Master Your Money in 2025: Monarch Money's Biggest Discount Yet

New Year's resolutions are a dime a dozen, but most of them fall apart by February. You know the type—the gym membership you'll actually use, the diet you'll definitely stick to, the promise to finally get your finances together.

Here's the thing though: getting your finances in order is different from the rest. It's not about willpower or motivation. It's about visibility. And that's where budgeting apps come in.

Right now, Monarch Money is offering one of its best deals of the year: a full year of the app for just

But before you jump on the deal, let's talk about what Monarch Money actually is, whether it's right for your situation, and how it compares to other budgeting apps on the market. Because a good deal on the wrong tool is still the wrong deal.

Monarch Money isn't just another spreadsheet alternative. It's one of the most comprehensive budgeting platforms available right now, and for $50 a year, it's hard to beat the value proposition. The app has been featured as one of the best budgeting solutions by major tech publications, and the reasons why become clear the moment you start using it.

The core promise of any budgeting app is straightforward: help you understand where your money goes, so you can make better decisions about where it should go. Monarch Money does this better than most of the competition. Whether you're trying to save for a specific goal, pay down debt, or just get a basic handle on your monthly spending, this app provides the tools and insights you need.

What Exactly Is Monarch Money?

Monarch Money is a personal finance management platform that sits between your bank accounts and your financial goals. Think of it as the command center for your money.

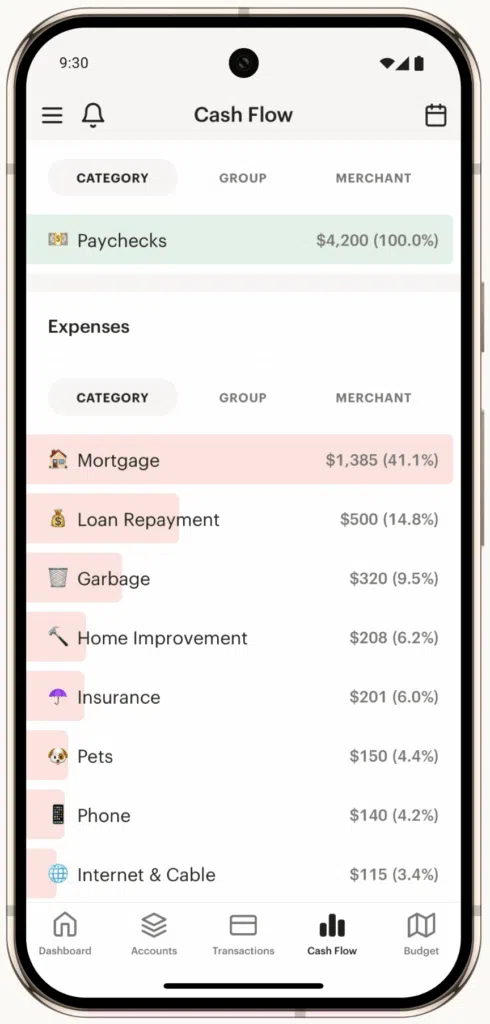

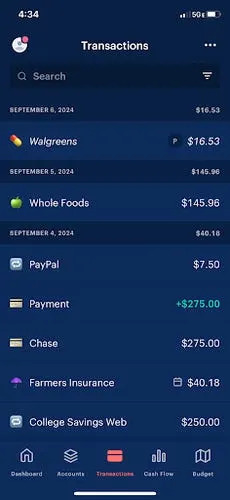

When you connect your financial accounts to Monarch Money—and the platform supports thousands of them—the app automatically pulls in all your transactions. From there, it categorizes your spending, tracks it over time, and presents it back to you in ways that actually make sense.

The platform operates across multiple devices and platforms. You can use it on iOS or Android if you prefer mobile. There's a full-featured web app if you're working from a desktop. There's even a Chrome extension that can hook directly into Amazon and Target to automatically log your purchases from those specific retailers.

That's one of the underrated features of Monarch Money: the integration ecosystem. Most budgeting apps just wait for transactions to clear your bank account, which can take days. Monarch Money's extensions and integrations pull data faster and more comprehensively.

Under the hood, Monarch Money is built for people who want granular control over their finances. This isn't a simple savings app with a cute mascot. This is a tool for people who actually care about understanding their financial behavior.

The platform launched around 2022 and has grown steadily. It's backed by venture capital, which means it has resources behind it for ongoing development. The team is actively adding features and improving the experience based on user feedback.

One thing that sets Monarch Money apart from competitors is its philosophy on data privacy. The company doesn't sell your data or use your financial information for advertising purposes. That might seem like a baseline requirement, but it's not. Many "free" budgeting apps make their money by analyzing your spending patterns and selling that data to marketers. Monarch Money makes its money directly from you.

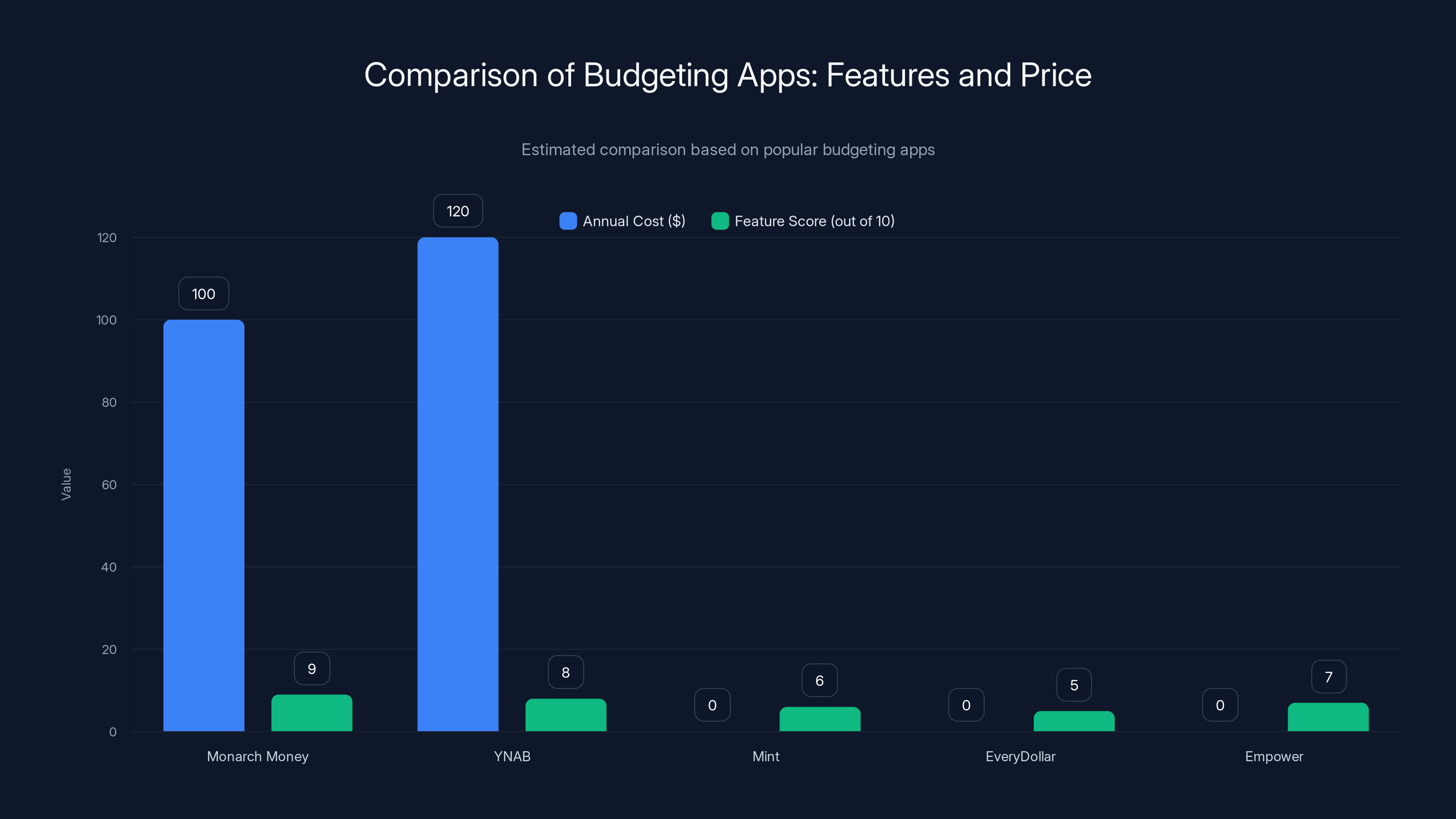

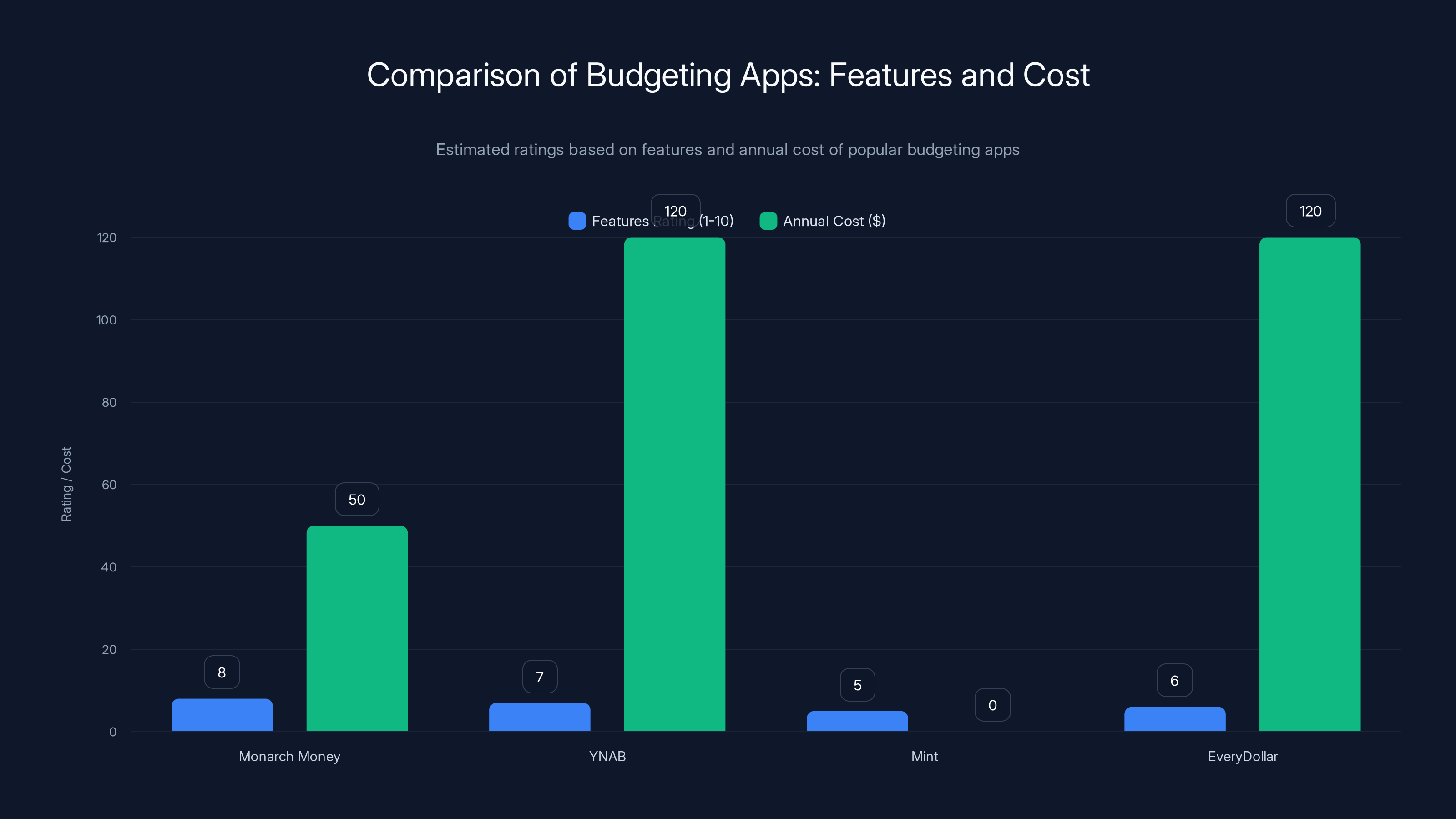

Monarch Money offers a competitive feature set at a lower cost compared to YNAB, while providing more flexibility and features than Mint and EveryDollar. Estimated data based on typical features and pricing.

The Current Promotion: $50 for a Full Year

Right now, if you're a new user, you can get 12 months of Monarch Money for just $50 by using the code NEWYEAR2026 at checkout. Let's break down what that means in practical terms.

Normally, Monarch Money costs

That's cheaper than a single specialty coffee per month. It's cheaper than a Netflix subscription. It's borderline absurdly cheap for a full-featured financial management platform.

The promotion applies to new subscribers only, so if you've used Monarch Money before, this deal won't work for you. But if you're considering trying the platform and have been on the fence, this removes a major barrier to entry.

The code is valid for a limited time, and Monarch Money hasn't announced exactly when it expires. Based on previous promotional patterns, these New Year deals typically run through late January or early February. Once you sign up with the discount, you lock in that price for the full year.

One important caveat: this is an annual subscription. You're paying for 12 months upfront at $50. That's still an incredible deal, but it's worth knowing if you're skeptical about whether you'll actually use the tool. You'll want to commit to at least giving it a real try for a few weeks before the auto-renewal happens.

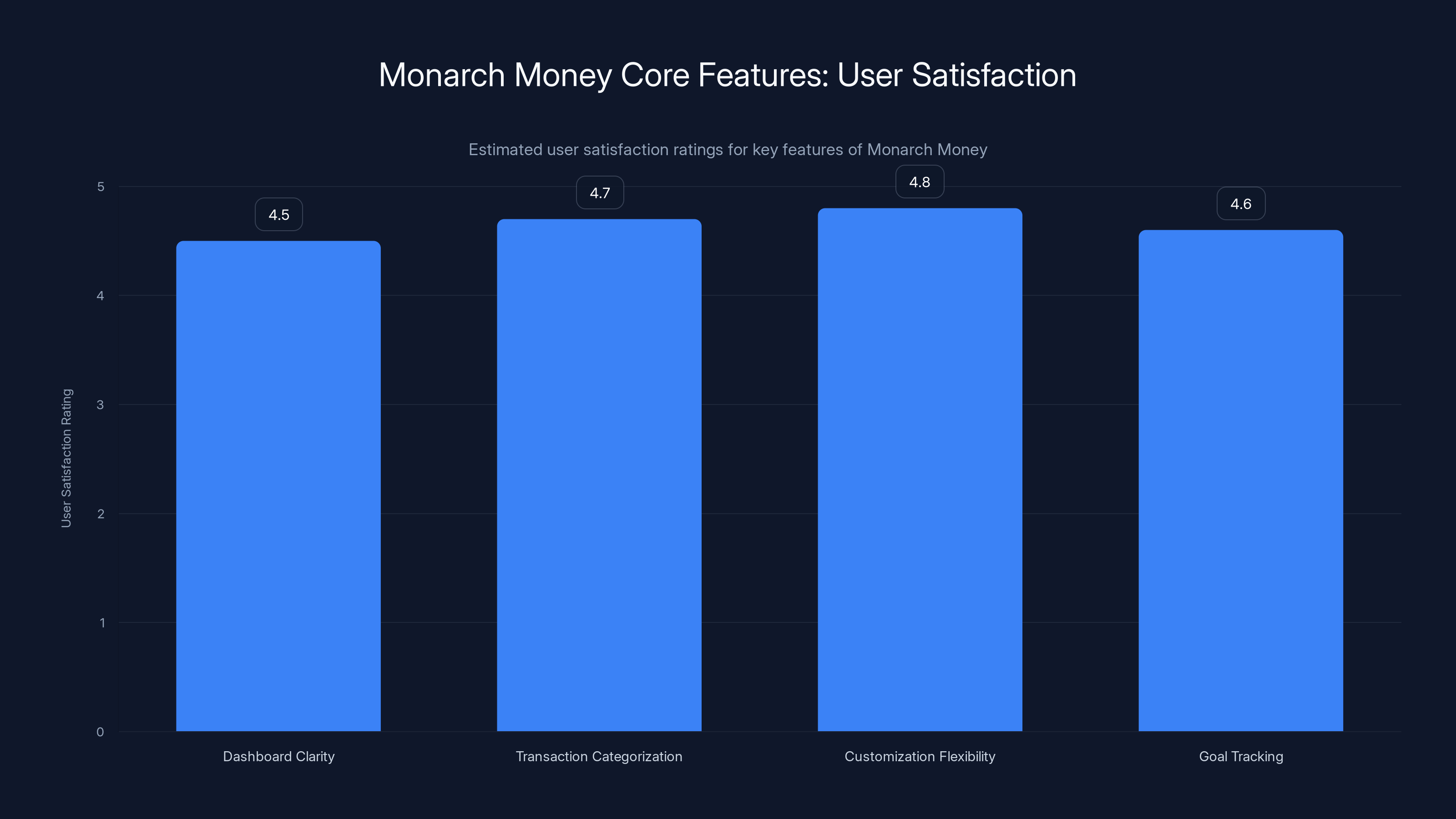

Monarch Money's features like transaction categorization and customization flexibility receive high user satisfaction ratings, highlighting their effectiveness and user-centric design. (Estimated data)

How Monarch Money Works: The Core Features

Once you set up your account and connect your financial institutions, Monarch Money starts doing the heavy lifting immediately.

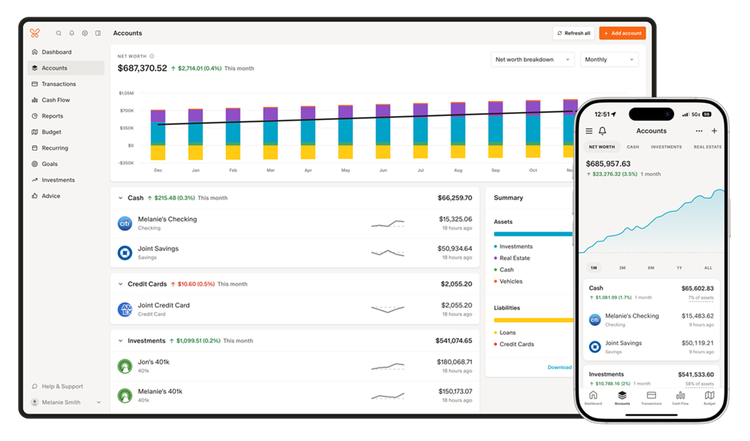

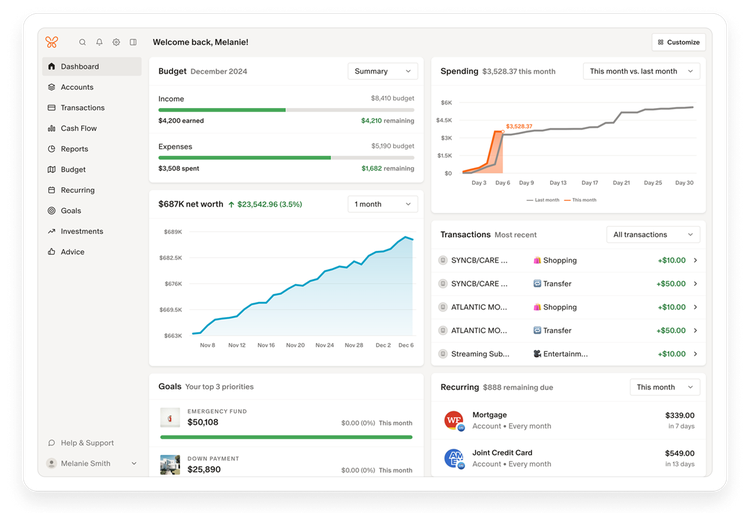

The first thing you notice is the dashboard. It's designed to give you an at-a-glance understanding of your financial situation. You see your total net worth, your spending trends, your account balances, and your progress toward any financial goals you've set.

Unlike other apps that overwhelm you with data, Monarch Money's dashboard is relatively clean. The default view shows you what matters: how much money you have, where it's going, and whether you're on track with your budget.

Transaction Categorization and Tracking

One of the biggest time-wasters in personal finance is manually organizing transactions. Monarch Money automates this as much as possible.

When a transaction comes in, the app uses machine learning to categorize it automatically. You spent $47 at Target? It gets labeled as "Shopping" or "Household" depending on what you bought. You swiped your card at a restaurant? It's automatically "Dining Out."

These categories aren't random either. Monarch Money learns from your behavior. If you consistently label certain merchants a certain way, the app remembers that. Over time, the categorization becomes incredibly accurate.

But the system isn't purely automated. You have complete control. If the app miscategorizes something, you can fix it with one tap. You can create custom categories tailored to how you actually think about your spending. You can split transactions if you bought multiple things at once.

This flexibility is crucial because every person's financial situation is different. Maybe you need a custom "Pet Care" category. Maybe you want to break "Groceries" into "Staples" and "Specialty Items." Maybe you need a "Work Reimbursement" category for expenses you'll get money back for.

Monarch Money lets you build the categorization system that actually matches your life.

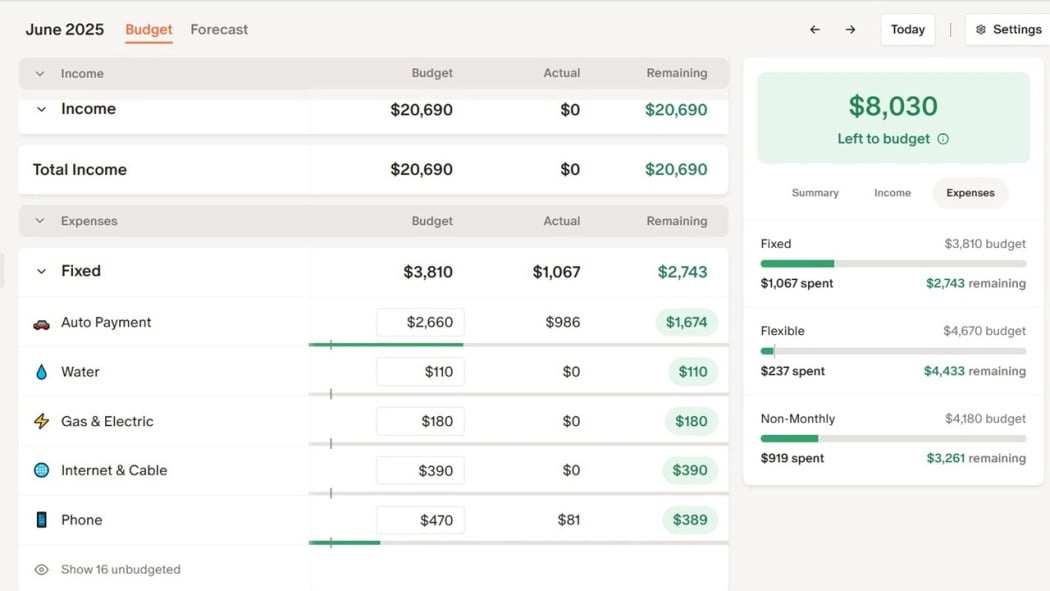

Budget Planning: Flexible and Category-Based Approaches

Monarch Money offers two different philosophies for budgeting, and this is where the app shows real sophistication.

The first approach is category budgeting. You decide how much you want to spend in each category each month, and the app tracks your actual spending against those targets. If you budget

This is the traditional budgeting approach that most people learn. It's effective because it's specific. You're not just trying to "spend less." You're trying to hit concrete targets in concrete categories.

The second approach is flexible budgeting. This is for people who find traditional budgets too constraining. Instead of setting hard limits for each category, you set a target total spending amount. The app then shows you how your actual spending compares to that target, but without the category-level constraints.

Flexible budgeting is popular with people who have variable income, or who find that strict category budgets lead to decision fatigue or overspending anxiety. You still have visibility into where your money goes, but you have more freedom in how you allocate it.

Most people find one approach works better for their personality. Some people thrive with strict targets. Others thrive with overall guidelines and freedom. The fact that Monarch Money supports both is a significant advantage.

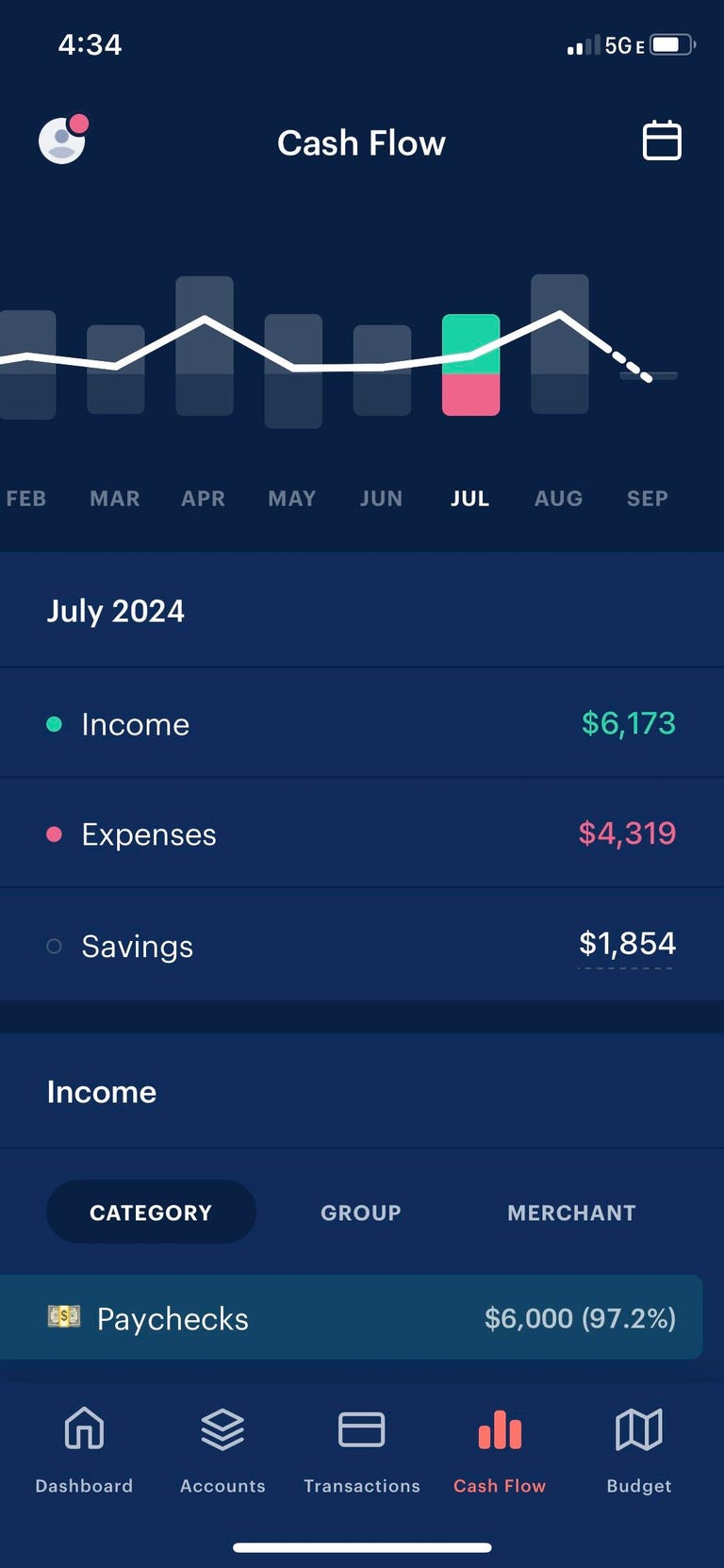

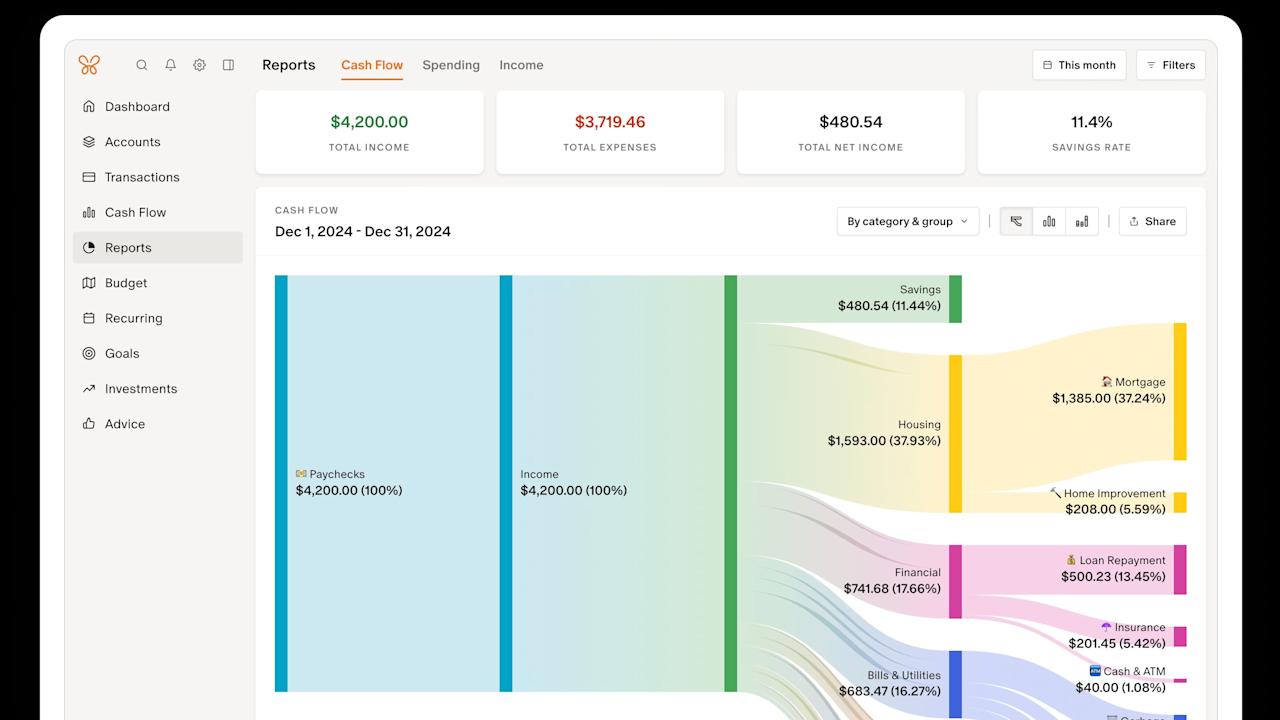

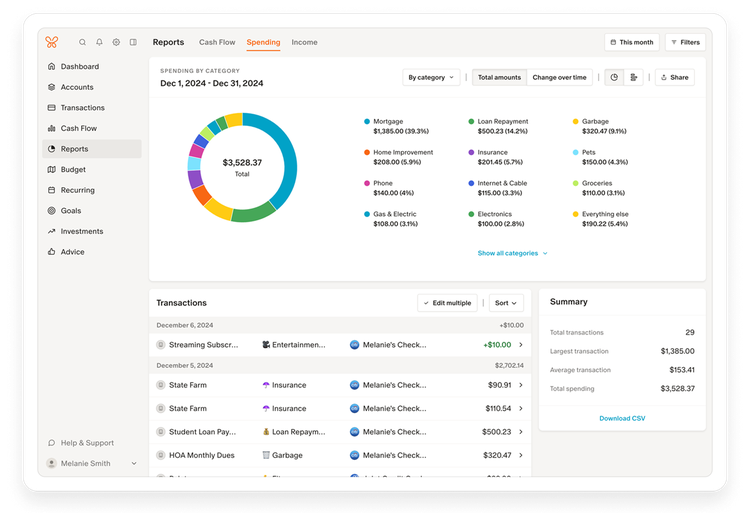

Spending Analytics and Visualization

Raw numbers tell you what happened. Graphs tell you why it matters.

Monarch Money generates multiple visualizations of your spending data. You get pie charts showing how your budget is distributed across categories. You get line graphs showing your spending trends over time. You get heat maps showing which days or weeks you spend the most.

These visualizations do two things. First, they make it immediately obvious where your money is going. You can't argue with a pie chart that shows 23% of your spending goes to dining out. That visual hit is more powerful than reading "$340 spent on restaurants last month."

Second, they help you spot patterns you might not otherwise notice. Maybe you spend more on weekends. Maybe your spending spikes around certain times of the month. Maybe one category is trending upward significantly. These patterns are the raw material for actual behavior change.

You can customize these visualizations too. Want to see spending across a specific date range? You can set that. Want to compare two different categories? The app lets you do that side-by-side. Want to exclude certain transactions from the analysis? You can filter those out.

Investment and Net Worth Tracking

Budgeting is about controlling spending. But building wealth is about increasing the gap between what you earn and what you spend.

Monarch Money includes investment tracking that many competitors don't offer at this price point. You can connect your brokerage accounts, see your portfolio holdings, and track your net worth over time.

It's not a full investment analysis platform. You're not getting detailed analysis of your portfolio allocation or tax-loss harvesting recommendations. But you're getting a unified view of your complete financial picture.

This matters because most people manage their money in silos. You have your checking account, your savings account, maybe a couple of investment accounts. Seeing all of these together in one place, and understanding how they're trending over time, is surprisingly powerful.

Collaborative Budgeting for Couples and Partners

If you share finances with a partner, Monarch Money handles this exceptionally well.

You can set up the app so both partners can see the full financial picture. You can see each other's spending in real-time. You can collaborate on budget goals. You can see whether you're hitting your joint financial targets.

This is massively underrated. Money is a leading cause of relationship stress, and much of that stress comes from a lack of transparency or misalignment on financial priorities. When both partners can see what's happening with money, and when you're working toward shared goals, the friction decreases significantly.

The app lets you assign transactions to individual partners too, so you can see "my" spending versus "partner's" spending if you want that granularity. Or you can treat everything as joint. It's flexible.

Why People Actually Use Monarch Money

There's a difference between a good app and an app that actually changes behavior.

Monarch Money is in the second category for a lot of people. And it's worth understanding why.

First, the onboarding experience is relatively painless. You connect your bank account, you see your last 90 days of transactions automatically imported and categorized, and you instantly have visibility into your spending. There's no manual data entry required. You're not starting from scratch.

Second, the app doesn't judge you. Some budgeting apps are designed with a tone of financial shame. They highlight overspending, they encourage austere minimalism, they make you feel bad about your choices. Monarch Money presents data in a neutral, matter-of-fact way. Here's where you're spending money. Here's your plan. Are you on track? It's an informational tool, not a motivational one.

Third, it's actually useful. This might sound obvious, but a lot of apps are more useful in theory than in practice. Monarch Money is designed for real people with real financial lives. It handles edge cases. It lets you customize things. It works the way your brain actually thinks about money.

Fourth, the team actively listens to feedback and adds features that users actually want. This is an app that improves based on how people use it, not just on what executives think people should want.

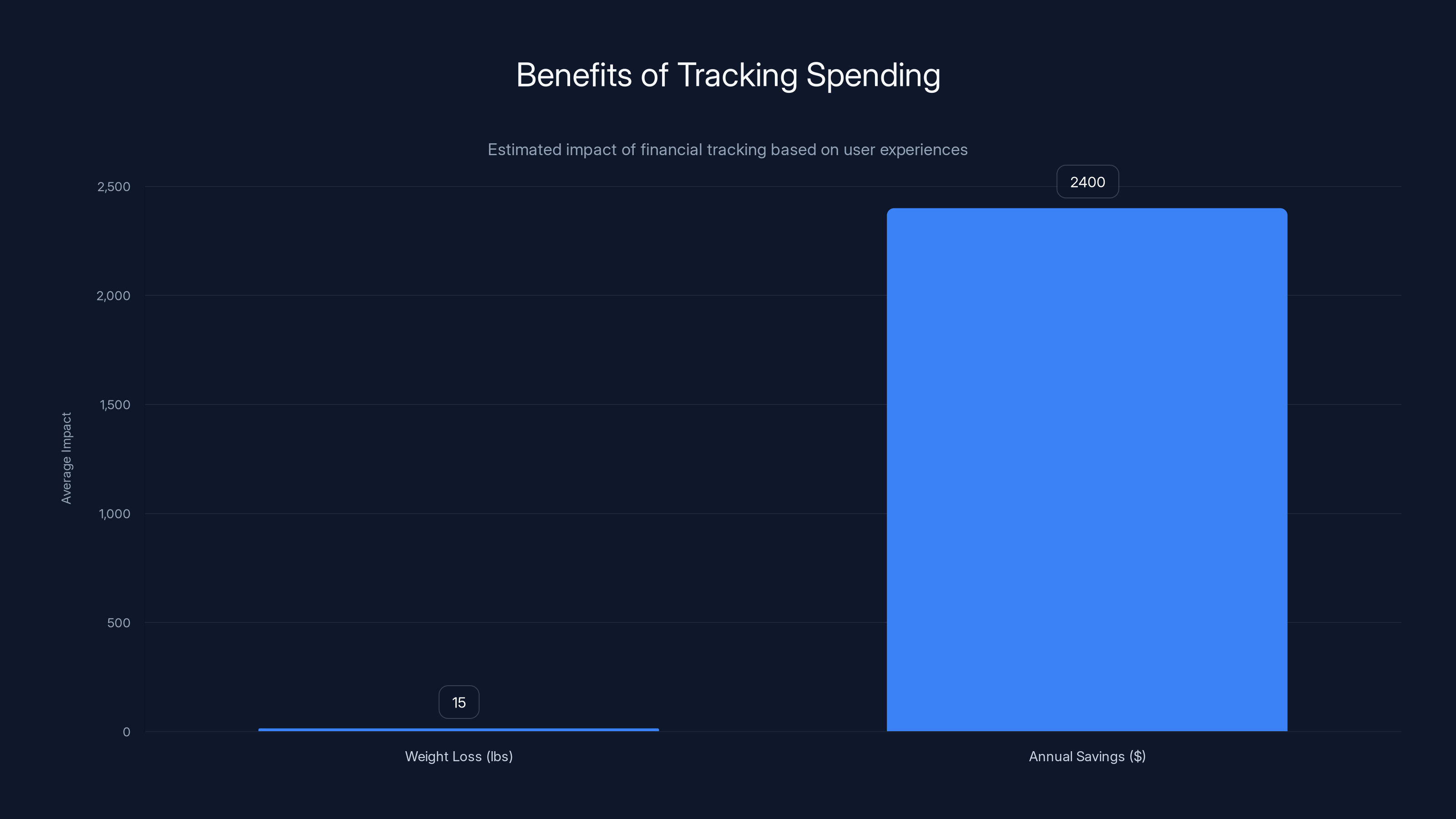

Tracking spending can lead to significant benefits, such as an average weight loss of 15 pounds (from fitness tracking) and savings of $2,400 annually. Estimated data.

The Real Drawbacks (Being Honest)

No app is perfect, and being honest about the limitations is more useful than pretending otherwise.

The Learning Curve

Monarch Money is comprehensive. That comprehensiveness comes with a cost: there's definitely a learning curve.

If you're coming from a simple savings app or a basic spreadsheet, the first few weeks with Monarch Money might feel overwhelming. There are a lot of features. There are a lot of options. You'll probably want to spend a few hours really learning the platform before it becomes second nature.

That's not a terrible thing. Most people spend more than a few hours learning how to use their phone or their email client. But if you're looking for something that you can understand and fully utilize in 10 minutes, Monarch Money isn't it.

The good news is that the learning curve isn't steep. Spend an afternoon with the app, watch a couple of tutorials, and you'll know how to use 90% of the features. The remaining 10% you can discover as you need them.

Web and Mobile Inconsistencies

Monarch Money is a cross-platform app, and like many cross-platform apps, there are occasional inconsistencies between the web version and the mobile versions.

Sometimes a feature works slightly differently on mobile versus web. Sometimes the mobile app is a bit slower. Sometimes you'll encounter a bug on one platform but not another. This isn't unusual for apps that support iOS, Android, and web, but it's worth knowing about.

In practice, this matters less than it might sound. Most people settle into one primary platform (usually mobile) and use that for 90% of their work. But if you're the type of person who switches between devices frequently, you might occasionally feel minor friction.

The company is actively working on these consistency issues, and they get better with each update.

Chrome Extension Limited to Amazon and Target

The Chrome extension is genuinely useful for catching online purchases automatically. But it only works with Amazon and Target right now.

If you do most of your online shopping on those platforms, it's fantastic. If you're a frequent Etsy, eBay, Walmart, or specialized retailer shopper, you'll still be entering those manually.

Based on the company's roadmap, they're planning to expand this to more retailers, but at launch, it's limited.

Comparing Monarch Money to Other Budgeting Apps

Monarch Money doesn't exist in a vacuum. Let's talk about how it compares to other popular budgeting solutions.

Monarch Money vs. YNAB (You Need a Budget)

YNAB is the gold standard budgeting app for people who want to be really intentional about their money. It's based on a specific budgeting methodology that requires some buy-in.

YNAB costs about

YNAB is better if you want to follow a very specific budgeting philosophy. YNAB is worse if you want flexibility and investment tracking.

Monarch Money is the better choice if you want comprehensive features including investment tracking at a lower price point.

Monarch Money vs. Mint

Mint was the dominant free budgeting app for years. Unfortunately, the original Mint was shut down in early 2024 and has been replaced with an entirely new product managed by Intuit.

The new Mint is less feature-rich than Monarch Money, though it's still respectable. The advantage of new Mint is that it's free. The disadvantage is limited functionality compared to what Monarch Money offers.

If you're budget-conscious and want something simple, new Mint is worth trying. If you want comprehensive features and investment tracking, Monarch Money is the better option. And at $50 for a year, you're not paying that much more than Mint's inherent costs (ads, data monetization, etc.).

Monarch Money vs. Every Dollar

Every Dollar is another budget-first app that focuses on the "zero-based budgeting" methodology. It starts at

Every Dollar is good if you like the zero-based approach and want simplicity. Monarch Money is more flexible and includes investment tracking.

For most people, Monarch Money offers more features for comparable or lower cost, especially at the current $50 promotional price.

Monarch Money vs. Personal Capital (Now Empower)

Empower (formerly Personal Capital) blends budgeting with investment management and wealth advisory features.

It's an excellent tool if you have significant investments and want coordinated management. It's overkill if you have basic investments or simple finances.

Monarch Money is more accessible to the average person. Empower is better if you're working with a financial advisor or managing a complex investment portfolio.

Monarch Money offers a strong balance of features and affordability, with a high feature rating and lower cost compared to YNAB and EveryDollar. Mint remains free but offers fewer features. (Estimated data)

How to Maximize Your $50 Monarch Money Investment

Okay, you've decided to grab the deal. Here's how to actually get value from it.

Step 1: Connect All Your Financial Accounts

Don't just connect your main checking account. Connect everything: savings accounts, credit cards, investment accounts, even old 401(k)s if you have them.

The power of Monarch Money comes from seeing your complete financial picture. The more accounts you connect, the more useful the insights become.

Step 2: Spend a Full Month Just Observing

Don't set budgets immediately. Don't try to change your behavior. Just let the app observe your normal spending for 30 days.

This gives you real data to work with. Instead of guessing how much you spend on groceries, you'll know. Instead of estimating dining out costs, you'll see the actual numbers.

When you set budgets based on real data from your actual life, they're much more likely to be targets you can actually hit.

Step 3: Set Realistic Targets Based on Data

After a month, look at your actual spending. This is your baseline.

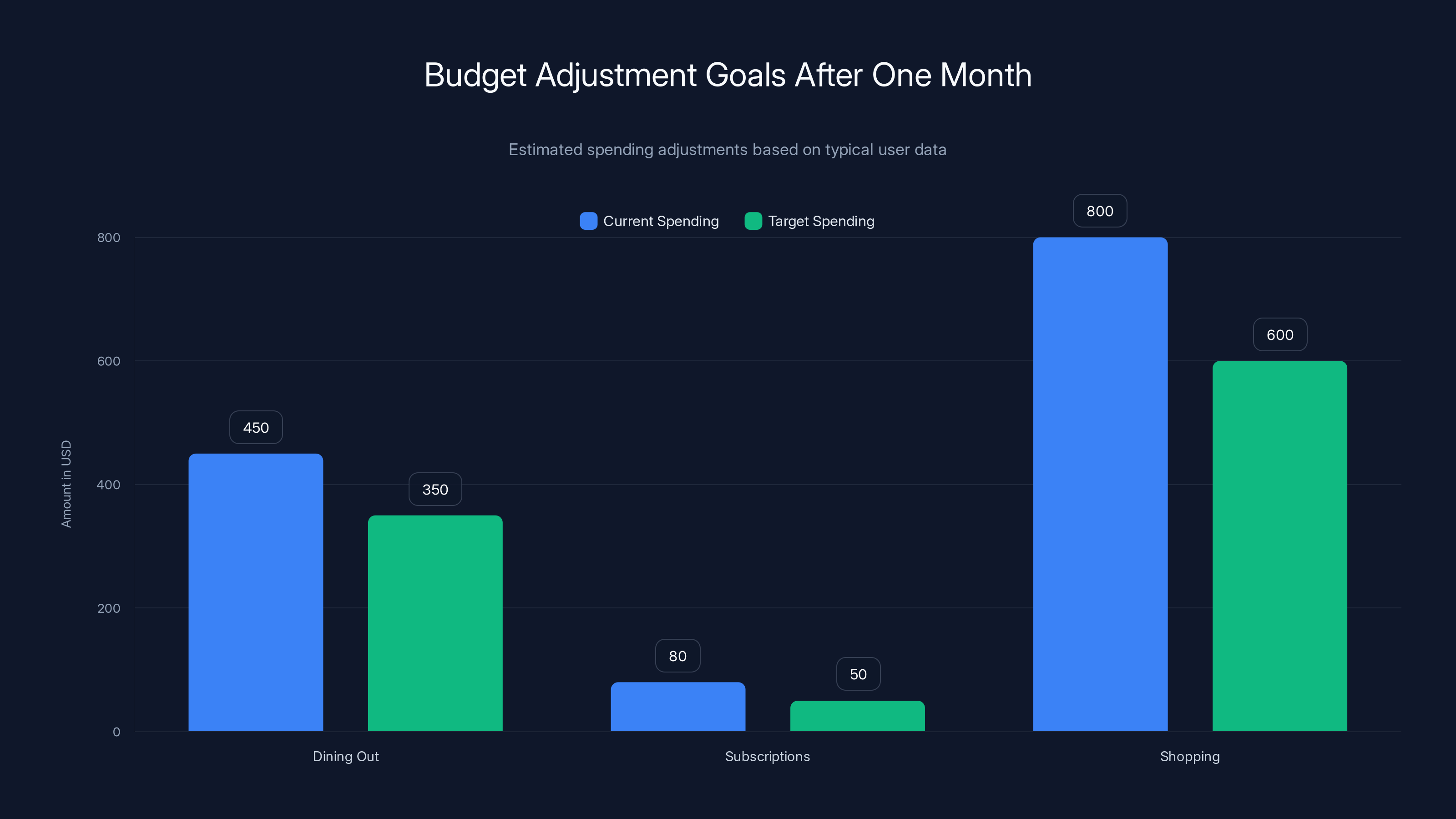

Now, decide where you want to improve. Maybe you spent

The key is basing your targets on reality, not on what you think you should spend. Overly aggressive budgets fail. Realistic budgets, ones that require actual change but not unrealistic changes, have a much higher success rate.

Step 4: Check In Weekly, Not Daily

People often get overwhelmed by checking their budget too frequently. But checking too rarely means you don't course-correct.

Weekly check-ins are the sweet spot. Every Sunday evening, spend 10 minutes reviewing the past week. Are you on track? Are any categories trending toward overspending? Do you need to adjust your behavior for the coming week?

That 10 minutes per week is way more valuable than either daily obsessive checking or never checking at all.

Step 5: Use the Collaborative Features If You Have a Partner

If you share finances, set up the app for collaborative use from day one. This prevents financial surprises and keeps both partners aligned.

Many relationship conflicts around money come from lack of transparency. Using Monarch Money together eliminates that problem.

Step 6: Automate Everything That's Automatable

Monarch Money can automatically categorize transactions, track spending, and generate reports. Let it.

Your job isn't to do administrative work. Your job is to make intentional decisions about your money. Let the app handle the busywork.

The Bigger Picture: Why Budgeting Apps Matter

Monarch Money is a tool. But let's talk about what the real problem it solves is.

Studies consistently show that people dramatically underestimate how much they spend. When asked to estimate their spending in various categories, most people are off by 30% to 50%. Sometimes they underestimate; sometimes they overestimate. But the inaccuracy is consistent.

This inaccuracy creates problems. You can't make good financial decisions based on bad data. You can't set achievable goals without understanding baseline reality. You can't fix problems you don't realize exist.

A budgeting app solves this by creating that transparency. You see exactly where your money goes. The first benefit of Monarch Money isn't that it helps you save money. It's that it shows you the truth about your finances.

Once you see the truth, change becomes possible. Maybe you realize you're spending way more on subscriptions than you thought. Maybe you see that dining out is your biggest discretionary expense. Maybe you notice that your partner and you have very different spending habits.

These realizations are uncomfortable sometimes. But they're the foundation of actual change.

From there, the question becomes: what do I want to do about this information? Monarch Money helps you answer that question by turning the information into actionable insights and accountability mechanisms.

Estimated data suggests realistic budget adjustments can lead to significant savings, with dining out reduced by

Financial Wellness in 2025: A Strategic Approach

We're in an economic period where financial stability matters more than ever. Inflation is still elevated relative to historical averages. Saving rates are concerning. Debt levels are high.

In this environment, financial tools aren't luxuries. They're necessities.

Monarch Money is one of the better tools available for developing financial awareness and control. At $50 for a year, it's an investment in your financial future that pays for itself many times over if you actually use it.

The deal is good. But the real value isn't in the discount. It's in the functionality, reliability, and thoughtfulness of the platform itself.

What Happens After Year One?

This is worth understanding before you sign up.

Right now, you're getting a year for

You can cancel before the renewal if you decide the app isn't for you. There's no penalty, no lock-in contract.

But here's the thing: most people don't cancel. Once you've been using Monarch Money for a year, once your account contains 12 months of categorized spending data, once you've built financial habits around the platform, paying

That's kind of the genius of the promotion actually. The company knows that once you use the app seriously for a month or two, you'll get enough value that you'll happily pay full price.

They're not trying to trick you with bait-and-switch pricing. They're just recognizing that people who try the app at a discount often become long-term paying customers.

Monarch Money's promotional offer provides a 50% discount, reducing the annual cost from

The Setup Process: What to Expect

When you sign up for Monarch Money, here's roughly how it goes.

First, you create an account with your email. That takes 30 seconds.

Second, you connect your bank accounts. This is done through a service called Plaid, which is an industry-standard secure connection method. You're not giving Monarch Money your bank password; you're using Plaid as an intermediary.

This part typically takes 2 to 5 minutes per account, depending on your bank and whether you're connecting through your bank's mobile app or web interface.

Third, the app imports your transaction history. Most banks provide 90 days of history automatically. Some provide more. This is instant or takes just a few seconds.

Fourth, the app categorizes all of those transactions using its machine learning system. This also happens automatically and usually takes less than a minute.

Within about 10 to 15 minutes from creating your account, you have a complete view of your last 90 days of spending, organized by category, with a bunch of useful visualizations and insights.

It's a surprisingly smooth process. There's no "create a profile, answer 100 questions" nonsense. You connect your money, the app does its thing, and you're ready to use it.

Security and Privacy: What You Actually Need to Know

Whenever you're giving a financial app access to your accounts, security and privacy should be questions you ask.

Monarch Money handles this well. The platform uses 256-bit encryption, which is the same standard used by banks and government institutions. Your data is stored on secure servers with redundancy.

The company doesn't sell your financial data. This is actually pretty unusual in the fintech space. Many "free" financial apps make money by selling insights about consumer spending to marketers and advertisers. Monarch Money makes money directly from users, so they don't have an incentive to monetize your data.

That said, like any online service, using Monarch Money requires trusting the company to manage your data responsibly. The company has been transparent about their security practices, and there haven't been any reported breaches, but no system is 100% risk-free.

If you're extremely paranoid about data security, you might want to use one of the offline budgeting options (like a spreadsheet or a locally-stored app). But for most people, the convenience and functionality benefits of Monarch Money far outweigh the minimal additional security risk.

Who Should Actually Use Monarch Money

Monarch Money is great, but it's not right for everyone.

You should use Monarch Money if:

- You want comprehensive budgeting features including investment tracking

- You want automation and are tired of manual spreadsheet tracking

- You're willing to learn a new app in exchange for better financial visibility

- You want to collaborate on finances with a partner

- You value privacy and don't want your data sold to advertisers

- You want flexibility in how you approach budgeting

You might want to look elsewhere if:

- You want something simpler (try Mint)

- You want a specific budgeting methodology (try YNAB)

- You want to manage complex investments (try Empower)

- You never use apps and prefer spreadsheets or pen and paper

- You're extremely private and don't want to give any app access to your accounts

For the vast majority of people trying to get control of their finances, Monarch Money is an excellent choice.

The Bottom Line on the $50 Deal

Monarch Money at $50 for a year is one of the best values in personal finance software right now.

You're getting a comprehensive, well-designed, feature-rich budgeting platform that would otherwise cost you $100 annually. That's a genuine 50% discount on an app that's actually worth its full price.

The promotion is only available to new users, and only for a limited time. If you've been on the fence about trying Monarch Money, this is probably the right time to jump in.

The bigger point though is that this deal represents something more important: a commitment to making financial tools accessible. Budgeting shouldn't require expensive consultants or complex software. Everyone should have access to tools that help them understand and control their money.

Monarch Money gets that. And if the company is willing to discount the service by 50% to get more people using it, that speaks to the team's values.

Taking Action: Next Steps

If you decide to give Monarch Money a shot, here's exactly what to do.

- Go to the Monarch Money website (monarchmoney.com)

- Click "Sign Up" or "Start Free"

- Create an account with your email

- When prompted, enter code NEWYEAR2026 to apply the 50% discount

- Pay $50 for the year (credit card or other payment method)

- Connect your financial accounts

- Spend 30 minutes exploring the features

- Let it collect data for a month before setting budgets

- Check in weekly to monitor your spending

- Enjoy having actually financial visibility for the first time

That's it. You're not committing to anything long-term. You're just trying a tool that might genuinely change how you relate to money.

For $50, that's an experiment worth running.

Maximizing Your First Year: Pro Tips

Now that you're going to use Monarch Money, let's talk about how to get maximum value from that first year.

Export Your Data Regularly

Monarch Money is a solid company, but no company is permanent. Every year or so, export your data to a CSV file. This ensures you have a backup of your financial history that's independent of the platform.

Build Custom Reports

Monarch Money lets you build custom reports. If you have specific financial questions, create a report that answers them. Save those reports so you can track them over time.

Set Multiple Goals

Don't just budget for spending control. Set positive goals too: emergency fund, vacation savings, debt payoff, investment targets. Monarch Money can help you track progress toward all of them.

Review Quarterly, Not Just Weekly

Weekly check-ins are tactical. Quarterly reviews are strategic. Every three months, step back and ask: am I on track? Is my plan still working? Do I need to adjust?

Involve Your Family or Partner From Day One

If you share finances with anyone, loop them in immediately. The value of financial transparency is exponentially higher when everyone has access to the same information.

Common Mistakes People Make With Budgeting Apps

Knowing what not to do is as valuable as knowing what to do.

Mistake 1: Setting budgets before understanding reality. Don't guess how much you spend. Collect data for 30 days first. Then set realistic targets based on that data.

Mistake 2: Abandoning the app after a month. It takes two to three months for a budgeting app to become actually useful. Your categorizations improve. You understand the patterns. You start seeing the benefits. Don't quit after a month.

Mistake 3: Obsessive daily checking. Checking your budget compulsively creates anxiety and often leads to negative behavior. Weekly is better. Monthly check-ins are better still if you have the discipline.

Mistake 4: Not connecting all accounts. The power of Monarch Money comes from seeing your complete picture. Partial information is often worse than no information because it's misleading.

Mistake 5: Using budgets to shame yourself. If you go over budget, that's information, not failure. The budget should be a guide, not a guilt mechanism. Adjust and move forward.

Mistake 6: Ignoring the investment tracking features. Monarch Money's investment tracking is genuinely useful. Don't just use it for spending. Connect your investment accounts and watch your net worth grow.

Mistake 7: Not customizing categories. The default categories are fine, but customizing them to match how you actually think about money makes everything better. Create categories that mean something to you.

The Bigger Personal Finance Picture

Monarch Money is a tool. But like any tool, it's most powerful when it's part of a comprehensive approach.

A budgeting app helps you understand where your money goes. But building real wealth requires understanding where you want it to go.

That's a different question. It's a question about values, goals, and priorities.

Some of your money should go to living your life right now. Some should go to building security (emergency fund, insurance, diversified investments). Some should go to future opportunities (education, skill development, starting a business). Some should go to helping others.

The balance between those buckets is personal. Monarchy Money doesn't decide that for you. You decide, and the app helps you execute.

That's why this tool is useful at any price point, but especially useful at $50 for a year. You're buying visibility and accountability. What you do with those things is up to you.

Wrapping Up: Is This Deal Worth It?

Yes. The answer is yes.

$50 for a year of comprehensive financial management is a great deal. Monarch Money is a legitimate, well-built app that actually helps people get control of their finances.

The promotion is limited. The code NEWYEAR2026 will eventually expire. New Year's is when people are most motivated to change their financial habits.

If you've been thinking about trying a budgeting app, this is the time. If you've tried other apps and haven't found one you like, Monarch Money is worth a shot. If you're already using a budgeting tool but it's clunky or limited, Monarch Money is worth switching to.

The worst case scenario? You sign up, use it for a month, realize it's not for you, and you've spent $50 on an experiment. That's the price of a decent meal out. The best case scenario? You gain financial clarity, reduce financial stress, make better money decisions, and save thousands of dollars over the next year.

The odds of the best case scenario are pretty good if you actually use the tool.

FAQ

What is Monarch Money and how does it work?

Monarch Money is a personal finance management platform that connects to your bank accounts and automatically categorizes and tracks your spending. Once you link your financial accounts, the app pulls in your transaction history, categorizes expenses automatically using machine learning, and presents your spending patterns through dashboards and visualizations. The platform helps you create budgets, track financial goals, monitor investments, and understand where your money goes each month.

How much does Monarch Money cost normally and what's the current deal?

Monarch Money normally costs

What are the main features of Monarch Money?

Monarch Money includes automatic transaction categorization and tracking, flexible and category-based budgeting approaches, spending analytics with charts and visualizations, investment and net worth tracking, collaborative budgeting for couples, Chrome extensions for Amazon and Target, custom reports, and goal tracking. The platform works across iOS, Android, iPadOS, and web browsers, giving you access to your financial data across all your devices.

How does Monarch Money compare to other budgeting apps?

Monarch Money compares favorably to other popular budgeting apps in terms of features and price. It's more affordable than YNAB (

Is my financial data safe with Monarch Money?

Monarch Money uses industry-standard security measures including 256-bit encryption, the same standard used by banks. The company uses Plaid as a secure intermediary to connect to your banks, so you're not sharing your login credentials directly. Importantly, Monarch Money doesn't sell your financial data to third parties—they make money from user subscriptions, not data monetization. The platform has maintained a clean security record with no reported breaches.

Who should use Monarch Money and who might want to look elsewhere?

Monarch Money works best for people who want comprehensive budgeting features including investment tracking, prefer automation over manual spreadsheet work, want flexibility in their budgeting approach, value privacy, and are willing to spend some time learning a feature-rich platform. You might prefer alternatives if you want extreme simplicity, follow a specific budgeting methodology like zero-based budgeting, manage complex investments requiring deep analysis, or are uncomfortable sharing any financial data digitally.

What are the main drawbacks of Monarch Money?

The primary drawbacks include a learning curve for first-time users (though manageable), occasional inconsistencies between the web and mobile versions, and the Chrome extension currently only working with Amazon and Target purchases. The app also requires connecting to your financial institutions, which some extremely privacy-conscious users might be uncomfortable with. However, these limitations are minor compared to the platform's overall functionality and value.

How can I maximize the value I get from Monarch Money in the first year?

To maximize value, connect all your financial accounts from day one, spend a full month observing your spending before setting budgets, set realistic targets based on actual spending data, check in weekly for 10 minutes to monitor progress, use collaborative features if you share finances, automate everything possible, set both positive goals and spending constraints, and review your strategy quarterly. Most people should wait 2-3 months before judging whether the app is working for them, as it takes time to learn the platform and build useful habits.

What happens after the first year when the promotional price expires?

After your first year at the promotional price of

How does Monarch Money handle collaborative budgeting for couples?

Monarch Money includes built-in collaborative features that allow both partners to see the complete financial picture, including all accounts and spending in real-time. You can assign transactions to individual partners, set joint financial goals, and work together toward shared budget targets. This transparency helps couples stay aligned on finances and reduces the financial stress and miscommunication that often occurs when partners manage money separately.

Should I connect my investment accounts to Monarch Money?

Yes, you should connect all your financial accounts including investment accounts. Monarch Money's investment tracking features provide valuable visibility into your complete financial picture by showing your net worth, portfolio holdings, and how your net worth changes over time. Even though it's not a full investment management platform, this comprehensive view helps you understand the relationship between your spending, savings, and investment growth—which is crucial for long-term financial planning.

Key Takeaways

- Monarch Money is 50% off for new users at 100/year price

- The app includes automatic transaction categorization, flexible budgeting options, investment tracking, and collaborative features for couples

- Monarch Money offers more comprehensive features than competitors like Mint at a lower price point than YNAB

- The primary drawbacks are a moderate learning curve, occasional web/mobile inconsistencies, and limited Chrome extension support

- Maximum value comes from connecting all accounts, observing spending for 30 days before setting budgets, and checking in weekly

![Monarch Money 50% Off Deal: Complete Guide to Annual Budgeting [2025]](https://tryrunable.com/blog/monarch-money-50-off-deal-complete-guide-to-annual-budgeting/image-1-1767992789128.jpg)