Netflix's Massive Sony Deal: What It Means for Streaming and Your Favorite Games

Something just happened in the streaming world that's going to reshape how you watch movies and shows for the next several years. Netflix and Sony Pictures Entertainment announced an expanded partnership that's worth north of $7 billion. And while that's a staggering number on its surface, what really matters is what it gets you access to: the live-action Legend of Zelda movie, four Beatles biopics, and essentially first dibs on every major Sony film release worldwide.

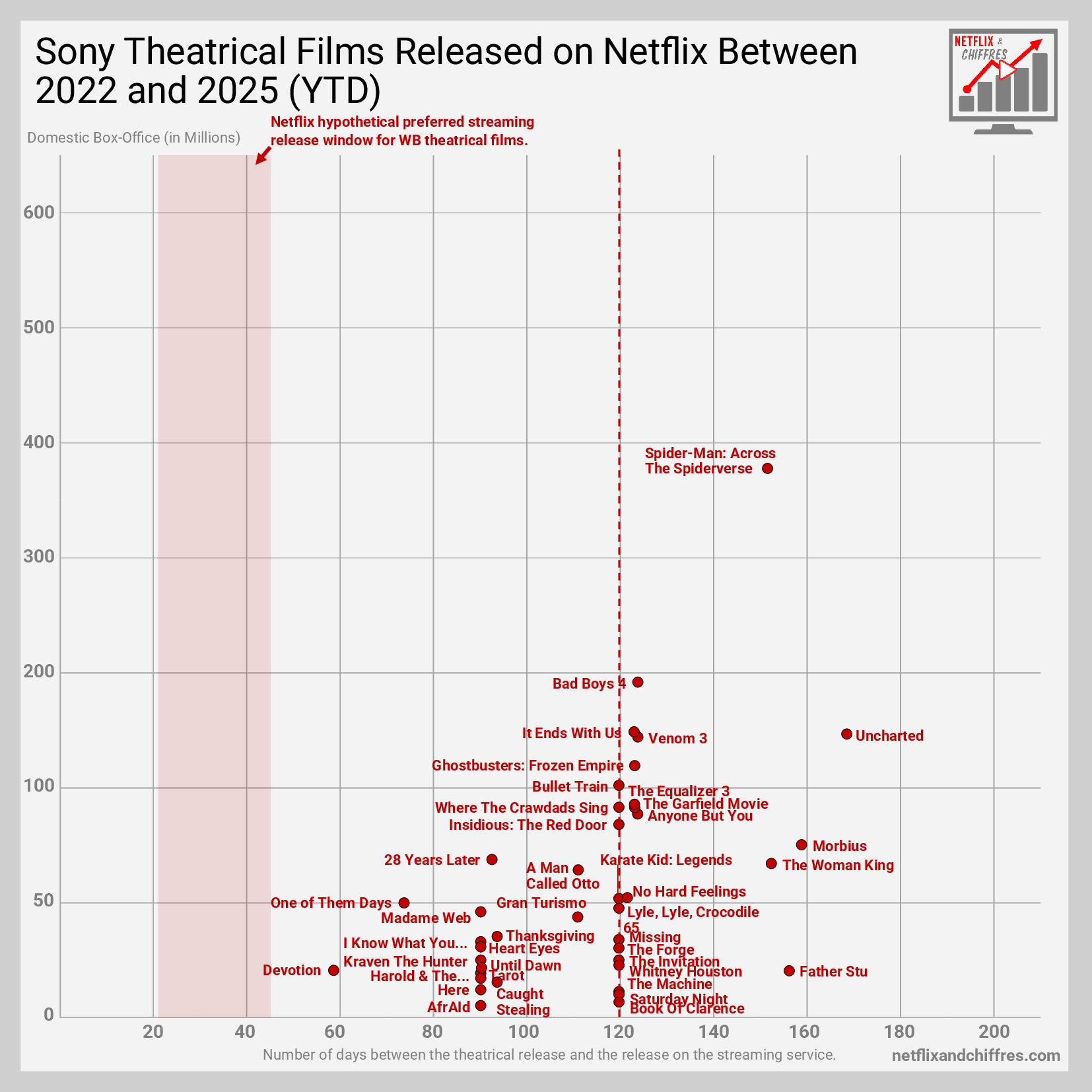

Let me break down why this matters beyond the headline. For years, streaming deals have been fragmented. You'd finish watching a movie in theaters, and then it might bounce around between three different streaming services before landing somewhere permanently. Sony had already partnered with Netflix for U.S. streaming rights, but this new deal changes the game entirely. Netflix is now paying for worldwide "Pay-1" distribution rights, which means it gets to be the first streaming home for Sony movies globally, right after theatrical and VOD releases end.

The sheer scope of this agreement is difficult to overstate. We're talking about legendary game franchises becoming films on Netflix first. We're talking about major Beatles content hitting the platform before anywhere else. We're talking about reshaping the streaming hierarchy in a way that gives Netflix serious leverage over competitors.

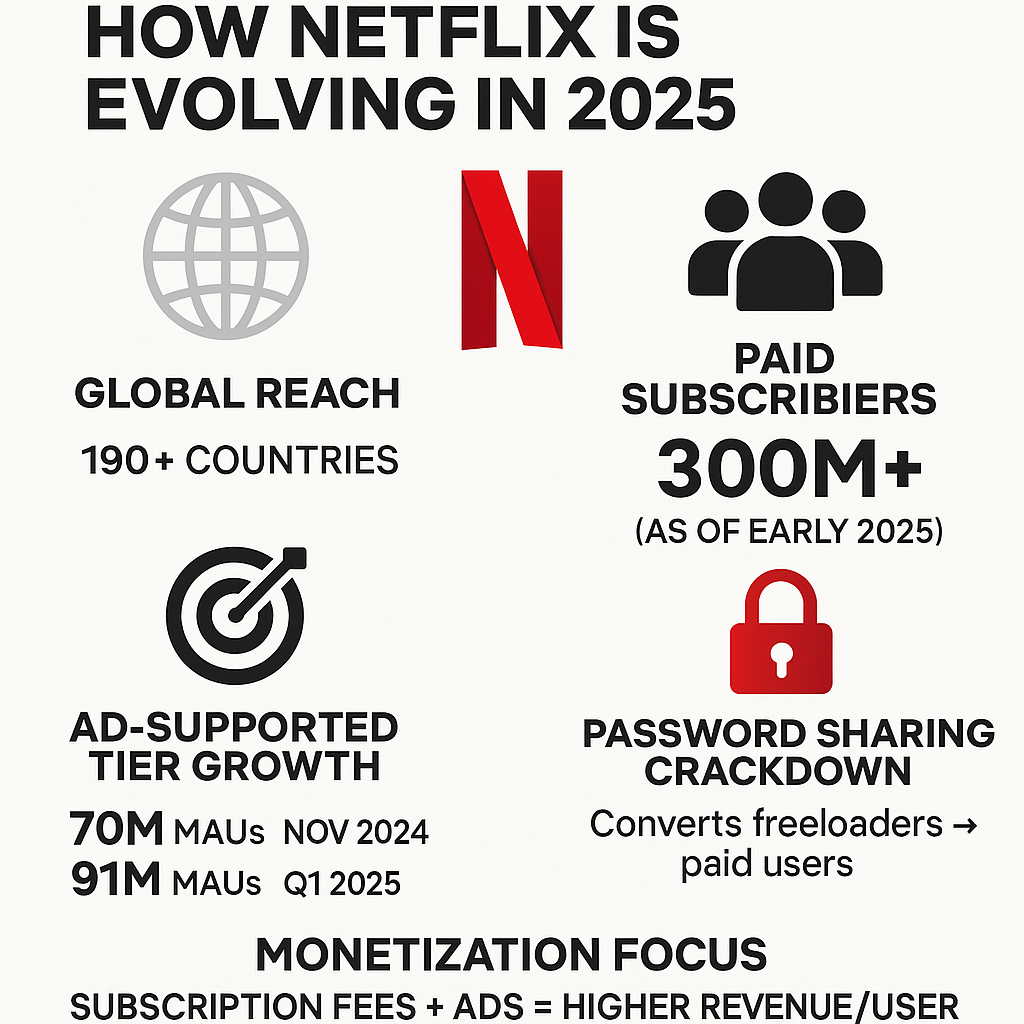

But here's what's really interesting: this deal also says something profound about where Netflix stands right now. The company is spending enormous amounts of money to secure content partnerships that lock in exclusive rights. That's not the behavior of a platform playing defense. That's the behavior of a company trying to dominate.

In this article, I'm going to walk you through every angle of this deal. Why Netflix paid $7 billion. What it means for gaming fans waiting on that Zelda adaptation. How this affects the broader streaming landscape. Whether you should actually care about this as a consumer. And what comes next in the streaming wars.

Let's start with the fundamentals.

TL; DR

- Netflix paid $7 billion for expanded worldwide streaming rights to Sony Pictures films, starting with "Pay-1" availability after theatrical releases

- The Legend of Zelda live-action movie will premiere on Netflix first, along with four Beatles biopics, making it the exclusive streaming home for these major adaptations

- Sony's entire back catalog becomes available on Netflix gradually through 2029, with full library integration expected by end of that year

- This is a multi-year agreement that positions Netflix as the first streaming home for all new Sony Pictures theatrical releases worldwide

- The deal echoes Netflix's universal strategy, following a similar arrangement with Universal Pictures and building on the company's track record with Nintendo adaptations like Super Mario Bros. Movie

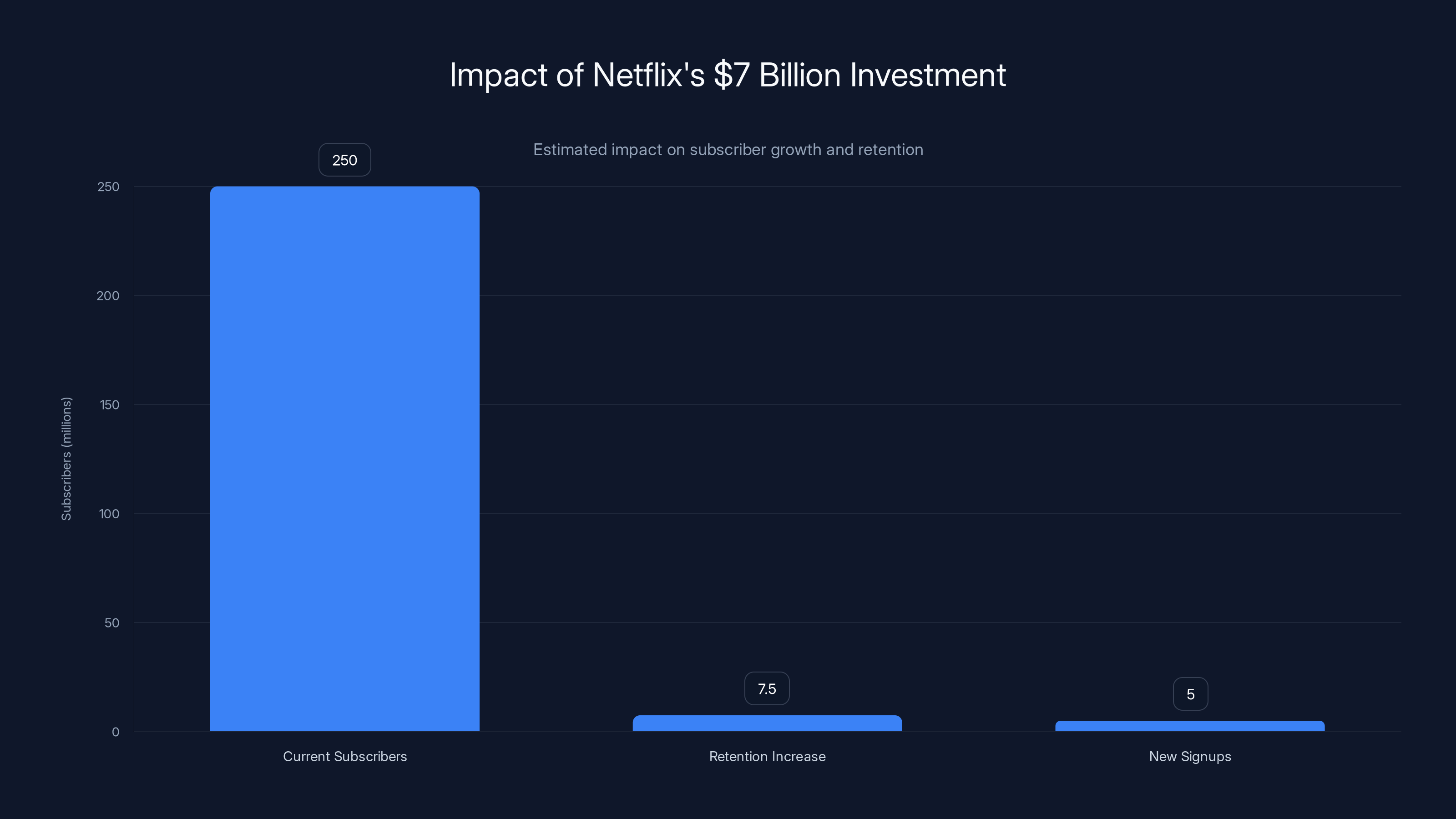

Estimated data shows that a 2-3% retention increase and 1-2% new signups could add 12.5 million subscribers, helping Netflix recoup its $7 billion investment within 3-4 years.

The Core Deal: What Netflix and Sony Actually Agreed To

Let's get granular about what this agreement actually covers. Netflix didn't just throw $7 billion at Sony to be nice. The deal has specific components, specific windows, and specific content.

First, the new releases. Starting immediately (with "rollout gradually" through 2025 and into 2026), Netflix becomes the first streaming home for all new Sony Pictures theatrical releases. This includes major tentpoles, mid-budget films, and prestige pictures. When a Sony film finishes its theatrical run and completes its Video on Demand window, Netflix is where it lands first. This is called "Pay-1" in industry parlance, meaning it's the first paid streaming window after consumers have already bought or rented it on iTunes, Amazon, Google Play, or other VOD platforms.

The geographical scope is critical here. This isn't just the United States anymore. Netflix secured these rights worldwide. That's the real significance. Previously, Netflix had exclusive U.S. streaming rights to Sony films. Now it's global. A person in Japan, Germany, Brazil, or Australia will see these Sony releases hit Netflix first.

Second, there's the back catalog component. Netflix is licensing an undisclosed number of films and television shows from Sony Pictures' existing library. That means hundreds, potentially thousands, of films and shows that Sony owns the streaming rights to are being added to Netflix. This isn't just recent releases. This includes classic films, deep catalog shows, and properties that Sony has held onto for decades.

Third, there's the games-to-film angle. The Legend of Zelda movie is the centerpiece of media coverage, but it's part of a larger strategy. Netflix is getting the streaming home for multiple major franchise adaptations simultaneously. The Beatles biopics are another massive draw. These aren't C-list projects. These are tentpole films with significant budgets and A-list talent.

Why Netflix Paid $7 Billion: The Strategic Math

Seven billion dollars is a number that makes people pause. It's an enormous amount of money. So why would Netflix commit this much?

The answer involves understanding how streaming services make money. Netflix makes money in three primary ways: subscriber growth, increasing prices, and retention. A massive exclusive content library that contains marquee titles is the fuel for all three. If you're deciding between Netflix and Disney Plus, and you know the new Sony films hit Netflix first, that swings the decision.

Let's do some basic math. Netflix has roughly 250 million subscribers globally. The average Netflix subscriber in developed markets pays between

Consider the practical scenario. Someone who watches one major Sony film per quarter on Netflix that they would have otherwise watched on a different service or in theaters represents

But there's a second strategic reason. Netflix is in a battle for franchise supremacy. Disney controls Marvel and Star Wars. Warner Bros. controls DC and Harry Potter. Amazon controls Lord of the Rings. Netflix needed major franchises with cultural weight. The Legend of Zelda movie is one of the biggest entertainment properties in the world. Securing its streaming home first is a massive win in the franchise wars.

There's also a consolidation angle. Netflix has been building streaming exclusivity with major studios. Universal has a similar deal. Disney+ gets Disney content naturally. HBO Max gets Warner Bros. content naturally. But Sony previously distributed widely. This deal narrows that distribution significantly, making Netflix the primary streaming destination for Sony content. That's a fundamental shift in market structure.

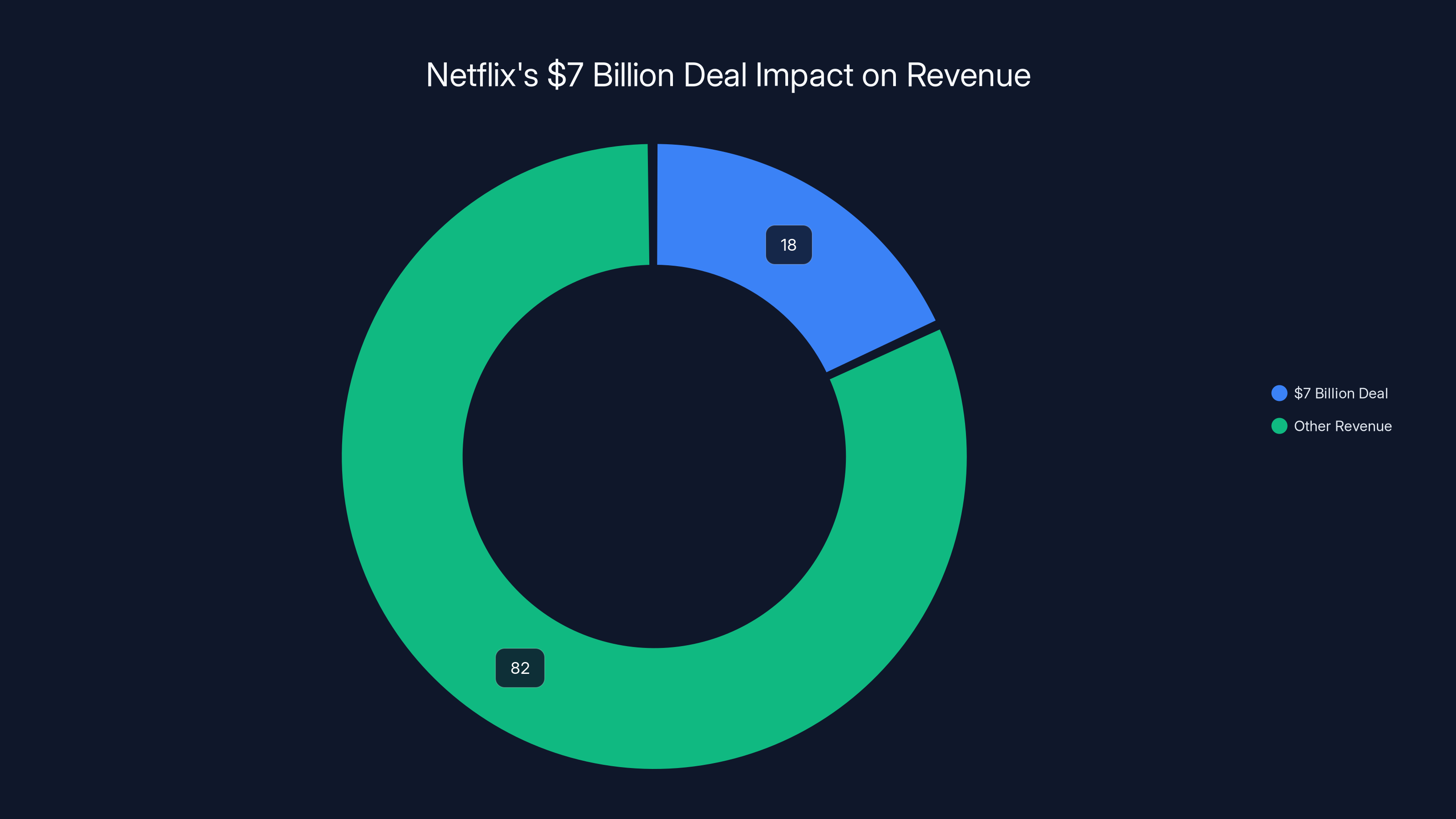

The $7 billion deal represents approximately 18% of Netflix's annual revenue, highlighting its significant impact on the company's financial strategy. Estimated data.

The Legend of Zelda Movie: The Headline Deal

Let's talk about what everyone cares about. The live-action Legend of Zelda adaptation is coming to Netflix first.

Here's what we know: it's in development, it has A-list talent involved (though specific casting hasn't been officially announced), and it's being treated as a major tentpole production. This is not some direct-to-streaming B-movie. This is a film with theatrical release potential and substantial production value.

The gaming community has been skeptical about live-action video game adaptations for decades. Most of them have failed. But Netflix has had success with gaming IP. The Castlevania animated series built a legitimate fanbase. The Arcane League of Legends series won Emmy nominations and critical acclaim. Super Mario Bros. Movie, which Netflix streamed after theatrical release, became one of the highest-grossing animated films ever.

So there's genuine precedent for this working.

The significance of Netflix getting exclusive streaming rights to the Zelda movie first means that the platform becomes the canonical first viewing destination. You don't watch it on HBO Max or Amazon Prime or go to a separate app. You open Netflix, and there it is. For casual fans, that frictionless access drives viewing. For hardcore fans, it's where community discussion happens.

This also matters for franchise expansion. If the Zelda movie is successful on Netflix, Netflix can pitch a Zelda TV series prequel. Or an animated continuation. Or a documentary about the making of the film. There's ancillary content value that Netflix captures first.

The Beatles Biopics: Prestige Content at Scale

Beyond Zelda, the deal includes four Beatles biopics. Let that sink in for a moment. Four separate biographical films about the most culturally significant band in modern history, all hitting Netflix first.

This is prestige content. These aren't forgettable streaming originals designed to pad runtime. These are major productions with significant talent involved. Beatles content has always been scarce and controlled. John Lennon's estate, Paul McCartney, the surviving Beatles, and their heirs have been notoriously protective of biographical material.

That Netflix secured rights to four of these simultaneously suggests serious production scale. We're potentially talking about films focused on individual band members, or their journey as a group broken into acts, or different periods of their career. Whatever the specific approach, Netflix is getting deep Beatles IP access.

This matters culturally because Beatles-related content drives significant streaming engagement. People want to understand the band's history, their music-making process, their personal dynamics, and their cultural impact. The Beatles streaming rights have always been fragmented, with music on Spotify, old documentaries scattered across platforms, and rare documentary access.

This deal consolidates that somewhat. Netflix becomes the central location for Beatles biographical film content. That's powerful for subscriber acquisition among music fans, history enthusiasts, and documentary lovers.

Understanding "Pay-1" and Streaming Windows

Let me explain the mechanics because this is where the deal's actual power becomes clear.

When a studio releases a film theatrically, it doesn't immediately go to streaming. There's a sequence of windows:

- Theatrical Window: Film is exclusively in cinemas (typically 45-90 days)

- Premium VOD Window: Film available for $20-25 rental on iTunes, Amazon, Google Play (typically 30-45 days)

- SVOD Window (Pay-1): Film available on subscription services with first-mover advantage (typically 6-24 months exclusive)

- Other Streaming Windows (Pay-2, Pay-3): Film may appear on other platforms after exclusivity ends

- AVOD/Free Window: Eventually, film may become free on ad-supported platforms

Netflix now owns the Pay-1 window for Sony Pictures films globally. That's the most valuable streaming window. It's where theatrical audiences transition to streaming. It's where word-of-mouth peaks. It's where critical discussion happens. Being first means you capture all that attention.

The multi-year structure is important too. We don't know the exact term, but typical studio deals run 5-7 years. This agreement locks in this arrangement for years. During that time, Sony's new releases will habitually premiere on Netflix first. That trains viewers to check Netflix for new major releases.

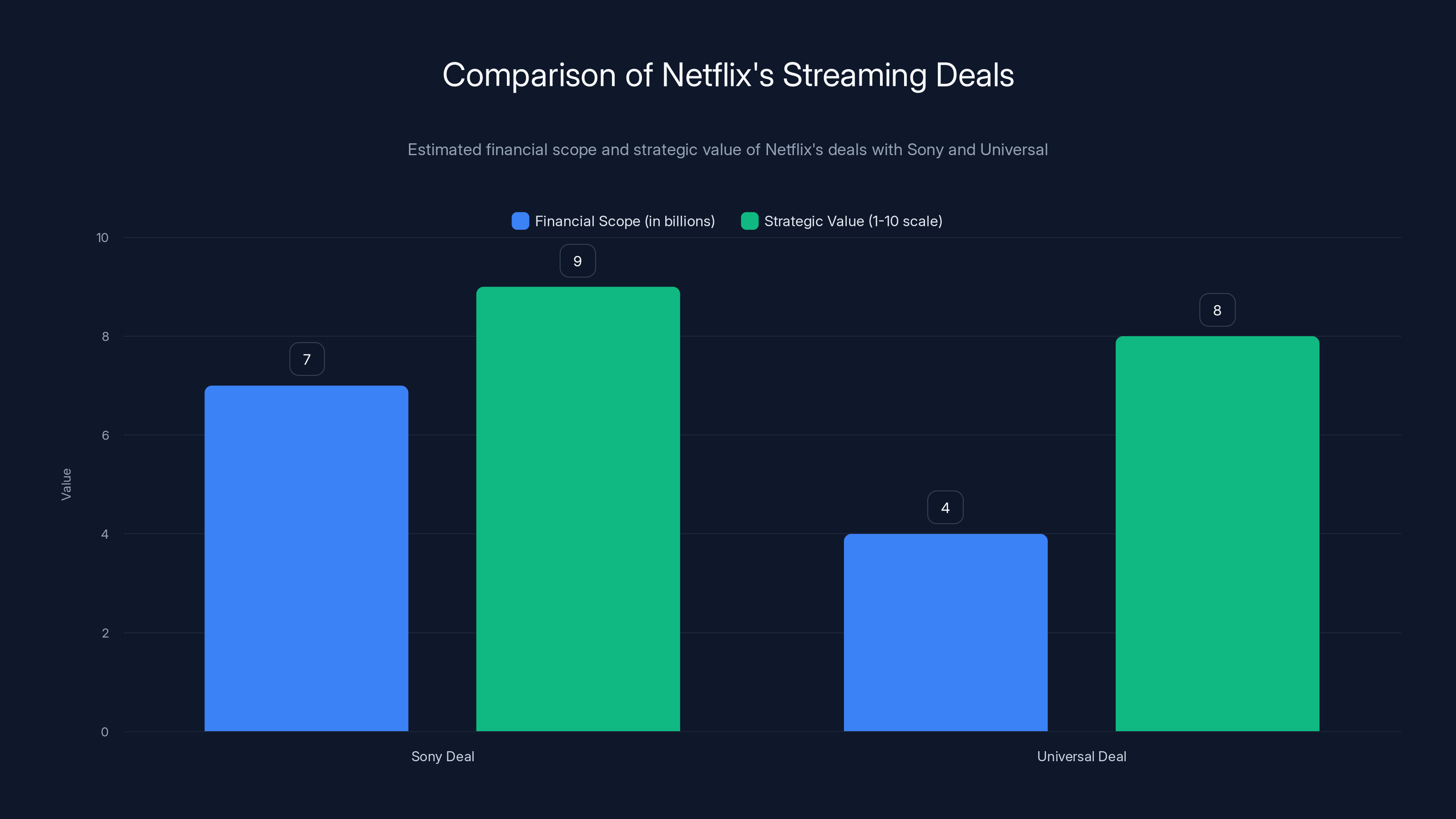

The Sony deal is estimated at $7 billion and offers a higher strategic value due to its worldwide scope and inclusion of major projects. Estimated data.

The Back Catalog: Building the Library

While the new release component gets headlines, the back catalog licensing might be more important for Netflix's platform strategy.

Sony Pictures owns an enormous film library. We're talking about everything from Columbia Pictures releases to classic studio films acquired through mergers. This includes iconic films, forgotten gems, B-movies, foreign language films, and decades of television shows.

Netflix is licensing an "undisclosed number" from this catalog. That's deliberately vague, but industry analysis suggests it could be 500-2,000 titles, depending on the scope and what rights Sony still controls.

Here's why this matters: streaming subscribers don't just want new content. They want depth. They want to browse and discover. They want to find films they've heard about but never seen. They want comfort-watching classics. A massive back catalog provides all of that.

The rollout timing is deliberate too. Netflix says the back catalog content will "roll out gradually throughout the year, with full availability happening sometime in 2029." That's three years of staggered content drops. Netflix gets to spread announcements and content discoveries across multiple years. Every few months, fresh library content arrives, giving subscribers reasons to explore the catalog.

This also protects Sony's other revenue streams. Not all Sony-owned content makes sense for Netflix simultaneously. Some titles might have existing theatrical re-release plans. Some might be committed to other platforms through existing contracts. Staggering availability until 2029 allows Sony to honor those commitments while steadily shifting its streaming presence toward Netflix.

How This Compares to Netflix's Universal Deal

Netflix has a similar arrangement with Universal Pictures that provides useful context.

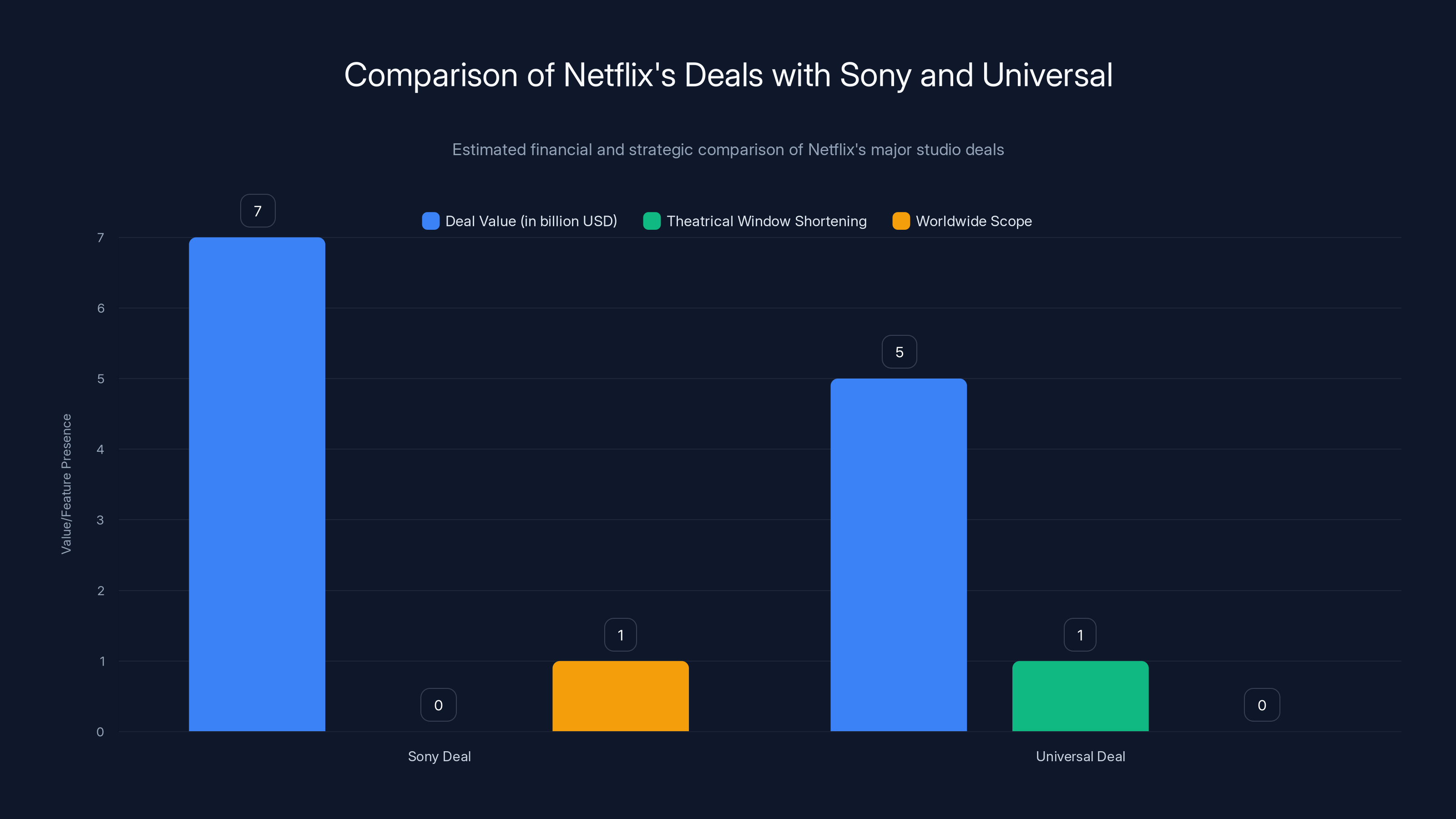

Universal agreed to make theatrical windows shorter for Netflix films and to give Netflix early Pay-1 access to Universal releases. That deal, announced in 2023, similarly sent shock waves through the industry because it represented major studio capitulation to streaming primacy.

But the Sony deal is structured differently in important ways. The Universal deal involves some mutual commitments where Netflix releases films theatrically for Universal to distribute. The Sony deal appears to be more straightforward: Netflix pays, Sony delivers streaming rights.

The scale also differs. The Sony deal's $7 billion is larger than the Universal agreement's reported terms, and includes explicit worldwide scope from day one.

What's consistent is the pattern: Netflix is systematically locking in exclusive relationships with major studios. That puts immense pressure on competitors. Disney+ has to rely on Disney-owned content. Amazon Prime has a hodgepodge of licensing deals. Apple TV+ has prestige originals but limited theatrical content. Netflix is building a moat of exclusive studio partnerships.

This is Netflix saying: "We will pay for exclusive first-look rights to your entire output." That's a different business model than traditional licensing, where services share content across windows. Netflix is buying primacy.

The Video Game Adaptation Strategy

There's a broader strategic thread here about gaming IP becoming film IP.

Netflix has noticed something important: video game franchises have incredibly passionate fanbases and massive cultural reach, but historically terrible film adaptations. The Mario movie proved you could do gaming IP right at scale. Arcane proved you could make gaming-adjacent animated series that exceed original expectations.

Legend of Zelda is one of the three or four most iconic gaming franchises ever. It has the dramatic tension (Link's journey), the mythology (Hyrule's lore), the romance (Link and Zelda), and the action sequences (dungeon boss fights) that work for visual media. It's been adapted into the occasional official Nintendo short, but never a major theatrical or streaming film.

Netflix securing first-streaming rights to this adaptation means that if it's successful, Netflix owns the franchise momentum. Fans talk about it on Netflix. Clips get shared from Netflix versions. The sequel or prequel films Netflix might develop happen on Netflix. That's a franchise anchor for years.

The broader pattern: Netflix is trying to become the "home of gaming IP films." Super Mario Bros. Movie streamed on Netflix. The live-action Zelda movie will premiere on Netflix. There's clearly a strategic push to position the platform as the central distribution channel for major gaming franchises.

The Sony deal, valued at $7 billion, is larger and includes worldwide scope from day one, unlike the Universal deal which focuses on theatrical window shortening. Estimated data.

Why Sony Said Yes: The Streaming Reality Check

Let's flip the perspective. Why did Sony agree to this?

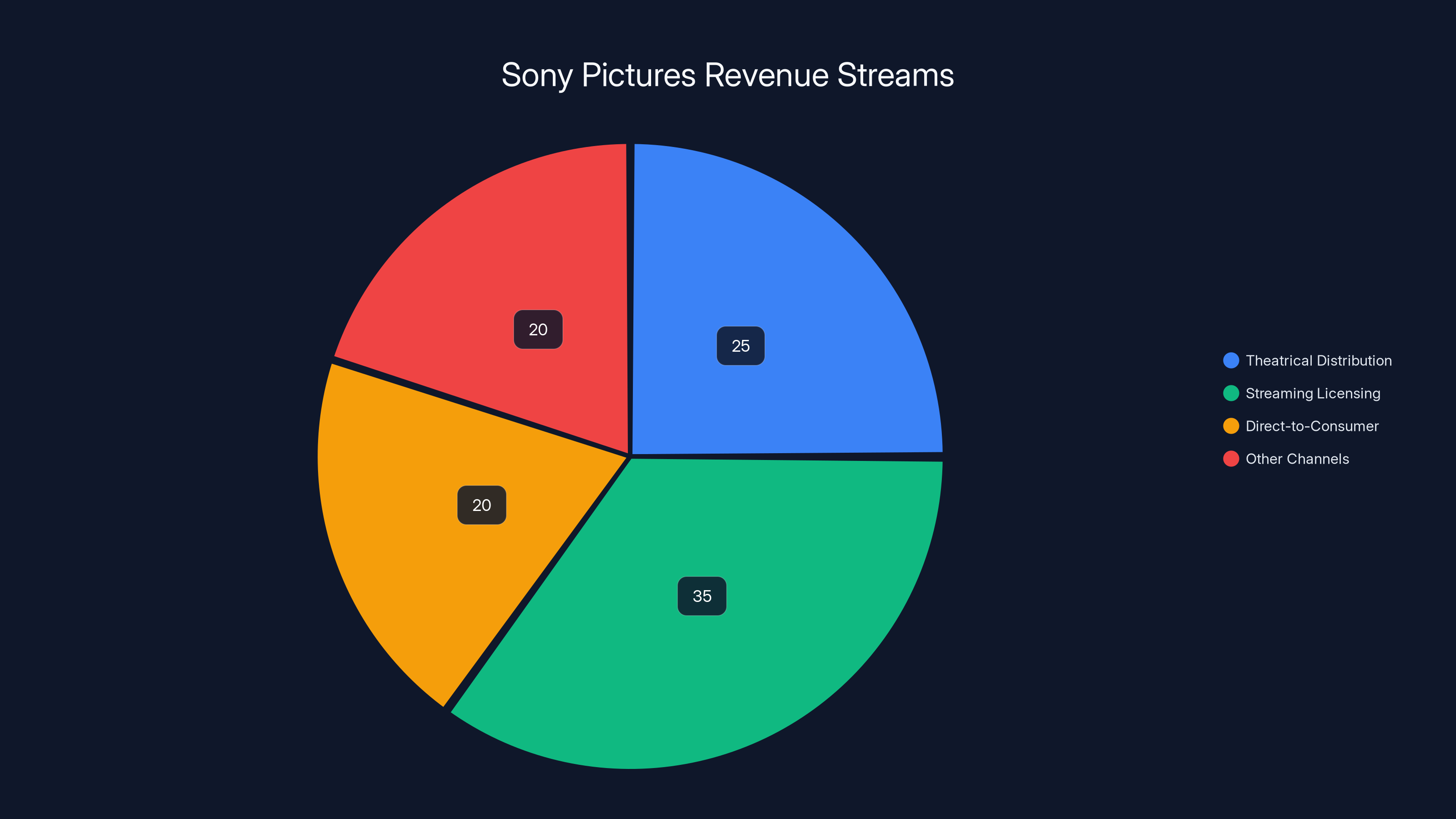

Sony Pictures is owned by Sony, a Japanese conglomerate with interests in electronics, music, gaming, and entertainment. Sony Pictures itself generates revenue through theatrical distribution, streaming licensing, and now increasingly through direct-to-consumer channels.

But here's the reality Sony faces: theatrical distribution is declining. Global box office revenues have been flat-to-down for a decade when adjusted for inflation. Production costs keep rising. International distribution complexity keeps growing. Streaming licensing provides reliable, upfront revenue.

A

There's also a strategic element. If Sony didn't do this deal with Netflix, Netflix would invest more heavily in original films and acquisition of competing studio content. By doing the deal, Sony ensures its theatrical releases get preferential streaming treatment and prevents Netflix from becoming a competitor acquisition threat.

Additionally, Sony Pictures likely negotiated clauses protecting other revenue streams. Premium VOD sales are likely excluded from this deal (you can still rent new Sony films for $20 on other platforms). Theatrical windows are likely protected. Physical media sales and other distribution channels probably have carve-outs.

The deal isn't Sony abandoning theatrical release. It's Sony acknowledging that streaming is now the primary second-window revenue source and ensuring it captures that revenue in a structured way.

Implications for Competitors: The Streaming Wars Heat Up

If you subscribe to Disney+, Amazon Prime, or Apple TV+, you should be paying attention to what this means.

Netflix just secured exclusive first-look rights to one of the six major studios. That's about 20% of major theatrical film output going to Netflix first. Add in the Universal deal, and Netflix is capturing roughly 30-35% of major studio releases on an exclusive-first basis.

Disney+ has an advantage: it owns Disney, Pixar, Marvel, and Star Wars. But Disney's theatrical output is smaller than Sony's or Warner Bros.'

Amazon Prime has the most chaotic content library: some exclusives, some shared window timing, some acquisition-driven content. It lacks the systemic first-look deals that Netflix has built.

Apple TV+ has prestige content and some exclusive films, but minimal theatrical blockbuster rights. It's positioned as a premium original channel, not a primary theatrical-to-streaming pipeline.

HBO Max has Warner Bros. theatrical content naturally, but Warner Bros. is also exploring other distribution models.

The practical implication: if you want to see new major studio films on Day One of their streaming availability, Netflix is becoming essential. That's a powerful competitive advantage.

Competitors will respond. We might see Amazon negotiate more exclusive theater-to-streaming partnerships. Disney might accelerate Star Wars and Marvel release schedules to competitive timelines. Apple might increase Apple TV+ spend to fund more exclusive films.

But the immediate winner is Netflix. The company just cemented itself as the first stop for major films from Sony (and similar arrangements with Universal).

The $7 Billion Question: Is It Worth It?

Let's apply some financial scrutiny.

Netflix's global annual revenue is roughly

For this to make sense, Netflix needs to capture enough subscriber value to recoup the investment within a reasonable timeframe. Industry models typically value subscriber-year at $100-200 depending on geography and tier.

Here's a basic calculation: if the deal costs

But the real value isn't just the direct film-watching revenue. It's the subscriber retention value. How many people keep Netflix specifically because new major films premiere there first? How many people upgrade from Basic to Premium specifically to watch films in 4K? How many people international markets subscribe specifically because they have early access to major releases?

If the deal prevents churn and drives upgrades worth $100-200 million annually beyond direct viewing revenue, it's highly profitable.

The counterargument:

But Netflix's analysis clearly suggests the strategic value of exclusive theatrical partnerships exceeds the opportunity cost. The company is prioritizing streaming supremacy over capital flexibility.

Streaming licensing is a significant revenue source for Sony Pictures, highlighting its strategic importance. (Estimated data)

How This Affects the Movie Theater Industry

There's a real question about whether exclusive early streaming windows hurt theatrical exhibition.

The traditional window system existed to protect theater revenues. If films went to streaming immediately, why would audiences pay for theatrical releases? But the evolution of streaming has created a new equilibrium.

Theaters aren't dying. They're consolidating and specializing. IMAX, premium large format, and luxury theater chains are thriving because they offer experiences you can't replicate at home. Standard multiplexes are struggling.

The Sony-Netflix deal doesn't change theatrical windows significantly. Films still get 45-90 days of theatrical exclusivity. The streaming Pay-1 window still starts after that theatrical revenue is maximized.

What it does change is making Netflix the obvious second choice for consumers. If a film doesn't get theatrical release or you miss the theatrical window, Netflix is where you go.

For independent theaters and smaller multiplex chains, this is challenging. For premium experience theaters (IMAX, luxury recliners, premium snacks), it's less impactful.

The net effect: this deal probably accelerates the consolidation trend where big franchises play exclusively in premium format theaters while mid-budget and smaller releases go more directly to streaming.

The Content Creation Timeline: When You'll Actually See These Releases

Here's the practical question: when does this content actually arrive?

The back catalog content starts arriving gradually in 2025, with full availability by 2029. That's a 4-year rollout, which seems intentionally slow. Netflix doesn't want to dump 2,000 titles simultaneously. It wants staggered discoveries.

New releases start rolling out as Sony theatrical releases hit streaming windows. A Sony film released in theaters in Q1 2025 would hit Netflix in Q2-Q3 2025, depending on VOD window length.

The Legend of Zelda movie and Beatles biopics don't have confirmed release dates, but industry speculation puts them somewhere in 2026-2027. The Zelda movie has been in development for several years, so production is likely underway or nearing completion. Netflix films typically get 1-2 year production timelines for live-action projects.

This means for most people watching this deal, the immediate impact is minimal. The concrete benefits arrive over 12-24 months, with full library depth hitting by 2029.

Runable and the Content Creation World

While we're discussing how Netflix and Sony are reshaping entertainment distribution, it's worth noting that content creation itself has become increasingly accessible to individuals and small teams. Platforms like Runable enable creators to generate professional-quality presentations, documents, and multimedia content at scale, which is relevant as Netflix itself invests in more original content. The democratization of content creation tools means that while major studios like Sony control theatrical releases, independent creators have more tools than ever to build competing content. That said, Netflix's studio partnerships remain unmatched for blockbuster content access.

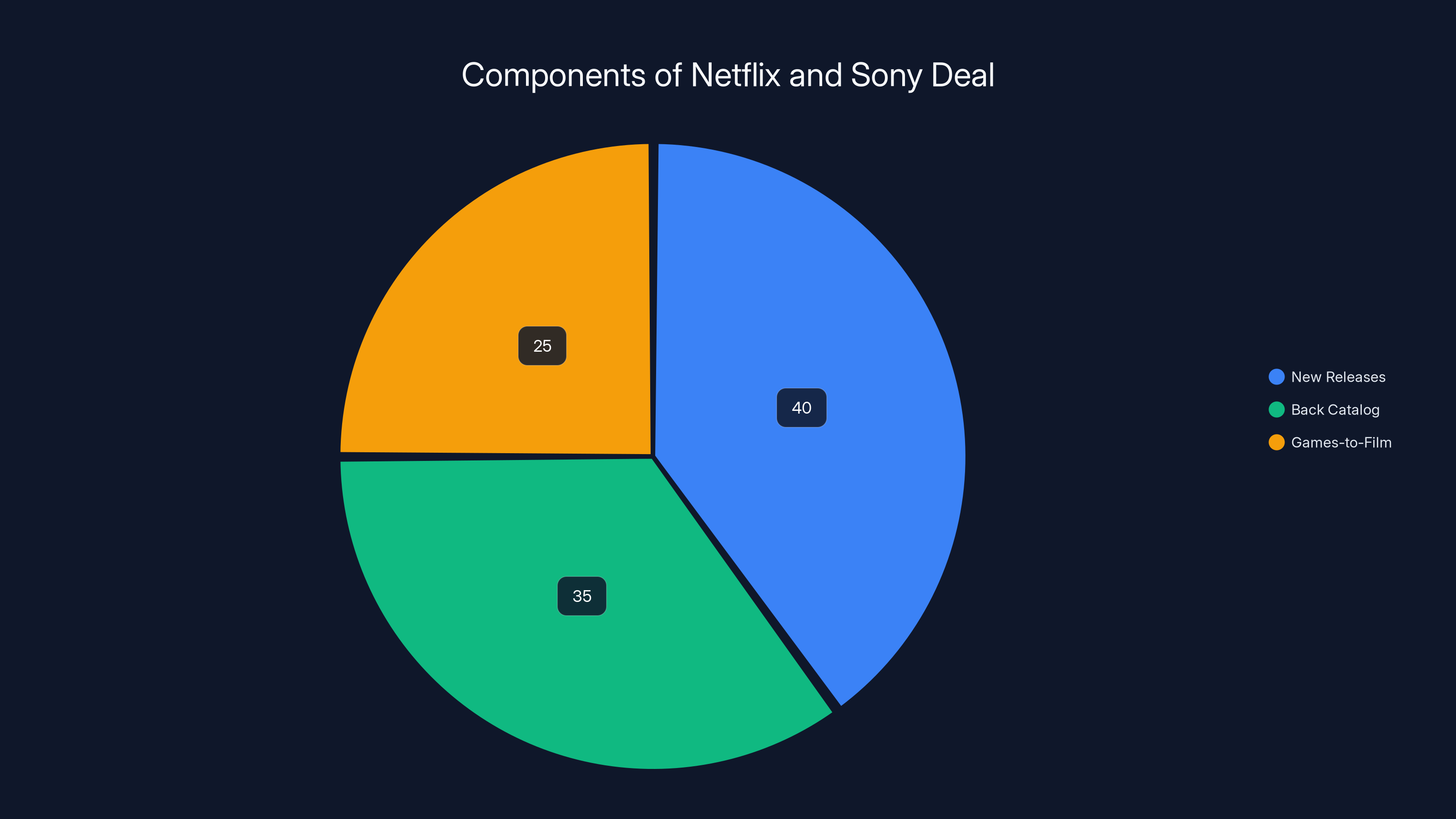

The Netflix-Sony deal includes new releases (40%), back catalog content (35%), and games-to-film adaptations (25%). Estimated data based on content description.

What This Means for Netflix Subscribers

If you already subscribe to Netflix, this is mostly good news with minimal downside.

You get earlier access to major Sony theatrical releases. You get a deeper back catalog as Sony content rolls out. You get exclusive first-window access to cultural events like the Zelda movie and Beatles biopics.

The price might increase. Netflix has been steadily raising prices, and major content investments typically precede price increases as the company needs to fund them. But that's speculative.

The real change is behavioral. You'll probably spend more time browsing Netflix's expanded library. You'll encounter more serendipitous film discoveries as the back catalog arrives. You might upgrade your plan tier to watch films in 4K or with better audio quality.

If you don't subscribe to Netflix, this deal represents a meaningful reason to consider it. The combination of Netflix originals plus exclusive first-window access to Sony theatrical releases is a compelling value proposition.

If you subscribe to other streaming services but not Netflix, you're now potentially missing cultural moments. When the Zelda movie drops, that's going to be water-cooler conversation. Missing it because you don't subscribe to Netflix means cultural dissonance.

The Broader Shift: From Windowing to Dominance

Let's zoom out and see the bigger pattern.

For decades, theatrical distribution was the primary release format. Streaming was a secondary window, sometimes delayed significantly (12-18 months after theatrical).

Netflix fundamentally changed that by building platforms where theatrical and streaming became simultaneous or nearly simultaneous. The pandemic accelerated that shift. Consumer behavior changed faster than the industry expected.

Now we're in a new era where major studios are actually paying streaming platforms to be the preferred secondary window. That's not streaming as an afterthought. That's streaming as the commercial priority.

The Sony deal is part of that larger transformation. Netflix isn't buying exclusivity as a luxury add-on. It's buying exclusivity as the primary distribution strategy.

This has implications for theatrical exhibition, for how films are marketed, for how streaming becomes the default expectation rather than the compromise choice when you can't see something in theaters.

International Expansion and Global Content Strategy

One often-overlooked aspect of this deal is its global scope.

Netflix specified that the Sony deal includes worldwide streaming rights. That means someone in India gets the same Pay-1 window access as someone in the United States. Someone in Brazil sees the Zelda movie premiere on Netflix first. Someone in South Korea gets early Beatles biopics access.

That's different from how studios traditionally operated. International releases were often staggered. A film might hit Netflix in the U.S. months before hitting international platforms. This deal appears to consolidate that into simultaneous worldwide availability.

For Netflix's international subscriber base (which now exceeds U.S. subscribers), this is significant. International subscribers have historically felt like second-class citizens, getting content after U.S. releases or missing exclusive content entirely. This deal suggests Netflix is prioritizing simultaneous global releases.

This also matters for Sony's international theatrical partners. Distributors in various countries have traditionally had negotiating power over windowing. A worldwide exclusive deal with Netflix reduces that local negotiating leverage. That's probably why Sony structured it as worldwide rather than regional.

The practical effect: if you watch Netflix internationally, your experience is improving dramatically. You're no longer watching delayed content. You're getting simultaneous access to major releases.

The Streaming Wars Arms Race Continues

This deal is part of a broader arms race where streaming platforms are spending increasingly large sums to lock in content exclusivity.

Amazon is doing similar negotiations. Apple is investing heavily in exclusive content. Even smaller services like Peacock are attempting exclusive partnerships.

The question is whether this is sustainable. Can streaming platforms keep increasing spending on exclusive content partnerships without hitting financial limits?

Netflix's answer appears to be yes, at least for now. The company is profitable and generating strong cash flow, which gives it leverage to make large capital commitments.

But eventually, equilibrium arrives. At some point, paying $7 billion for exclusive Sony rights produces diminishing returns. At some point, subscribers have chosen their platforms and windowing no longer drives switching.

We're probably not at that point yet. The streaming wars are still in the investment phase where platforms are building moats through exclusive content. But this might be closer to the peak of deal-making spending than we realize.

What Happens Next: Looking Ahead to 2026 and Beyond

Based on this deal and Netflix's broader strategy, here's what I'd expect:

Short term (2025-2026): Back catalog content steadily arrives on Netflix. First Sony releases hit the platform through the new Pay-1 window. Zelda movie and Beatles biopics enter production final phases with Netflix-linked marketing.

Medium term (2026-2027): Major gaming franchise films premier on Netflix (Zelda becomes a tentpole event). Beatles content arrives simultaneously across multiple films. Netflix potentially negotiates similar deals with other studios seeing Sony's success.

Long term (2028-2029): Full Sony back catalog is integrated into Netflix. The deal either renews or expires, depending on success metrics. Competitors either match Netflix's exclusive partnerships or differentiate through original content.

The larger question: does Netflix's dominance in exclusive partnerships sustain competitive advantage? Or does the industry shift to a model where platforms share content across windows again?

My read: Netflix has temporarily locked in significant competitive advantage through these partnerships. For the next 3-5 years, Netflix is the primary platform for major theatrical releases. After that, competitive pressure and consumer preferences may force different windowing models.

Conclusion: Why You Should Care About This Deal

Understanding the Netflix-Sony deal matters because it shapes what you watch and where you watch it.

On the surface, it's a business transaction. Netflix pays Sony $7 billion, gets exclusive streaming rights, everybody makes money.

But beneath that surface, it's a fundamental shift in how entertainment works. Theatrical releases are no longer the primary revenue stream. Streaming is. Studios are now competing to get their content on the most popular streaming platforms in the most prominent windows. Netflix has positioned itself to win that competition.

For consumers, that means: Netflix is becoming increasingly essential if you want to watch major theatrical films without waiting. The platform is expanding its library simultaneously with exclusive access to new releases. The experience gap between Netflix and competitors is widening.

For the entertainment industry, it means: studio negotiating power is shifting. Netflix isn't just buying content; it's reshaping how content gets distributed. The traditional windowing system is evolving toward streaming-first models.

For culture more broadly, it means: when the Legend of Zelda movie becomes a cultural phenomenon (and if it's successful, it will), that conversation happens on Netflix. When Beatles biopics premiere, that premiere happens on Netflix. Netflix isn't just distributing content anymore; it's shaping culture.

Is the $7 billion worth it? Ask yourself this: would you drop your other streaming services and keep only Netflix if it had exclusive first access to all major films plus a deep library? For many people, the answer is yes. That's what Netflix is buying.

FAQ

What exactly did Netflix and Sony agree to in this deal?

Netflix acquired exclusive worldwide "Pay-1" streaming rights to all new Sony Pictures theatrical releases, meaning Netflix gets first access to stream these films after their theatrical and Video on Demand windows end. Additionally, Netflix licensed an undisclosed number of films and television shows from Sony's back catalog, which will roll out gradually through 2029. The deal is worth $7 billion and includes exclusive streaming rights to major projects like the live-action Legend of Zelda movie and four Beatles biopics.

When will the Legend of Zelda movie and Beatles biopics actually arrive on Netflix?

Neither Netflix nor Sony has announced official release dates, but industry analysis suggests the Zelda movie and Beatles biopics are in active production and likely to premiere in 2026-2027. The back catalog content begins arriving in 2025 with gradual rollout through 2029. The exact timing depends on production schedules and Netflix's content calendar strategy.

What is "Pay-1" and why does it matter?

"Pay-1" refers to the first subscription streaming window after theatrical and rental (VOD) releases. It's the most valuable streaming window because audiences are most eager to watch content at that point, and word-of-mouth is strongest. Netflix securing exclusive Pay-1 rights means it's the first and only streaming platform where new Sony theatrical releases appear, creating significant competitive advantage and subscriber draw.

How does this deal compare to Netflix's arrangement with Universal Pictures?

Netflix has a similar multi-year agreement with Universal Pictures giving it exclusive first-streaming access to Universal theatrical releases. The Sony deal is larger in financial scope ($7 billion versus reported smaller figures for Universal) and explicitly includes worldwide rights from inception. Both deals represent Netflix systematically locking in exclusive partnerships with major studios to prevent competitors from accessing the same content.

How much does this deal affect theatrical movie releases and cinema going?

This deal doesn't significantly change theatrical windows. Films still get 45-90 days of exclusive theatrical availability before moving to premium VOD, then to Netflix. What changes is that Netflix becomes the obvious streaming choice post-theatrical release. For premium format theaters (IMAX, luxury chains), this is minimally impactful. For standard multiplexes, it accelerates the trend toward consolidation around prestige content and franchise releases.

Why would Sony agree to exclusivity with Netflix when it could license to multiple streaming platforms?

Sony agreed because the $7 billion upfront payment provides guaranteed, immediate revenue without depending on theatrical success. This is particularly valuable given declining theatrical revenues and rising production costs. The deal also prevents Netflix from becoming a competitor acquisition threat in the prestige film space. Additionally, Sony likely negotiated carve-outs protecting premium VOD sales, theatrical windows, physical media, and other distribution channels.

Will this deal cause Netflix prices to increase?

Netflix has been steadily raising prices for years, and major content investments typically precede price increases as the company needs to fund them. While not confirmed, it's reasonable to expect potential price increases within 12-24 months as Netflix invests in this Sony deal and other premium content. However, Netflix could theoretically fund this through ad-supported tier expansion and premium tier upsells.

How does this deal affect other streaming services like Disney+, Amazon Prime, and Apple TV+?

This deal puts pressure on competitors by giving Netflix exclusive first-window access to roughly 20% of major theatrical output (Sony's share of major studio releases). Competitors may respond by negotiating similar exclusive deals with other studios, increasing original content budgets, or differentiating through unique content strategies. The deal strengthens Netflix's competitive moat and makes the platform more essential for mainstream audiences.

What happens when this multi-year agreement expires?

Netflix and Sony haven't disclosed the exact term length, but typical studio deals run 5-7 years. When it expires, Sony could renegotiate with Netflix on new terms, shop for higher bids from competitors, or develop its own streaming platform. The success of this current deal's content (particularly the Zelda movie) will significantly influence whether Sony wants to renew or explore other options.

How does this affect international Netflix subscribers differently than US subscribers?

The deal explicitly includes worldwide rights from inception, meaning international subscribers get simultaneous access to new Sony releases as US subscribers. This is a significant improvement over historical patterns where international releases were staggered. Subscribers in major markets like the UK, Germany, India, Brazil, and South Korea will see identical Pay-1 window access as US subscribers, eliminating the "second-class citizen" experience many international subscribers previously faced.

Key Takeaways

- Netflix paid $7 billion for exclusive worldwide streaming rights to Sony Pictures films, starting with 'Pay-1' availability after theatrical releases

- The Legend of Zelda live-action movie and four Beatles biopics will premiere on Netflix first, making them exclusive streaming events

- Netflix is building systematic exclusive partnerships with major studios, giving it significant competitive advantage over rivals like Disney+, Amazon Prime, and Apple TV+

- Sony's back catalog will roll out gradually through 2029, providing three years of staggered library expansion and multiple reasons for audience to explore Netflix

- This deal represents the ongoing transformation of streaming from a secondary window to the primary distribution strategy for major theatrical releases

Related Articles

- Why Stranger Things Finale in Theaters Proved Streaming's Missing Piece [2025]

- Netflix's Video Podcast Strategy: Challenging YouTube With Original Shows [2025]

- Netflix's Video Podcast Bet: Pete Davidson and Michael Irvin [2025]

- Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]

- Paramount Skydance's Lawsuit Against Warner Bros. Discovery [2025]

- The Complete History of TiVo: How It Changed TV Forever [2025]

![Netflix's Sony Deal: Zelda Movie, $7B Investment & Global Streaming Rights [2025]](https://tryrunable.com/blog/netflix-s-sony-deal-zelda-movie-7b-investment-global-streami/image-1-1768511307374.jpg)