiable outcomes. For B2B vendors, it means longer sales cycles, more competitive selling, and higher proof-point requirements. For the research firms themselves, it means adapting business models to an era where free AI tools make traditional research subscriptions harder to justify.

The companies that thrive through this period will be those that adapt quickest. They'll be the ones that remove friction from the sales process. They'll be the ones that clearly articulate ROI. They'll be the ones that price for the market realities, not historical margins. They'll be the ones that focus on solving specific, urgent problems rather than selling transformational visions.

Enterprise spending isn't disappearing. It's just becoming more disciplined. In some ways, that's healthy. It means money goes to solutions that deliver real value. It's harder to sell based on hype or potential. You have to deliver results.

The next 12-18 months will be interesting. If the research firms' guidance proves correct and 2026 sees further contraction, it'll signal that the slowdown is structural, not cyclical. If instead we see reacceleration in H2 2026, it'll suggest we're in a temporary pause before the next growth phase. The data will tell the story.

Key Takeaways

- Enterprise research firms saw stock prices collapse 71% and market caps compress dramatically, signaling broader budget constraints across B2B technology spending

- Contract Value growth of less than 1% indicates future revenue will remain flat or decline unless customer commitment increases materially

- Consulting revenue declines of 9-16% show enterprises are pausing transformation projects and strategic initiatives, focusing instead on operational optimization

- Buying cycles have extended from 60-90 days to 120-180 days with higher approval authority requirements, requiring sales teams to build relationships across multiple organizational levels

- AI creates simultaneous opportunity and threat: massive demand for AI research guidance but free AI tools commoditize traditional research subscriptions

- During budget constraints, enterprises prioritize operational efficiency improvements and cost reduction over new innovation investments and transformational projects

- Pilot programs and proof of concepts convert to full deployment at 3-4x higher rates than traditional sales approaches during budget-constrained periods

- Market is pricing in continued weakness through 2026, suggesting enterprise spending constraints are structural rather than cyclical

Related Articles

- Instagram on Trial: Meta's Addiction Battle and Tech's RAM Crisis [2025]

- Meta's Smart Glasses Problem: Why Facial Recognition Could Ruin Everything [2025]

- Boldr Kelvin Space Heater Review [2026]: Modern Design Meets Reality Check

- Pokémon FireRed and LeafGreen on Switch: Complete Guide to the 30th Anniversary Re-release [2025]

- DJI Osmo Pocket 4 Leak: New Camera Escapes US Ban [2025]

- Best Legend of Zelda Games & Merch for 40th Anniversary [2025]

![How Gartner and Forrester Revenue Declines Reveal True B2B Market Health [2025]](https://tryrunable.com/blog/how-gartner-and-forrester-revenue-declines-reveal-true-b2b-m/image-1-1771594810282.jpg)