Nevada Sues Kalshi: The Prediction Betting Market Legal Battle Reshaping Financial Regulation [2025]

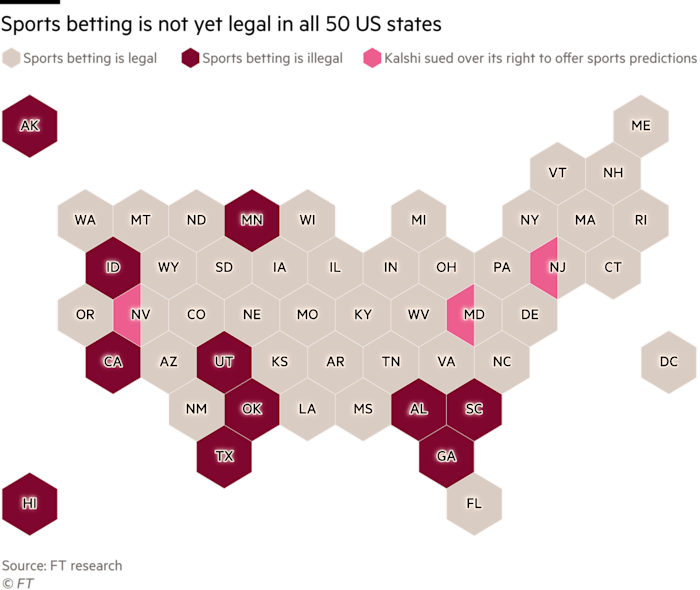

Here's the thing about prediction markets—they seem too good to be true because they kind of are, at least legally speaking. In early 2025, Nevada took a sledgehammer to the booming prediction betting industry by filing a lawsuit against Kalshi, one of the fastest-growing prediction market platforms in the country. The complaint? Kalshi's been letting people bet on everything from election outcomes to sports games without proper licensing, and worse, they're allegedly allowing users under 21 to participate.

This isn't some isolated state-level complaint getting lost in bureaucratic channels. Nevada's lawsuit represents a watershed moment in how governments are starting to fight back against the prediction market boom. And that battle is about to reshape how financial regulators, state authorities, and tech companies think about betting, speculation, and what counts as legitimate commerce.

The lawsuit dropped just hours after a federal appeals court denied Kalshi's own request to block Nevada from taking action. That timing's no accident. Nevada's attorney general saw an opening and moved fast. But what makes this case genuinely interesting isn't just the legal maneuvering—it's the collision between federal and state authority, the question of whether prediction markets should be treated like casinos or stock exchanges, and whether the future of betting in America gets decided by regulators or by platforms moving fast and asking permission later.

By the end of this article, you'll understand why Nevada's lawsuit matters far beyond Nevada, how the federal Commodity Futures Trading Commission (CFTC) is positioning itself as the true authority over these markets, and what happens to prediction betting if state regulators start winning these legal fights.

TL; DR

- Nevada filed a lawsuit against Kalshi claiming the platform operates without proper state gambling licenses and allows users under 21 to bet

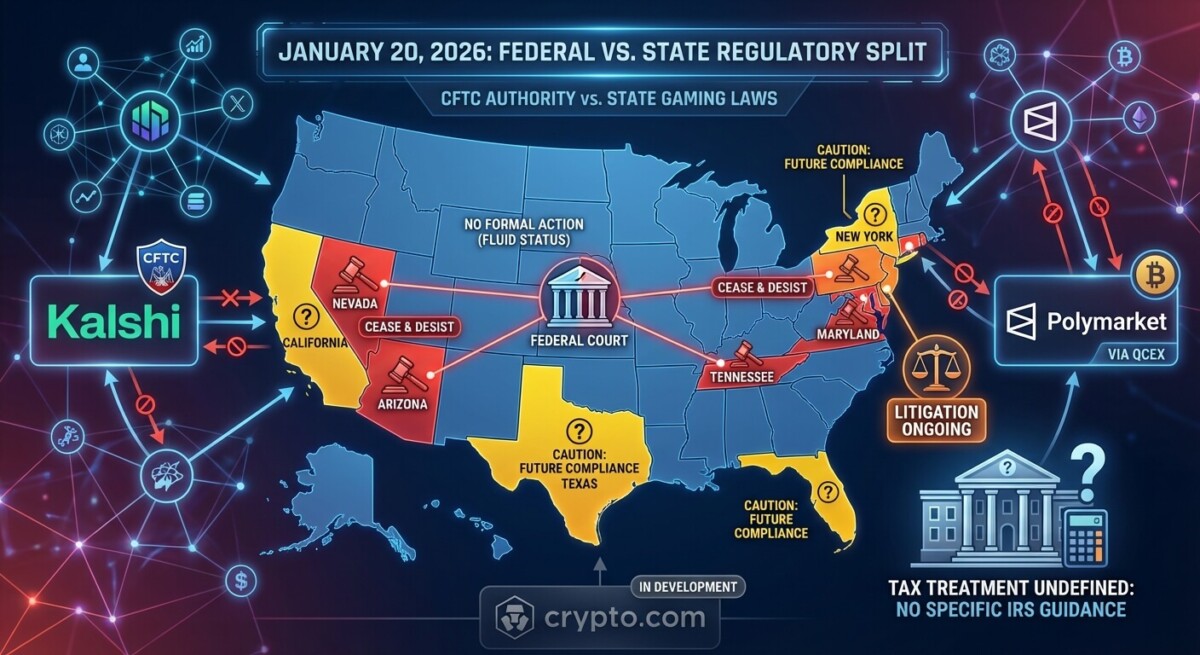

- The CFTC is fighting state regulation with the argument that federal authority over prediction markets is exclusive, dismissing concerns about consumer protection

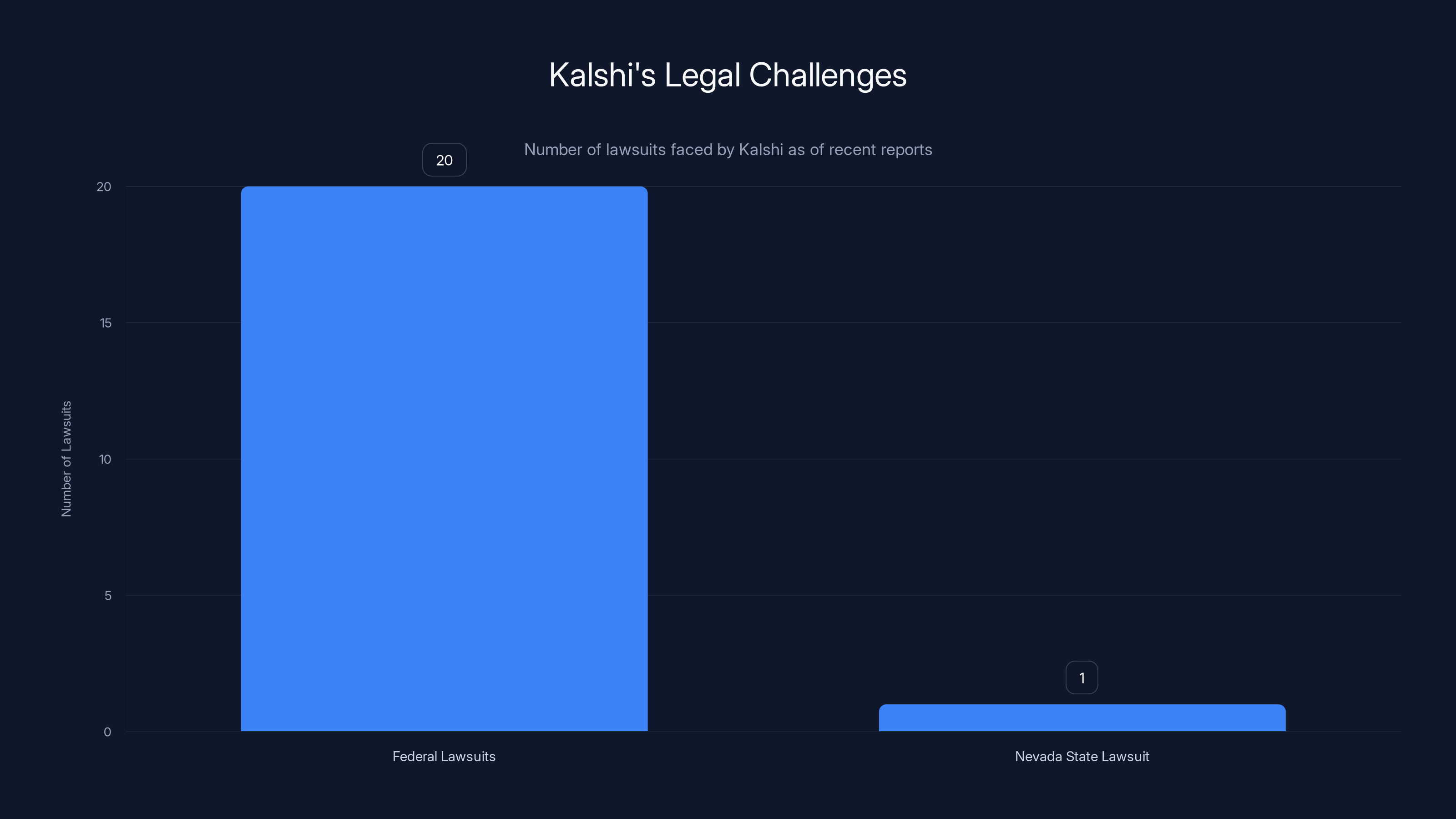

- Kalshi faces at least 20 federal lawsuits related to sports betting and recently lost a Massachusetts court battle requiring a statewide betting ban

- The regulatory landscape is fractured between states trying to protect their gambling markets and federal authorities trying to prevent a patchwork of local regulations

- Prediction market growth is exponential with platforms like Polymarket enabling billions in speculative bets on everything from political events to celebrity outcomes

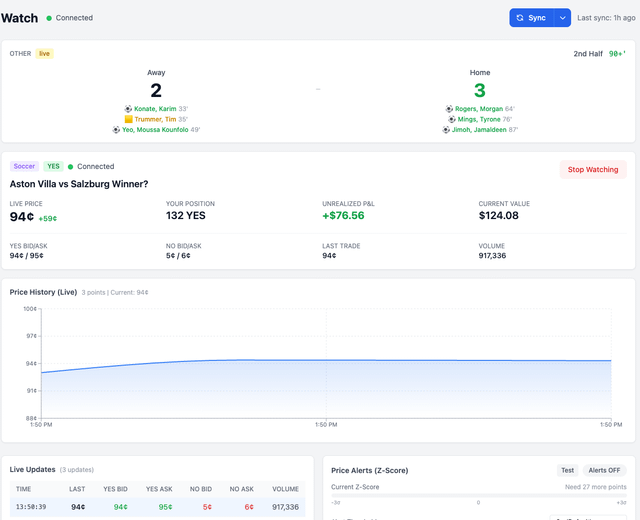

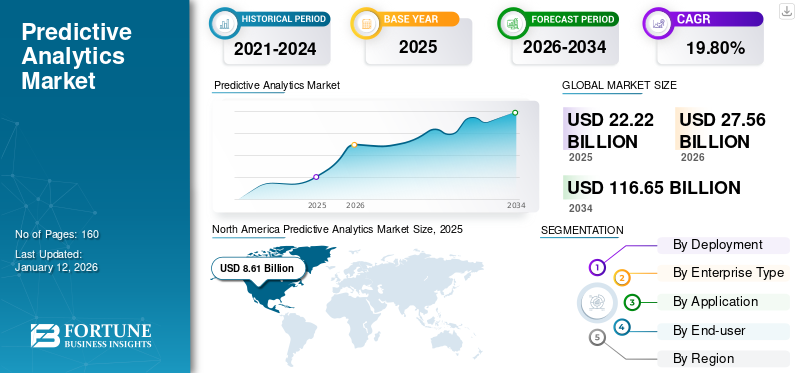

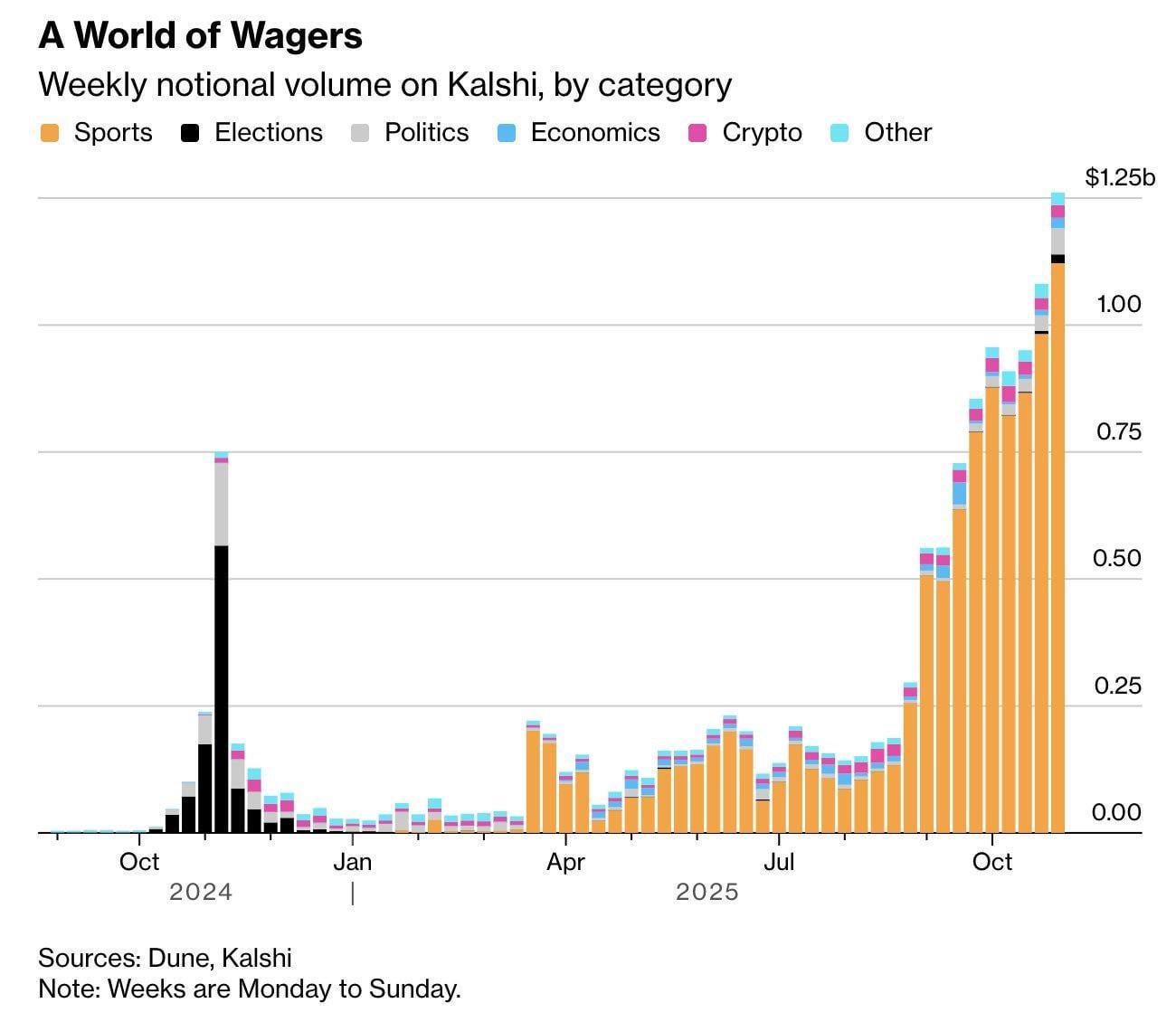

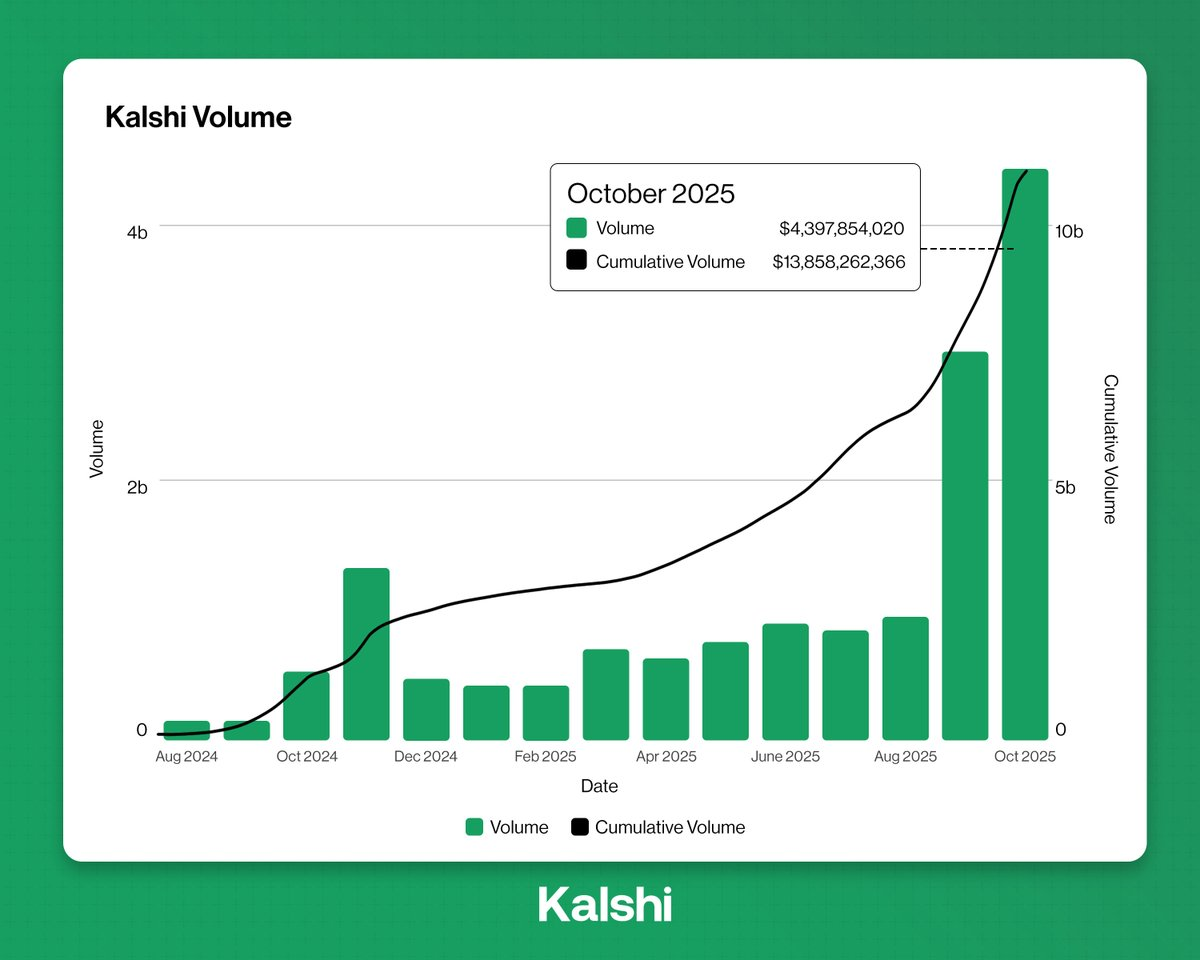

Prediction markets have seen substantial growth, with trading volumes increasing from

Understanding Prediction Markets: What They Are and Why They're Exploding

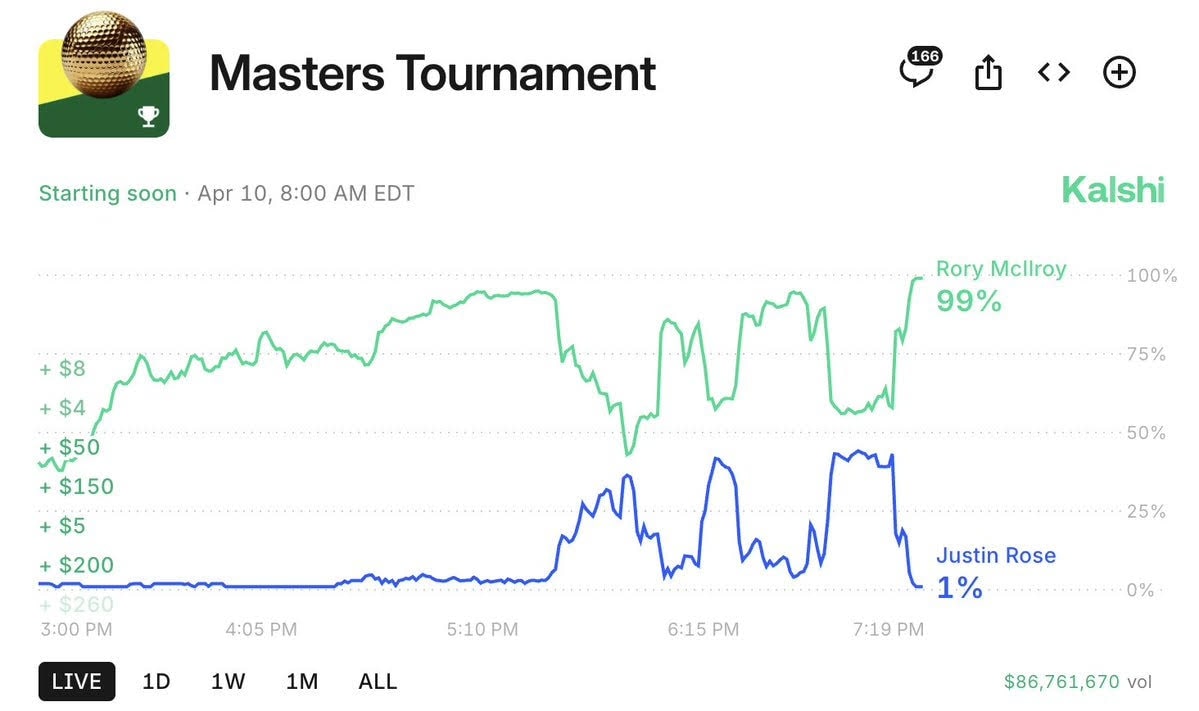

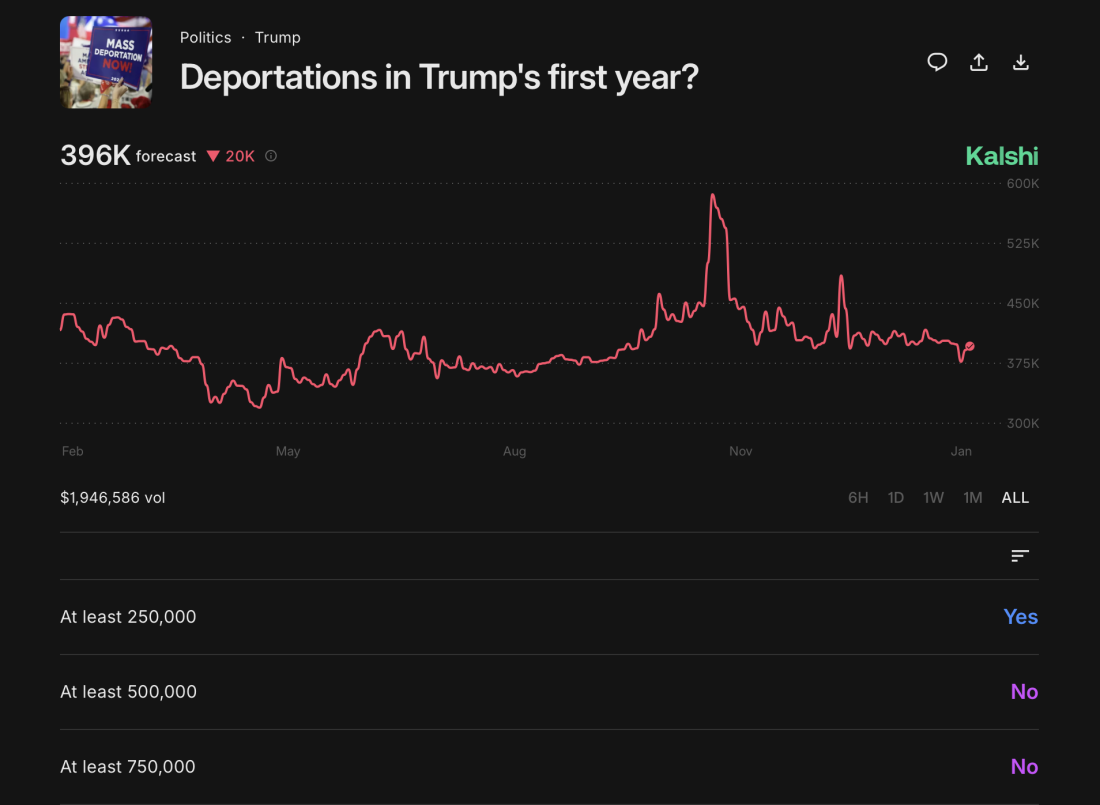

Prediction markets sound complicated until you actually look at them, and then they seem weirdly simple. You pick an outcome you think will happen—say, a particular candidate wins an election or a specific team wins the Super Bowl—and you buy shares reflecting that outcome. If you're right, your shares go up in value and you cash out. If you're wrong, you lose your investment.

The appeal is obvious. Unlike traditional sports betting where the house has a built-in edge and you're always fighting against odds designed to benefit the casino, prediction markets theoretically reflect real collective belief. If 70% of traders think Candidate A will win, the market's basically saying there's a 70% probability of that outcome. That's powerful information, and it's attractive to people who want to make educated bets.

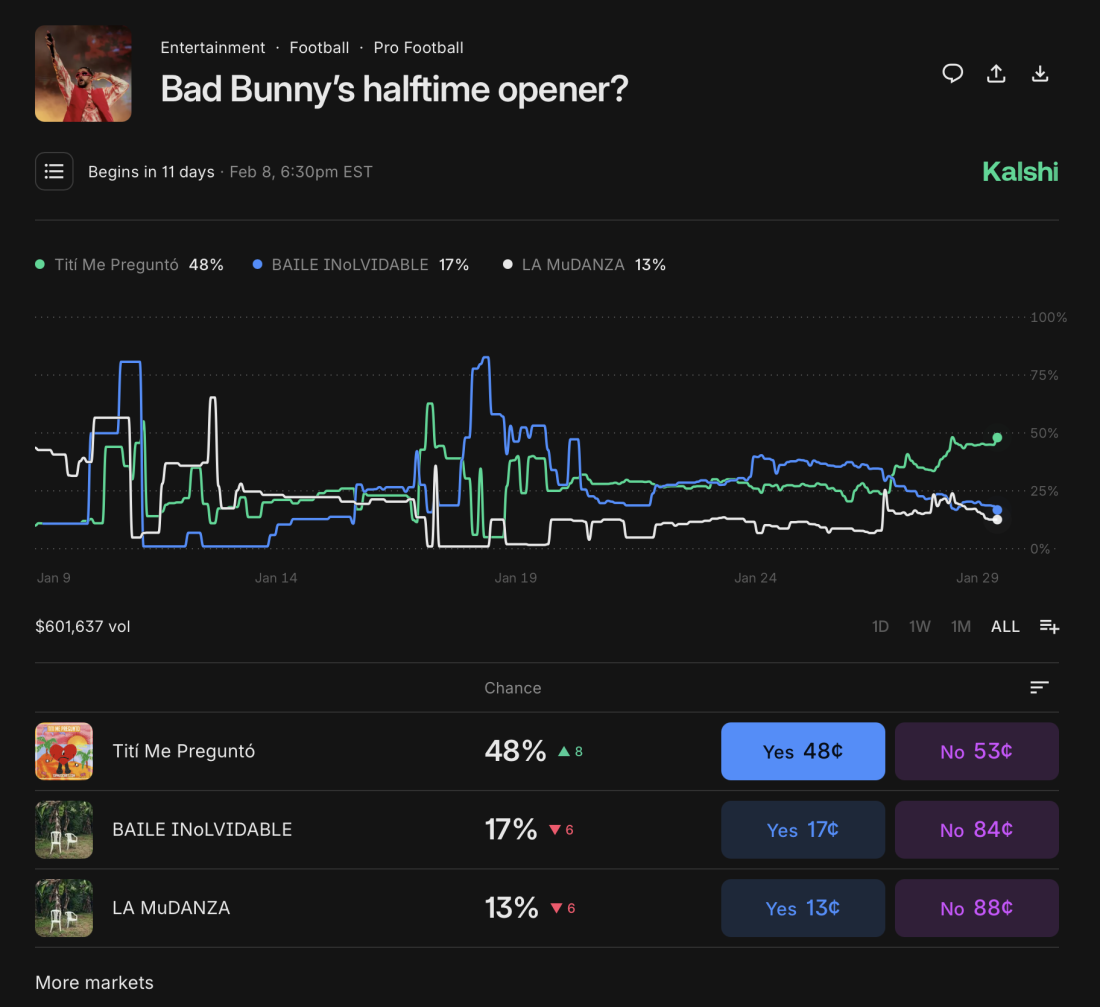

Platforms like Kalshi and Polymarket have exploded in popularity because they've made this accessible. You don't need to be an institutional trader with a Bloomberg terminal. You can open an account on your phone and start betting on outcomes within minutes. The range of what you can bet on has gotten absurdly broad—you can bet on whether Elon Musk will become CEO of the U. S. Space Force, whether it'll snow in Denver on a specific date, or whether a specific executive will be fired.

What makes prediction markets attractive to regulators, ironically, is also what makes them dangerous from a consumer protection standpoint. They're built on the premise that outcomes can be objectively verified. Did the candidate win? Yes or no. Did the team score more points? Check the official stats. This feels safer than games of pure chance because it's not about luck—it's about prediction. But that reasoning has a fundamental flaw: just because an outcome is verifiable doesn't mean the betting is actually fair or that the platform isn't letting bad actors manipulate results.

The real problem emerges when you think about sports betting specifically. Nevada's lawsuit isn't just about unlicensed operations—it's about specific safeguards that should prevent match-fixing and point-shaving. If you let anyone bet on a game, and some of those people are coaches, players, or officials involved in that game, you've created a massive incentive for fraud. Traditional Nevada sports books have evolved over decades with rules specifically designed to prevent this. Prediction market platforms? Many came up during the crypto boom when move-fast-and-break-things was a business philosophy, not a regulatory nightmare.

Estimated data shows financial issues as the most significant impact of underage gambling, followed by mental health problems and family disruptions.

The Nevada Lawsuit: What Specifically Is the State Claiming?

Let's get specific about what Nevada is actually arguing. The state's lawsuit makes three core claims, and understanding them matters because they're going to shape how prediction markets operate for the next decade.

First, Nevada says Kalshi doesn't have the proper license to operate in the state. Nevada's gambling market is tightly controlled. If you want to let people place bets in Nevada, you need explicit permission from the Nevada Gaming Control Board. Kalshi apparently decided that federal regulation from the CFTC was sufficient, and Nevada residents could access the platform without any state-level permission. Nevada is saying that's not how it works—that federal regulation doesn't override state authority over gambling within state borders.

Second, the lawsuit claims that Kalshi allows users under 21 to place bets. This is probably the most damning claim. Every regulated gambling operation in America has age verification built in as a basic safeguard. If Kalshi genuinely allowed minors to bet, that's not a technical gray area—it's a straightforward violation of basic consumer protection principles that date back decades.

Third, and this is where Nevada gets really specific, the state claims that Kalshi doesn't have adequate safeguards to prevent insiders from betting on events they're involved in. Nevada's exact language is worth noting: "Kalshi does not employ adequate safeguards to ensure that wagers are not being placed on an event by owners, coaches, players, or officials participating in the event, and does not communicate about potential evidence of match fixing or point shaving with Nevada gaming regulatory authorities."

That's a serious accusation. It's saying that Kalshi not only lacks basic protections against insider betting, but also fails to report suspicious activity to state authorities. In traditional Nevada sports books, there are entire departments dedicated to spotting unusual betting patterns that might indicate game-fixing. If Kalshi has no equivalent system, that's a massive regulatory gap.

Now here's what's fascinating: Kalshi declined to comment. That's their right, legally. But in the court of public opinion, not responding to specific allegations about allowing underage betting and failing to prevent insider trading looks like admitting the core claims are accurate. It's possible Kalshi is making no comment because their lawyers advised silence until litigation resolves. But it also might mean they don't have good answers.

The timing of Nevada's lawsuit matters too. The state filed just hours after a federal appeals court denied Kalshi's request for an injunction preventing Nevada from taking action. That suggests Nevada was waiting for this legal moment—waiting for the court to essentially say, "Yeah, Nevada can do this," before they pulled the trigger.

The CFTC's Power Play: Federal Authority vs. State Control

Here's where things get genuinely complicated and honestly a bit troubling from a regulatory standpoint. The CFTC has been actively arguing against state-level regulation of prediction markets. And I don't mean passively defending their turf—I mean aggressively intervening in state litigation to prevent state regulators from blocking prediction market operations.

In January 2025, CFTC head Michael Selig published an op-ed in the Wall Street Journal making the case that state regulations "undermine the agency's exclusive jurisdiction over these markets." His argument is straightforward: prediction markets are derivative markets, derivatives fall under federal Commodity Exchange Act authority, therefore states don't get to regulate them. He also defended the platforms themselves, arguing that "exchanges aren't the Wild West, as some critics claim, but self-regulatory organizations that are examined and supervised by experienced CFTC staff."

That last part is worth really examining because it contains both truth and propaganda. Yes, the CFTC does supervise these platforms. But "examined and supervised by experienced CFTC staff" makes it sound like there's an army of regulators watching every transaction. In reality, the CFTC has finite resources. They can't examine every platform in detail. They do spot checks, respond to complaints, and review submissions. That's actual supervision, sure, but it's not the constant oversight that traditional gambling has in Nevada.

The CFTC also filed an amicus (friend of the court) brief in support of Crypto.com's appeal when the company was fighting with Nevada over its own prediction market offering. That's a significant move—federal regulators actively backing a platform in litigation against a state. It signals that the CFTC sees state regulation of prediction markets as an existential threat to their authority.

But here's the counterargument that Nevada (and soon probably other states) will make: the CFTC has never claimed exclusive jurisdiction over consumer protection within state borders. States have always been able to regulate gambling because gambling is fundamentally a local issue. People gamble in Nevada, not in some federal jurisdiction. Nevada has a specific history and expertise in gambling regulation. The CFTC is a financial regulator, not a gambling regulator. Confusing the two could be dangerous.

The legal doctrine that might resolve this conflict is called "cooperative federalism," where states and the feds coordinate on regulation rather than fighting. But that requires the CFTC to be willing to work with states, and right now they seem more interested in preventing states from acting at all.

Nevada's gambling regulations are robust, addressing insider betting, underage betting, and licensing effectively. Kalshi's practices, however, appear to lack similar safeguards. (Estimated data)

Kalshi's Broader Legal Problem: 20+ Lawsuits and Counting

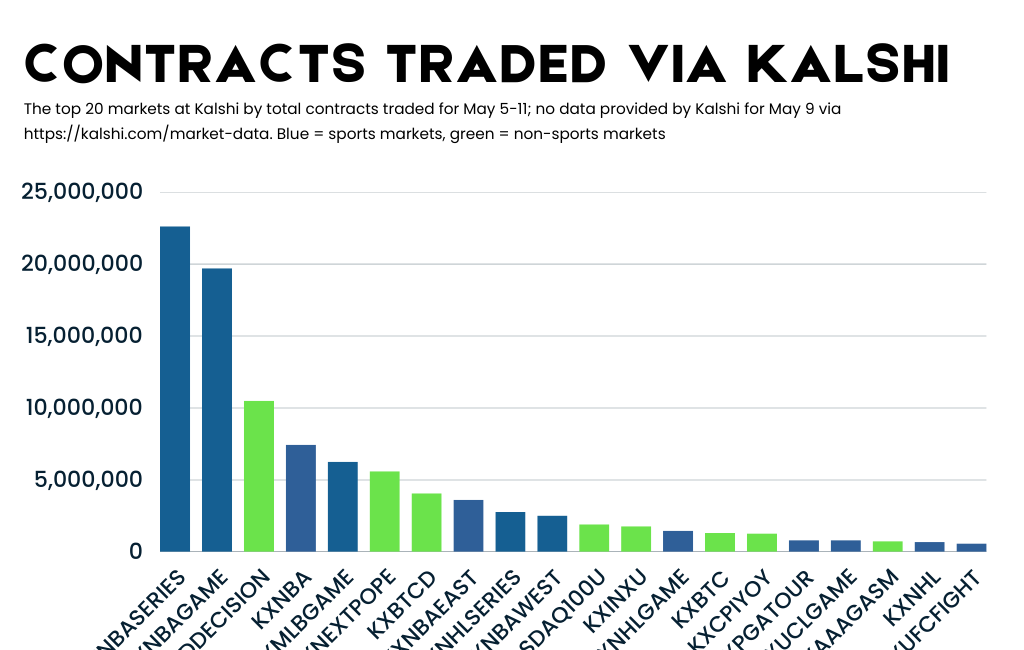

Nevada's lawsuit isn't some anomaly for Kalshi. It's just the most recent and visible battle in what's become a legal war of attrition. According to reporting, Kalshi is currently facing at least 20 federal lawsuits specifically related to its sports betting offerings.

That's... a lot. Most startups would have shut down or pivoted by this point. But Kalshi has apparently decided to litigate aggressively rather than comply with individual state demands. That could be a brilliant long-term strategy if they believe they can establish federal precedent for their right to operate without state licenses. Or it could be a catastrophically expensive mistake.

One specific loss is particularly significant: a Massachusetts judge ordered Kalshi to stop allowing residents to place bets on sports. Massachusetts isn't Nevada—it doesn't have the same gambling tradition or regulatory infrastructure. But when a judge in a major state says "stop," that's hard to ignore even if you believe the judge is wrong.

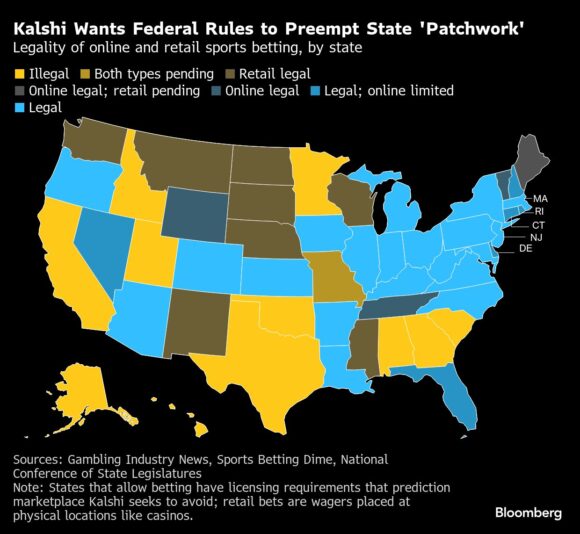

The Massachusetts decision creates a cascade problem for Kalshi. If Massachusetts can block sports betting, why can't California? Why can't New York? Why can't Texas? Pretty soon you've got Kalshi trying to maintain different feature sets and compliance rules for every state. That's nightmarish operationally.

What makes Kalshi's situation particularly precarious is that they can't rely on the CFTC to actually force states to stop suing them. The CFTC can file amicus briefs and argue about jurisdiction, but they can't directly command Massachusetts judges or Nevada attorneys general to stand down. States have their own constitutional authority to protect consumers within their borders. So even if the CFTC eventually wins a nationwide precedent case in the Supreme Court, that could take five years of litigation.

Meanwhile, Kalshi is hemorrhaging money on legal fees, losing revenue in states where courts have blocked them, and burning credibility with every new loss.

The Polymarket Elephant: Why This Matters Beyond Kalshi

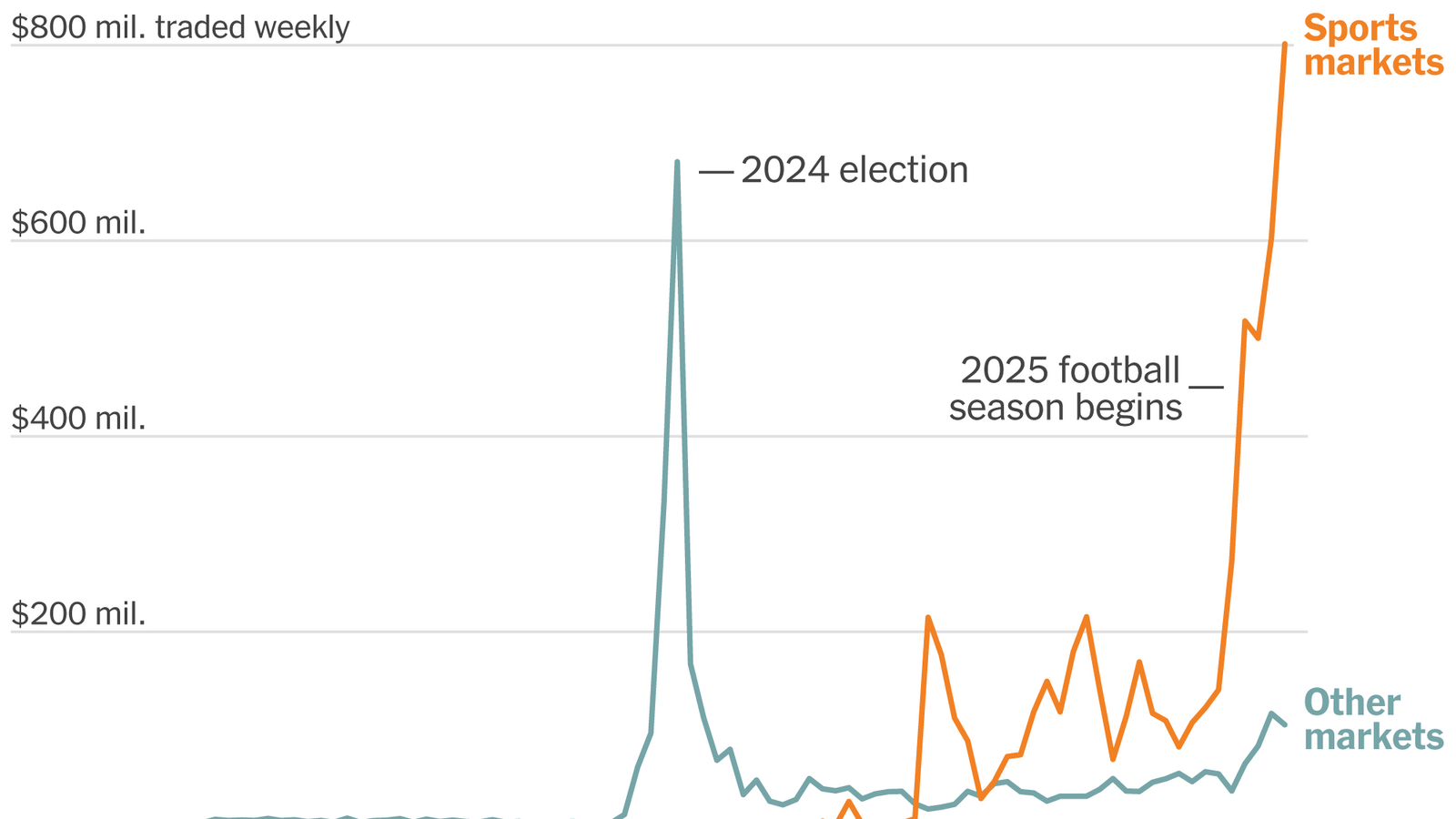

If Nevada's lawsuit were just about Kalshi, it would be mildly interesting tech policy news. But prediction markets in general have exploded in popularity and sophistication. And Polymarket is the elephant in the room.

Polymarket operates similarly to Kalshi, but with a crucial difference in scale and cultural prominence. Polymarket became mainstream during the 2024 election cycle, with mainstream media outlets regularly citing Polymarket probabilities as if they were official forecasts. The platform processed over $1 billion in trading volume in just the election-related markets.

That scale creates regulatory pressure that Polymarket can't ignore. When prediction markets are tiny niche products used by sophisticated traders, regulators often look the other way. When prediction markets are becoming a major source of price discovery for high-stakes outcomes—elections, major company decisions, geopolitical events—suddenly regulators start paying attention.

The interesting question is whether Polymarket will experience similar lawsuits. The company is structured differently, with its parent company based outside the United States. That might provide some regulatory distance, or it might just delay the inevitable. Regulators have long memories and eventually figure out how to reach offshore entities.

The broader pattern is clear: prediction markets were able to grow relatively unimpeded for a few years because regulators didn't understand them and hadn't developed a coherent policy. That window is rapidly closing. Within the next 12-24 months, I expect:

- Multiple states will file lawsuits similar to Nevada's

- The CFTC will attempt to formalize its authority through new rulemaking

- At least one state will win a significant legal victory that constrains prediction market operations

- Congress will hold hearings about whether prediction markets should exist at all

This isn't just theoretical risk. It's already starting.

Kalshi is currently facing a total of 21 lawsuits, with 20 at the federal level and 1 from the state of Nevada. Estimated data based on recent reports.

Regulatory Gaps: Why Nevada's Concerns Are Legitimate

Let's be fair to Nevada for a moment. Nevada isn't being unreasonable here. The state has operated a heavily regulated gambling market for nearly a century. They've learned—sometimes through hard lessons and scandals—what safeguards are actually necessary to prevent fraud, protect consumers, and maintain the integrity of betting markets.

Nevada's concerns map directly onto historical gambling scandals:

The insider betting problem: In the 1950s, there were legitimate concerns about professional athletes being incentivized to throw games or manipulate outcomes because gamblers with inside information could bet on results. Nevada developed detailed rules about who can bet on sports and reporting mechanisms for suspicious activity. Kalshi apparently has no equivalent system. If Kalshi allows a professional baseball pitcher to place bets on games he's pitching in, that's not a minor compliance violation—that's recreating conditions for game-fixing that Nevada thought they'd solved decades ago.

The underage betting problem: This is less about historical gambling and more about basic consumer protection. Minors don't have the cognitive development to manage risk the way adults do. They're more prone to compulsive behavior. Allowing minors to bet on prediction markets is essentially allowing them to gamble with real money on speculative outcomes. That's not okay even if the outcomes are objectively verifiable.

The licensing and oversight problem: Nevada's licensing system exists specifically so that the state can: (1) vet operators for financial stability, (2) conduct regular audits, (3) respond quickly to consumer complaints, and (4) shut down operations if fraud occurs. Kalshi operating without Nevada state licensing means Nevada has zero oversight of the platform's finances, operations, or customer safeguards within state borders.

The counterargument from the CFTC is that prediction markets are different because they're not gambling—they're derivatives trading. An outcome either happens or it doesn't, and the contract's value is determined by an objective external event. That's less like a casino and more like buying a put option on a stock.

But here's the problem with that argument: whether you call something gambling or derivatives trading, the actual human activity is identical. A person is putting money at risk on an uncertain outcome. If you're a consumer protection regulator, the label matters a lot less than the actual risk exposure. And if a platform allows underage access or insider betting, that's a problem whether you're calling it gambling or derivatives trading.

The Federalism Question: Who Actually Gets to Decide?

This lawsuit might look like it's about whether Kalshi can operate in Nevada, but the deeper question is fundamentally about federalism. In the American system, states have traditionally regulated gambling because gambling is considered a matter of local morality, public order, and consumer protection. The federal government regulates interstate commerce and interstate fraud.

Prediction markets create a weird hybrid situation. They're technically interstate commerce (if someone in Nevada is trading on Kalshi's platform, there's an interstate transaction). But they're also local because the person using the platform is in Nevada and Nevada has a specific interest in protecting its citizens and preserving its gambling market structure.

The CFTC's position is that because prediction markets trade contracts based on future events, they fall under the Commodity Exchange Act, which gives the federal government jurisdiction over commodity exchanges and derivatives. That's technically correct as a matter of law. But it's also a relatively recent interpretation. The Commodity Exchange Act predates prediction markets by decades. The CFTC is essentially stretching its existing authority to cover something that didn't exist when the law was written.

Nevada's position is simpler: gambling operations in Nevada require state licenses. Kalshi's prediction market looks and feels like gambling to Nevada residents. Therefore, Kalshi needs a state license. Federal law doesn't prohibit states from requiring licenses for activities within their borders.

Historically, courts have sided with states on gambling regulation questions. But we're in a period where federal agencies are increasingly asserting authority over areas that were previously state-dominated. This case will be a test of whether that trend continues or reverses.

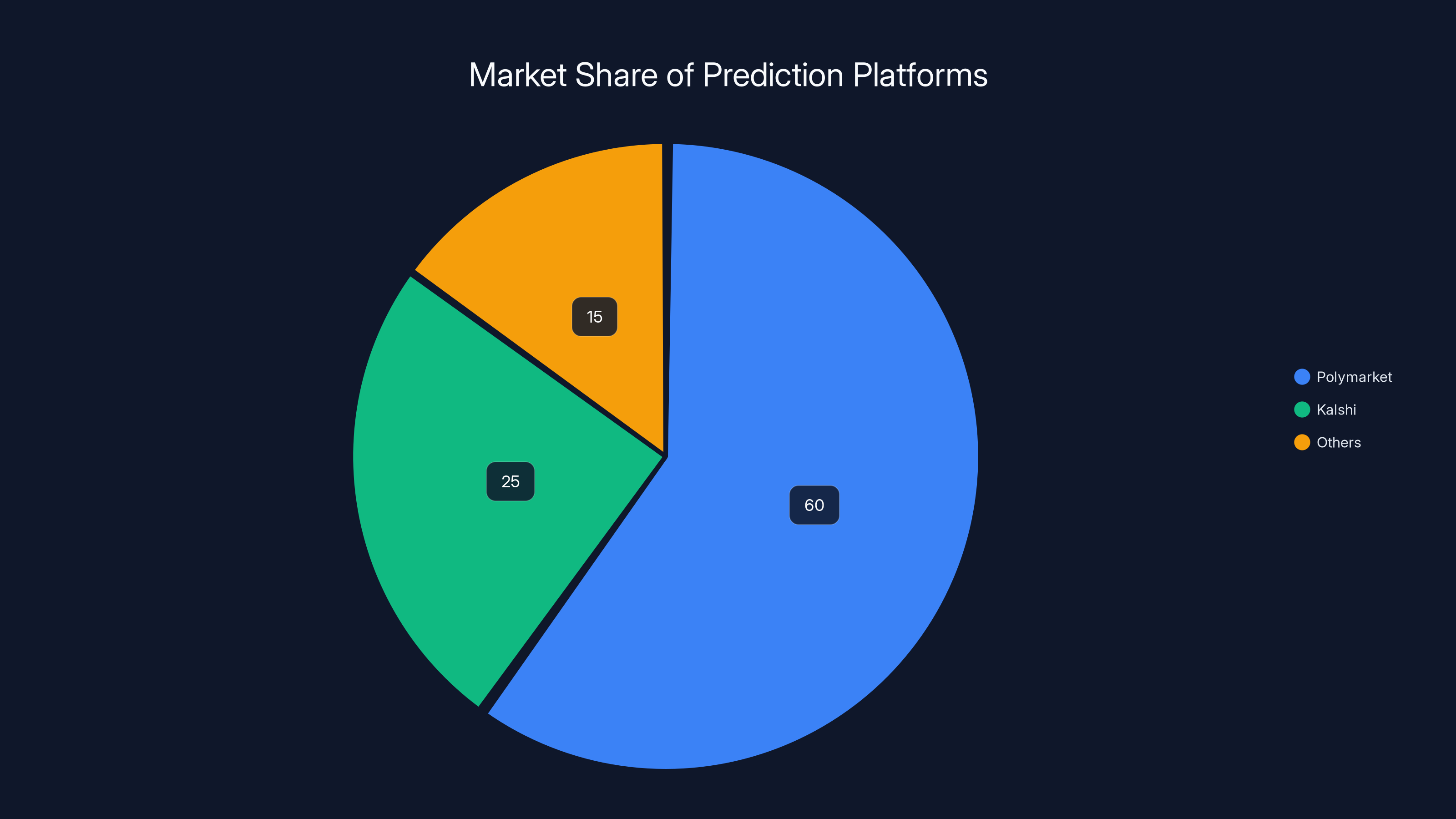

Polymarket dominates the prediction market with an estimated 60% share, driven by its high trading volume and media prominence. Estimated data.

The Integrity Argument: Sports Betting's Unique Problems

One thing that's worth examining in detail is Nevada's specific claim about insider betting and match-fixing. Sports betting occupies a unique place in gambling regulation because unlike casino games or lotteries, the outcome isn't determined by a random number generator or house operation. The outcome is determined by athletic competition.

That means you have actual people who can influence the result: athletes, coaches, referees, team executives. If any of those people know they can profit from a particular outcome, suddenly the entire integrity of the competition is at risk. This isn't theoretical. There have been actual match-fixing scandals in professional sports, and the way regulators prevent them is by:

- Preventing insiders from betting on events they're involved in

- Monitoring betting patterns for unusual activity that might indicate collusion

- Requiring platforms to report suspicious betting activity to authorities

- Coordinating with sports leagues to cross-check betting data with competition data

Traditional Nevada sports books have all of these systems in place. A sportsbook operator can't legally accept a bet from a professional baseball player on a game that player's involved in. If the sportsbook notices that someone's suddenly placing huge bets on a game right before it happens, they flag it and potentially report it to authorities. They share data with Major League Baseball, the NBA, and the NFL so those leagues can monitor for suspicious activity.

Kalshi apparently has none of this. Nevada's lawsuit specifically cites their failure to "communicate about potential evidence of match fixing or point shaving with Nevada gaming regulatory authorities." That's saying Kalshi isn't just missing safeguards—they're not even attempting to coordinate with sports integrity authorities.

Does that mean Kalshi is enabling widespread match-fixing? Probably not. The fact that there hasn't been a huge explosion of exposed sports fixing on Kalshi suggests either the platform's user base is small enough that insiders haven't bothered exploiting it, or the incentives aren't aligned for widespread fraud. But Nevada isn't asking for perfect certainty. They're asking for basic safeguards that have been industry standard for decades.

That's actually a reasonable regulatory position. You don't wait until fraud happens to prevent it. You put safeguards in place proactively. Nevada is making that argument here, and it's hard to see how Kalshi responds without either complying with Nevada's demands or convincing a court that Nevada has no jurisdiction.

The Consumer Protection Dimension: Why Underage Access Matters

Let's focus for a moment on Nevada's claim that Kalshi allows users under 21 to place bets. This is simultaneously the most obvious violation and the most consequential claim in Nevada's lawsuit.

It's the most obvious because there's no ambiguity about what the law requires. Every gambling operation in America has age verification built in. You can't legally let minors bet. Full stop. If Kalshi violated this, it's not a close call. It's a clear breach.

It's the most consequential because of what it implies about Kalshi's compliance culture. If a company doesn't verify age before allowing betting, what else are they not doing? Are they verifying that people aren't using fake identities? Are they checking that accounts are funded from the account holder's own bank account, not a parent's credit card? Are they monitoring for compulsive gambling behavior?

Consumer protection regulators worry about this stuff because gambling has real societal costs. Problem gambling is a documented phenomenon with measurable harm: broken families, bankruptcy, suicide. And it disproportionately affects vulnerable populations like minors, people with mental health issues, and people with low financial literacy.

Prediction markets make this worse in some ways because the stakes feel lower than casino gambling or sports betting. You're not putting

Nevada's concern about underage access isn't just regulatory hair-splitting. It's a legitimate consumer protection issue. And the fact that Kalshi apparently didn't implement basic age verification is concerning.

What's particularly odd is that age verification is relatively trivial technically. You can integrate with ID verification services that check someone's age against government databases in seconds. It's not expensive. It's not burdensome. The only reason you'd skip it is if you didn't think you needed to or if you wanted to maximize your user acquisition by not blocking younger users.

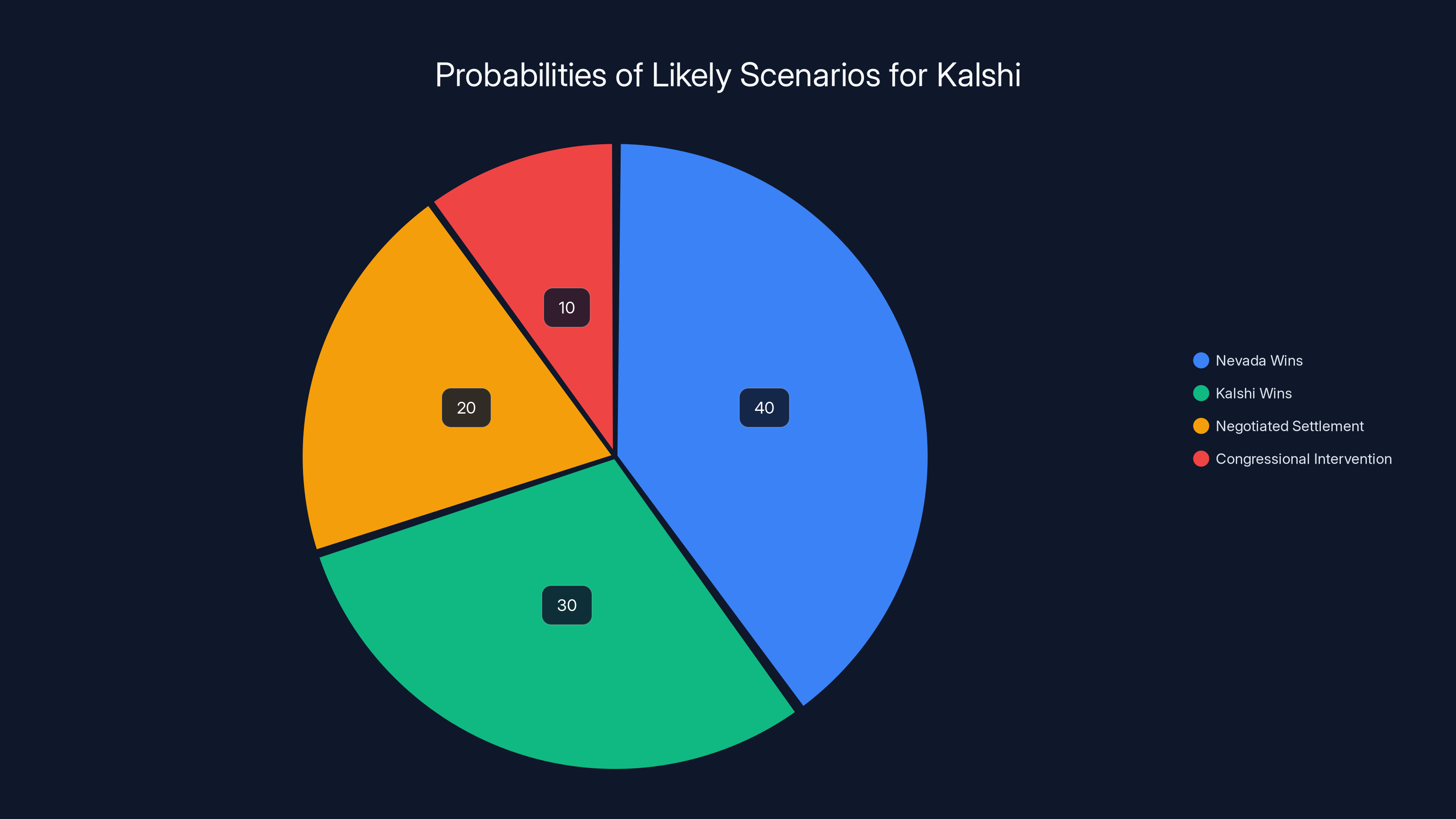

The pie chart illustrates the estimated probabilities of different legal scenarios for Kalshi. The most likely outcome is Nevada winning with a 40% probability, followed by Kalshi winning with CFTC support at 30%. Estimated data.

The Market Structure Argument: Is This Really About Protecting Nevada Gambling?

Here's a more cynical take on Nevada's lawsuit that's also worth considering: Nevada has a massive interest in keeping traditional gambling within its borders because gambling is a major revenue source. Las Vegas generates tens of billions of dollars annually in gambling revenue. If prediction markets become popular and take market share away from casinos and sportsbooks, that hurts Nevada's economy.

So is Nevada's lawsuit really about consumer protection and integrity safeguards, or is it actually about protecting their gambling monopoly?

The honest answer is probably both. Nevada genuinely believes that prediction markets should be regulated like other gambling in Nevada. That's not crazy—they have legitimate concerns about underage access and insider betting. But Nevada also cares about the fact that online prediction betting is potential lost revenue compared to Nevada-based casinos and sportsbooks.

That doesn't necessarily invalidate Nevada's lawsuit. Regulators can have multiple motivations and still be right about the underlying issue. But it's worth acknowledging. Nevada isn't a neutral actor here. They have a direct financial interest in the outcome.

The CFTC, by contrast, doesn't have a direct financial interest. They have a jurisdictional interest. They want to preserve their authority over financial derivatives. That's also a political motivation, just framed differently.

The public interest question is: which regulatory framework—state-level gambling regulation or federal-level derivatives regulation—actually provides better consumer protection? That's genuinely hard to answer because they're designed for different purposes. Nevada's system is designed to prevent fraud and protect consumers from predatory operations. The CFTC's system is designed to prevent systemic market risks and fraud at the institutional level.

For prediction markets specifically, Nevada's approach makes more sense. These are recreational betting products used by individuals, not institutional derivative positions. They're more similar to sports betting than to Treasury futures. Nevada's regulatory framework is optimized for exactly this kind of product.

But the federal precedent argument is also legitimate. If states can completely ban or heavily regulate prediction markets, you end up with a fragmented market where platforms have to maintain separate compliance systems for each state. That creates costs and barriers to entry that might protect established operators but could harm innovation.

So this is genuinely a hard policy question, not a case where one side is clearly right and the other is clearly wrong.

Historical Precedent: How Did We Get Here?

Prediction markets are new, but the regulatory questions they raise aren't. The U. S. has a long history of federal-state regulatory conflicts over financial products. Understanding that history helps explain why the CFTC is so aggressive about asserting federal authority.

In the 1970s, futures trading was primarily a commodity business regulated by the CFTC. In the 1980s and 1990s, derivatives became increasingly complex, and it wasn't always clear whether particular products fell under CFTC or SEC jurisdiction. The lack of clarity led to regulatory gaps and eventually to major financial crises.

Based on that experience, the CFTC developed a philosophy: federal regulators should have clear, exclusive jurisdiction over derivatives markets. No patchwork of state rules. That prevents gaps and enables consistent oversight.

But that philosophy was developed in the context of institutional derivatives trading, not recreational betting. Applying it to prediction markets is a stretch.

Historically, gambling has always been regulated at the state level. The federal government regulates sports betting through the Unlawful Internet Gambling Enforcement Act, but that's about preventing wire fraud, not creating positive regulation. States actually run casinos in some cases (see: state-operated casinos) and license all gambling operations.

Prediction markets represent a test of whether the federal derivatives framework or the state gambling framework is more appropriate. Based on historical precedent, state gambling regulation seems more applicable. But based on modern federal regulatory philosophy, the CFTC's aggressive centralization makes sense.

This conflict will probably persist for years. But my prediction: states will gradually prevail because they control local law enforcement and have more direct accountability to residents. The CFTC will end up with a hybrid authority where they regulate the platforms (licensing, financial soundness, basic compliance) and states regulate local operations (age verification, advertising, consumer protection).

What Happens Next: Likely Scenarios

Okay, so Nevada filed its lawsuit. Kalshi declined to comment. The CFTC is probably already drafting its amicus brief. What actually happens next?

Scenario 1: Nevada Wins

Kalshi gets ordered to block Nevada residents from using the platform or to obtain a Nevada gambling license (which they'll probably be denied). This creates pressure for other states to file similar suits. Within 18 months, Kalshi's addressable market shrinks by 30-40% as they're blocked from the largest states. The company either becomes much smaller or pivots its business model.

Probability: 40%

Scenario 2: Kalshi Wins (via CFTC Support)

A federal court rules that the CFTC has exclusive jurisdiction over prediction markets and that Nevada can't regulate them as gambling. Kalshi becomes legally protected from state-level regulation. This sets a precedent for Polymarket and other platforms. Prediction markets boom because the regulatory path is clear.

Probability: 30%

Scenario 3: Negotiated Settlement

Kalshi and Nevada negotiate a middle path where Kalshi implements additional safeguards (better age verification, insider betting restrictions, sports integrity coordination) in exchange for being allowed to operate in Nevada. This becomes the template for other state negotiations.

Probability: 20%

Scenario 4: Congressional Intervention

Congress passes legislation clarifying that prediction markets fall under federal jurisdiction and can't be regulated as gambling by states. This is the cleanest outcome legally but requires Congress to actually do something, which is harder than litigation.

Probability: 10%

Most likely outcome: Scenario 1 (Nevada wins at least initially), which leads to a cascade of state lawsuits, followed by Scenario 3 (negotiated settlements) as Kalshi decides it's cheaper to comply with state regulations than to fight 20+ lawsuits.

The Bigger Picture: What This Means for Financial Innovation

Look, this Nevada lawsuit is ostensibly about whether one company can let people bet on elections in one state. But it's actually about something much larger: whether financial innovation in America gets shaped by federal regulators trying to be efficient, or by state-by-state litigation that creates regional variation.

There's a real tension here. On one hand, you want consistent national rules so financial companies can operate efficiently. On the other hand, states have distinct interests and values. New York might be okay with aggressive financial products. Utah might not. Why should Utah residents have to accept products that New York's regulators approve?

Prediction markets are just the latest case where this tension plays out. We went through the same thing with cryptocurrency, where federal regulators and states fought over who gets to regulate crypto operations. We're going through it with AI regulation now, where some states are rushing to create rules while the feds are slower to act.

The Nevada lawsuit suggests that states still have power in this system. They can't permanently block something the federal government authorizes. But they can create enough friction that companies have to negotiate. That's not nothing.

For Kalshi and Polymarket, this is either a wake-up call that compliance matters more than they thought, or validation that the CFTC has their back and will eventually force states to stand down. Probably it's somewhere in between.

The outcome of Nevada's lawsuit will set the tone for whether prediction markets become mainstream financial infrastructure in America, or whether they remain niche products used primarily in states that actively permit them.

FAQ

What exactly is a prediction market?

A prediction market is a platform where people trade contracts whose value depends on whether a specific future event occurs. For example, you might buy a contract that's worth

Why is Nevada suing Kalshi?

Nevada claims that Kalshi operates without proper state gambling licenses, allows users under 21 to place bets, and lacks safeguards to prevent insider betting on sports events. Nevada argues that prediction markets should be regulated like other gambling operations within the state, which means obtaining state licensure and implementing consumer protection measures that Nevada requires.

Does the CFTC support Kalshi?

Not directly, but the CFTC has filed amicus briefs supporting prediction market platforms against state regulatory action. The agency argues that prediction markets are derivatives that fall under its exclusive federal jurisdiction, and that state-level gambling regulations shouldn't apply. This positions the CFTC as an implicit ally of platforms like Kalshi, even if the relationship is more about federal authority than platform support.

How many lawsuits is Kalshi facing?

According to reporting, Kalshi is facing at least 20 federal lawsuits related to its sports betting offerings, plus the Nevada state lawsuit. Additionally, a Massachusetts judge ordered the company to stop allowing residents to place bets on sports, representing a significant jurisdictional loss. These lawsuits collectively suggest that Kalshi's business model faces substantial regulatory challenges.

What's the difference between prediction markets and gambling?

Technically, prediction markets trade derivative contracts based on objective future outcomes, while gambling involves games of chance or competition with uncertain results. But practically, the human experience is nearly identical: you're putting money at risk on an uncertain outcome. The regulatory difference is that the CFTC treats prediction markets as derivatives (under its jurisdiction), while states treat them as gambling (under their jurisdiction). This jurisdictional dispute is the core of Nevada's lawsuit.

Could Congress intervene in this dispute?

Yes, Congress could pass legislation explicitly stating that prediction markets fall under federal CFTC jurisdiction and preempt state regulations. Alternatively, Congress could authorize state gambling regulation of prediction markets. However, Congressional action requires political will, and prediction markets aren't yet a priority issue for most legislators. More likely, courts will resolve the federalism question through litigation over the next several years.

What happens to my money if Kalshi gets blocked in my state?

Depending on the court order, Kalshi might be required to block new residents from opening accounts, allow existing residents to continue with restrictions, or entirely exit the state. Most platforms would allow you to withdraw existing funds but prevent new trading. Check Kalshi's terms of service for specific scenarios, and have an exit plan if you're using the platform in a state where litigation is active.

How might this lawsuit affect Polymarket?

If Nevada wins against Kalshi, Polymarket will likely face similar lawsuits from multiple states. Polymarket's offshore structure might provide some legal distance, but regulators eventually figure out how to reach offshore entities. A cascade of state lawsuits against prediction markets is probably inevitable regardless of Kalshi's specific outcome.

Conclusion: The Regulatory Crossroads

Nevada's lawsuit against Kalshi is more than just another tech policy dispute. It's a fundamental test of how financial innovation gets governed in America and which regulators get to set the rules.

On one side, you have the CFTC arguing for centralized federal oversight that prevents a patchwork of conflicting state rules. That argument has merit. Regulatory consistency matters. But it's also an argument made by an agency that has every incentive to expand its authority, and it's being applied to a product category (recreational betting) where states have historically had primary jurisdiction.

On the other side, you have Nevada arguing for the right to protect its residents and preserve its regulatory structure. That argument also has merit, particularly when Kalshi's violations seem clear-cut: allowing underage users, operating without licenses, and failing to implement basic integrity safeguards that have been standard for decades.

The truth is probably going to land somewhere in the middle. Kalshi will face years of litigation, significant regulatory pressure, and a dramatically smaller addressable market if states start winning court orders. Some platforms will choose to settle with states and implement stronger safeguards. Some will fight all the way up to appellate courts hoping the CFTC's federal jurisdiction argument ultimately prevails.

But here's what's clear: the era of prediction markets operating in legal gray areas is over. Regulators now understand the products, recognize the risks, and have legal tools to respond. The question isn't whether prediction markets will face regulation. It's what kind of regulation they'll face and whether that regulation comes from Washington, state capitals, or through negotiated settlements.

For users, that means understanding that the prediction market platforms you use today might be blocked tomorrow. That's not a bug in the system—it's a feature of federalism. States get to decide what financial products their residents can access. Federal regulators get to prevent states from fragmenting national markets beyond reason. And startups get to navigate this complicated middle ground.

Nevada's lawsuit is just the beginning of what will probably be a decade-long process of prediction market regulation. The next states are probably already preparing lawsuits. Kalshi's legal team is already preparing responses. The CFTC is already drafting guidance and rules.

What we're really watching is the birth of a regulatory framework for an entirely new category of financial products. That process is messy, expensive, and frustrating for everyone involved. But it's also necessary. Financial innovation that happens without regulatory oversight eventually creates problems. Nevada understands that better than most states, and that's why this lawsuit matters far beyond Nevada's borders.

Key Takeaways

- Nevada's lawsuit against Kalshi represents a critical test of federal vs state authority over prediction markets and financial innovation

- The CFTC is aggressively defending federal jurisdiction while Nevada argues states should regulate prediction markets like traditional gambling

- Kalshi faces 20+ lawsuits and has already been blocked from sports betting in Massachusetts, threatening the entire business model

- Nevada's specific claims about underage access and lack of insider betting safeguards map directly to decades of proven gambling fraud prevention mechanisms

- The outcome will likely trigger a cascade of similar state actions, fundamentally reshaping how prediction markets can operate in America

![Nevada Sues Kalshi: Prediction Betting Market Legal Battle [2025]](https://tryrunable.com/blog/nevada-sues-kalshi-prediction-betting-market-legal-battle-20/image-1-1771430839557.jpg)