Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]

When Snap announced that it was creating Specs Inc., a wholly-owned subsidiary dedicated entirely to its augmented reality glasses business, the move sent ripples through the wearables industry. On the surface, it looks like a corporate restructuring. Dig deeper, and you're looking at a strategic pivot that could reshape how major tech companies approach hardware innovation, funding, and brand separation.

I've watched Snap navigate the AR space for years now. They've stumbled a few times (remember when Spectacles were mostly a novelty?), but they've also shown genuine commitment to getting this right. This spinoff isn't just about splitting a business unit. It's about creating a focused entity that can move faster, attract specialized investors, and compete more directly with Meta's massive augmented reality ambitions.

The company that created a billion-dollar social platform through camera innovation is now betting that AR glasses are the next frontier. Whether you're a tech investor, a product manager, or just someone curious about where wearables are headed, understanding this move matters. It tells you something crucial about the direction of consumer tech.

Let me walk you through what this spinoff actually means, why Snap decided now was the time, and what comes next for both Specs Inc and the broader AR glasses market.

Understanding the Specs Inc Spinoff

Snap's decision to create Specs Inc as a wholly-owned subsidiary marks a significant structural shift. Rather than keep AR glasses development buried inside Snap Inc alongside the social platform, messaging app, and advertising business, the company decided to spin off the hardware division entirely. According to Bloomberg, this move allows Specs Inc to operate with its own management and pursue outside capital.

Here's what this actually changes: Specs Inc now has its own board, its own management structure, and most importantly, its own path to outside capital. A subsidiary structure lets Snap keep control while creating clear separation between the core social business and the hardware venture. The subsidiary can raise its own funding rounds, negotiate its own partnerships, and operate with the independence that venture capitalists love to see.

Snap CEO Evan Spiegel made the reasoning explicit in the company's announcement: this structure "enables Snap to more easily secure investors and partnerships for its wearables, as well as to grow Specs into a distinct brand while running it within Snap Inc." This strategic move was also highlighted by The Indian Express.

That's the key phrase. Specs becomes its own brand. That matters because AR glasses aren't just another Snapchat accessory anymore—they're a primary computing device. Users won't wear them because Snapchat told them to. They'll wear them because the hardware is genuinely useful and the software ecosystem supports that utility.

The timing of this move is equally revealing. Snap had been exploring outside funding for its AR glasses since mid-2025, according to reports from industry observers. The company recognized that competing with Meta on hardware requires capital and focus that traditional corporate budgeting doesn't always provide. Meta has spent billions developing AR glasses. For context, Reality Labs, Meta's AR/VR division, lost over $16 billion between 2020 and 2023 alone. That's the scale of investment required to stay competitive, as noted by CNBC.

Snap doesn't have Meta's resources, but it has something else: deep expertise in visual computing, a young user base that's more receptive to AR adoption, and genuine innovation in spatial computing. The spinoff lets the company leverage these advantages while pursuing outside capital to match Meta's investment pace.

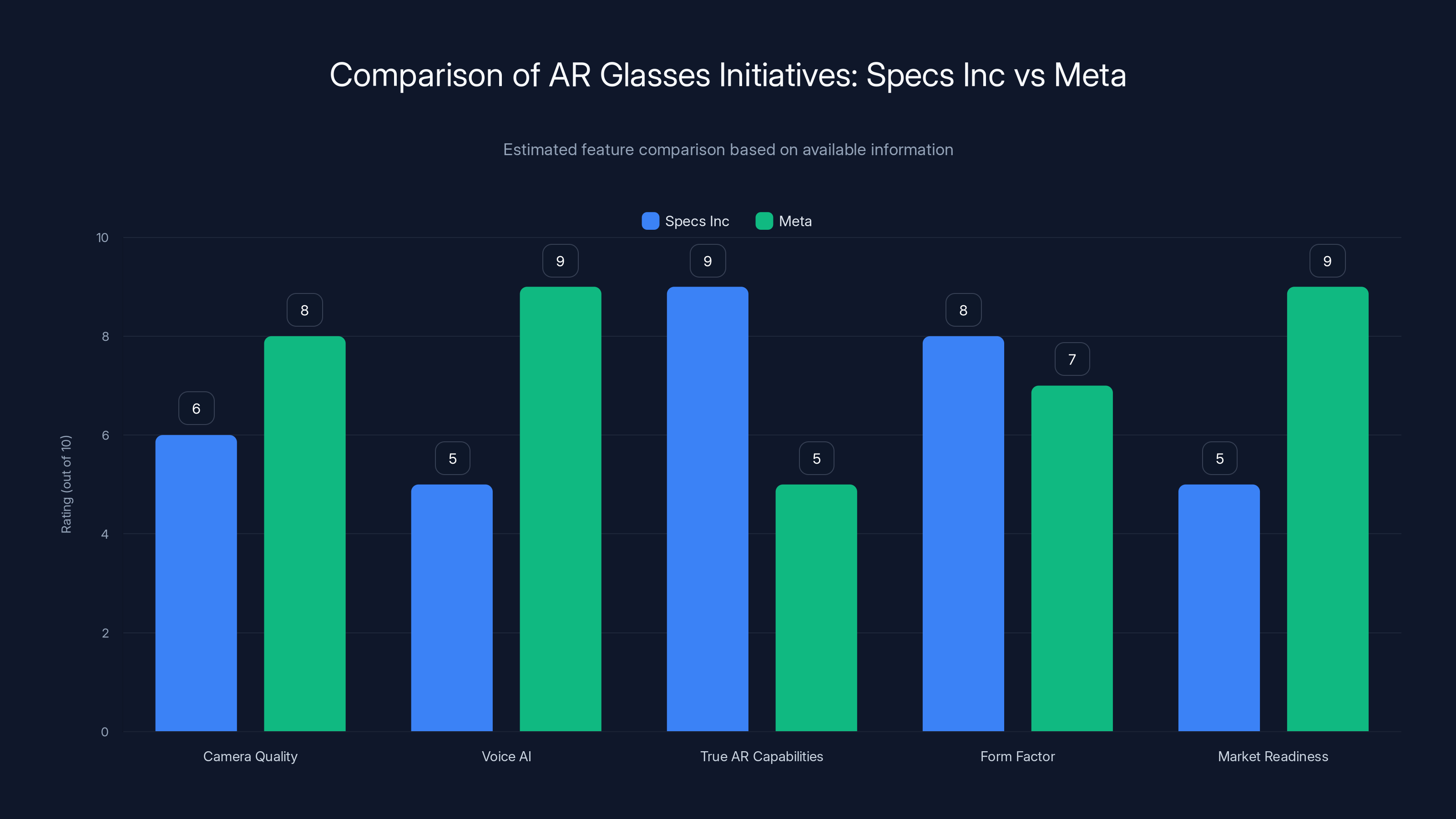

Specs Inc focuses on true AR capabilities with a smaller form factor, while Meta excels in camera quality and market readiness. (Estimated data)

Why Hardware Spinoffs Matter in Tech

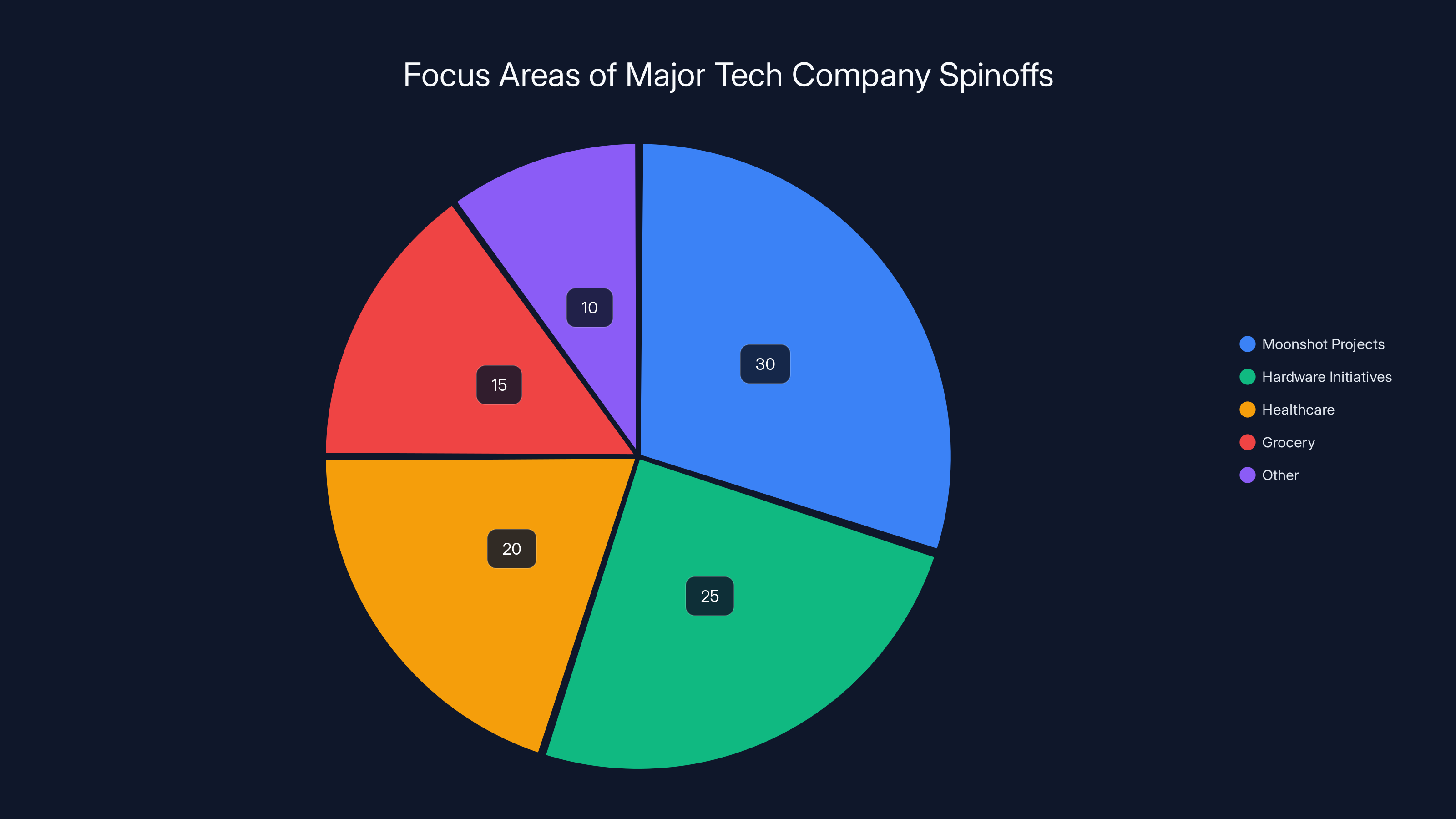

Snap isn't inventing the spinoff strategy. Google created Alphabet specifically to house "moonshot" bets like self-driving cars and quantum computing. Alphabet's structure lets those divisions pursue different financial models and timelines than the core search business. Apple has continuously spun off hardware initiatives into separate teams with distinct leadership. Even Amazon created subsidiaries for everything from healthcare to grocery.

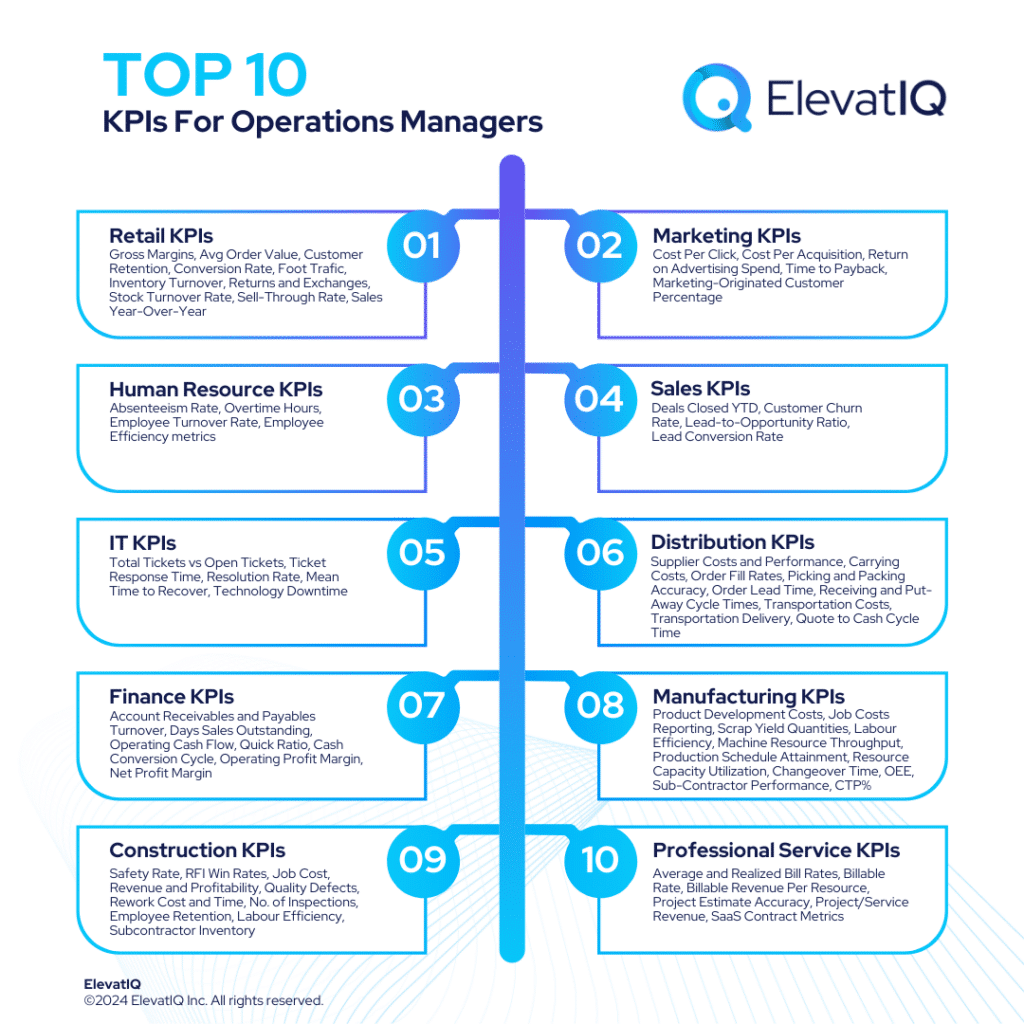

The pattern reveals something important about how mature tech companies handle radical innovation. Your core business—whether that's advertising, search, or social networking—operates on quarterly earnings cycles. Investors expect predictable growth, consistent margins, and clear paths to profitability.

Hardware moonshots don't work that way. AR glasses require sustained investment with uncertain timelines. You're building entirely new manufacturing pipelines, supply chains, and distribution networks. You're competing against companies that have been doing this for decades. The financial model looks terrible when you're measuring quarterly returns.

By separating the business, Snap achieves several things simultaneously. First, it buffers the core social business from hardware losses. Snapchat's advertising revenue stays strong regardless of AR glasses development costs. Second, it attracts a different class of investor. Venture capitalists and hardware-focused funds have different expectations than public market investors. They understand the timeline required for AR glasses to become mainstream.

Third, and this gets underestimated, it changes hiring and retention dynamics. Engineers working on moonshot hardware want autonomy, vision-driven leadership, and the chance to build something genuinely new. Those incentives sometimes conflict with the operational efficiency required for a mature social platform. A separate company solves that tension.

Look at what happened with Google Ventures and X Development Lab. Both operate with different investment patterns, different decision-making speeds, and different success metrics than core Google. The spinoff structure isn't about abandonment. It's about creating the optimal organizational environment for different kinds of innovation.

Estimated data shows that moonshot projects and hardware initiatives are the primary focus areas for tech company spinoffs, highlighting their importance in driving innovation.

The AR Glasses Market Today

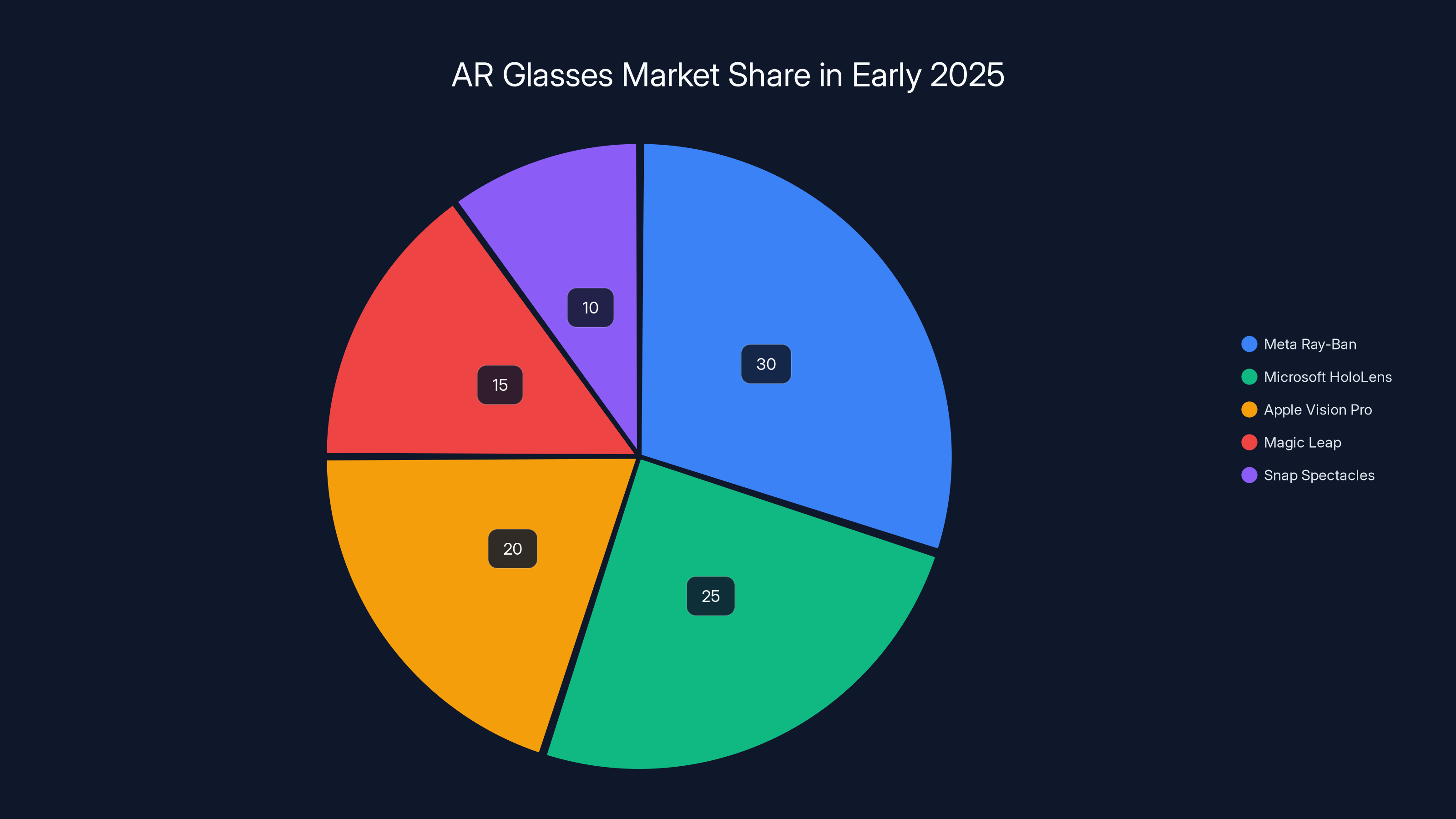

Where does AR hardware actually stand in early 2025? The honest answer is "not where anyone predicted it would be five years ago."

Meta's Ray-Ban Meta glasses have become genuinely popular, but they're primarily cameras and audio devices with some AI features overlaid. Real AR—where virtual content seamlessly integrates with your view of reality—remains mostly laboratory technology. Microsoft's Holo Lens exists primarily in enterprise settings because they're too expensive and bulky for consumer use. Apple released its Vision Pro at $3,500 to mostly niche early adopters. Magic Leap essentially surrendered to reality and pivoted to enterprise applications.

The consumer AR glasses market is still waiting for its breakthrough moment. We have the software starting to mature. We have the sensors improving. We have manufacturing capabilities increasing. But we don't yet have the form factor that makes someone want to wear these glasses all day instead of their regular glasses or sunglasses.

Snap's Spectacles have occupied an interesting middle ground. Early versions were primarily novelties—they could capture and share photos from your perspective, which was cool but not essential. Later versions became developer tools, letting engineers test AR applications in hardware. The company has been methodical about this, understanding that consumer adoption requires genuine utility.

Snap's next generation of standalone AR glasses, expected to launch later in 2025, promises to be lighter, smaller, and more capable than previous versions. This isn't vapor-ware territory. Snap has been hiring aggressively—over 100 new roles globally for Specs Inc alone. The company is clearly building toward something tangible, as reported by WebProNews.

The market timing is interesting too. We're in a narrow window where AR technology has matured enough to be feasible, but adoption is still early enough that brand positioning matters enormously. Whatever company solves the "AR glasses people actually want to wear" problem will own a massive market. Strategy Analytics estimates the AR glasses market could grow to over 500 million units by 2035. That's the prize driving this competition.

Snap's AR Advantages and Weaknesses

Let's be honest about Snap's position. The company has real strengths here, but it's not starting from the most advantaged position.

Snap's Advantages:

First, the company built its entire business on visual communication. Since the beginning, Snap has focused on how people share visual information. Filters, lenses, and effects—these are core to Snap's DNA. An AR glasses company absolutely needs that expertise. The ability to apply visual effects to the real world in real-time is exactly what makes AR compelling. Snap understands this intuitively.

Second, Snap has a young user base that's more willing to adopt emerging technology. Your grandmother probably won't be an early adopter of AR glasses. Your teenager, already comfortable with Snapchat's filters and effects, is much more likely to put on glasses that offer similar experiences but in 3D space. That user base becomes a ready audience for early testing and iteration.

Third, Snap has proven it can execute hardware. The original Spectacles weren't perfect, but they worked. The company figured out manufacturing, supply chains, quality control, and distribution. That institutional knowledge is valuable when building the next generation of devices.

Fourth, Snap owns meaningful patents in AR and visual computing. The company has been filing patents on spatial computing, object recognition, and AR interface design for years. These form a defensive moat against competitors and can generate licensing revenue.

Snap's Weaknesses:

Meanwhile, Snap faces real challenges. Meta has spent billions on AR research and has deep partnerships with hardware manufacturers. Ray-Ban is one of the most recognized eyewear brands globally, and Meta has leveraged that credibility. Snap's brand is synonymous with social media and filters, not with hardware or computing fundamentals.

Snap also lacks the manufacturing scale that Meta, Apple, and traditional hardware companies have built. This means higher per-unit costs and more difficulty achieving the form factor and price point that drives consumer adoption. Building a supply chain for millions of units per year is genuinely difficult.

There's also the reality that Snap needs to solve a chicken-and-egg problem. Consumers won't buy AR glasses unless there's a compelling software ecosystem. Developers won't build for AR glasses unless there's a large installed base of users. That's how the original Spectacles struggled—insufficient user base meant insufficient apps, which reinforced the perception that the device wasn't essential.

The spinoff helps address this by attracting capital and talent, but it doesn't automatically solve the market problem. Specs Inc will still be competing against Meta, Apple, and whatever surprise entrants emerge from Samsung, Google, or other hardware players.

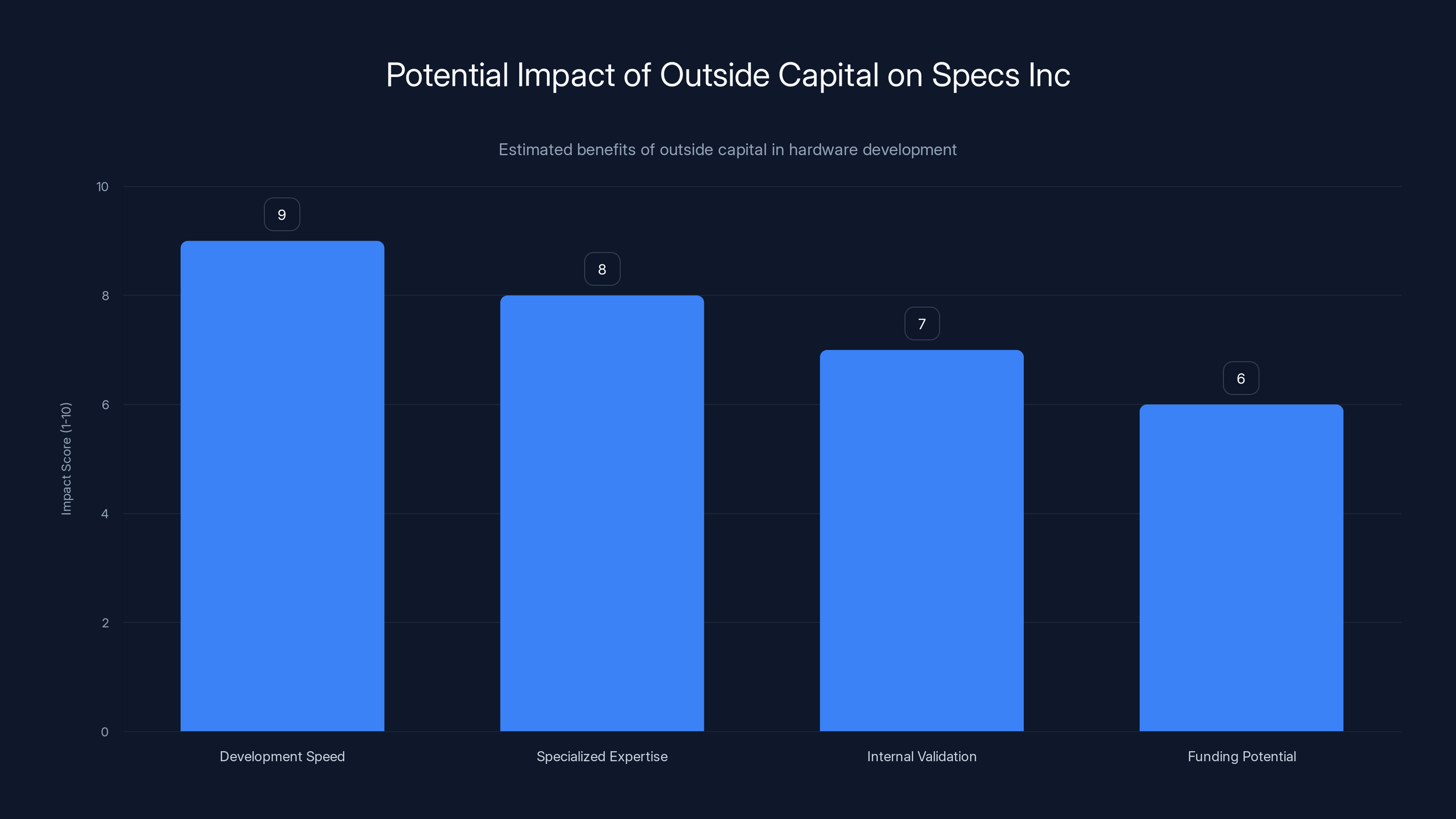

Outside capital significantly accelerates development speed and brings specialized expertise, with an estimated funding potential of

How Outside Capital Changes the Game

This is where the spinoff structure becomes strategically crucial. By creating an independent subsidiary, Specs Inc can now raise its own funding rounds from venture investors, strategic investors, and potentially even sovereign wealth funds interested in hardware innovation.

What does that capital unlock? First, it accelerates the development timeline. Instead of waiting for internal budget cycles, Specs can move faster on hardware iteration, manufacturing partnerships, and supply chain development. In a hardware market, speed often determines success. The company that solves the form factor problem first gains enormous advantage.

Second, outside capital brings specialized expertise. Venture firms that focus on hardware have networks in manufacturing, supply chain, retail distribution, and component design. That network is worth as much as the money itself. A good hardware VC firm can introduce Specs to manufacturers who've optimized for their specific needs, suppliers who understand their cost constraints, and retailers who can handle their distribution.

Third, and this matters psychologically, outside investment validates the vision internally. When a tier-one VC firm commits capital, it sends a signal to Specs' employees that this company is on track to become something significant. That affects hiring, retention, and the pace at which teams execute.

Snap didn't reveal whether investors are already committed, but the company is hiring aggressively for Specs Inc. That suggests investor conversations are advancing. The typical venture funding timeline for a hardware company at this stage would be 12-18 months for a Series A, followed by more rounds as the company scales manufacturing and distribution.

For context, Meta spent roughly

The Strategic Implications for Snap Inc

What does the spinoff mean for Snap's core social business? Actually quite a bit.

First, it removes uncertainty from earnings reports. Wall Street can now evaluate Snapchat's social platform business on its own merits without the drag of hardware losses. If Specs Inc raises outside capital and those investors bear the financial burden of development, then Snapchat's profitability looks cleaner. That should improve the stock valuation, all else equal.

Second, it creates optionality for the future. If Specs Inc becomes successful and valuable, Snap can eventually take it public as a separate company, much like Alphabet did with Waymo (though Waymo remains private). If it becomes wildly successful, it could be spun out entirely, creating two distinct public companies. Conversely, if market conditions change and AR glasses don't materialize on the timeline everyone expects, Snap can wind down Specs more cleanly without damaging the core business.

Third, it lets Snap repurpose its AR expertise for the social platform. Snapchat's filter and lens technology can evolve independently from the glasses business. The company can continue pushing visual effects innovation without being constrained by the hardware development cycle. That keeps the social product competitive against Tik Tok and Instagram.

Fourth, it positions Snap as a platform company rather than just a social app. If Specs Inc can build a successful AR glasses platform with apps and services from third-party developers, then Snap moves into the same category as Apple, Google, and Microsoft—companies that control computing platforms rather than just user-facing applications. That's an entirely different business valuation.

The real genius of the move is that Snap doesn't have to choose between these outcomes. The spinoff structure lets both businesses pursue their optimal path while maintaining connection to the core company.

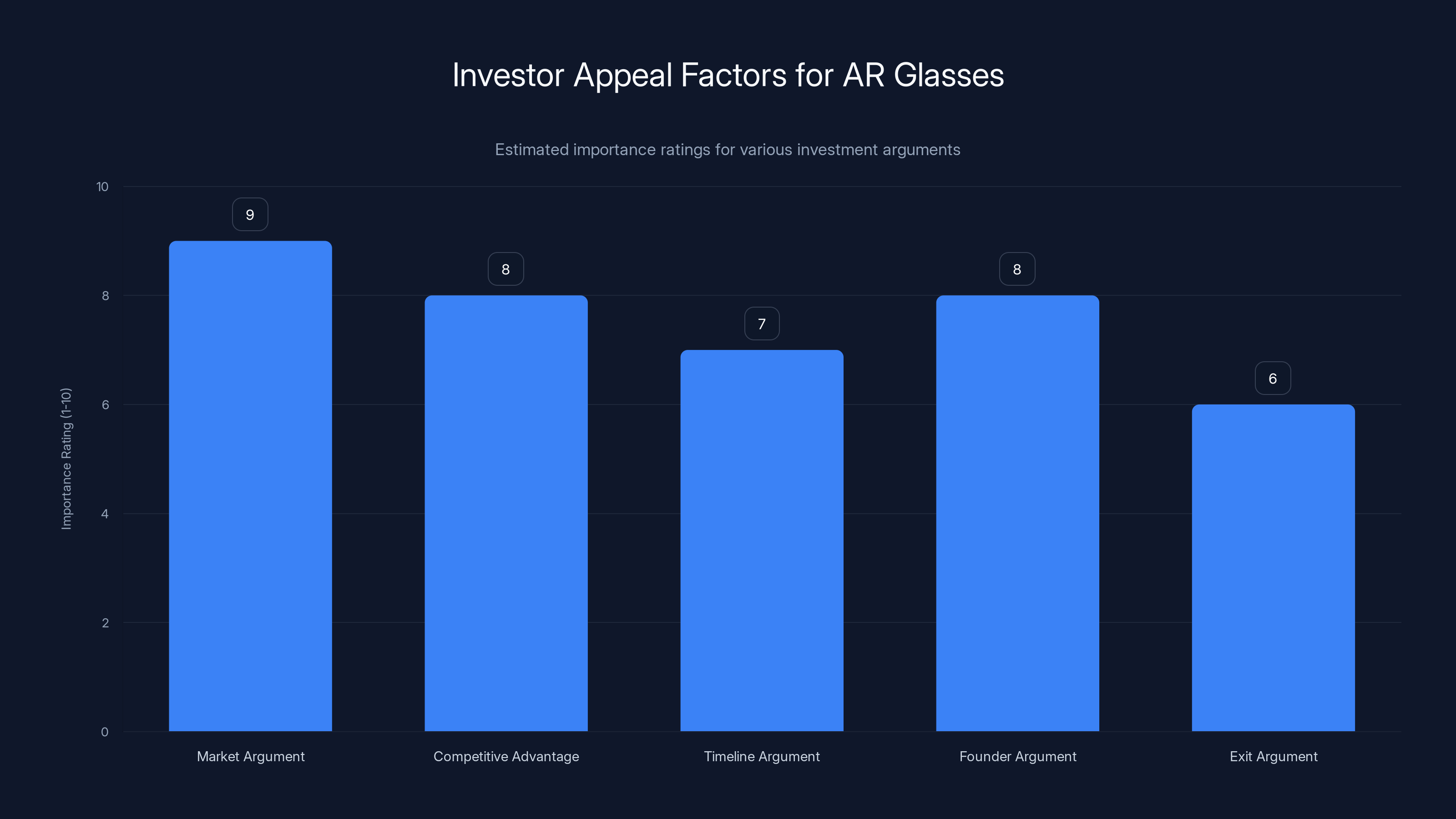

Market potential and competitive advantage are highly rated factors for investor appeal in AR glasses. Estimated data based on typical investor considerations.

Manufacturing and Supply Chain Challenges

Here's where the rubber meets the road for AR glasses: actually making them at scale.

Snap has experience manufacturing Spectacles, but previous versions shipped in relatively limited quantities. Building millions of units per year is a completely different challenge. You need multiple suppliers for different components. You need manufacturing partners with capacity and expertise in precision optics, electronics miniaturization, and battery technology. You need quality control processes that ensure reliability at scale.

Meta solved this partly by partnering with established eyewear manufacturers. Ray-Ban (owned by Essilor Luxottica, which has massive manufacturing capability) gives Meta instant access to factories, supply chains, and distribution networks that took other companies decades to build.

Snap doesn't have that luxury. The company will likely need to partner with contract manufacturers like Foxconn, Pegatron, or similar companies that specialize in consumer electronics manufacturing. That's expensive and requires careful partnership negotiation. Specs Inc will need to invest heavily in manufacturing partnerships during 2025 and 2026 to have any chance of reaching meaningful volume in 2027 and beyond.

The battery problem alone is non-trivial. Existing AR glasses require recharging multiple times per day because the optics and processing are power-intensive. Consumer expectations are set by smartphones—all-day battery life is table stakes now. Building glasses that deliver AR experiences while maintaining all-day battery life requires either breakthrough battery technology or massive optimization of power consumption.

There's also the question of component sourcing. Advanced display technology for AR glasses comes from a limited number of suppliers. Qualcomm dominates mobile processors. Sony makes some of the best sensors. These suppliers have established relationships with large manufacturers. A new entrant might struggle to secure priority access or favorable pricing until they're shipping serious volume.

Snap's advantage here is that it has experience navigating these challenges with Spectacles. The company understands supply chain complexity and has established vendor relationships. But the scaling problem remains real. It's one thing to manufacture 100,000 units of developer-focused hardware. It's completely different to manufacture 5 million or 10 million consumer units with consistent quality.

The Software Ecosystem Challenge

Hardware is just the foundation. The glasses themselves matter only if people can do useful things with them.

Snap's biggest advantage here is the existing lens ecosystem from Snapchat. Developers are already building visual effects and augmented reality experiences for Snapchat. That knowledge, that technical foundation, and those developer relationships transfer directly to AR glasses.

But building for glasses is fundamentally different than building for phones. Your screen is finite. You can't overwhelm the user with information or UI elements because they're wearing it on their face all day. The form factor creates constraints that mobile development never imposed.

Meta is working through these challenges with its Ray-Ban smart glasses. Right now, those glasses are primarily cameras—you can capture photos and video, access voice AI, and stream information to your phone. They're not true AR glasses where virtual objects appear in your actual visual field.

Snap's next-generation glasses will need to solve true AR—where digital content appears in your field of view and responds to what you're looking at. That's a harder software problem than it sounds. You need object recognition to understand what the user is looking at. You need real-time 3D rendering optimized for very low-power hardware. You need user interfaces that don't feel intrusive or overwhelming.

The app developer story will be critical. If third-party developers can build useful apps for Specs glasses, that creates network effects and stickiness. If the software ecosystem remains limited to what Snap itself builds, adoption will plateau. Meta benefits here from developer familiarity with mobile platforms. Snap needs to create something equally compelling but different.

Industry observers expect Snap to announce the initial developer program for Specs glasses sometime in 2025. That's where the real test happens. If developers embrace the platform, if compelling applications emerge quickly, then Specs has a real shot. If developer adoption is slow or the tools feel clunky, the hardware alone won't carry the business.

Meta's Ray-Ban leads the AR glasses market with a 30% share, followed by Microsoft's HoloLens at 25%. Snap's Spectacles hold a smaller share but are poised for growth. (Estimated data)

Competitive Landscape in AR Glasses

Snap isn't operating in a vacuum. The AR glasses market is heating up with multiple players pursuing different strategies.

Meta's approach focuses on the Ray-Ban partnership and gradual functionality expansion. Ray-Ban smart glasses are already on the market with reasonable consumer adoption. They're not true AR yet, but Meta has a clear roadmap to more advanced functionality. The company has unlimited capital and can afford to take losses for years while developing this market.

Apple's Vision Pro represents the premium, desktop-replacement approach. At $3,500, it's clearly not a consumer device in the traditional sense. But it establishes the technical possibilities and creates developer interest. If Apple eventually releases a lighter, cheaper version for consumers, that could reshape the market entirely. Apple's ecosystem power and retail presence are massive advantages.

Microsoft's Holo Lens remains primarily enterprise-focused. The company has found real revenue and use cases in manufacturing, healthcare, and military applications. That's a sustainable business even if consumer AR takes longer to materialize.

Samsung, Google, and other hardware makers are working on various AR initiatives without yet announcing consumer glasses. If Samsung released AR glasses tomorrow, that would immediately become relevant to the competitive landscape.

Snap's challenge is that it's entering this crowded market from a position of strength in software (filters and lenses) but relative weakness in hardware and brand recognition. The company needs to execute flawlessly while competitors are also advancing. First-mover advantage matters in platform markets, but first-mover is arguably already Meta or Apple. Snap is a strong second-mover with unique advantages but facing an uphill climb.

The market could support multiple winners, especially if different players target different segments. Apple owns premium consumers willing to pay high prices. Meta owns the social media integration angle and casual consumers. Snap could own the fashion-forward and youth-oriented segments. But that's speculative—market dynamics will ultimately determine winners.

The Role of Artificial Intelligence in Specs

Here's something that separates Specs from previous AR glasses concepts: AI integration.

Snap's announcement specifically highlighted that the glasses' operating system "can help you get things done faster based on what they see and what they know about your behaviors." That's essentially describing an AI assistant that lives in your glasses, responding to visual context and understanding your patterns.

Large language models like GPT-4, Claude, and others have matured enough that they can run on modest hardware with decent performance. Imagine asking your glasses a question about what you're looking at. "What's that plant?" "How do I fix this?" "What's the cheapest place to buy this product?" The glasses could answer using visual understanding and real-time knowledge.

That's actually compelling. It's not just novelty—it's genuinely useful. And it's something that smaller form-factor devices like glasses can do better than phones because you don't need to pull out the phone to ask the question.

Snap is also experimenting with generative AI for creating filters and effects. Their technology can generate visual effects based on text descriptions. If that capability moves into glasses, users could say "make this flower bloom" or "add sparkles" and watch it happen in their field of view in real-time.

That's where Snap's advantage becomes clear. The company has spent years building AI models for visual understanding, effect generation, and user behavior prediction. That IP transfers directly to glasses. The challenge is running these models efficiently enough on glasses hardware that battery life doesn't become unbearable.

For Specs Inc, this is both an opportunity and a requirement. If the glasses can't do intelligent things that justify wearing them, they're just cameras. If they can act as a capable AI assistant that happens to have a visual component, they become genuinely useful. The company's historical focus on visual AI positions it well for this transition.

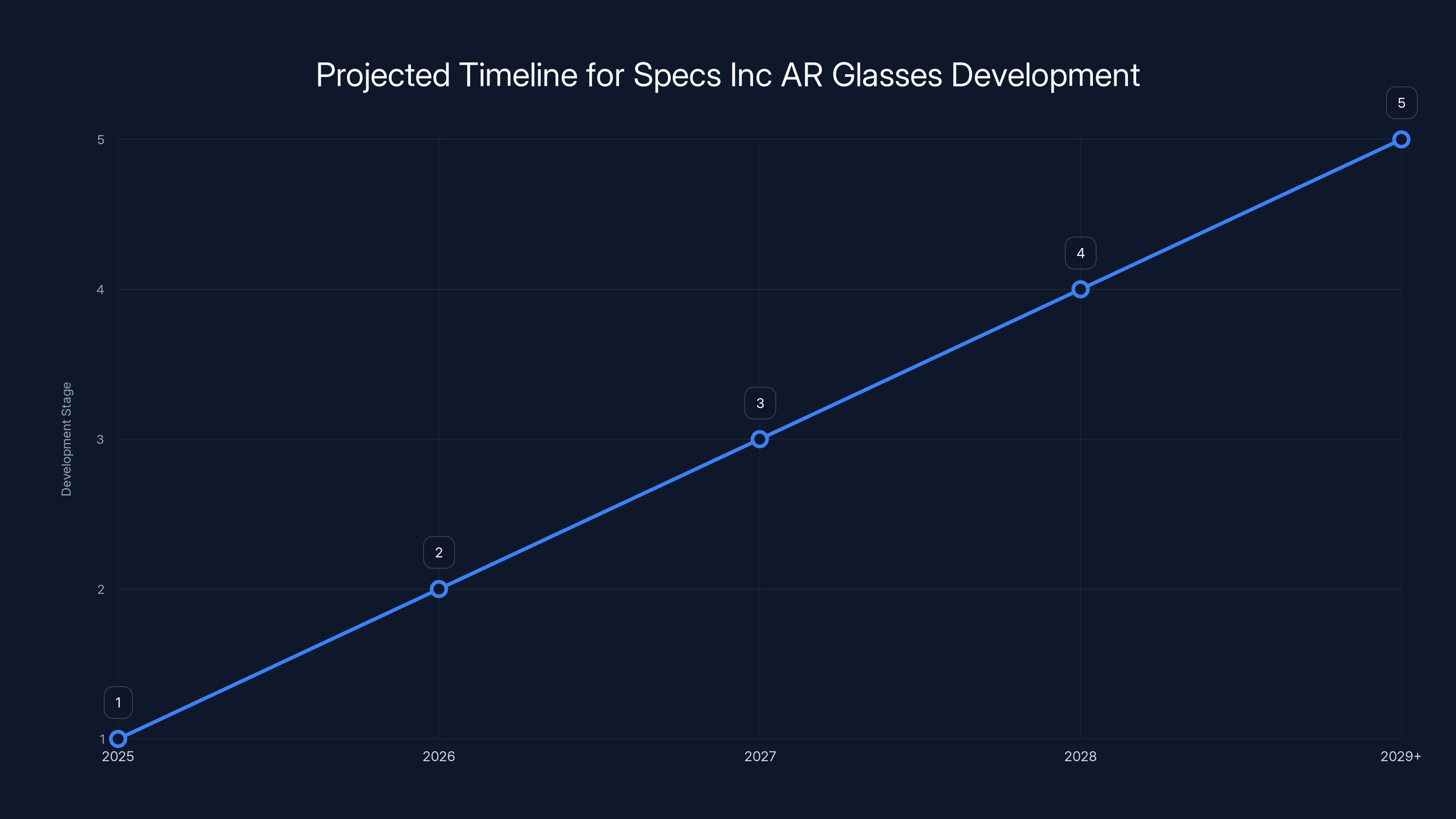

Specs Inc is expected to launch consumer AR glasses by 2025, with significant adoption projected by 2029. Estimated data based on industry trends.

Funding Strategies and Investor Appeal

Why would investors be excited about pouring capital into a consumer hardware business in a crowded market? Let's think through the investor thesis.

The market argument: AR glasses could become the next major computing platform after smartphones. That's worth trillions of dollars globally. Early positioning in a platform market matters enormously. Investors who back the "winner" in AR glasses are betting on that value creation.

The competitive advantage argument: Snap has unique capabilities in visual computing and social integration. The company has proven it can execute consumer products at scale. The Snapchat platform provides a ready audience for testing and distributing AR experiences.

The timeline argument: Unlike previous AR attempts that felt like science fiction, today's technology is genuinely close to solving real problems. It's not a 15-year bet anymore—it's a 5-to-10-year bet. That's within venture capital's time horizon.

The founder argument: Evan Spiegel has proven himself by building Snap into a global platform. Investors trust his vision and execution. That matters more than it should in venture capital.

The exit argument: Multiple exit scenarios exist. Specs could become a billion-dollar hardware business. It could be acquired by a strategic buyer like Meta (though that's complex for antitrust reasons), Apple, Google, or Samsung. It could eventually go public. Or if things change, it could be merged back with Snap without destroying the parent company's value.

A Series A for Specs Inc would likely be in the

Snap hasn't revealed actual funding plans, but the scale of hiring suggests the company is confident about capital availability. Over 100 open positions globally is consistent with expectations of $300-500 million+ in funding. That's enough runway to build first-generation consumer glasses, launch them, and begin iterating based on market feedback.

The Environmental and Social Angle

Snap emphasized an interesting point in its announcement: AR glasses could reduce waste by replacing physical objects with digital alternatives.

Instead of printing manuals, you could overlay contextual instructions directly in someone's field of view. Instead of physical whiteboards, design teams could collaborate on digital surfaces visible only to them. Instead of physical documents, you could share digital information that appears precisely where needed.

This is arguably true, but it requires a massive shift in how we work and share information. It's also somewhat overselling the environmental benefit. Manufacturing millions of AR glasses involves material extraction, energy consumption, and eventual e-waste. That has environmental costs that need to be measured against the waste saved from reducing physical objects.

Still, the argument resonates with investors and consumers increasingly concerned about sustainability. If Specs glasses can genuinely reduce paper usage and physical material waste at scale, that's a real value proposition beyond just novelty or personal entertainment.

The social angle is more straightforward. Specs glasses keep people "present in the moment with friends and family unlike phones and computers, since they superimpose digital tools over your view of the real world." This positioning suggests that AR glasses are less interruptive than phones—you don't need to look down at a screen, which means you maintain eye contact and spatial awareness.

There's merit here too. But there's also risk. If glasses become as attention-consuming as phones, just in a different form factor, you've simply moved the problem from handhelds to wearables. The social benefit only materializes if users actually use glasses to enhance presence rather than replace it with digital content. That's a product design challenge, not a technology challenge.

Investors and consumers will ultimately judge Specs on whether it delivers on these promises. The environmental and social angles are marketing talking points, but they do reflect genuine thinking about what makes glasses different from phones.

Timeline Expectations and Roadmap

Based on what Snap has revealed and industry norms, what should we expect from Specs Inc over the next several years?

2025: Specs launches its next-generation standalone AR glasses. These are positioned as the first true consumer-facing model, lighter and more capable than previous versions. Developer programs launch to begin building the application ecosystem. The company continues aggressive hiring and likely announces funding rounds during the year.

2026-2027: Production scales up as manufacturing partnerships mature. The company begins iterating on hardware based on user feedback. The developer ecosystem expands significantly. Some enterprise applications emerge alongside consumer apps. Competitors (Meta, Apple, Samsung) also advance their own AR glasses offerings, intensifying market competition.

2027-2028: Meaningful consumer adoption begins if the product actually solves real problems. Market dynamics become clearer—which use cases drive adoption? Who buys AR glasses and why? Specs refines its product strategy based on real-world data. The company might expand into adjacent categories like AR contacts or different form factors.

2029+: If all goes well, AR glasses transition from "emerging technology" to "normal consumer product" status. Success looks like tens of millions of units installed globally. The ecosystem has matured with diverse applications. Specs is recognized as one of several major players in AR rather than a startup betting on moonshots.

That timeline is optimistic. Pessimistic scenarios involve slower adoption, manufacturing challenges, or competitive dynamics that make the market harder to enter. There's genuine uncertainty here. But the spinoff structure at least gives Specs the independence and capital to execute without the constraints that would apply inside Snap Inc.

What This Means for Consumers

If you're not a tech investor or industry analyst, why should you care about Snap spinning off its AR glasses business?

Because this move affects what products you'll actually be able to buy in a few years. Snap's success or failure in AR glasses will influence what options exist in the consumer market. If Specs becomes a viable competitor to Meta and Apple, that drives innovation and gives consumers more choices. If Specs fails, AR glasses might remain niche products for years longer.

The spinoff also suggests that AR glasses are becoming a serious part of how major tech companies see the future. This isn't experimental anymore. Snap is committing real capital and talent to become a hardware company. That conviction from a major platform signals that AR glasses are closer to mainstream adoption than they appeared a few years ago.

Consumers should also understand that AR glasses are not a small iteration on smartphones. They're a potential shift in how we interact with information and each other. When (or if) AR glasses become as ubiquitous as smartphones are today, they'll change social interactions, work processes, privacy expectations, and what "always connected" means. The companies building those glasses today are making choices that will affect all of us.

Specs Inc's specific role in this shift is still being determined. But the spinoff tells you that Snap is serious about being a meaningful player in computing's next chapter.

Competitive Advantages and Realistic Limitations

Let's be clear-eyed about Specs' prospects. The company has real advantages, but also genuine challenges.

What Specs can execute well on: Visual effects and filter creation. AI-powered features that understand visual context. Integration with existing Snapchat users and developers. Speed and design sensibility around what appeals to younger demographics.

What remains challenging: Building a hardware manufacturing operation that competes on cost and quality with established manufacturers. Creating an application ecosystem that attracts diverse developers, not just Snapchat lens creators. Educating consumers on why AR glasses matter. Defending market share against competitors with vastly more capital.

The honest assessment: Specs is betting that it can establish a meaningful position in AR glasses despite late entry into the market. That's possible but not guaranteed. The company's visual computing expertise and developer ecosystem are real advantages. But advantages aren't enough—execution matters, timing matters, and market adoption timing is unpredictable.

Investors backing Specs are essentially betting that AR glasses will become important enough to support multiple winners, and that Snap can be one of them. That's not an unreasonable bet, but it's definitely a bet. There's real risk here.

The Bigger Picture: Platforms and Computing Evolution

Zoom out from Specs Inc specifically. What does this spinoff reveal about how computing is evolving?

We're in a transition period where smartphones are still dominant, but new form factors (AR glasses, potentially AR contacts, spatial computing devices) are emerging as viable alternatives. Companies with platform ambitions—Apple, Google, Meta, now Snap—are racing to own the next computing platform.

The spinoff structure itself is revealing. Mature tech companies are discovering that moonshot businesses can't operate under the same constraints as core businesses. You need different capital structures, different management incentives, different organizational rhythms. That's why Google created Alphabet. That's why Microsoft created Azure as a separate business unit before folding it back. That's why Snap is creating Specs.

We'll likely see more of this pattern. Companies with successful platforms will spawn specialized subsidiaries for hardware, AI, robotics, or other moonshot areas. Some of those subsidiaries will eventually become as important as the parent company. Some will fail. But the structure lets companies pursue platform ambitions without destabilizing their existing businesses.

For consumers, this is good news. It means more resources flowing into emerging technologies. More competition between multiple approaches. More chance that something genuinely useful emerges rather than each company betting the entire farm on their vision.

For investors, it means more opportunities but also more complexity. Evaluating whether Specs Inc becomes valuable requires judging both Snap's execution and broader market dynamics around AR adoption. That's hard to predict.

But that's what makes this moment interesting. We're at an inflection point where new computing platforms are possible. The companies making bets now—Meta with Ray-Ban and Quest, Apple with Vision Pro, Snap with Specs—are shaping what comes next. The spinoff is a signal that Snap takes this opportunity seriously.

FAQ

What is Specs Inc and how does it differ from Snap Inc?

Specs Inc is a wholly-owned subsidiary of Snap Inc that houses the company's augmented reality glasses business. Rather than keeping AR glasses development inside the main Snap corporation alongside the social platform and advertising business, the company created Specs Inc as a separate entity. This structure allows Specs to operate independently with its own management, pursue outside capital investment, and establish itself as a distinct brand while remaining controlled by Snap Inc.

Why did Snap decide to spin off its AR glasses into a separate company?

Snap's spinoff structure enables the company to more easily secure investors and partnerships for its wearables business. Building AR glasses requires sustained investment with uncertain timelines—the type of spending that can pressure quarterly earnings for a public company. By separating Specs, Snap can pursue outside capital from venture investors while keeping the core social business financially clean. The spinoff also attracts specialized talent and allows Specs to move faster on hardware development without constraints from the parent company's operational processes.

When will Specs Inc launch its first consumer AR glasses?

Specs Inc is expected to launch its next-generation standalone AR glasses sometime in 2025. According to announcements, these glasses will be lighter, have a smaller form factor, and feature more capabilities than previous developer-focused versions. However, the exact launch date hasn't been specified. The company is currently hiring aggressively for over 100 positions globally, suggesting active development progress.

How does Specs Inc compete with Meta's AR glasses initiative?

Meta's Ray-Ban smart glasses are already on the market and focus primarily on camera and voice AI capabilities rather than true augmented reality. Snap's glasses are positioning toward true AR where digital content overlays your view of reality. Snap's advantages include deep expertise in visual effects and filter creation, a young user base familiar with AR experiences, and established developer relationships from Snapchat. However, Meta has vastly more capital, an iconic eyewear brand partnership with Ray-Ban, and manufacturing scale that Snap lacks. Both companies are pursuing different timelines and market segments, so the market could potentially support both as winners in different categories.

What type of investors will fund Specs Inc?

Specs Inc will likely attract venture capital firms specializing in hardware innovation, strategic investors from technology companies seeking AR capabilities, and potentially specialized funds focused on wearable technology. Venture firms bring not only capital but also networks in manufacturing, supply chain, and retail distribution—advantages nearly as valuable as the funding itself. Series A funding for a hardware venture like Specs would likely range from

What will the software ecosystem look like for Specs glasses?

Snap plans to leverage its existing lens and filter developer community as the foundation for Specs apps. Developers already creating visual effects for Snapchat possess the technical knowledge to build for AR glasses. However, the company will need to expand beyond Snapchat creators to attract diverse application developers in productivity, enterprise, entertainment, and other categories. Snap is expected to announce a formal developer program during 2025 that will define the tools, APIs, and incentives for building Specs applications.

How will Specs Inc generate revenue?

Revenue models for Specs will likely include hardware sales (selling the glasses to consumers), software subscriptions or premium services, application marketplace revenue sharing, and potentially advertising within AR experiences. The company hasn't detailed specific pricing, but industry comparisons suggest consumer AR glasses will price between

What are the main manufacturing challenges for Specs Inc?

Scaling AR glasses production involves sourcing specialized components (custom optics, processors, sensors, batteries), establishing relationships with contract manufacturers, and implementing quality control processes for complex hardware. Unlike software, hardware manufacturing can't be easily iterated after launch—mistakes are expensive. Snap must build supply chains for millions of units while managing costs to reach price points consumers will accept. The company has experience manufacturing Spectacles but previous versions shipped in smaller volumes, so scaling to mainstream production is a significant challenge.

How does the spinoff structure affect Snap Inc's financial reporting?

With Specs operating as a separate subsidiary, Snap Inc's core social business can be evaluated independently without the drag of hardware losses on profitability metrics. Hardware development is expensive and requires years before generating revenue. Separating Specs means Snapchat's advertising revenue and margins look cleaner to public market investors, which should improve the company's stock valuation. Snap can still consolidate Specs' financial results for reporting purposes but can segment them clearly so investors understand both business units separately.

What timeline should we expect for Specs Inc to reach profitability?

Profitability for a hardware startup like Specs typically requires 5-10 years after initial product launch. First years focus on establishing manufacturing, achieving volume, and building the software ecosystem—all investments rather than profit centers. Meta's Reality Labs division operated at billions of dollars in annual losses while developing AR capabilities. Specs will likely follow a similar arc: launch, scale, establish market position, then work toward profitability. Investors understand this timeline and evaluate success based on market adoption trajectory rather than near-term profitability.

The AR glasses market is entering a critical phase. Snap's decision to spin off Specs Inc signals that the company believes this opportunity is real, significant, and worth betting the future on. Whether that bet pays off depends on execution, market timing, and competitive dynamics that remain uncertain.

But what's clear is that AR glasses are moving from science fiction to engineering problem. Companies with serious capital and technical expertise are now building actual products for actual consumers. Within a few years, we'll know whether AR glasses become as ubiquitous as smartphones or remain niche devices for enthusiasts.

Snap's spinoff puts the company in position to be part of that outcome. The success or failure of Specs Inc will say a lot about whether Snap can execute in hardware as well as it has in software.

Key Takeaways

- Snap created Specs Inc as a wholly-owned subsidiary to enable independent funding and faster hardware development without constraining the core social business

- The spinoff structure allows Specs to attract venture capital, specialized hardware expertise, and manufacturing partnerships that wouldn't be available under traditional corporate budgeting

- AR glasses market is heating up with Meta's Ray-Ban glasses, Apple's Vision Pro, and other competitors pursuing different strategies, making early market positioning critical

- Specs Inc faces genuine challenges including hardware manufacturing at scale, building a compelling software ecosystem, and competing against better-capitalized rivals, though the company has real advantages in visual computing expertise

- Timeline suggests Specs glasses launch in 2025 with meaningful consumer adoption scaling through 2027-2028, positioning AR glasses as a realistic near-term consumer technology rather than distant speculation

Related Articles

- Snap's Specs Subsidiary: The Bold AR Glasses Bet [2025]

- Redwood Materials $425M Series E: Google's Bet on AI Energy Storage [2025]

- Best Fitness Trackers & Watches [2026]: Complete Buyer's Guide

- Anker Soundcore Space A40: Budget Earbuds Under $50 [2025]

- Best Laptops 2026: Complete Buying Guide & Analysis

- Northwood Space Lands 50M Space Force Contract [2026]

![Snap's AR Glasses Spinoff: What Specs Inc Means for the Future [2025]](https://tryrunable.com/blog/snap-s-ar-glasses-spinoff-what-specs-inc-means-for-the-futur/image-1-1769611352366.jpg)