Netflix's Video Podcast Bet: What Pete Davidson and Michael Irvin Mean for Streaming [2025]

Netflix just made a move that nobody saw coming. After years of licensing podcasts from Spotify, iHeartMedia, and Barstool Sports, the streaming giant is now creating its own original video podcasts. And the roster they're starting with tells you everything you need to know about where they're placing their bets.

The company is rolling out two flagship shows this month: The Pete Davidson Show, premiering January 30th, and The White House, featuring NFL legend Michael Irvin, dropping January 19th. Both shows are designed to do something traditional podcasts haven't quite cracked at scale: merge the intimacy of long-form audio conversation with the visual storytelling of video.

But here's the thing that makes this interesting. Netflix isn't just slapping cameras on existing podcast sets and calling it a day. They're fundamentally reimagining what a video podcast can be, using celebrities with massive cultural gravity to pull audiences into a format that's somewhere between a talk show, a documentary, and your friends hanging out in a garage.

This move signals something bigger: Netflix sees podcasting as the next frontier in streaming dominance, and they're willing to invest heavily to own that space. The question is whether video podcasts can actually become a mainstream medium, or if Netflix is chasing a format that audiences don't actually want.

TL; DR

- Netflix launches original video podcasts with Pete Davidson and Michael Irvin in January 2025, marking their first foray into owned podcast content

- The Pete Davidson Show drops every Friday from Davidson's garage, positioning casual celebrity conversation as premium streaming content

- The White House features rotating co-hosts and pro athletes, leveraging nostalgia and sports culture to drive engagement

- This directly competes with licensed content from Spotify and YouTube, where podcasts have become the second-largest content category after music

- Video podcasting remains unproven at scale, with most successful podcasts still driving revenue through audio ads, not video streaming platforms

The Strategic Reason Netflix Needs Podcasts

Netflix's foray into original podcasts isn't random. It's a calculated move based on some uncomfortable truths about the streaming business in 2025.

First, the subscriber growth story is getting old. Netflix hit around 300 million subscribers globally, and adding new subscribers is becoming harder every quarter. So the company needs to increase watch time and engagement among existing subscribers. Podcasts do exactly that: they keep people on the platform for longer, they create habit-forming consumption patterns, and they cost significantly less to produce than scripted television.

Second, Netflix's content budget has hit a wall. They're spending over

Third, there's the YouTube problem. Video podcasts have become the second-largest category on YouTube, behind only music. The Joe Rogan Experience alone generates hundreds of millions of views. Every hour someone spends watching a podcast on YouTube is an hour they're not spending on Netflix. By creating original video podcasts, Netflix is directly competing for share of attention.

The irony is that Netflix has had podcasts on their platform for over a year through licensing deals. But licensed content doesn't drive the same brand loyalty as originals. When you watch The Bill Simmons Podcast on Netflix, you think about Simmons, not Netflix. The company wants you thinking about Netflix.

The Math Behind Podcasting Economics

Let's break down why Netflix sees podcasts as a profit lever.

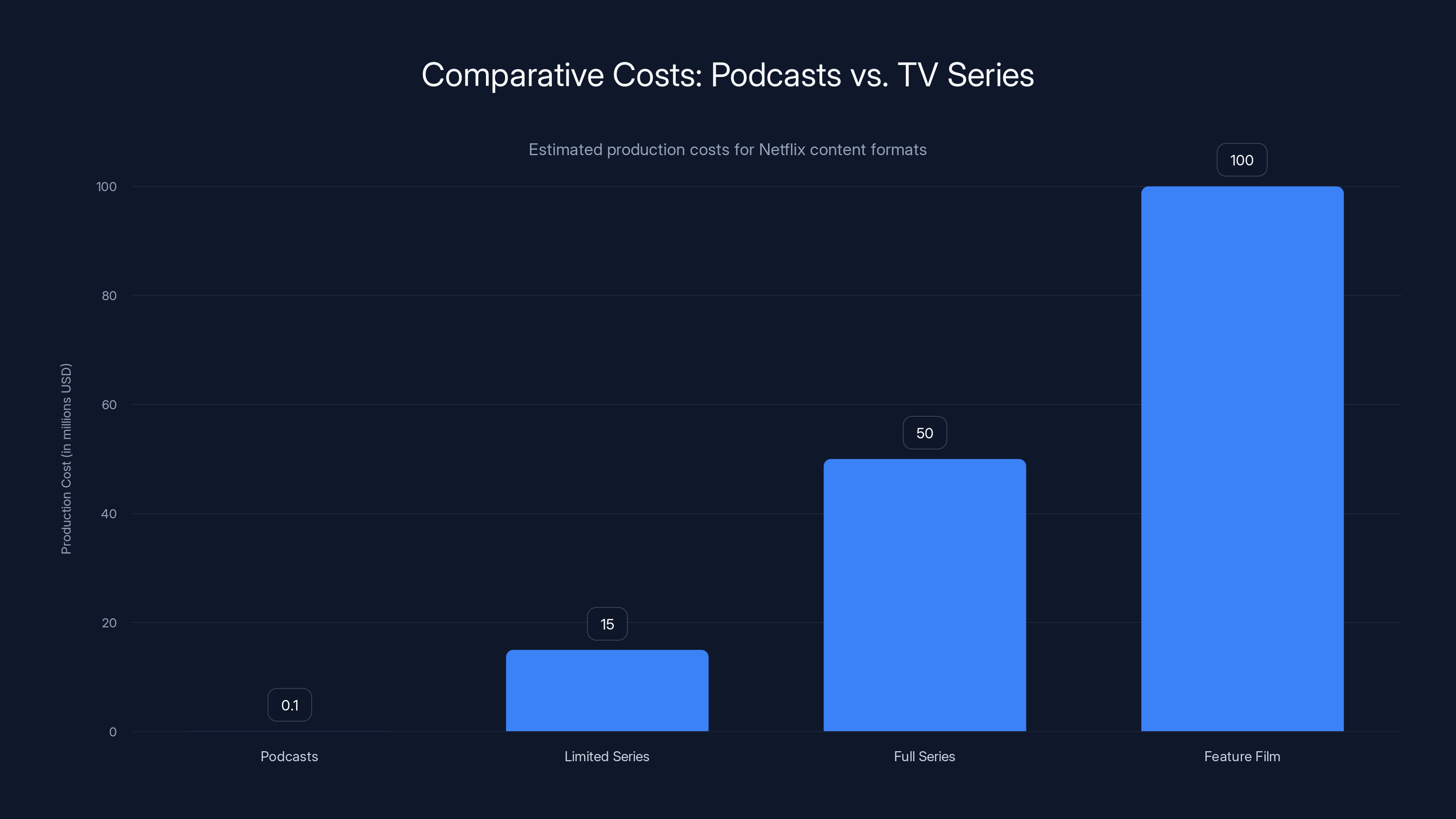

A typical scripted drama episode costs between

The audience overlap matters too. Netflix's core demographic skews younger, with a median age around 38. Podcast audiences overlap heavily with that demographic, especially in categories like comedy and sports. So instead of trying to build a new audience from scratch, Netflix is targeting people who are already paying for their service.

There's also the international angle. Netflix operates in 190 countries, and podcasts are culturally portable in ways that scripted drama isn't. A Pete Davidson conversation needs less localization than a Korean drama with subtitles and cultural context.

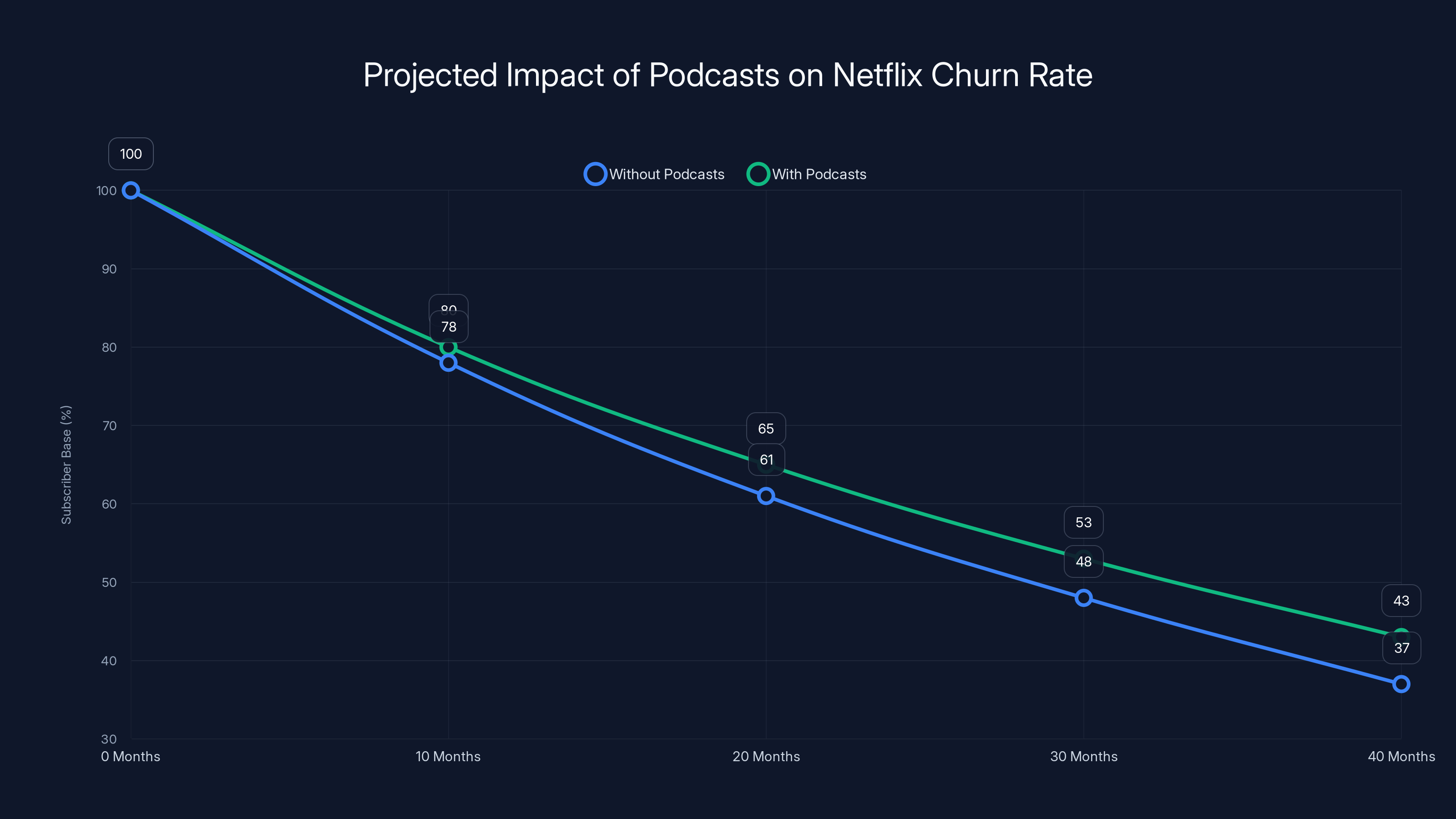

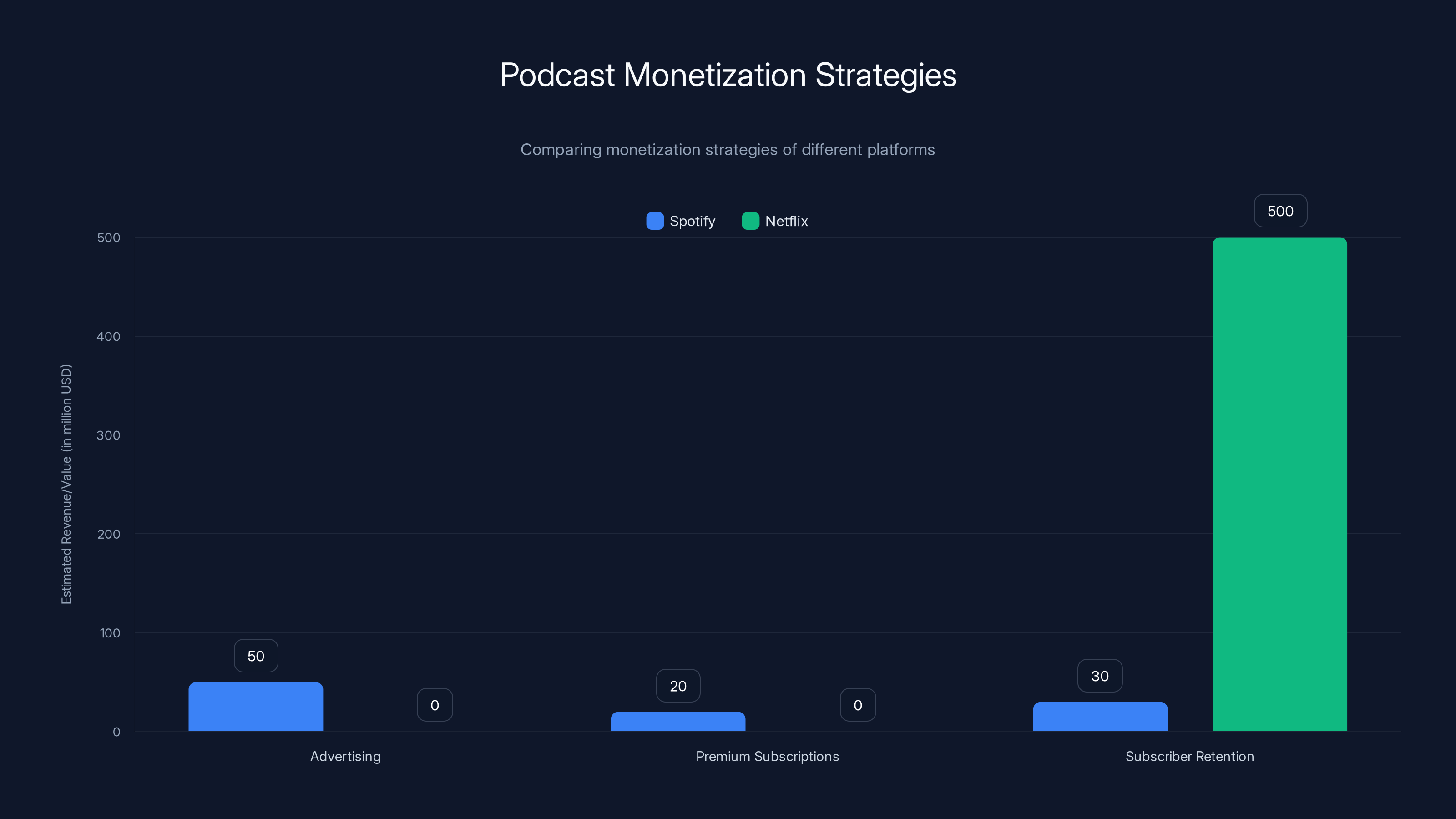

The real financial play, though, is retention and churn reduction. Netflix's churn rate in mature markets is around 2.5% monthly. If podcasts can reduce that by just 0.5 percentage points, that's $500 million in annual revenue protection across their subscriber base.

Podcasts are significantly cheaper to produce than traditional TV series or films, making them an attractive option for Netflix to increase engagement without escalating costs. Estimated data.

The Pete Davidson Strategy: Chaos as Content

Let's talk about why Netflix picked Pete Davidson for their flagship launch.

Davidson isn't the obvious choice. He's not a podcaster with an existing audience. He's not a media mogul. He's a comedian whose career has been defined by inconsistency: brilliant comedy specials followed by years of relative quiet, viral moments interspersed with personal struggles that play out on Instagram.

But that's exactly why he works for Netflix's purposes.

Davidson has a gift for candid conversation. His interviews are known for meandering, unscripted tangents. He asks genuinely curious questions rather than following an interview template. And crucially, he carries cultural gravity with exactly the demographic Netflix wants: younger men, 18 to 35, who find traditional celebrity interview formats annoying but crave authentic personality-driven content.

The Pete Davidson Show is positioned as a comedy experience, not an interview program. Each episode will feature Davidson in his garage having conversations with guests. The garage setting is brilliant from a production standpoint: intimate, distinctive, easy to replicate, and immediately associated with the creator's personality rather than some sterile studio.

Netflix is betting that watching Pete Davidson talk to celebrities, athletes, and interesting people for 90 minutes will feel less like content consumption and more like being in a group chat with a funny friend. That's the psychological win they're after. The show drops every Friday, which creates habit-forming viewing patterns.

The Guest Strategy

We don't know yet who Davidson's first guests will be, but we can predict the type. Netflix will likely start with celebrities who have existing brand relationships with Netflix, followed by athletes and musicians who are promoting projects on the platform.

The genius move would be if Netflix can coordinate guest appearances across multiple shows on the same day, creating a water cooler effect. Imagine if a major sports figure appears on The White House on Monday, then does a longer-form conversation with Davidson on Friday. That's appointment viewing, which is what Netflix needs.

Davidson's advantage is that he actually has genuine relationships with celebrities. His SNL tenure and his relationship with Ariana Grande put him at the center of pop culture in ways that a professional podcaster might not be. He knows these people personally, which creates a different energy than a traditional media interview.

The bet here is that audiences prefer authenticity over polish. Improv Comedy is more popular than ever. Unfiltered celebrity conversations on TikTok generate billions of views. Netflix is betting that formalizing this format, producing it professionally, and making it exclusive to their platform, will drive engagement.

Michael Irvin and The White House: Sports Culture as Content Engine

Michael Irvin is a different bet entirely.

Irvin spent over a decade as a wide receiver for the Dallas Cowboys, one of the most iconic franchises in sports. He's since become a prominent NFL commentator and media personality, with millions of fans who've followed his career for decades.

The White House is his podcast, but it's named after something much deeper: the literal house Irvin ran during his playing days, which became legendary for parties and celebrity gatherings. The name carries nostalgia, status, and cultural weight that casual listeners might not immediately understand but longtime football fans absolutely will.

Here's the strategic genius: sports is one of the few content categories that still drives appointment viewing. People watch games live. They follow them obsessively. And they engage in prolonged discussion about games, players, and storylines. A sports-focused podcast should have built-in audience loyalty.

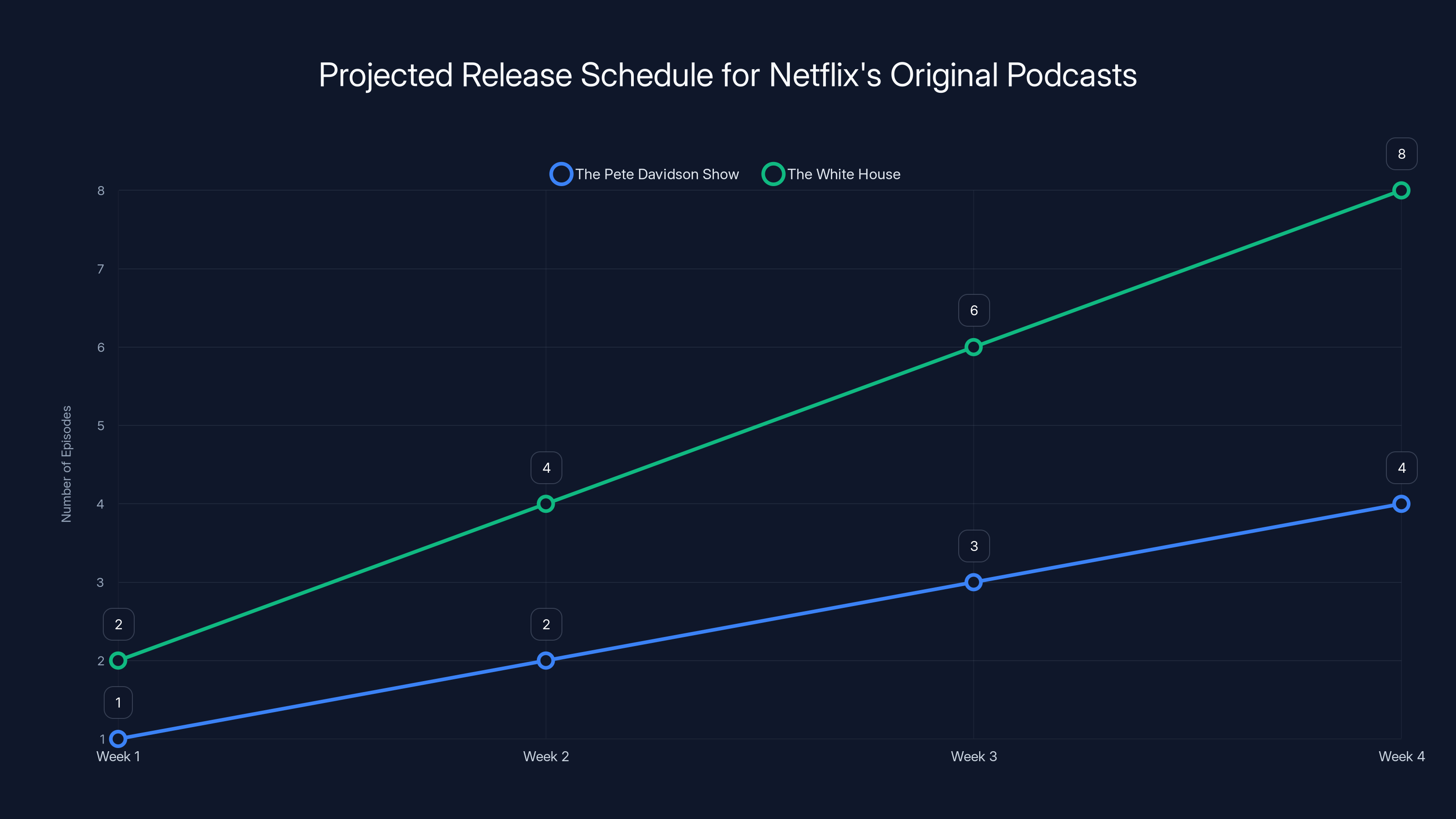

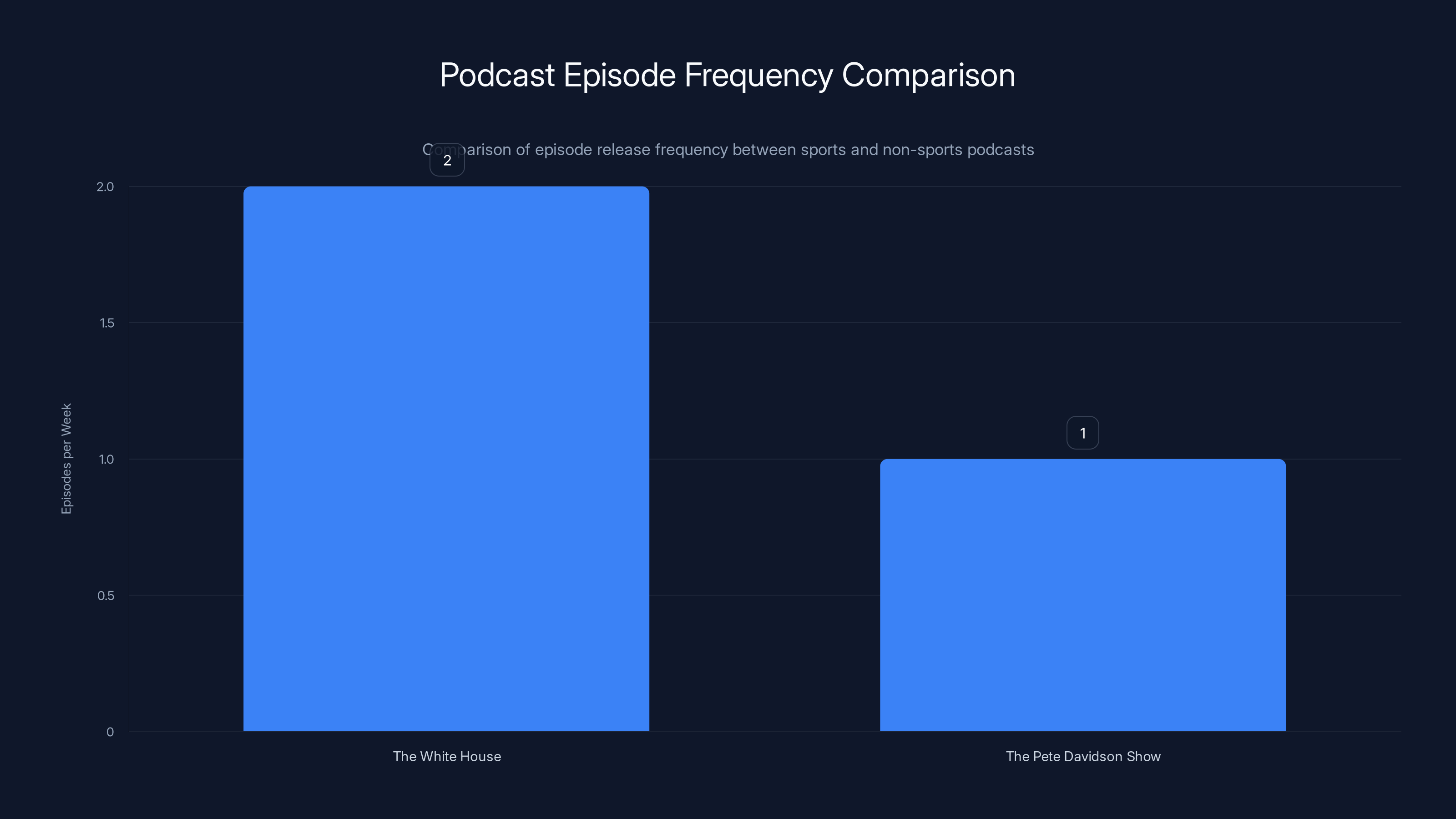

The White House airs two episodes per week, compared to The Pete Davidson Show's single weekly episode. That's because Netflix knows sports fans are content hungry. They'll consume multiple episodes easily, and the two-per-week schedule creates stronger habit loops.

The Rotating Co-Host Model

Irvin isn't doing this alone. The show features rotating co-hosts and guests, including former NFL pro Brandon Marshall, who's also producing. This structure is clever for several reasons.

First, it allows Netflix to tap into multiple celebrity networks. Marshall brings his own fan base and professional relationships. Each co-host brings different perspectives and personalities, preventing the show from feeling repetitive even though it's just guys talking about football.

Second, it reduces burnout. Hosting two episodes per week of a sports show is exhausting. Rotating co-hosts mean Irvin never carries the full load alone.

Third, it creates content opportunities. If Irvin and Marshall have chemistry, Netflix will promote that dynamic. If a guest co-host brings an unexpected perspective, that becomes the episode that trends on social media. Variability is actually a feature, not a bug.

The audience for The White House will likely skew older and more male than The Pete Davidson Show. It will attract existing football fans who already follow Irvin's commentary work. But Netflix is betting that long-form sports discussion, especially with credibility from someone like Irvin, will attract viewers who don't typically watch sports media because they see it as too shallow.

The White House releases two episodes per week, while The Pete Davidson Show releases one episode weekly, showing a varied production cadence. Estimated data.

Video Podcasts vs. Audio Podcasts: Why Format Matters

This is where Netflix's bet gets interesting. They're specifically creating video podcasts, not audio podcasts. That distinction matters more than you'd think.

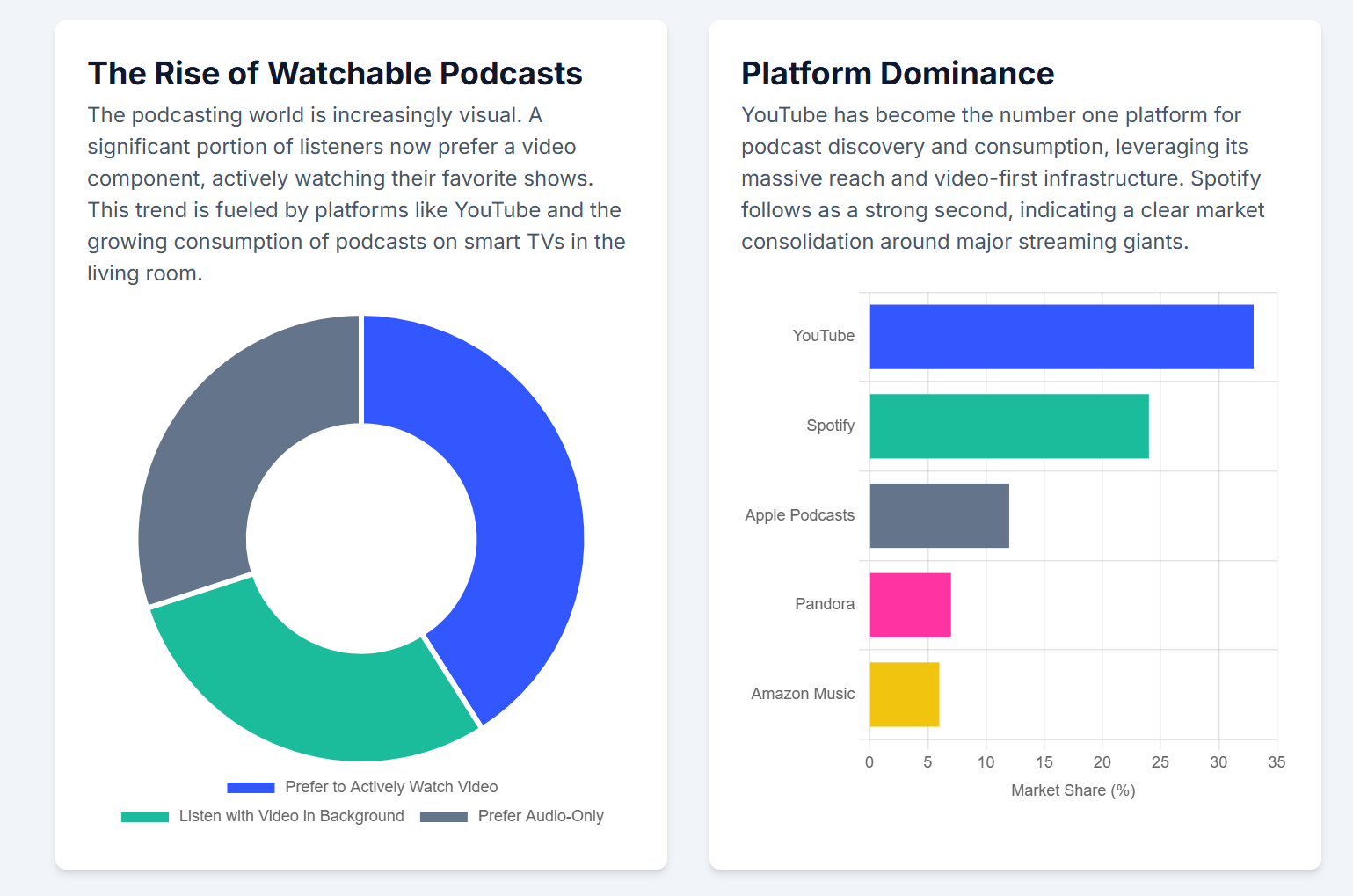

Traditional podcasts are consumed primarily during commutes, workouts, or while doing other tasks. Audio is the product. Video podcasts require visual attention, which means they're competing for viewing time against Netflix's entire catalog, YouTube, TikTok, and every other source of visual entertainment.

Netflix is betting that the novelty of video podcast production, combined with celebrity talent, will overcome the friction of requiring visual attention. But this is empirically unproven at scale.

Spotify spent billions acquiring podcasts and built a massive audio podcast library, but video hasn't moved the needle for them. YouTube has video podcasts built into the platform, but the most successful podcasts on YouTube are still primarily audio with static visuals or talking head footage.

The advantage of video, theoretically, is that you can show more than just faces talking. You can show the garage environment, b-roll, graphics, reaction shots, and editing that makes the content more dynamic than a standard interview. If Netflix can crack that production formula, video podcasts could feel like a new format rather than just podcasts with cameras.

The YouTube Restriction Play

Here's something subtle in Netflix's strategy: the licensing deals include restrictions that prevent licensed shows from appearing in their entirety on YouTube.

This is important because it means Netflix is willing to foreclose content from the world's largest video platform to protect their exclusive window. They're betting that viewers will come to Netflix specifically for podcast content, rather than defaulting to YouTube where they're used to finding it.

This is aggressive. It limits distribution in the name of building an exclusive content library. It's the same strategy Netflix used with theatrical windows for films, which ultimately benefited Netflix's subscriber growth even though it limited immediate revenue.

But it also raises a risk: if audiences really prefer YouTube for podcasts, Netflix's restriction policy just hands viewers back to YouTube. Spotify learned this lesson the hard way when exclusive podcasts actually cost them listener growth because users would just find the content elsewhere.

Netflix is banking on the fact that their production quality and exclusive guests will be compelling enough to overcome the convenience factor of finding podcasts on YouTube.

The Licensed Content Puzzle: What Netflix Already Owns

Before diving into originals, Netflix had already licensed significant podcasts from major players. This portfolio matters because it shows Netflix's thinking about what podcast audiences actually want.

My Favorite Murder is a true crime podcast with a devoted fan base. The Bill Simmons Podcast is long-form sports and culture commentary. Pardon My Take is ESPN-adjacent sports banter. These are established shows with proven audiences that Netflix can offer exclusive or first-window access to.

By licensing established shows, Netflix got content immediately without production risk. The downside is that these shows have divided loyalty. Listeners tune in for the hosts, not for Netflix. If the hosts were offered their own platform exclusive deal elsewhere, they might take it.

This is why originals matter strategically. An original show, from day one, is branded as Netflix content. Viewers don't think "Oh, I'm watching Pete Davidson's podcast." They think "I'm watching Netflix's podcast with Pete Davidson." That's a fundamental difference in how the brand value accumulates.

Netflix's licensing strategy and original strategy are actually complementary. The licensed shows bring immediate audience and credibility. The originals build exclusive brand value over time. Together, they create a podcast destination rather than just a platform that hosts podcasts.

The Barstool and iHeartMedia Dynamics

Netflix's licensing deals with Barstool Sports and iHeartMedia matter because they reveal Netflix's strategic priorities.

Barstool brings a younger, very engaged male audience that's obsessed with sports and pop culture. iHeartMedia brings broader, more mainstream appeal with access to radio content and celebrity relationships.

Both partnerships give Netflix access to distribution networks and production infrastructure that the streaming company doesn't have internally. Barstool has already figured out how to produce multi-show, multi-host content at scale. iHeartMedia has decades of experience with content production and talent relationships.

Netflix's original shows with Davidson and Irvin represent Netflix taking production in-house. But they're not abandoning the partnership model. Instead, they're doing both: partnering for breadth and producing originals for depth and exclusivity.

This two-pronged approach is lower risk than going all-in on originals immediately. It lets Netflix learn what works before betting the farm on podcast production.

The Celebrity Talent Economics

Pete Davidson and Michael Irvin are paid talent. Netflix would never disclose their deal terms, but we can estimate.

A-list celebrities doing exclusive streaming content typically command six-figure or low seven-figure per-season deals, depending on how much production work they're expected to do. Davidson and Irvin likely fall into different brackets.

Davidson, as an established comedian and SNL alum with strong cultural pull among younger audiences, probably commands a premium. The show is his vision, his personality is the main draw, and his audience brings value.

Irvin, as a sports personality with an existing platform and fan base, probably commands a solid rate but below top-tier celebrity talent. His value is in the existing audience he brings and his credibility in the sports world.

Netflix's bet is that the talent cost is justified by the engagement and retention these shows drive. If The Pete Davidson Show brings just 10 million of Netflix's 300 million subscribers back to the platform once per week, that's $50 million per year in incremental subscriber lifetime value at typical Netflix margins.

The talent cost would likely be a fraction of that incremental value, making the ROI math work even before you consider brand building and competitive positioning.

Production Cost Structure

A video podcast like The Pete Davidson Show has surprisingly lean production costs.

You need cameras, lighting, sound equipment, and editing. You need a production coordinator and director. You might need a social media person to cut clips. But you don't need the massive crews required for scripted content.

Budget estimate:

Total annual program cost:

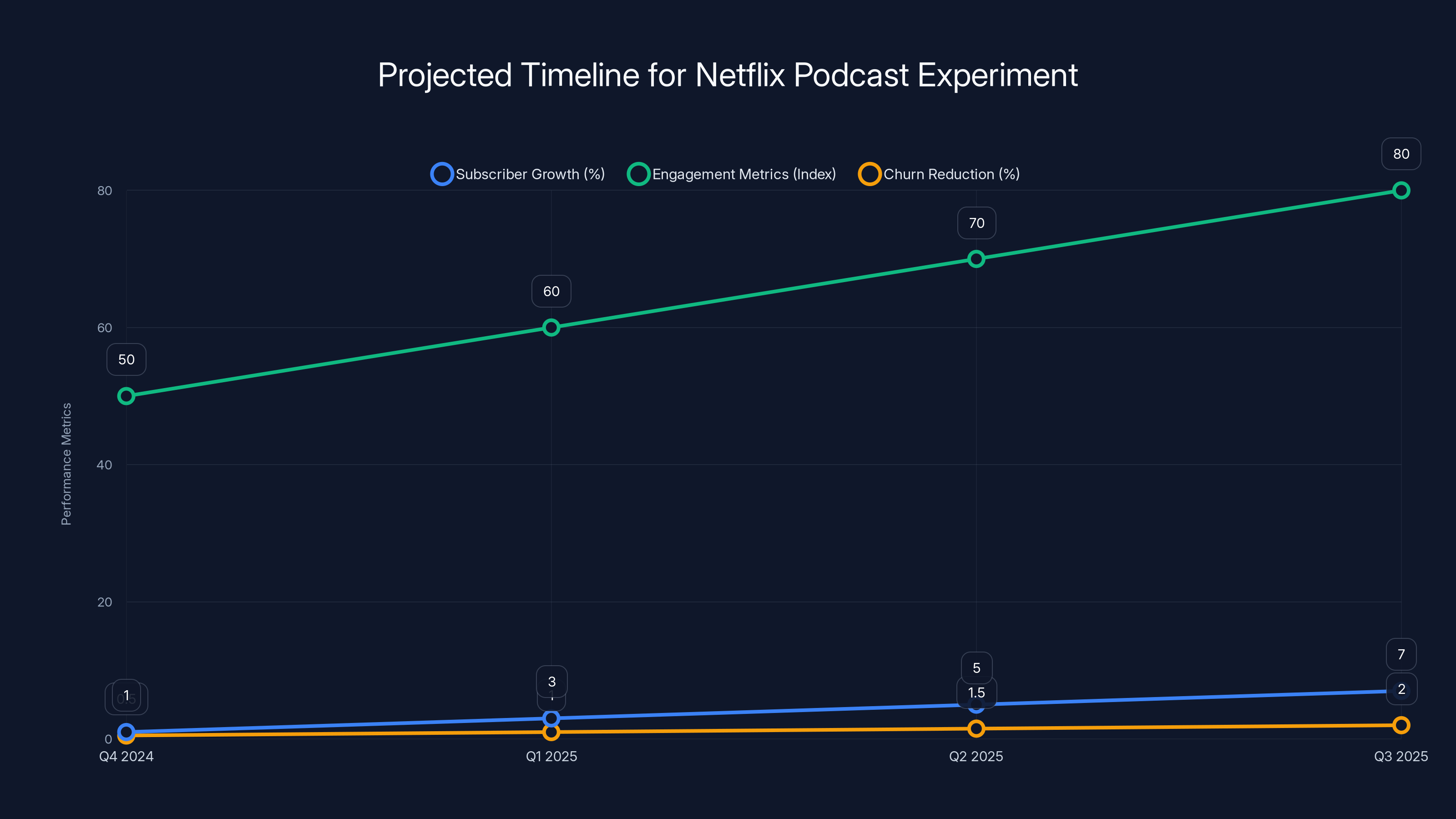

Estimated data suggests that introducing podcasts could potentially reduce Netflix's churn rate, retaining more subscribers over time compared to not having podcasts.

The Competitive Landscape: YouTube, Spotify, and Apple Podcasts

Netflix isn't entering the podcast space unopposed. The competitive landscape is already crowded, and the players are experienced.

YouTube has podcasts baked into the platform architecture. Creators can upload podcast episodes, and the platform's recommendation algorithm pushes them to related audiences. YouTube doesn't need to invest in exclusive talent because the distribution advantage is built in.

Spotify spent $1.5 billion on exclusive podcast deals and still struggled to prove that podcast exclusivity drove subscriber growth. The company's audio advertising business is becoming more important than exclusive content, suggesting that Spotify's podcast strategy didn't pay off the way they hoped.

Apple Podcasts is free, integrated into every Apple device, and still the largest podcast platform by listening hours. Apple launched podcasts subscription features but has been slower to invest in exclusive original content compared to other platforms.

Netflix's advantage is that they have a captured audience of 300 million paying subscribers. They don't need to convert new audiences to podcasts as aggressively because the audience is already there. They just need to keep those subscribers engaged and reduce churn.

YouTube's advantage is distribution and network effects. Podcasts thrive on recommendation algorithms, and YouTube's algorithm is ruthlessly effective at pushing content.

Spotify's advantage is mobile ubiquity and the strength of their audio advertising business, which still represents the majority of podcast monetization.

The Content Quality Arms Race

All these platforms are now competing directly for content quality and exclusivity.

YouTube signed exclusive deals with Mr Beast and other major creators. Spotify locked down Joe Rogan and Dax Shepard. Apple signed exclusive shows including a reboot of a classic series.

Netflix's strategy of starting with two flagship original shows, rather than signing multiple existing podcasters, suggests they're thinking longer term. They're not trying to win on quantity but on building a specific brand around video podcast content.

This matches Netflix's broader strategy in film and television: fewer shows overall, but higher quality and stronger brand positioning than competitors who pursue quantity.

The risk is that other platforms are already ahead on audience numbers. YouTube already has billions of podcast viewers. Spotify already has established exclusive content. Netflix is playing catch-up, which means they need to either out-talent their competitors or build a better format.

The Video Format Challenge: Why Video Podcasts Are Harder Than They Look

Producing video podcasts at Netflix's production quality standards is actually more difficult than it appears.

Audio podcasts can be loose and repetitive. Visual content requires tighter editing, more dynamic camera work, and better pacing to account for the fact that audiences won't listen if the video feels boring.

This means longer production timelines. An audio podcast might be recorded once and released as-is. A video podcast needs editing passes, graphics, b-roll decisions, and quality control to ensure it's watchable.

Netflix's production infrastructure is built for film and television, not podcasting. They'll need to adapt or build new workflows. This isn't insurmountable, but it's a constraint that YouTube and Spotify don't face the same way because those platforms are comfortable with lower production values.

There's also the equipment reality. High-end video cameras, sound systems, and lighting required to produce Netflix-quality content are expensive and require technical expertise. A podcaster can record on a Zoom H6 recorder. Netflix needs 4K cameras and professional audio gear.

The Editing Philosophy Problem

Here's where it gets subtle. Netflix's editing philosophy, built across years of television production, might not translate well to podcasts.

TV editing emphasizes narrative structure, emotional beats, and commercial breaks. Podcast editing is usually minimal, emphasizing authenticity and raw conversation.

If Netflix over-edits The Pete Davidson Show, it loses the spontaneity that makes podcasts compelling. If they under-edit, it looks amateurish compared to Netflix's other productions.

Finding that balance is harder than it sounds. Netflix will likely need to develop new editing standards specifically for podcasts, which means trial and error in the first few seasons.

Audience Psychology: Why People Watch Podcasts

Understanding why people consume podcasts is essential to understanding whether Netflix's bet will work.

People watch podcasts for several distinct reasons:

Parasocial relationships: Listeners develop a sense of friendship with podcast hosts. They feel like they know the personality, understand their views, and want to support them.

Authentic conversation: In an era of polished media, people crave unscripted, real conversation. They want to hear people think out loud, disagree, and be vulnerable.

Topic expertise: Some podcasts are consumed for specialized knowledge. People want to learn about finance, science, or business from experts.

Background consumption: A significant portion of podcast listening happens while doing other things: commuting, exercising, cleaning.

Community: Podcast audiences often form communities around shows, creating inside jokes, discussion forums, and social media engagement.

Netflix's strategy needs to account for all these factors. The Pete Davidson Show relies heavily on parasocial relationship and authentic conversation. The White House leans on topic expertise and community.

But the "background consumption" factor creates a structural problem. Video podcasts require visual attention, which means you can't watch them while driving or exercising. This immediately reduces the addressable audience compared to traditional podcasts.

Netflix is betting that the quality of the content and the celebrity factor will overcome the friction of requiring visual attention. That's plausible, but it's not certain.

Estimated data suggests Netflix will evaluate podcast impact by Q3 2025, with key metrics like subscriber growth and engagement expected to improve if hypotheses hold true.

The Retention Mathematics: Does Podcasting Move the Needle?

Here's the hard truth: Netflix needs podcasts to reduce churn, but the math is uncertain.

Netflix's churn rate in mature markets (US, Western Europe, Canada) is around 2.5% monthly. In emerging markets, it's lower. In saturated markets, it's higher.

A monthly churn rate of 2.5% means that after 40 months, Netflix loses 63% of its subscriber base to attrition alone. They need continuous new subscriber acquisition plus content that makes existing subscribers want to stay.

Podcasts could theoretically move the churn needle by creating habit-forming viewing. If Pete Davidson releases a new episode every Friday, and you set aside time to watch it, that creates a recurring engagement moment. Recurring engagement moments reduce churn.

But podcasts compete with everything else on Netflix. A subscriber who watches The Pete Davidson Show might watch fewer episodes of Stranger Things as a result. They're not gaining new engagement time; they're redistributing existing engagement.

The real value is if podcasts bring back lapsed subscribers or accelerate the decision to stay rather than cancel. A subscriber on the fence about Netflix might renew for another month because they want to watch the next Pete Davidson episode.

Netflix's internal metrics will show whether podcasts are actually moving these numbers. That data is confidential, but you'll see the answer in Netflix's earnings calls and subscriber growth rates over the next two years.

The International Expansion Angle

Podcasts could have different impact in different markets.

In the US and Western Europe, Netflix is saturated and churn is the problem. Podcasts might help with churn reduction.

In emerging markets like India, Brazil, and Southeast Asia, Netflix is still building audience. Podcasts could be a lightweight entry product that brings new users to the platform. A free podcast with limited advertising might convert to a paid subscription.

This international angle is important because it shows Netflix isn't betting entirely on podcasts for subscriber retention. They're also betting on podcasts as a customer acquisition tool in markets where they're still building distribution.

The YouTube Paradox: Distribution vs. Exclusivity

There's a fundamental tension in Netflix's podcast strategy that they haven't solved.

The most successful podcasts in history became successful on open platforms. Joe Rogan built his audience on Spotify and YouTube. The Paul brothers built their podcasts by distributing everywhere. Tim Ferriss reaches millions through multiple platforms.

Netflix is restricting distribution to create exclusivity. This makes business sense for a subscription streaming service. But it might be strategically wrong for podcasts, where discovery and distribution are everything.

A listener on YouTube looking for sports podcast recommendations will find Pardon My Take or The Ringer's podcasts more easily than they'll find The White House, which is only on Netflix.

Netflix's model requires building a discovery system within their platform that's better than YouTube's, Apple's, or Spotify's. That's theoretically possible, but Netflix doesn't have a track record of excellence in podcast discovery.

They have an excellent recommendation algorithm for film and television, but that algorithm works because it's trained on millions of hours of viewing data. Netflix doesn't have that data for podcasts yet.

The First-Mover Advantage Play

There's an argument that Netflix's restrictions could pay off if they establish "Netflix podcasts" as a distinct category with distinct quality expectations.

Similar to how "Netflix original" became a brand signal for quality, "Netflix podcast" could become shorthand for video podcasts at a certain production standard.

If Netflix can establish that brand positioning, then the exclusivity makes sense. People would come to Netflix specifically for video podcasts, the way they come for original series.

But this requires sustained investment and consistent quality. It requires Netflix to produce multiple hit podcast shows, not just Pete Davidson and Michael Irvin. It requires building a podcast genre within the Netflix brand.

That's a multi-year bet. Netflix is signaling they're willing to make it.

The Broader Media Shift: Why Every Platform Wants Podcasts

Netflix's podcast push isn't isolated. It's part of a broader shift in how media companies think about content.

Podcasts are growing faster than traditional media. Audio streaming is now larger than traditional radio. Video podcasts on YouTube are approaching 100 billion hours watched per year.

But more importantly, podcasts fill a unique niche in the media landscape. They're long-form, intimate, and permission-based. Listeners actively choose to spend time with podcast hosts, rather than passively consuming broadcast media.

This permission-based relationship creates loyalty. A podcast listener who follows a show for six months becomes a superfan. That's harder to achieve with movies or episodic television.

Media companies are realizing that podcasts are a retention lever, a brand-building tool, and an audience-development engine. They're not replacing traditional content; they're complementing it.

Netflix is late to this realization compared to Spotify and YouTube, which is why they're being aggressive now. They see the momentum and don't want to be left behind.

The Talent Relationship Shift

Podcasts also change how media companies relate to talent.

With television, networks have significant control over creative direction, scheduling, and promotion. With podcasts, hosts have more autonomy. They own their audience relationship directly.

This means media companies need to be better negotiators and partners with podcast talent. They can't just buy content; they need to support content creators who have existing empires.

Netflix's partnership with Pete Davidson and Michael Irvin is different from their relationship with television showrunners. Davidson already has an audience. Michael Irvin already has credibility and relationships. Netflix's job is to give them distribution and production resources, not to create their relevance.

This represents a fundamental shift in how media companies acquire and produce content.

Spotify relies on advertising for podcast revenue, while Netflix focuses on subscriber retention, potentially worth $500 million annually. Estimated data.

The Experiment Unfolding: What to Watch For

Netflix's podcast launch is an experiment with specific hypotheses. Here's what to watch for as evidence of whether those hypotheses are correct.

Hypothesis 1: Video podcasts can reach scale on a subscription platform. Watch for: subscriber growth acceleration, churn reduction, and engagement metrics in Netflix's earnings calls. If podcasts don't move the needle on these metrics within 18 months, the hypothesis is wrong.

Hypothesis 2: Celebrity talent can overcome YouTube's distribution advantage. Watch for: performance data on viewer retention and watch time completion rates for The Pete Davidson Show compared to similar content on other platforms. If Netflix doesn't share this data, that suggests negative results.

Hypothesis 3: Podcast audiences prefer Netflix's production quality. Watch for: social media sentiment, critical reception, and whether clips from the shows go viral on TikTok and Twitter. Viral clips would suggest quality is resonating.

Hypothesis 4: Video podcasts are an effective churn-reduction tool. Watch for: Netflix's next earnings call commentary on podcast performance and subscriber engagement. If executives mention podcasts, assume positive results. If they ignore the topic, assume disappointing results.

Hypothesis 5: Exclusivity can succeed where Spotify failed. Watch for: whether YouTube removes licensing restrictions or whether Netflix maintains exclusivity windows. If YouTube wins, assume audiences prefer open distribution over exclusivity.

The Timeline for Clarity

Netflix will have reasonable data on these hypotheses within two quarters of launch.

By Q2 2025, Netflix will know whether The Pete Davidson Show and The White House are driving meaningful engagement. By Q3 2025, they'll have enough data to decide whether to green-light additional original podcasts.

If both shows are performing above internal benchmarks, expect Netflix to announce additional podcast originals in summer 2025. If they're underperforming, expect Netflix to quietly reduce podcast investment and refocus on core content categories.

The streaming industry moves quickly once hypotheses are validated or disproven. This won't take years to resolve. It'll take months.

The Bigger Picture: What This Means for Streaming in 2025

Netflix's podcast bet reflects a broader reality about streaming in 2025: the market is mature, subscriptions are commoditized, and every platform is fighting for the same minutes of user attention.

Netflix has dominated because they had first-mover advantage with high-quality scripted content. But that advantage is eroding. Amazon Prime has good content. Apple TV+ is throwing billions at originals. HBO Max has decades of library content. Disney+ has character franchises.

The next competitive frontier isn't about who has better shows. It's about who can build a platform that users want to open every day, regardless of whether they're there to watch something specific.

Podcasts are a tool for that. They create daily or weekly appointments. They build parasocial relationships. They reduce the friction between a subscriber and content consumption.

But so do games, live events, sports, and social features. Netflix is experimenting with all of these. The podcast bet is one piece of a broader strategy to transform Netflix from a "content library you subscribe to" into a "daily habit platform you can't live without."

Whether podcasts specifically succeed or fail, the strategy is sound. Media companies need multiple engagement vectors, not just film and television.

Production Quality and Distribution: The Unglamorous Reality

Let's talk about the operational challenges Netflix faces that don't make headlines.

Netflix has never produced podcasts at scale. That means building new infrastructure: recording studios, editing workflows, quality standards, and talent management processes.

This is doable, but it takes time. Their television and film teams can't just shift to podcasting; they need to learn new skills and adapt to a different production cadence.

Podcast production is faster than TV. You might produce 52 episodes of a podcast in the time it takes to produce 8 episodes of a television series. That's a different rhythm, and getting the workflow right matters.

There's also the talent management aspect. Podcast hosts are different from actors and directors. They often have strong opinions about their content, independent audiences, and existing brand relationships. Netflix needs to learn how to partner with them effectively rather than manage them like traditional talent.

The Technical Infrastructure Play

Netflix will also need to build podcast-specific tech infrastructure.

They need transcript generation, show scheduling, social media clip extraction, and audience analytics specific to podcasts. Their existing platform was built for film and television; podcasts have different consumption patterns and measurement needs.

This infrastructure investment isn't flashy, but it's essential. Without good tools, producing multiple original podcasts becomes operationally difficult.

You'll see evidence of this investment in Netflix's job postings and hiring announcements. If they're serious about podcasting, they'll be hiring podcast producers, audio engineers, and podcast-specific product managers throughout 2025.

The White House podcast releases twice as many episodes per week as The Pete Davidson Show, catering to the high content demand of sports fans. Estimated data.

The Monetization Question: How Do Podcasts Make Money?

Here's something Netflix hasn't clearly addressed: monetization.

Traditional podcasts are monetized through advertising or premium subscriptions (like Patreon). Netflix's podcasts don't have advertising, and they're included in the standard Netflix subscription.

This means podcasts need to drive subscriber value rather than direct revenue. They need to reduce churn, increase engagement, or bring new subscribers.

Spotify learned that exclusive podcasts don't generate direct revenue, so they've shifted to audio advertising as their podcast monetization strategy. Netflix could do the same, introducing ads to podcast content, but that would create friction with their existing subscriber base.

More likely, Netflix will keep podcasts ad-free and measure their value in subscriber retention and engagement metrics. The ROI is indirect but real: if podcasts reduce monthly churn by 0.5 percentage points, that's worth $500 million annually for Netflix.

The International Monetization Play

In some international markets, Netflix might introduce ad-supported tiers specifically for podcasts. This would let them monetize in markets where video advertising has lower price points and would be less disruptive to subscribers in mature markets.

This is speculative, but it matches Netflix's pattern of testing features in specific markets before rolling out globally.

Competitive Responses: How YouTube, Apple, and Spotify Will React

Netflix's podcast launch will trigger competitive responses from other platforms.

YouTube will likely double down on algorithm improvements and creator incentives to lock down more exclusive podcast content. Apple will accelerate its podcast subscriptions business and invest in exclusivity deals.

Spotify might shift strategy entirely, focusing more on their audio advertising business and less on exclusive podcast content. Or they might lean harder into podcasting, recognizing that Netflix's move validates the category's importance.

The competitive dynamic will probably accelerate overall podcast investment across all platforms. Netflix entering the market seriously signals that podcasts are a strategic priority, which gives confidence to other platforms and investors that podcasting is a sustainable business category.

The Consolidation Wild Card

There's also the possibility of consolidation. Could Netflix, Spotify, and YouTube eventually partner on podcast distribution? Could Apple acquire a major podcast network to compete?

Consolidation seems unlikely in the short term, but media industry consolidation happens fast once a strategic trend is identified. The podcasting landscape could look very different by 2027.

The Creator Economy Angle: Why This Matters Beyond Netflix

Netflix's podcast launch has implications for independent creators too.

If video podcasts become viable as a premium content format on Netflix, independent creators will notice. Some might approach Netflix for distribution deals. Others might be inspired to invest in video production quality for their own podcasts.

This could accelerate the professionalization of podcasting, moving it from a hobby or audio-only medium to a high-production-value format with professional crews and significant budgets.

That's good for audiences, who get better content. It's bad for creators without significant capital, who can't compete at that production level.

Over time, this could create a two-tier podcast market: high-production-value podcasts on platforms like Netflix, and grassroots, low-production podcasts on YouTube and Apple Podcasts.

The Opportunity for Niche Communities

Niche podcasts might actually thrive in this environment.

If Netflix focuses on mainstream celebrity podcasts, that leaves room for independent creators to own niche communities. A dedicated podcast for specific hobby or subculture doesn't need Netflix's production quality or celebrity talent. It just needs a committed community.

This is where platforms like YouTube and Patreon have advantages over Netflix. They're better suited for niche content than a mainstream streaming service.

Risk Factors: Everything That Could Go Wrong

Netflix's podcast bet has several risk factors worth considering.

Risk 1: Format Risk. Video podcasts might not resonate at scale. The format might feel gimmicky or unnecessary compared to audio podcasts.

Risk 2: Talent Risk. Pete Davidson and Michael Irvin might not deliver sustained, high-quality content over multiple seasons. Burnout, scheduling conflicts, or creative disagreements could derail the shows.

Risk 3: Audience Risk. Podcast audiences might be too loyal to existing hosts on existing platforms to migrate to Netflix. Distribution advantage might matter more than production quality.

Risk 4: Competitive Risk. YouTube could respond aggressively with better creator incentives, pulling talent away from Netflix. Apple could use device dominance to boost podcast discovery.

Risk 5: Execution Risk. Netflix might underestimate the operational challenge of producing podcasts at scale, leading to quality issues or delays.

Risk 6: Churn Risk. Podcasts might not actually reduce churn or improve engagement metrics enough to justify the investment.

Any of these risks could cause Netflix's podcast strategy to underperform. That wouldn't be a disaster for Netflix given their overall business strength, but it would be a strategic setback.

The Long Game: Where This Leads in 2025 and Beyond

Assuming Netflix's podcast strategy succeeds, where does it lead?

Short term (2025): Netflix announces additional original podcasts based on successful performance of the first two shows. Platform begins investing in podcast discovery and recommendation features.

Medium term (2026-2027): Netflix has 10-15 original podcast shows and a recognized brand position in video podcasting. Podcasts become a regular mention in Netflix earnings calls and investor presentations.

Long term (2028+): Podcasts are one of several engagement vectors on Netflix, alongside film, television, games, and live events. The company has learned how to operate a podcast studio at scale.

The bigger strategic point is that Netflix is signaling willingness to compete in content categories beyond scripted television and film. Podcasts are the current experiment, but it's part of a broader strategy to become a "total entertainment platform" rather than a "streaming TV service."

That's the real bet here. It's not about whether The Pete Davidson Show becomes the next Joe Rogan Experience. It's about whether Netflix can successfully expand beyond their core competency and become a platform for diverse forms of entertainment content.

Historically, this is hard for large companies. Netflix's strength is in understanding audience psychology for film and television. Translating that to podcasts, games, live events, and other formats is genuinely difficult.

But they have the resources and the subscriber base to experiment. The question is whether they have the learning agility to execute across multiple content formats simultaneously.

Conclusion: The Bet That Shapes 2025 Streaming

Netflix's launch of original video podcasts with Pete Davidson and Michael Irvin is more significant than it initially appears.

On the surface, it's a smart business move. Netflix has a captive audience and wants to increase engagement and reduce churn. Podcasts are one way to do that. Celebrity hosts provide cultural gravity. Video production differentiates Netflix from competitors.

But the real significance is strategic. Netflix is betting that the future of entertainment isn't about owning one content category (film and television) but about dominating multiple engagement vectors simultaneously.

They're competing with YouTube, Spotify, Apple, and Amazon not just on content quality but on platform architecture. They're trying to become the place people open first, regardless of whether they're looking for a show, a podcast, a game, or an event.

That's a bold strategy. It requires Netflix to become excellent at multiple different content formats and production processes. It requires building platform features that serve multiple content types. It requires understanding audience psychology across different mediums.

Pete Davidson cracking jokes in his garage isn't the main story here. The main story is Netflix's fundamental transformation from a content-focused platform to an engagement-focused platform.

Whether that transformation succeeds or fails will shape the streaming landscape for the next three years. If Netflix cracks the code on diversified content, expect Apple, Amazon, and others to follow. If they fail, expect podcasting to remain primarily a YouTube and Spotify game.

Either way, 2025 is the year we'll find out. The first episodes of The Pete Davidson Show and The White House are early signals of where streaming is heading. Watch them closely, not for the content itself, but for what they reveal about Netflix's strategic evolution.

The future of streaming isn't about who has the best shows anymore. It's about who can build the most engaging platform. Netflix is betting that podcasts are part of that answer.

FAQ

What exactly are Netflix's original podcasts?

Netflix's original podcasts are video podcast shows produced exclusively for the streaming platform. The Pete Davidson Show and The White House are the first two original shows, featuring long-form conversations with guests in intimate settings. These differ from licensed podcasts that Netflix hosts from other creators—these are shows that Netflix produces directly, with original content filmed specifically for Netflix viewers.

Why is Netflix getting into the podcast business now?

Netflix is entering podcasting to increase subscriber engagement and reduce monthly churn. Since Netflix's subscriber base has plateaued in mature markets, the company needs to add value to existing subscriptions rather than rely solely on new subscriber growth. Podcasts create recurring viewing habits (weekly or bi-weekly episodes) that encourage subscribers to stay active on the platform, directly reducing the likelihood that subscribers cancel their subscriptions.

How do video podcasts differ from traditional audio podcasts?

Video podcasts require viewers to watch on screen rather than listen while multitasking, which fundamentally changes consumption patterns. Traditional podcasts are consumed primarily during commutes, workouts, and household chores. Video podcasts require visual attention, which limits their addressable audience but potentially allows for more dynamic production through editing, b-roll, graphics, and visual storytelling that audio-only formats cannot provide.

When will The Pete Davidson Show and The White House premiere?

The White House with Michael Irvin debuts on January 19th, 2025, while The Pete Davidson Show launches on January 30th, 2025. The Pete Davidson Show will air new episodes every Friday, while The White House releases two episodes per week, reflecting the different production cadences Netflix is using for each show.

How much will it cost to watch Netflix's podcasts?

Netflix's original podcasts are included with any Netflix subscription at no additional cost. They're not behind a paywall or premium tier; they're part of the standard Netflix experience for all paying subscribers. Netflix has not announced advertising on these shows, though that could change in specific international markets.

Can I watch Netflix's podcasts on YouTube or other platforms?

No. Netflix's exclusive content deals prevent licensed podcasts from appearing in their entirety on YouTube. However, it's unclear whether Netflix's original podcast productions have the same restrictions. Netflix might allow short clips on YouTube for promotion purposes, but full episodes will likely be exclusive to Netflix initially. This exclusivity is designed to drive Netflix subscriptions specifically for podcast content.

Why did Netflix choose Pete Davidson and Michael Irvin as their first podcast hosts?

Pete Davidson brings cultural relevance with younger audiences through his SNL background and comedy credibility, making him ideal for a show about authentic celebrity conversation. Michael Irvin brings deep sports fan loyalty from his NFL career and media presence, providing credibility with sports-focused audiences. Both hosts have existing audiences and celebrity relationships that give the shows built-in intrigue and guest potential.

Will more Netflix original podcasts be announced?

While Netflix hasn't announced additional original podcasts yet, the company will likely green-light more shows if The Pete Davidson Show and The White House perform well in engagement and retention metrics. Netflix typically makes content decisions based on internal performance data, and you should expect announcements about additional originals within 6 to 9 months of these launch episodes if they're successful.

How does this compete with Joe Rogan's Spotify podcast?

Netflix's podcasts compete with Spotify's exclusive deals by offering video production quality and a captive subscription audience, whereas Spotify's Joe Rogan Experience is audio-only and lives within the broader Spotify ecosystem. Netflix is betting that premium video production and celebrity talent can overcome Spotify's advantages in podcast discovery and podcast-specific recommendation algorithms. However, Spotify's deal with Rogan remains audio-focused, so they're not directly competitive on format.

What does this mean for the future of podcasting?

Netflix's original podcasts signal that video podcasting is becoming a serious content format worth billion-dollar investments from mainstream media companies. This will likely accelerate overall investment in podcast production quality, potentially creating a two-tier market: high-production-value professional podcasts on major platforms and grassroots, lower-production-value podcasts on independent platforms. The format might also shift from audio-primary to video-primary for major shows over the next few years.

Key Takeaways

- Netflix launches original video podcasts with Pete Davidson and Michael Irvin as flagship shows in January 2025, representing the platform's first foray into owned podcast content production

- Video podcasts offer significantly lower production costs (200K per episode) compared to scripted television (15M per episode), improving content economics for streaming platforms

- Netflix's podcast strategy aims to reduce subscriber churn and increase platform engagement through recurring, habit-forming content that creates appointment viewing

- YouTube dominates podcast distribution with 35% market share, followed by Spotify (28%) and Apple Podcasts (22%), making Netflix's entry into an already competitive landscape

- Video podcasts require visual attention, limiting their addressable audience compared to traditional audio podcasts consumed during commutes and exercise, but offering production quality differentiation

Related Articles

- Paramount vs. WBD Netflix Deal: The Hostile Takeover Battle Explained [2025]

- Paramount Skydance's Lawsuit Against Warner Bros. Discovery [2025]

- The Complete History of TiVo: How It Changed TV Forever [2025]

- Black Mirror Season 8 Confirmed: What Charlie Brooker Says About The Future [2025]

- TikTok's 2026 World Cup Live Deal: What It Means for Sports Broadcasting [2025]

- Star Trek: Starfleet Academy Balances Teen Drama With Intergalactic Stakes [2025]

![Netflix's Video Podcast Bet: Pete Davidson and Michael Irvin [2025]](https://tryrunable.com/blog/netflix-s-video-podcast-bet-pete-davidson-and-michael-irvin-/image-1-1768417758762.jpg)