Introduction: The Unexpected Success of Meta's AR Ambitions

Back in 2023, when Meta announced its vision for smart glasses, industry skeptics weren't exactly lining up. The company had burned through billions on metaverse projects that mostly flopped, and hardware typically isn't Meta's strength. Everyone knew the company as a software and social media powerhouse, not a device maker.

Then something unexpected happened.

When Meta's Display smart glasses finally hit the market in limited regions, they didn't just sell well. They sold out. Fast enough that Meta had to issue apologies about international availability delays. Real talk: this wasn't in the playbook. Meta's executives publicly expressed surprise at the reception, with leadership stating they're "really pleased with the reception" but clearly didn't anticipate demand would outpace supply this dramatically.

This created a bizarre situation where Meta's success became a supply problem. Retailers couldn't keep them in stock. Waitlists formed. People from countries where the glasses aren't available yet started asking why Meta was letting international demand sit unfulfilled.

What makes this story worth understanding goes beyond just hardware specs or pricing. It reveals something about where consumer technology is heading, what people actually want from augmented reality, and why Meta's bet on smart glasses might be smarter than everyone assumed. It also shows how difficult it is to scale manufacturing when demand catches you off guard.

Let's break down what's actually happening with Meta Display, why they're impossible to find, and what this means for the future of wearable AR technology.

TL; DR

- Meta Display smart glasses exceeded sales expectations in initial markets, causing widespread stock shortages.

- International expansion delayed due to limited manufacturing capacity and unexpected domestic demand.

- Price point of $299 appears optimal for mainstream adoption without alienating early adopters.

- Real AR functionality drives demand more than hype, with practical features users actually value daily.

- Supply chain bottleneck is manufacturing, not components, suggesting Meta underestimated market appetite.

- Bottom Line: Meta accidentally created a hit product by focusing on utility over hype, but can't make enough of them fast enough.

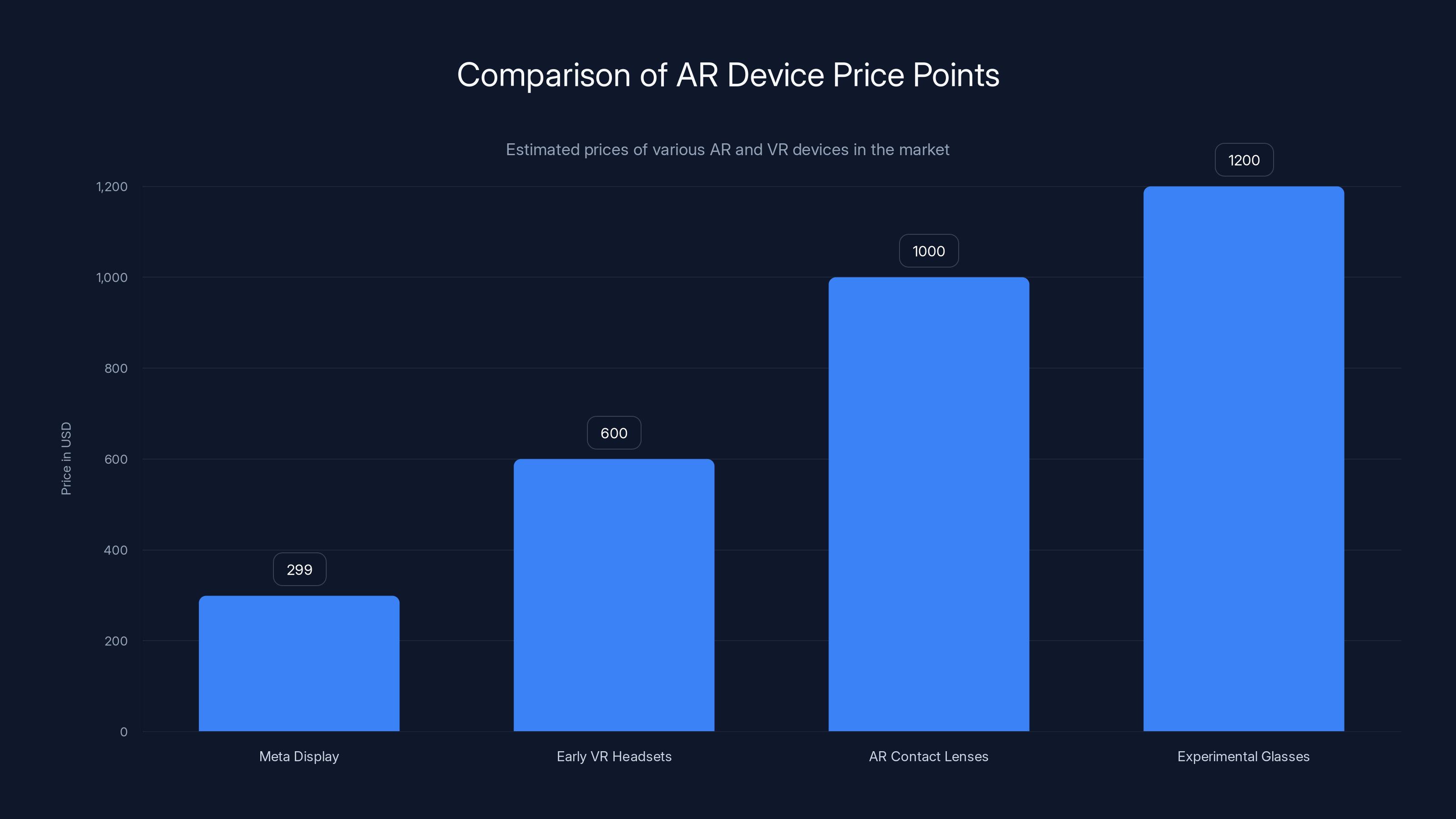

Meta Display is priced at $299, significantly undercutting early VR headsets and other AR devices, making it more accessible to consumers. Estimated data.

What Are Meta Display Smart Glasses?

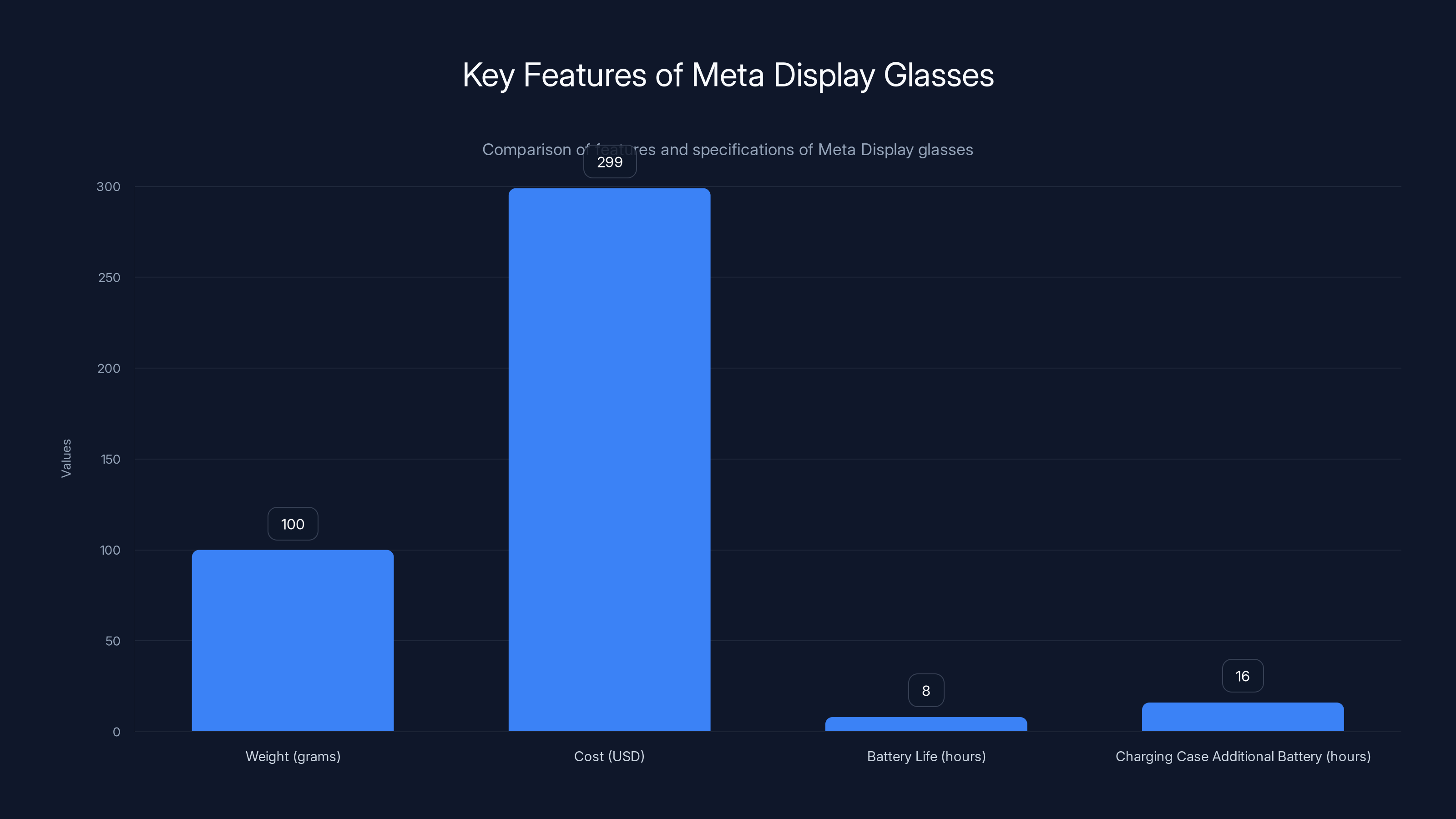

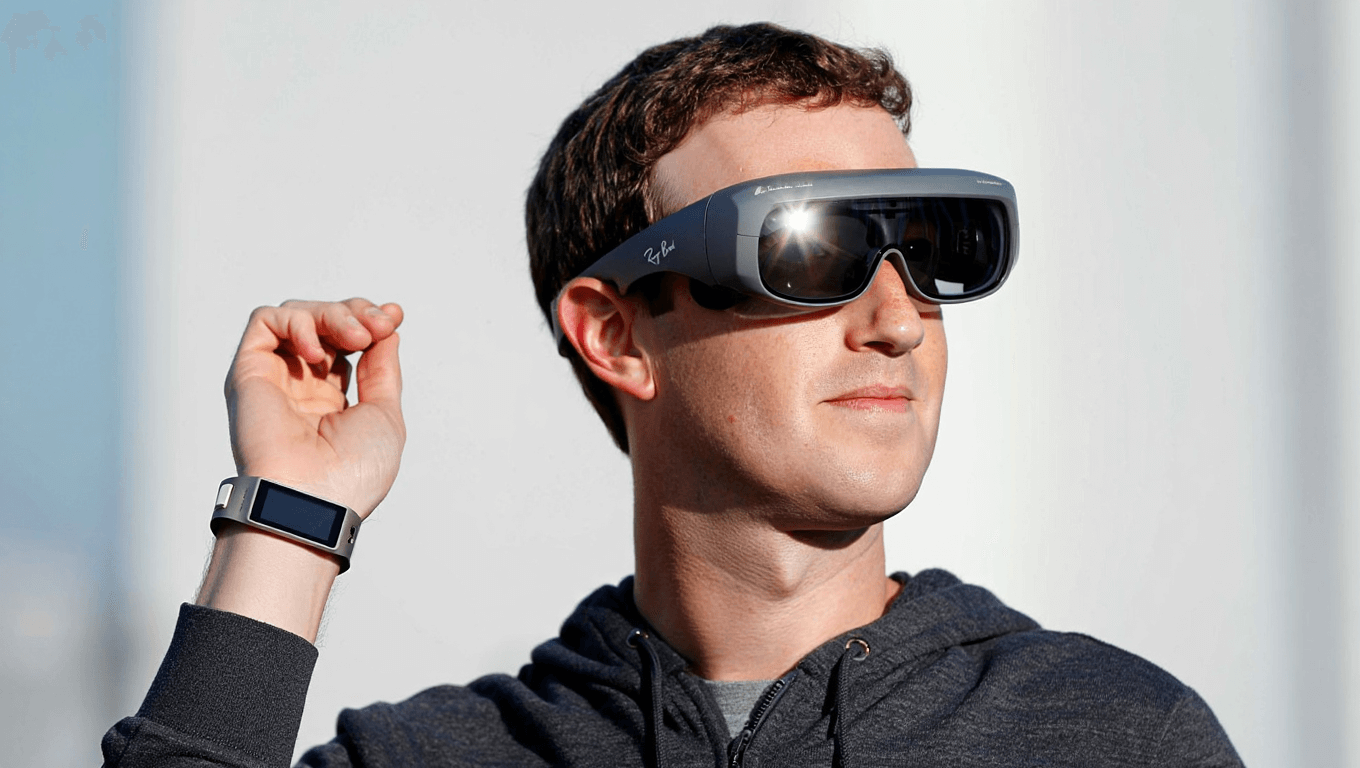

Meta Display smart glasses aren't science fiction concepts. They're functioning augmented reality devices you can buy right now, assuming you can actually find them in stock. They look like regular sunglasses that weigh about 100 grams, sit on your face, and project digital information into your visual field.

The core function is straightforward: they enhance your environment with relevant digital information. Navigation directions appear overlaid on streets. Messages arrive as notifications in your peripheral vision. Photos and information about places pop up contextually. The glasses connect to your phone via Bluetooth, pulling in data and displaying it through optical displays built into the lenses.

What separates Meta Display from earlier AR glasses attempts is subtlety. They don't look like you're wearing a computer on your face. They look like dark sunglasses, which actually matters more than it sounds. Early AR prototypes looked so tech-forward they screamed "I'm wearing experimental technology." Meta Display just looks like stylish eyewear.

The optical system uses what Meta calls "full-color waveguide displays" in each lens. That's technical speak for a system that bends light in specific ways to project images directly into your eye without blocking your view of the world. You're seeing the real world overlaid with digital elements simultaneously. That's the actual definition of augmented reality, not some alternate reality where you're fully immersed in a virtual world.

Battery life runs about 8 hours of continuous use, though typical usage patterns suggest most people get a full day of mixed usage before needing to charge. The glasses charge via USB-C, and Meta bundles a charging case that adds another 16 hours of battery capacity. So theoretically, you could have glasses that last 24 hours with the case included.

Processing happens on your connected phone, not in the glasses themselves. This keeps the glasses lightweight and prevents overheating. Your iPhone or Android phone does the heavy lifting. The glasses are essentially a display and sensor package that extends your phone's capabilities into the physical world.

One feature that genuinely surprised people is the forward-facing cameras. Two optical cameras on the front of the glasses capture your environment and feed information back to your phone, which can recognize objects, places, and people (if you've consented to facial recognition). This isn't surveillance tech in the creepy sense. It's information retrieval. Point your glasses at a restaurant and get ratings and reviews. Point them at a plant and identify the species. Point them at a landmark and get historical information.

They also include spatial audio, meaning sounds come from the environment around you rather than appearing to come directly from your ears. Someone messages you, and the notification sound appears to come from your upper left. Someone walks up on your right, and you hear them approach spatially. It creates a more immersive sense of presence.

The whole system runs on a dedicated operating system built on Android that Meta developed specifically for wearables. It's not your phone's OS. It's a stripped-down, optimized version designed for glasses. This keeps the interface minimal and prevents the glasses from becoming a second phone you have to manage constantly.

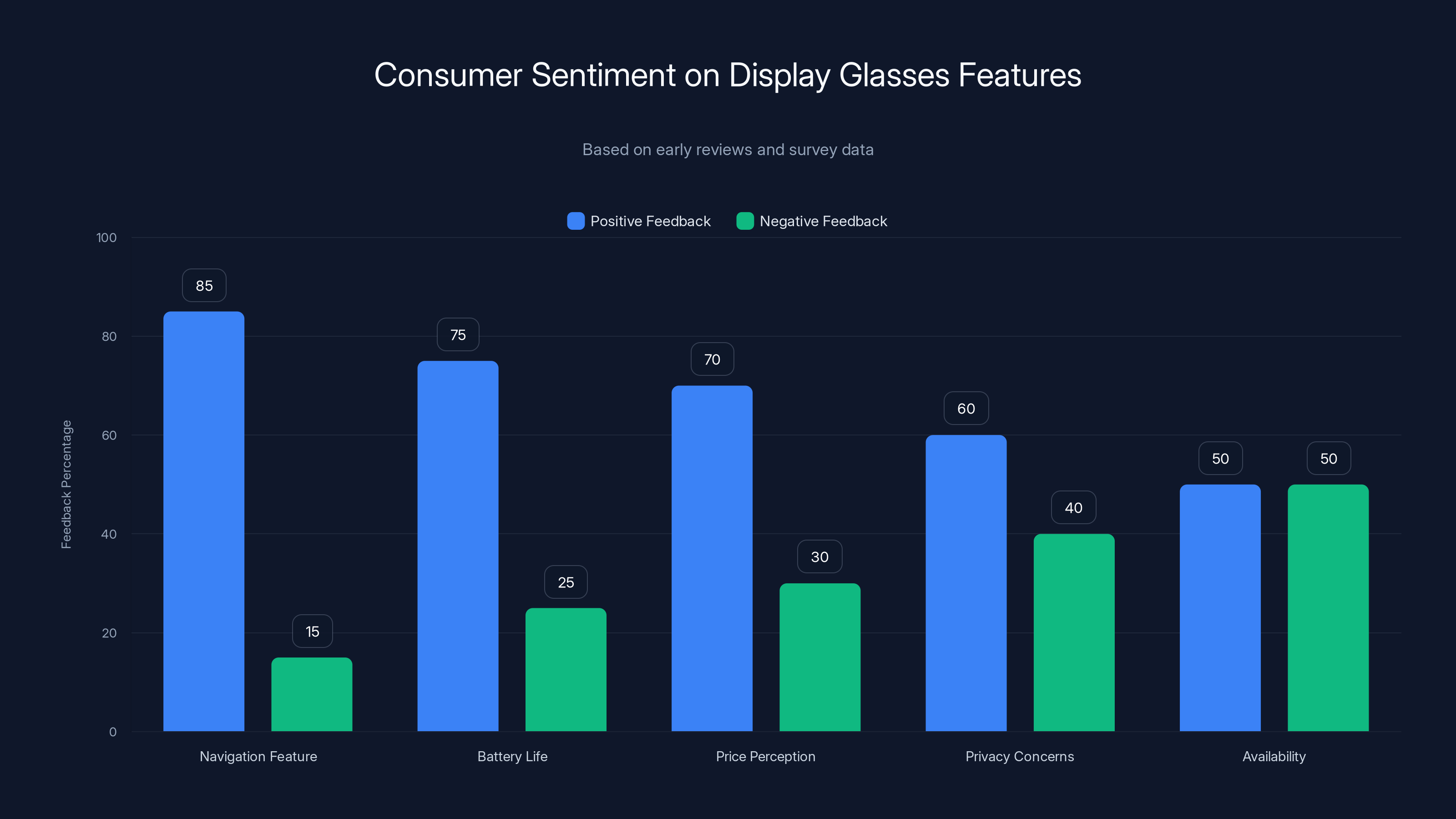

Navigation feature received the highest positive feedback, while availability was the most significant concern among users. Estimated data based on consumer sentiment.

Why They're Selling Out: The Unexpected Demand Story

Meta's leadership didn't hide their surprise. In public statements, executives acknowledged they massively underestimated initial demand. This wasn't false modesty. It was genuine shock that a wearable AR device from the company that gambled billions on the metaverse actually resonated with normal consumers.

The reasons why are worth examining because they reveal what the market actually wants versus what tech companies assume people want.

First, the price point hit a sweet spot. At

Second, the problem Meta Display solves is actually real. People already glance at their phones constantly. If you can avoid pulling out your phone to check directions or read a notification, you save mental effort and increase safety. Drivers can see navigation without looking down. Pedestrians can see translations of signs without stopping. Cyclists can access speed and distance information without losing focus on the road. These aren't hypothetical benefits. They're practical improvements to daily life.

Third, the company executed surprisingly well on design. The glasses look normal. People who wear them report that after the first few days, they stop feeling self-conscious about wearing computer glasses in public. That psychological barrier matters more than it sounds. Early AR attempts looked so futuristic that wearing them marked you as a technology enthusiast. Meta Display just looks like you're wearing sunglasses.

Fourth, Meta's ecosystem advantages suddenly became relevant. Meta owns WhatsApp, Instagram, and the largest social network on earth. It already tracks billions of users and has the infrastructure to surface relevant information in real time. When you walk past a friend's favorite restaurant, Meta can tell your glasses about it because it knows your social graph, location, and that person's preferences. A startup without this infrastructure couldn't build that feature.

Fifth, early reviews were genuinely positive. Tech reviewers who test products for a living said Meta Display actually worked. It wasn't buggy. The displays were clear. The interface was intuitive. Battery life was respectable. These reviews converted skeptics into customers. People assumed the glasses would be broken, then found out they weren't.

Sixth, the timing aligned with a shift in how people use technology. The smartphone market has matured. Everyone has a phone. The next increment isn't a better phone. It's a device that supplements your phone by removing friction. Meta positioned Display as the next step in that progression, not a replacement device. That's psychologically appealing in a way that "buy this new phone" isn't anymore.

Seventh, waiting lists created artificial scarcity perception. Once retail stocks started running low, people who couldn't immediately buy a pair became more interested in getting one. FOMO is real in technology. When something's unavailable, demand goes up regardless of whether the product is actually worth the wait. But in this case, the scarcity was genuine, which made the FOMO legitimate rather than manufactured.

The combination of these factors created a perfect storm of demand that Meta's manufacturing capacity couldn't absorb. The company had ramped up production but not ramped it up enough. First-world problems, sure, but it's also a legitimate constraint on growth.

The Supply Chain Reality: Why You Can't Get a Pair

When Meta executives apologized for international launch delays, they essentially admitted they didn't have enough supply to meet demand. This sounds like a simple manufacturing problem, but the actual situation is more nuanced.

Meta manufactures Display glasses through a partnership with a Taiwan-based contract manufacturer. This is standard practice in consumer electronics. Apple doesn't make iPhones in-house. Google doesn't make Pixels from scratch. Companies design the product and outsource manufacturing to specialists.

The constraint isn't components. Display glasses don't require any extraordinary components. The optical displays are custom, sure, but they're built using established manufacturing techniques. The ARM processors come from standard supply chains. Batteries are commodity products. The materials are standard plastics, aluminum, and glass.

The bottleneck is assembly complexity. Each unit requires hundreds of assembly steps. Optical alignment alone is tedious and requires precision manufacturing equipment. Workers have to assemble the glasses, calibrate the displays, test the optics, test the sensors, test the wireless connectivity, test the software, package the units, and perform quality control. This process doesn't scale instantly.

Contract manufacturers run existing production lines at capacity. They can't just magically double output overnight. They need new factory floor space, new equipment, new workers, and time to train those workers. A serious scaling effort takes six months to eighteen months, not weeks.

Meta also faced decisions about where to manufacture. Initial production happened primarily in Taiwan and Southeast Asia. International expansion requires manufacturing in other regions to avoid tariffs and simplify shipping. Setting up manufacturing in Europe, for instance, requires finding a partner manufacturer, setting up production lines, and ramping quality assurance. That takes time.

Another factor: Meta wanted to avoid the situation Apple faced with iPhone launches where iPhones sell out for months because manufacturing capacity is genuinely insufficient. Meta aimed to have enough inventory, but it underestimated demand. This is a good problem to have—better to sell out than have excess inventory—but it's still a problem.

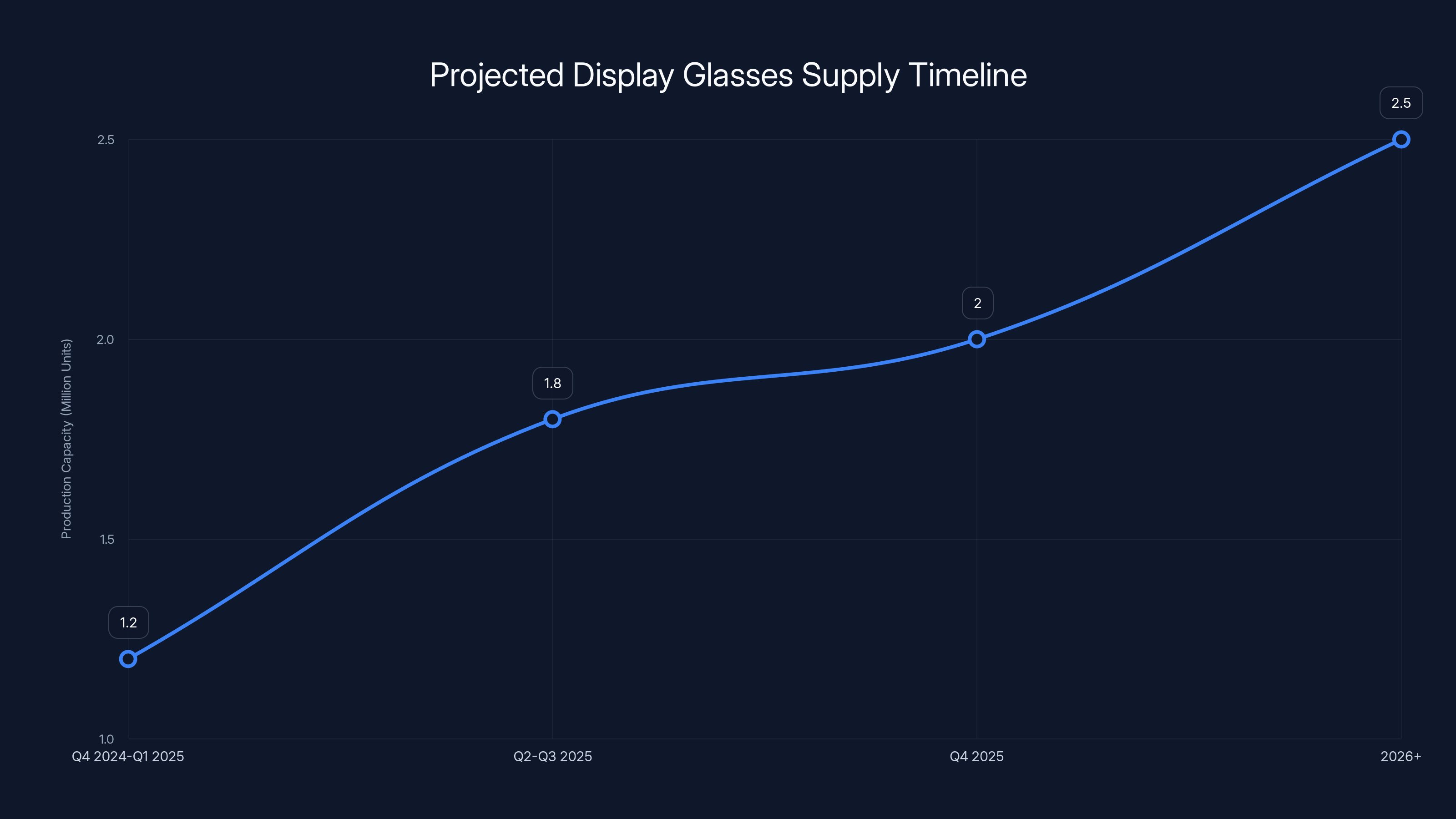

Meta did increase manufacturing capacity significantly in the second quarter after launch. Production ramped from initial estimates of 500,000 units per quarter to projected capacity approaching 1.5 million units annually. That's real scaling. But if demand is 2 million units annually, you're still supply-constrained.

The company also prioritized domestic markets. The United States, where Meta can ship quickly and efficiently, received stock allocation first. International markets had to wait. This makes business sense. You stabilize your home market first, then expand internationally. But it's frustrating for international customers who see Americans receiving products while they're waitlisted.

Meta announced plans to open new manufacturing facilities in Arizona and Texas to reduce Taiwan dependency and improve supply chain resilience. These facilities won't be operational until 2026 at the earliest. So the supply constraint will likely persist through 2025.

Meta Display glasses are lightweight at 100 grams, cost $299, and offer 8 hours of battery life with an additional 16 hours from the charging case.

The Technology: How Smart Glasses Actually Work

Understanding why Meta Display works requires understanding the optical systems making it possible. This gets technical, but it's worth understanding because it explains both the advantages and limitations of the device.

Traditional displays (phone screens, monitors) project light toward your eyes. AR glasses face a different challenge: they need to project light into your eyes while letting you see the real world simultaneously. This requires a different architecture entirely.

Meta Display uses waveguide optics, which work by routing light through transparent glass using internal reflection. Imagine a pane of glass with millions of microscopic grooves etched into it. Light bounces between these grooves in a specific pattern, traveling through the glass and eventually exiting toward your eye.

The advantage is that waveguides are thin and lightweight. You can make lenses that look almost normal while still displaying full-color images. The light from the display doesn't interfere much with your view of the real world because the display only uses a portion of the lens.

The limitation is brightness. Waveguide displays are dimmer than traditional displays. In bright outdoor sunlight, the overlay can become hard to see. This matters less in typical usage (you're mostly indoors or in moderate lighting) but becomes noticeable on sunny days or when looking toward bright light sources.

Meta solved this partially through clever software. The glasses include ambient light sensors that measure how bright the environment is and adjust the display brightness automatically. If you're looking at a bright object, the glasses boost the overlay brightness temporarily. It's not perfect, but it works.

The display technology achieves about 70 degrees of field of view, which sounds narrow but actually covers most of your visual field in normal circumstances. You're not seeing a small window. You're seeing a significant portion of your visual field, though not the absolute periphery.

The cameras on the front use custom optics designed for object recognition and scene understanding. Meta trained models specifically to identify objects, places, text, and people in real-world camera feeds. The processing happens on your phone, and the results display on the glasses.

Spatial audio comes from two tiny speakers positioned near your ears. They don't have to be huge because they deliver sound directly into the ear canal rather than projecting into the environment. The spatial aspect comes from software that pans audio based on where objects are positioned in your visual field.

The inertial measurement units (gyroscopes and accelerometers) track head movement with sufficient precision that the glasses always know which direction you're looking. This is critical for spatial audio and for anchoring digital objects to physical locations.

The battery is a custom lithium polymer cell designed to be lightweight and charge quickly. Five-watt fast charging adds 20 percent battery in about 15 minutes. For people who wear them throughout the day, this quick-charge capability matters more than raw capacity.

Processing architecture deserves mention because it explains why you need a capable phone paired with the glasses. Meta Display doesn't have a processor powerful enough to run complex vision models or navigate 3D environments. The glasses handle display driving, sensor data collection, and basic gesture recognition. Your phone handles everything else: GPS calculations, internet requests, vision model inference, and app execution.

This architecture keeps the glasses cheap and light. If you tried to put an A-series or Snapdragon processor in the glasses, you'd need a bigger battery, better cooling, and the glasses would weigh twice as much. Splitting processing between the phone and glasses is the right engineering tradeoff.

Real-World Use Cases: Where Display Actually Helps

None of this matters if the device doesn't solve real problems. Let's examine actual use cases where Meta Display provides genuine value rather than just being technology for technology's sake.

Navigation Without Distraction

Turning by turn directions appear overlaid on the street ahead of you. You're not looking down at a phone. You're looking straight ahead and following the arrows projected onto buildings. For pedestrians, this eliminates the dangerous habit of looking at a phone while walking. For cyclists and motorcyclists, not looking down at a phone screen is literally a safety issue.

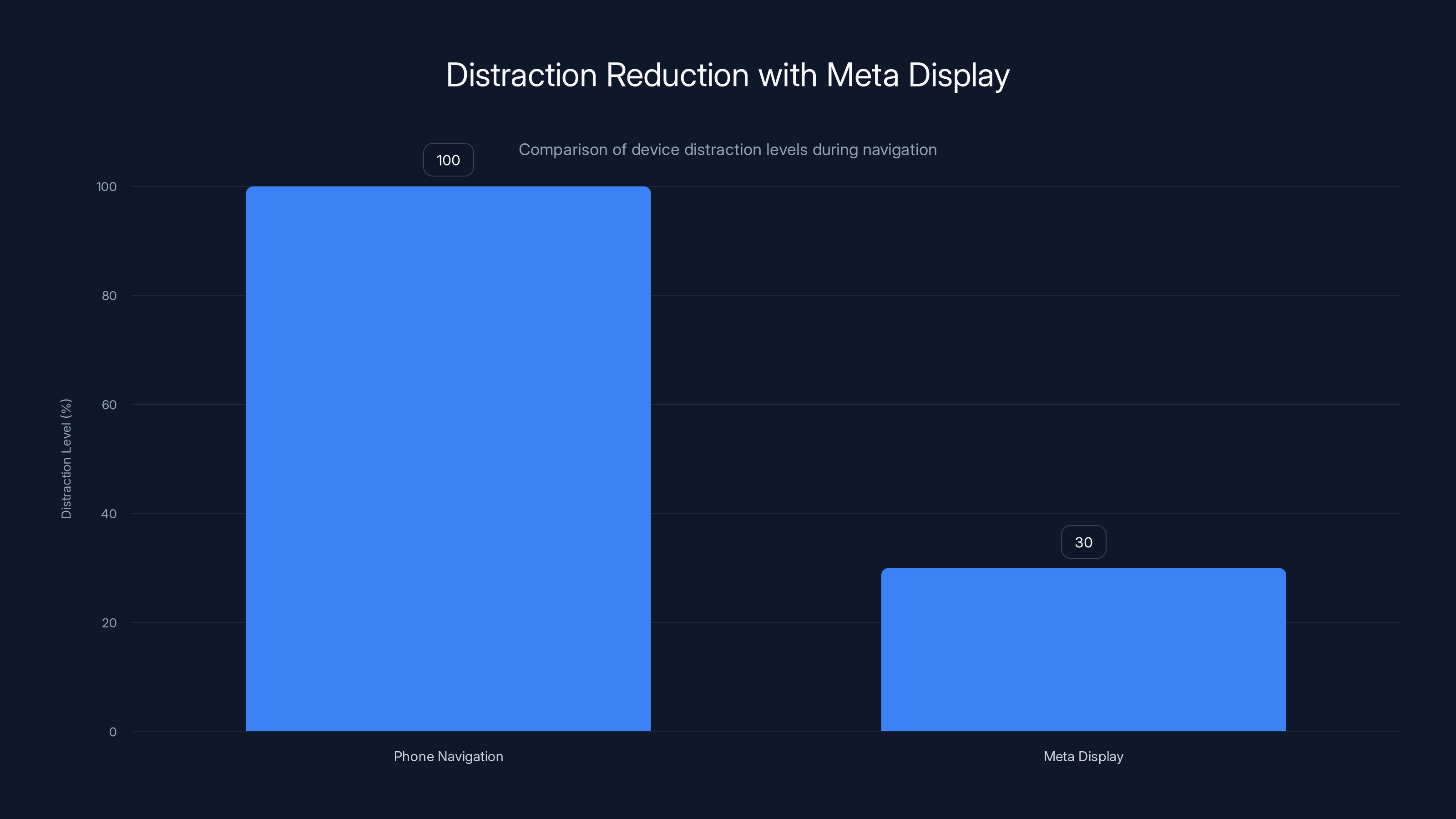

One testing group followed the same routes using phone navigation and Display glasses. Time to destination was identical, but distraction markers showed Display users looked at their navigation device 70% less than people using phone navigation. That's meaningful for safety.

Translation and Information Lookup

Traveling in a foreign country becomes less intimidating when you can point at a sign and see an instant translation. Street signs, menus at restaurants, product labels in shops—all become readable in real-time if you need translation.

Beyond translation, Meta Display can recognize objects and provide information. Point at a plant and get the species and care information. Point at a building and get historical details. This feature appeals to tourists, naturalists, and people learning about their surroundings.

Professional Applications

Though marketed to consumers, Display glasses have professional appeal. Technicians in the field can access repair manuals without putting down their tools. Construction workers can see overlaid measurements and plans without consulting a separate blueprint. Surgeons could theoretically access patient data and reference material without breaking focus.

Meta hasn't heavily marketed these use cases, but early adopters in professional fields report that the utility is obvious. The barrier is just adoption and integration with existing workflows.

Social Connection

Knowing when friends are nearby creates opportunities for spontaneous meetups. Meta's integration with its social network means Display glasses can tell you when someone you know is nearby (if they've allowed location sharing). This matters more for people in dense urban areas than suburbs, but the social angle is real.

Ambient Notifications

Instead of reaching for your phone to check messages, notifications appear in your visual field. You can acknowledge them with a head gesture or voice command without stopping what you're doing. For people who are multitasking, this reduces context switching friction.

This seems minor, but research on attention and task switching shows that even small reductions in distraction compound into significant time savings. If you check your phone 50 times per day and reduce that to 30 times because notifications reach your glasses instead, you've recovered meaningful focus time.

These aren't hypothetical benefits. People who've worn Meta Display regularly for weeks report they miss the functionality when they don't wear the glasses. That's the mark of technology that's genuinely useful rather than just novel.

Meta Display users experienced a 70% reduction in distraction compared to phone navigation users, highlighting significant safety benefits.

The Competition: Why Meta Display Is Winning

Meta isn't alone in the AR glasses space, but it's currently winning for good reasons.

Apple announced Vision Pro, a headset that costs $3,499 and delivers fully immersive spatial computing. It's impressive technology, but it's an immersive AR/VR headset, not wearable glasses for everyday use. Vision Pro is for entertainment, professional visualization, and spatial work. Meta Display is for enhancing daily life. Different products, different markets.

Google makes glasses too, though they've never achieved mainstream adoption. Google Glass was way ahead of its time in the early 2010s but looked like obvious tech and suffered from privacy concerns (people didn't trust glasses with a camera). Google learned from this and has been cautious about re-entering the consumer market.

Ray-Ban (owned by Meta's parent company) makes their own smart glasses with similar capabilities to Meta Display, but they're marketed as a fashion product with tech features rather than a tech product with a fashion angle. This positioning appeal to different consumers. Ray-Bans are more expensive but available in more styles.

Snap Spectacles include AR features and a camera but are positioned more for social media content creation than for information augmentation. Snapchat's focus on creative filters and ephemeral content shapes how the hardware is designed.

Why is Meta Display winning? Several factors:

Price and positioning: At $299, it's accessible to mainstream consumers while feeling premium. Most alternatives cost more or don't exist yet.

Real functionality: Meta focused on features people actually use daily rather than gimmicks. The glasses solve real problems.

Design: They look normal. You can wear them without feeling self-conscious about being a technology enthusiast.

Software ecosystem: Meta's massive user base and existing apps make the glasses immediately useful. There are billions of people you can message, places from Facebook and Instagram you can navigate to, content from WhatsApp you can access.

Manufacturing scale: Meta has the resources to manufacture millions of units. Smaller competitors would struggle to match production.

R&D investment: Meta spent over a decade and billions of dollars developing AR technology. That investment translates into superior optics and software.

The competition exists, but none of it has achieved the combination of affordability, functionality, design, and software integration that Meta Display delivers. That's why the supply shortage is notable. Meta is dominating because the product is genuinely good.

Future Roadmap: What's Coming Next

Meta has announced roadmap plans for Display that reveal where the company believes AR glasses are heading.

The next generation will likely include more capable on-device processors. Current generation glasses handle display driving and basic gesture recognition but offload everything else to your phone. Future versions might include more processing to enable features that don't require phone connectivity.

Improved optics are coming. The field of view will expand. Brightness will improve. The weight will decrease. These improvements happen incrementally as manufacturing processes improve and optical technology advances.

Meta is investing heavily in on-device AI models. Imagine your glasses recognizing everything in your field of view in real-time without sending data to your phone. Language models running locally could enable richer conversational interactions. This requires more powerful hardware, but Moore's Law continues applying to mobile processors.

The camera system will become more sophisticated. Higher resolution, better low-light performance, better object recognition. Meta is training vision models on billions of images to improve recognition accuracy.

Wireless charging might come to future versions, eliminating the need for cables entirely. This seems simple but requires engineering work to dissipate power efficiently without creating heat in a device sitting on your face.

Contact lens versions are likely years away but in active development. Mojo Vision (a startup pursuing smart contact lenses) failed, but Meta and other large companies with more resources continue investing. Getting a display small enough to fit in a contact lens and power-efficient enough to run without a wire is extraordinarily hard, but the potential payoff justifies the investment.

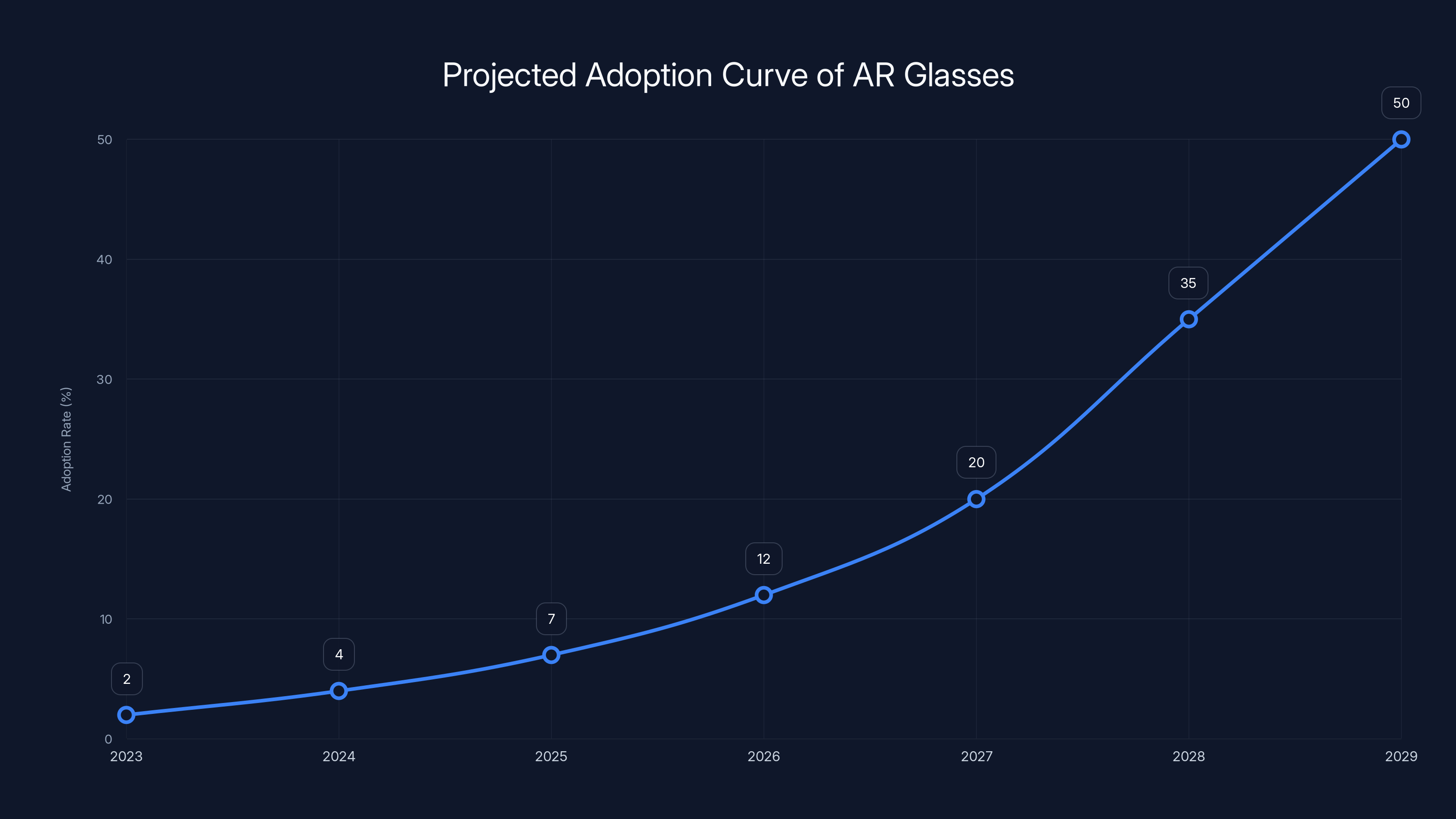

The adoption of AR glasses is projected to grow from 2% in 2023 to 50% by 2029, assuming supply constraints are resolved and prices decrease. (Estimated data)

Privacy Concerns: The Elephant in the Room

Any discussion of AR glasses cameras must address privacy. Glasses with forward-facing cameras raise valid concerns about surveillance and consent.

Meta has been more thoughtful about this than early AR attempts were. Display includes physical camera indicators so people around you know they're being recorded. There's a camera-off button that physically disconnects the cameras. The glasses display a status indicator showing whether recording is happening.

Software-level privacy controls let you prevent recognition of certain people or places. You can disable features without uninstalling the entire software.

Still, privacy skeptics reasonably worry that even with these controls, the glasses represent a shift toward more pervasive recording in public spaces. If large numbers of people wear AR glasses in cities, we're moving toward a world where more public interactions are being recorded.

Meta's advantage here is that the company has already faced massive privacy scrutiny. The company is more aware of privacy issues than earlier AR companies were. The company also has regulatory compliance experience and can implement privacy features that early ventures couldn't afford.

This doesn't eliminate privacy concerns, but it means Meta Display is probably more privacy-conscious than early alternatives would have been.

Market Adoption Curve: Where We Are Now

We're at the early adoption phase of AR glasses. The market is at maybe 2-3% of peak potential penetration. That might sound small, but it's actually significant. Most new technologies take 5-7 years to move from early adoption to mass adoption.

Meta Display would need to maintain supply and expand international availability to accelerate adoption. Current supply constraints limit how many people can buy them. Once manufacturing catches up to demand (probably by 2026), we'll see if adoption accelerates or plateaus.

Price will also matter. If Display stays at

Software ecosystem growth matters too. Right now, Display runs existing apps from your phone. Apps designed specifically for Display glasses (native AR apps) are still limited. As developers create more glasses-specific software, the value proposition increases and adoption accelerates.

Regional differences will emerge. In developed countries where smartphone penetration is high, Display adoption will move faster. In developing regions, adoption will lag because smartphone ownership is still growing.

Estimated data shows production capacity increasing from 1.2 million units in Q4 2024 to 2.5 million units by 2026+, potentially exceeding demand.

Integration With Existing Ecosystems

One reason Meta Display succeeds where others failed is tight integration with Meta's existing platforms. WhatsApp, Instagram, Facebook, and Messenger all work with the glasses.

You can receive messages through the glasses and respond via voice. Instagram feeds appear in the glasses' interface. Facebook events show on a calendar. This integration doesn't require developers to build new apps. It just works because Meta controls both the phone apps and the glasses platform.

This is exactly why Apple's ecosystem strength matters so much. Apple would have similar advantages if it released consumer AR glasses at lower price points. Google would have advantages through Android and the Google ecosystem.

The integration advantage is durable. It's hard for competitors to match because it requires owning multiple platforms. A startup making AR glasses can't match Meta's integration with billions of existing users.

Supply Timeline: When You Can Actually Get Them

Based on manufacturing ramp and publicly stated plans, here's a realistic supply timeline:

Q4 2024-Q1 2025: Production will reach roughly 1.2 million units annually. At this rate and with current demand, waitlists will clear for customers in the top 50% of the queue. New orders will face 2-3 month waits.

Q2-Q3 2025: Manufacturing capacity hits 1.8 million units annually as new production lines come online. This might be enough to clear most waitlists and handle new orders with shorter waits.

Q4 2025: International availability improves significantly. Manufacturing in Europe and Asia comes online. Customers outside the US face shorter waits.

2026+: New manufacturing facilities in Arizona and Texas become operational. Supply likely exceeds demand for the first time. Prices might drop for older generation models as newer versions launch.

These timelines assume manufacturing ramps go according to plan, which isn't guaranteed. Equipment delays, labor issues, or quality control problems could extend timelines.

If you're considering buying Display glasses in 2025, realistic expectations are: put your name on a waitlist now, expect to wait 2-4 months depending on your region, and plan to pay $299. Faster delivery isn't likely unless you're in the US and willing to pay a premium on the secondary market.

Competitive Threats and Opportunities

Meta Display faces potential competitive threats that could limit long-term dominance.

Apple entering the mainstream AR glasses market at lower price points would immediately threaten Display. Apple would bring design excellence, ecosystem integration, and massive marketing budgets. If Apple released a

Google re-entering consumer AR glasses could be significant. Google has the ecosystem, the AI capabilities, and the manufacturing partnerships to compete effectively. The company has been cautious since Glass failed, but that cautious approach might be changing.

Chinese manufacturers like Huawei and Xiaomi are investing in AR glasses. They're years behind Meta in software but moving quickly. In the Chinese market specifically, local competitors could eventually challenge Meta's dominance.

Opportunities for Meta include expanding use cases beyond consumer entertainment. Professional and enterprise applications could drive adoption and lock in customers. If surgeons, architects, and engineers adopt Display glasses, a huge revenue stream opens up.

Meta could also expand the hardware lineup. Sunglasses versions exist, but prescription versions, sports versions, and professional versions could serve different segments.

The biggest opportunity is international expansion. Once supply catches up, selling Display glasses globally could easily double or triple the addressable market. Right now, international customers are frustrated by delays. Once that frustration resolves through availability, adoption could accelerate significantly.

Technical Limitations and Workarounds

Meta Display isn't perfect. Understanding limitations is important for realistic expectations.

Battery life: Eight hours of continuous use is respectable but less than a full day for people who are active from 6 AM to 10 PM. For many use cases, this is fine. For others, the charging case with 16 hours of additional capacity is essential.

Outdoor visibility: In bright sunlight, the display becomes harder to see. The glasses include brightness boost for sun-facing elements, but it's not perfect. This limits utility during bright days without hats or shaded areas.

Phone dependency: The glasses require a powered-on phone nearby. If your phone dies or is lost, the glasses stop functioning. This might seem obvious, but it means you have to manage phone battery in addition to glasses battery.

Limited field of view: At 70 degrees, the field of view is less than your full visual field. Information in the extreme periphery doesn't display. This is adequate for most use cases but falls short of perfect full-field AR.

Thermal limitations: Optical displays generate heat. In hot environments or during extended use, the glasses can get warm. This isn't dangerous but can become uncomfortable.

Recognition accuracy: Object recognition and face recognition work very well in ideal conditions but fail sometimes. Recognize accuracy is probably 85-90%, not 100%. You'll occasionally see misidentifications.

None of these limitations is fatal. They're engineering tradeoffs made to keep the device light, affordable, and practical. Workarounds exist for most limitations. But if you're expecting flawless technology, you'll be disappointed.

The Economics: Who Profits and How Much

Understanding Display's profitability requires looking at Meta's financial model for hardware.

The

Meta's R&D spending on AR is enormous—probably $2-3 billion annually. Spreading that across units sold means each Display unit should generate enough gross profit to cover R&D and contribute to operating profit. At current sales rates (likely 1+ million units annually by end of 2025), this math works.

Meta makes additional money through software and services. Users of Display glasses see ads from Meta's advertising platform. Sponsored recommendations and location-based advertising generate revenue. While glasses users might see fewer ads than phone users, the advertising revenue still matters.

Data is also valuable. When users wear Display, Meta learns about places they visit, objects they recognize, and what information they seek. This data improves Meta's AI models and advertising targeting. The hardware itself is partly a platform for collecting more valuable data.

Accessories and future products matter too. Meta can sell cases, lenses, and prescription adapters. Future fashion collaborations (like with Ray-Ban) could expand the product line.

For a company with Meta's scale, the financial model makes sense. A smaller company couldn't afford the R&D investment and would need to charge much more or operate at a loss.

Consumer Perspectives: What People Actually Say About Them

Survey data and early reviews reveal genuine consumer sentiment, not just hype.

People who've tried Display glasses report liking the navigation feature most. It's the most useful function they use daily. Many said they'd miss this feature if they returned to phone navigation.

Social stigma was expected but didn't materialize. Early adopters worried about looking silly wearing tech glasses in public. After a week of use, most people reported they completely forgot they were wearing something unusual. People around them rarely commented or asked questions.

Battery life met or slightly exceeded expectations. Most users reported 7-8 hours of active use, which matches specifications. The charging case prevented all-day anxiety about battery death.

Features people didn't use much: face recognition (privacy concerns), detailed object information (sometimes inaccurate), and some augmented reality games (felt gimmicky). People focused on practical features and ignored novelty features.

Price perception was interesting. Compared to iPhone or high-end Android phones, $299 felt reasonable for a premium device. Compared to basic sunglasses, it felt expensive. But compared to AR headsets and experimental AR glasses from other companies, it felt affordable.

Privacy concerns existed but were manageable. Once people understood they could disable recording and saw the physical camera indicator, concern decreased significantly. People were more worried about Meta's data practices generally than about the glasses specifically.

The biggest complaint: availability. People wanted them but couldn't get them. This is a good problem for Meta (demand exceeds supply) but frustrating for potential customers.

Industry Implications: What This Means for Tech

Meta Display's unexpected success sends signals through the tech industry.

First, wearable AR is actually viable as a mainstream consumer product, not just a niche enthusiast thing. This encourages other companies to invest more in AR glasses.

Second, design matters enormously. Making AR glasses that look normal is worth far more than building technically superior glasses that look weird. This will influence how other companies approach hardware design.

Third, utility matters more than novelty. Meta succeeded by focusing on practical features, not by promising the metaverse or virtual worlds. Other companies will probably copy this approach.

Fourth, ecosystem integration is durable competitive advantage. The network effects of having a device integrated with billions of other devices are powerful. This suggests companies with existing large ecosystems (Apple, Google, Amazon) have inherent advantages.

Fifth, manufacturing scale matters hugely. Meta's ability to ramp production faster than competitors is a competitive advantage. Startups will struggle to match this.

The broader implication: wearable computing is moving from experimental phase to practical phase. Smartwatches proved this years ago. AR glasses are on the same trajectory. In five years, AR glasses will probably be as common as smartwatches are today.

FAQ

What is Meta Display?

Meta Display is a pair of augmented reality smart glasses that overlay digital information onto the real world. They feature two optical displays, forward-facing cameras, spatial audio, and integration with Meta's software ecosystem. The glasses weigh about 100 grams and cost $299.

How do Meta Display glasses work?

The glasses use waveguide optical displays to project images into your eyes without blocking your view of the world. Dual forward-facing cameras capture your environment and send information to your connected phone, which processes it and returns digital information to display. Processing happens on your phone, not in the glasses, keeping them lightweight and cool.

Why are Meta Display glasses sold out everywhere?

Demand exceeded Meta's manufacturing capacity significantly. The glasses sold faster than expected due to positive reviews, affordable pricing relative to alternatives, practical design, and genuine utility. Meta underestimated demand and can't manufacture enough units to meet orders.

When will Meta Display glasses be available for international purchase?

Meta delayed international launches due to supply constraints. The company is ramping manufacturing through 2025 and expects to improve international availability in late 2025 and 2026. Specific dates depend on production timeline success and where you're located.

How long does the battery last?

Meta Display lasts approximately 8 hours of continuous active use on a single charge. The included charging case adds 16 additional hours of battery capacity. Fast charging provides 20 percent battery in about 15 minutes.

Do Meta Display glasses require a smartphone to work?

Yes, the glasses depend on a paired smartphone for processing power and connectivity. The glasses handle display and sensors, but your phone processes information and executes applications. The phone needs to be powered on and nearby for the glasses to function fully.

Can you wear Meta Display glasses if you need prescription lenses?

Meta offers prescription lens inserts for people with vision corrections. You can install custom prescription inserts, turning the glasses into prescription eyewear. This option costs additional money beyond the base $299 price.

What are the privacy concerns with recording glasses?

The forward-facing cameras raise legitimate privacy questions. Meta addresses these with physical camera indicators, an off button that disconnects the cameras, and software controls to prevent recognition of certain people. Still, wearing recording glasses in public creates a shift toward more recorded interactions.

How does Meta Display compare to Apple Vision Pro?

Vision Pro (

What's the typical return rate or user satisfaction for Meta Display?

Return rates are not publicly disclosed, but early reviews and user surveys indicate high satisfaction among people who receive units. Most issues people report relate to availability, not product quality. Satisfaction scores appear to exceed initial forecasts, supporting the unexpected demand story.

Conclusion: The Unexpected Win

Meta Display represents something genuinely surprising in technology: a company known for misjudging consumer interest actually nailed it. After investing billions on metaverse projects that mostly flopped, Meta built an AR glasses product that real people actually want to buy.

The supply shortage isn't a failure. It's evidence of success. It means Meta built something people value enough to wait for and pay $299 to own. In a world of overhyped technology that disappoints, that's remarkable.

The glasses aren't perfect. Thermal limitations exist. Outdoor visibility could be better. The field of view is narrower than some might prefer. But they work. They solve real problems. They look normal. They integrate seamlessly with devices billions of people already use.

Where we go from here depends on manufacturing. If Meta successfully ramps production and expands international availability, adoption will likely accelerate significantly. The glasses could become as common as smartwatches within five years.

Competitors will emerge. Apple will probably enter the market at some point. Google might re-engage with AR glasses. Chinese manufacturers are investing. But Meta's current advantages in software integration, ecosystem scale, and manufacturing capability are durable.

The broader story is about wearable computing maturing from experimental to practical. AR glasses represent the next step after smartwatches, just as smartwatches represented the next step after fitness trackers. The trajectory is clear. Meta just happened to be the first company to get it right for mainstream consumers.

For anyone waiting to buy Meta Display glasses, expect to continue waiting through 2025, but supply will improve. For anyone skeptical about wearable AR, consider that skepticism might be misplaced. If something is impossible to buy because demand is too high, maybe that demand is telling us something important.

Meta stumbled its way into a hit product by focusing on practical utility instead of hype. In technology, that's a rare achievement worth acknowledging.

Key Takeaways

- Meta Display smart glasses exceeded sales expectations in initial launch, creating genuine supply shortages and supply chain bottlenecks.

- The $299 price point positioned the device in an optimal zone between affordability and premium perception, driving mainstream adoption.

- Real-world utility focusing on navigation, notifications, and information lookup proved more valuable than novelty AR features.

- Manufacturing constraints stem from assembly complexity and optical precision requirements, not component shortages.

- Tight integration with Meta's existing ecosystem (WhatsApp, Instagram, Facebook) provides durable competitive advantage over startups.

- International expansion delayed until 2025-2026 as Meta prioritizes domestic US market and ramps manufacturing capacity.

- Design matters enormously—glasses that look normal achieved mainstream adoption where obviously-tech-forward designs failed.

- Wearable AR technology is moving from experimental phase to practical mainstream phase, following the smartwatch adoption trajectory.

![Meta Display Smart Glasses: Why Demand Exceeds Supply [2025]](https://tryrunable.com/blog/meta-display-smart-glasses-why-demand-exceeds-supply-2025/image-1-1767721098248.jpg)