Meta's Historic Metaverse Pivot: What Really Happened and What's Next

Remember when Mark Zuckerberg declared the metaverse as the future of human connection? When Meta rebranded from Facebook, invested tens of billions into virtual reality, and promised a transformational shift in how we work, play, and socialize? Yeah. That's not happening anymore. At least not the way anyone imagined.

In early 2025, Meta made a stunning announcement that sent shockwaves through the tech industry. The company was effectively shelving Horizon Worlds, its flagship metaverse platform, as a VR-exclusive service. Instead, the company is pivoting aggressively toward mobile and shifting its entire strategy away from first-party content development toward supporting third-party developers, as reported by TechBuzz.

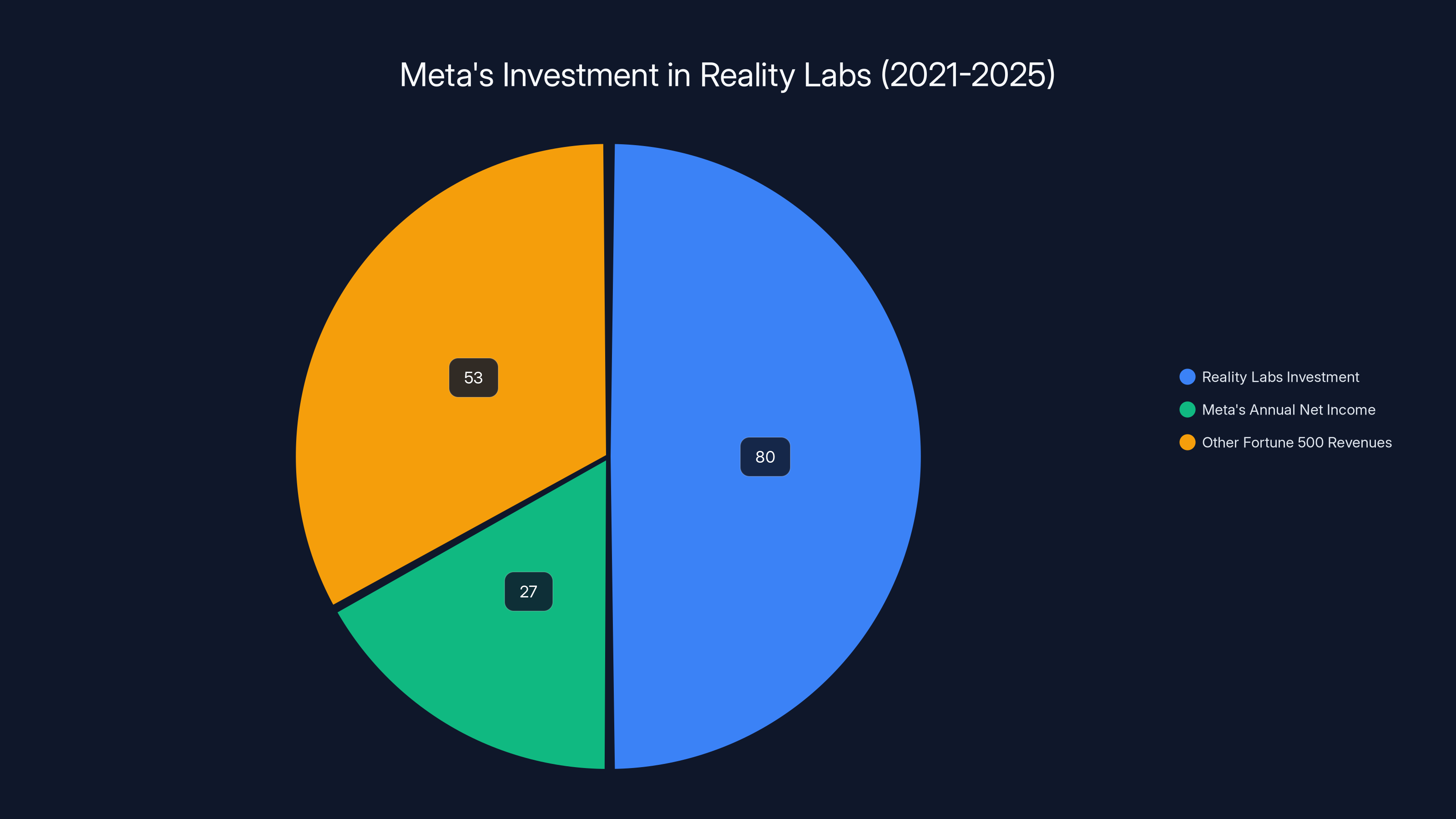

Here's the thing: this isn't just a minor product adjustment. This represents a fundamental admission that Meta's $80 billion metaverse gamble didn't deliver what executives promised. It's a strategic reset that reveals hard truths about the viability of virtual reality as a mainstream consumer platform and Meta's own struggles to build compelling experiences people actually want, as noted by TechBuzz.

But before you think Meta is abandoning mixed reality entirely, hold on. The company still plans to manufacture VR headsets, maintain digital storefronts, and invest heavily in augmented reality technology for future smart glasses. What's changing is the philosophy. Instead of spending billions to build the metaverse themselves, Meta is betting that third-party developers will create the killer experiences that consumers demand, according to Business Insider.

This article breaks down everything you need to understand about Meta's metaverse pivot: what triggered it, what it means for VR's future, and where Meta is actually placing its bets now. Because the real story isn't about Meta giving up on mixed reality. It's about Meta finally accepting that the path to the future looks nothing like the path they'd planned.

The Rise and Fall of Meta's Metaverse Dream

The Original Vision: Why Meta Bet Everything on the Metaverse

When Mark Zuckerberg announced Facebook's rebrand to Meta in October 2021, he wasn't just changing a corporate name. He was making a public declaration that the company's future depended entirely on succeeding in virtual reality. In fact, he went further, suggesting that the metaverse represented a fundamental shift in how humans would interact with technology itself.

The vision was seductive and expansive. Imagine putting on a VR headset and entering a digital world where you could meet friends from across the globe in photorealistic environments. You'd attend meetings, shop, attend concerts, and socialize—all within immersive 3D spaces. Meta positioned itself as the architect of this future, the company that would build the infrastructure, platforms, and experiences that would enable this transformation.

To make this happen, Meta poured resources into the effort at unprecedented scales. The company acquired startups, built internal studios, recruited top talent, and essentially said to Wall Street: trust us, this is worth the investment. Reality Labs, the division tasked with making this vision real, ballooned to over 15,000 employees by 2024, as detailed by TechBuzz.

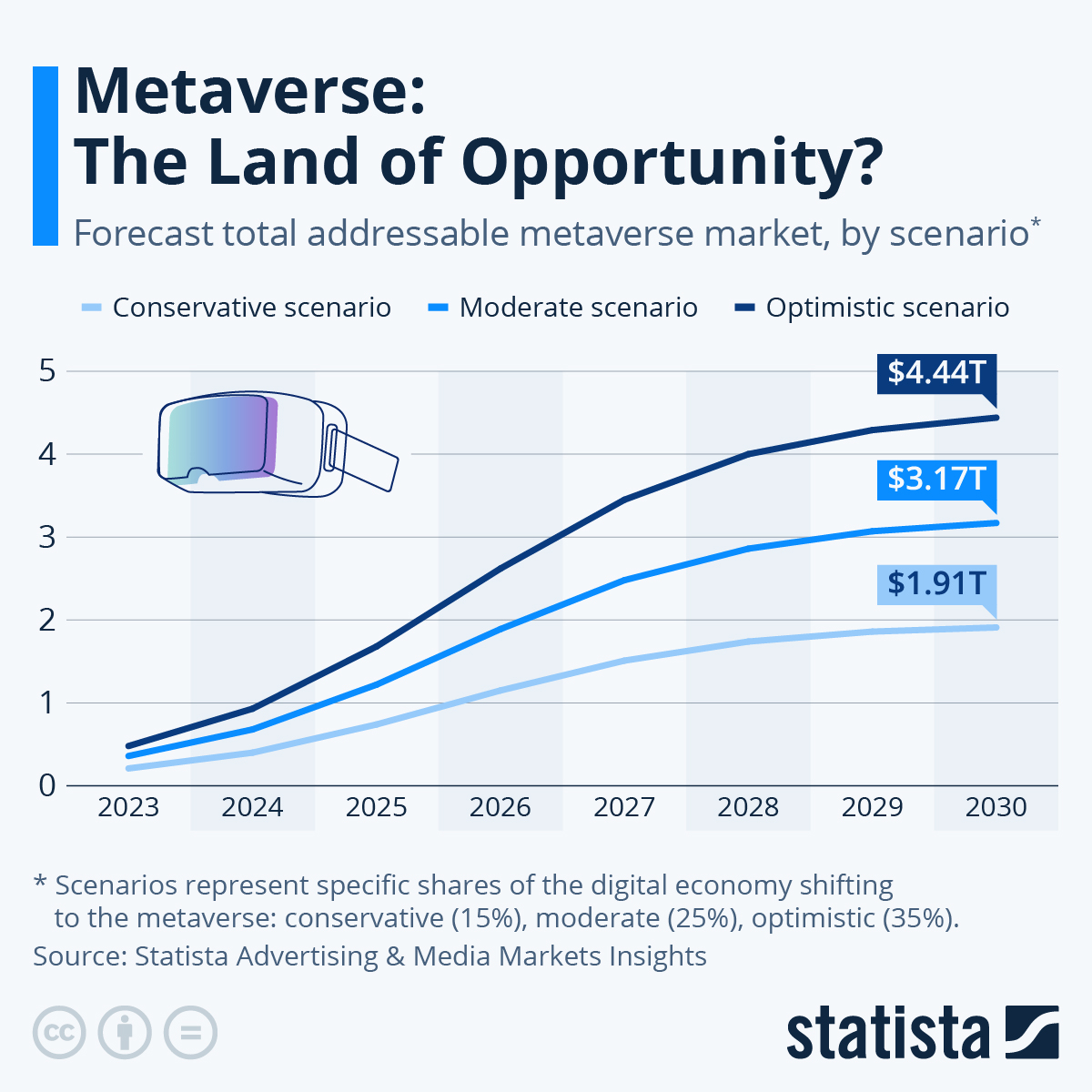

The economic argument seemed straightforward enough. If Meta could establish the dominant platform for the metaverse, just as it had dominated social media, it would capture an enormous market opportunity. Analysts projected that the metaverse economy could eventually be worth trillions of dollars. Who wouldn't bet on that?

The Reality Check: Why the Metaverse Never Took Off

Except it never took off. Not even close.

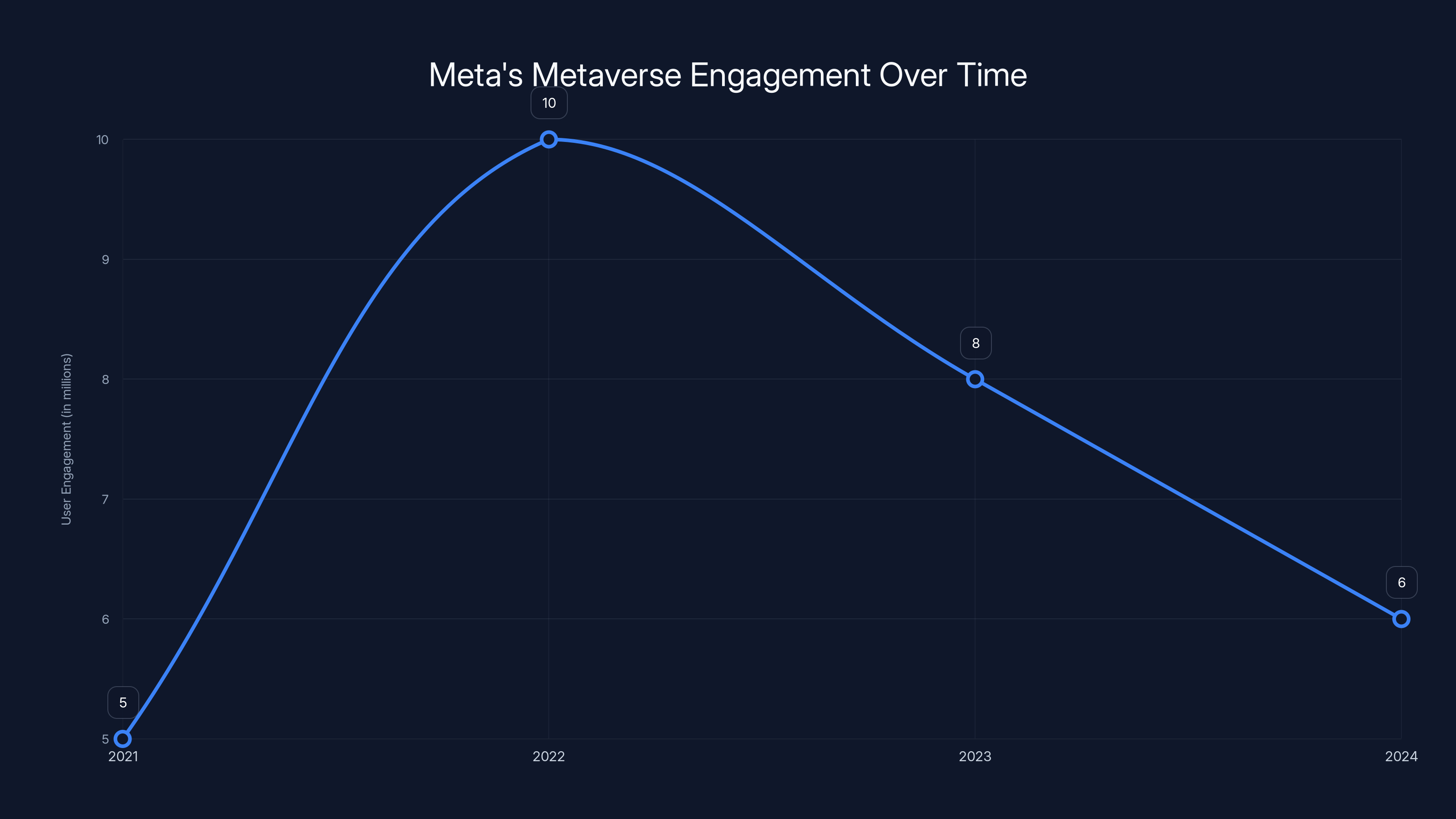

Despite millions of VR headsets shipped, usage remained limited and engagement stayed stubbornly shallow. Horizon Worlds, Meta's social and gaming platform within the VR ecosystem, never achieved meaningful adoption. User engagement metrics were reportedly so bad that Meta largely stopped publicizing them. The platform failed to attract millions of users, let alone become the social network of the future, as reported by Virtual Reality News.

Multiple factors contributed to this failure. First, VR hardware remained expensive and uncomfortable. The Quest 3, Meta's flagship headset, cost $499 at launch. Motion sickness, heat buildup, limited field of view, and bulky form factors meant that most casual users couldn't sustain more than an hour or two of VR usage without discomfort. For comparison, people spend hours per day on their smartphones without issue.

Second, the content library remained limited. Despite having access to third-party developers, Meta's internal studios failed to create killer experiences that drove headset sales. Games like Beat Saber and Resident Evil 4 VR showed promise, but these were exceptions, not the rule. Most VR experiences felt gimmicky, expensive to produce, and appealed only to hardcore enthusiasts rather than mainstream audiences.

Third, the social experience didn't translate to VR the way Meta hoped. When users put on a VR headset to socialize, they found themselves staring at crude avatars with limited facial animations. The experience often felt awkward and uncanny. High-end VR social platforms like VRChat actually offered better experiences than Horizon Worlds, and they did so without Meta's resources.

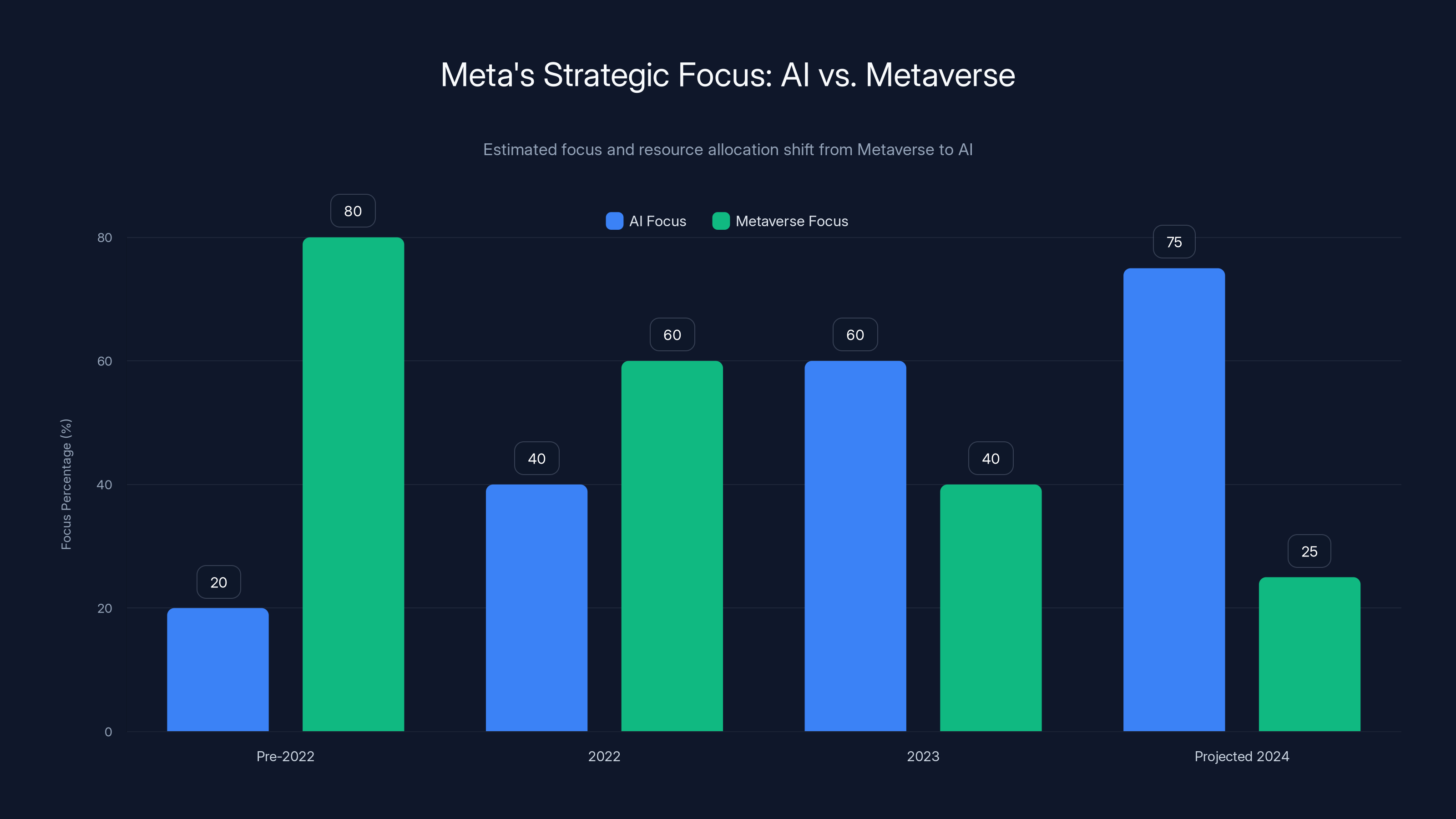

Fourth, timing worked against Meta. The company made its massive bet just as AI was exploding. Chat GPT launched in November 2022, just thirteen months after Meta's rebrand. Suddenly, the most exciting technology discussions in Silicon Valley shifted entirely away from virtual reality toward artificial intelligence. Investors, engineers, and entrepreneurs all pivoted toward AI. The cultural moment for metaverse investment had passed, as noted by TechBuzz.

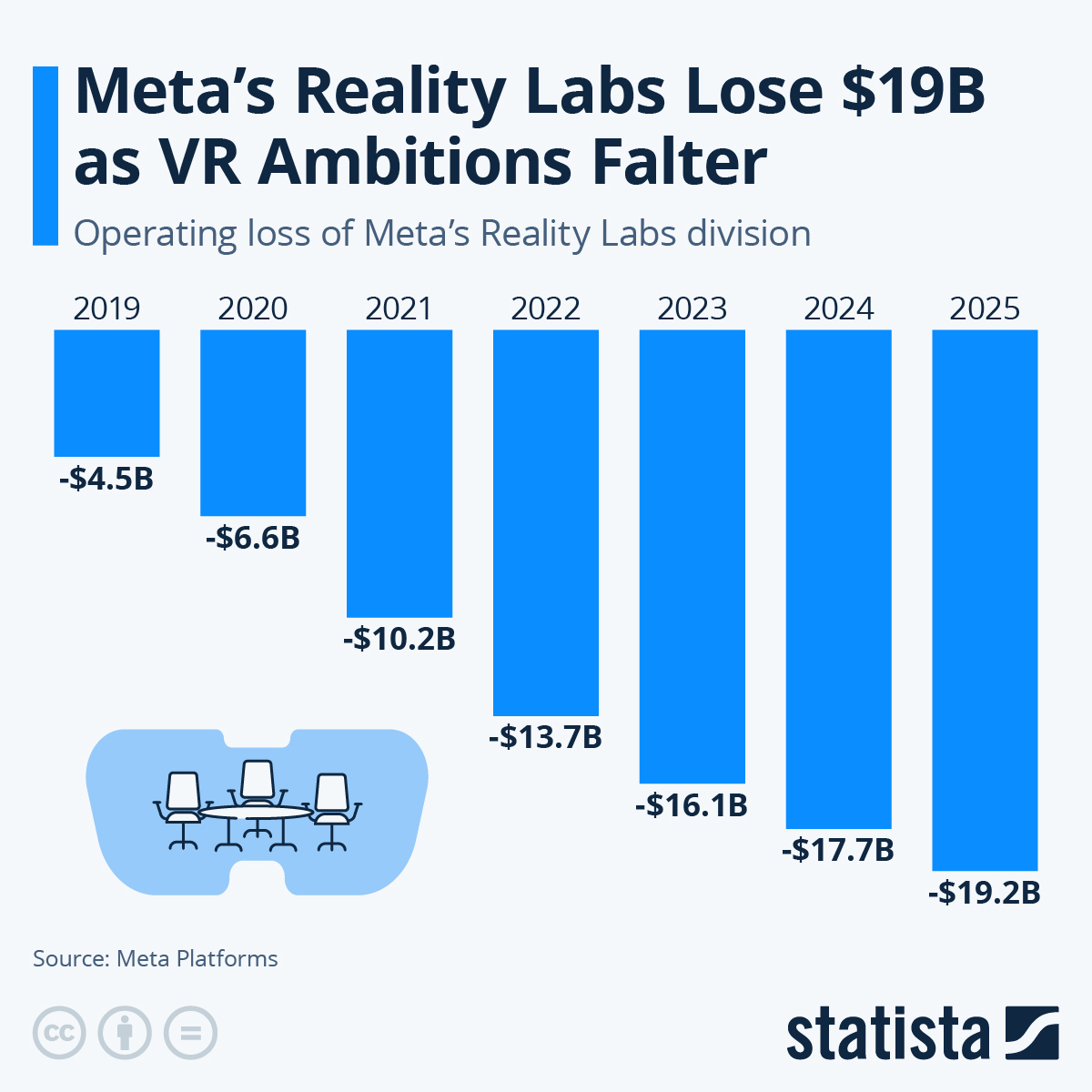

The Financial Reckoning: $80 Billion in Losses

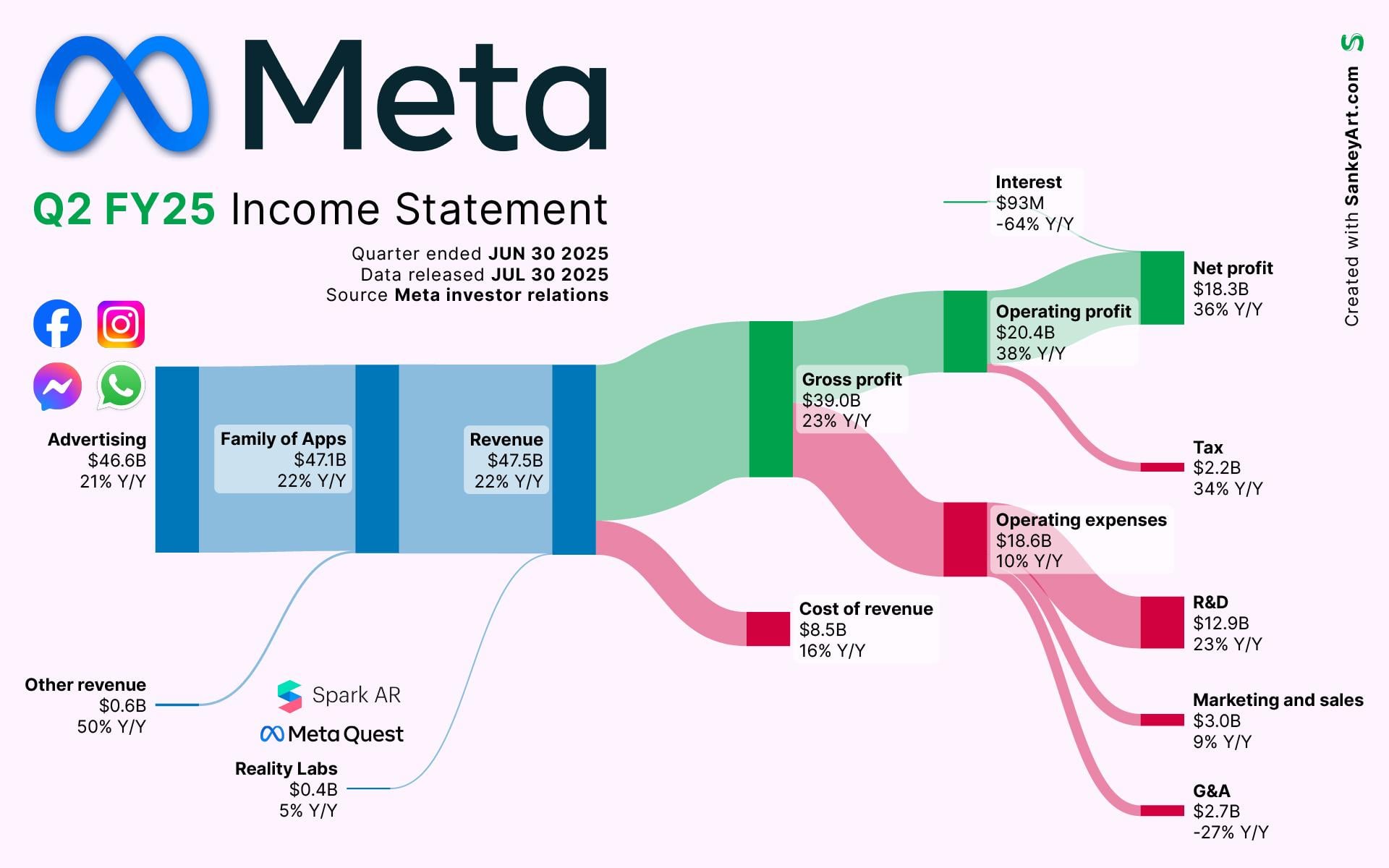

By 2024, Reality Labs had become a massive financial drag on Meta's overall business. The company had invested approximately $80 billion into its mixed reality division with virtually nothing to show for it in terms of revenue or market traction. That number represents roughly three times what Meta earned in total profit during that same period, as highlighted by TechBuzz.

Internally, the mood shifted dramatically. What had once been positioned as Meta's most important initiative became an embarrassment. Executives were forced to confront an uncomfortable reality: throwing more money at VR development wasn't solving the fundamental problem that consumers didn't want VR at scale.

Then came the restructuring. In January 2025, Meta laid off more than 1,000 Reality Labs employees. These weren't cuts across the entire division. They were targeted: most of the layoffs affected internal content studios. Artists, designers, game developers, and experience creators were shown the door. Meanwhile, engineers working on hardware, infrastructure, and third-party developer tools were largely spared, as reported by GMToday.

The message was unmistakable. Meta was no longer interested in betting billions on in-house content development. It was exiting the business of being a content creator for VR.

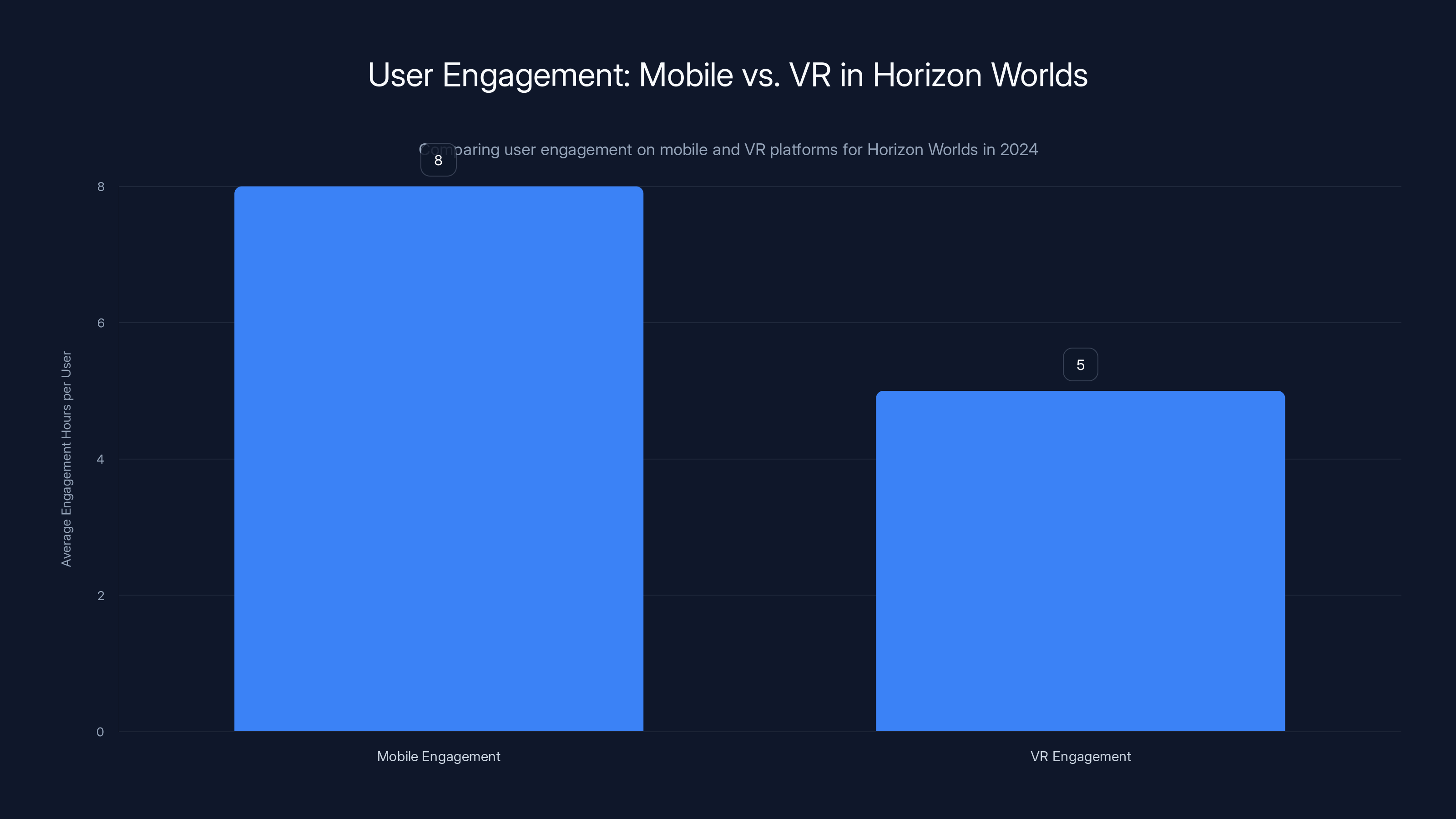

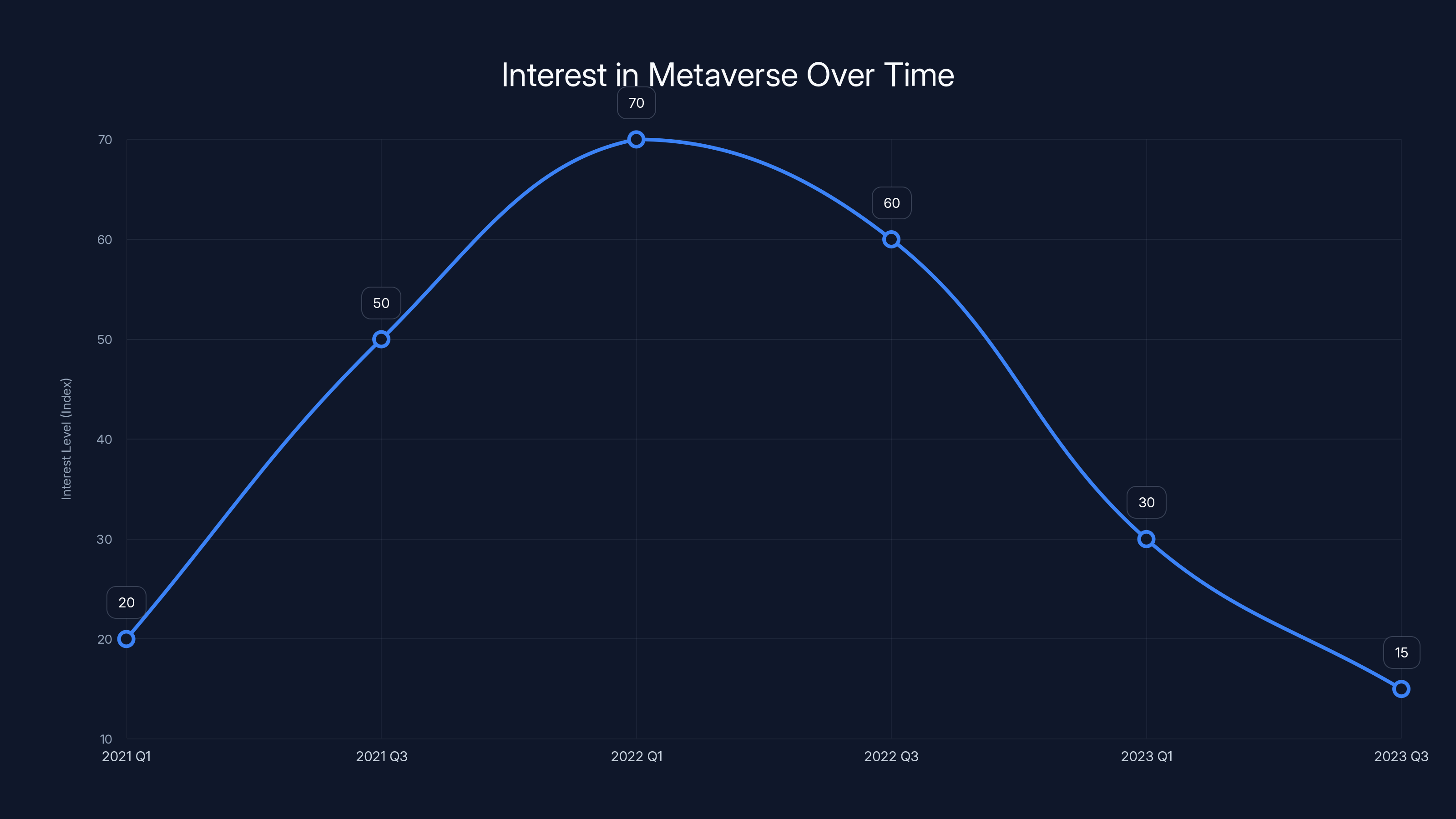

Despite initial investments and efforts, user engagement in Meta's metaverse showed a declining trend from 2023 to 2024. Estimated data.

Understanding Meta's New Strategy: Mobile-First Metaverse

Why Horizon Worlds Went Mobile

Here's where the story gets interesting. Buried within Meta's massive write-down and organizational restructuring was a data point that suggested a different path forward: when Meta launched Horizon Worlds as a mobile app in 2024, usage actually increased, as reported by Virtual Reality News.

The mobile version of Horizon Worlds attracted users who had zero interest in VR. These users wanted the social and gaming aspects of the platform without needing to strap on a headset and deal with all the associated friction. They wanted to interact with friends, play games, attend events, and explore digital spaces—but they wanted to do it on their phones, which they already carry with them everywhere.

Metrics showed that people were spending more time in Horizon Worlds on mobile than they ever had on VR. The engagement was genuinely higher. The user base was genuinely larger. And the experience was genuinely more accessible to mainstream audiences.

This data forced a reckoning with Meta's entire strategic premise. For years, the company had been trying to push people toward VR because that's where Meta believed the future lay. But what if the future didn't involve VR headsets for most people? What if the metaverse, if it existed at all, was actually a mobile-first phenomenon?

The Shift to Third-Party Development

Simultaneously, Meta made another strategic pivot that proved equally important: it committed to supporting third-party developers rather than building experiences in-house.

The data on this point was also instructive. Meta discovered that 86 percent of the time people spent in VR was using third-party applications, not Meta's own content. Users preferred independent developers' games and experiences to what Meta's substantial internal teams had produced, as noted by TechBuzz.

Instead of accepting this as a condemnation of their development approach, Meta decided to lean into it. The reasoning was logical from a business perspective: why spend billions on internal content development when independent developers were creating better experiences at a fraction of the cost? Meta could provide the platform, the tools, the distribution network, and strategic investments in promising developers. Let the market sort out what works.

This represented a massive philosophical shift from the original metaverse vision. Meta wasn't going to build the metaverse anymore. Meta was going to operate the infrastructure and let others build on top of it.

Discontinuing VR-Exclusive Content

As part of this pivot, Meta began removing individual worlds from its VR store. This sounds like a retreat, and in some ways it is. But Meta framed it differently: they were consolidating the store to improve discoverability and focus resources on platforms where the actual audience was spending time.

Internally, this meant shutting down several internal content initiatives. VR games and experiences that had consumed millions in development costs simply ceased to exist. Some projects that had been in development for years were cancelled outright.

For VR enthusiasts and industry observers, this felt like a betrayal. For Meta executives, it was pragmatic triage. The company was finally acknowledging that VR content, at least at the scale Meta had been pursuing it, wasn't commercially viable, as reported by TechBuzz.

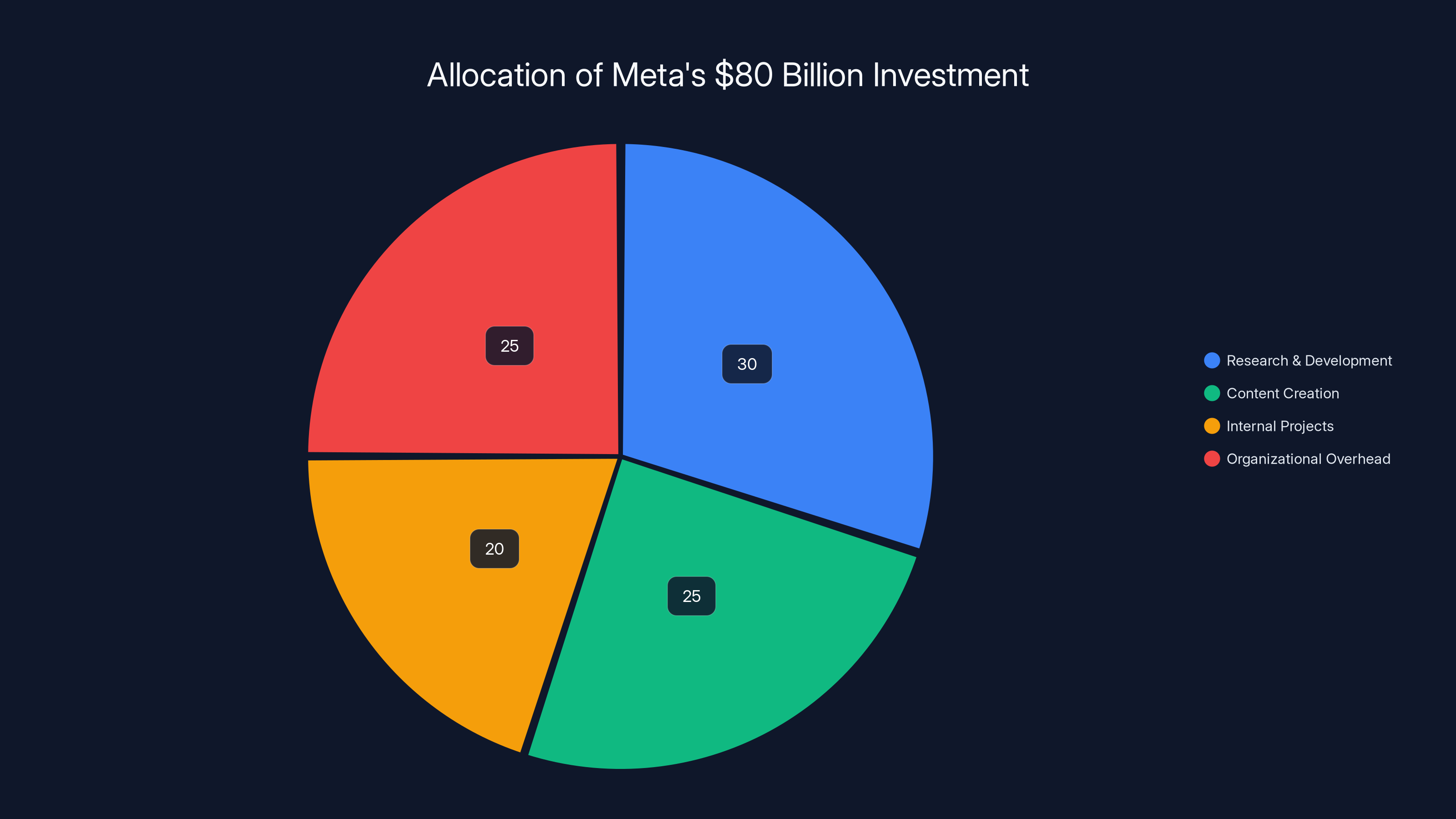

Meta's $80 billion investment in Reality Labs is three times its annual net income and exceeds most Fortune 500 companies' revenues. Estimated data.

The Reality Labs Restructuring: What Actually Changed

Who Got Laid Off and Why

When Meta cut over 1,000 Reality Labs employees in January 2025, the cuts weren't random. The company made deliberate choices about which teams to preserve and which to dismantle.

The layoffs primarily affected internal content creation teams. Game developers, artists, animators, sound designers, and creative directors were disproportionately impacted. These were the people responsible for building experiences like Horizon Worlds' internal experiences, VR games, and other first-party content.

Meanwhile, engineers building VR hardware, AR technology, and third-party developer tools were largely unaffected. The teams working on Quest headset improvements, operating systems, and developer infrastructure remained substantially intact, as reported by GMToday.

Also largely spared were teams working on augmented reality technology. This is particularly significant because it reveals where Meta actually believes the future lies. While VR adoption remained limited, AR technology could theoretically be deployed through regular glasses, which represent a far more mainstream form factor than VR headsets.

The Remaining 15,000 Reality Labs Employees

Despite the layoffs, Reality Labs still employed approximately 14,000 people after the cuts. That's a staggering number of human beings working on mixed reality technology. For context, most software companies with annual revenues of several billion dollars employ far fewer people than this.

These remaining employees weren't split equally between consumer products and exploration. The company maintained significant investment in fundamental research, hardware engineering, and platform development. They were also increasing investment in strategic partnerships with third-party developers and emerging startups in the mixed reality space.

What Meta was doing, in essence, was transforming Reality Labs from a content production machine into a platform and infrastructure company. The pivot required different skill sets, different management structures, and different success metrics, as noted by TechBuzz.

The Hardware Commitment: Why Meta Isn't Abandoning VR Headsets

Continuing to Build and Sell VR Hardware

When Meta announced the Horizon Worlds mobile shift, it simultaneously promised to continue manufacturing, improving, and selling VR headsets. This might seem contradictory, but it actually makes strategic sense when you understand the long-term vision.

Meta's bet is that VR hardware will eventually improve enough to become mainstream. They're betting on continued improvements in display technology, processing power, form factors, and comfort. They're betting that in five to ten years, VR headsets might become as ubiquitous as smartphones are today.

If that happens, Meta wants to be the dominant platform when it does. The company can't afford to cede the hardware market to Apple or other competitors. So they continue investing in the Quest line, pushing technology forward, and maintaining their position as the largest VR hardware manufacturer, as reported by TechBuzz.

In practical terms, this means continued investment in processor design, display technology, software optimization, and manufacturing scale. Meta was expanding its VR hardware team even as it cut content developers.

The Strategic Value of the App Store

Another reason Meta maintains VR hardware and associated storefronts is control over distribution. The Quest App Store is where third-party developers sell VR software and experiences. It's a revenue stream and, more importantly, a walled garden that Meta controls.

If Meta abandoned VR hardware entirely, it would lose that distribution channel. Apple, Microsoft, or other competitors could establish dominance. By maintaining hardware and storefronts, Meta ensures that if VR ever does become mainstream, they capture the value from that transition.

This is fundamentally a defensive play. Meta isn't necessarily bullish on VR in the near term, but it's not willing to completely surrender its position in case VR becomes important in the future, as noted by TechBuzz.

Estimated data shows Meta's strategic shift from the Metaverse to AI, with AI focus projected to increase significantly by 2024.

The Augmented Reality Wild Card: Where Meta's Real Money Is Going

Why AR, Not VR, Is Meta's Long-Term Bet

Here's the essential insight that explains Meta's entire restructuring: the company is pivoting from VR to AR.

Augmented reality, which overlays digital information on the real world through transparent glasses or smartphone cameras, has fundamentally different dynamics than virtual reality. AR doesn't require users to remove themselves from the physical world. It doesn't cause motion sickness. It doesn't require expensive, bulky headsets. It can eventually be delivered through regular-looking glasses.

Most importantly, AR has clearer use cases. Real estate agents can use AR to show property features. Surgeons can use AR for guidance during operations. Manufacturers can use AR for training. Consumers can use AR for shopping, navigation, and entertainment. These are applications that people would actually want to use throughout their day.

Meta has been quietly investing in AR technology even as it was publicly hyping the metaverse. The company acquired companies like Ctrl-labs, which develops brain-computer interfaces, and continued developing its smart glasses initiatives. The Orion project, Meta's internal AR glasses prototype, reportedly uses advanced holographic displays and has been in development for years, as reported by TechBuzz.

The Smart Glasses Strategy

Meta's real vision, it turns out, is smart glasses. Imagine normal-looking eyeglasses that could display digital information, enable video calling, provide navigation assistance, and unlock entirely new ways of interacting with the world. That's the future Meta is actually betting on.

Smart glasses represent the ultimate form factor for mixed reality technology. They're socially acceptable. They're accessible to mainstream users. They don't cause discomfort or motion sickness. And they could eventually be produced at scale at price points similar to high-end sunglasses.

The challenge, of course, is that smart glasses are extraordinarily difficult to manufacture. They require advances in displays, processing power, battery technology, and optical engineering. They're years away from mainstream consumer availability, which is probably why Meta is still hedging its bets by manufacturing VR headsets, as noted by TechBuzz.

The AI Pivot Within Mixed Reality

Interestingly, Meta's smart glasses are expected to be powered by advanced AI systems. The glasses would use computer vision to understand your environment, natural language processing to understand your voice commands, and large language models to provide helpful suggestions and assistance.

In other words, the future of Meta's mixed reality platform might be less about immersive virtual worlds and more about AI-powered assistance delivered through smart glasses. That's a fundamentally different business than the metaverse Zuckerberg originally described, as reported by TechBuzz.

What This Means for the VR Industry

The Broader Metaverse Moment Has Passed

Meta's pivot isn't just significant for Meta. It's significant for the entire virtual reality industry. Meta was the company that believed in VR most ardently and was willing to spend the most money to make it happen. If Meta couldn't make the metaverse work at scale, it's reasonable to ask whether anyone can.

Other companies that had invested heavily in VR are also pulling back. Microsoft, which developed Holo Lens for mixed reality, significantly reduced its commitment to the technology. Apple, which had positioned Vision Pro as the premium mixed reality device, has struggled with adoption and profitability, as noted by TechBuzz.

The narrative around the metaverse shifted dramatically around 2023 and 2024. Where once it had been a technology inevitability that everyone needed to invest in, it became increasingly niche. The companies talking about the metaverse shifted from mainstream tech leaders to specialized VR companies and startups.

Opportunities for Smaller VR Companies

Paradoxically, Meta's retreat from content development created opportunities for smaller VR companies and independent developers. With Meta no longer dominating the content landscape, there's more room for specialized experiences, niche audiences, and innovative approaches to VR.

Companies developing VR games, enterprise applications, and specialized experiences have seen renewed interest from investors and customers. The space is no longer dominated by the Meta metaverse narrative. Instead, it's becoming more pluralistic, with multiple approaches to how VR might be useful, as reported by TechBuzz.

VRChat, a social VR platform built by a smaller independent company, actually offers a better social experience than Meta's Horizon Worlds ever did. Beat Saber continues to sell millions of copies as a game. Enterprise applications like training simulations and virtual collaboration tools show genuine utility and profitability.

The Lesson: Consumer Adoption Is What Matters

The fundamental lesson from Meta's metaverse failure is that you can't will consumer adoption into existence through spending alone. No amount of investment can force people to adopt a technology they don't find compelling. And no corporate vision, no matter how grand, can overcome fundamental friction points like discomfort, expense, and limited compelling content.

The companies that succeeded in mixed reality were those that focused on specific problems VR actually solved well, not those that tried to imagine entire new social paradigms centered around VR, as noted by TechBuzz.

In 2024, users spent more time engaging with Horizon Worlds on mobile devices compared to VR, highlighting a shift towards mobile-first metaverse experiences. (Estimated data)

AI Takes Center Stage: Why Meta Pivoted Toward Artificial Intelligence

The Moment When AI Captured Everyone's Attention

Timing is everything in technology, and Meta's timing was terrible. The company had committed to the metaverse narrative just as artificial intelligence was about to explode into mainstream consciousness.

When Chat GPT launched in November 2022, it represented a genuine inflection point in the AI narrative. Suddenly, the hottest technology conversations shifted entirely away from virtual reality. Investors, engineers, and entrepreneurs who had been interested in the metaverse pivoted to AI. Academic research accelerated. Startup funding flowed toward AI applications. The cultural moment had shifted, as reported by TechBuzz.

This created a dilemma for Meta. The company had already committed tens of billions to the metaverse. But it also had some of the world's best AI researchers and significant AI infrastructure. Could it credibly pursue both? Increasingly, the answer became clear: no. The company needed to pick its battles.

Meta's AI Strategy Emerges

What happened next was predictable but significant. Meta shifted resources toward AI. The company open-sourced some of its AI models, like Llama, which became one of the most widely used language models in the industry. It invested in improving LLaMA further. It began integrating AI throughout its products, as reported by TechBuzz.

Meta's management team, particularly Chief AI Officer Yann Le Cun, became increasingly vocal about AI's importance and relatively quiet about the metaverse. In earnings calls, management discussed AI opportunities far more than they discussed Reality Labs' progress.

This wasn't an explicit abandonment of the metaverse. It was an implicit rebalancing of priorities. If the metaverse was truly going to be the future, it would likely be powered by AI anyway. But AI itself represented more immediate opportunities and stronger commercial potential.

The Commercial Reality of AI vs. Metaverse

The difference between AI and VR is that AI has clear, immediate commercial applications. Businesses want AI tools for customer service, content creation, data analysis, and productivity. Consumers are using AI for writing, coding, image generation, and information seeking. The market is hungry for AI today.

In contrast, consumers aren't clamoring for VR experiences. They're not complaining that their lives lack immersive virtual worlds. They're not willing to spend $500 on a headset or sacrifice comfort and time to use VR when they could be doing other things.

Meta recognized this reality, however reluctantly. The company was investing in the future it wished existed rather than the future that consumers were actually demanding. Once that became clear, the pivot toward AI made inevitable sense, as noted by TechBuzz.

The Mobile-First Future: Why Smartphones Won Out Over Headsets

The Persistent Dominance of Mobile Phones

One lesson from Meta's metaverse saga is that replacing smartphones as the primary computing device is extraordinarily difficult. Despite years of predicting the decline of mobile phones, smartphones have only become more important to users' daily lives.

VR promised to offer something more immersive than smartphones. But it did so at the cost of accessibility, portability, and comfort. For most users, most of the time, those tradeoffs aren't worth it.

Horizon Worlds on mobile proved that people would engage with metaverse-adjacent experiences as long as those experiences didn't require expensive hardware and physical discomfort. Meta's own data suggested that mobile Horizon Worlds had better engagement metrics than VR Horizon Worlds, as reported by Virtual Reality News.

This shouldn't have been surprising. Smartphones are ubiquitous, always with you, require no setup, and don't cause discomfort. VR headsets are expensive, require dedicated space, and cause fatigue. From a pure technology adoption perspective, smartphones have massive structural advantages.

The Limitations of Mobile as a Gateway

That said, mobile also has limitations. A smartphone display can't replicate the immersive quality of a VR headset. Smartphone games can't match the environmental immersion of VR. For certain applications, VR is genuinely superior.

Meta's strategy seems to be betting that these applications are niche enough to sustain VR as a specialty product rather than a mainstream computing platform. The company will continue serving gamers, enterprise customers, and enthusiasts. But it's no longer expecting VR to become the primary way humans interact with digital information, as noted by Virtual Reality News.

Estimated data shows that a significant portion of Meta's $80 billion investment was allocated to R&D and organizational overhead, with substantial funds also directed towards content creation and internal projects.

The Financial Impact: What $80 Billion Bought Meta

Accounting for the Loss

The $80 billion that Meta invested in Reality Labs represents one of the largest failed bets in technology history. For context, that sum exceeds the annual revenue of all but a handful of Fortune 500 companies. It's roughly equivalent to what Google's entire revenue was in 2012.

Some of that money went into research that has value even though the metaverse didn't succeed. Display technology, processing architectures, and AR glasses development could eventually pay dividends if Meta's smart glasses initiative succeeds.

But much of that money disappeared into content creation, internal projects that were cancelled, and organizational overhead for a division that's now being restructured. It's gone, unlikely to be recovered in any direct sense, as reported by TechBuzz.

The Opportunity Cost

What makes the $80 billion figure even more painful for Meta shareholders is considering what else the company could have done with that capital. The company could have acquired major software companies, invested heavily in AI from the beginning, returned capital to shareholders, or developed entirely new product categories.

Instead, Meta made a bet on a technology that the market wasn't actually demanding and an idea about the future that proved prescient only in retrospect—and then only partially. The company had genuine reasons to believe in the metaverse in 2021. By 2024, those reasons were looking increasingly flimsy, as noted by TechBuzz.

Employee and Industry Impacts

What Happened to the People Working in Reality Labs

Beyond the headline figures about layoffs, there's a human story here. Thousands of talented engineers, artists, designers, and managers who believed in the metaverse vision were forced to find new roles or exit the company.

Most of the laid-off content creators and designers found positions at other game companies, animation studios, or startups. The VR industry, being smaller than mainstream tech, has limited capacity to absorb all these displaced workers. Some likely transitioned into different fields entirely.

For those remaining in Reality Labs, the restructuring created profound uncertainty. The division that had been positioned as Meta's most important initiative was now explicitly deprioritized. Remaining employees faced the question of whether to stay committed to mixed reality or look for opportunities in more obviously successful parts of the company, as reported by GMToday.

Effects on the Broader VR Industry

Meta's retreat sent shockwaves through the VR industry. For years, the company had been the primary driver of adoption, funding, and attention. Its pivot away from the metaverse narrative meant that other companies also felt less pressure to invest in VR development.

VR arcades, which had experienced some growth as consumer adoption remained limited, saw renewed interest. Enterprise VR applications like training simulations and design visualization tools continued to see commercial adoption. But the sense that VR was about to become mainstream—that underpinned much investment and development activity—dissipated significantly, as noted by TechBuzz.

Interest in the metaverse peaked in early 2022 but has since declined significantly, reflecting a cultural shift towards more incremental technological progress. (Estimated data)

Understanding Meta's True Long-Term Strategy

The Three-Part Vision

Once you move past the headlines, Meta's actual strategy becomes clearer. The company is making three distinct bets on the future of computing:

First, they're betting on AI as the near-term and medium-term future. The company is investing heavily in language models, computer vision, and AI infrastructure. These are technologies with immediate commercial applications and clear user demand.

Second, they're betting on smart glasses and AR as the long-term vision for how humans will interact with digital information. If the company can eventually produce smart glasses with advanced displays and AI integration, that could represent a significant shift in computing.

Third, they're hedging by maintaining VR hardware and the Quest platform, acknowledging that VR might eventually find its place as a specialty computing platform for gaming, entertainment, and enterprise applications, as reported by TechBuzz.

This three-part strategy is substantially different from "building the metaverse." It's also far more realistic about what technology adoption actually looks like and what consumers actually want.

The Shift From Consumer Dreams to Enterprise Reality

Another pattern in Meta's restructuring is a shift from pursuing consumer VR adoption toward enterprise applications. VR training simulations, design visualization, surgical assistance, and collaborative tools all have demonstrated value. Businesses are willing to pay for these applications.

Meta is positioning itself to serve this market through its hardware, software infrastructure, and developer partnerships. It's less romantic than the metaverse vision, but it's also more likely to be profitable and sustainable, as noted by TechBuzz.

Comparing Meta's Pivot to Other Tech Industry Trajectories

How This Differs From Facebook to Meta

When Meta pivoted from Facebook to Meta, the company maintained its core business while expanding into new territory. The social network continued generating hundreds of billions in revenue. The metaverse was supposed to be additive, not cannibalistic.

When companies like Apple pivoted from personal computers to music players to phones to watches to services, each new category built on their existing platform and brand. The iPhone wasn't a replacement for the Mac. It complemented it. And the transition happened because customers actually wanted these new products.

Meta's metaverse pivot was different. It was supposed to be transformational and replace the smartphone as the primary computing device. It required customers to want something they hadn't previously demanded. And instead of building on Meta's existing strengths in social networking and platform development, it relied on entirely different competencies in content creation and hardware manufacturing, as reported by TechBuzz.

Lessons From Other Failed Tech Bets

History is full of examples of companies making massive bets on the wrong future. Microsoft invested billions in mobile phones and completely missed the smartphone revolution. Yahoo committed to a vision of the internet that became obsolete within years. Kodak invented digital photography but couldn't cannibalize its film business.

What these examples share is that massive investment and genuine belief aren't sufficient to make a technology successful if the market doesn't want it. The gap between what technology leaders believe will be important and what actually becomes important is one of the consistent patterns in tech history.

Meta's metaverse bet is significant less as a unique failure and more as a vivid contemporary example of this pattern. The company wasn't incompetent. It wasn't foolish. It simply made a bet that the market didn't validate, as noted by TechBuzz.

The Future of VR: Where It Actually Goes From Here

VR as a Specialty Category

With Meta deprioritizing VR content development, the technology is settling into what appears to be its actual market positioning: a specialty tool for specific use cases rather than a mainstream computing platform.

VR excels for applications where immersion is directly valuable: gaming, entertainment, training simulations, and design visualization. It's genuinely useful for these purposes. But outside of these niches, VR hasn't proven essential.

The VR market will likely continue growing, but slowly and within these specific domains. Gaming will probably remain the largest consumer use case, with enterprise applications growing steadily. But we're unlikely to see VR headsets replace smartphones for most users, at least not in any timeframe investors care about, as reported by TechBuzz.

AR's Uncertain Timeline

Augmented reality remains technically more challenging but strategically more promising than VR. Smart glasses that display useful information without immersing users completely in a digital world have clearer use cases.

The timeline for mainstream AR adoption remains genuinely uncertain. The technology is advancing, but it's years away from the point where it could replace smartphones as the primary computing device. Meta, Apple, and other companies are investing to be ready when that inflection point arrives. Whether it arrives in 5 years, 10 years, or never remains an open question, as noted by TechBuzz.

The Role of Independent VR Companies

Meta's pivot creates space for smaller, more focused VR companies to thrive. Companies that specialize in VR games, enterprise applications, or specific genres don't need to build a complete metaverse or achieve mainstream adoption. They just need to serve their market well.

Steam VR continues supporting numerous independent VR games. VRChat remains popular despite Meta's competition. Enterprise VR software companies have attracted significant investment. The VR industry is becoming less dependent on Meta's vision and more diverse in its approaches, as reported by TechBuzz.

Implications for Technology Investors and Entrepreneurs

What This Teaches About Technology Adoption

Meta's metaverse failure offers clear lessons for anyone making bets about the future of technology. First, consumer adoption is harder to predict than any amount of technical sophistication suggests. Second, you can't spend your way to market acceptance if the market doesn't want what you're building. Third, sometimes the technology that's logically better (VR being more immersive than smartphones) loses to the technology that's more convenient and accessible.

These lessons apply far beyond VR. They apply to autonomous vehicles, flying cars, fusion energy, and any number of technologies where enthusiasts are convinced mainstream adoption is imminent.

The Importance of Realistic Market Expectations

Investors and executives often fall into what might be called "technology enthusiasm overconfidence." They become convinced that a technology is the future and that anyone betting against it is being unimaginative. Meta's metaverse bet exemplifies this pattern at massive scale.

Savvy investors recognize that even technologies that eventually succeed often require longer timelines than proponents expect. And many technologies that seem like obvious winners never achieve mainstream adoption. Distinguishing between these categories is one of the core challenges of technology investment.

Implications for AR and AI Investments

As Meta pivots toward smart glasses and AI, investors are watching closely. Will AR actually achieve mainstream adoption? Will AI remain valuable as the initial excitement wears off? These are open questions where Meta's track record—one metaverse-sized failure and ongoing investments in platforms that haven't yet achieved mainstream success—might be relevant.

Meta's ability to succeed with AR and AI likely depends on whether it can avoid the same patterns that led to the metaverse failure. The company needs technologies that solve real problems consumers are willing to pay for, not just technologies that are technically impressive or that executives believe represent the future, as noted by TechBuzz.

The Broader Cultural Shift: Moving Beyond Hype

The End of the Metaverse Narrative

Perhaps the most significant impact of Meta's pivot is cultural. The metaverse was one of the most talked-about technology trends of 2021 and 2022. Major companies released metaverse strategies. Investors rushed to fund metaverse startups. The term became synonymous with the future of the internet.

That narrative is largely gone now. The metaverse still exists as a term, but it's no longer positioned as the inevitable future that every company needs to prepare for. It's been repositioned as a niche interest within gaming and some enterprise applications.

This represents a broader cultural shift in how the tech industry thinks about technological futures. The days of grand narratives about single transformational technologies might be over, at least for a while. Companies are becoming more cautious about making trillion-dollar bets on unproven platforms, as noted by TechBuzz.

The Reality of Incremental Progress

What's replacing the metaverse narrative is something closer to reality: technological progress is usually incremental rather than transformational. Smartphones took decades to develop. The internet was built on top of years of academic research. AI progress, while accelerating, has been gradual within the context of decades of research.

The idea that Meta could spend $80 billion and create the future through sheer will and investment was always somewhat magical thinking. The metaverse didn't fail because Meta didn't spend enough money. It failed because consumers didn't want it, and no amount of money changes that, as reported by TechBuzz.

What Meta's Pivot Means for the Average Consumer

For VR Headset Owners

If you already own a Meta Quest headset, the pivot doesn't change much about your immediate experience. Meta still operates the Quest store and will continue supporting existing hardware. Games and experiences you've purchased still work. The content library isn't going to disappear overnight.

What will change is the rate of new first-party content development. Meta will be investing less in new Horizon Worlds experiences and internal VR games. Over time, the content library will grow more slowly, relying more heavily on third-party developers, as reported by TechBuzz.

For serious VR enthusiasts, this might actually be welcome. The VR community has often complained that Meta's first-party content wasn't particularly good. A shift toward more diverse third-party content could improve the overall experience.

For Those Considering VR Adoption

If you were on the fence about buying a VR headset because you believed Meta's metaverse narrative would make VR essential, you can probably drop that from your decision calculus. VR is becoming a specialized entertainment and productivity tool, not the future of human computing.

For most people, most of the time, a smartphone does what they need. VR is valuable if you want to play certain games, use specific enterprise tools, or experience immersive entertainment. But it's not becoming a smartphone replacement anytime soon, as noted by TechBuzz.

The Continued Importance of Smartphones

Perhaps the clearest practical implication for consumers is that smartphones remain the center of digital life. Rather than being displaced by VR, smartphones are being enhanced with AI. Expect to see AI-powered features becoming increasingly common in mobile devices and applications.

The camera in your phone is becoming smarter. Your phone's assistant is becoming more capable. Text input is becoming less necessary as voice and AI improve. These are the changes that will actually affect most people's daily digital lives, as reported by TechBuzz.

FAQ

What exactly is Horizon Worlds and why did Meta pivot it to mobile?

Horizon Worlds is Meta's social and gaming platform within its VR ecosystem, intended to be the flagship experience in Meta's metaverse vision. Meta developed Horizon Worlds exclusively for VR headsets initially, but found that when it launched a mobile app version in 2024, it attracted significantly more users and generated higher engagement than the VR version. Because these metrics demonstrated that people wanted the social and gaming features without requiring VR hardware, Meta made the strategic decision to shift the entire platform's focus exclusively to mobile devices, effectively abandoning VR-only content development, as reported by Virtual Reality News.

How much money did Meta actually lose on Reality Labs and the metaverse?

Meta invested approximately

Why did Meta lay off over 1,000 Reality Labs employees if they're not exiting mixed reality?

Meta specifically targeted layoffs at internal content creation teams including game developers, artists, animators, and designers who were building first-party VR experiences. The company simultaneously preserved engineering teams working on VR hardware, AR technology, and third-party developer tools. This strategic restructuring reflects Meta's shift away from building metaverse content internally and toward providing infrastructure and platforms that third-party developers can build upon, while still maintaining commitment to mixed reality as a long-term technology category, as reported by GMToday.

Is Meta still making VR headsets and how does that work with the metaverse pivot?

Yes, Meta continues manufacturing, improving, and selling VR headsets like the Quest line. The company maintains this commitment as a defensive strategic position, betting that VR hardware will eventually improve enough to become more mainstream through advances in display technology, processing power, and comfort. Additionally, maintaining VR hardware ensures Meta controls the distribution channel through its Quest App Store and doesn't completely cede the VR market to competitors like Apple if VR eventually becomes important. However, Meta is deprioritizing the consumer metaverse narrative in favor of a more modest positioning of VR as a specialty platform for gaming and enterprise applications, as noted by TechBuzz.

How does Meta's pivot toward AI connect to its abandonment of the metaverse narrative?

Meta's shift toward AI represents both a cultural response and a strategic rebalancing. When Chat GPT launched in November 2022, roughly a year after Meta's metaverse rebrand, it immediately captured industry attention, investment capital, and developer focus at the expense of VR discussions. Simultaneously, AI offers more immediate commercial applications and genuine consumer demand, whereas VR engagement remained limited despite Meta's massive investments. Rather than pursuing both paths equally, Meta essentially picked the technologies where it could compete more effectively and see clearer near-term returns while maintaining long-term hedges on VR and smart glasses development, as reported by TechBuzz.

What does Meta's failed metaverse bet teach us about technology adoption and predicting the future?

Meta's experience demonstrates that massive investment, genuine belief, and technical sophistication are insufficient to force consumer adoption of technologies people don't actually want. The company had legitimate reasons to believe in VR in 2021, but failed to account for the reality that consumers prefer convenience and accessibility (smartphones) over technical superiority (immersive VR). Additionally, the case illustrates that even the most well-resourced companies can misread market signals and make incorrect bets about technological futures. Finally, it demonstrates that the gap between what technology leaders believe will be important and what actually becomes important remains one of the most consistent patterns in tech history, affecting investment decisions and corporate strategy across the industry, as noted by TechBuzz.

Is augmented reality actually going to succeed where VR failed?

Augmented reality has structural advantages over VR that make mainstream adoption more plausible, since it doesn't require users to remove themselves from the physical world, cause motion sickness, or sacrifice comfort. AR applications have clearer immediate use cases in enterprise, navigation, shopping, and entertainment. However, AR success remains uncertain and depends on solving significant technical challenges in display technology, processing power, and battery life. Meta and other companies are investing heavily in AR smart glasses, betting on eventual success, but the timeline remains genuinely unclear and could span years or decades. The fact that Meta couldn't make the metaverse work doesn't automatically guarantee AR will succeed, but it does offer advantages that suggest it has better long-term potential than VR, as reported by TechBuzz.

What happened to all the internal VR content Meta was developing?

Most internal VR content projects were cancelled as part of the restructuring. Games, experiences, and applications that had consumed millions in development costs essentially ceased development. Some projects that had been in development for years were shuttered entirely. This effectively ended Meta's strategy of being a major first-party content creator for VR. The company's rationale was that 86 percent of time people spent in VR was already being spent on third-party applications rather than Meta's own content, suggesting that independent developers were creating more compelling experiences than Meta's internal teams produced. Rather than continue funding these underperforming projects, Meta reallocated resources to developer tools and infrastructure, as noted by TechBuzz.

How does Meta's pivot affect independent VR companies and developers?

Paradoxically, Meta's retreat from content development actually creates opportunities for smaller VR companies and independent developers. With Meta no longer dominating the VR content landscape, there's increased room for specialized experiences, niche gaming genres, and innovative approaches to VR that weren't possible when Meta was competing with massive resources. Companies like VRChat, developers of Beat Saber, and enterprise VR software companies have all seen renewed attention and investment. The VR space is becoming less dependent on Meta's narrative and vision, and more pluralistic in its approaches to which applications and experiences actually serve users well, as reported by TechBuzz.

Should I buy a Meta Quest headset given all these changes?

That depends on your specific use case. If you're interested in VR gaming, particularly games like Beat Saber or Resident Evil 4 VR, or if you want to explore enterprise applications, a Quest headset remains a viable option. Meta will continue supporting the hardware and operating the app store, so your existing content library won't disappear. However, if your interest was driven by the metaverse narrative—the idea that you'd socialize with friends in virtual worlds and that VR would become the primary way you interact with digital information—you should reset those expectations. VR is settling into a specialized tool category rather than becoming a mainstream replacement for smartphones. Make your purchasing decision based on what VR actually is today, not what Meta hoped it would become, as noted by TechBuzz.

What's Meta actually doing with all its remaining Reality Labs employees?

The approximately 14,000 remaining Reality Labs employees are focused on three primary areas: VR hardware engineering and improvement, AR technology development, and fundamental research in mixed reality. The company is also increasing investment in strategic partnerships with third-party developers and emerging startups in the mixed reality space, essentially transforming Reality Labs from a content production machine into a platform and infrastructure company. Significant resources continue flowing toward smart glasses development, as that represents Meta's actual long-term bet for how mixed reality becomes mainstream. These remaining employees represent a massive continuing commitment to mixed reality technology, just with different priorities than under the metaverse strategy, as reported by TechBuzz.

Conclusion

Meta's pivot away from the metaverse represents one of the most significant corporate strategy shifts in recent technology history. What began as Zuckerberg's vision of a transformational future where virtual worlds would become central to human life has quietly transformed into a far more modest bet on VR as a specialty platform, while the company's actual strategic focus shifts toward artificial intelligence and eventual augmented reality through smart glasses.

The $80 billion that Meta invested in Reality Labs and the metaverse didn't completely disappear. Some of that investment generated valuable research, technology, and infrastructure that might eventually pay dividends. The company will continue manufacturing VR headsets and supporting third-party developers. The metaverse, as a concept and technology category, still exists and has supporters.

But the grand narrative is over. The metaverse won't replace smartphones as the primary computing device. VR won't become mainstream in the timeline anyone imagined. And Meta, the company that believed most ardently in this future and was willing to spend the most money to make it happen, has effectively admitted those expectations were wrong.

What's remarkable is how quietly this happened. There was no dramatic announcement saying "We're abandoning the metaverse." Instead, Meta shifted resources, restructured its organization, and gradually reframed its strategy. It's a textbook example of how large organizations often admit failure: not with grand speeches, but through subtle reorganization and changed priorities.

For the technology industry more broadly, Meta's pivot is instructive. It's a vivid reminder that even the most well-resourced companies, with the most brilliant engineers and the clearest vision of the future, can be wrong about what matters. It demonstrates that market demand ultimately trumps technical sophistication and corporate investment. And it shows that sometimes the most important strategic skill isn't identifying new trends, but rather quickly recognizing when a bet isn't paying off and pivoting toward more promising opportunities.

The metaverse narrative dominated technology discourse in 2021 and 2022. It's entirely possible that future technology histories will barely mention it, treating it as a brief detour rather than a central trend. Meta's job now is ensuring that its next technological bets—AI, smart glasses, and whatever else emerges—prove more aligned with what consumers actually want than the metaverse turned out to be.

Key Takeaways

- Meta abandoned the metaverse narrative after losing $80 billion on Reality Labs with minimal consumer adoption

- Horizon Worlds pivoted to mobile after discovering higher engagement without VR headsets required

- The company shifted strategy from first-party content development to supporting third-party developers

- VR is settling into a specialty platform for gaming and enterprise rather than mainstream computing

- Meta's actual future bets are artificial intelligence, augmented reality smart glasses, and continued VR hardware as hedges

Related Articles

- Meta's Metaverse Collapse: Why VR Lost to Mobile and AI [2025]

- Snap's Specs VR Glasses Hit Leadership Crisis: What Went Wrong [2025]

- AI Adoption Requirements for Employee Promotions [2025]

- Meta's Smartwatch 2025: What Malibu 2 Means for Wearables [2025]

- Smart Glasses in Court: The Privacy Nightmare Judges Can't Ignore [2025]

- Google Gemini 3.1 Pro: AI Reasoning Power Doubles [2025]

![Meta's Metaverse Pivot: From VR to Mobile-First Strategy [2025]](https://tryrunable.com/blog/meta-s-metaverse-pivot-from-vr-to-mobile-first-strategy-2025/image-1-1771625221112.jpg)