Meta Ray-Ban Smart Glasses International Expansion Pause: What It Means for AR Wearables

In January 2025, Meta announced it was pausing its international expansion plans for its Ray-Ban Display smart glasses. The company had originally planned to launch in France, Italy, Canada, and the United Kingdom in early 2026. Instead, it's focusing resources on fulfilling backlogged U.S. orders that now stretch well into 2026, as reported by The Verge.

On the surface, this sounds like a setback. But dig deeper, and it reveals something far more interesting about the state of augmented reality wearables, supply chain realities, and where consumer technology is actually heading in 2025.

Meta's move isn't a failure. It's a strategic recalibration. The company is choosing to dominate one market first rather than spreading thin across multiple regions. After years of AR hype that never quite materialized into mainstream products, Meta's Ray-Ban Display glasses represent something different: a product people actually want to buy, as noted by Virtual Reality News.

The demand is real. Product waitlists extending into 2026 aren't marketing spin. They're evidence that Meta has cracked something the industry has been chasing for a decade: AR glasses that users genuinely prefer to their phones.

This pause tells us three critical things about the future of wearables. First, supply constraints are the real bottleneck in consumer hardware, not consumer interest. Second, the U.S. market is mature enough to absorb production faster than Meta anticipated. Third, international regulatory complexity—particularly around data privacy and AR functionality in Europe—makes launching simultaneously across regions more complicated than it sounds, as highlighted by PPC Land.

Let's break down what's actually happening here, why Meta made this call, and what it means for the broader AR wearables industry.

The Ray-Ban Display Glasses: What You're Actually Looking At

Meta's Ray-Ban Display glasses are a collaboration with Ray-Ban, the iconic eyewear brand owned by Essilor Luxottica. They're not science fiction. They're shipping products. Real people are wearing them right now.

The glasses themselves look like regular Ray-Bans. There's no bulky visor, no obvious computing hardware mounted on your face. The form factor matters because it's the entire point. For AR glasses to become mainstream, they can't look like a prototype from 2012.

The technical implementation is clever. The glasses contain micro-displays that project information onto the lenses without obscuring your view of the real world. They're paired with a Meta Neural Band, a wristband that detects subtle hand gestures. You don't need voice commands or external controllers. You just move your fingers, and the glasses respond.

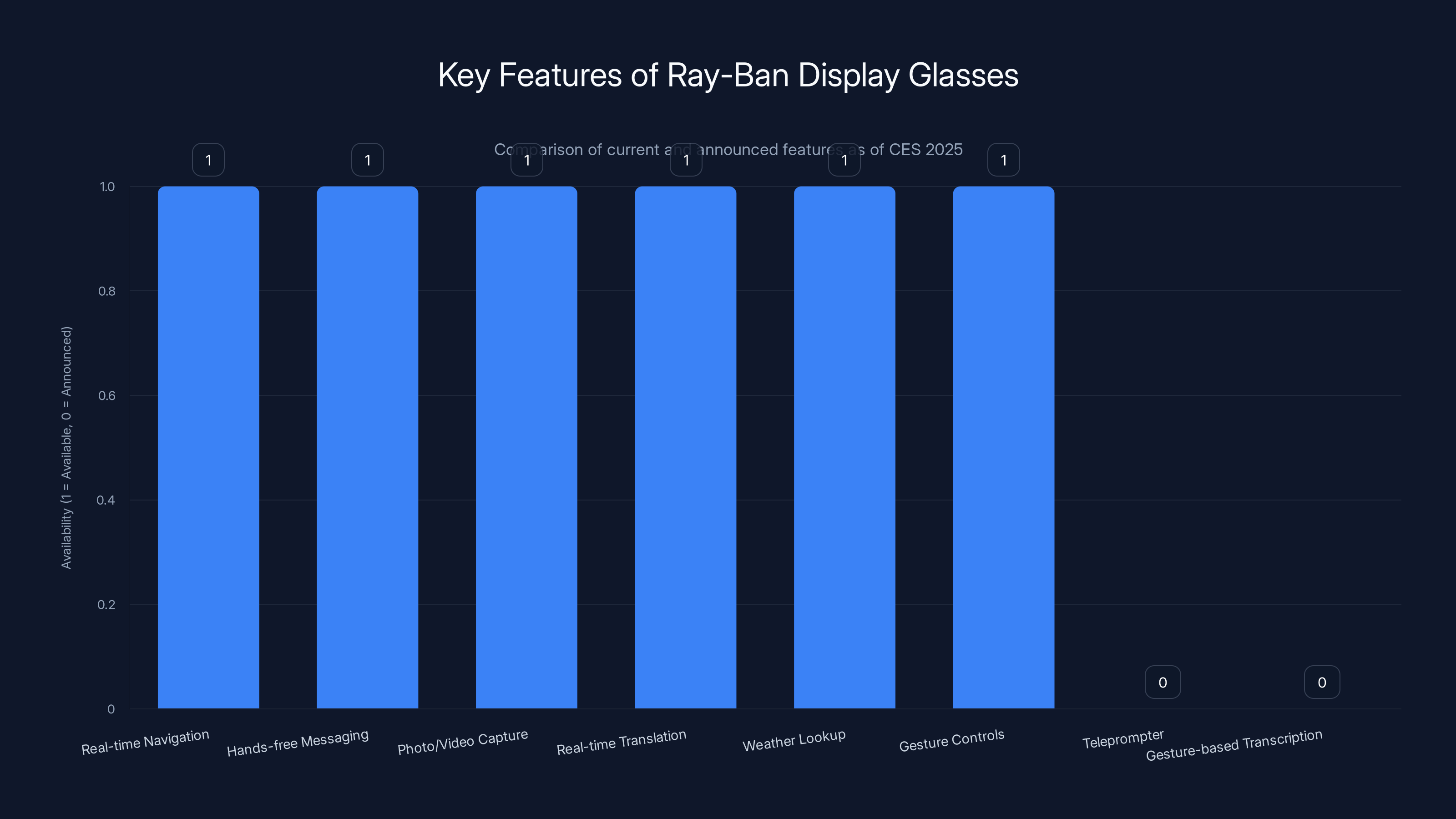

What can the glasses actually do right now?

The current feature set is focused and practical rather than gimmicky. You can get real-time navigation with pedestrian directions overlaid on your view of the street. Your hands are free because you're not holding a phone. You can see translation in real-time when traveling. You can take photos and videos from your eye level without pulling out a camera. You can see notifications without checking your phone.

At CES 2025, Meta announced new features coming soon. A teleprompter function lets you read prepared remarks while maintaining eye contact with an audience. Gesture-based messaging lets you write text in the air or on any surface, and the Neural Band converts your finger movements into digital messages. Navigation is expanding to Denver, Las Vegas, Portland, and Salt Lake City, moving beyond the initial U.S. rollout cities, as reported by The Verge.

The glasses use a combination of Qualcomm processors and Meta's custom silicon to handle AI processing and gesture recognition on-device. That's important because it means the glasses don't need constant cloud connectivity. Your privacy isn't compromised by every gesture being sent to Meta's servers.

Battery life is roughly 4 hours in normal use, with a charging case that gets you to a full day. It's not iPhone-level convenience, but it's acceptable for a first-generation wearable.

The price is $299 for the glasses themselves, which positions them in the premium eyewear category but not the "accessible only to early adopters" tier. That's part of why demand exceeded expectations, as noted by PYMNTS.

Current features of Ray-Ban Display glasses include real-time navigation and gesture controls, with new features like a teleprompter announced for future updates.

Why Demand Exploded: The Psychology of Wearables Done Right

Meta didn't invent the demand. They just finally built something that justified it.

Smartglasses have been a "coming soon" technology for nearly twenty years. Companies promised them. Hype cycles inflated them. But the actual products were either ridiculous (look like cyborg terminator hardware), useless (augmented reality that didn't augment anything), or both.

Google Glass was a surveillance device wearing the mask of innovation. The Hololens was a $3,500 scientific instrument, not a consumer product. Snapchat Spectacles were fun but limited. Every attempt tried to make AR glasses do everything, everywhere, for everyone.

Meta's approach is different. The Ray-Ban Display glasses do a few things really well. Navigation. Messaging. Notifications. Documentation. They're complementary to your phone, not a replacement for it. That's psychologically different from the previous generation of AR hype.

When you're wearing regular glasses, you're already comfortable with something on your face. Ray-Ban is a brand people voluntarily spend

The gesture control is less intrusive than voice commands. You're not the person in the coffee shop barking orders at your wrist. You're quietly making small hand movements. Socially, it's less awkward.

Most importantly, the value proposition is immediate and concrete. Navigation works better when you're walking. You can document things without holding your phone. You can respond to messages hands-free. These aren't hypothetical benefits. Users experience them within five minutes of putting the glasses on.

Demand exceeded Meta's projections because the product actually works. It's not revolutionary, but it's functional. It's useful. It doesn't require you to adopt an entirely new interaction paradigm. It extends what you already do, just making it more convenient.

When Meta says product waitlists extend into 2026, they're describing what happens when supply can't meet demand. That's not a problem most new consumer tech faces. Usually, demand is the constraint. Here, manufacturing capacity is the constraint, as highlighted by Reuters.

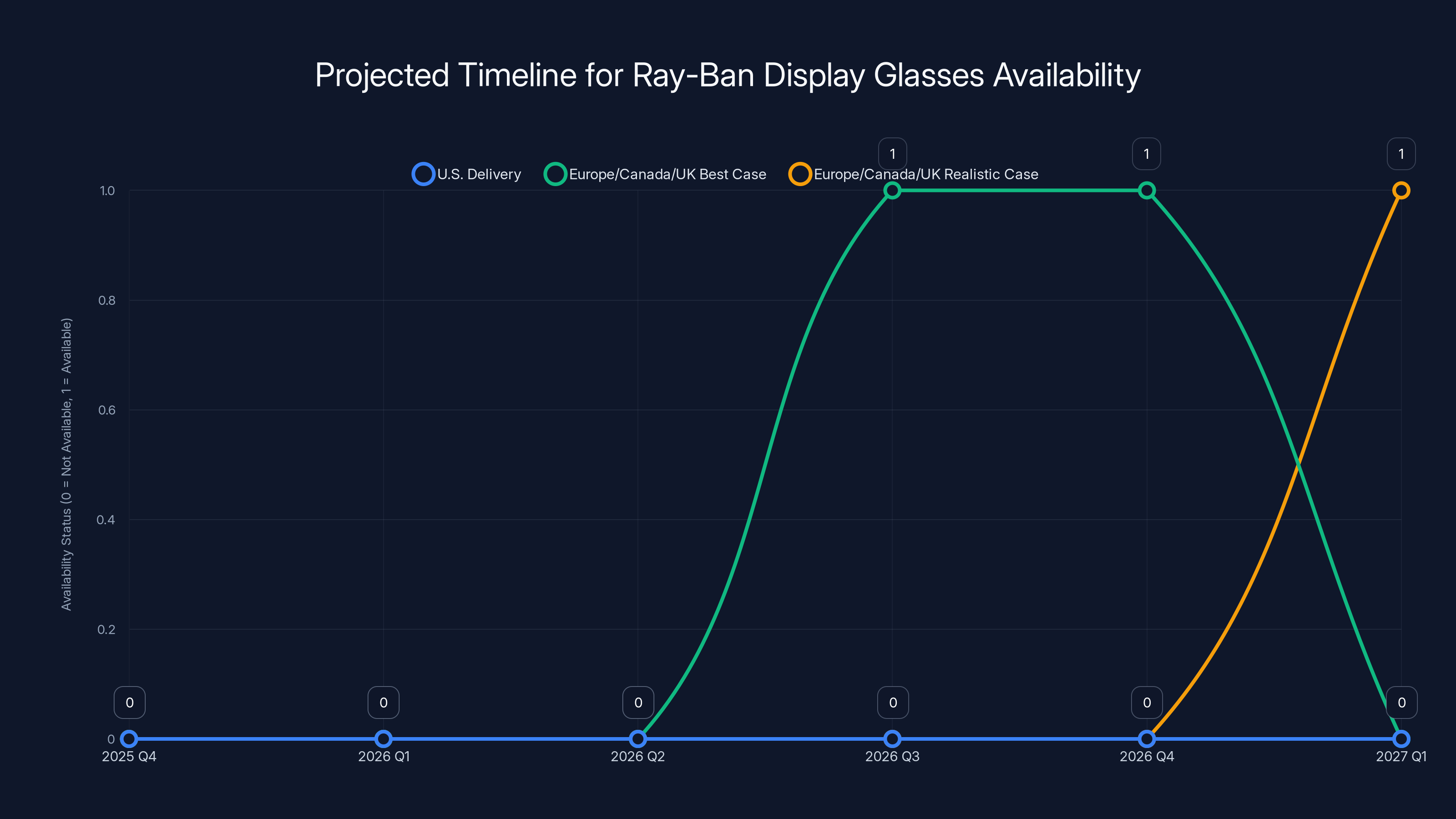

The U.S. market is expected to receive Ray-Ban Display glasses by 2026, while Europe, Canada, and the UK face delays, with availability projected between late 2026 and early 2027. Estimated data.

The Supply Chain Reality: Why Global Expansion Is Harder Than It Looks

Meta's decision to pause international expansion reveals something uncomfortable about manufacturing at scale in 2025.

Building glasses is hard. You need precision manufacturing for the optics. You need integration with the display technology. You need to source components from multiple suppliers across different geographies. You need quality control strict enough that defect rates stay under 5 percent.

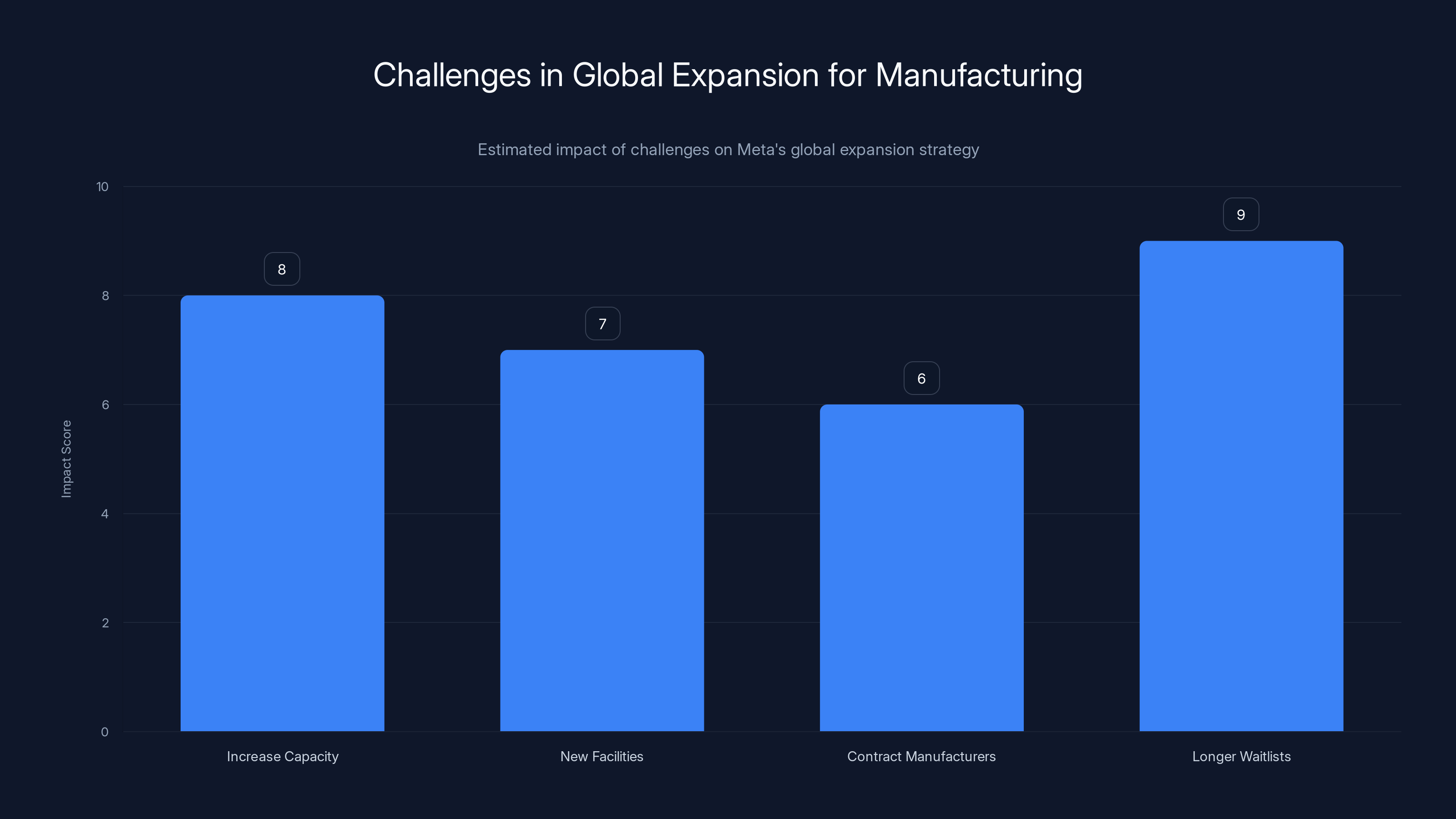

Even for companies with massive manufacturing expertise and supply chain relationships, scaling production is a multi-month process. Meta would need to increase manufacturing capacity by 30 to 50 percent just to serve Europe and Canada on top of the U.S. backlog, as noted by Virtual Reality News.

The math is straightforward:

If the U.S. market alone has demand stretching into 2026, adding France, Italy, Canada, and the UK simultaneously would require Meta to either:

- Stop fulfilling U.S. orders to manufacture for international markets

- Invest in new manufacturing facilities and tooling (months of lead time)

- Partner with additional contract manufacturers (complexity and quality risk)

- Accept longer waitlists everywhere (customer satisfaction damage)

None of those options are good. So Meta chose the rational alternative: finish dominating the U.S. market first, then expand internationally when manufacturing catches up.

There's also a strategic advantage to this approach. The U.S. is Meta's home market. American consumers drive trends. Media coverage in the U.S. influences global perception. By flooding the U.S. market first, Meta ensures the glasses become culturally normal before attempting international expansion.

International markets, particularly Europe, have different regulatory requirements. The EU's AI Act applies to any AI-powered features in the glasses. Data privacy regulations are stricter. Consumer protection standards differ. Rather than navigate all of that simultaneously while trying to scale manufacturing, Meta is deferring complexity, as discussed by PPC Land.

It's also possible that initial manufacturing partners are at capacity. Contract manufacturers like Taiwan's Foxconn and others often have multi-year commitments. Ramping production for a new device requires negotiating new contracts, investing in new production lines, and hiring specialized workers. That takes time.

Supply chain optimization for consumer electronics has improved dramatically since the pandemic, but it's still not instant. A six-month manufacturing lead time from decision to first unit off the assembly line is normal for complex hardware.

Market Implications: What This Means for AR Wearables

Meta's pause isn't bad news for the AR wearables industry. It's validation.

For years, AR experts have argued that consumer interest exists but technology and manufacturing capabilities don't. The Ray-Ban Display glasses prove that consumer interest definitely exists. When a product has a multi-month waitlist at a $299 price point, you've created something people actually want, as noted by SEIA.

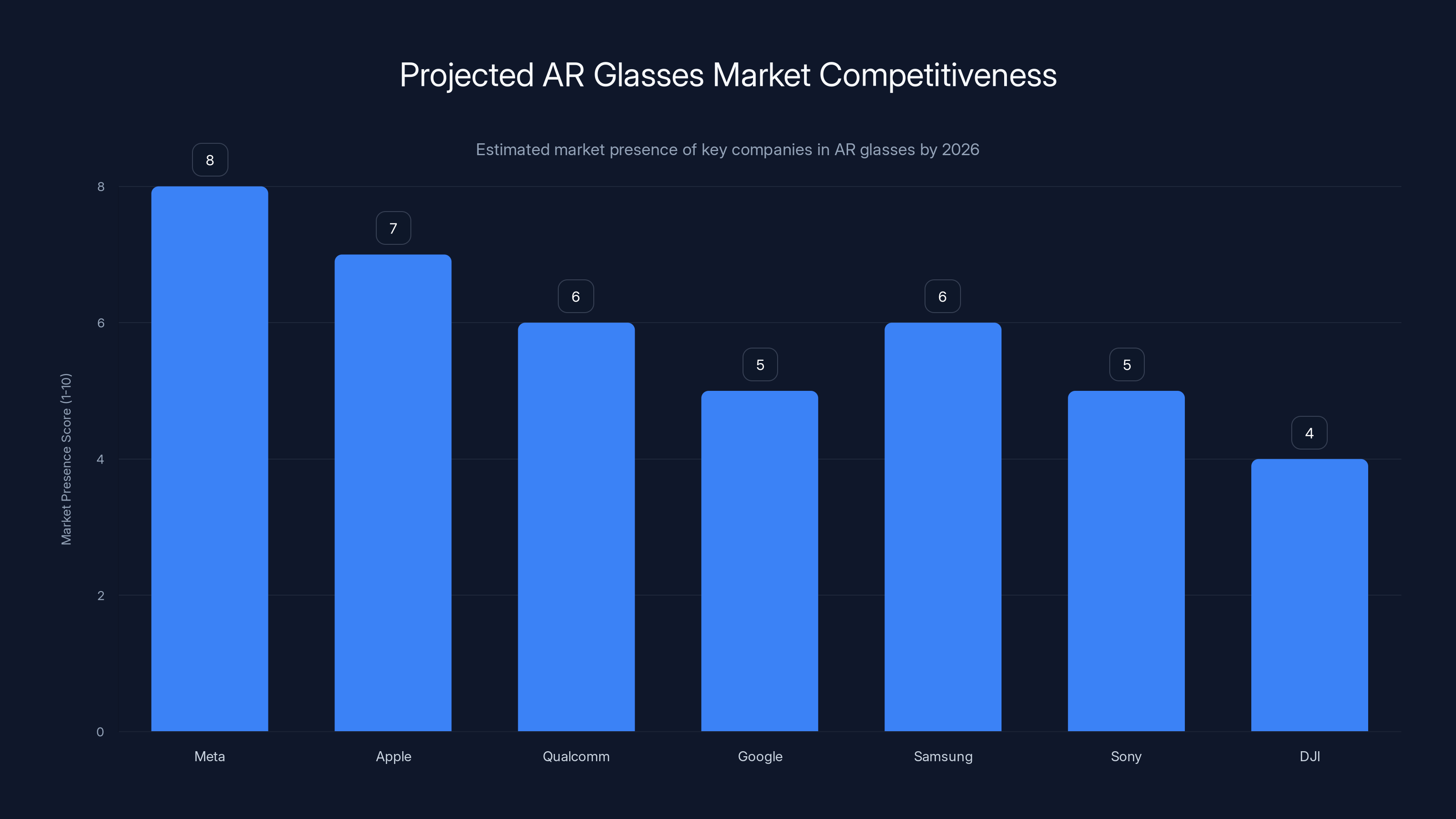

This changes how venture capital and major tech companies think about AR investment. Skeptics who said "nobody wants to wear computers on their face" now have to explain why thousands of people are waiting six months to buy Ray-Ban Display glasses.

Apple's long-rumored AR glasses project just became more urgent. Apple was already working on AR glasses, but Meta's success accelerates the timeline. Apple can't let Meta own the AR glasses market for 18 months before competing.

Samsung, Google, and Qualcomm are all developing competing AR glasses. Microsoft's Holo Lens has been enterprise-focused, but Meta's consumer success might push Microsoft to develop consumer-grade hardware. Sony, Lenovo, and other companies with wearables expertise will all reevaluate their AR strategies.

This is exactly how markets work. One company proves demand exists. Competition follows. Prices fall. Technology improves. Mainstream adoption accelerates.

Meta is benefiting from being first to market with a product that actually works and looks normal. But that advantage is temporary. Within two years, you'll have multiple credible AR glasses options at different price points, with different feature sets.

Estimated data shows that increasing capacity and longer waitlists have the highest impact on Meta's expansion strategy, indicating significant challenges in scaling production for international markets.

The European Complexity Factor: Why International Expansion Isn't Just Scaling

Meta's decision to pause European expansion reveals a deeper challenge: regulatory fragmentation.

The EU's AI Act applies to any AI-powered features in consumer products. The Ray-Ban Display glasses use AI for gesture recognition, navigation optimization, and potentially for real-time translation and content recommendations. Each of these might trigger different regulatory requirements under the AI Act.

Does gesture recognition count as "biometric identification"? Under EU law, biometric systems face strict requirements. Meta would need to argue that gesture recognition isn't biometric identification, but the interpretation is still evolving.

Real-time translation uses machine learning models trained on vast datasets. The EU's transparency requirements might require Meta to disclose exactly what training data was used, how the model works, and what potential biases exist. That's documentation work that takes weeks for legal teams to prepare.

General Data Protection Regulation (GDPR) adds another layer. Every feature that collects, processes, or stores user data needs documented data protection impact assessments. Wearables with cameras, microphones, and AI features generate significant regulatory documentation requirements.

Canada and the UK have different regulatory frameworks. Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) is less stringent than GDPR but still requires significant data protection measures. The UK's Data Protection Act 2018 is similar to GDPR but with different enforcement mechanisms.

France and Italy have additional national regulations on top of EU-wide requirements. The French National Commission for Computing and Liberty (CNIL) has been particularly aggressive about enforcing data protection standards for new technologies.

Meta could navigate all of this, but it requires legal expertise, compliance infrastructure, and time. Pausing international expansion while working through regulatory requirements is the conservative approach. It also avoids the risk of launching in Europe, facing a regulatory objection, and having to pull the product from shelves—which would damage the brand.

This pattern will repeat with every major tech company launching new AR products. Regulatory complexity in Europe is a real cost that doesn't exist in the same way for U.S. companies launching in the U.S. market first.

Consumer Impact: What This Delay Means for You

If you're in the U.S. and want Ray-Ban Display glasses, the pause doesn't change anything. You're still in a waitlist that extends into 2026. Your expected delivery timeline is roughly the same.

If you're in Europe, Canada, or the UK, this pause adds 6 to 12 months to your timeline. Meta's best-case scenario is probably international availability in Q3 or Q4 2026. Realistic scenario is early 2027.

In the meantime, you have other options. Companies like Xreal and Nreal offer AR glasses, though with different feature sets and use cases. These are more specialized toward gaming and content consumption rather than navigation and messaging.

Microsoft Holo Lens 2 is available internationally but costs $3,500 and targets enterprise users. Magic Leap offers similar enterprise-focused hardware. These aren't consumer products in the traditional sense.

The consumer AR glasses market is effectively dominated by Meta's Ray-Ban Display right now. That dominance is likely to last 12 to 18 months before serious competition emerges.

One positive: the pause gives Meta time to listen to early user feedback and improve the product. The first generation of any major consumer hardware usually has usability issues that the second generation fixes. By the time international users get Ray-Ban Display glasses, they might be buying version 2.0 with improved battery life, better software integration, and more features.

Meta could also use the time to build out the app ecosystem. Right now, the glasses work with Meta apps and a limited set of third-party integrations. By late 2026, you'll probably have apps from navigation providers like Waze and Google Maps, messaging apps, translation services, and productivity tools. A richer ecosystem makes the glasses more compelling.

Meta currently leads in consumer AR glasses, but Apple and Qualcomm are expected to significantly enhance their market presence by 2026. Estimated data reflects potential market dynamics.

The Competitive Landscape: Where Are Other Companies?

While Meta dominates consumer AR glasses right now, the competitive landscape is heating up fast.

Apple hasn't launched consumer AR glasses yet, but every major tech publication expects an announcement within the next 12 to 18 months. Apple's approach will likely emphasize visual design and integration with the Apple ecosystem. Expect premium pricing, excellent hardware, and software that just works.

Qualcomm is investing heavily in AR platforms and processors specifically designed for glasses. They're working with multiple manufacturers to ensure that AR becomes as ubiquitous as smartphones. Qualcomm's success here would create a competitive platform similar to Android for phones.

Google is quietly developing AR glasses under its Google Glass brand, though they're being positioned for enterprise use rather than consumers. Google's search and mapping capabilities could make AR glasses incredibly useful for information lookup and navigation.

Samsung is developing AR glasses and has partnerships with manufacturers. Samsung's existing smartphone ecosystem is massive, so integration would be natural.

Sony is leveraging its expertise in optics and displays to develop competing hardware. Sony's ability to manufacture components gives them a manufacturing advantage.

Chinese companies like DJI and others are developing AR glasses for both consumer and enterprise markets. They're competing aggressively on price and hardware capabilities.

Within 3 to 5 years, you'll have multiple credible AR glasses options at different price points. The

Meta's move to pause international expansion isn't aggressive market dominance. It's actually defensive. By establishing a strong U.S. presence first, Meta makes it harder for competitors to unseat them even as competition intensifies.

What's Next: The 2026 AR Wearables Roadmap

We can anticipate some developments with reasonable confidence.

Q1-Q2 2026: Manufacturing ramping

Meta will likely announce updated availability timelines as manufacturing capacity increases. They'll provide estimated ship dates for different regional waitlists. The company will highlight usage statistics from early adopters to prove the product is catching on.

Q2-Q3 2026: Feature announcements

At developer conferences or through press announcements, Meta will showcase new capabilities coming to Ray-Ban Display glasses. Expect expanded navigation in more cities, better gesture recognition, new integration partnerships, and software improvements.

Q3-Q4 2026: Competitive launches

Apple or Google will likely announce consumer AR glasses during this window. These will generate significant media attention and push the broader conversation about AR from "novelty" to "legitimate platform."

Q4 2026-Q1 2027: International expansion

Meta will begin selling Ray-Ban Display glasses in Europe, Canada, and potentially other markets. The expansion will be gradual, starting in the largest markets first.

Throughout 2026: Ecosystem development

More third-party apps will launch for Ray-Ban Display glasses. We'll see expanded enterprise use cases. Companies will start building internal tools for the platform.

The broader trend is clear: AR wearables are transitioning from "future technology" to "present reality." It'll take years for them to replace phones or computers in daily life, but the transition is starting now.

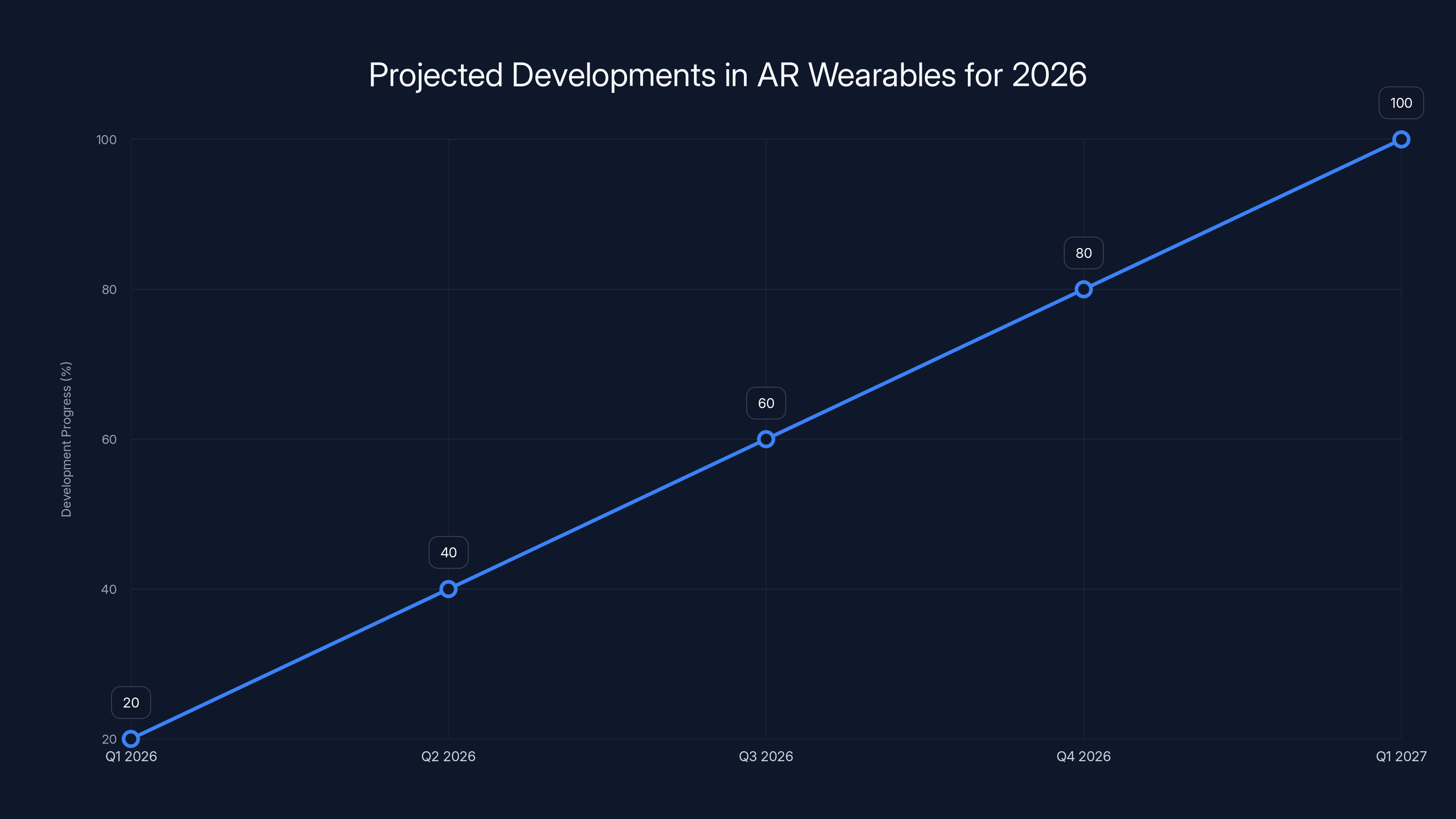

Estimated data shows a steady progression of AR wearable developments throughout 2026, with significant milestones in manufacturing, feature announcements, competitive launches, and international expansion.

The Bigger Picture: Why AR Wearables Matter

The significance of Meta's Ray-Ban Display glasses extends beyond just selling hardware.

Smartphones were revolutionary because they made computing portable and always accessible. AR wearables are potentially more revolutionary because they make computing ambient. You don't look at an external device to get information. The information appears in your field of view.

Think about the implications. In 5 to 10 years, your AR glasses could show you the names of people at a party before they introduce themselves. They could translate conversations in real-time. They could overlay useful information on every object you look at. They could let you video-call someone while your hands are free doing something else.

These capabilities don't require technological breakthroughs. The tech already exists in labs. What AR glasses needed was exactly what Meta provided: a form factor people would actually wear, features that genuinely improve daily life, and manufacturing at the scale required for consumer distribution.

Meta's pause of international expansion is a short-term setback but a long-term validation. It proves that AR wearables aren't a niche technology for enthusiasts. They're becoming mainstream consumer products that people want to buy, wear, and use regularly.

The manufacturing constraints that caused the pause are temporary. By 2027, production will scale. By 2030, AR glasses will be as common as smartphones are today.

Meta had to pause international expansion because domestic demand exceeded expectations. That's a problem every successful product manufacturer wants to have.

FAQ

Why did Meta pause Ray-Ban Display glasses international expansion?

Meta faced overwhelming demand for the glasses in the U.S., with waitlists extending well into 2026. To fulfill these backorders without overstretching manufacturing capacity, the company decided to pause planned launches in France, Italy, Canada, and the UK. This allows Meta to focus resources on satisfying domestic demand before expanding internationally, as reported by Reuters.

When will Ray-Ban Display glasses be available internationally?

Meta hasn't provided a specific timeline, but based on current waitlist patterns and manufacturing capacity, international availability is likely in Q3-Q4 2026 at the earliest, with more realistic expectations pointing toward early 2027. The company is re-evaluating its international approach, which includes navigating regulatory requirements in different regions.

What features do Ray-Ban Display glasses have right now?

Current features include real-time pedestrian navigation with directions overlay, hands-free messaging and notifications, photo and video capture from your perspective, real-time translation, weather and information lookup, and gesture-based controls. Meta announced new features at CES 2025, including a teleprompter function and gesture-based message transcription. Navigation support is expanding to additional cities.

How much do Ray-Ban Display glasses cost?

The Ray-Ban Display glasses are priced at $299, positioning them in the premium eyewear market but below specialized AR hardware. This price point made them more accessible than previous generation AR glasses, contributing to the unexpectedly high demand. Additional costs include the Meta Neural Band wristband, which is included with the glasses.

How is the gesture recognition system better than voice commands?

The Meta Neural Band detects subtle hand movements and translates them into commands without requiring you to speak. This approach is less intrusive socially (you're not the person talking to their wrist in a coffee shop), more reliable in noisy environments, and faster than voice commands in many situations. Gesture control feels more natural for quick interactions.

What regulatory challenges did Meta face for international expansion?

European expansion requires compliance with the EU's AI Act, which categorizes AI systems by risk level and imposes strict requirements on high-risk applications. GDPR adds data protection requirements. France and Italy have additional national regulations. Canada's PIPEDA and the UK's Data Protection Act 2018 create different requirements. Navigating these regulatory frameworks takes time and legal expertise, which Meta decided to address after establishing a strong U.S. presence.

Who are the main competitors to Ray-Ban Display glasses?

Apple is widely expected to launch consumer AR glasses within 12-18 months. Google, Samsung, Sony, and Qualcomm are all developing competing hardware. Xreal and Nreal offer AR glasses but with different feature sets. Microsoft's Holo Lens is available but targets enterprise users at a $3,500 price point. Most competitors haven't launched consumer-focused hardware yet, giving Meta a significant first-mover advantage.

Should I wait for Ray-Ban Display glasses or buy alternatives now?

If you're in the U.S., getting on the waitlist now means delivery in late 2025 or early 2026 depending on demand. If you're international, expect longer waits. If you need AR glasses immediately, Xreal and other companies offer alternatives, though they focus on different use cases. Most AR experts expect Apple's offering to be compelling, but launch timing is still uncertain. For practical navigation and messaging, Meta's glasses are the most mature consumer option available.

What does this expansion pause mean for the broader AR industry?

The pause actually validates the AR wearables industry. For years, skeptics questioned whether consumers wanted AR glasses. Ray-Ban Display's demand proves they do. This success encourages competitors to accelerate their own launches, attracting venture capital and corporate investment. Within 3-5 years, you'll have multiple credible options at different price points. Meta's pause is a temporary pause on expansion, not on the industry's fundamental momentum.

How will Meta's pause affect app developers building for the platform?

Meta will likely announce timeline updates for international availability, giving developers certainty about when they need to support additional markets. The pause also gives the company time to build out the app ecosystem before international launch. Developers can expect Meta to invest in developer tools, documentation, and partner support during this period. By the time international users get access to the glasses, the available app selection should be significantly richer than at launch.

Key Takeaways

Meta's decision to pause international Ray-Ban Display glasses expansion reveals more than just manufacturing constraints. It's a strategic choice that prioritizes market dominance in the U.S. over rapid global scaling. The company has stumbled into exactly the problem every tech manufacturer wants: supply constraints due to overwhelming demand.

The glasses themselves represent a genuine breakthrough in wearable AR. They look normal, work reliably, and provide immediate practical value. That combination is why waitlists extended farther than Meta anticipated.

International expansion requires navigating complex regulatory frameworks, particularly in Europe where AI Act compliance and GDPR create real compliance costs. By pausing expansion, Meta buys time to work through these challenges while manufacturing catches up.

For consumers waiting for Ray-Ban Display glasses outside the U.S., this means longer waits. Expect availability in late 2026 or early 2027. For the broader tech industry, this is validation that AR wearables are becoming mainstream. Competition is accelerating, and the market will look completely different within 2 to 3 years.

The real story isn't that Meta is pausing expansion. It's that Meta has created something people actually want to wear. That's the breakthrough the industry has been waiting for.

Related Articles

- Meta Pauses Ray-Ban Display International Expansion: What It Means [2025]

- NAOX EEG Wireless Earbuds: Brain Monitoring Technology [2025]

- Rokid Style AI Smartglasses: Everything You Need to Know [2026]

- The End of Smartphones? How AI Wearables Will Reshape Computing in 2026 [2025]

- CES 2026: Why AI Integration Matters More Than AI Hype [2025]

- Plaud NotePin S: AI Wearable with Highlight Button [2025]

![Meta Ray-Ban Smart Glasses Pause: What It Means for AR [2025]](https://tryrunable.com/blog/meta-ray-ban-smart-glasses-pause-what-it-means-for-ar-2025/image-1-1767713863239.jpg)