Netflix's 45-Day Theater Window: What It Means for WBD and the Future of Cinema [2025]

Introduction: A Turning Point for Streaming and Theater Wars

The entertainment industry just witnessed something remarkable. Netflix, the company that fundamentally disrupted theatrical distribution over the past decade, is now making a serious commitment to the very thing it's been accused of destroying. If Netflix successfully acquires Warner Bros. Discovery, Ted Sarandos has promised to maintain a 45-day theatrical exclusivity window for all WBD films. This isn't just a negotiating tactic or a throwaway comment in passing. It's a formal statement made to one of America's most respected news organizations, The New York Times.

Why does this matter? Because it signals a seismic shift in how the world's largest streaming platform views the relationship between streaming and theatrical exhibition. For years, Netflix has operated in almost complete secrecy about its theatrical intentions. The company kept its box office experiments quiet. It didn't publicize numbers. It certainly didn't commit to specific windows in major media interviews.

But here's what's actually happening beneath the surface of this announcement. The media landscape has fundamentally changed. The streaming wars have cooled from a frenzy to a more mature market. Paramount's rival bid for WBD throws everything into chaos. And Netflix CEO Sarandos is fighting on multiple fronts: appeasing theater chains who've publicly opposed the deal, reassuring Hollywood's creative community that theatrical exhibition still matters, and trying to convince regulators that consolidation won't destroy the film industry.

This article breaks down everything you need to understand about Netflix's 45-day window commitment, what it reveals about the future of theatrical distribution, why this deal matters for cinema, and what it means for the billions of dollars still at stake in the entertainment ecosystem.

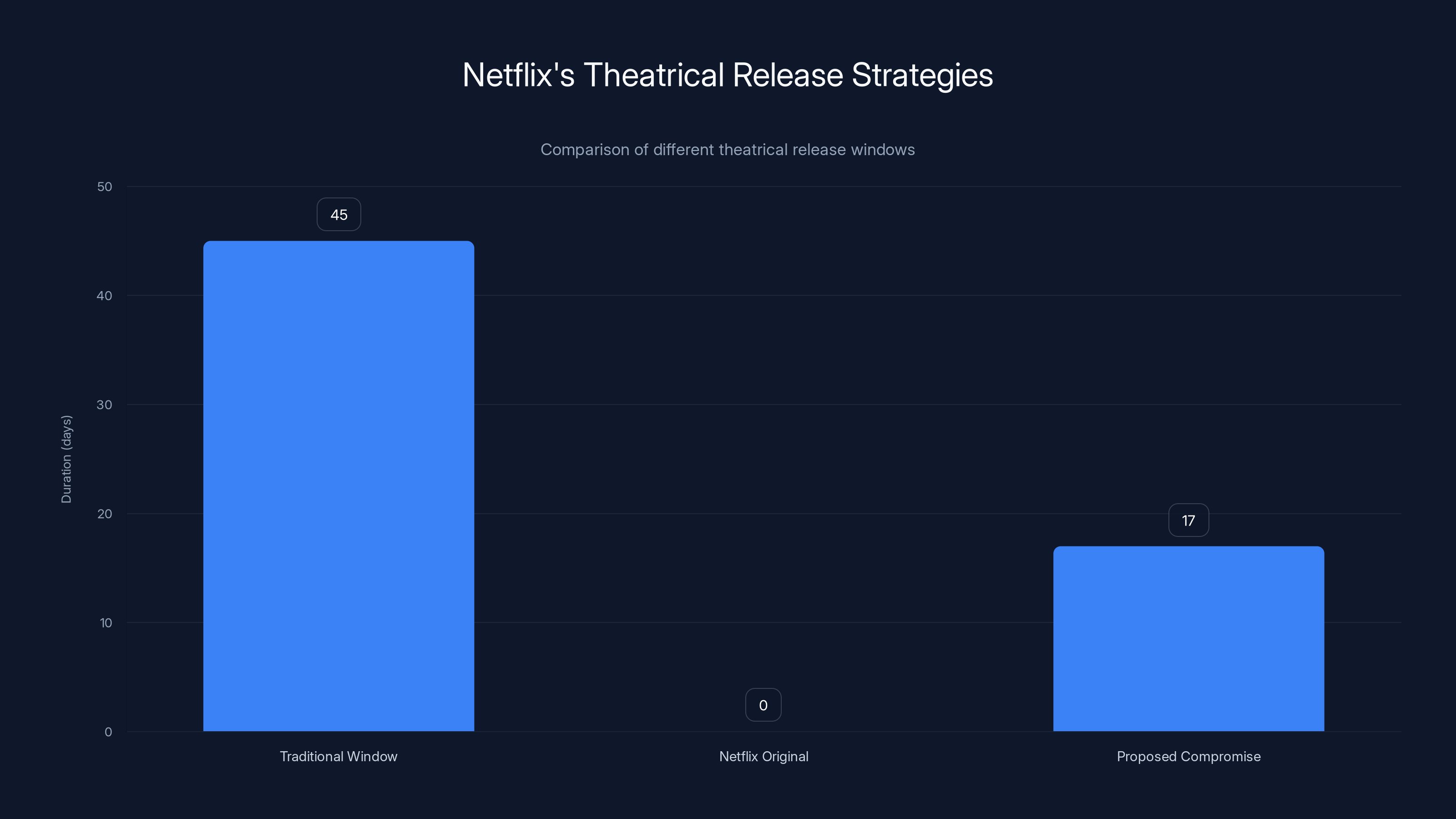

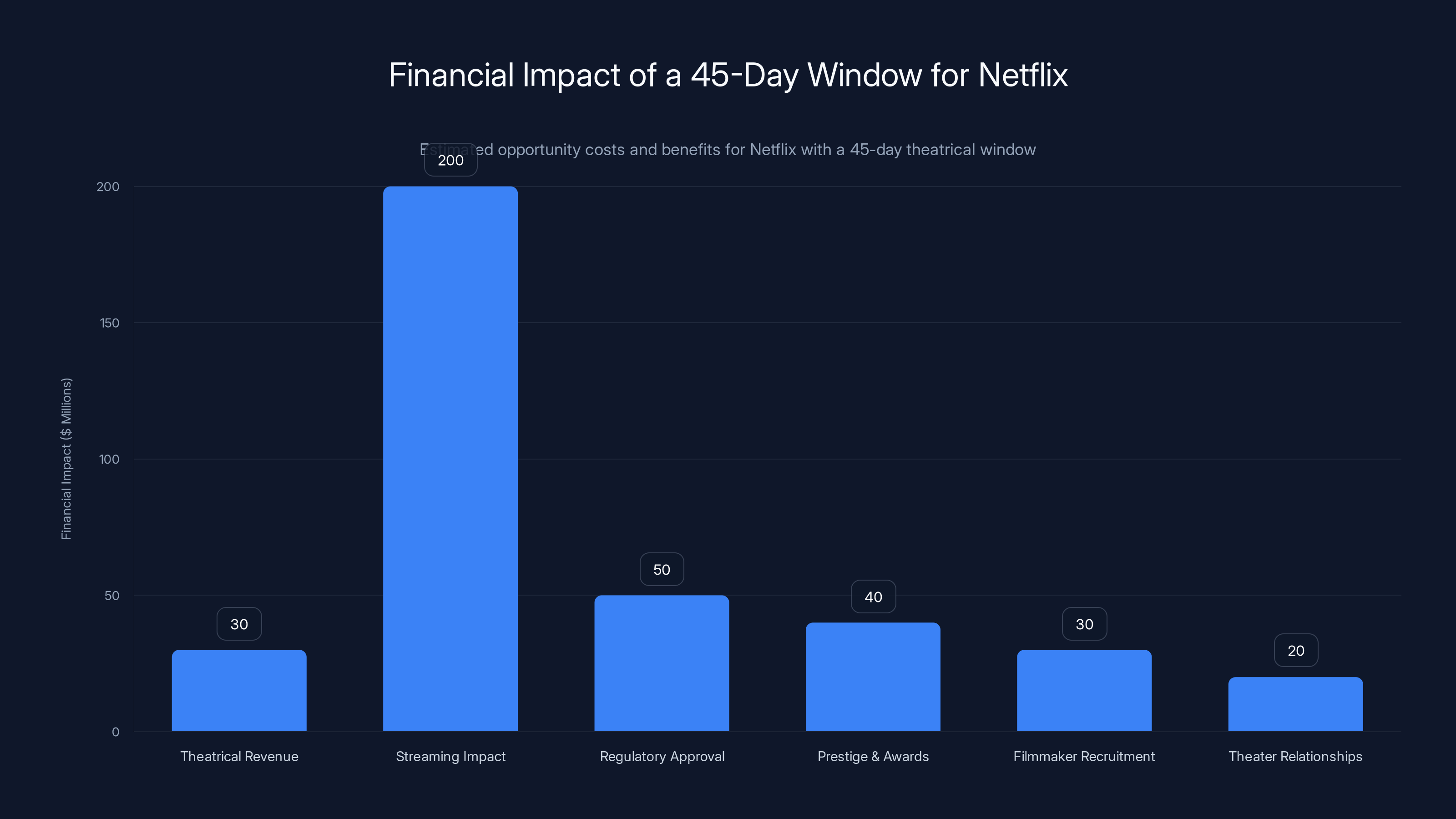

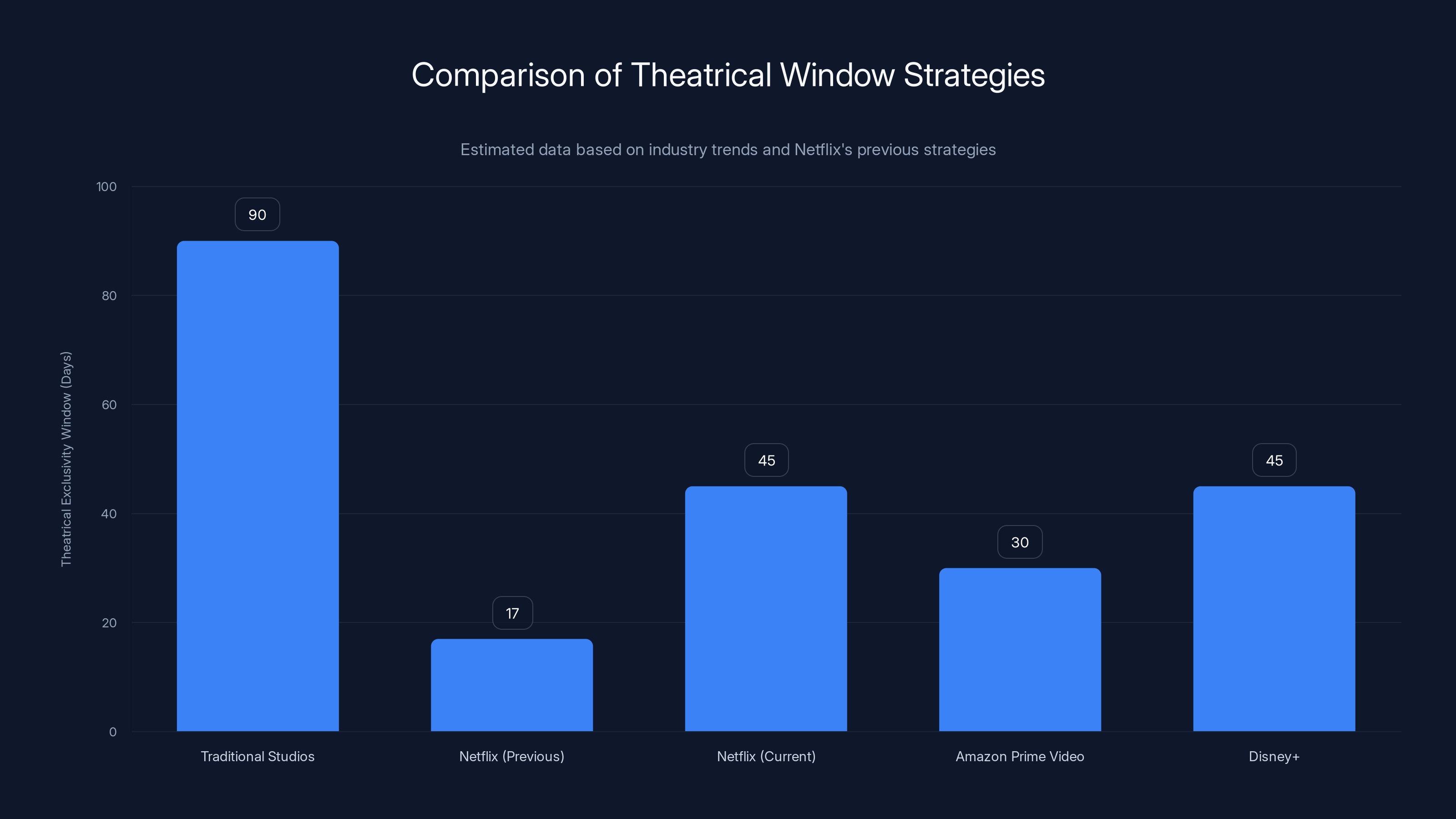

Netflix's original strategy eliminated the theatrical window entirely, while a proposed compromise suggested a 17-day window. Estimated data based on industry reports.

TL; DR

- Netflix commitment: If it acquires WBD, Netflix promises to maintain 45-day theatrical windows for all Warner Bros. films

- Previous reports: Sources had claimed Netflix supported only a 17-day window, which would devastate theater chains

- Strategic shift: This represents Netflix's most concrete commitment to theatrical distribution in company history

- Competition factor: Paramount's rival WBD bid has forced Netflix to make stronger concessions to regulators and industry partners

- Theater chains' stance: Major cinema organizations have publicly opposed the Netflix acquisition, citing consolidation concerns

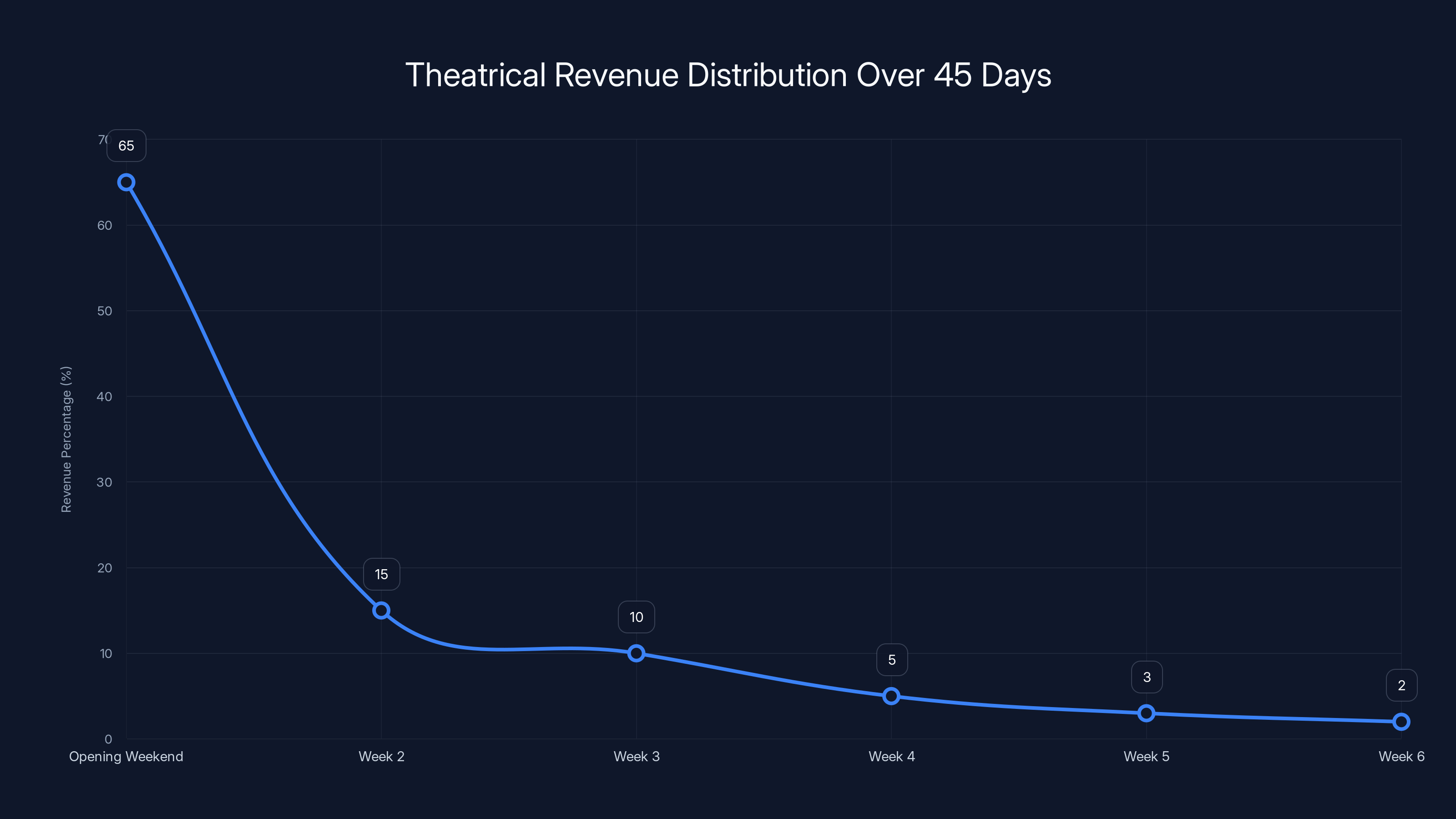

Estimated data shows that a major blockbuster earns approximately 65% of its total theatrical revenue during the opening weekend, with diminishing returns in subsequent weeks.

The Original Netflix Theater Strategy: What We Thought We Knew

For over a decade, Netflix's approach to theatrical distribution has been deliberately vague. The company pioneered a radical model in the late 2010s. They'd release films simultaneously on their streaming platform and in select theaters. No exclusivity window. No waiting period. If you wanted to watch an Adam Sandler comedy or a Martin Scorsese prestige drama, you could do it at home immediately, whether or not you had access to the nearest movie theater.

This wasn't an accident. It was philosophical. Netflix founder Reed Hastings explicitly argued that the theatrical release window was outdated. The company viewed the traditional 45-day exclusive theatrical window (roughly seven weeks where films only play in cinemas before moving to home viewing) as an antiquated relic of the 20th century. Why should someone in rural Montana wait weeks longer to watch a movie than someone in Manhattan with three AMCs within walking distance?

But Netflix's aggressive approach created significant problems. Theater owners became increasingly hostile. Filmmakers caught in the middle felt pressured. Directors like Christopher Nolan and Denis Villeneuve publicly criticized the strategy. Industry organizations representing both theaters and creators pushed back hard.

The 17-day window reported by Deadline represented what Netflix allegedly considered internally as a compromise. Seventeen days would let films have their theatrical moment, generate some box office buzz, create opening weekend marketing momentum, but then move quickly to streaming where the real money actually lives. From a pure Netflix business perspective, this made sense. The company makes roughly 80% of its revenue from subscriptions, not theatrical box office. Streaming is where the metrics matter.

But politically, culturally, and regulatorily, 17 days became a liability.

Why Ted Sarandos Changed His Tune: Strategic Necessity Meets Industry Reality

Ted Sarandos's recent comments to The New York Times represent a significant tactical retreat from Netflix's previous position. But calling it a "retreat" misses the larger strategic calculation. Sarandos is playing 4D chess across multiple boards simultaneously.

First, let's understand the regulatory environment. Any acquisition of Warner Bros. Discovery by Netflix would trigger immediate scrutiny from the Federal Trade Commission and potentially international regulators. The media landscape is already highly concentrated. Disney controls Marvel, Pixar, Lucasfilm, and more. Warner Bros. Discovery already controls DC, HBO, and numerous production studios. If Netflix swallows WBD, the FTC would need to explain to Congress and the public why three companies should control such a massive percentage of American entertainment production and distribution.

Theater chains understand this leverage. When Cinema United, the trade organization representing independent theater chains, testified to Congress opposing the deal, they were playing the regulatory game perfectly. They made public statements about consolidation. They positioned theaters as the underdog fighting against a monopoly. They gave regulators the political cover to scrutinize Netflix's intentions.

Second, Sarandos had to contend with Hollywood itself. Major directors, producers, and actors still care about theatrical exhibition. The Oscars still matter culturally. Theatrical releases still generate prestige and cultural relevance that streaming releases don't command. Christopher Nolan doesn't make movies for streaming platforms. Denis Villeneuve fought Netflix explicitly. If Netflix wants to keep the biggest creative talent and produce prestige projects, it needs to demonstrate credibility with the theatrical exhibition space.

Third, there's the Paramount factor. Paramount's competing bid for WBD creates urgency and demands concessions. If Netflix appears too hostile to theaters, it strengthens Paramount's position as the "theater-friendly" alternative. Paramount owns Paramount theaters. Its leadership comes from traditional media. By contrast, Netflix is the streaming upstart that killed Blockbuster. In the court of public opinion and regulatory judgment, Paramount looks like the safer choice for protecting the theatrical business.

Sarandos had to make a calculation: What's the minimum concession that gets Netflix the deal and passes regulatory scrutiny? A 45-day window sits right in that Goldilocks zone. It's long enough to appease theater chains and filmmakers. It's short enough that Netflix can work with it economically. It's specific enough to actually mean something.

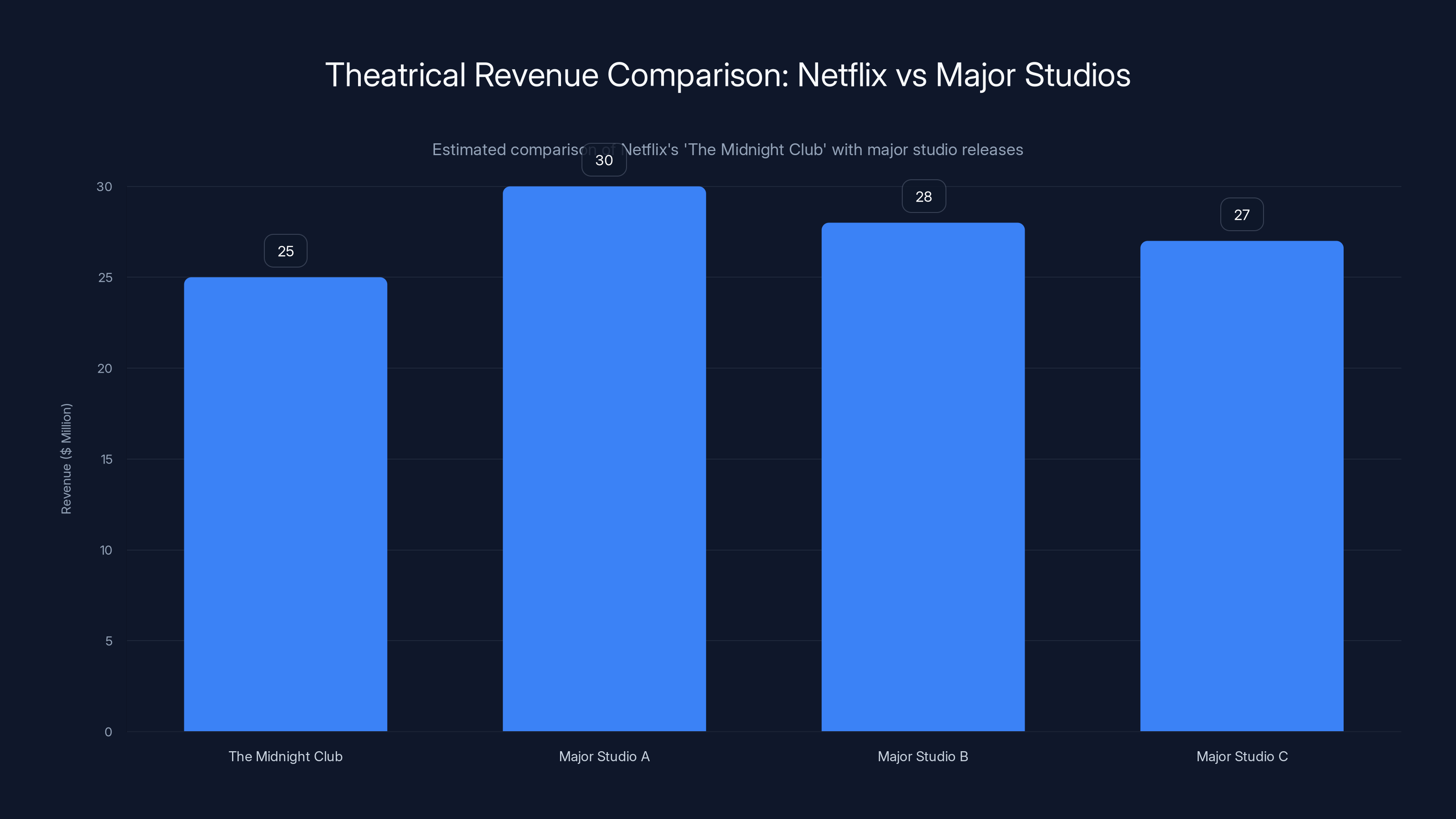

The Midnight Club's $25 million box office revenue demonstrates Netflix's potential to compete with major studios in theatrical releases. Estimated data for major studios.

Understanding the 45-Day Window: What This Actually Means

Let's get specific about what a 45-day theatrical exclusivity window means in practical terms. Forty-five days is roughly six and a half weeks. For a film released on a Friday, that means it would play exclusively in theaters from that opening day until approximately mid-week of the seventh week.

Historically, this was the industry standard. Major studios built entire release strategies around it. Studios had data suggesting that most of a film's theatrical revenue happened in the first four to six weeks. After that, screens got reallocated to new releases. The next blockbuster needed room. If you didn't catch it in theaters by week six, you'd wait for home video or cable.

But the theatrical landscape has changed dramatically. Today, a major blockbuster might make 60-70% of its total theatrical revenue in the opening weekend alone. Then it bleeds audience over subsequent weeks. The window has become less about capturing incremental revenue and more about prestige, cultural impact, and marketing momentum.

From Netflix's perspective, a 45-day window is actually manageable. Consider the economics: A WBD film released in theaters on opening weekend could generate its opening weekend box office ($50-200 million for a major release, depending on the film). Over the next six weeks, it would collect another 30-40% of that theatrical gross. Meanwhile, Netflix gets the data, the PR, the prestige, and the awards season positioning. Then, when the film hits Netflix after 45 days, it lands with tremendous momentum. People want to see it. They're talking about it. It becomes a cultural event on the streaming platform.

Compare this to Netflix's previous simultaneous release strategy. A film lands on Netflix and in 200 theaters at the same time. Which one do people watch? The data suggests most Netflix subscribers never even knew the theatrical option existed. The theatrical run underperformed while the film got watched at home by millions. From a pure business perspective, the simultaneous release was actually worse for theatrical exhibitors and potentially suboptimal for Netflix's own goals.

A 45-day window creates a logical progression. Theater first. Prestige and opening weekend revenue. Then streaming where the real subscriber engagement happens. This is actually a smarter strategy than what Netflix was doing before.

The Stranger Things Precedent: Why the Numbers Changed Everything

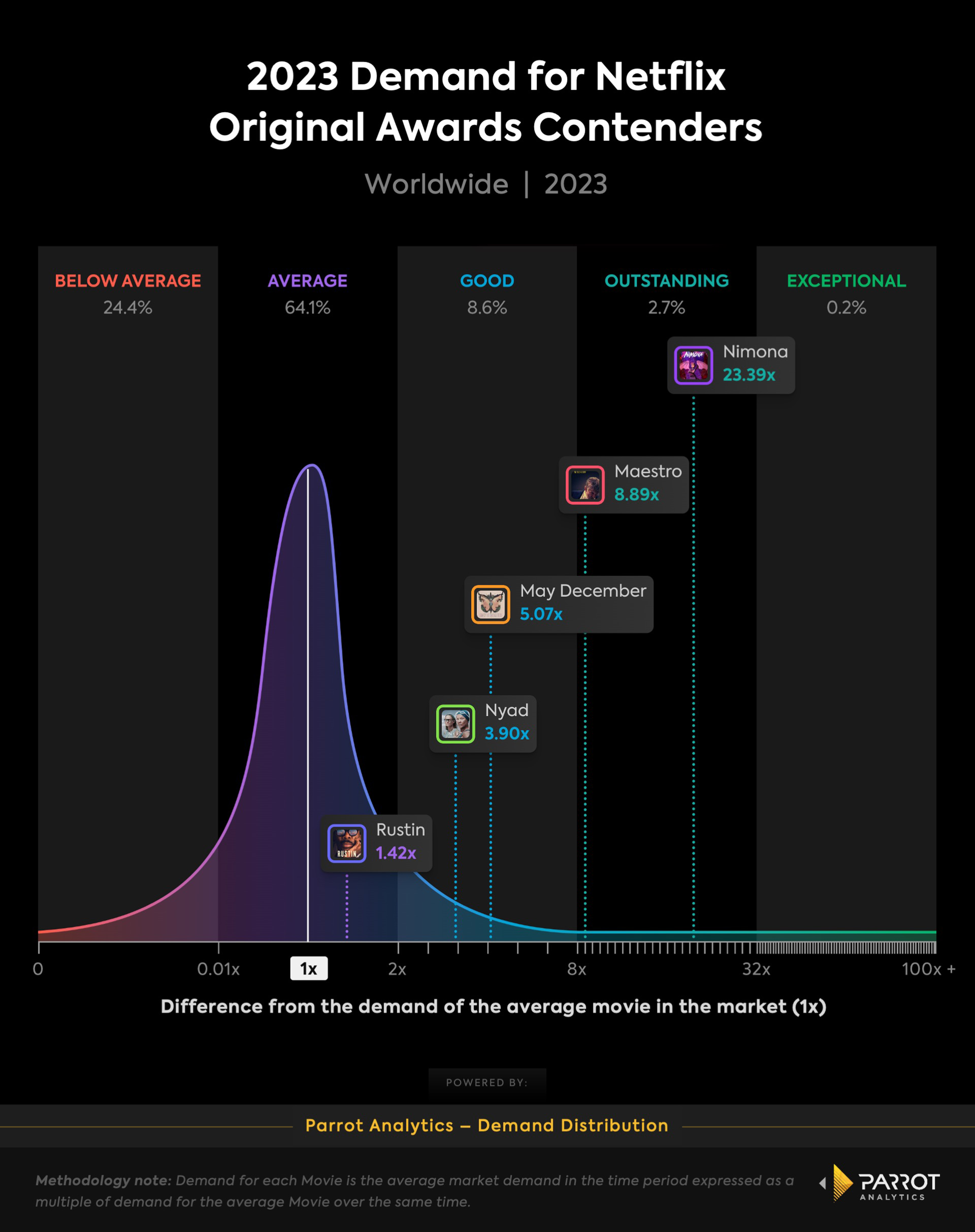

The Midnight Club theatrical release deserves its own analysis because it fundamentally shifted how Netflix executives think about theatrical distribution. Stranger Things isn't a peripheral Netflix property. It's arguably the company's most culturally significant television series. It has massive fan loyalty. Global recognition. Awards prestige.

When Netflix announced a theatrical release for The Midnight Club around New Year's, industry observers were skeptical. Who goes to see a TV series in theaters? The answer, it turned out, was millions of people. The film generated approximately $25 million in box office revenue during its brief theatrical window over New Year's Eve and New Year's Day.

Consider what that number means. That's roughly equivalent to theatrical releases by major studios. It proves that Netflix properties can compete for theatrical audiences. It proves that fans will show up in multiplexes for content they love. It proves that theatrical and streaming aren't enemies, they're potentially complementary.

For Ted Sarandos, this number became the evidence he needed. If Netflix's own streaming IP could generate $25 million in theatrical revenue during a holiday weekend, what could WBD's entire theatrical slate generate with proper planning and commitment? The math suddenly made sense. Theater chains suddenly became less of an enemy and more of an asset.

This is why the timing of Sarandos's 45-day window commitment matters so much. It came after The Midnight Club proved the thesis. Netflix has data showing that theatrical can work for streaming content. The company isn't committing to 45 days out of altruism. It's committing because the financials now support it.

The 45-day window costs Netflix an estimated

The 17-Day Gap: Why the Deadline Report Shook the Industry

When Deadline published the report that Netflix sources had indicated support for a 17-day window, theater chains essentially declared war. Seventeen days is barely enough for a normal theatrical run. A film opens Friday. Plays Thursday nights and weekends for two weeks. Gets the MLK weekend bump perhaps. Then leaves theaters as Netflix gears up to put it on the platform.

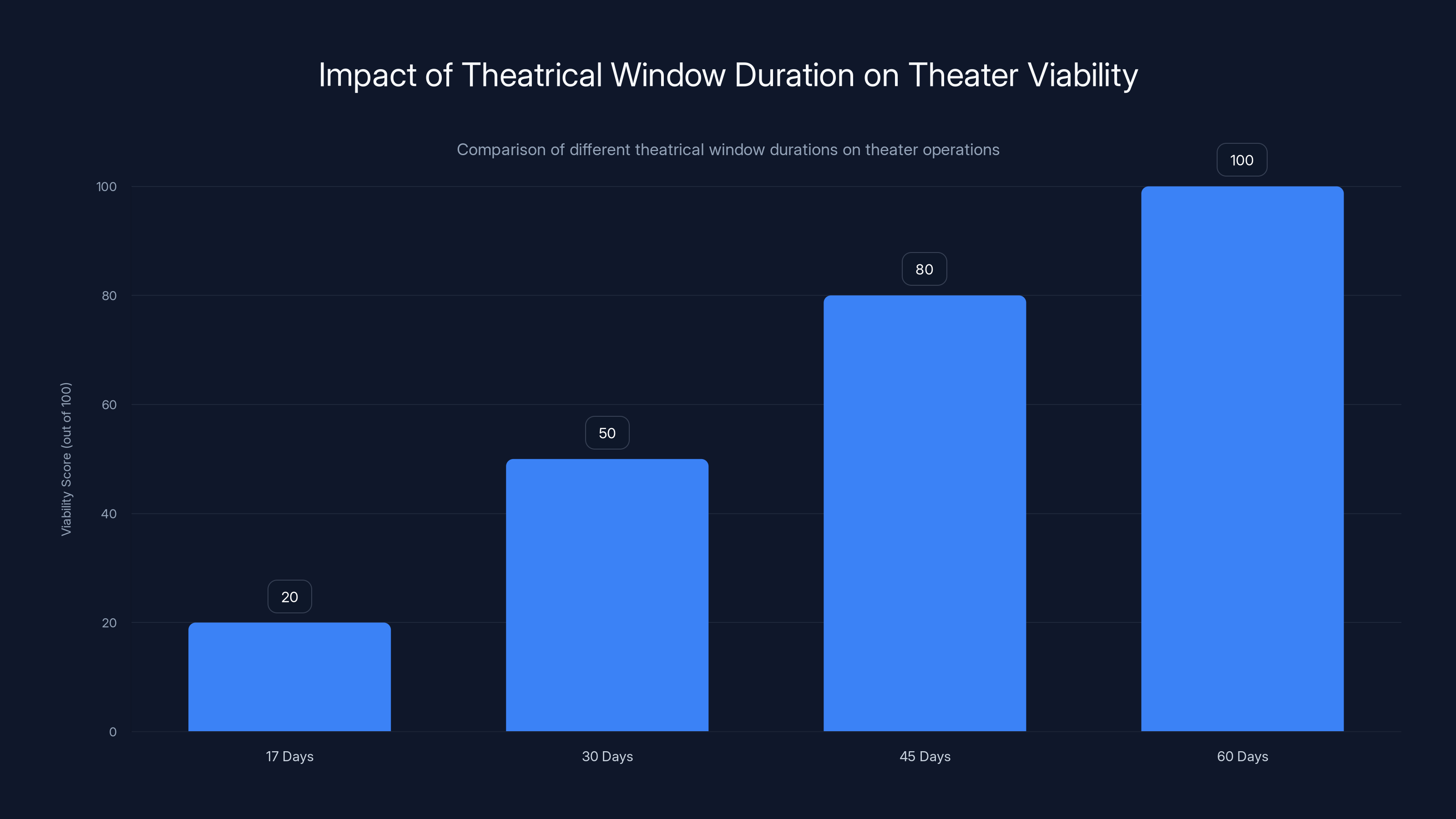

For regional theaters, 17 days is a death sentence. These chains don't have the volume of major metropolitan areas. They rely on extended runs. A movie might play Wednesday through Thursday nights plus weekends for 4-6 weeks in a smaller market. A 17-day window effectively cuts them out of the theatrical business entirely. Only major multiplexes in cities could sustain a 17-day exclusive window. The rest get nothing.

This is why the theater industry fought back so hard. Cinema United's congressional testimony wasn't just political theater. It reflected genuine existential concerns. If Netflix acquires WBD and then implements a 17-day window for all theatrical releases, the financial impact on regional and independent theaters would be catastrophic.

The gap between 17 days and 45 days represents the difference between theater-hostile consolidation and manageable market adaptation. Thirty additional days of exclusivity might not sound like much in business jargon. But in theater operations, it's the difference between viability and bankruptcy for many smaller chains.

But here's the crucial detail that Sarandos addressed in his comments: Was Netflix actually considering 17 days, or was that just internal speculation? Sarandos used his NYT interview to flatly reject any suggestion that Netflix would go short. He gave a "hard number." 45 days. Done. Finalized. No ambiguity.

Whether Netflix was seriously considering 17 days or whether Deadline's sources were speculating, we may never know. But Sarandos's explicit rejection of a short window solved the political problem. He gave theater chains a binding commitment. He gave regulators assurance. He gave studios clarity.

The "Outmoded" Comment: Context and Clarification

During his NYT interview, Sarandos also addressed a previous comment that had become controversial. He'd described theatrical distribution as "outmoded." Theater chains, filmmakers, and industry commentators interpreted this as Netflix's CEO dismissing cinema entirely.

But Sarandos pushed back on the interpretation. He clarified that he'd said theatrical was "outmoded for some," not universally outmoded. And he used examples to explain what he meant.

His example involved the film "Sinners," which is set in the 1930s in a small town. Sarandos argued that for people living in towns without movie theaters, theatrical releases are functionally outmoded. They can't access them regardless. Meanwhile, for someone like his daughter living in Manhattan with multiple theaters within walking distance, theatrical isn't outmoded at all. It's viable and desirable.

This distinction matters because it reveals Netflix's actual thinking. The company isn't arguing that cinema should disappear globally. It's arguing that theatrical distribution works differently depending on geography, demographics, and infrastructure. In major cities with dense theater networks, theatrical makes sense. In rural areas and small towns, streaming is actually more inclusive and practical.

This is actually defensible from a consumer perspective. A family in rural Wyoming can't drive three hours to see a movie in theaters. But they can stream it immediately. Is that "outmoded" theater, or is it actually more consumer-friendly?

However, Sarandos's example choice was awkward. "Sinners" is set in the 1930s, a time when cinema technology was nascent and novel. Using a period piece about the past to justify modern distribution decisions created confusion rather than clarity. It felt like the CEO was reaching for a justification rather than making a coherent argument.

The larger point remained valid though: Netflix's position isn't anti-theater. It's pro-consumer. The company believes people should be able to watch content when and where they choose, not on schedules dictated by theatrical release windows and geography.

Netflix's shift to a 45-day theatrical window aligns more closely with traditional studios, contrasting its previous 17-day window approach. Estimated data.

Regulatory Scrutiny: Why the FTC Cares About Theater Windows

The Federal Trade Commission's potential review of a Netflix-WBD deal isn't primarily about theatrical exhibition. It's about market concentration in content production and distribution. But theatrical exclusivity windows became a proxy for whether Netflix would exercise monopolistic power over the entire entertainment ecosystem.

Here's the regulatory logic: If Netflix owns Warner Bros. Discovery, it controls a massive percentage of theatrical releases, streaming content, television production, and international rights. It would have the power to do things that no individual company could do before. It could demand exclusive rights from theaters. It could set theatrical windows unilaterally. It could bundle streaming with theatrical access. It could use its streaming dominance to disadvantage theatrical competition.

The FTC needs evidence that Netflix won't abuse this consolidated power. A specific commitment to 45-day windows serves as that evidence. It shows Netflix accepting limitations on its own behavior. It demonstrates Netflix willing to work within industry norms rather than unilaterally rewriting them.

This is why Sarandos's specific "hard number" matters to regulators. A vague promise to "support theaters" doesn't constrain Netflix. A specific 45-day window actually limits Netflix's options. The company is committing to something measurable that regulators can verify and potentially enforce.

Cinema United understood this as well. By making public statements opposing the deal and raising consolidation concerns, the theater industry was giving the FTC political cover to scrutinize Netflix heavily. The agency could point to organized industry opposition and say, "We have to investigate this deal because stakeholders have serious concerns."

Paramount, meanwhile, was playing the same regulatory game from the other side. By positioning itself as the "traditional media company" that respects theatrical exhibition, Paramount was essentially arguing to regulators: "We're the safe choice. We won't disrupt the theatrical business the way Netflix might."

The 45-day window commitment is Netflix's response: "See? We respect theaters too. We're offering guarantees. We're not the threat you think we are."

The Paramount Factor: Competition and Forced Concessions

Paramount's rival bid for Warner Bros. Discovery is the elephant in every room where Netflix's WBD deal is discussed. Without Paramount's competing bid, Netflix might have acquired WBD with minimal negotiation and without making public commitments about theatrical windows.

But Paramount's presence forces Netflix to compete. And competing means making concessions that Netflix might not otherwise make.

Paramount Global is a traditional media company. It owns theaters (Paramount movie theaters). It owns traditional TV networks. It was built in the era of theatrical exhibition and broadcast television. When Paramount makes promises about supporting theaters, the industry believes it because theaters are literally part of Paramount's business model.

Netflix, by contrast, is the company that disrupted theaters. Theater owners assume Netflix is hostile to their interests. So Netflix has to work harder to prove otherwise.

Paramount's bid essentially forces Netflix to make commitments it might not volunteer. The 45-day window is Netflix saying, "We understand your concerns. Here's specific evidence that we'll respect theatrical business."

Without Paramount's bid, Netflix could have tried to acquire WBD with vaguer promises or even attempted a smaller strategic acquisition focused on streaming content alone. But with Paramount bidding aggressively, Netflix has to put theater-friendly commitments on the table to remain competitive.

This is how bidding wars work in corporate M&A. The competing bidder forces both parties to make concessions and commitments they wouldn't otherwise make. Theater chains benefit from this competition because it drives Netflix to promise theatrical support.

If Netflix ultimately loses the WBD bid to Paramount, the irony would be profound. Netflix spent decades disrupting theatrical distribution and was willing to tolerate short windows. Competing with Paramount forced Netflix to commit to longer theatrical exclusivity. And if Paramount wins, it implemented theater-friendly policies that Netflix itself proposed as concessions.

Estimated data shows that a 17-day window severely impacts theater viability, with scores improving significantly as the window extends to 45 days or more.

Financial Implications: What a 45-Day Window Costs Netflix

Let's do some rough math on what a 45-day window actually costs Netflix financially.

A major WBD theatrical release might gross

Compare that to what Netflix might have made with a simultaneous release or 17-day window. More people would have watched it at home immediately. Netflix would have converted more of its subscription base to content they're consuming (and justifying their subscriptions). The streaming impact on subscriber retention and new signups might be worth $100-300 million in additional lifetime value.

So the financial cost to Netflix of honoring a 45-day window is the opportunity cost of delayed streaming access. Netflix is essentially saying: "We'll forfeit 4-6 weeks of streaming momentum and premium subscriber engagement in exchange for theatrical prestige and regulatory approval."

Is it worth it? From Netflix's perspective, probably yes. Here's why:

Regulatory approval: If Netflix doesn't get the WBD acquisition approved, the entire deal is worthless. A 45-day window is cheap insurance on a multi-billion-dollar acquisition.

Prestige and awards: WBD films reaching theaters means awards potential. Oscars campaigns. Critical acclaim. This improves the prestige of Netflix's entire content library.

Filmmaker recruitment: If Netflix wants to attract top directors and stars, it needs to prove it respects theatrical. A 45-day window is that proof.

Theater chain relationships: For 80 years, major studios have needed theaters. If Netflix wants to maintain access and good relationships with theater chains, it needs to demonstrate commitment.

The 45-day window isn't actually that expensive when you factor in these strategic benefits. It's a form of payment for accessing the theatrical system and the legitimacy that comes with it.

Industry Impact: What This Means for Other Streaming Platforms

Netflix's 45-day window commitment will inevitably ripple across the entire streaming industry. Other platforms will face pressure to make similar commitments. But they may not have the same leverage or the same willingness.

Amazon Prime Video has theatrical ambitions. It's acquiring MGM. It's producing prestige films. If Netflix commits to 45 days for WBD, Amazon might face questions about why it's not making similar commitments for MGM releases.

Apple TV+ has invested heavily in theatrical prestige content. Should it extend exclusivity windows to compete with Netflix's promise?

Disney+ is backed by Disney, which owns theaters and has a vested interest in theatrical exclusivity. Disney will probably maintain longer windows anyway, so this doesn't change Disney's calculus.

But the broader implication is that Netflix's move legitimizes theatrical distribution again. The company that most aggressively disrupted theatrical is now saying, "Okay, we get it. Theaters matter. We'll commit." This validation comes at exactly the moment when the entire entertainment industry is questioning whether theatrical has a future.

For theater chains, Netflix's commitment is a validation that their business model still works. For filmmakers, it's evidence that theatrical releases remain viable even in a streaming-dominant world.

The Filmmaker Perspective: Why Directors Care About Theatrical

Christopher Nolan has made his position clear: He makes films for theatrical exhibition. Denis Villeneuve feels similarly. These aren't minor voices in the industry. They're visionary directors whose works define filmmaking for their generations.

When Nolan criticized streaming platforms for downplaying theatrical, he wasn't being nostalgic. He was making a technical and artistic argument. Films shot in IMAX, Dolby Cinema, and other premium formats are designed to be experienced on large screens. Watching them on a TV at home is literally a diminished experience.

Filmmakers like Nolan have leverage. Major studios compete to work with them because their names and visions guarantee audiences. But those filmmakers have also made clear they won't work with platforms that don't respect theatrical exhibition.

Netflix's 45-day commitment is partly an attempt to recruit and retain top creative talent. By proving it values theatrical, Netflix becomes a viable partner for prestige directors. They're not making a film that will be buried on a streaming platform with no theatrical presence. They're making a film that gets a proper theatrical release before moving to streaming.

For WBD specifically, this matters because Warner Bros. has relationships with some of the world's best filmmakers. These directors have approval rights. They have leverage. If Netflix acquires WBD and immediately announces that WBD films will get only 17-day windows or simultaneous release, many of those directors would exercise their contractual options to exit.

The 45-day window removes that risk. It signals that Netflix respects the filmmakers' intentions and the theatrical presentation of their work.

The Streaming Wars Context: Why Now Matters

Netflix's theater-friendly shift comes at a moment when the streaming wars have fundamentally changed. Five years ago, every streaming platform was in panic mode. They all had to acquire massive amounts of content. They all had to prove they could compete with Netflix. Everybody was scrambling.

Now, the market has matured. Netflix is profitable and disciplined about spending. Disney+ stabilized. HBO Max found its footing. Paramount+ is fighting to survive. The frenzy has stopped.

In this more mature market, Netflix can afford to be thoughtful. It doesn't need to acquire everything immediately. It doesn't need to disrupt theatrical to create urgency. It can think strategically about theatrical as part of a broader entertainment ecosystem.

The WBD deal is Netflix signaling that it's not an insurgent anymore. It's the incumbent. It's powerful enough to negotiate terms that work for multiple stakeholders. It's willing to coexist with theatrical because its dominance is secure.

This is what happens to disrupters. They succeed. They become incumbents. And then they adapt to coexist with the old systems they disrupted. Uber now works with taxi commissions. Tesla negotiates with dealership regulations. Netflix commits to 45-day windows.

International Considerations: A Global Approach to Theatrical Windows

One aspect Sarandos didn't deeply address in his NYT interview is how the 45-day window would apply internationally. Different countries have different theatrical windows and regulations.

Europe, for instance, has stricter requirements around theatrical exclusivity. Some European countries have regulations that effectively mandate longer windows. If Netflix wants to distribute WBD films globally, it might need to accept longer windows in some territories.

China has unique distribution rules. Bollywood releases follow different patterns. The theatrical ecosystems vary wildly by region.

A global 45-day window is actually simplified compared to the complexity of managing regional variations. So Netflix's commitment probably means: "A baseline 45-day window in major markets, with regional variations as needed for local regulations."

This is yet another way the 45-day commitment simplifies negotiations. It gives Netflix and stakeholders a starting point. From there, specific regional deals can be made.

International expansion is crucial for WBD films. Many Warner Bros. blockbusters now make more money internationally than domestically. A streamlined approach to theatrical windows helps Netflix manage that complexity.

The Awards Season Implications: Prestige and Recognition

Theater exclusivity has always been tied to awards eligibility. The Academy Awards, BAFTAs, and Golden Globes all have requirements about theatrical exhibition. If a film gets a streaming release too quickly, it might not qualify for major awards.

Netflix has long chafed under these restrictions. The company wanted to release films on streaming without losing awards eligibility. But the awards bodies maintained that theatrical exhibition was a prerequisite for major awards consideration.

A 45-day window solves this problem for Netflix. Films can play theaters long enough to satisfy awards body requirements. Then they move to streaming without sacrificing eligibility.

For WBD specifically, this matters because the studio has a history of prestige films. It makes Oscar-contending dramas. If Netflix acquired WBD and compromised awards eligibility, that would undermine the value of the studio's output.

The 45-day window allows Netflix to maintain awards prestige while still achieving its core goal of moving films to streaming relatively quickly.

The Experimental Future: Can 45 Days Actually Work?

Ultimately, Netflix's commitment to 45 days is a theory that needs testing. Can a Netflix-owned WBD actually make 45-day windows work financially and creatively?

There are legitimate concerns. Some films might not find audiences in a 45-day window. Some releases might flop theatrically and then underperform on streaming because the theatrical failure created negative perception. Marketing costs might not be optimized for a 45-day runway.

But there's also evidence that it could work. The Stranger Things precedent suggests demand exists. Theater chains clearly want longer windows. Filmmakers respect theatrical presentation. Awards bodies require it.

The 45-day commitment is essentially Netflix saying, "We're willing to experiment with this model. We'll prove it can work. But only if this deal gets approved."

This is the strategic brilliance of Sarandos's statement. It addresses every stakeholder's concerns simultaneously. It positions Netflix as reasonable. It sets a measurable standard. It creates accountability.

Whether the actual execution works is a separate question. But Netflix has bought itself the political capital to find out.

The Deal's Uncertain Future: Paramount Still in the Game

As of early 2025, the Netflix-WBD deal is far from certain. Paramount's competing bid keeps everything in flux. The WBD board has to choose between them. Regulators have to approve whichever buyer emerges.

Netflix's 45-day window commitment is one piece of ammunition in a larger negotiation. It helps Netflix's case. But it doesn't guarantee Netflix wins.

Paramount could counter with its own commitments. Or the WBD board could decide that Paramount's traditional media background and existing theater relationships make it a safer steward of the WBD catalog.

The entertainment industry is watching this deal intently because the outcome will shape how streaming and theatrical coexist for the next decade. If Netflix wins and successfully implements 45-day windows across WBD's slate, it proves streaming and theaters can coexist. If Paramount wins, it sends the message that traditional media companies are better equipped to manage theatrical-streaming dynamics.

Sarandos's 45-day commitment is ultimately a bet that Netflix can execute on theatrical strategy. History suggests Netflix is willing to change course when necessary. The company pivoted from original series exclusively to films and documentaries. It went from standard definition to 4K. It went from simultaneous releases to selective theatrical exclusivity.

Netflix's adaptability is actually its greatest strength. The 45-day window commitment might seem like a compromise. But it's actually Netflix saying, "We'll figure this out. We'll make it work." And the company's track record suggests it probably will.

FAQ

What does a 45-day theatrical window mean?

A 45-day theatrical exclusivity window means a film plays exclusively in movie theaters for approximately six and a half weeks before becoming available on streaming platforms. This is roughly equivalent to the historical standard for major studio releases, allowing films to complete their theatrical run and collect box office revenue before transitioning to streaming access.

Why is Netflix making this commitment only for WBD films?

Netflix is committing to the 45-day window specifically as a condition of acquiring Warner Bros. Discovery. This is a negotiating position designed to appease theater chains, filmmakers, and regulators who have opposed the deal on consolidation grounds. By promising protection for WBD's theatrical releases, Netflix removes one major objection to the acquisition.

How does a 45-day window compare to what Netflix previously supported?

Previously, Netflix championed simultaneous theatrical and streaming releases or had explored much shorter windows. Industry reports suggested Netflix internally considered a 17-day window, which would have been devastating to theater chains. The 45-day commitment represents a significant shift toward traditional theatrical exclusivity periods.

Will the 45-day window apply to all WBD films or just theatrical releases?

Based on Sarandos's statements, the 45-day window would apply to WBD theatrical releases. Films made specifically for streaming would presumably remain on streaming. But any WBD film that gets a theatrical release would maintain exclusive access for 45 days before moving to the Netflix platform.

What impact does this have on competing streamers like Amazon Prime Video or Apple TV+?

Other streaming platforms will likely face pressure to make similar theatrical commitments. Amazon Prime Video, which acquired MGM, might face questions about why MGM releases don't get comparable theatrical windows. However, Disney+ already operates within the Disney theatrical framework, so it has less need to make new commitments.

Is the 45-day window enough to satisfy theater chains?

Theater chains have not formally endorsed the commitment, but industry observers note that 45 days represents a workable scenario for theaters. It's significantly better than the reported 17-day window that had prompted strong opposition. Regional and independent theaters can run films for extended periods during a 45-day window, making the arrangement viable for their business models.

How does this commitment affect awards eligibility for WBD films?

The 45-day theatrical window satisfies the requirements of major awards bodies including the Academy Awards, BAFTAs, and Golden Globes. Films completing their theatrical run within this window would remain eligible for major awards consideration, allowing Netflix to maintain prestige and recognition while moving films to streaming on a manageable timeline.

What does this reveal about Netflix's future theatrical strategy?

Netflix's commitment suggests the company is moving from viewing theatrical and streaming as competitors toward seeing them as complementary distribution channels. The 45-day window indicates Netflix believes theatrical releases can enhance a film's prestige, generate marketing momentum, and drive streaming engagement when films eventually transition to the platform.

Conclusion: The New Reality of Streaming and Theatrical Coexistence

Ted Sarandos's commitment to a 45-day theatrical window for WBD films marks a fundamental shift in how Netflix views its place in the entertainment ecosystem. This isn't surrender. It's strategic maturation.

Netflix spent its first decade disrupting theatrical distribution. It proved that streaming could deliver content successfully. It reduced the power of theaters as gatekeepers. It democratized access by making content available at home immediately.

But that disruption is mostly complete. Netflix won. It's the dominant global streaming platform. It's profitable. It's secure. Now the company can afford to be thoughtful about coexistence rather than focused on disruption.

The 45-day window is Netflix's way of saying: "We understand why theatrical matters. We understand why filmmakers care. We understand why theaters need protection. We're willing to work within that system because we're confident our streaming platform is so valuable that 45 days of waiting won't diminish it."

This confidence is grounded in data. Netflix has proven that when major films eventually reach the platform, subscribers engage enthusiastically. The prestige of theatrical releases translates to streaming appeal. The marketing generated by theatrical campaigns drives awareness that benefits Netflix when streaming access begins.

For the entertainment industry, this is actually good news. It suggests theatrical and streaming can coexist indefinitely. Filmmakers can make theatrical releases. Theater chains can remain viable. Streaming platforms can acquire content. Everyone can find an equilibrium.

Paramount's competing bid will determine whether Netflix actually gets to execute this strategy with WBD. But regardless of which company wins, the industry has moved past viewing theatrical and streaming as zero-sum competitors. They're now recognized as complementary parts of the entertainment distribution ecosystem.

Netflix's 45-day commitment is that recognition. It's the moment when the disrupter became the incumbent and acknowledged the value of the systems it had disrupted. That's how industries mature.

Key Takeaways

-

Discovery, Ted Sarandos has promised to maintain a 45-day theatrical exclusivity window for all WBD films

-

It certainly didn't commit to specific windows in major media interviews

-

-

Netflix commitment: If it acquires WBD, Netflix promises to maintain 45-day theatrical windows for all Warner Bros

-

Png)

*Estimated data shows that a major blockbuster earns approximately 65% of its total theatrical revenue during the opening weekend, with diminishing returns in subsequent weeks

- Why should someone in rural Montana wait weeks longer to watch a movie than someone in Manhattan with three AMCs within walking distance

![Netflix's 45-Day Theater Window: What It Means for WBD [2025]](https://tryrunable.com/blog/netflix-s-45-day-theater-window-what-it-means-for-wbd-2025/image-1-1768574399211.jpg)