The Rise of Sodium-Ion Batteries in Electric Vehicles [2025]

For years, lithium-ion batteries ruled the electric vehicle world. They were the default choice, the technology everyone assumed would power the EV revolution forever. Then, in late 2024, something shifted. The world got its first mass-market electric vehicle powered by sodium-ion batteries, and it didn't arrive as some experimental prototype or limited beta. It came as a fully realized production vehicle, ready to compete with established EV models.

That car is the NIO Qin Plus DM-i, and its arrival marks a genuine turning point in battery technology. Not because sodium-ion batteries are revolutionary in terms of raw performance. They're not faster, not lighter, not more powerful than lithium batteries. But they beat lithium in one way that actually matters more to everyday people: cost.

This is the story of how sodium, a chemical element so common you probably have it in your kitchen salt shaker, became a legitimate competitor to lithium in the multi-trillion-dollar EV market. It's a story about economics, scaling, supply chains, and the unglamorous reality that the "best" technology often loses to the "most affordable" one.

Let's be honest: EV adoption is struggling in many markets, not because people don't want electric cars, but because they can't afford them. The average new EV costs roughly

Over the next 5 to 10 years, sodium-ion batteries won't replace lithium entirely. Instead, they'll exist alongside lithium, serving different market segments. Premium EVs will keep lithium batteries. Budget EVs will shift to sodium-ion. And that's perfectly fine, because the goal isn't technological supremacy. It's getting more people into electric vehicles, regardless of what's in the battery pack.

Let me walk you through exactly how this technology works, why it costs less, what the trade-offs are, and what it means for the future of electric vehicles.

TL; DR

- Sodium-ion batteries cost 20-30% less than lithium-ion due to cheaper raw materials and simpler manufacturing

- The NIO Qin Plus DM-i is the first production EV with sodium-ion batteries, proving the technology is viable at scale

- Key advantage: affordability, not performance (range and power are slightly lower than lithium)

- Supply chain resilience matters: Sodium is abundant globally, reducing geopolitical risk from lithium mining

- Bottom line: Sodium-ion batteries will democratize EV ownership by making entry-level electric cars genuinely affordable

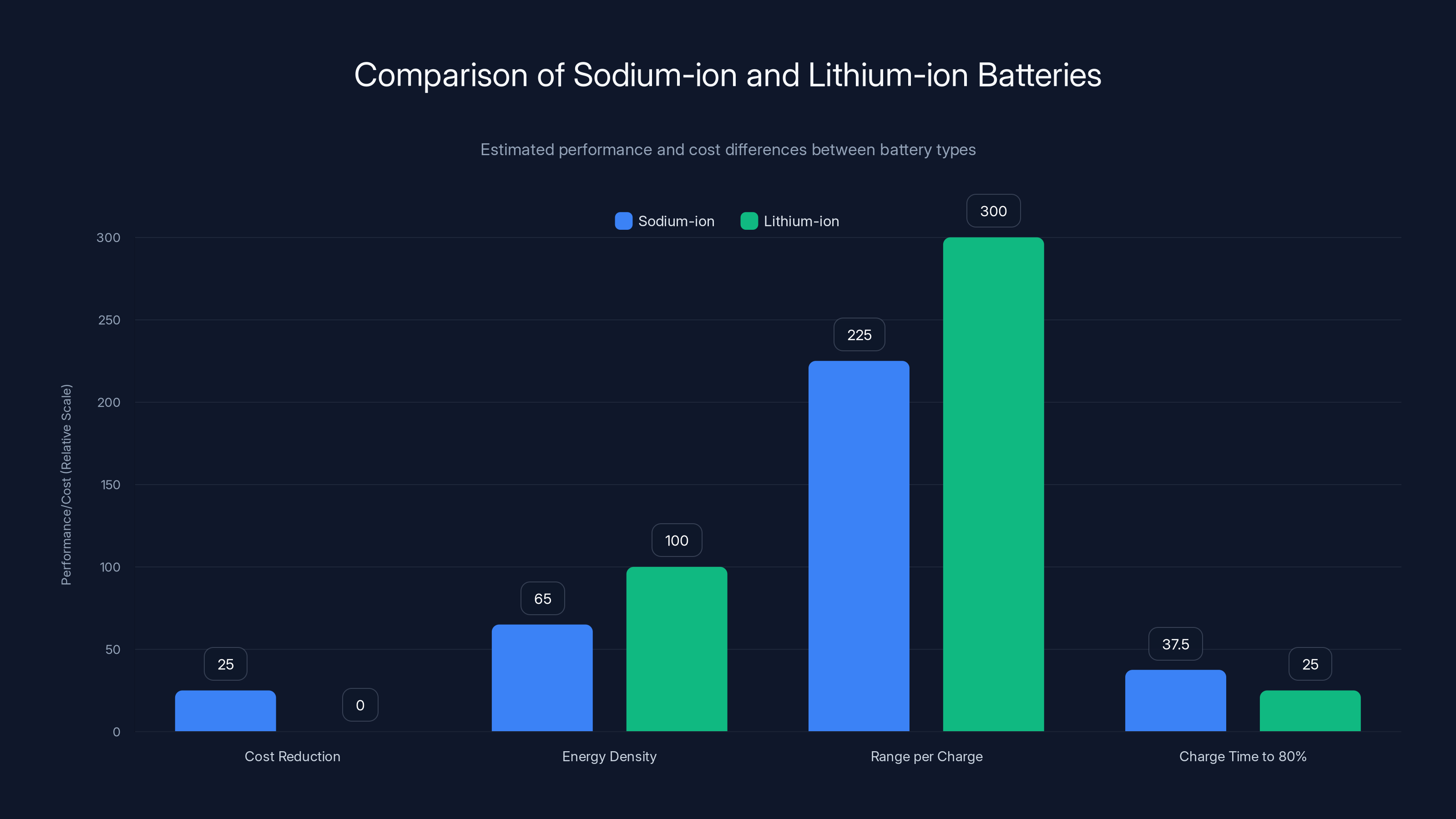

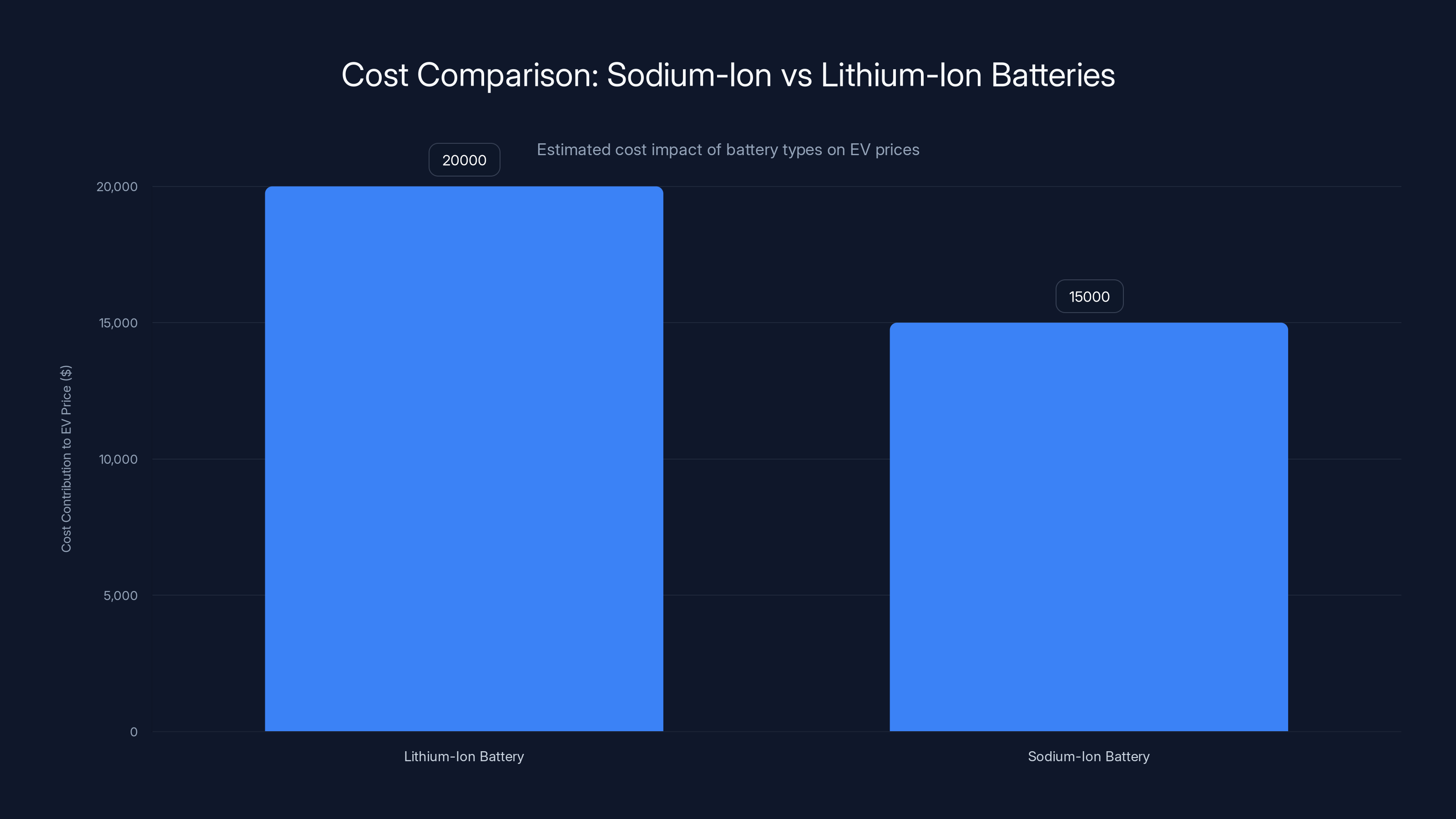

Sodium-ion batteries offer a 20-30% cost reduction but have 30-35% lower energy density and range compared to lithium-ion. They also take longer to charge to 80%. Estimated data.

Understanding Battery Chemistry: Lithium vs. Sodium

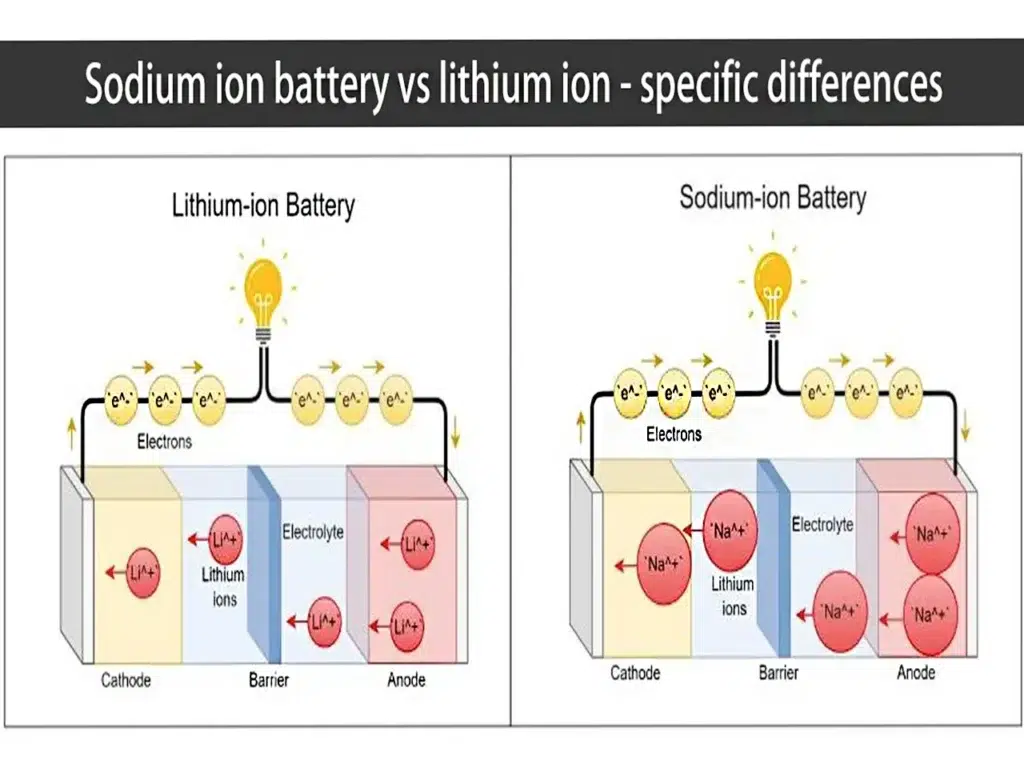

Before diving into sodium-ion batteries, you need to understand what makes lithium batteries special in the first place. A battery works by moving electrons from one terminal (anode) to another (cathode) through a chemical reaction. The faster and more efficiently you can move those electrons, the more power you get, and the longer the battery lasts.

Lithium is exceptionally good at this job. It's the third lightest element on the periodic table, has a very high energy density (meaning you can pack a lot of power into a small, light package), and handles charge and discharge cycles efficiently over hundreds of thousands of uses. For electric vehicles specifically, this means longer range per pound of battery, which is critical because every extra kilogram of battery weight reduces range and efficiency.

But lithium has a problem: it's not evenly distributed around the world. The top lithium producers are Chile, Australia, and China, which means the EV supply chain depends heavily on a few countries. Mining lithium is also expensive, energy-intensive, and environmentally contentious. In 2023 and 2024, lithium prices fluctuated wildly, creating uncertainty for automakers trying to forecast battery costs.

Now consider sodium. It's literally everywhere. Table salt is sodium chloride. Seawater contains dissolved sodium. It's the sixth most abundant element in the Earth's crust. The geopolitical advantage is obvious: no one controls the global sodium supply the way a handful of countries control lithium. From a mining perspective, sodium extraction is far simpler and cheaper.

Here's the chemistry: In a lithium-ion battery, lithium ions shuttle between the anode and cathode. In a sodium-ion battery, sodium ions do the same job. They're slightly larger atoms and heavier than lithium, which means less energy density per kilogram. But if the battery is bigger and heavier, that problem becomes negligible for many applications.

The trade-off is straightforward: sodium-ion batteries deliver slightly lower energy density (around 140-160 Wh/kg versus 200-250 Wh/kg for lithium-ion), meaning the same range requires a heavier, bulkier battery. For a compact sedan or budget EV, that's acceptable. For a high-performance sports car where every gram matters, it's not.

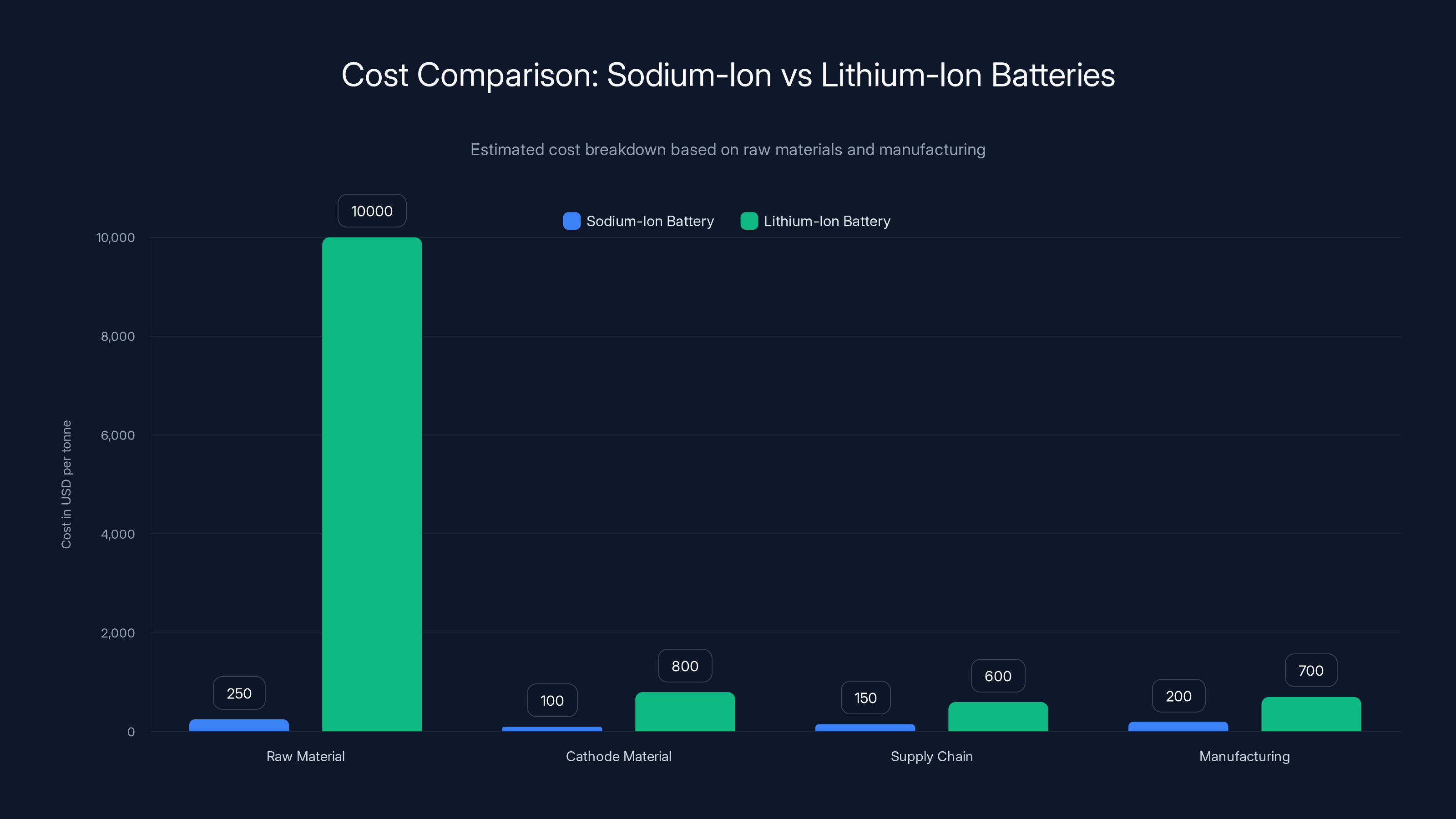

Sodium-ion batteries are significantly cheaper across all cost components, especially in raw material and cathode costs. Estimated data based on typical market conditions.

Why Sodium-Ion Batteries Cost 20-30% Less

Let's talk money, because that's what actually drives technology adoption. The National Renewable Energy Laboratory (NREL) has studied sodium-ion battery costs extensively, and the numbers tell a clear story.

First, raw material costs. Lithium carbonate (the refined form used in batteries) costs roughly

Second, the cathode material. Lithium batteries typically use nickel-cobalt-aluminum (NCA) or nickel-manganese-cobalt (NMC) cathodes, which require expensive refining and precise manufacturing. Sodium-ion batteries use iron-manganese-nickel (for better performance) or pure iron-manganese (for cost leadership). Iron and manganese are dirt cheap—iron is one of the most abundant elements, and manganese is inexpensive and widely available.

Third, the supply chain is simpler. Lithium refinement is capital-intensive and concentrated in a few regions. You have specific bottlenecks: lithium mining in Chile or Australia, conversion facilities in China, battery cell manufacturing in a limited number of global facilities. This concentration drives costs up and creates supply shortages. Sodium extraction and refining can happen almost anywhere, using well-established chemical processes. There's no bottleneck.

Fourth, manufacturing complexity. Lithium batteries require very strict thermal management and charging protocols because lithium's high reactivity means thermal runaway (fires) are a real risk if something goes wrong. Sodium-ion batteries are slightly more forgiving, allowing manufacturers to use simpler cooling systems and less sophisticated battery management electronics. That saves money.

Let me give you a concrete example. The NIO Qin Plus DM-i, equipped with a 44.9 k Wh sodium-ion battery pack, starts at around 145,800 Chinese Yuan (roughly $20,000 USD). Compare that to a comparable lithium-ion equipped EV from a different manufacturer, and you're looking at 20-30% higher pricing for similar range and performance. That gap is entirely battery-driven.

Industry estimates suggest sodium-ion battery packs will eventually cost

The NIO Qin Plus DM-i: First Production Vehicle with Sodium-Ion

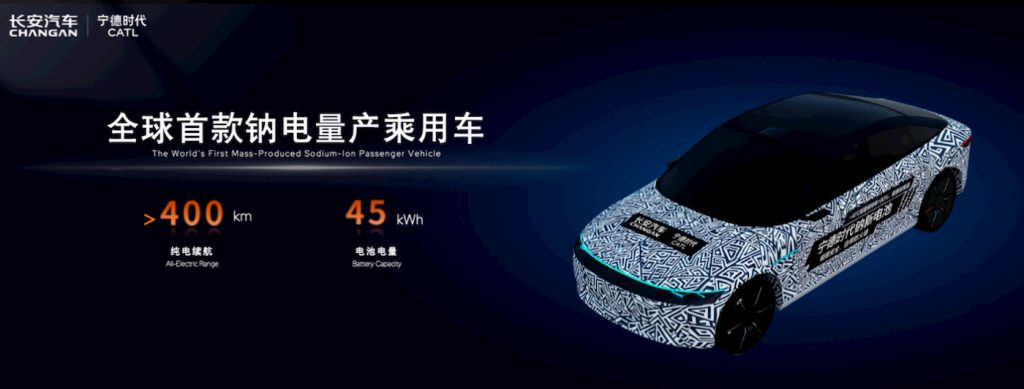

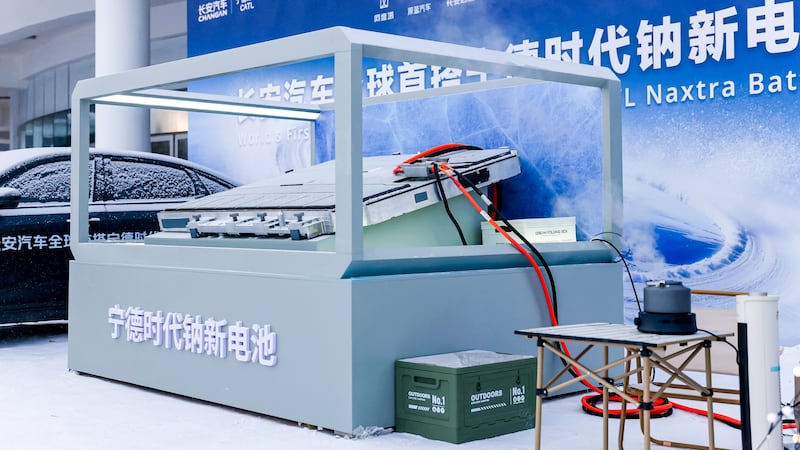

In September 2023, the Chinese automaker NIO unveiled the Qin Plus DM-i, a mid-size sedan with an available sodium-ion battery option. This wasn't a concept car or a limited trial. It went straight into mass production. Within months, tens of thousands were on the road in China.

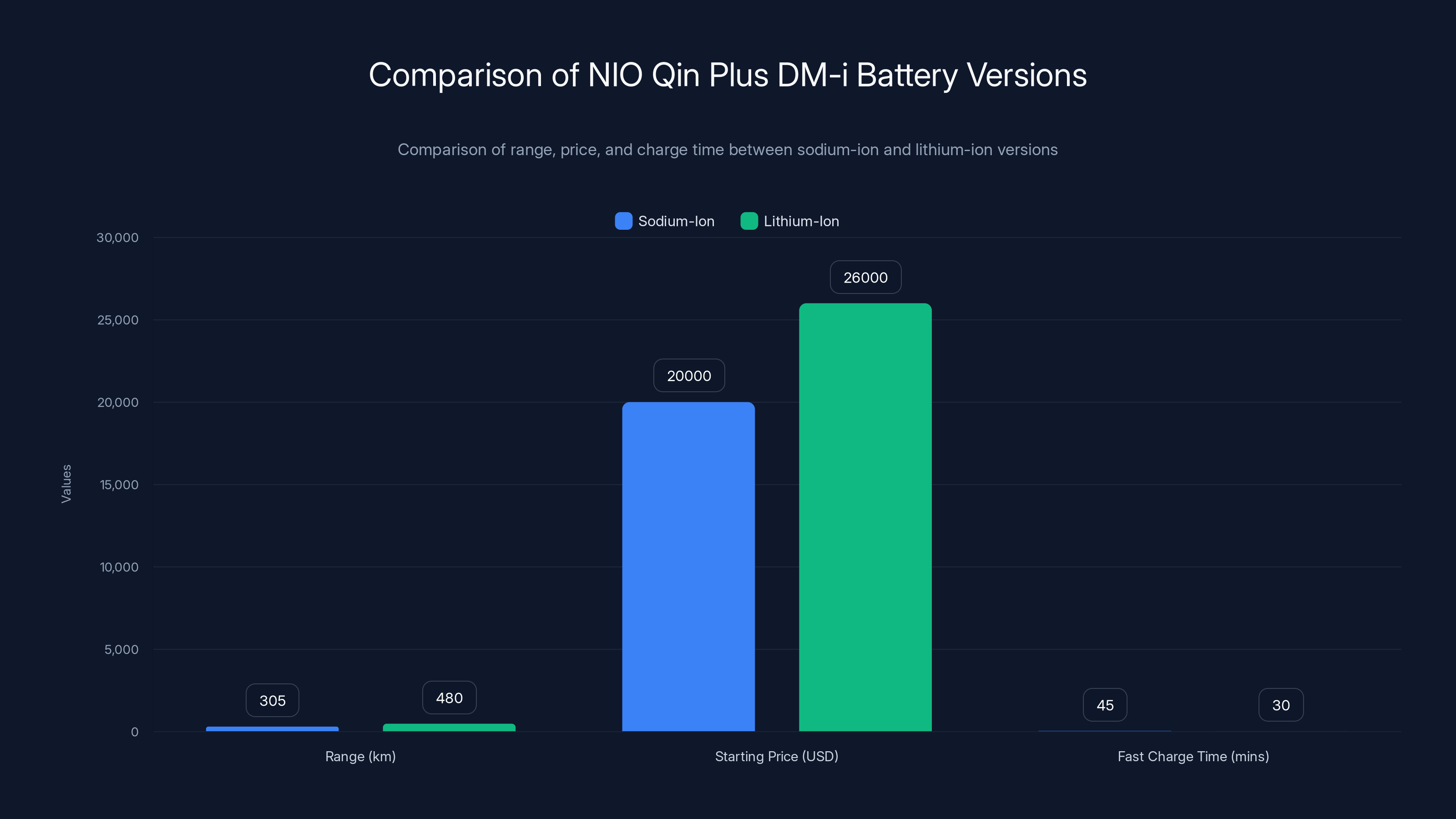

The Qin Plus DM-i comes in two variants: a 44.9 k Wh sodium-ion battery version and a traditional 55.4 k Wh lithium-ion version. The specs tell you everything about the trade-offs:

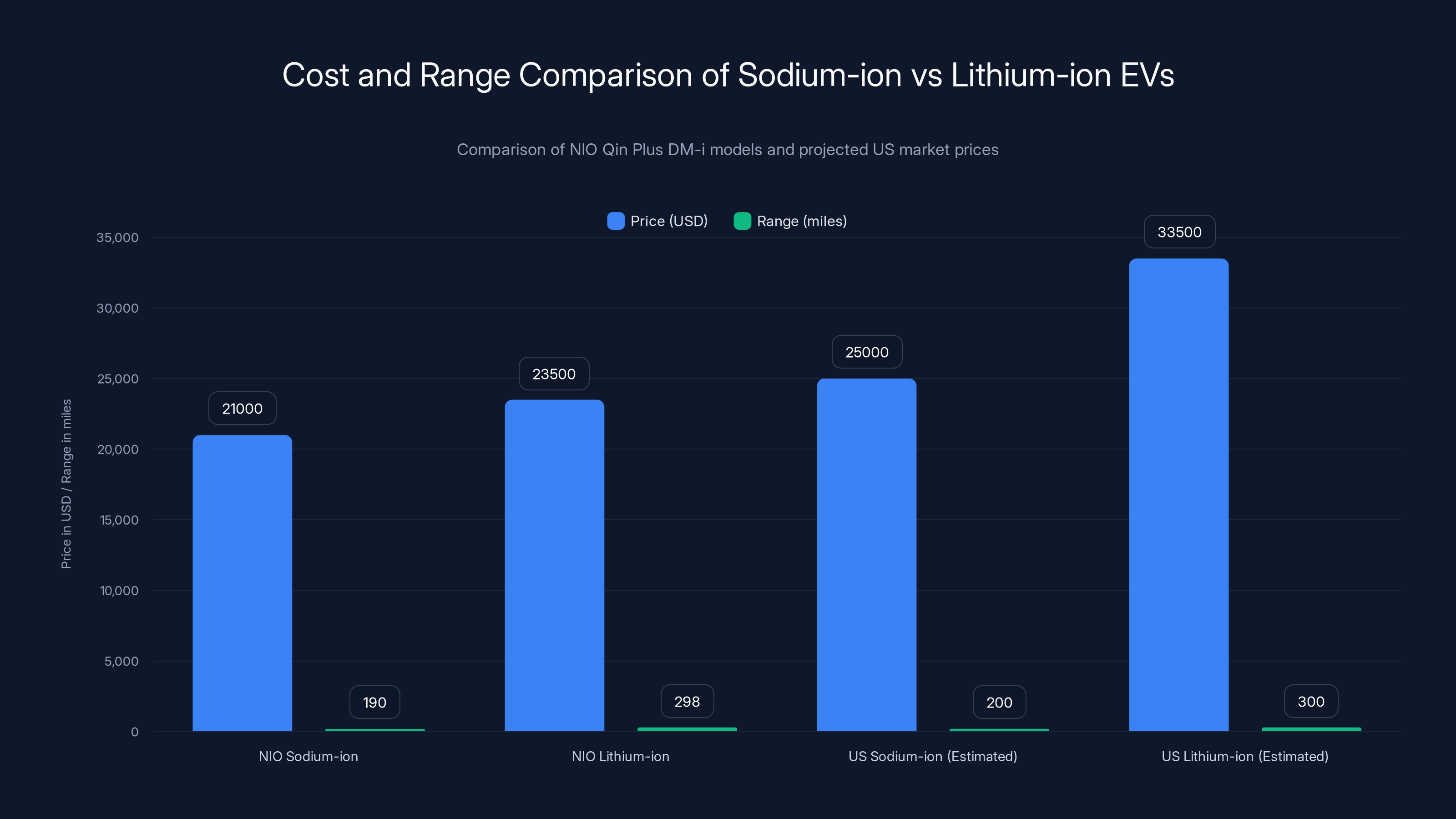

Sodium-ion version: 305 km (190 miles) EPA-equivalent range, starting price roughly

What's most important here is that NIO didn't market the sodium-ion version as experimental or limited. It's a standard offering available at dealerships right now. That's the real milestone. It proves sodium-ion batteries aren't theoretical—they're production-ready.

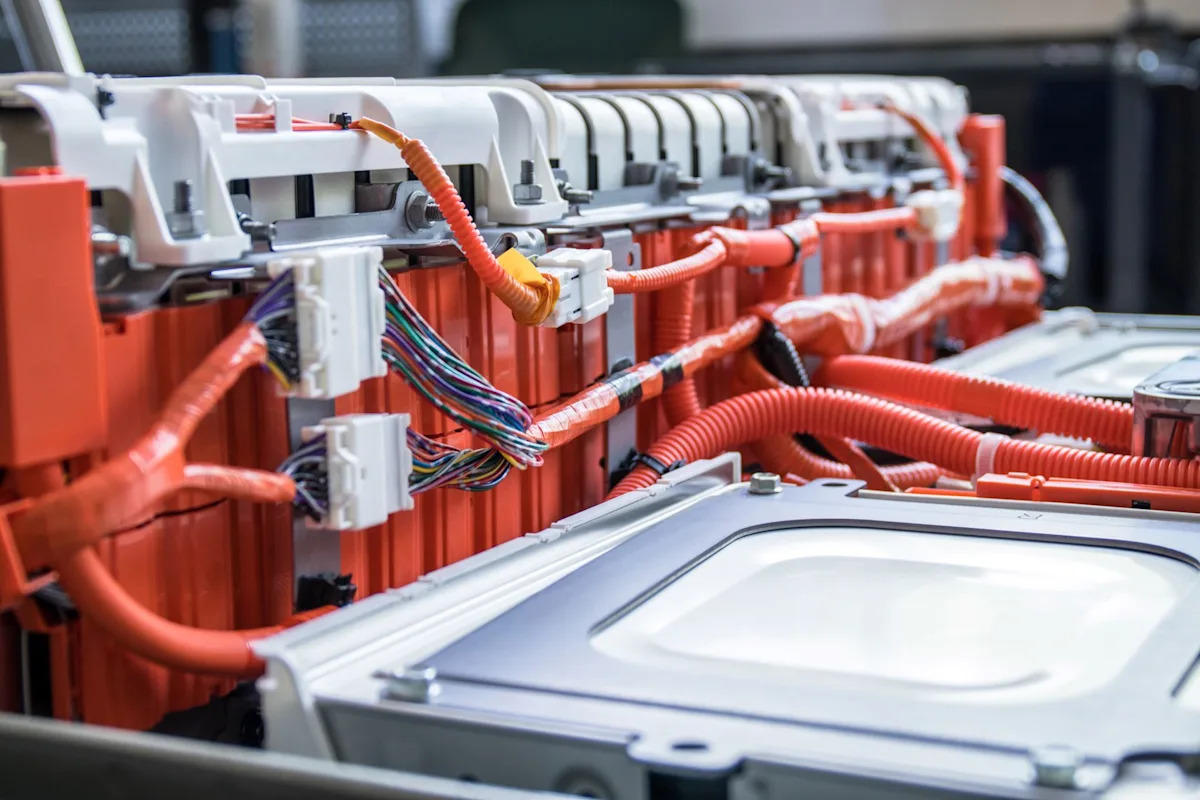

The battery itself comes from CATL (Contemporary Amperex Technology Co. Limited), the world's largest battery manufacturer by volume. CATL has been developing sodium-ion batteries for years and has already proven manufacturing expertise at massive scale. This isn't some startup company betting on unproven technology. This is the world's dominant battery maker saying: yes, we can make these cheaply, reliably, and in large volumes.

Charge time for the sodium-ion version is about 30-45 minutes to 80% capacity on a fast DC charger, and roughly 10-12 hours on a standard 120V home charger. Those speeds are comparable to older lithium-ion batteries but slower than the latest fast-charging lithium chemistries. Again, acceptable trade-offs for the price reduction.

Temperature performance is actually a strength for sodium-ion. They handle cold weather better than lithium batteries. In freezing temperatures, a lithium battery's capacity drops significantly; a sodium battery holds its performance better. For drivers in cold climates, this is a genuine advantage.

The sodium-ion model offers a lower price but also a shorter range compared to lithium-ion. In both markets, sodium-ion presents a cost-effective option for those prioritizing price over range. Estimated data for US market.

Energy Density: Where Sodium Falls Behind

Let's not oversell sodium-ion batteries. They have real limitations, and energy density is the big one.

Energy density is measured in watt-hours per kilogram (Wh/kg). Lithium-ion batteries achieve 200-250 Wh/kg in production vehicles. Current sodium-ion batteries achieve 140-160 Wh/kg. That's a meaningful gap—roughly 30-35% lower energy density.

What does that mean in practical terms? Imagine two batteries with identical energy capacity: 60 k Wh. A lithium pack might weigh 240 kg and fit in a 200-liter space. A sodium pack with the same capacity would weigh 350+ kg and require 290 liters of space. More weight means worse acceleration, longer braking distances, and less efficiency. More bulk means less interior space or a bigger, heavier vehicle.

For a compact sedan designed from the ground up with sodium-ion batteries, engineers can optimize around these constraints. They'll make the battery pack flatter to fit under the floor, use a lighter frame design to compensate for the extra weight, and accept slightly reduced acceleration.

But for a performance EV or a long-range sedan, sodium-ion simply won't work without massive compromises. You'd need a 120 k Wh sodium battery to match a 75 k Wh lithium battery's range, and that's not practical.

This is why the market segmentation makes sense: lithium for premium and performance, sodium for budget and mid-market. Both technologies coexist. Both have their place.

Research into improving sodium-ion energy density is ongoing. Lab tests have achieved 200+ Wh/kg using new cathode materials, but scaling that to production is years away. The good news: manufacturers don't need to hit lithium's energy density to make sodium-ion viable. They just need to be good enough, and at the right price.

The Thermal Management Advantage

Here's something counterintuitive: sodium-ion batteries might actually be safer than lithium batteries, thanks to different thermal properties.

Lithium-ion batteries are prone to thermal runaway—a cascade reaction where heat from one cell triggers overheating in adjacent cells, potentially causing a fire. This happens because lithium is incredibly reactive. If the electrolyte breaks down or a manufacturing defect creates an internal short circuit, the temperature spikes rapidly. Modern lithium batteries have sophisticated battery management systems (BMS) to prevent this, but the risk always exists.

Sodium-ion batteries don't have the same thermal runaway risk because sodium is less reactive. If something goes wrong inside the battery, it degrades gracefully rather than exploding. That means manufacturers can use simpler, less expensive thermal management systems: fewer cooling channels, less sophisticated monitoring electronics, smaller fuses and relays.

That's another cost advantage and a safety advantage. The Chinese government has been particularly focused on battery safety, so the fact that sodium-ion batteries are inherently more stable made them attractive for regulatory approval.

Temperature performance at the operational level is also better. In cold weather (below 0°C), lithium batteries lose 20-40% of their capacity because the chemical reactions slow down. Sodium-ion batteries are more tolerant of cold, losing only 10-15% of capacity in similar conditions. For drivers in Canada, Northern Europe, or the northern United States, this is a significant practical advantage.

At the high end (above 50°C), sodium-ion batteries also perform better. Lithium batteries degrade faster at elevated temperatures. Sodium batteries are more stable, which extends their usable lifespan in hot climates or when subjected to fast charging.

The sodium-ion version of the NIO Qin Plus DM-i offers a 35% lower range but is 20% cheaper than the lithium-ion version. Charge times are slightly longer for sodium-ion.

Supply Chain Resilience and Geopolitical Stability

This is the argument that actually gets policymakers excited about sodium-ion batteries. Let's zoom out from the individual consumer and look at the global scale.

Lithium production is concentrated. The "lithium triangle" of Chile, Argentina, and Bolivia controls roughly 60% of global reserves. Add Australia (which has massive reserves) and you're looking at 80% of world supply controlled by just four countries. China controls 60-70% of battery manufacturing capacity. That's a dangerous concentration.

When one country or company has that much control over a critical resource, you get supply disruptions and price spikes. In 2022, lithium prices quadrupled in a single year because supply couldn't keep up with EV demand. That uncertainty ripples through the entire industry: automakers can't forecast costs reliably, battery makers can't lock in margins, and consumers pay higher prices.

Sodium is different. It's globally distributed. Every country with an ocean has access to sodium (through seawater) and every country with salt deposits can extract it. The supply is stable, abundant, and fundamentally immune to any single nation's mining policies.

This matters strategically for developed nations outside the lithium-producing world. The United States, Europe, and India all view lithium supply chains as a vulnerability. Strategic dependency on China (which refines and processes lithium globally) is particularly concerning. Sodium-ion batteries offer a way to reduce that dependency. A country can build sodium-ion battery factories and supply its own batteries without relying on imported lithium or foreign battery manufacturers.

China understands this too. That's why state-owned enterprises like CATL have invested heavily in sodium-ion battery R&D. From China's perspective, reducing global reliance on lithium (which it mostly imports and refines) while growing its battery manufacturing dominance is a win. From everyone else's perspective, having a domestically producible battery technology reduces geopolitical risk.

It's not just about cost. It's about national energy security. And that's driving government support for sodium-ion technology globally.

Cycling Life and Longevity Expectations

People often ask: if sodium-ion batteries are different from lithium batteries, do they last as long? The answer is becoming clear from early data: yes, and in some conditions, better.

A typical lithium-ion battery retains 80% of its capacity after 500-1,000 charge cycles (roughly 5-8 years of normal use). Degradation accelerates after that, though the battery usually remains usable, just with reduced range.

Sodium-ion batteries show similar or slightly better longevity in early real-world testing. CATL claims their sodium-ion batteries retain 90% of capacity after 1,000 cycles. That's competitive with premium lithium-ion batteries.

Why? A few reasons. First, sodium ions are larger than lithium ions, so they diffuse through the electrolyte more slowly, putting less stress on the electrode structure during fast charging. Second, the battery chemistry is inherently more forgiving—there's less risk of irreversible side reactions that degrade the cathode. Third, sodium-ion batteries can tolerate deeper discharges (it's okay to run them all the way to 0% without damage), which gives you more usable capacity.

The catch: sodium batteries do degrade faster in very hot conditions (above 60°C) compared to some lithium chemistries. But for a car parked in a garage most of the time, that's not a real-world concern.

Based on current data and projections, a sodium-ion battery should last the life of the vehicle (10-15 years or 200,000+ miles) with minimal capacity loss. That's sufficient for most consumers. It's not better than the best lithium batteries, but it's good enough.

Estimated data shows sodium-ion batteries could reduce EV costs by $5,000 compared to lithium-ion, making EVs more affordable.

Real-World Range: What You Actually Get

Here's where the rubber meets the road, literally. In laboratory conditions, that 305 km (190-mile) range estimate for the NIO Qin Plus's sodium-ion variant sounds respectable. In the real world, you need to subtract 15-30% depending on driving conditions.

Heavy city traffic with lots of acceleration and braking? You might see 250-260 km of real-world range. Cold weather (below 5°C)? Still 270-280 km—sodium-ion batteries hold up better than lithium in cold. Highway driving at 70+ mph? 230-240 km. For an average city commuter with a 30-50 mile daily drive, charging at night, 250+ km of real-world range is more than sufficient. You'd charge once per night and go the entire week without plugging in during the day.

The range anxiety argument that dominated EV discussions five years ago is less relevant now. Most people don't drive more than 50-60 miles daily. A 200-km EV covers a week's worth of commuting. Weekend trips need a fast charger, but those are increasingly available in urban areas.

Where sodium-ion falls short is inter-city driving. If you frequently take 300+ mile road trips, a 190-mile range means frequent charging stops. A lithium-ion EV with 300+ mile range means you can do 300 miles and reach 80% charge before stopping. That's a meaningful difference for road trip performance.

But again: segmentation. Long-distance travelers should buy lithium-powered EVs. Daily commuters should buy sodium-ion if the price difference is 20-30%.

Manufacturing Scalability and Production Costs

Here's the behind-the-scenes reality: sodium-ion batteries are easier and cheaper to manufacture than lithium batteries, and that gap widens as production scales.

Lithium-ion battery production requires:

- Lithium refinement facilities (capital-intensive, require specialized chemicals)

- NCA or NMC cathode material synthesis (multi-step process, tight tolerance requirements)

- Dry coating or wet coating of cathode materials (requires specific equipment)

- Ultra-pure electrolyte preparation (contamination ruins batches)

- Extremely controlled assembly environment (dust particles break batteries)

- Sophisticated battery management systems (lithium-specific firmware)

Sodium-ion battery production requires:

- Sodium material sourcing (simple, abundant)

- Iron-manganese cathode synthesis (simpler chemistry, more forgiving)

- Standard electrode coating processes (same equipment as lithium, fewer precision requirements)

- Electrolyte preparation (less stringent purity requirements)

- Controlled assembly (still important, but less extreme than lithium)

- Simpler BMS (sodium batteries don't need as much sophistication)

The labor cost, equipment depreciation, and facility overhead are simply lower for sodium-ion. A factory that produces 100,000 sodium-ion battery packs per year has lower per-unit costs than a factory producing 100,000 lithium packs because the manufacturing steps are faster and fewer.

At 1 million units per year (the scale we'll see by 2027-2028), those advantages compound. Industry projections suggest sodium-ion pack costs will drop to

And as production scales, the cost advantage of sodium becomes more pronounced because the technology is simpler and the supply chain is shorter. Lithium costs money to extract and refine no matter what. Sodium is essentially free.

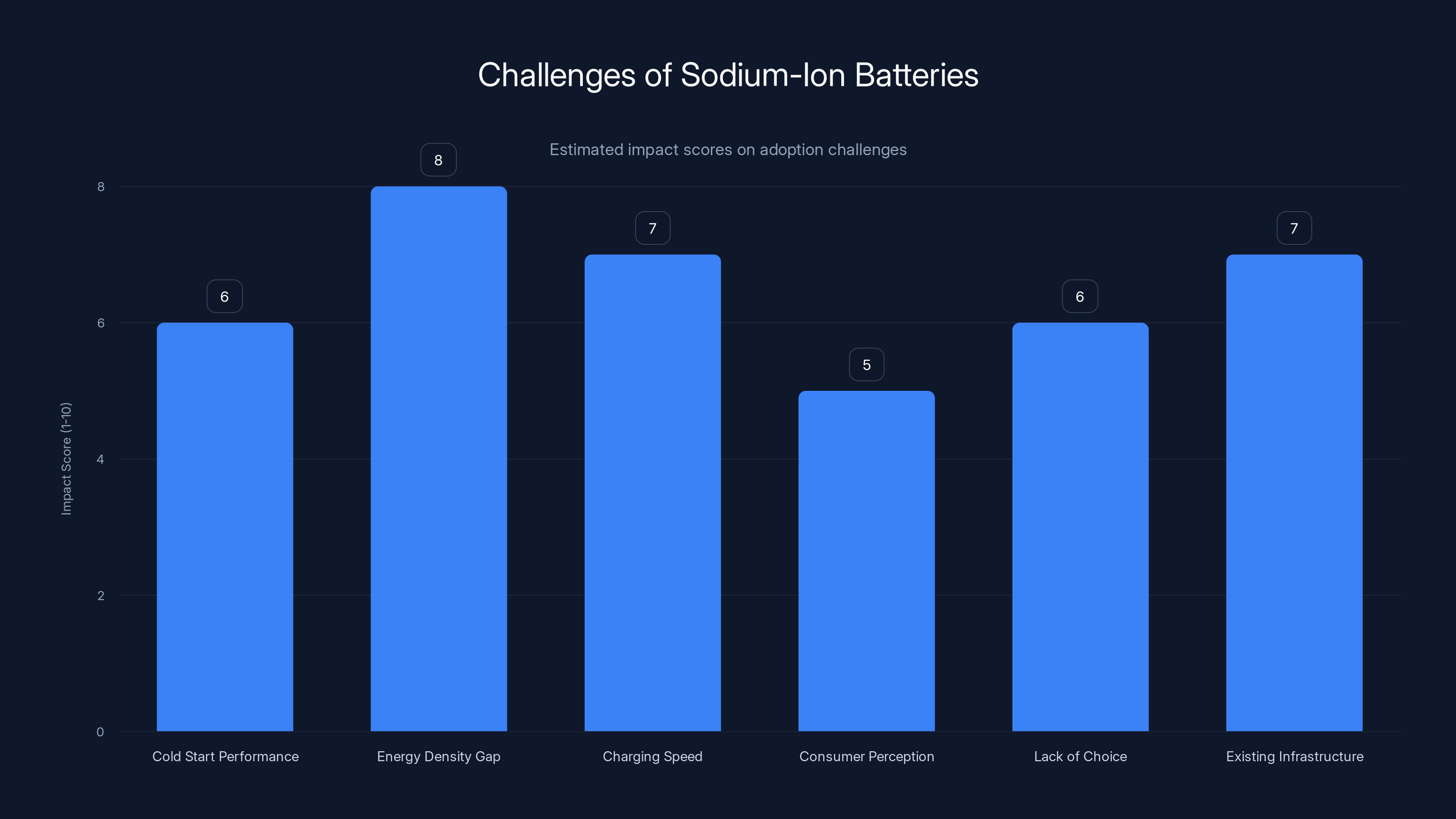

Energy density gap and charging speed are major challenges for sodium-ion battery adoption. Estimated data.

Environmental Impact: Extraction and Mining

Lithium mining is controversial. In Chile, lithium extraction from salt flats consumes massive amounts of water—40,000 gallons per ton of lithium produced. In a country where freshwater is scarce, that's environmentally damaging. Mining also creates toxic runoff that affects groundwater and agriculture.

Cobalt mining (used in many lithium cathodes) involves child labor concerns in the Democratic Republic of Congo and environmental damage from unregulated operations.

Sodium extraction is dramatically cleaner. If you extract sodium from seawater (via electrolysis), it's just taking salt from an effectively infinite source and using electricity to break it down into sodium. If you extract it from salt deposits, it's simple underground mining—less intensive than most mineral extraction.

Iron and manganese (used in sodium-ion cathodes) are abundant and have well-established, regulated mining operations in developed nations. Manganese mining has environmental impacts, but nothing like lithium or cobalt.

For consumers who care about environmental impact, sodium-ion batteries are the greener option. For manufacturers trying to source batteries responsibly, sodium-ion reduces risk of supply chain scandals or ethical issues.

This is particularly important for companies in Europe, where regulatory pressure around supply chain ethics is intense. The EU's proposed battery regulation requires transparency about sourcing and environmental impact. Sodium-ion batteries check those boxes more easily than lithium batteries.

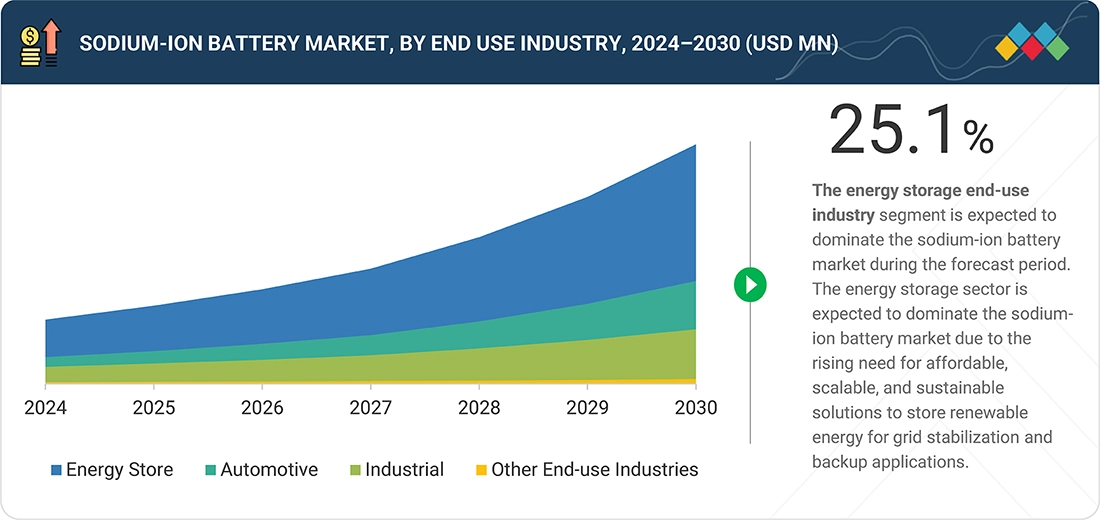

Market Predictions: When Sodium-Ion Goes Mainstream

Based on current trends, here's what the EV battery market will likely look like in 5-10 years:

By 2027-2028: Sodium-ion batteries will account for roughly 15-20% of global EV battery production. Chinese automakers will dominate sodium-ion vehicle production, with CATL and other Chinese battery makers controlling 80%+ of sodium battery output. Prices for sodium-ion equipped EVs will be 25-35% lower than comparable lithium-ion models.

By 2030-2032: Sodium-ion will reach 30-40% of global production as more manufacturers enter the market and costs continue dropping. European and American companies will finally launch mass-market sodium-ion EVs (they're behind on adoption). The technology will extend beyond budget vehicles into the mid-market segment.

By 2035+: Sodium-ion and lithium-ion will be roughly equal in market share, with clear segmentation by application. Budget EVs will be sodium-only. Premium and performance EVs will be lithium-only. Mass-market models will offer both options, letting consumers choose based on budget versus range/performance.

One wild card: battery swapping. If manufacturers like NIO expand battery-swapping networks (where you swap empty batteries for charged ones rather than charging), sodium-ion batteries become even more appealing because the customer never has to worry about range. They just swap batteries at stations, similar to refueling. That could accelerate sodium adoption dramatically.

Another wildcard: solid-state batteries. A few companies claim they'll have solid-state lithium batteries in production vehicles by 2025-2026. If that happens, it changes the game—solid-state batteries would have higher energy density than both current lithium and sodium options. But solid-state has been "five years away" for a decade, so skepticism is warranted.

Challenges and Limitations Sodium-Ion Still Faces

Let's be realistic about the problems. Sodium-ion batteries aren't perfect, and there are genuine challenges to widespread adoption:

Cold Start Performance: While sodium-ion handles cold weather better than lithium overall, they're still slower to warm up than lithium batteries in extremely cold conditions (below -20°C). This affects range in places like Canada and Scandinavia.

Energy Density Gap: The 30-35% lower energy density is real and non-negotiable with current chemistry. That limits applications. Long-range EVs simply won't use sodium-ion until new chemistries improve.

Charging Speed: Fast charging (0-80% in 20 minutes) is harder with sodium because the larger ions diffuse more slowly. It's possible, but it increases stress on the battery and reduces longevity. Most sodium-ion EVs will max out at 30-45 minute fast-charging times.

Consumer Perception: People don't understand sodium-ion batteries. They hear "sodium" and think of road salt damaging cars. Marketing will be crucial to overcome that perception.

Lack of Choice: Right now, sodium-ion EVs are only available in China. If you live in North America or Europe, you can't buy one even if you want to. That will change, but it takes time.

Existing Battery Infrastructure: Every fast-charging network, battery recycling facility, and battery swapping program is optimized for lithium-ion. Introducing sodium-ion means adapting all that infrastructure or building new infrastructure.

These are solvable problems, not insurmountable ones. But they're real, and they'll slow adoption.

What This Means for EV Buyers Right Now

If you're shopping for an EV today in the United States or Europe, sodium-ion batteries don't directly affect you. They're not available in your market yet.

But here's why you should care: sodium-ion batteries will accelerate EV adoption globally, which will drive down prices for everyone. As more manufacturers build cheaper EVs powered by sodium batteries, the entire market becomes more competitive. Lithium-ion EVs will need to drop prices to compete. That's good for consumers.

Second, the existence of a cheaper battery technology proves that ultra-expensive lithium batteries aren't inevitable. Battery costs will keep dropping. That

Third, if you're planning to buy an EV in 2-3 years and want the absolute lowest total cost of ownership, waiting for a sodium-ion option might make sense—if you can wait for availability outside China. Or, you could buy a discounted older lithium-ion model now that prices are dropping due to competition.

For long-term EV owners, sodium-ion batteries probably won't be relevant until you buy your next vehicle. But for EV companies planning their next generation, sodium-ion is now a strategic necessity.

The Future of Battery Chemistry Beyond Sodium and Lithium

Here's something important: the energy storage revolution doesn't stop with sodium-ion. Researchers are already working on next-generation chemistries that could be even better:

Potassium-ion batteries: Similar concept to sodium-ion but with potassium instead of sodium. Potassium is also abundant and might offer slightly better energy density than sodium. Still in lab phase, but promising.

Sodium-sulfur batteries: Different chemistry that could offer 50% higher energy density than current sodium-ion. Challenges include long-term stability and cycle life, but breakthroughs are coming.

Lithium-air batteries: A theoretical battery chemistry that could achieve 5-10x energy density of current lithium-ion. Would require huge technical breakthroughs and is at least 10 years away from production.

Solid-state batteries: Using a solid electrolyte instead of liquid allows for higher energy density and better safety. Multiple companies claim production vehicles by 2026-2027, though that timeline has slipped multiple times.

The point: battery technology is improving on multiple fronts. Sodium-ion isn't the end game. It's the practical near-term solution that will democratize EV ownership while researchers work on the next breakthrough.

Government Support and Global Strategy

Governments worldwide are quietly backing sodium-ion battery development as a strategic priority. Here's why:

China has made sodium-ion a stated goal in its 14th Five-Year Plan, directing funding to battery research and manufacturing. This isn't casual support—it's long-term strategic commitment.

The European Union is funding sodium-ion research through Horizon Europe and viewing it as a way to reduce lithium dependency. The EU's new battery regulations also favor sodium-ion because sourcing is cleaner and more ethical.

The United States, through the Department of Energy and ARPA-E, has funded sodium-ion research to reduce lithium supply chain vulnerability. It's not as aggressive as China's support, but it's real.

India is exploring sodium-ion as a way to build a domestic battery industry without importing expensive lithium.

This isn't just market forces. Governments see sodium-ion as a strategic asset because it:

- Reduces dependency on lithium-producing nations

- Supports domestic manufacturing

- Improves supply chain resilience

- Reduces environmental impact of mining

Government support accelerates development and reduces investment risk for companies. That's why the next 3-5 years will see rapid progress in sodium-ion manufacturing and deployment.

Cost Comparison: Real Numbers for Real Vehicles

Let me give you actual numbers to visualize the price difference:

NIO Qin Plus DM-i with 44.9 k Wh sodium-ion battery:

- Launch price: 145,800 Chinese Yuan (approximately 21,000 USD)

- Equivalent model with 55.4 k Wh lithium-ion battery: 169,800 CNY (approximately 24,000 USD)

- Price difference: 24,000 CNY (4,000 USD), or roughly 16% more for lithium

- Range difference: 305 km sodium-ion vs 480 km lithium-ion (36% more range for lithium)

- Cost per kilometer: 47.7 CNY/km sodium-ion vs 35.4 CNY/km lithium-ion

For everyday use where range needs are modest, the sodium option offers better value.

Let's project to the US market. Hypothetically, if a US manufacturer launches a sodium-ion EV with 200-mile range at

That's the real advantage. Not performance. Not range. Just price.

FAQ

What exactly is a sodium-ion battery?

A sodium-ion battery is an energy storage device that uses sodium ions (charged sodium atoms) instead of lithium ions to move electrical charge between terminals. The basic structure is similar to lithium-ion batteries with an anode, cathode, and electrolyte, but the chemistry and materials are different. Sodium-ion batteries cost 20-30% less than lithium-ion because sodium and the other materials needed are more abundant and cheaper.

How does a sodium-ion battery work compared to lithium?

Both battery types work by moving ions between the cathode and anode through an electrolyte, generating electrical current. Sodium ions are larger and heavier than lithium ions, so they move more slowly through the electrolyte, resulting in lower energy density (roughly 30-35% less power per kilogram). For an EV, this means a sodium-ion battery needs to be bigger and heavier to achieve the same range as a lithium-ion battery, but the total cost is still lower because the materials are cheaper.

What are the main benefits of sodium-ion batteries for electric vehicles?

The primary benefit is cost: sodium-ion batteries reduce EV prices by 20-30%, making electric vehicles accessible to more consumers. Secondary benefits include better cold-weather performance (sodium batteries maintain capacity better in freezing temperatures), improved safety (sodium is less prone to thermal runaway), and superior supply chain resilience (sodium is globally abundant, unlike lithium which is concentrated in a few countries).

What are the disadvantages of sodium-ion batteries?

The main disadvantage is lower energy density, which limits range to roughly 200-250 miles per charge instead of 300+ miles for comparable lithium-ion batteries. Sodium-ion batteries also charge more slowly at the top end, typically reaching 80% capacity in 30-45 minutes rather than 20-30 minutes for fast-charging lithium batteries. Additionally, they're currently only available in the Chinese market, and consumer familiarity is low.

When will sodium-ion batteries be available in the United States and Europe?

Based on current announcements, mainstream sodium-ion EVs should arrive in North American and European markets by 2026-2027. Chinese manufacturers like NIO will likely lead, followed by European and American automakers. Full market penetration with multiple models and price points will likely occur by 2028-2030.

How long do sodium-ion batteries last?

Early real-world data suggests sodium-ion batteries retain approximately 90% of their capacity after 1,000 charge cycles, which is comparable to premium lithium-ion batteries. This translates to roughly 8-10 years or 150,000-200,000 miles of useful lifespan before noticing significant range reduction. Sodium-ion batteries may actually last longer in certain conditions because they tolerate deeper discharges and cold weather better.

Are sodium-ion batteries safe?

Yes, sodium-ion batteries are generally considered as safe or safer than lithium-ion batteries because sodium is less reactive and doesn't exhibit the same thermal runaway risk. However, all batteries require proper management systems and careful manufacturing to ensure safe operation. Manufacturers like CATL have proven that sodium-ion batteries can meet the same safety standards as lithium-ion through rigorous testing.

Will sodium-ion batteries completely replace lithium-ion batteries?

Unlikely. The two technologies will coexist with clear market segmentation. Lithium-ion will remain the choice for premium and performance EVs where maximum range and acceleration are priorities. Sodium-ion will dominate the budget and entry-level markets where affordability and adequate range matter more than peak performance. Both technologies will improve over time.

How much will a sodium-ion EV cost compared to a gasoline car?

Based on current Chinese market pricing, a sodium-ion EV will likely cost

Can I charge a sodium-ion battery at a regular EV charger?

Yes. Sodium-ion batteries use the same charging connectors and protocols as current lithium-ion EVs (Tesla Supercharger, CCS, CHAde MO standards). Existing charging infrastructure will work with sodium-ion vehicles without modification, though some optimization may occur over time as the technology becomes more common.

The Bottom Line

The arrival of the NIO Qin Plus DM-i with a sodium-ion battery isn't just a minor product launch. It's validation that a cheaper, simpler, globally resilient battery chemistry can power electric vehicles at scale. It's proof that lithium dominance isn't inevitable—it's just the current favorite due to historical first-mover advantage and decades of optimization.

Over the next decade, sodium-ion batteries will quietly reshape the EV market. Not by replacing lithium entirely, but by democratizing access to electric vehicles. People who couldn't afford a

The global EV market has been constrained by high battery costs and limited supply chains. Sodium-ion removes both constraints. Add government support from China, Europe, and the US, plus the strategic advantage of supply chain independence, and you're looking at aggressive adoption through the late 2020s.

For consumers right now, the practical implication is this: if you've been waiting for EV prices to drop, you don't need to wait much longer. By 2026-2027, affordable sodium-ion options will exist. By 2030, they'll be commonplace. The decade-long struggle for EV affordability is finally reaching its conclusion, and sodium-ion batteries are the key.

The revolution won't feel dramatic because it's happening quietly, through cheaper battery chemistry and better manufacturing processes. But revolutions that reduce prices by 30% are the ones that change markets forever.

Key Takeaways

- Sodium-ion batteries cost 20-30% less than lithium-ion because sodium is abundant, widely available, and simpler to process

- The NIO Qin Plus DM-i proves sodium-ion technology is production-ready and commercially viable, not experimental

- Sodium-ion delivers 30-35% lower energy density, limiting range to 200-250 miles instead of 300+ for lithium, making it ideal for commuters and budget vehicles

- Sodium-ion batteries perform better in cold weather, handle thermal stress better, and are inherently safer than reactive lithium chemistry

- By 2030-2032, sodium-ion batteries will capture 30-40% of global EV battery production as prices drop further and manufacturing scales

- Supply chain resilience is a strategic advantage: sodium is globally distributed unlike lithium, which is concentrated in four countries

Related Articles

- Stellantis $26 Billion EV Writedown: What It Means for Auto Industry [2025]

- Digital Car Keys: The Future of Vehicle Access [2025]

- Apple CarPlay Third-Party AI Chatbots Integration [2025]

- Why America's $12B Mineral Stockpile Proves the Future Is Electric [2025]

- Is Tesla Still a Car Company? The EV Giant's Pivot to AI and Robotics [2025]

- Audi's Return to Analog Buttons: The Death of Touchscreen Dashboards [2025]

![Sodium-Ion Batteries for EVs: Why They're Cheaper Than Lithium [2025]](https://tryrunable.com/blog/sodium-ion-batteries-for-evs-why-they-re-cheaper-than-lithiu/image-1-1770647762252.jpg)