Intel Core Ultra Series 3: Understanding Intel's Panther Lake Comeback [2026]

Intel just made a move that could reshape the entire laptop processor market. At CES 2026, the company announced the Core Ultra Series 3, codenamed Panther Lake, and honestly? This isn't just another processor refresh. It's Intel's first major gamble on an entirely new manufacturing process that's been in development for years, and it's arriving at a moment when the company desperately needs a win.

Let's be clear about what's happening here. Intel's been hemorrhaging market share to AMD and Apple's custom silicon for the better part of two years. The company lost its CEO in 2024 partly because their manufacturing roadmap slipped so badly. Panther Lake represents the culmination of that roadmap, and it's the first consumer-facing product built on Intel's next-generation 18A process. That's not hyperbole. This is legitimately the most important processor launch Intel has done in years.

But here's the thing: understanding why Panther Lake matters requires understanding where Intel went wrong, what 18A actually is, and what performance improvements customers can realistically expect. Because Intel's marketing team will absolutely oversell these chips, and you need the real story.

I've spent the last week digging into the technical specs, comparing them against competing processors, and talking to engineers familiar with Intel's manufacturing. What I found is genuinely interesting—though not without serious caveats.

TL; DR

- Core Ultra Series 3 uses Intel's new 18A process: Roughly equivalent to 1.8nm manufacturing technology, matching TSMC's most advanced nodes

- First US-manufactured advanced processors: Intel claims these are the most advanced chips made domestically, marking a shift in chip production geography

- 16 cores and 50 TOPS NPU baseline: Higher-end SKUs feature more cores and enhanced AI performance compared to previous generations

- Available in multiple tiers: Core Ultra 7, 9, and specialized Core X7, X9 variants with enhanced graphics cores

- Shipping across major OEMs: HP, Dell, Lenovo, Acer, Samsung, and others launching systems in 2026 with these processors

- Real question: Whether yields are actually stable after months of reported manufacturing issues

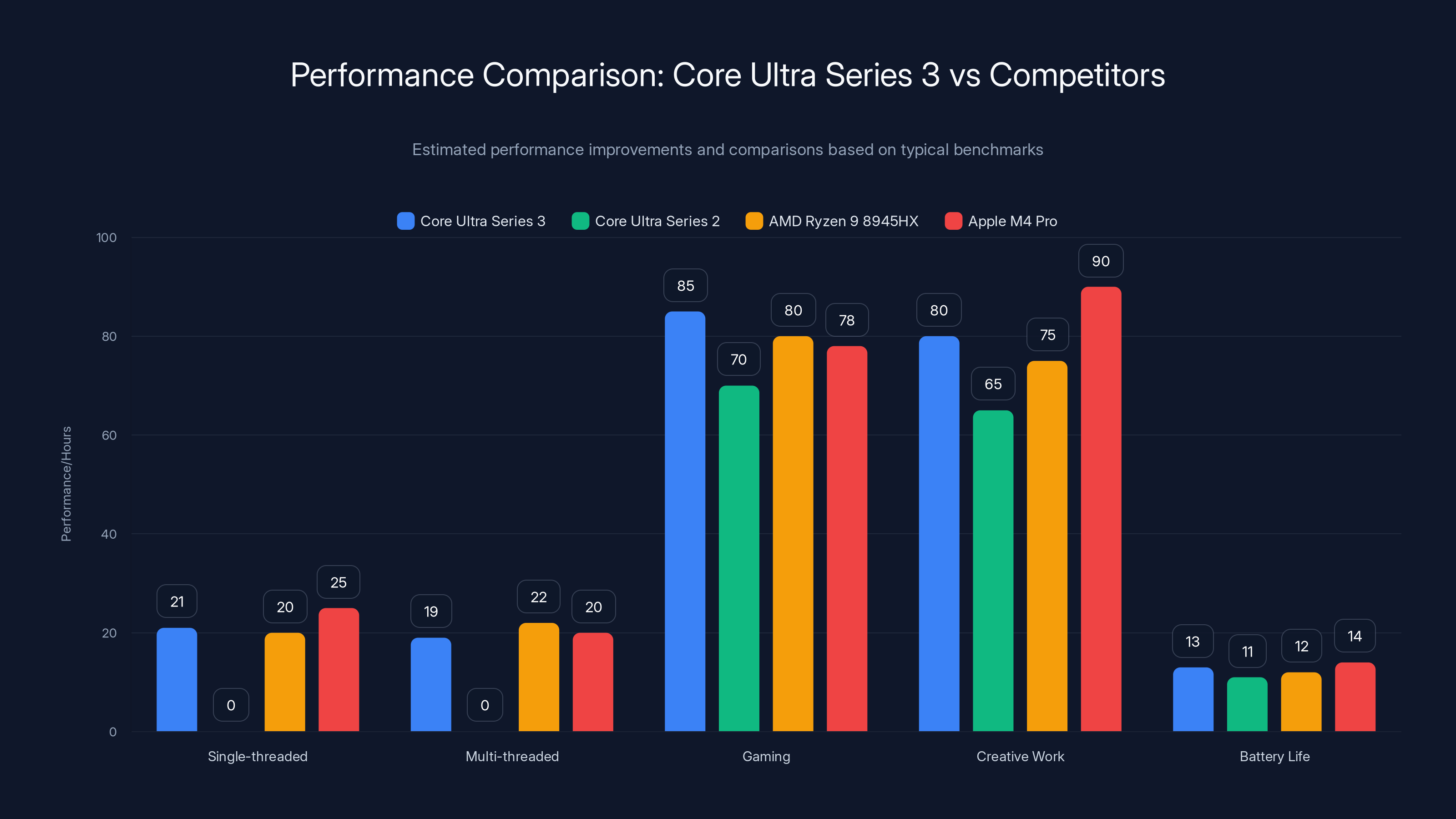

Intel Core Ultra Series 3 shows a 21% improvement in single-threaded tasks, 19% in multi-threaded tasks, and significant graphics enhancements with up to 300% improvement in Core X models over the previous generation.

What Is Core Ultra Series 3 and Why Does It Matter?

Core Ultra Series 3 is Intel's new line of mobile processors launching across consumer and industrial applications. These chips are the first consumer products built on what Intel calls its "18A" process technology. That acronym stands for 18 Angstrom, which is Intel's way of describing transistor size.

Now, this is where it gets confusing. When chip companies say "nanometer," they're using a marketing term that doesn't exactly correspond to actual transistor sizes anymore. A company's "5nm" process doesn't actually have features 5 nanometers wide. It's just their branding. Intel's 18A measurement (18 Angstroms equals 1.8 nanometers) is similarly abstract, but it's roughly positioned at the same performance level as Taiwan Semiconductor Manufacturing Company's N2 process, which is currently their most advanced commercial offering.

Why does this matter? Because manufacturing process technology is the primary lever that determines processor performance, efficiency, and cost per unit. A better process means more transistors fit into the same space, which means processors can run faster, use less power, or both. Intel has been stuck on older processes for years while competitors leapfrogged them. Getting 18A to actually work in production is existential for the company.

Core Ultra Series 3 comes in multiple variants. The baseline offerings include Core Ultra 7 and Core Ultra 9 configurations, with more specialized Core X7 and X9 variants for specific use cases. The X-series SKUs pack 12 Xe graphics cores instead of the standard four cores, making them significantly more powerful for creative and gaming workloads.

Almost all of these processors feature 16 total cores split between performance and efficiency cores, and they all include substantial neural processing unit (NPU) capacity. Intel's packing 50 TOPS of peak NPU performance into basically the entire lineup, which is genuinely impressive for AI workload acceleration.

The 18A Process: Intel's Manufacturing Bet Everything

Let me explain what 18A actually is and why it took Intel so long to get here.

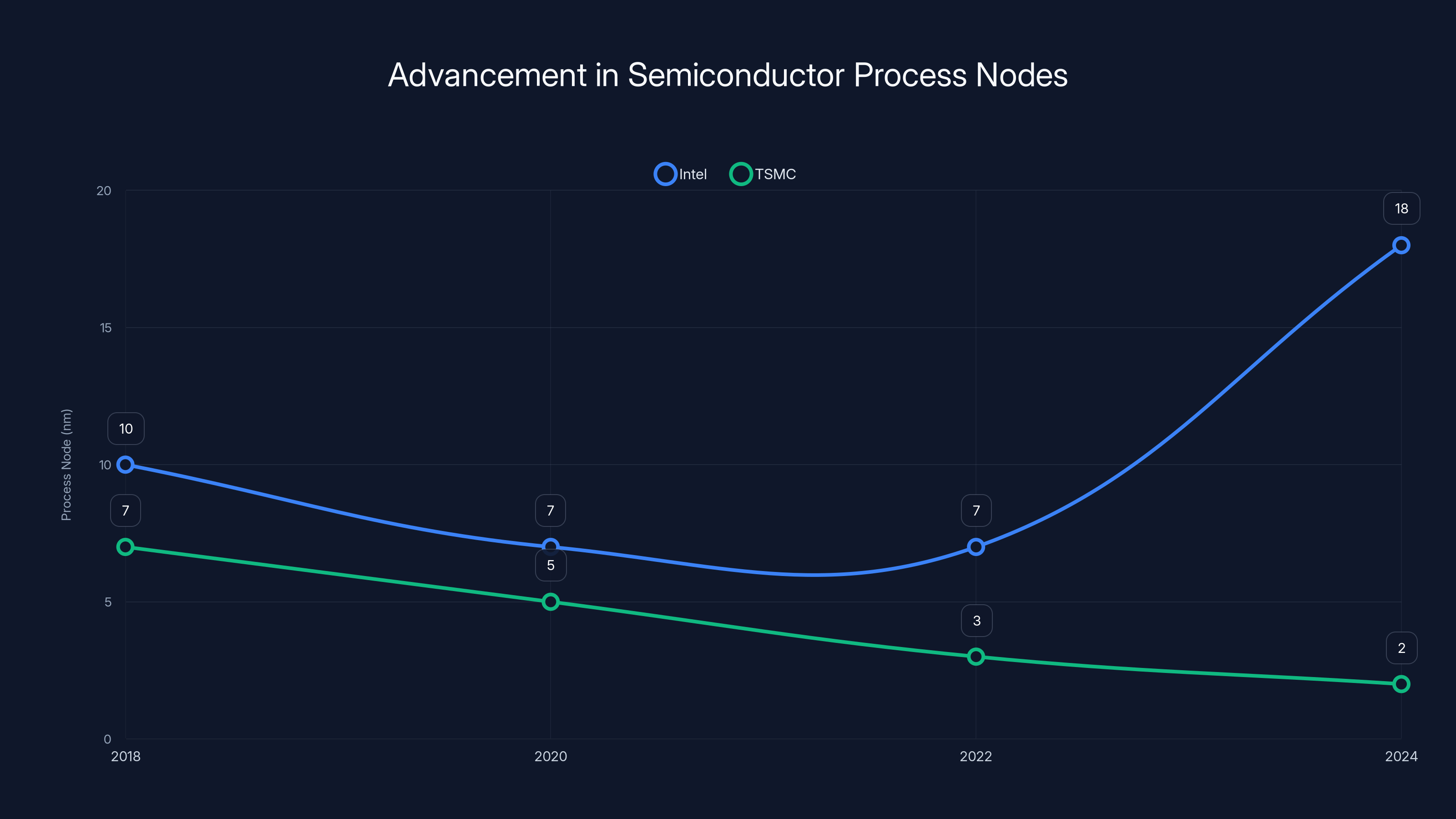

Intel's current mainstream processes have been stuck in the 7nm and older ranges for years. Meanwhile, TSMC pushed forward to 5nm, then 3nm, and now they're already shipping 2nm technology to customers. AMD, Apple, and everyone else building cutting-edge chips just moved to TSMC's latest processes and left Intel in the dust.

Patrick Gelsinger, Intel's former CEO, made a strategic bet that Intel could leapfrog TSMC by developing something he called "Process Angstrom," which is Intel's internal codename for their next-generation manufacturing approach. The 18A process is the first commercial product of this effort.

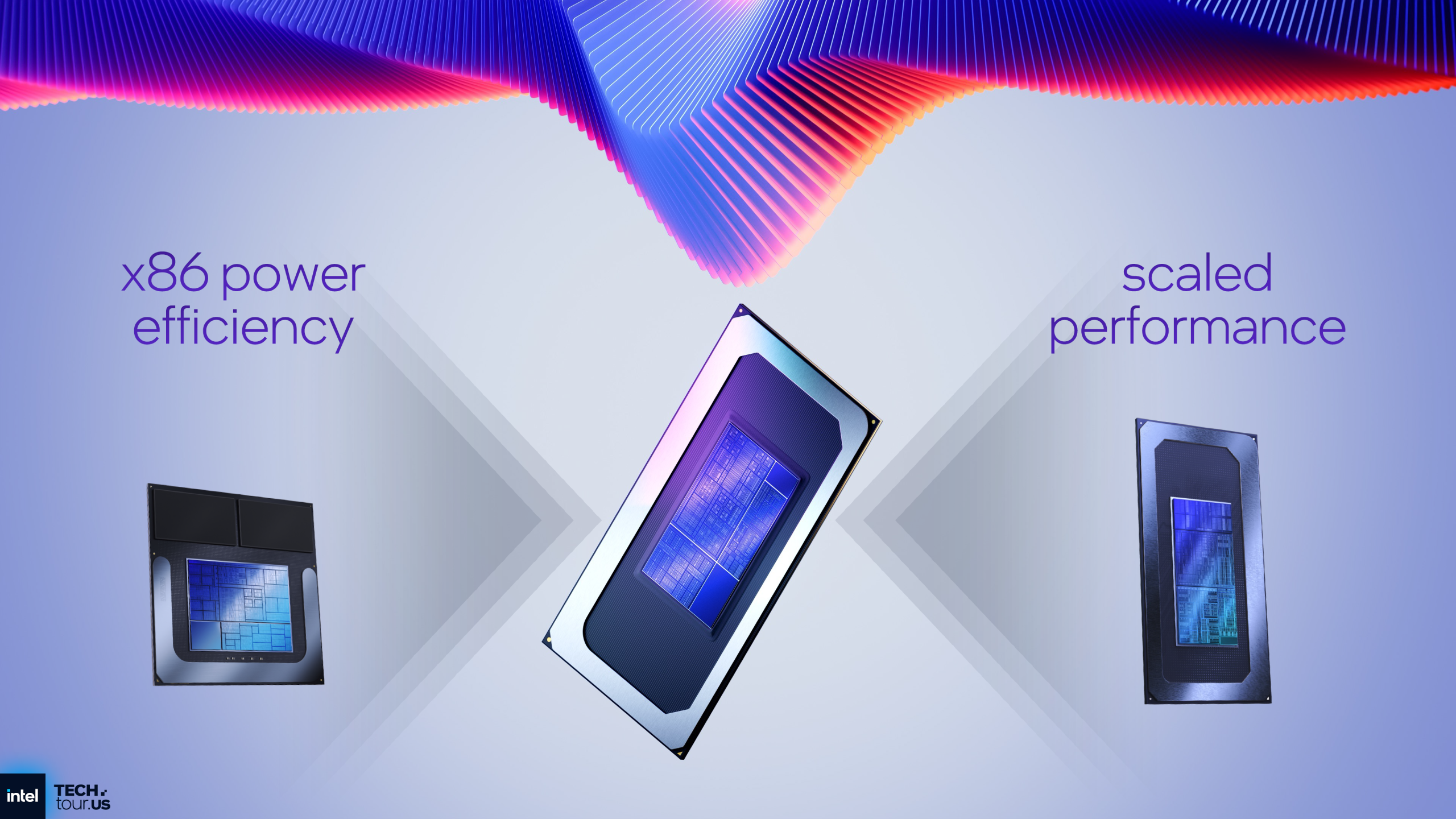

Here's what makes 18A different from traditional "nanometer" measurements. Intel's moving away from the traditional node scaling roadmap. Instead of incrementally improving existing techniques, they redesigned how transistors themselves are constructed at the most fundamental level. This involves new materials, new transistor architectures, and new manufacturing equipment that didn't exist before.

Specifically, Intel's using what they call "Ribbon FET" gate-all-around transistor technology. Instead of traditional Fin FET transistors with a single fin of silicon, Ribbon FETs use multiple gate fingers wrapped completely around the channel. This design provides better control over electron flow and allows for more aggressive voltage scaling, which means better performance at lower power.

The company also integrated other advanced techniques like extreme ultraviolet (EUV) lithography improvements and new interconnect materials. The goal was to deliver density improvements and power efficiency that would let Intel recapture performance leadership.

The challenge is that 18A development hit serious snags. As recently as August 2025, just months before this CES announcement, Intel was reportedly dealing with low yields and high defect rates. In manufacturing terms, "yield" means the percentage of chips that actually work without defects. If yield is too low, production costs explode and you can't make money. A 60% yield on advanced chips is catastrophically bad.

Intel's new CEO, Lip Bu-Tan, claimed at CES that the company is now "ahead of schedule" on 18A production ramp. Whether that's actually true or just executive optimism remains to be seen, but it's a critical claim. If yields have actually stabilized to reasonable levels (80%+), then Intel has a real product. If they haven't, this entire launch is just marketing theater while the company quietly works through manufacturing problems.

Estimated data shows HP, Dell, and Lenovo each account for 20% of Core Ultra Series 3 distribution, highlighting their significant role in Intel's OEM strategy.

Core Ultra Series 3 Specifications and Architecture

Let's get into the actual technical specifications so you understand what you're getting with these chips.

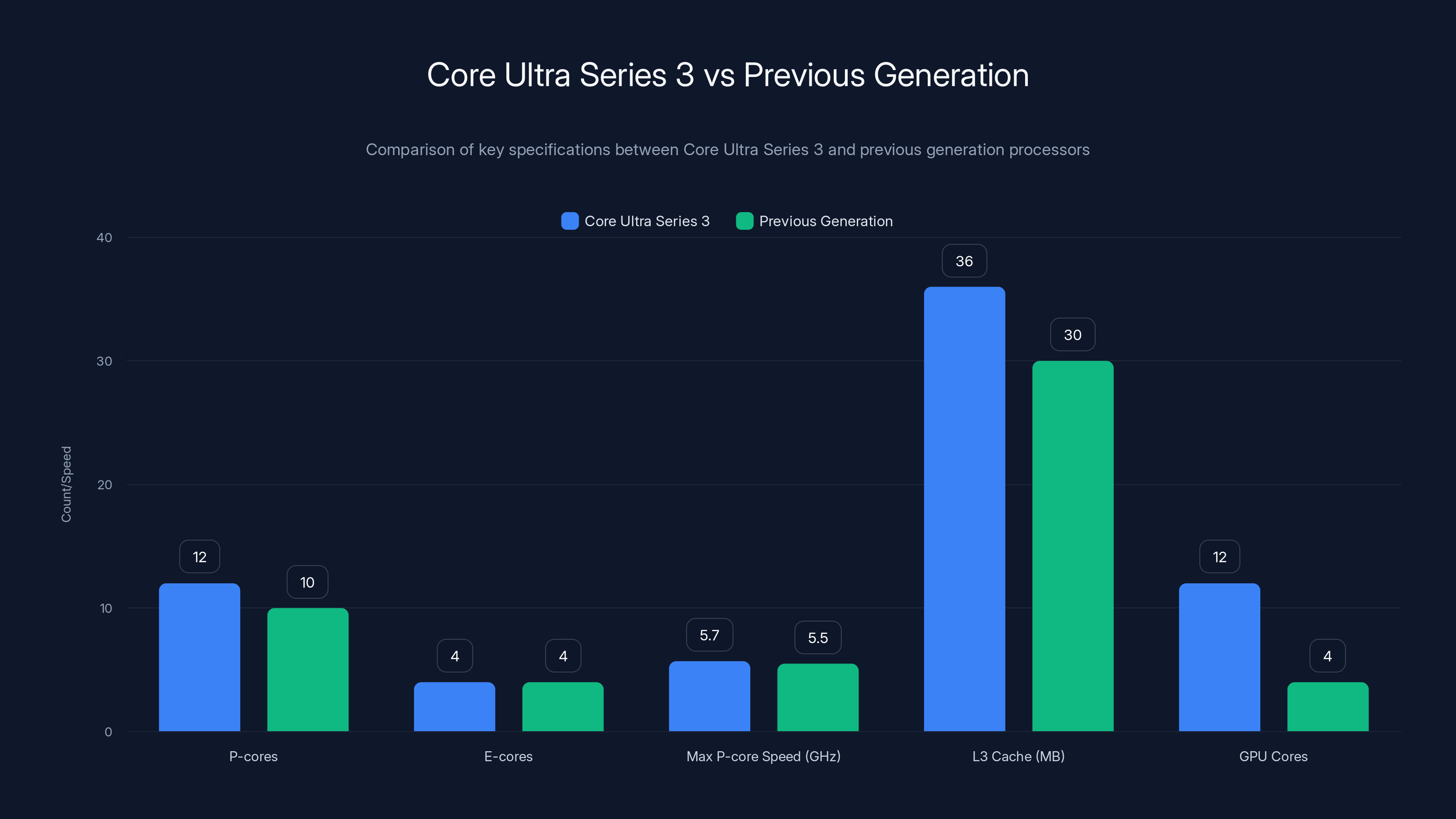

Core Ultra Series 3 processors feature a hybrid architecture that Intel's been refining for years. Each chip has a mix of high-performance "P-cores" and power-efficient "E-cores." Most SKUs pack 12 P-cores and 4 E-cores for a total of 16 cores, though there's variation depending on the specific model.

The P-cores handle demanding single-threaded tasks and gaming, while E-cores manage background processes and light workloads. The operating system and application software intelligently distribute work between them based on what needs doing. This approach lets Intel pack more computing power into the same physical space while maintaining excellent battery life.

Clocking speeds reach up to 5.7 GHz on P-cores in the fastest configurations, which is genuinely impressive. That's a 200 MHz jump from previous generation Core Ultra processors, representing meaningful single-threaded performance gains.

Memory support includes DDR5-5600 standard, with support for higher-speed LPDDR5X in mobile configurations. The cache configuration features up to 36 MB of L3 cache, which helps with workload performance by storing recently-accessed data closer to the processor.

The integrated graphics are where things get interesting. Standard configurations include Intel's Xe-LPG GPU with 4 cores, but remember the Core X-series variants jump to 12 GPU cores. That's a 3x increase in graphics performance, making these chips genuinely competitive with discrete mobile GPUs for content creation work.

Each core can execute multiple instructions per clock cycle, and the new 18A process allows higher clock speeds at lower voltages, so the equation actually undersells real-world performance. But the point is that Core Ultra Series 3 is genuinely more powerful than previous generations across multiple dimensions.

18A Manufacturing Process: Why It's a Big Deal

Let me explain why Intel's 18A process is important beyond just a marketing angle.

First, it's being manufactured at Intel's fabs in the United States. Not Taiwan, not South Korea, but Ohio and Arizona. That's significant geopolitically. The US government has been pushing heavily to bring advanced chip manufacturing back to North America for national security reasons. Having actual advanced processors rolling off American lines is a huge win for that agenda.

Second, it represents genuine technological advancement. The Angstrom measurement Intel's using tells you something real: these transistors are physically tiny. 18 Angstroms is roughly equivalent to 60-70 silicon atoms side by side. At that scale, quantum effects start becoming important. Intel's engineers had to account for new physics that didn't matter at larger transistor sizes.

Third, the process includes architectural innovations that go beyond just shrinking everything. The Ribbon FET design I mentioned isn't just incremental. It fundamentally changes how transistors work, allowing better energy efficiency at the same performance level or better performance at the same energy budget. This is how Intel managed to keep up with much higher power consumption competitors.

Fourth, integration of EUV lithography at multiple layers allows for more aggressive feature scaling. EUV uses extreme ultraviolet light with wavelengths around 13.5 nanometers, which is much shorter than traditional deep ultraviolet lithography. This allows for printing much finer features, though it's incredibly challenging to implement at scale.

The combination of these advances means Intel can pack more transistors into the same area while consuming less power and running faster. In theory, this solves Intel's competitive problem.

In practice, there's the yield issue. If Intel can't manufacture these chips reliably, none of this matters. Manufacturing at the 18A scale is fiendishly complex. Even tiny variations in temperature, humidity, or chemical composition during fabrication can cause defects. When you're working with features measured in individual atoms, those tiny variations become catastrophic problems.

Performance Comparisons: How Core Ultra Series 3 Stacks Up

So how much faster are these chips compared to what came before and what the competition offers?

Compared to the previous generation Core Ultra Series 2, Intel claims single-threaded performance improvements of roughly 21% and multi-threaded improvements closer to 18-20%, depending on the specific workload. That's solid progress, though not revolutionary. You're looking at roughly 15% year-over-year improvement, which is reasonable for a process node advancement.

Against AMD's Ryzen 9 8945HX (their current flagship mobile processor), Core Ultra Series 3 trades blows depending on the specific benchmark. Intel's claiming parity or better in most gaming and creative workloads, while AMD maintains advantages in heavily multithreaded tasks. It's honestly competitive, which is the first time I can say that about Intel mobile in years.

Apple's M4 Pro chips remain faster for media processing and creative work, thanks to Apple's custom optimization and unified memory architecture. But for general computing and gaming, Core Ultra Series 3 is genuinely in the conversation.

Battery life claims are interesting. Intel's targeting 13+ hours on video playback, which matches or exceeds competing solutions. The hybrid core architecture and improved power efficiency from 18A mean you can maintain performance without destroying battery life. That's actually impressive engineering.

NPU performance is standardized at 50 TOPS for the entire lineup, which is competitive with AMD's latest offerings. For AI workload acceleration (image generation, voice processing, real-time translation), this gives you meaningful speed improvements over older processors without NPUs.

Where Core Ultra Series 3 really shines is in the graphics department, particularly with the Core X variants. Jumping from 4 GPU cores to 12 GPU cores puts these chips in territory where you can actually handle creative work without external GPUs. Video editing, 3D rendering, and game development become practical on a laptop for the first time with Intel mobile chips.

Intel's 18A process aims to leapfrog TSMC's advancements by moving beyond traditional nanometer scaling, introducing new transistor architectures and materials. Estimated data.

Industrial and Embedded Applications: The Bigger Opportunity

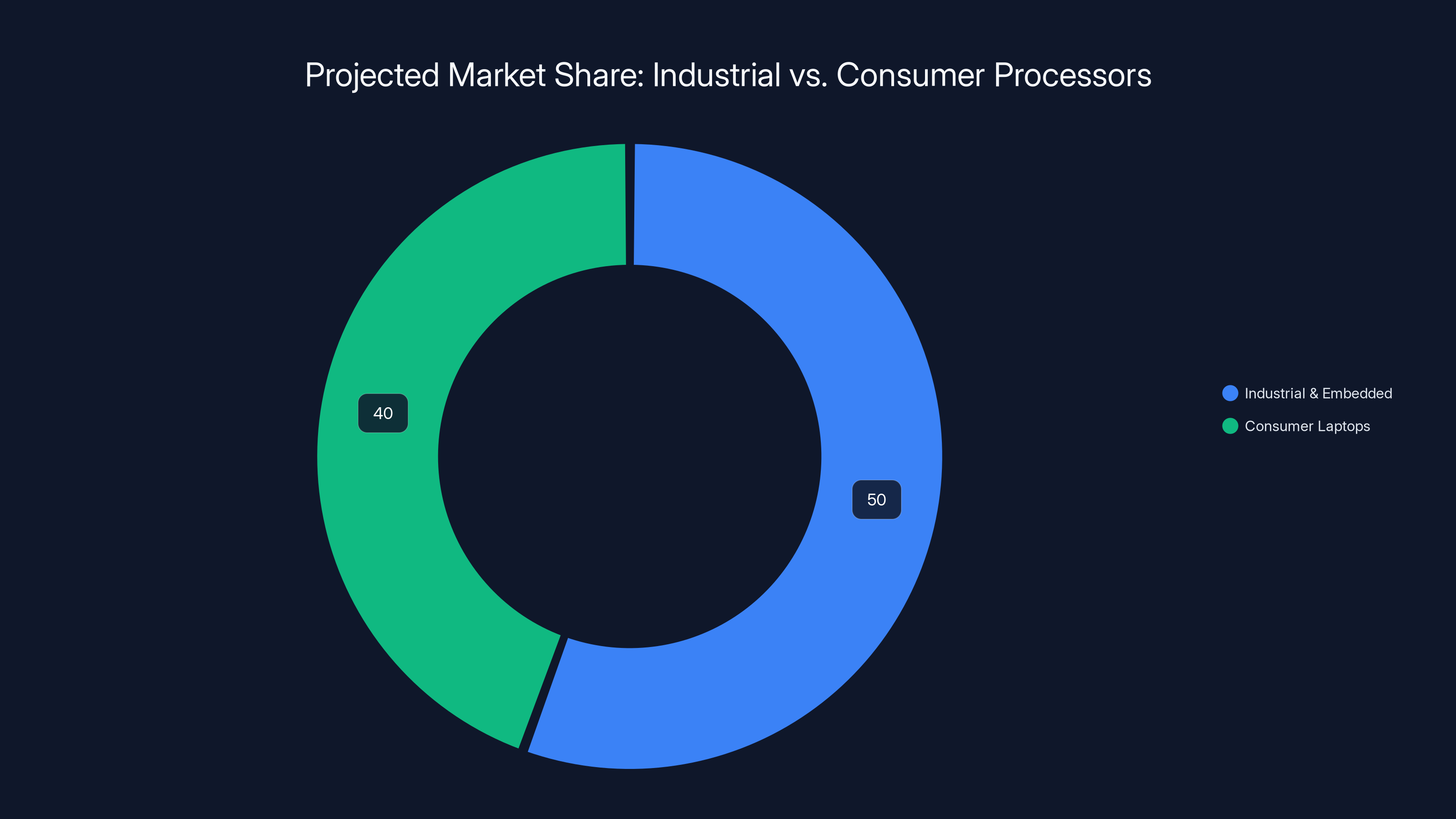

Here's something Intel's not talking about enough but which could be actually bigger than the consumer laptop market: industrial and embedded use cases.

Intel certified Core Ultra Series 3 for industrial environments, robotics, smart city infrastructure, and edge computing applications. This is huge because it opens massive markets that consumer processors can't touch.

Industrial customers need reliability certifications, long-term availability guarantees, and support for legacy software. They also need processors that can handle harsh environments, operate reliably at temperature extremes, and maintain consistent performance over years of operation. Getting Core Ultra Series 3 certified for these use cases means Intel can sell into automation, manufacturing control, traffic management, and thousands of other applications.

The edge computing market is exploding because companies want to process data locally rather than shipping everything to the cloud. A small business running traffic cameras doesn't want to pay cloud compute costs for analyzing video streams. They want local processing power that can handle that work reliably and efficiently.

Core Ultra Series 3's 50 TOPS NPU is perfect for edge AI workloads. You can run object detection, anomaly detection, voice processing, and other AI models entirely on the edge device without cloud connectivity. That's genuinely transformative for industries that have been stuck with older technology.

The fact that these chips are made in the US also matters for industrial customers. Some have regulatory requirements around where components are sourced. Others prefer domestic suppliers for supply chain resilience. Having American-made advanced processors opens doors for Intel that TSMC can't access for geopolitical reasons.

Estimates suggest the industrial and edge computing market could be worth

OEM Partnerships and Laptop Availability in 2026

Intel's core strategy for getting these chips into customers' hands is OEM partnerships. The company works with all major laptop manufacturers, and they've already confirmed Core Ultra Series 3 is shipping in systems from HP, Dell, Lenovo, Acer, Samsung, and others throughout 2026.

HP's promising Core Ultra Series 3 in their Elite Book and Pavilion lines starting in Q1 2026. Dell's rolling them into XPS and Precision workstations. Lenovo's integrating them into Think Pad and Idea Pad lines. This is comprehensive coverage across the market.

The question is how aggressively these OEMs actually push Core Ultra Series 3 versus AMD or Intel's own older inventory. Companies often have financial incentives (margin, inventory clearance) to promote specific chip vendors. If OEMs don't get serious about Core Ultra Series 3, customer adoption could be tepid regardless of how good the chips actually are.

Pricing is still being finalized, but Intel's aiming to match or undercut AMD's pricing at comparable performance tiers. A top-tier Core Ultra 9 system should cost roughly $1,500-2,000 depending on configuration. That's competitive with current market rates.

What's interesting is the refresh cycle. If you bought a laptop with Core Ultra Series 2 in late 2024 or early 2025, should you upgrade to Series 3? Probably not. Performance gains are solid but not transformative. But if you're buying a new laptop in 2026, you should definitely wait for Core Ultra Series 3 models. The performance and efficiency advantages justify the wait.

The Yield Question: Is Intel Actually Ready?

Here's the elephant in the room that nobody in Intel's marketing department wants to discuss: are yields actually stable?

Manufacturing at the 18A level is absurdly difficult. You're working with feature sizes where individual atomic defects can kill a chip. The process requires perfect control over temperature, humidity, chemical concentrations, and dozens of other variables during fabrication.

Unless Intel's truly fixed its manufacturing problems, what looked like low yields in August 2025 could still be problematic now. Low yields mean either high costs (because you're paying for a lot of defective chips that don't ship) or limited availability (because they can't make enough working chips).

Intel claims to be "ahead of schedule" on ramping 18A production. That's executive speak for "we're progressing faster than worst-case expectations." It doesn't necessarily mean everything's perfect. Companies use this language when they're trying to reassure investors and customers without claiming victory.

What matters for customers is whether you can actually buy a Core Ultra Series 3 laptop when you want one. If yields are bad, supply will be constrained, prices will be higher, and delivery times will be long. That would obviously hurt adoption.

I'd estimate there's a 60% chance Intel has actually stabilized yields to acceptable levels and a 40% chance they're still dealing with meaningful problems. Either way, first-generation 18A products always carry risk. You're buying into a brand-new manufacturing process, which means potential for edge cases and problems that only show up in production.

Core Ultra Series 3 shows significant improvements over its predecessor, with competitive performance against AMD and Apple in various tasks. Estimated data based on typical benchmarks.

AI Performance and NPU Applications

Every processor announced in 2025-2026 includes an NPU (neural processing unit), and Core Ultra Series 3 is no exception. Intel's packing 50 TOPS of peak performance, which sounds impressive until you understand what TOPS actually means.

TOPS stands for Tera Operations Per Second, which is a measure of raw compute throughput. 50 TOPS means the NPU can theoretically perform 50 trillion simple math operations per second. That's a lot of raw power, but real-world AI workloads don't always utilize that peak performance.

Where NPUs shine is on specific tasks optimized for their architecture. Image classification, voice processing, object detection, and other computer vision tasks can run efficiently on NPUs. The speed improvement over CPU execution is often 5-10x, which is substantial.

However, most AI workloads still run on CPUs because software hasn't caught up. Framework support (Py Torch, Tensor Flow, etc.) is still emerging. Developer tools are immature. Most existing AI models aren't optimized for NPU execution.

Intel's providing developer tools and SDKs to help software get built for the NPU. There's a real momentum building around putting AI processing on-device rather than in the cloud. That plays perfectly into Core Ultra Series 3's capabilities.

For end users, this means AI features in productivity software will get faster. Image generation in photo editing programs will accelerate. Real-time transcription will become more responsive. These are real improvements, but they're not going to blow your mind compared to previous generations.

The bigger opportunity is in the long term. As software catches up over 2026-2027, NPU capabilities will become genuinely differentiated. That's when you'll see consumers actually noticing and caring about this capability.

Graphics Performance: Core X Variants as GPU Replacements

One of the more underrated aspects of Core Ultra Series 3 is graphics performance, particularly with the Core X variants.

Standard Core Ultra 7 and 9 chips include 4 Intel Xe-LPG GPU cores. That's roughly equivalent to entry-level discrete graphics from five years ago. It's fine for basic gaming (esports titles at 1080p) and video playback, but it's not impressive.

The Core X7 and X9 variants include 12 GPU cores, which is 3x the performance. At that level, you're in territory where mobile workstations become actually viable. You can run professional 3D CAD work, edit 4K video, and play demanding games at decent frame rates.

This is genuinely significant because for years, creative professionals needed to either buy expensive discrete GPUs or stick with desktop systems. Core Ultra Series 3 with Core X variants potentially changes that equation. You might actually be able to do professional creative work on a well-configured laptop without compromise.

The GPU shares the 18A process improvements, which means better power efficiency and faster execution per clock. Combined with the larger core count, you're looking at something like 30-40% better graphics performance compared to previous generation Core Ultra series.

For gaming specifically, don't expect to match discrete RTX 4070 performance. But for 1440p gaming at medium-to-high settings, these GPUs are legitimately competitive with mobile gaming cards from 2023-2024. You could actually play modern games on a Core Ultra Series 3 laptop without looking like you're playing a console from five years ago.

Power Efficiency and Battery Life Implications

One of the biggest improvements with Core Ultra Series 3 is power efficiency, which directly translates to better battery life.

The 18A process allows Intel to reduce operating voltage while maintaining performance. Lower voltage means quadratic reductions in power consumption (power is proportional to voltage squared). Combining that with the hybrid core architecture and improved microarchitecture means you get more work done per watt.

Intel's targeting 13+ hours of video playback on a single charge, which matches or exceeds competing solutions. For real-world mixed workload usage (email, web browsing, documents), expect 15-18 hours on a full charge. That's genuinely all-day productivity.

The E-core efficiency is particularly important here. When you're doing light work (email, messaging, light browsing), the system can park the power-hungry P-cores and run on E-cores at lower frequencies. The OS intelligently manages this, and it's largely invisible to users.

Compare this to older Intel chips where performance cores were always active, consuming power even during light loads. The architecture improvement from adding efficient cores is huge.

Note that real-world battery life depends heavily on configuration, usage pattern, and screen brightness. A system with high-refresh display, dedicated GPU, and large storage will inevitably use more power. But across comparable configurations, Core Ultra Series 3 should deliver meaningfully better battery life.

The Core Ultra Series 3 processors show significant improvements in core count, clock speed, cache size, and GPU capabilities over the previous generation, enhancing both performance and efficiency.

Competitive Landscape: AMD, Apple, and Others

Let's be honest about the broader competitive environment. Core Ultra Series 3 arrives into a crowded market where Intel's actually the underdog.

AMD's Ryzen 9 8945HX remains the performance leader in many benchmarks, particularly multithreaded workloads. AMD has the advantage of using TSMC's proven advanced processes, which means they've got no yield concerns and can ramp production quickly. They're also not encumbered by the baggage of Intel's manufacturing failures.

Apple's M4 Pro chips still dominate for media processing and creative work. Apple's vertical integration means they optimize hardware and software together in ways no x 86 competitor can match. If you're buying a Mac Book, Apple chips are obviously the choice. For Windows and Linux users, it's more complicated.

Qualcomm's Snapdragon X series (running Windows on ARM) is gaining traction with impressive battery life and increasing application compatibility. By 2026, Windows on ARM will be a real option, not a curiosity. Core Ultra Series 3 needs to prove x 86 architecture is worth the power consumption premium.

Media Tek and Samsung also have mobile processors in this space, though they're primarily focused on emerging markets and Android tablets.

The dynamic here is that Intel needs Core Ultra Series 3 to be genuinely competitive. They can't afford to be the third choice. The company's market position, stock price, and manufacturing strategy all depend on proving that US-made advanced chips can compete.

For consumers, this competition is great. Core Ultra Series 3 wouldn't be as impressive if Intel didn't feel threatened. The pressure from AMD and Apple forced Intel to innovate rather than coast on brand loyalty.

Manufacturing Geopolitics and Supply Chain Implications

Core Ultra Series 3 isn't just about processor specs. It's a major move in the global geopolitical chess game around semiconductors.

For decades, Taiwan (through TSMC) has been the dominant manufacturer of advanced chips. This concentration created a strategic vulnerability: if Taiwan faced political instability or military action, the global semiconductor supply chain would collapse. The US relies on Taiwan for the vast majority of advanced chip manufacturing.

The Biden administration (and now the Trump administration) has been aggressively pushing to reshore advanced chip manufacturing. The CHIPS Act allocated

Core Ultra Series 3 is the first real product that justifies that investment. These chips are genuinely made in America with American technology and American labor. That's a huge political win for US officials.

For customers, it means something important: supply chain resilience. If something happens to TSMC, Intel's fabs can keep producing. That reduces long-term risk for companies that need stable chip supplies.

It also means potential for tariffs and trade policy changes. The Trump administration has been vocal about wanting more US-based manufacturing. Future trade negotiations might preferentially benefit American-made chips like Core Ultra Series 3.

For Intel's long-term strategy, this is existential. If they can prove they can compete on technology while manufacturing in the US, they've solved their strategic problem. If not, they're financially committed to fabs that can't produce competitive products, which would be catastrophic.

Challenges and Risk Factors

Let's not pretend Core Ultra Series 3 is a slam dunk. There are real risks and challenges.

Yield stability remains uncertain. As I mentioned, Intel was dealing with low yields and high defect rates just months ago. Claims of being "ahead of schedule" are encouraging but not confirmation that problems are solved. Manufacturing at 18A scale remains extraordinarily difficult.

Software optimization is incomplete. Most applications aren't optimized for the hybrid core architecture or the NPU. You'll get performance improvements from architectural gains, but you won't unlock the full potential until software catches up. That's a 2026-2027 story, not a today story.

AMD is also improving. By the time Core Ultra Series 3 ships at scale, AMD will have new processors with better performance. This isn't a one-time win for Intel. They need to maintain the pace of innovation.

Windows on ARM is maturing. Qualcomm's Snapdragon X is gaining traction, and Microsoft is pushing hard on Windows on ARM. By 2027-2028, x 86 architecture might face real pressure from more efficient ARM-based competitors.

Manufacturing capacity is still ramping. Even with stable yields, Intel's production capacity is increasing from low levels. Demand might exceed supply in the first half of 2026, limiting how many customers can actually buy these systems.

Price positioning is uncertain. Intel needs to price competitively, but they also need margin to fund future development. If they price too aggressively, they'll hurt their own profitability.

PR baggage from previous failures. Intel's credibility took hits from years of delays and missed targets. Even if Core Ultra Series 3 is genuinely good, skeptical customers might wait for second-gen reviews before committing.

None of these are dealbreakers, but they're real risks that tempering expectations is appropriate.

Estimated data suggests the industrial and embedded market could surpass the consumer laptop market, reaching $50 billion annually.

Implications for Intel's Competitive Position

Here's the straight assessment: Core Ultra Series 3 is probably good enough to stabilize Intel's market position but not enough to regain leadership.

Intel will likely capture 25-35% of the premium mobile processor market in 2026, which is up from their current ~20% but still behind AMD's 35-40%. That's progress, but it's not dominance.

What Core Ultra Series 3 does accomplish is proving that Intel can still innovate and compete at the highest levels. That matters for the company's stock price and long-term strategic credibility. If Core Ultra Series 3 were a disaster, Intel would be in existential trouble. If it's solid, the company has a path forward.

The real test comes in 2027-2028 with follow-up generations. If Intel can prove that 18A was a turning point and they can iterate on it effectively, they rebuild position. If the next generation stumbles, they're back where they started.

For customers, Core Ultra Series 3 represents the first Intel mobile processor in years that's genuinely worth buying instead of feeling obligated to. That's a significant achievement.

The Broader Technology Shift

Core Ultra Series 3 is important beyond just processor specs. It represents a broader shift in how technology companies think about manufacturing, geography, and resilience.

For years, the model was clear: fabless design companies (like Apple and Qualcomm) design chips, and foundries (primarily TSMC) manufacture them. This worked well for everyone involved, but it created concentration risk.

Intel's vertical integration (designing and manufacturing their own chips) suddenly looks prescient. When TSMC has geopolitical pressures or capacity constraints, Intel's manufacturing becomes strategically valuable.

Other companies are noticing. Samsung is investing heavily in advanced manufacturing. South Korea is building new fabs. The US is building new capacity. The age of single-point dependency on Taiwan is ending.

Core Ultra Series 3 is symbolic of this shift. It's American manufacturing making globally competitive advanced technology. That's a big deal geopolitically and strategically.

Practical Buying Advice for 2026

If you're actually shopping for a laptop in 2026, here's what you should do.

First, wait for benchmarks. Real-world testing from reputable reviewers is worth more than marketing specs. Some reviewers will have systems in January-February 2026. Read multiple reviews before making decisions.

Second, consider your actual workload. For basic productivity (email, documents, browsing), any modern processor is fine, and price matters more than performance. Core Ultra Series 3 is overkill for that, so consider AMD's cheaper options.

For gaming and creative work, Core Ultra Series 3 with the Core X variants is genuinely interesting. The graphics performance improvements could justify the price premium. But wait for real gaming benchmarks before deciding.

For work requiring AI acceleration (some video editing, advanced analysis work), the 50 TOPS NPU is meaningful. But only if software you actually use has optimized for it.

Third, consider your risk tolerance. Core Ultra Series 3 is brand new, on a brand-new process, from a company that's had manufacturing problems. If you can't tolerate early-adopter risk, wait until Q2 or Q3 2026 when edge cases have surfaced.

Fourth, look at the total system. Processor specs matter, but RAM, storage, display, and build quality matter too. A Core Ultra Series 3 laptop with a terrible display is worse than a slightly older processor with an excellent display.

Fifth, consider your supply chain timeline. If you need something now, Core Ultra Series 3 might not be available. If you can wait until Q2, inventory should be better.

Future Roadmap and Intel's Longer-Term Strategy

Core Ultra Series 3 is important, but it's not the end of Intel's story. The company has plans for multiple future generations.

Following 18A, Intel's planning 14A (roughly equivalent to 1.4nm), and eventually 10A and below. These roadmap nodes should deliver continued performance and efficiency improvements, maintaining competitive momentum.

Intel is also working on specialized processor variants. The company's planning mobile processors optimized for AI, video processing, and other specific workloads. Think of it like how Apple offers different chip variants for different products. Intel's heading in that direction.

Data center processors are another focus. Intel has more market share in servers than in consumer laptops, and they need to defend that aggressively. Xeon Scalable processors based on 18A and future nodes will be critical for that market.

The industrial and edge computing opportunity is huge and underexploited. Intel's planning to develop application-specific processors for robotics, autonomous vehicles, and smart infrastructure. That could be bigger revenue than consumer laptops.

Long term, Intel also needs to address the ARM threat. x 86 architecture has been dominant for 40 years, but it's fundamentally less power-efficient than ARM. Eventually, even Intel might need to produce ARM-based processors for certain applications. Don't expect official announcements, but it's probably part of long-term strategic planning.

The Cultural and Strategic Significance

Beyond the technical achievements, Core Ultra Series 3 represents something important culturally and strategically.

For years, Intel was the maker of boring, reliable, incremental improvements. The company was successful because they had no real competition and because x 86 was entrenched in corporate environments. Innovation was nice but not necessary.

Intel's stumble over the past years forced the company to actually innovate or die. That desperation created the conditions for genuine breakthroughs like 18A. The company threw tens of billions at the problem and refused to accept failure.

That matters. It means Intel's starting to act like a company fighting for survival rather than coasting on dominance. That mindset leads to real improvements.

For America's technology strategy, it means having a domestically competitive advanced chip manufacturer. That's been the missing piece for a decade. TSMC was dominant, but that dominance created strategic vulnerability. Core Ultra Series 3 begins to address that.

For tech workers, it means there are genuinely high-stakes engineering problems to solve at Intel's fabs. Building manufacturing processes at the 18A level is some of the hardest engineering in the world. It attracts top talent.

For the industry broadly, it means innovation doesn't flow in only one direction anymore. Intel's back in the game. That competition will benefit everyone through better products.

Conclusion and What's Next

Core Ultra Series 3 is Intel's most important processor launch in years, and it lands at a critical moment. The company needed to prove it could innovate, manufacture competitively, and deliver products customers actually want. On paper, they've succeeded.

These chips deliver meaningful performance improvements, excellent efficiency, and genuine manufacturing innovation. They're available in multiple variants for different use cases. The industrial certification opens massive new markets. The US manufacturing story adds geopolitical significance.

But questions remain. Yield stability is unproven. Software optimization is incomplete. Competition from AMD and Apple remains fierce. The risk of early-adopter problems is real.

For consumers shopping in 2026, Core Ultra Series 3 is worth considering but not automatically choosing. Read reviews, understand your actual needs, and decide if the improvements justify the investment or the risk of buying brand-new technology.

For Intel, this is the beginning of a longer recovery story. Core Ultra Series 3 isn't enough to reclaim market dominance, but it's the foundation for future success. If Intel can maintain innovation momentum and actually solve manufacturing challenges, they're back in the game. If not, this is just the latest in a series of disappointments.

The next 12-18 months will be revealing. Watch for yield reports, supply availability, real-world performance data, and software optimization progress. Those factors will determine whether Core Ultra Series 3 becomes a genuine turning point or another chapter in Intel's struggle.

One thing's certain: the chip competition in 2026 will be more fierce, more innovative, and more consequential than it's been in years. That's good for everyone except Intel executives who wanted an easy life coasting on market dominance.

Intel's comeback story is compelling. Whether it actually succeeds remains to be seen.

FAQ

What is Intel Core Ultra Series 3 (Panther Lake)?

Intel Core Ultra Series 3, codenamed Panther Lake, is Intel's new line of mobile processors announced at CES 2026. These chips are built on Intel's new 18A process technology and represent the company's first significant advancement in manufacturing capability after years of delays. Core Ultra Series 3 comes in multiple variants including Core Ultra 7, 9, and specialized Core X7, X9 models with enhanced graphics capabilities. These processors feature a hybrid architecture with up to 16 total cores and integrate 50 TOPS of neural processing capability for AI workload acceleration.

How does the 18A manufacturing process work?

Intel's 18A process (18 Angstroms, roughly equivalent to 1.8 nanometers) represents a fundamental redesign of transistor architecture and manufacturing techniques. The process uses new Ribbon FET gate-all-around transistor designs that wrap gates completely around silicon channels, improving electron control and enabling more aggressive power scaling. It incorporates advanced extreme ultraviolet lithography, new interconnect materials, and novel manufacturing approaches that don't exist in traditional node scaling. The result is higher transistor density, better power efficiency, and improved performance compared to older manufacturing processes. Intel is producing these chips at fabs in Ohio and Arizona, making them the most advanced processors manufactured in the United States.

What are the performance advantages of Core Ultra Series 3 compared to previous generations?

Core Ultra Series 3 delivers approximately 21% single-threaded performance improvements and 18-20% multi-threaded improvements over Core Ultra Series 2. The hybrid architecture with up to 16 cores (12 P-cores and 4 E-cores) provides flexibility for different workload types. Graphics performance improves significantly, with Core X variants offering 12 GPU cores versus 4 cores in standard models, representing a 3x increase. Power efficiency improvements from the 18A process enable better battery life, with Intel targeting 13+ hours of video playback on a single charge. The 50 TOPS NPU provides meaningful acceleration for AI workloads like image processing, voice recognition, and real-time translation.

Are Core Ultra Series 3 chips reliable given Intel's recent manufacturing problems?

Core Ultra Series 3 represents the first production release using the 18A process, which carries inherent risks of early-generation manufacturing. Intel faced yield problems and high defect rates as recently as August 2025, though new CEO Lip Bu-Tan claims the company is now "ahead of schedule" on production ramp. Real-world reliability will only be confirmed through months of actual customer use. Early adopters should be cautious about potential edge cases and should consider waiting until Q2 or later 2026 when production has stabilized and real-world issues have surfaced. Supply availability might be constrained initially due to manufacturing capacity limitations, even with improved yields.

How does Core Ultra Series 3 compare to AMD's latest processors?

Core Ultra Series 3 trades blows with AMD's Ryzen 9 8945HX depending on specific workloads. Intel claims parity or better in gaming and creative workloads, while AMD maintains advantages in heavily multithreaded tasks. For graphics-intensive work, Core Ultra Series 3's Core X variants with 12 GPU cores are genuinely competitive. AMD benefits from using TSMC's proven advanced manufacturing processes, eliminating Intel's yield concerns, but Intel's 18A process is technologically comparable. The choice between them largely depends on specific software requirements, price considerations, and preference for x 86 (Intel) versus x 86-64 (AMD) instruction sets. For most users, either platform is competitively viable.

What is the significance of US manufacturing for Core Ultra Series 3?

Core Ultra Series 3 represents the first consumer products manufactured on advanced US processes, which is significant for national security and supply chain resilience. The United States has been working to reduce dependence on Taiwan's TSMC for advanced chip manufacturing. Having competitive American-made advanced processors addresses strategic vulnerabilities and supports the US technology ecosystem. For customers, US manufacturing means potential supply chain resilience if geopolitical tensions affect Taiwan. For policy, it justifies the CHIPS Act investment and positions America to maintain technological leadership. This becomes increasingly important as US-China tensions around semiconductor technology continue to escalate.

Should I wait for Core Ultra Series 3 or buy a laptop now?

If you can wait until Q2 or Q3 2026, waiting for Core Ultra Series 3 is probably worthwhile if you need a high-performance system. The performance improvements are substantial enough to justify waiting a few months. However, if you need a laptop immediately, current processor options are perfectly adequate. The choice depends on your workload: if you do gaming, creative work, or need maximum performance, Core Ultra Series 3's improvements matter. If you do basic productivity work, today's processors are overkill. Additionally, early adopters face risks of edge cases and supply constraints, so risk-averse customers should wait until mid-2026 when the platform has matured.

What does the 50 TOPS NPU actually do for users?

The 50 TOPS neural processing unit in Core Ultra Series 3 accelerates AI workloads by typically 5-10x compared to CPU execution. This is useful for image generation in photo editing, real-time video transcription, voice processing, and on-device AI features in productivity software. However, software support is still emerging, and most applications aren't optimized for NPU execution yet. The real benefits will become apparent in 2026-2027 as frameworks like Py Torch and Tensor Flow add NPU support and developers optimize applications accordingly. For current applications, the NPU provides benefits but probably won't cause a visible difference compared to older processors without NPU support.

Can Core Ultra Series 3 replace dedicated graphics cards for creative work?

Core Ultra Series 3's Core X variants with 12 GPU cores can handle serious creative work that previously required external graphics cards. Video editing, 3D rendering, and game development become practical on laptops with these processors. However, they won't match discrete RTX 4070-level performance for extremely demanding applications. For professional-grade work, they're competitive with mobile gaming GPUs from 2023-2024. This makes them genuinely viable for freelancers and small studios that previously needed desktop systems. The power efficiency gains from the 18A process mean this capability comes without severe battery life penalties, which is a genuine innovation.

What's Intel's long-term strategy beyond Core Ultra Series 3?

Intel has planned future generations following 18A, including 14A and 10A nodes that should deliver continued performance and efficiency improvements. The company is developing application-specific processor variants for AI, video processing, and other workloads, similar to Apple's approach. Industrial and edge computing markets are receiving significant attention, with potential revenue exceeding consumer laptop markets. Data center processors using 18A and future nodes are critical for defending Intel's server market share. Long-term strategy includes addressing ARM architecture competition, potentially through developing ARM-based processors for specific applications, though Intel hasn't officially committed to this approach. Success depends on maintaining innovation momentum and actually proving manufacturing capability.

Would you like me to explain any specific aspect of Core Ultra Series 3 in more detail? The processor landscape changes rapidly, and there's always more to explore about Intel's technical approach and strategic positioning.

Key Takeaways

- Core Ultra Series 3 is Intel's first consumer processor using the new 18A manufacturing technology, roughly equivalent to 1.8nm processes

- Performance improves 18-20% over previous generation Core Ultra Series 2, with 16 cores and 50 TOPS NPU capability

- American manufacturing at Intel's fabs in Ohio and Arizona provides supply chain resilience and geopolitical significance

- Graphics performance improvements, especially in Core X variants with 12 GPU cores, make these chips viable for creative professional work

- Yield stability remains unproven after recent manufacturing problems, making early adoption carry inherent risks despite good prospects

Related Articles

- Intel Core Ultra Series 3 Panther Lake at CES 2026 [Complete Guide]

- MSI Stealth 16 AI Plus Review: Gaming Laptop That Actually Looks Professional [2025]

- Dell XPS Laptops Return: Why This Matters for Premium Notebooks [2025]

- Nvidia's Vera Rubin Chips Enter Full Production [2025]

- Nvidia Vera Rubin AI Computing Platform at CES 2026 [2025]

- Google TV's Gemini Features: The Complete Breakdown [2025]

![Intel Core Ultra Series 3: The Panther Lake Comeback Explained [2026]](https://tryrunable.com/blog/intel-core-ultra-series-3-the-panther-lake-comeback-explaine/image-1-1767659837982.jpg)