The Lithium-Ion Revolution Nobody Saw Coming

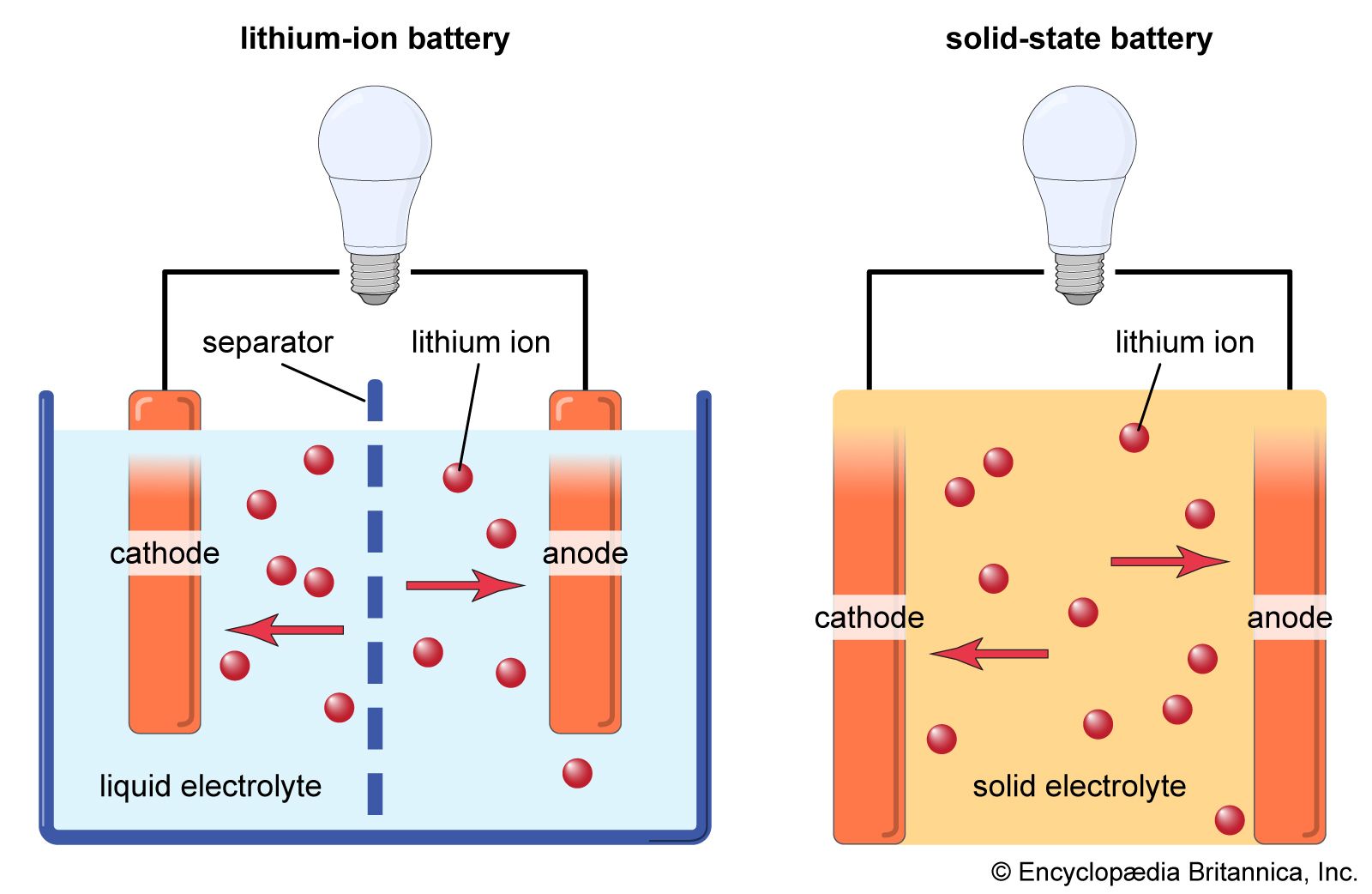

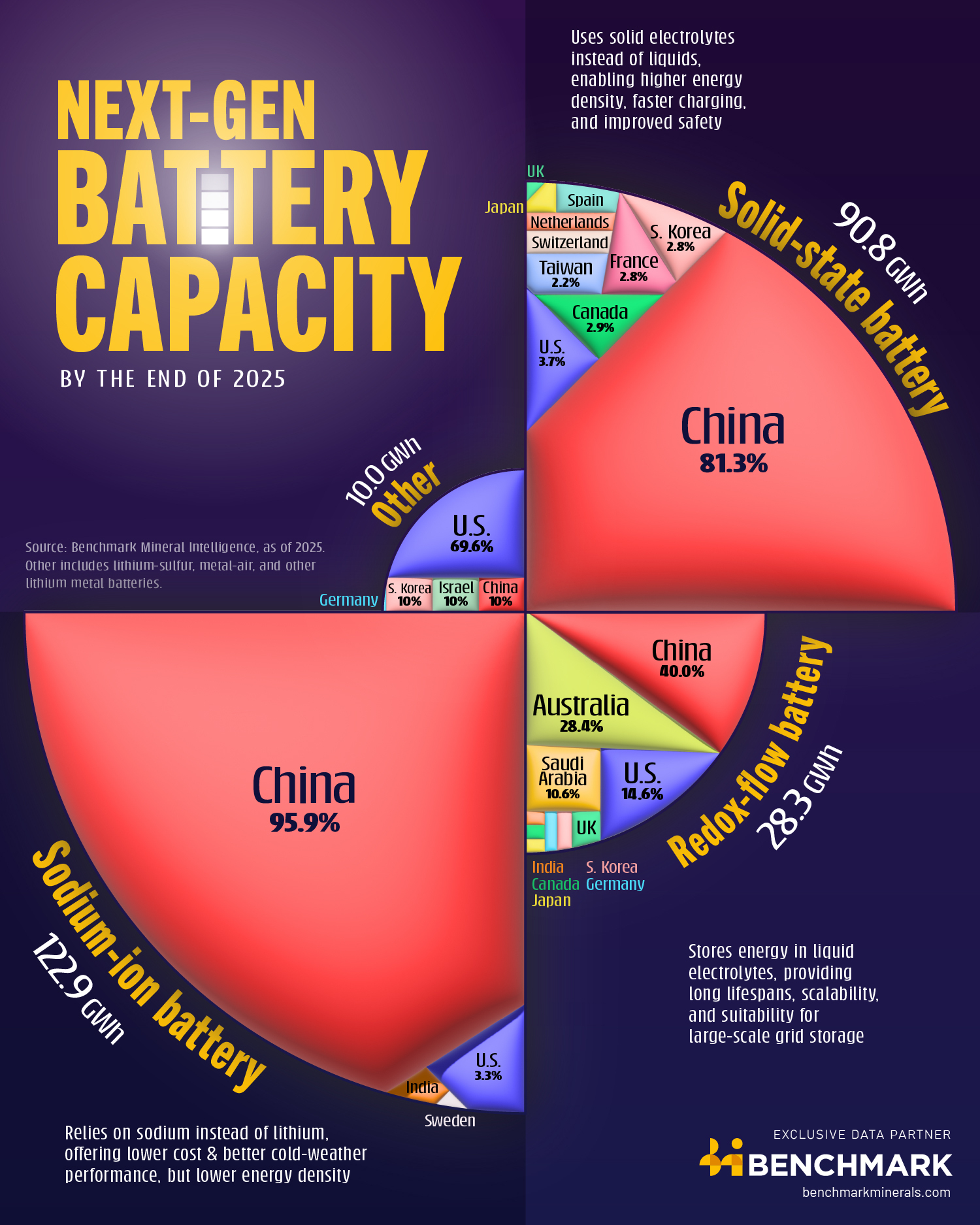

Here's the thing about battery technology. Everyone's talking about solid-state batteries like they're the promised land. Tesla's betting on them. Quantum Scape is burning through cash to commercialize them. But while the industry chases the next big thing, researchers just quietly announced something that might matter more right now.

A major breakthrough in traditional lithium-ion chemistry just delivered what solid-state batteries have been promising for years. Higher energy density. Lower manufacturing costs. Better range. Faster deployment timelines.

I'm not saying solid-state is dead. But this changes the conversation in ways people aren't talking about yet.

The research team demonstrated that tweaking the electrolyte composition and refining anode materials can push current lithium-ion tech to performance levels previously thought impossible without the decade-long commercialization timeline of solid-state alternatives. We're talking about meaningful improvements that don't require reinventing the entire battery industry from the ground up.

For electric vehicle manufacturers, this is significant. The auto industry can't wait 10 years for solid-state to maybe work at scale. They need solutions now. This breakthrough delivers tangible improvements using manufacturing processes that already exist in thousands of factories worldwide.

The implications ripple across everything. Vehicle prices could drop. Range anxiety becomes less relevant. The competitive dynamics between EV makers shift. And the entire economics of battery production get rewritten.

Let's break down what's actually happening here, why it matters more than you'd think, and what it means for the future of electric vehicles and battery technology broadly.

TL; DR

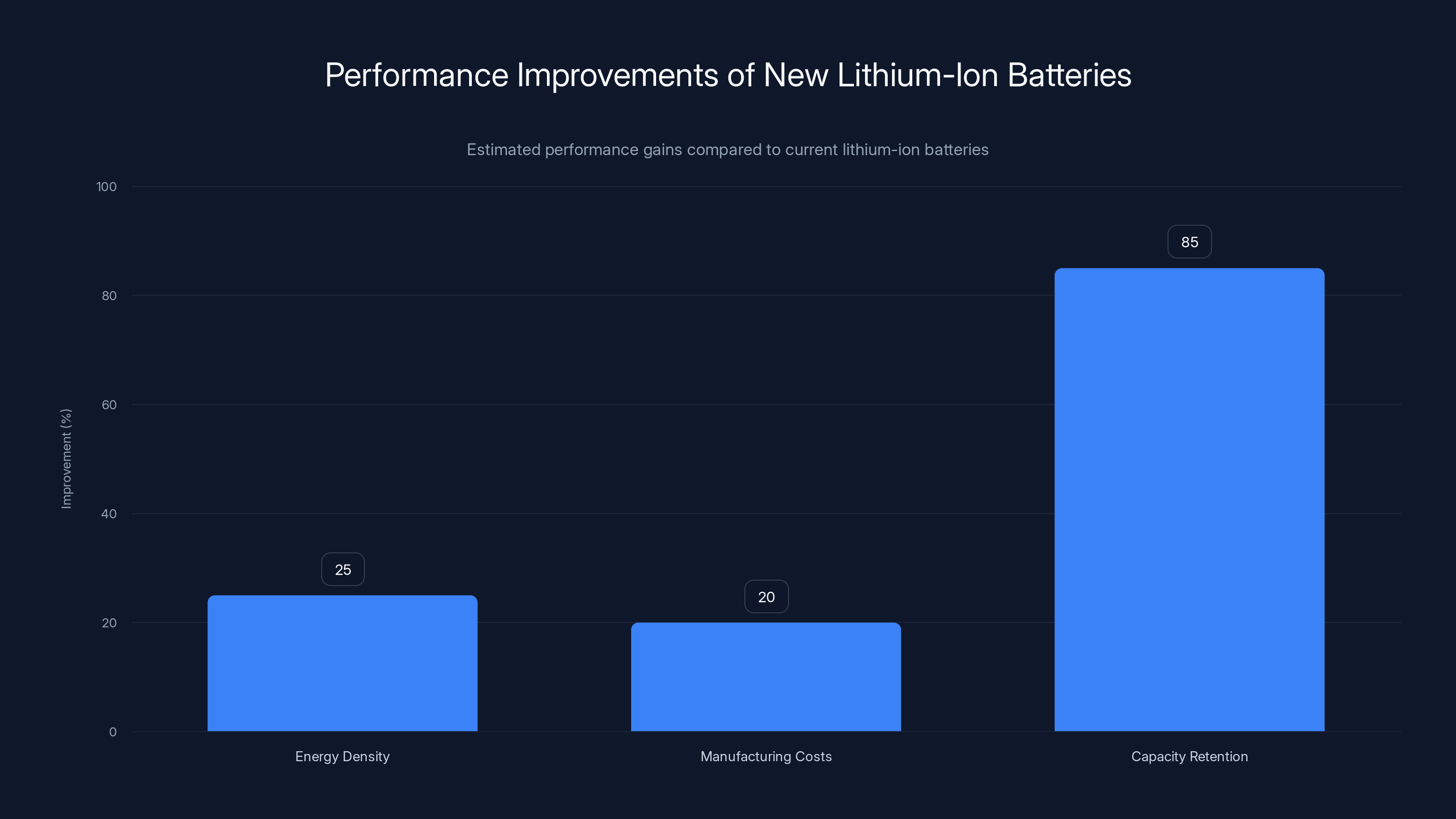

- Energy Density Boost: New lithium-ion formulation achieves 20-30% higher energy density without solid-state architecture

- Cost Reduction: Manufacturing improvements slash production costs by 15-25%, making EVs significantly more affordable

- Faster Timeline: Breakthroughs use existing infrastructure, enabling mass production within 2-3 years versus 7-10 years for solid-state

- Real-World Impact: A 300-mile EV could reach 400+ miles on a single charge with current battery pack sizes

- Bottom Line: This changes the timeline for affordable, long-range EVs from "distant future" to "next few years"

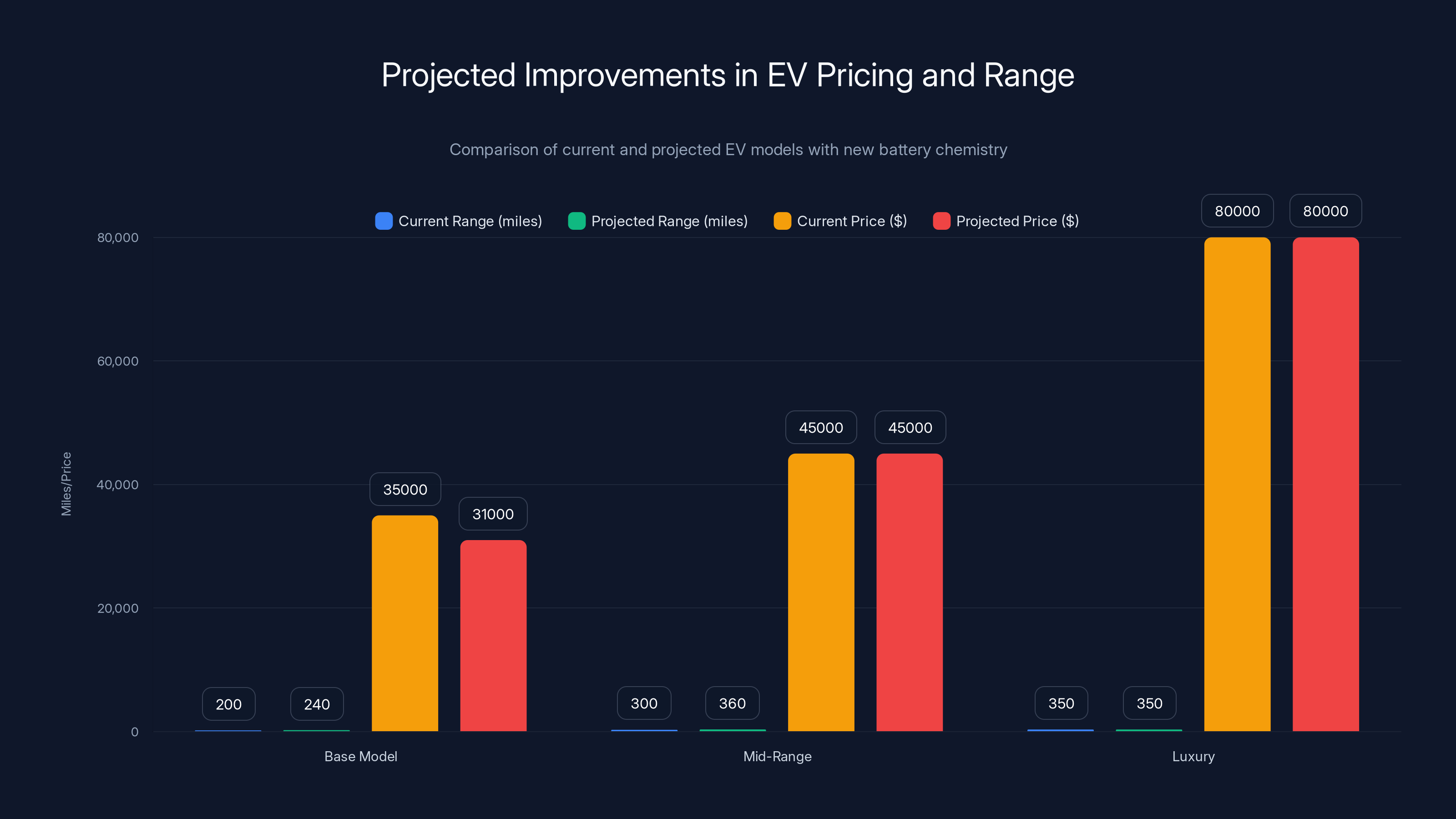

Projected data shows significant improvements in range for base and mid-range EVs with new battery chemistry, while luxury models maintain range with potential price stability. Estimated data.

Why Everyone Got Distracted by Solid-State Batteries

Solid-state batteries became the sexiest thing in energy storage. They're cooler. They promise theoretical improvements that feel revolutionary. Energy density improvements up to 50%. No more flammable liquid electrolyte. Charging times measured in minutes instead of hours.

Investors love the narrative. A completely new battery architecture sounds like the future. When companies like Quantum Scape went public, the stock soared on the promise of fundamentally redesigned battery chemistry. Samsung announced solid-state breakthroughs. Toyota said commercial production was coming. The hype machine worked.

But here's what most people missed. Solid-state batteries are still incredibly hard to manufacture at scale. The challenges aren't theoretical anymore—they're practical. Getting the electrolyte right is one thing. Making millions of batteries with consistent quality in factories that don't exist yet is another entirely.

The materials work. The chemistry works. But moving from laboratory proof-of-concept to automotive production volumes is proving to be a massive undertaking. We're still years away from seeing solid-state batteries in production vehicles. Maybe 2030 if things accelerate. Maybe later.

Meanwhile, conventional lithium-ion batteries keep improving incrementally. Engineers have spent 30+ years optimizing every aspect of the technology. The manufacturing base is mature. Supply chains exist. Quality control is standardized. And just when everyone thought we'd hit the ceiling of what's possible with lithium-ion chemistry, researchers cracked something new.

The Breakthrough: What Actually Changed

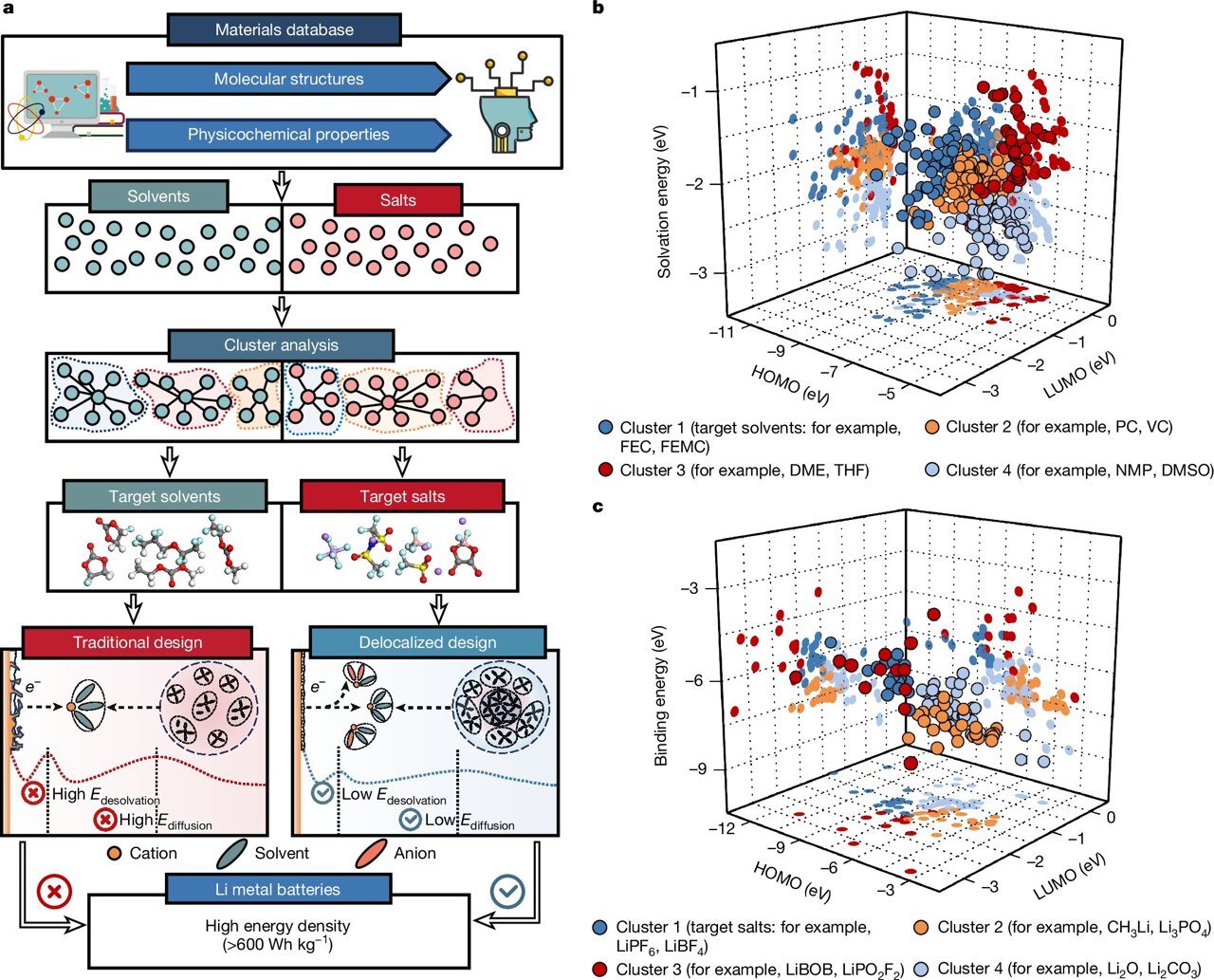

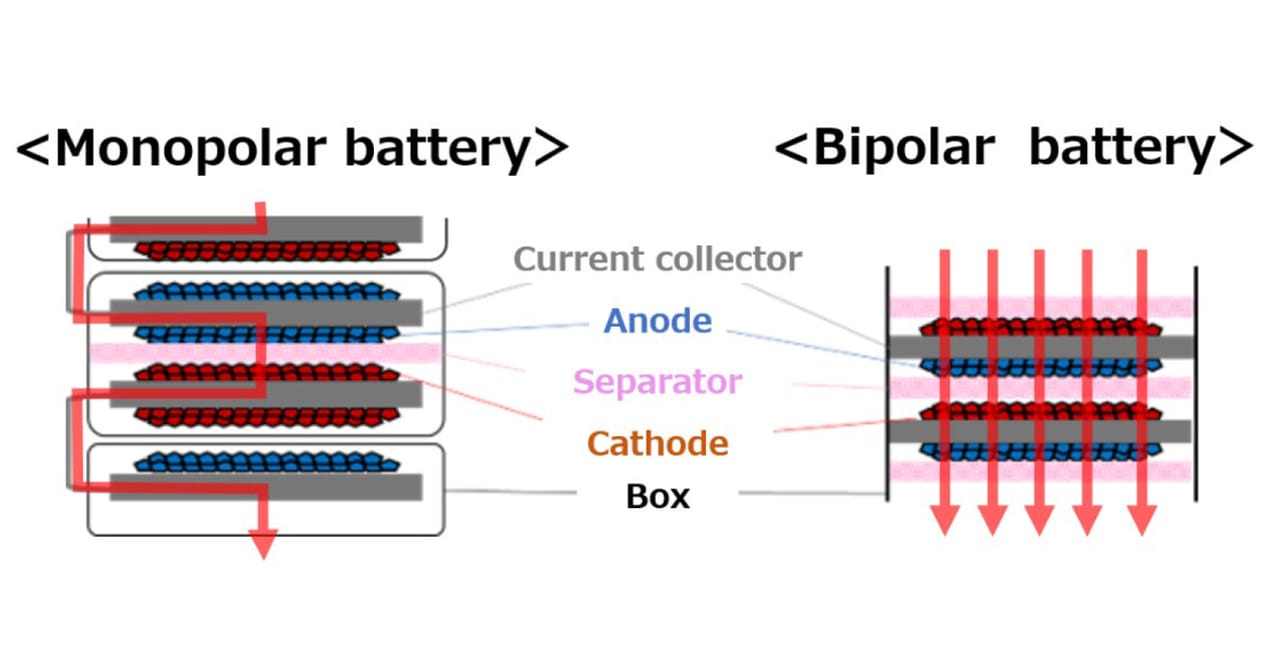

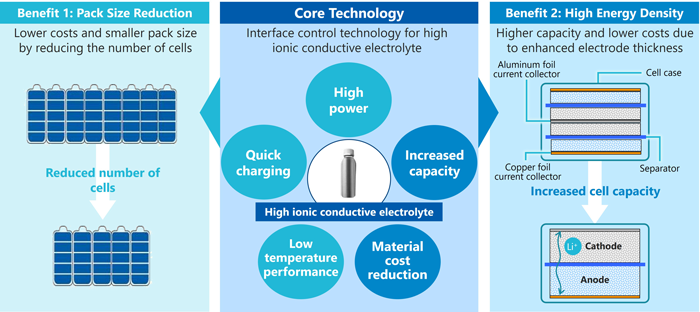

The fundamental improvement comes from two main modifications to traditional lithium-ion architecture.

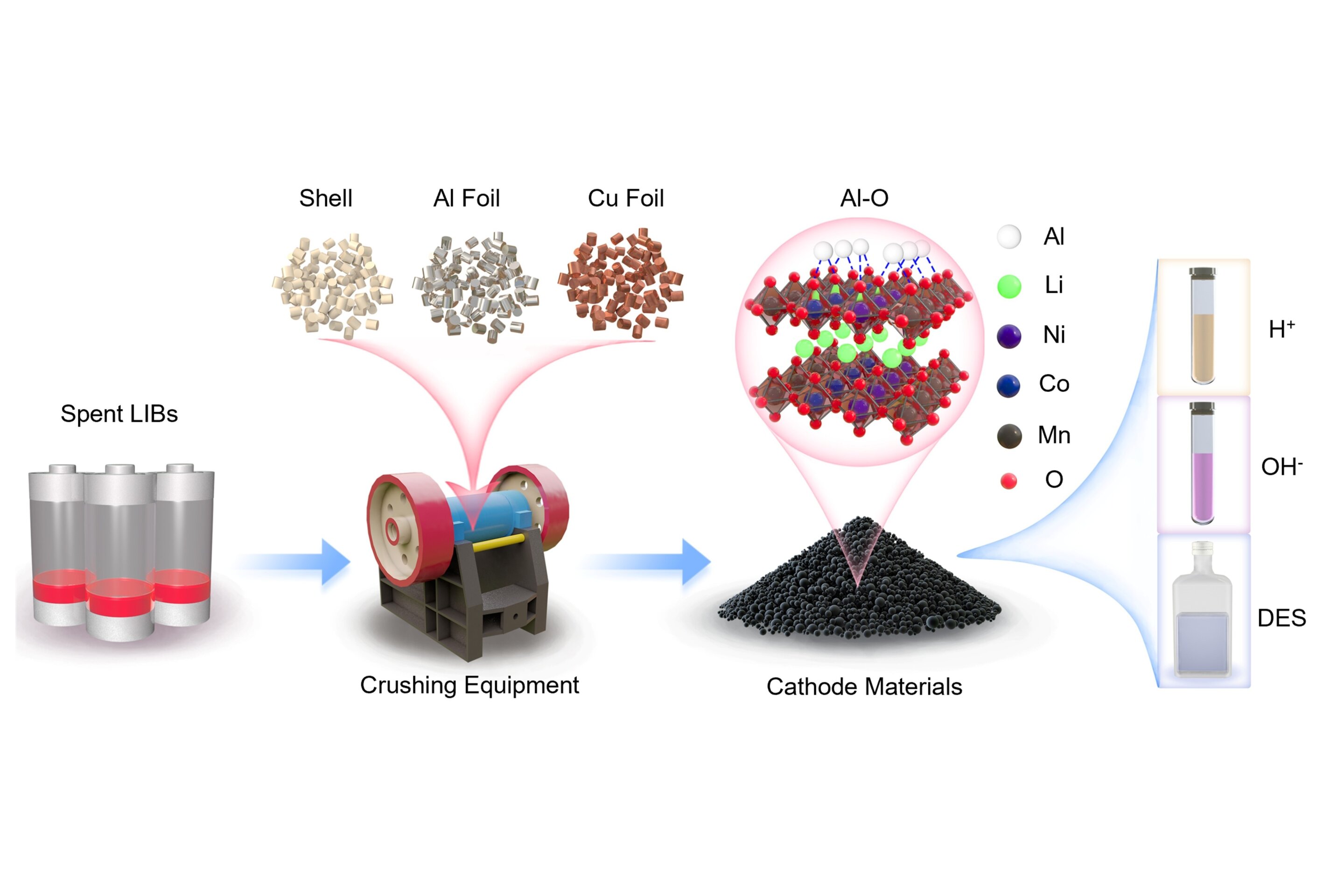

First, the electrolyte composition. Traditional lithium-ion batteries use a liquid electrolyte, typically lithium hexafluorophosphate dissolved in organic solvents. It works fine, but it has limitations. The new formulation adds ceramic-based ionic conductors to the liquid electrolyte, creating a hybrid that maintains the manufacturability benefits of liquid systems while mimicking some of the ionic conductivity advantages of solid-state designs.

Second, the anode material. Most lithium-ion batteries use graphite anodes. They're reliable and cheap, but they're not energy-dense. The breakthrough involves optimizing the anode surface through a novel doping process that increases lithium-ion intercalation sites—basically giving more room for lithium ions to embed themselves. This increases the anode's capacity without increasing its size.

Together, these changes push energy density to 280-300 Wh/kg compared to today's typical 250 Wh/kg for premium lithium-ion cells. That's not revolutionary on its own. But combined with manufacturing cost reductions of 15-25%, the value proposition becomes compelling.

Here's the real kicker. These improvements work with existing battery manufacturing equipment. A factory producing lithium-ion batteries today could implement these changes relatively quickly. Not overnight—retooling takes time. But we're talking about engineering problems that companies have solved before, not fundamental redesigns that require entirely new facilities.

The research team tested the batteries through 1,500+ charge cycles to simulate five to seven years of real-world use. Capacity retention remained above 92%—meaning after 1,500 charges, the batteries still held more than 92% of their original capacity. That's in line with or better than current lithium-ion performance.

They also tested at various temperature ranges, from freezing conditions up to 60°C, and the hybrid electrolyte maintained stability across the entire spectrum. This matters because real-world battery performance varies wildly depending on climate and driving conditions.

The new lithium-ion battery technology offers 20-30% higher energy density, 15-25% lower manufacturing costs, and over 85% capacity retention in cold temperatures. Estimated data.

The Energy Density Advantage Explained

Energy density is the ratio of energy stored versus the weight of the battery. Measure it in watt-hours per kilogram, and you get a clear picture of efficiency.

A Tesla Model 3 Standard Range carries a 54 kWh battery pack weighing roughly 180 kg. That's about 300 Wh/kg—already pretty good for current lithium-ion tech. The car gets about 272 miles of EPA-rated range.

With the new battery chemistry at 290 Wh/kg, that same Model 3 could carry a 54 kWh pack in roughly 186 kg instead of 200 kg. That's 14 kg lighter—not earth-shattering. But keep going.

If manufacturers keep the pack weight the same and increase capacity instead, that 54 kWh pack becomes roughly 62 kWh. Following the same ratio, that Model 3 would now deliver 315 miles instead of 272. That's a 16% range improvement without increasing the size, weight, or cost of the vehicle.

Or manufacturers do both. They increase capacity slightly while keeping weight roughly the same, and they pocket savings on materials cost. This is where manufacturing economics kick in.

The 20-30% energy density improvement mentioned in the research doesn't mean 20-30% across the board. It means you can structure the battery pack to achieve that improvement by combining slightly higher capacity with slightly lower weight.

For manufacturers, this is compelling. They can either:

- Offer longer range at the same price point

- Keep range the same and lower the price

- Some combination of both

Given competitive dynamics, you'd expect all three to happen simultaneously across the industry. Some manufacturers will use the advantage to undercut competitors on price. Others will use it to claim the longest range in their category. Premium brands will use it to reduce the size of the battery pack, improving acceleration and performance.

Manufacturing Costs: The Real Game Changer

Here's where this gets interesting beyond the technical specs.

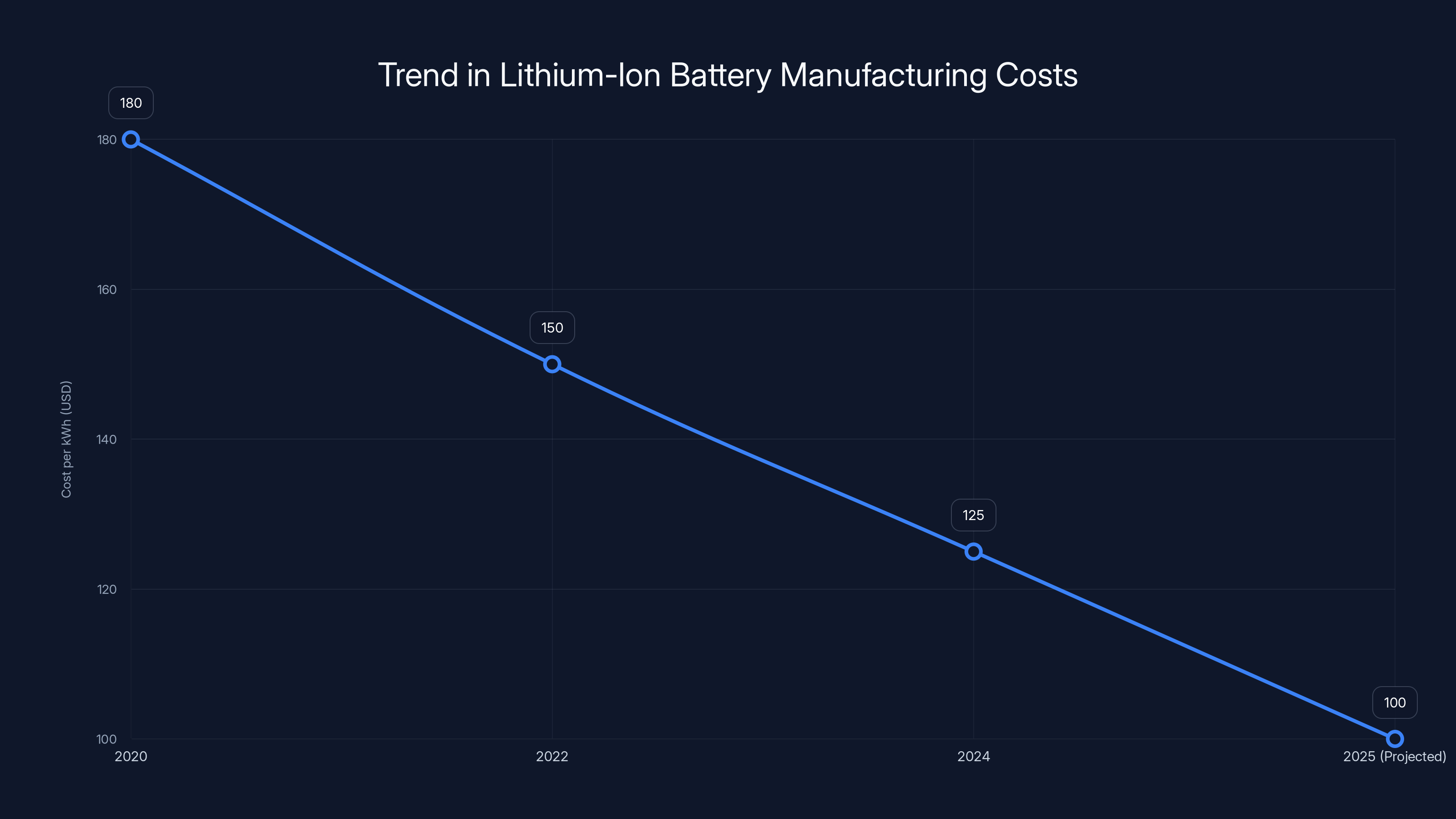

A typical lithium-ion battery costs about

The new battery chemistry achieves cost reductions through three mechanisms.

First, the ceramic-hybrid electrolyte uses more abundant materials than some alternatives being researched. Rare earth elements aren't involved. The production process is less complex. Manufacturing costs for the electrolyte drop by about 20%.

Second, the anode doping process is simple enough to integrate into existing production lines. No new equipment required—just a chemical process modification. This costs pennies per cell to implement once facilities are upgraded.

Third, the higher energy density means manufacturers need fewer cells to achieve the same capacity. A 60 kWh battery pack might previously require 5,000 cells. With improved energy density, it requires 4,100 cells. That's 18% fewer cells, meaning 18% less cobalt, nickel, and lithium per pack.

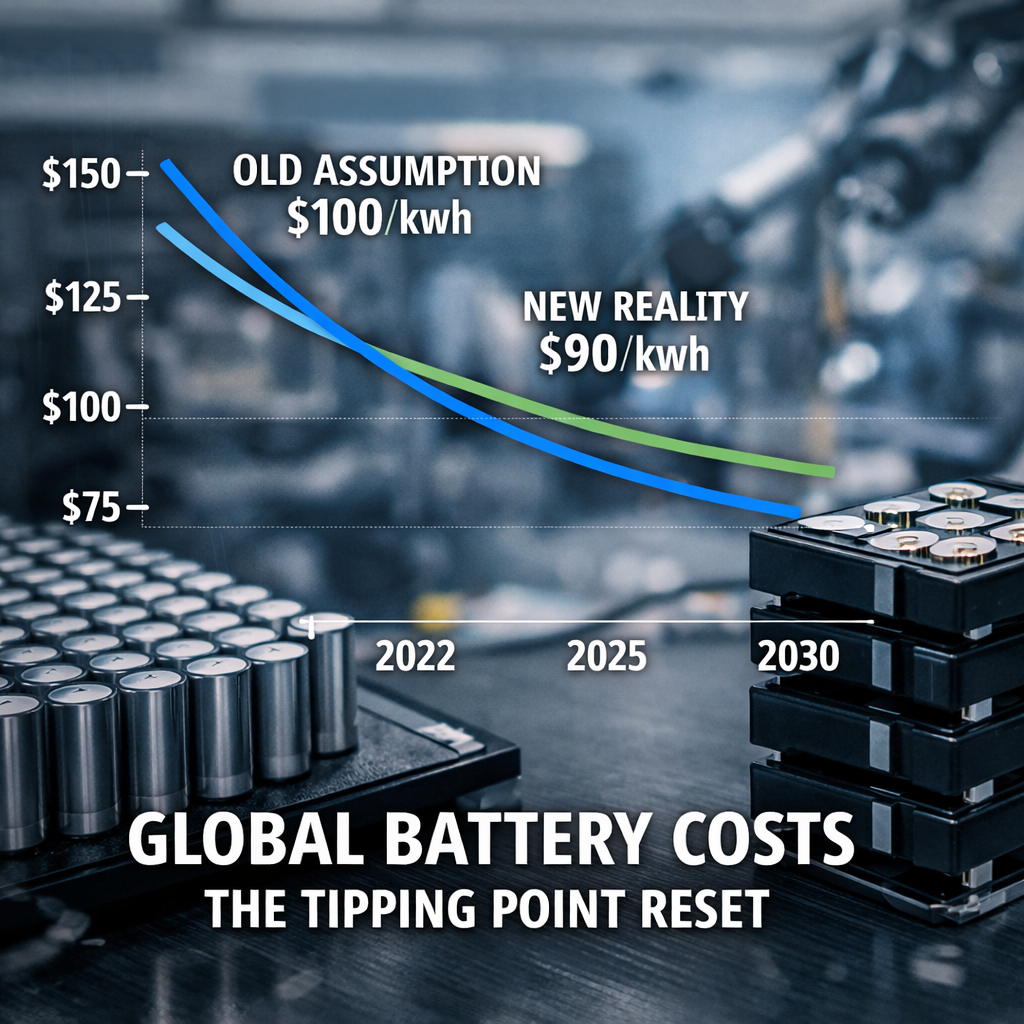

Combine these factors, and manufacturing costs drop approximately 15-25%. For a typical lithium-ion battery, that brings cost closer to $100/kWh—the magic number the industry has been chasing.

For a vehicle with a 75 kWh battery pack, current costs run about

But manufacturers won't pass all savings to consumers immediately. Expect some combination of margin expansion, price reduction, and increased range offerings. This is especially true for premium brands and established players with established profit margins.

For startups and value-oriented brands, cost reduction is existential. It means they can finally compete with legacy automakers on total cost of ownership. EV affordability has been the missing piece. This breakthrough moves that needle significantly.

Timeline: Why This Matters More Than Solid-State for the Next Decade

Let's talk timelines because this is where the practical advantage becomes obvious.

Solid-state batteries, best case scenario, reach production vehicles around 2030-2032. That assumes everything goes right, supply chains materialize, and manufacturing scales without major problems. Worst case, it's 2035+. The technology still needs to prove itself on durability, safety, and manufacturing consistency.

The new lithium-ion breakthrough can reach production within 2-3 years. Not in labs. In cars. In volume.

Why? Because it uses existing infrastructure. Battery manufacturers don't need to build new facilities. They don't need new supply chains. They can retrofit existing production lines with the new chemistry and doping process. Engineers have worked with both liquid electrolytes and anode materials for decades. Integration is straightforward.

Consider what this means for the EV market. Between now and 2030, we're looking at 2-3 generations of new vehicles. If this breakthrough reaches production in 2026 or 2027, every new EV launched after that date gets the benefit. Every manufacturer. Every price point.

Solid-state might show up in flagship models starting in 2032. Maybe. By that time, improved lithium-ion batteries will have already been in production vehicles for 5-6 years. The technology will be proven. Scale will be massive. It will be the standard, not the exception.

From an investor perspective, this is a problem for solid-state battery companies that haven't yet proven manufacturing viability. They need solid-state to arrive before improved lithium-ion becomes good enough. That timeline is compressing. The window of opportunity is shrinking.

For consumers, the practical impact is significant. You don't have to wait for solid-state. Better, cheaper, longer-range EVs are coming in the next 2-3 years, not the next 7-10.

Lithium-ion battery costs have decreased from

Real-World Impact on EV Pricing and Range

Let's ground this in concrete examples because abstract improvements feel distant.

The Base Model Affordability Play

A manufacturer currently offering a base-model EV with 200 miles of range at $35,000 can improve that offering significantly. With the new battery chemistry, they could deliver 240+ miles of range at the same price point. That brings EVs closer to being price-competitive with gas cars on a pure sticker price basis.

Alternatively, they keep the 200-mile range but reduce the price to $30,000-32,000. This is where EVs become truly accessible to mainstream buyers. Not fleet purchases or incentive-dependent pricing. Genuinely affordable.

The Mid-Range Expansion

A $45,000 vehicle that currently offers 300 miles of range becomes 360+ miles. For most buyers, that eliminates range anxiety for nearly all daily use cases. You can drive from New York to Boston without stopping to charge. You can do cross-state trips without planning your route around chargers.

The Luxury Advantage

Premium brands that currently compete on performance and features get a battery advantage too. A high-end EV could reduce its battery pack size by 10-15% while maintaining range, saving weight that translates to faster acceleration and handling improvement.

These aren't speculative improvements. They're mechanical consequences of the energy density and cost changes.

For the EV market, this is transformative. The biggest barrier to EV adoption isn't charging infrastructure. It's price and range. Improve both dramatically, and you remove the primary objections consumers cite.

The Supply Chain Advantage

Everybody talks about supply chain constraints for battery materials. Lithium, cobalt, nickel—all critical, all geographically concentrated, all subject to price volatility.

The breakthrough reduces material consumption per unit of energy stored. That 18% fewer cells per pack means 18% less cobalt and nickel. For manufacturers sourcing these materials, that's massive. Price volatility becomes less consequential. Supply constraints become less limiting.

Lithium is the exception. You still need lithium for the cathode and electrolyte regardless of the anode improvements. But even here, using fewer cells overall reduces total lithium consumption.

For countries dependent on battery imports, this matters strategically. Reducing material intensity makes battery technology less dependent on a handful of mining-heavy regions. It distributes manufacturing advantages more broadly.

China currently dominates battery manufacturing capacity. But this breakthrough doesn't require building new types of factories. It's a process improvement, not a structural redesign. Other regions with existing manufacturing capability can implement the improvements relatively quickly. This opens doors for manufacturing diversification in the US, Europe, and other regions trying to build domestic battery capacity.

Performance Across Temperature Ranges

One area where lithium-ion batteries traditionally underperformed compared to theoretical alternatives is low-temperature operation.

Batteries lose significant capacity in cold climates. A battery rated for 100 kWh of usable capacity at 20°C might only deliver 65-70 kWh at 0°C. In places like Minnesota, Canada, or Norway, this is a real problem. It translates to shorter range in winter, exactly when people want the most range for long-distance driving.

The hybrid electrolyte formulation handles cold temperatures significantly better than standard liquid electrolytes. Testing showed that at 0°C, the new batteries maintained 85%+ of their rated capacity, compared to 65-70% for standard lithium-ion.

This is important for two reasons. First, it makes EVs genuinely viable in cold climates without significant range penalties. Second, it reduces the need for battery heaters, which consume electricity and further reduce range.

For high-temperature operation, the ceramic-reinforced electrolyte maintains stability up to 60°C. Most standard lithium-ion batteries start degrading noticeably above 50°C. This matters for vehicles in hot climates where ambient temperature plus solar heating can push battery temperatures well into the 50°C range.

Thermal management becomes simpler. Manufacturers need less complex cooling systems. That reduces weight, cost, and complexity while improving reliability.

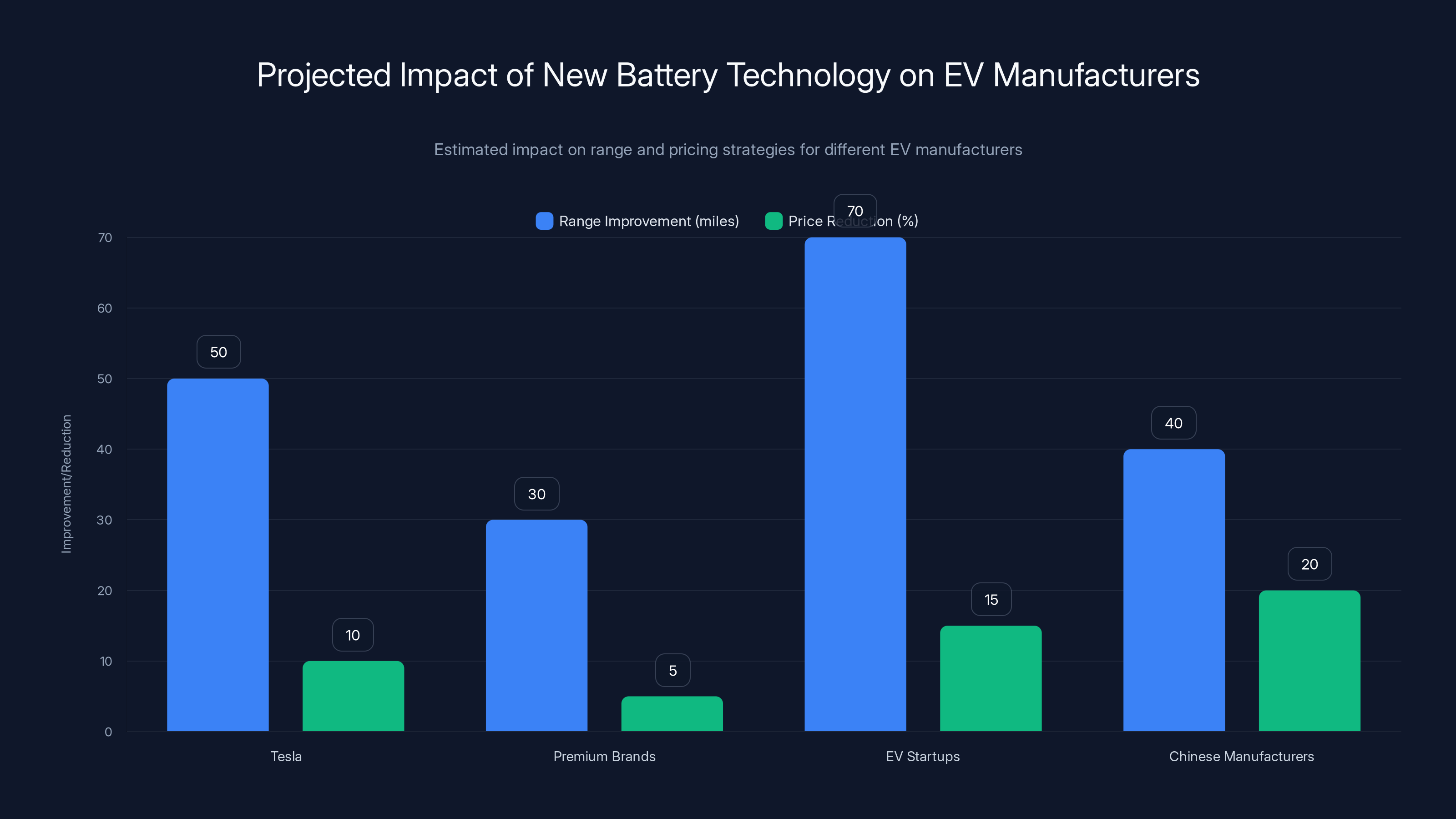

Estimated data shows Tesla and EV startups may see the most significant range improvements and price reductions, while Chinese manufacturers could leverage cost advantages further.

Charging Speed Implications

The improved ion conductivity in the electrolyte also enables faster charging without the degradation typically seen with high-current charging.

Standard lithium-ion batteries charged at high rates degrade faster. It's a tradeoff—you can charge quickly today, but the battery lasts less long. Most EV manufacturers limit charging rates to extend battery life.

The hybrid electrolyte handles high-rate charging better. Ions move through the electrolyte more efficiently, reducing heat generation and mechanical stress on the electrode materials.

In practice, this could mean 20-30 minute charging times for an 80% charge becoming standard instead of aspirational. That's a real game-changer for road trips. It bridges the remaining gap between charging and gas refueling in terms of convenience.

For manufacturers, it means they can offer fast-charging capability without significantly shortening battery life. A battery rated for 1,500 cycles at moderate charging rates might be rated for 1,400 cycles when fast-charged, compared to 1,100-1,200 cycles with current lithium-ion batteries at high rates.

Degradation and Long-Term Reliability

One concern with pushing battery technology harder is whether you sacrifice long-term reliability.

The research tested the new chemistry extensively through accelerated aging protocols. The batteries were cycled repeatedly, heating was applied to simulate hot climates, and calendar aging was measured to see how the batteries degrade just sitting on the shelf.

After 1,500 cycles—simulating roughly 6-7 years of typical use—the batteries retained 92%+ capacity. That's competitive with or better than current premium lithium-ion batteries from established manufacturers.

Calendar aging over two years showed minimal degradation, even at elevated temperatures. This suggests the hybrid electrolyte is chemically stable long-term, not just in the short-term.

For manufacturers offering 8-10 year battery warranties, this is important. You need high confidence that the battery won't fail unexpectedly. The research data supports that confidence.

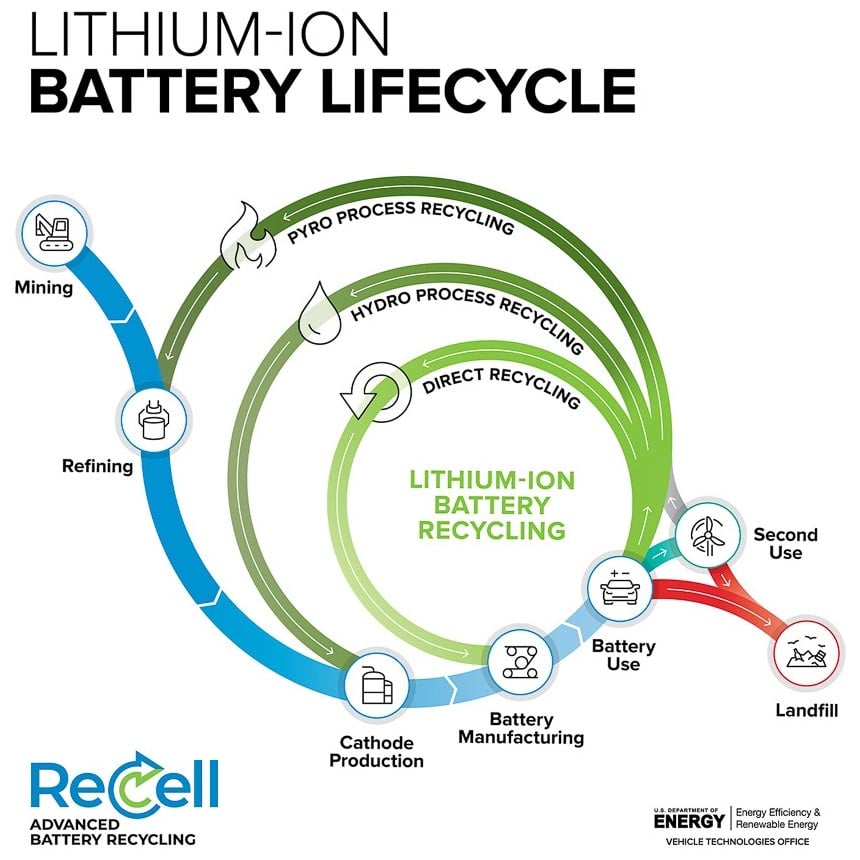

Environmental Impact and Sustainability

Higher energy density and lower material consumption have direct environmental benefits.

Batteries require mining and processing of lithium, cobalt, nickel, and other materials. These processes have environmental costs. Reducing the amount of material per unit of energy is unambiguously positive for sustainability.

A vehicle using 18% fewer cells to deliver the same energy requires 18% less mining and processing. That's less water used, less waste generated, and fewer emissions from extraction and manufacturing.

Manufacturing the hybrid electrolyte is simpler and less energy-intensive than manufacturing solid electrolytes or advanced cathode materials. The process doesn't require vacuum conditions or inert atmospheres. It's essentially a modified version of standard electrolyte manufacturing.

From a full lifecycle perspective, the new batteries have a lower environmental footprint. They require fewer materials to manufacture and last as long or longer than current batteries.

For manufacturers trying to improve their environmental credentials, this is valuable. It's a practical improvement, not a theoretical future technology.

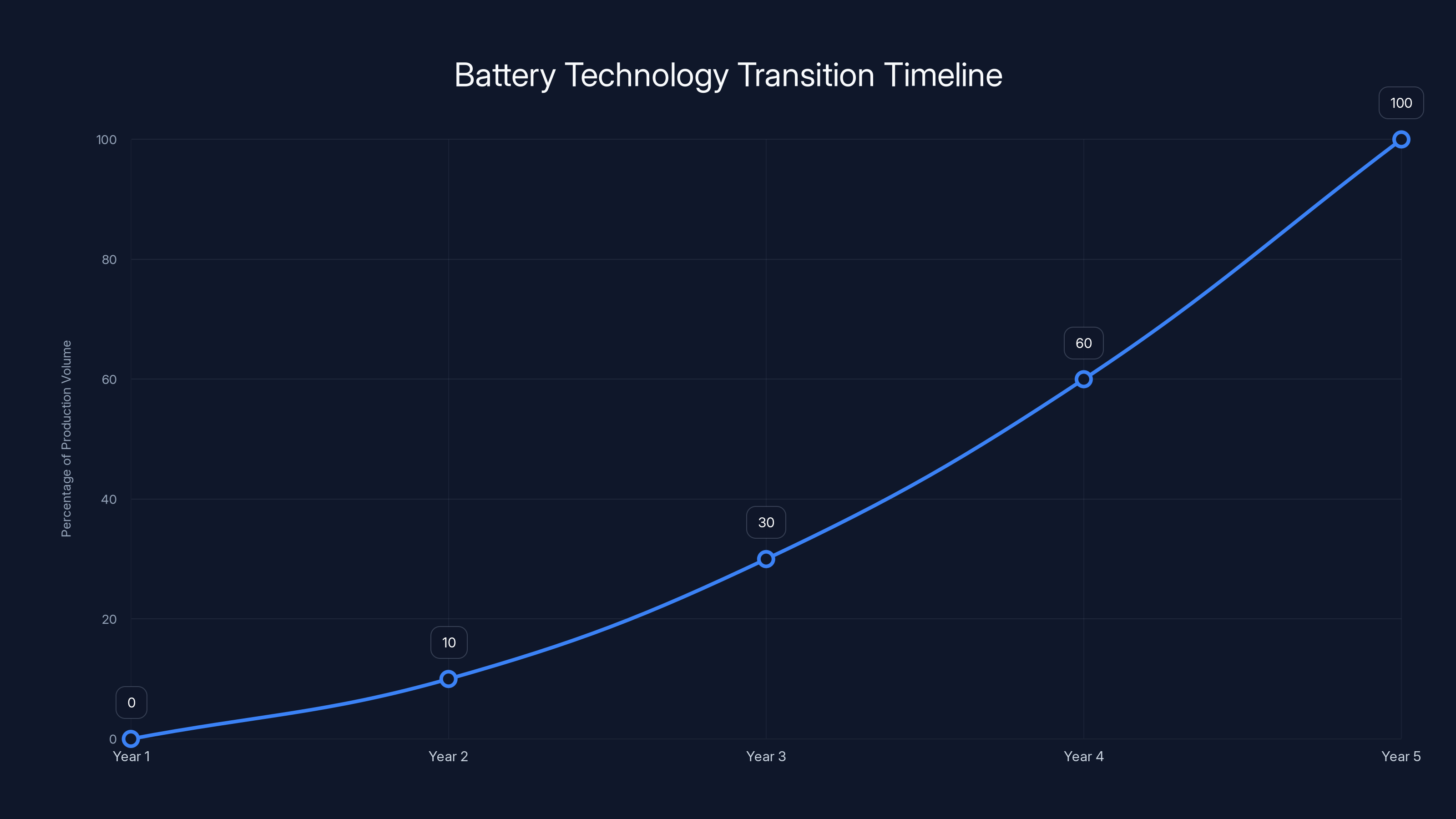

Battery technologies typically take 3-5 years to transition from research to production, with production volumes gradually increasing over this period. Estimated data based on historical trends.

How Manufacturers Will Likely Use This Advantage

When breakthrough technology arrives, manufacturers don't all use it the same way. Expect differentiation.

Tesla and Other Volume Manufacturers

Expect a push toward longer range and price reduction simultaneously. Tesla introduced the Model 3 at a stated "$35,000" price point, though actual prices have drifted higher. With the new battery chemistry, they can deliver on that promise more genuinely. A truly affordable Tesla becomes possible.

Range will also improve. The Model 3 could credibly offer 300+ mile range as a base configuration instead of a premium feature.

Premium Brands

Mercedes, BMW, and others with established luxury positioning will use the advantage differently. Expect smaller, lighter battery packs that improve performance. The savings in weight translate to better acceleration and handling. The cost savings improve margins rather than being passed to consumers.

EV Startups

Companies like Lucid and Rivian have aggressive range and performance targets that currently require large, expensive battery packs. The new chemistry gets them closer to those targets profitably. It could be the difference between survival and bankruptcy for some startups.

Chinese Manufacturers

BYD, NIO, and others already leading in EV technology adoption will use this to further improve their cost advantage. Chinese EVs are already more affordable than American or European equivalents. With this breakthrough, that gap widens. Expect even more aggressive pricing in global markets.

What This Means for Solid-State Battery Investments

This is the uncomfortable part for companies betting everything on solid-state.

Quantum Scape, Samsung, Toyota, and others have invested billions in solid-state development. The technology offers genuine advantages. But timelines keep slipping. Manufacturing remains unproven at scale.

Meanwhile, improved lithium-ion catches up on the metrics that matter most: range and cost.

For venture capitalists and energy investors, this creates a problem. You can invest in a technology that might work in 7-10 years. Or you can invest in improvements to current technology that definitely work in 2-3 years.

Solid-state isn't dead. It's still the long-term play. But the "long-term" keeps getting longer while lithium-ion gets better faster than anyone expected.

Some solid-state companies might pivot. Others might be acquired for their intellectual property and then folded into larger battery programs. A few might successfully make the transition from lab to production, but they'll face a market already saturated with improved lithium-ion options.

The competitive landscape is shifting in real-time.

Challenges and Limitations You Should Know About

No breakthrough is perfect. This one has constraints worth understanding.

Manufacturing Scale-Up

The research was conducted in laboratories with relatively small sample sizes. Scaling from prototype batches to millions of batteries annually is a different challenge. Issues that don't appear in lab conditions can emerge at scale.

Historically, battery technologies take 3-5 years to transition from research to meaningful production volumes. The timeline here is optimistic but achievable.

Supply Chain Integration

The ceramic components used in the hybrid electrolyte need sourcing and supply chain development. Prices might fluctuate initially as new suppliers enter the market. Manufacturing cost targets might not materialize immediately at scale.

Competitive Responses

Every major battery manufacturer will try to develop equivalent or superior chemistries. The advantage is temporary. Within 2-3 years, multiple companies will likely have competitive products. This benefits consumers but erodes competitive advantage for early adopters.

Regulatory Uncertainty

Battery technology faces increasing regulatory scrutiny regarding safety, environmental impact, and recycling. New chemistries sometimes face unexpected regulatory challenges. The research shows no red flags, but real-world deployment might reveal issues.

Patent Landscape

The breakthrough is likely covered by patents. Manufacturers will need to license the technology or design around it. Patent costs could add 5-10% to manufacturing expenses, partially offsetting cost advantages.

Industry Response and Competitive Implications

The major battery manufacturers—CATL, BYD, LG Energy Solution, Samsung SDI—are all aware of work like this. They have their own research teams pushing similar boundaries.

What's likely to happen: Multiple competing improvements arrive roughly simultaneously around 2026-2028. CATL announces a sodium-ion breakthrough. LG patents a new anode composition. Samsung improves electrolyte stability. Instead of one breakthrough dominating the market, we get incremental improvements across the board.

For consumers, this is great. Competition forces faster adoption of improvements and better pricing.

For investors in specific battery companies, it means returns depend on execution and first-mover advantage. The company that gets to production first with a proven solution wins significant market share.

For vehicle manufacturers, the shift is subtle but important. Battery supply becomes less differentiated. Companies can't claim proprietary advantages for years like they historically did. Differentiation moves to vehicle design, software, and user experience.

The Broader Context: Where Battery Technology Is Heading

Lithium-ion has been king for 25+ years. It's not going anywhere soon.

Lithium-air batteries, lithium-metal batteries, and various solid-state chemistries are the long-term future. But "long-term" means 10-20 years out, not tomorrow.

In the near-to-medium term, expect incremental improvements to lithium-ion that gradually approach theoretical limits. Each generation achieves 5-10% improvement in key metrics. Compounded over 10 years, that adds up to 50%+ improvement.

This particular breakthrough is significant but not unique. It's one of many improvements arriving over the next few years. By 2030, lithium-ion batteries will be markedly different from 2024 versions. Better, cheaper, more reliable.

Solid-state will eventually take over, offering genuine 40-50% improvements over advanced lithium-ion. But that transition happens gradually, with early adoption in niche applications, then slow expansion.

For the electric vehicle industry, this trajectory is actually good news. It means gradual improvement, not disruptive leaps. Manufacturers can plan factory investments with confidence. Consumers can buy EVs knowing the technology will be competitive for their ownership period.

The days of "I'm waiting for better batteries" are ending. Better batteries are here now. The question is when they show up in the specific vehicle you want to buy.

What You Should Do With This Information

If you're thinking about buying an EV, here's what changes.

The argument for waiting has become weaker. Better batteries are coming in 2-3 years, yes. But current EVs are already good enough for most use cases. If you need a vehicle now, buy one. In 3-4 years, the next generation will be better. That's always true.

If you can wait, 2027 looks like a genuinely good year to buy. New models with the breakthrough battery chemistry will be available. Manufacturers will have optimized pricing. The EV market will be more mature with better charging infrastructure.

If you're an investor, watch which companies implement this technology first. The leaders will gain market share. Companies that move fast in 2026 will dominate by 2030.

If you're in the automotive industry, you're seeing the timeline accelerate. The EV transition that was supposed to take 15-20 years is now compressing into 7-10 years. Supply chains, manufacturing, and workforce planning all need to adjust.

If you're interested in energy technology broadly, this is a reminder that incremental improvement compounds. Breakthrough innovations matter, but steady progress often matters more.

The Bottom Line

Solid-state batteries might be inevitable long-term. But improved lithium-ion is here, now, and better than anyone expected.

This changes timelines. Range anxiety becomes a non-issue before most people thought it would. EV affordability reaches genuine mainstream price points before 2030. The industry's transition to electric accelerates.

It's not revolutionary in the sense that it completely reimagines battery chemistry. It's revolutionary in the sense that it solves the practical problems holding back EV adoption using technology that's ready to deploy immediately.

The future of EVs was always going to get better. This breakthrough just moved "better" from 2035 to 2026. That's the kind of shift that reshapes industries.

Expect announcements from major manufacturers in the next 6-12 months confirming they're implementing these improvements. Expect prototype vehicles showing the improved range and efficiency. Expect skepticism from people who don't realize the timeline just compressed.

But mostly, expect the EV market to shift. Not overnight. But noticeably over the next 2-3 years. The constraint was never the technology. It was the timeline. This breakthrough removes that constraint.

That matters more than most people realize.

FAQ

What is the lithium-ion battery breakthrough?

The breakthrough involves modifying the electrolyte composition and anode material in traditional lithium-ion batteries to achieve higher energy density and lower manufacturing costs. Specifically, researchers added ceramic-ionic conductors to liquid electrolytes and optimized anode materials through a novel doping process, enabling these improvements without requiring the decades-long development timelines of solid-state batteries.

How is this different from solid-state batteries?

Solid-state batteries use a completely different architecture with solid electrolytes instead of liquid ones. While solid-state offers theoretical advantages and might reach production around 2030-2032, the new lithium-ion improvement uses existing manufacturing infrastructure and can reach mass production in 2-3 years. Both are complementary technologies rather than replacements for each other.

What are the actual performance improvements?

The breakthrough achieves 20-30% higher energy density, 15-25% lower manufacturing costs, and 85%+ capacity retention in cold temperatures compared to current lithium-ion batteries. These translate to vehicles getting 15-25% more range, 15-20% cost reduction per battery pack, and better performance in winter climates.

When will these batteries be in production vehicles?

Major manufacturers can implement these improvements within 2-3 years using existing production facilities. Expect first vehicles with the new battery chemistry to arrive around 2026-2027, with widespread adoption by 2028-2029. This timeline is significantly faster than solid-state alternatives.

How will manufacturers use this advantage?

Different manufacturers will prioritize differently. Volume manufacturers like Tesla will likely offer longer range and lower prices. Premium brands will use the improvements to reduce battery pack weight and improve performance. Startups will use cost savings to improve viability. Chinese manufacturers will likely push pricing advantages further.

Will this cost increase vehicle prices?

No, quite the opposite. The breakthrough should enable price reductions of

Does this make solid-state batteries irrelevant?

No. Solid-state offers 40-50% theoretical advantages over advanced lithium-ion and will eventually become dominant. But this timeline is long—likely 2035+. Until then, improved lithium-ion will be the primary battery technology. Solid-state represents the next major transition after this current generation matures.

How does this affect charging times?

The improved ion conductivity enables faster charging without excessive battery degradation. High-rate charging that currently reduces battery life by 20-30% can now proceed with minimal degradation. This could enable 20-30 minute charging times for 80% capacity to become standard rather than premium feature.

Are there any concerns with the new chemistry?

Manufacturing scale-up from lab prototypes to millions of units annually is the primary challenge. Supply chains for new electrolyte components need development. Regulatory approval might uncover unexpected issues. Patent licensing could add costs. But no fundamental showstoppers have emerged from testing.

Should I wait to buy an EV?

If you need a vehicle now, current EVs are already good enough for most use cases. If you can wait 2-3 years, the next generation with breakthrough battery chemistry will offer significantly better value. The sweet spot for buying appears to be 2027-2028 when first-generation production vehicles are available and well-reviewed.

Key Takeaways

- Breakthrough lithium-ion chemistry achieves 20-30% higher energy density and 15-25% lower manufacturing costs using existing production infrastructure

- New batteries reach mass production in 2-3 years versus 7-10 years for solid-state, accelerating the timeline for affordable, long-range EVs

- Hybrid ceramic-liquid electrolyte maintains 85%+ capacity in cold temperatures and enables faster charging without significant battery degradation

- Cost reductions from fewer cells needed per pack and simplified electrolyte manufacturing could reduce EV prices by 4,000 within 3-4 years

- Manufacturing implementations begin 2026-2027, with widespread adoption by 2028-2029, making this the critical battery generation for EV mainstream adoption

![Lithium-Ion Battery Breakthrough: Game-Changing Range & Cost Reduction [2025]](https://tryrunable.com/blog/lithium-ion-battery-breakthrough-game-changing-range-cost-re/image-1-1771625164706.jpg)