The Crucial Moment That Changed PC Gaming and Building Forever

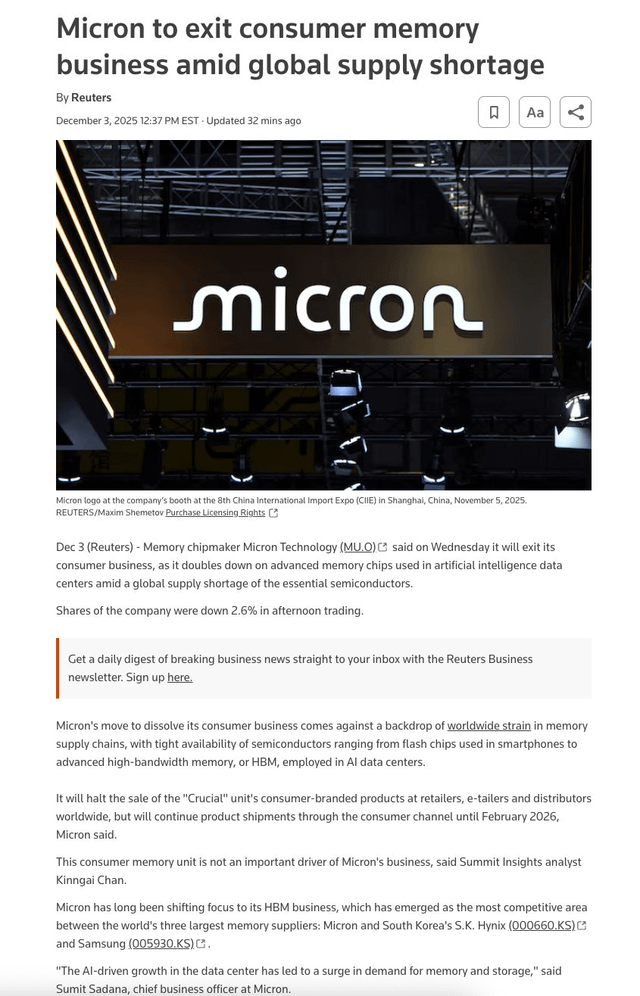

Something strange happened in the memory market recently. Micron, one of the world's largest RAM manufacturers, made a decision that left millions of PC builders, gamers, and system integrators genuinely angry. The company announced it was discontinuing the Crucial brand, a product line that's been trusted by enthusiasts for nearly two decades. But here's the weird part: when executives explained the move, they insisted they were actually helping consumers.

I'll be honest. That explanation landed like a lead balloon.

The move sent shockwaves through the PC building community. Reddit threads exploded. Twitter was flooded with angry posts. YouTube channels dedicated to PC builds were suddenly scrambling to figure out what happens next. This isn't just a corporate reorganization. It's about trust, accessibility, and what happens when one of the industry's gatekeepers decides to change the rules on everyone at once.

Micron's statement said: "We are trying to help consumers. We're just doing it through different channels." But the community heard something different. They heard that a beloved brand they'd relied on for years was being erased from existence. They heard that their trusted source for reliable, affordable memory was going away. And they heard that corporate consolidation was winning again.

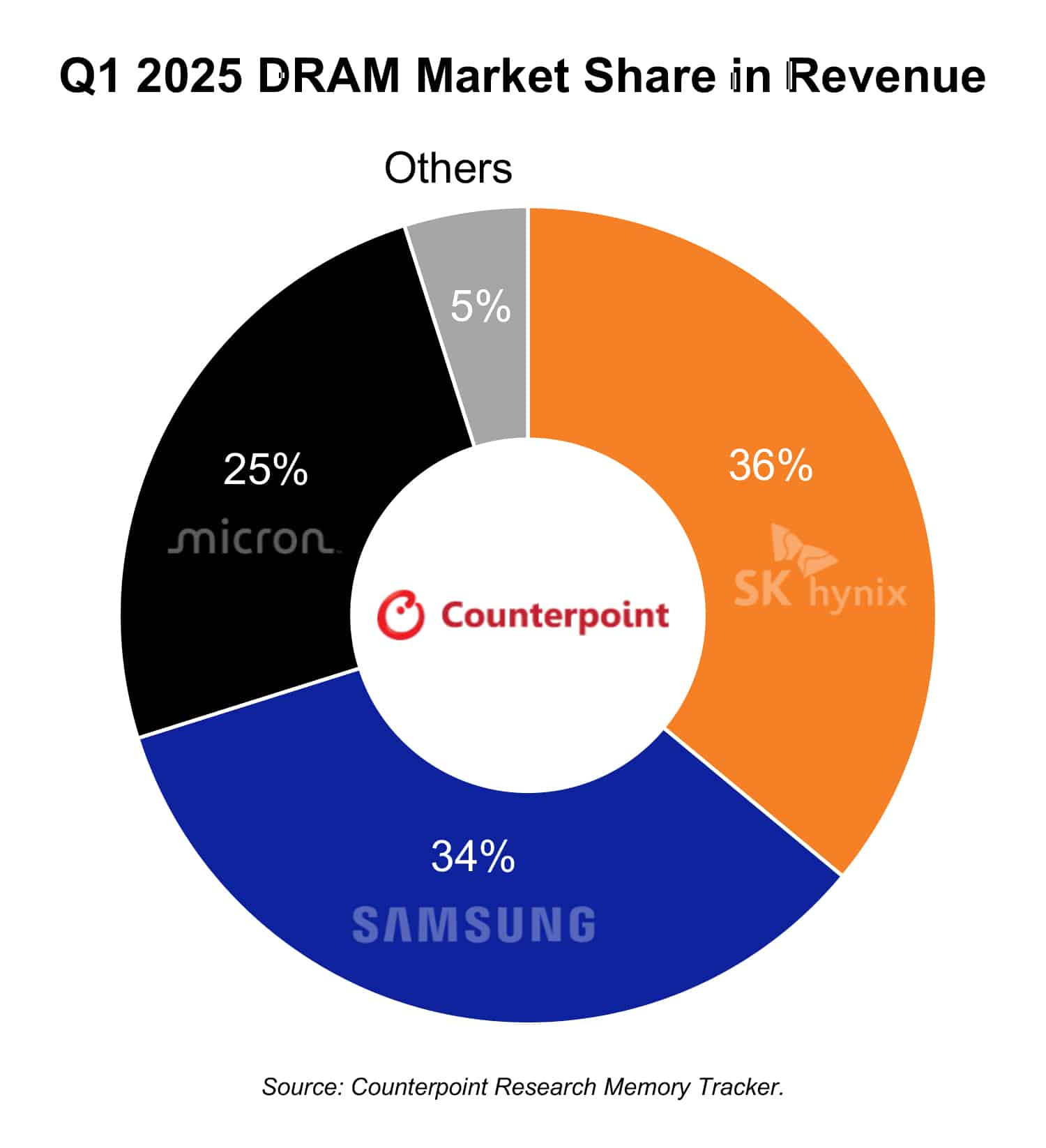

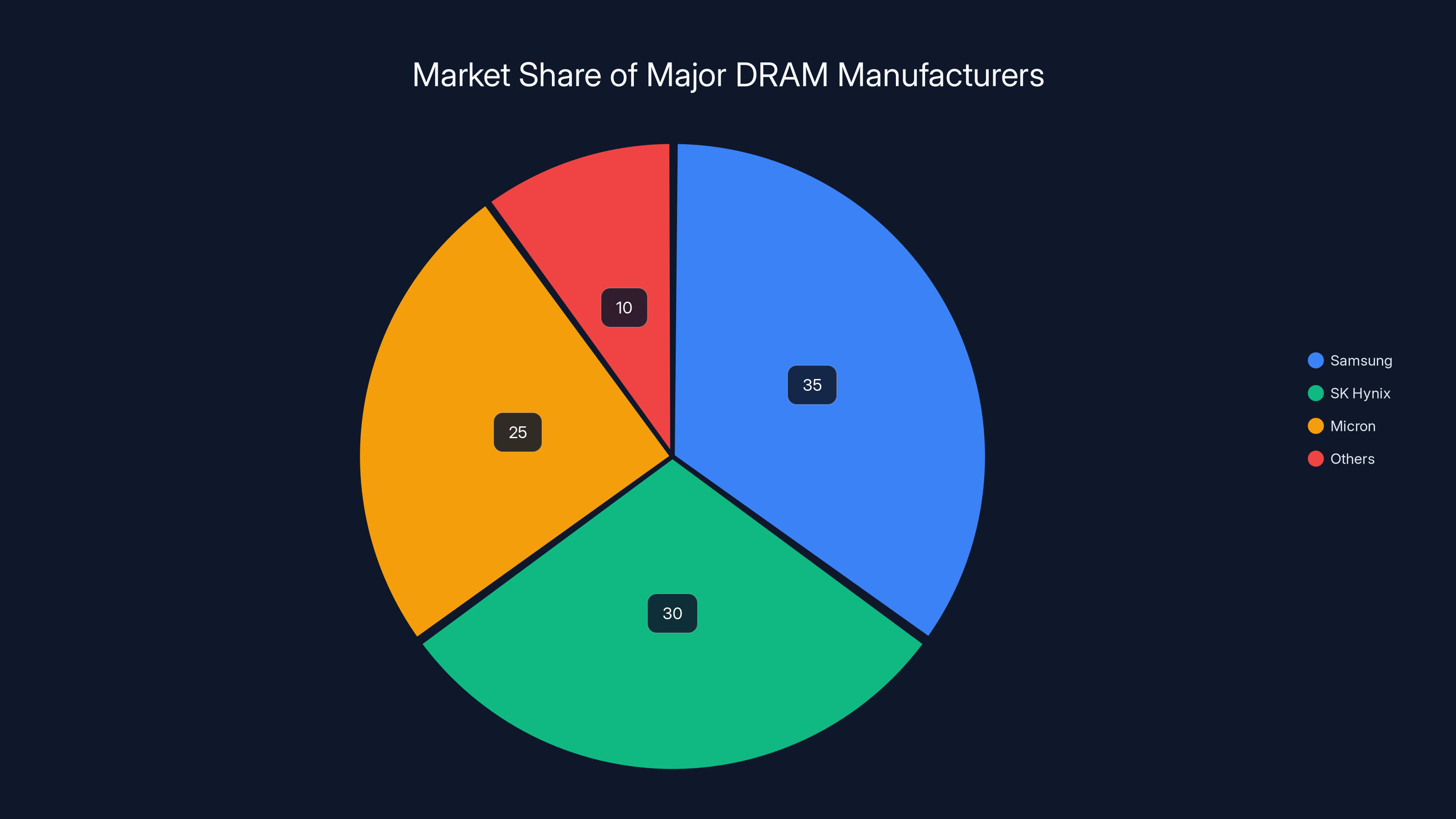

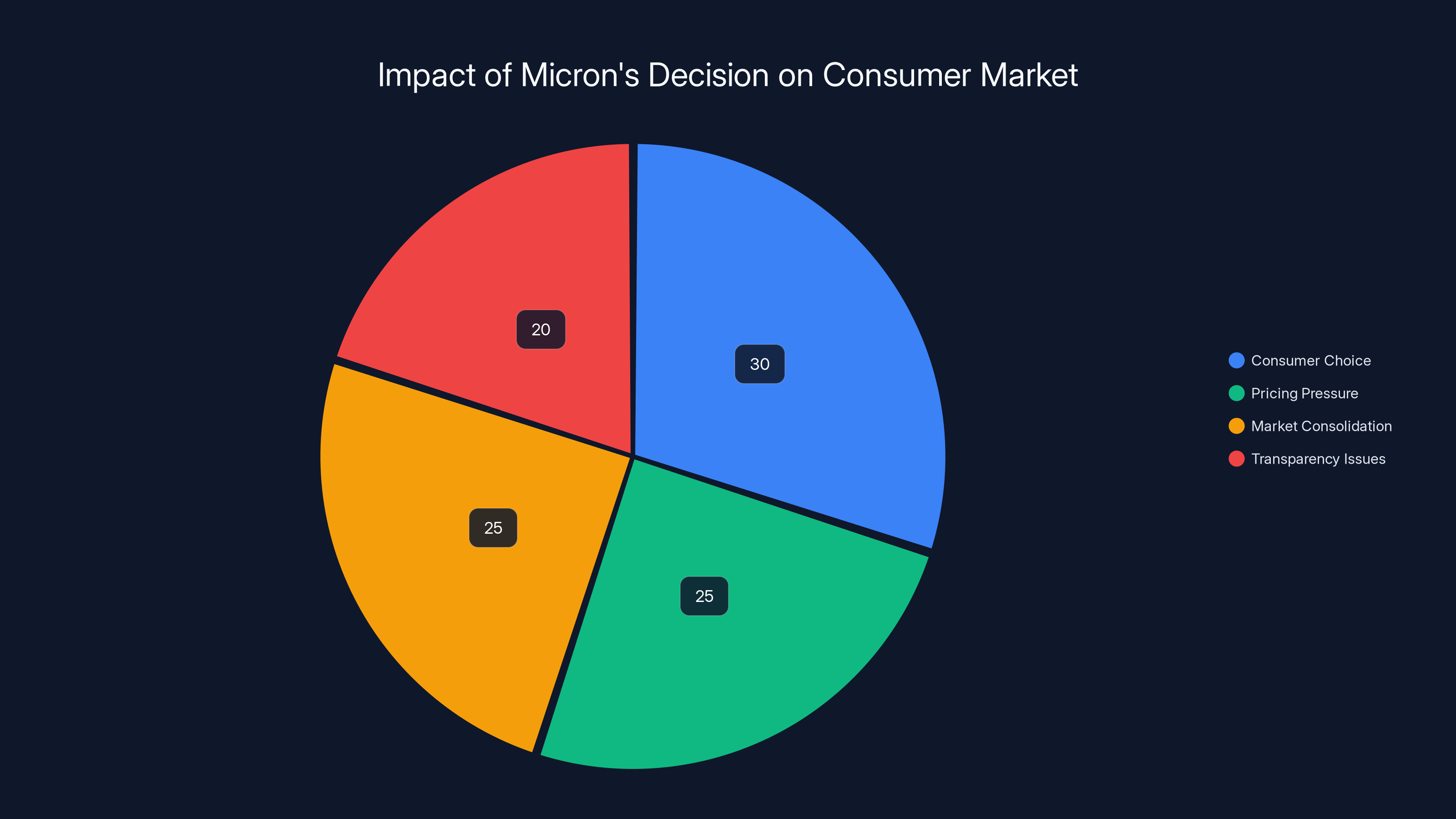

This moment reveals something important about the memory market that most people don't understand. The RAM industry isn't as competitive as it looks. A handful of companies control almost everything. Micron, Samsung, and SK Hynix produce the vast majority of DRAM chips worldwide. When one of them makes a major move, it ripples across the entire industry. And when that move involves killing a consumer-facing brand that millions of people know and trust, the consequences are real.

The Crucial discontinuation is more than a corporate restructuring. It's a case study in how market consolidation affects consumers, how brand loyalty gets weaponized, and what happens when companies prioritize efficiency over the relationships they've built with their customers. It's also a window into the actual RAM crisis that nobody's really talking about.

TL; DR

- Micron discontinues Crucial brand: The move shifts focus from consumer-facing products to OEM partnerships and different distribution channels

- PC building community furious: Enthusiasts, builders, and system integrators relied heavily on Crucial for affordable, reliable RAM without premium pricing

- Market consolidation risk: Only three companies control 85%+ of global DRAM production; Crucial's removal reduces consumer choice

- "Different channels" unclear: Micron's explanation left key details vague about how consumers will access Crucial products going forward

- Trust collapse: The decision damages customer relationships built over nearly two decades of consistent, affordable memory solutions

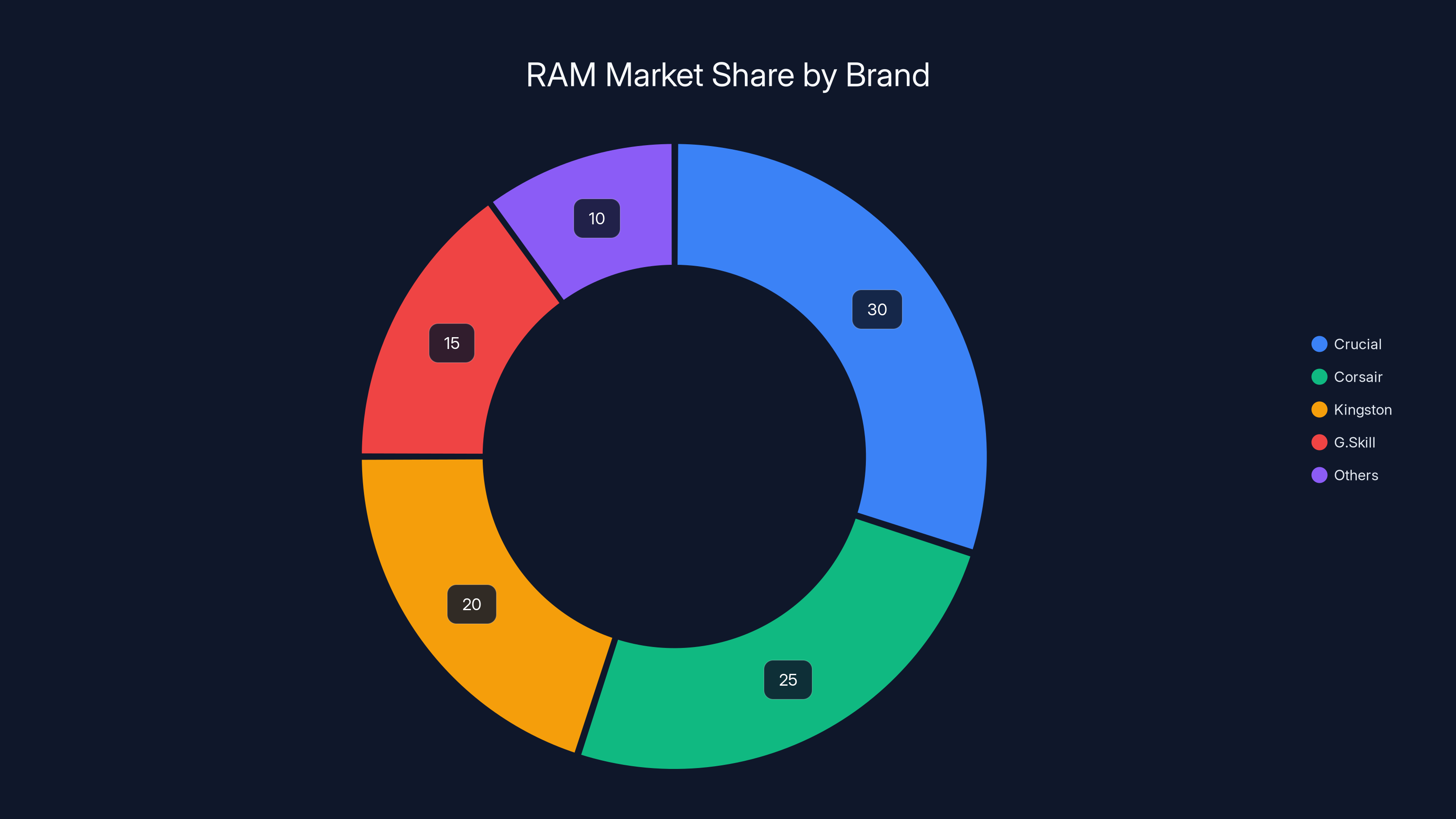

Crucial held a significant 30% share in the RAM market among PC builders, offering a balance of performance and price without the premium cost. (Estimated data)

Why Crucial Mattered More Than You Probably Realized

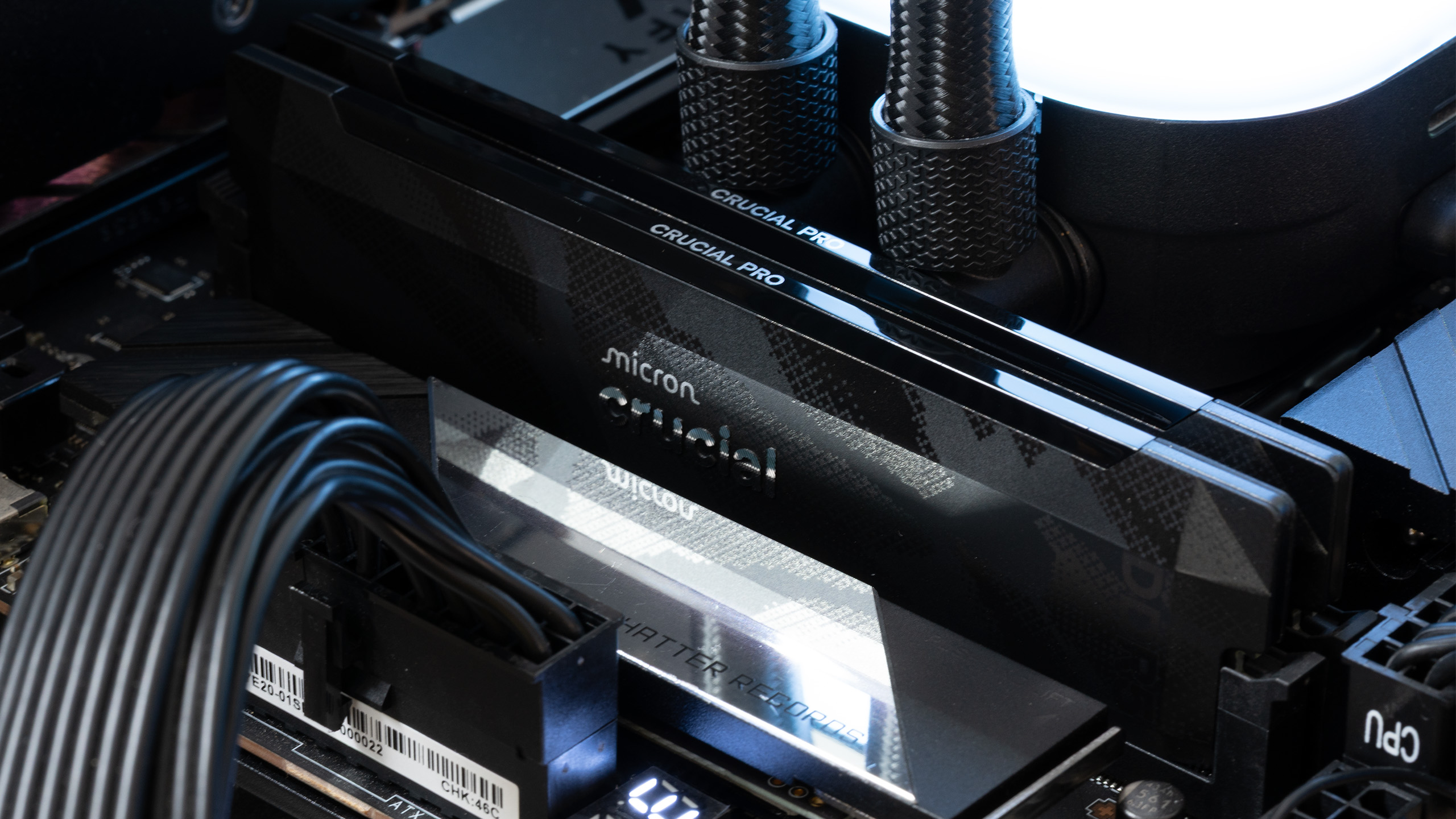

Most people don't think about RAM. They buy a laptop or build a PC, pick whatever memory comes with it or is recommended, and move on. But for millions of enthusiasts, builders, system integrators, and small tech shops, Crucial was something different. It was the trusted alternative to premium brands like Corsair that cost 20-30% more for nearly identical performance.

Crucial occupied a specific market position that mattered tremendously. The brand represented proven reliability without the audiophile pricing. When you needed 32GB or 64GB for a workstation build, Crucial wouldn't charge you extra for RGB lighting you didn't want or fancy marketing you didn't need. You got quality memory at sensible prices. That sounds simple, but it's actually rare in the premium PC components market.

The brand started as a sub-label of Micron, launched in 1997. For most of its existence, it remained almost invisible to casual consumers but absolutely essential to people who actually built computers. If you spent time in PC building forums, subreddits, or Discord servers, Crucial was everywhere. People recommended it constantly. "Crucial's cheap and solid," they'd say. "Never had a stick die on me." These weren't paid endorsements. These were genuine recommendations from people who had actual experience.

That trust took decades to build. And Micron decided to throw it away in a single announcement.

The irony cuts deep because Crucial actually solved a real problem. The RAM market had become increasingly stratified. You had ultra-premium brands charging extreme prices for modest performance gains. You had budget brands with questionable longevity. And then you had Crucial, sitting in that goldilocks zone where performance, reliability, and price all aligned reasonably well.

For system integrators, this mattered enormously. A shop building 50 workstations per month could spec Crucial memory, order with confidence, and know the units would last. The warranty was solid. Support was responsive. Returns were rare. This reliability translated into fewer callbacks, fewer warranty claims, and fewer customer complaints. That's worth real money when you're operating at scale.

For individual PC builders, Crucial meant you could upgrade your own system without feeling like you were gambling. You weren't dropping $300 on memory you couldn't verify independently. You were getting decent performance at prices that made economic sense. That accessibility mattered. It meant more people could actually upgrade their systems instead of accepting whatever came pre-installed.

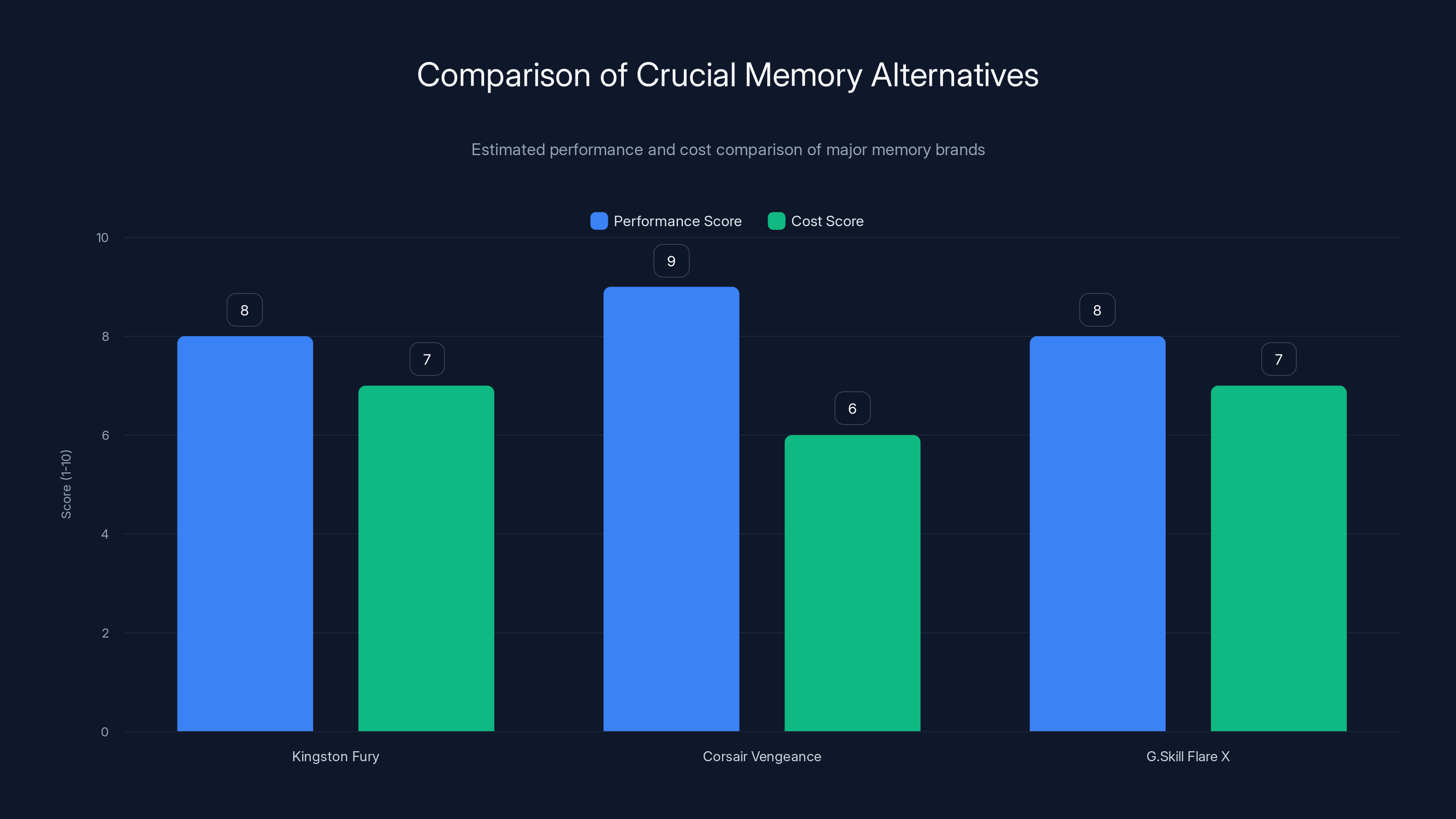

Kingston Fury and G.Skill Flare X offer balanced performance and cost, while Corsair Vengeance provides higher performance at a slightly higher cost. Estimated data.

The RAM Market's Dirty Secret Nobody Talks About

To understand why Crucial's discontinuation matters, you have to understand something fundamental about the memory market that the industry works hard to keep quiet: it's essentially controlled by three companies, and that's become increasingly true over the past decade.

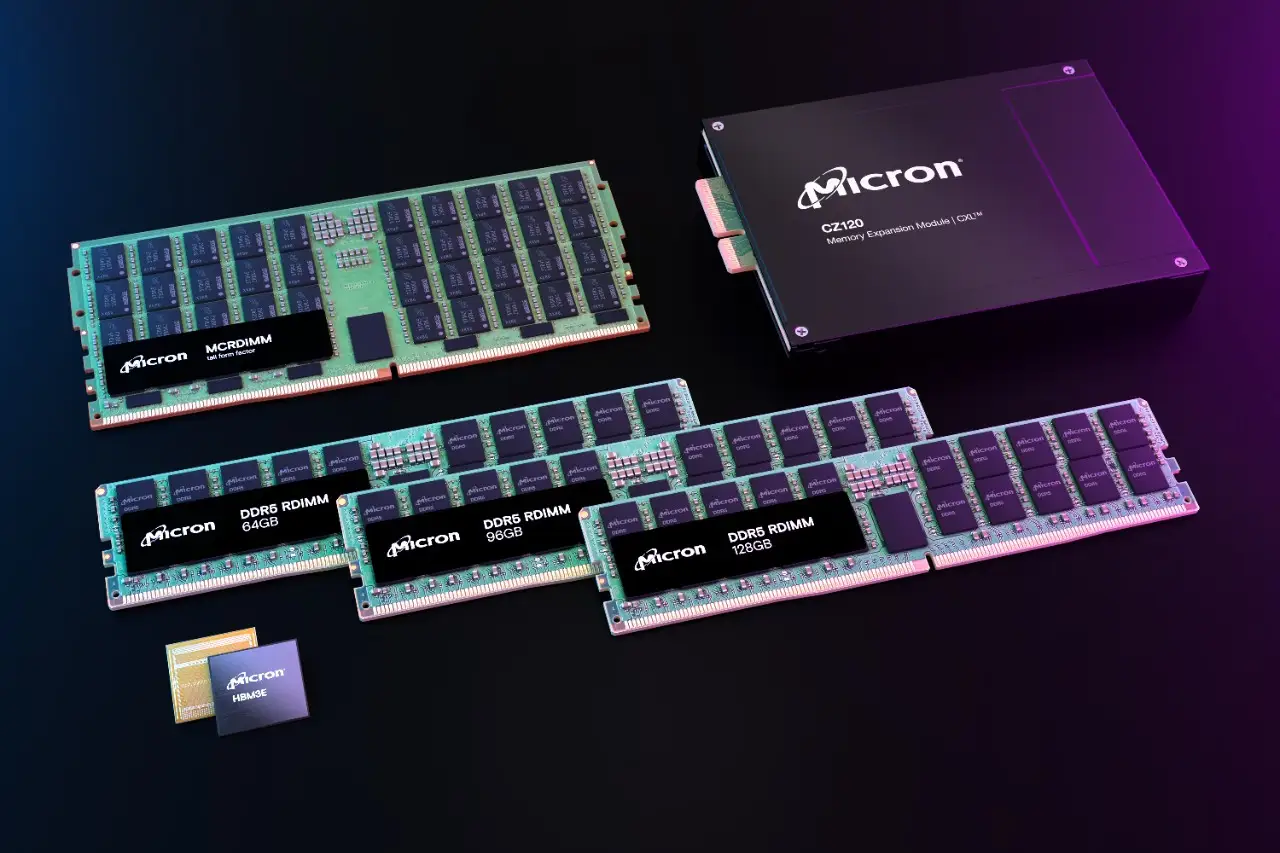

Micron, Samsung, and SK Hynix manufacture something like 85-90% of all DRAM chips used in every computer, phone, server, and electronic device globally. These companies produce the raw silicon. Everything else in the market builds on their chips. CORSAIR doesn't make memory chips. G. Skill doesn't. Kingston doesn't. They buy chips from the big three, add heatspreaders, test them, and sell them under their own brands.

This concentration creates a hidden layer of control. When Micron decides something, it doesn't just affect Micron products. It affects the entire market's economics. When SK Hynix faces production challenges, prices across the entire industry spike. When Samsung increases production, prices fall everywhere. Individual companies like Corsair can differentiate their testing, warranty, or marketing, but they cannot escape the upstream reality of who controls the actual silicon.

Crucial's existence as a direct-to-consumer brand actually represented something rare: a memory chip manufacturer selling directly to end users instead of exclusively through OEM and distributor channels. This direct relationship gave consumers a clearer path to the actual manufacturers and prevented markup stacking. When you bought Crucial, you were closer to the source than when you bought any other brand.

Killing that direct channel doesn't make memory cheaper or better. It does the opposite. It removes a pricing anchor that forces other brands to remain competitive. With Crucial gone, the market shifts. Corsair, G. Skill, and other brands feel less pressure to keep prices rational. System integrators have fewer options for affordable OEM purchasing. Individual consumers lose a trusted reference point.

Micron's statement about "helping consumers through different channels" glosses over this reality. The company is essentially saying: "You'll still have access to Micron memory chips, just not under the Crucial brand, and not with the same direct relationship you had before." That's not the same thing. It's materially worse for consumers.

What Actually Happens to Crucial Products Now?

This is where things get murky, and it's the part that generated most of the anger from the community. Micron's official statements haven't been entirely clear about the transition. The company said it would continue to support existing Crucial memory under warranty and would shift to serving customers "through different channels." But what does that actually mean?

Here's what we know: Micron isn't announcing that Crucial memory will disappear immediately. Products already manufactured will continue to be sold through existing channels until stocks run out. Warranty support continues as promised. The company isn't abandoning customers who bought Crucial in the past or recently.

What's changing is the future. No new Crucial products will be developed. The brand won't receive the same investment. The direct-to-consumer relationship that defined Crucial will be replaced with something else. According to Micron, this "something else" involves distribution through other channels, but the specifics remain fuzzy.

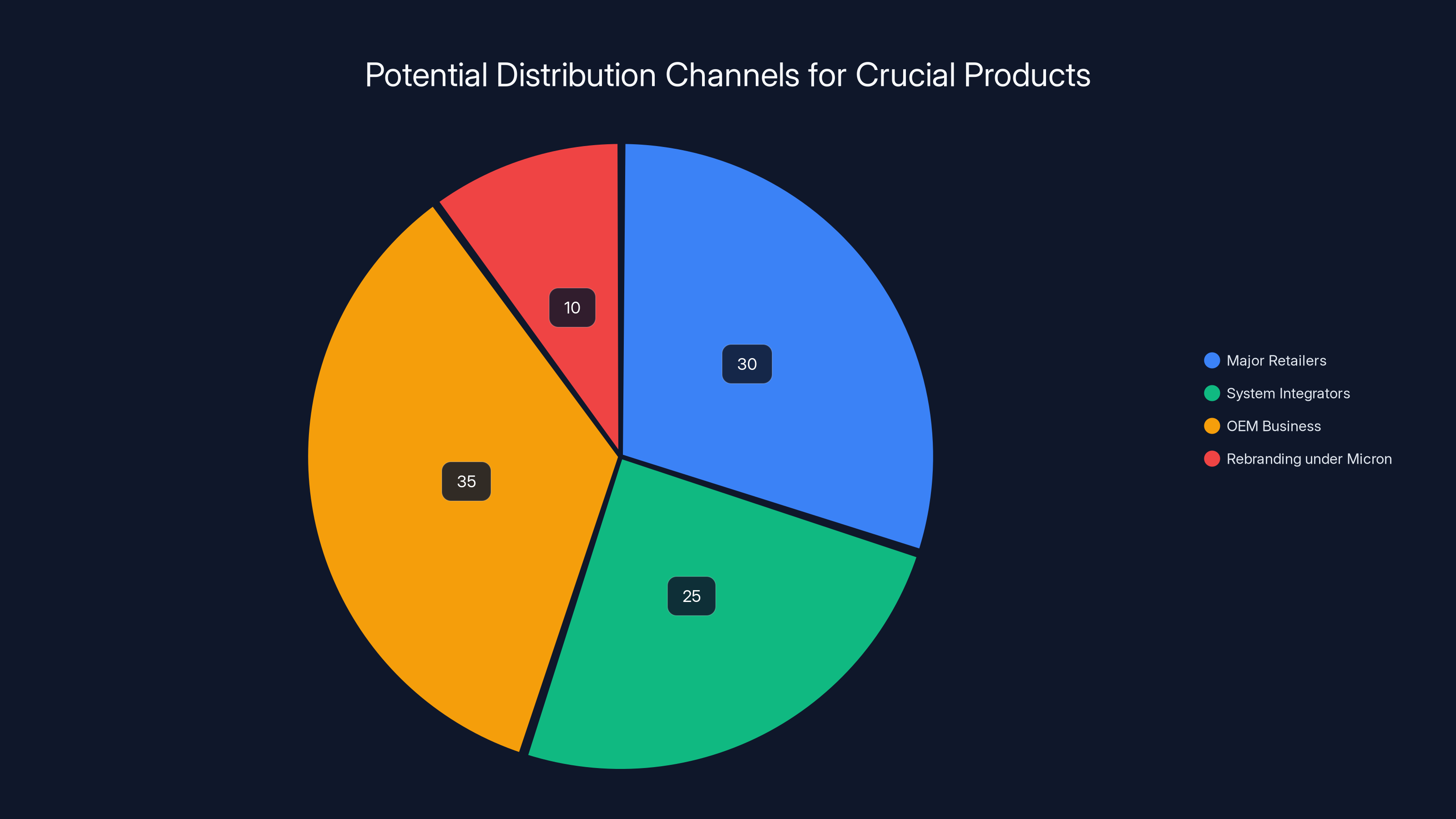

Industry analysis suggests several possibilities. Micron might shift Crucial products to distribution through major retailers and system integrators instead of selling directly. The company might rebrand some products under the Micron name directly, keeping the same memory but losing the Crucial identity. Micron might focus on OEM business where they sell massive volumes to companies like HP, Dell, and Lenovo, who then bundle memory in their systems.

Each scenario has different implications. Direct-to-consumer sales disappear regardless. The consumer brand recognition accumulated over 27 years gets reset. And the market loses a pricing benchmark that kept other brands honest.

The community's anger stems partly from this uncertainty. Nobody likes a transition plan with missing details. When Micron said "different channels," people wanted specifics. Which retailers? What pricing structure? How fast? When will the transition complete? How long until existing stock is gone? These questions haven't been answered clearly, leaving consumers and integrators in an uncomfortable information vacuum.

Samsung, SK Hynix, and Micron dominate the DRAM market, collectively controlling around 90% of global production. Estimated data.

The Economics That Led to This Decision

Micron didn't make this decision randomly. There's actual business logic behind it, even if the execution was tone-deaf. Understanding the company's perspective doesn't make the consumer impact acceptable, but it helps explain why the decision happened in the first place.

Brand management is expensive. Maintaining Crucial as a distinct product line required dedicated marketing teams, separate product development processes, different warranty and support infrastructure, and independent channel relationships with retailers worldwide. Consolidating all of that into Micron's existing corporate structure saves money. Probably a lot of money. Cost-cutting at this scale could save tens of millions annually.

From a pure business efficiency standpoint, that's compelling. Micron's shareholders want profitability and margins. When you own the brand that competes with your other products, you're creating internal complexity. Crucial products sometimes had better value propositions than Micron-branded memory of the same generation. That's awkward for shareholders. One brand is cannibalizing potential profits from the other.

The OEM market, meanwhile, is where the real scale and margins exist. Dell orders millions of memory modules annually. HP does the same. Lenovo, Asus, and every other major system builder purchases memory in massive volume. These deals offer better margins and more predictable revenue than retail operations. They also require less brand management and customer service overhead.

Micron's strategy seems to be shifting from being a consumer brand with premium positioning to being the invisible layer behind other companies' products. You don't see Micron branding much when you buy a Dell laptop or HP desktop. But Micron memory is probably inside it. That invisibility is fine for B2B, but it's a problem for direct consumers who want a trusted name when they upgrade their own systems.

The company is also consolidating its position in a market where consolidation is already extreme. With Crucial gone, consumers have fewer direct-to-manufacturer options. They become more dependent on retailers, system builders, and the remaining brands like Corsair and G. Skill. Each of those intermediaries adds cost. Prices rise. Margins improve. This benefits Micron.

It's a rational business decision that's economically terrible for consumers.

Why the PR Response Made Everything Worse

Here's something I've noticed: when companies make unpopular decisions, the explanation matters as much as the decision itself. Sometimes more. A honest, transparent explanation of why something is happening, even if it's bad news, can maintain customer goodwill. A vague, tone-deaf response does the opposite.

Micron's response was definitely the latter.

The quote "we are trying to help consumers. We're just doing it through different channels" became a meme in gaming and PC building communities within hours. It wasn't that the statement was false exactly. It was that it was so obviously disconnected from reality that it felt insulting to anyone paying attention.

Help consumers? By removing their direct access to a trusted brand? By consolidating choices further in an already-consolidated market? By forcing them to rely more heavily on retailers and system builders? The disconnect was so stark that it generated more anger than the discontinuation itself would have.

What would have worked better? Honesty. Something like: "We're discontinuing Crucial as a consumer brand to consolidate our operations and improve profitability. This allows us to focus resources on OEM partnerships where we can achieve better scale. We understand this reduces consumer choice, and we're not pretending otherwise. Here's how we'll support existing customers. Here are the new channels where you can access our memory products."

That would have been unpopular. It would have generated criticism. But it would have maintained credibility. Instead, Micron tried to spin a consolidation that benefits the company and harms consumers as a consumer benefit. The cognitive dissonance is what really triggered the backlash.

Consumers aren't stupid. PC builders and enthusiasts especially aren't stupid—they're technical people who understand how markets work. When you try to convince them that something obviously bad for them is actually good for them, they notice. They call it out. They tell everyone else.

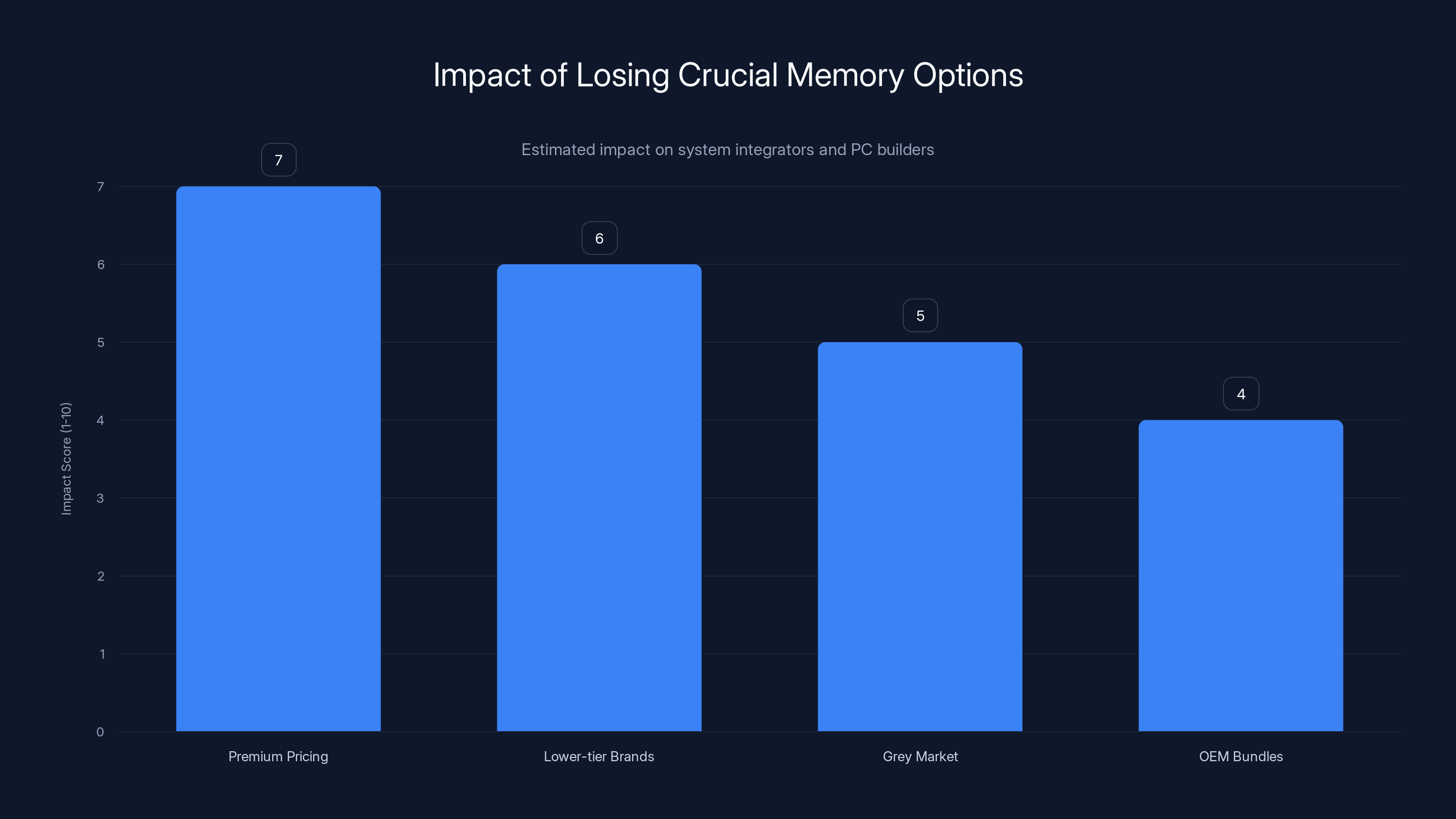

Estimated data shows that system integrators face significant challenges with higher costs and reliability issues when losing Crucial as a memory option.

The Broader RAM Market Crisis That Nobody's Discussing

Crucial's discontinuation is a symptom of a much larger problem in the memory market that gets almost no attention from mainstream tech press. The DRAM market has been in a state of crisis for years, but it's a crisis of a type that doesn't make good headlines. There are no dramatic shortages. There are no stories of scientists working around the clock. It's a much quieter crisis: market consolidation, reduced competition, and the slow erosion of consumer choice.

Over the past decade, the number of significant memory manufacturers has dropped sharply. Companies that once competed directly in the consumer space have either been acquired, exited the market, or refocused on OEM business. Elpida was bought by Micron in 2013. Nanya Technology makes memory mostly for OEM, not consumers. SK Hynix focuses heavily on enterprise and OEM customers. Kingston became more of a distributor than a manufacturer. Crucial was one of the few remaining direct consumer options from an actual chip maker.

This consolidation happened quietly because it didn't involve dramatic collapses or high-profile bankruptcies. It was just a slow shift in corporate strategy. One company after another decided that consumer markets were lower-margin, higher-headache operations compared to enterprise and OEM channels. As each manufacturer exited, consumers had fewer choices.

The "crisis" in this situation is the lack of market turmoil. If the market were actively competitive, Crucial would need to defend its position. Instead, Micron can discontinue it without fear that a nimble competitor will steal customers. Why? Because there are no other consumers-focused competitors at Crucial's price point from actual manufacturers.

This is what market consolidation looks like after it wins. It's not dramatic. It's just the steady erosion of choices and the slow increase in prices. Crucial's discontinuation accelerates that process.

Prices for DDR5 memory have been falling over the past year, but that's tied to supply exceeding demand in the enterprise market after AI buildout slowed. Consumer pricing remains stickier. System builders are charging more per GB than they did five years ago for consumer-grade memory, despite manufacturing costs declining sharply.

With Crucial removed from the direct consumer market, pressure on prices actually decreases. Corsair, G. Skill, Kingston, and other brands can maintain higher margins because the value alternative is gone. This isn't a coincidence. It's a feature of the consolidation, not a bug.

What PC Builders and System Integrators Actually Lost

The reaction from system builders and integrators has been the most pointed. These are professionals who stake their reputation on the components they spec for customers. A bad memory choice creates a failing system. A cost-effective but reliable choice like Crucial made these professionals look good to their customers.

System integrators, especially small shops building 50-200 systems monthly, relied on Crucial heavily. Here's why: the economics had to work for both the integrator and the customer. A shop couldn't recommend $200 memory modules to customers on tight budgets. Premium brands didn't fit the price point. Crucial occupied that exact middle ground. Good enough for demanding workstations. Cheap enough for budget builds. Reliable enough to avoid callbacks.

Losing that option creates a gap. Small integrators now face a choice between:

- Recommending Corsair or G. Skill at premium pricing, which makes the system more expensive and reduces competitiveness

- Using lower-tier brands with questionable reliability, which increases support costs and warranty claims

- Sourcing from grey market or unclear channels, which creates liability issues

- Shifting to OEM bundles, which reduces the customization that differentiates them from large system builders

None of these options are good.

For individual PC builders and hobbyists, the loss is different but still real. Building a high-end gaming rig or a creative workstation has always been an accessible hobby for people with technical skills but limited budgets. Crucial memory made this possible. Pay for the expensive GPU and processor, get Crucial memory, and stay within budget. Remove Crucial, and the total system cost rises. Some people who would have built their own system might now just buy a prebuilt instead.

This actually benefits Micron's B2B business because Dell and HP will provide that memory internally in their prebuilts. So Micron wins even as consumers lose. The market consolidates further toward the big OEMs.

Micron's decision to discontinue Crucial impacts consumer choice (30%), pricing pressure (25%), market consolidation (25%), and transparency (20%). Estimated data.

The Timeline of the Decision and What Actually Happened

Micron didn't announce Crucial's discontinuation all at once with a detailed transition plan. The news came through relatively quiet channels initially, which is part of why the community response was so explosive. People found out by noticing that Crucial products were being delisted from retailers or seeing quiet updates on Micron's corporate site. That's never how you want to communicate significant decisions.

What we know about the timeline: Micron has been gradually shifting investment away from Crucial toward Micron-branded enterprise and OEM products for several years. This wasn't a sudden change. The company reduced Crucial's marketing budget, cut back on new product announcements under the Crucial brand, and increasingly directed customer inquiries toward Micron offerings instead.

The actual discontinuation announcement appears to have come in early 2024, though different sources cite slightly different dates. This suggests Micron was rolling out the decision gradually to different channels rather than making a coordinated public announcement. Press received different information than retailers, who received different information than customers.

Currently, Crucial memory is still available from major retailers, but inventory is finite. Once current stock sells through, availability becomes unclear. Warranty support continues, but future product development under the Crucial name has ended. The transition period is expected to take 12-18 months, but no specific cutoff date has been publicly announced.

This undefined timeline is actually making things worse. If Micron said "Crucial products will be discontinued as of December 2025," at least everyone would know when to shift strategies. Instead, there's ambiguity. Integrators don't know when stock will run out. Retailers don't know whether to keep carrying the brand. Consumers don't know whether they're buying something that will be supported or something being phased out.

Unclarity is often more damaging than bad news with a clear timeline. People can plan around bad news. They struggle with uncertainty.

Micron's Alternative Channels: What They Actually Are

Micron's vague references to "different channels" for customer support have generated endless speculation. What does this actually mean? Let's break down the likely scenarios based on how Micron operates and what's typical in the industry.

Direct Micron branding for some consumer products: Micron could start selling memory directly to consumers under the Micron corporate brand instead of Crucial. This would maintain the direct relationship but lose the accumulated brand trust and market positioning. Micron is not a consumer brand. It's a B2B name. Marketing memory as "Micron" instead of "Crucial" changes consumer perception immediately. It sounds more corporate and less trustworthy in consumer contexts.

OEM partnerships and system builder channels: Micron could focus exclusively on selling memory to companies like Dell, HP, and Lenovo, who then include it in their systems. Consumers get memory, but it's bundled invisibly. There's no consumer brand to recognize. This is probably Micron's preferred approach because it's lower-cost operationally.

Retail channel partnerships: Micron could sell to distributors who then work with Best Buy, Amazon, and Newegg to make memory available. This maintains some consumer accessibility but adds a layer of middlemen. Prices increase slightly due to distributor margins. Micron's direct relationship with consumers is severed.

Specialized channel focusing on enthusiasts and overclockers: This is possible but seems less likely. Micron could partner with specialized retailers like Newegg that cater to PC enthusiasts and gamers. Crucial memory would still be available but only through specific channels, not everywhere.

Most likely, Micron is using a combination of these approaches. High-volume, standard products move through OEM channels. Specialty products might move through retail. Some products might get Micron branding directly. The unifying factor is that the Crucial brand, as consumers know it, is gone.

The frustration stems from not knowing which scenario applies, when the transition happens, and how consumers are supposed to navigate this new landscape. Micron's responsibility is to make this clear. It hasn't.

Estimated data suggests that Micron may focus on OEM business (35%) and major retailers (30%) for distributing Crucial products, with a smaller focus on system integrators (25%) and rebranding (10%).

How This Affects RAM Pricing Going Forward

One of the most important but least discussed consequences of Crucial's discontinuation is how it affects RAM pricing. Memory pricing is already complex because it's driven by supply and demand in commodity markets, manufacturing capacity, and competition between brands. Removing Crucial as a price anchor changes the dynamics.

Historically, Crucial pricing has served as a reference point. When memory brands like Corsair priced premium products significantly higher than Crucial, consumers could see the price gap and make informed decisions. That visibility creates pressure on other brands to remain competitive. With Crucial gone, other brands face less pricing pressure.

Think about this practically. A 32GB DDR5 memory kit from Corsair might cost

This dynamic plays out over time. It's not like memory will suddenly cost 30% more. It's more subtle. Retailers will have fewer options to show at aggressive price points. Brands will have less pressure to defend pricing when premium features are the only available option. Consumers will gradually pay more without seeing a dramatic price jump.

Enterprise buyers won't feel this impact as much because they negotiate volume deals directly with manufacturers. The small business and consumer market, though, will experience gradually increasing prices with fewer options to push back.

Micron benefits from this dynamic. Higher prices mean higher margins. The company is essentially using market consolidation to extract more revenue from consumers without providing additional value. It's legal, it's rational from a business perspective, and it's terrible for consumer interests.

The Warranty and Support Question That's Still Unclear

One of the few pieces of good news Micron announced was that warranty support for existing Crucial products would continue. This is important because memory can fail, and customers need recourse when it does. But the details of how this support will work post-discontinuation are fuzzy.

Currently, if your Crucial memory fails, you contact Crucial support directly. They verify it's defective and issue a replacement. This is a streamlined process built on 27 years of organizational infrastructure specifically designed to handle Crucial customer service.

What happens after Crucial is discontinued? Will Micron fold Crucial support into general Micron support? Will they maintain a dedicated legacy support team? Will support be available through retailers instead of directly? Each scenario has implications.

If Micron consolidates support into its general customer service infrastructure, response times might increase. Crucial support is specialized. Generic Micron support might not be as familiar with consumer needs. Or it might be fine, just different. We don't know.

If support moves to retailers, warranty claims become more complicated. You'd have to work through Best Buy or wherever you bought the memory instead of going directly to the manufacturer. This adds friction. Some retailers are excellent at handling warranty claims. Others treat them as a hassle.

Micron saying "we'll continue to support existing Crucial products" sounds good until you realize they haven't explained how. The implementation details matter enormously for actual customers who need support. Another example of how the company's vague messaging generated unnecessary frustration.

For warranty purposes, RAM typically has a 5-10 year lifespan in terms of Micron's support commitments. So even though Crucial products won't be sold in the future, support for currently sold products is supposed to continue indefinitely. That's actually a solid commitment, assuming it's honored. But the uncertainty around the mechanism for providing that support creates legitimate questions.

Industry Precedents and What Happened When Others Discontinued Brands

Micron isn't the first manufacturer to discontinue a consumer brand. Looking at how similar situations played out in the industry provides useful perspective.

Intel and Larrabee: Intel developed Larrabee as a GPU project but discontinued it. Engineers moved to other projects. The market noticed, but it wasn't dramatic because Larrabee was experimental, not an established consumer product that people relied on.

AMD and ATI: AMD acquired ATI and initially maintained both brands. Eventually, they consolidated ATI into the AMD brand. The transition took years, but AMD remained committed to consumer graphics, so the impact was minimal. Performance and pricing continued improving under the AMD brand.

Nvidia and Phys X: Nvidia acquired Phys X but didn't discontinue it as a consumer brand. They maintained it specifically because the community valued it. The company recognized the goodwill associated with the brand and kept it alive.

Micron's approach is different from these precedents. The company isn't killing Crucial to fold it into a stronger consumer brand. Micron-branded memory isn't positioned to attract consumers the way AMD or Nvidia positioned their acquiring brands. Micron is killing Crucial to exit the consumer market entirely, focusing instead on B2B where margins are better.

The Nvidia/Phys X precedent is actually the most relevant. Nvidia understood that brand goodwill has value and that discontinuing Phys X would have damaged customer relationships and company reputation. Micron apparently didn't have that insight, or decided the cost savings justified the relationship damage.

These industry examples matter because they show that discontinuing a consumer brand doesn't have to happen this way. It's a choice. Micron chose to do this with minimal transparency, vague explanations, and undefined transition timelines. Other companies have managed similar transitions with more care for customer relationships. Micron could have too, but didn't.

What Should Micron Have Done Instead?

Let's talk about what a better decision-making process would have looked like. This isn't hindsight criticism so much as standard business practice that Micron appears to have skipped.

Transparent announcement with clear timeline: Announce the discontinuation publicly with a detailed timeline. Don't let it trickle out through different channels at different times. Everyone should hear the same information simultaneously.

Detailed transition plan: Explain exactly which products are being discontinued when. Are all Crucial products being discontinued, or just certain lines? When will new shipments stop? When will support transition to different channels? How long will retailers be supported in carrying inventory?

Consumer engagement before announcement: Micron should have engaged with major customers (system builders, retailers, large enthusiasts) before making a public announcement. These stakeholders could have provided feedback and helped shape a better transition.

Commitment to consumer access: Rather than vague references to "different channels," Micron should have explicitly committed to maintaining consumer access to memory at competitive pricing through specific retailers or channels. This would have given consumers confidence that they'd still have options.

Honest explanation of motivations: Instead of claiming this helps consumers, Micron should have said: "This decision allows us to focus resources on higher-margin business segments while maintaining consumer access through other channels. We understand this reduces brand choice and are committed to ensuring quality memory remains available to consumers."

Warranty support clarity: Specify exactly how warranty support will work for existing Crucial products and provide a customer service contact plan.

Relationship building with replacement brands: Since Crucial is disappearing, Micron should have been explicit about working with other brands (Kingston, Corsair, etc.) to ensure consumers have quality alternatives. This shows genuine commitment to consumer interests.

None of this is rocket science. It's just basic change management and customer relations. Micron's failure to do these things suggests either poor planning or a genuine lack of concern for consumer relationships.

The Bigger Picture: Market Power and Regulatory Questions

Crucial's discontinuation raises larger questions about market power in semiconductors that regulators should probably be thinking about harder than they currently are.

Micron, Samsung, and SK Hynix control the production of essentially all DRAM globally. This isn't a hypothetical concentration of power. It's absolute. When one of these three companies makes a major decision about who has access to memory and at what prices, it affects billions of people worldwide.

Micron's decision to exit the consumer market reduces consumer choice in ways that aren't obvious but are real. The company isn't exiting memory production. It's exiting direct relationships with end consumers, which consolidates power toward large system builders and OEMs who can negotiate with Micron directly.

This is fine from an antitrust perspective in the US and EU because Micron isn't violating any specific laws. The company isn't engaging in illegal price fixing or market division. It's making business decisions about which customer segments to serve. Those are normal corporate choices.

But the cumulative effect across the industry is worth examining. When the only three companies that make DRAM all consolidate their consumer relationships into OEM channels, what's the actual impact on consumer access to memory and pricing? This is a question antitrust authorities aren't really asking.

It's particularly relevant in the context of right-to-repair movements and consumer advocacy around system upgradability. If consumers can't easily access quality memory to upgrade their own systems, they become more dependent on manufacturers' proprietary solutions and forced obsolescence timelines. This is a consumer harm, even if it's not technically illegal.

Micron's decision doesn't violate anyone's rights. But it does raise questions about whether regulatory frameworks designed for the 20th century are adequate for managing concentration in 21st century semiconductors.

What Consumers Should Do Right Now

If you're a consumer affected by this news, here are the practical steps to consider:

For current Crucial owners: Your memory works fine and will continue to work fine. Warranty support is supposedly continuing, though the mechanism is unclear. Keep your existing Crucial memory. It's not going to become less reliable because the brand is being discontinued.

For planned upgrades using Crucial memory: If you were planning to upgrade with Crucial memory in the next 6-12 months, you might want to accelerate that timeline. Buy the Crucial memory now while it's clearly available and while your current build can use it. As inventory depletes, finding Crucial products becomes harder.

For system builders and integrators: Start evaluating alternatives now. Kingston, Corsair, and G. Skill are your main options at similar price points. Build relationships with supplier reps for these brands before inventory decisions become urgent.

For retail and distribution: If you're selling memory professionally, diversify your sources now. Don't overcommit to Crucial expecting supply to continue indefinitely. Build alternate supplier relationships.

For future builds: Accept that memory pricing might increase slowly as Crucial's competitive pressure disappears. Factor that into budgets. Spec memory more carefully and don't assume budget options will remain available indefinitely.

For enthusiasts: This is a good moment to join or support advocacy groups pushing for more competition and transparency in semiconductor markets. Market consolidation affects everyone's ability to access and repair technology. Making noise about it matters.

None of this is catastrophic. Memory is still available. Prices are still reasonable by historical standards. But the trajectory is worth paying attention to, because these incremental consolidations compound over time.

FAQ

Why did Micron discontinue the Crucial brand?

Micron is discontinuing Crucial to consolidate its product lines and focus on higher-margin business segments like OEM partnerships. Maintaining Crucial as a distinct brand requires dedicated teams for marketing, product development, and customer support. Consolidating these functions into Micron's main operation reduces costs significantly, even though it harms consumer choice. The company says it's doing this to help consumers, but the decision actually makes memory less accessible at competitive prices for individual buyers.

Can I still buy Crucial memory after discontinuation?

Yes, but with caveats. Current inventory will continue to be sold until depleted, which should take 6-18 months depending on the retailer and product. After that, availability becomes unclear based on Micron's vague statements about "different channels." Warranty support is supposed to continue for existing Crucial products indefinitely, though the specific mechanism hasn't been clearly explained. If you want Crucial memory, buying soon is safer than waiting.

What are the best alternatives to Crucial memory?

Kingston, Corsair, and G. Skill are the main alternatives that offer similar price-to-performance positioning. Kingston Fury DDR5 kits offer good balance of performance and cost. Corsair Vengeance series is slightly pricier but offers more features. G. Skill Flare X series is solid for gaming and enthusiast builds. All three brands are likely to remain available because they source chips from Micron, Samsung, and SK Hynix, and these brands maintain stronger consumer-focused operations than Micron does directly.

Will this increase memory prices?

Likely, yes, but gradually. Crucial's pricing served as a reference point that kept other brands honest. With Crucial removed, upward pricing pressure decreases. Retailers will have fewer options to show at aggressive price points. System builders will recommend higher-priced alternatives because budget options are gone. This doesn't mean memory will suddenly become expensive, but price increases of 5-15% are likely over 12-24 months as the market adjusts to reduced competition.

Is Crucial's warranty still valid after discontinuation?

According to Micron, yes. Existing Crucial products will continue to receive warranty support through their warranty period, which typically spans 5-10 years. However, the specific mechanism for accessing this support post-discontinuation hasn't been clearly explained. It might move from Crucial-specific support to Micron customer service, or it might work through retailers. Get your support contact and warranty proof documented now if you own Crucial memory.

Will this affect laptop and desktop prebuilts?

Yes, but positively for most consumers. OEM partners like Dell and HP rely heavily on Micron for memory supply. By focusing on OEM business, Micron is actually improving its relationship with these companies, which means prebuilt systems might see more consistent memory quality and potentially better pricing. The tradeoff is that consumers who upgrade their own systems lose the Crucial option, while those who buy prebuilts won't notice a change.

Should I stock up on Crucial memory before it's discontinued?

Depends on your situation. If you're planning an upgrade within 6-12 months, buying now ensures you get exactly what you want at current prices. If you're building multiple systems or managing a business, acquiring reasonable inventory makes sense. If you're a casual user upgrading a single PC sometime in the future, you probably have time to explore alternatives. Panic buying isn't necessary, but strategic purchasing makes sense.

Final Thoughts: The Micron Decision and What It Means for Tech Consumers

Micron's discontinuation of Crucial represents more than a corporate reorganization. It's a moment where market consolidation crossed from the invisible level into something consumers actually notice and care about. Most people don't think about RAM. But the people who do—builders, integrators, enthusiasts—cared deeply about Crucial, and watching that brand disappear has generated genuine anger.

That anger is justified. Not because Micron did anything illegal or even necessarily wrong from a shareholder perspective. The company is making decisions that benefit its business. But those decisions come at the cost of consumer choice, pricing pressure, and accessibility. That's worth being angry about.

The frustrating part is how unnecessary the collateral damage was. Micron could have managed this transition with far more transparency, clearer planning, and better communication. Instead, the company chose vague statements and undefined timelines. This generated more anger than the actual decision probably deserved.

Looking forward, this decision matters as a precedent. If other manufacturers see Micron successfully exiting the consumer market with minimal pushback, they'll consider doing the same. If Samsung or SK Hynix decide to follow suit, consumer access to memory contracts further. Market consolidation accelerates. Pricing pressure decreases. Consumers lose.

The PC building and enthusiast community is relatively small, but their influence on the broader market is significant. They try new products first. They write reviews. They recommend stuff to friends. They build their own systems and influence others to build theirs. When they're angry, companies eventually notice.

Micron is counting on that community being small enough that losing them doesn't matter. Maybe it is. Maybe the company will be fine focusing on OEM and enterprise customers. But there's a long history in tech of companies underestimating the influence of enthusiasts and small builders. Those communities often have outsized impact on brand reputation and market direction.

This situation isn't about stopping Micron's decision—that ship has sailed. It's about what happens next. Will other manufacturers consolidate similarly? Will regulators start paying attention to concentration in semiconductor markets? Will consumers demand more transparency and competition?

Those questions will shape the tech market for years to come. Micron's Crucial discontinuation is just the beginning of a larger story about how market consolidation changes the products available to consumers.

One more thing worth noting: this entire mess was avoidable. Micron could have discontinued Crucial while maintaining consumer goodwill by being transparent, clear, and genuinely supportive of customers navigating the transition. Instead, the company chose efficiency and vague messaging. That choice created more damage than the actual decision needed to.

For consumers, the takeaway is clear. The companies that seem stable and established today might consolidate away tomorrow. The brands you trust might disappear. And the explanations you get might not be honest. Plan accordingly. Support diverse options while they exist. And pay attention to these seemingly small market decisions because they compound into much larger changes over time.

Key Takeaways

- Micron discontinued Crucial, a beloved consumer RAM brand, to consolidate operations and focus on higher-margin OEM business

- Only three companies control 85-90% of global DRAM production, so Crucial's removal eliminates meaningful consumer choice

- Market consolidation removes pricing competition, likely resulting in 5-15% price increases over the next 12-24 months

- PC builders and system integrators lose a trusted, affordable alternative and face reduced options for cost-effective memory

- Micron's vague messaging about 'different channels' and unclear transition timeline made the situation worse than the actual decision

Related Articles

- Best Amazon Tech Deals on TVs, Headphones & Smartwatches [2025]

- Gigabyte Z890 AORUS 256GB DDR5 Memory Support [2025]

- CES 2026's Best and Weirdest Tech Products Explained [2026]

- Apple AirTags 4-Pack $65 Deal: Complete Buying Guide [2025]

- Apple Adopts Google Gemini for Siri AI: What It Means [2025]

- Pebble's Comeback: Why Eric Migicovsky Says His New Company Isn't a Startup [2025]

![Micron Kills Crucial Brand: What It Means for RAM Consumers [2025]](https://tryrunable.com/blog/micron-kills-crucial-brand-what-it-means-for-ram-consumers-2/image-1-1768430229779.jpg)