Introduction: When Superstars Meet Prediction Markets

You probably saw it coming before the tweet even hit. In early 2026, Giannis Antetokounmpo, the Milwaukee Bucks' two-time MVP and one of basketball's most dominant forces, announced he'd become a shareholder in Kalshi, a prediction market platform. The announcement was simple, almost casual: "The internet is full of opinions. I decided it was time to make some of my own. Today, I'm joining Kalshi as a shareholder. We all on Kalshi now."

Sounds innocuous enough, right? But the internet had a different take. Reddit erupted with accusations of conflicts of interest. Twitter users questioned whether this even complied with NBA rules. Some wondered aloud if this was the beginning of the end for sports integrity.

Here's what makes this moment significant: Giannis isn't just some celebrity slapping his name on a financial product for a check. He's the first NBA player to directly invest in a prediction market platform. That matters. It signals something bigger about how sports intersects with fintech, how athletes are thinking about their wealth, and where the future of sports betting might be heading.

But before we get into the broader implications, let's be clear about what's actually happening here. This isn't a casual endorsement deal. This is capital deployment. This is an athlete with hundreds of millions of dollars saying, "I believe in this company enough to put my money where my mouth is." That's different. That deserves attention.

The question isn't whether Giannis is allowed to do this, though we'll get into the regulatory nuances. The real question is: what does this mean for prediction markets? What does it mean for how athletes think about side investments? And what does it signal about the legitimacy and mainstream acceptance of platforms like Kalshi?

Let's dig into it.

TL; DR

- First NBA Player Direct Investment: Giannis becomes the first NBA player to directly invest in Kalshi, a regulated prediction market platform

- Regulatory Compliance Exists: The NBA's CBA allows players to own up to 1% stakes in sports betting companies, provided they don't promote league-specific wagers

- Prediction Markets Are Growing: The prediction market industry has exploded from niche to mainstream, with platforms like Kalshi leading regulatory legitimacy

- Celebrity Capital Matters: When athletes invest personal capital (not just endorse), it signals confidence that changes how markets perceive a company's credibility

- Conflict of Interest Questions Are Valid: The announcement raised legitimate questions about whether athletes betting on events they can influence creates ethical gray areas

Estimated data suggests insider trading poses the highest risk to competitive fairness, followed by performance incentives. Regulatory compliance is crucial but perceived as less risky if enforced effectively.

What Is Kalshi and Why Does It Matter?

Kalshi isn't your average sportsbook. It's a prediction market platform that lets users bet on outcomes of events, but not in the traditional sense. Instead of picking which team wins, you're predicting whether inflation will rise by a certain percentage, whether a tech company's stock will hit a price target, or whether specific geopolitical events will occur.

Think of it as a hybrid between Vegas and the stock market, but regulated like a futures exchange. The platform received approval from the Commodity Futures Trading Commission (CFTC) in 2023, making it one of the first prediction market platforms to operate legally in the United States with explicit regulatory blessing.

The regulatory approval is crucial here. For years, prediction markets existed in legal gray zones. They operated offshore or under unclear regulatory frameworks. Kalshi changed that. By obtaining CFTC approval, the company essentially legitimized the entire category. Suddenly, prediction markets weren't underground gambling operations. They were regulated financial products.

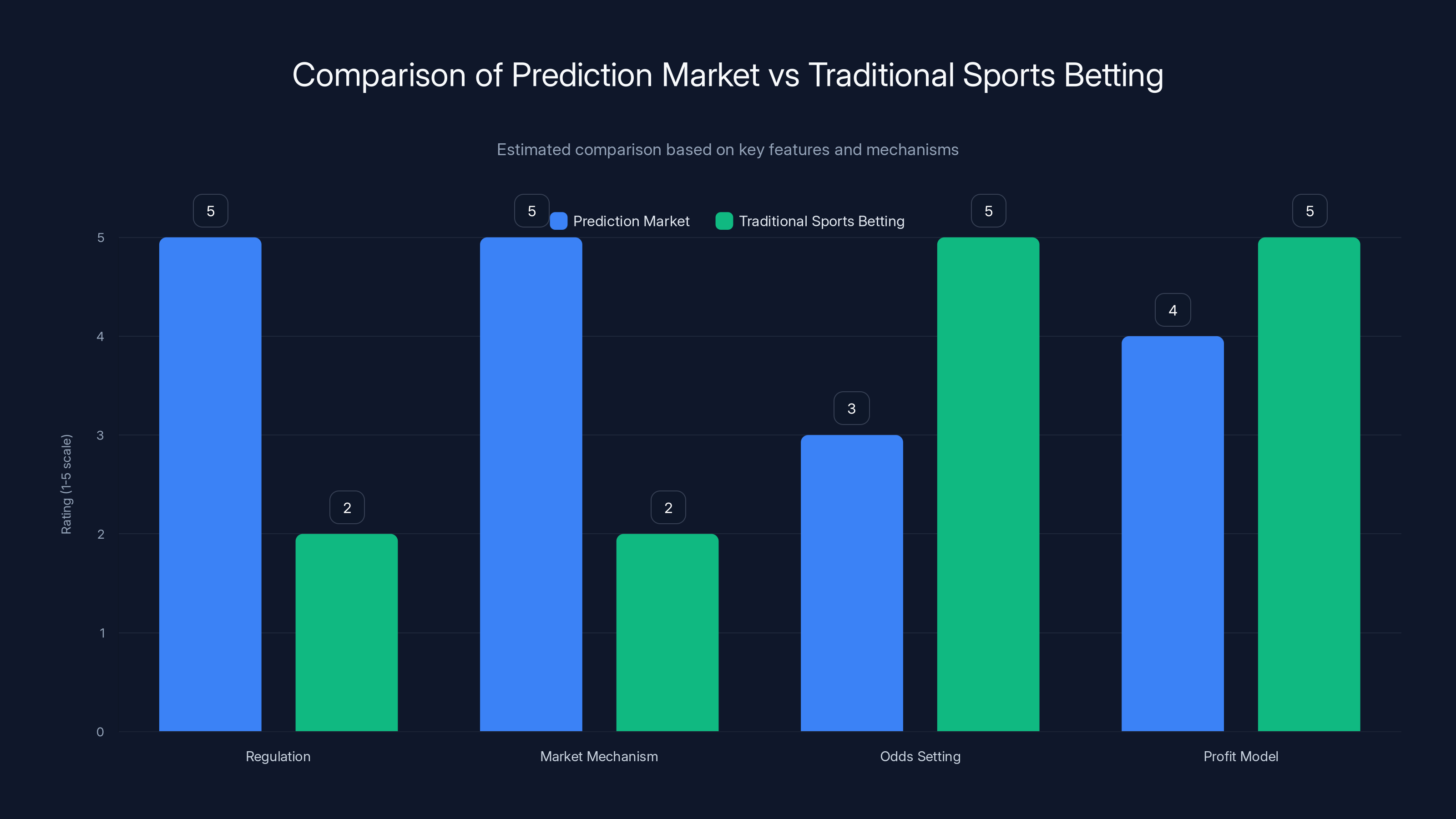

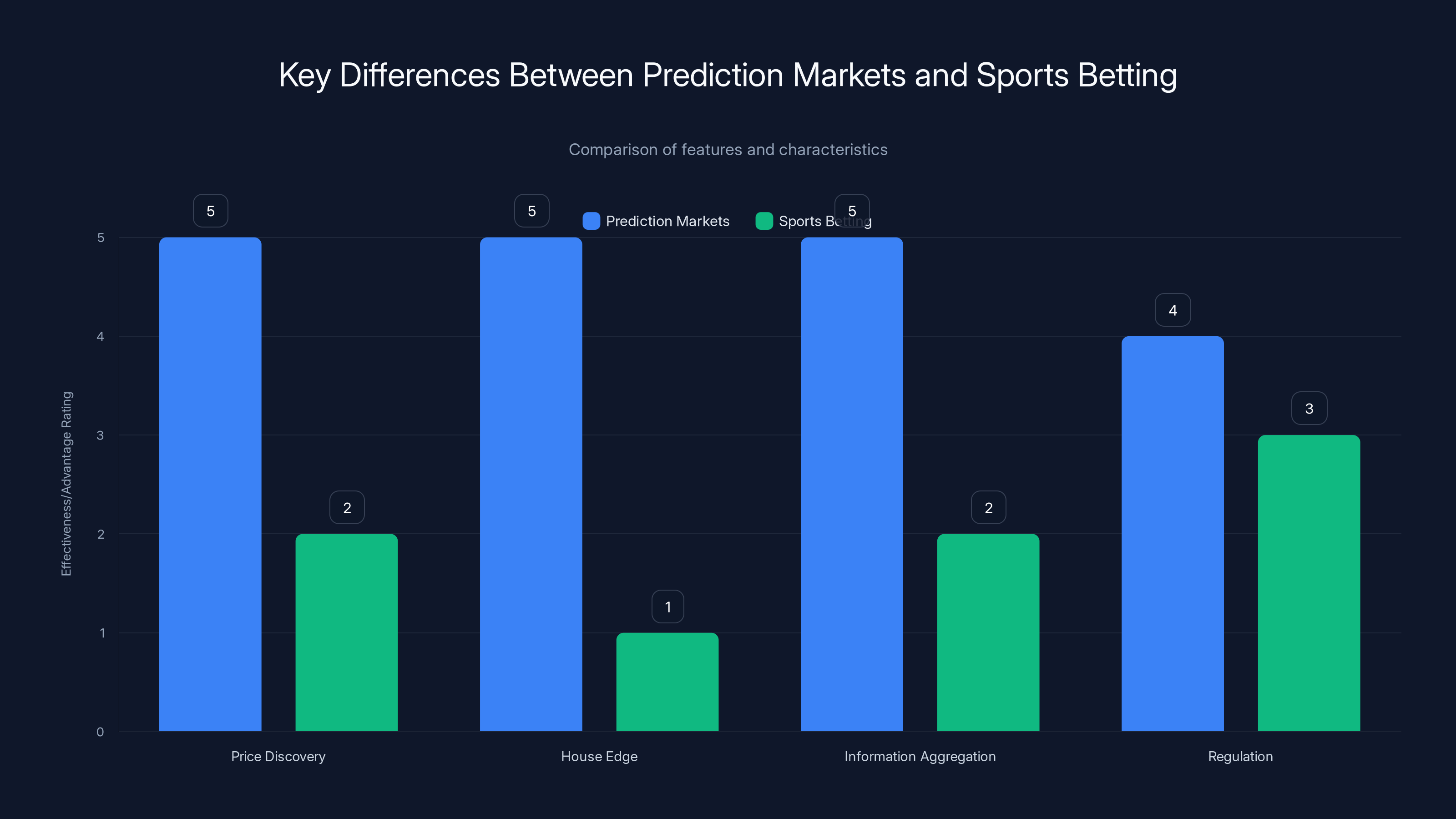

What makes prediction markets different from traditional sports betting? In traditional betting, you're wagering against a sportsbook. The house sets odds, takes a cut, and profits regardless of the outcome. In a prediction market, you're betting against other users. The price of a contract reflects what the collective market thinks the probability of an outcome is. As new information emerges, the price updates. It's more like a stock market than a casino.

This mechanism has some advantages. Prediction markets often outperform expert predictions because they aggregate information efficiently. When thousands of people are putting real money behind their beliefs, the resulting prices tend to be more accurate than any single expert's forecast. That's the theory, anyway. In practice, prediction markets can be subject to manipulation, herding behavior, and irrational exuberance, just like any other market.

Kalshi specifically focuses on events that can be objectively resolved. They avoid binary sports bets (which are more heavily regulated) and instead focus on things like: Will the Fed cut rates by at least 0.5% this year? Will Tesla's stock price exceed $400 by Q4? Will a specific political event occur?

For athletes like Giannis, the appeal is clear. Unlike traditional betting, prediction markets are legitimate, regulated financial instruments. There's no stigma. There's intellectual legitimacy. And for someone with serious capital, they represent an opportunity to profit from superior insight or information.

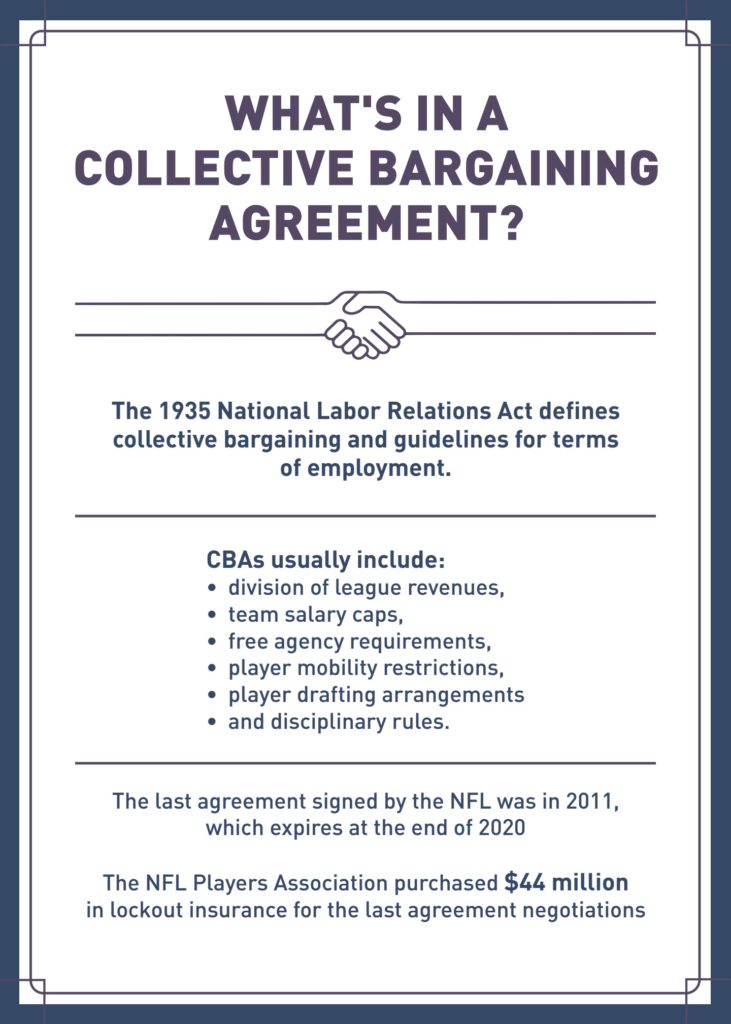

The NBA Collective Bargaining Agreement: What the Rules Actually Say

Let's address the elephant in the room immediately. Is what Giannis did legal under NBA rules? The short answer: yes, but with conditions.

The NBA's current collective bargaining agreement, ratified in 2023, includes specific language about how players can engage with sports betting and gaming companies. The key section allows players to advertise and take equity stakes in sports betting companies, with one major caveat: they cannot promote league-specific wagers.

This is important. You can't have NBA players on national TV saying, "I love betting on NBA games using this platform." That would create obvious conflicts of interest and potentially undermine league integrity. But you can have players invest in and affiliate with sports betting companies as long as they're not explicitly promoting bets on their own league or teams.

The CBA also caps equity ownership. Players can hold up to 1% of a sports betting company. This is a regulatory safeguard. It prevents a situation where an NBA star owns a controlling stake and has a direct financial incentive to influence game outcomes or market data.

Giannis's investment presumably complies with these rules. He's holding under 1% (investor stakes are rarely disclosed publicly at the exact percentage, but when a company announces someone as an investor, it's typically a relatively small stake). And Kalshi primarily focuses on non-sports predictions, which makes promotion of league-specific wagers moot.

But here's where it gets interesting. The rules exist for a reason. The NBA learned hard lessons in the 1980s and 1990s about what happens when you don't take gambling seriously. The league has spent decades rebuilding its reputation after those scandals. So while Giannis's investment is technically legal, it exists in a space the NBA is still figuring out.

The real question isn't whether it's allowed. It's whether the safeguards in the CBA are sufficient to prevent conflicts of interest as athletes invest more deeply in prediction markets.

Prediction markets like Kalshi are more regulated and operate on user-driven market mechanisms, whereas traditional sports betting relies on house-set odds and profits. Estimated data based on typical platform characteristics.

Why the Internet Freaked Out: The Conflict of Interest Argument

When Giannis announced his Kalshi investment, Reddit and Twitter erupted. The most common complaint: this is a conflict of interest. And on the surface, the argument makes sense. Here's a guy who plays professional basketball. He's arguably one of the most dominant players in the league. Now he owns a piece of a platform where people can bet on outcomes of events that might include information relevant to his sport or his team.

Even if Giannis never explicitly bets on NBA games (and presumably he doesn't, or at least isn't supposed to), critics argue that his financial interest in Kalshi's success creates a perverse incentive structure. What if Kalshi becomes hugely profitable? What if the prediction market becomes a massive platform where billions flow through it? Wouldn't Giannis benefit regardless of what he personally bets on?

It's a fair point, but it's also worth unpacking carefully.

First, prediction markets aren't zero-sum gambling platforms in the same way sports betting is. Kalshi makes money by taking a small transaction fee on every trade. The company's success depends on volume and user engagement, not on specific outcomes. If Kalshi becomes massive and valuable, Giannis profits as an investor regardless of what events people are betting on.

Second, athletes invest in all kinds of companies all the time. When LeBron James bought a stake in Liverpool Football Club, was that a conflict of interest? He doesn't play soccer. He has no ability to influence soccer outcomes. But he does have a financial stake in the club's success. Is that problematic? Some might argue yes; most would say no.

Third, and most importantly, the NBA has explicit rules about this. Players can't bet on their own league if they're trying to influence games. They can't promote league-specific betting. They have to disclose material financial interests. These rules exist specifically to mitigate conflict of interest concerns.

But critics have a point too. Rules are only as good as their enforcement. And enforcement of gambling regulations in professional sports has a mixed track record.

The tension here is real. You want to allow athletes to make smart financial decisions. You want to allow them to invest in companies they believe in. But you also want to protect the integrity of competition. Those goals can conflict.

Celebrity Capital vs. Celebrity Endorsements: Why Giannis Is Different

Here's something that doesn't get enough attention: there's a huge difference between a celebrity endorsement and a celebrity investment.

When a celebrity endorses a product, they're being paid to say they like it. That's straightforward. We understand the incentive structure. They get money, they say nice things, everybody moves on.

When a celebrity invests personal capital, the incentive structure is different. Now the celebrity is betting their own wealth on the company's success. They're not getting paid a flat fee. They're exposing themselves to downside risk. If the company fails, they lose money.

For a platform like Kalshi, that matters a lot. The company is still relatively young and unproven. It's operating in a heavily regulated industry where regulatory changes could tank the entire business model. Kalshi has navigated CFTC approval successfully, which is impressive, but the broader regulatory environment for prediction markets could shift.

When Giannis invests personal capital, he's essentially saying, "I believe in this company's fundamentals enough to accept this risk." That's more credible than if he just said, "I think Kalshi is cool" in exchange for a paycheck.

For Kalshi specifically, Giannis's investment is a huge credibility boost. It signals to other potential investors, users, and regulators that serious people with real wealth think this company has a future. That kind of endorsement is worth way more than a TV commercial.

But it also raises the stakes. If Giannis's investment goes south, if Kalshi gets hammered by regulatory changes or fails to grow, it's not just a bad brand tie-in. It's a real loss for Giannis. He cares about the outcome. He's not just a hired spokesperson.

That's why the SEC and other regulators watch celebrity investors closely. When celebrities invest personal wealth, there's more potential for them to pump-and-dump or manipulate markets. The incentives are stronger.

In Giannis's case, everything suggests this is a genuine belief in the company. He's not promoting Kalshi aggressively. He's not making public statements about prediction markets being the future of everything. He announced his investment casually, almost as an aside. That lack of promotional pushiness actually adds credibility to the deal.

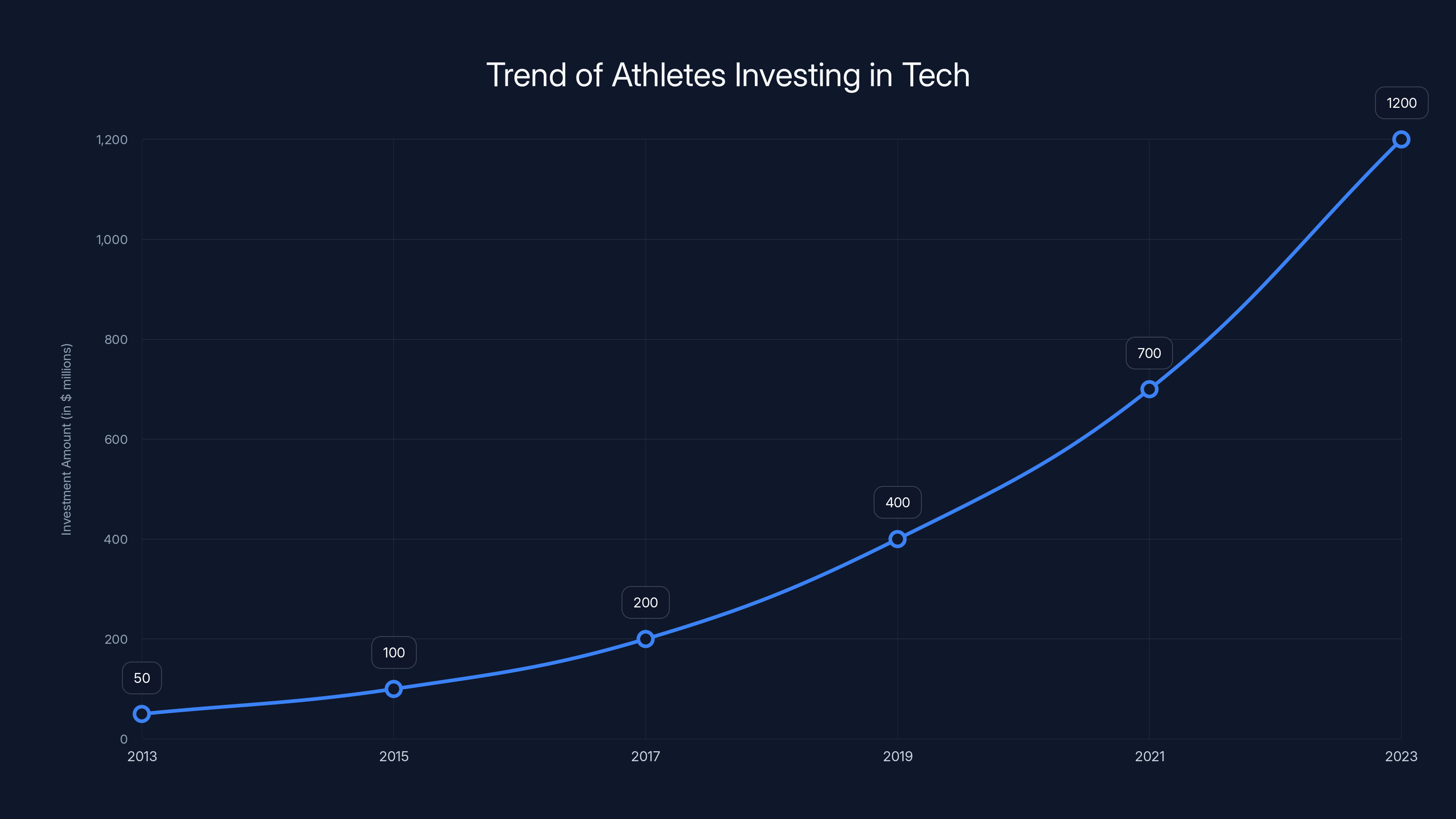

The Bigger Trend: Athletes Becoming Tech Investors

Giannis's Kalshi investment isn't happening in a vacuum. It's part of a much larger trend of professional athletes becoming serious venture and growth investors.

For decades, athlete investments were limited to obvious stuff. Players would own restaurants, bars, nightclubs. They'd invest in real estate. They'd buy stakes in sports franchises. These were natural extensions of their wealth and interests.

But over the last ten years, we've seen athletes increasingly diversify into technology and fintech. LeBron James has invested in companies like Blaze Pizza and Liverpool Football Club, but also in venture funds. James Harden invested in tech startups. Kevin Durant has his own venture fund focused on tech investing.

Why is this happening? A few reasons:

First, athletes have a lot of money and need places to put it. You can only buy so many houses and cars. Real estate and traditional investments have their limits. Tech offers potentially higher returns and more upside.

Second, athletes are getting smarter about their wealth. They're hiring better advisors. They're learning about venture capital, growth equity, and alternative assets. The old stereotype of athletes blowing their money is outdated.

Third, tech and fintech companies actively court athlete investors. Why? Because athlete endorsements are valuable, but athlete capital is even more valuable. When a tech company can announce that a famous athlete is not just promoting the company but has invested personal wealth, it's a strong signal to the market.

Fourth, athletes have unique insights that can be valuable to tech companies. Giannis has spent his entire life in competitive environments where small advantages matter. He understands how to evaluate talent, how to optimize performance, how to work within regulated environments (the NBA). Those insights translate to other competitive domains.

Kalshi likely recruited Giannis specifically because they wanted a high-profile athlete investor. They wanted to send a signal that serious people take their platform seriously. But the fact that Giannis agreed to invest suggests he also saw something in Kalshi that interested him.

Prediction markets excel in price discovery and have no house edge, making them more efficient and regulated compared to sports betting. Estimated data based on qualitative analysis.

Prediction Markets in 2025-2026: Market Maturity and Growth

To understand why Giannis's investment matters, you need to understand the state of prediction markets in 2025-2026.

Prediction markets have been around for decades. The idea goes back to academic research showing that markets are better at forecasting than experts. But for most of that history, prediction markets existed in legal and regulatory limbo.

Then everything changed. In 2023, the CFTC approved Kalshi as a Derivatives Clearing Organization (DCO), making it the first U. S.-regulated prediction market platform. This was huge. It meant that prediction markets, as a category, were now legitimate financial instruments.

Following Kalshi's approval, we've seen the prediction market space explode. Polymarket launched in the U. S. Manifold Markets expanded. New platforms are launching regularly. Venture capital is flowing into the space. Major financial institutions are building prediction market infrastructure.

The market is still small compared to traditional betting or stock markets, but it's growing rapidly. Some estimates suggest the U. S. prediction market could reach billions in annual volume within five years, assuming regulatory frameworks continue to support growth.

What's driving this growth? A few factors:

Accuracy: Prediction markets have a proven track record of being more accurate than expert predictions and polls. For anyone trying to forecast outcomes, they're genuinely useful.

Efficiency: Prediction markets price in information quickly. As new data emerges, market prices update instantly. This efficiency is valuable for traders, analysts, and anyone trying to understand what the market thinks.

Legitimacy: CFTC approval brought legitimacy. Institutions can now invest in prediction markets without legal risk. That opens up massive capital flows.

Scope: Unlike sports betting, which is limited to sports, prediction markets can be applied to anything with an objective outcome. Business forecasts, election outcomes, weather, technology milestones, scientific breakthroughs.

For Kalshi specifically, they're positioned at the forefront of this growth. They have regulatory approval. They have first-mover advantage. They have capital. And now they have celebrity credibility from Giannis's investment.

The timing of Giannis's investment is interesting. It comes as prediction markets are transitioning from fringe to mainstream. Having a recognizable face associated with the category helps normalize it and accelerate adoption.

How Prediction Markets Differ from Sports Betting

One thing that confuses people is the relationship between prediction markets and sports betting. They're related, but not the same.

Traditional sports betting is bilateral. You bet with a sportsbook (or with other bettors through an exchange). The sportsbook sets odds based on its analysis and what it thinks will balance action on both sides. You win or lose based on whether your prediction is right.

Prediction markets are different. They're continuous and bilateral. Instead of a fixed bet with a fixed payout, you're trading a contract whose value fluctuates based on the probability of an outcome. The market price reflects what all participants collectively think is the probability.

Let's say there's a prediction market contract for "Will the Fed cut rates by 0.5% in Q2 2026?" The contract might be priced at 65 cents, meaning the market thinks there's a 65% chance it happens. If you believe there's a 75% chance, you'd buy at 65 cents, hoping to sell later when the price rises. If you think there's a 55% chance, you'd sell at 65 cents, hoping to buy back cheaper.

This creates several advantages:

Price discovery: The market price reflects real-time information and belief. It's continuously updated. Unlike expert forecasts (which come out once), prediction market prices update as new information emerges.

No house edge: Unlike sports betting, there's no sportsbook taking a cut. Transaction costs are minimal. What you win comes directly from what other traders lose, minus transaction fees. This makes prediction markets more efficient.

Aggregation: Prediction markets aggregate information from all participants. Each person's money vote is weighted equally (roughly speaking). This aggregation tends to produce accurate forecasts.

Regulation: Prediction markets are regulated as futures contracts, which gives them more legitimacy than gambling, but also subjects them to stricter rules.

For someone like Giannis, prediction markets probably appeal because they feel more legitimate than sports betting. They're regulated. They're financial instruments. Investing in a prediction market platform is investing in a fintech company, not a gambling company.

But there's overlap. You could theoretically create prediction markets on sports outcomes (though U. S. regulation limits this currently). And some prediction markets do touch on sports-adjacent outcomes like player performance or team records.

The distinction matters for regulatory purposes and for public perception. Kalshi emphasizes non-sports outcomes specifically to distinguish itself from traditional sports betting and avoid some of the regulatory baggage that comes with that category.

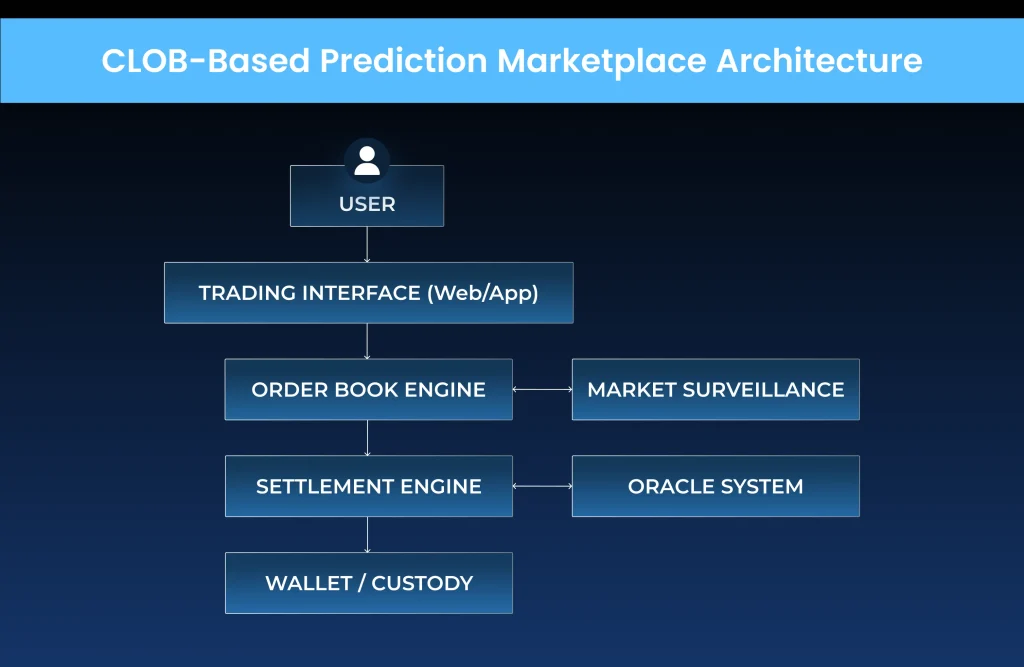

The Regulatory Landscape: CFTC Oversight and Future Challenges

Understanding Giannis's investment requires understanding the regulatory framework that governs prediction markets.

For years, prediction markets existed in legal gray zones. They operated under vague interpretations of gambling laws, financial regulation, and other rules. Some platforms operated offshore. Others claimed exemptions or argued they weren't actually gambling.

Kalshi changed that by pursuing explicit CFTC approval. The company spent years working with regulators to develop a framework for prediction markets. The CFTC ultimately approved Kalshi as a Derivatives Clearing Organization, which is the highest form of regulatory legitimacy available.

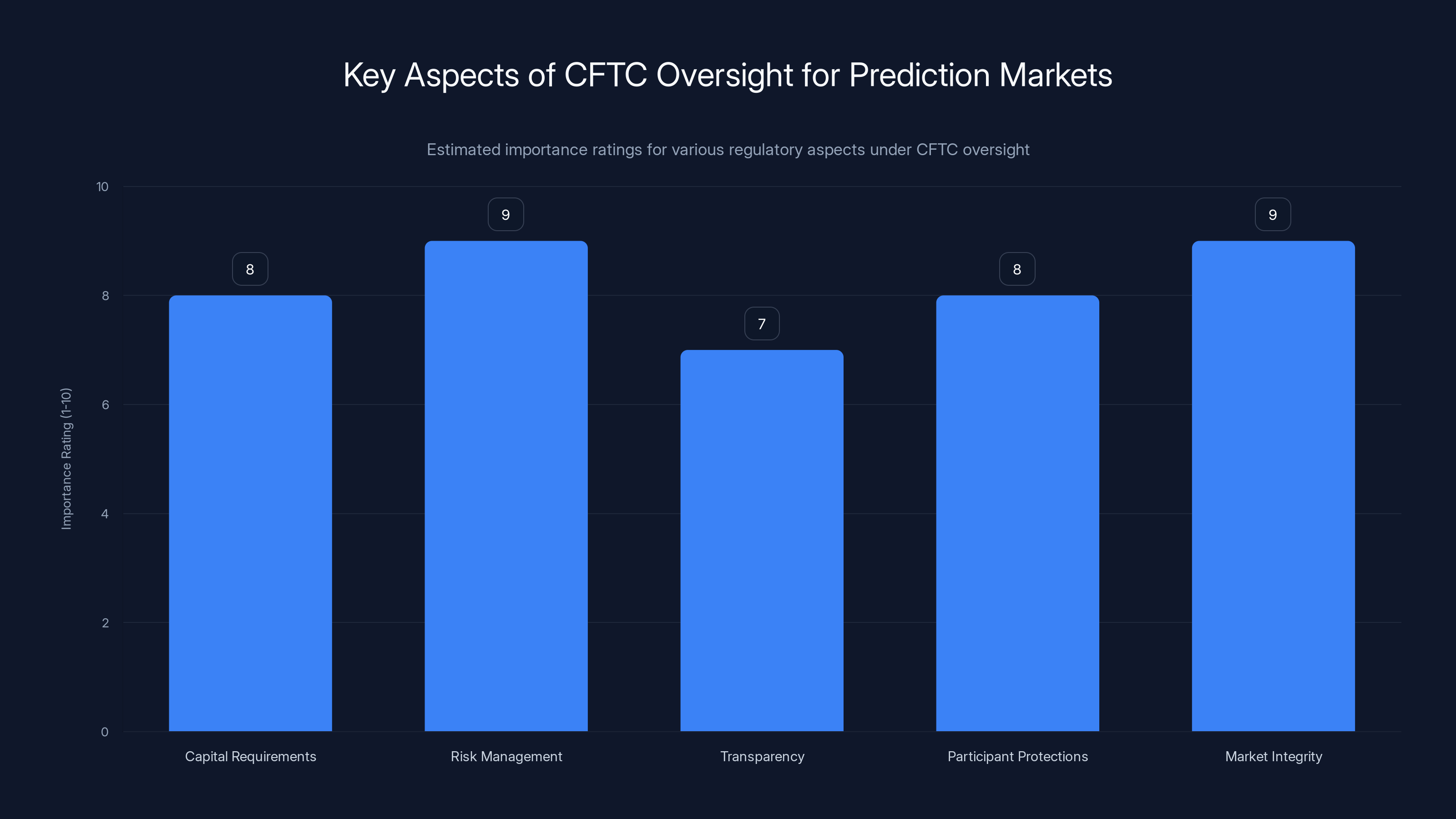

What does CFTC oversight mean practically? Several things:

Capital requirements: Kalshi must maintain minimum capital levels to protect customer funds.

Risk management: The company must have systems in place to manage counterparty risk, market risk, and operational risk.

Transparency: Transaction data must be reported to regulators. Market surveillance must be continuous.

Participant protections: Customer funds must be segregated and protected.

Market integrity: Kalshi must have rules against manipulation and must monitor for suspicious activity.

These requirements are expensive and complex. But they also provide enormous legitimacy. Investors and users can be confident that Kalshi won't disappear overnight with their money. They can be confident that markets aren't being manipulated by Kalshi or insiders.

For Giannis and other investors, CFTC oversight is a major risk mitigant. If Kalshi were just another fintech startup operating in a legal gray zone, the investment would be riskier. But with explicit regulatory approval, much of that uncertainty is removed.

That said, challenges remain. The regulatory framework for prediction markets is still evolving. There's been ongoing debate about what kinds of outcomes prediction markets can cover. Some proposals would restrict prediction markets on political outcomes, citing concerns about foreign interference. Others would expand them to cover sports.

Kalshi's strategy has been to stay conservative and focus on non-sports, non-political outcomes initially. This avoids regulatory landmines and builds a track record of success. As the company matures and the regulatory environment becomes clearer, they might expand.

For investors like Giannis, regulatory risk is real but manageable. The CFTC approval significantly reduces the probability of the entire category being shut down or heavily restricted. But changes at the margins are possible.

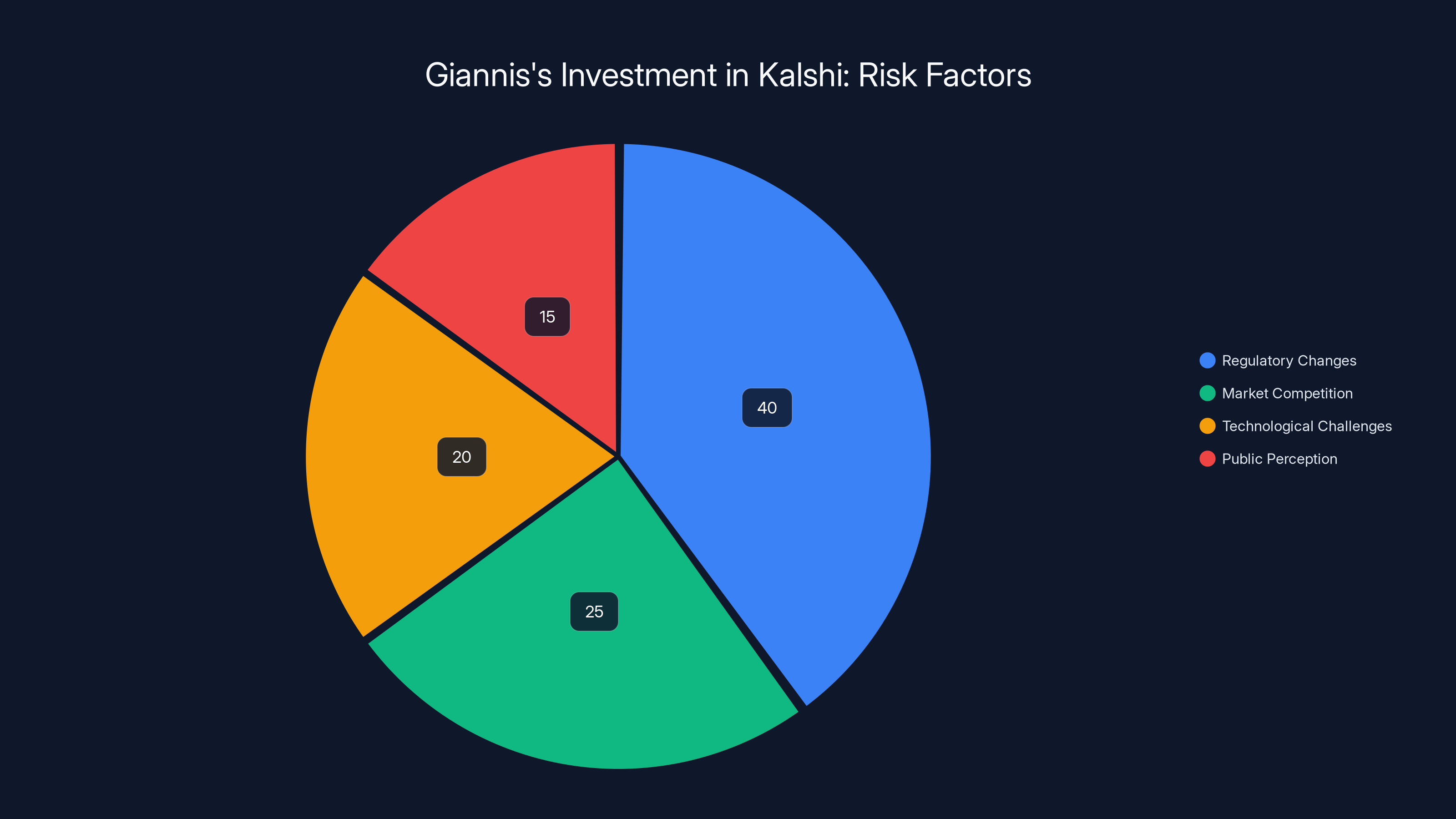

Regulatory changes pose the largest risk to Giannis's investment in Kalshi, estimated at 40%, followed by market competition and technological challenges. Estimated data.

Celebrity Investors and Market Credibility: The Giannis Effect

Why does it matter that Giannis, specifically, is investing in Kalshi? Not just because he's famous, but because he's credible in a specific way.

Giannis is a two-time NBA MVP. He's one of the most dominant athletes in the world. He's also known for being smart. He doesn't say dumb things. He's thoughtful. He's international (born in Greece), so he brings a different perspective. He's built his image on hard work and excellence, not controversy.

When someone like that invests personal capital, it moves the needle. It's not like a celebrity endorsement where you assume they're being paid. It's a real financial decision.

For Kalshi, this accomplishes several things:

Legitimacy: Having a world-famous athlete invest in your company signals to regulators and mainstream media that you're serious and credible.

User acquisition: Casual investors who might never have heard of Kalshi now know about it because Giannis tweeted. That's worth millions in marketing.

Investor confidence: Other venture capitalists and institutional investors take note. If Giannis, who presumably has access to world-class financial advisors, believes in Kalshi, that's a positive signal.

Mainstream adoption: Prediction markets have a credibility problem with mainstream audiences. Many people still think of them as fringe or gambling-adjacent. Giannis's involvement helps normalize them.

But there's a flip side. If Kalshi fails, if the company runs into trouble, if regulators change the rules in unfavorable ways, Giannis's reputation takes a hit. He's now tied to this company's success or failure. That's real risk.

This is probably why most celebrities do endorsement deals instead of investments. Endorsement deals are transactional. The celebrity gets paid, the company gets exposure, and then everyone moves on. Investments create ongoing entanglement.

For Giannis to take that risk suggests he actually believes in Kalshi's long-term potential. That's credible. That's the kind of thing that moves markets.

Fintech Adoption Among Athletes: A Broader Pattern

Giannis's prediction market investment is part of a broader trend of athletes becoming fintech investors.

Why fintech specifically? A few reasons:

Accessibility: Fintech companies are often easier for high-net-worth individuals to understand than hardware companies or complex biotechs. If you understand how money moves, fintech is intuitive.

Growth potential: Fintech is growing faster than almost any sector. The market opportunity is enormous. Athletes understand that growth creates returns.

Regulation becoming clear: Ten years ago, fintech was mostly unregulated. Now, as fintech matures and regulatory frameworks develop, the risk profile becomes clearer. Athletes want to invest in regulated fintech, not cowboys in garages.

Relevance to personal wealth: Athletes understand personal wealth management. Fintech tools are relevant to their own lives. They're not investing in some abstract technology they don't understand.

Kalshi is a perfect example. It's fintech. It's regulated. It's growing. It's relevant to anyone managing significant wealth. An athlete looking to diversify beyond real estate and traditional investments would logically look at prediction markets.

We're likely to see more athletes making fintech investments in coming years. As prediction markets mature, we might see athletes on prediction market platforms more directly (though this raises ethical questions around information asymmetry).

The broader pattern is healthy. It means athletes are thinking seriously about wealth and capital allocation. It means they're not blowing money on frivolous stuff. It means they're considering long-term value creation.

For fintech companies, having athlete investors is hugely valuable. It brings capital, yes, but more importantly it brings credibility and connections. Giannis knows hundreds of other wealthy people. Some of those people might now invest in Kalshi because Giannis did. That's how networks work.

Integrity and Competitive Fairness: The Real Concerns

When people on Reddit got upset about Giannis's Kalshi investment, the core concern was competitive fairness. Does investing in a prediction market platform create perverse incentives?

Let's be specific about the concern. Say Kalshi has a prediction market on Milwaukee Bucks performance next season. Giannis owns a piece of Kalshi. If he's aware that Kalshi profits when more people use the platform, he might (subconsciously or consciously) have an incentive to perform better, generate more media coverage, etc., thereby driving more interest in Kalshi.

Or, more problematically, imagine Giannis has inside information about a teammate's injury status that hasn't been publicly reported. He knows this will affect team performance. He could trade on prediction markets based on this information, and as an investor in Kalshi, he benefits both from trading profits and from the increased trading volume the information generates.

These concerns are real. They're not paranoid. They're the kinds of things that leagues have to worry about.

But here's where the NBA's CBA provisions come in. Players are explicitly prohibited from trading on league-specific prediction markets. There are compliance requirements. There are monitoring mechanisms (in theory).

The effectiveness of these provisions depends on enforcement. If the NBA actively monitors player trading activity, if they investigate suspicious patterns, if they penalize violations, then the regulations work. If they're just words on paper, then they don't.

Giannis doesn't strike me as the type to cheat. He's built his career on excellence and legitimacy. Gaming the system doesn't fit his public image. But that's subjective. The rules should protect the integrity of competition regardless of an individual player's personal character.

The broader question: is the current regulatory framework sufficient? Does the 1% ownership cap actually prevent conflicts of interest? Does the prohibition on league-specific betting actually prevent informed trading?

Maybe. But there's clearly room for improvement. The NBA might eventually implement:

Active monitoring: Real-time monitoring of trading patterns by players and their family members.

Restricted activity: Preventing players from trading on any prediction market contracts related to their league, even indirectly.

Disclosure: Requiring players to disclose all fintech investments and trading activity.

Cooling-off periods: Preventing players from trading within X hours of games or material information releases.

None of these have been announced. But as prediction markets grow and more athletes invest, the pressure to strengthen rules will increase.

CFTC oversight ensures robust protection and legitimacy for prediction markets, with risk management and market integrity rated as highly important. Estimated data.

What This Means for Other Athletes: The Giannis Precedent

Now that Giannis has cleared the path, expect more athletes to follow. He's the first NBA player to directly invest in Kalshi, but he won't be the last.

Why? Because he's demonstrated that it's legal, it's legitimate, and it can be profitable. Other athletes will see the announcement, understand that this complies with their league's rules, and start looking for similar opportunities.

We'll probably see:

More prediction market investments: Other athletes will invest in Kalshi or competing platforms like Polymarket.

Broader fintech investments: As athletes see the success of Giannis's move, they'll become more aggressive fintech investors generally.

Athlete advisor services: Financial advisors specializing in high-net-worth athlete clients will start actively recruiting investments in fintech as a diversification strategy.

League rule changes: As more athletes invest in these platforms, leagues will likely update their rules to be more specific and stringent.

Alternative investments: We might see athletes investing in sports analytics companies, player evaluation software, and other fintech tied more directly to their sports. These create more complicated conflict-of-interest situations that leagues will have to navigate.

The Giannis precedent is significant precisely because it's a high-profile first move. It normalizes the idea of athlete tech investors. It shows that leagues allow this (within bounds). And it demonstrates that the investment case is real—prediction markets are growing and could be valuable long-term assets.

For younger athletes just entering their professional careers, Giannis's move is probably instructive. It shows that wealth management isn't just about real estate and restaurants. It's about understanding capital flows, growth markets, and making strategic investments.

The Broader Ecosystem: How Prediction Markets Fit Into Fintech

Prediction markets are one piece of a much larger fintech ecosystem. Understanding where they fit helps explain why Giannis's investment matters.

Fintech broadly includes:

Payments and money movement: Apps like Stripe, Pay Pal, Square that make it easy to move money around.

Lending and credit: Companies like Affirm and So Fi that provide credit products.

Investing and trading: Companies like Robinhood, E*TRADE, and now prediction market platforms.

Personal finance: Apps like Mint and YNAB that help people manage money.

Cryptocurrency and blockchain: Bitcoin, Ethereum, and various De Fi protocols.

Insurance and risk management: Insure Tech companies offering insurance, title services, etc.

Prediction markets fit into the "investing and trading" category. They're competing for the same pool of retail investor money. Every dollar someone puts into prediction markets is a dollar they're not putting into stock trading or crypto.

But prediction markets have advantages over traditional stock trading for certain use cases. They're better for betting on specific events. They're more efficient because they aggregate information better. They're less prone to the behavioral biases that affect stock markets.

For Kalshi, being part of the fintech ecosystem means access to:

Talent: Engineers and product people who might have worked at other fintech companies are easier to recruit.

Capital: Venture investors who've made money in fintech are eager to back the next generation of fintech companies.

Infrastructure: Existing fintech infrastructure, payment systems, etc. makes it easier to build new products.

Credibility: Being part of fintech's success story gives Kalshi credibility by association.

Giannis's investment signals that prediction markets have graduated from fringe to mainstream fintech. They're no longer experimental. They're a legitimate asset class with legitimate growth potential.

Regulatory Precedent and Future Expansion

Kalshi's CFTC approval set a precedent that will shape prediction markets for years.

When the CFTC approved Kalshi, they essentially said, "Yes, prediction markets can operate legally in the United States under our oversight." This opened the door for other platforms.

But CFTC approval is the easy part. The hard part is figuring out what kinds of prediction markets are allowed.

Currently, Kalshi focuses on non-sports, non-political outcomes. This avoids regulatory conflicts with state gambling laws (which ban some sports betting), election fraud concerns (which make political prediction markets controversial), and league-integrity concerns (which make sports betting politically sensitive).

But as prediction markets mature, we'll likely see pressure to expand:

Sports outcomes: Why should prediction markets be allowed on whether inflation rises but not on whether the Lakers beat the Warriors? The underlying logic is similar.

Political outcomes: Prediction markets have historically been excellent at forecasting election outcomes. Legalizing political prediction markets could improve political discourse and forecasting accuracy.

Long-term events: Prediction markets on scientific breakthroughs, technological milestones, or climate outcomes could help coordinate expectations and allocate capital more efficiently.

The question is whether regulators will allow these expansions, and under what conditions.

For Giannis and other investors, the regulatory trajectory matters. If prediction markets remain limited to non-sports, non-political outcomes, the addressable market is constrained. If regulators expand the scope, the market opportunity explodes.

Most likely outcome? Gradual expansion with increased safeguards. Prediction markets on sports outcomes will probably eventually be allowed, but only in states where sports betting is legal, and with restrictions on participation by league insiders. Political prediction markets might be restricted to prevent foreign interference. Long-term outcome markets might face fewer restrictions because the stakes are lower.

Either way, Kalshi's first-mover advantage with CFTC approval is probably sustainable. They've set the regulatory standard. New entrants will have to follow similar paths.

Athlete investments in tech have grown significantly over the past decade, with an estimated increase from

The Sports Tech Investment Boom

Giannis's prediction market investment is part of a broader boom in sports tech investment.

Sports tech includes everything from prediction markets to player analytics to fan engagement tools to injury prevention software. It's a massive market opportunity.

Why? Because sports generate enormous amounts of data and money. Professional sports leagues worldwide generate hundreds of billions in revenue annually. Teams are desperate to gain competitive advantages, even marginal ones. Fans want better experiences. Media companies want better content.

This creates investment opportunities. Some of the most notable sports tech investors include:

LeBron James: Invested in Blaze Pizza (food and fitness tech), Liverpool Football Club (soccer analytics), and various other ventures.

Kevin Durant: Created his own venture fund focused on tech investments.

Serena Williams: Invested in female-focused startups and sports tech companies.

Alex Rodriguez: Active tech investor across multiple sectors including sports tech.

What we're seeing is a pattern where the most successful and smartest athletes are becoming serious investors. They're not just taking appearance fees. They're deploying capital and building investment portfolios.

For Giannis, the Kalshi investment fits naturally into this pattern. He's a smart athlete with substantial wealth looking to diversify and deploy capital into growth opportunities.

The sports tech boom is likely to accelerate. As more athletes invest, more capital flows in. As more capital flows in, more startups launch. As more startups launch, more innovation happens. And the cycle continues.

For Kalshi specifically, being affiliated with Giannis positions the company to attract more sports-focused capital and attention, even if they don't focus on sports-specific prediction markets.

What Could Go Wrong: Risk Factors for Kalshi

When you invest in a startup, you're taking risk. Giannis's Kalshi investment faces several potential risks:

Regulatory changes: The government could change rules around prediction markets, restrict what kinds of outcomes they can cover, or increase compliance costs. Any of these would hurt Kalshi's profitability.

Competitor emergence: Polymarket and other platforms are growing. If a competitor captures the market, Kalshi's growth stalls.

User acquisition slowdown: Kalshi needs to continue acquiring users to grow volume. If user acquisition slows or costs increase, profitability suffers.

Market manipulation: If Kalshi fails to prevent market manipulation or insider trading, it could face regulatory sanctions or lose user trust.

Macro economic conditions: If a recession hits, retail investors pull money out of trading and speculative investments. Prediction market volume could decline dramatically.

Attention from major financial institutions: If JPMorgan, Goldman Sachs, or other financial giants decide to enter prediction markets, they could outcompete Kalshi with superior technology and distribution.

Reputational risks: If a major prediction market event goes badly (market manipulation, regulatory violation, user fraud), the whole category suffers, and Kalshi with it.

These aren't fatal risks, but they're real. Investors in Kalshi are accepting them in exchange for potential upside if the company succeeds and prediction markets grow as expected.

For Giannis, the risk is manageable because it's a portfolio investment. He's presumably diversified across multiple assets. Losing this investment would hurt, but it wouldn't devastate his net worth.

But it's worth noting that prediction markets are not a risk-free asset class. They're betting on regulatory approval continuing, market adoption accelerating, and the company executing flawlessly.

The Future of Prediction Markets and Athlete Involvement

What's the future of prediction markets in five, ten, fifteen years?

Most likely scenario: continued mainstream adoption with increased regulation.

Prediction markets will probably become a normal part of mainstream finance. Retail investors will use them alongside stock trading and crypto. Professional traders will use them for portfolio hedging. Institutional investors will use them for quantitative trading strategies.

For athlete involvement specifically, expect:

More direct investment: Following Giannis's lead, more athletes will invest in prediction market platforms and related fintech.

More active participation: Some athletes might become active traders on prediction markets, using superior insight about their own sports to generate trading profits. This will raise integrity questions.

League-specific prediction markets: Eventually, prediction markets on league-specific outcomes will probably be allowed, but with strict safeguards preventing participation by league insiders.

Integration with social media: Prediction markets will probably integrate with social media, allowing celebrities and athletes to express opinions as tradeable contracts. This will create new forms of social media influence.

Celebrity prediction market platforms: Platforms might launch that specialize in celebrity predictions and allow fans to bet on whether celebrities' predictions come true.

The long-term vision is prediction markets becoming as normal and mainstream as stock trading. When that happens, athlete involvement will be unremarkable. Of course athletes invest in prediction market platforms, just like they invest in sports franchises or tech startups.

We're probably 5-10 years away from that normalization. Giannis's investment is a step along that path.

Key Takeaways for Investors and Observers

Let's summarize what Giannis's Kalshi investment actually means:

It's legally allowed under NBA rules, provided Giannis doesn't promote league-specific betting and keeps his stake under 1%. The NBA's CBA explicitly permits this.

It's a credibility boost for Kalshi, signaling to regulators, users, and investors that serious people take prediction markets seriously.

It's part of a larger trend of athletes becoming serious fintech and venture investors, moving beyond endorsement deals to personal capital deployment.

It raises legitimate questions about conflict of interest, though the regulatory safeguards in the NBA's CBA are probably sufficient to mitigate the most serious risks.

It suggests prediction markets are maturing, graduating from fringe to mainstream fintech. When world-famous athletes start investing, the category is no longer experimental.

It creates precedent for other athletes, normalizing prediction market investment as a legitimate wealth allocation strategy.

Most importantly, Giannis's investment is probably not a sign that he has some special insight into prediction markets that others lack. More likely, it's a strategic capital allocation decision made with world-class financial advisors. He's diversifying into a growing sector, getting exposure to a category with strong fundamentals, and adding credibility to his personal brand as a thoughtful investor.

For casual observers, the takeaway is simple: prediction markets are becoming legitimate financial instruments. When celebrities start investing personal capital, you know a category has graduated from fringe to mainstream.

FAQ

Is Giannis's investment in Kalshi legal under NBA rules?

Yes. The NBA's current collective bargaining agreement explicitly allows players to own up to 1% of sports betting companies, provided they don't promote league-specific wagers. Kalshi primarily focuses on non-sports prediction markets, which further distances the investment from league integrity concerns. The investment appears to comply fully with CBA requirements.

What is a prediction market and how does it differ from sports betting?

A prediction market is a platform where users trade contracts based on the probability of real-world events occurring. Unlike traditional sports betting where you bet against a sportsbook at fixed odds, prediction markets have continuously updating prices that reflect what participants collectively think will happen. The CFTC regulates prediction markets as futures contracts, which gives them more legitimacy than gambling while making them subject to stricter regulatory oversight. For example, on a prediction market you might trade contracts on whether inflation will exceed 5% by year-end, not just whether your favorite team wins its next game.

Why does Giannis's investment matter more than a typical celebrity endorsement?

When celebrities invest personal capital instead of just endorsing, they're exposing themselves to real financial risk. An endorsement is transactional: you get paid, you promote the product, everyone moves on. An investment means the celebrity benefits if the company succeeds but loses if it fails. This alignment of interests creates credibility. For Kalshi, Giannis's investment signals to regulators, users, and other investors that serious people with deep resources believe in the company's fundamentals and future potential.

What are the main risks associated with Giannis's Kalshi investment?

Regulatory changes represent the biggest risk. If the CFTC restricts what kinds of prediction markets are allowed, or if new rules increase compliance costs, Kalshi's profitability could suffer. Other risks include competitive pressure from platforms like Polymarket, slower-than-expected user acquisition, macro economic downturns that reduce retail trading volume, and market manipulation that damages Kalshi's reputation. There's also always the risk of execution failure where the company simply fails to build a sustainable business.

Could Giannis's investment create conflicts of interest with his basketball career?

There's potential for conflicts of interest, which is why the NBA has explicit rules addressing it. Players cannot trade on league-specific prediction markets, and they must limit equity stakes to 1%. However, critics argue that even without actively betting, an athlete has a financial incentive in the platform's success, which could theoretically influence behavior. The NBA's safeguards include monitoring requirements (in theory) and explicit prohibitions on league-specific betting. The effectiveness depends on enforcement.

Is this the beginning of more athletes investing in prediction markets?

Very likely. Giannis has cleared the path, demonstrated legal compliance, and shown that prediction market investment can be a legitimate part of a diversified portfolio. Other wealthy athletes with access to sophisticated financial advisors will probably follow. This is part of a broader trend where professional athletes are becoming serious venture capital and growth equity investors, not just doing celebrity endorsement deals. Expect to see more athlete investments in Kalshi, competing platforms, and broader fintech.

How does Kalshi make money and what's the business model?

Kalshi generates revenue through transaction fees charged on every trade. The company takes a small percentage of each contract that's bought and sold. Unlike sportsbooks that profit from imbalanced action, Kalshi profits from volume. The company's value increases as more users trade more contracts. This is why Giannis's investment in Kalshi is valuable but different from owning a sports team. He benefits from the platform's success regardless of specific outcomes, which reduces conflict-of-interest concerns compared to direct betting.

What makes Kalshi different from other prediction market platforms?

Kalshi has several key differentiators. First, it was the first prediction market platform to receive explicit CFTC approval as a Derivatives Clearing Organization, giving it unmatched regulatory legitimacy. Second, it focuses primarily on non-sports, non-political outcomes, which avoids regulatory landmines. Third, it has a track record of successfully navigating the regulatory environment while maintaining platform growth. Other platforms like Polymarket exist, but Kalshi's regulatory status and focus on institutional-grade infrastructure give it advantages.

Could prediction markets eventually be legalized for sports betting?

Probably, but with restrictions. Currently, Kalshi avoids sports-specific prediction markets partly to navigate regulatory uncertainty. As the regulatory environment matures, we'll likely see sports-focused prediction markets become legal, but probably with safeguards. These might include restrictions on participation by athletes and league insiders, or geographic limitations to states where sports betting is already legal. The long-term trajectory probably includes prediction markets on sports outcomes, but only after significant regulatory development and probably not for several more years.

How valuable is Giannis's stake in Kalshi likely to be?

That depends on Kalshi's future valuation. If prediction markets become massively adopted and Kalshi captures significant market share, the company's valuation could grow substantially, making Giannis's stake valuable. If the market develops more slowly or competitors capture market share, the stake might not appreciate much. As an early investor in a growing fintech company with real traction and regulatory approval, Giannis is probably positioned for meaningful returns if things go well. But fintech is risky, and prediction markets are still an emerging category, so downside is also possible.

Conclusion: A Signal of Market Maturation

When Giannis Antetokounmpo announced his investment in Kalshi, he wasn't just making a financial decision. He was sending a signal. A signal that prediction markets have graduated from experimental to mainstream. A signal that serious people with serious money think this is a legitimate asset class. A signal that the future of fintech probably includes prediction markets as a normal part of the landscape.

The internet's immediate reaction—concern about conflicts of interest, regulatory uncertainty, the strangeness of an NBA player investing in a prediction market platform—is understandable. These are legitimate questions. But they're also questions that regulators have already thought through. The NBA's CBA addresses them. The CFTC has regulatory frameworks. The infrastructure exists to manage the risks.

What we're really seeing is the normalization of celebrity tech investing. For decades, athletes invested in real estate, restaurants, and sports franchises. Now they're investing in fintech. They're deploying capital like venture capitalists. They're thinking about portfolio diversification, growth sectors, and long-term value creation.

Giannis's Kalshi investment is probably just the first of many similar moves. In five years, we'll look back and wonder why it was ever unusual. Of course world-famous athletes invest in growing fintech platforms. Of course they have the capital and access to world-class advisors to make smart investment decisions. Of course they want exposure to prediction markets.

For Kalshi, the investment is huge. It brings capital, credibility, and a connection to someone with massive influence and network effects. More importantly, it brings legitimacy. When a world-class athlete invests personal wealth, it's a vote of confidence that moves markets.

For the prediction market category as a whole, Giannis's move is significant because it shows mainstream acceptance. These aren't fringe gambling platforms. They're regulated financial instruments. They're attracting serious investors. They're becoming part of mainstream fintech.

The question isn't whether prediction markets will be part of the future financial landscape. Giannis's investment suggests they already are. The question is how quickly they'll grow, what kinds of outcomes they'll eventually cover, and how regulators will manage the inevitable tensions between growth and integrity.

Giannis just placed his bet. We'll find out if it pays off.

Related Articles

- State Department Deletes X Posts Before Trump's Term: What It Means [2025]

- Netflix DOJ Antitrust Investigation: What It Means for Streaming [2025]

- GOG Galaxy is Getting Native Linux Support. Here's What it Means [2025]

- Why Returning to Linux Desktop Was a Mistake: A Real User's 2025 Experience

- Trump Mobile T1 Phone: Release Date, Price & Specs [2025]

- New York Data Center Moratorium: What You Need to Know [2025]

![Giannis Antetokounmpo Kalshi Investment: What It Means for Sports Betting [2025]](https://tryrunable.com/blog/giannis-antetokounmpo-kalshi-investment-what-it-means-for-sp/image-1-1770502022593.jpg)