Meta Pauses Ray-Ban Display International Expansion: What It Means [2025]

Last fall, Meta launched the Ray-Ban Display smart glasses in the United States to what can only be described as overwhelming enthusiasm. The device, a collaboration between Meta and Ray-Ban's parent company Essilor Luxottica, quickly became one of the most sought-after pieces of wearable technology on the market. But just as international customers in France, Italy, Canada, and the UK started circling launch dates on their calendars, Meta pulled the plug on those plans. The company announced at CES 2026 that it's pausing its international expansion, citing unprecedented demand and severely limited inventory.

This decision represents a fascinating inflection point in the wearable technology landscape. It's not often that a tech company delays global expansion because a product is too popular. Yet here we are. The move also reveals deeper truths about manufacturing constraints, supply chain realities, and the challenge of scaling cutting-edge hardware in an era when consumer appetite vastly outpaces production capacity.

In this guide, we'll explore what triggered Meta's pause, why this matters for the wearable tech industry, what it tells us about the state of consumer demand for AR glasses, and what comes next for international customers stuck waiting. We'll also examine the broader implications for Meta's hardware strategy and the future of smart eyewear as a category.

TL; DR

- Meta delayed Ray-Ban Display expansion to France, Italy, Canada, and the UK due to overwhelming demand and limited inventory extending into 2026.

- U. S. focus remains priority as Meta works through existing waitlists that have ballooned far beyond initial expectations.

- Supply chain constraints are real and affect even well-capitalized tech companies launching premium hardware.

- International customers face uncertainty with no confirmed timeline for when these glasses will actually become available outside the United States.

- Market signal is clear: demand for smart glasses vastly exceeds production capacity, reshaping hardware launch strategies across the industry.

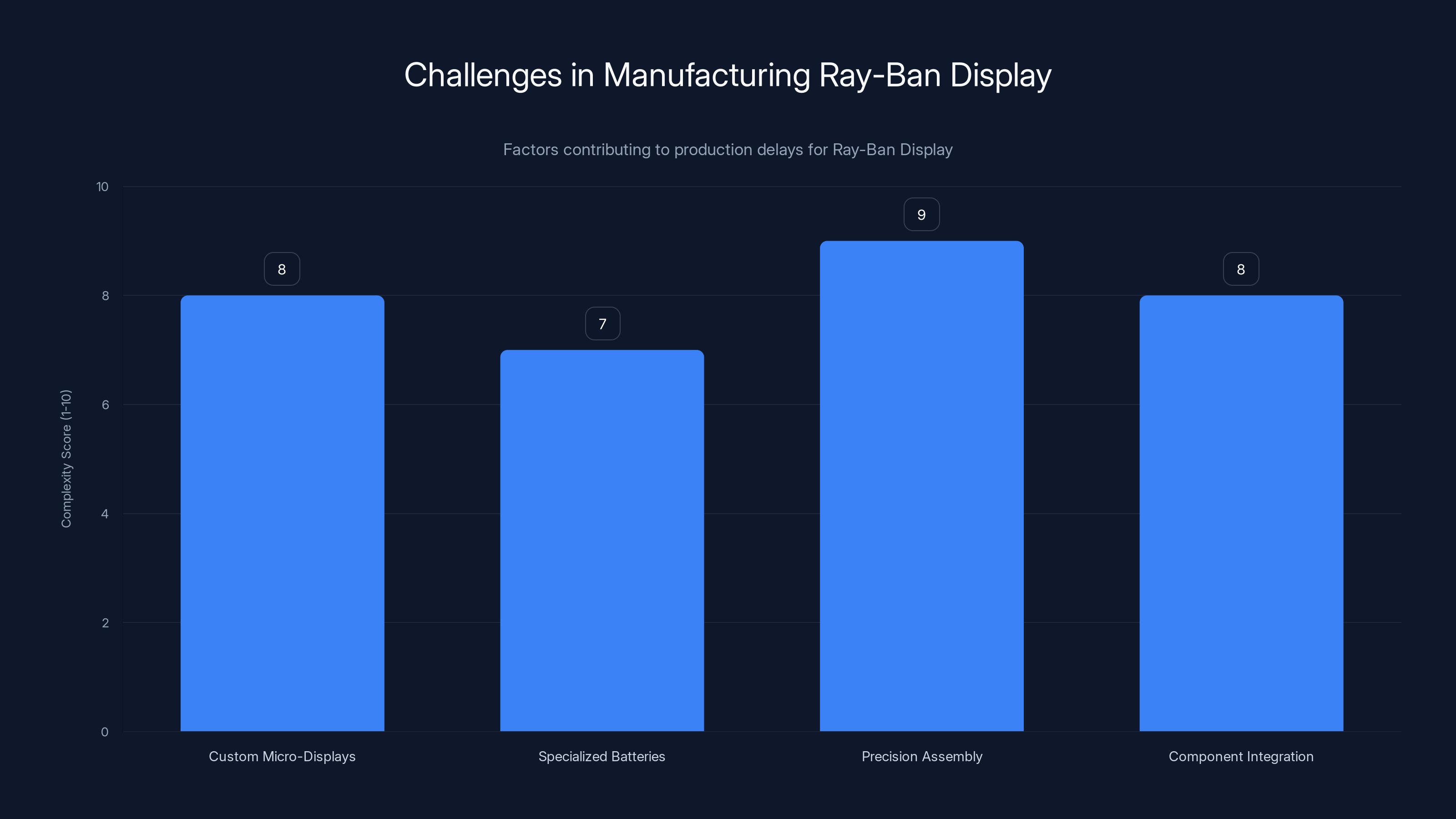

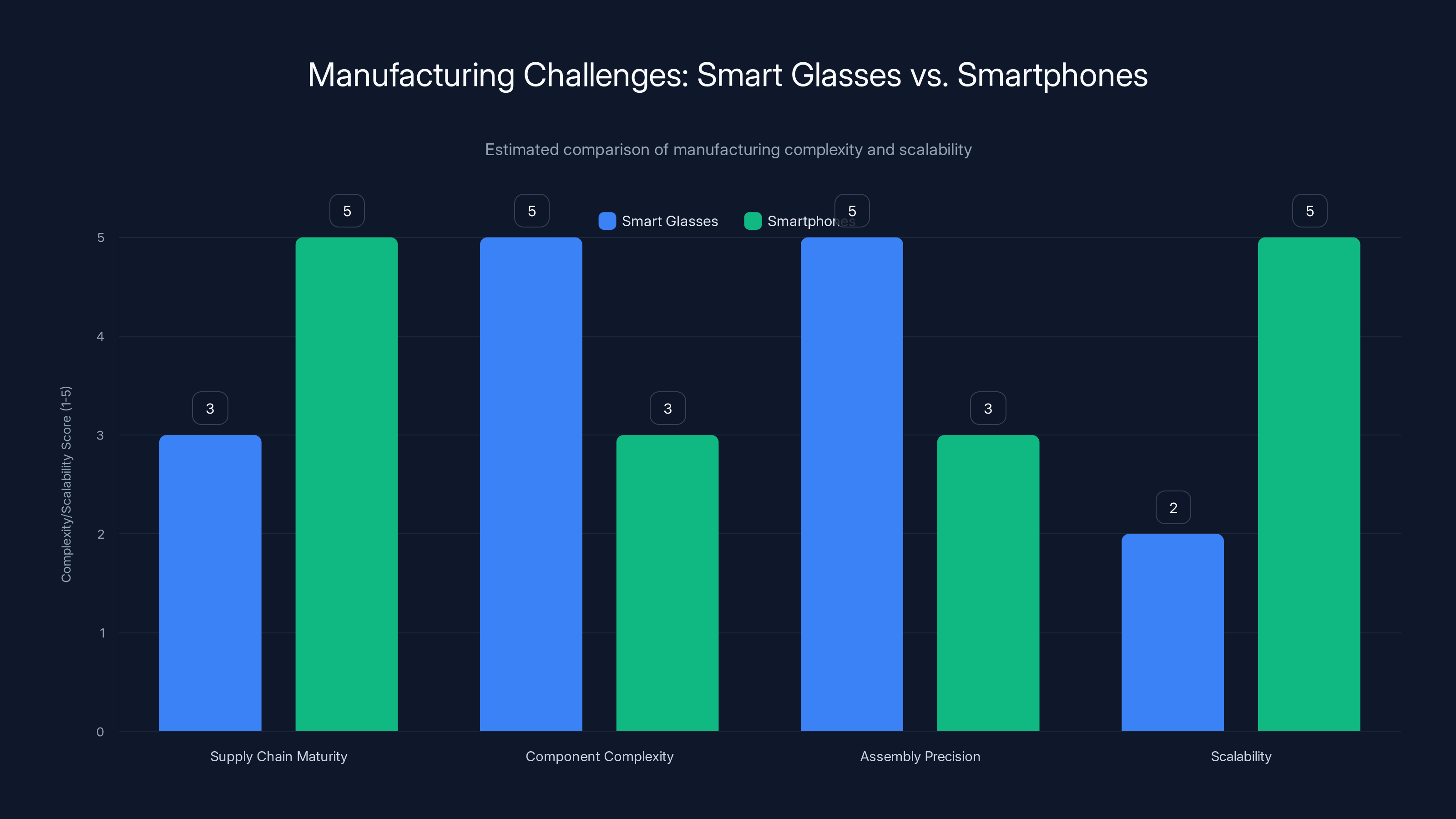

Manufacturing the Ray-Ban Display involves high complexity due to custom components and precision requirements, contributing to production delays. Estimated data.

The Ray-Ban Display Success Story: Why the Pause Actually Makes Sense

Before diving into the pause itself, understanding why the Ray-Ban Display became such a hot property is essential context. The glasses launched in the fall of 2024 with genuine technological achievement behind them. Unlike previous attempts at smart eyewear, the Ray-Ban Display managed to cram meaningful functionality into a form factor that doesn't look ridiculous. That matters more than it might sound.

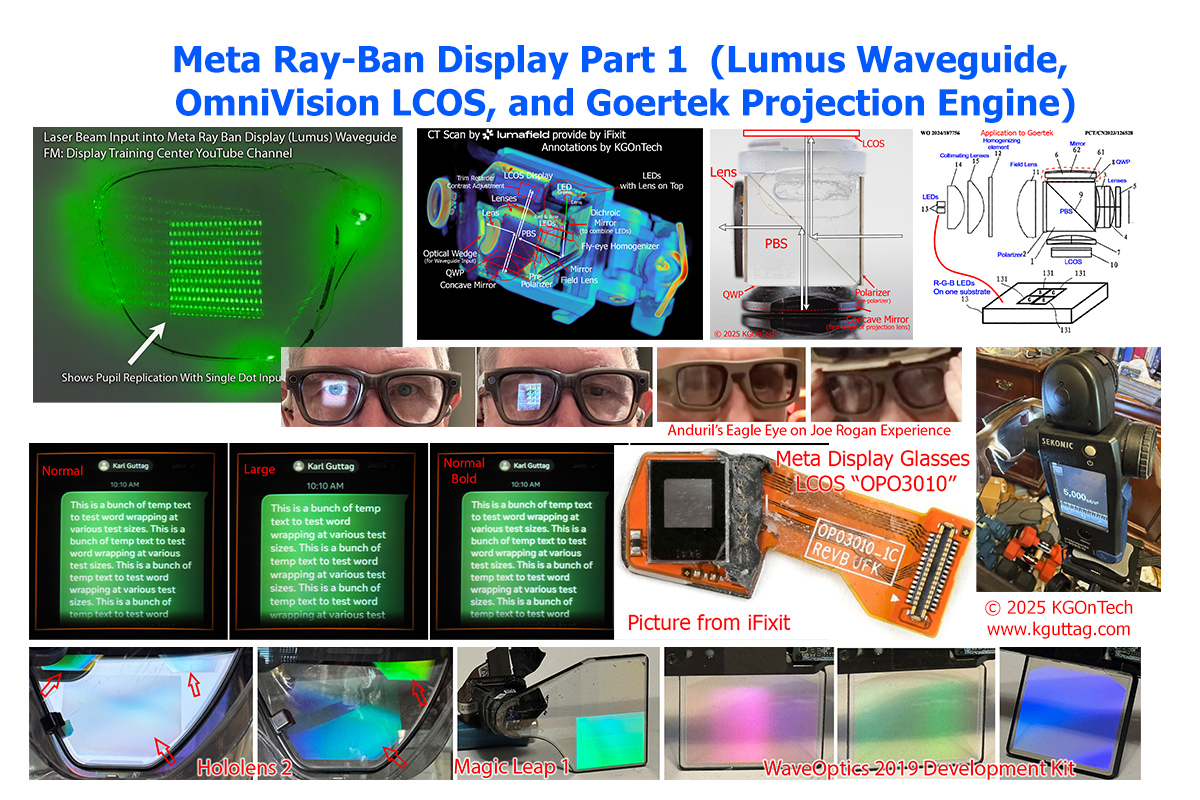

The device features a camera for capturing photos and video, a microphone for voice commands, and a small display that sits above your right eye. It integrates with Meta's AI assistant and can respond to voice prompts without requiring you to hold a phone. The battery lasts through a full day of moderate use. For people who've spent years hearing promises about augmented reality eyewear, the Ray-Ban Display felt like the first genuine step forward.

Meta's partnership with Ray-Ban (owned by Essilor Luxottica, one of the world's largest eyewear conglomerates) gave the product legitimacy that pure tech companies struggling with design couldn't match. Ray-Ban's heritage in eyewear manufacturing meant the glasses actually fit properly and looked acceptable on your face. That's the difference between a tech curiosity and something people actually want to wear in public.

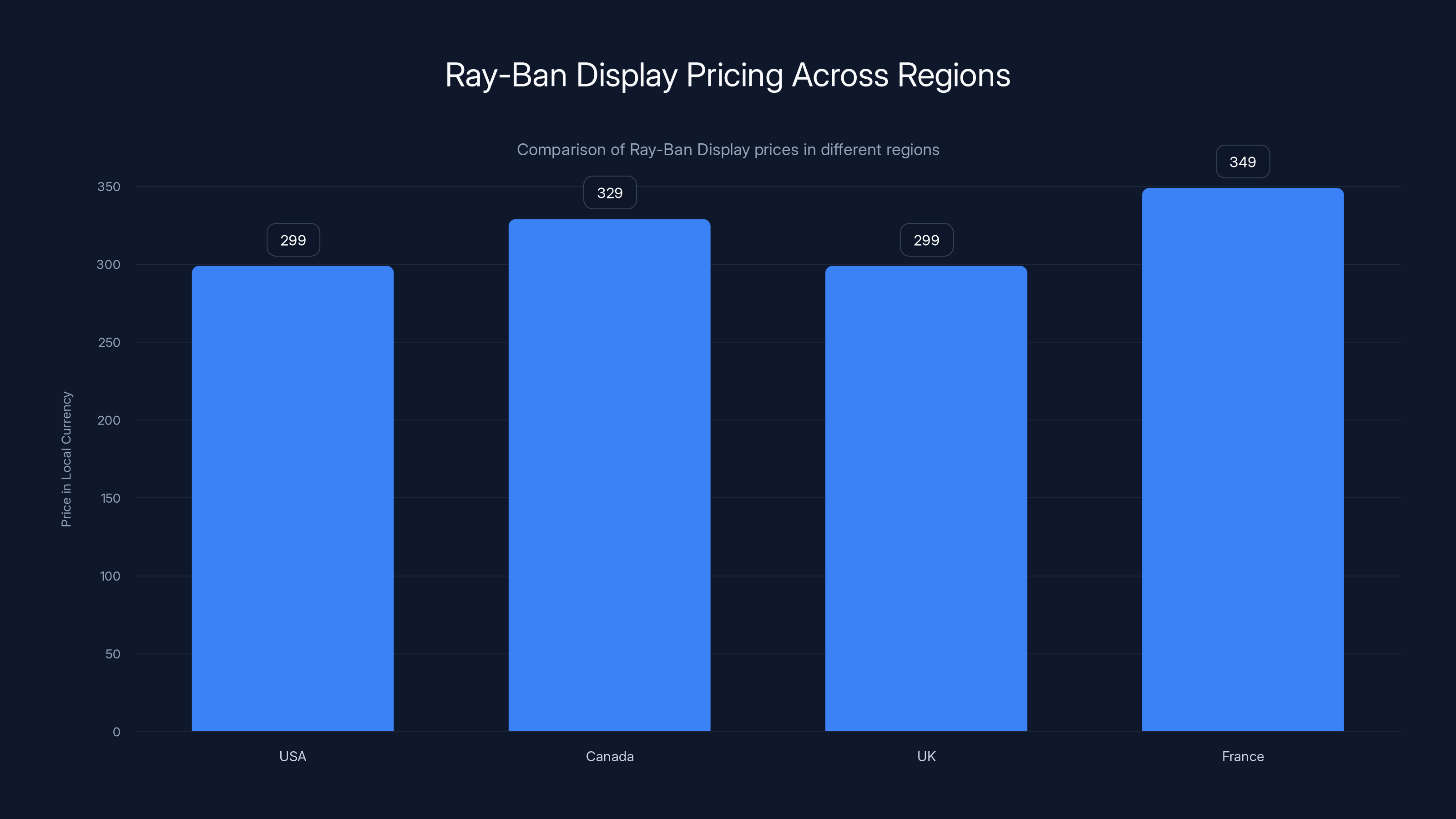

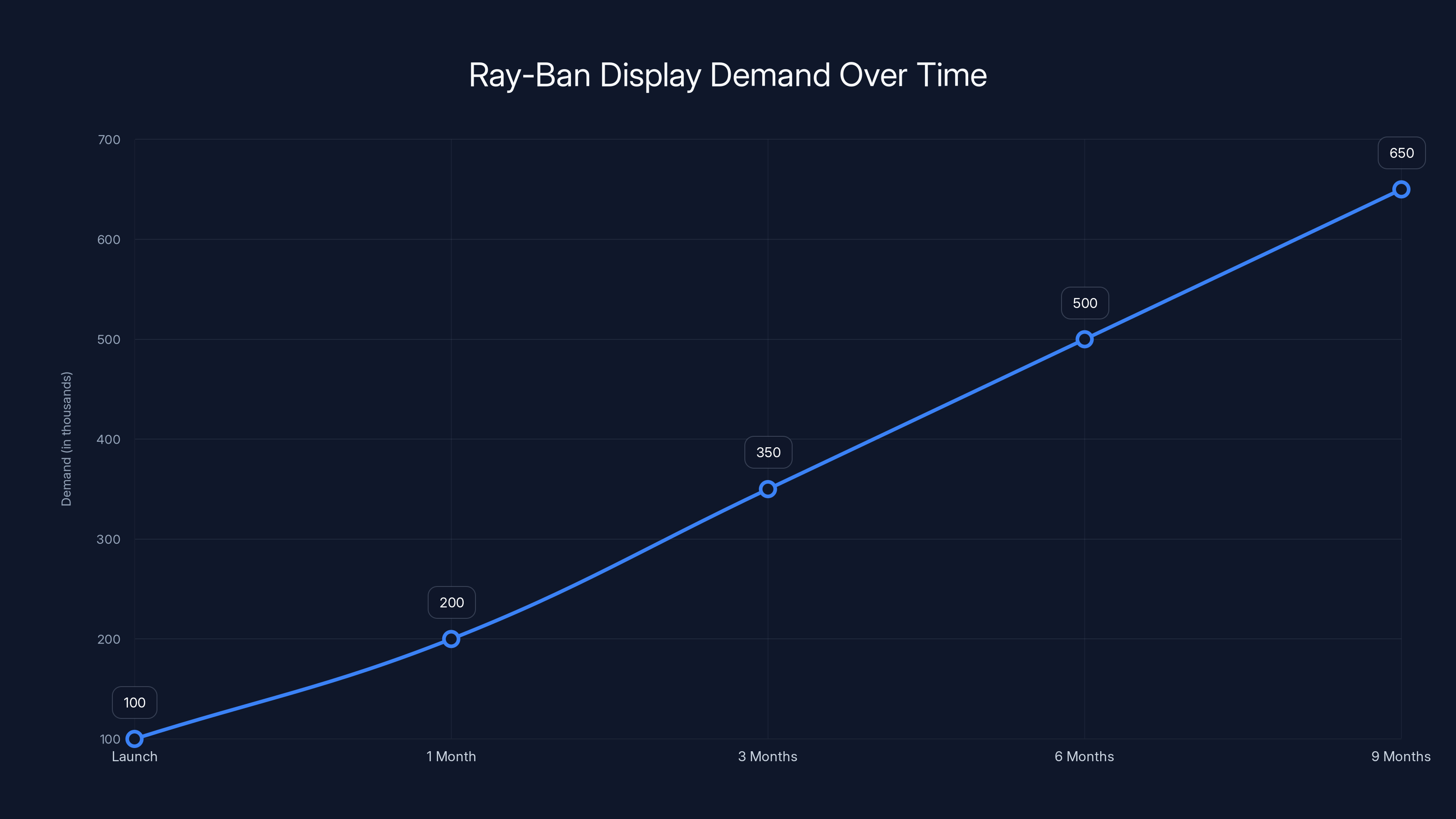

When the glasses launched at $299 (a relatively accessible price point for early adopters), the response was immediate. Within weeks, waitlists stretched months into the future. Meta, being a company that prides itself on data and user growth metrics, recognized something rare: a hardware product with genuine consumer demand. But that demand created a problem. The company couldn't make enough glasses to satisfy even the U. S. market, let alone expand internationally.

That's the crucial context. This isn't a case of a product failing to gain traction. It's the opposite problem. Meta has a hit on its hands, but it can't manufacture fast enough to meet demand.

The Ray-Ban Display is priced at

Manufacturing Realities: Why Smart Glasses Are Harder to Scale Than Smartphones

Understanding why Meta hit a manufacturing wall requires understanding how different smart glasses are from other consumer electronics. A smartphone is relatively straightforward to manufacture at scale. The supply chains are mature, the processes are optimized, and companies like TSMC, Samsung, and others have decades of experience pushing volumes into the hundreds of millions annually.

Smart glasses are different. They're a nascent product category with complex components stacked into tiny spaces. The Ray-Ban Display includes a custom camera, a micro-display, processors, batteries, and wireless chips all compressed into something that needs to look good on your face. Each component is a miniaturized version of standard electronics, which means each faces unique manufacturing challenges.

The display component alone is a constraint. Micro-displays that can project images visible only to the wearer require specialized manufacturing capabilities. Only a handful of companies in the world produce these components, and they're already supplying multiple customers with competing products. When demand spikes faster than anticipated, there's no place to source additional units. You can't just add another production line for micro-displays the way you might with smartphone screens.

Battery constraints also play a role. The Ray-Ban Display uses a custom battery pack designed to balance weight, form factor, and runtime. Manufacturing custom batteries at scale requires significant capital investment and time. If Meta wanted to increase production by 50%, they couldn't simply order more batteries from suppliers. They'd need to invest in new production lines or negotiate with competitors to buy available capacity, which competitors obviously won't do.

Assembly is another bottleneck. Unlike smartphones, which can be assembled in standardized factories, smart glasses require precision assembly of tiny components in tight tolerances. The same factories that assemble regular glasses often lack the specialized equipment for electronics integration. This limits the pool of manufacturers who can actually build the product at all.

Meta's decision to pause international expansion likely reflects conversations with their manufacturing partners about realistic production timelines. If they couldn't meet demand in one country, adding four more markets would only make the situation worse. The waitlists would extend years into the future, and the company would face constant negative PR about unavailability.

The Waitlist Problem: When Demand Becomes a Supply Crisis

Meta's announcement mentioned that "product waitlists now extend well into 2026." This phrase deserves unpacking because it indicates something extraordinary about the demand problem. In the current iteration of consumer tech, waitlists extending 12+ months ahead are almost unheard of, outside of Apple's occasional product launches.

When Meta says waitlists extend into 2026, they're describing a situation where someone placing an order today wouldn't receive their glasses until summer or later. That's not a minor inconvenience. That's a fundamental supply-demand mismatch that destroys customer satisfaction no matter how good the product actually is.

This creates several cascading problems. First, it demoralizes potential customers. If you can't buy something immediately, your interest decays. You start looking at alternatives. Competitors see an opening. By the time the product becomes available to international markets, some of that initial enthusiasm will have evaporated.

Second, it creates inventory management nightmares. Meta needs to plan manufacturing months in advance. If they commit to producing 100,000 units, they need to know whether demand will support that. With waitlists already extending so far into the future, increasing production becomes a guess. What if demand is actually declining by the time new units come online? Overproduction could result in inventory that doesn't sell, which would be embarrassing given the current supply constraints.

Third, it opens doors for competitors. While Meta focuses on fulfilling U. S. orders, companies like Apple could launch their own smart glasses in international markets. The window of exclusive availability in markets like Europe is narrowing every month. Competitors see Ray-Ban Display unavailability as a strategic opportunity.

Meta's pragmatic decision was to acknowledge these realities. Rather than overpromise an international launch date that couldn't be met, the company chose to pause. This preserves customer goodwill (somewhat), focuses production on existing commitments, and buys time to figure out realistic expansion timelines.

The Ray-Ban Display experienced a rapid increase in demand post-launch, with waitlists extending months due to high consumer interest and limited production capacity. (Estimated data)

The Strategic Implications: What Meta's Pause Says About Hardware Strategy

Meta's decision to pause international expansion reveals something important about the company's evolving hardware strategy. For years, Meta was primarily a software and services company. Hardware was supplementary. The Oculus Quest was successful but represented a niche category. The Portal smart display never really took off. Meta's phone ventures (the Facebook Phone, various partnerships) mostly failed.

But the Ray-Ban Display represents Meta's most successful consumer hardware product in years. The company is finally creating a device that people actually want, independent of software lock-in or ecosystem effects. It's successful because it solves a real problem (better social media capture), looks acceptable in public, and doesn't require learning entirely new interfaces.

This success is forcing Meta to confront hard realities about hardware that software companies rarely face. You can't scale hardware as fast as software. You can't push updates overnight. You can't fix manufacturing issues with code patches. Every unit sold represents physical atoms that needed to be assembled, tested, and shipped. Scale doesn't happen easily or quickly.

The pause also signals that Meta is willing to make customer-unfriendly decisions when supply constraints demand it. That's a sign of a company thinking strategically about long-term market position rather than chasing short-term growth metrics. International customers are disappointed, but Meta is protecting its brand by not overpromising availability it can't deliver.

This decision may also influence how Meta approaches future hardware products. The company clearly has the capital to invest in new manufacturing capacity. If the Ray-Ban Display continues selling well (and demand remains high through 2026), Meta might invest in building or acquiring dedicated smart glasses manufacturing facilities. That would give the company more control over production timelines and reduce dependence on existing suppliers who are already capacity-constrained.

But that's an expensive, risky move. Manufacturing facilities require significant capital investment, long-term commitments, and operational expertise that software companies don't typically have. Meta would need to hire experienced hardware manufacturing leadership and build organizational muscle that doesn't currently exist at the company.

Competitive Landscape: How This Pause Affects the Broader Smart Glasses Market

Meta's pause on international expansion creates opportunities for competitors, but it also signals something important about market demand. The Ray-Ban Display's success proves that consumers are ready for smart glasses. That's a huge validation for the category after years of skepticism.

Apple has been working on AR glasses for years, though the company hasn't officially acknowledged a product timeline. If Apple launches a competing product in Europe or Canada before the Ray-Ban Display becomes available, the company could capture market share that Meta would otherwise dominate. The longer Meta's pause extends, the larger this window of opportunity becomes for competitors.

Google has its own smart glasses projects, though they've been less visible than Apple's efforts. Snap has been pushing Spectacles, though adoption has remained limited to niche enthusiasts. None of these competitors currently have a product as polished as the Ray-Ban Display, but that could change.

International hardware makers are also paying attention. Companies in China and Korea are developing smart glasses prototypes. They may not be as refined as Meta's offering, but if they can reach market before the Ray-Ban Display, they'll build early adopter communities in regions where Meta isn't present.

This competitive pressure actually validates Meta's decision, even though it seems counterintuitive. By pausing expansion, Meta is signaling confidence that the Ray-Ban Display's quality and brand strength will eventually overcome any competitive advantages rivals might gain during the pause. The company is betting that fixing supply constraints and maintaining product quality matters more than racing to market.

It's also worth noting that Meta's pause buys time for the company to refine the product. First-generation devices often have issues that become apparent only after real-world use at scale. By maintaining a measured expansion approach, Meta can gather feedback from U. S. users, iterate on hardware design, and potentially release an improved version (or additional configurations) by the time international launch happens.

Smart glasses face higher complexity in component integration and precision assembly compared to smartphones, which benefit from mature supply chains and scalability. Estimated data.

Consumer Sentiment: The Disappointment Factor and Managing Expectations

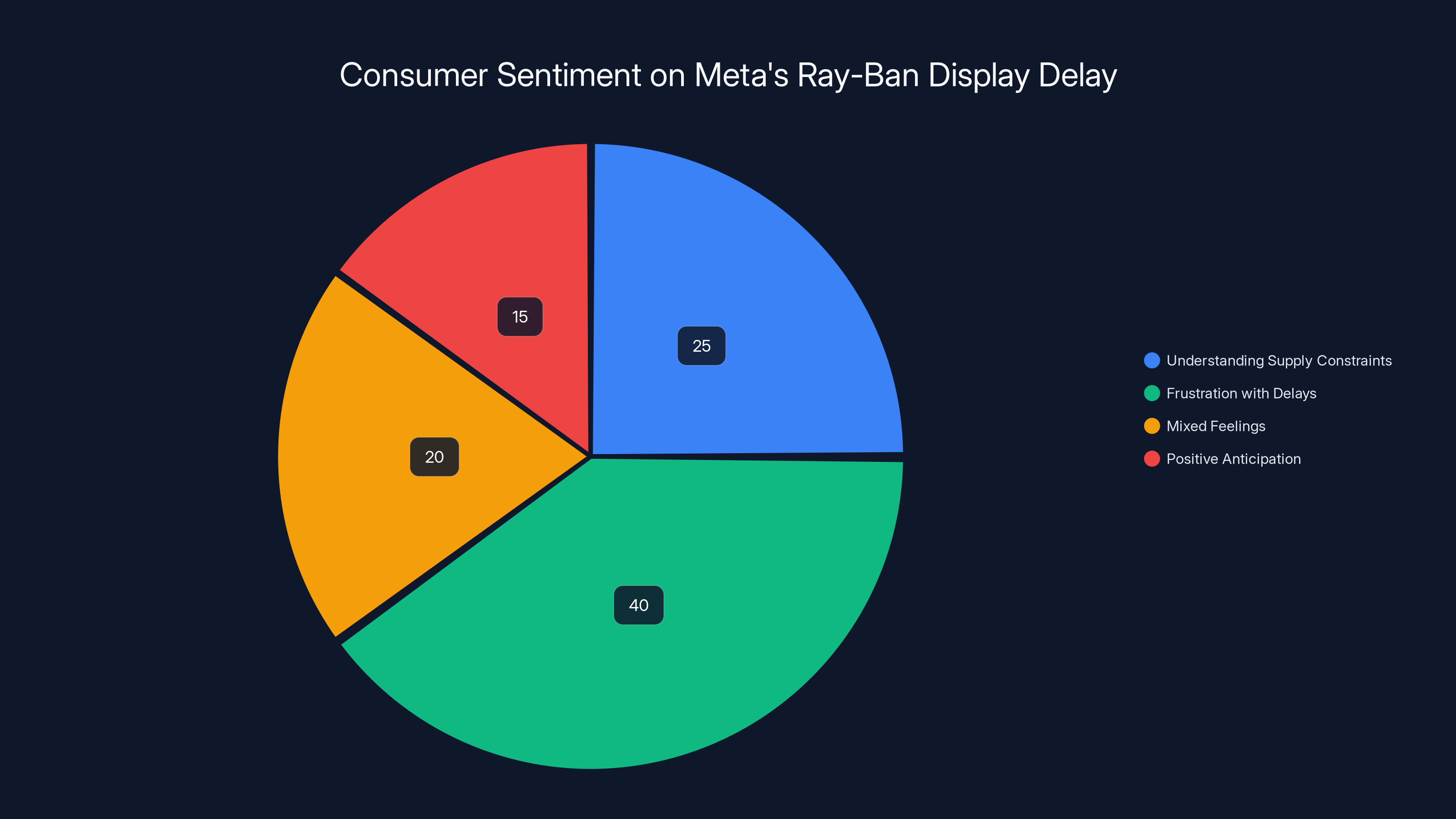

International customers waiting for the Ray-Ban Display are understandably disappointed. Meta explicitly mentioned that the glasses are "the best" according to Verge reviewer Victoria Song, which only heightens frustration for people who can't buy them. When you know a product is excellent but can't access it for months or years, that's genuinely frustrating.

This disappointment has real consequences for Meta's brand perception internationally. In France and Italy, where the company has significant operations and user bases, the inability to deliver on promised timelines damages credibility. Customers remember. When Meta eventually does launch internationally, some percentage of initial enthusiasm will have dissipated.

Social media sentiment around the pause has been mixed. Some people understand the supply constraints and appreciate Meta's transparency about them. Others view it as Meta overselling capabilities to international markets without the manufacturing backing to support those promises.

Managing customer expectations is crucial in situations like this. Meta's CES announcement was straightforward about the pause, which is good. But the company hasn't provided any realistic timelines for international availability. That creates uncertainty that frustrates people more than a clearly stated "two-year wait" would.

Going forward, Meta should provide clearer guidance about what factors would need to change before international expansion becomes possible. Is it purely production volume? Cost reduction? Perfection of the manufacturing process? Increased battery life? Different configurations for different markets? Better communication about these variables would help customers understand what to expect.

There's also a lesson here about how to announce future availability. Mentioning upcoming launches in France, Italy, Canada, and the UK created expectations that the company ultimately couldn't meet in the timeline promised. A better approach would have been to announce the product and availability first, with manufacturing constraints front and center from the beginning.

The Manufacturing Timeline: When Might International Customers Actually Get the Glasses?

Meta's announcement provides no specific date for when international expansion might resume. That's intentional. The company doesn't want to make another promise it might not keep. But we can make some educated guesses based on industry norms and current capacity constraints.

First, consider current production volumes. If Meta is currently producing enough Ray-Ban Display units to fulfill existing U. S. waitlists (which extend into 2026), the company is probably manufacturing somewhere in the range of 100,000 to 300,000 units annually, based on typical smart device production numbers for niche products. That's significant but not massive.

To expand internationally without creating even longer waitlists, Meta would need to double or triple production capacity. That takes time. Even if the company accelerated manufacturing commitments today, new production lines would take 12-18 months to come online and reach full capacity.

Add to that the time needed to actually work through existing U. S. waitlists. If people ordered before the pause announcement, and the longest wait is mid-2026, Meta probably isn't even clearing current orders until summer or fall of 2026. Only after that point would the company be in a position to reliably promise international availability.

A realistic timeline probably looks like this: Summer 2026 (current U. S. waitlists nearly cleared), Q4 2026 or Q1 2027 (new production capacity comes online), early 2027 (international expansion finally begins in limited quantities). That's more than a year away from when this article is being written.

For perspective, that's a long time in consumer tech. iPhone 15 will have been replaced by iPhone 17. Competitors will have launched their own products. The sense of urgency around smart glasses will have shifted. Meta is essentially conceding that it won't be a first-mover advantage in most international markets. The company is choosing market dominance in the U. S. over geographic expansion.

This timeline also assumes nothing goes wrong. If there are supply disruptions, shipping delays, or production yields lower than expected, timelines slip further. Recent history (semiconductor shortages, battery supply issues) suggests that hardware-related delays are more common than on-time launches.

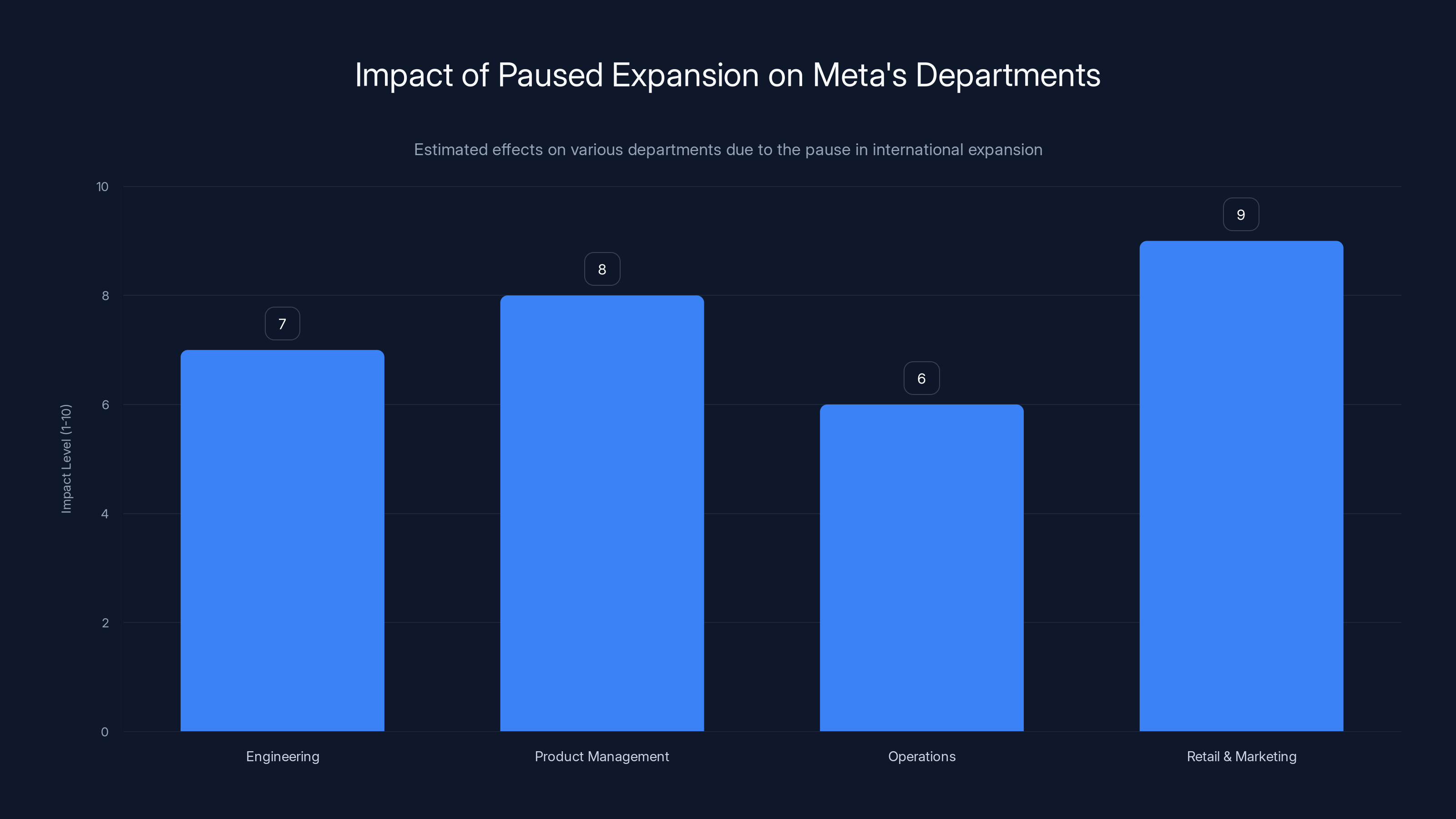

The pause in Meta's international expansion significantly impacts various departments, with Retail & Marketing facing the highest level of disruption. (Estimated data)

The Essilor Luxottica Relationship: How the Ray-Ban Partnership Shapes Constraints

Understanding Meta's manufacturing challenges requires understanding the partnership structure with Essilor Luxottica. The Ray-Ban Display isn't purely a Meta product. It's a collaboration where Essilor Luxottica brings eyewear manufacturing expertise and the Ray-Ban brand, while Meta brings software, AI integration, and camera technology.

This partnership is beneficial in many ways. Essilor Luxottica's manufacturing capabilities are world-class, which is why the Ray-Ban Display looks and feels like real glasses rather than a tech prototype. The company's supply chain relationships and distribution network are invaluable.

But partnerships also create constraints. Meta can't unilaterally decide to triple production. The decision requires Essilor Luxottica's agreement and investment. If Essilor Luxottica doesn't see a return on manufacturing expansion, the company might resist. Essilor Luxottica's primary business is eyewear fashion, not tech gadgets. The Ray-Ban Display is interesting but still a relatively small part of the company's overall business.

This also explains why Meta won't simply move production to different manufacturers. The Ray-Ban brand name and the specific eyewear form factor are crucial to the product's appeal. You can't farm out manufacturing to a contract manufacturer and maintain the same quality and brand positioning.

Essilor Luxottica likely has opinions about international expansion timing too. The company might prefer a measured, controlled rollout that maintains premium positioning over a rapid global expansion that could cheapen the brand. European markets where Essilor Luxottica is particularly strong might actually benefit from a more gradual approach.

This partnership dynamic, while not publicly visible, probably shapes Meta's strategic decisions more than pure manufacturing capacity does. It's one reason the company can't simply commit to aggressive timelines.

Price and Positioning: Why the Ray-Ban Display Isn't Just a Camera

At $299, the Ray-Ban Display sits in an interesting price position. It's expensive for a gadget but inexpensive for augmented reality technology. That price point reflects the product's positioning as a consumer device, not a professional tool. This matters for understanding the demand surge.

Consumers at that price point are willing to wait longer than they would be for a

If Meta were to expand internationally without addressing manufacturing constraints, the company might need to raise the price to reduce demand and improve supply-demand balance. That would be terrible for market share. A

International pricing will be interesting when expansion finally happens. Different regions have different tariffs, taxes, and distribution costs. The Ray-Ban Display might cost $329 in Canada, £299 in the UK, and €349 in France. These price variations could affect demand patterns and inventory management.

The current $299 price in the U. S. is also artificially attractive because it's the launch price. Historically, prices for successful consumer tech products don't drop significantly in the first 2-3 years. If anything, Meta might maintain or slightly increase the price as demand continues to exceed supply. That would further frustrate international customers waiting to buy.

Estimated data shows that 40% of consumers express frustration with delays, while 25% understand supply constraints. Better communication could shift sentiment positively.

Looking Forward: What the Ray-Ban Display's Success Means for AR Glasses Evolution

Beyond the immediate supply constraints, Meta's pause on international expansion signals something broader about augmented reality glasses adoption. The overwhelming demand for the Ray-Ban Display proves that consumers are ready for smart eyewear. This validates years of speculation and research suggesting that AR glasses could be as significant as smartphones.

That demand is translating into real business metrics. Meta has never disclosed Ray-Ban Display sales numbers, but the extended waitlists suggest the product is selling many tens of thousands of units. For a brand-new product category, that's substantial. It suggests a multi-billion dollar market opportunity if production could scale to meet demand.

This success will likely accelerate investment in smart glasses across the industry. Companies that have been skeptical about AR glasses viability will now see evidence of consumer demand. Apple will probably accelerate its launch timeline. Google and Snap will increase their investments. Chinese and Korean companies will ramp up development.

The technical challenges Meta has faced will also drive innovation. Better micro-displays, more efficient processors, longer-lasting batteries, and lighter form factors will all become priorities across the industry. Companies will invest in manufacturing equipment and facilities specifically designed for smart glasses. In five years, the industry will have the infrastructure to support much larger production volumes.

Meta's pause might actually accelerate this process. The company is clearly serious about smart glasses as a core business priority, willing to invest capital and endure customer dissatisfaction to get the foundation right. That commitment will attract more players to the market and justify infrastructure investments.

Ultimately, the Ray-Ban Display might be remembered not as the product that created AR glasses demand, but as the device that proved demand existed. That's an important distinction. Meta is establishing market leadership not through innovation (the technology is impressive but not revolutionary) but through execution and brand positioning. The company is doing smart glasses the right way: focusing on a consumer product that works, looks acceptable, and solves a real problem.

The Essilor Luxottica Relationship: How the Ray-Ban Partnership Shapes Constraints

Meta's choice to partner with Essilor Luxottica for the Ray-Ban Display was strategic. Rather than developing smart glasses entirely in-house (as Meta tried with previous hardware products), the company leveraged one of the world's largest eyewear manufacturers. This partnership brought manufacturing expertise, supply chain relationships, and most importantly, the Ray-Ban brand.

But partnerships create mutual dependencies. Meta can't unilaterally decide to triple production without Essilor Luxottica's cooperation. Essilor Luxottica's core business is eyewear fashion, not consumer electronics. Smart glasses are interesting but still represent a small fraction of the company's revenue.

The pause likely reflects conversations between Meta and Essilor Luxottica about realistic production timelines. Neither company wants to overpromise and underdeliver. By pausing international expansion, both partners are protecting their reputations and managing customer expectations responsibly.

Essilor Luxottica also brings distribution advantages. The company operates retail stores globally and has relationships with eyewear retailers worldwide. When international expansion does happen, Essilor Luxottica's retail network will be crucial for getting the product into customers' hands quickly. That's another reason to take time perfecting the domestic launch before expanding internationally.

The partnership also affects product roadmap decisions. Essilor Luxottica is interested in fashion and style. Meta is interested in features and AI integration. These priorities don't always align. The first-generation Ray-Ban Display probably represents compromises from both sides. Taking time to refine the product before international launch allows both partners to push toward their respective priorities.

Lessons for Other Hardware Companies: When Demand Outpaces Supply

Meta's situation offers lessons for any company launching hardware at scale. The Ray-Ban Display demonstrates how quickly demand can outpace manufacturing capacity, even for companies with unlimited capital and mature manufacturing partnerships.

Apple, when launching new iPhones, sometimes sees waitlists extending several weeks, but rarely months. The difference is that Apple has spent decades building manufacturing infrastructure and has multiple suppliers producing components in parallel. When a new iPhone component is in demand, Apple has options for sourcing additional units.

Meta doesn't have that luxury with smart glasses. The entire industry is immature. Supplier options are limited. Custom components can't be quickly sourced from multiple vendors. The company is essentially at the mercy of whatever manufacturing capacity Essilor Luxottica can allocate.

This suggests that hardware companies entering new categories should either invest heavily in manufacturing capacity before launch or prepare for supply constraints after success. Meta arguably did neither. The company hoped that existing manufacturing relationships would be sufficient but underestimated demand.

For future hardware products, Meta will probably take a different approach. The company might invest in dedicated manufacturing facilities, even if it means higher upfront costs and longer development timelines. Or the company might license technology to multiple manufacturers, reducing dependence on a single partner.

Another lesson is the importance of transparent communication about constraints. Meta's CES announcement was straightforward: demand is high, supply is limited, international expansion is paused. Customers understood the situation, even though they weren't happy about it. A company that tried to obscure the pause or promised timelines it couldn't meet would face much worse customer backlash.

The Waiting Game: What Paused Expansion Means for Employees and Operations

Meta's pause on international expansion probably affects more than just customers. The company likely has teams that were preparing for France, Italy, Canada, and UK launches. People have been hired, supply chains have been planned, retail partnerships have been negotiated. All of that work is now on hold.

This creates management challenges within Meta. Teams that built their roadmaps around international expansion now need to pivot. Engineers might be redeployed to other projects. Product managers need new priorities. The company needs to maintain momentum and enthusiasm even as growth plans are constrained.

On the positive side, the pause gives Meta time to address manufacturing challenges more thoroughly. Instead of rushing to expand globally, the company can invest in process improvements, yield optimization, and cost reduction. By the time international expansion actually happens, the product might be cheaper to manufacture and easier to produce at scale.

Operations teams at Meta are probably working on capacity planning for how to grow production from current levels to something that can support international markets. That involves negotiating with component suppliers, potentially investing in equipment, and training manufacturing partners on quality standards.

Meanwhile, the retail and marketing teams that prepared for international launches are in a holding pattern. They've done the work planning go-to-market strategies, but those strategies are now on indefinite delay. That's frustrating for teams excited about expanding into new markets, but it's probably the right business decision.

Beyond Hardware: What Smart Glasses Mean for Meta's AI Strategy

The Ray-Ban Display's integration with Meta AI is crucial to understanding why this product is so important for the company. The glasses aren't just a camera. They're an AI interface that learns from user behavior and context.

When you wear the glasses consistently, the AI assistant understands what you're looking at, where you are, and what you're interested in. Over time, the AI can provide increasingly relevant suggestions and assistance. That's a valuable data stream for Meta's AI development.

Meta is positioning itself as an AI-first company, competing with OpenAI, Google, and others in the large language model space. But Meta's AI needs to be multimodal, understanding text, images, video, and audio. The Ray-Ban Display provides training data for vision-based AI across all these modalities.

Every person wearing the glasses is essentially feeding computer vision training data to Meta's AI models. That's valuable. Over time, Meta's AI will understand visual contexts that competitors' models might miss. The company will have training data from real-world usage patterns, not just synthetic datasets.

This explains why Meta is willing to accept supply constraints on the Ray-Ban Display hardware. The company isn't trying to maximize short-term hardware revenue. It's investing in AI training infrastructure. The glasses are a tool for gathering the data that will make Meta's AI better than competitors' models.

International expansion makes sense in this context. More countries mean more diverse visual data, more language variations, more cultural contexts. But if Meta is already getting valuable data from U. S. users, expanding internationally isn't as urgent from an AI perspective. The company can wait until manufacturing constraints ease before capturing data from international users.

The Broader Context: Smart Glasses in the Wearable Technology Ecosystem

The Ray-Ban Display doesn't exist in isolation. It's part of a broader shift toward wearable computing devices that sit closer to the user than smartphones. Smartwatches, fitness trackers, and wireless earbuds have already established wearables as a significant product category. Smart glasses are the next evolution.

The installed base of smartwatches has already crossed 500 million units globally. Wireless earbuds are similarly ubiquitous. These devices have conditioned consumers to accept small, lightweight technology that stays with them throughout the day. Smart glasses are a natural extension of that trend.

But smart glasses face unique challenges. They're more expensive than earbuds or watches, they require more power, and they involve wearing something on your face (which raises privacy concerns). The Ray-Ban Display overcomes some of these challenges through great industrial design and strategic positioning as a fashion product first, tech product second.

This positioning is crucial. If smart glasses are marketed as computers for your face (like Google Glass), consumers are skeptical. If they're marketed as stylish eyewear with integrated technology (like Ray-Ban Display), the calculus changes. Fashion legitimacy translates to consumer acceptance.

The wearable ecosystem is also expanding into new categories. AR glasses, smartrings, smart patches, and other form factors are being developed. The Ray-Ban Display's success validates the vision that wearables will eventually become the primary computing interface for many users, eventually replacing or supplementing smartphones.

Meta's pause on expansion shouldn't be interpreted as a sign of skepticism about smart glasses. Quite the opposite. The pause reflects the company's commitment to getting smart glasses right, even if that means slower market expansion. Meta is playing a long-term game where being first to establish dominant market position matters more than being first to reach every geography.

The Role of Hype Cycles: Managing Expectations in Emerging Product Categories

The Ray-Ban Display exists at an interesting point in the hype cycle for smart glasses. The technology isn't new. Google Glass failed a decade ago. Microsoft HoloLens exists but remained niche. Yet somehow, the Ray-Ban Display is succeeding where predecessors failed.

The reason is nuanced. The Ray-Ban Display is the first smart glasses product that offers genuine value without requiring a fundamental change in user behavior. You're not wearing a computer on your face. You're wearing stylish glasses that happen to have integrated technology. That messaging matters.

But hype cycles are dangerous. When a product becomes hot, investors expect exponential growth. Customers expect rapid expansion. Media hypes the story beyond reality. Meta is deliberately resisting that hype cycle by pausing international expansion and being transparent about constraints.

This measured approach could actually extend the Ray-Ban Display's market dominance. If Meta had rushed into international markets with insufficient supply, the company would have faced constant stories about unavailability, dissatisfied customers, and competitive opportunities. By pausing, Meta is managing the hype cycle and setting realistic expectations.

Historically, products that grow gradually often sustain that growth longer than products that spike quickly. The iPhone had explosive growth but also sustained growth for over a decade. Products that hit hype peaks quickly often face disappointing declines. Meta is trying to avoid that trap with the Ray-Ban Display.

Conclusion: Strategic Patience and the Future of Wearable Computing

Meta's decision to pause Ray-Ban Display international expansion is ultimately a display of strategic confidence. The company isn't losing faith in smart glasses. It's not acknowledging failure or reconsidering the category's viability. Instead, Meta is saying: this product is successful, demand is strong, and we're willing to disappoint customers in the short term to maintain long-term market leadership.

That's a counterintuitive move for a company known for aggressive expansion and rapid scaling. But it also reflects maturity. Meta is thinking beyond the next quarter or even the next year. The company is building the foundation for smart glasses to become a core computing platform over the next decade.

International customers waiting for the Ray-Ban Display are understandably frustrated. The pause is disappointing and suggests timelines longer than anyone wanted. But it's also a signal that Meta is serious about smart glasses. The company isn't treating it as a sideline product. It's investing capital, managing expectations, and taking the time to get manufacturing right.

By 2027 or 2028, when the Ray-Ban Display finally becomes widely available internationally, the product will probably be improved from the current version. It'll be cheaper to manufacture, perhaps offer better battery life, and integrate more deeply with Meta's AI ecosystem. The wait will have been frustrating, but the final product will be better because Meta took time to scale it properly.

For the broader smart glasses industry, Meta's patience is validating. It confirms that smart glasses aren't a failed category doomed to niche adoption. The Ray-Ban Display is proving that consumers want this technology, will wait for it, and will use it regularly. That's the strongest possible signal for a new product category.

Meanwhile, Meta's competitors have time to respond. Apple, Google, and others can refine their own smart glasses products knowing that market demand exists. The window for Meta's exclusive market dominance is closing, but that might be acceptable if it means a larger overall market as others enter the space.

Ultimately, the Ray-Ban Display pause is about recognizing that hardware innovation works differently than software innovation. You can't scale infinitely fast. You can't fix supply constraints overnight. You have to respect manufacturing realities and manage expectations honestly. Meta's willingness to do that, even at the cost of disappointing customers and competitors seeing opportunities, suggests the company understands the long game. Smart glasses are the future. Meta is positioning itself to dominate that future, even if it means waiting a bit longer.

FAQ

What is the Ray-Ban Display and why is it important?

The Ray-Ban Display is a pair of smart glasses developed by Meta in partnership with Ray-Ban. The device features an integrated camera, microphone, and small display designed to work seamlessly with Meta AI. It's important because it represents the first mainstream consumer smart glasses product that looks acceptable in public and offers genuine utility beyond novelty, validating the viability of AR glasses as a product category.

Why did Meta pause international expansion of the Ray-Ban Display?

Meta paused plans to launch the Ray-Ban Display in France, Italy, Canada, and the UK due to unprecedented demand in the United States that far exceeded manufacturing capacity. The company stated that product waitlists now extend well into 2026, and expanding internationally would only exacerbate supply constraints. By focusing resources on fulfilling U. S. orders, Meta is prioritizing customer satisfaction and brand reputation over rapid geographic expansion.

When will the Ray-Ban Display become available internationally?

Meta has not provided a specific timeline for international availability. Based on current waitlist patterns and typical manufacturing scaling timelines, most experts expect international launches to begin sometime in late 2026 or early 2027, though this depends on production capacity increases and existing order fulfillment. Meta deliberately avoided committing to specific dates to manage expectations after the initial pause announcement.

What are the manufacturing challenges preventing faster production?

Smart glasses are fundamentally more complex to manufacture than smartphones. The Ray-Ban Display requires custom micro-displays, specialized batteries, precision assembly, and integration of multiple proprietary components. Unlike smartphones with mature supply chains, smart glasses have limited suppliers and no optimized manufacturing processes. Additionally, the partnership with Essilor Luxottica adds constraints because manufacturing capacity decisions require agreement from both companies.

How does the pause affect competition in the smart glasses market?

The pause creates opportunities for competitors like Apple, Google, and others to enter markets (particularly Europe and Canada) before the Ray-Ban Display becomes available. However, the strong demand demonstrated by Ray-Ban Display waitlists validates the entire smart glasses category, likely accelerating competitors' timelines and investment in smart eyewear development. The pause doesn't indicate weakness in the product category; it indicates strength that outpaces current manufacturing capacity.

What can international customers do while waiting for availability?

International customers can subscribe to waitlists on Meta's official website and authorized retailers in their country, ensuring they're notified immediately when availability is announced. Following tech news outlets for updates on production timelines and competitor launches is also recommended. Some retailers may offer pre-orders once a concrete launch date is confirmed, so monitoring official sources is essential to secure early access.

Does the pause indicate problems with the Ray-Ban Display product itself?

No. The pause is actually a positive signal about product quality and market demand. Meta only paused expansion because demand exceeded all expectations, not because customers disliked the product or sales disappointed. The Verge's review called the Ray-Ban Display "the best I've ever tried," and waitlists extending into 2026 indicate sustained consumer interest. The pause reflects manufacturing constraints, not product issues.

How does this pause fit into Meta's broader AI and wearable strategy?

The Ray-Ban Display is central to Meta's strategy of becoming an AI-first company. The glasses generate valuable training data for Meta's computer vision AI models through real-world usage patterns. Rather than maximizing short-term hardware revenue, Meta is using the Ray-Ban Display to build AI capabilities that will benefit the company's entire product ecosystem. The measured rollout allows Meta to gather diverse AI training data while maintaining product quality and brand positioning.

What does this mean for the future of smart glasses as a product category?

The Ray-Ban Display's overwhelming success proves that consumers are ready for smart glasses and willing to wait for quality products. This validation will likely accelerate investment across the industry as competitors and new entrants recognize viable market demand. Within five years, smart glasses manufacturing infrastructure will likely improve significantly, supporting larger production volumes and more companies entering the market. The Ray-Ban Display is establishing smart glasses as a legitimate computing category alongside smartphones and tablets.

How will pricing be affected when international expansion eventually happens?

International pricing will likely be higher than the current

Key Takeaways

- Meta paused Ray-Ban Display expansion in France, Italy, Canada, and UK due to overwhelming U.S. demand and limited manufacturing capacity.

- Waitlists extending well into 2026 represent unprecedented demand for smart glasses, validating the category's viability.

- Smart glasses manufacturing is inherently more constrained than smartphone production due to custom components, limited suppliers, and complex assembly requirements.

- Partnership with Essilor Luxottica brings design legitimacy but also creates mutual dependencies that affect production timelines.

- International expansion likely won't resume until 2027 at earliest, giving competitors time to enter markets where Ray-Ban Display is unavailable.

Related Articles

- Apple Vision Pro: Why This $3,500 Headset is Actually Dying [2025]

- Acer Nitro Blaze 11 Cancelled: What Happened to Gaming's Biggest Handheld [2025]

- Post-Boxing Day Tech Deals Still Going Strong [2025]

- NAOX EEG Wireless Earbuds: Brain Monitoring Technology [2025]

- Rokid Style AI Smartglasses: Everything You Need to Know [2026]

- AMD at CES 2026: Lisa Su's AI Revolution & Ryzen Announcements [2026]

![Meta Pauses Ray-Ban Display International Expansion: What It Means [2025]](https://tryrunable.com/blog/meta-pauses-ray-ban-display-international-expansion-what-it-/image-1-1767704891757.jpg)