Netflix's Video Podcast Strategy: Challenging YouTube With Original Shows [2025]

Netflix just made a bold move into the podcast space that most people aren't paying attention to yet. But they should be.

The streaming giant announced two major original video podcast launches featuring A-list talent: Pete Davidson's candid garage conversation show and Michael Irvin's sports analysis platform. These aren't side projects or experimental content. They're Netflix's opening salvo in what's shaping up to be a massive battle for podcast dominance, as detailed in The Verge.

Here's why this matters. YouTube has dominated the long-form video space for years, but podcasts have remained fragmented across a dozen platforms. Spotify spent billions acquiring podcasts and platforms. Amazon integrated podcasting into Music. YouTube itself has become the de facto home for podcast-watching, with viewers consuming over 700 million hours of podcast content monthly on living room devices alone in 2025, according to YouTube's blog.

Netflix is looking at that number and thinking: "Why aren't we getting a piece of that?"

The answer isn't simple. Netflix built its empire on scripted originals, reality shows, and licensed films. Podcasting requires a different playbook entirely. You need content creators who don't think like Hollywood producers. You need distribution mechanics that work across apps, not just on your platform. You need the kind of intimate, unscripted energy that comes from creators who've built audiences in other places.

But Netflix has advantages YouTube and Spotify don't. They have a massive subscriber base with a proven payment system. They have the production infrastructure to polish video content at scale. And crucially, they have the cash to sign big-name talent.

What's happening right now is the beginning of a fundamental shift in how media companies think about podcasting. It's no longer a side channel or a way to keep audiences engaged between shows. It's becoming a primary content category with serious investment, exclusive deals, and strategic importance, as noted by Variety.

This deep dive explores what Netflix is actually doing, why they're doing it, and what it means for the entire podcast ecosystem. We'll look at the specific shows they're launching, the competitive landscape they're entering, how their strategy compares to Spotify and YouTube, and what creators need to understand about this new era of podcasting.

TL; DR

- Netflix is entering podcasting aggressively with original shows from Pete Davidson and Michael Irvin launching in January 2026, signaling a major strategic pivot

- The podcast market is massive and fragmented with 700 million+ monthly hours consumed on living room devices alone, but YouTube currently dominates video podcasting

- Licensing deals are critical to Netflix's strategy, with exclusive content from iHeartMedia, Spotify, and Barstool Sports giving them immediate scale, as reported by Content Grip

- Video-first is Netflix's advantage over pure audio platforms like Spotify, but it requires different creator relationships and distribution mechanics

- This is just the beginning of a multi-year content offensive that will reshape how creators think about exclusive deals and platform loyalty

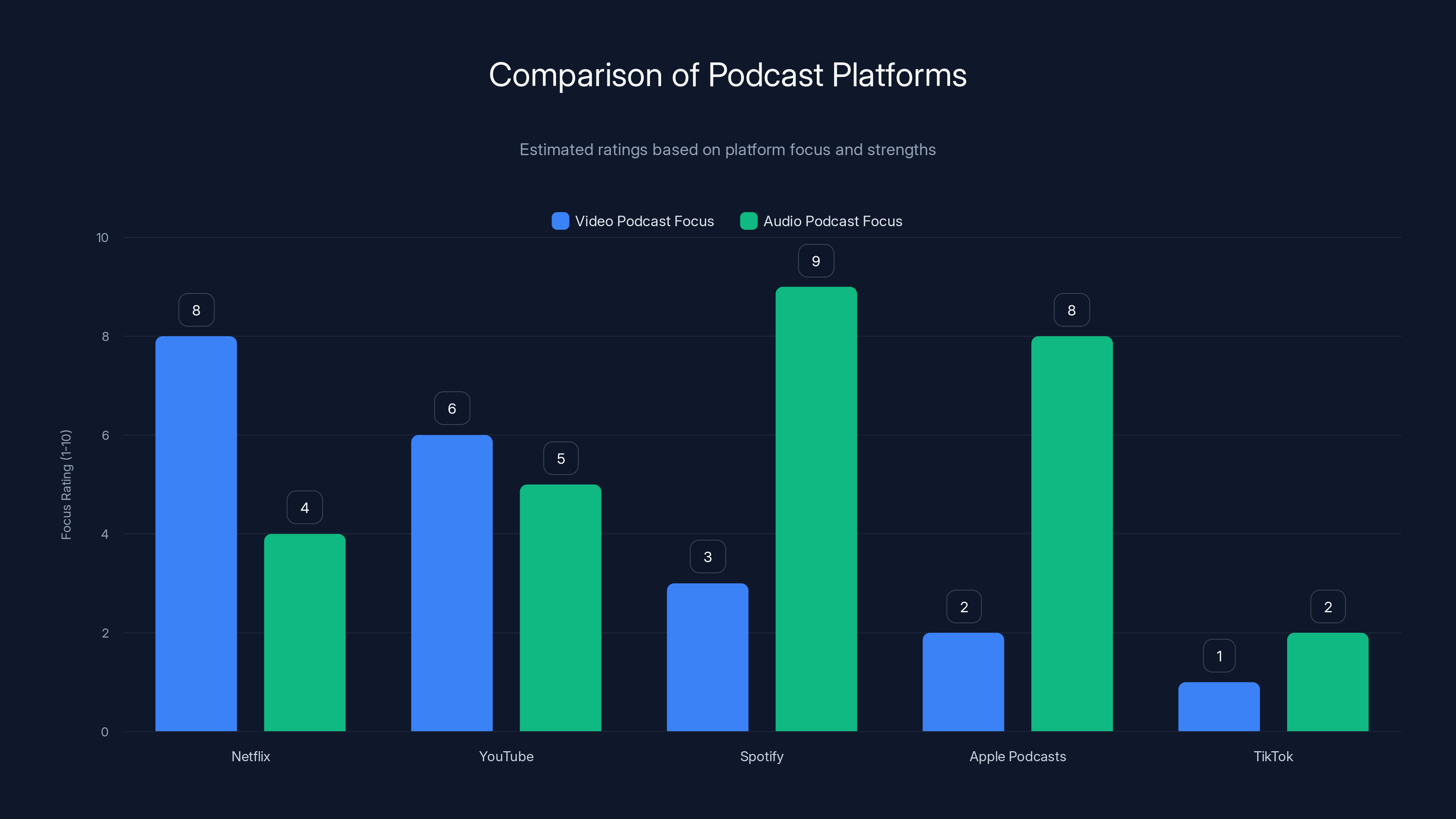

Netflix is positioning itself as a leader in video podcasting with a focus on high-quality content, while Spotify remains dominant in audio podcasting. (Estimated data)

Understanding Netflix's Podcast Pivot

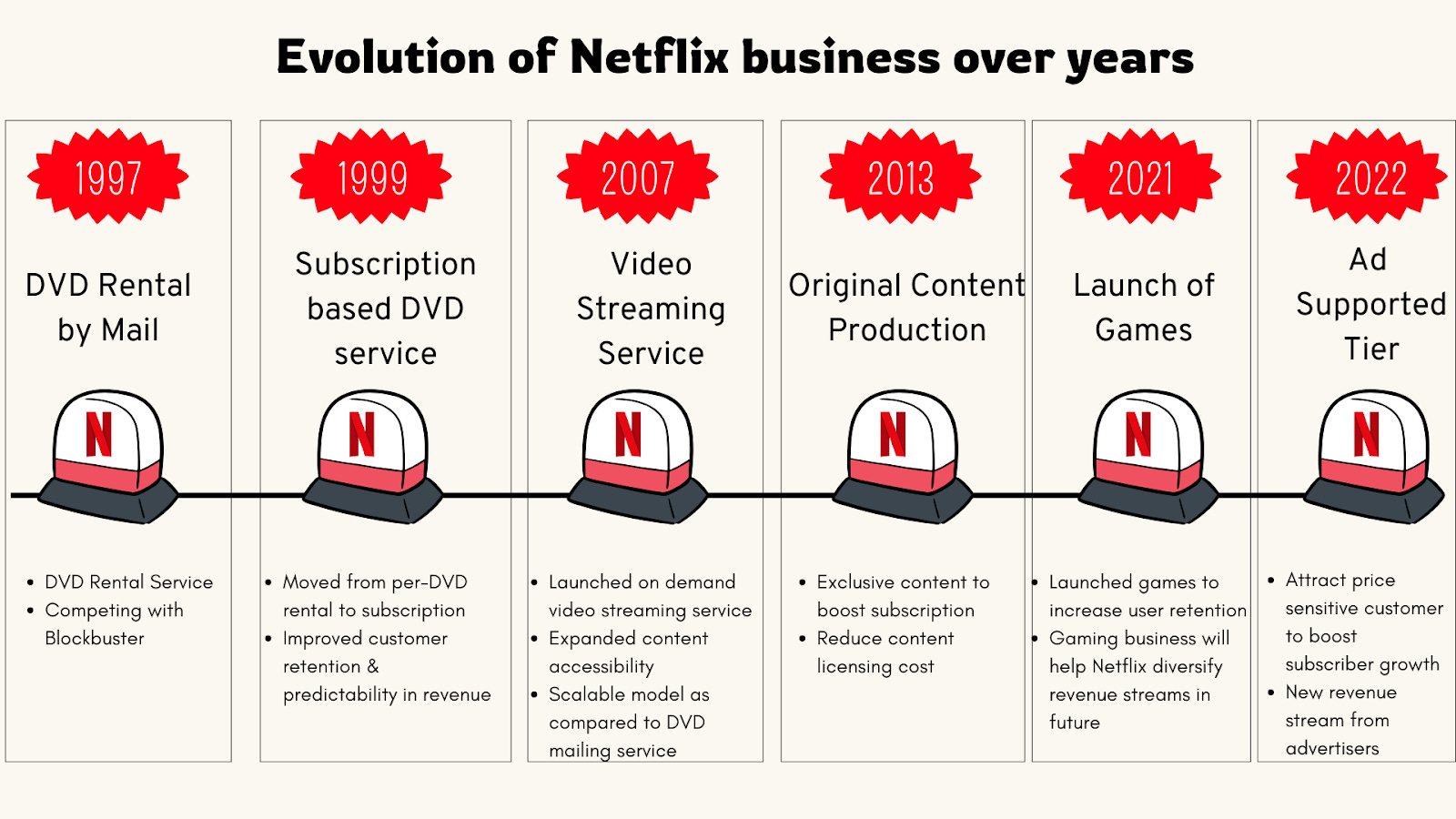

Netflix didn't wake up one morning and decide podcasts were trendy. This strategy emerged from cold, hard data.

When you look at how people consume content, audio and video have become increasingly blended. A creator might start with an audio podcast, build an audience of hundreds of thousands of listeners, then realize that 40% of their audience is watching on YouTube anyway. The audio gets uploaded separately, sometimes days later, sometimes as a direct feed.

Netflix recognized a gap: there's no premium platform that treats video podcasts as a primary content category with the same investment and prominence as their scripted series. YouTube hosts everything, but YouTube's algorithm favors short-form content now. Spotify dominates audio, but video is an afterthought. Apple Podcasts is a directory, not a creator platform. TikTok is for clips, not full-length conversations.

So Netflix stepped in. The company recognized that their existing infrastructure gives them a unique advantage. They already have the video encoding technology. They have the global CDN that can deliver high-quality streams to 100+ countries simultaneously. They have a payment system and a subscriber relationship with hundreds of millions of people.

But here's the crucial part: Netflix isn't trying to replicate what Spotify did. Spotify spent $1B+ acquiring podcasting companies like Gimlet Media and Anchor, then built out a creator-first ecosystem. That made sense for audio, where production barriers are low and creator diversity is the competitive advantage.

Netflix is taking a different approach. They're treating podcasting like Hollywood treats television: invest in major talent, secure exclusive content, build prestige through association with famous creators, and use that as a draw to keep subscribers engaged, as discussed in Puck News.

This is actually smarter than it first appears. Netflix already knows how to market talent. They've spent years building the machinery to promote creators and shows globally. Turning that machinery toward podcasting means they start with an advantage that pure podcast platforms don't have.

The Pete Davidson Show: Casual Stardom as Content Strategy

Pete Davidson's show is brilliant from a strategic perspective, even if you don't care about Pete Davidson specifically.

The premise is intentionally low-stakes: Davidson sits in his garage, talks to friends, and lets the camera roll. Every Friday. No script. No theme. Just conversation with people like Travis Barker, Machine Gun Kelly, and whoever else shows up.

This is exactly the kind of content that YouTube recommends heavily but Spotify can't really monetize at scale. It's video-dependent. The chemistry between the hosts matters. You want to see the expressions, the body language, the moment someone laughs hard enough to lose it.

But here's the strategic brilliance: Pete Davidson is a household name. For anyone who knows who he is, the show is automatically positioned as "access to Pete Davidson's actual friends and life." That's a powerful draw. It's not a podcast about comedy or entertainment industry news. It's "what does Pete Davidson actually do when he's not performing."

That positioning solves Netflix's biggest challenge: why would someone with a Netflix account actually choose to watch a podcast on Netflix instead of watching it on YouTube where it might be free?

The answer: exclusivity and presence. If the show only exists on Netflix, and Netflix makes it easy to access (which they do), then that's where the audience goes.

From a production perspective, the show is smart because it's cheap to make. Davidson doesn't need writers. He doesn't need a studio. The garage is the set. The production team is probably small. Netflix can produce 50 episodes of this for the cost of producing one prestige drama series.

That economics also means Netflix can afford to take more creative risks. If an episode doesn't perform well, it doesn't matter that much. They're making enough content that the hits vastly outweigh the misses.

The real test will be consistency. Will Davidson actually produce 52 episodes a year? Or will the schedule slip the way most podcasts do? Netflix probably has contractual guarantees around this, but maintaining frequency is one of the hardest parts of podcasting, especially for celebrities with busy schedules.

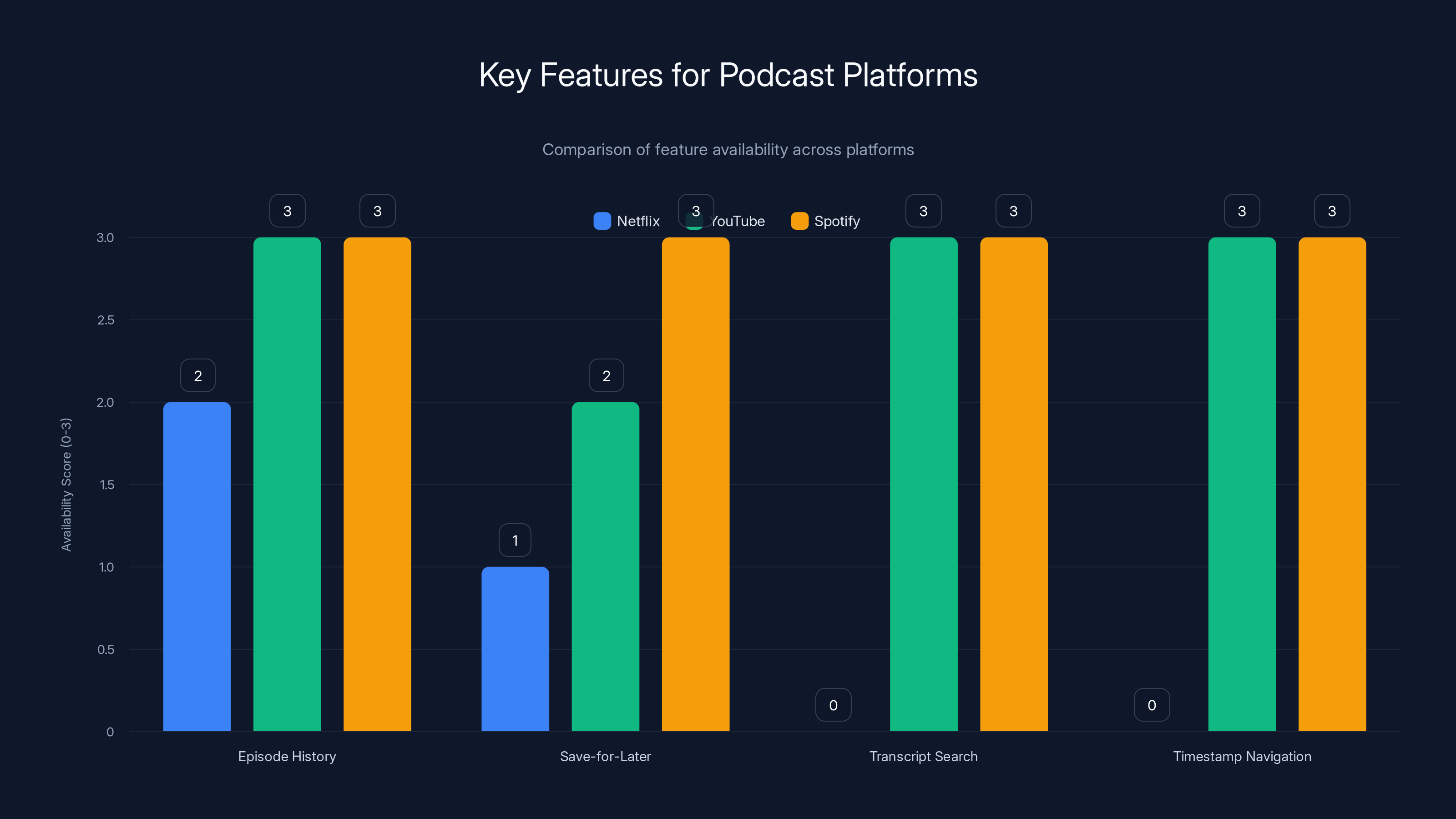

Spotify leads with comprehensive podcast features, while Netflix needs to enhance its platform to match competitors. Estimated data based on feature presence.

Michael Irvin's Sports Podcast: Expertise as Differentiation

Michael Irvin's "The White House" takes a completely different approach, and that's intentional.

Irvin is a Hall-of-Famer. He's one of the few people in the world who actually knows professional football from the inside at the highest level. When he talks about football strategy, evaluation, and the NFL, he's speaking from lived experience and decades of analysis.

This is positioning that Spotify can't really replicate, because it's not about discovery or algorithmic reach. It's about expertise and credibility. If you want deep football analysis from someone who played at the highest level, you go to Irvin. Not because a playlist recommended him, but because you specifically want his perspective.

The format is also different from Davidson's show. This is structured content. Twice weekly. In-depth analysis. Guest co-hosts like Brandon Marshall, another Hall-of-Famer and former NFL All-Pro. Production value matters here in a different way. You're getting a sports show, not a casual conversation.

Netflix's strategy here is to become a destination for expertise-driven content. They're not competing with YouTube for random clips or casual discovery. They're competing with ESPN and The Athletic for serious sports analysis.

That's actually a smarter competitive angle. ESPN's video offerings are fragmented between the main network, ESPN+, and various platforms. The Athletic is pure written content and podcasts. Neither has a unified, premium video platform where a sports fan can go to find analysis from people they trust.

Netflix potentially fills that gap. And since they own both the distribution and the production, they can bundle. Watch the Irvin analysis, see clips from the games, read breakdowns from other contributors.

The Brandon Marshall co-hosting arrangement is also telling. Marshall has his own podcast presence ("The Brandon Marshall Podcast"). Bringing him into Irvin's show as a co-host suggests Netflix is thinking about a network strategy, not just individual shows. Get the top voices in sports talking to each other on Netflix, and suddenly Netflix becomes a sports platform.

That's a long-term play. Irvin's show is the opening move.

The Licensing Strategy: Building Content Velocity

Original content is important, but Netflix's real strategy is about licensing. They announced partnerships with iHeartMedia, Spotify, and Barstool Sports to bring shows like "Dear Chelsea" and "My Favorite Murder" to Netflix, as noted in Awful Announcing.

This is the smart move that most people are missing.

Building a podcast audience from scratch takes years. Spotify realized this and just bought their way in with massive acquisition spending. Netflix is taking a hybrid approach: license proven, popular shows from other platforms while simultaneously investing in originals.

This gives them immediate scale and diversity. Instead of Netflix needing to wait two years for Irvin's show to build audience momentum, they can say "we have 300+ hours of premium podcast content available now" because they've licensed existing shows.

The Spotify licensing deal is particularly interesting. Spotify is now willing to license their content to competitors, which suggests confidence that they have enough subscriber value that losing the exclusive distribution of certain shows doesn't hurt their business. Or, more likely, the licensing deals are lucrative enough that Spotify is happy to take the cash while Netflix drives awareness that benefits everyone in the ecosystem.

From Netflix's perspective, these licensing deals solve multiple problems simultaneously:

Immediate catalog building without massive investment in original production.

Audience retention by giving subscribers more reasons to stay (and more content to discover).

Distribution advantages for creators, since Netflix's global reach and marketing can introduce these shows to audiences that might never have found them on the original platform.

Production learning as Netflix watches which shows resonate with their subscriber base and learns how to make better original decisions.

The licensing approach also suggests Netflix doesn't need podcasting to be a massive percentage of their business. They just need it to be a credible content category that adds value to the subscription. If podcasting becomes 5% of engagement but that 5% keeps 2% of subscribers from leaving, the ROI is enormous.

YouTube's Dominance: Why Netflix Needs to Act Now

YouTube is crushing the podcast space right now, and Netflix is watching them do it with a platform that wasn't designed for podcasts specifically.

YouTube's podcast dominance isn't because they built a podcast platform. It's because podcasting is just video content, and YouTube is the dominant video platform globally. Someone uploads a podcast, and YouTube's algorithm handles the rest.

But here's the thing: YouTube's algorithm isn't optimized for podcast discovery. It's optimized for watch time and engagement. This means a 3-hour conversation between Joe Rogan and some physicist gets recommended alongside 10-minute clips of cats doing funny things.

YouTube's podcast creators are constantly fighting the algorithm to get their long-form content recommended to the right audience. They learn hacks. They put clickbait titles and thumbnails on episodes. They add chapters and timestamps so the algorithm understands the content better.

All of this works, but it's suboptimal. The platform wasn't designed with podcasters in mind, so podcasters have to adapt their behavior to YouTube's incentive structure.

Netflix sees this and thinks: what if we build a platform that's actually designed for podcasts?

What if discovery was based on "which podcasts do you already listen to" instead of "which videos maximize watch time"? What if episodes were presented chronologically, with the most recent first, instead of sorted by estimated engagement?

What if Netflix could guarantee that if you subscribe and someone recommends a podcast to you, you can actually find it instantly instead of scrolling through "recommended for you" which includes content you don't want?

These seem like small differences, but they compound. Podcast audiences are loyal. They're willing to pay. They engage across multiple episodes. The metrics are different from general video content.

YouTube dominates because of distribution, not because their platform is best. Netflix could theoretically dominate by actually optimizing for the podcast experience.

But that requires patience. YouTube's dominance took a decade to build. Netflix is starting from zero in podcasting. The question is whether their existing subscriber base and distribution advantages can compress that timeline.

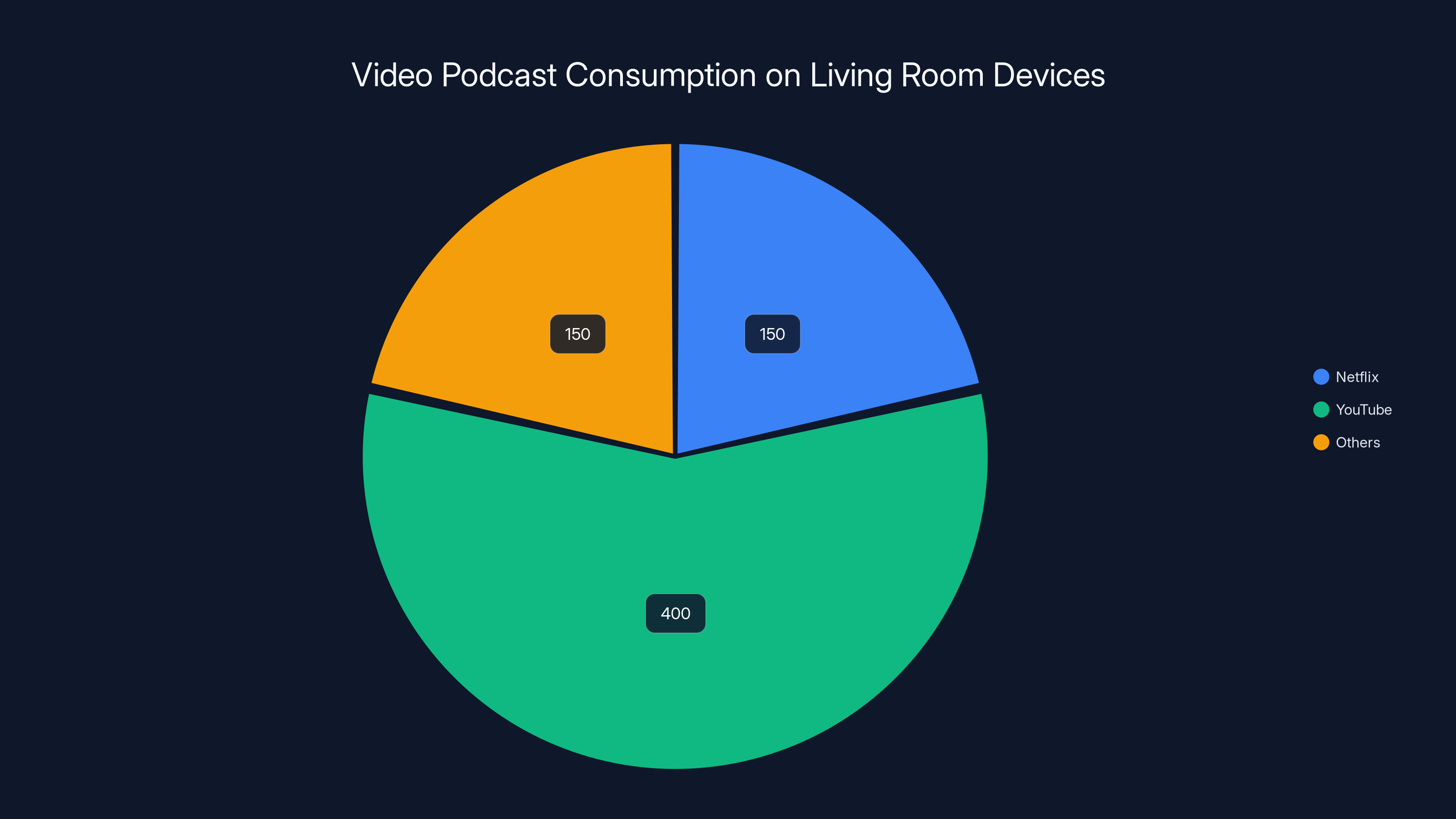

In 2025, YouTube dominated video podcast consumption on living room devices with 400 million hours, while Netflix aimed to capture a significant share with 150 million hours. Estimated data.

Spotify's Podcast Strategy: What Netflix Is Learning From

Spotify spent roughly $1 billion acquiring podcasts and podcast platforms, and the results have been... mixed.

On one hand, Spotify is now the home for serious podcast listeners. Their podcast catalog is unmatched. Their creator tools are sophisticated. Artists like Joe Rogan, Dax Shepard, and others signed exclusive deals, which generated headlines and brought attention.

On the other hand, that billion dollars didn't generate the ROI Spotify probably hoped for. Some of their exclusive deals became notorious for not paying out as promised. Creators got frustrated. Audiences sometimes pirated episodes rather than subscribing to Spotify's premium tier.

Netflix is learning from Spotify's experience. Instead of trying to own the entire podcast ecosystem, Netflix is taking a more selective approach:

Pick big names strategically rather than trying to sign every major creator.

Balance exclusivity with non-exclusive content to build catalog without over-investing.

Lean on video differentiation rather than trying to compete with Spotify's audio quality or podcast-specific features.

Bundle podcasts with existing entertainment content rather than trying to make podcasts a standalone product worth subscribing to.

This is smarter than Spotify's approach, honestly. Spotify bet that podcasts alone would drive subscription value. They were wrong. Most Spotify subscribers use the service primarily for music, with podcasts as a secondary feature.

Netflix is making no such bet. Podcasts are an additional feature for an already-strong entertainment platform. That removes the pressure for podcasts to justify their entire unit economics.

Spotify's other lesson: licensing matters. Spotify eventually realized that exclusive deals were less important than having a comprehensive catalog. By licensing broadly and building relationships with creators, they became the default platform for podcast listening, even if they didn't own every show.

Netflix is applying this lesson immediately. They're licensing content while building original offerings. This gives them the best of both worlds: content velocity (from licensing) and prestige (from originals).

The Competitive Landscape: Apple, Amazon, and YouTube

Netflix isn't just competing with Spotify and YouTube. They're entering a landscape where nearly every major tech company is trying to own the podcast experience.

Apple Podcasts is the largest podcast directory by submission numbers, but Apple has never invested in podcasts the way Spotify did. Apple Podcasts is a distribution mechanism, not a creator platform. Apple seems content to let podcasting be a free service that drives iPhone and Apple Watch usage, rather than a revenue driver.

Amazon Music quietly built podcast functionality and has been acquiring podcasting-adjacent companies. Amazon has the same advantages Netflix does: a massive subscriber base, global infrastructure, and existing payment relationships. But Amazon hasn't made podcasting a strategic priority the way Netflix is doing now.

YouTube continues to dominate because they don't need to do anything special. Podcasts are just video to YouTube. But Google is clearly thinking about podcasts more strategically. YouTube Music could theoretically become YouTube's answer to Spotify's podcast integration.

iHeartMedia and Barstool Sports are the creators Netflix is licensing from. These are platforms that built audiences but lacked global distribution. Netflix is giving them distribution; they're giving Netflix credible content.

The landscape is actually quite open. No single player has dominance the way Spotify does in audio or YouTube does in general video. This is Netflix's window of opportunity.

But here's the competitive reality: none of these companies is earning significant revenue from podcasting yet. They're all treating it as a platform feature or audience engagement tool. The economics of podcasting are still unclear.

Advertiser-supported podcasting works, but it requires scale and sophisticated ad targeting. Spotify has struggled with this. Premium podcasting (subscription-only) works for niche audiences but doesn't scale broadly.

Netflix's advantage is that they don't need podcasting to be profitable as a standalone business. They just need it to keep subscribers engaged. That removes the pressure to make aggressive monetization plays that might alienate audiences.

The Content Strategy: Thinking Like a Curator, Not a Platform

What Netflix is doing is fundamentally different from how they approach other content.

With scripted series and films, Netflix invests in production. They control creative decisions. They manage budgets. They own the content outright.

With podcasting, Netflix is starting with a mixed approach. Original content where they own the relationships (Davidson, Irvin). Licensed content where they acquire distribution rights (shows from Spotify, iHeartMedia).

This curation-focused approach is actually closer to how Apple TV+ operates than how Netflix traditionally built its library. They're being selective. They're thinking about editorial value, not just volume.

That's a fundamental shift in strategy. Netflix built scale by dumping thousands of hours of content into the platform. They could afford to do that because scripted content production is incredibly expensive, so limiting volume actually made sense economically. But podcasting has different economics. You can produce hundreds of hours of podcast content for the cost of producing a few episodes of a prestige drama.

Yet Netflix is choosing curation anyway. That suggests they've learned that volume alone doesn't drive engagement. Curation does. Discovery does. Trust does.

The question is whether they can sustain this approach long-term or whether they'll eventually fall back on the volume-focused strategy that built their streaming empire.

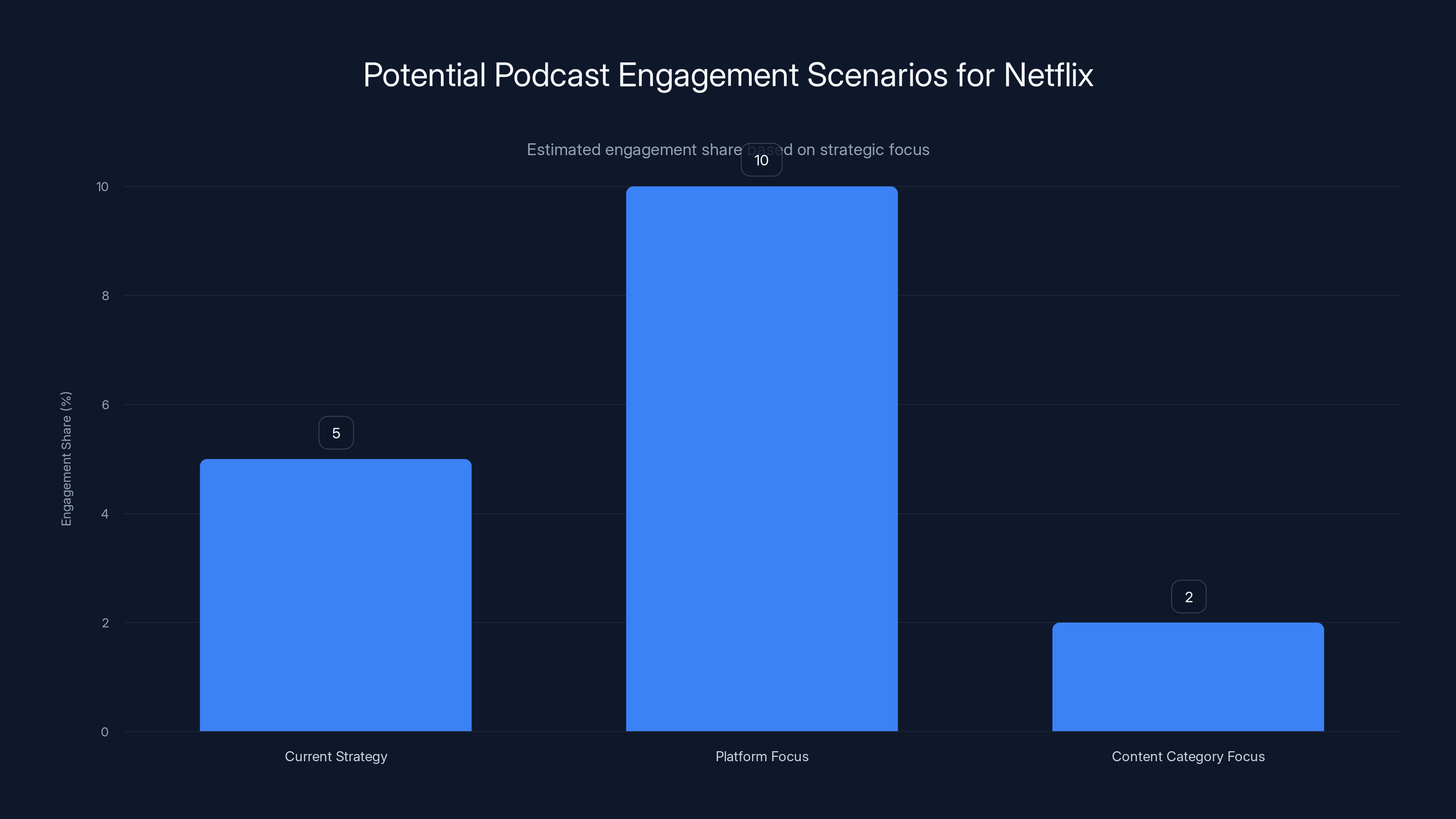

Estimated data suggests Netflix's current strategy could yield 5% podcast engagement, while a platform focus might increase it to 10%. A content category focus might see engagement at 2%.

The Production and Distribution Reality

From a practical perspective, Netflix's podcasting operation requires completely different infrastructure and workflows than their traditional content production.

With their scripted series, Netflix can measure success in binary terms: did people watch the full season? Did they subscribe because of this show? Will they renew their subscription?

With podcasts, the metrics are different. Podcasts are episodic but built for regular engagement. The success metric is consistency: does the audience come back every week?

That requires different content planning. Netflix usually produces content in seasons, with months of gap time between releases. Podcasts need to maintain momentum. If there's a 4-week gap between episodes, audiences drift.

Distribution is also fundamentally different. Netflix releases shows on specific days and times (usually Fridays or Wednesdays). Podcasts benefit from consistency too, but the real challenge is metadata, episode management, and subscription status.

When someone watches a Netflix show, they have a clear starting point (episode 1) and a clear progress metric (watch the series). Podcasts are different. A new listener might start with the most recent episode, or they might scroll back to episode 1, or they might discover an episode from 3 months ago that was recommended.

Netflix's experience managing episodes and continuity in their series actually translates well to podcasting. But they'll need to build new features: episode history, save-for-later, transcript search, timestamp navigation.

YouTube has some of these features already (timestamps are built into the platform). Spotify has deep podcast-specific UX. Netflix will need to rapidly build similar functionality if they want the podcast experience to feel native to their platform rather than bolted-on.

The production side is more straightforward. Davidson's show probably needs a small production team: maybe one producer to schedule guests, two camera operators, an audio engineer, and an editor. That's maybe

Irvin's show is more expensive but probably not dramatically so. Maybe

Compare that to a typical Netflix drama, which costs

That economics explains the strategic pivot. Why aren't they doing this already?

Creator Relationships: Building the Ecosystem

Netflix's biggest challenge isn't production or distribution. It's creator relationships.

Davidson and Irvin presumably signed multi-year deals with Netflix. These deals probably include guarantees: a certain number of episodes per year, production support, marketing support, revenue guarantees.

For emerging creators, these terms are incredibly attractive. A Netflix deal provides stability, reach, and prestige.

But for established creators, the calculus is different. Davidson and Irvin already have audiences. They don't need Netflix to build credibility. What Netflix is providing is distribution and production support.

Creators like Joe Rogan explicitly rejected Netflix deals (he went exclusive with Spotify, then later released content on YouTube simultaneously). The calculus there was that his existing audience is loyal and follows him wherever he goes. The upside of a Netflix deal didn't outweigh the downside of limiting his exposure.

Netflix will face this tension repeatedly. The creators they most want to work with are the ones least dependent on Netflix. But those creators provide the most value to Netflix because they bring existing audiences.

One way to solve this is to offer truly attractive economics. Pay creators more, give them creative control, provide better production support. But that gets expensive quickly.

Another way is to develop emerging creators who are eager to build audiences. Netflix could position themselves as a creator platform that's willing to invest in up-and-coming talent. This would require a different operational model (more like YouTube or TikTok), but it could work.

The third approach, which Netflix seems to be pursuing, is to carefully pick established creators in specific niches (comedy, sports, culture) and offer them deals that align incentives. Davidson works because it's exclusive and valuable. Irvin works because he can become Netflix's definitive sports voice.

This is sustainable but doesn't scale to hundreds or thousands of shows. Netflix will eventually hit the limit of how many major creators they can sign.

The Video-First Advantage: Why This Isn't Just Spotify's Strategy

Here's what Netflix understands that pure audio platforms don't: video podcasting is the future.

Data from YouTube shows that video podcasts are watched at 2-3x the rate of audio-only podcasts. Audiences like seeing the hosts. They like watching reactions and body language. They like the production value that video provides.

Spotify positioned themselves as an audio-first platform. They eventually added video, but it was an afterthought. The platform, the features, the UX all prioritize audio. Video is supplementary.

Netflix's advantage is that they think in video first. Their entire technical infrastructure is built around video delivery. Their UI/UX is optimized for video. Their creators understand how to make video content.

When Netflix adds podcasts, they can leverage this entire ecosystem. Davidson's show benefits from Netflix's video production expertise. The platform can deliver high-quality video globally. The UI can be optimized for video in ways Spotify never can be.

But there's a trade-off. Podcasting traditionally has been audio-first because production barriers are low and creator diversity is high. Making video a requirement increases production friction. Not every podcaster wants to be on camera.

Netflix is accepting this trade-off because they're not trying to be the platform for all podcasts. They're trying to be the platform for premium, video-first podcasting.

This is a narrower market than Spotify's ambitions. But it's potentially more defensible. If Netflix becomes known as "the place for high-production-value, video-first podcasts from major creators," they've carved out a niche they can own.

Spotify is the place for audio discovery and creator diversity. Apple Podcasts is the directory. YouTube is the default. Netflix becomes the premium video destination.

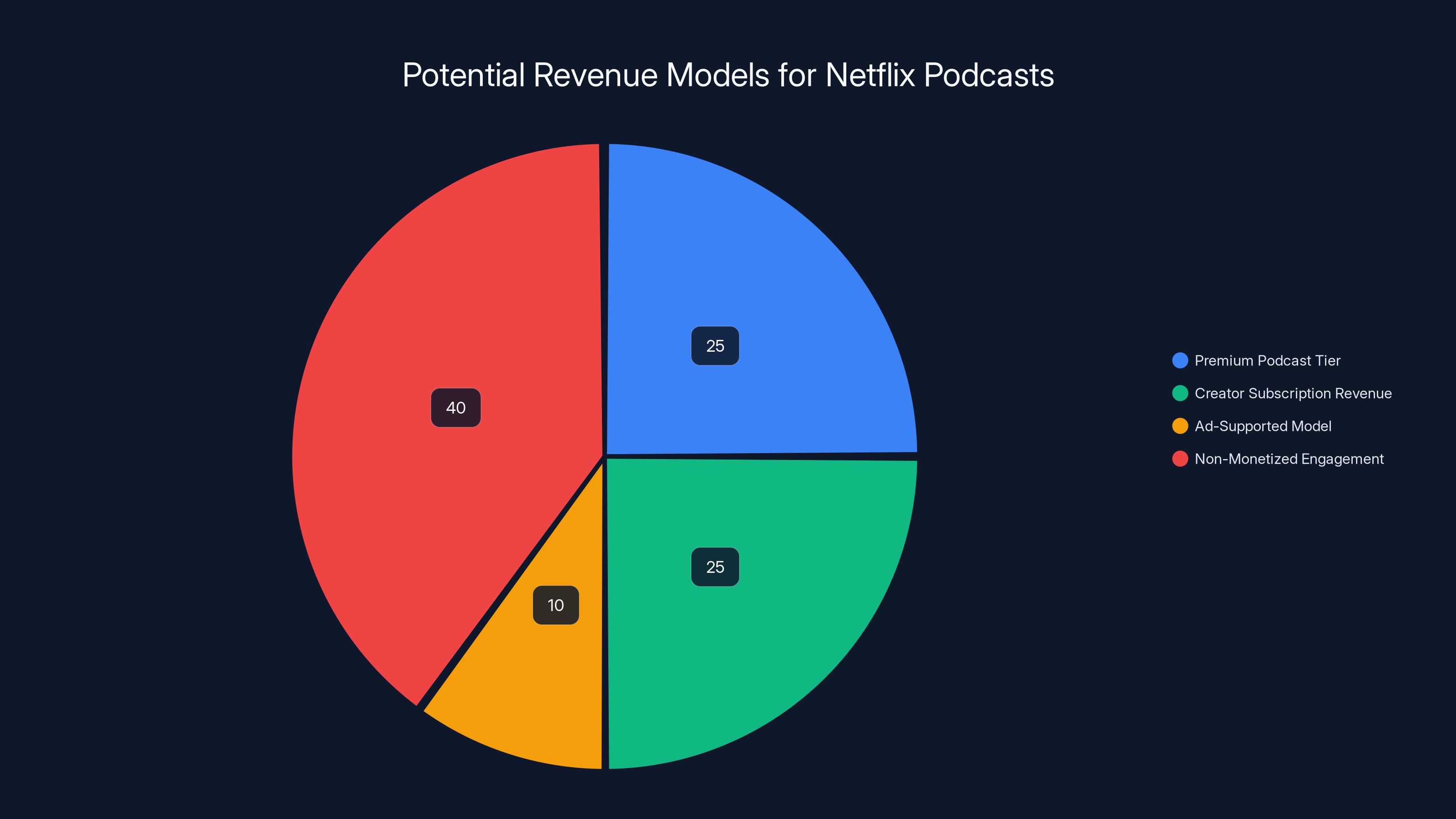

Estimated data: Netflix could explore various podcast monetization strategies, with a significant focus on non-monetized engagement to reduce churn.

Viewing Behavior: The 700 Million Hour Opportunity

Netflix's entire strategy is built on one statistic: viewers consumed over 700 million hours of podcasts on living room devices in 2025, as reported by MediaPost.

Let that number sink in. Seven hundred million hours. On living room devices specifically (TVs, Home speakers, etc.).

That's not total podcast consumption. That's just video podcasts watched on big screens in people's homes.

If Netflix captures even 5% of that, they're looking at 35 million hours of podcast watching annually. If the average subscriber watches 2 hours of podcasts per month (an estimate), that's over 10 million engaged viewers.

For context, a successful Netflix series gets maybe 50-100 million views globally over an entire month. A successful podcast could eventually drive similar or greater engagement.

But here's the key insight: most of this viewing is currently happening on YouTube. Netflix is trying to capture the shift of podcast watching from YouTube to their platform.

They're competing on convenience ("it's on Netflix, and you already subscribe"), discovery ("Netflix's algorithms know what podcasts I like"), and integration ("I can watch podcasts between my shows").

YouTube is competing on ubiquity, breadth of content, and discoverability through recommendations.

It's genuinely unclear who wins this competition. YouTube's dominance is powerful, but Netflix's existing relationship with 250+ million subscribers is also powerful.

The next 2-3 years will tell us a lot. If Netflix invests aggressively in podcasting and it becomes a notable percentage of engagement, we'll know the strategy is working. If it stays a minor feature, Netflix might dial back investment and focus elsewhere.

The Exclusive vs. Non-Exclusive Strategy

Netflix is using both exclusive original content (Davidson, Irvin) and non-exclusive licensed content (shows that remain on other platforms).

This is smart because it gives them the best of both worlds. Exclusivity drives differentiation ("you can only watch this on Netflix"). Non-exclusive licensing provides reach and catalog depth ("we have 300+ hours of podcast content").

But it creates a messaging challenge. If viewers can watch most Netflix podcasts on YouTube anyway, why does the Netflix podcast existence matter?

The answer is about positioning and bundling. Netflix is saying "we have podcasts" as part of a broader entertainment offering. They're not saying "our podcasts are exclusive." Most of them aren't.

This is similar to how Netflix treats documentary content. They have original documentaries, but they also have licensed content. The value is the curation, not the exclusivity.

For creators, the non-exclusive arrangement is attractive because it doesn't limit their reach. The show can exist on Netflix, YouTube, and the creator's own platform simultaneously. Netflix is just providing another distribution channel.

For Netflix, the non-exclusive approach is less risky. They get content without betting on exclusivity. If exclusivity is important later, they can renegotiate when licenses renew.

But there's a risk: if most Netflix podcasts are available elsewhere, what's the incentive to watch them on Netflix specifically?

Netflix's answer is user experience. The Davidson and Irvin shows are exclusive, so they provide differentiation. The licensed content provides depth. Together, they create a comprehensive podcast offering that's easier to access on Netflix than hunting across multiple platforms.

Whether that's enough remains to be seen.

The Monetization Challenge: How Does Netflix Make Money From Podcasts?

This is the question nobody's asking but should be.

Netflix's core business is subscriber fees. They don't sell ads (except on their lower-tier, ad-supported plan). They make money when people subscribe and stay subscribed.

Podcasts don't change this fundamental model. Netflix isn't trying to build a podcast-specific revenue stream. They're trying to keep existing subscribers from leaving.

But there's an opportunity Netflix might be thinking about: premium podcasting tiers.

What if Netflix created a "Netflix Podcasts Premium" tier that offered ad-free, exclusive podcast content for a small additional fee? Spotify has done versions of this with success.

Or what if Netflix allowed creators to charge premium subscriptions for exclusive podcast content that Netflix hosts? They'd take a 30% cut (matching YouTube's revenue share) and creators would get distribution.

Right now, Netflix isn't discussing these models. But they're probably exploring them internally.

The challenge is that podcasting's economics are tough. Advertising-supported podcasts work at scale (Joe Rogan's Spotify deal is estimated at $200M+, but Rogan brings massive audiences and premium advertiser appeal). Premium subscription podcasts work for niche audiences but don't scale broadly.

The hybrid model (free with ads, premium without ads) works reasonably well. But Netflix's brand positioning is "premium without ads," so the free-with-ads model doesn't fit their existing product.

They could carve out a separate product, but that adds complexity.

Most likely, Netflix keeps podcasting non-monetized from a revenue perspective. Podcasts stay free for all subscribers, and Netflix measures success in engagement metrics and churn reduction, not in direct revenue.

If podcasts reduce monthly churn by 0.5%, and the average Netflix subscriber lifetime value is $500, then each 1% reduction in churn is worth billions. Podcast investment looks cheap in that context.

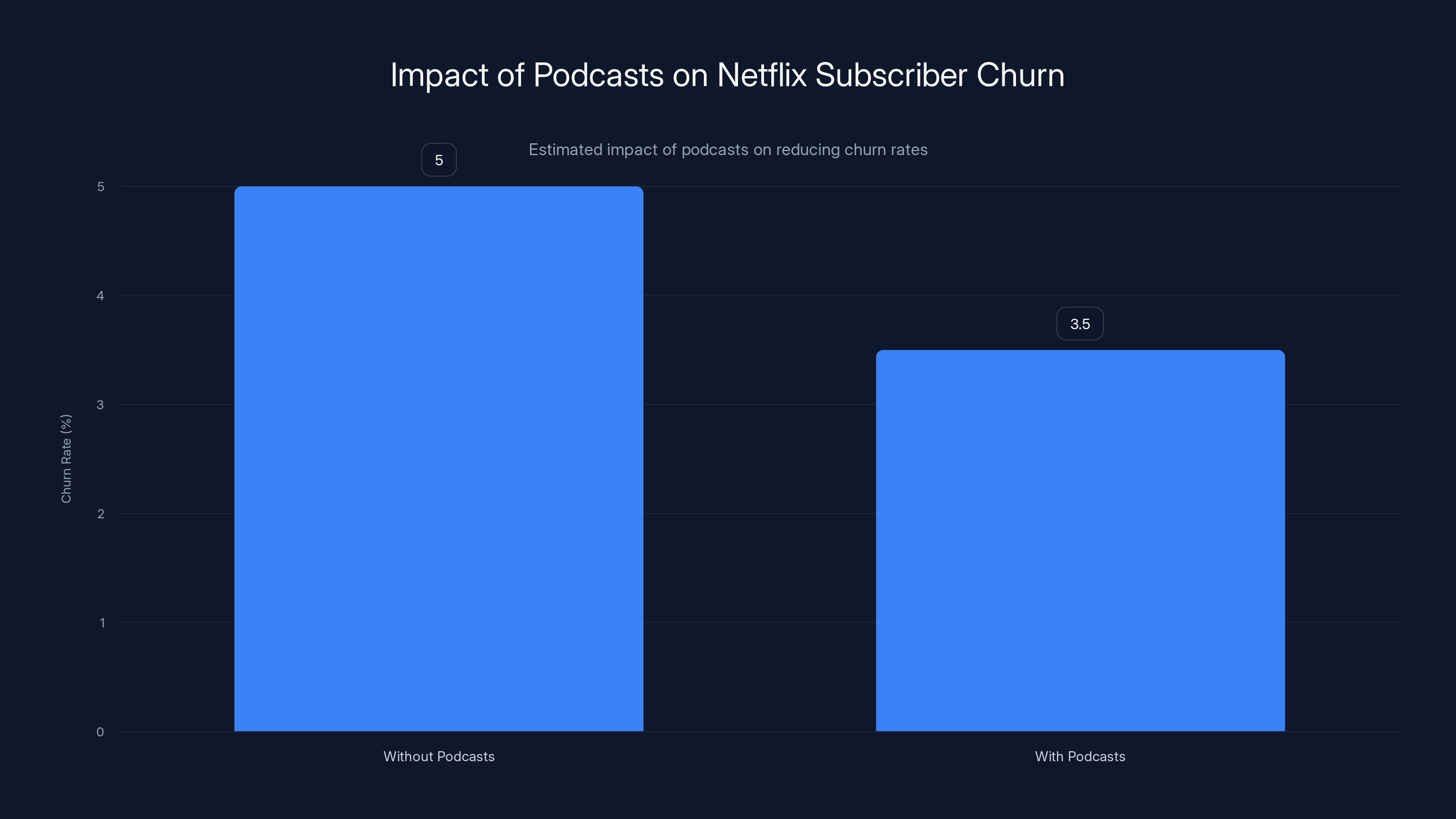

Podcasts could reduce Netflix's subscriber churn rate by an estimated 1.5%, making the investment in podcast content a potentially profitable strategy.

International Expansion: The Global Opportunity

Netflix's true advantage in podcasting is international reach.

Davidson is an American celebrity, so his global audience is smaller than in the US. But Irvin's sports focus is interesting internationally because sports are globally universal.

Think about soccer. There's massive interest in soccer in Latin America, Europe, Africa, and Asia. If Netflix could develop an Irvin-equivalent podcast focused on global soccer analysis from major personalities, they'd have a genuinely global content property.

Or consider Bollywood, K-pop, or anime-focused podcasts. Netflix is already the home for entertainment from these communities. Podcasts about this content, featuring major creators from these industries, would fit naturally into their platform.

Spotify and YouTube have this global reach, but neither has Netflix's ability to bundle podcast content with existing entertainment from the same creative communities.

This is actually Netflix's biggest opportunity in podcasting: using their existing global content relationships to build podcasts that complement their existing shows and films.

A podcast featuring the creators of a hit Netflix series, for example, would be incredibly valuable. It deepens engagement with existing content while creating new content.

International expansion also explains why Netflix is moving carefully. They need to understand regional preferences before they invest heavily. The Davidson and Irvin shows are tests. If they work globally, Netflix scales aggressively. If they're primarily US-focused, Netflix develops region-specific content.

The Long-Term Vision: Podcast Platform or Content Feature?

The biggest question facing Netflix's podcast strategy is conceptual: are they trying to build a podcast platform, or are they trying to add podcasts as a feature to their entertainment platform?

The answer is clearly the latter, but it's worth exploring the implications.

Spotify tried to build a podcast platform. They created podcast-specific features, invested in podcast-only creators, and positioned podcasting as a primary reason to subscribe.

Netflix is treating podcasts as an entertainment content category, like their documentary or stand-up comedy selections.

This positioning affects everything: feature investment, creator recruitment, marketing, competitive positioning.

If Netflix decides "podcasts are a platform," they'd need to build podcast-specific features like transcripts, chapters, clip sharing, and audience metrics. They'd invest in 100+ original podcasts. They'd market podcasts as a category, not just bundled with their other content.

If they decide "podcasts are a content category," they'd focus on quality over quantity. They'd integrate podcasts into their existing discovery and recommendation systems. They'd market podcasts alongside their shows and films, not separately.

Based on their current strategy, Netflix is clearly in the second camp. But that doesn't mean they won't shift.

If podcasts become 10% of engagement but podcasting-focused platforms get 3x the engagement, Netflix would likely reevaluate and shift to a platform-focused approach.

Conversely, if podcasts become 2% of engagement while requiring constant creator management and production oversight, Netflix might dial back investment and focus on higher-ROI content categories.

The next 18-24 months will be crucial for determining which direction this goes.

Lessons for Other Streaming Services

Netflix's podcast strategy has ripple effects for everyone in streaming.

Apple TV+ has the resources to compete in podcasting but has never shown interest. The question is whether they'll follow Netflix's lead.

Amazon Prime Video has similar resources and a massive music subscription service (Amazon Music) where podcasts are already available. They could integrate podcasts into Prime Video surprisingly easily.

Disney+ could use podcasts as a way to create ancillary content around Marvel, Star Wars, and their existing franchises. A Behind-the-Scenes Podcast featuring writers and directors could drive engagement between season releases.

YouTube will probably continue to assume podcasting grows on their platform naturally, without needing specific investment. This assumption could be wrong if Netflix proves that curation and integration drive significant engagement.

The broader lesson is that podcasting has matured enough that major platforms can't ignore it. It's not a niche anymore. It's a primary content category that drives engagement across age groups and demographics.

Netflix's move is forcing the entire industry to take podcasting more seriously.

The Creator Impact: What This Means for Podcasters

If you're a podcaster, Netflix's strategy has multiple implications.

First, there's more money available. Netflix has billions to spend on content. If they commit seriously to podcasting, they can outbid Spotify and YouTube for exclusive deals.

Second, platform choice is becoming less binary. A year ago, the choice was Spotify or YouTube or independent. Now there's Netflix. Eventually, there will be more platforms. Creators should start thinking about multi-platform strategies rather than betting everything on one exclusive deal.

Third, video is becoming more important. Netflix's video-first approach signals that the industry is shifting toward video podcasts. Creators who are camera-comfortable will have more opportunities.

Fourth, production quality matters more. Davidson and Irvin are getting Netflix deals because they bring audiences and credibility. But they're also getting significant production support. As platforms mature, they'll start demanding higher production values from creators, even for emerging talent.

Fifth, audience owns their relationship. The best hedge for creators is building an audience on their own platform (email list, YouTube channel, etc.) where they're not dependent on any single platform. That gives them negotiating power and reduces risk if a platform changes terms or shut down.

Challenges and Risks

Netflix's strategy isn't without risks.

Production complexity: Managing episodic content with celebrities is harder than it seems. If Davidson misses episodes or Irvin's quality drops, Netflix's investment looks wasted.

Audience friction: Existing Netflix subscribers might be frustrated by podcasts cluttering their interface. The signal-to-noise ratio could get worse.

Creator burnout: Maintaining weekly episode schedules is brutal. Even established creators struggle with consistency. If shows fade or get cancelled, Netflix loses the investment and credibility.

Competitive response: If Netflix's podcast strategy works, YouTube will likely respond by becoming more aggressive about podcast creators. YouTube has massive reach and doesn't need creator exclusivity. They can probably offer better economics than Netflix while keeping creators' content available everywhere.

International challenges: Davidson and Irvin work in the US because they're household names. Developing that kind of talent in 190+ countries is extraordinarily expensive.

These challenges are real, but none are insurmountable. Netflix has enough resources and expertise to navigate them.

The Market Opportunity: Valuing Podcasting

How big is the podcast market, really?

Advertiser-supported podcasting is estimated at

Total addressable market for podcasting: somewhere in the $4-6B range globally.

For context, the streaming video market is $60B+ globally. Podcasting is 10% of that at most.

But podcasting is growing faster than streaming video. It's more intimate, more portable, and in some ways, more engaging (listeners are more devoted to their favorite podcasts than their favorite shows).

Netflix's investment in podcasting is ultimately a bet that this category continues growing and that they can capture meaningful market share.

If Netflix captures 5% of the podcast market and the market grows to

Strategic Implications: Where Netflix Is Actually Betting

Here's what Netflix is really doing, stripped of the excitement and hype.

They're recognizing that subscriber growth is slowing. Churn is increasing. They need to give existing subscribers more reasons to stay.

Podcasts aren't a growth driver in themselves. They're a retention driver.

Netflix has already captured most of the addressable market in developed countries. Growth in emerging markets is happening, but it's slower than they'd like. Profitability has become the focus, which means reducing churn and increasing lifetime value.

Podcasts, if done right, increase engagement and reduce churn. They're a relatively cheap way to add content diversity that keeps subscribers scrolling and watching.

Netflix's strategy is actually quite conservative: pick a few high-profile creators, give them production support, license popular shows from other platforms, and integrate everything into the existing interface.

That's not a revolutionary strategy. It's a incremental strategy that leverages Netflix's existing advantages.

But incremental is fine. It works. And if podcasts successfully reduce churn by even 1-2%, the entire investment is profitable.

What Success Looks Like: Metrics That Matter

How will we know if Netflix's podcast strategy is working?

Watch time: If podcasts represent 5%+ of total watch time within 12 months, that's a signal.

Subscriber impact: If subscriber churn decreases measurably after podcasts launch, that's meaningful.

Cultural presence: If people discuss Netflix podcasts in the same breath as YouTube podcasts, that's success.

Creator quality: If Netflix attracts more major creators to exclusive deals, that's a sign the strategy is working.

Geographic expansion: If podcast strategy works in English-speaking markets and extends to other languages, that's scaling.

Netflix will measure these metrics internally, but they probably won't share them publicly unless the numbers look good.

We'll know the strategy is working through proxy signals: how many podcasts Netflix announces, how much they market podcasts, whether they invest in new podcast features, and whether they expand the strategy to emerging markets.

The Competitive Future: Where This Leads

If Netflix successfully establishes podcasting as a meaningful content category, the entire industry responds.

YouTube doubles down on podcast discovery features. Apple TV+ launches a podcast strategy. Amazon Music becomes more prominent in conversations about podcast consumption.

Spotify accelerates their video podcast investments to compete with Netflix on video quality.

The result is a genuinely competitive podcast ecosystem with multiple platforms competing for creators and audiences.

That competition benefits creators (more options, better economics) and audiences (better quality, more choice).

But it could also fragment the audience. If the best podcasts are split across Netflix, YouTube, Spotify, Apple, and Amazon, no single platform dominates, and creators have to maintain presence across multiple platforms.

This is where the industry is actually headed. The exclusive deal era (where Spotify paid $200M for Joe Rogan) is ending because the platforms learned that exclusive deals don't drive the massive engagement they expected.

The future is creator presence across multiple platforms, with some content exclusive to specific platforms for specific regions or specific audiences.

Netflix is positioning themselves well for this future. They're not betting everything on exclusivity. They're building a diversified podcast offering with both originals and licensed content.

FAQ

What are Netflix's first original video podcasts?

Netflix announced two original video podcasts launching in January 2026: "The Pete Davidson Show," featuring comedian Pete Davidson in candid garage conversations with celebrity guests, debuting January 30 and airing every Friday; and "The White House," featuring Cowboys Hall-of-Famer Michael Irvin delivering sports analysis and commentary twice weekly with guest co-hosts like Brandon Marshall.

Why is Netflix entering the podcast market?

Netflix is entering podcasting to increase subscriber engagement and reduce churn by providing additional content diversity. The company recognizes that video podcast consumption is growing (700+ million hours monthly on living room devices in 2025), and they see an opportunity to compete with YouTube's podcast dominance while leveraging their existing video production expertise, global distribution infrastructure, and subscriber relationships.

How does Netflix's podcast strategy differ from Spotify's?

Netflix is taking a curated, video-first approach by selecting high-profile creators and licensing popular shows rather than attempting to own the entire podcast ecosystem like Spotify did. Netflix is bundling podcasts into their existing entertainment platform rather than positioning podcasting as a standalone product reason to subscribe. They're also focusing on video-first content where production quality and on-camera presence matter, whereas Spotify emphasized audio discovery and creator diversity.

What are Netflix's licensing partnerships?

Netflix has licensing agreements with iHeartMedia, Spotify, and Barstool Sports to bring existing podcast shows to their platform, including titles like "Dear Chelsea" and "My Favorite Murder." These non-exclusive shows remain available on their original platforms, allowing Netflix to build immediate catalog depth without massive investment in original production while creators maintain multi-platform presence.

How does Netflix's podcast offering differ from YouTube's?

While YouTube dominates podcast viewership through algorithmic recommendation and ubiquity, Netflix is building a podcast offering that's specifically curated and integrated with their entertainment platform. YouTube's podcast discovery is optimized for watch time and engagement metrics, whereas Netflix is focusing on creating a podcast experience tailored to dedicated listeners who want to discover shows recommended by Netflix's curation and integrated with other entertainment content they're already consuming.

Will Netflix make podcasts exclusive to their platform?

Netflix is using a mixed approach: original shows like Davidson's and Irvin's are exclusive to Netflix, while most licensed content remains available on other platforms. This balances differentiation through exclusive content with catalog depth through non-exclusive content, ensuring Netflix has reasons to attract podcast audiences while licensed creators maintain reach across all platforms.

Can creators make money from Netflix podcasts?

Creators signing original deals with Netflix receive production support, revenue guarantees, and access to Netflix's global subscriber base for distribution. Netflix is also exploring licensing agreements with existing podcast platforms, meaning successful creators on other platforms can negotiate licensing deals to bring their shows to Netflix without making them exclusive, generating additional revenue from distribution partners.

How will Netflix compete with YouTube's podcast dominance?

Netflix's advantages include their existing subscriber base and global distribution infrastructure, video production expertise, bundle integration with other entertainment content, and ability to guarantee high production value through production support. However, YouTube's advantage of being the default video platform and having algorithms optimized for discovery means Netflix will need to prove that curation and integration drive sufficient engagement to justify choosing Netflix over the convenience and familiarity of YouTube.

What does this mean for the future of podcasting?

Netflix's investment signals that podcasting has matured into a primary content category worthy of major platform investment. The result will likely be increased competition for podcast creators and audiences across Netflix, YouTube, Spotify, Apple, and Amazon, with exclusive deal eras ending in favor of multi-platform creator presence. Creators will have more negotiating power and more platform options, but will also face pressure to maintain presence across multiple platforms rather than relying on a single exclusive deal.

How many podcasts does Netflix plan to launch?

Netflix hasn't announced a specific number of podcasts they plan to develop. The Davidson and Irvin shows are launching in January 2026 as initial originals, with licensing partnerships providing immediate catalog additions. Netflix appears to be taking a selective, quality-focused approach rather than pursuing aggressive expansion, suggesting they'll grow the podcast library gradually based on performance metrics and creator availability rather than launching dozens of shows simultaneously.

Conclusion: The Beginning of Netflix's Content Evolution

Netflix's podcast strategy is neither revolutionary nor surprising. It's the logical extension of their existing business: use production expertise and distribution advantages to create and distribute quality entertainment that keeps subscribers engaged.

But the strategy signals something larger about how media companies are thinking about content in 2025 and beyond.

The era of platform exclusivity is ending. The streaming wars that defined 2015-2020 created an oversupply of mediocre content scattered across competing platforms. Audiences got tired of subscribing to everything. Cord-cutting economics broke down. The golden age of "peak TV" ended.

What's replacing it is an era of integration. Platforms are recognizing that bundling diverse content categories (shows, films, sports, podcasts, gaming) creates stickier products than single-category focus.

Netflix is 30 years into the streaming era and has mastered scripted and unscripted content. They're now extending their expertise to podcasting, knowing that the production and distribution playbooks are similar enough to transfer, but the audience behaviors and creator relationships are different enough to require dedicated focus.

The Davidson and Irvin shows are just the beginning. What matters is whether Netflix sustains investment over 2-3 years, expands the strategy to other regions and genres, and successfully positions podcasting as a genuine content category on their platform rather than a gimmick.

Based on their moves so far, they seem committed to the long game. They're not trying to immediately compete with Spotify's podcast library or YouTube's podcast ubiquity. They're trying to capture a slice of the podcast audience by providing curation, production quality, and integration that other platforms don't offer.

Whether they succeed depends on execution: can Davidson maintain weekly episodes? Will Irvin's analysis attract sports fans? Will audiences actually prefer watching podcasts on Netflix rather than YouTube? Will the licensed content provide meaningful engagement?

These are practical questions with unpredictable answers. But Netflix has the resources and expertise to find out, and the stakes are low enough (podcasting is a platform feature, not their core business) that they can afford to experiment.

The broader implication is that the podcast industry is entering a new phase: professional, well-funded, and competitive. That's good news for audiences (more choice, higher quality), creators (more economic opportunity), and the industry (faster growth, more sustainable business models).

Netflix's move is the signal that the era of podcast maturation has truly begun.

Key Takeaways

- Netflix's podcast strategy prioritizes retention over growth by providing additional content diversity to existing subscribers rather than creating a standalone podcast platform

- The company is balancing exclusive originals (Davidson, Irvin) with non-exclusive licensed content to build catalog depth without overcommitting to exclusivity deals

- Netflix's video-first approach offers a genuine differentiation from Spotify's audio focus and YouTube's general-purpose algorithm, but requires higher production standards

- The 700 million monthly hours of podcast consumption on living room devices represents the actual market Netflix is targeting, though YouTube currently captures most of this viewing

- Creator relationships matter more than platform features in podcasting, and Netflix's strategy of securing high-profile talent signals they're willing to invest significantly in this category

Related Articles

- Netflix's Video Podcast Bet: Pete Davidson and Michael Irvin [2025]

- Amazon & Roku's 50 Free Streaming Channels: Complete Guide [2025]

- Fender Play on Samsung TV: 2025 Guide, Features & Learning Alternatives

- Disney+ Hulu Bundle Deal: Everything You Need to Know [2025]

- Arsenal vs Liverpool Live Stream 2025-26: Complete Viewing Guide

- How to Watch The Hunting Party Season 2 Online [2025]

![Netflix's Video Podcast Strategy: Challenging YouTube With Original Shows [2025]](https://tryrunable.com/blog/netflix-s-video-podcast-strategy-challenging-youtube-with-or/image-1-1768424872339.jpg)