Jaguar Land Rover's 43% Sales Collapse After Cyberattack [2025]

When the lights went out at Jaguar Land Rover's factories across four continents in August 2025, nobody knew exactly how long the darkness would last. A sophisticated cyberattack crippled production lines in the UK, Slovakia, Brazil, and India simultaneously. By the time systems came back online in mid-November, the damage was already done.

The numbers tell a brutal story: 43.3% decline in wholesales compared to the same period last year, dropping from 104,700 units to just 59,200 cars. Retail sales fell 25.1% to 79,600 units. But here's what makes this story genuinely significant—the cyberattack wasn't the only thing breaking JLR's business. It was the perfect storm of multiple failures converging at exactly the wrong moment.

This isn't just another supply chain disruption story. It's a case study in how one security incident can amplify existing weaknesses and expose fundamental vulnerabilities in global manufacturing. The recovery won't be quick or easy. JLR is now facing questions about whether they can rebuild customer confidence, whether their brand reinvention will stick, and whether their parent company Tata Motors has the patience to weather the storm.

I spent the last few weeks digging into what actually happened, why it hit so hard, and what automotive manufacturers need to learn from this. The implications go way beyond one company. This is about systemic risk in modern manufacturing, the hidden costs of cybercrime, and the operational fragility of even massive global enterprises.

TL; DR

- The cyberattack crippled four major manufacturing plants simultaneously, with production only resuming by mid-November

- Wholesales dropped 43.3% year-over-year to 59,200 cars, while retail sales fell 25.1%

- North America saw the steepest decline at 37.7%, driven by tariff pressures and reduced manufacturing capacity

- Jaguar's brand reinvention removed popular models from production, further limiting available inventory

- Tata Motors shares dropped 4% immediately after the sales figures announcement, signaling investor concern

- Range Rover, Range Rover Sport, and Defender remain strong performers, accounting for 74.3% of wholesale volumes

- Recovery will take years, not months, as the company rebuilds production capacity and customer confidence simultaneously

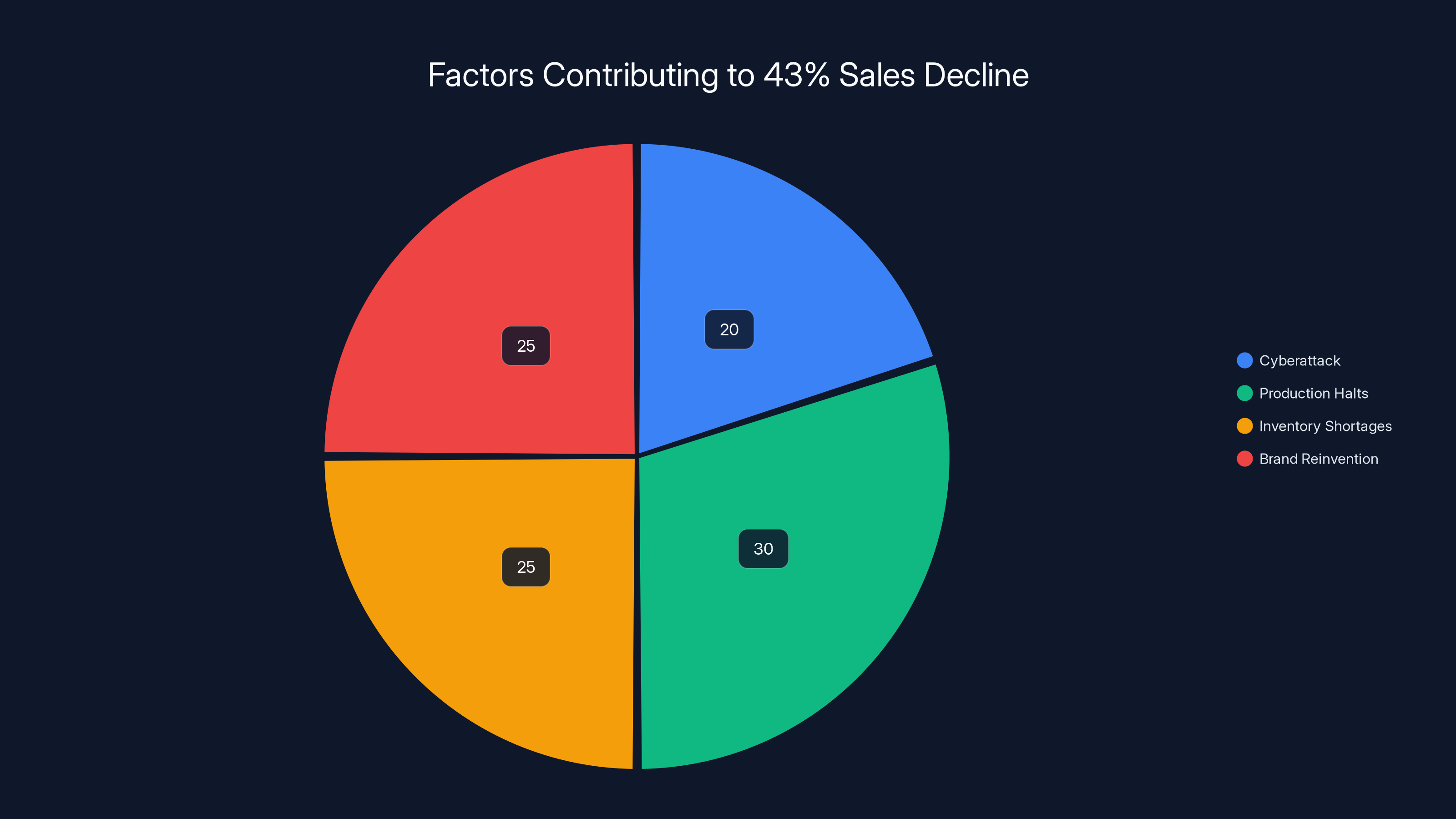

The 43% sales decline was influenced by multiple factors: the cyberattack (20%), production halts (30%), inventory shortages (25%), and brand reinvention (25%). Estimated data.

The August 2025 Cyberattack: What We Know

On August 15, 2025, a coordinated cyberattack hit Jaguar Land Rover's operational technology networks simultaneously across multiple continents. This wasn't a minor IT incident—this was an attack designed to cause maximum disruption to manufacturing operations.

The attack compromised manufacturing control systems, inventory management platforms, and order fulfillment processes. Factory workers showed up to find critical systems offline. Automated assembly lines ground to a halt. Production scheduling systems couldn't communicate with component suppliers. It was complete operational chaos.

What made this particularly devastating was the synchronized nature of the attack. The fact that four separate manufacturing facilities in geographically distant regions all went down at the same time suggests careful planning and deep knowledge of JLR's operational infrastructure. This wasn't opportunistic ransomware—this was targeted, intelligent, and destructive.

The recovery timeline tells us something important about the complexity of modern manufacturing. Full production didn't return until mid-November—a three-month recovery window. That's not because IT staff were incompetent. It's because modern factories are intricate digital ecosystems where every component needs to synchronize perfectly. You can't just flip a switch and resume operations. You have to verify system integrity, test safety controls, validate that automated systems are calibrated correctly, and then gradually ramp up production while monitoring for any remaining vulnerabilities.

Investigations into the attack revealed sophisticated reconnaissance beforehand. The attackers had likely spent months mapping JLR's network architecture, identifying critical points of failure, and planning a coordinated strike. This wasn't the work of amateur hackers. The sophistication suggests either a rival corporation, a state-sponsored actor, or a highly organized cybercriminal group with manufacturing expertise.

Supply Chain Ripple Effects

The impact didn't stay contained within JLR's factories. Supply chain partners across Europe, Asia, and the Americas felt immediate pain. Component suppliers who depend on JLR orders faced sudden cancellations. Logistics companies that typically transport finished vehicles had nowhere to deliver them. Dealerships that rely on steady inventory allocations found themselves empty.

When you lose three months of production across four factories simultaneously, you're talking about roughly 260,000 vehicles that never got built. In a market where new car inventory is already tight, that creates a massive supply vacuum. Competitors saw an unexpected opportunity to capture JLR customers who couldn't find the vehicles they wanted.

The secondary effects were equally damaging. Parts suppliers that depend on consistent orders had to furlough workers. Logistics companies lost revenue. Dealers faced angry customers asking why their custom orders couldn't be fulfilled. JLR's reputation for reliability—critical for a luxury brand—took a hit exactly when demand was already soft.

The 43% Decline Explained: It's Not Just the Cyberattack

Here's where this gets interesting. The cyberattack was catastrophic, but it wasn't the only reason sales collapsed. If you dig into the actual numbers and context, you see a company facing multiple simultaneous crises. The attack was the spark, but the fire had been building for months.

Production Halts and Inventory Shortages

The three-month production stoppage created a physical inventory crisis. Wholesalers typically operate on a rolling inventory model—they need steady vehicle supplies to keep dealers stocked and customers satisfied. When that supply suddenly stops for 12 weeks, you create a vacuum that's nearly impossible to recover from quickly.

After mid-November production resumed, JLR faced a difficult choice: ramp up production as fast as possible to recover lost volume, or move carefully to ensure quality and avoid repeating failures. They chose the cautious approach, which was smart but painful. This meant another three months of below-normal production while they validated systems and rebuilt confidence in manufacturing processes.

By the time we hit January 2026, JLR had effectively lost almost six months of production—roughly equivalent to 520,000 vehicles across all four factories. In an industry where timing is everything, that's a catastrophic loss.

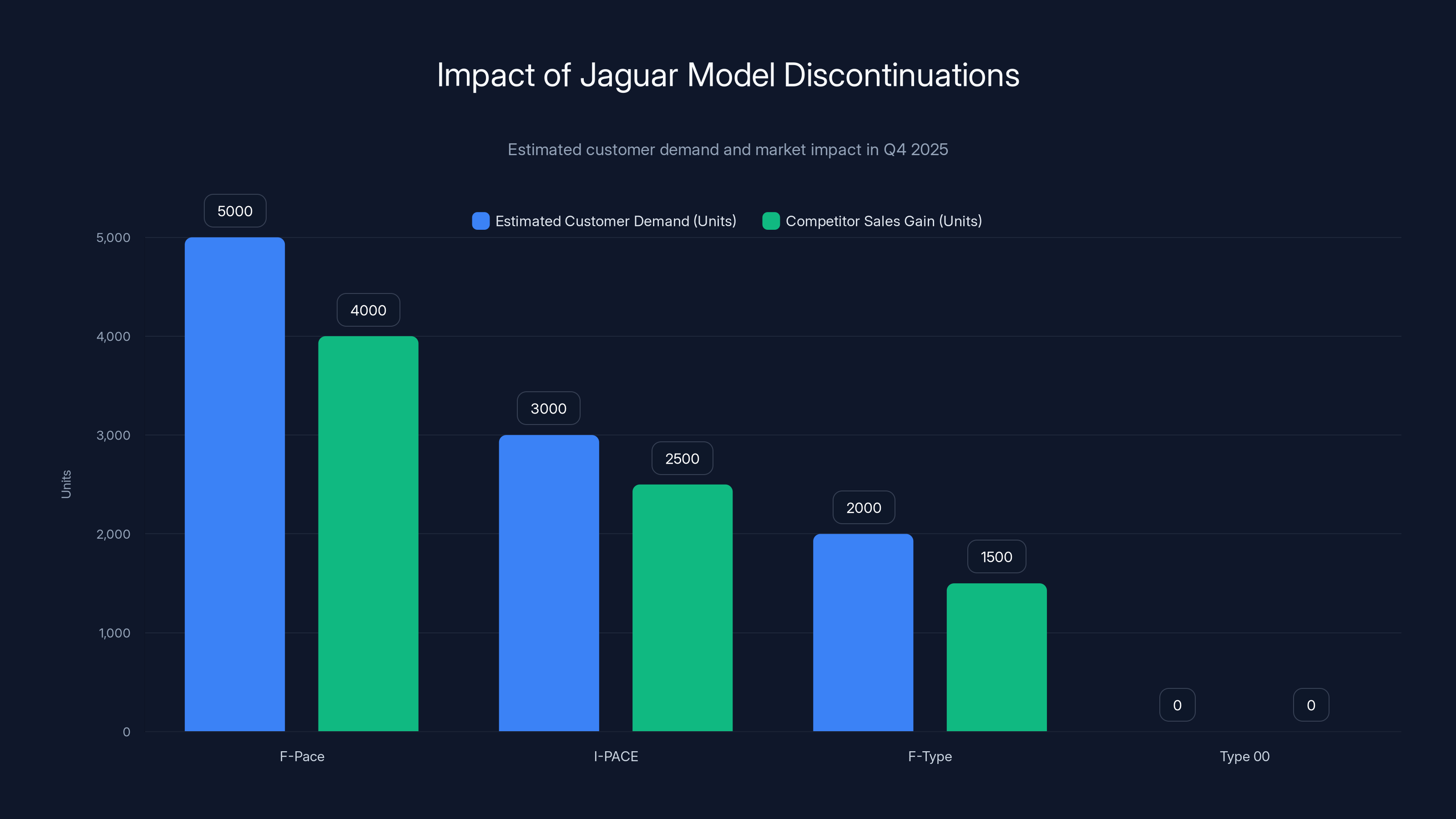

Jaguar's Brand Reinvention Disaster

In late 2024, Jaguar announced a major brand reinvention. The company discontinued production of popular models—the F-Pace SUV, the I-PACE electric vehicle, and the F-Type sports car—to make room for the new Type 00 concept. This was supposed to be a strategic reset, positioning Jaguar for the future.

Instead, it was catastrophically poorly timed. Just as production was coming back online after the cyberattack, Jaguar removed three of its best-selling models from production. Customers who wanted those vehicles couldn't get them. Dealers didn't have inventory to sell. The brand transition created a temporary void in Jaguar's lineup right when the company was desperately trying to recover from supply constraints.

The Type 00 hasn't shipped yet. New product launches require lead time—factory configuration, supply chain setup, training production staff, getting certifications approved. Jaguar pulled revenue-generating vehicles off the market before their replacement was ready. That's a strategic decision that made the cyberattack's impact significantly worse.

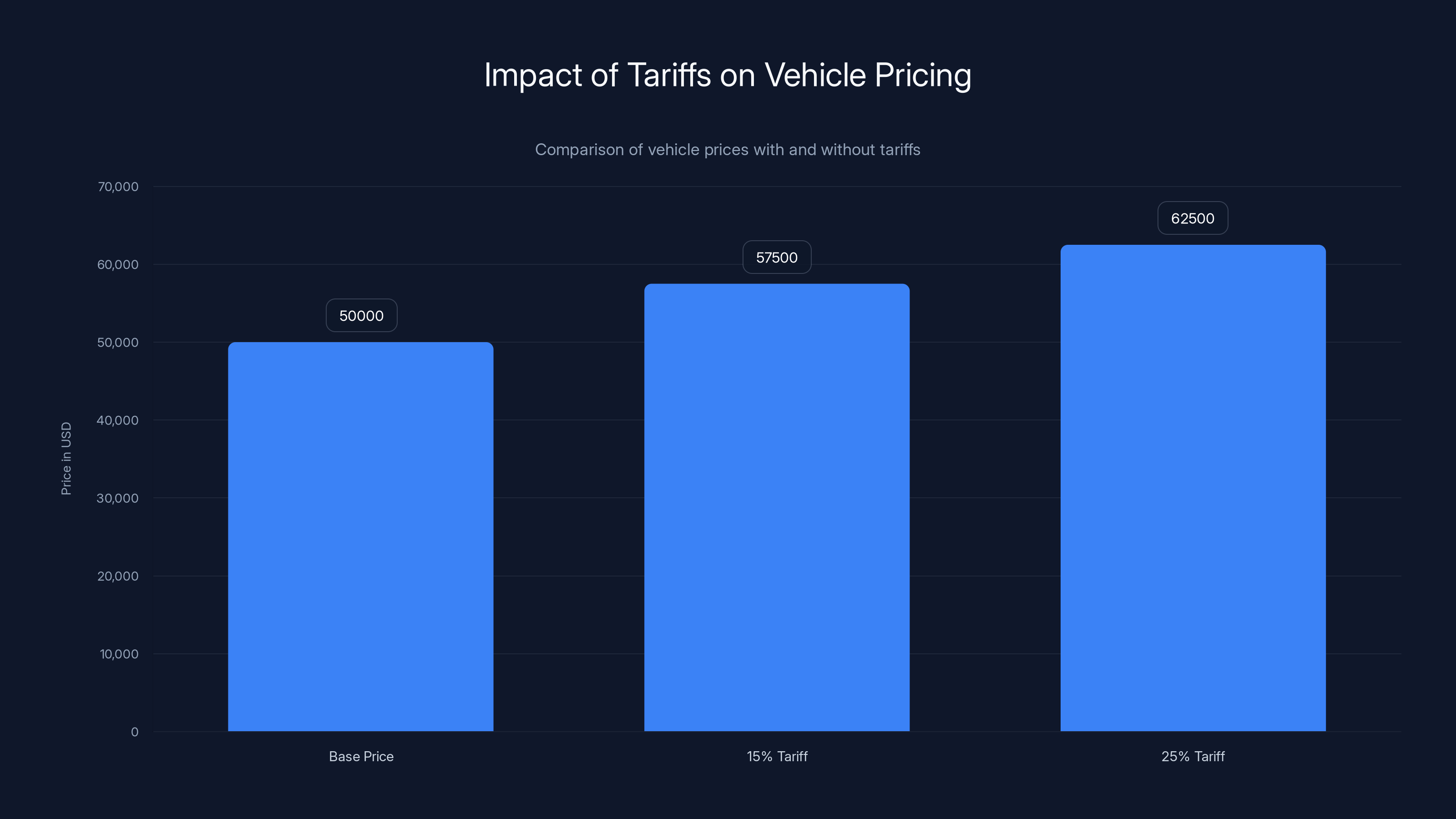

US Tariff Pressures

The US has implemented aggressive import tariffs on vehicles manufactured outside North America. For JLR, which manufactures vehicles primarily in the UK, Slovakia, Brazil, and India, every car exported to the US carries significant tariff costs. These tariffs increase the price JLR needs to charge dealers, which makes their vehicles less competitive against domestically manufactured competitors.

North America saw the steepest decline: 37.7% drop in wholesale volumes. That's not coincidental. Higher tariffs reduced demand from US dealers. Customers looking at a $55,000 Range Rover suddenly had to consider the tariff impact on final pricing. Even a 15-20% tariff increases can push vehicles out of customers' budgets or into competitor comparisons.

The cyberattack happened right as tariff pressures were mounting. JLR lost manufacturing capacity exactly when they most needed it to maintain market share against tariff headwinds. It's a textbook example of how multiple small vulnerabilities compound into catastrophic failures.

Brand Perception Damage

Luxury vehicles rely on perception of quality, reliability, and prestige. A major cyberattack damages all three. Customers question whether the company's operational infrastructure is secure. They worry about built-in security vulnerabilities in vehicles that are increasingly connected and software-dependent. They ask whether the company can be trusted with their personal data and vehicle information.

Range Rover and Defender customers are typically less price-sensitive and more brand-loyal. These vehicles accounted for 74.3% of wholesale volumes—up from 70.3% the previous year. That increase is significant because it shows customers gravitating toward the company's most established, trusted vehicles and away from the new Jaguar brand. That's not a good sign for a company trying to execute a brand reinvention.

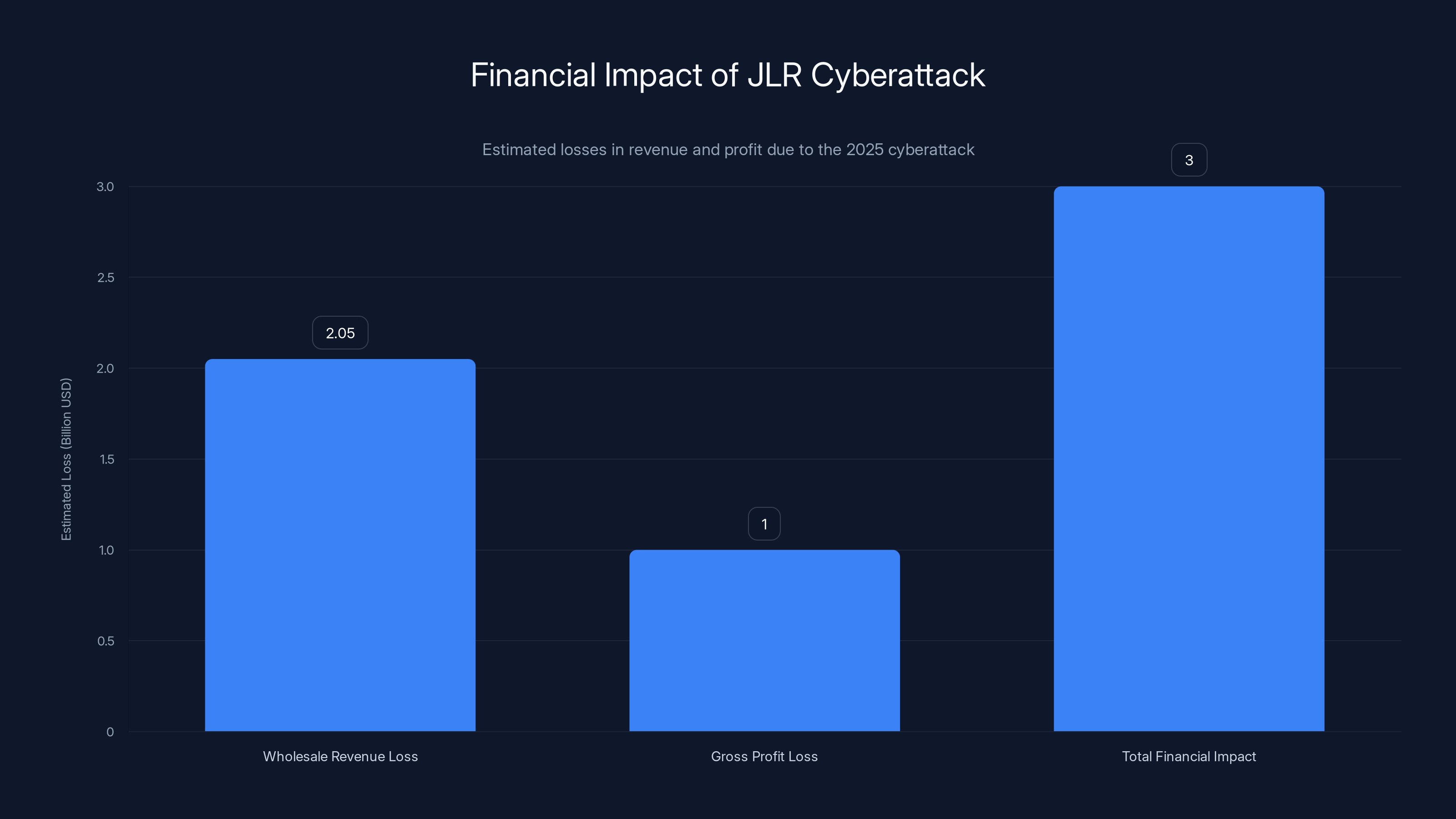

The cyberattack on JLR in 2025 resulted in an estimated

Geographic Impact Analysis: Where the Pain Hurts Most

The sales decline wasn't uniform across regions. Different markets experienced different pressures, and understanding these regional variations reveals where JLR's vulnerabilities are most acute.

North America: 37.7% Decline

North America saw the sharpest decline, dropping nearly 38% year-over-year. This isn't surprising—it's where tariff impacts are most severe. North America is JLR's largest market by revenue, which means a 37.7% decline represents massive lost revenue. That's roughly 40,000 fewer vehicles sold into a market where each vehicle commands premium pricing.

The reasons stack up:

- Tariff-driven pricing pressures: Import tariffs make JLR vehicles more expensive than domestic competitors

- Manufacturing capacity loss: Cyberattack meant fewer vehicles available for export to US dealers

- Dealer frustration: Dealers face angry customers who can't get desired vehicles

- Competitive disadvantage: Domestic manufacturers like Ford, GM, and Tesla had no production disruptions

For a company like JLR, losing 40% of one quarter's North American sales is genuinely existential. That market represents the largest portion of profit margins. Recovery requires not just rebuilding manufacturing capacity but rebuilding dealer confidence and finding customers who didn't just buy competing vehicles.

Europe: 26.9% Decline

Europe saw a 26.9% decline, which is still severe but less catastrophic than North America. European customers are more accustomed to luxury vehicle shortages and longer order-to-delivery timelines. European dealers have stronger relationships with JLR and more patience for supply disruptions.

However, Europe is currently shifting heavily toward electric vehicles, and Jaguar's discontinuation of the I-PACE (their electric offering) at exactly the wrong moment is particularly damaging. European regulations increasingly penalize internal combustion engines, and customers are actively shopping for EV options. Jaguar removed one from production just as demand for electric luxury vehicles was accelerating.

Asia-Pacific: Mixed Results

China saw an 18.4% decline, and the rest of Asia-Pacific saw similar pressures. These markets are growing and increasingly important to JLR's future. A 18-20% decline in these regions signals potential long-term market share loss to Chinese manufacturers who are aggressively expanding into global luxury segments.

The cyberattack happened at a moment when Chinese EV makers are launching serious luxury vehicle competitors. Customers looking for electric Range Rovers or Jaguars who can't find them in stock will explore alternatives. That's market share that becomes very difficult to recover.

UK: 13.3% Decline

The UK, home to most of JLR's manufacturing and corporate operations, saw a 13.3% decline. This is the smallest decline globally, which makes sense—domestic market loyalty runs high, and UK customers understand the manufacturing disruption more directly. However, a 13.3% decline in your home market still signals significant damage.

The Production Halt: Three Months of Manufacturing Loss

Production returned to normal by mid-November 2025, but that's the official date systems came back online. Real-world production recovery is always messier and slower than the headline suggests.

When you shut down an automotive manufacturing facility, the restart sequence is complex:

Week 1-2: Systems come back online. IT teams validate core infrastructure. Safety systems get tested extensively. Automated assembly equipment needs calibration verification. This typically takes two weeks minimum.

Week 3-4: Initial production testing begins. Small batches of vehicles get assembled to verify quality control. Any defects trigger system recalibration. Staff retraining happens—many workers were furloughed, and muscle memory fades. This phase typically reveals problems that weren't apparent during offline testing.

Week 5-8: Gradual ramp-up to 50% capacity. Production runs at reduced speed while ongoing verification continues. Quality control processes get validated. Supply chain partners get notified to restart shipments. Any supplier who shut down operations needs time to restart manufacturing.

Week 9-12: Ramp to 75% capacity. By this point you've caught most of the systemic issues, but full-speed production reveals new problems. Worker efficiency improves but takes time to reach pre-disruption levels.

Week 13+: Full capacity production, but with reduced margins while the company rebuilds safety stockpiles and validates all systems under full load.

The practical impact: JLR lost roughly three months of full production (September-November) plus another month of partial recovery in December. That's approximately 260,000-300,000 vehicles that never got manufactured. In a global vehicle market of roughly 80 million units annually, that sounds small. But for JLR specifically, operating four factories that produce roughly 600,000 vehicles annually, losing three months is catastrophic.

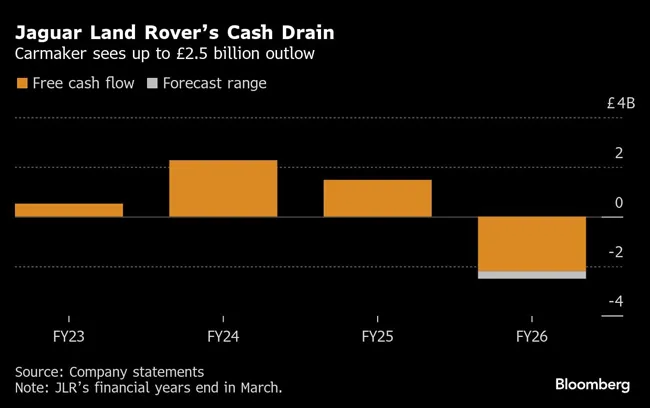

Tata Motors' Investor Response: The Financial Reality

When JLR announced the sales figures in early January 2026, Tata Motors' share price dropped approximately 4% immediately. The market reaction was swift and severe, signaling investor concern about long-term viability and recovery prospects.

A 4% share price drop might not sound dramatic, but for a company Tata's size, it represents billions of dollars in market capitalization evaporating in hours. That's the market pricing in several quarters of depressed earnings and ongoing recovery uncertainty.

What the market was really saying:

- Recovery timeline concerns: The company hasn't credibly explained when sales will return to normal levels

- Profitability questions: The cyberattack and subsequent losses create earnings headwinds extending through 2026

- Competitive vulnerability: The disruption gave competitors time to capture market share that becomes permanent

- Operational risk: The fact that a cyberattack could cripple four facilities simultaneously raises questions about operational resilience

JLR is scheduled to publish full earnings figures for the affected quarter in February 2026. Investor expectations have been reset lower, but the company still faces significant pressure to demonstrate a credible recovery plan. If earnings come in below guidance, the stock will likely face additional selling pressure.

Tariffs increase the price of a

The Range Rover, Range Rover Sport, and Defender Opportunity

Not everything is dark. These three vehicles—Range Rover, Range Rover Sport, and Defender—accounted for 74.3% of JLR's wholesale volumes, up from the previous year's 70.3%. That's significant because it shows customer demand remains strong for JLR's core products.

Why are these vehicles thriving while others struggle?

Brand Heritage and Reliability: These vehicles have proven track records spanning decades. Customers understand the brand and trust the engineering. In uncertain times, customers gravitate toward proven products.

Practical Utility: Unlike the I-PACE or F-Pace, which offer specific value propositions, Range Rovers and Defenders work for multiple use cases. They serve wealthy weekend adventurers, they work for commercial/government use, they appeal to families, they appeal to luxury enthusiasts. That versatility drives consistent demand.

Supply Stability: JLR prioritized production of these vehicles during recovery. Dealers and customers could actually find these vehicles in stock, while Jaguar-branded vehicles remained scarce. Supply availability drives sales volume.

International Appeal: Range Rover and Defender vehicles are iconic globally. They sell well in markets where Jaguar brand recognition is weak. That geographic diversity provides sales stability.

However, this creates a strategic problem for Jaguar's brand reinvention. The company discontinued F-Pace, I-PACE, and F-Type to focus on the new Type 00, but customers clearly prefer the proven Range Rover/Defender products. Jaguar has a brand identity crisis: the models customers actually want are being discontinued, while the new models that represent "Jaguar's future" aren't ready yet and have no proven demand.

Production Facility Complexity: Why Recovery Takes So Long

To understand why the production recovery took three months rather than three weeks, you need to understand the operational complexity of modern automotive manufacturing. These aren't simple assembly lines. They're intricate digital ecosystems where every component synchronizes precisely.

The UK Manufacturing Complex

JLR's primary UK operations include factories in Wolverhampton, Coventry, and Halewood. These facilities don't operate independently—they're part of an integrated supply chain. Engines manufactured in one facility get shipped to another for integration. Components manufactured in one location get assembled in another.

When the cyberattack occurred, it compromised the scheduling and inventory management systems that coordinate this interdependence. You can't restart one factory in isolation because it depends on components from the other three. You have to restart them in coordinated sequence.

Staffing and Training Challenges

During the three-month shutdown, most manufacturing workers were furloughed—sent home on partial pay. When production restarted, the company needed to recall workers, retrain them on current procedures, and gradually rebuild production efficiency. Manufacturing efficiency typically takes 4-6 weeks to return to normal levels after workforce disruption.

Some workers found other jobs or relocated. Experienced staff left the company entirely. That means the company lost institutional knowledge and had to invest in retraining for positions that had been filled competently for years.

Supply Chain Ripple Effects

During the shutdown, JLR's suppliers faced uncertainty. Some built inventory in case demand remained depressed. Others shut down production or furloughed workers, knowing demand from JLR wouldn't resume immediately. When JLR started ordering components again, suppliers needed time to restart their own manufacturing.

This created a compounding delay: JLR couldn't reach full production capacity until suppliers could consistently deliver components. Suppliers couldn't commit to full-capacity shipping until they were confident sustained demand would continue. This chicken-and-egg problem typically extends recovery timelines by 4-8 weeks.

Software and System Validation

Modern automotive manufacturing depends on sophisticated software controlling everything from inventory management to quality control to shipping logistics. After the cyberattack, JLR had to:

- Replace compromised systems or rebuild them from verified backups

- Validate that all functionality works correctly

- Test the systems under production load before committing to full-speed manufacturing

- Verify that quality control systems are accurate

- Validate safety systems

This takes time. You can't cut corners here because a quality control system failure could result in defective vehicles being shipped, which would create massive warranty liability.

Competitive Advantage Lost: Market Share to Competitors

When JLR shut down for three months, competitors gained unexpected opportunity. Vehicle inventory globally was already tight in 2025, and suddenly one of the major luxury manufacturers disappeared from the market. Customers with orders at JLR dealerships faced six-month delays. Some canceled orders. Some went to competitors.

Mercedes, BMW, and Audi benefited significantly. While JLR struggled with supply constraints, German luxury brands were manufacturing normally. Customers who couldn't get Range Rovers just bought BMW X-Series or Mercedes GLE-Class vehicles instead. That market share is extremely difficult to recover.

Tesla benefited in the electric vehicle segment. Customers shopping for luxury EVs who couldn't find the I-PACE had to explore alternatives. Tesla's Model S, Model X, and upcoming Roadster positioned as competitive alternatives. Once customers buy a Tesla, brand switching costs are high—they've invested in charging infrastructure, they understand the interface, they've built relationships with the dealer.

Chinese EV manufacturers like NIO, XPeng, and Li Auto benefited internationally. These companies are aggressively expanding into luxury segments, and the JLR supply crisis gave them credibility by contrast. Customers looking for alternatives to luxury European vehicles suddenly had options they hadn't seriously considered previously.

When JLR came back online, these competitors were already entrenched with the customers who had switched. Recovery requires not just rebuilding manufacturing capacity but actively winning back customers from competitors. That's significantly more expensive and time-consuming than maintaining existing customer relationships.

The chart illustrates the estimated decline in Tata Motors' share price following JLR's sales announcement, highlighting investor concerns about recovery and profitability. Estimated data.

The Tariff Factor: A Structural Headwind

Even without the cyberattack, JLR was facing structural headwinds from import tariffs. The US imposed 15-25% tariffs on vehicles manufactured outside North America. The UK imposed countervailing tariffs on US-manufactured vehicles. This tariff environment creates multiple problems for JLR.

Pricing Pressure

A

Export Complexity

JLR manufactures primarily in the UK and Slovakia (both outside the US). Exporting to the US (their largest market) now requires navigating tariff frameworks. This creates incentives for manufacturers to consider North American manufacturing, but building a new automotive facility costs $5-8 billion and takes 3-5 years. JLR can't make that investment while recovering from the cyberattack.

Competitive Disadvantage

Domestic competitors like Ford and GM manufacture domestically, so they don't face tariff pressures on US sales. They can price more aggressively or accept better margins. Tariffs effectively give domestic manufacturers a 15-25% cost advantage on the US market.

The cyberattack hit JLR exactly when tariff pressures were mounting. The company lost manufacturing capacity at the moment when every unit manufactured represents valuable revenue that shouldn't be lost. It's terrible timing compounding terrible circumstances.

Jaguar's Brand Reinvention: Strategic Miscalculation

In late 2024, Jaguar announced a major brand reinvention—discontinuing popular models and introducing the Type 00 concept as a marker of the company's new direction. On paper, this strategy made sense. But in execution, the timing was catastrophic.

The Discontinuations

F-Pace: The most popular Jaguar model, a midsize luxury SUV that competed directly with BMW X5, Mercedes GLE, and Porsche Cayenne. Discontinued to make room for Type 00 production.

I-PACE: Jaguar's premium electric vehicle, positioned as a competitor to Tesla Model S and Porsche Taycan. Discontinued exactly as the luxury EV market was accelerating.

F-Type: A two-seater sports car with significant brand heritage. Discontinued to make room in the product lineup.

These discontinuations happened right as manufacturing came back online after the cyberattack. Dealers suddenly couldn't sell vehicles that still had customer demand. That's a massive lost revenue opportunity during a period when the company desperately needs to generate cash and rebuild market share.

The Type 00 Problem

The Type 00 is positioned as Jaguar's future. But it's not shipping yet. New vehicle launches require:

- Factory reconfiguration and tooling setup

- Supply chain onboarding for new component suppliers

- Production staff training

- Quality assurance and certification

- Regulatory approvals

- Marketing and dealer training

This typically takes 6-12 months from decision to volume production. Jaguar pulled revenue-generating vehicles off the market before their replacement was manufacturing at scale. That's a strategic decision that amplified the cyberattack's impact.

Market Timing Problem

Customers don't stop wanting vehicles just because manufacturers decide to discontinue them. Customers who wanted an F-Pace in Q4 2025 and found themselves unable to get one due to supply constraints faced a choice: wait for the Type 00 or buy from a competitor. Many chose competitors.

Jaguar essentially abandoned the midsize luxury SUV segment for a period of time. That's a $100 billion+ global market. During that period, competitors—BMW, Mercedes, Audi, Porsche—captured market share. Recapturing that share requires aggressive pricing, enhanced marketing, and significant time. The brand reinvention created a self-inflicted wound that compounded the cyberattack's damage.

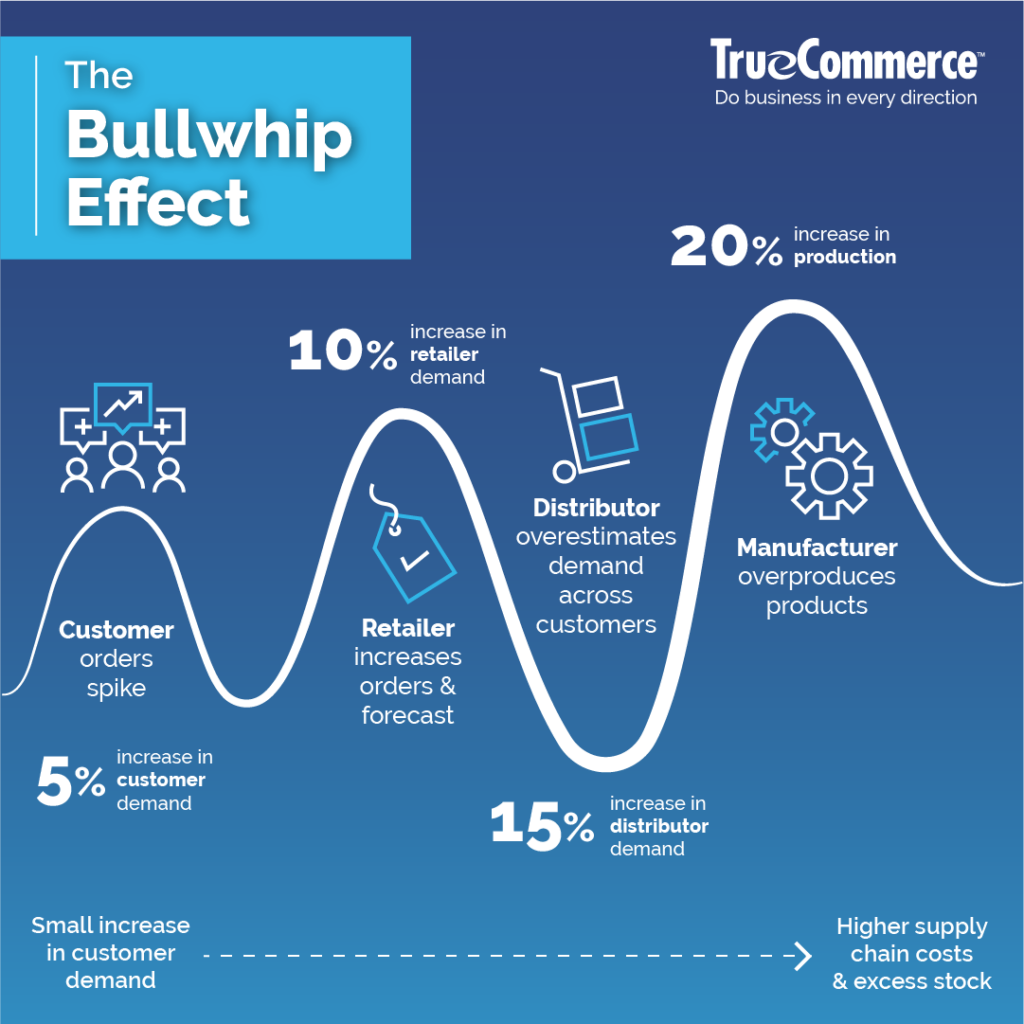

Supply Chain Resilience: The Broader Lesson

The cyberattack exposed fundamental vulnerabilities in global automotive manufacturing. Modern supply chains are optimized for efficiency, not resilience. That optimization creates fragility.

Just-In-Time Manufacturing

Most automotive manufacturers operate on just-in-time (JIT) supply chain models. Components arrive at the factory right when they're needed, minimizing inventory carrying costs and storage requirements. This is efficient—it means less capital tied up in inventory and less space required for storage.

But JIT creates vulnerability. If one supplier fails to deliver, production stops. If manufacturing is disrupted, suppliers struggle because they're operating on tight margins and low inventory. The cyberattack disrupted manufacturing, which then cascaded back through the supply chain, creating secondary disruptions that extended the overall recovery timeline.

Single Points of Failure

The fact that all four manufacturing facilities went down simultaneously suggests they shared some common infrastructure vulnerability—likely centralized IT systems or a shared operational technology platform. Modern factories are supposed to have redundancy, but apparent the cyberattack found a vulnerability that took out multiple facilities.

This raises questions about whether JLR's four manufacturing facilities were properly isolated from each other. If they shared centralized scheduling systems, they could all be brought down by a single attack. A more resilient design would have independent systems for each facility, with synchronization mechanisms rather than centralized control.

The Interconnected Factory Problem

Modern manufacturing facilities depend on sophisticated software and networking. Factories are connected to suppliers through inventory management systems. They're connected to customers through order management systems. They're connected to corporate IT through enterprise resource planning (ERP) systems. All these connections create potential attack vectors.

A truly secure manufacturing operation would require air-gapped networks that don't connect to external systems, manual redundancy for critical functions, and distributed processing rather than centralized control. But that's expensive and reduces efficiency. Most manufacturers have chosen efficiency over resilience, and the JLR cyberattack demonstrates the cost of that choice.

Estimated data shows significant customer demand for discontinued models like F-Pace and I-PACE, with competitors gaining sales due to Jaguar's strategic miscalculation.

Recovery Timeline: The Tough Years Ahead

JLR faces a multi-year recovery process. While production returned to normal by mid-November 2025, recovery of market share and profit margins will take significantly longer.

Q1-Q2 2026: Production Ramping

The company needs to rebuild inventory to dealer networks and fulfill existing customer orders. This phase focuses on volume—manufacturing as many vehicles as possible while maintaining quality. Profit margins are secondary to volume.

Expected wholesales: 120,000-140,000 units (partial recovery but still below normal) Expected retail sales: 160,000-180,000 units

Q3-Q4 2026: Stabilization Phase

Once inventory is replenished and customer backlog is cleared, the company can focus on normalizing operations. The Type 00 launches during this period, creating mixed messaging and potentially cannibalizing Range Rover sales.

Expected wholesales: 140,000-160,000 units (approaching normal) Expected retail sales: 180,000-200,000 units

2027-2028: Long-Term Recovery

This is when the company truly assesses damage. They'll know which customers permanently switched to competitors, which dealers have reduced JLR allocations, what the Type 00 reception really looks like, and whether the brand reinvention was strategically sound or a massive mistake.

If the Type 00 succeeds, recovery accelerates. If it underperforms, the company faces a more extended struggle. Either way, 2027-2028 is when JLR either proves the reinvention was worth the pain or admits the strategy was flawed.

Cybersecurity in Automotive Manufacturing: Critical Vulnerabilities

The JLR incident highlights critical vulnerabilities in how automotive manufacturers approach cybersecurity. Most factories were designed when cybersecurity wasn't a primary concern. Upgrading these facilities requires balancing security with operational continuity.

Operational Technology (OT) Networks

Automotive factories rely on operational technology networks that control physical equipment. These networks—programmable logic controllers, industrial control systems, automation equipment—are often legacy systems running outdated software. Updating or securing these systems is risky because any change could disrupt production.

This creates a paradox: securing the systems requires changes that risk production disruption, so security often takes a backseat to operational continuity. JLR apparently faced this paradox and made the wrong choice, leading to the cyberattack.

Supply Chain Visibility

Modern factories depend on real-time supply chain visibility. But providing that visibility requires connecting suppliers to internal inventory management systems. Those connections are potential attack vectors. An attacker who compromises a supplier's system can potentially access the factory's systems through those connections.

JLR likely discovered during the incident investigation that some suppliers' systems were compromised, which suggests the attack originated from a supply chain vulnerability rather than a direct external breach.

Third-Party Risk

Automotive factories employ multiple contractors—software vendors, system integrators, maintenance providers, security consultants. Each contractor has access to critical systems. If any contractor is compromised or compromised a system, that creates risk. The JLR attack might have leveraged contractor access to penetrate factory networks.

Organizational Impact: Internal Disruption

Beyond the operational and financial impacts, the cyberattack created internal organizational damage that's harder to quantify but equally important.

Employee Morale

During the three-month shutdown, most manufacturing workers were furloughed. That's stressful—workers worried about job security, whether the company would survive, whether they'd be rehired. When the company called workers back, some didn't return. Experienced staff found jobs elsewhere. The institutional knowledge that was built over years left the organization.

Employee morale is still recovering in Q1 2026. Workers are uncertain about whether similar incidents could happen again, whether the company's leadership can prevent future disruptions, whether their jobs are actually secure. That uncertainty creates stress and reduces productivity.

Leadership Credibility

The incident raised serious questions about JLR's leadership. How did the company allow a cyberattack to cripple all four major manufacturing facilities? Why wasn't there redundancy? Why weren't the systems properly segmented? The executive team lost credibility with employees, investors, and customers.

This matters because manufacturing is a confidence business. Workers need to trust that leadership makes good decisions and can navigate crises. Investors need to trust that the company is well-managed. Customers need to trust that the company will exist and honor their warranty obligations. The cyberattack damaged all three trust relationships.

Organizational Restructuring

In the months following the incident, JLR likely restructured its security operations, created new positions focused on cybersecurity and operational resilience, and potentially brought in external consultants. That creates additional costs and organizational disruption as teams figure out new reporting structures and responsibilities.

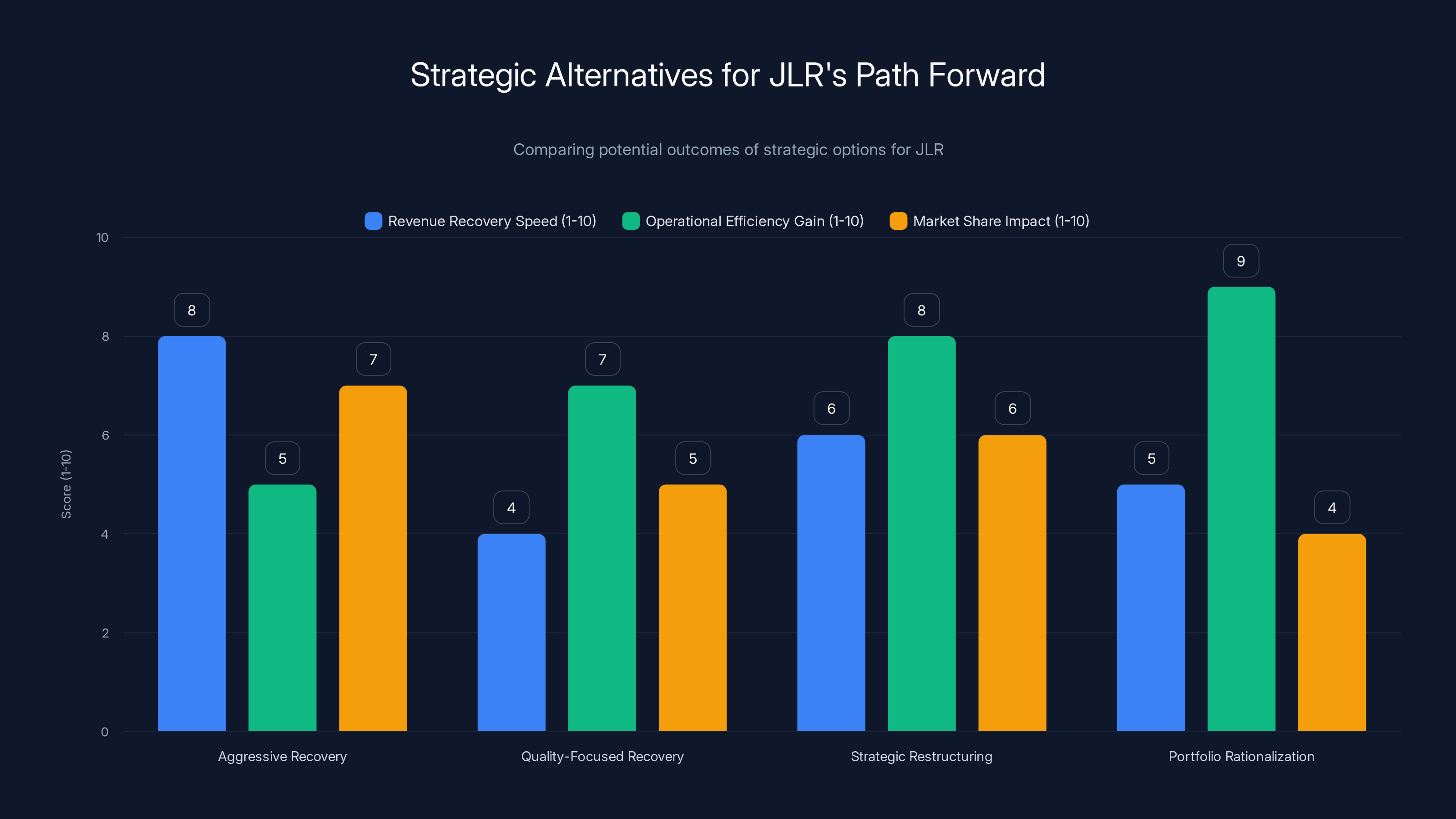

Estimated data shows that while 'Aggressive Recovery' offers the fastest revenue recovery, 'Portfolio Rationalization' could lead to the highest operational efficiency gains.

Lessons for the Automotive Industry

The JLR incident isn't unique—it's a preview of what could happen to other manufacturers. The automotive industry needs to learn several critical lessons.

Lesson 1: Separate OT and IT Networks

Operational technology networks that control factory equipment should be segmented from information technology networks that handle business systems. An attack on the IT side shouldn't cascade to the OT side. This requires network segmentation, firewalls, and careful monitoring of all connections between the systems.

Most factories don't have proper segmentation because it's expensive and adds complexity. But the cost of a three-month production shutdown dwarfs the cost of implementing proper segmentation.

Lesson 2: Build Redundancy Into Critical Systems

Critical systems—scheduling, inventory management, quality control—should have redundancy. If the primary system fails, a backup system should take over. This is expensive and adds complexity, but it prevents total failures.

JLR apparently didn't have redundancy for critical scheduling and inventory systems. A more resilient design would have had geographic redundancy—duplicate systems in different locations that can take over if the primary location is compromised.

Lesson 3: Regular Backup Testing

Companies routinely back up their systems, but many never test whether those backups actually work. In the recovery phase, JLR discovered that some backups were corrupted, incomplete, or incompatible with current systems. That's why recovery took three months instead of one month.

Manufacturers should regularly test backup restoration to ensure backups are actually valid and complete. That takes time and resources, but it's critical insurance against recovery delays.

Lesson 4: Diversify Supply Chain

During the shutdown, suppliers who depended on JLR suffered. If you're a critical supplier to a major manufacturer, you need customers beyond that one manufacturer. Diversification reduces vulnerability to single-customer disruptions.

Simultaneously, manufacturers need to ensure they're not dependent on single suppliers for critical components. Having multiple suppliers for components as critical as engines, transmissions, and electronic control systems reduces vulnerability to supply disruptions.

Lesson 5: Insurance and Recovery Planning

JLR apparently didn't have adequate cyber insurance or disaster recovery insurance. Many cyber insurance policies have exclusions or caps that don't cover catastrophic production disruptions. Manufacturers should assess their insurance coverage and ensure it's adequate for realistic worst-case scenarios.

The Type 00 Launch and Future Implications

Jaguar's future depends significantly on the Type 00 launch succeeding. If the new vehicle is well-received and captures market share, the brand reinvention was worth the pain. If the Type 00 underperforms, the company faces years of strategic repositioning.

The Type 00 is being positioned as a luxury EV, competing with Tesla Model S, Porsche Taycan, BMW i X M60, and Mercedes EQE. The luxury EV market is competitive and growing. JLR enters this market with brand heritage but without recent success in the EV segment (the I-PACE was discontinued).

Customers buying a luxury EV in 2026 are making a statement about brand values and purchasing priorities. The Jaguar brand has been quietly declining for years—the company has focused on Range Rover and Defender while Jaguar struggled to articulate a coherent value proposition. Now they're trying to reestablish Jaguar with an EV that hasn't been tested by customers yet.

The odds of success are mixed. The company has the manufacturing capacity and financial backing from Tata Motors. But the brand reinvention is risky, the timing of the cyberattack created distractions, and the EV luxury segment is crowded with strong competitors. If the Type 00 launches successfully in Q3 2026, we'll have clarity on whether the strategy was sound. If it underperforms, JLR faces additional challenges in its recovery.

Financial Impact: Hidden Costs Beyond Lost Sales

The 43% wholesale decline represents lost revenue, but the financial impact extends well beyond that headline number. The cyberattack created multiple financial drains:

Incident Response and Recovery Costs

JLR had to hire external security consultants, incident response specialists, and infrastructure teams. They had to replace compromised systems, rebuild networks, and validate security controls. These response costs are substantial—likely in the range of $50-150 million for a company JLR's size.

Lost Production Profit

Wholesale revenues dropped 43%, but manufacturing profit margins on those vehicles typically run 15-25%. A 43% drop in wholesales at 20% margins represents roughly $800 million in lost gross profit on manufacturing operations.

Warranty and Liability Costs

Vehicles manufactured during recovery often have higher defect rates because production processes are still being validated. Higher defect rates mean higher warranty claims. JLR will likely face elevated warranty costs for 12-18 months as the company normalizes manufacturing.

Dealer Compensation

Dealers who lost inventory and had customers cancel orders needed compensation to maintain relationships. JLR likely provided incentive payments, extended payment terms, or increased dealer discounts. These costs aren't typically disclosed but are substantial.

Investor Relations and Communication

The company had to communicate with investors, manage share price volatility, and provide guidance on recovery. Many companies in this situation incur significant communication costs and face analyst downgrades that affect financing costs.

Total financial impact is likely in the range of $2-4 billion when accounting for lost revenue, response costs, warranty costs, and indirect costs.

Comparative Analysis: How Other Automakers Handled Crises

Understanding how other automotive manufacturers handled major disruptions provides context for evaluating JLR's situation.

Toyota's 2011 Fukushima Response

When the Fukushima earthquake disrupted Japanese manufacturing, Toyota had to rebuild operations without clear information about supply chain damage. The company faced nuclear fallout concerns, infrastructure damage, and massive supply chain disruption. Recovery took 4-6 months to reach normal production levels.

Toyota managed the crisis better than JLR is managing this one because:

- Toyota had pre-existing disaster recovery plans

- The company had geographic supply chain diversification

- Management provided clear, transparent communication

- The company didn't simultaneously undergo a brand reinvention

Ford's 2020 COVID-19 Response

When COVID-19 closed manufacturing globally, Ford faced a demand shock and supply chain disruption simultaneously. The company managed recovery by:

- Quickly understanding which vehicle segments had demand and which didn't

- Focusing manufacturing on high-demand vehicles

- Maintaining cash reserves to weather months of reduced production

- Providing transparent communication about recovery timelines

Ford's recovery was faster than JLR's because the company had financial reserves, didn't face tariff pressures, and could adjust manufacturing quickly to match demand.

Volkswagen's Diesel Scandal

Volkswagen faced a reputational crisis from diesel emissions cheating. Recovery required:

- Transparent admission of wrongdoing

- Comprehensive financial compensation

- Major strategic pivot toward EVs

- Years of rebuilding brand trust

VW's recovery was complicated by reputational damage but the company had financial resources to invest in recovery. JLR faces similar reputational damage (from the cyberattack's operational failure) but with fewer financial resources.

Investor Sentiment and Market Recovery

Tata Motors shares dropped 4% immediately after the sales announcement. That's notable because it shows investors believe this is a serious, material event requiring repricing of company valuation.

Investor concerns likely include:

Near-term: Depressed earnings for 2-4 quarters while JLR recovers Medium-term: Uncertainty about whether the Type 00 and brand reinvention will succeed Long-term: Questions about whether JLR is a viable business or if Tata should divest the company

Tata Motors is a diversified conglomerate with operations in IT services, steel, and other industries. JLR is important but not the core business. If JLR's recovery extends beyond 2-3 years or the Type 00 underperforms, Tata may face pressure to divest or restructure.

Investor sentiment will likely improve if:

- Q1 2026 production numbers show strong recovery trajectory

- The Type 00 receives positive initial reviews and customer feedback

- Market share losses to competitors stabilize

- Tata provides clear financial guidance for 2026-2027

Investor sentiment will likely deteriorate if:

- Production recovery proves slower than expected

- Type 00 launch is delayed

- Major customers reduce JLR allocations

- The company provides cautious financial guidance

Strategic Alternatives and Path Forward

JLR faces several strategic alternatives for the path forward. Each has different implications for recovery timeline and ultimate success.

Option 1: Aggressive Recovery Focus

Prioritize manufacturing capacity maximization to recover market share as quickly as possible. This approach emphasizes volume over margins, accepting lower profitability to maintain dealer relationships and customer satisfaction.

Pros: Faster revenue recovery, maintains dealer network, captures customers before they fully commit to competitors Cons: Depressed margins extend earnings recovery timeline, may sacrifice quality if rushing production

Option 2: Cautious, Quality-Focused Recovery

Prioritize quality and careful validation of manufacturing processes. Accept slower production ramp to ensure no repeat quality issues. This approach emphasizes sustainable operations over rapid recovery.

Pros: Avoids quality issues that could extend recovery timeline, demonstrates operational competence Cons: Slower revenue recovery, may lose market share to faster-recovering competitors

Option 3: Strategic Restructuring

Use the crisis as an opportunity to restructure operations, divest underperforming assets, and reallocate resources. This might include consolidating manufacturing to fewer facilities, focusing on higher-margin vehicles, or strategic partnerships.

Pros: Emerges from crisis with more efficient operations Cons: Creates additional short-term disruption, employee uncertainty

Option 4: Portfolio Rationalization

Divest Jaguar brand entirely, focusing JLR on Range Rover and Defender. These vehicles drive 74% of volume anyway. Eliminate the complexity of brand reinvention and focus on strengthening the strongest brands.

Pros: Simplifies business, eliminates brand identity crisis, focuses on proven winners Cons: Admits brand reinvention strategy was wrong, limits long-term growth options

The company appears to be pursuing Option 1 (aggressive recovery) with elements of Option 2 (quality focus). If Type 00 launch succeeds, that validates the brand reinvention strategy and justifies the pain. If it fails, the company may be forced into Option 4 (portfolio rationalization).

Sector-Wide Implications

The JLR cyberattack has implications that extend beyond one company. It signals risks to the entire automotive manufacturing sector.

Other manufacturers are likely reviewing their own cybersecurity posture, asking themselves whether their operations have similar vulnerabilities. If other companies discover similar risks, the industry might see:

- Increased investment in cybersecurity infrastructure

- Regulatory pressure for mandatory security standards

- Supply chain security requirements (manufacturers auditing suppliers' security)

- Industry insurance premium increases

- Mandatory cyber insurance requirements

Earth governments are also likely evaluating whether automotive manufacturing cybersecurity is a national security concern. Critical infrastructure protection often triggers regulatory responses. We might see policy initiatives focused on securing automotive supply chains.

Conclusion: Long-Term Outlook

Jaguar Land Rover faces a multi-year recovery process that will test the company's strategic vision, operational competence, and financial resources. The 43% wholesale decline is severe, but it's not unique in automotive history. The question isn't whether JLR can recover from the cyberattack—the company has the resources to rebuild manufacturing capacity. The question is whether they'll emerge stronger or weaker.

The real danger isn't the cyberattack itself. It's the cascade of compounding strategic errors and market headwinds that made the attack's impact so severe. The brand reinvention was poorly timed. The tariff environment was already creating headwinds. The company's strategic focus had been drifting for years. The cyberattack simply accelerated the timeline for addressing those underlying issues.

JLR's recovery depends on several factors coming together:

-

Type 00 success: The new vehicle needs to generate customer enthusiasm and deliver on its promises. If the Type 00 fails, the entire brand reinvention was a waste.

-

Manufacturing resilience: The company needs to demonstrate that the cyberattack was a one-time event and that manufacturing is now secure. Customers and investors both need confidence in operational stability.

-

Market share stabilization: Competitors have captured customers during the crisis. JLR needs to stop the bleeding and stabilize market share by mid-2026. If share continues declining through 2026, recovery becomes exponentially harder.

-

Tariff environment resolution: The ongoing US tariff situation is creating structural headwinds. Either tariffs need to decline or JLR needs to establish North American manufacturing. Neither is likely in the near term, so the company will continue facing pricing pressures.

-

Financial discipline: Tata Motors needs to maintain investment in recovery while managing overall financial performance. If Tata's parent company faces financial stress, investment in JLR might be reduced, slowing recovery.

If all five factors align positively, JLR could achieve reasonable recovery by late 2026 and emerge as a stronger, more resilient company. If any of these factors becomes negative, recovery extends beyond 2027 and becomes increasingly uncertain.

The 43% sales decline is painful, but automotive history shows that companies can recover from severe disruptions. What matters now is whether JLR has learned the right lessons, whether the leadership team can execute the recovery strategy, and whether the underlying business fundamentals support long-term viability. The next 12 months will provide clarity on all three questions.

FAQ

What caused the Jaguar Land Rover cyberattack in August 2025?

The cyberattack was a coordinated, sophisticated assault that targeted operational technology networks across JLR's four major manufacturing facilities simultaneously in the UK, Slovakia, Brazil, and India. While specific attribution hasn't been publicly detailed, the coordinated nature and targeting of critical manufacturing systems suggest either a state-sponsored actor, a rival corporation with manufacturing expertise, or a highly organized cybercriminal group that conducted extensive reconnaissance beforehand.

How much did JLR lose in sales revenue due to the cyberattack?

Wholesale volumes dropped 43.3% year-over-year from 104,700 units to 59,200 cars. Assuming an average wholesale value of

Why did the recovery process take three months instead of three weeks?

Modern automotive manufacturing is an integrated digital ecosystem where every component synchronizes precisely. Recovery required validating safety systems, retraining workers, rebuilding supply chain relationships, testing quality control systems, and gradually ramping production while monitoring for any remaining vulnerabilities. Additionally, many suppliers had shut down their own operations, so they needed 4-8 weeks to restart manufacturing and resume reliable component delivery.

How did tariffs contribute to JLR's sales decline?

US import tariffs on vehicles manufactured outside North America increased the effective price of JLR vehicles by 15-25%. A

Why did Jaguar discontinue popular models right as the company was struggling to recover?

Jaguar's brand reinvention strategy, announced in late 2024, discontinued the F-Pace SUV, I-PACE electric vehicle, and F-Type sports car to make room for the new Type 00 concept. The timing was catastrophically poor because production restarted from the cyberattack right as these models disappeared from inventory. Customers who wanted these vehicles couldn't get them, and many switched to competitors. The discontinuations weren't technically caused by the cyberattack, but the timing amplified the impact significantly.

What does the 74.3% concentration in three vehicles tell us about JLR's business?

Range Rover, Range Rover Sport, and Defender accounting for 74.3% of wholesale volumes indicates that these three proven, heritage-rich vehicles drive the vast majority of JLR's revenue. This concentration is both a strength and a weakness—it shows strong core products, but it also means the company's future depends on these three vehicles plus the unproven Type 00. If the Type 00 underperforms, the company has limited growth options beyond these core vehicles.

How long will it take JLR to fully recover sales to pre-attack levels?

Based on comparable manufacturing disruptions, full recovery typically takes 18-24 months. JLR should see production return to normal levels by mid-2026, but market share recovery will extend through 2027. The company likely won't reach pre-attack profitability levels until 2027-2028 as they rebuild margins on recovered volume. The multi-year timeline reflects both the direct impact of lost manufacturing capacity and the indirect competitive damage from customers switching to alternative brands.

What should other automotive manufacturers learn from this incident?

The primary lessons are: (1) segment operational technology networks from information technology networks to prevent cascade failures, (2) build redundancy into critical systems like scheduling and inventory management, (3) test backup restoration procedures regularly, (4) diversify supply chains to reduce vulnerability to single-supplier disruptions, and (5) maintain adequate cyber insurance that covers production disruption scenarios. Most manufacturers have optimized for efficiency over resilience, creating fragility that a sophisticate cyberattack can exploit.

Did Tata Motors consider divesting JLR following the cyberattack?

Tata Motors hasn't publicly stated divestment plans, but the 4% share price drop immediately after the sales announcement indicates investor concern about long-term viability. Tata is a diversified conglomerate and JLR represents a significant but non-core portion of the business. If recovery extends beyond 2027 or the Type 00 significantly underperforms, investor pressure for divestment would likely increase.

What is the Type 00 and why is JLR's future dependent on it succeeding?

The Type 00 is Jaguar's new luxury electric vehicle, positioned as the company's future direction. It's designed to compete with Tesla Model S, Porsche Taycan, and BMW i X M60 in the premium EV segment. JLR discontinuing existing Jaguar models to focus on the Type 00 means the company's growth prospects and brand viability depend entirely on customer acceptance of this unproven vehicle. If the Type 00 succeeds, the brand reinvention was worth the pain. If it underperforms, JLR faces strategic repositioning choices.

Key Takeaways

- JLR wholesales plummeted 43.3% year-over-year due to August 2025 cyberattack affecting four manufacturing facilities simultaneously, with three-month production recovery

- North America experienced the steepest decline at 37.7% due to compound effects of US tariffs, manufacturing capacity loss, and competitive displacement

- The cyberattack amplified existing vulnerabilities including Jaguar's poorly-timed brand reinvention, discontinuation of popular models, and heavy dependence on three core vehicles (74.3% of volume)

- Supply chain recovery extends beyond manufacturing—suppliers needed 4-8 weeks to restart, dealers lost confidence, and customer switching to competitors created permanent market share loss

- Multi-year recovery through 2027-2028 depends on Type 00 success, manufacturing resilience demonstration, market share stabilization, and favorable tariff resolution

- Tata Motors shares dropped 4% immediately, signaling investor concerns about recovery timeline and whether JLR remains a viable core business

- Industry must implement operational technology network segmentation, system redundancy, backup testing, and supply chain diversification to prevent similar cascade failures

Related Articles

- Tesla Loses EV Crown to BYD: Market Shift Explained [2025]

- Deepfakes & Digital Trust: How Human Provenance Rebuilds Confidence [2025]

- Covenant Health Breach Exposes 500K Patients: What Happened [2025]

- WhatsApp Security Features: Complete Privacy Guide [2025]

- 1Password Coupons & Free Trial: Complete Savings Guide [2025]

- Watch Lego's Historic CES 2026 Press Conference Live [2025]

![Jaguar Land Rover's 43% Sales Collapse After Cyberattack [2025]](https://tryrunable.com/blog/jaguar-land-rover-s-43-sales-collapse-after-cyberattack-2025/image-1-1767715818290.jpg)