Meta's Smartwatch 2025: What Malibu 2 Means for Wearables

Meta is making a serious move back into the smartwatch game. After shelving its wearables ambitions in 2022, the company is reportedly dusting off an internal project called "Malibu 2" and planning to launch it sometime this year. This isn't just another product refresh—it's a fundamental shift in how Meta wants to compete in the wearables space.

Let me be clear about why this matters. The smartwatch market is worth billions, and it's dominated by players like Apple, Samsung, and Google. Meta has spent the last few years focused on its Reality Labs division, burning through billions to develop VR headsets and AR glasses. But the smartwatch? That's the gateway device. It's where casual users meet serious computing. And Meta apparently realized it can't afford to miss this segment anymore.

The Malibu 2 project represents Meta's answer to a simple question: what if a smartwatch wasn't just about notifications and fitness tracking, but about delivering AI directly to your wrist? What if it could understand context, handle natural language, and actually make your life simpler? That's the pitch, anyway.

But here's what's actually interesting. Meta's history with wearables is messy. The company tried this before. They developed smartwatch prototypes with detachable cameras, explored multiple camera configurations, and invested heavily in hardware engineering. Then they stopped. Just like that. The question everyone's asking now is whether Malibu 2 is a genuine product or another false start.

The History Behind Meta's Smartwatch Attempts

Meta's wearables journey didn't start with Malibu 2. It started years earlier, back when the company was still figuring out what "Meta" even meant.

In 2021, reports emerged that Meta was developing a smartwatch running a custom version of Android. This wasn't some pie-in-the-sky concept—the company was actively building hardware, experimenting with form factors, and thinking seriously about how to challenge Apple Watch. The earliest prototypes reportedly featured a detachable camera, which honestly sounds wild until you think about what you'd actually use that for. Imagine recording your perspective hands-free, capturing video without holding your phone. It's genuinely innovative, even if it sounds awkward.

Over the next year, details leaked about Meta's smartwatch ambitions. The company was exploring models with multiple cameras—reports suggested they were testing configurations with up to three cameras. This wasn't just feature creep. Meta was trying to figure out how to make a smartwatch that could do what their VR headsets do: understand the world around you through computer vision.

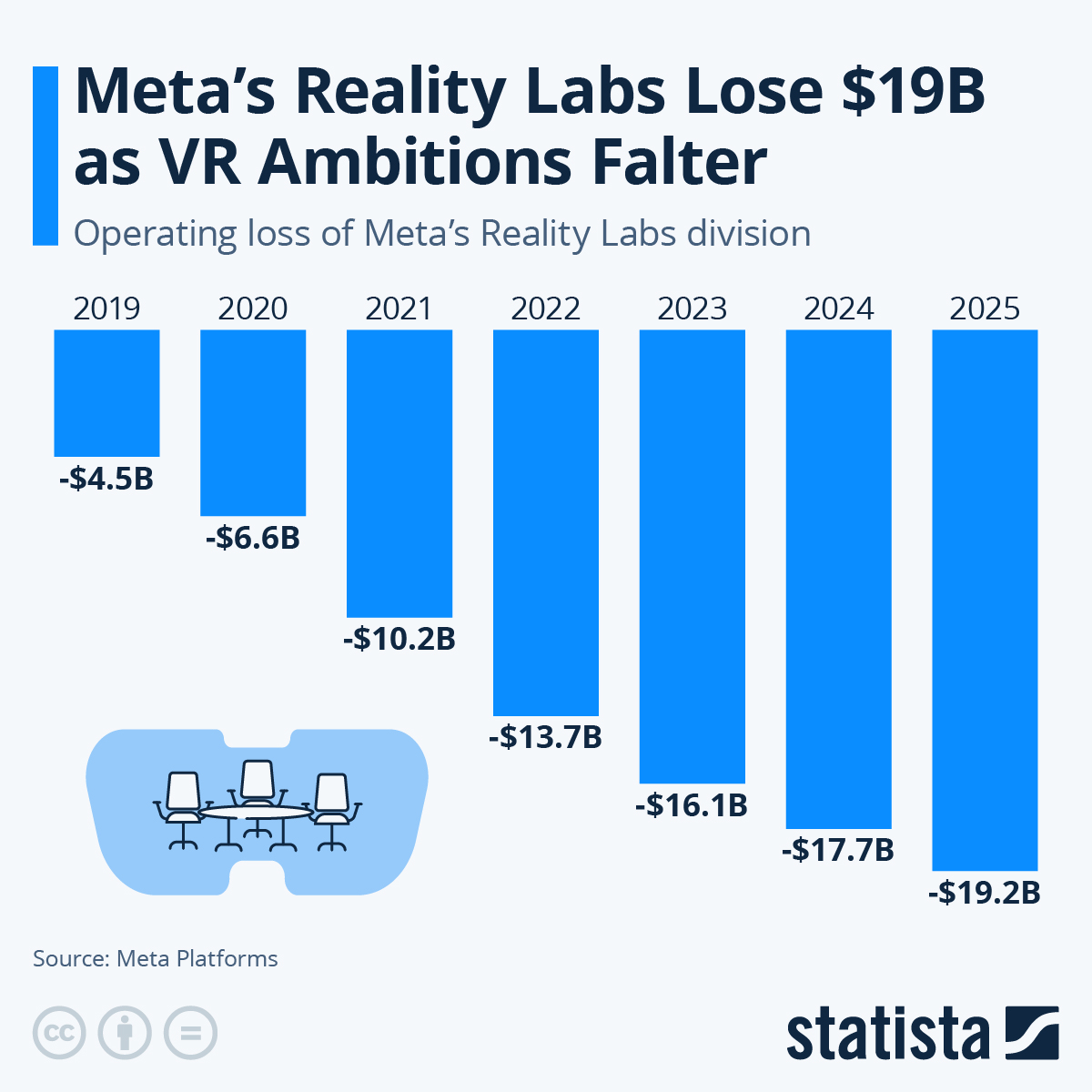

But then 2022 happened. Reality Labs, the division responsible for VR, AR, and apparently smartwatches, became a financial black hole. The division was losing staggering amounts of money every quarter. Mark Zuckerberg faced intense pressure from investors, employees, and the board to justify the spending. Something had to give.

The smartwatch project got shelved. Not cancelled, necessarily. Just paused. Put on the shelf. Maybe for later. This is important because it suggests Meta's leadership never actually stopped believing in smartwatches—they just couldn't afford to pursue everything at once.

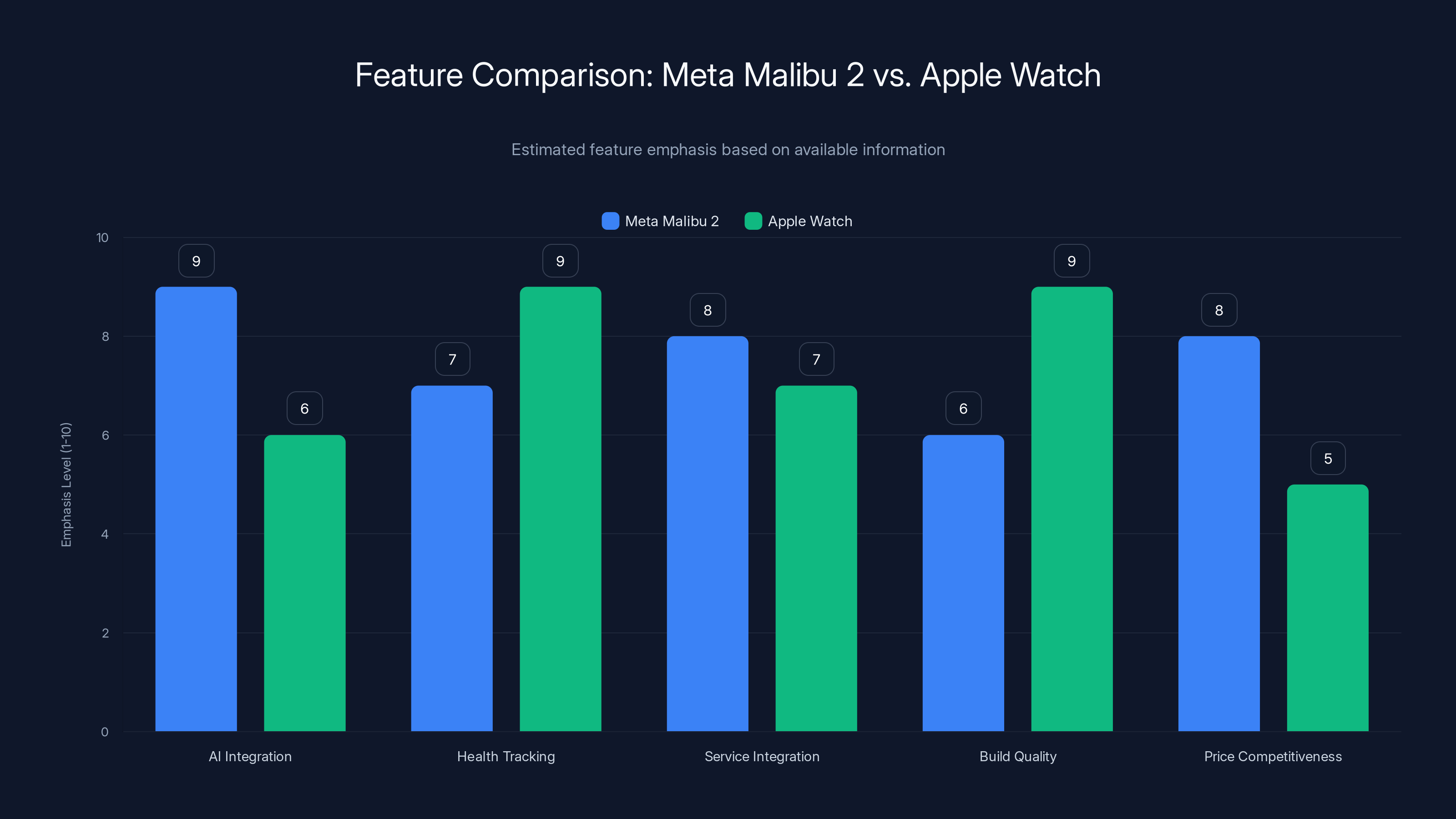

Meta's Malibu 2 smartwatch is expected to emphasize AI integration and service connectivity, while Apple Watch focuses on health tracking and build quality. Estimated data based on current insights.

Why Meta Paused and What Changed

The decision to pause the smartwatch project came during a broader reality check at Meta. In January 2022, the company laid off more than 1,000 employees from Reality Labs. This wasn't a small adjustment—it was a significant downsizing of an entire division.

During earnings calls, Zuckerberg was direct about the strategy shift. When asked about Reality Labs' direction, he said the company was focusing most of its investment "towards glasses and wearables going forward." Notice the language: "glasses and wearables." Not "smartwatches specifically," but the broader wearables category.

This is where the narrative gets interesting. For a few years, Meta seemed content to focus on its Ray-Ban smartglasses partnership. The Meta Ray-Bans became a genuine success story for the company. They offer AR features, camera integration, and audio without looking ridiculous. By most accounts, they're flying off shelves in the US market.

So what changed? Why is Meta suddenly interested in smartwatches again?

A few factors probably contributed. First, the AI boom shifted the entire tech landscape. What seemed like a niche wearable device in 2021 now looks like a natural extension of AI assistants. If Chat GPT can live on your phone, why not on your wrist? The computing power exists. The software frameworks exist. The user demand probably exists too.

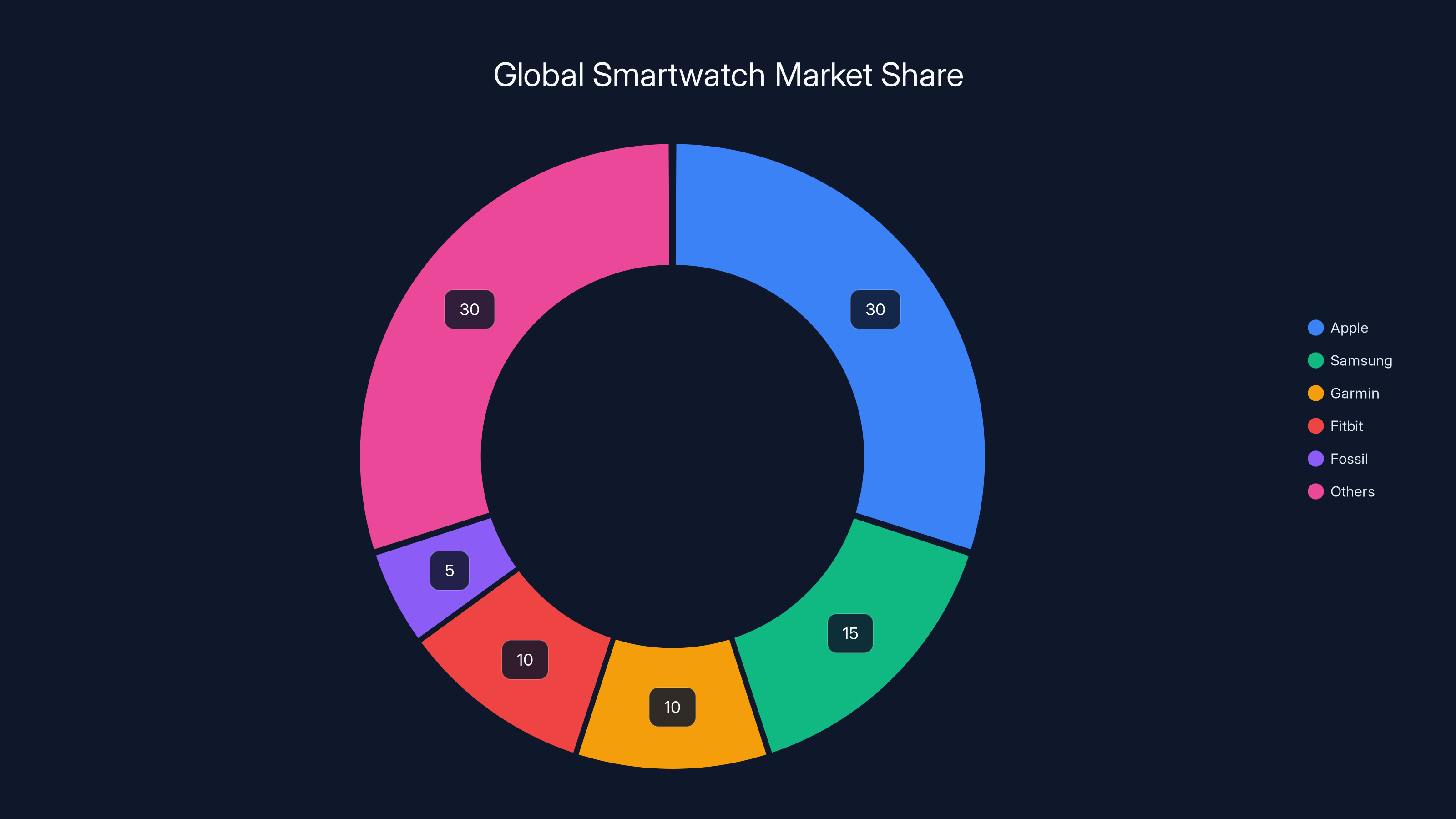

Second, competition is fierce. Apple Watch owns the smartwatch market with roughly 30% market share. But that means 70% of the market is fragmented among competitors. Google's Wear OS has been improving. Samsung's Galaxy Watch line is competitive. Meta looked at the landscape and realized they had the brand power, the software infrastructure, and the user base to genuinely compete.

Third, smartwatches are part of a broader health and fitness ecosystem that Meta wants to own. The company has been investing heavily in health-related features across Instagram, WhatsApp, and its other platforms. A smartwatch is the natural hardware companion to that software strategy.

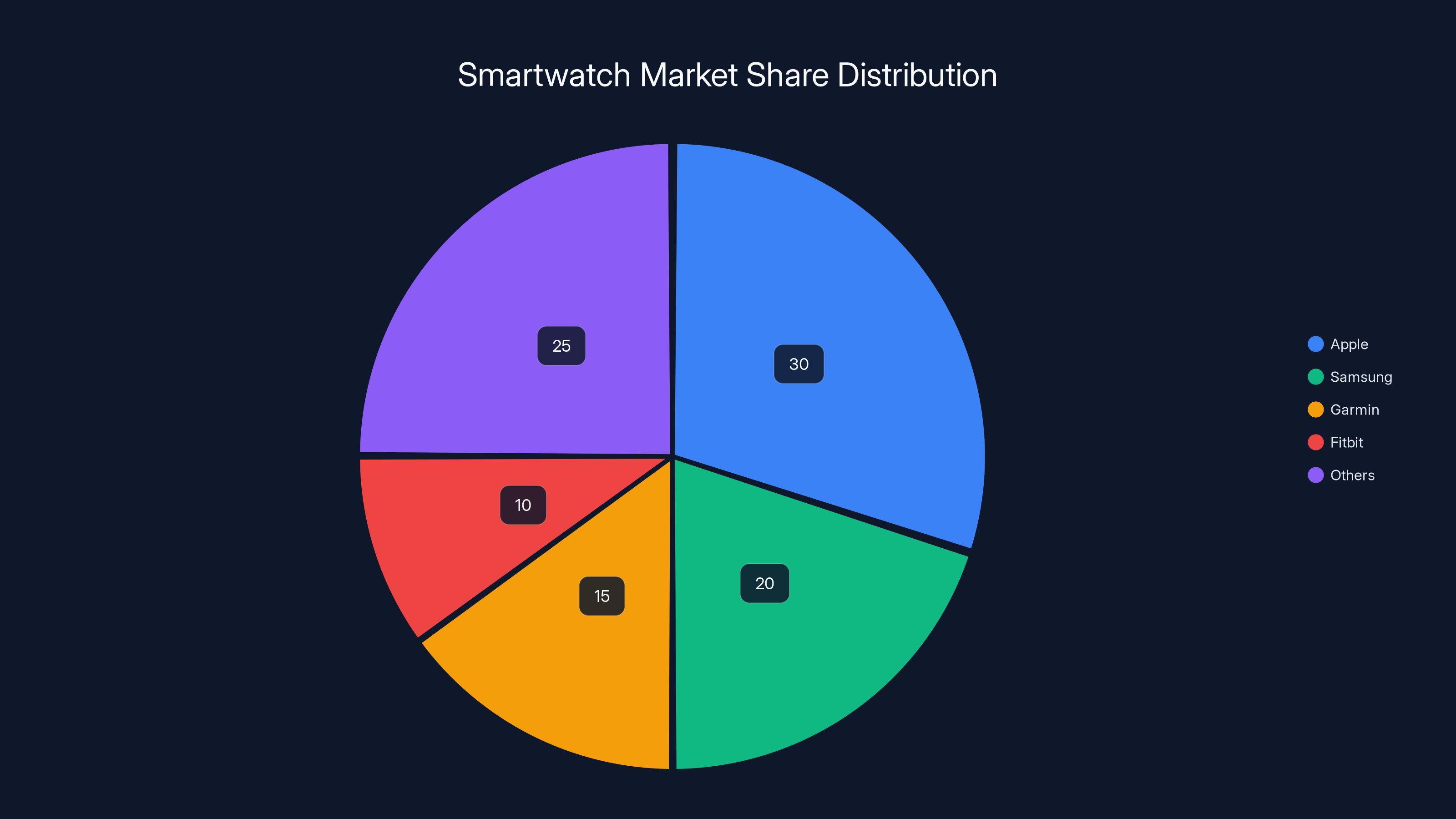

Apple leads the smartwatch market with a 30% share, while Samsung, Garmin, Fitbit, and Fossil compete for the remaining 70%. Estimated data based on market dynamics.

Understanding Malibu 2: The Project Details

Malibu 2 is the codename for Meta's revived smartwatch initiative. The original project, which started around 2021, was simply called "Malibu." By reviving it and calling it Malibu 2, Meta is signaling that this is a fresh start with new leadership, new priorities, and presumably new technical decisions.

According to available information, Malibu 2 will include Meta AI integration and health tracking capabilities. These are the baseline features, the table stakes for any modern smartwatch. But the emphasis on Meta AI suggests the company sees this device as an AI delivery mechanism first, and a fitness tracker second.

What does "Meta AI integration" actually mean? It probably means the device will have access to Meta's AI assistants, which are getting increasingly capable. You'd be able to ask questions, get information, control smart home devices, and maybe even run basic work tasks from your wrist. The smartwatch becomes an endpoint for Meta's AI infrastructure.

The health tracking side is less clear, but smartwatch health features are fairly standardized by now. Heart rate monitoring, step counting, workout tracking, sleep monitoring. The differentiation comes from how intelligently the device uses that data. Can it predict health issues? Can it offer personalized recommendations? Can it integrate with healthcare providers? Meta probably hasn't figured all this out yet, but they'll need something competitive here.

One question everyone's asking: will Malibu 2 have cameras like the original Malibu project? The reports are unclear. Given the camera experiments in the original project, it's possible. But adding cameras to a smartwatch raises privacy concerns and adds significant cost. Meta might have decided to skip cameras for the first generation.

The Role of Meta AI in the Smartwatch Strategy

Here's the thing about Meta's AI strategy: it's built on the assumption that AI should be everywhere. In your messages. In your stories. On your headset. On your wrist.

Meta AI is the company's answer to Chat GPT and Claude. It's available on WhatsApp, Instagram, Facebook Messenger, and various other Meta properties. The assistant can answer questions, help with creative tasks, and perform basic research. It's not the most advanced AI out there, but it's respectable and deeply integrated into Meta's ecosystem.

Putting Meta AI on a smartwatch makes sense from a product strategy perspective. Imagine getting a notification, and instead of reading a paragraph, you tap your watch and say "summarize this for me." Or you're in a meeting and need quick information—you ask your wrist instead of pulling out your phone. Or you're working out and want coaching feedback, and Meta AI analyzes your form through the watch's sensors and offers real-time guidance.

The smartwatch is actually a superior form factor for some AI interactions. It's always with you, it's discrete, and it naturally encourages voice-based input. Typing on a smartwatch screen is terrible, but talking to one feels natural. This is where Meta's AI strategy can genuinely differentiate from competitors.

The challenge, of course, is that Apple's Siri, Google's Assistant, and Samsung's Bixby are all already on smartwatches doing similar things. Meta AI needs to be noticeably better at common tasks, or integrated so deeply with Meta's ecosystem that using an alternative feels wrong.

Meta's advantage here is integration. If you use WhatsApp, Instagram, and Facebook (and frankly, who doesn't?), then having Meta AI on your wrist means it understands the context of your digital life. It knows what you messaged your friend about. It knows what you follow. It can surface relevant information without you explicitly asking.

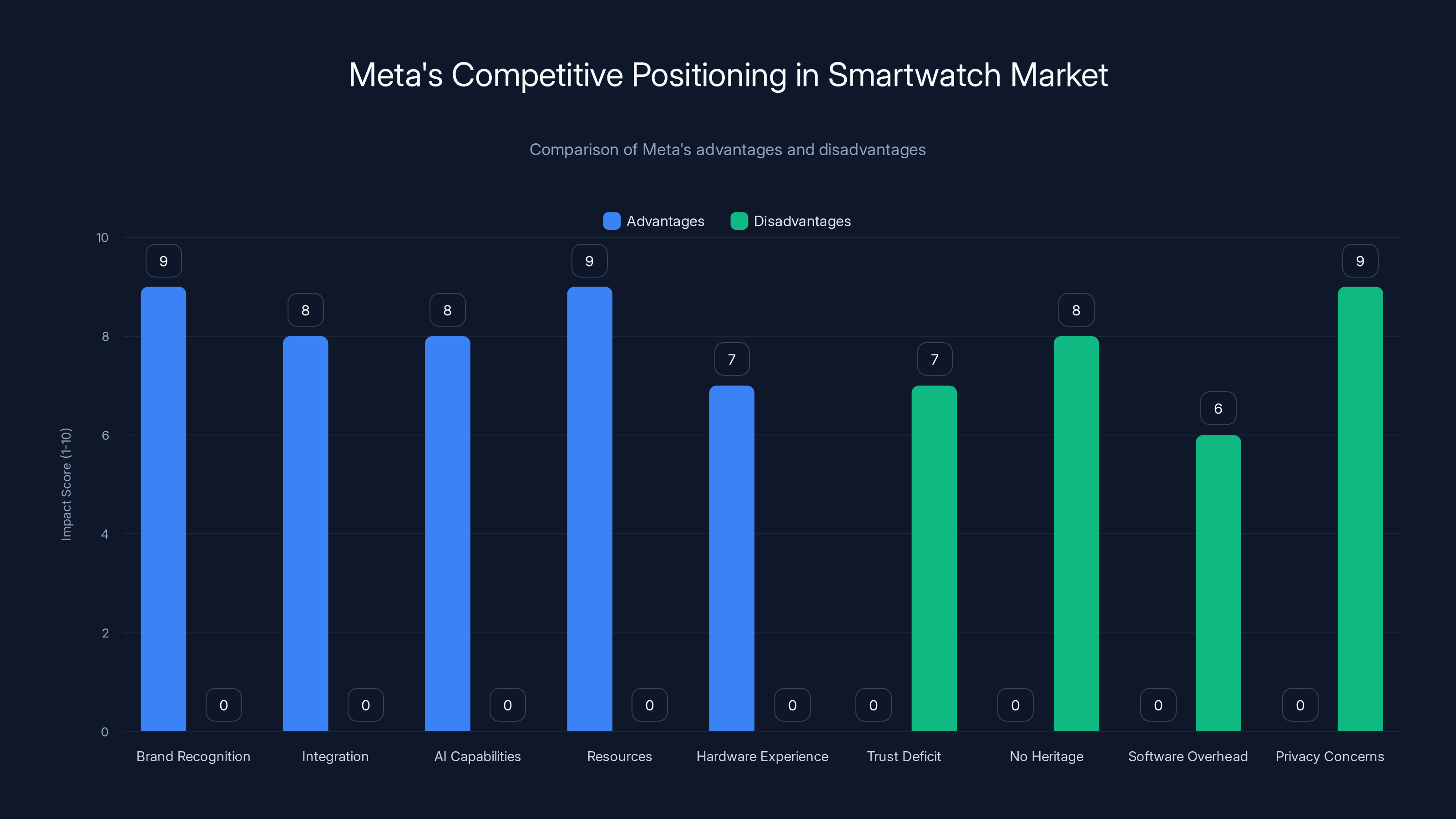

Meta's competitive positioning shows strong advantages in brand recognition, integration, AI capabilities, and resources, but faces significant challenges with trust, heritage, software performance, and privacy concerns. Estimated data based on qualitative assessment.

Meta's Broader Wearables Ecosystem

The smartwatch isn't Meta's only wearable. The company is building out a broader ecosystem, and understanding this context is crucial to understanding why Malibu 2 matters.

The Meta Ray-Bans are the crown jewel of Meta's wearables right now. These aren't full AR glasses with a heads-up display—they're smart glasses with cameras, audio, and AR overlays through a connected app. You can record video from your perspective, get notifications without pulling out your phone, and access various services hands-free. They're also legitimately fashionable, which matters more than tech companies usually acknowledge.

The Ray-Bans are proving that there's genuine consumer demand for Meta-branded wearables. They're selling well. They're getting positive reviews. They're establishing Meta as a credible wearables company, not just a social media platform.

But Ray-Bans aren't enough. Meta wants multiple entry points into the wearables market. A smartwatch reaches people who might not be interested in smart glasses. A smartwatch is cheaper than Ray-Bans. A smartwatch is less conspicuous than glasses. Different products for different use cases.

Meta also has AR and VR headsets. The Quest line is the company's flagship VR product, with millions of units sold worldwide. The company has four different AR and mixed reality glasses projects in development, codenamed things like Phoenix (the next-gen mixed reality headset launching in 2027) and other experimental projects.

So the full ecosystem looks something like this: VR headsets for immersive experiences, AR glasses for everyday augmentation, smartwatches for quick access to AI and health data, and smartphone integrations through WhatsApp and Instagram. Each device serves a different purpose, but they're all connected through Meta's software and AI infrastructure.

This is actually a pretty smart strategy. Microsoft tried something similar with Holo Lens, Apple is building toward this with their Vision Pro, but Meta has the advantage of existing software dominance. They own WhatsApp, which has 2 billion users. They own Instagram, which has 2 billion users. A smartwatch that integrates deeply with these services has immediate relevance to a massive audience.

Smartwatch Market Dynamics and Competition

Before diving into Meta's specific strategy, let's understand the smartwatch market itself. It's worth understanding because it explains both the opportunity and the challenge for Meta.

Apple dominates. The Apple Watch holds about 30% of global smartwatch market share, making it the undisputed leader. But here's what's interesting: that 30% translates to roughly 40 million units per year. The broader smartwatch market is huge. Samsung, Garmin, Fitbit, Fossil, and numerous Chinese manufacturers are all fighting for the remaining 70%.

The market breaks down into a few segments. There are luxury sports watches that cost hundreds and focus on fitness tracking. There are mainstream smartwatches that try to do everything. There are ultra-budget watches that offer basic functionality. Meta's positioning will probably be in the mainstream segment, trying to compete on brand, software integration, and AI features rather than on price alone.

Wear OS, which powers most non-Apple smartwatches, has improved dramatically in recent years. Google took over the project, integrated more of their own resources, and made the operating system actually competitive. Samsung's custom interface on top of Wear OS is also quite good. Garmin's proprietary software dominates the sports watch segment with superior battery life and fitness tracking.

What's the actual opportunity for Meta?

First, there's no dominant non-Apple player in the mainstream smartwatch market. Samsung is strong, but they're also fighting with Google for integration. The market is fragmented enough that a well-executed product with strong software differentiation could carve out meaningful market share.

Second, smartwatch owners are increasingly interested in AI features. The early data suggests that smartwatch owners value conversational AI capabilities, health insights, and predictive features. This plays directly to Meta's strengths.

Third, Meta has an existing relationship with wearables through Ray-Bans. They've established the brand, proven the execution, and built consumer trust. Launching a smartwatch as part of an ecosystem makes sense.

But here's the challenge: execution matters. Meta's Reality Labs division has a spotty track record on hardware launches. They've had successes with Ray-Bans, but struggles with other projects. A smartwatch launch needs to be perfect. The hardware needs to work flawlessly. The software needs to be responsive. The AI needs to be actually useful, not just a gimmick.

Apple dominates the smartwatch market with a 30% share, while the rest is fragmented among competitors like Samsung, Garmin, and Fitbit. Estimated data.

Expected Features of Malibu 2

Based on the history of Meta's smartwatch projects and the current state of smartwatch technology, we can make some educated guesses about what Malibu 2 might include.

AI Integration: Almost certainly. Meta AI will be accessible on the watch, probably through voice commands. You'll be able to ask questions, get summaries, and interact with your digital life hands-free.

Health Monitoring: Basic fitness tracking is mandatory these days. Heart rate, step count, sleep tracking, workout modes. Meta probably needs to offer at least this much to compete.

Integration with Meta Services: The watch will likely integrate deeply with WhatsApp, Instagram, and Facebook. You might be able to read and respond to messages, view stories, and get notifications from friends and followers.

Notifications: Like every smartwatch, Malibu 2 will probably surface alerts from your phone directly to your wrist. Calls, messages, calendar reminders, and app notifications.

Payments: Most modern smartwatches support contactless payments. Meta's watch probably will too, likely integrating with existing payment systems.

Smart Home Control: If you use Meta's smart home products or third-party connected devices, the watch might be able to control them.

Possibly Camera: The original Malibu project had cameras. Malibu 2 might too, though this is the most uncertain feature. Cameras raise privacy concerns and add cost, but they enable powerful features like video recording and AR overlays.

What probably won't be included:

Full AR Display: That's what the upcoming AR glasses are for. The smartwatch won't have a heads-up display with holographic overlays. It'll have a traditional display.

Full Cellular: Meta probably won't offer a cellular version at launch. This adds significant cost and complexity.

Extreme Battery Life: No smartwatch offering rich AI features will last three weeks on a charge. Expect 1-3 days of battery life, typical for modern smartwatches.

Technical Challenges Meta Will Face

Building a competitive smartwatch is harder than it sounds. Meta hasn't released a smartwatch before, so they're not starting from a known playbook. They'll face some genuine technical challenges.

Battery Optimization: Running AI models on a smartwatch is computationally expensive. Meta needs to either significantly optimize their AI models to run locally, or stream everything to cloud servers. Local processing means better privacy and responsiveness. Cloud processing means better AI but requires constant connectivity and has latency issues. This is a fundamental tension Meta will need to solve.

Thermal Management: A small device with significant processing power generates heat. The watch needs to stay cool without the form factor becoming bulky. This is genuinely difficult engineering.

Supply Chain: Building millions of smartwatches requires established relationships with component suppliers, manufacturing partners, and logistics networks. Meta has experience with this through Ray-Bans and Quest headsets, but it's still complex.

Software Optimization: Wear OS or whatever operating system Meta chooses needs to run smoothly on their hardware. It needs to handle AI queries without stuttering, manage battery consumption intelligently, and integrate seamlessly with their services.

Quality Control: Smartwatches are always-on devices that sit on your wrist. They need to be waterproof, durable, and reliable. Quality failures are immediately obvious to users.

Meta has the resources to solve these problems. The question is whether they've learned enough from their VR and AR projects to avoid the mistakes that plagued some of those initiatives.

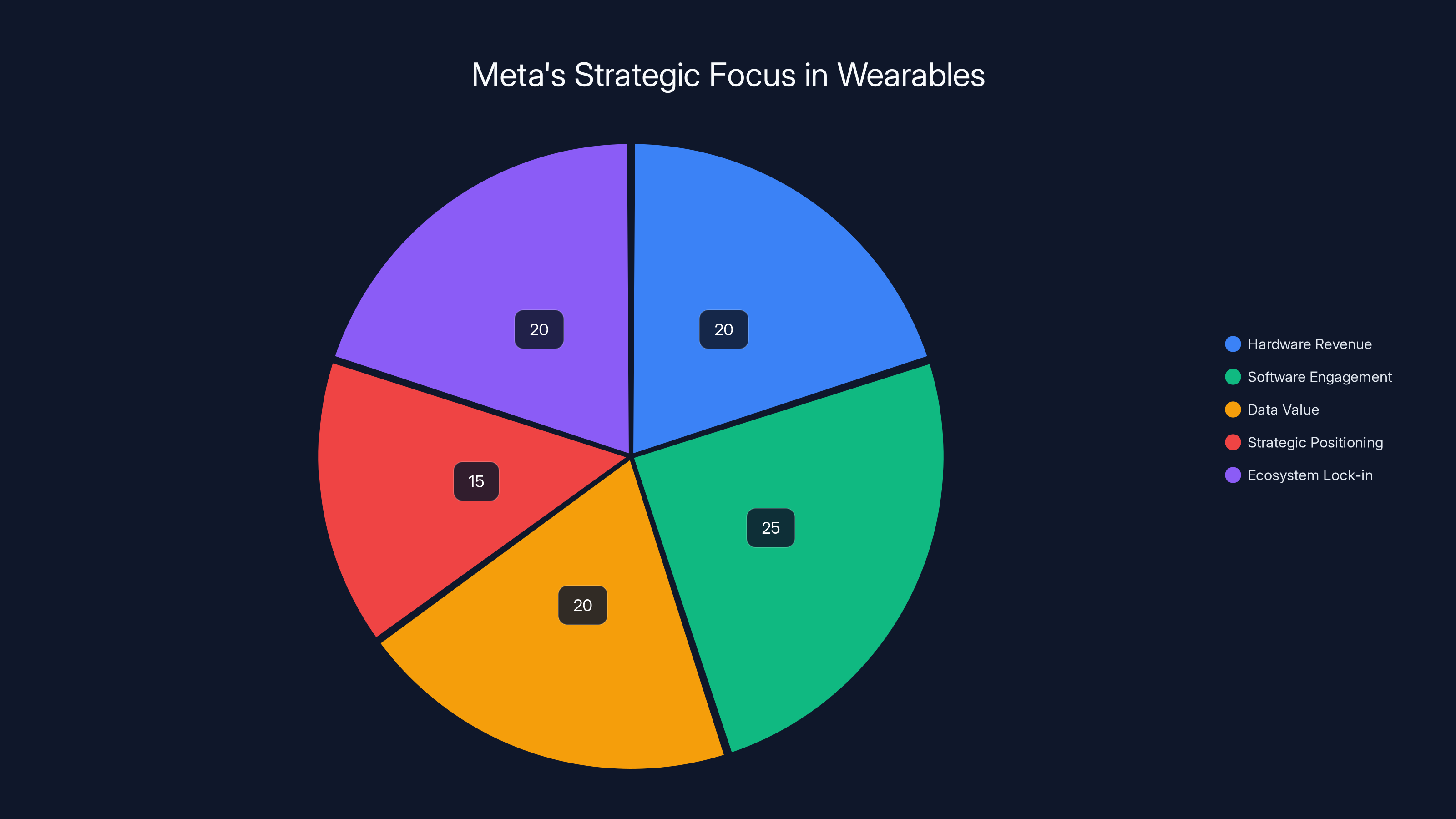

Estimated data: While hardware revenue is significant, Meta's wearables strategy is equally focused on software engagement, data value, and ecosystem advantages.

The Timeline: 2025 and Beyond

Meta is reportedly planning to release Malibu 2 sometime in 2025. This is vague enough that it could mean any time from January to December, but it's a commitment from the company that they're serious about this.

What does 2025 as a launch window mean for the actual product? Probably that Meta is in the latter stages of development. They've likely finalized the hardware design, the software is in beta, and they're working on supply chain logistics and marketing.

A 2025 launch makes sense timing-wise. It's early enough that Meta can still surprise the market with something genuinely new, but late enough that they've had time to perfect it. The market will be watching for how they differentiate from Apple Watch, which typically launches in September.

What about beyond 2025? Meta has several other wearable projects in the pipeline. The Phoenix mixed reality headset is coming in early 2027. The company is also working on additional AR glasses variants. There's probably a multi-year roadmap for wearables that includes follow-up smartwatch models, updated Ray-Bans, and completely new form factors.

The smartwatch is likely not the end goal, but a step on the path toward Meta's broader vision of ubiquitous wearable computing. Each device teaches them something about hardware, software, and user behavior. Each launch builds toward the next one.

How Malibu 2 Fits Into Meta's Reality Labs Strategy

Understanding Malibu 2 requires understanding Reality Labs, the division responsible for all of Meta's wearable and immersive computing projects.

Reality Labs has been through a lot. It's burned through tens of billions of dollars pursuing Zuckerberg's vision of the metaverse. That vision has… evolved. The metaverse hype of 2021-2022 gave way to more grounded expectations. But the underlying commitment to building wearable computing hardware remains.

When Zuckerberg said Reality Labs would focus on "glasses and wearables going forward," he was being strategic. Glasses means the Ray-Ban partnership and the AR glasses projects. Wearables means smartwatches, fitness trackers, and possibly other devices.

But here's the key insight: Meta's betting that the path to AR glasses runs through smartwatches. You get users comfortable with always-on wearable computing. You establish a brand in the category. You gather data about how people want to interact with wearable devices. Then, you introduce AR glasses when the technology and market are ready.

It's a staircase approach. Start with something people already want (health tracking, AI access, messaging). Build from there to something more ambitious (AR glasses with digital overlays). Eventually reach the ultimate goal (true mixed reality computing).

Malibu 2 is a step on that staircase. It's not the destination. It's the journey. Meta needs to prove they can launch a smartwatch successfully, keep users engaged, and build the infrastructure to support wearable software at scale. Then they can take another step.

This explains why they're willing to invest in it despite Reality Labs' ongoing losses. The smartwatch isn't supposed to be hugely profitable. It's supposed to be a foundation for future products that will be hugely profitable.

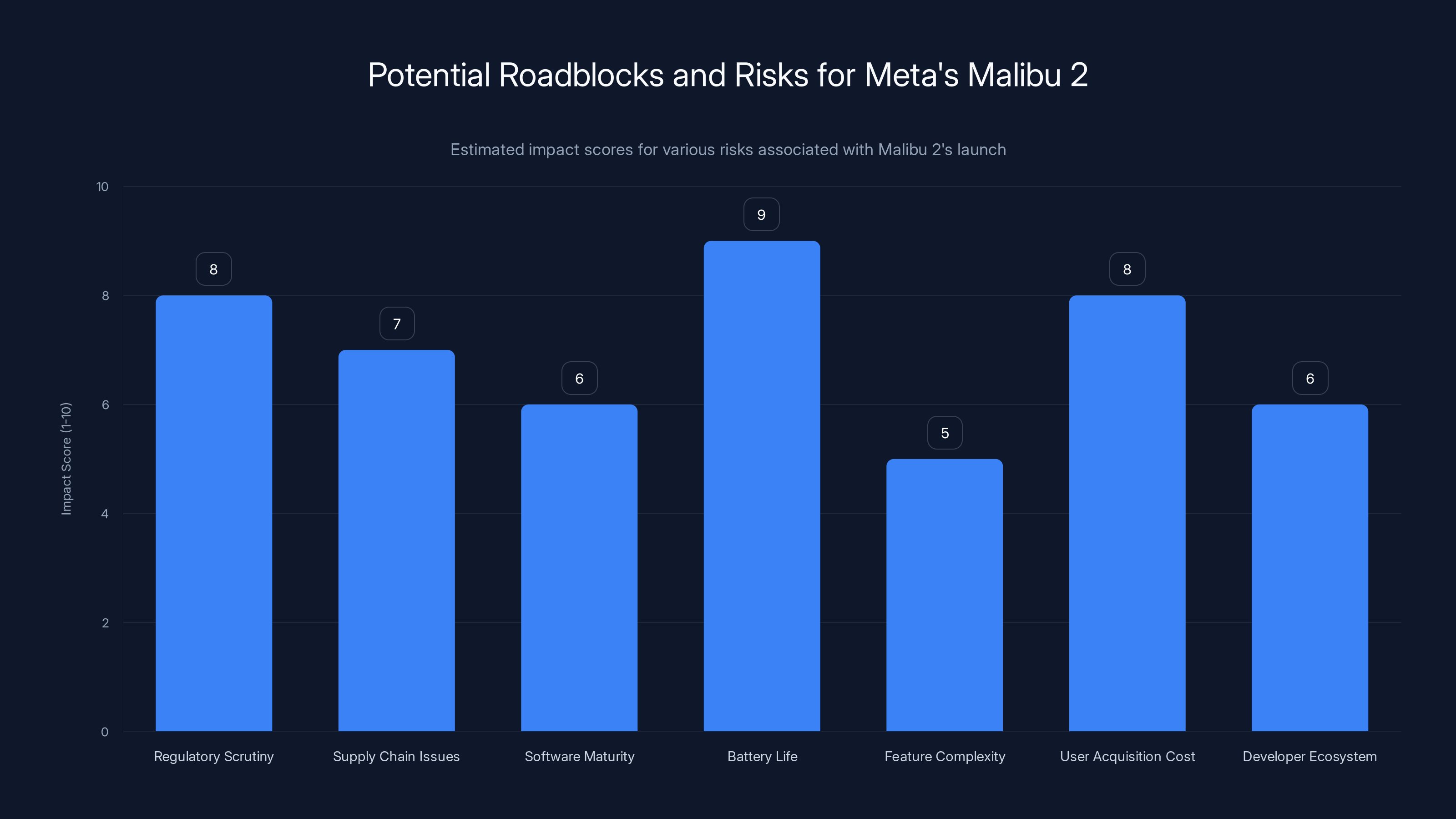

The most significant risks for Meta's Malibu 2 are battery life and regulatory scrutiny, both scoring high on potential impact. Estimated data.

Competitive Positioning: How Meta Plans to Win

Meta has several advantages in the smartwatch market, and several disadvantages. Understanding both is crucial.

Meta's Advantages:

Brand recognition and reach. The company has 3 billion monthly active users across its family of apps. A smartwatch announcement reaches billions of people instantly. This gives Meta an enormous distribution advantage.

Integration with existing services. WhatsApp, Instagram, and Facebook are where billions of people spend their digital lives. A smartwatch deeply integrated with these services has immediate value to users.

AI capabilities. Meta's AI is advancing rapidly, and it's already integrated into most of their services. Putting capable AI on a smartwatch is a natural next step.

Resource availability. Meta can spend whatever it takes to make this work. They have the financial resources to absorb losses if needed, perfect the product, and outspend competitors on manufacturing and marketing.

Hardware experience. Through Ray-Bans and Quest headsets, Meta has proven they can design and manufacture consumer hardware at scale.

Meta's Disadvantages:

Trust deficit around hardware. Reality Labs projects have had mixed results. Some succeed (Ray-Bans), others underwhelm (Meta Quest 3 sales). Users might be skeptical of Meta hardware.

No smartwatch heritage. Apple and Samsung have established smartwatch brands. Garmin dominates sports watches. Meta is starting from zero brand equity specifically in smartwatches.

Software overhead. Meta's apps are known for being heavy on features and light on performance. A smartwatch needs to be snappy and battery-efficient. Meta's typical approach might not translate well.

Privacy concerns. Meta's data practices are under scrutiny everywhere. Putting a wearable on people's bodies will intensify privacy concerns. The company needs to be extremely careful about what data the watch collects and how it's used.

Faced with these trade-offs, how will Meta actually position the Malibu 2 smartwatch? Probably as the AI smartwatch. Not the "most features," not "the cheapest," but the one with the best AI integration and the deepest connection to your digital life.

Imagine marketing that emphasizes: you get Meta AI on your wrist. You stay connected to everyone you care about without pulling out your phone. Your watch understands you because it's connected to all your Meta data. It's not trying to compete on fitness tracking or elegance or heritage. It's competing on relevance and integration.

This is actually a solid positioning. It plays to Meta's strengths and addresses a real user need: people want quick access to information and communication without constant phone usage. A smartwatch that makes this frictionless has genuine value.

The Broader Smartwatch Market in 2025

Meta's timing for entering the smartwatch market is interesting because the market itself is at an inflection point.

For the past five years, smartwatch growth has been steady but not explosive. The category matured earlier than other wearables. Most people who wanted a smartwatch already had one. Market growth was driven mostly by replacements, not new users entering the market.

But AI is changing this calculus. Suddenly, a smartwatch isn't just a fitness tracker or a notification display. It's a personal AI assistant on your wrist. This could expand the market by attracting users who previously didn't see the value in smartwatches.

Apple is already moving in this direction. The latest Apple Watches have more advanced Siri capabilities. Google is integrating its AI Overviews into Wear OS. Samsung is adding more AI features to its watches. Everyone's moving toward AI-first smartwatches.

Meta is entering at exactly the right moment. The category is being redefined around AI. Meta has world-class AI capabilities. They can genuinely compete here.

But they also need to move fast. This moment of market transition won't last forever. Once competitors solidify their AI implementations and users settle into ecosystems, it becomes harder to disrupt. Meta's 2025 launch window suggests they understand this urgency.

What Success Looks Like for Meta

How should we measure whether Malibu 2 is successful? What counts as a win for Meta?

Short-term (Year 1): Ship the product on time. Don't have major quality issues. Sell enough units that the launch is seen as credible. Meta doesn't need to outsell Apple, but they need to demonstrate that Meta-branded smartwatches are viable products. Even 2-3 million units sold in year one would be a solid start.

Medium-term (Years 2-3): Establish a dedicated user base. Build community around the watch. Improve the software significantly based on user feedback. Develop a sequel or variant that improves on the original. Establish Meta as a legitimate smartwatch vendor, not an experiment from a social media company.

Long-term (Years 4+): Support an ecosystem of third-party developers building apps and services for the Meta smartwatch. Achieve profitable operations (this might take several years). Integrate the smartwatch deeply with the upcoming AR glasses releases. Make the smartwatch essential for anyone in Meta's ecosystem.

The ambitious interpretation of success is that Meta becomes as important in wearables as Apple is. The realistic interpretation is that Meta carves out 10-15% of the smartwatch market, which would be enormous by any standard.

The Investment Case: Why Meta Is Betting Big on Wearables

Why does Meta believe smartwatches are worth the investment? What's the return on investment calculation here?

First, there's the direct revenue from hardware sales. If Meta sells 5 million smartwatches per year at an average selling price of

Second, there's the software ecosystem. Once users have a Meta smartwatch, they're more engaged with Meta's services. They're using WhatsApp more frequently. They're checking Instagram more often. They're interacting with Meta AI more regularly. Higher engagement means more ad impressions, which means higher ad revenue.

Third, there's the data value. A smartwatch collects intimate data about your behavior, your health, your location, your social connections. This data is extremely valuable for targeted advertising and product improvement.

Fourth, there's the strategic positioning. Having presence across devices, operating systems, and form factors makes Meta more resilient as a company. If mobile phones ever become less important (unlikely, but consider the scenario), Meta isn't completely dependent on smartphone advertising.

Fifth, there's the ecosystem lock-in. Every Meta device is connected to every other Meta device. Users who invest in Meta hardware become more likely to use Meta software. The ecosystem becomes more valuable the more devices you have in it.

So while the smartwatch itself might not be hugely profitable, the ecosystem value is significant. Meta's not trying to win the smartwatch market. They're trying to win wearable computing, and the smartwatch is one piece of a much larger strategy.

Potential Roadblocks and Risks

Not everything will go perfectly. Meta will face obstacles and risks as they bring Malibu 2 to market.

Regulatory Scrutiny: Meta is already under intense regulatory scrutiny in the US and Europe around data privacy and antitrust issues. A wearable device that collects health and location data will definitely attract regulatory attention.

Supply Chain Issues: Global supply chains for consumer electronics are recovering but still fragile. Shortages of specific components could delay launch or limit initial supply.

Software Maturity: Wear OS, or whatever operating system Meta uses, needs to be genuinely stable and performant. Early software issues could tank user reviews and damage the product's reputation.

Battery Life: If Malibu 2 lasts less than 24 hours on a charge, it will be considered a failure. Battery life is one of the most common complaints about smartwatches, and Meta needs to solve this.

Feature Complexity: Meta might be tempted to cram too many features into the first smartwatch. This leads to bloated software, poor performance, and confused positioning. Restraint would actually be better here.

User Acquisition Cost: Meta will need to spend heavily on marketing and distribution to convince people to buy a Meta smartwatch instead of Apple Watch or Samsung Galaxy Watch. This cost is significant and directly impacts profitability.

Developer Ecosystem: A smartwatch is only as good as the apps and services available for it. Meta needs to attract developers to build for their platform. This requires clear API documentation, development tools, and incentives.

These risks are real, but they're not insurmountable. Meta has the resources to address all of them if they prioritize execution.

The Larger Vision: Wearables as the Foundation of Meta's Future

Step back for a moment and consider the larger picture. Malibu 2 isn't Meta's final form. It's a foundation.

Meta's ultimate goal is probably something like this: a fully immersive computing experience that surrounds you. Smartglasses for AR. A smartwatch for quick information and AI access. Headsets for VR. Brain-computer interfaces for direct neural input (Meta is researching this). Eventually, the vision converges on a world where digital and physical reality are seamlessly blended, and Meta is the infrastructure company enabling that blend.

This is ambitious, arguably too ambitious. But it's a coherent vision. Every product Meta launches is a step toward this future. The Ray-Bans were a step. The Quest headsets are steps. The smartwatch is another step.

We're currently in an era of mobile-first computing. Phones are the center of your digital life. Everything else is peripheral. But Meta believes we're transitioning to a wearables-first era, where multiple devices work together to provide computing and information at all times and in all contexts.

If Meta is right, then investing billions in smartwatches, glasses, headsets, and neural interfaces makes sense. If they're wrong, then Reality Labs is a massive waste of shareholder money.

History suggests Meta is at least partially right. Mobile devices went from luxury to essential in about a decade. Wearables are following a similar trajectory. Whether Meta will successfully own a meaningful part of that market is still an open question.

Timeline Expectations: What to Watch For

As we approach Meta's smartwatch launch, here's what to watch for and when to expect announcements.

Early 2025: Meta likely announces Malibu 2 formally, providing specifications, features, pricing, and availability. This could happen at a virtual event or through press release and media briefings.

Spring/Summer 2025: Meta begins pre-orders if they're planning an exclusive early access period. They might also start providing review units to tech media.

Fall 2025: General availability launches. Meta's smartwatch becomes available for purchase through their website, major retailers, and carrier partnerships.

Late 2025/Early 2026: First software updates address early user feedback and add features that weren't ready at launch.

2026 and beyond: Meta potentially announces a second-generation smartwatch with improvements, or variant models (sport version, basic version, premium version).

This timeline is speculative, but based on how Meta typically launches hardware products, it's reasonable.

TL; DR

- Malibu 2 is Meta's revived smartwatch project: After shelving smartwatch development in 2022, Meta is bringing it back with plans for a 2025 release featuring Meta AI and health tracking.

- The smartwatch is part of a broader wearables strategy: Meta's ultimate vision includes smartglasses, smartwatches, VR headsets, and potentially neural interfaces working together as a unified ecosystem.

- AI is the key differentiation: Meta's smartwatch won't compete on fitness tracking or heritage, but on AI integration and connection to Meta's 3 billion user ecosystem.

- Competition is real but fragmented: While Apple dominates with 30% market share, the remaining smartwatch market is fragmented, giving Meta room to establish a meaningful presence.

- Execution will determine success: The smartwatch market is proven and competitive. Meta's success depends on hardware quality, software performance, and genuine user value creation.

- Bottom Line: Malibu 2 represents Meta's commitment to wearables as the foundation of future computing. It's ambitious, it's risky, but it's a bet Meta's clearly willing to make.

FAQ

What is Meta's Malibu 2 smartwatch project?

Malibu 2 is Meta's internal codename for their revived smartwatch initiative. The project was originally started in 2021 as "Malibu," then shelved in 2022 when Meta faced financial pressures. Now the company is reviving it with updated specifications, new leadership, and a planned 2025 release date. According to reports, Malibu 2 will feature Meta AI integration and health tracking capabilities as core features.

When will Meta's smartwatch be released?

Meta reportedly plans to release Malibu 2 sometime in 2025, though the exact date hasn't been announced. "Sometime in 2025" suggests the company is still in development but committed to a 2025 window. Industry observers expect potential announcements in early 2025 with availability possibly following in the spring or fall of that year, though Meta could surprise the market with timing.

What features will Malibu 2 include?

Based on available information, Malibu 2 will include Meta AI integration (allowing you to interact with Meta's AI assistant on your wrist), health and fitness tracking, integration with Meta services like WhatsApp and Instagram, notifications, smart home control, and possibly contactless payments. The original Malibu project explored cameras, though it's unclear if Malibu 2 will include this feature. Full AR displays and cellular connectivity are probably not included in the first generation.

How does Meta's smartwatch compare to Apple Watch?

Meta's smartwatch will take a different positioning approach than Apple Watch. While Apple Watch emphasizes fitness, premium build quality, and comprehensive health monitoring, Meta's smartwatch will likely emphasize AI integration and deep connection to Meta's ecosystem of services. Price positioning is unknown but could potentially undercut Apple Watch to build market share. The smartwatches will offer different experiences optimized for different user bases rather than directly competing feature-for-feature.

Why did Meta shelve its smartwatch project, and why bring it back now?

Meta paused its smartwatch development in 2022 when Reality Labs was losing billions of dollars annually. The company needed to focus resources on its most important projects: VR headsets and AR glasses research. The project is being revived now because the AI landscape has shifted dramatically. What seemed like a niche device in 2021 now looks like a natural extension of AI assistants. Additionally, competition in the smartwatch market has shifted toward AI features, which plays to Meta's strengths.

Will Meta's smartwatch work with iPhone users?

This is unclear based on current information, but it's likely that Meta's smartwatch will work primarily with Android phones for full integration. However, a companion app for iPhone could allow basic functionality like notifications and messaging. Meta's ecosystem focus means the smartwatch will be optimized for users of Meta's services regardless of phone choice, but the best experience will probably be on Android devices where Meta software is more deeply integrated.

How much will Meta's smartwatch cost?

Pricing hasn't been announced, but educated guesses based on the competitive landscape suggest Malibu 2 could be priced between

Is Meta's smartwatch part of their metaverse strategy?

Indirectly, yes. Meta's broader vision is toward ubiquitous computing across multiple devices and form factors. The smartwatch is one device in a larger ecosystem that also includes VR headsets, AR glasses, and smartphone integrations. However, the smartwatch itself is focused on practical near-term features like AI and health tracking rather than metaverse-specific functionality. It's a step toward Meta's longer-term vision rather than a metaverse-specific product.

What's the expected battery life of Malibu 2?

No official specifications have been announced, but based on current smartwatch technology and the power consumption of AI features, expect battery life in the 24-48 hour range. Modern smartwatches typically last 1-3 days depending on usage patterns. Running AI models locally is power-intensive, so Meta will need to optimize carefully. If they rely heavily on cloud-based AI processing, battery life could be better, but latency and privacy could suffer.

Can I use Meta's smartwatch without having Meta services?

Probably not optimally. Meta's smartwatch will likely be designed around deep integration with WhatsApp, Instagram, and Facebook. While it might function as a basic smartwatch for someone not using these services, the value proposition requires an active Meta ecosystem presence. Users primarily using iMessage, Gmail, and Google services would likely get more value from an Apple Watch or Wear OS device.

Conclusion

Meta's decision to revive its smartwatch project and bring Malibu 2 to market in 2025 represents a significant strategic pivot. After years of focusing Reality Labs resources on VR and AR hardware that haven't achieved mainstream adoption, the company is acknowledging that smartwatches—a proven, profitable category—deserve investment.

The smartwatch market is ready for disruption. Apple owns 30% of the market, but the remaining 70% is fragmented. Competitors are making incremental improvements rather than fundamental innovations. The rise of AI creates a new use case for smartwatches beyond fitness tracking and notifications. Meta is entering at exactly the right moment.

What Meta has going for it: massive user base across WhatsApp, Instagram, and Facebook; world-class AI capabilities; proven hardware experience with Ray-Bans; and almost unlimited resources for development and marketing.

What Meta faces as challenges: trust deficit from failed hardware projects, privacy concerns that will plague a wearable device, and the reality that they're entering a mature category where execution is everything.

Will Malibu 2 succeed? That depends entirely on execution. The product needs to work reliably, the software needs to be responsive, the AI needs to be genuinely useful, and the integration with Meta services needs to feel natural rather than forced. These are high bars, but Meta has the resources to clear them.

The bigger picture is that Malibu 2 is Meta's entry into an era where multiple wearable devices work together as a computing platform. The smartwatch today becomes the foundation for AR glasses tomorrow and more advanced wearables the day after. If Meta executes well on this smartwatch, it proves they can build consumer wearables at scale. That capability becomes increasingly valuable as the market evolves.

For users, the launch of Meta's smartwatch creates genuine competition and choice. The smartwatch market will be more interesting with Meta in it. More innovation. More features. Better pricing. More integration options for users in Meta's ecosystem.

For Meta's investors, Malibu 2 represents a bet that the company can succeed in consumer hardware beyond smartphones. Reality Labs has burned through enormous resources. A successful smartwatch proves that those resources aren't being completely wasted, that Meta can convert technical research into consumer products people actually want.

For the broader tech industry, Meta's smartwatch signals a shift. The mobile era that lasted two decades is transitioning to a wearables era. The companies that successfully navigate this transition will remain dominant. Those that don't will fade. Meta's making it clear they're committed to navigating this transition, even if it takes billions of dollars and multiple product cycles to get it right.

Watch this space. Malibu 2 launches in 2025. When it does, it will be the most interesting smartwatch launch since Apple Watch. Not necessarily the best smartwatch, not necessarily the most popular, but definitely the most important for understanding where computing is heading.

Key Takeaways

- Meta is reviving its Malibu 2 smartwatch project with a planned 2025 launch, representing a strategic shift after shelving the initiative in 2022.

- Malibu 2 will feature Meta AI integration and health tracking as core features, positioning the smartwatch as an AI delivery mechanism rather than just a fitness tracker.

- The smartwatch is one component of Meta's broader wearables ecosystem that includes Ray-Bans, VR headsets, and upcoming AR glasses, all designed to work together.

- Apple Watch dominates with 30% market share, but the remaining smartwatch market is fragmented, creating genuine opportunity for Meta to establish meaningful presence.

- AI features are driving smartwatch adoption growth, with AI assistants showing 45% expected growth, which aligns perfectly with Meta's AI capabilities and strategy.

- Meta's advantages include massive ecosystem reach (3B WhatsApp and Instagram users), deep AI integration, and proven hardware experience, but faces challenges around privacy concerns and hardware execution.

Related Articles

- Garmin Vivoactive 6 vs Apple Watch: Complete Smartwatch Showdown [2025]

- Huawei Smartwatch Diabetes Monitoring: World-First Feature Explained [2025]

- Why Apple Should Prioritize Battery Life Over New Features in watchOS 27 [2025]

- Apple's AI Wearables Revolution: What We Know About the Trio [2025]

- Best Apple Watch in 2026: Complete Buyer's Guide [2026]

- Best Fitness Tracker Deals for Presidents' Day 2025

![Meta's Smartwatch 2025: What Malibu 2 Means for Wearables [2025]](https://tryrunable.com/blog/meta-s-smartwatch-2025-what-malibu-2-means-for-wearables-202/image-1-1771504625012.jpg)