The $30,000 EV Dream Is Finally Becoming Reality

The electric vehicle revolution has been a rough ride for American automakers. Ford and General Motors invested billions into full-size electric trucks, betting that early adopters would embrace the instant torque and zero-emission benefits. The result? A financial disaster costing Ford nearly

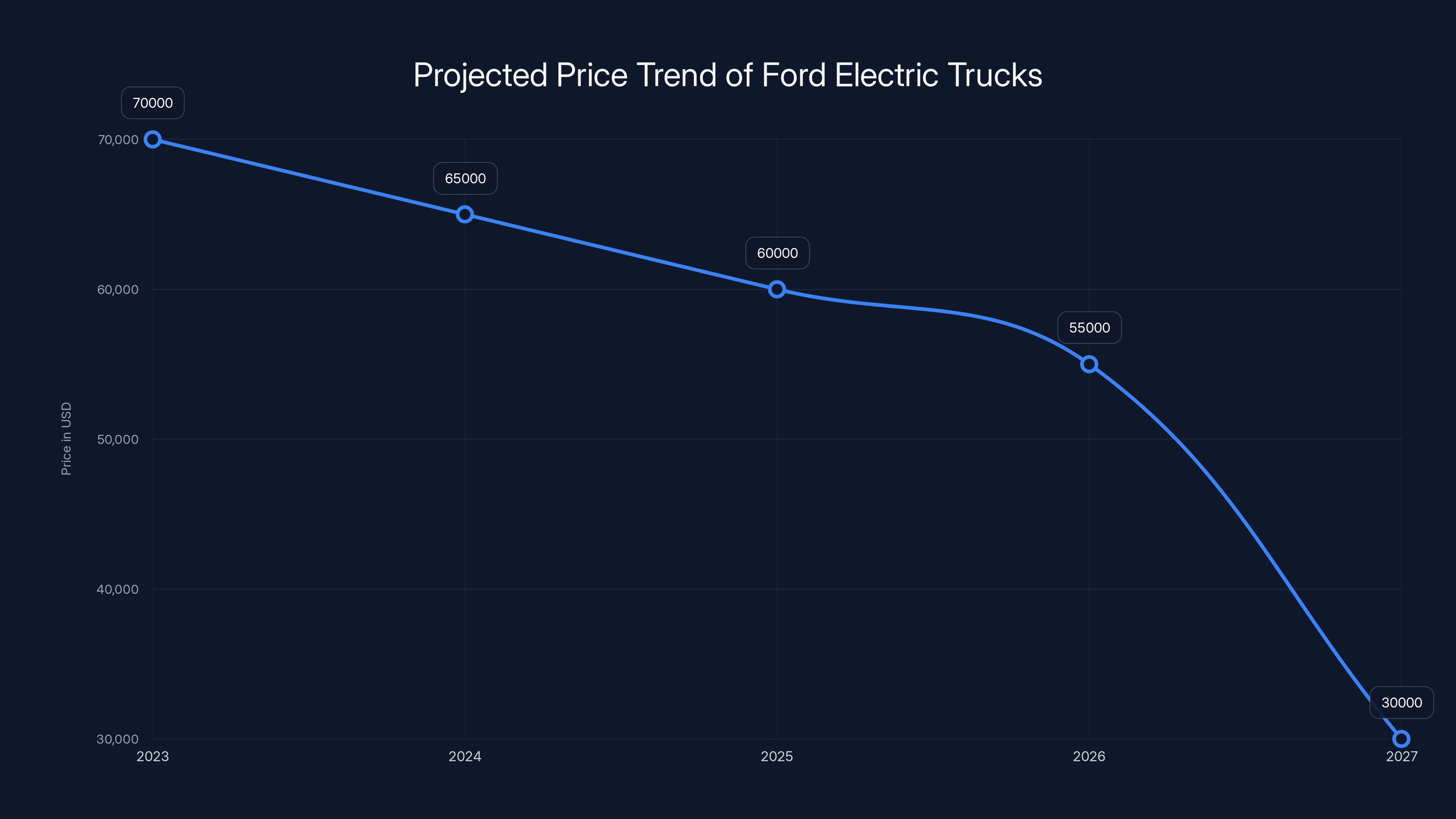

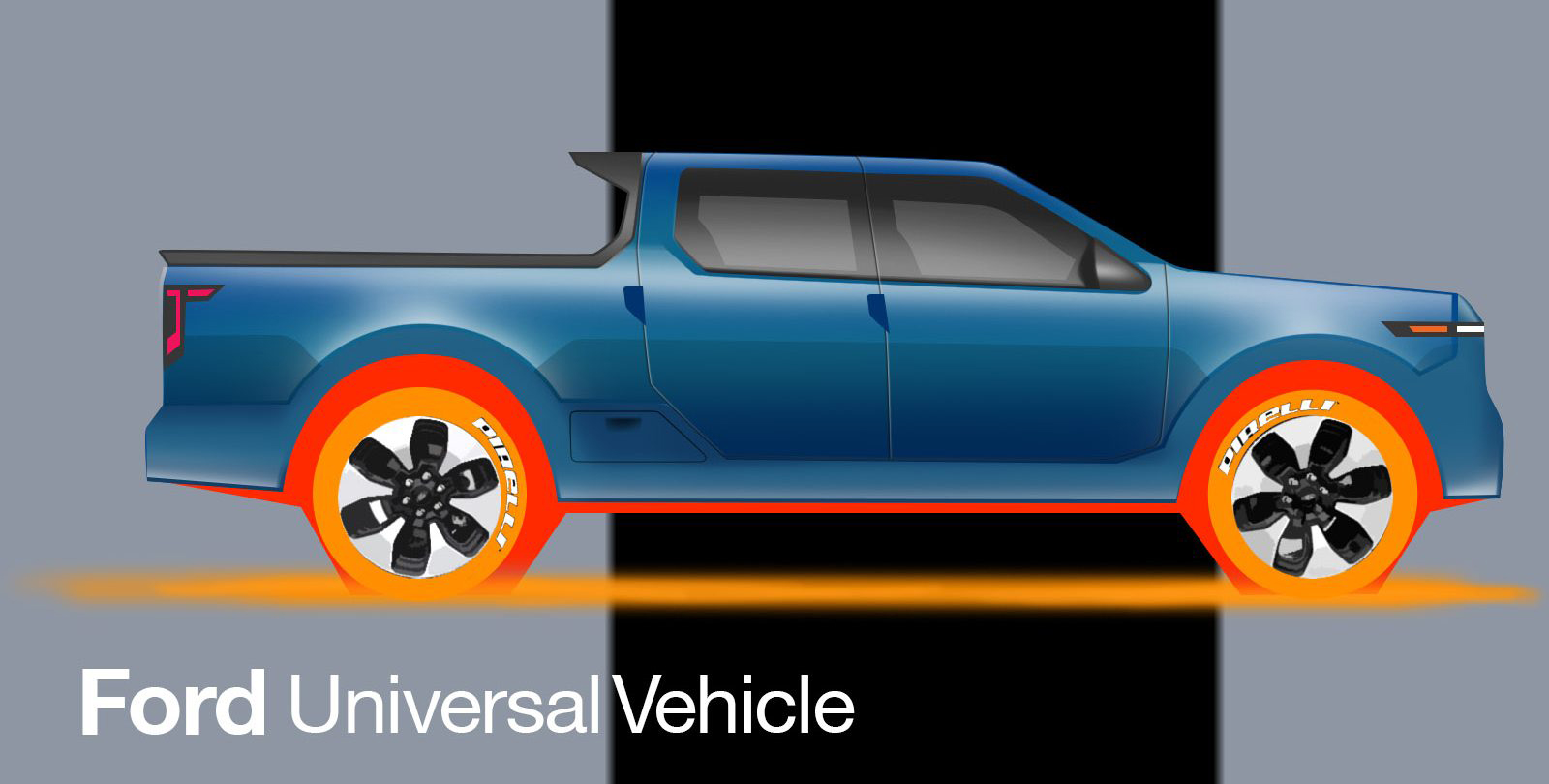

But here's what's fascinating: Ford didn't give up. Instead, the company learned from its mistakes and built something smarter. In 2027, Ford plans to launch a midsize electric pickup truck starting at $30,000. That's half the price of the Lightning. It's the kind of price point that actually gets people excited about switching from gas.

The catch? There's always a catch. Ford can't make this work by simply shrinking the F-150 Lightning and slashing the price. The economics don't work that way. Instead, the company went back to first principles. Engineers asked themselves a radical question: what if we designed an electric truck specifically to be affordable, rather than converting an existing truck design to electric?

That's where the "Universal EV Platform" comes in. For years, Ford has been running an internal skunkworks to rethink how electric vehicles get built. The focus isn't on more power or more features. It's on doing more with less. Fewer components. Less material. Less energy needed to move the vehicle down the road. This isn't flashy engineering. It's efficient engineering.

Over the past year, Ford has been remarkably transparent about how it's pulling off this feat. The company has revealed engineering details about aerodynamics, battery chemistry, manufacturing processes, and component design. What emerges is a masterclass in constraint-driven innovation. When you have a hard price ceiling, you can't throw engineering problems at shareholders. You have to solve them with cleverness.

The result? A truck that Ford claims will deliver 15% better efficiency than any comparable midsize pickup on the market. That's not massive, but it's significant enough to make a smaller battery work. And that smaller battery is the entire price advantage.

Let's break down how Ford is making the impossible affordable.

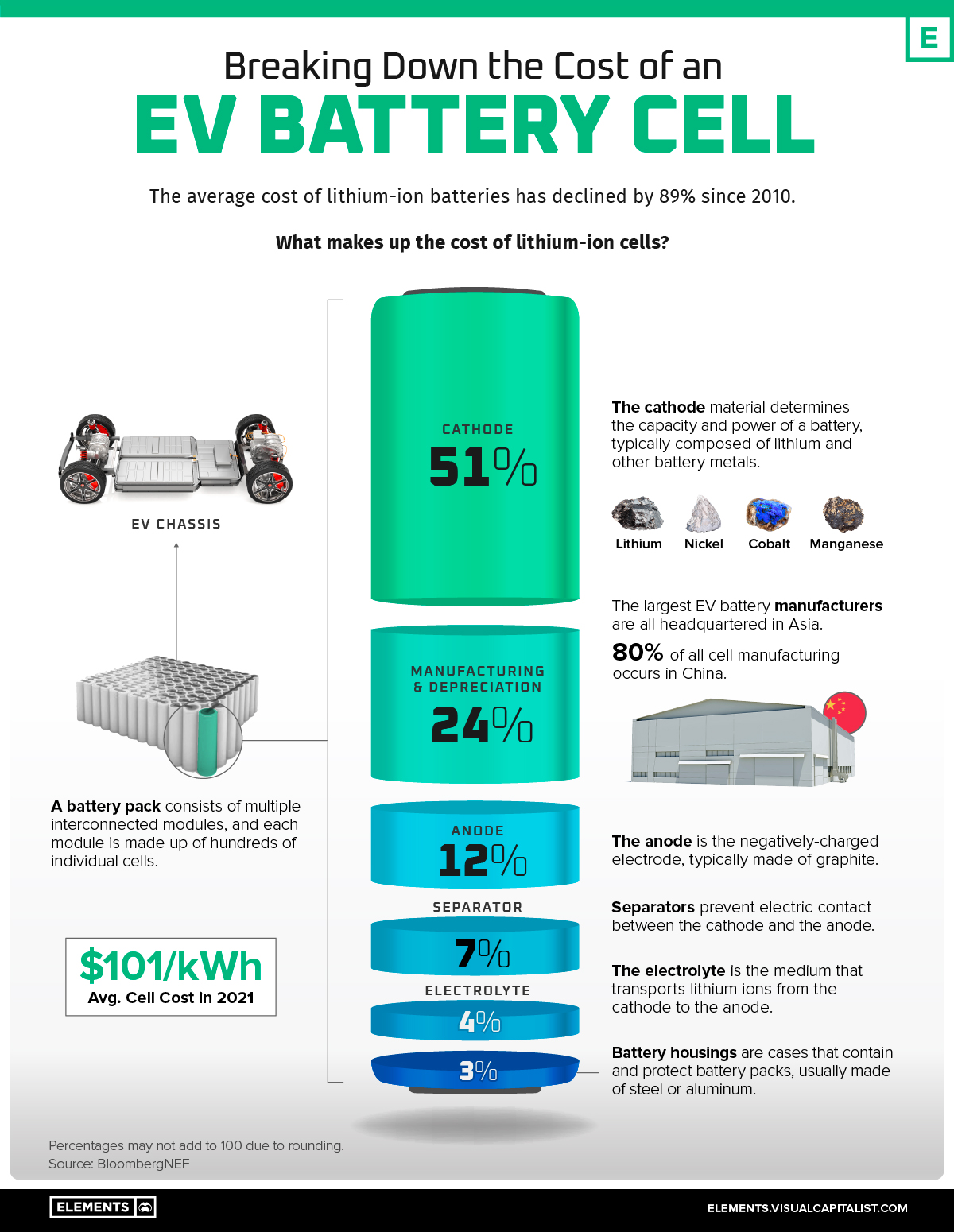

Why Battery Cost Became the Bottleneck

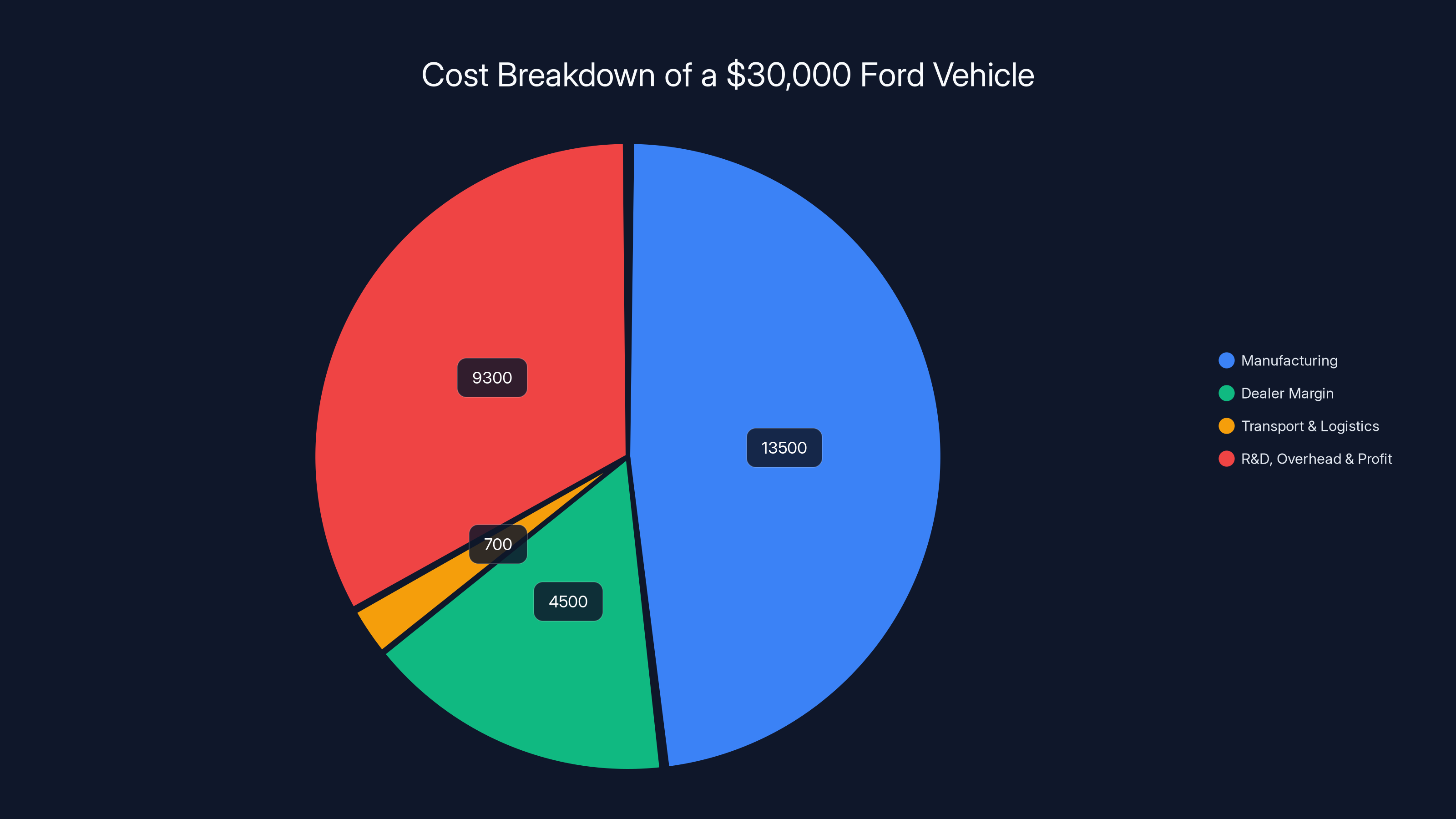

Understand one fundamental fact about electric vehicles: the battery is the hardest part to get right, and it's shockingly expensive. Ford has stated clearly that roughly 40% of the total vehicle cost comes from the battery pack. This isn't a minor component. It's nearly half the entire vehicle.

If you're trying to build a

The traditional EV strategy was to throw massive batteries at the problem. Want more range? Add more cells. Need to compete on range? Stuff the biggest pack that physically fits. This approach works fine when you're selling premium vehicles to early adopters who don't care about cost. Tesla, Lucid, and Rivian all followed this playbook.

But Ford realized that strategy was a dead end for affordable vehicles. You simply can't build a $30,000 truck with a 150-kilowatt-hour battery pack. The battery alone would cost too much.

So Ford flipped the problem upside down. Instead of asking "how big a battery do we need?", the company asked "how small can we make the battery and still deliver acceptable range?" That question sounds simple. Executing it demands ruthless efficiency in every other system.

Ford's solution involves three parallel approaches. First, use smaller, cheaper battery cells made with lithium iron phosphate chemistry. Second, design the truck to use less energy moving down the road. Third, optimize the manufacturing process to reduce production costs.

Let's explore each approach in detail, because this is where the actual engineering genius emerges.

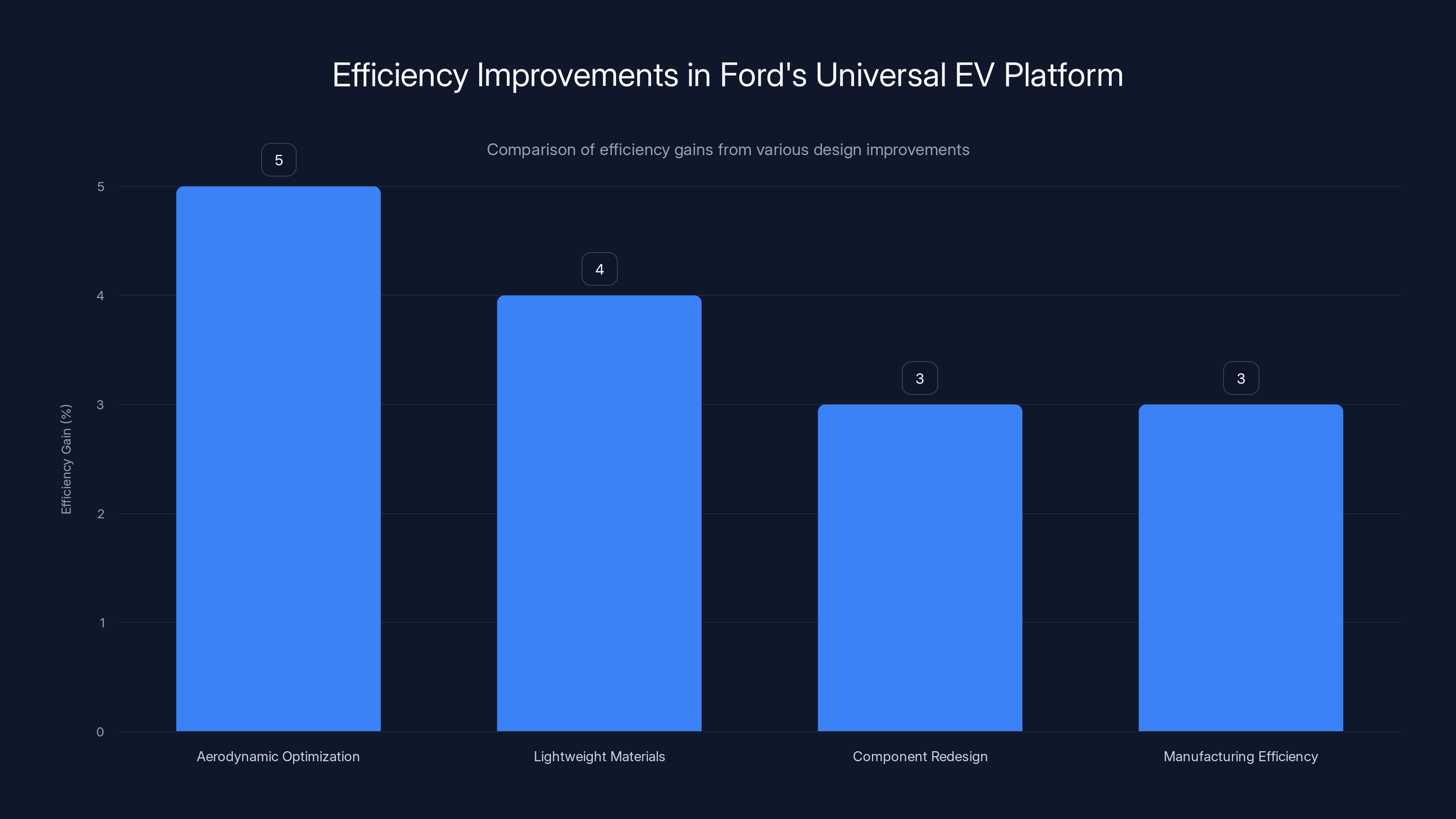

Ford achieves a 15% efficiency improvement through a combination of aerodynamic optimization, lightweight materials, component redesign, and manufacturing efficiency. Estimated data based on described improvements.

Aerodynamics: The Invisible Efficiency Multiplier

At highway speeds, aerodynamic drag becomes the dominant force working against a vehicle. It's not a minor factor. It's the difference between a truck that can travel 300 miles on a charge and one that struggles to hit 200 miles. For engineers, this is the leverage point.

Here's the physics: drag force increases with the square of velocity. Drive twice as fast, and you need four times as much energy to overcome drag. This means highway efficiency is disproportionately important for any EV that needs real-world range.

The problem? Pickup trucks are aerodynamically terrible. They're boxy. They're big. They have mirrors sticking out. They have wheels and tires that plow through air. A traditional pickup truck sits in the atmosphere like a brick, creating a massive wake of turbulence behind it.

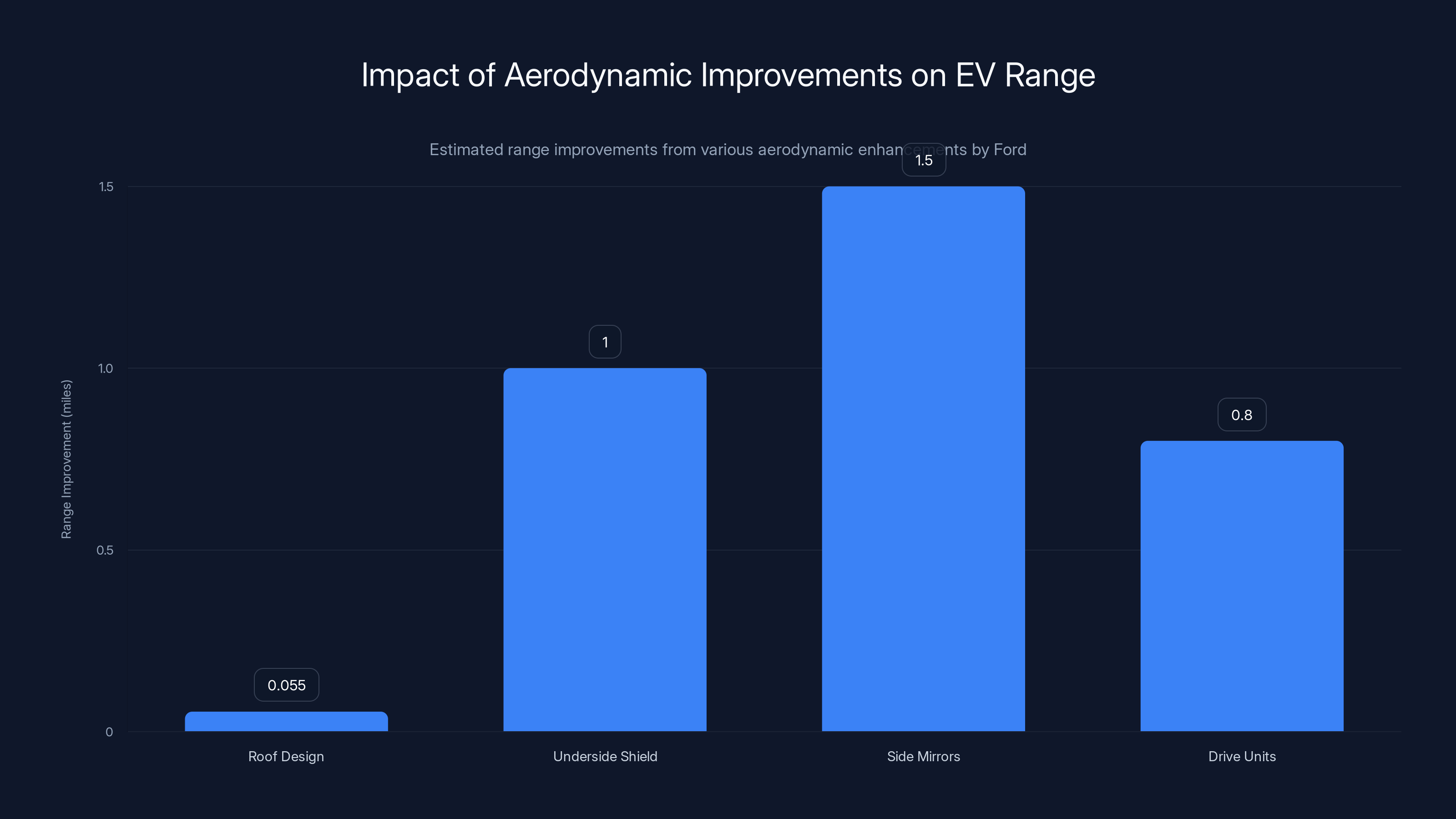

Ford's aerodynamics team, many of whom came from Formula 1 racing, approached this differently. Rather than accept the shape of a traditional truck, they asked what happens if you design the aerodynamics first and adapt the truck design around that.

The result looks like a traditional truck at first glance, but the details are radically different. The roof tapers back in a gentle curve, helping air flow over the truck rather than colliding with the tailgate. To the naked eye, you'd barely notice. To the air moving around the truck, it's profound. Ford's engineering team calculated that this single change costs just $1.30 in additional battery expense per 0.055 miles of range lost. That's an acceptable trade-off.

But that's just the beginning. Ford's team optimized the underside shield to reduce drag from the wheels. They redesigned the side mirrors using a single actuator, shrinking the mirror housing by over 20%. That reduction in frontal area unlocked an estimated 1.5 miles of additional range through better aerodynamics alone.

The drive units were aero-optimized. The driveshafts were angled to minimize friction. Even the suspension was tested thousands of times in 3D-printed configurations, swapped in and out of the wind tunnel in minutes to identify micro-improvements.

This is where Ford's F1 heritage really showed. Instead of running a handful of wind tunnel tests with full-scale prototypes, Ford's team used rapid iteration. They'd 3D-print a component, test it, get data, modify it, and test again. Within hours, not weeks. This "fail fast, learn faster" mentality generated data-driven insights that traditional automotive engineering never uncovers.

The cumulative effect? Ford claims 15% better efficiency than comparable midsize trucks. That single metric means you need a proportionally smaller battery to deliver the same range. And since battery cost is 40% of vehicle cost, that efficiency advantage directly translates to a lower sticker price.

Ford's strategic shift is projected to reduce the price of its electric trucks from

Component Reduction: Fewer Parts, Lower Cost

There's an old engineering principle: the most reliable component is the one that doesn't exist. Fewer parts mean fewer things that can break, lower assembly costs, and reduced complexity.

Ford's Universal EV Platform was designed with this principle in mind. Every component got scrutinized. Does it need to be there? Can two parts be consolidated into one? Can the design be simplified without losing functionality?

This thinking manifested in some concrete ways. The side mirror is a perfect example. Traditional vehicle mirrors use two separate actuators: one to adjust the glass, another to fold the mirror. That means the mirror housing needs internal clearance for the glass to move independently. It's a small thing, but multiply it across a vehicle, and you get a lot of unnecessary complexity.

Ford's engineers designed a single actuator that handles both functions. The glass doesn't need independent movement space anymore. So the entire mirror housing got smaller. Less material. Less weight. Lower cost.

That specific change saved an estimated 1.5 miles of range through reduced mass and improved aerodynamics. And the component itself costs less to manufacture.

Repeat this across hundreds of components, and suddenly you're not looking at incremental improvements. You're looking at a fundamentally more efficient vehicle.

The assembly process also got redesigned. Ford's new manufacturing approach uses 40% fewer workstations than traditional assembly lines. That's not a marginal improvement. That's a wholesale reimagining of how vehicles get built.

Fewer workstations mean fewer parts moving through the line, less handling, less opportunity for errors, and lower labor costs per vehicle. The Louisville plant, where this truck will be built, was designed from scratch for this specific platform. There's no legacy inefficiency to overcome. No retrofitted tooling. Just pure, efficient manufacturing.

The Battery Technology: Lithium Iron Phosphate Cells from Michigan

For years, the automotive industry assumed that electric vehicles required expensive nickel-cobalt lithium-ion batteries. That chemistry delivers high energy density and impressive performance, but it's pricey. The cobalt sourcing is ethically problematic. The nickel is expensive. The recycling is complex.

Lithium iron phosphate (LFP) chemistry changes the equation entirely. These batteries use iron and phosphate instead of cobalt and nickel. That means lower material costs. The chemistry is more stable, which means better safety margins. The cycle life is excellent, meaning these batteries hold their capacity longer than traditional lithium-ion cells.

The trade-off? LFP batteries have lower energy density. You need more cells to store the same amount of energy. For a premium vehicle trying to maximize range, that's a deal-breaker. For an affordable vehicle trying to minimize cost, it's the perfect solution.

Ford is manufacturing its LFP cells in Michigan, using a supply chain it controls. That domestic production means fewer transportation costs, faster iteration, and supply chain resilience. It also addresses the geopolitical anxiety around Chinese battery suppliers.

The specific cell chemistry and form factor haven't been fully detailed publicly, but Ford's team has emphasized that these cells are optimized for this specific platform. They're not generic LFP cells designed for other purposes. They're engineered specifically to deliver the energy needed while minimizing cost and weight.

Another benefit of LFP chemistry that Ford hasn't explicitly highlighted: thermal stability. These batteries run cooler than nickel-based chemistries. That means simpler cooling systems, lower energy spent on thermal management, and better efficiency overall. In the context of a cost-optimized vehicle, simpler cooling means lower manufacturing complexity and cost.

Ford's aerodynamic enhancements, such as mirror redesign and roof tapering, significantly improve EV range, with side mirrors alone adding an estimated 1.5 miles. Estimated data.

Engineering Trade-Offs: The "Bounty" System

Here's where Ford's approach gets genuinely interesting. Traditional vehicle design involves multiple departments, each with conflicting priorities. The aerodynamics team wants the lowest roof possible. The occupant package team wants the highest roof possible. The interior team wants to minimize cabin size. The structural team wants maximum safety. The suspension team wants maximum ground clearance.

These departments typically negotiate until someone makes a call that satisfies most people. The result? Trade-offs that nobody really loves, but everyone can live with.

Ford created something called a "bounty system" to align all departments toward a single objective: maximize range while minimizing battery cost. Every design decision gets evaluated through that lens.

Here's a concrete example. Adding 1mm to the roof height sounds trivial. But that 1mm of height, multiplied across the entire roof, adds up. It increases frontal area slightly. It changes the aerodynamic wake. It adds weight. All of those factors reduce efficiency.

Ford's bounty system quantified it: adding 1mm to roof height costs $1.30 in additional battery expense or reduces range by 0.055 miles. Suddenly, the roof height decision isn't abstract. It's measurable. Every department can see the exact cost of their preference.

Aerodynamics team wants a lower roof? They get it, because the bounty system shows them the exact range benefit. Interior team wants more headroom? They have to pay for it with higher battery cost. Suddenly, everyone's priorities are aligned. You're not maximizing individual departmental preferences. You're maximizing customer value: range and affordability.

This kind of aligned incentive structure is simple in concept but revolutionary in practice. It prevents the kind of engineering compromise that leads to mediocre products. Instead, every choice supports the same goal.

Material Science: Lightweight Without Compromise

Weight is the enemy of efficiency. Heavier vehicles need more energy to move the same distance. For gasoline trucks, that's a minor concern. For electric trucks with limited battery capacity, it's critical.

Ford's platform uses a combination of lightweight materials to reduce mass without sacrificing strength or safety. High-strength steel in structural areas. Aluminum in components where weight matters but strength requirements are lower. Composites in non-structural panels where corrosion resistance is important.

But here's the key insight: Ford didn't just swap materials. They redesigned components specifically for lightweight materials. That's different from taking a steel design and making it aluminum. When you fundamentally redesign for a different material, you can optimize the shape, the thickness, the internal structure.

A concrete example: aluminum brake components. Traditional steel brake calipers are heavy and dissipate heat slowly. Aluminum calipers are lighter, but they require different internal cooling passages because aluminum conducts heat differently than steel. Ford redesigned the caliper geometry specifically for aluminum, optimizing heat dissipation while minimizing weight.

That's the difference between material substitution and real lightweight engineering. Substitution saves some weight. Real engineering saves significant weight while improving performance.

The cumulative weight reduction across hundreds of components adds up to a truck that's several hundred pounds lighter than comparable vehicles. In EV terms, that translates to meaningful range improvement without larger batteries.

Estimated data shows manufacturing costs at

Manufacturing Innovation: 40% Fewer Workstations

Most electric vehicle factories inherit old manufacturing processes. You take a traditional car plant and adapt it for EVs. That's inefficient. You're building new processes around old infrastructure.

Ford's Louisville plant is different. It was designed from scratch for the Universal EV Platform. The entire manufacturing flow was rethought with a specific goal: minimize labor, minimize complexity, maximize quality.

The result is 40% fewer workstations than traditional Ford assembly lines. That's a staggering reduction. It doesn't just mean 40% fewer people on the line, though that's part of it. It means 40% less handling of components, 40% fewer opportunities for assembly errors, 40% less tooling and equipment.

How is this possible? Partly through automation. Robots are getting better and more capable every year. Partly through design simplification. When components are designed to be easier to assemble, the assembly process gets faster. Partly through consolidation. Two separate assembly operations get combined into one.

The effect on cost is enormous. Labor is one of the largest cost components in vehicle manufacturing. Reducing it by 40% means real savings that flow directly to the customer through lower prices.

But there's another benefit that Ford hasn't publicized as heavily: quality. Fewer assembly steps mean fewer opportunities for errors. Simpler assembly means higher accuracy. The result should be higher quality vehicles, which means lower warranty costs and better reliability.

Price Target: How $30,000 Actually Works

Let's talk about the math. A $30,000 vehicle needs to generate profit for Ford while covering manufacturing costs, distribution, warranty, and dealer margins. That's a tight margin in the automotive industry.

Here's the rough breakdown. Manufacturing cost for a vehicle in Ford's class typically runs 45-50% of the retail price. So

That's tight. Really tight. It only works if manufacturing efficiency is exceptional, which Ford claims it is with the 40% reduction in workstations.

The battery cost is the key variable. A small battery using commodity LFP cells costs significantly less than a large battery using premium nickel-cobalt cells. If Ford can source LFP cells for under

Everything Ford has announced supports this math: aerodynamic efficiency reducing energy consumption, lightweight design reducing battery requirements, simplified manufacturing reducing cost per unit, domestic supply chain reducing sourcing costs.

Will it actually hit

If sales disappoint, Ford might have to subsidize the price, which would undermine the whole project. But based on the engineering transparency, Ford seems confident in the demand.

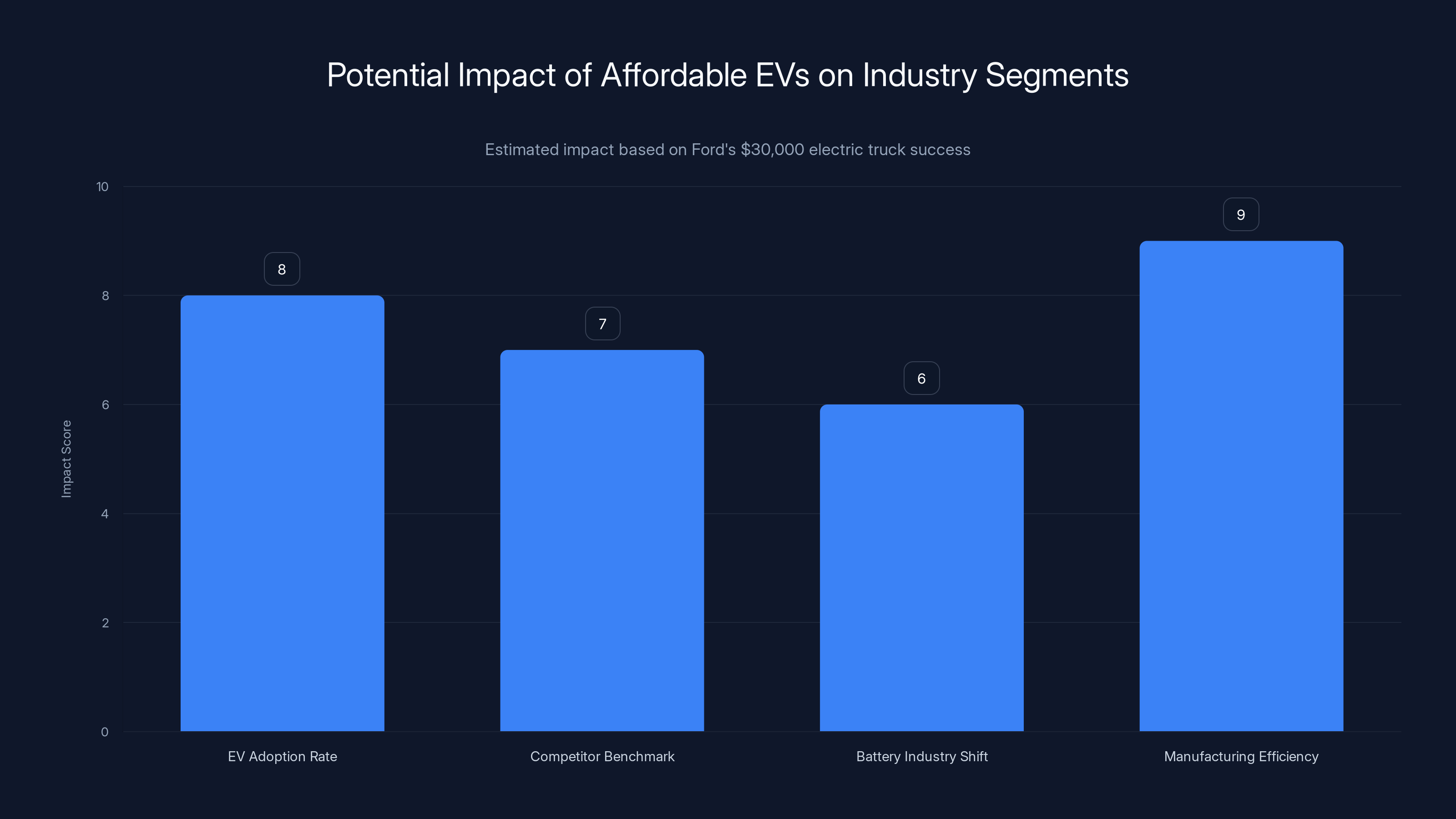

Ford's affordable electric truck could significantly impact EV adoption, set new benchmarks for competitors, shift battery industry preferences, and enhance manufacturing efficiency. (Estimated data)

Market Context: Why This Matters Now

The EV market has evolved dramatically in the past two years. In 2023-2024, it was all about premium vehicles and early adopters. In 2025, it's about mainstream affordability. That's a fundamental shift.

China's BYD has been selling affordable EVs for years. The Seagull hatchback starts around

For American manufacturers, this is existential. If you can't compete on price with Chinese EVs, you lose market share to imports. Ford's $30,000 truck is a direct response to this market reality.

At

The pickup truck market is enormous in America. The F-150 alone sells over 700,000 units annually. If Ford can capture even 5% of the midsize truck market with an affordable EV, that's over 100,000 units per year. At volume like that, the economics work beautifully.

Competition: How This Stacks Up

Ford isn't alone in chasing affordable EVs. General Motors is working on similar initiatives. Stellantis is exploring the market. Traditional truck makers are adapting. International companies are entering the American market.

But Ford's approach appears uniquely focused on efficiency over features. Other manufacturers might add more technology, more power, more range. Ford is optimizing for the opposite: maximum value per dollar. That's a different mindset.

Lucid, Rivian, and other EV startups are building premium vehicles with massive batteries and impressive performance. Ford is building a practical vehicle that solves a real problem: how do ordinary people afford an electric truck?

The competition will come from two directions. Cheap imports from BYD, Nio, or other Chinese manufacturers. And from gas trucks that continue to improve in fuel efficiency. Ford's weapon against both is affordability combined with reliability and brand trust.

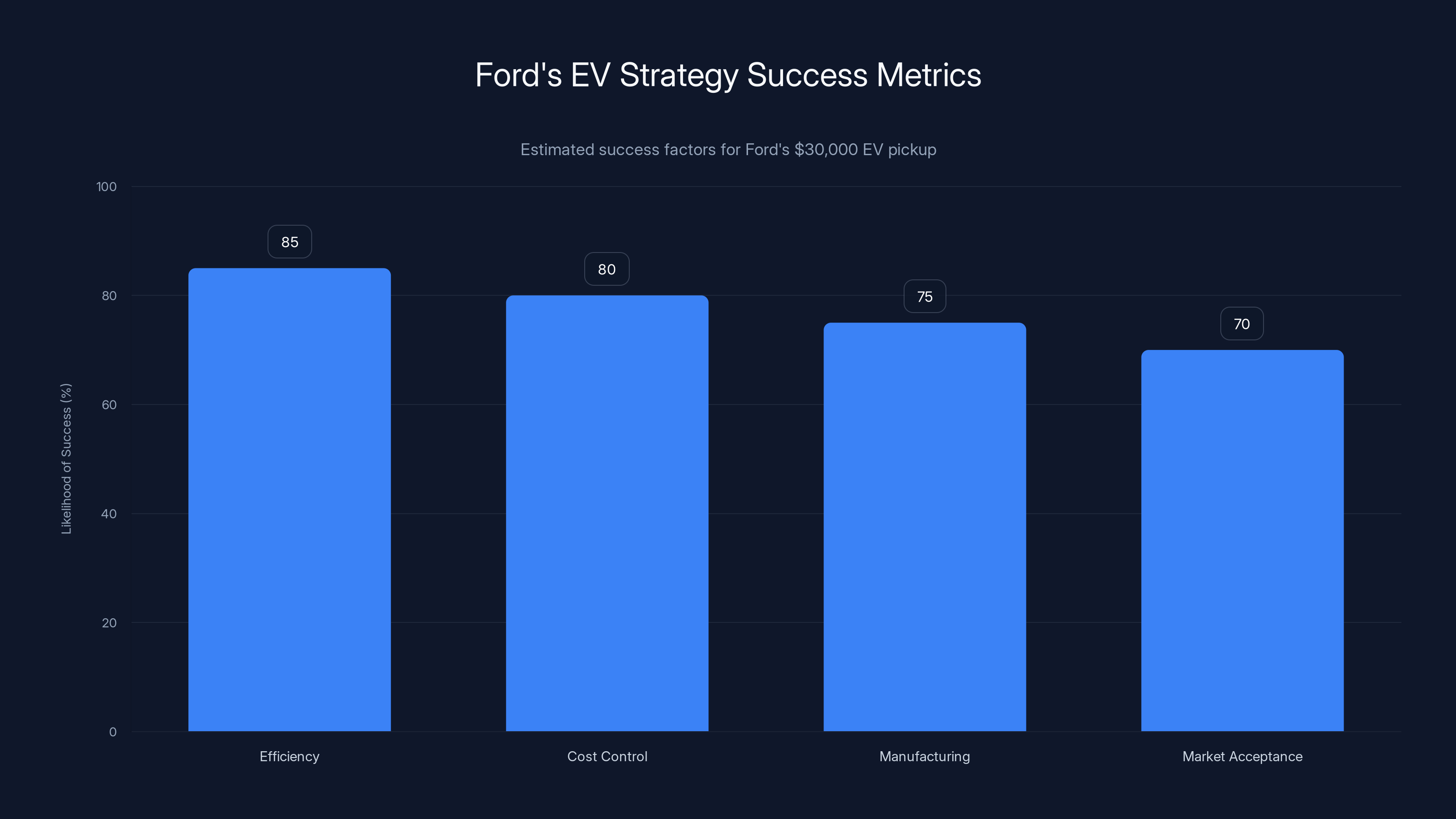

Estimated data suggests Ford's focus on efficiency and cost control are key success factors for its $30,000 EV pickup, with market acceptance being the most uncertain aspect.

The Timeline: 2027 Feels Distant Until It Doesn't

Production starts in 2027. That's roughly 18 months away from the current moment. It sounds distant, but in automotive development, it's remarkably tight. Tooling needs to be built. Supply chains need to be established. Dealerships need to be trained. Manufacturing needs to be validated.

Ford is clearly confident it can hit this timeline, given how much engineering detail has been shared publicly. Usually, automakers are secretive about upcoming vehicles. Ford's openness suggests they're not worried about competitors copying the approach. The design is locked down. The manufacturing is being built. The battery supply is committed.

Pre-orders likely begin in 2026. Initial production will probably be allocated to early adopters and fleet customers. By 2028, wider availability should emerge. By 2030, if the truck is successful, it could become a volume product that generates real profit for Ford.

Implications for the EV Industry

If Ford succeeds, it changes everything. A profitable $30,000 electric truck proves that affordability and practicality can coexist with electrification. It proves that you don't need massive batteries and premium pricing to make EVs work.

This could accelerate EV adoption faster than any subsidies or regulations. People choose affordable products. If the Ford truck is reliable, practical, and genuinely costs $30,000, buyers will choose it over gas trucks. Dealerships will stock it. Word of mouth will spread.

For competitors, it sets a new benchmark. You can't just build premium EVs and hope for mainstream adoption. You need affordable options that work for ordinary customers.

For the battery industry, it validates LFP chemistry for mainstream vehicles. It proves that you don't need expensive nickel-cobalt batteries to build good EVs. That changes the entire supply chain economics.

For manufacturing, it shows that automotive plants can be fundamentally more efficient than legacy approaches. That has implications far beyond Ford. If other manufacturers adopt similar "fewer workstations" approaches, they'll reduce costs across the board.

The Challenges Ford Still Needs to Solve

Despite the ambitious engineering, real challenges remain. Range anxiety is still the biggest concern for EV truck buyers. Ford's truck will likely offer somewhere between 200-300 miles of range, depending on final specifications. For towing, that range will drop significantly. For many truck buyers, that's acceptable. For others, it's a dealbreaker.

Charging infrastructure needs to be more robust. Pickup truck owners often have rough terrain vehicles that spend time away from grid access. Fast charging networks are improving, but coverage outside major cities remains sparse.

Resale value uncertainty is real. The first generation of affordable EVs will have uncertain long-term value. Battery degradation could hurt resale prices if owners can't afford replacement batteries.

Trade-offs in comfort and capability are inevitable. A

What This Means for Ford's Future

The $30,000 pickup is a critical test for Ford's EV strategy. The F-150 Lightning taught Ford that you can't just electrify existing vehicles and hope for the best. You need purpose-built electric vehicles designed for specific price and performance targets.

If this truck succeeds, Ford has a path to profitability in EVs. More platforms will follow. Sedans. Crossovers. Other sizes of trucks. Each platform can follow the same design philosophy: maximize efficiency, minimize unnecessary complexity, hit specific price targets.

If the truck fails, Ford has a bigger problem. It suggests that the economics of affordable EVs don't work in the American market, at least not for Ford's business model.

But based on the engineering discipline shown so far, failure seems unlikely. Ford isn't making grand promises about revolutionary features. It's making specific claims about efficiency, cost, and manufacturing. Those are claims that can be measured, verified, and held accountable.

The Broader EV Transition

The full-size F-150 Lightning was a necessary step. It proved the concept. It showed that electric trucks could work. It taught Ford what customers wanted and what they were willing to pay. Those lessons are embedded in the $30,000 truck.

The transition from F-150 Lightning to Universal EV Platform represents a maturation of EV thinking. First-generation EVs were about proving viability. Second-generation EVs are about profitability. That maturation changes the industry.

When mainstream automakers focus on profitability rather than proof of concept, the EV market shifts. You stop competing on performance specs and start competing on value. That's where mass adoption happens.

Ford's $30,000 truck might not be the most powerful truck. It might not be the most feature-rich. But if it's the most affordable truck that people can rely on, it wins.

FAQ

What exactly is Ford's Universal EV Platform?

Ford's Universal EV Platform is a completely redesigned electric vehicle architecture built from scratch specifically for affordability and efficiency. Unlike the F-150 Lightning, which adapted existing truck design for electric motors, this platform was engineered with efficiency as the primary design driver. The first vehicle using this platform will be the 2027 midsize electric pickup truck starting at $30,000. The platform emphasizes lightweight design, aerodynamic efficiency, simplified manufacturing, and smaller battery packs that use lithium iron phosphate chemistry. Ford designed the platform using modular architecture, meaning multiple vehicle types (sedans, crossovers, different truck sizes) could share the same fundamental electric components while using different body styles. This approach dramatically reduces development costs and allows Ford to apply efficiency improvements across multiple vehicle classes simultaneously.

How does Ford achieve 15% better efficiency than comparable trucks?

Ford's efficiency gains come from multiple reinforcing improvements rather than a single breakthrough. Aerodynamic optimization reduces energy consumption at highway speeds, where drag is the dominant resistance force. The truck's roof tapers gently to help air flow over the vehicle, mirrors are redesigned to reduce frontal area, and the underside is fully shielded to minimize drag from wheels and suspension. Lightweight materials and component redesign reduce overall mass, which decreases the energy needed to accelerate and maintain speed. Simplified mechanical components, like the single-actuator side mirrors, eliminate unnecessary weight. Manufacturing efficiency improvements don't directly reduce vehicle efficiency, but they lower production costs, which allows for smaller batteries without sacrificing range. The net effect is that the truck needs roughly 15% less energy per mile traveled compared to traditional midsize trucks, making a smaller battery sufficient for adequate range.

Why is a smaller battery possible if the truck still needs to deliver acceptable range?

Battery size and vehicle efficiency are inversely related. A more efficient vehicle travels further on the same amount of stored energy. Conversely, an efficient vehicle needs less total energy storage to achieve a target range. Ford's efficiency improvements mean a 40-50 kWh battery pack can deliver comparable real-world range to a much larger battery in a less-efficient vehicle. Since battery cost represents roughly 40% of the vehicle's total price, using a smaller battery directly reduces the price without sacrificing functionality. Additionally, smaller batteries weigh less, which further improves efficiency in a virtuous cycle. The trade-off is that range will be lower than premium EVs with larger batteries, and range will suffer more significantly during heavy towing. But for most customer use cases, the smaller battery delivers adequate range at a price point that makes the truck accessible to mainstream buyers.

What is lithium iron phosphate chemistry, and why does Ford use it?

Lithium iron phosphate (LFP) is a battery chemistry that substitutes iron and phosphate compounds for the nickel and cobalt found in traditional automotive lithium-ion batteries. This chemistry offers several advantages for cost-optimized vehicles. LFP cells are significantly cheaper to manufacture because iron and phosphate are abundant, inexpensive materials compared to cobalt or nickel. The chemistry is inherently more thermally stable, meaning it runs cooler and requires simpler cooling systems. LFP cells have excellent cycle life, meaning they retain capacity better over many charge-discharge cycles. The downside is lower energy density, meaning you need more cells to store the same amount of energy. For premium vehicles trying to maximize range, that's unacceptable. For affordable vehicles trying to minimize cost, it's the perfect solution. Ford's LFP cells are being manufactured in Michigan using domestic supply chains, which reduces sourcing complexity and transportation costs. The specific cell format and chemistry have been optimized for the Universal EV Platform's power and efficiency requirements.

How does Ford's "bounty system" change vehicle engineering?

The bounty system is an incentive alignment mechanism that makes different engineering departments work toward the same objective: maximizing range while minimizing battery cost. Traditionally, vehicle design involves competing priorities. The aerodynamics team wants the lowest possible roof. The occupant package team wants the highest roof. The interior team wants to minimize cabin size. These departments negotiate until someone makes a judgment call that satisfies most stakeholders but usually represents a compromise nobody loves. Ford's bounty system quantifies the trade-offs. Adding 1mm to roof height, for example, costs $1.30 in additional battery expense or reduces range by 0.055 miles. This quantification means every department can see the exact customer impact of their design preference. Suddenly, the aerodynamics team's desire for a lower roof isn't abstract preference. It's measurable customer value. Similarly, the interior team's request for more headroom has a concrete cost that everyone can see. This transparency aligns all departments toward maximizing customer value rather than optimizing individual departmental preferences.

What will the 2027 truck's real-world range actually be?

Ford hasn't publicly committed to a specific EPA range figure, though they've implied acceptable range for customer use. Based on the platform details, a likely scenario is 200-280 miles of EPA-rated range, depending on final battery size and specifications. Real-world highway range will be lower due to higher energy consumption at sustained highway speeds. For reference, a 250-mile EPA rating typically translates to roughly 200 miles in real-world highway driving. Range will diminish significantly during towing, similar to how the F-150 Lightning's range drops substantially when hauling cargo. For local and regional driving, 200+ miles covers most daily use cases. For cross-country trips or heavy towing, the truck will require more frequent charging stops than gas trucks. Ford will likely offer different battery sizes at different price points, allowing customers to choose between maximum affordability ($30,000 base) and additional range at higher price tiers. The critical question is whether mainstream truck buyers accept that range reduction in exchange for zero emissions and low operating costs.

When will the truck actually be available for purchase?

Ford has announced 2027 as the production start date, which likely means the first vehicles arrive at dealerships in late 2026 or early 2027. Industry convention suggests pre-orders would begin in 2026, probably with initial allocations reserved for fleet customers and early adopters rather than open retail sales. Fleet customers (utilities, construction companies, delivery services) often provide initial volume for new vehicle platforms, which helps manufacturers validate production and supply chain. By 2028, wider availability to retail customers should emerge. By 2029-2030, if the truck is successful, inventory should normalize and customers can order with reasonable delivery timelines. The timeline assumes Ford maintains its current engineering schedule and manufacturing construction stays on track. Automotive projects frequently experience delays, so the 2027 date is aspirational rather than guaranteed. Any significant supply chain disruption, regulatory change, or manufacturing challenge could push production back.

How much money is Ford investing in this truck's development?

Ford hasn't disclosed specific development costs for the Universal EV Platform. However, the company has mentioned that it created an internal "skunkworks" several years ago dedicated to developing this platform, suggesting a multi-year, substantial investment. Industry analysts estimate that developing a completely new vehicle platform typically costs

What happens if the truck doesn't achieve the $30,000 price target?

If Ford can't hit

Will other automakers copy Ford's approach with their own affordable electric trucks?

Absolutely. Ford's engineering philosophy, emphasizing efficiency and simplified manufacturing, isn't proprietary. General Motors is developing similar platforms focused on affordability. Stellantis is exploring the market. Once Ford demonstrates that a $30,000 profitable electric truck is feasible, competitors will accelerate their own programs. The specific design details might differ, but the underlying principles will be adopted across the industry. Chinese automakers already embrace this philosophy, which is why BYD and other manufacturers can sell EVs at lower prices than American companies. The difference is that Ford, GM, and Stellantis have higher labor costs, more complex regulatory requirements, and legacy manufacturing infrastructure. If they can still compete on price by improving efficiency and simplifying manufacturing, the competitive landscape shifts fundamentally. Within three to five years, expect multiple affordable electric trucks from different manufacturers. That competition will drive prices lower and push the entire industry toward better efficiency.

Final Thoughts: The Inflection Point

Ford's $30,000 electric pickup represents an inflection point in EV adoption. The industry has spent years proving that electric vehicles work. Now it's proving they can be affordable for ordinary people. That's the transition from niche to mainstream.

The F-150 Lightning was a necessary failure. It taught Ford that you can't electrify existing trucks and expect mainstream acceptance if the price is $70,000. The Universal EV Platform is the lesson learned. Design for affordability from the start. Build efficiency into every component. Simplify manufacturing. Make trade-offs explicitly rather than accidentally.

The truck probably won't be perfect. It won't have the range of a gas truck. It won't have the power of a high-performance EV. It won't have all the creature comforts of a luxury truck. But it will be genuinely affordable, genuinely electric, and genuinely practical for ordinary customers.

That's the equation that changes the market. Not technology for its own sake. Not features that nobody needs. Just practical engineering that delivers real value at a fair price.

If Ford executes well, the 2027 electric truck could become as transformative as the original F-150 was in 1948. It could redefine what trucks are and how they're powered. It could accelerate EV adoption by a decade.

That's a lot riding on an engineering platform. But based on what Ford has already revealed, the company seems ready for the responsibility.

Key Takeaways

- Ford's 2027 electric pickup targets $30,000 by using smaller batteries and maximizing efficiency rather than adding features

- The truck achieves 15% better efficiency through aerodynamic design, lightweight materials, and simplified components

- Battery cost represents 40% of vehicle price, making smaller LFP battery packs critical to affordability

- Ford's manufacturing redesign uses 40% fewer workstations than traditional assembly lines, directly reducing production costs

- The Universal EV Platform represents a strategic shift from trying to electrify existing trucks to purpose-building efficient EVs from scratch

Related Articles

- Rivian's Software Partnership Saves the EV Maker: 2025 Analysis [2025]

- MG S5 vs MG4: Complete SUV Comparison & EV Alternatives [2025]

- 2026 Nissan Leaf Review: The Best Budget EV [2025]

- Rivian R2 Manual Door Release: Design Changes Explained [2025]

- Toyota's Fluorite Game Engine: Redefining In-Car Graphics [2025]

- Sodium-Ion Batteries for EVs: Why They're Cheaper Than Lithium [2025]

![Ford's $30,000 EV Pickup Truck Strategy: How Efficiency Replaces Battery Cost [2025]](https://tryrunable.com/blog/ford-s-30-000-ev-pickup-truck-strategy-how-efficiency-replac/image-1-1771346345182.jpg)