Why Apple's iPhone 18 Price Hold Matters More Than You Think

Apple's smartphone pricing strategy has always been a bellwether for the entire tech industry. When Apple moves, competitors follow. When Apple holds the line, investors take notice. So when reports emerge that Apple intends to keep the iPhone 18's starting price flat despite global memory shortages, it's not just a news headline—it's a window into how the world's most valuable company manages supply chain chaos while protecting its most valuable product line. According to Ming-Chi Kuo, Apple plans to absorb rising memory costs rather than passing them to consumers.

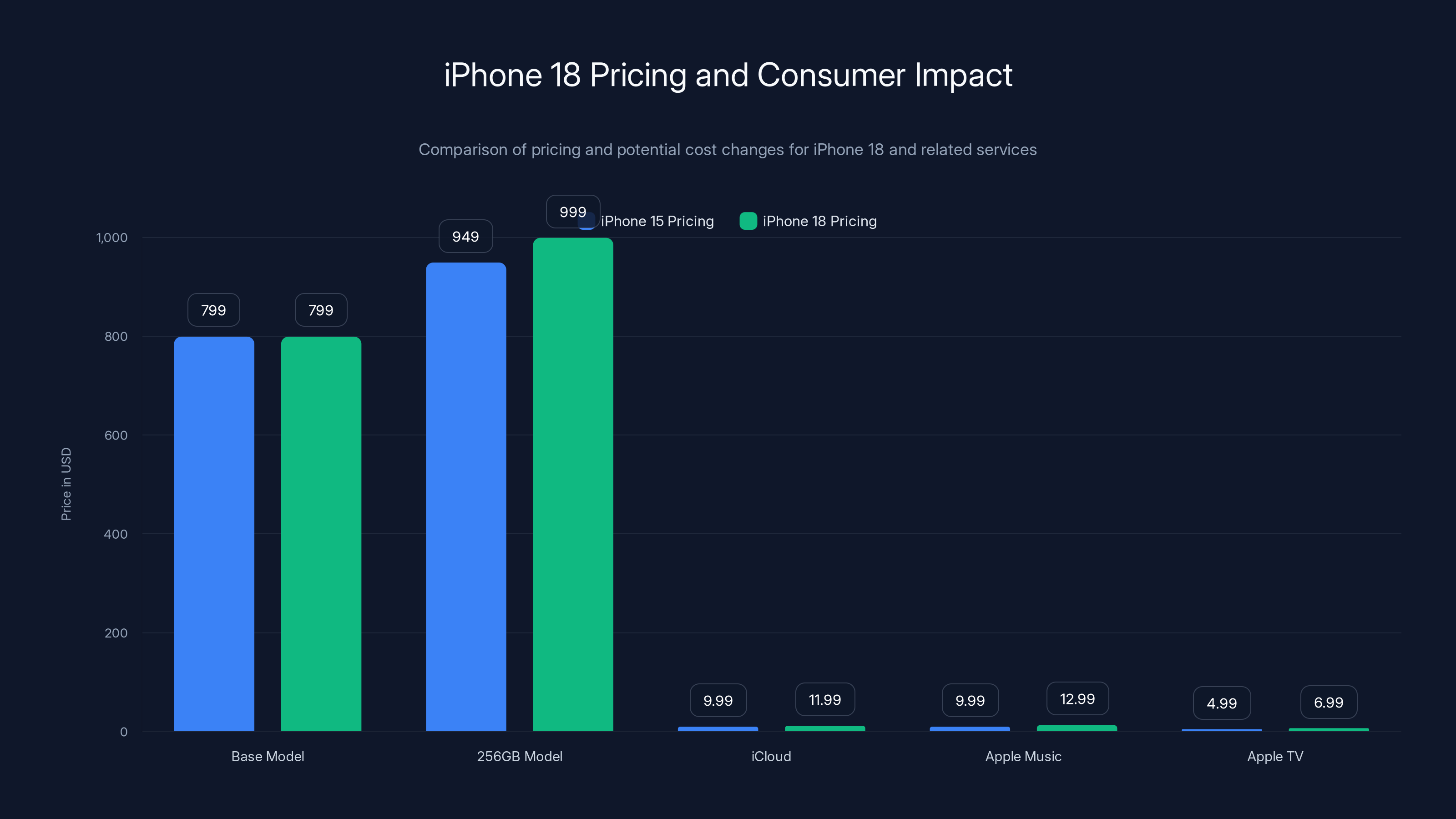

The stakes here are massive. Historically, each new iPhone generation brought incremental price increases. The iPhone 14 started at $799. The iPhone 15 maintained that price point. Now, with RAM costs climbing and component shortages rippling through the supply chain, Apple faces an unusual choice: pass costs to consumers or absorb them internally. According to supply chain analyst Ming-Chi Kuo, Apple has chosen the latter—at least for now.

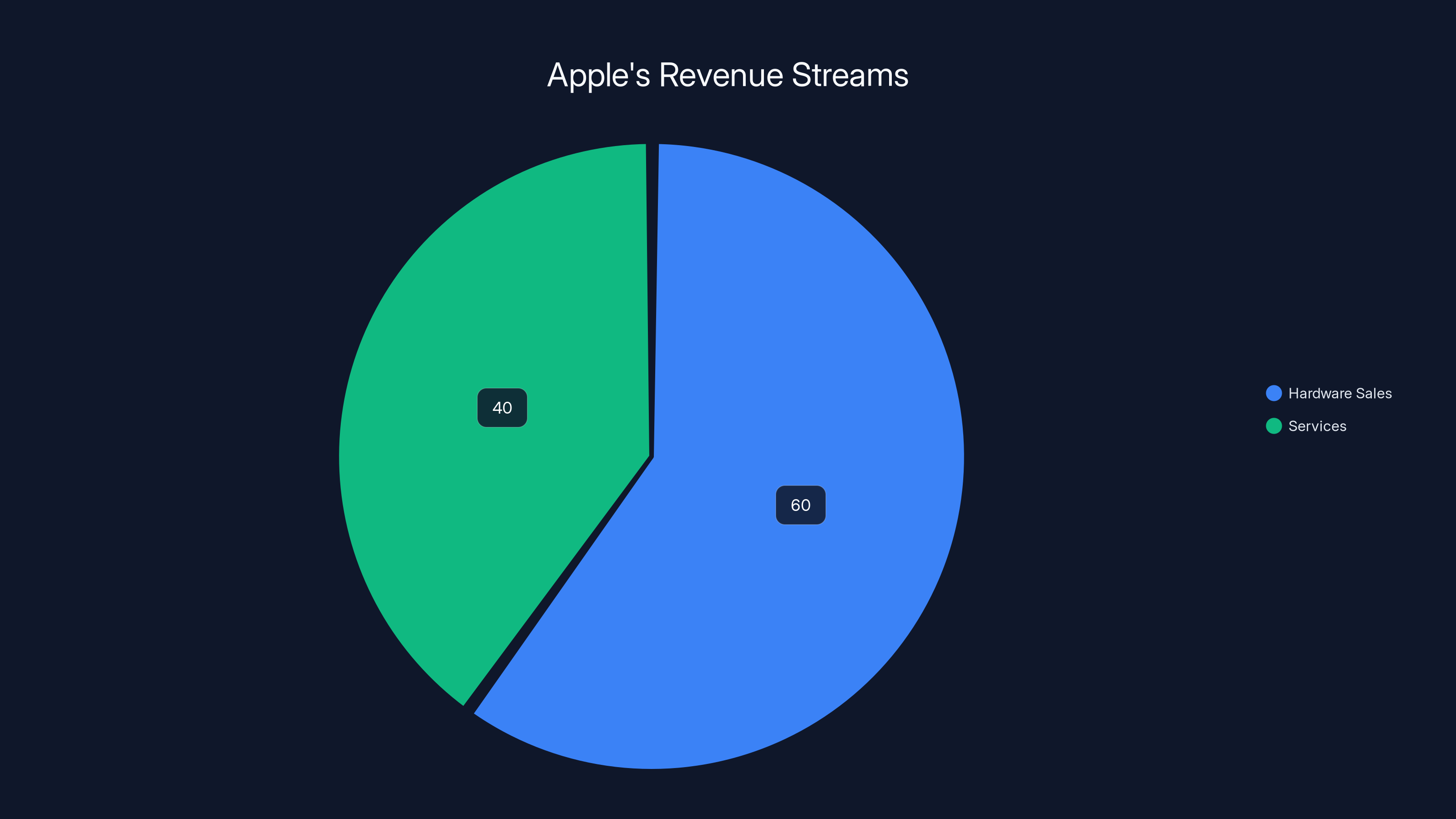

But here's where it gets interesting. This decision isn't about altruism or protecting market share alone. It's about strategic positioning in an era where AI capabilities are reshaping what consumers expect from their phones, where memory supplies are tighter than they've been in years, and where services revenue has become just as critical as hardware sales. Apple's willingness to absorb costs signals confidence in its ability to offset those expenses through its increasingly lucrative services business.

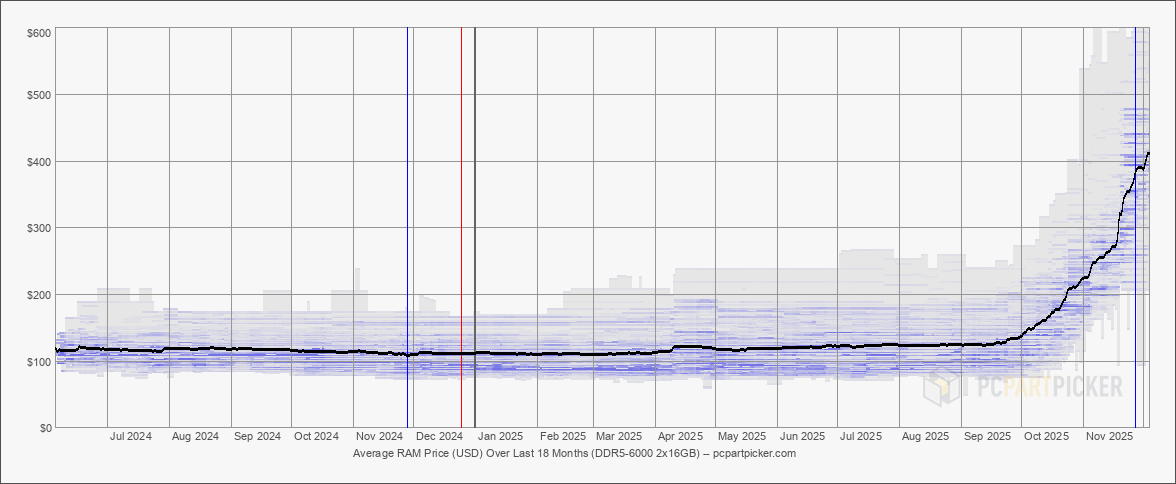

The global memory shortage itself stems from an unexpected culprit: artificial intelligence. Data centers, cloud infrastructure, and AI companies are hoovering up available RAM and specialized components at unprecedented rates. This demand isn't temporary fluctuation—it's structural. Companies building large language models, training neural networks, and deploying AI infrastructure need memory bandwidth that rivals traditional smartphone manufacturers. When AI vendors win the supply competition, smartphones lose.

What's remarkable is that Apple is choosing not to penalize early adopters. Instead, the company is opting for a strategy that's been successful before: absorb short-term margin pressure, maintain price stability to drive volume, and make up the difference through services, ecosystem lock-in, and premium tier upgrades. This approach assumes that keeping iPhone 18 entry-level pricing accessible will drive upgrade cycles and services adoption across the installed base.

The RAM situation compounds other supply chain headaches. Beyond just memory chips, Apple and its competitors are facing bottlenecks in glass cloth—a material used on printed circuit boards that's become suddenly precious as AI companies stockpile it for their own infrastructure projects. When an entire industry sector (AI) is suddenly competing for the same limited resources as a mature industry (smartphones), pricing dynamics shift in unexpected ways.

This article dives deep into what's really happening with Apple's iPhone 18 pricing strategy, how the RAM shortage is reshaping the smartphone market, what it means for consumers, and why Apple's decision to absorb costs might be the smartest play it's made in years.

TL; DR

- Apple won't raise iPhone 18 prices despite rising RAM costs, according to supply chain analyst Ming-Chi Kuo.

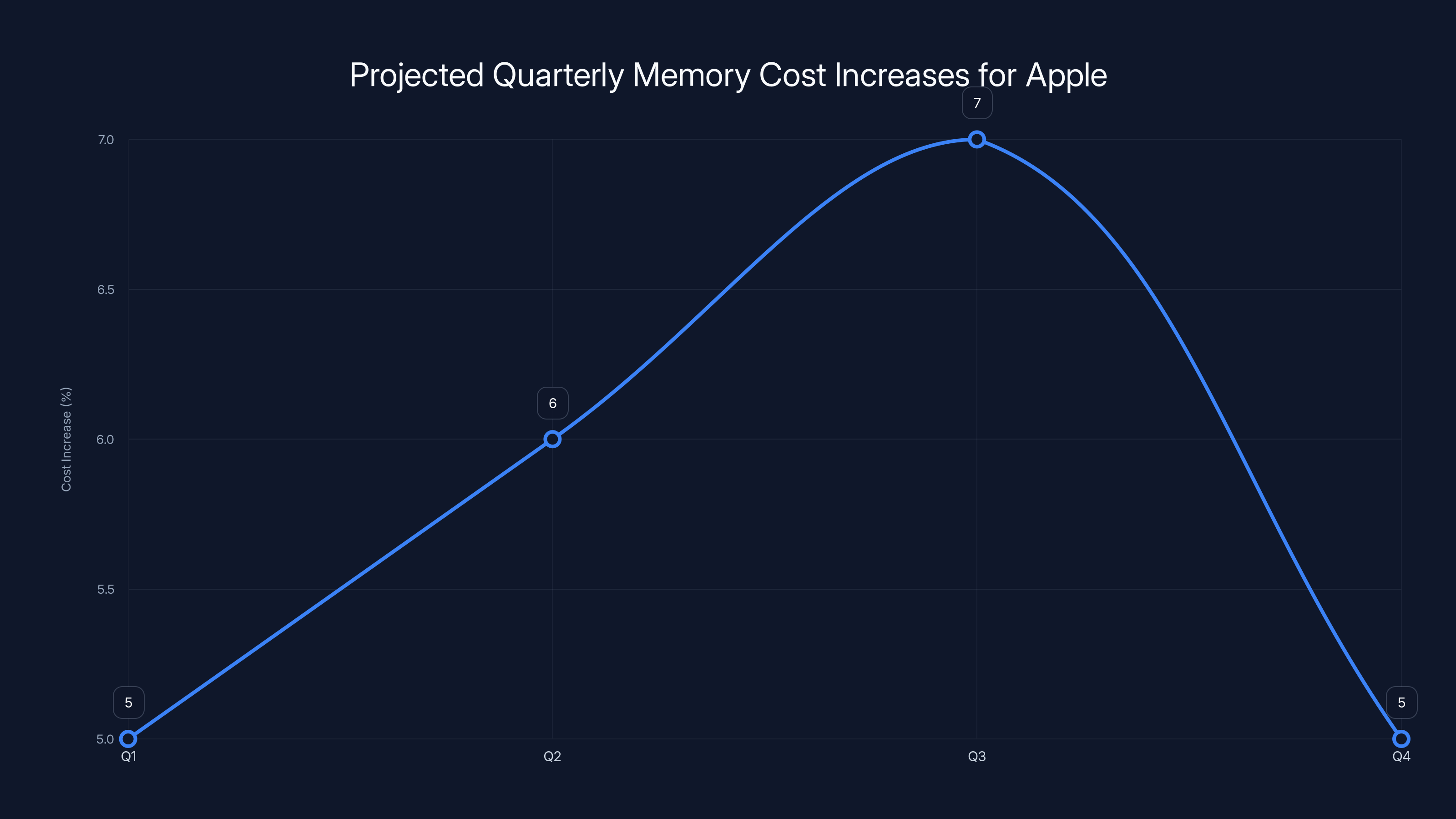

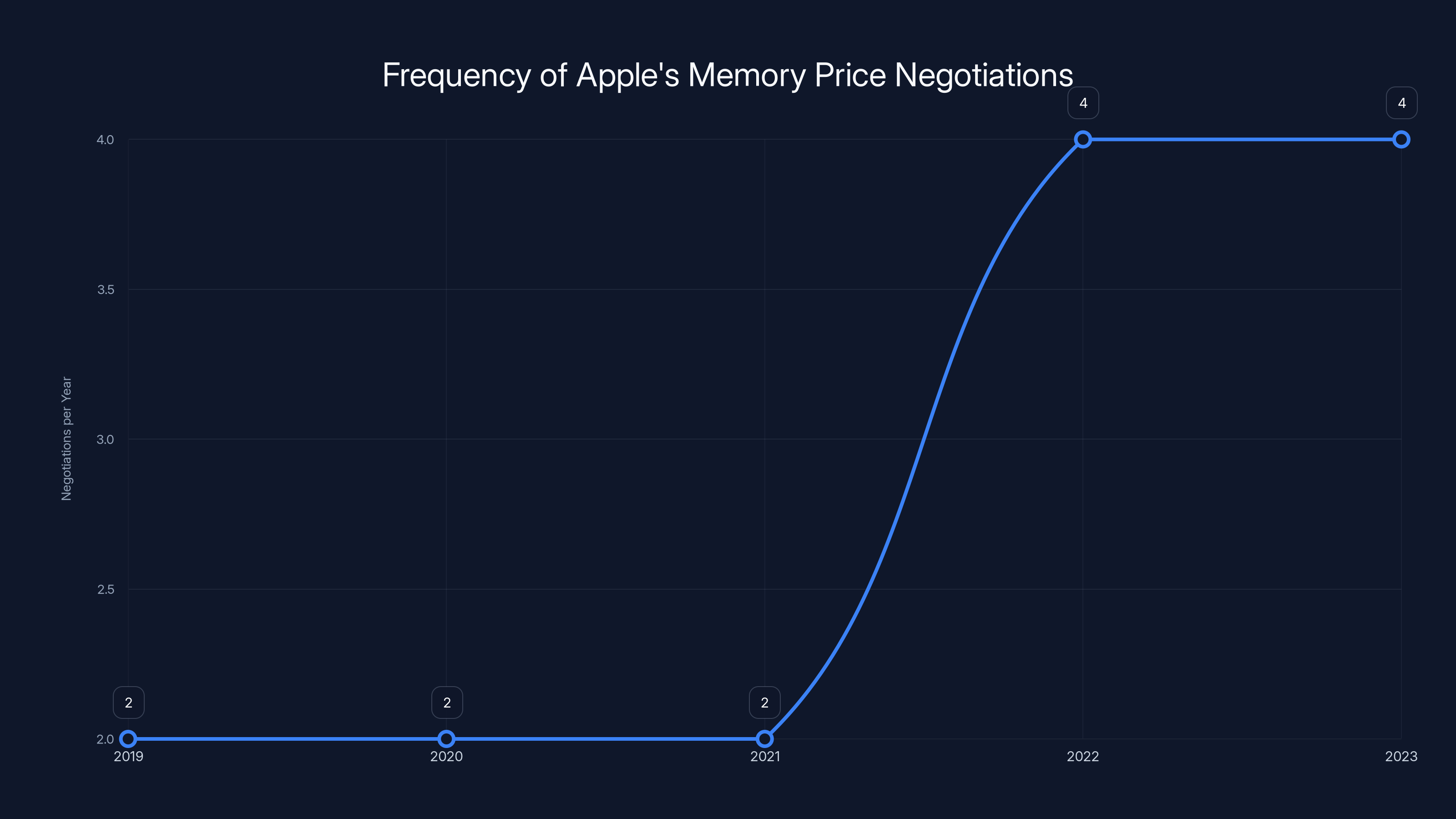

- RAM prices are climbing quarterly as AI companies compete for memory supplies, forcing Apple to renegotiate with suppliers every three months instead of every six.

- Services revenue offset is Apple's strategy for absorbing memory cost increases through subscriptions like Apple Music, iCloud, and Apple TV+.

- Component shortages extend beyond RAM to include glass cloth used in PCBs, as AI infrastructure projects drain supplies across multiple materials.

- Price stability protects volume and upgrade cycles, allowing Apple to maintain market momentum despite supply chain turbulence.

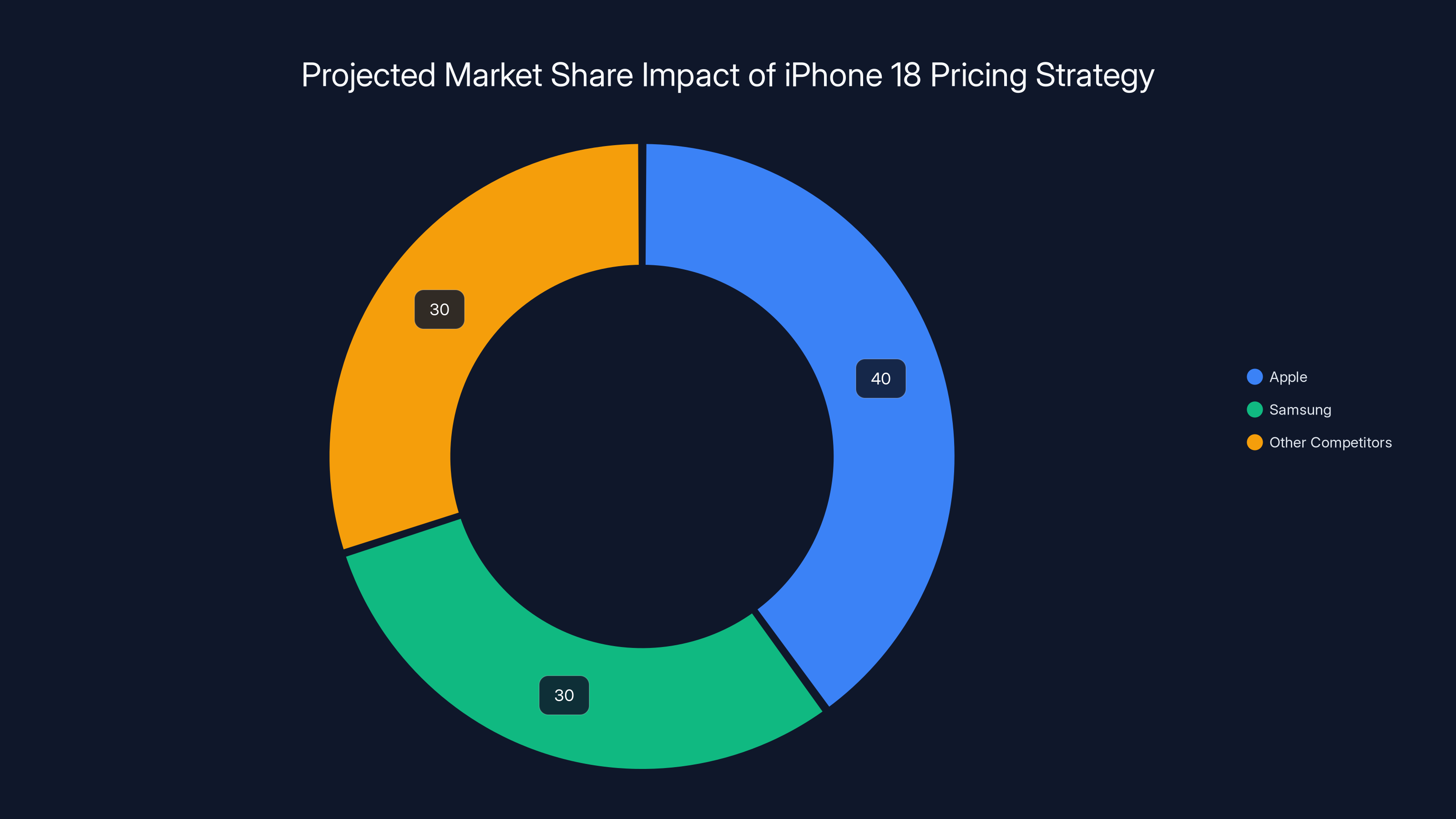

Estimated data suggests Apple's flat pricing strategy for the iPhone 18 could increase its market share to 40% in the premium segment, leveraging price sensitivity and value proposition advantages.

The Global RAM Shortage: What's Actually Happening

Random Access Memory isn't experiencing a gradual increase in cost. It's experiencing what supply chain experts call a "supply shock"—a sudden, significant disruption that scrambles traditional pricing models. In 2025, this shock has a specific source: artificial intelligence infrastructure expansion.

Datacenters building out capacity for large language model inference, training, and fine-tuning require massive amounts of memory. An NVIDIA H100 GPU has 80GB of HBM2E memory. A cluster of hundreds or thousands of these GPUs requires terabytes of coordinated memory systems. When you multiply that across Google, Meta, Amazon, Microsoft, and countless startups building AI systems, you're talking about memory demand that dwarfs traditional PC and smartphone markets combined.

The memory supply chain can't pivot overnight. DRAM manufacturing requires multi-billion dollar fabrication plants that take years to build and ramp into production. When demand spikes, suppliers face a choice: expand capacity (slow, expensive, risky) or allocate existing inventory to the highest bidder. AI infrastructure companies have deeper pockets and longer-term commitments than smartphone makers accustomed to annual upgrade cycles.

What makes this particularly acute for Apple is the timing. The iPhone 18 launch cycle overlaps with peak AI infrastructure expansion. Companies finalizing multi-year AI buildouts are signing massive memory contracts. This creates bidding wars at the component level. Suppliers can charge premium prices to AI vendors, then offer smartphone makers steeper price increases or delayed delivery commitments.

Kuo reports that Apple has shifted from semi-annual to quarterly memory price negotiations with suppliers. This suggests the situation is dynamic and volatile. The company isn't locking in annual contracts at fixed prices. Instead, it's engaging in rapid-cycle discussions to manage costs as they fluctuate. This operational agility is expensive in its own right—each negotiation cycle requires dedicated supply chain personnel, analytical support, and strategic decision-making overhead.

The supply crunch extends beyond DRAM. Glass cloth, a material laminated onto printed circuit boards to provide structural integrity and electrical properties, is facing unexpected bottlenecks. Apple, Nvidia, AMD, and Qualcomm all use glass cloth in their products. AI companies building custom silicon and server infrastructure have dramatically increased their PCB orders, creating cascading effects through materials suppliers that can't easily increase output.

The broader lesson: smartphone pricing no longer exists in isolation. When entire industries compete for the same component supplies, traditional demand-supply models break down. Apple's decision to absorb RAM costs rather than pass them along reflects this new competitive reality.

Apple's Quarterly Negotiation Strategy: A Shift in Procurement Tactics

For years, Apple negotiated component pricing on a predictable cycle. Suppliers would quote annual prices with some adjustability for large volume changes. This gave Apple stability and suppliers visibility. Both sides could plan.

Quarterly renegotiations change that dynamic entirely. Instead of locking prices for 12 months, Apple is now renegotiating every 90 days. This is simultaneously more aggressive and more defensive—aggressive because it forces suppliers to accept short-term pricing pressure without long-term security, defensive because it allows Apple to avoid being locked into escalating costs if supply tightens further.

For suppliers, quarterly negotiations create operational complexity. They can't commit capital to capacity expansion without knowing next quarter's pricing. They must maintain pricing flexibility, which typically means maintaining margin buffers or limiting supply commitments. This paradoxically makes supply tighter, not looser.

Apple's quarterly approach also signals to suppliers that the company is price-sensitive and actively shopping around. In memory supply, this matters. Samsung, SK Hynix, and Micron all manufacture DRAM and NAND flash. By renegotiating frequently, Apple can pit suppliers against each other, rewarding those who offer competitive rates with larger order commitments.

The data point Kuo provides is significant: Apple expects another price increase in its next quarterly round. This suggests that current price pressures aren't easing. AI demand remains strong, supplies remain constrained, and suppliers have pricing power. Apple's quarterly negotiation window will likely see another 3-7% increase in memory costs, on top of increases from previous quarters.

What's not discussed in public statements is how these costs cascade. If DRAM pricing increases 5% per quarter, that's roughly 20% annually—a material hit to margin on iPhone units. For a

Apple's choice to absorb this rather than raise prices is economically defensible only if the company can offset the margin loss elsewhere. This is where services become critical to the narrative.

Estimated data shows Apple's services account for 40% of revenue, helping offset hardware cost pressures.

The Services Offset: How Apple's Subscription Business Saves Hardware Margins

Apple's services business has become the company's profit engine. While iPhones, Macs, and iPads generate headline revenue numbers, the margins on services—subscriptions to Apple Music, iCloud, Apple TV+, Apple News+, Apple Arcade, and Apple One bundles—are substantially higher than hardware margins.

Typical smartphone hardware margins fall in the 35-40% range for premium devices. Services margins can exceed 70%. This means a single $10.99/month iCloud+ subscription represents roughly equivalent profit to several hundred dollars in iPhone sales. When Apple absorbs an incremental cost on hardware to drive services adoption or retention, the math often works out in the company's favor.

Here's the economic model: Keep iPhone 18 pricing flat, drive upgrade volumes to historically high levels. Every new iPhone activated is a potential entrant into the services ecosystem. A user upgrading from an iPhone 15 to an iPhone 18 might not see an immediate benefit to changing subscription status, but the predictable upgrade cycle positions Apple to cross-sell services with specific use cases: more storage via iCloud+, premium cloud gaming via Apple Arcade, music via Apple Music as bundled options, or family plans via Apple One that lock in all services together.

The attachment rate matters enormously here. If keeping iPhones $50 cheaper (absorbing RAM cost increases) drives 5% higher upgrade rates, and those additional users represent a 20% conversion to services subscriptions they wouldn't have otherwise purchased, the ROI is massively positive. Apple's financial analysts have likely modeled this scenario extensively.

Services revenue is also more resilient to competition than hardware. Once a user has invested in the Apple ecosystem—uses iCloud for photos, subscribes to Apple Music, has Apple TV+ episodes partially watched, has family members on a shared Apple One plan—switching costs increase dramatically. Services create stickiness that protects margins and improves lifetime customer value.

For shareholders, services growth matters because it smooths revenue volatility. Smartphone upgrades follow cyclical patterns—every 3-4 years for most users. Services revenue, by contrast, recurs monthly and scales with the active installed base. The installed base only grows, rarely shrinks. This predictable recurring revenue justifies Apple's willingness to sacrifice some hardware margin.

Another consideration: services revenue is increasingly global, less capital-intensive, and less dependent on component availability. When RAM supplies tighten, services don't suffer. When transportation costs spike or manufacturing complexity increases, services margins remain stable. Apple's strategic shift toward hardware price stability with services offsets is thus a hedge against future component supply volatility.

How AI Infrastructure Demand Distorted Memory Supply Chains

The RAM shortage isn't accidental. It's a direct consequence of AI infrastructure buildout exceeding historical demand forecasts by orders of magnitude. To understand how, you need to understand what data centers actually require.

A large language model serving millions of requests requires memory in two forms: DRAM for rapid access to model weights during inference, and specialized high-bandwidth memory (HBM) for GPU clusters training and fine-tuning models. When a company like Meta or Google decides to deploy an internally-trained large language model, they're building infrastructure that requires:

- GPU clusters with thousands of high-end accelerators

- Corresponding high-bandwidth memory integrated with those GPUs

- Network interconnect memory for cluster communication

- Main DRAM for CPU operations and caching

A single modern AI training cluster might require terabytes of HBM and additional terabytes of DRAM. When every major cloud provider, tech giant, and numerous startups are simultaneously building these clusters, the aggregate demand overwhelms existing supply.

Memory manufacturers like Samsung, SK Hynix, and Micron expanded capacity in anticipation of AI demand, but capacity expansion takes time. A new fabrication plant takes 3-5 years to plan, build, and bring into production. When demand exceeds existing capacity, the shortage compounds quarter-over-quarter.

Smartphone manufacturers historically accounted for roughly 40-50% of DRAM demand globally. When AI infrastructure captures 20-30% of incremental production, it immediately tightens smartphone-destined supplies. Suppliers naturally allocate components to the highest bidder. AI infrastructure companies, funded by massive venture rounds or backed by profitable tech giants, consistently outbid smartphone makers.

What's particularly disruptive is that AI demand is structural, not cyclical. It's not like the PC boom of the 2000s, which peaked and declined as smartphone penetration increased. AI infrastructure demand is still in early exponential growth. Unlike smartphones, which are approaching saturation in developed markets, AI infrastructure doesn't have a natural ceiling in sight. This means memory constraints will likely persist for years.

This dynamic incentivizes companies like Apple to accept flat pricing (not increasing it despite cost increases) because raising prices could suppress volume, and volume is how the company maintains market dominance. Volume also feeds more iPhone users into services, which become increasingly important as hardware margin pressure persists.

Component Bottlenecks Beyond RAM: The Glass Cloth Crisis

RAM is the headline story, but it's not the only component squeezed by AI infrastructure competition. Glass cloth—a material used on printed circuit boards as a substrate for copper traces and electrical components—is experiencing similar bottleneck effects.

Glass cloth serves a critical function. It provides the structural basis for PCBs, offering both mechanical rigidity and electrical properties necessary for reliable circuit operation. Every smartphone, server, GPU, and modern electronic device requires glass cloth. It's not a sexy component—engineers rarely think about it—but without it, nothing works.

As AI companies design custom silicon and deploy server infrastructure, they're ordering massive quantities of PCBs. A single GPU cluster might require thousands of custom PCBs for various control logic, power distribution, and interconnect functions. When demand from AI infrastructure suddenly increases, suppliers of glass cloth who've optimized production for traditional electronics demand find themselves unable to scale quickly.

Glass cloth manufacturing, like many materials production processes, benefits from economies of scale but struggles with rapid capacity expansion. Suppliers can't instantly bring new lines online. Raw materials—fiberglass itself—may also face supply constraints if not planned months in advance.

The result is a cascading shortage affecting everyone. Apple needs glass cloth for iPhones. Qualcomm needs it for Snapdragon processors. AMD needs it for CPUs. But AI companies need it for their infrastructure, and they're willing to pay premium prices and commit long-term purchases that convince suppliers to deprioritize smartphone and consumer electronics orders.

Apple's decision to navigate this landscape by holding prices flat while absorbing costs is a strategic acknowledgment that component shortages are the new normal. Rather than continuously raising prices and risking market share loss, the company is protecting volume and margin through services offsets.

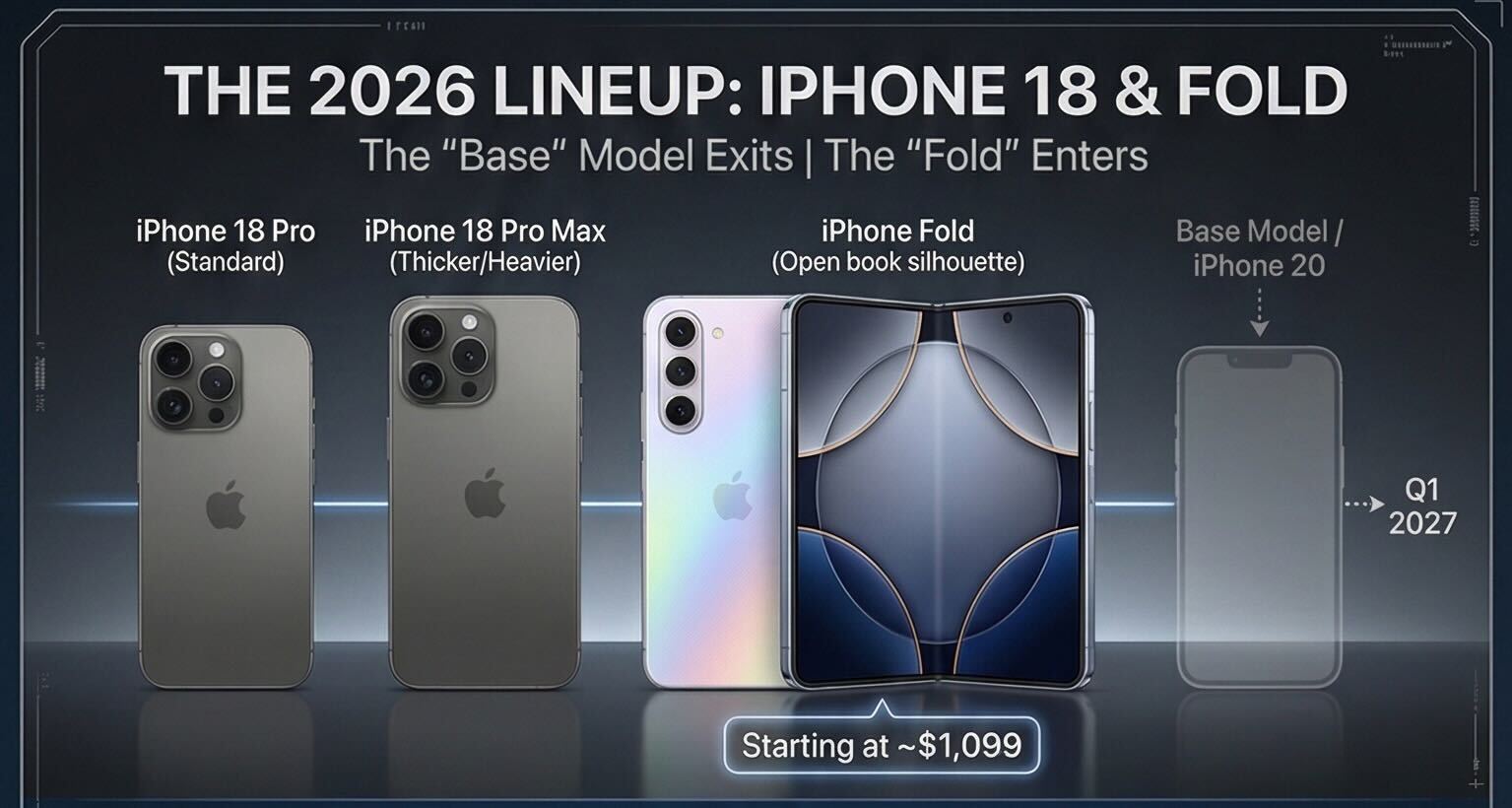

Estimated data: While the base model price remains stable, premium tiers are expected to see price increases, with the highest increase for the 1TB model.

Supply Chain Renegotiation Frequency and What It Signals

Apple's shift from semi-annual to quarterly memory price negotiations is a tactical move with strategic implications. It signals several things to suppliers, competitors, and investors:

First, it signals price sensitivity. Apple isn't accepting supplier price increases passively. The company is actively engaging in rapid-cycle negotiations, presumably comparing offers across suppliers and playing them against each other. This is negotiating leverage in its purest form.

Second, it signals volatility management. By renegotiating quarterly instead of annually, Apple protects itself from large surprise cost increases mid-year. If a supplier tries to impose a 10% increase in month six of an annual contract, Apple is locked in. Quarterly negotiations prevent this scenario.

Third, it signals forward-looking supply management. Apple's analysts are clearly tracking memory supply trends closely enough to know that another price increase is coming in the next quarter. This suggests sophisticated supply chain intelligence, perhaps including direct conversations with DRAM manufacturers about their production capacity, demand from other customers, and pricing outlook.

Fourth, it signals operational complexity. Quarterly negotiations aren't free. They require dedicated personnel, analytical support, legal review, and executive decision-making. Apple is willing to invest this operational overhead because the financial stakes justify it.

The fact that Kuo reports Apple expects another price increase in the next quarterly round is telling. Apple isn't expecting relief. The company is preparing for continued pressure. This expectation likely informs product roadmap decisions—what components to use, how to optimize power efficiency to potentially reduce memory requirements, whether to introduce new SKUs with tiered memory configurations that absorb cost increases at different price points.

For consumers, this translates to stability at entry-level pricing but potential increased pricing for higher-capacity models. Apple might maintain a

iPhone 18 Pricing Architecture: Base Price Stability, Upper Tier Flexibility

Understanding Apple's iPhone pricing requires distinguishing between the base model (which gets the most marketing attention and drives upgrade cycle decisions) and the premium tiers (which drive average selling price and margin).

Historically, when Apple faces cost increases, it often holds base pricing flat while increasing premium tier prices. The iPhone 14 launched at

With the iPhone 18, expect Apple to follow this established pattern. The

This strategy works because most buyers don't carefully compare storage pricing across generations. They either buy the base model (price-sensitive segment) or pick whichever storage capacity matches their needs (less price-sensitive segment). By holding base pricing flat and raising premium tiers, Apple maintains perceived affordability while capturing margin where customers have demonstrated less price sensitivity.

The mathematics are straightforward: If base model sales represent 30% of unit volume and 15% of revenue, holding that price flat preserves volume momentum. The remaining 70% of volume, concentrated in higher-capacity models, provides flexibility for margin recovery through pricing increases.

Historical iPhone Pricing Patterns and Market Reactions

Apple's history with iPhone pricing reveals clear patterns about how the market responds to price changes and how Apple manages them strategically.

The iPhone 14 Pro and Pro Max introduced notably higher pricing (

When the iPhone 15 launched in 2023, analysts predicted price increases due to component costs and AI feature development. Instead, Apple surprised with flat pricing on the base model. The USB-C port change, while not a major feature, was perceived as justifying the existing price point. The company maintained

This pattern reveals Apple's sophisticated approach: Feature improvements and operational efficiency gains offset cost increases at the base level, maintaining headline pricing. Premium tiers and new product lines (Pro models) absorb margin expansion when possible. This three-tiered approach (base, Plus, Pro, and occasionally Pro Max) gives Apple flexibility across the entire price spectrum.

Market data supports the effectiveness of this strategy. iPhone upgrade cycles have stabilized around 3-4 years as users upgrade less frequently than in earlier generations. Base model pricing stability appears to contribute to maintaining upgrade cycle momentum. Users perceive value stability and feel the upgrade is worth their time and effort.

Apple's willingness to absorb costs for the iPhone 18 base model suggests the company has learned that volume and ecosystem expansion (which feeds services adoption) may provide better long-term returns than aggressive margin capture through pricing increases. This is especially true when competitors are also facing supply chain pressures and might raise prices, giving Apple a potential competitive advantage if it holds the line.

Estimated data shows a 3-7% increase in memory costs per quarter, potentially leading to a 20% annual increase. This reflects the impact of Apple's quarterly renegotiation strategy on supplier pricing dynamics.

Competitive Implications: How Samsung, Google, and Other OEMs Respond

Apple doesn't exist in a vacuum. When Apple holds prices flat while competitors may raise prices, it creates competitive pressure that ripples through the entire market.

Samsung faces similar memory costs but has historically been more aggressive about pricing increases when faced with component cost spikes. The Galaxy S25 series could see price increases of

Google's Pixel line has historically been positioned below premium flagship pricing, but the company faces similar memory cost pressures. If Google maintains aggressive pricing while Samsung and Apple adjust, Google could gain market share. However, Google's smaller supply chain negotiating power compared to Apple makes this scenario less likely. Google will probably see steeper cost increases than Apple due to lower volume leverage with suppliers.

OnePlus and other mid-range manufacturers typically feel cost pressures most acutely, as they have the least negotiating leverage with component suppliers. These companies will likely see the most significant price increases or be forced to reduce specifications (dropping RAM, using lower-capacity storage) to maintain pricing.

Apple's decision to absorb costs and maintain base pricing effectively sends a market signal: premium quality devices don't need price increases if you manage costs and margins across your entire business (including services). This puts pressure on competitors who may not have equivalent services revenue to offset hardware margin pressure.

The net result is likely to accelerate Apple's market share gains in premium segments and potentially push some competitors down-market into lower-margin categories. This dynamic favors Apple's integrated ecosystem approach where services revenue provides strategic flexibility.

The Role of AI Features in Justifying Flat Pricing

While the publicly stated reason for flat iPhone 18 pricing is Apple's strategic choice to absorb costs, the feature story matters equally. Apple typically justifies pricing through new capabilities. If the iPhone 18 introduces compelling AI features—on-device processing for machine learning tasks, enhanced Siri with language model capabilities, intelligent photo organization and editing, real-time translation—users perceive value even at flat pricing.

Apple's rumored integration of AI features into iOS 18 and the iPhone 18's A-series processor likely includes enhanced neural processing. These capabilities would explain how Apple justifies flat pricing to consumers (new features at the same price) even if the real story is internal cost absorption and services offset.

The AI features narrative is important because it sets customer expectations. Consumers don't care about supply chain dynamics or margin pressures. They care about what they get for their money. If the iPhone 18 delivers notably better AI-powered functionality compared to the iPhone 15 or 17, the flat $799 price point feels like a win for consumers, even if the device costs Apple slightly more to produce.

This is where Apple's integration of hardware and software becomes strategically valuable. Samsung's or Google's AI features depend partly on cloud processing and server-side models. Apple can do more on-device with local models because the company controls both hardware (the A-series processor with custom neural accelerators) and software (iOS with deep framework support for machine learning).

On-device AI also has privacy implications that Apple emphasizes—processing happens on your device, not on Apple's servers. This differentiates iPhone from competitors' offerings, justifies pricing parity, and creates genuine technical advantages that don't require cost increases to communicate.

Memory Specifications and iPhone 18 Configuration Tiers

The iPhone 18 will likely ship with multiple RAM configurations, as has become standard in Apple's mobile lineup. Historical progression suggests:

- Base model: 8GB LPDDR5X RAM

- Standard and Plus models: 8GB RAM (base) with 10GB or 12GB options

- Pro models: 10GB or 12GB base, up to 16GB in Pro Max

These configurations represent the engineering trade-offs between performance, power efficiency, and cost. The base 8GB represents the minimum for smooth iOS operation. Higher capacities enable better multitasking and AI feature performance, but require proportionally higher DRAM costs.

With DRAM prices increasing, Apple's decision to hold base model pricing flat means the company is either absorbing the full cost increase across all tiers or making subtle specification changes (using slightly lower-density memory architectures, optimizing power profiles) that offset cost increases through efficiency gains.

The iPhone 17 likely set precedent for RAM configurations that inform iPhone 18 planning. If the iPhone 17 shipped with 8GB base/12GB Pro, the iPhone 18 would probably maintain similar configurations, with possible increases (8GB base/12GB Pro Max) only if other component costs decrease or Apple finds efficiency gains elsewhere.

Memory bandwidth has become increasingly important for AI features. LPDDR5X memory offers higher bandwidth than prior generations, enabling faster neural network inference on-device. This specification improvement justifies to consumers why the iPhone 18 is worth upgrading to, even at flat pricing.

Apple's shift from semi-annual to quarterly memory price negotiations indicates increased price sensitivity and volatility management. Estimated data.

Manufacturing and Logistics: Hidden Cost Pressures Beyond Components

The RAM and glass cloth shortages capture headlines, but Apple faces additional cost pressures throughout manufacturing and logistics that rarely get discussed publicly.

Transportation costs remain elevated compared to pre-pandemic levels. Shipping containers from Asia to North America and Europe have stabilized at higher prices than 2019 baselines. Labor costs in manufacturing facilities continue upward pressure. Factory automation investments required to maintain production at massive scale require ongoing capital expenditure.

Apple's supply chain resilience strategy—maintaining multiple manufacturing partners across geography, working with Foxconn, Pegatron, and Wistron to diversify production—incurs premium costs compared to single-source manufacturing. These costs aren't optional; they're strategic investments in supply chain robustness that prevent single-point-of-failure scenarios.

Packaging and logistics add complexity too. Apple's commitment to reducing carbon footprint and removing plastic from packaging costs more than traditional packaging approaches. These are brand-value decisions that carry economic costs but align with corporate environmental commitments and consumer preferences.

The cumulative effect of these pressures—components, transportation, labor, strategic manufacturing diversification, sustainability investments—exceeds the headline RAM cost increase. Apple's decision to hold pricing flat absorbs all these pressures, which is why the services offset and volume strategy become so critical.

Manufacturing partners like Foxconn also face margin pressure from these cost increases, but they can't raise prices without Apple's approval. This creates a complex dynamic where Foxconn absorbs some costs (or passes them back to Apple through margin reduction) while Apple absorbs component cost increases. Everyone is motivated to find efficiency gains through process improvement, yield optimization, and supply chain streamlining.

Quarterly Negotiations in Practice: What Actually Happens in Those Meetings

Understanding what quarterly memory price negotiations actually entail provides insight into how Apple manages costs in real time.

These meetings involve Apple's Vice President of Procurement, commodity managers, supply chain analysts, financial planners, and strategic procurement experts meeting with suppliers' sales leadership, product management, and pricing teams. The discussions are highly technical and commercially sensitive.

Apple arrives with data: historical usage patterns, forecast demand for the next quarter and beyond, competitive alternatives, and fallback options. The company's intelligence includes knowledge of suppliers' available capacity, what other major customers are requesting, and what pricing comparable customers negotiated in recent weeks.

Suppliers arrive with their own data: manufacturing costs, wafer yields, capacity constraints, commitments to other customers, and demands from their own supply chains (silicon, chemicals, electricity, labor). Both sides have sophisticated financial models predicting memory costs for coming quarters based on market conditions.

These meetings are fundamentally about discovering the intersection of Apple's willingness to pay and the supplier's willingness to accept. Apple wants the lowest price; the supplier wants the highest. Both have walk-away points—prices where the economics don't work.

Apple's leverage comes from several sources: the massive volume it commands (roughly 250 million iPhones annually), the ability to switch between suppliers (though not instantly, due to qualification periods), and strategic relationships spanning decades. A supplier losing Apple's business doesn't just lose current revenue—it loses scale that makes DRAM production efficient.

Suppliers' leverage comes from scarcity. When DRAM supply is genuinely constrained, suppliers can push harder on pricing. Quarterly negotiations give them the opportunity to capture margin from supply tightness. If the next quarter's supply forecast shows continued constraints, suppliers can justify higher pricing.

The typical outcome is a negotiated price between the two walk-away points. Apple might accept a 5% increase while pushing back hard against a 10% request. The supplier might accept 5% while hoping to recover more in subsequent quarters. These incremental increases, compounded quarterly, drive the year-over-year cost increases that force Apple to make strategic choices about pricing and margin management.

Services Ecosystem Lock-In as a Strategic Moat

Apple's willingness to absorb hardware costs makes more sense when you understand services lock-in economics. Once a user has invested in the Apple ecosystem, switching costs increase substantially.

Consider the typical power user scenario: iCloud photos backed up automatically, iCloud mail established across years of correspondence, Apple Music library with thousands of saved songs and playlists, Apple TV+ shows and movies watched across devices, Apple Arcade games with progression saved, Apple News+ subscriptions to premium publications, and potentially Apple One family plan connecting multiple family members.

This user can't easily switch to Android. They'd lose photo continuity, email accessibility (technically possible but cumbersome), music library context, video progress, game saves, and publication access. Each individual service isn't a tremendous switching cost, but the cumulative ecosystem creates stickiness that's economically valuable to Apple.

From a lifetime value perspective, this user might generate

Services also create more predictable revenue patterns. iPhone sales are lumpy, concentrated around new product launches. Services revenue is continuous, recurring monthly, and grows steadily as the installed base expands. Wall Street values predictable recurring revenue more highly than lumpy transactional revenue. Apple's shift toward services revenue elevation improves investor perception of the company's financial stability.

The ecosystem lock-in also works defensively. If a user is locked into Apple services, they're less likely to experiment with Android alternatives, Windows computers, or Google smart home devices. They remain within Apple's ecosystem, making subsequent services upsells (premium iCloud storage, family plan expansion, new services like a potential health services offering) more successful.

The iPhone 18 maintains stable entry-level pricing at $799, while higher-capacity models and services like iCloud and Apple Music may see modest price increases. Estimated data for services pricing.

Market Share Implications and Customer Upgrade Momentum

Apple's decision to hold iPhone 18 pricing flat while competitors likely raise prices should positively impact market share, particularly in premium segments where Apple is already strong.

Historically, when premium smartphone prices approach

Market data from prior years supports this pattern. When Apple held iPhone XS Max pricing steady while Samsung raised Galaxy S10+ pricing, Apple saw improved market share in premium segments. Price parity becomes a significant competitive advantage when features are comparable.

For markets outside developed Western regions, where price sensitivity is even higher, Apple holding prices flat while competitors increase them is strategically significant. In India, Southeast Asia, and Latin America, iPhone adoption is growing but price-sensitive. Flat pricing removes a major barrier to upgrade cycles in these growing markets.

Upgrade momentum is particularly important for services. Every user who upgrades to an iPhone 18 is a potential services customer. Even if the attachment rate to new services is just 15-20%, that represents millions of new subscribers across Apple's services portfolio. At $10.99/month average services revenue per new subscriber, millions of upgrades drive significant services revenue growth.

The compound effect—holding base pricing flat drives higher upgrade volumes, higher upgrade volumes drive services adoption, services adoption locks in customer lifetime value, locked-in customers provide resilience against competitive threats—creates a virtuous cycle favoring Apple.

Longer-Term Supply Chain Resilience and Capacity Investments

Beyond quarterly negotiations and immediate pricing decisions, Apple's response to the current supply chain situation influences its longer-term capacity investment strategy.

If Apple expects continued component scarcity and pricing pressure, the company's incentives to invest in alternative suppliers, bring manufacturing more in-house, or invest in proprietary component design increases. Apple already designs custom chips (A-series processors), custom GPUs, custom neural processors, and custom wireless components. These investments require massive R&D spending but provide long-term margin benefits and supply security.

Expanding in-house component design for memory (DRAM) or other critical components would take years and billions in investment. It's not feasible for a single company to compete with Samsung or SK Hynix at DRAM manufacturing scale. But Apple could partner with component manufacturers to develop custom DRAM architectures optimized for iPhone's specific needs, reducing overall DRAM quantity requirements while maintaining performance.

Alternatively, Apple could deepen relationships with memory suppliers through long-term capacity commitments or even investment in supplier capacity expansion. If Apple committed to purchasing guaranteed quantities at slightly elevated prices in exchange for guaranteed supply and favorable long-term pricing, both Apple and suppliers would benefit from certainty.

These longer-term strategic decisions often happen in parallel with quarterly price negotiations. Kuo's reporting on quarterly negotiations reflects Apple's immediate tactical response to supply pressure. Simultaneously, Apple is likely analyzing whether to invest in strategic capacity expansions, alternative suppliers, or proprietary component development to reduce vulnerability to future shortages.

Analyst Perspectives: Ming-Chi Kuo and Other Supply Chain Watchers

Ming-Chi Kuo has established himself as one of the most reliable sources on Apple supply chain developments. His accuracy on product specifications, timing, and component details has made him a closely watched analyst across the tech industry.

Kuo's reporting that Apple aims to "absorb the costs" of rising RAM prices represents significant intel. Analysts don't typically have direct access to confidential Apple supply chain negotiations. This level of detail suggests Kuo either has direct contacts within suppliers' organizations, or Apple's supply chain communications are sufficiently transparent that industry observers can infer strategic direction from procurement pattern shifts.

The reporting on quarterly renegotiations (moving from semi-annual cycles) is particularly valuable because it reveals operational changes in Apple's procurement process. This isn't something Apple discloses publicly. Supply chain analysts observe these changes through supplier communications, industry conferences, or direct contacts within the supply ecosystem.

Other analysts covering Apple and the memory market (Gartner, IDC, TrendForce) provide broader context on memory pricing trends, supply forecasts, and industry dynamics. Kuo's granular Apple-specific reporting combined with broader market analysis creates a complete picture of what's happening in the smartphone memory market.

For investors, these analyst reports matter because they influence stock price movements. If investors believe Apple is absorbing costs and protecting margin through services, they may interpret this positively (strategic flexibility, long-term orientation, customer-focused approach). If investors believe margin compression is forced rather than chosen, they interpret it negatively (weakening pricing power, commoditization risk).

Kuo's framing—that Apple is choosing to "absorb costs" rather than being forced to—matters significantly for market perception. It suggests Apple has the financial strength and strategic flexibility to choose this path, not that the company lacks pricing power.

Consumer Impact: What This Means for iPhone Buyers

For the typical consumer considering upgrading to an iPhone 18, these supply chain dynamics translate into a straightforward benefit: entry-level pricing stability.

The base iPhone 18 will likely cost $799, the same as the base iPhone 15. This eliminates a major psychological barrier to upgrading. Consumers don't have to decide whether to spend more on the new phone; they can spend the same amount and get new technology.

The trade-offs are subtle and invisible to consumers. Apple is absorbing memory cost increases through margin compression on hardware and offsetting through services revenue. Consumers don't see this complexity. They see stable pricing and improved features.

For consumers who prefer higher-capacity models, pricing may increase modestly. A 256GB iPhone 18 might cost $50-100 more than the iPhone 15 equivalent. These are the buyers with lower price sensitivity who have demonstrated willingness to spend more for additional storage or features.

Services pricing itself might increase modestly. iCloud, Apple Music, Apple TV, and other services may see incremental price increases as Apple optimizes services pricing across the portfolio. These increases typically occur in $0.99-2.99 increments and often include new features or storage allocations justifying the increase.

The net effect for consumers is favorable. Flat hardware pricing, potential services price increases that remain negligible as percentages of household spending, and new AI features and capabilities that improve the daily user experience create a compelling upgrade value proposition.

For price-sensitive consumers, the iPhone 18's flat pricing compared to competitor increases makes it more attractive. For loyal Apple users already in the ecosystem, services ecosystem lock-in ensures continued engagement. For potential switchers from Android, flat pricing removes a barrier to trying iPhone.

Global Implications: How Regional Supply Chains Differ

Apple's supply chain is global, but different regions have different supply chain dynamics, and Apple's pricing strategy accounts for these variations.

In China, where Apple has significant manufacturing partnerships and component supplier relationships, memory costs may be less constraining due to deeper integration with suppliers and longer-term relationships. China-destined iPhones might have slightly different component sourcing than models sold in the US or Europe, allowing regional optimization.

In developing markets (India, Southeast Asia, Latin America), where iPhone adoption is growing rapidly, supply chain constraints hit harder due to less established supplier relationships and smaller negotiating leverage. Apple's willingness to hold global pricing flat absorbs these regional supply constraints and protects expansion potential in high-growth markets.

The European market has additional complexity due to regulatory requirements (USB-C, e-SIM support, right-to-repair considerations) that can affect manufacturing costs. UK's post-Brexit supply dynamics differ from EU dynamics. Apple's global pricing strategy averages these regional variations, with flat base pricing that works across all regions.

For markets where competitors have stronger positions (Samsung in South Korea and parts of Europe, Xiaomi in India and China), Apple's flat pricing strategy is strategically essential for maintaining competitiveness. If Apple raised prices while competitors maintained or lowered prices, growth in these markets would suffer.

The Long Game: Services Revenue as the Ultimate Strategy

Understanding Apple's decision to absorb iPhone 18 costs requires stepping back and viewing the company's broader strategy. Apple isn't a smartphone manufacturer that dabbles in services. Apple is increasingly a services company that uses smartphones as a distribution and adoption channel.

This perspective shift explains many recent Apple decisions:

- Flat iPhone pricing despite component cost increases (protects volume and ecosystem entrants)

- Aggressive services pricing optimization (iCloud+ tiers, Apple One bundling, regional pricing)

- Enhanced on-device AI capabilities (drives services integration and ecosystem engagement)

- Wearables and smart home expansion (ecosystem expansion opportunities)

- Health and fitness tracking expansion (services integration with health data)

The company's financial statements tell the story. Services margins exceed 70%. Hardware margins, despite premium pricing, are often 35-40%. A rational company maximizes the higher-margin category. For Apple, this means protecting hardware volume (which drives services adoption) while aggressively optimizing services pricing.

This strategy has implications for the next 5-10 years. As services revenue grows as a percentage of total revenue, Apple's stock becomes less volatile, more predictable to investors, and valued differently. A company with 40% recurring services revenue trades at different multiples than a company with 15% recurring revenue.

Apple's willingness to absorb hardware costs today is an investment in this longer-term services revenue growth. Every iPhone 18 shipped at flat pricing is an opportunity to add another subscriber to iCloud, Apple Music, Apple TV+, Apple News+, or Apple Arcade. The cumulative effect, across hundreds of millions of devices, is billions in additional services revenue.

For shareholders, this transformation is positive—it reduces earnings volatility and improves long-term value. For competitors, it's challenging—they lack equivalent services revenue to employ this strategy. Samsung, Google, and others must choose between protecting margins (raising hardware prices) and protecting volume (holding prices flat). Apple's services revenue provides a third option: protect volume while sacrificing hardware margin, knowing services will compensate.

FAQ

What is Apple's strategy for keeping iPhone 18 prices flat?

According to supply chain analyst Ming-Chi Kuo, Apple plans to absorb rising memory costs rather than passing them to consumers through price increases. The company offsets these absorbed hardware costs through its services business, which includes subscriptions like iCloud, Apple Music, Apple TV+, and Apple News+, all of which have significantly higher profit margins than hardware sales.

How often is Apple renegotiating memory prices with suppliers?

Apple has shifted from semi-annual (every six months) to quarterly (every three months) memory price negotiations with suppliers like Samsung, SK Hynix, and Micron. This increased renegotiation frequency allows Apple to manage volatile pricing and protect itself from unexpected cost increases, though it also signals that memory price pressure isn't expected to ease quickly.

Why is there a global RAM shortage affecting iPhone production?

Artificial intelligence infrastructure expansion is consuming massive quantities of RAM as companies build datacenters and deploy large language models. Memory manufacturers can't instantly expand capacity, creating supply bottlenecks. AI companies, backed by massive funding and revenue, consistently outbid smartphone manufacturers for limited supplies, making DRAM increasingly expensive and scarce.

What other components besides RAM are facing supply constraints?

Glass cloth, used on printed circuit boards across smartphones, servers, and AI infrastructure, is experiencing similar bottleneck effects. As AI companies order massive quantities of custom PCBs and server hardware, suppliers of glass cloth struggle to keep pace with demand. This material shortage cascades through the supply chain, affecting Apple, Samsung, Qualcomm, AMD, and countless other electronics manufacturers.

How do Apple's services offset hardware margin compression?

Apple's services, including iCloud subscriptions, Apple Music, and Apple TV+, generate profit margins exceeding 70%, compared to 35-40% for hardware. By keeping hardware pricing stable to protect upgrade volumes, Apple drives increased services adoption across its growing installed base. Even modest conversion rates to paid services generate sufficient recurring revenue to offset hardware margin losses.

What does flat iPhone 18 pricing mean for competitive market dynamics?

If competitors like Samsung and Google raise prices due to component cost pressures while Apple holds pricing flat, Apple gains a significant competitive advantage at equivalent or superior specifications. This pricing advantage drives market share gains and upgrade cycle acceleration, particularly in premium segments where Apple is already strong. For consumers, flat pricing increases perceived value even as underlying component costs rise.

Will premium iPhone 18 models see price increases even if base model stays at $799?

Historically, Apple holds base model pricing flat while increasing premium tier pricing when facing cost pressures. Expect the base iPhone 18 to remain at

How long will memory supply constraints continue?

Artificial intelligence demand remains in early exponential growth with no natural ceiling in sight, suggesting memory supply constraints will persist for years. Unlike cyclical demand spikes that peak and decline, AI infrastructure demand is structural. This means smartphone manufacturers should expect continued memory cost pressure through at least 2026-2027.

What strategic investments might Apple make in response to ongoing supply constraints?

Apple might invest in custom memory chip design partnerships with suppliers, deepen long-term capacity commitments with preferred vendors, expand in-house component design capabilities, or develop proprietary DRAM architectures optimized for iPhone's specific performance needs. These long-term investments would reduce dependency on spot market pricing and improve supply security.

How does this pricing strategy affect Apple's stock valuation and investor perception?

Apple's willingness to absorb hardware costs while growing services revenue improves investor perception of earnings stability and recurring revenue. The company becomes less dependent on annual hardware launch cycles and more aligned with software-service businesses valued at premium multiples. Flat hardware pricing protecting volume, combined with services revenue growth, creates a positive narrative for long-term shareholder value.

Conclusion: The Future of Premium Smartphone Pricing in a Supply-Constrained World

Apple's decision to keep iPhone 18 pricing flat despite rising RAM costs and global supply chain pressures signals a fundamental shift in how premium smartphone makers approach competitive dynamics and long-term value creation. This isn't a temporary response to near-term component shortages. It's a strategic acknowledgment that the smartphone market has matured, that component supply chains are increasingly contested by high-margin industries like AI infrastructure, and that sustainable competitive advantage comes from ecosystem lock-in and services revenue rather than hardware margin maximization.

The quarterly memory price negotiations reveal operational sophistication in supply chain management. Apple isn't passively accepting supplier price increases. The company is actively engaging in rapid-cycle discussions, leveraging its enormous purchasing power to negotiate, and preparing strategically for continued price pressure in future quarters. This operational agility protects margins through efficiency and strategic sourcing, not pricing increases.

For consumers, the immediate benefit is clear: entry-level iPhone pricing stability at a moment when competitor pricing likely increases. But the longer-term benefit is more subtle. Flat pricing protects upgrade momentum, which drives services adoption, which locks consumers into the Apple ecosystem through recurring subscriptions and integrated experiences. From Apple's perspective, this is optimal—volume protection leading to services revenue growth that compounds over years.

The supply chain story extends beyond smartphones to the entire electronics industry. When AI infrastructure demands start competing with consumer electronics for the same components, pricing dynamics shift. Companies with diversified revenue streams (Apple with services, Microsoft with enterprise software, Google with advertising) can absorb component cost increases. Pure hardware manufacturers face difficult choices between margin compression and volume loss.

This dynamic will likely persist through the iPhone 18 product cycle and potentially beyond. Memory prices may stabilize eventually if AI infrastructure spending moderates, but historical precedent suggests demand will remain elevated as AI applications proliferate across computing. Glass cloth shortages and other component bottlenecks will continue as long as AI infrastructure investment exceeds historical normal. Apple's strategic positioning—with services revenue offsetting hardware margin pressure—gives the company competitive advantage in this environment.

For shareholders, Apple's strategy validates management's long-term vision. The company is willing to sacrifice short-term hardware margin for long-term services growth and customer ecosystem lock-in. This orientation toward recurring revenue improves valuation multiples and reduces earnings volatility. For competitors, the challenge is clear: Apple's services business provides strategic flexibility that pure hardware makers lack.

For the broader industry, Apple's iPhone 18 pricing decision sets a precedent. As other premium smartphone makers face similar supply chain pressures, they'll watch closely to see whether Apple's strategy succeeds. If flat pricing, combined with compelling features and services integration, drives upgrade cycles and market share gains, others will follow. If the strategy fails to protect profitability, competitors will pursue more aggressive pricing to capture margin.

The next major test comes at the iPhone 18's launch and in quarterly earnings reports over the following 12 months. If Apple achieves record iPhone unit sales while maintaining or improving operating margin through services growth, the strategy validates decisively. If unit sales miss expectations or services adoption disappoints, the strategy faces questions.

Historically, Apple has made long-term strategic bets that seemed risky in the short term but proved visionary in hindsight. The shift from hardware to services, from transactional to recurring revenue, from individual products to integrated ecosystems—these are themes that have played out across Apple's business over the past decade. iPhone 18 pricing strategy represents another chapter in this evolution, signaling that Apple's future is defined not by what the company manufactures, but by the ecosystems and services that bind customers to Apple's platforms.

As supply chain constraints persist, as AI infrastructure continues expanding, as memory and component costs remain elevated, Apple's willingness to absorb those costs while maintaining customer value represents not a compromise but a strength. It's a choice that reflects confidence in the company's long-term strategy and willingness to sacrifice short-term margin for long-term competitive advantage. Whether that proves wise depends on execution, but the strategic logic is sound.

Key Takeaways

- Apple maintains iPhone 18 base pricing at $799 despite rising DRAM costs, absorbing expenses through services revenue and operational efficiency

- Quarterly memory price negotiations reveal ongoing cost pressures as AI infrastructure competes with smartphones for limited supply

- Services business with 70% margins offsets hardware margin compression, making volume protection strategically optimal

- Competitors likely face price increase pressure, giving Apple significant competitive advantage on pricing at equivalent specifications

- Supply chain constraints remain structural long-term as AI infrastructure demand continues exponential growth trajectory

Related Articles

- Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]

- Anker Soundcore Space A40: Budget Earbuds Under $50 [2025]

- LG TV Subscription Rentals: Why £277/Month Doesn't Make Financial Sense [2025]

- Best Laptops 2026: Complete Buying Guide & Analysis

- RGB TVs vs OLED: The Display Technology Battle Reshaping TV Market [2025]

- Apple's New AirTag 2: Everything You Need to Know [2025]

![iPhone 18 Pricing Strategy: How Apple Navigates the RAM Shortage [2025]](https://tryrunable.com/blog/iphone-18-pricing-strategy-how-apple-navigates-the-ram-short/image-1-1769613120387.jpg)